2019 Year-End False Claims Act Update

Client Alert | January 31, 2020

The books are now closed on another decade of False Claims Act (FCA) enforcement, and what a decade it was. During the last ten years, the government recovered nearly $38 billion dollars under the FCA from companies that do business with the federal government. This ten-year total is more than double the amount recovered in the prior decade (2000 to 2009), and there are no signs of relief in sight.

This past year, as in preceding years, the government continued to rely on the FCA to combat alleged fraud and corruption by companies doing business with the government, and the Department of Justice (DOJ) obtained more than $3 billion in recoveries. This figure marks a slight uptick from 2018 and remains relatively consistent with recent recovery trends. The pipeline of new cases—which will drive recoveries in future years—also remains full. More than 780 new FCA matters were initiated in 2019, marking the tenth year in a row in which over 700 new FCA cases were filed.

In other news, while this year has seen no major legislative developments at the federal level, states continue to enact or amend false claims statutes that will enable states to receive a higher percentage share of any recoveries under such laws. Meanwhile, the courts continued to develop a body of law beneath the statutory text. During the last year, there were a number of noteworthy circuit court decisions that concern the scope of the statute’s reach in relation to government programs, materiality, causation, and even DOJ’s authority to seek dismissal of qui tam suits pursued by whistleblowers, among other important topics.

We address these and other developments in greater depth below. We first focus on enforcement activity during the fiscal year ending on September 30, 2019 and recent, noteworthy FCA settlements. Next, we turn to legislative and policy updates at the federal and state levels. Finally, we analyze significant case law developments.

As always, Gibson Dunn’s recent publications on the FCA may be found on our website, including industry-specific articles, webcasts, presentations, and practical guidance to help companies avoid or limit liability under the FCA. And, of course, we would be happy to discuss these developments—and their implications for your business—with you.

I. FCA ENFORCEMENT ACTIVITY

A. Total Recovery Amounts: 2019 Recoveries Exceed $3 Billion

The federal government recovered more than $3 billion during fiscal year 2019.[1] This amount is a slight increase from last year ($2.9 billion), and marks the eleventh straight year that total FCA recoveries have been $2.45 billion or more.[2] With the exception of 2012, 2014, and 2016, when DOJ hit high-water marks of $5 to $6 billion (driven in part by mortgage-related settlements resulting from the 2008 financial crisis), the modern era of FCA enforcement appears to have settled into a remarkable rhythm: every year, the federal government recovers somewhere in the neighborhood of $3 billion dollars using the FCA.

There are no signs of these staggering recovery amounts abating, and this trend has held regardless of the administration. Although the Trump Administration had overseen a slight downtick in the annual recoveries during each of the prior two years, this year’s recoveries reversed the trend with an increase from last year.

These recoveries, while very high in their own right, do not even include all of the recoveries attributable to false claims activity, because the DOJ figures represent only federal recoveries, not state recoveries. Yet, in FCA cases there is very often a state component to any settlement or judgment, especially in health care cases where there is a nexus with state Medicaid programs. Indeed, DOJ touted in its press release announcing these figures that “in many of these cases the department was instrumental in recovering additional millions of dollars for state Medicaid programs.”[3]

B. Qui Tam Activity

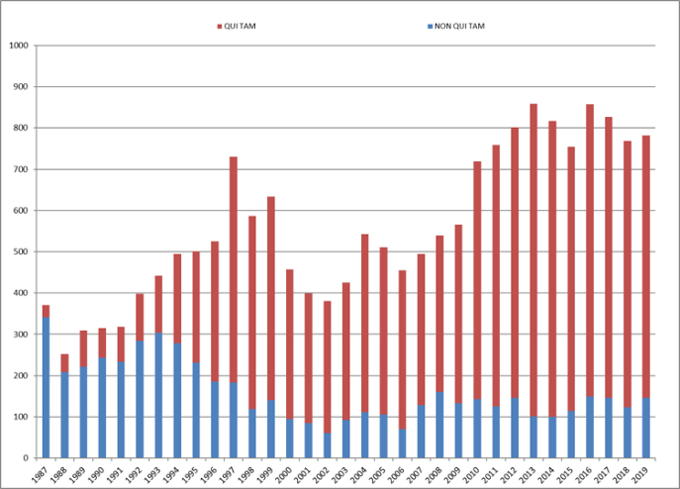

The total number of FCA cases filed each year remains remarkably high, too. This year, there were 782 new FCA cases. Of those, 146 (or 19%) were initiated by the government, while the other 636 (or 81%) were initiated by qui tam whistleblowers.[4] This is consistent with past years, as demonstrated in the chart below.

Number of FCA New Matters, Including Qui Tam Actions

Source: DOJ “Fraud Statistics – Overview” (Jan. 9, 2020)

Qui tam suits (particularly those in which the government decides to intervene) also continue to drive the bulk of the recovery amounts. This year, more than $2.2 billion of the total $3 billion in settlements and judgments resulted from lawsuits originally filed under the FCA’s qui tam provisions.[5]

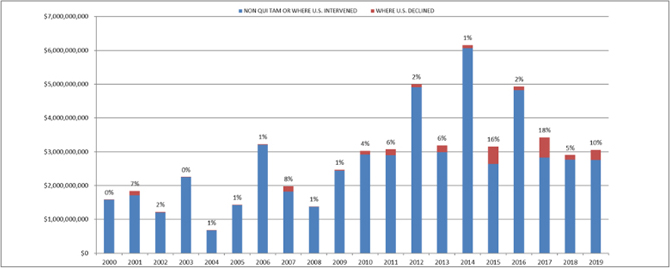

Notably, the federal government recovered $1.9 billion (63% of the total amount of recoveries) in qui tam cases where the government intervened, and $844 million (28% of total recoveries) in non-qui tam cases (i.e., cases initiated by the government, not a whistleblower). This also means the government recovered $293 million (10% of the total) in cases where DOJ declined to intervene in a qui tam, the third highest total in declined cases during the last 20 years. This is also a significant increase from last year, when recoveries in declined cases were $135 million, and signifies the ongoing threat of FCA cases even if a company can convince the government to stand down in the first instance.[6]

Settlements or Judgments in Cases Where the Government Declined Intervention as a Percentage of Total FCA Recoveries

Source: DOJ “Fraud Statistics – Overview” (Jan. 9, 2020)

C. Industry Breakdown

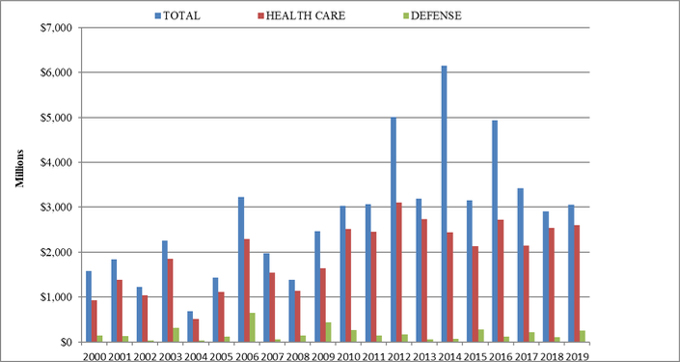

Once again, the vast majority of the federal government’s FCA recoveries came from the health care industry. This year, $2.6 billion (more than 85%) of the $3 billion in recoveries came from the health care sector, including providers, pharmaceutical companies, and medical device manufacturers. Recoveries from the defense industry accounted for another approximately $250 million.[7]

FCA Recoveries by Industry

Source: DOJ “Fraud Statistics – Overview” (Jan. 9, 2020)

Enforcement efforts in the health care industry are notable for both their breadth and depth, targeting a wide variety of companies under a wide variety of theories. As in past years, however, a large number of the FCA settlements with health care companies were premised on alleged kickbacks, including violations of the Anti-Kickback Statute (AKS) and Stark Law. This year, in particular, DOJ also continued its strong focus on companies involved with the opioid crisis, including both opioid manufacturers and companies that provided services to opioid manufacturers.[8]

Stemming from these theories and enforcement priorities, settlements with health care companies included both relatively small settlements with small businesses (e.g., a health clinic) as well as blockbuster settlements with large companies. But this latter category—big settlements with big companies—once again drove the high dollar volumes. As summarized below (and in our 2019 Mid-Year False Claims Act Update), some of the biggest settlements of 2019 included settlements of $500 million and $195 million from opioid manufacturers; and settlements of $124 million and $122 million by pharmaceutical companies in connection with charitable foundations. There were also 505 new health care FCA cases initiated in the last year,[9] making it all but certain that health care will remain the leading source of FCA recoveries in years to come.

Outside of the health care space, the theories of liability and types of companies that DOJ targeted were more disparate. Among the most notable and novel theories this year included $162 million in settlements premised on a hybrid antitrust-FCA theory (a theory we discussed in our recent webcast on antitrust enforcement in the government procurement space). In that case, in particular, South Korean companies allegedly drove up fuel prices charged to the United State military through concerted anticompetitive conduct, as we covered in our 2019 Mid-Year False Claims Act Update.[10] In another novel case, DOJ and a coalition of state attorneys general secured the first-ever FCA settlement premised on cybersecurity vulnerabilities, after a technology company failed to report or remedy flaws in the security surveillance system it sold to multiple states and the federal government. There was also an array of more traditional procurement and government contracting settlements, as discussed below.

II. NOTEWORTHY DOJ ENFORCEMENT ACTIVITY DURING THE SECOND HALF OF 2019

We summarize below some of the notable FCA settlements announced since July 2019 (we covered notable settlements and judgments from the first half of 2019 in our 2019 Mid-Year False Claims Act Update). These summaries reveal details of some of the most notable settlements and provide insight into the theories of liability and industries that have been a focus of government (and relator) enforcement efforts during the last year.

A. Health Care and Life Science Industries

- On July 11, an international consumer goods conglomerate agreed to pay the federal government $1.4 billion to resolve potential criminal and civil liability related to the marketing of an opioid addiction treatment drug. The resolution is the largest recovery by the United States related to opioid drugs, and includes forfeiture of proceeds totaling $647 million, civil settlements with the federal government and the states totaling $700 million, and an administrative resolution with the FTC for $50 million. DOJ alleged that the consumer goods conglomerate directly, or through its subsidiary pharmaceutical company, knowingly (1) promoted the sale and use of the drug to physicians who were writing prescriptions for unsafe and medically unnecessary uses; (2) promoted the sale or use of the drug to physicians and state Medicaid agencies with false claims that the drug was less susceptible to diversion, abuse, and accidental pediatric exposure than alternative drugs; and (3) took measures to delay the entry of generic competitor drugs in an attempt to control pricing of the drug.[11]

- On July 24, a Pennsylvania-based addiction treatment hospital agreed to pay almost $2.9 million to settle allegations that it violated the FCA by submitting bills to Medicare, Medicaid, and the Federal Employees Health Benefits Program for detoxification treatment services on behalf of patients who did not meet the qualifying medical criteria or lacked documentation to support their claims. The hospital also entered into a Corporate Integrity Agreement. The whistleblower will receive over $500,000 for his share of the recovery.[12]

- On August 8, a California-based medical group and one of its physicians agreed to pay more than $5 million to resolve allegations that they reported invalid diagnoses to Medicare Advantage plans and in doing so caused the plans to receive inflated payments from Medicare and increased their own share of payments received from the Medicare Advantage Organizations. The whistleblower, a former employee of the medical group, will receive approximately $850,000 as his share of the federal recovery.[13]

- On August 29, a provider of overseas health care services for the federal government agreed to pay $940,000 to resolve allegations that it overcharged TRICARE, the federal health care program for military members and their families, for aeromedical evacuation services. DOJ alleged that the company concealed discounts it received from air ambulance providers that it was required to pass along to TRICARE, resulting in inflated invoices. The whistleblower will receive $165,000 as his share of the recovery.[14]

- On September 4, a pharmaceutical company agreed to pay $15.4 million to settle allegations that it paid illegal kickbacks under the FCA and AKS by providing meals and entertainment to health care providers allegedly to induce them to prescribe the company’s drug. The whistleblowers will receive approximately $2.9 million as their share of the settlement. The government is continuing to pursue other FCA claims against the pharmaceutical company related to allegations that the company paid illegal kickbacks in the form of co-pay subsidies.[15]

- On September 18, a compounding pharmacy, two of its executives, and a private equity firm agreed to a $21.4 million settlement in total to resolve allegations that they violated the FCA through their involvement in an alleged kickback scheme to induce referrals of prescriptions that were reimbursed by TRICARE. DOJ alleged that the compounding pharmacy (1) paid kickbacks to outside “marketers” that paid telemedicine doctors to prescribe military members and their families compounded creams and vitamins that were formulated to ensure the highest reimbursement from TRICARE; (2) regularly paid patient copayments without verifying patients’ financial needs and disguised the source of the payments as a sham charitable organization; and (3) continued to seek reimbursement for prescriptions despite receiving complaints from patients that prescriptions were being written without patient consent or a valid relationship between the patient and prescriber. DOJ alleged that the private equity firm that managed the pharmacy agreed to and financed the plan to pay kickbacks to outside marketers to help generate prescriptions.[16]

- On September 25, a national provider of mobile health diagnostic services agreed to pay $8.5 million to settle allegations that it engaged in a kickback scheme with skilled nursing facilities. DOJ alleged that the diagnostic services company provided x-rays to nursing facilities at prices below fair market value in an effort to induce the facilities to refer federal health care business to the company. The settlement was announced months after the company filed for bankruptcy earlier this year. The two whistleblowers will receive a total of more than $2 million as their share of the federal recovery.[17]

- On September 26, a California-based pharmaceutical company was charged for allegedly paying kickbacks to a health care provider to prescribe the company’s drug to beneficiaries of federal health care programs. The company agreed to pay more than $108 million in criminal penalties, forfeiture, and civil damages. Of the total settlement, the pharmaceutical company agreed to pay over $95 million to resolve FCA allegations. DOJ alleged that the pharmaceutical company paid kickbacks in the form of money, honoraria, travel, and meals to health care providers of elderly patients at long-term care facilities to induce them to prescribe the company’s drug for behaviors associated with dementia patients, which is not an approved use of the drug. Three whistleblowers will share more than $17.7 million from the civil settlement. Additionally, the pharmaceutical company will pay approximately $7 million to resolve state Medicaid claims and has agreed to cooperate with indictments against four individuals alleged to be involved in the alleged kickback scheme. The company also entered into a Corporate Integrity Agreement.[18]

- On October 4, a California-based medical group, its former CEO, and several physicians paid the United States and California nearly $6.7 million to settle allegations that they billed for medically unnecessary eye exams, improperly waived Medicare co-payments, and violated other regulations. The settlement resolves claims that personnel improperly billed Medicare and Medicaid/Medi-Cal by misclassifying simpler exams as being more complex, and also waived Medicare co-payments and deductibles without proper documentation of patients’ financial hardship in an effort to receive referrals.[19]

- On October 9, a genetic testing company and its three principals agreed to pay $42.6 million in total to settle claims that they violated the FCA by paying kickbacks to physicians in exchange for laboratory referrals and for providing and billing medically unnecessary tests. The company and its principals allegedly paid the kickbacks to induce orders of pharmacogenetic tests, in return for the physicians’ participation in a clinical trial. The federal government also alleged that the company and its principals furnished tests that were not medically necessary and billed Medicare. The company also agreed to a 25-year exclusion period from participation in federal health care programs.[20]

- On October 9, an operator of kidney dialysis clinics agreed to pay $5.2 million to settle claims that the company tested dialysis patients for Hepatitis B more than medically necessary and then billed Medicare for those tests. The government alleged that the company conducted, and billed Medicare for, tests of patients it knew to be immune to Hepatitis B infection. The whistleblower will receive 27.5% of the federal government’s recovery.[21]

- On October 18, seven clinics and their owners agreed to pay the federal government more than $7.1 million to settle allegations that they violated the FCA by submitting false claims to Medicare for medically unnecessary viscosupplementation injections and knee braces. The settling clinics and related parties also entered into a Corporate Integrity Agreement with the Department of Health and Human Services Office of Inspector General that requires implementation of compliance controls and annual claims review. The whistleblower will receive $857,550 of the settlement amount.[22]

- On November 7, the U.S. Attorney for the Southern District of New York announced a civil settlement in which a medical device company and two executives agreed to pay nearly $6 million in total to settle the federal government’s FCA claims that they violated the AKS by paying surgeons to use and promote their products, resulting in false claims for payment from Medicare and Medicaid. The settlement resolves allegations that the company and the executives recruited doctors and paid them millions in consulting fees, royalties, and intellectual property purchase fees to induce them to use the company’s products. The government had intervened in a private qui tam lawsuit.[23]

- On October 28, several South Dakota-based hospital entities agreed to pay $20.25 million to settle FCA allegations that they submitted false claims to federal health care programs resulting from violations of the AKS and medically unnecessary spinal surgeries. The settlement resolves allegations that the hospital entities received repeated warnings that one of its top neurosurgeons was improperly receiving kickbacks from his use of implantable devices distributed by his physician-owned distributorship and was performing medically unnecessary procedures. The United States alleged that, despite these warnings, the companies continued to employ the physician, allowed him to profit from use of his device, and continued to submit claims for medically unnecessary procedures. The whistleblowers will receive $3.4 million from the federal government.[24]

- On November 7, a pharmaceutical company agreed to pay $20.5 million to settle allegations concerning the establishment of false and inflated Average Wholesale Prices (AWPs) for active pharmaceutical ingredients used in compound prescriptions. The settlement resolves claims that the company knowingly inflated the AWPs for its ingredients to increase the reimbursement that its pharmacy customers received from federal health care programs for using the company’s ingredients to prepare and fill specially-made compound prescriptions. The company allegedly promoted its high AWPs and profit potential as an inducement to pharmacies to purchase its ingredients. The settlement also resolved other allegations against other related entities. The whistleblowers will receive $3.7 million from the federal government.[25]

- On November 8, a hospital company and its affiliate agreed to pay $12.3 million to settle claims that it violated the FCA by submitting false claims to Medicare for procedures only partially performed or supervised by attending surgeons. The settlement resolves allegations that the hospital billed for endoscopic and robotic procedures that were insufficiently supervised by medical residents instead of the attending physician, and that it administered unnecessary and improperly documented treatments. The alleged scheme centered on the practice of the former chairman of the urology department conducting a high-revenue robotic operation in one operating room while unsupervised residents were performing surgeries on patients in the other room.[26]

- On November 15, several hospitals agreed to pay the federal government $46 million to resolve allegations arising from claims they submitted to Medicare. The settlement resolves allegations that one hospital violated the Stark Law by billing Medicare for services referred by an affiliated physician group, to whom it allegedly paid amounts under a series of compensation agreements that exceeded the fair market value for the services provided. The United States also alleged that the physician group submitted duplicative bills to Medicare for services performed by physicians’ assistants it was leasing to the hospital. The hospital also agreed to settle claims related to other self-disclosed conduct. The whistleblower will receive $5.9 million as her share of the federal government’s recovery.[27]

- On November 20, a hospital pharmacy agreed to pay $10 million to the federal government to settle claims that it violated the FCA by submitting false claims to Medicare for prescription drugs that did not meet Medicare coverage requirements. The settlement also resolves allegations that the company submitted claims to Medicare that resulted from improper remuneration provided to Medicare beneficiaries in the form of free blood glucose testing supplies and waiver of co-payments and deductibles for insulin, in violation of the AKS. The whistleblower will receive $1.9 million from the United States.[28]

- On November 26, a Massachusetts-based laboratory company agreed to pay $26.7 million to settle allegations that it violated the AKS and the Stark Law, as well as allegations that it improperly billed claims to the federal government for laboratory testing. The settlement resolves claims that the laboratory agreed to provide laboratory testing for small Texas hospitals in exchange for per-test payments. To generate more referrals for the hospitals and more money for itself, the company allegedly conspired with the hospitals’ independent marketers to make payments to referring physicians that were disguised as investment returns, but were actually based on, and offered in exchange for, the physicians’ referrals. These physicians allegedly referred patients to the Texas hospitals for laboratory testing performed by the company, which were then billed to Medicare, Medicaid, and TRICARE. The whistleblowers will receive approximately $4.4 million of the settlement.[29]

B. Government Contracting

- On July 16, a producer of electrical connectors agreed to pay $11 million to settle allegations that it violated the FCA by supplying connectors to the U.S. military that did not comply with testing protocols. DOJ alleged that the company did not conduct required periodic testing on six models of electrical connectors from 2008 to 2017. The whistleblower will receive $2.1 million from the federal government.[30]

- On July 31, a manufacturer of security camera software agreed to pay $8.6 million to settle multistate litigation alleging that the company violated the FCA and state whistleblower acts because it allegedly knowingly failed to report or remedy flaws in the security surveillance system it sold to multiple states and the federal government that made the system vulnerable to hackers. The settlement provided refunds to the federal government and sixteen states that had purchased the allegedly defective software.[31]

- On August 5, a New York-based construction company admitted to underpaying its workers on two federally funded construction projects and submitting payroll records to the federal government that falsely described the nature of the employees’ work. The construction company agreed to pay $435,000 to resolve lawsuits alleging civil fraud and FCA violations.[32]

- On August 8, a company that provides medical supplies to the Departments of Defense and Veterans Affairs agreed to pay $3.3 million to settle FCA allegations that it manufactured products in China and Malaysia, knowing that these countries did not comply with the Trade Agreements Act’s requirement that all products sold to government agencies come from countries with which the United States has a trade agreement.[33]

- On August 19, a Georgia-based producer of prefabricated modular structures agreed to pay $2.4 million to settle allegations that it violated the FCA by allegedly selling products to the Army, Department of Veterans Affairs, and General Services Administration that did not comply with electrical and structural standards. As part of the settlement agreement, the company also agreed to repair all allegedly deficient products previously supplied to the federal government.[34]

- On August 20, the majority owner and former CEO of a Virginia-based defense contractor agreed to pay $20 million to resolve allegations that it violated the FCA by fraudulently procuring federal contracts reserved for small businesses. DOJ alleged that, based on misrepresentations made by the former CEO, the company was awarded multiple small business set-aside contracts for which it was ineligible. DOJ previously resolved claims against the defense contractor and its former general counsel related to the alleged scheme, resulting in combined settlements totaling more than $36 million, making it the largest FCA recovery related to allegations of small business contracting fraud.[35]

- On August 20, an international airline headquartered in Texas agreed to pay approximately $22.1 million to resolve allegations under the FCA that the airline falsely reported the times at which it delivered United States mail to foreign postal administrations or other intended mail recipients allegedly to conceal its noncompliance with contractual obligations to the United States Postal Service.[36]

- On November 13, a development corporation agreed to pay $2.8 million and give up $16 million in potential administrative claims to settle allegations that the company fraudulently induced the Army to award the company a contract for renovation of a shipyard by falsely representing that it would perform the contract when, in fact, its Israeli parent company intended to do so, and for presenting false claims to the United States certifying that it was performing the work as the prime contractor when in fact the work was being performed by its parent company.[37]

III. LEGISLATIVE AND POLICY DEVELOPMENTS

A. Federal Developments

The second half of the year remained quiet on the legislative front, and 2019 passed without any major federal legislative developments pertaining to the FCA. But we did identify some noteworthy developments on topics that we detailed in our 2019 Mid-Year False Claims Act Update.

1. Attention on Application of the Granston Memo

Section 3730(c)(2)(A) of the FCA provides the government with authority to seek to dismiss declined qui tam cases, stating that “the Government may dismiss the action notwithstanding the objections of the person initiating the action if [1] the person has been notified by the Government of the filing of the motion and [2] the court has provided the person with an opportunity for a hearing on the motion.”

DOJ continued its more active exercise of discretion to seek dismissals pursuant to Section 3730(c)(2)(A) in 2019, guided by the Granston Memo DOJ released in January 2018, which is codified in DOJ’s Justice Manual,[38] and which we discussed most recently in this year’s Mid-Year Update. As we have explained, the Granston Memo set forth a non-exhaustive list of factors for DOJ to consider when determining whether to move to dismiss a qui tam relator’s case under Section 3730(c)(2)(A), including whether dismissal would serve the government’s interests.[39]

In the wake of the Granston Memo, lower courts have faced an increasing number of government requests to dismiss qui tam cases pursuant to the government’s authority under Section 3730(c)(2)(A). Courts have been split on the proper legal standard to apply to such requests, a question that the FCA’s text does not directly address.

Some lower courts have followed the Ninth Circuit’s Sequoia test, also adopted by the Tenth Circuit, under which the government may only dismiss if: (1) it identifies a valid government purpose; (2) a rational relation exits between the dismissal and accomplishment of that purpose; and (3) dismissal is not fraudulent, arbitrary and capricious, or illegal. United States ex rel. Sequoia Orange Co. v. Baird-Neece Packing Corp., 151 F.3d 1139, 1145 (9th Cir. 1998). Other courts have followed the D.C. Circuit’s more government-friendly test under which the government has “an unfettered” right to dismiss such that dismissals are “unreviewable” (with a possible exception for “fraud on the court”). Swift v. United States, 318 F.3d 250, 252-53 (D.C. Cir. 2003).

In a decision exploring this issue, the Third Circuit held last year that “the dismissal provisions in the FCA . . . do not guarantee an automatic in-person hearing in every instance,” notwithstanding the requirement that a court provide the “opportunity for a hearing.” United States ex rel. Chang v. Children’s Advocacy Ctr. of Del., 938 F.3d 384, 387-88 (3d Cir. 2019). There, the district court granted the government’s request to dismiss after the government asserted that it had declined the case because the relator’s allegations were “factually incorrect and legally insufficient.” Id. at 386. Although the relator opposed the request, he did not specifically request a hearing and was not provided one.

On appeal, the Third Circuit concluded that “an in-person hearing is unnecessary unless the relator expressly requests a hearing or makes a colorable threshold showing of arbitrary government action.” Id. at 388. The court also affirmed the dismissal, but—despite requests from the parties—declined to “take a side in this circuit split” regarding the proper standard to apply to the government’s dismissal requests under Section 3730(c)(2)(A). Instead, the Third Circuit concluded that the government’s request passed muster under “even the more restrictive standard” requiring a “rational relation” between dismissal and accomplishment of a valid purpose. Id. at 387.

The Third Circuit’s decision reaffirms that the government’s dismissal power under Section 3730(c)(2)(A) remains a forceful tool in its arsenal, and it highlights the challenges that relators face in opposing such requests for dismissal.

Other courts also continued to grapple with the implications of the Granston Memo during the second half of 2019.

On November 5, 2019, the U.S. District Court for the Northern District of California granted the government’s motion to dismiss the qui tam relators’ FCA claims in United States ex rel. Campie v. Gilead Sciences, Inc., No. 11-cv-00941-EMC, 2019 WL 5722618 (N.D. Cal. Nov. 5, 2019). FCA defendants and practitioners have watched this case closely in hopes of discerning more about the impact of the Granston Memo. (We have covered Campie in past updates, including here and here.) The government previewed late last year in an amicus brief before the U.S. Supreme Court that if Campie were remanded to the district court, the government would move to dismiss the case under Section 3730(c)(2)(A).[40]

The government stayed true to its word. In its motion after remand, the government asserted that dismissal of the relators’ FCA claim would serve the government’s interests by (1) preventing the relators “from undermining the considered decisions of [the U.S. Food and Drug Administration (FDA)] and [Centers for Medicare and Medicaid Services (CMS)] about how to address the conduct at issue here,” and (2) avoiding “the additional expenditure of government resources on a case that it fully investigated and decided not to pursue,” especially given that FDA already had taken regulatory actions it deemed appropriate. United States ex rel. Campie, 2019 WL 5722618 at *5. The district court granted the government’s motion, applying the test for dismissal set forth in Sequoia, under which the court examines whether the government has set forth a valid reason for dismissal, as discussed above. The court observed that the government investigated the relators’ claims for more than two years after the suit was filed, and that FDA was involved with oversight of Gilead even before the relators filed the suit, so the decision to move for dismissal was not “cursory.” Id. at *5-7. The court also rejected relators’ assertion that the government lacked sufficient basis to argue for dismissal based on the cost of continued litigation; according to the district court, the ultimate question is whether the government engaged in a meaningful consideration of cost and benefit such that its decision to seek dismissal is supported by a rational basis. Id. at *7.

It is clear that the Granston Memo and the scope of DOJ’s dismissal authority will remain important topics in the coming year. Indeed, just before the district court handed down its decision in Campie, Senator Charles E. Grassley of Iowa, Chairman of the Senate Committee on Finance, wrote to Attorney General William Barr expressing concerns with DOJ’s implementation of the Granston Memo and “efforts to dismiss greater numbers of qui tam cases for reasons that appear primarily unrelated to the merits of individual cases”—this, according to Senator Grassley, “could undermine the purpose of the False Claims Act.”[41] Senator Grassley highlighted three cases in which DOJ moved to dismiss relators’ claims and cited the cost of litigation, including Campie, United States ex rel. Polansky v. Executive Health Res., Inc., No. 12-CV-4239-MMB, 2019 WL 5790061 (E.D. Pa. Aug. 20, 2019), and United States ex rel. Cimznhca, LLC v. UCB, Inc., No. 17-CV-765-SMY-MAB, 2019 WL 1598109 (S.D. Ill. April 15, 2019), the latter of which we discussed in our 2019 Mid-Year Update. The Senator also asked DOJ to answer a number of questions about DOJ’s utilization of dismissal authority, including what role the Granston Memo played in DOJ’s decision to dismiss in Campie, whether DOJ would have moved to dismiss the case absent the Memo, and what resources have been devoted to dismissing qui tam claims since the Memo.[42] DOJ responded to Senator Grassley’s letter on December 19, stating that it shares the Senator’s view on the importance of the FCA and its qui tam provisions and that, since January 1, 2018, DOJ has moved to dismiss only 45 cases under Section 3730(c)(2)(A) out of 1,170 qui tam cases filed, or less than 4%.[43] DOJ provided some additional detail regarding the cases it sought to dismiss, including the fact that ten were filed by the same for-profit private investment group advancing the same allegations, which DOJ determined lacked merit.[44] Further, DOJ stated that it has recovered more than $60 billion under the FCA since 1986, “more than 70% of which was recovered in connection with lawsuits filed pursuant to the statute’s qui tam provisions.”[45] We will be watching carefully to see how this saga unfolds.

2. Action on Opioids

As discussed above, the government has indicated that it will make fighting the opioid crisis a priority. In the press release announcing the government’s $1.4 billion settlement with an international consumer goods conglomerate, for example, the government stated that the settlement demonstrated that it “will work tirelessly to address all facets of the opioid epidemic.”[46] In December 2019, DOJ announced that it would award more than $333 million to help communities affected by the opioid crisis, adding that DOJ has made fighting opioid addiction “a national priority.”[47] This announcement came on the heels of DOJ’s statement in July that ten districts with some of the highest drug overdose death rates in the country would focus on prosecuting every “readily available” case involving synthetic opioids,[48] and HHS’s statement in September that it had released more than $1.8 billion in funding to states to combat the opioid crisis.[49] We will continue to closely watch DOJ’s approach to opioids in the coming year.

3. Additional Developments

A few other recent government announcements bear mentioning as examples of how the current administration is thinking about the scope of FCA enforcement activity.

As we described in an alert earlier this year, DOJ announced on October 28, 2019, that it signed a memorandum of understanding with Housing and Urban Development (“HUD”) that establishes guidance for the use of the FCA in actions against Federal Housing Administration (“FHA”) lenders.[50] The memorandum makes clear that FHA requirements will be enforced primarily through HUD’s administrative proceedings, absent extenuating circumstances, and it follows a series of settlements with significant recoveries related to the FHA loan program.[51]

On October 31, 2019, HHS’s Office of the General Counsel, including Deputy General Counsel and CMS Chief Legal Officer Kelly Cleary, issued a memorandum (the “Cleary Memo”) assessing the impact of the Supreme Court’s recent opinion in Azar v. Allina Health Services, 139 S. Ct. 1804 (2019) on Medicare payment rules that form the basis of compliance actions.[52] As the Cleary Memo sets forth, the Court held that “any Medicare issuance that establishes or changes a ‘substantive legal standard’ . . . must go through notice-and-comment rulemaking.”[53] HHS cautioned in the Memo that guidance that should have been promulgated through notice-and-comment rulemaking under Allina (but was not) cannot validly be used to bring an enforcement action.[54] That is, an enforcement action cannot be predicated on a guidance document unless it was issued through notice-and-comment rulemaking.[55] HHS also acknowledged, however, that under long-standing legal principles recently articulated in the Brand Memo, which we discussed in our 2018 Mid-Year and Year-End False Claims Act Updates, even guidance documents consistent with Allina may not be used as the sole basis for an enforcement action, although they may be relevant for questions of scienter and materiality.[56]

Turning briefly to address Universal Health Services, Inc. v. United States ex rel. Escobar, 136 S. Ct. 1989 (2016), HHS stated that “the touchstone of materiality is whether the government would have paid the claims at issue had it known of a defendant’s alleged noncompliance with a law or regulation,” and that cases where a violation “may be material even if the government continued to pay with full knowledge of that violation” are “exceedingly rare” after Escobar.[57] Addressing specifically “healthcare qui tam suits” in which HHS would be the government payor in question, HHS explained that “the critical question is whether the alleged violation would have influenced our decision to pay.”[58] The Cleary Memo offers interesting insight from HHS on important FCA issues relating to materiality and the substantive standards underlying potential FCA theories.

Finally, on January 27, 2020, Deputy Associate Attorney General Stephen Cox gave a speech at the 2020 Advanced Forum on False Claims and Qui Tam Enforcement where he reviewed DOJ’s recent enforcement priorities and took a look ahead at the next year.[59] Many of the topics he addressed are covered above or in our 2019 Mid-Year Update—including opioid enforcement, the Granston Memo, reliance on subregulatory guidance, and cooperation credit. In addition to these topics, Cox also addressed the emerging issue of third-party litigation financing in qui tam actions. In class actions and other private cases, third-party financing for litigation is a common, albeit often secretive, feature of modern litigation. In his comments, Cox noted various reform efforts that are underway to address this issue, and acknowledged that third-party financing for litigation is very likely behind some qui tam suits as well. Notably, however, Cox indicated that the government often has “little insight into the extent to which they are backing the qui tam cases we are investigating, litigating, or monitoring.”[60] Given that qui tam cases are ostensibly undertaken in the government interest, this is remarkable: even the government does not know who is financing (and perhaps influencing) the direction of FCA lawsuits. Cox pledged that DOJ is “considering what, if any, interests the United States has with respect to third-party litigation financing in qui tam litigation and whether it is worth seeking some disclosure, at least to the department, of such arrangements.”[61]

B. State Developments

We detailed the HHS’s Office of Inspector General’s (HHS OIG) review and approval of state false claims statutes and other developments in state laws in our 2019 Mid-Year Update. Since then, HHS OIG also has reviewed and approved Hawaii’s false claims statute, bringing the total number of states with approved statutes to twenty-one.[62] As we explained mid-year, to receive approval, state statutes must contain provisions that are at least as effective in “rewarding and facilitating qui tam actions” as those in the federal FCA and contain civil penalties of at least an equivalent amount, among other requirements. As an incentive for implementing such requirements, states with qualifying laws can receive a 10% greater share of any damages recovered under those laws.[63] HHS OIG has yet to approve false claims statutes it has reviewed in eight states—Florida, Louisiana, Michigan, Minnesota, New Hampshire, New Jersey, New Mexico, and Wisconsin.[64]

We also reported in our 2019 Mid-Year Update on a bill passed by the California Assembly, Assembly Bill No. 1270, which would broaden the state’s false claim act considerably, including by amending the act to include consideration of “the potential effect” of an alleged false record or statement “when it is made,” and extending the act to tax-related cases where the damages pleaded exceed $200,000 and a defendant’s state-taxable income or sales exceed $500,000. The California Senate has amended the bill slightly to clarify that it would not apply retroactively to tax-related cases where the alleged false statement or record occurred before January 1, 2020, and the bill currently remains pending in the state senate.[65] The South Carolina bill that we also discussed in our mid-year update, which would enact the state’s first false claims act, likewise remains stalled in the state senate’s judiciary committee, where it has been sitting since January of 2019.[66] We will continue to watch state legislation in these states and others for signs of further movement or revisions.

IV. NOTABLE CASE LAW DEVELOPMENTS

The second half of 2019 was active on the case law front, featuring a number of notable circuit court decisions touching on various aspects of the FCA, including the statute’s materiality and causation requirements, and the statute’s reach in relation to government programs.

A. Second Circuit Holds that the FCA Applies to Federal Reserve Banks

Although broad in many respects, the FCA is cabined by its purpose of protecting the government fisc, and thus the statute expressly does not apply to efforts to defraud private entities who are not administering or using government funds. Under 31 U.S.C. § 3729(b)(2)(A), fraudulent “claims” are thus actionable when they are presented either (1) to an “officer, employee, or agent” of the United States, or (2) to a private “contractor, grantee, or other recipient” so long as a portion of the money is (a) “provided” or “reimburse[d]” by the United States and (b) used to advance its “interest[s].”

In United States v. Wells Fargo & Co., the Second Circuit grappled with this dividing line between public and private, holding that the FCA reaches allegedly fraudulent claims relating to emergency loans made by the twelve Federal Reserve Banks (FRBs). 943 F.3d 588 (2d Cir. 2019). There, relators pursued FCA claims based on allegations that certain banks had misrepresented their financial condition to the FRBs to qualify for emergency loans at favorable interest rates for which they were not, in fact, qualified. The district court concluded that the allegedly fraudulent loan requests were not “claims” within the meaning of the FCA because FRBs were not government “agents” and because the United States did not provide the money involved in the FRB emergency loan program. Id. at 594.

The Second Circuit reversed, holding that the FCA reaches claims to FRBs because they are “governmental instrumentalities operating under direct supervision of a government agency where the disbursement itself is part of a government program and where the money is created ex nihilo pursuant to congressional authority.” Id. at 605. The court held that FRBs act as “agents” of the United States in the context of emergency loans at issue because they “extend emergency loans pursuant to a statutory delegation from Congress” and are supervised by a government agency, the Federal Reserve Board, which “exercises substantial control over FRB emergency lending activities.” Id. at 599-600. The court reached its conclusion even though FRBs are not part of any executive department or agency, but instead are corporations with private banks as nominal shareholders, and even though that FRB loans are delivered in the form of credit to the borrowing bank, not lent out of treasury funds. As the Second Circuit explained, the “United States is the source of the purchasing power conferred on the banks when they borrow from the Fed’s emergency lending facilities.” Id. at 603.

Although the Second Circuit emphasized that its holding that the FCA applied was limited to “the narrow context” of claims involving FRBs with respect to “the Fed’s emergency lending facilities,” the decision may nevertheless encourage future arguments in other contexts that a broader swath of entities are “governmental instrumentalities” that fall within the statute’s scope. Id. at 605-06.

B. Eleventh Circuit Rejects FCA Liability Based on Reasonable Differences in Opinion

In United States v. AseraCare, Inc., the Eleventh Circuit held that claims cannot be “deemed false” under the FCA based solely on “a reasonable difference of opinion among physicians” as to a medical provider’s clinical judgment. 938 F.3d 1278, 1281 (11th Cir. 2019). There, the government relied on a false certification theory that claims for treatment for hospice patients were based on the provider’s representation of the patients as “terminally ill” when, according to expert physician witness testimony as to a sample subset of patients, they were, in fact, not. Id. at 1284-85. The district court vacated a jury finding in the government’s favor and entered summary judgment against it, concluding that the mere difference of opinion between physicians (the government’s expert and the provider) could not establish “falsity” as a matter of law. Id. at 1285-86.

On appeal, the Eleventh Circuit agreed, holding that when a certification to the government—including that a patient is terminally ill—is based on a physician’s clinical judgment, it cannot be “false,” and therefore is not actionable, unless the underlying clinical judgment reflects an “objective falsehood.” Id. at 1296-97. Concluding that a “mere difference of reasonable opinion” among medical providers alone does not constitute an “objective falsehood,” the court explained that plaintiffs instead “must identify facts and circumstances surrounding the patient’s certification that are inconsistent with the proper exercise of a physician’s clinical judgment. Where no such facts or circumstances are shown, the FCA claim fails as a matter of law.” Id. at 1297.

Although the Eleventh Circuit’s ruling reversed a grant of summary judgment for defendants, the opinion nonetheless articulated a standard for proving the specific alleged false claims at trial: “crucially, on remand the Government must be able to link this evidence of improper certification practices to the specific . . . claims at issue in its case. Such linkage is necessary to demonstrate both falsehood and knowledge.” Id. at 1305.

In reaching its conclusion regarding falsity, the AseraCare court considered but declined to follow decisions by both the Tenth and Sixth Circuits. Id. at 1300 n.15 (citing United States ex rel. Polukoff v. St. Mark’s Hospital, 895 F.3d 730 (10th Cir. 2018); and United States v. Paulus, 894 F.3d 267 (6th Cir. 2018)). The government had argued, unsuccessfully, that these cases established that a mere difference of medical opinion can be sufficient to show that a statement is false for FCA liability. Id. Whether AseraCare creates a circuit split of sorts on this issue will become clearer as other circuits consider it, as the AseraCare court sought expressly to distinguish Paulus and Palukoff on the grounds that the clinical standards at issue in the former case were capable of objective factual evaluation and the opinions at issue in the latter may not have been reasonable or even genuinely-held.

Although nominally a win for the government, the Eleventh Circuit’s AseraCare decision undoubtedly will reverberate in health care fraud cases of many types, given that the treating physician’s clinical judgment is the linchpin for reimbursement in many different federal health program settings. Under AseraCare, the government will have to show more than mere differences in medical opinions to prove falsity; and, the case likely will require more rigor in the use of statistical sampling to support evidence of false claims, insofar as the government will be required to establish a specific link between the government’s evidence and the particular false claims at issue.

C. Courts Continue to Interpret the FCA’s Materiality Requirement Post-Escobar

In 2019, as in past years, lower courts continued to develop the growing body of jurisprudence regarding materiality and government knowledge under the FCA in the wake of the Supreme Court’s decision in Escobar, 136 S. Ct. 1989, the landmark decision on the implied certification theory of liability. Consistent with the Supreme Court’s directive in Escobar, circuit courts continued to examine whether FCA plaintiffs have adequately alleged facts to satisfy the rigorous and demanding materiality standard at the pleadings stage, with mixed outcomes.

In Godecke v. Kinetic Concepts, Inc., the Ninth Circuit addressed materiality allegations in an FCA claim predicated on the theory that the defendants allegedly submitted claims for Medicare payment without disclosing that no written order had been received before delivery, in violation of regulatory requirements. 937 F.3d 1201 (9th Cir. 2019). As to materiality, the complaint alleged that Medicare would not have paid for the claims had it been aware of the lack of prior written orders, because that requirement was part of relevant government reimbursement rules (i.e., an express “condition of payment”). Further, according to the complaint, the requirement was not just some “paperwork issue” but instead was the result of “extensive negotiations” between the defendant and Medicare “in order to prevent fraud and abuse.” Id. at 1213. The Ninth Circuit held that these allegations indicated that noncompliance with the requirement was not “minor or insubstantial” and thus were sufficient to establish materiality (even though the allegations did not address how Medicare “has treated similar violations”). Id. at 1213-14.

In contrast, in United States ex rel. Patel v. Catholic Health Initiatives, the Fifth Circuit, in a per curiam opinion, affirmed dismissal of an FCA complaint because the alleged false claim—failure to report a change in ownership of a hospital—was not “material.” No. 18-20395, 2019 WL 6208665, at *4 (5th Cir. Nov. 20, 2019). The case involved an ownership dispute over a hospital that had originally been structured with individual doctors as partners. The hospital system then purchased or terminated their shares and then allegedly received reimbursements through an entity designated as the owner even after a court determined that, due to the partnership dispute, that entity was not really the owner. Invoking Escobar, the court held that the relator failed to adequately allege materiality. Despite the allegations as to misrepresentation of the ownership of the hospital, there was no evidence that the government “consistently refuses to pay claims” with incorrect statements regarding ownership, and the fact that the government had paid the claims at issue suggested that the government did not care who the rightful owner of the hospital was. Id. (citation omitted).

Although FCA defendants have had some success in recent years disputing materiality, cases like Patel reaffirm that challenges to allegations of materiality remain a strong potential basis for dismissal at the pleading stage.

D. Courts Continue to Analyze Rule 9(b)’s Particularity Requirement in FCA Claims

Rule 9(b) heightens the standard for pleading fraud claims, requiring that a party alleging fraud “must state with particularity the circumstances constituting fraud or mistake.” As we have noted in past updates, circuit courts have struggled with how to apply Rule 9(b)’s particularity requirement in FCA cases. This year was no exception, as is clear from two recent cases arising in the context of the Stark Act and AKS.

In United States ex rel. Bookwalter v. UPMC, the Third Circuit reversed a lower court’s decision dismissing an FCA case that involved claims predicated on productivity-based physician compensation structures. No. 18-1693, 946 F.3d 162, 166-67, 178 (3d Cir. 2019). The relator alleged that the compensation structures between physician practices and neurosurgeons resulted in improper bill-padding. The Third Circuit concluded that the relators had plausibly alleged the conduct at issue violated the Stark Law and, therefore, the claims were “false” for purposes of the FCA. Id. at 169-70. The court also explored the limits of Rule 9(b)’s heightened pleading standard, holding that the relators did not have to allege “the date, time, place, or content of every single allegedly false Medicare claim” involved in the allegedly unlawful compensation scheme. Id. at 176. Rather, the court determined that since the alleged “falsity” came not from a particular misrepresentation, but from a set of circumstances of alleged bill-padding that made a whole set of claims allegedly false, it was enough to allege the circumstances of that scheme with particularity. Id. The court focused on “[t]he sum total of the[] allegations,” which it concluded told a “detailed story about how the defendants designed a system to reward surgeons for creating and submitting false claims.” Id. at 177. This, the court reasoned, was “particular enough” to achieve Rule 9(b)’s goals of precision, substantiation of the fraud allegation, and notice to the defendant of the misconduct with which it is charged. Id. at 176-77.

In Bingham v. HCA, Inc., the Eleventh Circuit similarly explored the intersection between Rule 9(b) and FCA cases predicated on violations of the AKS and the Stark Law, but reached the opposite conclusion. 783 F. App’x 868, 870 (11th Cir. 2019). There, the relator’s FCA theory relied on his allegations the defendants allegedly provided “sweetheart deals to certain physicians who leased space in [its] medical office buildings . . . in exchange for patient referrals,” which constituted unlawful remuneration in violation of the AKS and Stark Law. Id. at 870-71. The court held, however, that the complaint was properly dismissed by the district court because it did not satisfy the heightened pleading requirements of Rule 9(b). Id. at 877. Specifically, the critical elements of the alleged kickback scheme relied entirely on “conclusory” allegations that were “based on information and belief,” and were “devoid of facts regarding the substance of [the] alleged misconduct,” including “when it occurred, and who engaged in it.” Id.

E. Fifth Circuit Clarifies Causation Standard for Mortgage Fraud Claims Under the FCA

Until recently, federal circuit courts were divided as to the standard for demonstrating proximate causation in FCA cases predicated on claims involving mortgage fraud. While the Fifth Circuit had articulated a rigorous causation standard widely viewed as difficult to meet, other circuits, including the Ninth and D.C. Circuits, employed a much more relaxed standard under which a false statement was deemed a proximate cause of the loss if the statement concerned factors that affected the likelihood of repayment, such as a borrower’s creditworthiness.

In United States v. Hodge, however, the Fifth Circuit clarified its standard, electing to step back from the “restrictive” causation standard that its prior precedent had been read to articulate, and expressly brought its standard into alignment with the more relaxed requirements imposed by other circuits. 933 F.3d 468, 474-75 (5th Cir. 2019), as revised (Aug. 9, 2019).

In Hodge, the Fifth Circuit affirmed a nearly $300 million treble damages judgment against two mortgage companies and their owner for allegedly fraudulently obtaining FHA insurance for loans that later defaulted. Id. at 472. After a five-week trial, a jury found that the defendants had misrepresented compliance with FHA underwriting guidelines and had concealed the use of unregistered branches to originate loans. Id.

On appeal, the Fifth Circuit rejected a challenge to the sufficiency of the evidence, holding that the government had shown scienter, materiality, and causation. Id. at 473-75. Specifically, evidence the defendants had continued to originate loans from unregistered branches after being notified by HUD that it was unlawful demonstrated scienter. Id. at 473. As to materiality, the court relied on the fact that HUD demanded indemnification from defendants after discovering a handful of loans were originated from unregistered branches, and later barred them from the FHA program entirely. Id. at 474. As to causation, the court held that the government’s evidence—which relied on sampling of loan files and extrapolation showing that loans from unregistered branches had higher default rates—was sufficient to show causation between the alleged misconduct and ultimate defaults (leading to alleged damages) even though it did not connect the alleged misconduct to specific loans. Id. at 475. The court concluded that “[e]ven if the defendants did not know which specific loans would eventually default, it was foreseeable that a higher percentage of them would,” which sufficiently demonstrated causation under the FCA. Id.

The decision, which allows the government to show causation at a higher level of generality using sampling, may encourage DOJ and relators to pursue similar theories in FCA claims with large numbers of alleged misstatements.

F. Several Circuits Address Causation and Other Issues in FCA Retaliation Claims

In the second half of 2019, several courts of appeals also addressed issues under the FCA’s anti-retaliation provision, which protects would-be whistleblowers from retaliation based on certain protected activity undertaken in furtherance of a potential FCA claim. We briefly summarize these decisions below.

In a matter of first impression for FCA retaliation claims before the Tenth Circuit, the court joined several other circuits in holding that when there is no direct evidence of retaliation, the McDonnell Douglas framework applies to FCA retaliation claims. Miller v. Inst. for Def. Analyses, No. 19-1110, 2019 WL 6997900, at *4 (10th Cir. Dec. 20, 2019) (citing McDonnell Douglas Corp. v. Green, 411 U.S. 792 (1973)). Under this three-step framework, “a plaintiff first must set forth a prima facie case of retaliation,” second, “the burden then shifts to the defendant to articulate a legitimate, nonretaliatory reason for the adverse employment action,” and then third, “if the employer produces evidence of a legitimate nonretaliatory reason, the plaintiff must assume the further burden of showing that the proffered reason is a pretext calculated to mask retaliation.” Id. at *4-5 (citations omitted). The Tenth Circuit affirmed a grant of summary judgment in the defendant’s favor, holding that although, at the first step, a short “temporal proximity between [a plaintiff’s] protected conduct and the adverse action” alone can be “relied on to prove causation,” the nearly five-month gap the plaintiff identified was insufficient. Id. at *5-6.

The Fifth Circuit, in a pair of decisions, likewise addressed the proper standard for analyzing causation in FCA retaliation claims under the McDonnell Douglas framework. In Garcia v. Professional Contract Services, the Fifth Circuit similarly ruled that in the first step of McDonnell Douglas, “a plaintiff can meet his burden of causation simply by showing close enough timing between his protected activity and his adverse employment action,” but that at the third step (the pretext stage), a “heightened but-for causation requirement applies.” 938 F.3d 236, 243 (5th Cir. 2019). Applying this framework to a retaliation claim brought by an employee with some responsibilities for ensuring “the company was complying with its contracts with the government,” the court reversed a grant of summary judgment in the defendants’ favor at the third step, holding that the plaintiff had pointed to enough evidence of pretext—including the temporal proximity between the alleged protected activity and termination of less than three months, as well as other factors, such as disparate treatment of a similarly situated employee—to survive summary judgment. Id. at 238, 244.

In Musser v. Paul Quinn College, however, the Fifth Circuit affirmed a grant of summary judgment for the defendant at the third step in a claim brought by an independent contractor “tasked with providing financial and accounting services” as an interim controller to defendant, where the plaintiff’s alleged evidence of retaliation did not include “other significant evidence of pretext” apart from temporal proximity, and thus fell “short of the . . . evidence described in Garcia.” 944 F.3d 557, 559-64 (5th Cir. 2019).

Finally, a split of the D.C. Circuit held that the plaintiff-veterinarian’s termination, allegedly in retaliation for complaints about the defendant’s violations of conditions of federal funding in animal research, could support an FCA retaliation claim even where the plaintiff’s warnings “did not accuse the [defendant] of fraud in terms.” Singletary v. Howard Univ., 939 F.3d 287, 297-98 (D.C. Cir. 2019). The majority held that despite the lack of direct accusations of fraud, the plaintiff had alleged a reasonable belief of an FCA violation because she alleged that the university was required to make annual certifications of compliance, and that her complaints “coincided” with the annual reporting period. Id. According to the dissent, however, because the defendant was never warned “about possible fraud,” the university had no reason to think the plaintiff was reporting in an effort to stop fraud. Id. at 307. The dissent further held that the claim was not viable because mere violations of contract or regulation do not equate to fraud unless they are material to a false claim for money, under Escobar—a topic the majority declined to address. Id.

V. CONCLUSION

As always, Gibson Dunn will continue to monitor these developments and others in the FCA space and stands ready to answer any questions you may have. We will report back to you on the latest news mid-year, in early July.

______________________

[1] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Justice Department Recovers over $3 Billion from False Claims Act Cases in Fiscal Year 2019 (Jan. 9, 2020), https://www.justice.gov/opa/pr/justice-department-recovers-over-3-billion-false-claims-act-cases-fiscal-year-2019 [hereinafter DOJ FY 2019 Recoveries Press Release].

[2] See U.S. Dep’t of Justice, Fraud Statistics Overview (Jan. 9, 2020), https://www.justice.gov/opa/press-release/file/1233201/download [hereinafter DOJ FY 2019 Stats].

[3] DOJ FY 2019 Recoveries Press Release.

[4] See DOJ FY 2019 Stats.

[5] Id.

[6] Id.

[7] Id.

[8] DOJ FY 2019 Recoveries Press Release.

[9] See DOJ FY 2019 Stats.

[10] DOJ FY 2019 Recoveries Press Release.

[11] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Justice Department Obtains $1.4 Billion from Reckitt Benckiser Group in Largest Recovery in a Case Concerning an Opioid Drug in United States History (Jul. 11, 2019), https://www.justice.gov/opa/pr/justice-department-obtains-14-billion-reckitt-benckiser-group-largest-recovery-case.

[12] See Press Release, U.S. Atty’s Office for the E. Dist. of Pa., Eagleville Hospital Pays $2.85 Million to Resolve Allegations of Improper Billing for Detox Treatment (Jul. 24, 2019), https://www.justice.gov/usao-edpa/pr/eagleville-hospital-pays-285-million-resolve-allegations-improper-billing-detox.

[13] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Medicare Advantage Provider and Physician to Pay $5 Million to Settle False Claims Act Allegations (Aug. 8, 2019), https://www.justice.gov/opa/pr/medicare-advantage-provider-and-physician-pay-5-million-settle-false-claims-act-allegations.

[14] See Press Release, U.S. Atty’s Office for the E. Dist. of Pa., Defense Contractor to Pay $940,000 to Resolve Allegations of Withholding Discounts from TRICARE (Aug. 29, 2019), https://www.justice.gov/usao-edpa/pr/defense-contractor-pay-940000-resolve-allegations-withholding-discounts-tricare.

[15] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Drug Maker Mallinckrodt Agrees to Pay Over $15 Million to Resolve Alleged False Claims Act Liability for “Wining and Dining” Doctors (Sept. 4, 2019), https://www.justice.gov/opa/pr/drug-maker-mallinckrodt-agrees-pay-over-15-million-resolve-alleged-false-claims-act-liability.

[16] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Compounding Pharmacy, Two of Its Executives, and Private Equity Firm Agree to Pay $21.36 Million to Resolve False Claims Act Allegations (Sept. 18, 2019), https://www.justice.gov/opa/pr/compounding-pharmacy-two-its-executives-and-private-equity-firm-agree-pay-2136-million.

[17] See Press Release, U.S. Atty’s Office for the E. Dist. of Pa., Trident USA Health Services LLC to Pay $8.5 Million to Resolve False Claims Act Liability for Alleged Kickback Scheme (Sept. 25, 2019), https://www.justice.gov/usao-edpa/pr/trident-usa-health-services-llc-pay-85-million-resolve-false-claims-act-liability.

[18] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Pharmaceutical Company Targeting Elderly Victims Admits to Paying Kickbacks, Resolves Related False Claims Act Violations (Sept. 26, 2019), https://www.justice.gov/opa/pr/pharmaceutical-company-targeting-elderly-victims-admits-paying-kickbacks-resolves-related.

[19] See Press Release, U.S. Atty’s Office for the C. Dist. of Cal., Eye Doctor Group, Physicians Pay $6.65 Million to Settle Allegations They Submitted Fraudulent Bills to Medicare and Medicaid (Oct. 4, 2019), https://www.justice.gov/usao-cdca/pr/eye-doctor-group-physicians-pay-665-million-settle-allegations-they-submitted.

[20] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Genetic Testing Company and Three Principals Agree to Pay $42.6 Million to Resolve Kickback and Medical Necessity Claims (Oct. 9, 2019), https://www.justice.gov/opa/pr/genetic-testing-company-and-three-principals-agree-pay-426-million-resolve-kickback-and.

[21] See Press Release, U.S. Atty’s Office for the Dist. of Mass., Fresenius Agrees to Pay $5.2 Million to Resolve Allegations that it Overbilled Medicare for Hepatitis B Tests (Oct. 9, 2019), https://www.justice.gov/usao-ma/pr/fresenius-agrees-pay-52-million-resolve-allegations-it-overbilled-medicare-hepatitis-b.

[22] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Former Osteo Relief Institutes and Their Owners to Pay Over $7.1 Million to Resolve Allegations of Unnecessary Knee Injections and Braces (Oct. 18, 2019), https://www.justice.gov/opa/pr/former-osteo-relief-institutes-and-their-owners-pay-over-71-million-resolve-allegations.

[23] See Press Release, U.S. Atty’s Office for the S. Dist. of N.Y., Manhattan U.S. Attorney Announces Settlement Of Lawsuit Against Spinal Implant Company, Its CEO, And Another Executive For Paying Millions Of Dollars In Kickbacks To Surgeons (Nov. 7, 2019), https://www.justice.gov/usao-sdny/pr/manhattan-us-attorney-announces-settlement-lawsuit-against-spinal-implant-company-its.

[24] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Sanford Health Entities to Pay $20.25 Million to Settle False Claims Act Allegations Regarding Kickbacks and Unnecessary Spinal Surgeries (Oct. 28, 2019), https://www.justice.gov/opa/pr/sanford-health-entities-pay-2025-million-settle-false-claims-act-allegations-regarding.

[25] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Compound Ingredient Supplier Fagron Holding USA LLC to Pay $22.05 Million to Resolve Allegations of False and Inflated Average Wholesale Prices for Ingredients Used in Compound Prescriptions (Nov. 7, 2019), https://www.justice.gov/opa/pr/compound-ingredient-supplier-fagron-holding-usa-llc-pay-2205-million-resolve-allegations.

[26] See Stipulation and Order of Settlement, U.S. ex rel. Markelson v. Lenox Hill Hospital et al., No. 1:17-cv-07986 (S.D.N.Y. Nov. 8, 2019)

[27] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, California Health System and Surgical Group Agree to Settle Claims Arising from Improper Compensation Agreements (Nov. 15, 2019), https://www.justice.gov/opa/pr/california-health-system-and-surgical-group-agree-settle-claims-arising-improper-compensation.

[28] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Kentucky Hospital to Pay over $10 Million to Resolve False Claims Act Allegations (Nov. 20, 2019), https://www.justice.gov/opa/pr/kentucky-hospital-pay-over-10-million-resolve-false-claims-act-allegations.

[29] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Laboratory to Pay $26.67 Million to Settle False Claim Act Allegations of Illegal Inducements to Referring Physicians (Nov. 26, 2019), https://www.justice.gov/opa/pr/laboratory-pay-2667-million-settle-false-claims-act-allegations-illegal-inducements-referring.

[30] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, ITT Cannon to Pay $11 Million to Settle False Claims Allegations for Untested Electrical Connectors (Jul. 16, 2019), https://www.justice.gov/opa/pr/itt-cannon-pay-11-million-settle-false-claims-allegations-untested-electrical-connectors.

[31] See Press Release, NY State Office of the Attorney General, Attorney General James Secures $6 Million From Cisco Systems In Multistate Settlement (Aug. 1, 2019), https://ag.ny.gov/press-release/2019/attorney-general-james-secures-6-million-cisco-systems-multistate-settlement; Mark Chandler, Executive Platform: A Changed Environment Requires a Changed Approach, Cisco Blogs (Jul. 31, 2019), https://blogs.cisco.com/news/a-changed-environment-requires-a-changed-approach.

[32] See Press Release, U.S. Atty’s Office for the S. Dist. of NY, Manhattan U.S. Attorney Announces Settlement With Construction Company For Underpaying Workers And Submitting False Payroll Reports On Two Federally Funded Projects (Aug. 5, 2019), https://www.justice.gov/usao-sdny/pr/manhattan-us-attorney-announces-settlement-construction-company-underpaying-workers-and.

[33] See Press Release, U.S. Atty’s Office for the E. Dist. of PA, Defense Contractor to Pay $3.3M to Resolve False Claims Act Allegations (Aug. 8, 2019), https://www.justice.gov/usao-edpa/pr/defense-contractor-pay-33m-resolve-false-claims-act-allegations.

[34] See Press Release, U.S. Atty’s Office for the S. Dist. of GA, Government Settles Alleged False Claims Act Violations with Sesolinc Group (Aug. 19, 2019), https://www.justice.gov/usao-sdga/pr/government-settles-alleged-false-claims-act-violations-sesolinc-group.

[35] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Former CEO of Virginia-Based Defense Contractor Agrees to Pay $20 Million to Settle False Claims Act Allegations Related to Fraudulent Procurement of Small Business Contracts (Aug. 20, 2019), https://www.justice.gov/opa/pr/former-ceo-virginia-based-defense-contractor-agrees-pay-20-million-settle-false-claims-act.

[36] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, American Airlines Inc. Agrees To Pay $22 Million to Settle False Claims Act Allegations for Falsely Reporting Delivery Times of U.S. Mail Transported Internationally (Aug. 20, 2019), https://www.justice.gov/opa/pr/american-airlines-inc-agrees-pay-22-million-settle-false-claims-act-allegations-falsely.

[37] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, ABS Development Corporation Agrees to Pay $2.8 Million to Settle False Claims Act Allegations and to Waive Administrative Claims (Nov. 13, 2019), https://www.justice.gov/opa/pr/abs-development-corporation-agrees-pay-28-million-settle-false-claims-act-allegations-and.

[38] U.S. Dep’t of Justice, Justice Manual, Section 4-4.111.

[39] See Memorandum, U.S. Dep’t of Justice, Factors for Evaluating Dismissal Pursuant to 31 U.S.C. 3730(c)(2)(A) (Jan. 10, 2018), https://assets.documentcloud.org/documents/4358602/Memo-for- Evaluating-Dismissal-Pursuant-to-31-U-S.pdf.

[40] Brief for the United States as Amicus Curiae at 15, Gilead Sciences, Inc. v. United States ex rel. Campie, 139 S. Ct. 783 (2019).

[41] Letter from Sen. Charles E. Grassley to Att’y Gen. William Barr at 1 (Sept. 4, 2019), https://www.grassley.senate.gov/sites/default/files/documents/2019-09-04%20CEG%20to%20DOJ%20%28FCA%20dismissals%29.pdf.

[42] Id. at 5-6.

[43] Letter from Assistant Att’y Gen. Stephen E. Boyd, Office of Legis. Affairs, U.S. Dep’t of Justice, to Sen. Charles E. Grassley at 1 (Dec. 19, 2019), https://www.grassley.senate.gov/sites/default/files/2019-12-19%20DOJ%20to%20CEG%20%28FCA%20dismissals%29.pdf.

[44] Id. at 2.

[45] Id. at 1.

[46] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Justice Department Obtains $1.4 Billion from Reckitt Benckiser Group in Largest Recovery in a Case Concerning an Opioid Drug in United States History (Jul. 11, 2019), https://www.justice.gov/opa/pr/justice-department-obtains-14-billion-reckitt-benckiser-group-largest-recovery-case.

[47] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Justice Department Awards More than $333 Million to Fight Opioid Crisis (Dec. 13, 2019), https://www.justice.gov/opa/pr/justice-department-awards-more-333-million-fight-opioid-crisis.

[48] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Justice Department Announces Results in Fight Against the Opioid Crisis At One Year Mark of Operation S.O.S. (July 16, 2019), https://www.justice.gov/opa/pr/justice-department-announces-results-fight-against-opioid-crisis-one-year-mark-operation-sos.

[49] See Press Release, U.S. Dep’t of Health & Human Servs., Trump Administration Announces $1.8 Billion in Funding to States to Continue Combating Opioid Crisis (Sept. 4, 2019), https://www.hhs.gov/about/news/2019/09/04/trump-administration-announces-1-8-billion-funding-states-combating-opioid.html.

[50] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Departments of Justice and Housing and Urban Development Sign Interagency Memorandum on the Application of the False Claims Act (Oct. 28, 2019), https://www.justice.gov/opa/pr/departments-justice-and-housing-and-urban-development-sign-interagency-memorandum-application.

[51] See, e.g., U.S. Dep’t of Justice, Recent Accomplishments of the Housing and Civil Enforcement Section (January 7, 2020), https://www.justice.gov/crt/recent-accomplishments-housing-and-civil-enforcement-section.

[52] See Memorandum, Dep’t of Health & Human Servs., Dep. Gen. Counsel & CMS Chief Legal Officer Kelly M. Cleary & Dep. Gen. Counsel Brenna E. Jenny, Impact of Allina on Medicare Payment Rules (Oct. 31, 2019).

[53] Id.

[54] Id.

[55] Id.

[56] Id.

[57] Id.

[58] Id.

[59] See Press Release, Office of Pub. Affairs, Deputy Associate Attorney General Stephen Cox Provides Keynote Remarks at the 2020 Advanced Forum on False Claims and Qui Tam Enforcement (Jan. 27, 2020), https://www.justice.gov/opa/speech/deputy-associate-attorney-general-stephen-cox-provides-keynote-remarks-2020-advanced.

[60] Id.

[61] Id.

[62] Dep’t of Health & Human Servs., Office of Inspector Gen., State False Claims Act Reviews, https://oig.hhs.gov/fraud/state-false-claims-act-reviews/index.asp.

[63] Id.

[64] Id.

[65] AB-1270 False Claims Act, California Legislative Information (Aug. 13, 2019), https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201920200AB1270, https://leginfo.legislature.ca.gov/faces/billStatusClient.xhtml?bill_id=201920200AB1270.

[66] See S. 40, A Bill to Amend Title 15 of the 1976 Code, by Adding Chapter 85, to Enact the “South Carolina False Claims Act” (123d Session), https://www.scstatehouse.gov/sess123_2019-2020/bills/40.htm.

The following Gibson Dunn lawyers assisted in preparing this client update: Stuart Delery, Jim Zelenay, John Partridge, Jon Phillips, Joseph Warin, Joseph West, Robert Blume, Ryan Bergsieker, Karen Manos, Charles Stevens, Winston Chan, Andrew Tulumello, Benjamin Wagner, Alexander Southwell, Reed Brodsky, Robert Walters, Monica Loseman, Geoffrey Sigler, Sean Twomey, Reid Rector, Alli Chapin, Jeremy Ochsenbein, Meghan Dunn, Jennifer Bracht, and Julie Hamilton.