2019 Year-End Sanctions Update

Client Alert | January 23, 2020

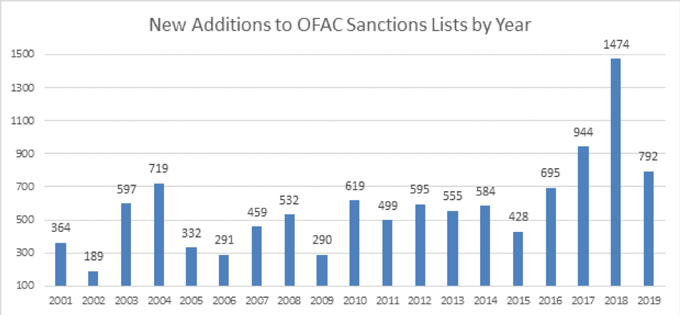

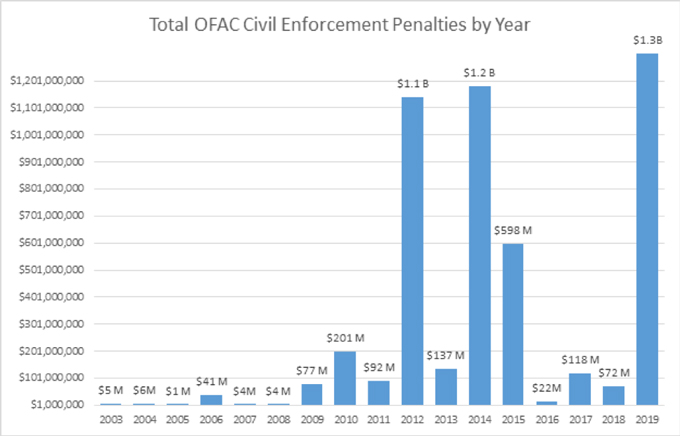

Between claims of “financial carpet bombing” and dire warnings regarding the “weaponization” of the U.S. dollar, it was difficult to avoid hyperbole when describing the use of economic sanctions in 2019. Sanctions promulgated by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) have become an increasingly prominent part of U.S. foreign policy under the Trump administration. For the third year in a row, OFAC blacklisted more entities than it had under any previous administration, adding an average of 1,000 names to the Specially Designated Nationals and Blocked Persons (“SDN”) List each year—more than twice the annual average increase seen under either President Barack Obama or President George W. Bush. Targets included major state-owned oil companies such as Petróleos de Venezuela, S.A. (“PdVSA”), ostensible U.S. allies such as Turkey (and—almost—Iraq), major shipping lines, foreign officials implicated in allegations of corruption and abuse, drug traffickers, sanctions evaders, and more. As if one blacklisting was not enough, some entities had the misfortune of being designated multiple times under different regulatory authorities—each new announcement resulting in widespread media coverage if little practical impact. At last count, Iran’s Islamic Revolutionary Guard Corps (“IRGC”) has been sanctioned under seven separate sanctions authorities. Eager to exert its own authorities in what has traditionally been a solely presidential prerogative, in 2019 the U.S. Congress proposed dozens of bills to increase the use of sanctions. Compounding the impact of expansive new sanctions, OFAC’s enforcement penalties hit a record of more than U.S. $1.2 billion.

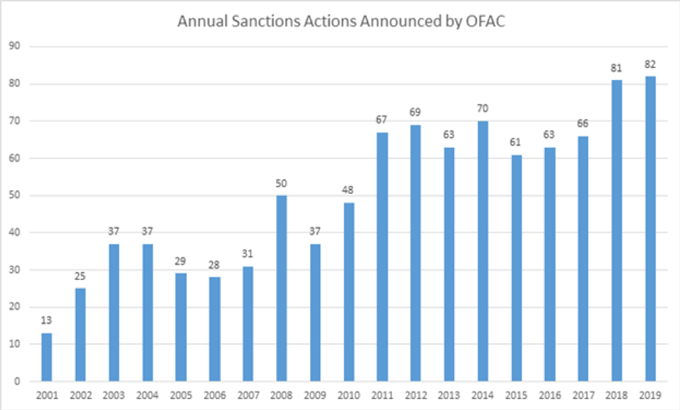

While President Obama described his sanctions team as his favorite “combatant command” (likening it to the traditional military forces employed by the United States), President Trump has truly unleashed the power of OFAC sanctions—employing them frequently, quickly, and unilaterally. The Trump administration announced new sanctions 82 times in 2019—eclipsing the previous record set in 2018. Much to the chagrin of the regulated community, more than one-quarter of the announcements in 2019 were made on a Friday. Under prior administrations, U.S. officials tried to avoid such late-week announcements to ensure that new designations were implemented consistently within the business week on both sides of the Atlantic. The willingness to impose Friday measures is an underappreciated indication of the breakdown in multilateral support for the use of U.S. sanctions, as well as the United States’ increasing willingness to go it alone.

This lack of multilateral sanctions engagement, however, should not be read as an indication that other jurisdictions are cooling to the idea of sanctions—quite the opposite. The United Kingdom, as a part of its Brexit process, announced that it would adopt existing European Union sanctions into its own domestic law in addition to promulgating independent, domestic measures that, at least initially, will target human rights abusers. The remainder of the European Union continued to threaten new measures against the regime of Venezuela’s Nicolás Maduro, paved the way for new sanctions against Iran by initiating the dispute resolution process allowed for under the Joint Comprehensive Plan of Action (“JCPOA”), and is considering sanctions targeting gross human rights violations. Meanwhile, companies began turning to the EU Blocking Statute—which aims to prohibit EU actors from complying with certain extraterritorial aspects of U.S. sanctions—to strengthen their position in contractual negotiations, disputes, and litigation.

Both China and Russia also proposed counter-sanctions in 2019 against parties who comply with U.S. measures. While China’s “unreliable suppliers” list has yet to be formalized and its sole counter-sanctions have thus far focused on non-economic actors (principally non-government organizations supportive of the Hong Kong democracy movement), and as of this writing Russian counter-sanctions remain un-enacted by the Duma, we expect the use of such counter-sanctions to increase in 2020.

Though it is hard to predict how sanctions will develop going forward, we feel it is safe to assume that sanctions will remain a centerpiece of the current U.S. administration’s approach to the world in 2020. We expect other world powers—both established and emerging—to respond in kind.

As the following charts illustrate, the two-decades-long trend toward increasing use of U.S. sanctions continued apace in 2019 and shows no signs of stopping during the year ahead.

OFAC Designations

OFAC Sanctions Actions

OFAC Monetary Penalties

I. Major U.S. Program Developments

A. Iran

When the United States abandoned the JCPOA and fully re-imposed nuclear sanctions on Iran in November 2018, the Trump administration warned that the United States would exert “maximum economic pressure” on all facets of the Iranian economy to both deter Iran’s “malign activities”—including its support for terrorism, missile proliferation, and regional disruption—and drive Iran back to the negotiating table. True to its word, the Trump administration continued to increase sanctions pressure on Iran and its trading partners in 2019 and expanded its enforcement efforts to new industries and institutions. Iran responded by pulling back from its commitments under the JCPOA, seeking alternative paths to avoid U.S. jurisdiction, and ramping up its provocative use of force. Hostilities with Iran escalated sharply by the end of the year—U.S. and Iranian-backed militias exchanged airstrikes and rocket attacks in late December, culminating in a militia-led breach of the U.S. embassy compound in Baghdad on December 31. When a U.S. airstrike killed Iranian General Qassem Soleimani on January 3, 2020, Iran vowed to retaliate, later carrying out a missile strike on two Iraqi military bases hosting U.S. troops. President Trump responded to this latest Iranian missile strike by promising the imposition of “additional punishing economic sanctions on the Iranian regime,” a promise that left many observers questioning whether anything in Iran was left to be sanctioned.

In pursuing “maximum economic pressure,” the United States has not only targeted new industries and entities but also has ramped up pressure on previously sanctioned persons. On April 8, 2019, as we described here, the United States designated the already-sanctioned IRGC as a foreign terrorist organization (“FTO”). Until this designation, the FTO label had been exclusively used on non-state actors, such as Al-Qaeda or the Islamic State of Iraq and Syria (“ISIS”). The FTO designation has limited practical impact, as the IRGC was already designated under several OFAC sanctions programs—including those related to counterterrorism.

As we discussed here, Iranian President Hassan Rouhani announced on May 8, 2019 that Iran would stop complying with the JCPOA’s limitations on Iran’s domestic build-up of enriched uranium and heavy water, and that same day President Trump signed an executive order authorizing new sanctions relating to the iron, steel, aluminum, and copper sectors of the Iranian economy.

Notably, Iran has responded to increasing economic pressure—particularly on Iranian banks—by seeking alternative tools to finance its operations. Specifically, U.S. sanctions effectively cut off Iran’s access to dollars and euros and contributed to a sharp drop in the value of the Iranian rial, making Iran’s foreign reserve currencies an increasingly important tool for the support of Iran’s activities in Iraq, Lebanon, Syria, and Yemen. According to OFAC, Iran used a network of Turkish and Emirati foreign exchange houses and front companies to exchange rials for foreign currencies used by a designated Iranian bank to support the IRGC’s Qods Force (“IRGC-QF”) and Iran’s Ministry of Defense and Armed Forces Logistics (“MODAFL”)—both of which have been designated to the SDN List. The United States responded to this workaround by designating 25 Iranian, Turkish, and Emirati exchange houses, trading companies, and officials on May 26, 2019. Rather than relying on its Iran sanctions authorities, OFAC used its counterterrorism sanctions—as it would later against Iran’s central bank—to ensure maximum impact. Entities designated under that program are not only subject to the broad sanctions restrictions typically imposed on SDNs but also may not participate in humanitarian trade with Iran—a category of activity generally exempt from sanctions restrictions. The designations also underscored OFAC’s willingness to extend its maximum economic pressure campaign to Iran’s international supporters, a possible harbinger of things to come in 2020.

In 2019, the United States continued to roll back sanctions relief that it had previously provided to other countries, including waivers that allowed certain jurisdictions to continue importing Iranian oil. In particular, waivers granted to China, India, South Korea, Japan, Italy, Greece, Taiwan, and Turkey allowed those jurisdictions to continue importing Iranian oil without being sanctioned by the United States, provided that those jurisdictions significantly reduced their Iranian oil imports. Our analyses of these temporary waivers, also known as Significant Reduction Exceptions (“SREs”), can be found here and here. The Trump administration also announced that, as part of its maximum pressure campaign, no further SREs would be issued and warned that those who continued to trade in Iranian crude would be sanctioned. The expiration of the SREs had relatively little effect on Taiwan, Italy, and Greece, which reportedly ceased importing oil from Iran long before the announcement.

By contrast, China increased its purchases of Iranian oil, cementing its status as Iran’s biggest customer. According to the U.S. State Department, China continued to purchase oil from Iran following the expiration of its SRE in May. In response, the Trump administration made good on its earlier warning—quickly sanctioning a Chinese state-owned oil trading company and its CEO in July. In announcing the designation, Secretary of State Mike Pompeo emphasized that the United States takes its secondary sanctions seriously and “will sanction any sanctionable behavior.” That warning, combined with the speed of the designation and the targeting of a state-owned firm, sent a clear signal that the Trump administration would continue aggressively applying maximum economic pressure both within and outside Iran.

In one of the more disruptive sanctions actions of the past year, OFAC on September 25, 2019, designated two subsidiaries of the giant Chinese company COSCO Shipping Corporation Ltd. (“COSCO”) for their involvement in transporting Iranian oil. While this action targeted only approximately 40 vessels belonging to the two designated entities (and their majority-owned subsidiaries), by not identifying those vessels by name the designation caused confusion to ripple through world markets regarding which among the approximately 1,100 vessels in the larger COSCO fleet were actually subject to U.S. sanctions. In an abundance of caution, many counterparties temporarily ceased doing business with all COSCO vessels—leaving numerous ships and their cargo stranded at sea. This confusion dissipated only after OFAC issued guidance indicating that non-U.S. persons that continue to deal with COSCO post-designation will generally not be at risk of U.S. sanctions exposure provided that such dealings do not involve Iran or otherwise have any U.S. nexus, and also issued a general license authorizing U.S. person involvement in transactions and activities ordinarily incident to the maintenance and wind down of pre-existing contracts involving one of the two sanctioned COSCO entities and its vessels.

In another example of the Trump administration’s maximum pressure campaign reaching beyond the typical industries, OFAC released an advisory on July 23, 2019 warning of Iran’s deceptive practices in the civil aviation industry and the heightened risk of enforcement actions against those that engage with Iran. The advisory formally put the global commercial aviation industry on notice of the role Iranian commercial airlines play in providing services to the Iranian government and military, as well as the deceptive practices commonly used to acquire U.S.-origin aircraft and related goods—including using front companies, misrepresenting that sanctions have been lifted, and falsely claiming OFAC authorization. The guidance specifically called out Mahan Air—designated in 2011 for its support of the IRGC-QF—for flying several flights per week with fighters and weapons to Damascus, and flying back the bodies of Iranian soldiers killed in Syria. The industry advisory used more than just the threat of sanctions to urge the civil aviation industry to avoid Mahan, noting that Germany and several other countries deny Mahan landing rights and urging others to do the same, as well as warning that Mahan has failed to pay its debt obligations.

As sanctions began to bite, economic tensions escalated to physical conflict. In September, Iran conducted airstrikes on Saudi Arabian oil facilities. The United States responded by imposing additional sanctions on the Central Bank of Iran (“CBI”) and Iran’s sovereign wealth fund on September 20. The United States accused those entities of supporting the IRGC, its Qods Force, and Hezbollah, and designated them using OFAC’s primary counterterrorism authority. Although President Trump characterized these designations as the “highest sanctions ever imposed on a country,” these sanctions in fact marked the latest in a series of actions targeting the CBI, including its earlier designation to the SDN List in November 2018. OFAC had also previously sanctioned senior CBI officials for their involvement in transactions supporting the IRGC and its Qods Force. These earlier sanctions already prohibited U.S. persons from engaging in transactions involving CBI and its designated officers, and non-U.S. persons were already subjected to secondary sanctions for doing so.

The new counterterrorism designations primarily impact the ability of U.S. and non-U.S. persons to provide food, other agricultural products, medicine, and medical devices to Iran. Such humanitarian goods can typically be provided to Iran pursuant to a general license. However, the license expressly prohibits the involvement of persons designated under OFAC’s counterterrorism sanctions—now including the CBI. Given the CBI’s key role in financing and otherwise facilitating humanitarian trade with Iran, many were concerned that the provision of humanitarian items to Iran had effectively become unlawful or sanctionable.

In response to these concerns, OFAC announced that it would implement a new mechanism to identify compliant financial channels to support humanitarian exports to Iran. According to Brian Hook, the U.S. Special Representative for Iran, the new financing channel would “make it easier for foreign governments, financial institutions, and private companies to engage in legitimate humanitarian trade on behalf of the Iranian people while reducing the risk that money ends up in the wrong hands.”

Under the new program, OFAC will provide written confirmation, or “comfort letters,” that proposed financial channels are not exposed to U.S. sanctions. However, to obtain these comfort letters, exporters of humanitarian items, foreign financial institutions, and foreign governments will be required to provide, on an ongoing basis, a significant amount of detailed information about their Iran-related activities and the proposed payment channel. Specifically, OFAC will require those seeking written confirmation to submit monthly reports that include detailed information about Iranian customers, their beneficial ownership, the seller of the items for export, the items included in the proposed exports, and the path of the export. Those who obtain written confirmation from OFAC will also be required to inform OFAC if they discover that their Iranian customers have misused the financial channel for non-humanitarian purposes. As of this writing, we are aware of no companies that have yet taken OFAC up on its offer.

On December 11, 2019, OFAC followed its warning to the civil aviation industry with the designation of three of Mahan’s general sales agents, which are third parties that provide services to an airline under the airline’s brand. None of the sales agents are based in Iran; the designated entities are registered in the United Arab Emirates and China. They were all designated purely for acting on behalf of Mahan Air, and were not alleged to have specifically been involved in flights to and from Syria.

On January 10, 2020, OFAC announced the designation of several senior Iranian government officials, as well as Iran’s largest steel, aluminum, copper, and iron manufacturers, a number of Iranian metal producers, and several Chinese and Seychellois companies involved in the purchase of Iranian metals. The President also issued a new executive order authorizing OFAC to designate entities operating in Iran’s construction, mining, manufacturing, or textile sectors or any other sector of the Iranian economy determined by the U.S. Secretary of the Treasury and authorizing the imposition of secondary sanctions for any entity that supports Iranian companies designated under the new authority. Following the U.S. drone strike that killed General Soleimani, Iran again announced that it would further reduce its commitments to restrain its nuclear program and would no longer comply with the restrictions on the number of centrifuges it may operate. The most meaningful response to Iran’s actions may come from the European Union which has triggered the dispute mechanism under the JCPOA—which could lead to the automatic re-imposition of sanctions against Iran.

With much of Iran now subject to comprehensive, sometimes overlapping sanctions regimes, it is not clear whether and how the Trump administration will continue to increase sanctions pressure on Iran. OFAC may target additional Iranian government officials, and 2020 will likely see designations under the newly released executive order targeting Iran’s construction, mining, manufacturing, and textiles sectors. If past is prologue, the Trump administration may also begin imposing secondary sanctions more robustly in an effort to further cut off Iran’s international support. These measures may have limited practical impact, however, as many non-U.S. entities have already decided not to participate in the Iranian economy out of concern for the tightening network of U.S. secondary sanctions.

B. Venezuela

U.S. sanctions targeting the regime of Venezuela’s President Nicolás Maduro significantly expanded in 2019, as the Trump administration designated the giant state-owned oil company PdVSA, the country’s central bank, and ultimately the entire Government of Venezuela. These seismic shifts in U.S. policy were prompted by a power struggle in Caracas between Nicolás Maduro and Juan Guaidó, the head of Venezuela’s National Assembly, that witnessed dueling claims to the presidency, widespread public protests, and an abortive military uprising. Against that tumultuous backdrop, the United States sought to hasten the transition to a democratically elected government by imposing more than 20 rounds of sanctions designed to deny the Maduro regime the financial resources to sustain its hold on power. In addition to designating progressively broader segments of the Venezuelan state, the Trump administration during 2019 also expanded U.S. sanctions to target Venezuela’s oil, financial, and defense and security sectors; a growing list of senior regime officials; as well as President Maduro’s perceived enablers in Russia and Cuba.

The rapid evolution of U.S. sanctions on Venezuela began immediately after the new year. In January 2019, Nicolás Maduro was inaugurated for a second term as president following an election widely described by outside observers as neither free nor fair. Within days, Juan Guaidó, acting as head of the National Assembly—the country’s sole remaining democratic institution—invoked a provision of Venezuela’s constitution to declare himself the country’s interim leader. (Guaidó’s claim to be Venezuela’s lawful head of state has since been recognized by the United States and nearly 60 other countries.) In a protective action designed to deny Maduro and his inner circle access to oil revenues and to prevent the regime from looting state assets, the Trump administration on January 28, 2019, imposed sanctions on the state-owned oil company PdVSA—by far the most economically significant actor in Venezuela’s oil-driven economy and one of the largest companies ever designated by OFAC. PdVSA’s designation and its implications are described at length in an earlier client alert, available here. Underscoring the strong U.S. policy interest in preserving PdVSA for use in rebuilding Venezuela’s economy under a post-Maduro government, OFAC has issued and repeatedly extended general licenses authorizing certain transactions involving PdVSA’s main U.S. subsidiary CITGO, as well as the activities of five named U.S. oil and oil services companies that operate joint ventures with PdVSA.

As the year progressed, the Trump administration continued to make use of the authorities set forth in Executive Order 13850—which empowers the U.S. Secretary of the Treasury to impose sanctions on persons who operate in the gold sector of the Venezuelan economy, and any other sector the Secretary deems appropriate—to target areas of the Venezuelan economy that generate large amounts of hard currency and are especially prone to corruption. In particular, OFAC during 2019 used this authority to impose sanctions on specific individuals and entities operating in the gold, oil, financial, and defense and security sectors of Venezuela’s economy. Among the targeted entities were the state gold mining company, Minerven; PdVSA’s majority-owned subsidiaries; Venezuela’s national development bank, BANDES, and four of its affiliates, including the prominent commercial lender Banco de Venezuela; and the Central Bank of Venezuela. Taken together, these measures sharply constrained the Maduro regime’s access to capital and closed off key channels for transferring funds in and out of Venezuela.

In August 2019, the United States went further and imposed sanctions on the entirety of the Government of Venezuela, including all of its agencies and political subdivisions. Importantly, however, this measure did not impose sanctions on all transactions involving the country of Venezuela and its practical impact was limited by the fact that the most economically significant arms of the Venezuelan state—including the national oil company, PdVSA, and its various subsidiaries, along with the country’s central bank—were already subject to U.S. sanctions. OFAC then further cabined this action by issuing general licenses—common across even the most restrictive U.S. sanctions programs (such as those targeting Cuba, Iran, North Korea, and the Crimea region)—authorizing certain transactions that involve the Venezuelan government and that are associated with telecommunications/mail; technology allowing internet communication; medical services; registration and defense of intellectual property; support for non-governmental organizations; transactions related to port and airport operations; overflight payments; and personal maintenance of U.S. persons inside Venezuela. Further details regarding this action can be found in our August 2019 client alert.

Throughout the past year, the United States also sought to target the Maduro regime’s perceived enablers, both within Venezuela and abroad. Consistent with past practice, the United States continued to designate a steady stream of senior Venezuelan government officials, including the country’s foreign minister and various members of the security services. Such designations appear designed both to punish previous bad behavior by senior officials—including corruption, mismanagement and the breakdown of democratic institutions—and to deter other officials from engaging in similar conduct in the future. Additionally, the Trump administration designated numerous foreign actors—principally from Russia and Cuba—for providing a financial lifeline to the government in Caracas. For example, in March 2019, OFAC designated the Russian-Venezuelan financial institution Evrofinance Mosnarbank for helping the regime to evade U.S. sanctions by, among other things, financing Venezuela’s cyber currency, the Petro. OFAC, across multiple actions, also designated dozens of companies and vessels involved in the Venezuela-Cuba oil trade, and has strongly suggested that Russian and Chinese individuals and entities may be sanctioned if they continue to prop up the Maduro regime.

Finally, amid a year of sweeping changes to the Venezuela sanctions program, OFAC has repeatedly emphasized that “U.S. sanctions need not be permanent and are intended to bring about a positive change of behavior.” Even if such an “off ramp” to sanctions has always existed—and parties do come off the SDN List—OFAC’s announcement that it would be amenable to de-listing parties if they manifest a change in behavior is new. Along those lines, the Trump administration has held out the prospect of sanctions relief for individuals and entities that renounce their previous support for President Maduro—an enticement OFAC has touted by de-listing the former head of Venezuela’s intelligence service, along with numerous shipping companies and vessels that had discontinued their Venezuela-related business activities and implemented sanctions compliance measures. Moreover, OFAC has indicated in published guidance that it is prepared to swiftly lift sanctions on PdVSA, and presumably the Government of Venezuela itself, upon a transfer of control “to Interim President Juan Guaidó or a subsequent, democratically elected government.” Accordingly, just as the United States rapidly tightened sanctions on Venezuela during 2019, there remains the possibility, if President Maduro were to fall, that U.S. sanctions could be eased just as quickly.

C. Cuba

In 2019, the Trump administration continued to reverse the Obama administration’s easing of measures on Cuba. In April 2019, President Trump removed a more than two-decades-long restriction on American citizens’ ability to bring suit over property confiscated by the Cuban regime. Title III of the Cuban Liberty and Democratic Solidarity (LIBERTAD) Act of 1996, commonly known as the Helms-Burton Act, authorizes U.S. citizens and companies whose property was confiscated by the Cuban government to sue those that “traffic” in that confiscated property. Since the Act’s entry into force in 1996, Presidents of both parties had continuously suspended the availability of this cause of action. As we discussed here, by lifting this suspension President Trump has—for the first time—opened up U.S. federal courts to a new type of lawsuit, which has important implications not only for U.S. relations with Cuba but also with countries that continue to operate in Cuba.

Title III actions can be based on claims certified by the Foreign Claims Settlement Commission of the United States (“FCSC”)—a quasi-judicial, independent federal agency created by the International Claims Settlement Act of 1949 (“certified claims”), or claims that have not been adjudicated by the FCSC process (“uncertified claims”). There are currently 6,000 certified claims, and by the State Department’s estimate, up to 200,000 uncertified claims. We have not yet witnessed a flood of litigation; rather, the filing of new Title III cases has averaged a little over two cases per month. By Gibson Dunn’s count, there have been 21 Title III cases filed in federal court to date, with the vast majority in the Southern District of Florida. Many of these cases were brought against defendants in the tourism industry, including airlines, cruise lines, hotels, and travel technology companies, with a number related to other industries such as oil refining, banking, and farming.

Also in April 2019, the Trump administration struck down a December 2018 deal between Major League Baseball (“MLB”) and the Cuban Baseball Federation (“CBF”) in which Cuban athletes would have been allowed to play in the United States without defecting. Under the MLB-CBF deal, an MLB team could sign a CBF player if it, among other things, paid the CBF a fee equivalent to 25% of the player’s signing bonus. (A similar arrangement exists for foreign players from other countries such as Japan.) The deal was originally thought to be authorized under a license established by the Obama administration that allowed the hiring of a Cuban national as long as payments were not made to the Cuban government in connection with such hiring. Per a senior Trump official, although this license remains in effect, the CBF is considered a part of the Cuban government and, as a result, the MLB-CBF deal as structured was illegal.

In June 2019, OFAC announced it would no longer authorize “people-to-people” educational group travel, which had allowed an organization subject to U.S. jurisdiction to sponsor exchanges that promoted contact with Cuban locals. Those travelers who had completed at least one travel-related transaction (e.g., purchasing a flight, booking a hotel) prior to June 5, 2019 were grandfathered in and allowed to proceed with their trip. Notably, OFAC left intact the “support for the Cuban people” travel authorization which also allows travel to Cuba but under strict conditions, such as avoiding all state-run businesses and institutions.

At the same time, the U.S. Commerce Department’s Bureau of Industry and Security (“BIS”), in coordination with OFAC, instituted a policy of denying licenses for passenger and recreational vessels (e.g., cruise ships, yachts), and private and corporate aircraft, to travel to Cuba on temporary sojourn. Moreover, such vessels and aircraft were made ineligible for license exceptions. This policy change left cruise lines scrambling to modify their trips.

In September 2019, OFAC announced a number of changes to the general license allowing for remittances to Cuba. First, the amount that one remitter can send to one Cuban national was capped at $1,000 per quarter. Second, close relatives of Cuban government officials or Cuban Communist Party officials could no longer be the recipients of such remittances. (The officials themselves had already been barred.) Third, “donative” remittances to certain individuals and organizations under 31 C.F.R. § 515.570(b) were eliminated. In that same action, OFAC also created a new authorization that allows for remittances to “self-employed individuals,” which includes small business owners, contractors, and farmers.

At the same time, OFAC announced changes to the “U-Turn” general license. The U-Turn license authorized U.S. financial institutions to “process fund transfers originating and terminating outside the United States, provided that neither the originator nor the beneficiary is a person subject to U.S. jurisdiction.” In effect, this allowed transactions between a Cuban national and a non-U.S. person, occurring outside the United States, to be conducted using U.S. dollars processed through the U.S. financial system via correspondent accounts maintained at U.S. intermediary banks. Now, such institutions are required to reject requests for these transactions. While this change dramatically limits the ability of Cubans to transact in U.S. dollars, notably banks are not required to block the funds at issue.

The Trump administration gave the same rationale for these financial restrictions as they did for the travel restrictions months earlier. As Treasury Secretary Steven Mnuchin expressed it, by imposing these restrictions, the United States is “hold[ing] the Cuban regime accountable for its oppression of the Cuban people and support of other dictatorships throughout the region, such as the illegitimate Maduro regime.”

In October 2019, citing Cuba’s “destructive behavior at home and abroad,” BIS amended the Export Administration Regulations (“EAR”) in a number of ways to further restrict exports and re-exports of items to Cuba. First, licenses to lease aircraft to Cuban state-owned airlines were revoked, and a general policy of denying future applications was instituted. Second, the de minimis level was revised downward for Cuba from 25% to 10%, meaning that items with at least 10% Cuban content would be subject to EAR restrictions. Third, the “Support for the Cuban People” license exception was limited in a number of ways, including barring donations to organizations controlled by or administered by the Cuban government or the Cuban Communist Party.

In addition to changes to the Cuba sanctions regulations, the Trump administration has consistently added Cuban persons and entities to the blacklist for their support of Venezuela’s Maduro regime. As discussed above, numerous shipping entities and vessels that have transported Venezuelan oil to Cuba have been sanctioned along with Cuban state-owned oil companies and individual Cuban government officials. Cuba’s defense minister, for example, has been barred by the U.S. State Department from entry into the United States for his actions “prop[ping] up the former Maduro regime in Venezuela.”

D. North Korea

Amid the stalled nuclear negotiations between President Trump and North Korean leader Kim Jong Un, the United States over the past year continued to target the illicit movement of goods in and out of North Korea. On March 21, 2019, OFAC published an advisory to address North Korea’s illicit shipping practices (the “North Korea Advisory”). That document serves as a comprehensive guide to key participants in the shipping trade, such as ship owners, financial institutions, brokers, oil companies, port operators, and insurance companies, and includes an overview of sanctions specific to the shipping industry. The North Korea Advisory also includes updated information about North Korea’s deceptive shipping practices, as well as additional guidance for members of the shipping industry on how to mitigate the risk of involvement in these practices.

According to OFAC, North Korea has been resorting to certain tactics to mask the identities of vessels and cargo in order to evade U.S. sanctions. These tactics include: (i) disabling a vessel’s location-tracking Automatic Identification System (“AIS”); (ii) physically altering a vessel’s identification or International Maritime Organization number; (iii) engaging in ship-to-ship transfers to conceal the origin or destination of the transferred cargo; (iv) falsifying cargo and vessel documents; and (v) manipulating data transmitted via AIS. To counter these deceptive practices, the North Korea Advisory encourages persons involved in shipping-related transactions to adopt certain risk mitigation measures, including but not limited to, carrying out necessary diligence to verify the identity of vessels, reviewing all applicable shipping documentation, and monitoring for AIS manipulation and disablement. The North Korea Advisory also identifies, in a series of annexes, 18 vessels believed to have engaged in ship-to-ship transfers with North Korean tankers, plus 49 vessels that are believed to have exported North Korean coal since the United Nations Security Council Resolution 2371 was passed on August 5, 2017.

Throughout 2019, OFAC continued to designate individuals and entities involved in the shipping industry for facilitating North Korean trade. On March 21, 2019, OFAC designated two Chinese shipping companies for their dealings with North Korea, citing the routine use of deceptive practices that enabled EU-based North Korean procurement officials to operate and purchase goods for the Kim regime. On August 30, 2019, OFAC announced North Korea-related designations of two individuals and three entities from Taiwan and Hong Kong for participating in illicit “ship-to-ship transfers” to enable North Korea’s import of refined petroleum products. Finally, U.S. prosecutors continued to pursue civil forfeiture actions against companies engaged in the illicit shipment of goods to North Korea, relying in many instances on money laundering or bank fraud charges in addition to violations of OFAC sanctions.

E. Russia

In 2019, OFAC took additional measures to address and combat Russia’s past and current attempts at interfering in the U.S. electoral process. On September 30, 2019, OFAC took its first action under Executive Order 13848, targeting Russia’s Internet Research Agency (“IRA”) and its financier, Yevgeniy Prigozhin, as well as entities, individuals, and assets associated with them, for their efforts to interfere with the 2018 midterm elections. Executive Order 13848, which was announced in September 2018, blocks all property in the United States of those who have “directly or indirectly engaged in, sponsored, concealed, or otherwise been complicit in foreign interference in a United States election,” as well as those found to have provided support for election interference. The action’s practical impact was limited by the fact that both the IRA and Prigozhin were previously designated in March 2018 under Executive Order 13694, which the Obama administration implemented to target “malicious cyber actors,” as were four of the six IRA members who were designated in this action. Adding additional pressure to Prigozhin, OFAC designated three of his private aircraft, a yacht, and three entities that operated those vessels.

On August 3, 2019, the Trump administration announced that OFAC will be issuing a second round of sanctions in response to Russia’s use of the Novichok nerve agent in the United Kingdom in March 2018. The Chemical and Biological Weapons Control and Warfare Elimination Act of 1991 (the “CBW Act”) requires, in the event that the President determines that a foreign government has used chemical or biological weapons, two rounds of sanctions. This second round of CBW Act sanctions prohibits U.S. banks, including foreign branches, from participating in the primary market for non-ruble denominated bonds issued by Russia and from issuing non-ruble denominated loans to Russia. As detailed in our 2018 Year-End Sanctions Update, the first round of sanctions were imposed on August 22, 2018. Though initially expected in November 2018, the second round of sanctions was not implemented until August 26, 2019, over a year after the first round’s implementation.

As described in detail here, on April 6, 2018, OFAC significantly enhanced the impact of sanctions against Russia by blacklisting almost 40 Russian oligarchs, officials, and their affiliated companies pursuant to Obama-era sanctions, as modified by the Countering America’s Adversaries Through Sanctions Act of 2017. On December 19, 2018, OFAC de-listed three entities that had been related to sanctioned oligarch Oleg Deripaska after the companies took significant steps to disentangle from Deripaska’s ownership.

Several months later, on March 15, 2019, Deripaska sued the Secretary of the Treasury, the Department of the Treasury, and OFAC in U.S. federal court in order to reverse the sanctions imposed upon him. Deripaska argued that OFAC acted outside the bounds of its authority by including him on “an arbitrarily contrived list of ‘oligarchs’” and that “[t]he effects of these unlawful sanctions has been the wholesale devastation of [his] wealth, reputation, and economic livelihood.” Although the U.S. government has filed a motion to dismiss (and, in the alternative, motion for summary judgment) and Deripaska has submitted his opposition, the court has stayed the motion until the parties file a joint status report, due on February 19, 2020.

Congress and the Trump administration took additional measures against Russia during the very last weeks of 2019, highlighting the geopolitical tension between the two countries.

On December 18, 2019, the Senate Foreign Relations Committee voted to approve the Defending American Security from Kremlin Aggression Act (“DASKA”), which aims to impose new sanctions on the Russian financial, energy, and cyber sectors. The draft bill limits the President’s ability to withdraw from NATO, establishes in the State Department a new office to address international cybersecurity, creates new offenses related to hacking, and directs the President to impose a host of sanctions against Russia. Among the many contemplated sanctions, the bill includes additional sanctions against Russian banks, the Russian energy, cyber, and shipbuilding sectors, sovereign debt, and, significantly, sanctions on persons who facilitate corrupt activities on behalf of President Vladimir Putin. Although the bipartisan bill has been dubbed the bill “from hell,” currently there is no scheduled date for the full Senate to vote on its adoption.

Two days after DASKA was approved by committee, the President signed the National Defense Authorization Act for Fiscal Year 2020 (the “NDAA”), which includes provisions requiring the imposition of sanctions against vessels and persons involved in the construction of two Russian gas export pipelines, the Nord Stream 2 and the Turkstream pipelines. Although the inclusion of these sanctions signals U.S. support for Ukraine—Russia is constructing these pipelines largely to bypass Ukraine—their impact may be minimal as the pipelines’ construction is nearly complete.

F. Syria

As we described in an earlier client alert, on October 14, 2019, the Trump administration authorized sanctions against core ministries of the Government of Turkey in response to Ankara’s incursion into northern Syria. Shortly thereafter, OFAC issued sanctions against Turkey’s Ministry of Energy and Natural Resources and Ministry of National Defense, as well as three senior officials. Less than two weeks later, following the announcement of a ceasefire in northern Syria, the Department of Treasury delisted the two ministries and three senior officials. To our knowledge, OFAC had never issued and then reversed sanctions so quickly against such significant targets.

On March 25, 2019, OFAC issued an updated advisory to the maritime petroleum shipping community “alert[ing] persons globally to the significant U.S. sanctions risks for parties involved in petroleum shipments to the Government of Syria” (the “Syria Advisory”). That document emphasizes that certain countries, in particular Iran and Russia, ship petroleum to Syria, and that the facilitation of such transactions by persons subject to U.S. jurisdiction puts those persons at risk for being targeted by OFAC. The Syria Advisory also includes a non-comprehensive list of deceptive practices employed by certain shipping companies to “obfuscat[e] the destination and recipient of oil shipments in the Mediterranean Sea ultimately destined for Syria,” as well as certain measures companies should take to mitigate risk presented by these practices.

Though very similar to an earlier advisory on which it is based, the latest version of the Syria Advisory includes “additional guidelines and risks associated with facilitating the shipment of petroleum destined for Syrian Government-owned and -operated ports, to include petroleum of Iranian origin.” Additionally, the updated Syria Advisory includes an expanded annex, listing additional vessels that are alleged to have delivered petroleum to Syria between 2016 and 2018, as well as vessels that are alleged to have engaged in ship-to-ship transfers of oil destined for Syria and those that had exported Syrian oil to other countries.

II. Other OFAC Programs

A. Global Magnitsky Sanctions

As we noted previously, on December 20, 2017, President Trump issued Executive Order 13818, an unusually broad executive order to implement the Global Magnitsky Human Rights Accountability Act (“Global Magnitsky Act”), a 2016 law that authorizes sanctions against those responsible for human rights abuses and significant government corruption around the world.

The Global Magnitsky Act is named for Sergei Magnitsky, a Russian accountant who was imprisoned after exposing a tax fraud scheme allegedly involving Russian government officials and who died under suspicious circumstances while in custody. The 2012 Sergei Magnitsky Rule of Law Accountability Act of 2012 (the “2012 Magnitsky Act”) authorizes sanctions against individuals and entities found to have been involved in Magnitsky’s mistreatment and death as well as subsequent efforts to obstruct the related investigation. The Global Magnitsky Act expands that sanctions authorization to cover serious human rights abuses and corruption worldwide.

In 2019, the Trump administration designated 97 individuals and entities under the Global Magnitsky Act. That figure was nearly double the 49 designations in 2018, a significant number of which were levied against those involved in the killing of the journalist Jamal Khashoggi. Together with the initial round of designations that accompanied issuance of Executive Order 13818, the total number of persons designated pursuant to the Global Magnitsky Act is currently 196 (two designations of senior Turkish government officials were lifted in 2018 following the release of American pastor Andrew Brunson). Also this past year, the administration designated six additional Russian persons pursuant to the 2012 Magnitsky Act.

On December 9 and 10, 2019, in conjunction with International Anticorruption Day and International Human Rights Day, respectively, OFAC announced a set of wide-ranging sanctions targeting notable cases of public corruption and serious abuses.

On December 9, 2019, Treasury announced the following Global Magnitsky Act designations:

- Try Pheap and Kun Kim, current and former senior Cambodian officials responsible for significant public corruption and misuse of state resources.

- Aivars Lembergs, a Latvian oligarch and mayor of Ventspils, Latvia, who is involved in significant public corruption, money laundering, and abuse of office. OFAC also designated four entities controlled by Lembergs, including the Ventspils Freeport Authority.

- Associates of and entities controlled by Slobodan Tesic, a Serbian arms dealer who was previously sanctioned by the UN for violating the arms embargo imposed on Liberia.

On December 10, 2019, Treasury announced the following designations:

- Four senior Burmese military officials, including the Commander-in-Chief of the Burmese military forces, for their involvement in serious human rights abuses committed against the minority Rohingya people in Rakhine State. Since 2017, over 500,000 Rohingya have fled Burma and, during that time, the Burmese military has been engaged in acts of mass violence directed against the Rohingya people.

- The leader and deputies of the Allied Democratic Forces (“ADF”) of the Democratic Republic of the Congo (“DRC”). The ADF has engaged in serious human rights abuses, committing acts of mass violence, torture, abduction, and the use of child soldiers for over two decades in the Eastern part of the DRC, near the border with Uganda.

- Marian Kocner, a Slovakian businessman, charged with ordering the murder of Jan Kuciak, a young reporter who had uncovered alleged corrupt dealings involving Kocner.

- A Pakistani senior superintendent of police reportedly responsible for staging encounters in which over 400 individuals were killed by police.

OFAC also used the Global Magnitsky authority to target several Iraqi officials, some of whom are known proxies of the IRGC-QF. In July 2019, Treasury designated two Iraqi militia leaders pursuant to the Global Magnitsky Act for human rights abuses and corruption carried out in the Nineveh region of Iraq, a former Islamic State stronghold, as well as two Iraqi former politicians accused of significant public corruption. In December 2019, Treasury designated three Iraqi militia leaders responsible for directing soldiers to open fire on protesters in Baghdad. The Iraqi militia leaders were described as proxies of the IRGC-QF. The designations were made just weeks before one of the designated militia leaders was photographed among those protesting at the U.S. Embassy in Baghdad on December 31. On January 3, 2020, two of the previously designated militia leaders were further designated as global terrorists.

As discussed further below, the European Union announced on December 9, 2019 that it would begin drafting its own Magnitsky-style sanctions framework for targeting human rights offenders. The United Kingdom and Canada have already adopted Magnitsky-style sanctions programs.

From a compliance perspective, the Global Magnitsky Act designations serve as a reminder to carefully assess contacts with, and screen business partners related to, jurisdictions of heightened concern, even if those jurisdictions are not subject to comprehensive sanctions. Particularly with respect to jurisdictions with increased risk related to public corruption, organized crime, or geopolitical instability, sanctions may be deployed with very little notice and may affect commercial networks both within and beyond the country concerned.

B. Narcotics Trafficking Kingpin Sanctions and New Fentanyl Sanctions Act

This past year brought renewed focus on using financial sanctions to target persons involved in the international trafficking of opioids. On August 21, 2019, the Treasury Department announced coordinated action by OFAC and by Treasury’s Financial Crimes Enforcement Network (“FinCEN”) to target manufacturers and distributors of illicit synthetic opioids. OFAC designated three Chinese individuals and two entities pursuant to the Foreign Narcotics Kingpin Designation Act (“Kingpin Act”) for operating an international drug trafficking network responsible for shipping hundreds of packages of synthetic opioids to the United States. Treasury highlighted the use of digital currency by the designated persons to launder the proceeds of illicit drug sales. The White House also announced actions to crack down on international fentanyl trafficking, including the publication of a series of private-sector advisories to help domestic and foreign businesses protect themselves and their supply chains from inadvertent fentanyl trafficking.

Congress took further action by adopting the Fentanyl Sanctions Act on December 20, 2019, as Title 72 of the NDAA. The Act requires the President to submit to Congress within 180 days a list of persons determined to be foreign opioid traffickers and requires the imposition of five or more sanctions measures against such persons, including, among other restrictions, an asset freeze, visa ban, exclusion from public procurement, and exclusion from the U.S. financial system. The statute also calls upon the government of China to follow through on its commitments to implement new regulations controlling the production and export of fentanyl and fentanyl analogues.

Separately, OFAC designated over 70 additional persons under the Kingpin Act in 2019, including drug trafficking and money laundering networks in Argentina, the Dominican Republic, Guatemala, Lebanon, Mexico, and the United Arab Emirates.

C. Mali

Despite the presence of 15,000 United Nations peacekeepers and police in Mali, renewed violence has continued to roil the country; news reports indicate that at least 200,000 people were displaced in the first half of 2019 alone. As a result, the Trump administration on July 26, 2019, announced a new sanctions program “to combat the worsening situation in Mali,” which was described to include “[m]align activities such as drug trafficking, hostage taking, attacks against civilians, and attacks against United Nations (UN) Multidimensional Integrated Stabilization Mission in Mali (MINUSMA) personnel.” In connection therewith, President Trump issued Executive Order 13882, finding the deterioration of peace and security in Mali to constitute a national security threat to the United States.

The Order blocks all property and interests in property under U.S. jurisdiction of persons determined to be responsible or complicit in: acts or policies that threaten the peace, security, stability, or the democratic processes or institutions in Mali; acts that threaten, violate, or obstruct the 2015 Agreement on Peace and Reconciliation in Mali; planning or sponsoring attacks against government institutions and the Malian defense and security forces, international security forces and peacekeepers, and any other U.N. personnel; obstructing the distribution of humanitarian aid; planning, directing, or committing any act that violates international humanitarian law or constitutes a serious human rights abuse; the use or recruitment of child soldiers in the Malian armed conflict; the illicit production of or trafficking in narcotics; trafficking in persons, arms, and illegally acquired cultural property; and any transaction(s) involving bribery or other corruption. Currently, five individuals have been added to the SDN List pursuant to this Order.

III. Other U.S. Developments

A. New Treasury Under Secretary for Terrorism and Financial Intelligence

On December 10, 2019, the Trump administration announced its intent to nominate Jessie K. Liu, the United States Attorney for the District of Columbia, to the position of Under Secretary for Terrorism and Financial Intelligence at the Treasury Department, a role previously held by Sigal Mandelker. In this role, Liu would lead the Treasury Department teams responsible for administration and enforcement of U.S. sanctions programs. Liu previously served as Deputy General Counsel of the Treasury Department and in a senior position within the Justice Department’s National Security Division, the office responsible for criminal enforcement of U.S. sanctions and export control laws.

B. OFAC Compliance Guidance

As we described in a previous client alert, OFAC in May 2019 published “A Framework for OFAC Compliance Commitments,” on what constitutes an effective sanctions compliance program. The document represents the most detailed statement to date of OFAC’s views on the best practices that companies should follow to ensure compliance with U.S. sanctions laws and regulations. Importantly, this guidance also aims to provide greater transparency with respect to how, should a sanctions violation occur, OFAC will assess the adequacy of a company’s existing compliance program in determining what penalty to impose.

The compliance guidelines contain five components of what OFAC deems to comprise an effective compliance framework: (i) management commitment; (ii) risk assessment; (iii) internal controls; (iv) testing and auditing; and (v) training. OFAC also provides examples of best practices that companies are expected to follow under each of the five components. With the publication of the new OFAC compliance framework, companies subject to U.S. jurisdiction now have the benefit of a more granular understanding of what policies and procedures will lead OFAC to conclude that their sanctions compliance program is adequate or deficient. The compliance guidelines also describe in detail ten root causes of sanctions violations, including but not limited to the lack of a formal sanctions compliance program; facilitating transactions by non-U.S. persons; exporting or re-exporting U.S.-origin goods, technology or services to OFAC sanctioned persons or countries; and utilizing non-standard payment or commercial practices. We recommend that companies use the OFAC framework as a baseline to assess their own compliance programs, and update them accordingly to reduce the risk of incurring U.S. sanctions liability.

C. New OFAC Transaction Reporting Procedures

On June 21, 2019, OFAC announced an Interim Final Rule amending the Reporting, Procedures, and Penalties Regulations (31 C.F.R Part 501). Notably, the amendment expands the reporting requirements for rejected transactions. Although financial and non-financial institutions alike had previously been required to file blocked property reports, only financial institutions had been required to file rejected transfer reports. Under the new amendment, however, all U.S. persons and persons subject to U.S. jurisdiction are required to submit reports on rejected transactions. The new amendment also makes clear that, in addition to rejected funds transfers, the reporting requirement applies to all rejected transactions, which includes rejected “transactions related to wire transfers, trade finance, securities, checks, foreign exchange, and goods or services.” Moreover, the scope of the information to be included in the rejection (and blocking) reports is expanded to include a host of information in order to reduce OFAC’s need to issue follow-up requests for additional information.

This new rule materially increases the number of transactions that may need to be reported to the agency; the regulated community and advisors have been engaging with OFAC ever since the announcement to understand the true scope of the transactions that OFAC would like to see reported.

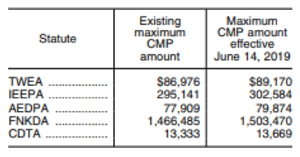

D. New OFAC Penalty Amounts

Also in June 2019, OFAC increased the maximum base penalties for sanctions violations pursuant to the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015. This is the fourth time that OFAC has adjusted the applicable civil monetary penalties (“CMPs”) since the Act was adopted in 2015.

Under this adjustment, the maximum CMP amount for the five applicable sanctions-related statutes increased as follows:

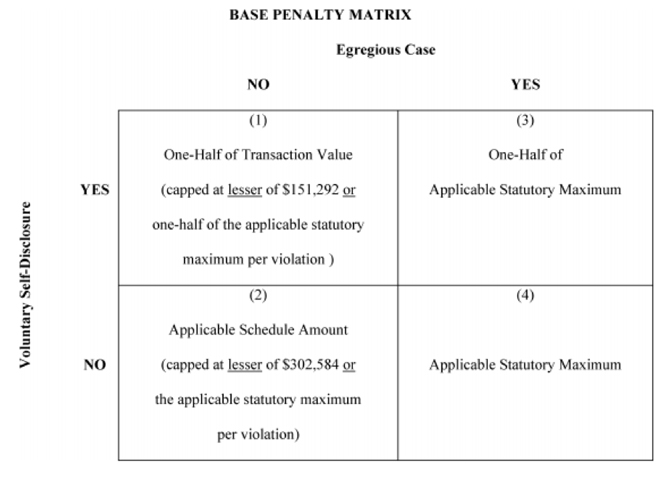

Additionally, the OFAC enforcement guidelines published as Appendix A to 31 C.F.R. Part 501 have been updated to reflect these new figures. The update includes a new “base penalty matrix” to assist in calculating possible penalty amounts under the various statutes, which takes into account the egregiousness of the offense and whether the offending transaction was voluntarily disclosed to OFAC:

E. CAPTA List

On March 14, 2019, OFAC introduced the List of Foreign Financial Institutions Subject to Correspondent Account or Payable-Through Account Sanctions (“CAPTA List”). This list includes identifying information of foreign financial institutions (“FFIs”) for whom it is prohibited to open or maintain correspondent or payable-through accounts in the United States under existing legal authorities, including: the Ukraine Freedom Support Act of 2014, as amended by the Countering America’s Adversaries Through Sanctions Act; the North Korea Sanctions Regulations; the Iranian Financial Sanctions Regulations; and the Hizballah International Financing Prevention Act of 2015.

Importantly, the CAPTA List is not a new list in its own right; rather, it consolidates information that had previously been included under other lists maintained under various sanctions programs, such as the now-defunct Part 561 List and the (never used) Hizballah Financial Sanctions Regulations List. Notably, entities appearing on the CAPTA List are not included on the SDN List.

Although this list does not contain new information per se, it may prove to be a useful resource for U.S. financial institutions when conducting diligence on FFIs seeking to open correspondent or payable-through accounts in the United States.

IV. Developments in U.S. Export Controls

The Trump administration’s practice of using all international trade tools at its disposal to advance its domestic and foreign policy objectives also extended to its use of certain authorities delegated to the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”). Although interagency coordination on sanctions is not new, the Administration’s apparent willingness in 2019 to use BIS’s export control licensing and enforcement tools to advance its foreign policy and national security interests, including the Administration’s trade agenda, was. This was most manifest in BIS’s designation of Huawei Technologies Co. Ltd. (“Huawei”) to the Export Administration Regulation’s (“EAR”) Entity List on May 16, 2019, though BIS made frequent use of this and another listing power throughout the year. Importantly, BIS’s measures are not technically “sanctions” though they operate in a similar manner and, depending upon the measure, can have similar impacts.

A. Entity List

Entities can be designated to the Entity List upon a determination by the End-User Review Committee (“ERC”) that the entities pose a significant risk of involvement in activities contrary to the national security or foreign policy interests of the United States. The ERC is an interagency body with representatives from the Departments of Commerce, State, Defense, Energy, and the Treasury, and which is chaired by Commerce. Through Entity List designations, BIS prohibits the export, re-export, or transfer (hereinafter “export”) of specified items to designated entities without BIS licensing. BIS will typically announce either a policy of denial or ad hoc evaluation of license requests.

The practical impact of any Entity List designation varies in part on the scope of items BIS defines as subject to the new export licensing requirement, which could include all or only some items that are “subject to the EAR.” In addition to items manufactured or exported from the United States, items “subject to the EAR” include (a) foreign-made items containing U.S. content that exceeds the EAR’s de minimis threshold for controlled content to the country of destination (25% for most countries, 10% for others), (b) certain U.S. content that is exempt from the de minimis rule, meaning that any amount of the controlled content will render the foreign-made item subject to the EAR, and to foreign-made items (c) that are the direct product of U.S.-origin technology or software, or (d) that are the products of whole plants or components of plants designed with certain U.S. technology or software. Those exporting to parties on the Entity List are also precluded from making use of any BIS license exceptions.

Because the Entity List prohibition applies only to exports of items subject to the EAR, U.S. persons are still free to provide many kinds of services and to otherwise continue dealing with those designated in transactions that occur wholly outside of the United States and without items subject to the EAR. While on the one hand, this makes the Entity List prohibition more limited than OFAC’s SDN prohibitions, the Entity List prohibition is more extraterritorial in reach because it also prohibits non-U.S. persons from re-exporting or transferring any items subject to the EAR to the listed parties wherever these items are located. OFAC’s SDN prohibitions are limited to U.S. person dealings with SDNs, though foreign person dealings with SDNs can be a basis for OFAC’s designating the foreign person under certain circumstances.

On May 16, 2019, BIS added Huawei and almost 70 Huawei affiliates to the Entity List. Later, on August 21, 2019, BIS expanded its Huawei designations to include its fabless semiconductor subsidiary, HiSilicon, plus 46 new designations, pushing the total number of Huawei entities designated to over 100. The ERC’s cited basis for its original determination was a Superseding Indictment of Huawei filed in the Eastern District of New York which includes among its 13 counts two charges that Huawei knowingly and willfully conspired and caused the export, re-export, sale and supply, directly and indirectly, or goods, technology, and services from the United States to Iran and the Government of Iran without authorization from OFAC.

BIS’s prohibition on dealings with Huawei was and continues to be comprehensive; BIS included the export of all items subject to the EAR within the scope of its prohibition and announced that it will review license applications to export to Huawei with a policy presumption of denial. No other company as large as Huawei or with operations in as many countries worldwide had ever been designated by the ERC to the Entity List.

B. BIS Made More Typical Entity List Designations Throughout the Year

On June 24, 2019, BIS designated five Chinese entities involved in exascale high performance computing out of concern that they were developing and using technologies to support nuclear explosive simulation and military simulation activities.

On May 14, 2019, BIS designated twelve entities to the Entity List. Two from China were added due to their role in the unauthorized export of syntactic foam to Chinese state-owned enterprises, defense industrial corporations, and military-related academic institutions. Four more Chinese and Hong Kong entities were added due to their attempts to procure U.S.-origin commodities that would provide material support to Iran’s weapons of mass destruction and military programs. A Pakistan entity was added due to its participation in unsafeguarded nuclear activities. Finally, four United Arab Emirates-based entities were designated for their role in procuring U.S.-origin commodities for the SDN Mahan Air and for another entity already identified on the Entity List.

On November 13, 2019, BIS added 22 new entities located in Bahrain, France, Iran, Jordan, Lebanon, Oman, Pakistan, Saudi Arabia, Senegal, Syria, Turkey, the United Arab Emirates, and the United Kingdom. The rationales provided for their designations ran the gamut of U.S. foreign policy concerns. An airline from France was designated for its role in transshipping U.S.-origin items to sanctioned jurisdictions. Entities in Oman, Pakistan, Saudi Arabia, and the United Arab Emirates were designated for their participation in unspecified unsafeguarded nuclear activities, and entities located in Bahrain, the United Arab Emirates, and Turkey were designated for diverting U.S.-origin items to Iran without authorization.

C. One Other Set of Entity List Designations Broke New Ground and Could Create a Path for Export Control Designations in 2020

While many of BIS’s other Entity List designations for the year tracked historical concerns of the United States—for example, nuclear proliferation and sanctions evasion—one set of Entity List designations broke new ground. On October 9, 2019, BIS designated 28 new Chinese entities, including eight major emerging technology companies, for their roles in the implementation of China’s campaign of repression, mass arbitrary detention, and high-technology surveillance against Uighurs, Kazakhs, and other members of Muslim minority groups in the Xinjiang Uighur Autonomous Region. While OFAC designations based on human rights concerns have become common in recent years, BIS has not historically used Entity List designations in this way and we anticipate that we will see additional Entity List designations on these grounds in 2020.

V. Legislative Developments: Focus on China

On November 21, 2019, amid mounting tensions between China and Hong Kong over a now-withdrawn extradition bill, the U.S. Congress passed the Hong Kong Human Rights and Democracy Act of 2019 (the “HK Act”), as described in our earlier client alert. The HK Act seeks to protect civil rights in Hong Kong and to deter human rights violations in the territory (including punishing those who commit them). Within a week after the HK Act was passed by supermajorities in both houses of Congress, President Trump signed the HK Act into law on November 27, 2019, despite hinting earlier that he might veto the legislation. An accompanying bill to prohibit the commercial export of covered munitions items to the Hong Kong police force was also signed into law the same day.

The HK Act augments the existing U.S.-Hong Kong Policy Act of 1992 by requiring the U.S. Secretary of State to annually certify to Congress whether Hong Kong retains sufficient autonomy to merit its special trade and investment status. An adverse assessment could potentially threaten this status. Under the HK Act, the President is also empowered to impose sanctions on individuals deemed responsible for human rights violations in Hong Kong. The potential sanctions are varied, and could include asset blocking, which would effectively blacklist any identified party from participating in transactions with U.S. persons, and limit the designated party’s ability to engage in U.S. dollar trade (which almost always requires clearing through a bank under U.S. jurisdiction). Other types of sanctions that could be imposed include the revocation or denial of U.S. visas currently issued or to be issued to identified individuals.

China has declared that the HK Act represents an interference in its domestic affairs and has retaliated by announcing sanctions against U.S.-based non-profit organizations, including the National Endowment for Democracy and Human Rights Watch. China also stated that it will prohibit U.S. military vessels from conducting port calls in Hong Kong—though, in practice, such port calls were already typically denied. It remains to be seen if Beijing will impose further retaliatory measures.

On December 3, 2019, the U.S. House of Representatives passed the Uighur Intervention and Global Humanitarian Unified Response Act of 2019 (the “UIGHUR Act”) in an attempt to hold Beijing accountable for its alleged human rights abuses against ethnic and religious minorities, particularly the Uighurs (alternatively “Uyghurs”) in the Xinjiang region. This bill, which passed by a vote of 407-1, would amend and strengthen a related Senate version of the bill by explicitly linking U.S. policy toward China with the human rights situation in Xinjiang and mandating many of the Senate version’s non-binding provisions. In particular, the UIGHUR Act stands to impose a host of sanctions on senior Chinese government officials involved in the human rights abuses towards the Uighurs and implement export controls on U.S.-made items destined for Xinjiang and that could be used by the Chinese government for certain surveillance and repressive activities. If enacted, it would mark the first time that sanctions would be imposed on a member of China’s politburo, namely Secretary Chen Quanguo. The Senate now must reconcile and approve the differences between the House and Senate versions, and the President must sign the final bill for enactment. Key lawmakers have expressed optimism that Congress will be able to move the legislation forward soon, even as concerns about the UIGHUR Act’s strengthened export controls provisions and President Trump’s impeachment trial may result in delay.

VI. Select U.S. Enforcement

2019 saw OFAC as busy as it has been in over a decade, finalizing 30 cases, assessing record fines, and pursuing novel and aggressive enforcement theories. While OFAC cases are not formally precedential, the agency does use enforcement to educate the public and to indicate OFAC’s foremost compliance concerns. In that regard, we provide below an overview of some of the more impactful enforcement actions of the past year.

A. Apollo Aviation

In November 2019, Apollo Aviation Group, LLC (“Apollo”) agreed to pay $210,600 to OFAC to settle its potential civil liability for apparent violations of U.S. sanctions on Sudan. OFAC alleged that Apollo violated U.S. sanctions when it leased three aircraft engines to an entity incorporated in the United Arab Emirates, which then subleased the engines to a Ukrainian airline, who in turn installed the engines on aircraft leased to Sudan Airways. The leases occurred between 2013 and 2015, when Sudan Airways was identified on the SDN List as meeting the definition of “Government of Sudan.” The lease agreements that Apollo entered into contained a provision prohibiting the lessee from maintaining, operating, flying, or transferring the engines to any countries subject to U.S. sanctions. However, OFAC alleged that Apollo did not periodically monitor or otherwise verify that the lessee and sublessee were adhering to this lease provision and, as a result, Apollo did not learn that its engines were installed on Sudan Airways aircraft until a review of the engine records after the end of the lease. In determining the appropriate penalty, OFAC considered that Apollo voluntarily self-disclosed the apparent violations, implemented a number of remedial measures in response, and no Apollo personnel had actual knowledge of the conduct leading to the apparent violations.

This case was one of the first to name in an enforcement action a non-operational, private equity investor that did not own the entity at the time of the alleged misconduct. This line of enforcement cases has made it clear that OFAC is increasingly willing to pursue enforcement actions under a theory of successor liability and even against parties not involved in the operational management of an alleged offender.

B. General Electric

In October 2019, the General Electric Company (“GE”), on behalf of three current and former GE subsidiaries, Getsco Technical Services Inc., Bentley Nevada, and GE Betz (collectively, the “GE Companies”), agreed to pay $2,718,581 to settle potential civil liability for 289 alleged violations of U.S. sanctions on Cuba. Specifically, OFAC alleged that between December 2010 and February 2014, the GE Companies accepted 289 payments from The Cobalt Refinery Company (“Cobalt”) for goods and services provided to a Canadian customer of GE. Cobalt, an entity owned by a public joint venture between GE’s Canadian customer and the Cuban government, has been on the SDN List since June 1995.

Although GE entered into contracts with and issued invoices directly to the Canadian customer, Cobalt paid the invoices in more than 65 percent of the total transactions during the relevant period, with payments totaling approximately $8,018,615. In setting the monetary penalty, OFAC considered the fact that GE identified the alleged violations by testing and auditing its compliance program and then voluntarily self-disclosed the payments to OFAC. This case demonstrated OFAC’s continued focus on Cuban violations and the agency’s willingness to “pierce the veil” in enforcement cases to find alleged wrongdoing on an indirect basis.

C. British Arab Commercial Bank

In September 2019, British Arab Commercial Bank (“BACB”) agreed to remit $4,000,000 to settle potential violations of the Sudanese Sanctions Regulations stemming from the bank’s processing of 72 transactions totaling $190,700,000. OFAC determined that BACB did not make a voluntary self-disclosure and that the violations represented an egregious case, but nonetheless found that the bank’s operating capacity was such that it would face disproportionate impact were it required to pay the proposed penalty of over $220 million.

Between September 2010 and August 2014, BACB processed 72 bulk funding payments related to Sudan in relation to its operation of U.S. dollar accounts for at least seven Sudanese financial institutions, including the Central Bank of Sudan. The transactions themselves were not processed to or through the U.S. financial system but the bank did operate a nostro account at a non-U.S. financial institution located in a country that imports Sudanese-origin oil to facilitate payments involving Sudan. The bank funded this nostro account with large, periodic U.S. dollar wire transfers from banks in Europe, which in turn transacted with U.S. financial institutions in a manner that violated OFAC sanctions. Several BACB employees, including managers and a member of the compliance team, had knowledge of this arrangement. In determining a settlement amount far lower than the potential penalty range, OFAC considered BACB’s record free from prior violations, the bank’s cooperation with the investigation, and the institution’s weak financial position. OFAC also credited BACB for undertaking several remedial measures, including exiting the Sudanese market, hiring new compliance staff and new senior management, and implementing additional compliance procedures.

This case was another in a line of enforcement actions that has seen OFAC continue to extend its theory of jurisdiction, using even an indirect and somewhat attenuated reliance on the U.S. dollar to bring an entire body of transactions under OFAC jurisdiction.

D. Atradius

On August 16, 2019, Atradius Trade Credit Insurance, Inc. (“Atradius”), a trade credit insurer licensed to operate in the state of Maryland, agreed to pay $345,315 to settle its potential civil liability for two apparent violations of the Foreign Narcotics Kingpin Sanctions Regulations. On May 5, 2016, OFAC designated Grupo Wisa, S.A. (“Grupo Wisa”) pursuant to the Kingpin Act and added the entity to the SDN List. In October 2016, approximately five months after Grupo Wisa’s designation, a cosmetics company located in the United States assigned to Atradius the right to collect on a debt owed by Grupo Wisa. Atradius subsequently filed a claim in Panama as a creditor in the liquidation of Grupo Wisa, and in June 2017, Atradius received a payment of approximately $4 million from the liquidation of Grupo Wisa’s assets in Panama. OFAC alleged that by accepting the assignment of the Grupo Wisa debt, and by receiving the payment from the Grupo Wisa liquidation, Atradius was alleged to have dealt in property or interests in property of a specially designated narcotics trafficker in violation of U.S. sanctions. OFAC considered it an aggravating factor that Atradius did not undertake any meaningful analysis or otherwise seek confirmation from OFAC that assignment of the SDN’s debt and acceptance of payment was permissible under existing authorizations.

This enforcement action underlines one of the surprising facts about OFAC designations. Atradius sought to extract money from a sanctioned party, which would presumably be in line with U.S. Government wishes to further harm a designated entity. However, that is not how OFAC sees such dealings. Whether a party is providing a benefit to or attempting to seize payments from a blocked party, it is the dealings with that party that are prohibited. Once on the SDN List, OFAC’s desire is to make the party a financial pariah, and almost any engagement requires an OFAC license.

E. DNI and Southern Cross

On August 8, 2019, OFAC issued Findings of Violation to two U.S. companies, DNI Express Shipping Company (“DNI”) and Southern Cross Aviation, LLC (“Southern Cross”), in relation to administrative subpoenas with follow-up responses deemed by OFAC to be materially inaccurate or incomplete. This is one of the few times OFAC has ever enforced solely on the basis of inadequate responses.