2019 Year-End FCPA Update

Client Alert | January 6, 2020

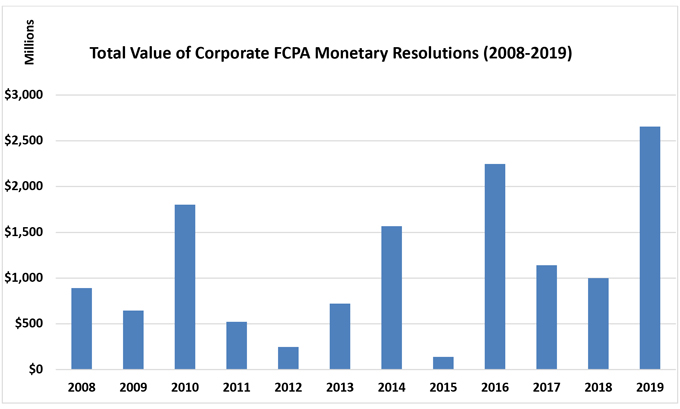

2019 was, by many measures, the most significant year ever in Foreign Corrupt Practices Act (“FCPA”) enforcement. More than $2.6 billion in corporate fines sets a new high-water mark, driven by the two largest corporate resolutions in the statute’s history. Fifty-four FCPA enforcement actions, or 73 total cases including ancillary actions, brought by the FCPA Units of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”), each rank second only to 2010 in the annals of FCPA enforcement. Four FCPA and FCPA-related trials is the most ever. Add on top of this new FCPA enforcement policy guidance from DOJ, an expanding body of case law on the FCPA and related offenses, among many other developments, and there is a strong argument that international anti-corruption enforcement has never been more robust.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2019, as well as the trends we see from this activity. We are privileged to help our clients navigate these challenges daily and are honored to have once again been ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices, as well as The American Lawyer’s “Litigation Department of the Year” ranking of the nation’s top litigation practices. For more analysis on the year in anti-corruption enforcement, compliance, and corporate governance developments, please join us for our upcoming complimentary webcast presentations: 10th Annual Webcast: FCPA Trends in Emerging Markets on January 8 (to register, click here) and 16th Annual Webcast: Challenges in Compliance and Corporate Governance on January 23 (to register, click here).

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) or American Depository Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

Foreign corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of DOJ have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent among these “FCPA-related” charges is money laundering—a generic shorthand term for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain “specified unlawful activities,” including corruption under the FCPA or laws of foreign nations, through the U.S. banking system. Although this has not always been the case, DOJ now frequently deploys the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is thus increasingly commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations. DOJ has even used these foreign officials to cooperate in ongoing investigations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

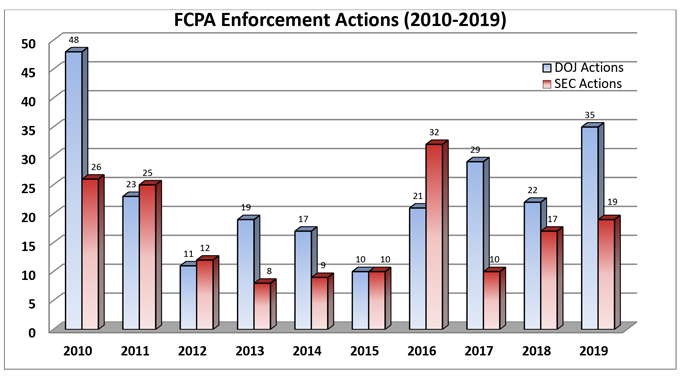

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during the past 10 years.

| ||||||||||||||||||||||||||||||||||||||||

|

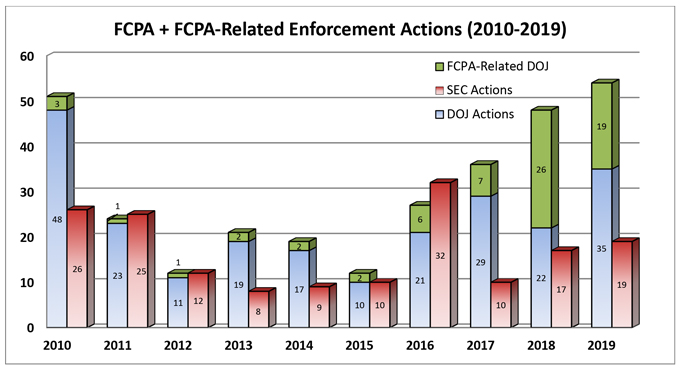

As impressive as these numbers are in their own right, as we noted in our 2018 Year-End FCPA Update these FCPA enforcement statistics increasingly tell only a part of the story in international anti-corruption enforcement by U.S. prosecutors and regulators. Last year, for the first time in the modern enforcement era, DOJ’s FCPA Unit brought more corruption cases under related statutes, such as money laundering, than it did under the FCPA. In 2019, criminal FCPA enforcement actions were back out in front with 35, but the additional subset of 19 FCPA-related criminal enforcement actions continued a trend of substantial extra-FCPA enforcement by DOJ. As can be seen from the below table and graph, which includes non-FCPA charges brought by the FCPA Unit in international corruption investigations, 2019 was the most prolific year in the history of foreign anti-corruption enforcement by DOJ’s FCPA Unit.

| ||||||||||||||||||||||||||||||||||||||||

|

2019 FCPA + FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not only to report on the year’s FCPA enforcement activity but also to distill the trends that stem from these actions. Given the long incubation period of most FCPA cases, enforcement trends often have a multi-year trajectory. 2019 was no different, as the year’s FCPA enforcement activity sounded in many of the themes we have observed over recent years. Although one could reasonably argue for the inclusion of others, we have identified six key enforcement trends for 2019 that we believe stand out from the rest:

- A new high-water mark for corporate FCPA financial penalties;

- FCPA clusters;

- DOJ issues declinations despite aggravating factors;

- SEC continues to invoke aggressive theories of FCPA liability;

- DOJ continues to bring a significant number of “FCPA-related” charges; and

- Several FCPA defendants go to trial.

A New High-Water Mark for Corporate FCPA Financial Penalties

We consistently advise against overreliance upon any single year’s enforcement statistics, lest aberration be confused with trend. That said, significant enforcement activity in 2019 pushed the FCPA to new limits. Four corporate FCPA enforcement actions included combined financial penalties of more than $200 million each. Two companies entered into resolutions earlier in the year for $282.6 million and $231.7 million. In other years, these might stand out as the most significant financial resolutions, but in 2019 they were overshadowed as the record for highest FCPA resolution was set two times over.

On March 6 and 7, 2019, the SEC and DOJ announced a combined $850 million FCPA resolution with Russian telecommunications company and U.S. issuer Mobile TeleSystems PJSC (“MTS”). The charges arise from the long-running investigation of alleged corrupt payments to Gulnara Karimova, daughter of the late Uzbek president, to facilitate access to the Uzbek telecom market. Similar conduct arising from the same investigation previously led to FCPA resolutions with VimpelCom Ltd. and Telia Company AB as reported in our 2016 Mid-Year and 2017 Year-End FCPA Updates, respectively. With respect to MTS, the government alleged that the company and its Uzbek subsidiary paid approximately $420 million in bribes to Karimova between 2004 and 2012 through shell companies, charities, sponsorships, and inflated prices paid to purchase shares in a company owned by Karimova.

To resolve the criminal charges, MTS entered into a deferred prosecution agreement with DOJ on charges of conspiracy to violate the FCPA’s anti-bribery and books-and-records provisions and a substantive violation of the internal controls provision, and its Uzbek subsidiary pleaded guilty to one count of conspiracy to violate the anti-bribery and books-and-records provisions. To resolve the civil charges, MTS consented to a cease-and-desist proceeding by the SEC alleging violations of the anti-bribery, books-and-records, and internal controls provisions. With offsetting credits, MTS paid $750 million to resolve the criminal FCPA charges and $100 million to resolve the civil FCPA charges, and it agreed to retain an independent compliance monitor for a three-year term.

Simultaneous with the corporate resolutions, DOJ announced unsealed indictments charging Karimova with one count of money laundering conspiracy and Bekhzod Akhmedov, a former MTS Uzbek subsidiary general director, with one count of FCPA conspiracy, two substantive FCPA violations, and one count of money laundering conspiracy. According to the indictments, in the early 2000s, the pair agreed that Akhmedov would facilitate bribe payments to Karimova, totaling more than $865 million over the course of the scheme, in exchange for her help facilitating the entry into the local telecom market for various companies. Neither defendant has yet made an appearance in U.S. court, with Karimova reportedly in Uzbek custody serving a prison term on local corruption charges.

MTS held the top spot as the largest corporate FCPA monetary resolution in history for nine months, until on December 6, 2019, DOJ and the SEC announced that Telefonaktiebolaget LM Ericsson agreed to pay more than $1 billion to resolve investigations into alleged FCPA violations in China, Djibouti, Indonesia, Kuwait, Saudi Arabia, and Vietnam. According to the charging documents, between 2000 and 2017, Ericsson allegedly entered into sham contracts with third-party agents for the payment of “corporate marketing fees” that were in reality used to facilitate corrupt payments to government officials, all with the knowledge of “high-level executives.”

To resolve criminal charges of conspiring to violate the FCPA anti-bribery, books-and-records, and internal controls provisions, Ericsson entered into a three-year deferred prosecution agreement with DOJ, pursuant to which it agreed to pay a criminal penalty of $520,650,432 and to retain a compliance monitor for three years. Ericsson’s Egyptian subsidiary also pleaded guilty to one count of conspiracy to violate the anti-bribery provisions.

To resolve the civil case with the SEC, Ericsson consented to an injunction from future violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions, and agreed to pay nearly $539,920,000 in disgorgement plus prejudgment interest, bringing the total financial resolution to $1,060,570,432. The SEC’s resolution also includes the same requirement for a compliance monitor with a three-year term.

Together with the other enforcement activity from 2019, corporate fines in FCPA cases topped $2.5 billion for the first time in the history of the statute. A chart tracking the total value of corporate FCPA monetary resolutions by year, since the advent of blockbuster fines brought in with the 2008 Siemens resolution, follows:

The Ericsson and MTS matters now hold the Number 1 and 2 positions on the Corporate FCPA Top 10 list, respectively, which currently reads as follows:

|

No. |

Company* |

Total Resolution |

DOJ Component |

SEC Component |

Date |

|

1 | Ericsson | $1,060,570,432 | $520,650,432 | $539,920,000 | 12/06/2019 |

|

2 | Mobile TeleSystems | $850,000,000 | $750,000,000 | $100,000,000 | 03/07/2019 |

|

3 | Siemens** | $800,000,000 | $450,000,000 | $350,000,000 | 12/15/2008 |

|

4 | Alstom | $772,290,000 | $772,290,000 | — | 12/22/2014 |

|

5 | KBR/Halliburton | $579,000,000 | $402,000,000 | $177,000,000 | 02/11/2009 |

|

6 | Teva | $519,000,000 | $283,000,000 | $236,000,000 | 12/22/2016 |

|

7 | Telia*** | $483,103,972 | $274,603,972 | $208,500,000 | 09/21/2017 |

|

8 | Och-Ziff | $412,000,000 | $213,000,000 | $199,000,000 | 09/29/2016 |

|

9 | BAE Systems**** | $400,000,000 | $400,000,000 | — | 02/04/2010 |

|

10 | Total S.A. | $398,200,000 | $245,200,000 | $153,000,000 | 05/29/2013 |

* Our figures do not include the 2018 FCPA case against Petróleo Brasileiro S.A. – Petrobras (“Petrobras”), even though some sources have reported the resolution as high as $1.78 billion, because the first-of-its kind resolution negotiated by Gibson Dunn offset the vast majority of payments against a shareholders’ class action lawsuit and foreign regulatory proceeding, leaving only $170.6 million fairly attributable to the DOJ / SEC FCPA resolution.

** Siemens’s U.S. FCPA resolutions were coordinated with a €395 million ($569 million) anti-corruption settlement with the Munich Public Prosecutor.

*** The combined amount of U.S., Dutch, and Swedish financial penalties was $965.6 million.

**** BAE pleaded guilty to non-FCPA conspiracy charges of making false statements and filing false export licenses, but the alleged false statements concerned the existence of the company’s FCPA compliance program, and the publicly reported conduct concerned alleged corrupt payments to foreign officials.

FCPA Clusters

A core platform of the stratospheric success of DOJ and SEC FCPA enforcement over the past 15 years is the significant leverage the agencies have employed to turn singular investigations into multiple—sometimes myriad—enforcement actions. One way to do this is to charge both the company and one or more of its employees or agents. Another is to use one entity at the center of a particular activity as a hub and then proceed out to each of the spokes—prominent examples include the “Panalpina” oil services cases of 2010 and the Petrobras “Operation Car Wash” investigation that has netted FCPA charges in each of the past four years. Yet a third method is to focus on a particular industry practice, with the “princeling” hiring of children of government officials for internships in the banking sector being a prominent recent example. Of whichever variety, the FCPA Unit prosecutors and regulators continue to follow the evidence and efficiently churn out new cases in clusters.

A great example of DOJ leveraging a relatively contained, one-country fact pattern into many cases over numerous years, extending into 2019, is Alstom S.A.’s alleged corrupt winning of the Taharan power plant contract in Indonesia. We first reported on this investigation in our 2013 Mid-Year FCPA Update, when charges were filed against former Alstom executives David Rothschild, Frederic Pierucci, William Pomponi, and Lawrence Hoskins. Corporate cases against Alstom (which extended well beyond Indonesia) and Marubeni Corporation followed the next year, as reported in our 2014 Year-End and 2014 Mid-Year FCPA Updates, respectively. In 2019, DOJ won a trial conviction of Hoskins, as covered below, but other new charges filed during the summer were against former Alstom Indonesia Country President Edward Thiessen and Regional Sales Manager Larry Puckett, each of whom had entered into plea agreements years ago, which remained non-public until their cooperation completed with testimony at Hoskins’s trial. This brings the number of defendants associated with this investigation to eight, and underscores our periodic point that even as we report on public prosecutions, there may be in any given year a number of additional cases pending under seal.

As noted above, Brazil’s Operation Car Wash is among the most prolific anti-corruption investigations of all time and a perfect example of a “hub and spoke” approach to FCPA matters. In 2019, there were four new FCPA cases that, while separate, all arose out of the same broader investigation:

- On November 22, 2019, DOJ announced an FCPA resolution with Korean engineering company Samsung Heavy Industries Co. Ltd. arising from the company’s alleged provision of $20 million to an intermediary, between 2007 and 2013, while knowing that some or all of that amount would be paid to officials at Petrobras. To resolve FCPA anti-bribery conspiracy charges, Samsung Heavy Industries entered into a deferred prosecution agreement with DOJ and agreed to pay a $75.5 million criminal fine, half of which is to be credited to a parallel resolution the company reached with Brazilian authorities.

- On November 20, 2019, DOJ announced the unsealing of a February indictment of Brazilian citizen Jose Carlos Grubisich, a former CEO and board member of Brazilian petrochemical company and U.S. ADS-issuer Braskem S.A. (which itself reached the first FCPA resolution arising from Operation Car Wash, together with parent company Odebrecht S.A., as covered in our 2016 Year-End FCPA Update). DOJ alleges that Grubisich directed corrupt payments, caused the falsification of Braskem’s records including by making false SOX sub-certifications, and engaged in a money laundering conspiracy. No trial date has yet been set. Grubisich, who was arrested at JFK Airport when he arrived in New York for a vacation unaware of the sealed indictment, is being held without bail while he contests DOJ’s argument that he is a flight risk.

- On June 25, 2019, DOJ and Brazilian authorities announced a coordinated resolution with UK oil and gas company TechnipFMC plc related to the conduct of its predecessor companies—Technip S.A. and FMC Technologies, Inc. There were two corruption schemes alleged, one related to Brazil and Technip and the other to Iraq and FMC Technologies (covered below). For the Brazilian scheme, DOJ and Brazilian prosecutors alleged that, from 2003 to 2013, the legacy Technip business conspired with Singapore-based Keppel Offshore & Marine Ltd. (which previously resolved FCPA charges as covered in our 2017 Year-End FCPA Update) to pay more than $69 million for the ultimate benefit of officials at Petrobras, as well as $6 million in payments to Brazil’s Workers’ Party and certain party officials. To resolve the overall charges with DOJ, TechnipFMC entered into a deferred prosecution agreement and its U.S. subsidiary pleaded guilty, both in connection with charges of conspiracy to violate the FCPA’s anti-bribery provisions, and TechnipFMC agreed to pay a total penalty of more than $296 million, 70% of which will be paid to Brazilian authorities. Notably, this penalty reflects a 25% discount for TechnipFMC’s cooperation, but that discount was applied to an amount near the middle of the Sentencing Guidelines range rather than the bottom, as is more frequently the case, because of Technip’s recidivism, having previously resolved FCPA charges with DOJ and the SEC in connection with the Bonny Island, Nigeria FCPA scheme as reported in our 2010 Mid-Year FCPA Update.

- Coincident with the corporate resolution with TechnipFMC, DOJ announced the guilty plea of Brazilian citizen Zwi Skornicki to a single count of conspiracy to violate the FCPA’s anti-bribery provisions. Skornicki admitted that as an agent of both TechnipFMC and Keppel Offshore & Marine, between 2001 and 2014, he participated in a scheme to pay $55 million in bribes to officials of Petrobras and the Brazilian Workers’ Party. Skornicki currently awaits a 2020 sentencing date.

As noted above, the TechnipFMC resolution also included an Iraqi component pertaining to the alleged conduct of its predecessor FMC Technologies. This would later serve as the sole basis for a case brought by the SEC on September 19, 2019, whereby the SEC alleged that, between 2008 and 2013, FMC paid nearly $800,000 in commissions to a Monaco-based oil services company while knowing that some or all of those payments would be provided to Iraqi government officials. To resolve the SEC charges, TechnipFMC consented to a cease-and-desist order enjoining future violations of the anti-bribery, books-and-records, and internal controls provisions and agreed to disgorge $5,061,906 in profits plus prejudgment interest.

The Iraqi scheme of the TechnipFMC resolution, and specifically the use of its Monaco-based oil services company, brings us to another, developing cluster of anti-corruption enforcement that we predict will spawn FCPA cases for years to come. The Monégasque oil services company has been publicly identified as Unaoil, and its imbroglio has grown to include the guilty pleas of former CEO Cyrus Allen Ahsani, former COO Saman Ahsani, and former Business Development Director Steven Hugh Hunter. All three pleaded guilty to a single count of conspiracy to violate the FCPA’s anti-bribery provision. Hunter’s case is narrower and alleges a corruption scheme in Libya between 2009 and 2015. The charges against the Ahsani brothers are far more sweeping, and allege a scheme spanning 1999 through 2016, 27 client companies (most of which are anonymized, but Rolls-Royce PLC and SBM Offshore N.V. are named based on their prior FCPA settlements as covered in our 2017 Mid-Year and 2017 Year-End FCPA Updates, respectively), and payments to government officials in Algeria, Angola, Azerbaijan, the Democratic Republic of the Congo, Iran, Iraq, Kazakhstan, Libya, and Syria. Each of the former Unaoil executives awaits a 2020 sentencing date. We cover Unaoil developments on the other side of the Atlantic in our UK section.

The third type of FCPA enforcement cluster concerns a similar pattern of conduct that is widespread throughout an industry. A prevalent example from recent years relates to the hiring of family members of foreign government officials, which though not inherently illegal under the FCPA, does present heightened risk as it may be later perceived that the hiring was not based on the merits of the candidate but rather on the hope that it would corruptly influence the government official. We have covered numerous examples of these cases in recent years, and 2019 brings us two more.

On August 22, 2019, the SEC announced a settled cease-and-desist proceeding against Deutsche Bank AG to resolve allegations that the bank did not adequately enforce its Asia-Pacific Region hiring policy. According to the SEC, the bank continued to hire individuals linked to state-owned entities and officials, often outside the typical application process, following circulation of a compliance memo identifying potential corruption risks associated with such practices. To resolve the allegations of books-and-records and internal controls violations, Deutsche Bank agreed to pay $10.8 million in disgorgement, $2.4 million in prejudgment interest, and a $3 million civil penalty, for a total of $16,179,850.

In a similar action, on September 27, 2019, Barclays PLC consented to an SEC cease-and-desist proceeding for alleged violations of the FCPA’s accounting provisions. According to the SEC, over approximately four years, subsidiaries in the Asia-Pacific Region hired more than 100 candidates who were referred by or connected to executives at clients, both governmental and commercial. Despite policies prohibiting that provision of employment in exchange for business, Barclays allegedly did not effectively train personnel on the policies or monitor compliance with them. To resolve the allegations, Barclays agreed to pay $4.8 million in disgorgement plus prejudgment interest and a $1.5 million penalty, for a total of $6,308,726.

DOJ Issues Declinations Despite Aggravating Factors

As discussed in our 2017 Year-End FCPA Update, DOJ’s FCPA Corporate Enforcement Policy introduced a presumption that DOJ will decline to prosecute a company that voluntarily discloses FCPA-related misconduct, cooperates fully in the investigation, and appropriately remediates the misconduct. Among the Policy’s many caveats, however, is that the presumption may be overcome by certain aggravating factors, which include the involvement of executive management in the misconduct. These caveats caused many to wonder if the exceptions might swallow the rule, even as DOJ officials have assured that this is not the case. Supporting DOJ’s notion, in 2019, DOJ issued two corporate declinations in cases involving alleged misconduct by senior leadership.

The first such example came on February 15, 2019, with New Jersey-headquartered information technology services company Cognizant Technology Solutions Corp. The company settled an SEC cease-and-desist proceeding for alleged FCPA bribery, books-and-records, and internal controls violations. The SEC’s order included allegations that then-President Gordon J. Coburn and then-Chief Legal Officer Steven E. Schwartz authorized Cognizant’s construction contractor in India to make a $2 million payment to government officials to obtain permits and licenses related to the construction and operation of various Cognizant facilities in that country, and then agreed to reimburse the contractor through $2.5 million in previously rejected change orders. Without admitting or denying the allegations, Cognizant consented to the cease-and-desist proceeding and agreed to pay a $6 million civil penalty together with disgorgement and prejudgment interest of $19,167,368, as well as to self-report to the SEC on remediation and compliance matters for a two-year period.

On the same day as the SEC resolution, DOJ published a letter declining to prosecute Cognizant for the same conduct, but requiring Cognizant to disgorge $2,976,210 in additional profits allegedly earned outside of the statute-of-limitations period covered by the SEC resolution, thus making this another “declination with disgorgement” included for statistical purposes. DOJ prominently noted the company’s timely voluntary disclosure, cooperation, remedial efforts, and agreement to disgorge all benefits from the conduct as determined by a “cost avoidance calculation,” which overcame the “aggravating factor” of senior management involvement in the misconduct.

Both Coburn and Schwartz have been charged criminally by DOJ and civilly by the SEC in connection with the alleged India bribery scheme. They have pleaded not guilty and filed a motion to dismiss the criminal charges. The civil case has been stayed on DOJ’s motion, pending resolution of the criminal cases. But the SEC has not rested on its laurels, as on September 13, 2019 it brought a third case, this one against former Cognizant COO and Indian national Sridhar Thiruvengadam. The SEC alleges that Thiruvengadam caused the falsification of Cognizant’s books and records, and circumvented its internal controls, including by signing false SOX sub-certifications stating that he was unaware of any fraud involving senior management when he allegedly was aware of the India bribery scheme. Without admitting or denying the allegations, Thiruvengadam consented to the cease-and-desist order and agreed to pay a civil penalty of $50,000. DOJ has not announced criminal charges against Thiruvengadam.

The second example of DOJ issuing a public declination in an FCPA matter, despite the alleged involvement of senior management, occurred on September 26, 2019 and involves Wisconsin-based digital printing company Quad/Graphics, Inc. According to the allegations in a parallel SEC cease-and-desist proceeding, Quad/Graphics engaged in bribery schemes in Peru and China, and concealed unlawful sales to Cuba by manipulating sales records, including with the involvement of senior sales and finance executives based in the United States. To resolve the SEC’s anti-bribery and accounting provisions charges, Quad/Graphics agreed to pay a total of $9,895,334 in disgorgement, prejudgment interest, and penalties and to a one-year self-reporting period. DOJ’s declination letter did not require additional disgorgement or punitive measures beyond the SEC resolution, and thus is not counted as a separate action for statistical purposes.

SEC Continues to Invoke Aggressive Theories of FCPA Liability

The SEC showed that it will continue to employ aggressive theories of liability utilizing the FCPA’s accounting provisions, a multi-year trend that we have highlighted in our 2018 and 2017 Year-End FCPA Updates. A notable example from 2019, covered above, is the use of the FCPA’s accounting provisions to charge sanctions-related misconduct involving Quad/Graphics and its sales to Cuba. The SEC alleged that the company “falsified” its corporate books and records by referring to transactions involving Cuba’s state-owned telecommunications company without mentioning the word “Cuba” and using generic terms like “broker” and customer initials. There also have been public reports of the SEC attempting to similarly expand the FCPA’s accounting provisions to punish AML-related deficiencies, although SEC FCPA Unit Chief Charles E. Cain has downplayed those reports.

In another recent example of aggressive SEC theories on display, on May 9, 2019, the SEC announced a settled cease-and-desist proceeding alleging that Brazilian telecommunications company and U.S. ADR issuer Telefônica Brasil provided 232 tickets to 127 government officials to attend the 2014 World Cup and the 2013 Confederations Cup, worth a total of $738,000, inclusive of hospitality (~ $5,800 per official, on average). Although the SEC intimated potential corruption by quoting from various company documents suggesting that the tickets were “for relationship-building activities with strategic audiences” and that guest lists took into account “the importance of the actions that each guest has already effectively done in our favor,” there was no allegation or charge of corruption or benefit received as a result of the tickets. Rather, the alleged violations were that Telefônica Brasil lacked internal controls to prevent gifts that “might influence or reward an official decision,” and “inaccurately” recorded the expenses as “Publicity Institutional Events” and “Advertising & Publicity” rather than explicitly noting that the tickets “were given to government officials.” To settle the SEC’s books-and-records and internal controls charges, and without admitting or denying the allegations, Telefônica Brasil consented to the entry of a cease-and-desist order and agreed to pay a $4,125,000 civil penalty. To date, it does not appear that DOJ intends to bring any charges.

DOJ Continues to Bring a Significant Number of “FCPA-Related” Charges

The SEC and DOJ initiated or unsealed FCPA charges against 30 individual defendants in 2019, including nine associated with corporate enforcement events involving Alstom (Puckett and Thiessen), Cognizant (Coburn, Schwartz, and Thiruvengadam), MTS (Akhmedov), TechnipFMC (Skornicki), Braskem (Grubisich), and Westport Fuel (Nancy Gougarty). Continuing a trend observed in our 2018 Year-End FCPA Update, DOJ’s FCPA Unit also brought a significant number of non-FCPA prosecutions against individuals, initiating an additional 19 individual prosecutions in non-FCPA actions arising out of FCPA investigations.

Increasingly pairing charges against bribe payer and bribe recipient, the non-FCPA charges in large part target foreign official bribe recipients, who under established case law cannot be charged under the FCPA but can be charged with other criminal offenses associated with the receipt of those bribes, most frequently money laundering. Another significant category of “FCPA-related” charges includes so-called “facilitators” who allegedly participated in the transfer of corrupt proceeds, but for jurisdictional, evidentiary, or other reasons are charged with money laundering rather than FCPA counts. Examples of each abound in the 2019 enforcement statistics.

One significant cluster of FCPA and FCPA-related enforcement activity continues to arise out of separate, long-running investigations of corruption tied to Venezuela’s state-owned energy company, Petróleos de Venezuela S.A. (“PDVSA”), among other departments, as follows:

- On February 26, 2019, in connection with a “pay to play” bid rigging scheme, DOJ unsealed FCPA charges against Venezuelan nationals Franz Herman Muller Huber and Rafael Enrique Pinto Franceschi, respectively the president and a sales representative of a U.S.-based industrial equipment company, for FCPA, wire fraud, and money laundering charges. DOJ alleges that, between 2009 and 2013, the two defendants paid bribes to three PDVSA officials to obtain favorable bidding treatment, inside information about competitors, and preferential payment on past due invoices. Both Muller and Pinto have pleaded guilty and await sentencing, as is also the case with two of the three alleged PDVSA bribe recipients, Jose Orlando Camacho and Ivan Alexis Guedez, who were covered in our 2018 Year-End FCPA Update.

- On September 4, 2019, a superseding indictment was unsealed charging Javier Alvarado Ochoa, Daisy Teresa Rafoi Bleuler, and Paulo Jorge Da Costa Casqueiro Murta with substantive and conspiracy money laundering charges, and Rafoi and Casqueiro additionally with FCPA conspiracy. The original indictment, which included Nervis Gerardo Villalobos Cardenas, Alejandro Isturiz Chiesa, and Rafael Ernesto Reiter Munoz, among others, as discussed in our 2018 Mid-Year FCPA Update, alleged that Venezuelan nationals and PDVSA officials solicited bribes and kickbacks from vendors in exchange for PDVSA contracts. The superseding indictment alleges that Alvarado (a Venezuelan national and PDVSA official) participated in the scheme, with Rafoi and Casqueiro (both Swiss-based wealth managers) laundering the proceeds through Swiss bank accounts.

- Illustrating the length of these PDVSA bid-rigging corruption investigations, in June 2019 DOJ moved to unseal a 2016 criminal information charging Darwin Enrique Padron Acosta with one count of conspiracy to commit FCPA bribery and money laundering in connection with corrupt payments allegedly made to Jose Luis Ramos Castillo, a PDVSA official whose money laundering plea we first covered in our 2016 Mid-Year FCPA Update. In November 2019, Padron was sentenced on his 2016 guilty plea to 18 months incarceration and the forfeiture of more than $9 million.

- In a separate Venezuelan corruption scheme, this one relating to state-owned electric company Corporación Eléctrica Nacional, S.A. (“Corpoelec”), DOJ has announced FCPA and FCPA-related charges against four defendants. On June 24, 2019, Venezuelan citizen Jesus Ramon Veroes and U.S. citizen Luis Alberto Chacin Haddad each pleaded guilty to FCPA conspiracy charges arising from an alleged scheme to pay bribes to senior Corpoelec officials in exchange for the award of contracts worth $60 million. Days later, on June 27, Luis Alfredo Motta Dominguez and Eustiquio Jose Lugo Gomez, respectively the former President and Procurement Director of Corpoelec, were indicted on money laundering charges. The underlying investigation reportedly stems from a would-be accomplice who initially was part of the scheme, but after feeling cheated out of money promised by Chacin and Veroes became a confidential witness for the U.S. government. Chacin and Veroes were each sentenced to 51-months imprisonment and agreed to disgorge more than $5 million in profits and to surrender Miami real estate, while both Motta and Lugo are currently considered fugitives. In a sign of the ever-increasing confluence of FCPA, anti-money laundering, and sanctions enforcement, the Department of Treasury’s Office of Foreign Assets Control has added Motta and Lugo to the specially designated nationals (“SDN”) list, thus prohibiting U.S. persons from engaging in business dealings with them or their assets.

- Staying in Venezuela, but with yet a third, fourth, and fifth government agency, on July 25, 2019, DOJ announced an indictment of Colombian citizens Alex Nain Saab Moran and Alvaro Pulido Vargas for their alleged roles in a bribery scheme involving the Servicio Nacional Integrado de Administración Aduanera y Tributaria (“SENIAT”), Comisión de Administración de Divisas (“CADIVI”), and Guardia Nacional Bolivariana de Venezuela (“GNB”), respectively Venezuela’s Revenue Service, currency exchange authority, and National Guard. According to the indictment, after securing a government contract to build public housing, Saab and Pulido submitted fraudulent invoices to the government for reimbursement of non-existent construction materials and paid SENIAT, CADIVI, and GNB officials to facilitate payment on those invoices. Saab and Pulido, who are at large, face one count of money laundering conspiracy and seven substantive money laundering counts. Like Motta and Lugo above, neither Saab nor Pulido have yet made an appearance in U.S. court and both were designated as SDNs following the announcement of their indictment.

Another significant cluster of FCPA and FCPA-related charges arising out of Latin America concerns Ecuador’s state-owned oil company, Empresa Pública de Hidrocarburos del Ecuador (“PetroEcuador”), as follows:

- On January 24, 2019, U.S. citizen Jose Luis De La Paz Roman pleaded guilty to an FCPA conspiracy charge arising from the PetroEcuador bribery scheme;

- On April 4, 2019, Ecuadorian citizen and Florida resident Gustavo Trujillo pleaded guilty to a two-count information charging wire fraud and money laundering conspiracy in connection with the same scheme to launder corrupt funds as charged in the 2017 FCPA case against Ramiro Andres Luque Flores;

- On May 10, 2019, DOJ announced the unsealing of an indictment charging Ecuadorian citizens Armengol Alfonso Cevallos Diaz and Jose Melquiades Cisneros Alarcon with FCPA and money laundering charges arising from millions in bribes allegedly paid to PetroEcuador officials;

- Finally, in September 2019, DOJ moved to unseal money laundering conspiracy charges against former PetroEcuador executive Jose Raul de la Torre Prado and his associate Roberto Barrera, as well as filed a criminal information on similar money laundering charges against Ecuadorian / U.S. businessperson Juan Sebastian Espinoza Calderon, all of whom have pleaded guilty and await sentencing.

In a textbook example of DOJ prosecuting both the demand and supply side of bribery, on February 11, 2019, Micronesian Transportation Department official Master Halbert was arrested on money laundering conspiracy charges associated with his alleged receipt of bribes from Frank James Lyon. Lyon, a co-owner of a privately held Hawaiian engineering company, had in January pleaded guilty to conspiracy to violate the FCPA’s anti-bribery provisions and to commit federal program fraud in connection with his alleged payment of approximately $200,000 in bribes to Halbert and other Micronesian officials in order to obtain FAA-funded airport contracts from the Micronesian Transportation Department. Separately, Lyon also admitted to paying $240,000 to Hawaiian state officials in connection with federally funded state contracts. On May 13, 2019, the Honorable Susan O. Mollway of the U.S. District Court of the District of Hawaii sentenced Lyon to a 30-month prison term. Halbert pleaded guilty on April 2, 2019, and received an 18-month prison term on July 29, 2019.

Accounting for additional FCPA-related charges this year, we reported in our 2018 Year-End FCPA Update on DOJ’s August 2018 “declination with disgorgement” letter to Barbadian insurance company Insurance Corporation of Barbados Limited (“ICBL”), which followed the unsealing of a March 2018 indictment charging Donville Inniss, a former Minister of Industry and member of Parliament of Barbados, with money laundering in connection with his alleged receipt of $36,000 from ICBL in exchange for agreeing to award government contracts to the insurer. As we observed at the time, a redacted superseding indictment filed in the Inniss case made clear that DOJ had filed money laundering charges under seal against two former senior executives of ICBL. On January 18, 2019, those portions of the indictment were unsealed, showing that former CEO Ingrid Innes and former senior vice president Alex Tasker were each charged with one count of money laundering conspiracy and two counts of money laundering in connection with the $36,000 paid to Inniss. Neither Innes nor Tasker are in U.S. custody, while Inniss’s trial is scheduled to begin in January 2020 before the Honorable Kiyo A. Matsumoto in the Eastern District of New York.

On December 20, 2019, Judge Matsumoto issued a comprehensive, 71-page memorandum and order addressing a number of pretrial motions in limine in the Inniss case. Among the rulings was a denial of a motion by DOJ to find that former ICBL CEO Innes waived her attorney-client privilege over a document that she prepared for her attorney by saving it to the hard drive of her company-issued computer, without any “confidential” or “privileged” notations, and then neglecting to delete it before turning her computer in to company representatives. Among the factors the Court found important to the decision that Inniss did not waive privilege were that Innis: (1) emailed the document to her attorney using a personal email address; (2) saved the document to her local “My Documents” folder and not the company’s shared document management system; (3) did not connect her device to the company’s network after preparing the document; (4) had forgotten when surrendering her device that she had saved the document to the computer; (5) immediately objected when company representatives attempted to use the document during an interview with her; and (6) while aware that ICBL had a policy stating the company may monitor usage of company devices, as CEO was not aware of the company ever enforcing that policy. Nonetheless, Judge Matsumoto stated in her ruling that this was a close call and this stands as an important caution to executives who learn they are under investigation by company representatives.

Finally, although much of the public docket remains shrouded in under-seal filings, the outlines of another FCPA-related case may be seen in a two-page criminal information filed against Fernando Carvalho Frimm on March 15, 2019 in the U.S. District Court for the Southern District of Texas. The bare-bone allegations charge that Frimm filed a false tax return that understated his 2010 income by at least $172,538, in violation of 26 U.S.C. § 7206(1). Based on the prosecutors, judicial assignment, and publicly available information, it appears this case may be related to DOJ’s investigation of SBM Offshore as reported in our 2017 Year-End FCPA Update.

Several FCPA Defendants Go To Trial

As DOJ continues to aggressively pursue more and more individuals for alleged FCPA and FCPA-related violations, it is inevitable that more and more we will see some opt to put the government to its burden at trial. This year saw multiple individual defendants take their cases to a jury.

Lawrence Hoskins

In what was undoubtedly the FCPA trial of the year, and arguably one of the most significant in the statute’s history, UK citizen Lawrence Hoskins was convicted in the long-running case arising from the Alstom Indonesia investigation. We last discussed the Hoskins case in our 2018 Year-End FCPA Update, in the context of the Second Circuit’s significant jurisdictional decision holding that the government could not charge a foreign national with conspiracy or aiding and abetting an FCPA offense if that person did not otherwise belong to the class of individuals that can be charged with committing a substantive FCPA violation. In light of the decision, a central question at trial was whether DOJ could prove that Hoskins was acting as an “agent” of a U.S. person (e.g., Alstom’s U.S. subsidiary). On November 8, 2019, after an eight-day trial and one day of deliberations, the jury answered that question in the affirmative, convicting Hoskins on 11 of the 12 FCPA and money laundering counts.

The trial centered on allegations that Hoskins functioned as an agent of Alstom USA for the purpose of its bribing Indonesian officials. The trial judge instructed the jury that the government had to prove that the U.S. subsidiary had given Hoskins authority to take actions on its behalf and had the ability to control Hoskins’s conduct. On the evidence presented at trial, this effectively reduced to whether Hoskins was taking direction from Alstom USA executive Frédéric Pierucci, who previously pleaded guilty and served time in prison (covered in our 2014 and 2017 Year-End FCPA Updates). The government alleged that Pierucci “controlled the strategy and approach” and “called the shots” in directing Hoskins’s participation in the bribery scheme, and argued that witness testimony and email communications were more probative than corporate org charts in demonstrating the relationship between Alstom USA and Hoskins. Hoskins’s defense counsel countered that he only supported but did not take direction from Pierucci when hiring consultants in Asia and seized on the fact that only one of the government’s five witnesses had ever even met with or spoken to Hoskins.

Based on the verdict, the jury apparently accepted the government’s agency evidence. The issue will likely be afforded further consideration, however, including in connection with Hoskins’s motion for judgment of acquittal, which was filed on November 29, 2019, and any subsequent appeal. Indicative of DOJ’s use of money laundering charges to pursue individuals in FCPA cases who pose jurisdictional challenges, the jury also returned convictions on all but one of the money laundering charges against Hoskins based on evidence that he and others retained consultants to conceal payments. Sentencing is currently scheduled for March 6, 2020.

Jean Boustani

Another example of DOJ’s 360-degree approach to prosecuting foreign corruption was announced on March 7, 2019, with an unsealed indictment against conspirators in an alleged bribery scheme involving loans to the Government of Mozambique. Specifically, three former UK-based investment bankers from a Swiss financial institution that is a U.S. issuer—Andrew Pearse, Surjan Singh, and Detelina Subeva—were charged with conspiracy to violate the FCPA’s anti-bribery and internal controls provisions, as well as wire fraud, securities fraud, and money laundering conspiracy. Two former Mozambican government officials—former Minister of Finance Manuel Chang and former State Information & Security Service official Antonio do Rosario—as well as Mozambique business consultant Teofilo Nhangumele, were collectively charged with an assortment of wire fraud, securities fraud, and money laundering conspiracy charges. Two Lebanese former executives of UAE shipbuilding company Privinvest Group—Jean Boustani and Najib Allam—also were charged with similar non-FCPA offenses, marking eight defendants charged by the FCPA Unit. The indictment alleges that between approximately 2013 and 2016, the defendants organized more than $2 billion in loans to companies owned and controlled by the Mozambican government, ostensibly for the purpose of funding maritime projects for which the UAE shipbuilding company would provide services, but Boustani and Allam allegedly diverted more than $200 million of the proceeds, paying $150 million as bribes to Chang and other officials and $50 million in kickbacks to investment bankers Pearse, Singh, and Subeva.

The initial charges were unsealed in January 2019 when Boustani was arrested at JFK Airport. Three defendants have entered guilty pleas: Subeva and Singh to one count each of money laundering conspiracy, and Pearse to conspiracy to commit wire fraud. Chang was arrested in South Africa in December 2018 and reportedly is contesting extradition to the United States. Rosario and Nhangumele were both arrested in Mozambique in February 2019; they have been detained along with a reported 18 additional individuals, all of whom are expected to stand trial on local charges. DOJ intends to seek extradition of Rosario and Nhangumele. Allam reportedly remains at large.

Boustani opted for trial, and pushed for a speedy one considering that he was held without bail. Pretrial motions to dismiss on jurisdictional grounds were denied but, on December 2, 2019, a jury sitting in the U.S. District Court for the Eastern District of New York acquitted him of all three counts he faced—conspiracy to commit wire fraud, securities fraud, and money laundering. Prosecutors emphasized that some of the bribe payments came through U.S. correspondent banks, while the defense argued that Boustani could not have foreseen that money paid via foreign banks would travel through the United States and that the United States “was not the world’s policeman.” Although these arguments did not work on the Honorable William F. Kuntz II in his pretrial rulings, post-trial interviews suggest the jury had concerns with DOJ’s theory of jurisdiction.

Joseph Baptiste + Roger Richard Boncy

We reported in our 2018 Year-End FCPA Update on the superseding indictment in the case against retired U.S. Army colonel and Haitian non-profit founder Joseph Baptiste to add Roger Richard Boncy, a former lawyer of dual U.S.-Haitian citizenship who once served as Haiti’s Ambassador-at-Large, as a defendant on FCPA conspiracy, Travel Act, and money laundering conspiracy charges. According to the indictment, Boncy and Baptiste solicited bribes from two undercover FBI agents who were posing as prospective investors for a multi-million dollar port development project in Haiti. But instead of funneling the money to Haitian officials, Baptiste allegedly pocketed it. Although the trial of Baptiste nearly went forward in late 2018, in light of the superseding indictment, a joint trial for Baptiste and Boncy was scheduled for June 2019.

On June 20, 2019, following a nine-day trial, the jury returned its verdict finding Boncy and Baptiste guilty of conspiracy to violate the Travel Act and the FCPA, as well as Baptiste guilty of money laundering conspiracy. The jury did acquit Boncy of additional money laundering and Travel Act counts. On August 26, 2019, Baptiste filed a motion for judgment of acquittal, arguing in part that the prosecution failed to prove that Baptiste conspired to procure any official act through bribery, that it failed to specify sufficiently the object of the alleged conspiracy, and that it failed to establish Baptiste’s corrupt intent. Baptiste also filed a motion seeking a new trial based on ineffective assistance of counsel. A motions hearing was held on December 16, 2019, but the Court has yet to rule.

Mark T. Lambert

We reported in our 2018 Mid-Year FCPA Update on the January 2018 FCPA, wire fraud, and money laundering indictment of Mark T. Lambert, the former Co-President of Transport Logistics International, alleged to have participated in a conspiracy to make corrupt payments to a Russian state-owned supplier of uranium and uranium enrichment services in return for sole-source contracts. Lambert was scheduled to go to trial in the District of Maryland in April, and then June 2019, but during the first half of the year DOJ superseded the indictment not once but twice, changing the operative dates when the conspiracy allegedly began and when Lambert allegedly joined it.

Following these delays, a three-week trial commenced in late October, resulting in the conviction of Lambert of four FCPA counts, two counts of wire fraud, and a single count of conspiracy to violate the FCPA and commit wire fraud. The jury acquitted Lambert on two other FCPA counts and one count of money laundering. The trial featured evidence that Lambert and coconspirators attempted to conceal the payments by using fake invoices and code words, and caused Transport Logistics International to fraudulently overbill the Russian state-owned entity. On December 6, 2019, Lambert filed a motion for judgment of acquittal on the two wire fraud convictions, arguing that the government failed to prove that he made any material misrepresentations or omissions that caused injury to the Russian state-owned entity, the alleged victim of the fraud. Lambert’s motion is still pending as of the date of this update and his sentencing is scheduled for March 2020.

Rounding Out the 2019 FCPA Enforcement Docket

Additional 2019 FCPA enforcement actions not covered elsewhere in this update include:

Microsoft Corporation

On July 22, 2019, DOJ and the SEC announced a joint FCPA resolution with leading technology company Microsoft, relating to alleged violations of the FCPA’s books-and-records and internal controls provisions. The SEC’s allegations included alleged payments to government officials in Hungary, inadequate documentation surrounding the role of an unauthorized distributor in Turkey, and excessive hospitality and gifts to governmental and commercial customers in Saudi Arabia and Thailand. DOJ’s allegations focused more narrowly on the Hungary conduct, which involved Microsoft’s subsidiary allegedly making improper payments to government officials through third parties.

To resolve the DOJ matter, Microsoft’s Hungarian subsidiary entered into a three-year non-prosecution agreement and paid a criminal fine of $8,751,795. To resolve the SEC matter, parent Microsoft consented to the entry of a cease-and-desist order and agreed to pay $16,565,151 in disgorgement plus prejudgment interest. Microsoft received the maximum (25%) cooperation credit available for its substantial cooperation and extensive remedial measures. Microsoft also was not required to retain a monitor, but will report on its compliance program efforts for the three-year non-prosecution period.

Ugandan Adoption Case

On August 29, 2019, adoption agent Robin Longoria pleaded guilty to a one-count information charging conspiracy to violate the FCPA, wire fraud, and visa fraud stemming from an alleged plot to illicitly facilitate adoptions of children from Uganda. Longoria admitted to participating in a scheme to bribe Ugandan probation officers to recommend that certain children be placed into orphanages, then bribe Ugandan judges and court personnel to grant guardianship of these children to the adoption agency’s clients. The bribes were allegedly funded through “foreign program fees” charged to clients. Longoria’s sentencing is currently scheduled for January 8, 2020.

Juniper Networks, Inc.

Also on August 29, 2019, the SEC announced a settled cease-and-desist proceeding with California-based network technology company Juniper, alleging violations of the FCPA’s accounting provisions. According to the SEC’s order, sales employees of Juniper subsidiaries in Russia and China increased sales discounts to channel partners, and rather than pass those savings on to end customers pooled them as “common funds” at the channel-partner level. These funds were allegedly used to pay for unauthorized customer travel, including for government officials and in some cases involving falsified trip and meeting agendas. A member of senior management allegedly learned of the “common funds” in late 2009, and Juniper instructed employees to stop the practices at issue, but they nevertheless continued through 2013. To resolve the allegations, Juniper agreed to pay $11,745,018, which includes a civil penalty of $6,500,000. Juniper previously announced that DOJ had closed its investigation with no action.

Westport Fuel Systems, Inc. + Former Chief Executive Officer

On September 27, 2019, the SEC announced a settled cease-and-desist proceeding against Canadian clean fuel systems manufacturer and U.S. issuer Westport and its former CEO, Nancy Gougarty. According to the SEC, Gougarty allegedly caused Westport to violate the FCPA when she knowingly transferred shares in a joint venture to a private equity fund while knowing that a Chinese government official had an undisclosed financial interest in the fund. The SEC further alleged that Gougarty concealed the official’s financial interest from the company’s Board, and also falsely identified the joint venture interests in public SEC filings.

To resolve the charges of FCPA anti-bribery, books-and-records, and internal controls violations, Westport agreed to pay disgorgement of $2.35 million, prejudgment interest of $196,000, and a civil penalty of $1.5 million, and Gougarty agreed to pay a $120,000 penalty. Westport also will self-report to the SEC for two years.

China-Based Executives of a Multi-Level Marketing Company

On November 14, 2019, DOJ unsealed an indictment charging two Chinese citizens who formerly served as senior executives of the Chinese subsidiary of a publicly traded “multi-level marketing company” headquartered in Los Angeles. China Managing Director Yanliang “Jerry” Li and China External Affairs Head Hongwei “Mary” Yang were each charged with conspiracy to violate the FCPA’s anti-bribery, books-and-records, and internal controls provisions. Li also was charged with criminal charges of perjury and destruction of records, and was named the defendant in a separate civil complaint filed by the SEC.

According to the charging documents, Li and Yang bribed Chinese government officials to obtain direct sales licenses and stifle negative media coverage, and approved forged reimbursement requests designed to conceal the expenditures. Li also allegedly perjured himself during investigative testimony before the SEC, and purportedly installed “wiping software” on his company computer in an effort to destroy electronic records when he learned of the investigation. The company has not been identified by DOJ or the SEC.

SEC FCPA Settlement in 1MDB Case

We reported in our 2018 Year-End FCPA Update on the criminal FCPA charges against Malaysian businessperson Low Taek Jho (“Jho Low”) and former bankers Tim Leissner and Ng Chong Hwa, who collectively were alleged to have participated in diverting more than $2.7 billion from Malaysian sovereign wealth fund 1Malaysia Development Berhad (“1MDB”) for their own benefit and to make payments to officials of state-owned investment funds. On December 16, 2019, the SEC announced its own FCPA resolution with Tim Leissner only, pursuant to which he consented to the entry of a cease-and-desist order finding that he violated the FCPA’s anti-bribery, books-and-records, and internal controls provisions and agreed to disgorge $43.7 million, offset dollar-for-dollar by the prior entry of a forfeiture order in connection with his 2018 guilty plea in the criminal case. The SEC forewent a civil penalty against Leissner in recognition of the criminal case, as well as a $1,425,000 civil penalty already imposed in an associated Federal Reserve Board proceeding initiated on March 11, 2019.

2019 YEAR-END FCPA-RELATED ENFORCEMENT LITIGATION

Following the filing of FCPA or FCPA-related charges, the lifecycle of criminal and civil enforcement proceedings can take years to wind their way through the courts. In addition to the FCPA trials covered above, a selection of prior-year matters that saw enforcement litigation developments during 2019 follows.

DOJ Dismisses 10-Year-Old Case Against the Siriwans

In one example of the multiyear “tail” that can follow the filing of FCPA-related charges, in January 2019, DOJ dismissed a 10-year-old FCPA-related case against a former Thai government official and her daughter. As an early example of DOJ pursuing alleged FCPA bribe recipients together with alleged bribe payers, we reported in our 2011 Year-End FCPA Update that Juthamas Siriwan, the former Governor of the Tourism Authority of Thailand, and her daughter, Jittisopa Siriwan, were charged in a criminal money laundering indictment for allegedly receiving approximately $1.8 million from husband and wife film producers Gerald and Patricia Green in return for awarding the Greens’ businesses up to $14 million in contracts.

The Siriwans sought to dismiss their indictment in federal court through the special appearance of their counsel, even as they technically remained fugitives in Thailand. The Honorable George H. Wu of the U.S. District Court for the Central District of California stayed the motion pending Thailand’s decision on whether to grant DOJ’s request to extradite the Siriwans. In the years that followed, Juthamas and Jittisopa ultimately were charged and sentenced to significant prison terms in Thailand for the same conduct, leading DOJ on January 3, 2019 to file a motion to dismiss the U.S. charges, which the Court granted the next day. Thereafter, Thailand’s Appeal Court in May 2019 upheld a significant 50-year sentence for Juthamas while reducing the sentence for Jittisopa by four years to a still significant 40-year term.

Court Rejects Samir Khoury’s Motion to Dismiss 10-Year-Old Indictment

Another example of the FCPA’s long tail is Lebanese businessperson Samir Khoury’s attack on a decade-old indictment charging him with mail and wire fraud offenses arising out of the Bonny Island, Nigeria corruption scheme. In our 2018 Year-End FCPA Update, we reported that after successfully moving to unseal a 2008 indictment that he long suspected had been filed against him, Khoury moved to compel the government to produce additional evidence necessary to file a revised motion to dismiss on Speedy Trial Act and statute-of-limitations grounds.

On March 13, 2019, the Honorable Keith P. Ellison of the U.S. District Court for the Southern District of Texas ordered the government to produce descriptions of certain communications regarding its efforts to apprehend Khoury. With this information in hand, Khoury on April 19 filed a renewed motion to dismiss the indictment, arguing that the evidence shows that the government failed to prosecute the case diligently. On December 6, 2019, the Court denied Khoury’s motion, holding that the government’s delay was attributable to Khoury’s decision to remain in Lebanon and rejecting his argument that the government not seeking his extradition warranted dismissal of the charges. Although the Court believed the issue to be a close one, the Court also found that the government’s claims were not time-barred, crediting the government’s application under 18 U.S.C. § 3292 to suspend the statute of limitations to allow it to gather foreign evidence; the Court held that such applications can be filed at any time before indictment, as long as the official request is made before the statute of limitations expires, which was the case here. As of the date of publication, no further proceedings have been scheduled in this case, although Khoury has filed an additional motion for a “Ruling on Constitutional Issues Not Addressed” in the Court’s December 6 order.

District Court Rejects Dmitry Firtash’s Motion to Dismiss

As reported in our 2014 Mid-Year FCPA Update, in 2014 DOJ announced an indictment charging several foreign nationals, including Ukrainian billionaire Dmitry Firtash, with FCPA bribery and related charges in connection with an alleged scheme to bribe government officials in India to procure titanium-ore mining rights. Even as Firtash contested extradition proceedings following his arrest in Austria, in May 2017 his counsel filed a motion to dismiss the U.S. charges in absentia, as covered in our 2017 Mid-Year FCPA Update. On June 21, 2019, the Honorable Rebecca R. Pallmeyer denied the motion, which had been joined by co-defendant Andras Knopp, in a detailed 39-page opinion and order.

The Court found venue to be proper in the Northern District of Illinois given the allegation that the criminal conspiracy ultimately sought to sell the subject titanium to a U.S. company operating in Illinois, and found sufficient U.S. contacts to satisfy due process in subjecting the defendants to prosecution in the United States. Judge Pallmeyer also rejected defendants’ arguments that the FCPA conspiracy charge should be dismissed in line with the Second Circuit’s decision in United States v. Hoskins (covered in our 2018 Year-End FCPA Update), which held that the government cannot charge foreign nationals with conspiracy or aiding and abetting an FCPA offense if those persons do not otherwise belong to the class of individuals that can be charged with committing a substantive FCPA violation. The Court here held that Firtash and Knopp could be charged with aiding and abetting an FCPA offense, rejecting the defendants’ Hoskins argument, by reasoning that Hoskins relied, in part, on precedents determining the statutory limits on who can be charged with complicity liability based not only on the statute’s text, but also on its legislative history, whereas the Seventh Circuit inferred “legislative intent only from the text of the statute.” Judge Pallmeyer recognized that the Seventh Circuit might reach a different result “where the defendant’s actions are extraterritorial and the underlying statute has no extraterritorial application,” which was a significant factor in the Second Circuit’s analysis in Hoskins. Without a clear precedent from the Seventh Circuit on the effect of extraterritoriality on complicity liability, however, Judge Pallmeyer was unwilling to follow Hoskins in this case.

A further setback for Firtash followed days later when, on June 25, 2019, the Austrian Supreme Court affirmed a lower court’s decision allowing for his extradition to the United States. Although the ultimate decision will now reside with Austria’s Justice Minister, Firtash is one step closer to facing a trial in a country in which he has never before set foot.

Rolls-Royce Defendant’s Appeal Dismissed

The U.S. Court of Appeals for the Sixth Circuit dismissed an interlocutory appeal in the ongoing prosecution of Azat Martirossian that raises the oft-recurring issue in FCPA and FCPA-related prosecutions of whether a foreign-located defendant can challenge an indictment without physically submitting to the jurisdiction of a U.S. court. As covered in our 2018 Year-End FCPA Update, on May 24, 2018, Martirossian—an Armenian citizen and Chinese resident who has never been to the United States—was indicted on money laundering charges associated with the alleged Rolls-Royce bribery scheme. While he remained outside of the United States, his counsel filed a motion to dismiss the indictment in absentia, alleging the charges insufficiently alleged a U.S. nexus. On October 9, 2018, Chief Judge Edmund A. Sargus, Jr., of the U.S. District Court for the Southern District of Ohio granted DOJ’s request to hold Martirossian’s motion in abeyance “until or unless he submits to the jurisdiction of this Court.”

Following Martirossian’s interlocutory appeal and petition for a writ of mandamus to the U.S. Court of Appeals for the Sixth Circuit, on March 7, 2019 the Sixth Circuit dismissed his appeal and denied his mandamus petition. The Court concluded that the District Court’s October 2018 decision was not a final appealable order and that Martirossian did not qualify for a writ of mandamus. Writing for the Sixth Circuit, Judge Jeffrey S. Sutton observed that under the fugitive disentitlement doctrine, “If a defendant refuses to show up to answer an indictment, ignores an arrest warrant, or leaves the jurisdiction, the court may decline to resolve any objections to the indictment in his absence.” The panel concluded that Martirossian did not qualify for a writ in large part because “he has a readily available means of obtaining a ruling on his motion to dismiss the indictment”—namely, showing up to court.

Second and Ninth Circuits Reject McDonnell Challenges to Money Laundering Convictions of Foreign Government Officials

We covered the 2017 trial conviction of former Wall Street banker-turned-Guinean Minister of Mines and Geology, Mahmoud Thiam, in our 2017 Mid-Year FCPA Update. On August 5, 2019, the U.S. Court of Appeals for the Second Circuit affirmed Thiam’s money laundering convictions in an opinion that gives wind for the wings of DOJ’s expansive use of the statute. Writing for the Court, the Honorable John M. Walker, Jr. rejected Thiam’s argument that the jury instructions were erroneous because they did not include the “official acts” guidance of the U.S. Supreme Court decision in United States v. McDonnell. In McDonnell, the Supreme Court concluded that the definition of an “official act” for purposes of the federal bribery statute should be interpreted narrowly, such that “[s]etting up a meeting, talking to another official, or organizing an event (or agreeing to do so)—without more—does not fit [the] definition of ‘official act.’” Here, the Second Circuit held that McDonnell does not apply to money laundering charges founded, as in this case, on foreign bribery statutes that do not have the same limitations as the U.S. domestic bribery statute at issue in McDonnell. Foreign nations may define their bribery statutes more broadly, the Court said, and in all events the evidence was sufficient for the jury to find that Thiam’s actions in negotiating favorable terms for a joint venture in exchange for bribes was an “official act” even under McDonnell. On December 9, 2019, the Supreme Court declined to take up Thiam’s petition for certiorari.

On August 30, 2019, the U.S. Court of Appeals for the Ninth Circuit turned aside a challenge by Dr. Heon-Cheol Chi, a former Director of the Korea Institute of Geoscience and Mineral Resources, to his money laundering conviction that we covered in our 2017 Year-End FCPA Update. Similar to its sister circuit, the Honorable Carlos T. Bea writing for the Ninth Circuit held that it was appropriate for the trial court to refuse to graft U.S. domestic bribery precedent, under McDonnell and otherwise, onto the “bribery of a public official” under foreign law specified unlawful activity in the money laundering statute.

2019 YEAR-END FCPA-RELATED POLICY DEVELOPMENTS

In addition to the enforcement activity covered above, the year saw DOJ issue important guidance on how it will administer corporate criminal enforcement, assess inability-to-pay claims, and evaluate corporate compliance programs; and another regulator—the Commodity Futures Trading Commission (“CFTC”)—signal its intention to take a seat at the table in foreign corruption matters.

DOJ Refines FCPA Corporate Enforcement Policy

On March 8, 2019, DOJ announced a number of revisions to the FCPA Corporate Enforcement Policy released in November 2017, as covered in our 2017 Year-End FCPA Update. In remarks announcing the changes, Assistant Attorney General and Criminal Division Leader Brian A. Benczkowski explained that they seek to “ensur[e] that our policies provide the right message and the right mix of incentives.” Among the most significant revisions are:

- Ephemeral Messaging: One of the most confounding provisions of the original FCPA Corporate Enforcement Policy required that in order to receive full cooperation credit in any FCPA resolution, companies had to “prohibit[] employees from using software that generates but does not appropriately retain business records and communications.” The pervasive use of ephemeral messaging apps, particularly outside of the United States, led many to question the practicality of this prohibition. The revised policy now stops short of an outright ban, and directs companies to implement “appropriate guidance and controls” to ensure that employees use these services in a way providing for adequate data retention.

- De-Confliction: The revised policy maintains the requirement that, to receive full cooperation credit, companies must be prepared to de-conflict interviews and other investigative steps to ensure they do not interfere with DOJ’s investigation. It adds a footnote, however, clarifying that although DOJ “may, where appropriate, request that a company refrain from taking a specific action for a limited period of time . . . the Department will not take any steps to affirmatively direct a company’s internal investigation efforts.” This mantra, which is now echoed consistently by DOJ FCPA prosecutors, is well timed in light of the prominent May 2, 2019 ruling by Chief Judge Colleen McMahon of the Southern District of New York in United States v. Connolly, which criticized the government’s purportedly excessive reliance on and coordination with outside counsel’s investigation in a non-FCPA matter.

- M&A Due Diligence: Consistent with remarks by Deputy Assistant Attorney General Matthew S. Miner in July 2018 (covered in our 2018 Year-End FCPA Update), the revised policy provides that “where a company undertakes a merger or acquisition, uncovers misconduct through thorough and timely due diligence or, in appropriate instances, through post-acquisition audits or compliance integration efforts, and voluntarily self-discloses the misconduct and otherwise takes action consistent with this Policy . . . there will be a presumption of a declination in accordance with and subject to the other requirements of this Policy.” Of further interest on this topic, in June 2019, at an American Bar Association white collar crime conference in the Czech Republic, Miner stated: “[I]f a company self-discloses misconduct that was discovered in the context of a merger or acquisition, and we determine that the conduct and financial impact was de minimis, we may be open to a company’s request that we not disclose the declination.”

- Significance of Aggravating Factors: In his remarks announcing the revisions to the policy, Assistant Attorney General Benczkowski clarified that the presence of one or more aggravating factors, for example the involvement of senior company management, will “not necessarily preclude a declination” where the subject company is otherwise in full compliance with the policy. DOJ’s decision in March 2019 not to prosecute Cognizant, discussed above, is consistent with this approach.

This policy was again updated in November 2019 to make clear that the obligation to disclose “all relevant facts” in order to qualify for voluntary disclosure credit applies only to those facts “known to [the company] at the time of the disclosure.” The substantive point behind this otherwise modest wording tweak is to acknowledge that companies may not always have full information at the time of a voluntary disclosure, and that DOJ encourages companies to come forward early, even before their investigations are fully concluded.

DOJ Announces Updated Guidance for Evaluating Corporate Compliance Programs

On April 30, 2019, DOJ’s Criminal Division released updated guidance to DOJ prosecutors on how to assess the effectiveness of corporate compliance programs when conducting investigations, making charging decisions, and negotiating resolutions. Reflecting DOJ’s continued focus on corporate compliance programs, this guidance, “Evaluation of Corporate Compliance Programs,” updates earlier guidance from DOJ’s Fraud Section in February 2017 (covered in our 2017 Mid-Year FCPA Update). Speaking at the GIR Live event on October 8, 2019, Assistant Attorney General Benczkowski summarized this guidance as revolving “around three questions that go to the heart of every compliance matter: First, is the compliance program well designed? Second, is the program being implemented effectively and in good faith? And third, does the compliance program work in practice?”

For more on this guidance, please see our separate Client Alert, “Updated DOJ Criminal Division Guidance on the ‘Evaluation of Corporate Compliance Programs.’”

DOJ Releases New Inability-To-Pay Guidance

On October 8, 2019, DOJ released new guidance on how prosecutors should evaluate inability-to-pay claims in criminal resolutions, titled “Evaluating a Business Organization’s Inability to Pay a Criminal Fine or Criminal Monetary Penalty.” Although the U.S. Sentencing Guidelines direct courts to consider a corporation’s financial resources in determining an appropriate monetary penalty, they lack detailed instructions about how to evaluate inability-to-pay claims, and this guidance seeks to fill that gap, at least for the Criminal Division attorneys to whom this guidance is directed.

The new guidance provides that, before DOJ will entertain any inability-to-pay claim, the parties must first agree on both the form of the criminal resolution and the amount of monetary penalty, based on the merits and without regard to the corporation’s financial condition. Then, the company must submit an “Inability-to-Pay Questionnaire.” Although completing a questionnaire has long been a requirement when claiming inability to pay, the questionnaire now seeks a number of forward-looking metrics. The answer to these questions will form the basis on which DOJ assesses inability-to-pay claims, which, according to the guidance, will often require consultation with accounting experts.

If there are serious questions that a company cannot afford the contemplated penalty, prosecutors must consider a variety of factors, including what gave rise to the company’s current financial condition. Prosecutors also should examine whether the corporation can raise alternative sources of capital to pay the penalty, as well as whether the penalty could adversely affect pension funds, prompt layoffs or production shortages, or cause it to fall below regulatory capital requirements. Not all collateral consequences are considered relevant, however. Prosecutors generally should not consider whether the penalty would harm growth, future dividends, future hiring or retention, or executive compensation.

If an inability to pay is found, prosecutors may, with the permission of the section chief, adjust the penalty downward as necessary to avoid threatening the company’s continued viability or ability to make restitution payments. Downward adjustments exceeding 25% of the contemplated penalty require approval from the Assistant Attorney General for the Criminal Division. Alternatively, DOJ may implement a payment plan over a reasonable time horizon if doing so would allow full payment of the proposed fine or penalty.

The CFTC Wades Into International Corruption Waters