May 24, 2016

Since our last update in March 2015, we have witnessed increasing volumes of M&A activity and a corresponding level of global competition law enforcement. Antitrust and competition enforcers around the world continued to devote substantial resources to policing mergers at a time when transactional activity is accelerating across a wide range of industries.

Nowhere is this trend more pronounced than in the United States. In April of last year, the Antitrust Division of the U.S. Department of Justice, supported by the Federal Communications Commission, successfully opposed Comcast’s $45 billion acquisition of Time Warner Cable. Two months later, the Federal Trade Commission persuaded a court to enjoin Sysco’s $8.2 billion takeover of rival distributor US Foods, despite the parties’ substantial remedy offer. And in recent weeks, Halliburton abandoned its $35 billion bid to buy Baker Hughes and the Federal Trade Commission won its high-profile court challenge to Staples’ attempted acquisition of Office Depot. Both agencies are also expected to make decisions in the coming months involving a series of healthcare-sector mergers. The FTC is investigating (and in some cases challenging) a number of significant transactions involving hospitals, pharmaceuticals, and retail pharmacies, while the DOJ is tasked with reviewing several large health insurer transactions.

A number of factors are driving the high level of antitrust enforcement in the United States:

- HSR filing volumes have recovered from the slowdown resulting from the 2008 financial crisis, and are now approaching the same level as a decade ago.

- The agencies have enhanced their litigation capabilities.

- The agencies are continuing to press more aggressive, less traditional theories of harm (e.g., potential competition and innovation).

- The agencies have been less willing to accept what they view as weak or risky remedy proposals, leading them to challenge mergers that in past years may have ended in a settlement.

As the Obama Administration reaches its final months, it is clear that the President’s 2008 campaign promise to increase merger enforcement has become a reality. As we reported in 2010, the agencies issued the first revision of the U.S. Horizontal Merger Guidelines in nearly two decades, which was aimed at strengthening the government’s hand in challenging mergers, particularly in high-technology sectors. Over the past five years, the agencies have successfully pursued challenges of high-profile deals based on many of the principles articulated in the 2010 Guidelines, most notably its reduced emphasis on market definition and greater focus on proving “direct effects.” Time will tell how far-reaching and lasting the agencies’ efforts will be.

Merger enforcement is also on the rise outside the U.S. The European Commission initiated 11 in-depth (Phase II) investigations of mergers in 2015, the highest annual total since 2007. The percentage of all EC merger filings that triggered a Phase II has more than doubled over the past five years. In addition to blocking large mergers such as the $15 billion takeover of mobile phone operator O2 by CK Hutchison, the EC has demonstrated its willingness to demand and impose substantial remedies.

Gibson Dunn’s Antitrust and Competition Law Practice

Gibson Dunn’s Antitrust and Competition Law Practice Group has extensive experience successfully representing clients in a broad range of industries in antitrust investigations conducted by enforcement agencies in the U.S., Europe, and other jurisdictions worldwide. In 2015 and 2016 alone, Gibson Dunn’s antitrust and competition lawyers represented AT&T in its $48 billion acquisition of DirecTV, Williams in its $33 billion proposed merger with Energy Transfer, Intel in its $16.7 billion acquisition of Altera, Schlumberger in its $14.8 billion acquisition of Cameron, Southern Power in its $8 billion acquisition of AGL Resources, Marriott in its $13.6 billion proposed acquisition of Starwood, St. Jude in its $25 billion sale to Abbott, Tenet Healthcare in its $2 billion acquisition of United Surgical Partners International, and Hewlett-Packard it its $3 billion acquisition of Aruba Networks.

Our worldwide Antitrust Practice Group numbers over 100 lawyers located throughout the United States and Europe. In addition, the Antitrust Group works closely with attorneys in Gibson Dunn’s other practice groups to provide efficient service for our clients.

CONTENTS

HSR VOLUME INCREASES AS HIGH ENFORCEMENT LEVELS PERSIST

Stability in DOJ’s Leadership

DOJ Lawsuits and Threats to Litigate Caused Parties to Abandon Mergers

DOJ Finds No Competitive Issues in Expedia/Orbitz and AT&T/DirecTV Transactions

United’s Lease of Slots from Delta at Newark Airport Abandoned Following DOJ Challenge and FAA Ruling

And Then There Were Three

Déjà Vu – FTC Blocks Staples’s Proposed Acquisition of Office Depot (Again)

FTC Obtains Injunction Blocking Sysco’s Proposed Acquisition of US Foods

FTC Loses Preliminary Injunction Case Premised on a Potential Competition Theory

FTC Enforcement in the Healthcare Provider Sector Reaches Unprecedented Levels

The FTC Continues to Resolve Competitive Issues Raised by Pharmaceutical and Medical Device Transactions Through Negotiated Remedies

The FTC Continues Vigorous Enforcement in Energy, Infrastructure, and Other Industries

Both the DOJ and the FTC Require Increasingly Demanding Remedies

The DOJ and the FTC Hold the Line on Merger Reporting Requirements

Increasing Number of Notifications and Tendency to Initiate In-Depth (“Phase II”) Investigations

In Depth (Phase II) Investigations in 2015 / 2016

2015

2016

Other High-Profile EU Investigations in 2015

European Commission Policy and Procedural Reforms

Merger Activity in the Telecommunications Sector

Appeals to the Courts of the European Union

Merger Control in EU Member States

Brazil’s Merger Control Reform: Three Years Later

High Profile CADE Merger Decisions in 2015

CADE Issues Eight Prohibitions Since the Entry into Force of the Brazilian Competition Act

Other Noteworthy Transactions

Other Noteworthy Transactions Subject to Remedies

Ongoing High-Profile Transactions

HSR VOLUME INCREASES AS HIGH ENFORCEMENT LEVELS PERSIST

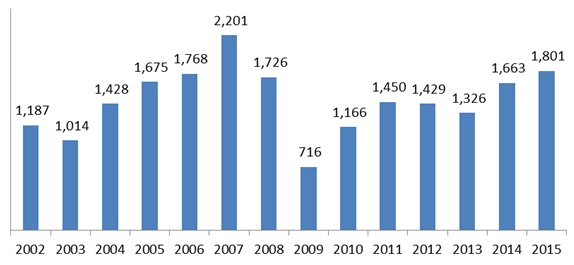

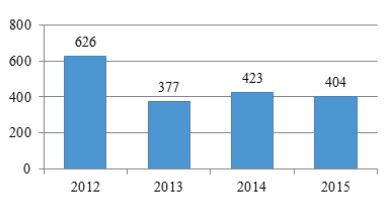

The well-publicized uptick in global M&A activity in 2014 was borne out in a 25% increase in the number of transactions reported under the Hart-Scott-Rodino (“HSR”) Act in FY 2014 over FY 2013 and another 8% increase in FY 2015 over FY 2014. Based on activity in the first half of FY 2016, it appears that total FY 2016 HSR transaction volume will be even higher than in FY 2015, perhaps approaching the extraordinary level of HSR activity in FY 2007.

HSR Act-Reportable Transactions

FY 2002–2015

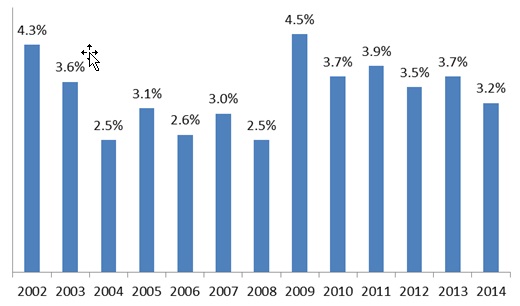

Of course, the number of HSR filings is a useful measure of overall US M&A activity, but because a small percentage of these filings trigger formal second request investigations (less than 5% historically), such figures provide little insight into the agencies’ enforcement workload. The rate at which the agencies investigate transactions and seek enforcement shows merger enforcement continues to be a priority. The percentage of HSR Act-reportable transactions subject to a second request was slightly lower (3.2% in FY 2014) than in previous years; however, because of the higher number of transactions reported, the actual number of second requests issued was higher in FY 2014 (51) than in FY 2013 (47).

Percentage of HSR Act

Transactions Resulting in a Second Request

FY 2002–2014

Enforcement rates (reflecting transactions that are either challenged in court, abandoned due to antitrust concerns, or subject to remedies) under the Obama Administration continue to be on the higher end of the historic range. Between FY 2006 and FY 2008, the agencies brought an average of 34 merger enforcement actions per year. By contrast, between FY 2010 and FY 2012, the agencies averaged 41 challenges annually, even though M&A volume was considerably lower than it is today. However, despite a number of high-profile challenges and increased overall M&A activity, the FTC and DOJ actually broughtfewer merger enforcement cases in each of the most recent three years where data is publicly available: The agencies challenged 44, 38, and 33 mergers in FY 2012, FY 2013, and FY 2014, respectively.

THE DEPARTMENT OF JUSTICE

In 2015, the Antitrust Division of the Department of Justice (“DOJ”) continued to aggressively investigate and challenge mergers in many sectors of the economy. The DOJ caused three deals—Halliburton/Baker Hughes, GE/Electrolux and National CineMedia/Screenvision—to collapse after filing court challenges, and caused the parties to five other transactions to abandon or modify their deals, including Applied Materials/Tokyo Electron and Comcast/Time Warner Cable. The DOJ’s decisions to oppose the Applied Materials and Comcast transactions were particularly notable because the parties to both deals arguably had relatively few directly competing lines of business. In its review of these two transactions, the DOJ focused on “conglomerate” market power and “innovation” issues, respectively, both of which are more commonly associated with reviews by the European Commission. These enforcement actions signal that DOJ may closely investigate any transaction that produces a large firm in a high-profile industry, even if there is not a clear cut traditional basis to conclude that it is likely to reduce competition.

The DOJ has also devoted substantial resources to investigating and challenging non-merger transactions. In November, the DOJ filed a lawsuit to stop United’s lease of slots from Delta at Newark Airport, alleging that United’s planned acquisition of 24 slots at Newark would increase United’s already dominant position at the airport, and would strengthen a barrier that diminishes the ability of other airlines to challenge United at the location. United announced that it would abandon the acquisition in April, citing the FAA’s decision to eliminate slot controls at Newark. ‘

Stability in DOJ’s Leadership

Heading into the final year of the Obama Administration, DOJ’s Front Office will continue to have a very experienced team. Assistant Attorney General Bill Baer will become the Department’s Associate Attorney General, which supervises the Antitrust Division. Renata Hesse is now serving as the Division’s Acting AAG, with David Gelfand and Sonia Pfaffenroth as the two Civil DAAGs. Underscoring that litigation readiness remains a key objective of the DOJ, Baer quickly replaced the Director of Litigation, Mark Ryan, with Eric Mahr when Ryan returned to private practice in May 2015.

DOJ Lawsuits and Threats to Litigate Caused Parties to Abandon Mergers

Throughout the year, the DOJ proactively used its ability to litigate to force parties into abandoning deals. This track record reflects that the DOJ is highly confident that it has the litigation team in place to win in court. Parties involved in transactions that raise material antitrust issues cannot count on any hesitancy by DOJ’s leadership to file a lawsuit.

Halliburton-Baker Hughes: On April 6, 2016, the DOJ filed a complaint against Halliburton and Baker Hughes alleging that their proposed merger would violate Section 7 of the Clayton Act by combining two of the three largest oilfield services providers in the world. In announcing the complaint, AAG Baer remarked that the “transaction is unprecedented in the breadth and scope of competitive overlaps and antitrust issues it presents.” DOJ alleged that the transaction would harm competition in at least 23 separate relevant markets involving a wide range of products and services used to drill and prepare oil and gas wells for production. In addition, the DOJ’s complaint highlighted the inadequacies of the parties’ divestiture packages, further underscoring the agencies’ tougher stance on remedies. Three weeks after the complaint was filed, the parties abandoned the transaction, ending the litigation and triggering a $3.5 Billion reverse-break-fee payment from Halliburton to Baker Hughes.

GE/Electrolux: In July 2015, the DOJ challenged Electrolux’s proposed $33 billion acquisition of GE’s appliance business in federal court, alleging that the transaction would reduce the number of providers of value-segment, major home appliances to homebuilders from three to two. Competitors such as Samsung and LG sold higher-end appliances but the DOJ alleged the parties were the primary suppliers of mid-range appliances. GE abandoned the transaction once it was contractually allowed to do so at the end of trial, before the court ruled on the injunction.

National CineMedia’s/Screenvision: In March 2015, National CineMedia walked away from its efforts to acquire Screenvision shortly before the scheduled trial. The DOJ had filed a lawsuit alleging that a merger between the only two significant cinema advertising networks in the United States would deprive movie theatres of options and risk raising ticket prices to consumers. According to the complaint, the companies had a combined 88% share of all movie theatre screens in the United States through long-term, exclusive contracts.

In the face of a DOJ that continues to succeed through litigation, 2015 saw the parties to five other mergers abandon or modify their transactions when confronted with concerns by the DOJ. Of particular significance are several transactions in which the DOJ was prepared to rely on “innovation” and “conglomerate” theories of anticompetitive effects in the Applied Materials and Comcast matters, respectively.

Applied Materials/Tokyo Electron: In April, eighteen months after proposing a merger, the two semiconductor manufacturers abandoned the transaction after the DOJ raised concerns about a loss of innovation for “next-generation semiconductors.” Significantly, in its press release after the parties abandoned the deal, the DOJ did not focus on a reduction in head-to-head competition between the parties, but on the development of new types of semiconductor manufacturing equipment. The CFO of Applied Materials in statements following the collapse of the deal underscored that the transaction ran into obstacles when the DOJ began looking at the products in development and general technology innovation.

Comcast/Time Warner Cable: In April, after 14 months of review, Comcast and Time Warner Cable abandoned their merger plans when faced with opposition from the DOJ and the Federal Communications Commission (“FCC”). Both reviewing agencies opposed the transaction notwithstanding that there appeared to be little local head-to-head competition between the parties. Instead, both the DOJ and FCC noted concerns that the transaction would “make Comcast an unavoidable gatekeeper for Internet-based services that rely on a broadband connection to reach consumers.” The DOJ’s approach shows that it may not be constrained by conventional merger theories when investigating transactions that will produce a company with a large footprint in a particular sector.

Chicken of the Sea/Bumble Bee: In the Chicken of the Sea/Bumble Bee merger, the DOJ alleged that the companies were the second- and third-largest sellers of shelf-stable seafood products. The DOJ also raised concerns that the market was “not functioning competitively today and further consolidation would only make things worse.” Faced with opposition based on traditional structural concerns, the parties abandoned the merger in December.

Entercom Communications Corp./Lincoln Financial Media Company: The DOJ also kept up its enforcement efforts in older industries. In July 2015, the DOJ challenged a transaction between Entercom Communications Corp. and Lincoln Financial Media Company. The parties entered into a consent decree which required them to divest three radio stations in Denver. Despite the substantial changes that have occurred in the media and advertising sectors, the DOJ continued to define the product market as “English-language broadcast radio stations.” As the media landscape continues to evolve, with Internet and social media outlets commanding an increasing share of advertising dollars, the DOJ may ultimately need to reevaluate this approach but for now, the DOJ’s policy is to take an aggressive stance of defining media markets by format type.

Tribune Publishing Co./Freedom Communications, Inc.: The newspaper industry also received close DOJ scrutiny. In March 2016, the DOJ challenged Tribune Publishing Co.’s (“Tribune”) purchase of Freedom Communications, Inc. (“Freedom”). Tribune owns the Los Angeles Times, while Freedom owned the Orange County Register and the Riverside County Press-Enterprise, the two other newspapers with significant circulation in Orange and Riverside counties that sell alongside Tribune’s Los Angeles Times. Freedom was in bankruptcy and its auction on March 16, 2016 resulted in Tribune winning. The DOJ alleged that the acquisition would create a monopoly by combining the two largest English-language local daily newspapers in the market, thereby increasing subscription prices, raising advertising rates and reducing the incentive to invest in the newspapers. Following the DOJ’s lawsuit, a California bankruptcy judge approved the sale of Freedom to another buyer. The lawsuit reflects that the DOJ continues to review transactions that are too small to trigger an HSR filing or occur through bankruptcy.

DOJ Finds No Competitive Issues in Expedia/Orbitz and AT&T/DirecTV Transactions

Notwithstanding its aggressive enforcement posture, the DOJ’s leadership demonstrated that they will decisively close investigations, without asking for remedies, when the parties persuasively demonstrate that the transaction is not anticompetitive. Most notable, following a six-month investigation, the DOJ decided to close its investigation into the Expedia/Orbitz transaction. The DOJ based its decision in part on its conclusion that “the online travel business is rapidly evolving” with new entry such as TripAdvisor’s Instant Booking service and Google’s Hotel and Flight Finder, both of which had booking functionality.

The DOJ also declined to challenge AT&T’s acquisition of DirecTV, concluding that the transaction did not pose a risk to competition. The FCC did require that AT&T commit to continue to build out broadband assets and not discriminate against content providers.

United’s Lease of Slots from Delta at Newark Airport Abandoned Following DOJ Challenge and FAA Ruling

In addition to the expected continuation of an aggressive review of mergers, the DOJ in 2016 will continue to challenge asset acquisitions as well as mergers. In November 2015, the DOJ filed a civil antitrust lawsuit seeking to block United Continental Holdings Inc.’s $14 million lease of slots from Delta Air Lines. Both United and Delta operate out of Newark Liberty International Airport with United already controlling 73 percent of the slots. United sought to lease an additional 24 takeoff and landing slots from Delta. The DOJ alleged that the lease was an acquisition and would strengthen United’s “monopoly position” and result in higher fares to the 35 million annual passengers traveling through Newark. The airlines abandoned their transaction before the court ruled on their motion to dismiss the DOJ’s complaint, citing an FAA ruling lifting takeoff restrictions at Newark.

THE FEDERAL TRADE COMMISSION

The last twelve months have been a veritable high water mark for FTC merger enforcement activity. The agency scored two high-profile litigation wins by securing injunctions blocking Staples’ $6.8 billion bid for Office Depot and Sysco’s $8.2 billion proposed acquisition of rival US Foods. In addition to requiring remedies in over 15 matters during the last year, the FTC initiated litigation to block five transactions, roughly doubling the agency’s recent historical average of approximately two-to-three merger litigations per year.

Not all of the FTC’s merger litigation efforts have succeeded. In particular, as discussed below, the FTC lost a significant preliminary injunction proceeding in federal court involving a merger between alleged potential competitors, and another federal court denied the FTC’s efforts to enjoin a hospital merger in central Pennsylvania. Time will tell how this might influence the FTC’s willingness to challenge potential competition and hospital cases going forward, but statements from the FTC officials suggest that the agency will continue to bring lawsuits where it concludes that enforcement is warranted.

Notably, several large transactions that raise interesting antitrust issues are currently pending before the agency, including Walgreens’ proposed $17 billion purchase of Rite Aid, ‘Teva Pharmaceuticals’ $40.5 billion acquisition of Allergan’s generic drugs portfolio, and Sherwin-Williams $8.9 billion proposed acquisition of Valspar. The agency’s actions–or inactions–in these matters will provide further insights into the agency’s future direction.

And Then There Were Three

Although the Commission’s Democratic majority will very likely persist through the election cycle, Commissioner Wright resigned on August 17, 2015, to return to the faculty of the George Mason law school and Commissioner Brill announced her resignation on March 22, 2016, to enter private practice. The President has not nominated a candidate for either position and, given the current acrimony between the President and Congress regarding appointments, both seats may remain empty for some time.

Other staffing changes at the Commission include the departure of the Commission’s General Counsel, Jonathan Nuechterlein, to private practice; the addition of Professor Ginger Zhe of the University of Maryland to the Bureau of Economics as the Bureau’s Director; and the addition of Lorrie Faith Cranor, a Professor of Computer Science and Engineering and Public Policy at Carnegie Mellon University, to replace Ashkan Soltani as Chief Technologist. While notable, these staffing changes are unlikely to materially alter the agency’s enforcement decisions.

Déjà Vu – FTC Blocks Staples’s Proposed Acquisition of Office Depot (Again)

On May 10, 2016, following a year-long investigation and two weeks of trial, the FTC secured an injunction in federal court blocking Staples’s proposed acquisition of rival Office Depot. This is the third time the FTC has weighed in on a major office supply superstore transaction, and marks the second time it has prevented Staples from acquiring Office Depot. Nearly two decades ago, in 1997, the Commission obtained an injunction from the same court blocking this very same deal. In the 1997 case, the Commission’s focus was on sales of disposable office supplies (e.g., Post-it notes, paper, and pens) to retail store consumers. Sixteen years later, in November 2013, the FTC cleared a merger of Office Depot and OfficeMax, which was then the third-largest operator of retail office supply stores in the United States. In clearing that transaction, the FTC issued a closing statement noting that the “current competitive dynamics are very different” than they were in 1997. In addition to concluding that office supply chains face “significant competition” for retail customers, the Commission explained that “[a] substantial body of evidence indicates that the merger is unlikely to substantially lessen competition or harm large [business] contract customers.”

Notwithstanding its 2013 closing statement, the Commission elected to challenge the Staples/Office Depot transaction after rejecting the parties’ offers to divest assets and customer contracts to a third party. Unlike its 1997 challenge, the agency’s case focused not on retail sales of office supplies to individual consumers, but rather on sales to large corporations. Specifically, the agency alleged that the relevant market “is the sale and distribution of consumable office supplies to large business-to-business [“B-to-B”] customers in the United States.” The agency’s economist, Dr. Carl Shapiro, estimated that Staples and Office Depot combined accounted for nearly 80% of consumable office supply sales to Fortune 100 companies.

In a 75-page opinion, Judge Sullivan explained that the FTC had met its burden of “showing that the merger would result in ‘undue concentration’ in the relevant market of the sale and distribution of consumable office supplies to large B-to-B customers in the United States.” In addition to accepting the FTC’s relevant market definition, Judge Sullivan noted that “Amazon Business’ lack of demonstrated ability to compete for [B-to-B contracts] and the structural and institutional challenges of its marketplace model” mean that it “will not be in a position to compete . . . on par with the proposed merged entity within three years,” and “it would be sheer speculation . . . for the Court to conclude otherwise.”

The outcome of this case was far from preordained, given the FTC’s 2013 Office Depot/OfficeMax closing statement, but reflects several emerging trends in U.S. merger enforcement. First, as discussed above, the agencies are increasingly skeptical of remedy proposals, particularly in large transactions where there is extensive pre-merger competition and overlap between the parties. Staples is yet another high-profile instance where the agency chose to litigate rather than agree to a substantial divestiture package. Second, the agencies are gaining confidence in defining national markets in which large players vie for business from customers that require services across multiple distribution facilities throughout the country. The DOJ relied on a similar market definition theory in its 2010 challenge of AT&T’s proposed acquisition of T-Mobile, and the FTC used it in its litigation against Sysco/US Foods (discussed below). Finally, the agencies are increasingly relying on evidence of head-to-head competition to support not only competitive effects, but also their proposed market definition. The Commission’s expert argued that evidence of competitive rivalry between Staples and Office Depot for large corporate customers supported the contention that these customers formed a distinct relevant market.

FTC Obtains Injunction Blocking Sysco’s Proposed Acquisition of US Foods

In June 2015, Sysco and US Foods abandoned their proposed merger after the FTC won a preliminary injunction enjoining the transaction in federal district court. The case was the FTC’s signature victory of 2015, and is noteworthy because it came outside of the healthcare sector, the focus of virtually all recent FTC competition-law litigation successes, merger or otherwise. Another impressive aspect of this win was that the FTC prevailed by alleging the merger would lessen competition in a market where the merging parties faced many (albeit differentiated) competitors.

In the litigation, the FTC contended–and the court agreed–that the relevant product market was broadline food product distribution, a market that excluded distributors who focused only on certain categories of food (or food-related products) or served only narrow geographic areas. The court found that the product market must be defined in a way that grasps the reality that large government agencies, healthcare systems, industrial catering companies, and restaurant chains conduct a very substantial portion of their business with the broadliners, who offer special services unavailable from others. The court also concluded that the sheer scale of certain national customers means they are categorically different from regional customers who only receive goods from a small set of distribution centers.

FTC Loses Preliminary Injunction Case Premised on a Potential Competition Theory

But the FTC’s fortunes changed several months later in September 2015, when the Northern District of Ohio denied the FTC’s motion for a preliminary injunction to block Steris Corporation’s (“Steris”) proposed acquisition of Synergy Health plc (“Synergy”). The $1.9 billion merger combined the second- and third-largest medical product sterilization companies in the world.

The FTC’s Complaint asserted an actual potential competition theory, under which the agency claimed that the merger would eliminate future rivalry between the two companies. Both Steris and Synergy provide contract sterilization services for companies that need to ensure their products (e.g., medical devices) are free of unwanted microorganisms before they reach customers. According to the FTC, gamma radiation is currently considered the only feasible method of sterilizing large volumes of dense and heterogeneously packaged products, and Steris is one of only two companies providing such services in the United States. The FTC further alleged that, prior to the proposed merger, Synergy was implementing a strategy to open new plants in the United States that would offer X-ray sterilization services, which would provide a competitive alternative to Steris’s dominant gamma radiation offering.

In evaluating its actual potential competition claim, the court accepted the FTC’s underlying legal theory – i.e., that a merger could be blocked on the ground that one party would enter and compete against the other absent the transaction. But at the preliminary injunction hearing the court focused on the evidence the FTC proffered in support of its claim that Synergy was likely to enter the US market by building one or more X-ray facilities within a reasonable period of time. The court concluded that the FTC failed to meet its evidentiary burden on this point. It concluded that, absent the deal, Synergy was unlikely to enter the market in any reasonable timeframe because the evidence demonstrated that it had failed to obtain customer commitments for its X-ray sterilization services, and that Synergy had failed to lower its capital costs to levels that would enable it to compete effectively. Following the court’s decision to deny the injunction, the Commission announced that it did not intend to appeal and was dropping the suit.

We do not expect the loss to portend the end of the Commission’s interest in pursuing cases premised on “potential competition” theories. Bureau of Competition Director Feinstein delivered a major policy speech outlining the FTC’s commitment to potential competition cases in September 2014 and the agency has an established history of pursuing remedies premised on competition that will occur only in the future, some of which were successful (e.g., the Commission’s successful defense of its Polypore decision in the Eleventh Circuit). However, Steris reflects the reality that potential competition cases inherently place a high evidentiary burden on the agency because it must prove future, rather than current, rivalry. Commissioner Ohlhausen recently commented that the Steris decision may reflect that the courts have a “different appetite than does the Commission” when it comes to forecasting future competitive dynamics.

FTC Enforcement in the Healthcare Provider Sector Reaches Unprecedented Levels

After pressing “pause” on merger enforcement in the healthcare provider sector after suffering a string of eight FTC and DOJ losses in hospital merger cases in the late 1990s, the FTC has now fully rebooted its efforts in this large and important sector. After successfully challenging the consummated acquisition of Highland Park Hospital by Evanston Northwestern Hospital in 2008, an action that resulted in relatively limited behavioral remedies, the FTC has aggressively policed hospital mergers on a prospective basis.

Indeed, since the FTC issued its decision in Evanston eight years ago, the agency is five-for-six, posting an impressive .833 batting average, in litigating hospital merger challenges. During the final two months of 2015, the FTC initiated three additional hospital merger challenges, two of which are currently pending in the courts. On May 10, 2016, the court in the third case involving two hospitals in Pennsylvania, denied the FTC’s motion for an injunction—the agency’s lone hospital-matter loss since the agency issued its decision in the Evanston case. This unprecedented level of enforcement reflects the agency’s commitment to policing combinations among healthcare providers.

- In the Matter of Cabell Huntington Hospital: The FTC moved to block the merger of two hospital systems located approximately three miles apart in Huntington, West Virginia. According to the FTC’s complaint, the combination would create a near monopoly for general acute care inpatient hospital services and outpatient surgical services in the surrounding four-county area, with a market share above 75%. The FTC also stated that the procompetitive benefits of the merger were speculative, not merger-specific, and insufficient to outweigh the likely competitive harm resulting from the acquisition. However, on March 20, 2016, West Virginia governor Earl Ray Tomblin signed into law a bill that ostensibly exempts hospitals and other healthcare providers subject to state regulation from antitrust scrutiny. How the law will alter the course of the FTC’s challenge remains to be seen.

- In the Matter of The Penn State Hershey Medical Center/PinnacleHealth System: Moving in cooperation with the Pennsylvania Attorney General, the FTC filed a complaint in federal district court to stop the proposed merger of two nonprofit hospital systems serving Harrisburg, Pennsylvania, and the surrounding area. The FTC alleged that the combined entity would have nearly 64% market share, and that the merger would likely lead to increased healthcare costs and diminished quality of care for more than 500,000 residents in the area. However, the court denied the FTC’s injunction, finding that the FTC’s purported four-county “Harrisburg Area” market was too narrow and improperly excluded 19 competing hospitals located within a 65 minute drive of Harrisburg. Moreover, the two largest insurers in Harrisburg, accounting for nearly 80% of the hospitals’ commercial patients, had executed contracts that would prevent the merging hospitals from raising prices for at least the next five years. The court was also persuaded by the parties’ claim that the merger would allow them to utilize capacity more efficiently and to avoid unnecessary capital expenditures. The FTC has appealed the decision to the Third Circuit, and briefing regarding a stay of the district court’s opinion is ongoing.

- In the Matter of Advocate Health Care Network: The FTC challenged the proposed merger of NorthShore University HealthSystem and Advocate Health Care Network, which would create the largest hospital system in the North Shore area of Chicago. According to the FTC, the combined entity would operate a majority of hospitals in the area, and control more than 50% of the general acute care inpatient hospital services.

In both Hershey and Cabell Huntington, the merging hospitals contracted with their largest payors to freeze rates at pre-merger levels for five and ten years, respectively. The court in Hershey concluded that the hospitals’ long-term agreements foreclosed the possibility of anticompetitive post-merger price increases. The FTC, according to the court, was “essentially asking the Court [to] prevent this merger based on a prediction of what might happen to . . . rates in 5 years.” In response, Chairwoman Ramirez voiced her “very serious” concerns with using such agreements as a means of deflecting antitrust attack. She described such strategies as “akin to conduct remedies” that fail to address the longer-term anticompetitive effects of horizontal mergers, including future reductions in innovation and quality. It remains to be seen whether long term price contracts will be more broadly accepted as a safeguard against the anticompetitive effects of mergers as the FTC pursues its appeal of the Hershey decision and awaits the outcome of Cabell Huntington. If this practice gains favor in the courts, it will have significant implications for merger remedies both in and outside the health care context.

Of these three challenges, the Advocate/NorthShore matter may turn out to be the most significant precedent. Unlike the FTC’s other recent hospital merger challenges, the area served by Advocate and NorthShore is not an isolated city (or town) surrounded by a rural area. Rather, the hospitals serve the suburbs north of downtown Chicago. The FTC alleged that the relevant market excluded hospitals located in downtown Chicago and to the west of the city. The court’s reaction to the FTC’s alleged geographic market may create an important benchmark for geographic market definition in healthcare provider markets in large metropolitan areas. In addition, unlike other recent FTC hospital challenges, the combined shares of Advocate and NorthShore (and market concentration) are relatively close to the thresholds specified in the Horizontal Merger Guidelines needed to establish a presumption of anticompetitive harm (i.e., a post-merger HHI greater than 2,500 and an increase in HHI of 200 or more). Thus, even if the court accepts the FTC’s geographic market, the court may give less weight to the presumption of harm associated with concentration thresholds, and correspondingly more weight to other evidence, including the parties’ efficiency justifications.

A notable trend in the FTC’s enforcement program in the healthcare provider sector is the extension of its enforcement beyond hospitals to include ambulatory surgery centers (ASCs), physician groups, and other low-acuity healthcare providers. Although the FTC had previously pursued merger enforcement cases involving dialysis clinics and laboratory services (and continues to do so, as evidenced by the remedy it required in approving U.S. Renal Care, Inc.’s acquisition of DSI Renal), the agency had not previously targeted low-acuity medical services offered by local providers. The FTC’s current position, however, appears to be that any transaction involving healthcare providers–no matter how small or “local”–that results in concentration levels in excess of the thresholds specified in the Horizontal Merger Guidelines merits scrutiny.

The FTC Continues to Resolve Competitive Issues Raised by Pharmaceutical and Medical Device Transactions Through Negotiated Remedies

During the last year, which witnessed a number of very large pharmaceutical transactions, the FTC has stayed the course in the pharmaceutical and medical device sector. In particular, the FTC maintained its approach to analyzing deals involving drugs and medical devices based on whether the transactions involve therapies that are substitute treatments for patient conditions.

Most notably, the FTC’s investigations of several blockbuster pharma deals–including Shire PLC’s $32 billion proposed merger with Baxalta’ and Teva Pharmaceuticals’ $40.5 billion acquisition of Allergan’s generic drugs portfolio–remain ongoing. Commentators anticipate the FTC requiring as much as $600 million in divestitures to clear the Teva/Allergan deal.

In November 2015, the FTC cleared Pfizer’s $16 billion acquisition of Hospira, Inc. after the parties agreed to divest assets related to four generic drugs. The FTC’s required divestitures related to two alleged product markets where the parties were two of three (acetylcysteine inhalation solution) or two of four (clindamycin phosphate injection) current sellers. The FTC also required divestitures of two products based on concerns that future (i.e., potential) competition would be harmed. Specifically, with regard to injectable voriconazole, Pfizer currently marketed a branded version and was expected to obtain and launch FDA approval for a generic version in May 2016. With regard to injectable melphalan hydrochloride, a drug used in conjunction with various chemotherapy treatments, the parties were the only companies with generic versions in late-stage development.

The FTC also required Endo International and Par Pharmaceuticals to divest generic drugs for treating ulcers and thyroid ailments as part of their $8 billion merger. Endo and Par were the two foremost producers of the generic ulcer medication; and the merger would have reduced the number of competitors from four to three for the thyroid medication in question.

The FTC cleared Mylan N.V.’s acquisition of Perrigo Company plc in November 2015 after the parties agreed to divest four generic pharmaceuticals in which they already competed, as well as three other generic medications for which the Commission deemed the parties future competitors.

In keeping with the potential-competition theme in this space, the Commission required a remedy in Impax Laboratories Inc.’s $700 million deal for CorePharma, LLC: the parties agreed to divest assets related to two different generic pharmaceuticals. In one, pilocarpine, the Commission alleged that the parties were the only two likely new entrants absent the proposed merger. Impax currently produces the other generic medication in question, ursodiol, and CorePharma is one of relatively few likely future entrants in a market that has suffered from supply shortages recently.

In June 2015, the FTC required Zimmer Holdings to divest overlapping products as a condition of clearing its $13 billion acquisition of Biomet Inc. First, the parties divested knee implant and elbow implant products. In these markets, the FTC alleged that the transaction would have reduced the number of current competitors from three to two. Second, the Commission required divestiture of bone cement assets, after finding that the deal would have reduced the number of competitors in the relevant market from four to three.

Most recently, in February of this year the Commission required divestitures in two other mergers of marketers of generic drugs. Lupin Ltd. will be allowed to close its $850 million acquisition of Gavis Pharmaceuticals LLC after agreeing to divest a pair of generic pharmaceuticals. The FTC alleged that the deal would have reduced the number of generic options from four to three for antibacterial drug doxycycline monohydrate, and that the parties were likely future competitors in the market for a generic ulcerative colitis medication called mesalamine. The Commission showed that no merger is too small to attract antitrust scrutiny when it mandated that Hikma Pharmaceuticals PLC divest five generic drugs to remedy allegations its $5 million acquisition of Ben Venue Laboratories would be anticompetitive. The five drugs in question treat a range of maladies, such as infections, hypertension, ulcers, and psychiatric and neurological disorders.

Notably, the Commission voted unanimously in each of these cases, reflecting the consensus within the agency regarding market definition and competition effects analysis in the pharmaceutical and medical device sectors.

The FTC Continues Vigorous Enforcement in Energy, Infrastructure, and Other Industries

Oil & Gas – In March 2015, the FTC announced that it had obtained a settlement in its challenge to the proposed $107 million acquisition of Mid Pac Petroleum, LLC by Texas-based energy company Par Petroleum Corporation. In its Administrative Complaint, the FTC alleged that the proposed merger would reduce competition and lead to higher prices for bulk supply of Hawaii-grade gasoline blendstock. Under the final consent order, Par Petroleum was required to terminate its storage and throughput rights at a key gasoline terminal in Hawaii.

Just before the New Year, the FTC announced that ArcLight Energy agreed to divest its stake in four petroleum product terminals in Pennsylvania. ArcLight had purchased the Gulf Oil Limited Partnership from Cumberland Farms, which the FTC deemed anticompetitive.

In addition, the FTC’s investigation of the proposed acquisition of Williams Companies, Inc. by Energy Transfer Equity, L.P. (“ETE”) remains ongoing. According to ETE, the combined company will be one of the five largest global energy companies. The FTC issued a Second Request in December 2015.

Infrastructure: In May 2015, the FTC announced that cement manufacturers Holcim Ltd. and Lafarge S.A. agreed to divest plants, terminals, and a quarry to settle FTC charges that their proposed $25 billion merger creating the world’s largest cement manufacturer would likely harm competition in the United States. According to the FTC’s Complaint, the merger would have harmed competition in 12 markets where the two companies either were the only significant suppliers of cement or were two of, at most, four significant suppliers in the market.

Automotive: Also in May 2015, the FTC reached a settlement requiring two of the world’s largest auto parts suppliers, ZF Friedrichshafen AG and TRW Automotive Holdings Corp., to divest TRW’s linkage and suspension business in North America and Europe as part of their proposed $12.4 billion merger. The merging companies were two of only three North American suppliers of heavy vehicle tie rods.

Tobacco: To resolve a closely watched transaction, tobacco companies Reynolds American Inc. and Lorillard Inc., the second- and third-largest US cigarette makers, agreed to divest four brands of cigarettes as part of their $27.4 billion merger. The May 2015 order required Reynolds to divest the four brands to Imperial Tobacco Group, a tobacco manufacturer with a significant international presence but a comparatively smaller presence in the United States. Significantly, the parties had proposed the divestiture to the FTC very early in its investigation, and negotiated with Imperial prior to announcing their deal. This strategy proved to be effective, although the FTC’s prolonged investigation underscores the reality that early remedy proposals do not necessarily result in expedited clearance.

Retail: Following up on what we reported on the dollar store industry last year, in January 2015, Family Dollar shareholders approved Dollar Tree’s $8.5 billion takeover bid and rejected a $9.1 billion bid from Dollar General, reasoning that the FTC would require divestiture of thousands of stores in a merger with Dollar General but only around 300 stores in a merger with Dollar Tree. Following shareholder approval, the FTC identified 330 stores in local markets across 35 states where competition would be lost if the acquisition went forward as proposed. On July 2, 2015, Dollar Tree agreed to sell the 330 Family Dollar stores to a private equity firm.

The Commission is also currently reviewing Walgreens’ proposed $17 billion purchase of Rite Aid. Walgreens and Rite Aid are the largest and third-largest retail pharmacy operators, respectively, in the United States. There are a variety of product markets the Commission will examine during its review, including local retail pharmacy markets, the market for the distribution of drugs billed by insurance companies, and other markets that may exist on a regional or national scale.

Electronics: In November, NXP Semiconductors N.V. agreed to sell its RF power amplifier assets to settle FTC charges that its proposed $11.8 billion acquisition of Freescale Semiconductor Ltd. is anticompetitive. The companies were two of only three major worldwide suppliers of RF power amplifiers–semiconductors that amplify radio signals used to transmit information between electronic devices such as cellular base stations and mobile phones.

Packaging: The FTC issued Second Requests to fully evaluate Ball Corporation’s proposed $7.8 billion acquisition of Rexam PLC in April 2015. Rexam and Ball Corp. are two of only three major aluminum can manufacturers in the US market. The merger was recently approved by the Administrative Council for Economic Defense, Brazil’s competition authority, with limited conditions and divestitures. Recent reports indicate that the EU is also likely to approve the deal following some additional recent concessions from Ball Corp. Neither Ball nor the FTC has issued a public statement regarding resolution of the FTC’s investigation.

Industrial Gases: In the FTC’s most recent merger remedy in May 2016, Air Liquide and Airgas obtained clearance for their $13.4 billion merger after agreeing to divest commercial gas production and distribution facilities that pertain to seven different commodities in numerous geographic markets. The FTC emphasized that the markets for these particular products – such as oxygen gas and dry ice – are already concentrated and that the barriers to new entry are high. In sum, the parties agreed to divest 18 Air Liquide facilities and seven Airgas facilities across the country.

Both the DOJ and the FTC Require Increasingly Demanding Remedies

The leadership at both the DOJ and FTC have made it clear that they will require robust remedies to resolve any competitive concerns from mergers and acquisitions. In a speech in February 2015, Assistant Attorney General Bill Baer explained that the Division had filed complaints against the AB InBev/Grupo Model and the USAir/American Airlines mergers because the parties had failed to put forward remedies that the DOJ believed would preserve competition in the industries at issue. Baer explained that in both cases, the DOJ was only willing to settle the cases after the parties had offered substantially greater remedies than they had prior to DOJ’s initiating the lawsuits.

Both agencies have continued to reject remedy packages that they view as inadequate, even when it means litigation. In each of the major litigations discussed above – Sysco, Staples, and Halliburton – the merging parties offered to divest substantial portions of their businesses before the agency filed its complaint. The agencies rejected these packages as insufficient to ensure that the level of post-merger competition (including innovation competition) would remain robust. As AAG Baer remarked at a press conference announcing the Halliburton complaint:

Halliburton wants the United States to agree to the most complicated array of piecemeal divestitures and entanglements that I have ever seen. Halliburton’s various proposals – and those have been a moving target – involve selling a grab bag of assets in certain product lines. . . . At the end of the day, Halliburton’s purported settlement would eliminate a formidable rival – Baker Hughes – and replace it with a smaller, weaker rival that is not the equivalent of Baker Hughes today.

These and other comments by agency leaders underscore the stricter scrutiny remedy proposals have received in recent years, particularly where the divestiture package (i) spans multiple business lines, (ii) is national or global in scope, (iii) requires that the merged firm provide extensive long-term support services, (iv) does not identify a buyer or includes a buyer with inadequate scale and resources, and (v) requires the agency to devote substantial resources over many years to supervise.

The DOJ also demonstrated that in certain cases it would require the parties to consummated mergers to disgorge what DOJ views as unlawful profits from an anticompetitive transaction. In March 2015, the DOJ and the New York State Attorney General settled the long-running investigation into Twin America, the joint venture between Coach USA Inc. and City Sights LLC, created in 2009. The lawsuit, which was filed in 2012, centered on hop-on, hop-off bus tours in New York City. The DOJ and NY AG alleged that Twin America had a monopoly over the hop-on, hop-off bus tour market in New York City and that the transaction had enabled Twin America to raise ticket prices by 10%. The settlement required the parties to divest all of City Sight’s Manhattan bus stop authorizations and disgorge $7.5 million in profits from the joint venture.

We noted in last year’s Update that the FTC had announced a second merger remedy retrospective, following on the heels of the Commission’s similar 1999 study. That effort has undergone the notice and comment process and is now underway. The Commission is gathering data from various parties–both voluntarily and by the use of compulsory process–and we expect the study to be released in late 2016 or 2017. We believe that the study is an integral component of a broader FTC effort to obtain more robust (and correspondingly onerous) merger remedies, including by requiring parties to divest more assets, provide more substantial transition services, and take various other steps to ensure that buyers are positioned to succeed in selling (or developing) the divestiture product(s).

The DOJ and the FTC Hold the Line on Merger Reporting Requirements

The agencies have continued to prosecute parties who failed to file the proper HSR notifications, regardless of whether the underlying transaction raised substantive antitrust issues. In April, DOJ filed a lawsuit against ValueAct seeking fines of at least $19 million – a record for an HSR Act violation – for failing to file before acquiring shares of Halliburton and Baker Hughes. As detailed above, Halliburton and Baker Hughes abandoned their proposed merger following a separate antitrust lawsuit from the DOJ. ValueAct allegedly purchased shares in both companies “with the intent to influence the companies’ business decisions as the merger unfolded,” and as a consequence its purchases did not qualify for the “investment-only” exemption to HSR’s notification requirements. This lawsuit follows a string of cases brought by the DOJ and FTC in recent years against activist investors that are alleged to have improperly claimed the investment-only exemption.

In September 2015, the DOJ fined Leucadia National Corp. $240,000 for violating the premerger notification rules by improperly relying on the institutional investor exemption when it acquired shares in KCG Holdings, Inc. in July 2013. Similarly, in October 2015, the DOJ fined Len Blavatnik $656,000 for violating the premerger notification rules when he acquired shares in TangoMe, Inc. in August 2014. Mr. Blavatnik purchased shares that brought his stake above the reporting threshold and failed to report the transaction. The multi-year gaps between the violation and DOJ prosecution underscores that the DOJ will seek penalties for failures to comply with the HSR Act whenever it learns about the violation.

The Commission made a point of enforcing the reporting requirements of the Hart-Scott-Rodino Act, securing nearly $900,000 in fines for two separate alleged violations. A year after fining Berkshire Hathaway nearly $900,000, the Commission fined a holding company $240,000 for failing to report a new investment–its second HSR violation since 2007. In October 2015, famed investor Len Blavatnik and his company paid a $656,000 fine for a similar violation, which came on the heels of a prior violation in 2010. These actions, which both involved unintentional violations of the HSR Act’s reporting requirements, reflect the seriousness with which the FTC polices its review process even where the transaction at issue does not pose antitrust concerns.

THE EUROPEAN UNION

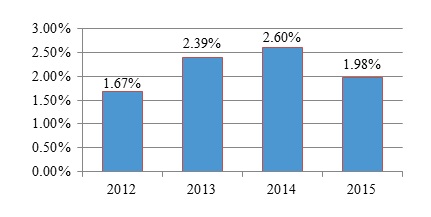

Increasing Number of Notifications and Tendency to Initiate In-Depth (“Phase II”) Investigations

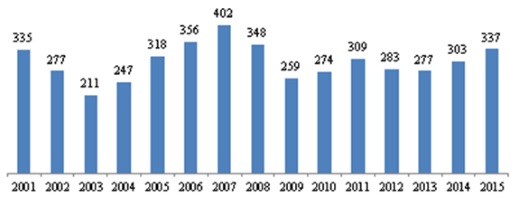

Shortly after the financial crisis brought an end to the last merger wave, there was an apparent decline in the number of mergers notified to the European Commission (with the number of notified transactions falling from 402 in 2007 to 259 in 2009). However, as of Q3 and Q4 of 2014, M&A activity in the EU has reached very high levels again, with the number of notified transactions growing from 277 in 2013 to 303 in 2014 and up to 337 in 2015. Consistent with this trend, 62 notifications had already been filed in 2016 by the end of the month of February.

Mergers Notified at EU Level 2001-2015

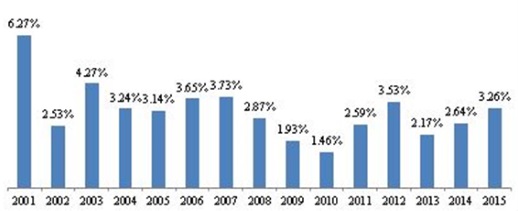

The trend towards greater scrutiny of notified transactions, which arguably commenced in 2011, has continued apace throughout the year in 2015. Over the course of 2015, the Commission has initiated 11 in-depth (Phase II) investigations, which reflects a record high since the year 2007. Over the past five years, the rate at which M&A transactions have triggered an in-depth investigation has more than doubled, from 1.46% in 2010 to 3.26% in 2015. Despite this increasing level of scrutiny, Competition Commissioner Vestager has yet to block her first merger, although notifying parties have decided to terminate their proposed mergers in at least two high-profile situations.

Percentage of Reported Transactions Resulting in Phase II Investigation

The appetite for mergers in the telecommunications industry in the EU remained undiminished over the course of 2015, even in the face of what appears to be a hardening of approach by the Commission to the review of mergers in the sector. There has also been an increasing amount of activity in the oil exploration industry recently, largely in response to the dramatically changed economic circumstances in which the sector finds itself. Finally, there is a continued interest in consolidation in the pharmaceutical sector, with the Zimmer/Biomed and GlaxoSmithKline/Novartis transactions being the main examples in 2015.

The Commission has continued its established preference for the use of structural remedies and the identification of up-front buyers as the basis for addressing identified theories of harm flowing from notified mergers (as reported in our 2015 Antitrust Merger Enforcement Update and Outlook), with the divesture of viable businesses to a suitable purchaser remaining the preferred remedy.

The Commission’s desire to review high profile mergers was given even greater impetus when, on 10 March 2016, Commissioner Vestager signaled her Directorate’s intention to consider the review of mergers by reference to the value of the deal, rather than simply on the basis of its traditional annual revenue thresholds test.

In Depth (Phase II) Investigations in 2015 / 2016

Phase II Clearances

The Commission cleared eight proposed transactions in 2015 after in-depth (Phase II) investigations, only one of which was cleared without any conditions attached. In the first two months of 2016, the Commission has cleared another four notified concentrations that were subject to Phase II investigations, with one being cleared unconditionally. Merger activity in the electronic communications sector escalated even further in 2015, and is subject to a separate discussion below.

After an in-depth investigation, the Commission cleared unconditionally the proposed acquisition of US corporation Dresser-Rand by Germany’s Siemens. Both companies supply a range of turbo compressors as well as their “drivers”, which take different forms, such as aero-derivative gas turbines (“ADGT”), industrial gas turbines (“IGT”), steam turbines and electric motors. The combination of a compressor with a driver (which creates a “turbo compressor train”) is widely used for various applications in the oil and gas industry. The Commission initially had concerns that the transaction would lead to less product variety and to higher prices by reducing the number of significant suppliers of ADGT-driven turbo compressor trains from three to two. In addition, the parties’ competitors for the supply of small steam turbines had a limited presence and might not pose a significant competitive constraint on the merged entity.

The Commission’s investigation revealed that, as regards ADGT-driven compressor trains, the activities of Dresser-Rand and Siemens were largely complementary, as they focused on different oil and gas applications. This was demonstrated by the fact that they were found to have bid rarely against each other in tender bids. In addition, the ADGT-driven compressor trains were found to be largely substitutable with light IGT-driven compressor trains, where the parties faced strong competition from entities such as Solar and GE. With regard to small steam turbines, the investigation again demonstrated that the two companies were not close competitors, given that their activities were largely complementary and they faced strong competition from other major suppliers. Moreover, not only were a number of smaller competitors already active in the small steam turbine market which were capable of expanding their production, but additional producers could also enter the market.

The acquisition of Biomet by Zimmer Holdings (both orthopedic implant producers for knees and elbows from the United States) was cleared subject to commitments. The Commission was concerned that the merger would lead to less innovation and choice (in what was in effect a 5-to-4 merger), as well as to price increases, since the transaction would combine two leading orthopedic implants manufacturers which collectively had significant market power in a large number of EEA countries. By contrast, the size of other competitors on the relevant affected markets was small and there were relatively high entry barriers.

To address these concerns, Zimmer offered an extensive remedy package, whereby it would divest: (i) its knee and elbow businesses across the EEA; and (ii) Biomet’s knee business in Denmark and Sweden. These divestures were to be accompanied by corresponding instrumentation, improvements and pipeline projects. The parties would also divest IP rights, know-how and customer contracts, as well as committing to supply the businesses’ product lines on reasonable conditions for a transitional period. Moreover, the purchaser of the Biomet knee business was to be granted an EEA-wide licence to the rights and know-how used to manufacture and sell exact copies of the knee implant. The companies also committed not to implement the transaction before one or more suitable purchasers were found.

The Commission approved the joint venture between two of the world’s leading coffee manufacturers – DEMB of The Netherlands and Mondelēz of the US – subject to commitments. Concerns were expressed that the transaction, as initially notified, would have led to price increases in roast and ground coffee products, as well as in filter pads. The transaction would combine all material assets of DEMB and the coffee business of Mondelēz. The joint venture would therefore be active across all coffee formats, including filter pads, discs and capsules for different single-serve coffee machines. Concerns were raised in relation to markets where the transaction would bring together consumer brands which competed closely against each another, as the remaining companies on the market would not be able to exert sufficient competitive pressure on the joint venture to avoid price increases.

To address these concerns, the parties offered to divest the Carte Noire business, together with manufacturing plants in France, and the Merrild business in Denmark and Latvia, as well as to license for the purpose of re-branding the Senseo brand so as to remove concerns in Austria. The Commission was also initially concerned that the joint venture could lead to higher prices and less innovation by bringing together the parties’ single-serve system of capsules and pods, as they could influence the price paid for single-serve coffee machines. However the in-depth investigation revealed these concerns were unfounded once the divestures were implemented.

The Commission approved a joint venture for online music licensing between three collective rights management organisations (“CMOs”): Britain’s PRSfM, Sweden’s STIM, and Germany’s GEMA, subject to commitments. CMOs manage the copyright of authors, performers and writers of musical works and grant licences on their behalf. There were concerns that the creation of the joint venture would render more difficult the task of other collecting societies to offer copyright administration services, by raising barriers to entry and expansion in the market. This was because the joint venture could bundle different types of copyright administration services and make it difficult for customers of its database to port their data to a competitor. Moreover, it might require its customers not to source their copyright administration services from any other third party. This would result in higher prices and worse commercial conditions for digital service providers (“DSPs”), resulting ultimately in less choice and higher prices for European consumers of digital music.

To address the Commission’s concerns, the parties committed not to use the joint venture’s control over performing rights to force their customers to purchase copyright administration services from it. In addition, the joint venture would offer key copyright administration services to other collecting societies on terms that are fair, reasonable and non-discriminatory when compared to the terms offered to the parent companies, as well as allowing collecting societies to terminate their contracts at any time (thereby allowing them to switch to other database providers). Finally, the joint venture committed not to enter into exclusive contracts with its customers for copyright administration services other than in relation to database services. The Commission considers that these commitments will ensure that the market for copyright administration services provided to CMOs and “option 3” publishers remains contestable, as they will remove PRSfM’s ability to use its performing rights to force CMOs or option 3 publishers to use the services of the joint venture and they will also enable CMOs to switch from the joint venture to another CMO that offers copyright administration services.

In July 2015, the Commission approved the acquisition of Archer Daniels Midland (“ADM”) Chocolate by Cargill, subject to conditions. The Commission opened a Phase II investigation in February 2015, focusing on competition in industrial chocolate markets. Both companies supply industrial chocolate, as well as fat-based coatings and fillings and are important suppliers of industrial chocolate to customers based around their plants in Germany. The Commission considered that the transaction would reduce competition, as the number of main competitors would be reduced from three to two, with smaller competitors not being able to exert a sufficient competitive constraint on the parties. The Commission also stated that the market structure is different in the areas around the parties’ plants in Belgium, France and the United Kingdom (the parties’ combined market share in these countries is smaller and Barry Callebaut is a much more important competitor). With regard to the cocoa market, which the Commission considered to be a related market as cocoa is used as a raw material for industrial chocolate, the Commission concluded that Cargill’s position in cocoa markets was not significant and there were sufficient alternative suppliers. Cargill offered commitments according to which it would divest ADM’s industrial chocolate plant in Mannheim to a suitable purchaser, as this plant is one of the largest ADM plants in Europe and its only industrial chocolate plant in Germany. The commitment thus ensures that an important alternative supplier will remain available.

In September 2015, following an in-depth review by the Commission, approval was granted for GE‘s acquisition of Alstom, subject to the divestiture of key elements of Alstom’s heavy-duty gas turbines business. Both companies are active in the market for heavy-duty gas turbines, which are mainly used in gas-fired power plants. The Commission expressed concern that the transaction would eliminate competition between GE and Alstom in that market, and identified the parties as two of four competitors (i.e., GE, Mitsubishi Hitachi Power Systems (MHPS), Siemens, and Alstom). The parties offered commitments in order to address the EC’s concerns, focusing mainly on the divestiture of: (i) Alstom’s heavy-duty gas turbine technology for the GT 26 and GT 36 turbines, existing upgrades and pipeline technology for future upgrades, excluding essentially only the technology for Alstom’s older GT 13 model in relation to which the Commission had no competition concerns; (ii) Alstom’s key personnel (R&D engineers); (iii) two test facilities for the GT 26 and GT 36 turbine models in Switzerland; and (iv) Alstom’s PSM servicing business based in Florida. GE proposed that Ansaldo, an Italian competitor in the heavy gas turbine market, be the purchaser for the assets. According to GE, Ansaldo already had the know-how and a factory for gas turbines and other power plants components (as steam turbines and generators) that are often sold together with heavy-duty gas turbines. The Commission concluded that the commitment would allow the purchaser to replicate Alstom’s previous role in the market, thus maintaining effective competition. Given the global reach of the parties’ activities, the Commission cooperated with the competition authorities of a number of countries, such as the DOJ in the US, along with the respective competition agencies of Canada, China, Brazil, South Africa and Israel.

In July 2015, the Commission opened an in-depth investigation into the proposed acquisition of TNT Express by FedEx. The companies are two of the four global “integrators” said to be active in the European small package delivery sector. Integrators are companies that control a comprehensive air and road delivery network in many parts of the world (including the EEA) capable of offering a broad portfolio of small package delivery services. The Commission was concerned that, on a number of European markets for international express and regular small package deliveries (for destinations within and outside the EEA), the merged entity would face insufficient competitive constraints from the remaining integrators (namely, UPS and DHL), which might eventually result in higher prices.

After an in-depth investigation, the transaction was authorised unconditionally, because FedEx and TNT were deemed to be not particularly close competitors and because the merged entity would continue to face sufficient competition from its rivals in all the relevant markets concerned. The investigation concluded that, within the EEA, FedEx still exerts a weaker competitive constraint on other integrators due to the lack of density and scale of its European network and that, outside the EEA, TNT is not a strong competitor to the other integrators. These conclusions were said to be supported by a Price Concentration Analysis, which was supposedly conducted in terms consistent with the Commission’s approach in the UPS/TNT case that was discussed in our 2014 Antitrust Merger Enforcement Update and Outlook. In addition, the Commission took into account merger-specific efficiencies put forth by the parties. The transaction was thus authorised unconditionally on 8 January, 2016.

In January 2016, the Commission cleared the acquisition of the UK-based beverage can manufacturer Rexam by the US-based Ball. Rexam is a UK-based company that is also active worldwide in beverage can manufacture. Ball is a US-based company active worldwide in the production and supply of metal packaging for beverages, food and household products and in the design, development and manufacture of aerospace systems. Rexam and Ball are, respectively, the largest and second-largest beverage can manufacturers, with both entities owning the most extensive network of plants across the EEA. The Commission opened an in-depth investigation in July 2015, due to its initial concerns that the proposed transaction might reduce competition in the beverage can and aluminum bottle manufacturing industry in the EEA. The Commission considered that the remaining two suppliers (Can-Pack and Crown) would not pose a sufficient competitive constraint on the merged entity. In addition, the Commission has found that the industry is characterised by high barriers to entry, primarily because of economies of scale. In order to address the Commission’s concerns, Ball committed to the divesture of ten plants manufacturing can bodies and two plants making can ends to a suitable purchaser, thereby ensuring that an important alternative supplier would constrain the merged entity. The divestiture consists of most of Ball’s Metal Beverage Packaging activities in Europe and two of Rexam’s can-body plants. The business to be divested will have a total manufacturing capacity in the EEA of over 18 billion cans.

In September 2015, the Commission opened an in-depth investigation into the acquisition of office supplies distributor Office Depot by its competitor Staples, both from the US. Both parties are active in the distribution of office products via a number of sales channels and are two of the three largest suppliers of office products for business customers in Europe. The Commission’s preliminary investigation indicated potential competition concerns that could lead to price increases and less choice in the market for the supply of office products to business customers through international contracts in the EEA, as well as in the market for the supply of office products to business customers through national contracts in the Netherlands and Sweden. According to the Commission, its Phase II investigation confirmed that the proposed transaction would have critically reduced competition in an already highly concentrated market. The Commission also found that barriers to enter the office supplies contract market were high. In February 2016, the Commission authorised the transaction conditional upon: (i) the divesture of the whole of Office Depot’s contract distribution business in the EEA and Switzerland; and (ii) the divesture of Office Depot’s entire business operations in Sweden. These commitments were deemed sufficient to remove in their entirety the problematic overlaps between the merging companies, with the clearance being made conditional upon the Commission approving the divestitures to a suitable purchaser.

In September 2015, the Commission opened an in-depth investigation to assess whether the proposed acquisition by Mondi of two industrial packaging plants owned by Walki raised competition concerns. Mondi and Walki are two leading suppliers of wrapping materials in the EEA. According to the Commission, the proposed acquisition could result in less choice and higher prices for consumers of wrapping materials, as it entailed the removal of a key competitor, with the remaining competitors being arguably unable to exert a sufficient competitive constraint. For this reason, Mondi and Walki started discussions with the European Commission in order to craft remedies that would eliminate competition concerns. However, as by December 2015, no workable solution had been found by the parties, with Mondi deciding to withdraw its notification and to terminate the acquisition agreement.

In January 2016, a Phase II investigation was opened in the proposed acquisition of oilfield service supplier Baker Hughes by rival Halliburton. The merging parties supply a broad range of services for the drilling and production of oil and gas wells. ‘Three months later, as discussed above, the parties abandoned the transaction in the wake of a lawsuit filed by the U.S. DOJ. The Commission’s statement following the termination of the merger noted that the merger “raised competition concerns on a very large number of markets relating to oilfield services . . . in the EEA.” At the time it was abandoned, the merger also faced opposition from the authorities in Brazil and Australia.

Refer also to the TeliaSonera/Telenor case below.

As reported in our 2015 Antitrust Merger Enforcement Update and Outlook, the Commission opened an in-depth investigation into the proposed acquisition of a majority stake (66%) in the Greek gas transmission system, DESFA, by the State Oil Company of Azerbaijan Republic (“SOCAR”) in November 2014. SOCAR operates and performs activities which include the production of natural gas and the upstream wholesale sale of gas in Greece. The entity being acquired, DESFA, owns and directs the only high-pressure gas transmission pipeline in Greece, including its only existing Liquefied natural gas (“LNG”) terminal, while mainly transporting gas through its network and not over the network facilities of competitors. As a result of SOCAR’s minority shareholdings in various gas pipelines, concerns have arisen as to whether the transaction might allow the merged entity to hinder the access of SOCAR’s competitors to the Greek gas transmission network (i.e., seeking to reduce competition on the upstream wholesale gas market) by strategically limiting investments in future expansions of import capacity, including an expansion of the LNG Terminal and the interconnection of the TAP pipeline (which has recently received EU State aid approval) with DESFA’s network. In addition, the merged entity could restrict inflows of gas into Greece by managing the gas transmission network in a discriminatory manner which favours SOCAR’s supplies over those of its competitors.

The Commission has concluded that the transposed Greek national regulatory framework would be unlikely under the circumstances to prevent the identified potential harm from occurring, thereby eliminating the ability of actual or potential competitors from competing effectively. The procedural clock for review was stopped in January 2015 and has not been resumed since that time. It is speculated that SOCAR will have to propose remedies to allow the proposed takeover to be approved by the Commission, although additional complications will have inevitably arisen in relation to SOCAR’s potential controlling interest in an EU energy operator, given its non-EU origins.

In February 2016, the Commission opened an in-depth Phase II investigation into the proposed acquisition of Arianespace by Airbus Safran Launchers (“ASL”). Arianespace is the global leader for launches of commercial satellites to geostationary transfer orbits. It has a de facto monopoly in the European markets for institutional launches and is entrusted by the European Space Agency (“ESA”) with the commercial exploitation of the two ESA-funded launchers, Ariane and Vega. ASL is a 50/50 joint venture between Airbus and Safran. Airbus is one of the leading global manufacturers of satellites, sub-systems for launchers and satellite operations for telecommunications and Earth observation satellites, while Safran is active in the provision of aerospace propulsion, aircraft equipment and defence and security.