2020 Mid-Year FCPA Update

Client Alert | July 16, 2020

The COVID-19 pandemic has had a seismic impact on virtually all aspects of commerce, law, and life, and enforcement of the U.S. Foreign Corrupt Practices Act (“FCPA”) is no exception. Indeed, the inherently cross-border nature of the FCPA renders it perhaps particularly susceptible to impacts—from interviews of witnesses located in foreign countries, to collecting documents from employees working from home, to remote presentations to government agencies, everything is more challenging in this environment.

But if one thing is clear from our practice, it is that the commitment of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”) to enforcing the FCPA has not waned. The relative numbers of FCPA enforcement actions are down—10 in the first half of 2020 versus more than twice that at this point a year ago—but we know from our own inventory of investigations and the broader enforcement landscape that DOJ, the SEC, and other global enforcers remain active and are continuing to adapt to the circumstances. From the largest coordinated foreign bribery settlement of all time, to the Second Edition of the joint DOJ/SEC FCPA Resource Guide, to updated compliance program guidance from DOJ, to a Supreme Court decision on the SEC’s authority to seek disgorgement, the first half of 2020 in FCPA enforcement provides much still to discuss.

This client update provides an overview of the FCPA as well as domestic and international anti-corruption enforcement, litigation, and policy developments from the first half of 2020.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) or American Depository Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

Foreign corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of DOJ have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain “specified unlawful activities,” including corruption under the laws of foreign nations, through the U.S. banking system. Although this has not always been the case, DOJ now frequently deploys the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is increasingly commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

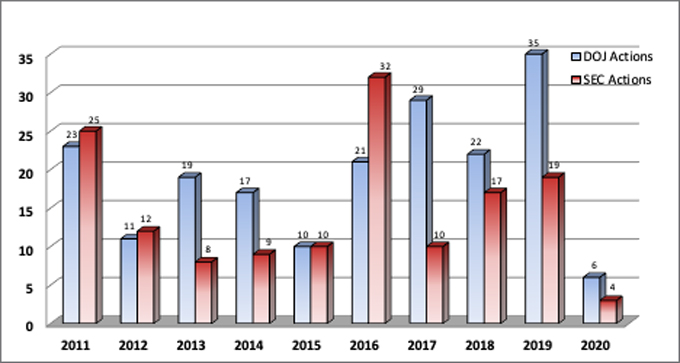

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during the past 10 years.

|

| Number of FCPA Enforcement Actions Per Year* |

* As of June 30, 2020

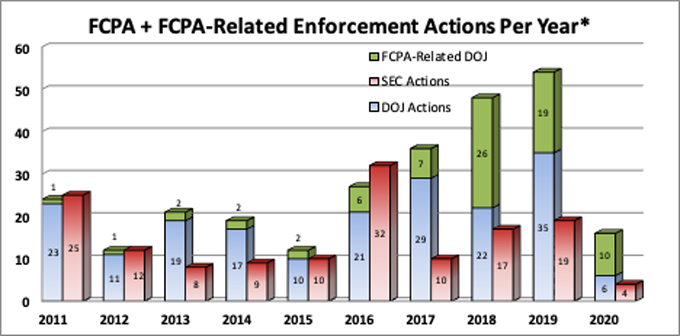

While the COVID-19 pandemic may contribute to 2020 being a statistically anomalous year—at least within the context of the modern era of FCPA enforcement—as we have noted for several years now, increasingly “FCPA-only” enforcement statistics do not tell the whole story in international anti-corruption enforcement by U.S. prosecutors and regulators. As can be seen from the below table and graph, which include non-FCPA charges brought by DOJ’s FCPA Unit in international corruption investigations, over the last two-and-a-half years the FCPA Unit has brought nearly as many cases under related statutes, such as money laundering, than it has under the FCPA. The 10 FCPA-related enforcement actions thus far in 2020 exceed DOJ’s FCPA total for the year and continue what is now a years-long trend of substantial extra-FCPA enforcement by DOJ that shows no signs of letting up.

|

* As of June 30, 2020

2020 MID-YEAR FCPA + FCPA-RELATED ENFORCEMENT ACTIONS

Corporate Enforcement Actions

There were four corporate FCPA enforcement events in the first half of 2020, not including an early July action involving Alexion Pharmaceuticals, Inc. that will be covered in our 2020 Year-End FCPA Update.

Airbus SE

Beginning the year in corporate anti-corruption enforcement in a big way, on January 31, 2020 French-headquartered airplane manufacturer Airbus reached a multi-billion-dollar coordinated resolution with authorities in France, the United Kingdom, and the United States. The combined allegations pertain to alleged improper payments to government officials in more than a dozen countries between at least 2008 and 2015, as well as export controls-related charges in the United States. With combined penalties of more than $3.9 billion, more than $3.67 billion of which relates to the anti-corruption matters, this resolution now stands as the largest foreign bribery settlement of all time.

On the U.S. front, Airbus entered into a deferred prosecution agreement with DOJ alleging conspiracy to violate the FCPA’s anti-bribery provisions as well as conspiracy to violate the Arms Export Control Act and the International Traffic in Arms Regulations (“ITAR”). With respect to the FCPA conduct, Airbus allegedly made payments to a Chinese business partner knowing that all or part of those funds would be used to bribe Chinese officials, while on the ITAR side the company allegedly made false reports to the U.S. government to facilitate the sale or export of defense articles and services. Airbus is not a U.S. issuer, so jurisdiction for the FCPA charge was premised on employees and agents allegedly having sent emails while in the United States and participating in and providing luxury travel to the United States for foreign government officials. The FCPA-related penalty was $2.09 billion, although the vast majority of that was credited against payments to foreign regulators and ultimately Airbus agreed to pay $294.5 million for the FCPA-related conduct and $232.7 million for the ITAR-related conduct, for a total of $527.2 million to U.S. authorities.

As imposed, the larger financial penalties came from the French Parquet National Financier (“PNF”) and the UK Serious Fraud Office (“SFO”), which each entered into their own deferred prosecution agreements with Airbus. Specifically, the PNF imposed a USD-equivalent penalty of $2.29 billion for alleged improper payments in China, Colombia, Nepal, Russia, Saudi Arabia, South Korea, Taiwan, and the United Arab Emirates, while the SFO imposed a USD-equivalent penalty of $1.09 billion (made up of disgorgement, a fine, and the SFO’s costs) for alleged improper payments in Ghana, Indonesia, Malaysia, Sri Lanka, and Taiwan.

The majority of the alleged conduct appears to have involved Airbus’s former Strategy and Marketing Department, a 150-person division devoted to engagement with business partners to obtain and manage business. As a significant remediation effort, in October 2014, Airbus disbanded this group and froze all payments to business partners worldwide until confirmatory due diligence could be performed on the purpose for the payments. Each of the regulators noted Airbus’s substantial cooperation with the investigation and remediation, and it is notable that no compliance monitor will be imposed for the anti-corruption related conduct, although that may well be due to the fact that the French Agence Française Anticorruption (“AFA”) will be conducting anti-corruption audits over the next three years.

Cardinal Health, Inc.

On February 28, 2020, the SEC announced an FCPA accounting provision resolution with Cardinal Health related to the allegedly improper use of marketing funds in China. According to the SEC, Cardinal Health’s former Chinese subsidiary served as the exclusive distributor for and administered marketing accounts on behalf of a European dermocosmetic (skin care) company, formally employing the European company’s workforce through administrative HR agreements but without directly supervising or applying all of Cardinal Health’s internal controls to those employees. The European company representatives, on the payroll of Cardinal Health, allegedly directed some of the marketing funds to promote the company’s products to Chinese healthcare professionals and employees of Chinese state-owned retail entities.

Without admitting or denying the allegations, Cardinal Health consented to the entry of a cease-and-desist order to resolve FCPA books-and-records and internal controls charges and agreed to disgorge $5.4 million of profits, plus $916,887 in prejudgment interest, and pay a $2.5 million civil penalty. The SEC’s order did not impose ongoing reporting requirements on Cardinal Health and acknowledged the company’s voluntary self-disclosure, cooperation with the SEC’s investigation, and the remedial actions taken by the company, including terminating the marketing accounts and its employment contracts with the marketing employees. Cardinal Health has announced that DOJ declined to take action.

Eni S.p.A.

On April 17, 2020, the SEC announced an FCPA resolution with Italian oil company and ADR-issuer Eni relating to alleged misconduct in obtaining government oil contracts in Algeria. According to the SEC, Eni violated the FCPA’s accounting provisions because a 43%-owned subsidiary entered into four purportedly sham contracts to pay approximately €198 million to an intermediary, which directed a portion of that money to Algerian officials to assist in obtaining contracts from Algeria’s state-owned oil company.

With respect to the books-and-records charge, the SEC contended that the Eni subsidiary classified these payments as “brokerage fees” in its books and records, which then were consolidated into the books of Eni, allegedly causing Eni’s books and records to be inaccurate. With respect to the internal controls charge, the SEC acknowledged that pursuant to 15 U.S.C. § 78m(b)(6), because Eni was a minority shareholder in the subsidiary, it was required only to “proceed in good faith to use its influence, to the extent reasonable under [the] circumstances,” to cause the subsidiary to maintain a system of internal controls consistent with the FCPA. The SEC alleged that Eni failed to satisfy this standard, in part because the subsidiary’s CFO, who along with others allegedly bypassed internal controls to enter into the contracts with the intermediary, later became CFO of Eni and in that role continued to participate in and conceal the nature of the relationship with the intermediary. According to the SEC: “As the principal finance officer of Eni, [the CFO] could not have been proceeding in good faith to cause [the subsidiary] to devise and maintain sufficient internal accounting controls while simultaneously being aware of, and participating in, conduct at [the subsidiary] that undermined those controls.”

Without admitting or denying the allegations, Eni consented to the entry of a cease-and-desist order to resolve the FCPA accounting charges and agreed to disgorge $19.75 million plus $4.75 million in prejudgment interest. The disgorgement amount was calculated based on the alleged tax benefit that Eni received from its subsidiary deducting the costs of the payments to the intermediary. DOJ closed its investigation in September 2019 without taking action, approximately one year after an Italian criminal court’s acquittal of Eni and corporate officers following a trial on Italian corruption charges. Italian trial convictions of the subsidiary and certain of its former employees were overturned by the Milan Court of Appeals in January 2020.

Novartis AG & Alcon Pte Ltd

Rounding out the first half of 2020 in corporate enforcement, on June 25 DOJ and the SEC announced the year’s first joint FCPA resolution, involving Swiss pharmaceutical company and issuer Novartis, its Greek subsidiary, and a former subsidiary. The charging documents allege that between 2012 and 2016, subsidiary employees provided things of value to healthcare providers in Greece, South Korea, and Vietnam.

To resolve the SEC’s investigation, Novartis consented to the entry of an administrative cease-and-desist order charging FCPA accounting violations and agreed to pay $112.8 million in disgorgement and prejudgment interest. To resolve criminal charges of FCPA anti-bribery and books-and-records conspiracy, Novartis’s Greek subsidiary entered into a deferred prosecution agreement and agreed to pay a criminal penalty of $225 million. In addition, former Novartis subsidiary Alcon Pte Ltd entered into a deferred prosecution agreement to resolve a charge of FCPA books-and-records conspiracy and agreed to pay a criminal penalty of $8,925,000. Novartis and Alcon were given full credit for their cooperation in the investigation and their significant remedial measures. They will self-report on the status of their compliance programs over the three-year term of the agreements with DOJ and the SEC. Gibson Dunn represented Novartis and Alcon in connection with the Alcon Pte Ltd-related conduct.

Individual Enforcement Actions

There were FCPA and FCPA-related charges filed or unsealed against 15 individual defendants during the first half of 2020.

Martinelli Brothers

On June 27, 2020, a criminal complaint was filed in the U.S. District Court for the Eastern District of New York charging Luis Enrique Martinelli Linares and Ricardo Alberto Martinelli Linares, brothers and the sons of former Panamanian President Ricardo Alberto Martinelli Berrocal, with money laundering. The charging documents were unsealed on July 6, when the brothers were arrested in Guatemala pursuant to a U.S. arrest warrant. According to the allegations, the brothers served as intermediaries to set up secret bank accounts to receive and disguise $28 million in bribe payments made by Brazilian construction conglomerate Odebrecht S.A. for the benefit of President Martinelli. We covered the December 2016 FCPA resolution with Odebrecht in our 2016 Year-End FCPA Update.

Asante K. Berko

On April 13, 2020, the SEC filed a civil complaint in the U.S. District Court for the Eastern District of New York against Asante Berko, a dual U.S. and Ghanaian citizen who formerly worked for the UK subsidiary of a U.S. financial services company and issuer. The complaint charges Berko with FCPA bribery associated with his alleged participation in a scheme to pay at least $2.5 million to an intermediary with the intention that all or substantially all of that amount would be paid to Ghanaian government officials making decisions on an electrical power plant project Berko’s Turkish-based client was building. The complaint further alleges that Berko personally received $2 million in secret commissions from the Turkish client, without the knowledge or approval of Berko’s employer. There is no current indication that the U.S. financial services company will be charged, and indeed the complaint against Berko speaks at length of Berko’s circumvention of his employer’s controls, including using personal rather than company email, falsifying or failing to correct inaccurate corporate documents, and lying to company compliance and legal personnel when they asked increasingly probing questions about the transaction.

The Berko case is significant for at least two reasons. First, many of the acts described above as to Berko’s circumvention of company existing controls are in other cases argued by the SEC to be evidence of the company’s deficient internal controls. Second, even as the SEC seems to take an accommodating stance with respect to controls, it takes a very aggressive stance with respect to its agency theory of liability for the bribery charges. Berko was not an employee of the U.S. issuer, but rather a UK subsidiary, so the SEC (which has jurisdiction only over issuers and their representatives) alleged that Berko was an agent of the parent issuer because the parent allegedly exercised general control over the subsidiary and its employees, Berko was subject to the parent’s compliance policies, and certain key documents relating to the transaction were reviewed by a committee of the parent issuer. This agency theory is oft-contested, but less frequently litigated. Berko has yet to make an appearance and, according to the SEC’s complaint, is residing in Ghana.

Additional PDVSA-Related FCPA and FCPA-Related Charges

DOJ’s ongoing investigation of alleged corruption in the bidding panels of Venezuelan state-owned oil company Petróleos de Venezuela, S.A. (“PDVSA”) continued apace through the first six months of 2020. As we have been covering since our 2015 Year-End FCPA Update, DOJ now has brought numerous FCPA and FCPA-related (primarily money laundering) prosecutions associated with an alleged “pay-to-play” corruption scheme whereby businesses paid millions of dollars in bribes to PDVSA officials to influence the award of competitively-bid contracts and to secure preferential treatment in the payment of PDVSA debts.

Charges from the first half of 2020 include:

- On February 7, 2020, Texas resident and Venezuelan citizen Tulio Anibal Farias-Perez was charged and then pleaded guilty to FCPA conspiracy associated with his alleged provision of more than $500,000 in payments to PDVSA representatives through cash, wire transfers, and tickets to high-profile sporting events such as the World Series and Super Bowl in exchange for contract awards to his companies;

- On March 11 and 12, 2020, respectively, DOJ unsealed November 2019 criminal informations charging Lennys Rangel, the procurement head of a PDVSA majority-owned joint venture, and Edoardo Orsoni, the former general counsel of PDVSA, each with conspiracy to commit money laundering in connection with the alleged receipt of more than a million dollars each in cash and property in exchange for favorable treatment in PDVSA bidding processes;

- On March 20, 2020, DOJ filed a criminal information charging Venezuelan businessperson Carlos Enrique Urbano Fermin with conspiracy to commit money laundering based on Urbano’s alleged $100,000 bribe to a Venezuelan government official, via U.S. bank accounts, to forestall a local bribery prosecution of Urbano’s companies in Venezuela; and

- Also on March 20, 2020, DOJ charged another Venezuelan businessperson, Leonardo Santilli, in a criminal money laundering complaint associated with Santilli’s alleged payment of more than $9 million in bribes to receive nearly $150 million in contracts from PDVSA.

Additional Alstom S.A. Defendants Charged

In our 2019 Year-End FCPA Update, we covered DOJ’s ongoing prosecutions arising from Alstom’s alleged corrupt winning of the Taharan power plant contract in Indonesia as an example of DOJ leveraging a relatively contained, one-country fact pattern into many cases over numerous years. This phenomenon extended into 2020, when on February 18 DOJ unsealed a superseding indictment, initially filed in 2015, charging two former executives of Alstom’s Indonesian subsidiary and a former executive of Alstom agent Marubeni with conspiracy to violate the FCPA and commit money laundering. Reza Moenaf and Eko Sulianto, the former president and director of sales of Alstom’s Indonesian subsidiary respectively, were each charged with two counts of FCPA bribery, and Junji Kusunoki, the former deputy general manager of Marubeni’s Overseas Power Project Department, was charged with six counts of FCPA bribery. All three defendants also face money laundering charges, and none have yet made an appearance in court.

Seguros Sucre Defendants

On February 13, 2020, DOJ filed a criminal complaint in the Southern District of Florida charging Juan Ribas Domenech, Jose Vicente Gomez Aviles, and Felipe Moncaleano Botero with money laundering conspiracy for their alleged roles in a scheme to secure contracts with Ecuador’s state-owned insurance company, Seguros Sucre. Separately, on March 3, 2020, DOJ filed a criminal complaint charging Roberto Heinert with a related money laundering offense.

Ribas is a former Seguros Sucre chairman and Ecuadorian citizen; Gomez is an Ecuadorian businessperson who helped companies secure contracts with Seguros Sucre; Heinert is a dual U.S. and Ecuadorian citizen who worked with Gomez; and Botero is a Colombian citizen and former executive of an unnamed UK reinsurance broker’s Colombian subsidiary that worked with Seguros Sucre. According to the criminal complaints, Ribas allegedly received bribes from Gomez, Heinert, and Botero, laundered through U.S. bank accounts, in exchange for awarding a reinsurance contract for Ecuador’s Ministry of Defense, provided through Seguros Sucre. On June 11, 2020, Gomez pleaded guilty. Ribas, Heinert, and Botero are before the Court and awaiting trial dates.

2020 MID-YEAR FCPA-RELATED ENFORCEMENT LITIGATION

Following the filing of FCPA or FCPA-related charges, criminal and civil enforcement proceedings can take years to wind through the courts. A selection of prior-year matters that saw enforcement litigation developments during the first half of 2020 follows.

Hoskins’s FCPA Convictions Reversed; Money Laundering Convictions Stand

In what is arguably one of the most significant, if not longest-running, enforcement cases in FCPA history, the Honorable Janet Bond Arterton of the District of Connecticut issued her decision on the Rule 29 Motion for a Judgment of Acquittal filed by Lawrence Hoskins, whose November 2019 convictions we covered in our 2019 Year-End FCPA Update. Following a key pretrial appeal in which the Second Circuit Court of Appeals held that the government could not charge foreign national Hoskins with conspiracy or aiding and abetting an FCPA offense because he did not otherwise belong to the class of individuals that can be charged with committing a substantive FCPA violation (covered in our 2018 Year-End FCPA Update), the key FCPA question at trial was whether DOJ could prove that Hoskins was acting as an “agent” of a U.S. person (i.e., Alstom’s U.S. subsidiary). The jury seemingly answered that question in the affirmative through its verdict, convicting Hoskins on all seven FCPA counts.

But on February 26, 2020, Judge Arterton set aside the FCPA guilty verdicts and entered a judgment of acquittal, finding that the evidence presented at trial did not support a conclusion that an agency relationship existed between Hoskins and Alstom’s U.S. subsidiary. Specifically, the Court held that the evidence DOJ presented was insufficient as a matter of law to show that the U.S. subsidiary retained the ability to control Hoskins’s actions. Nonetheless, demonstrating the relative power of money laundering charges to pursue international corruption cases outside the jurisdictional reach of the FCPA, Judge Arterton left Hoskins’s four money laundering convictions intact. There, the Court rejected Hoskins’s arguments that he could not be convicted absent knowledge that U.S. bank accounts would be used, and also held that Connecticut was an appropriate venue because the transfers from Connecticut (where Alstom’s subsidiary was based) to Maryland (where the agent was based) to Indonesia (where the foreign official was based) was all part of a single, continuing transaction for purposes of the money laundering statute.

On March 6, 2020, Hoskins was sentenced to 15 months in prison and to pay a $30,000 fine in connection with the money laundering convictions, although his surrender date has been postponed to October 2020 due to the COVID-19 pandemic situation. Each of DOJ and Hoskins have appealed the unfavorable portions of Judge Arterton’s decision to the Second Circuit, making it likely that we have not heard the last from this groundbreaking case.

Inniss Convicted by Jury

Donville Inniss, the former Barbados Minister of Industry, was indicted in March 2018 for allegedly receiving $36,000 in bribes from the Insurance Corporation of Barbados Limited in exchange for agreeing to award government contracts to the insurer. According to DOJ, Inniss allegedly laundered the funds through a New York bank account in the name of a dental company owned by his friend.

Following a four-day jury trial and two hours of deliberation, on January 16, 2020, Inniss was convicted by a jury sitting in the Eastern District of New York of one count of conspiracy to commit money laundering and two counts of money laundering. Inniss has filed a Rule 29 motion for judgment of acquittal of all counts, which remains pending.

Baptiste and Boncy Granted New Trial

We reported in our 2019 Year-End FCPA Update on the June 2019 jury convictions of retired U.S. Army colonel Joseph Baptiste and former lawyer and Haitian Ambassador-at-Large Roger Richard Boncy for allegedly soliciting bribes from two undercover FBI agents who were posing as prospective investors in a proposed $84 million port development project in Haiti. Following a nine-day jury trial, they were each found guilty of one count of FCPA conspiracy and one count of Travel Act conspiracy, with Baptiste additionally convicted of violating the Travel Act and money laundering conspiracy.

But in a post-conviction setback for DOJ, on March 11, 2020, the Honorable Allison Burroughs of the District of Massachusetts granted a new trial for both Baptiste and Boncy based on the ineffective performance of Baptiste’s trial attorney. Among other things, Judge Burroughs cited that Baptiste’s lawyer did not subpoena witnesses to testify on Baptiste’s behalf and pursued an entrapment defense after being told the defense was unavailable for Baptiste. In addition to prejudicing Baptiste, Judge Burroughs found that the attorney’s performance resulted in Boncy’s own attorney “having to play an outsized role at trial rather than pursue his preferred defense strategy,” thereby also prejudicing Boncy. DOJ has appealed Judge Burroughs’s order to the U.S. Court of Appeals for the First Circuit.

Seng’s Supreme Court Challenge re McDonnell Application to FCPA Denied

We covered in our 2018 Mid-Year FCPA Update the conviction and sentencing of billionaire Ng Lap Seng on FCPA, federal programs bribery, and money laundering charges associated with his role in a scheme to pay more than $1 million in bribes to two UN officials in connection with, among other things, a plan to build a UN-sponsored conference center in Macau. In August 2019, Seng’s conviction was upheld by the U.S. Court of Appeals for the Second Circuit, which rejected his argument that DOJ failed to prove that an “official act” occurred in exchange for the bribes as required by the Supreme Court’s decision in McDonnell v. United States, instead holding that McDonnell’s official acts standard does not apply to the FCPA. Seng filed a petition for writ of certiorari in the Supreme Court, which was denied on June 29, 2020.

Lambert’s Motion for Judgment of Acquittal on Wire Fraud Charges Denied

As reported in our 2019 Year-End FCPA Update, Mark T. Lambert, the former Co-President of Transport Logistics International, was convicted in November 2019 of FCPA, wire fraud, and conspiracy charges in connection with his alleged participation in a conspiracy to make corrupt payments to an official at a Russian state-owned supplier of uranium and uranium enrichment services in return for sole-source contracts. In December, Lambert filed a motion for judgment of acquittal on the two wire fraud convictions, arguing that the government failed to prove that he made any material misrepresentations or omissions that caused injury to the Russian state-owned entity, the alleged victim of the fraud.

On February 11, 2020, the Honorable Theodore D. Chuang of the District of Maryland denied Lambert’s motion. The Court found that the evidence that Lambert actively concealed bribes from the Russian state-owned entity was sufficient, and further that the government need not prove that the Russian state-owned entity actually lost money as a result of the scheme, provided Lambert intended to deprive the entity of money. Lambert’s sentencing has been delayed due to COVID-19 complications.

Fifth Circuit Dismisses Khoury’s Appeal

Lebanese businessperson Samir Khoury has continued his attack on a more than decade-old indictment charging him with mail and wire fraud offenses arising out of the Bonny Island, Nigeria corruption scheme. As reported in our 2019 Year-End FCPA Update, after successfully persuading the Southern District of Texas to unseal the indictment in absentia, Khoury filed a renewed motion to dismiss, arguing the government had failed to prosecute the case diligently and the indictment is time-barred. The Honorable Keith P. Ellison rejected Khoury’s motion on December 6, 2019, and denied Khoury’s additional motion for a “Ruling on Constitutional Issues Not Addressed” on February 24, 2020.

In March 2020, Khoury sought appellate and mandamus relief from the U.S. Court of Appeals for the Fifth Circuit, challenging, among other things, the district court’s conclusion that any delay in prosecution was caused by Khoury’s decision to remain in Lebanon. The government moved to dismiss Khoury’s appeal, arguing that it must wait a trial, judgment, and sentencing. On May 12, 2020, the Fifth Circuit granted the government’s motion to dismiss in a per curiam order. The Fifth Circuit rejected Khoury’s petition for en banc review on July 13, 2020.

Former Banker Permanently Barred for Role in 1MDB Bond Offerings

We have been tracking for years activity related to the alleged diversion of more than $2.7 billion from Malaysian sovereign wealth fund 1Malaysia Development Berhad (“1MDB”), including actions previously taken against Malaysian businessperson Low Taek Jho and two former bankers, Tim Leissner and Roger Ng Chong Hwa, for their alleged involvement in the scheme.

On February 4, 2020, the Federal Reserve Board of Governors announced that it was permanently barring from the banking industry former banker Andrea Vella, who had responsibility for three bond offerings by 1MDB. According to the Board’s debarment order, Vella failed to fully escalate Low Taek Jho’s involvement in the offerings, which the Board claimed indicated heighted potential underwriting risks. As part of the debarment order, Vella has agreed to cooperate with the Board’s investigations into 1MDB.

Coburn and Schwartz Indictment Challenge Turned Away

As covered in our 2019 Year-End FCPA Update, former Cognizant Technology Solutions executives Gordon J. Coburn and Steven E. Schwartz face a 12-count indictment charging them with FCPA bribery, conspiracy, falsification of books and records, and circumvention of internal controls in connection with their alleged participation in a bribery scheme in India. They each promptly moved to dismiss various counts in the indictment on a number of grounds, including most notably for practitioner purposes that three counts of FCPA bribery were multiplicitous because they charged three emails associated with the same alleged bribe as three separate violations of the FCPA’s anti-bribery provisions.

On February 14, 2020, the Honorable Kevin McNulty of the District of New Jersey issued a scholarly opinion analyzing this question, which has never been squarely presented in an FCPA case. In upholding the indictment, Judge McNulty agreed with DOJ that the relevant “unit of prosecution” for FCPA bribery is making use of interstate commerce in connection with a bribery scheme; thus, the emails cited in the three counts “are permissible, if not inevitable, units of prosecution.”

Odebrecht Plea Agreement Extended

We covered Odebrecht’s coordinated anti-corruption resolution with Brazilian, Swiss, and U.S. authorities in our 2016 Year-End FCPA Update. One of the conditions of the U.S. resolution was the engagement of an independent compliance monitor for a three-year period.

The monitorship period was scheduled to conclude in February 2020. However, in a January 29 letter filed with the Eastern District of New York, DOJ announced that Odebrecht had failed to complete its obligations to “implement and maintain a compliance and ethics program,” including by allegedly “failing to adopt and implement the agreed upon recommendations of the monitor and failing to allow the monitor to complete the monitorship.” DOJ reported that Odebrecht had agreed with these contentions and to extend the monitorship until November 2020 to allow the additional time to fulfill its obligations under the extended timeline.

2020 MID-YEAR FCPA-RELATED DEVELOPMENTS

In addition to the enforcement activity covered above, the first six months of 2020 saw important developments in FCPA policy, practice, and related matters. Among the developments covered below are DOJ and the SEC issuing their first comprehensive update to the 2012 FCPA Resource Guide, DOJ providing updated guidance on how it will evaluate corporate compliance programs, the announcement of a new privilege unit within DOJ’s Fraud Section, and a Supreme Court decision on the SEC’s ability to seek disgorgement in enforcement actions.

DOJ and SEC Issue First Comprehensive Update to FCPA Resource Guide

On July 3, 2020, DOJ and the SEC published the first substantive update to their consolidated FCPA guidance, “A Resource Guide to the U.S. Foreign Corrupt Practices Act,” which was first issued in November 2012. The Second Edition to this publication—which has served as an important resource for companies and practitioners seeking to understand both enforcers’ interpretations of the FCPA and approaches for enforcing it—does not necessarily break new ground, but incorporates a number of significant developments in government guidance, relevant case law, and enforcement activity in the seven-plus years since its original publication.

Among the more significant updates in the Second Edition are the inclusion of the FCPA Corporate Enforcement Policy (see below) and other recent governmental guidance; updated guidance regarding the application of the FCPA in M&A transactions; legal updates regarding the scope of the term “agent” for assessing corporate liability, the scope of the SEC’s disgorgement authority, and the requirements for criminal violations of the FCPA’s accounting provisions. This new edition likewise includes numerous new or updated case studies and hypotheticals to further illustrate relevant FCPA concepts. For additional details regarding the Second Edition, please see our recent client alert, “U.S. DOJ and SEC Issue First Comprehensive Update to FCPA Resource Guide Since 2012.”

DOJ Issues Updated Guidance for Evaluating Corporate Compliance Programs

On June 1, 2020, DOJ issued further updates to its guidance to DOJ prosecutors about how to assess the effectiveness of corporate compliance programs when conducting investigations, making charging decisions, and negotiating resolutions. This guidance, entitled “Evaluation of Corporate Compliance Programs,” updates the prior version of the guidance published in 2019.

Among other changes, the updated guidance places increased emphasis on evaluating corporate compliance programs on a case-by-case basis relative to the individual company’s “size, industry, geographic footprint, [and] regulatory landscape” and reflects an increased focus on whether control functions are provided with sufficient resources to effectively discharge their responsibilities and have access to the data needed to properly carry out their monitoring and auditing activities. For more on the updated guidance, please see our separate client alert, “DOJ Updates Guidance Regarding Its ‘Evaluation of Corporate Compliance Programs.’”

DOJ Fraud Section to Create New Privilege Unit

So-called “taint” or “filter” teams have long been DOJ’s preferred solution to address the oft-arising issue of how to handle attorney-client and other privileged materials seized during the execution of search warrants. To prevent prosecutors from being exposed to protected information, the filter team (typically from the same DOJ Unit but not assigned to the investigation) generally is responsible for segregating protected material before providing the remaining materials to the prosecutors leading the investigation. This practice has been subject to criticism from the defense bar and courts alike, not the least of which being a decision in October 2019 by the U.S. Court of Appeals for the Fourth Circuit.

Potentially in response to this scrutiny, the Fraud Section has restructured its privilege review process by creating a new unit—the Special Matters Unit. The Special Matters Unit, which will be led by Fraud Section and Miami U.S. Attorney’s Office alum Jerrob Duffy, will oversee the privilege review team and work with the other Fraud Section litigation units, including the FCPA Unit, to establish uniform protocols regarding evidence collection and review that may implicate attorney-client and other privileges.

U.S. Supreme Court Decision Limits Disgorgement Authority in Civil Actions

As our readership knows, disgorgement of purportedly illicit profits frequently is the key driver in determining the cost of an FCPA resolution with the SEC. On June 22, 2020, the Supreme Court issued an important decision in Liu v. SEC, a closely watched case involving a challenge to the SEC’s ability to seek disgorgement in civil enforcement actions filed in federal court. This case follows the Court’s 2017 opinion in Kokesh v. SEC (discussed in our client alert United States Supreme Court Limits SEC Power to Seek Disgorgement Based on Stale Conduct), in which the Court unanimously held that disgorgement ordered in an SEC enforcement action constituted a “penalty” and was therefore subject to the five-year statute of limitations defined by 28 U.S.C. § 2462, but expressly reserved the question of whether SEC had the authority to seek disgorgement as a form of “equitable relief” in civil actions filed in federal court.

In the instant Liu case, husband and wife Charles Liu and Xin Wang were ordered to disgorge nearly $27 million in profits and pay $8.2 million in penalties arising from a scheme in which they allegedly misappropriated funds invested with them for the purpose of building a cancer treatment center. The district court refused to permit the deduction of even legitimate business expenses from the disgorgement amount, which decision the Ninth Circuit affirmed, holding that “the proper amount of disgorgement in a scheme such as this one is the entire amount raised less the money paid back to the investors.” In an 8-1 opinion authored by Justice Sotomayor, the Supreme Court upheld the SEC’s ability to seek disgorgement as a form of equitable relief, but only provided that the disgorgement is limited to the amount of the defendants’ net profits from the wrongdoing after legitimate expenses are deducted and further that disgorgement is assessed at least partially for the benefit of victims. For more on the Supreme Court’s decision, please see our client alert, “Supreme Court Limits Disgorgement Remedy In SEC Civil Enforcement Actions.”

2020 MID-YEAR KLEPTOCRACY FORFEITURE ACTIONS

The first half of 2020 saw continued activity in the Kleptocracy Asset Recovery Initiative spearheaded by DOJ’s Money Laundering and Asset Recovery Section (“MLARS”) Unit, which uses civil forfeiture actions to freeze, recover, and, in some cases, repatriate the proceeds of foreign corruption. In particular, we have been tracking the 1MDB corruption case since it was first announced as a civil forfeiture proceeding, as covered in our 2016 Year-End FCPA Update.

On May 6, 2020, DOJ announced a settlement of its civil forfeiture cases against more than $49 million of assets acquired by Emirati businessperson Khadem al-Qubaisi, using funds allegedly misappropriated from 1MDB. The assets include sales proceeds of Beverly Hills real estate and a luxury penthouse in New York City. This was followed on July 1 by the announcement of six DOJ civil forfeiture complaints in the U.S. District Court for the Central District of California seeking the forfeiture and recovery of an additional $96 million in assets, including luxury real estate in Paris, artwork by Monet, Warhol, and Basquiat, and bank accounts in Luxembourg and Switzerland. Since July 2016, the United States has sought forfeiture of more than $1.8 billion in assets associated with 1MDB, with more than $600 million of that now returned to Malaysia.

2020 MID-YEAR PRIVATE CIVIL LITIGATION SECTION

Although the FCPA does not provide for a private right of action, civil litigants continue to pursue a variety of causes of action in connection with FCPA-related conduct. A selection of matters with developments in the first half of 2020 follows.

Shareholder Lawsuits

- Cemex S.A.B. de C.V. – On February 10, 2020, the Honorable Valerie E. Caproni of the Southern District of New York dismissed with prejudice the second amended complaint filed against Mexican building materials company and U.S. issuer Cemex for allegedly concealing a bribery scheme and then making misleading statements relating to the same. As reported in our 2019 Year-End FCPA Update, the lawsuit was filed in 2018 after an internal probe identified payments worth approximately $20 million to a Colombian company in return for land, mining rights, and tax benefits for a new cement plant. In dismissing the second amended complaint, Judge Caproni found that plaintiffs had failed to allege specific facts on which to base a securities fraud action and had failed to establish the existence of an underlying bribery scheme.

- BRF S.A. – On May 15, 2020, the U.S. District Court for the Southern District of New York preliminarily approved a $40 million settlement in a putative class action against Brazilian food processor BRF. The suit was brought in March 2018 following Brazilian investigations related to payments to allow the sale of rancid meat by circumventing safety inspections. Investors alleged that they were misled by the company after the investigation drove down the company’s stock price. BRF also had announced that it had initiated an internal investigation and was cooperating with DOJ and SEC prior to the filing of the shareholder suit. A settlement hearing is scheduled for October 2020.

Breach of Contract/Civil Fraud/RICO Actions

- Keppel Offshore & Marine Ltd. – On May 9, 2020, the Honorable Paul G. Gardephe of the Southern District of New York issued an order dismissing RICO conspiracy charges against Keppel Offshore & Marine, finding that the FCPA deferred prosecution agreement it entered with DOJ in 2017 does not constitute a criminal conviction for the purposes of the Private Securities Litigation Reform Act (“PSLRA”). Plaintiffs had argued that Keppel’s deferred prosecution agreement was a criminal conviction that qualified for a PSLRA exception for RICO claims against “any person that is criminally convicted in connection with the fraud,” but Judge Gardephe concluded that “[a] party that enters into a deferred prosecution agreement has not been convicted of a crime. Indeed, the obvious purpose of entering into a deferred prosecution agreement is to avoid a criminal conviction.” With the RICO claims dismissed, only the aiding and abetting fraud claims remain and the case is set for a pretrial conference later in July 2020.

- Citgo Petroleum Corp. – On May 26, 2020, CITGO, the Texas-based subsidiary of PDVSA, filed a complaint in the U.S. District Court for the Southern District of Texas against Jose Manuel Gonzalez Testino and his company alleging breach of contract, fraud, and RICO violations arising from Gonzalez’s violations of the FCPA. In May 2019, Gonzalez pleaded guilty to violations of the FCPA and failure to file a foreign bank account report, in connection with payments to PDVSA and CITGO officials. CITGO’s civil complaint alleges that Gonzalez bribed CITGO employees to induce CITGO to enter into a Service Contract Agreement with his company, and to win contracts under the same agreement. The complaint further alleges that Gonzalez’s conduct caused CITGO to lose millions of dollars, and seeks compensatory damages plus interest, treble damages, and punitive damages. As of the date of publication, the defendants have not filed a responsive pleading.

- Harvest Natural Resources, Inc. – As reported most recently in our 2019 Year-End FCPA Update, now-defunct Houston energy company Harvest Natural Resources filed suit in the U.S. District Court for the Southern District of Texas in 2018 alleging RICO and antitrust violations against various individuals and entities affiliated with the Venezuelan government and PDVSA. Harvest’s complaint alleged that approval for the sale of the company’s Venezuelan assets was wrongfully withheld after it refused to pay $40 million in bribes to Venezuelan officials, and that as a result, Harvest had to sell the assets to different buyers at a $470 million loss, leading to the company’s dissolution. Chief Judge Lee H. Rosenthal granted a default $1.4 billion judgment in the action against Rafael Darío Ramírez Carreño, Venezuela’s former Minister of Energy and former President of PDVSA, when Ramírez failed to appear. But on June 9, 2020, after Ramírez appeared and filed a motion to vacate the default judgment. Judge Rosenthal reopened the case, denied the motion to dismiss, and set a status conference to discuss scheduling for further proceedings.

2020 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

International Anti-Corruption Developments Related to COVID-19

The COVID-19 pandemic has had, and continues to have, profound societal, economic, and health impacts. The frenetic pace of procurement activity around the world to acquire personal protective equipment, pharmaceuticals, and other medical products needed to combat the virus also can create heightened corruption-related risks. The following selection of recent developments illustrates steps that anti-corruption organizations around the world are taking to combat these novel corruption risks.

- On April 15, 2020, the Council of Europe’s Group of States against Corruption (“GRECO”) issued guidance to its member states regarding how to combat bribery and corruption in the healthcare sector. The risk areas identified by GRECO’s guidance include government procurement of medical supplies, bribery related to the provision of medical services, corruption of government agencies involved in overseeing the research and development of new pharmaceutical products, financial scams relating to the sale of medical products, and whistleblower protection in the healthcare sector.

- On April 22, 2020, the Organisation for Economic Co-operation and Development’s (“OECD”) Working Group on Bribery issued a statement warning that the current pandemic environment could create conditions “ripe for corruption” given the scramble to obtain needed supplies. The Working Group called on its member states to uphold their commitments under the OECD Anti-Bribery Convention, and noted that the OECD would “examine the possible impact and consequences of the coronavirus pandemic on foreign bribery, as well as solutions to help countries strengthen their anti-bribery systems.”

- On May 5, 2020, the International Monetary Fund (“IMF”) issued guidance explaining that, in addition to its existing anti-corruption measures, it was taking additional steps to ensure that emergency funding provided to governments in support of their COVID-19 responses would be used properly. These steps include asking governments to commit in letters of intent to ensure the funds are used for the purpose of responding to the crisis; assessing the extent to which it is feasible to ask member states to take additional steps to prevent bribery, corruption, and money laundering without unduly delaying disbursements; and continuing to include governance and anti-corruption measures in multi-year financing arrangements provided to member states.

Multilateral Development Banks

The first half of 2020 saw important developments concerning the World Bank’s, and increasingly other multilateral development banks’ (“MDB”), mechanisms for investigating fraud, corruption, and other sanctionable conduct connected to MDB-supported projects.

Perhaps most notably, the World Bank announced in May 2020 that Mouhamadou Diagne will become the new head of the Bank’s Integrity Vice Presidency (“INT”), a position that has been held by an acting head since the departure of Pascale Dubois in November 2019. Diagne previously served as the Bank’s Inspector General of the Global Fund to Fight Aids, Tuberculosis, and Malaria, in which role he led that organization’s investigations and audit functions. In his new role, Diagne will report directly to Bank President David Malpass rather than to an intermediary Managing Director as previously had been the case.

We also direct our readers to the Bank’s updated Sanctions Board Law Digest published in December 2019. The Sanctions Board acts as the ultimate adjudicator of sanctions sought by INT, and the Digest helpfully summarizes key takeaways from the Board’s decisions since the last update several years ago. The Digest also details the current sanctions framework, and is a valuable resource for practitioners and companies that become ensnared in the World Bank sanctions process.

Those who have dealt with INT and enforcement personnel at other MDBs may feel that the enforcers follow a fairly rigid approach in meting out sanctions. Reflecting a possible change at least one key MDB, the Head of the Office of Anti-Corruption and Integrity of the Asian Development Bank (“ADB”) wrote in responses published in the Global Investigations Review in May 2020 that the ADB’s enforcement approach to corporate and individual sanctions is becoming more flexible. He noted that the Bank’s use of debarments has decreased as its use of reprimands, cautions, and conditional-non-debarments has increased. A more nuanced assessment provides opportunity for a more proportionate sanction, which is particularly important given the significant collateral consequences that can attend an MDB debarment.

In other MDB news, the Inter-American Development Bank (“IDB”), which provides financing in Latin America, has been active on the enforcement front. In April 2020, the IDB debarred Andrade Gutierrez Engenharia S.A. (“AGE”), one of Brazil’s largest private conglomerates, and 11 of its subsidiaries for three years, in connection with alleged bribes to secure four IDB-financed contracts. The IDB credited AGE’s substantial cooperation in the case, which no doubt reflects a strategic decision by the company to address the issue holistically—two years earlier, AGE paid more than $381 million in fines to Brazilian authorities to resolve this and other conduct.

Europe

United Kingdom

SFO Publishes Guidance for Evaluating Compliance Programs

On January 17, 2020, the UK Serious Fraud Office (“SFO”) published its guidance to SFO prosecutors and investigators on how to assess corporate compliance programs. The guidance, “Evaluating a Compliance Programme,” forms part of the SFO’s Operational Handbook and states that the SFO should consider the state of an organization’s compliance program at the time of the offense and when making a charging decision (which could impact whether a deferred prosecution agreement is suitable), as well as consider how the program may change going forward. The guidance recommends framing the assessment around the six principles that the Ministry of Justice published in 2011 to guide commercial organizations in developing adequate anti-bribery compliance programs (covered in our 2011 Mid-Year FCPA Update). The January 2020 guidance provides additional insight into how the SFO will consider corporate compliance programs, and therefore is a valuable resource for organizations subject to the jurisdiction of the SFO.

Two Unaoil Defendants Convicted; Hung Jury for Third

As covered in our 2019 Year-End FCPA Update, the Monaco-based oil services company Unaoil has been at the center of a developing cluster of anti-corruption enforcement that has grown to include enforcement activity on both sides of the Atlantic. January 2020 saw the start of the London trial of three individuals—Ziad Akle, Paul Bond, and Stephen Whiteley—who were accused of conspiring to bribe an Iraqi official alongside Iraqi business partner Basil Al Jarah, who himself pleaded guilty in the UK in July 2019. Due to COVID-19, the trio’s trial was suspended for several weeks, but was one of the first criminal trials to resume in May 2020.

On July 13, 2020, guilty verdicts were announced as to Akle and Whiteley. The jury convicted the two of conspiracy to provide corrupt payments associated with the payment of over $500,000 in bribes to secure a $55 million contract from the Iraqi South Oil Company. Akle, Whiteley, and Al Jarah are due to be sentenced on July 22 and 23, 2020. The jury was unable to reach a decision as to Bond, and the SFO has indicated that it will seek a retrial. The jury actually returned the verdicts on in June, but the verdicts were held in quarantine until July 13 to give the SFO time to assess its future action.

Nigeria’s Lawsuit against Royal Dutch Shell and Eni Dismissed

In May 2020, the High Court dismissed a $1 billion lawsuit brought by the Nigerian government against oil and gas giants Royal Dutch Shell Plc and Eni S.p.A., alleging that payments made by the companies to acquire an oil exploration license were used to personally enrich Nigerian officials. The High Court found that it did not have jurisdiction over the case because the same allegations and participants feature in ongoing criminal proceedings in Italy. As covered in our 2017 Year-End FCPA Update, in December 2017 the Milan Public Prosecutor’s Office brought criminal proceedings against the companies as well as several individuals, with the Nigerian government later joining as a civil claimant in March 2018. The Italian proceedings are ongoing.

France

Sanctions Committee Renders Second Decision

On February 7, 2020, the French Anticorruption Agency’s (“AFA”) Sanctions Committee (discussed in our separate client alert, “New French Anti-Corruption Regime”) rendered its second decision. Although it did not impose a fine, despite a recommendation to do so from the AFA, the Committee compelled French mineral extraction company Imerys to update its code of conduct and accounting procedures following an investigation that identified certain potential controls weaknesses.

Ministry of Justice Issues Directive to Combat International Bribery

On June 2, 2020, the French Minister of Justice issued a directive to prosecutors regarding “criminal policy in the fight against international corruption.” Among other things, the directive calls on the French National Financial Prosecutor (“PNF”) to redouble its efforts to detect international corruption by paying special attention to “domestic and foreign press articles” that may justify in-depth investigations. Taking a page from U.S. anti-corruption efforts, the directive also encourages companies to self-disclose potential incidents of bribery to the PNF.

Germany

As reported in our 2019 Year-End German Law Update and 2019 Year-End FCPA Update, the German government is pursuing a corporate criminal liability bill that could significantly change the practice of German criminal law. Unlike in the United States and many other countries, German criminal law does not currently provide for corporate criminal liability. Corporations may be fined only for administrative offenses.

A recently updated draft of the legislation includes modest changes from the 2019 draft discussed in our previous updates. The 2020 version of the proposed bill:

- Applies only to entities conducting an economic business (i.e., does not apply to nonprofits);

- Abandons the corporate “death penalty” (i.e., liquidation of the company); and

- Clarifies that when an internal investigation significantly contributes to resolving the matter, courts “should” provide mitigation credit when calculating a fine or determining a sentence, rather than more discretionary language in the prior version, but to qualify for mitigation credit, internal investigations must satisfy certain criteria, including being conducted by counsel distinct from the corporation’s defense counsel.

Overall, the core of the bill remains unchanged, and it still includes several potentially challenging issues, such as the separate representation point noted above and the effect that cooperating with German authorities may have on privilege in foreign jurisdictions. On June 16, 2020, the Federal Government adopted the draft bill and has introduced it to Parliament.

Russia

Over the past year, arrests have been made in connection with a long-running graft scheme involving officials from Russia’s FSB (the successor to the KGB), Deposit Insurance Agency (Russia’s version of the FDIC), and other government agencies. As alleged, the scheme was perpetrated in the context of bank supervision: in exchange for allowing banks to continue operating, representatives of security services allegedly demanded payments from bank owners; and, when government regulators took over privately owned banks, the same representatives of security services and other government officials illicitly extracted cash from the distressed banks. After one former FSB colonel was arrested and charged with fraud and bribery for his involvement in the scheme, Russian criminal authorities reportedly seized more than $100 million in his possession. Another former government official (formerly of the Deposit Insurance Agency), who is alleged to have aided the former FSB colonel, fled Russia before he could be apprehended.

In addition, as we anticipated in our 2019 Year-End FCPA Update, since January 1, 2020, information about administrative anti-corruption convictions of entities, as well as entry in the public register of corporate corruption offenders, has been included in their registration profiles in the public procurement register of suppliers participating in public procurement, meaning this information is available to prospective purchasers. In the first half of 2020, 57 new entities were added to the public register of corporate corruption offenders, bringing the total number of entities in the register to just over 1,000. In a June 17, 2020 speech before the upper chamber of the Russian parliament, Russia’s Prosecutor General emphasized the importance of using the register in conducting due diligence on suppliers to prevent corruption in public procurement.

Ukraine

On May 13, 2020, the Ukrainian parliament passed into law a bill that prohibits the return of nationalized banks to their former private owners. The effect of this legislation is to prevent international aid money from being siphoned from nationalized banks into the pockets of oligarchs. This move was critical in Ukraine securing a $5.5 billion loan from the IMF to help with pandemic relief, but is seen as an affront to Ihor Kolomoisky, the prominent co-founder of PrivatBank viewed by many as a large supporter of President’s Zelensky’s election campaign. In addition, a new law that offers protections to whistleblowers and includes rewards for tips helpful to investigations of corruption cases involving a certain level of damages to the state entered into effect earlier this year.

Balancing against these positive developments on the anti-corruption front, in March 2020, the parliament fired several government officials who were viewed internationally as reformers. The dismissals included the country’s top prosecutor as well as the well-regarded heads of the customs and tax bureaus. President Zelensky in particular argued that the top prosecutor had not produced any tangible results, whereas the latter claimed that President Zelensky’s party dismissed him for proposing significant anti-corruption reforms. This comes amid perceptions that President Zelensky’s fight against corruption is stalling: a February 2020 survey indicated that many Ukrainians believe that the president is failing in his fight against corruption.

Uzbekistan

In March 2020, Uzbekistan’s Supreme Court announced that Gulnara Karimova, the daughter of Uzbekistan’s former president, was found guilty of extortion, racketeering, money laundering, and embezzlement of up to $1.6 billion of public funds, and sentenced to 13 years in prison. According to the Court, Karimova illegally purchased shares in two state-owned cement companies at artificially low prices before selling those shares abroad for a large profit. Karimova previously was convicted of tax evasion, extortion, and embezzlement in 2015, and of fraud, customs and currency violations, and money laundering in 2017, and sentenced to house arrest. After violating the terms of her house arrest, Karimova was jailed in March 2019. According to local law, the new sentence will apply from August 2015 and run concurrently with the previous sentences, effectively resulting in an additional eight years of prison time. As reported in our 2019 Year-End FCPA Update, in 2019 DOJ charged Karimova with money laundering conspiracy as part of the alleged bribery scheme in the Uzbek telecommunications sector that has ensnared several companies and individuals, and efforts reportedly are underway in several countries, including France, Latvia, Russia, and Switzerland, to recover Karimova’s allegedly ill-gotten assets.

The Americas

Brazil

As Operation Car Wash enters its seventh year and launches its 71st phase, Brazil faces a new corruption scandal. In April 2020, Brazil’s justice minister and former Operation Car Wash judge, Sérgio Moro, resigned after accusing President Jair Bolsonaro of seeking to exercise improper control over the federal police. The public prosecutor has opened a criminal investigation into Moro’s claims that Bolsonaro fired the federal police chief, Mauricio Valeixo, in order to install a chief who would permit him to interfere in corruption investigations, and that the President previously sought to replace the head of police in Rio de Janeiro, where two of his sons are under investigation.

In January 2020, Brazil’s new Anticrime Law took effect. The law, which establishes protections for whistleblowers reporting public corruption and fraud, requires the government to establish an ombudsman office to facilitate whistleblower reports, shields whistleblowers from civil or criminal liability in connection with their reports, and offers financial incentives for whistleblowers who provide information that leads to the recovery of proceeds from crimes against the public administration. Although Brazil previously had employed leniency agreements to encourage whistleblower complaints (including throughout Operation Car Wash), the new law formalizes protections and financial incentives for whistleblowing relating to public corruption, fraud in government procurement and contracts, and other crimes or misconduct that harm the public interest.

Also beginning in January 2020, companies seeking to contract with the Federal District for more than R$5 million must adopt compliance policies and procedures. The new regulations bring the Federal District in line with several other Brazilian states requiring companies to report on their compliance programs when seeking government contracts. And beginning in October 2020, companies must comply with enhanced Brazilian Central Bank regulations relating to suspicious transaction reporting, money laundering, and terrorist financing.

Ecuador

Former president Rafael Correa, living in Belgium since leaving office in 2017, was found guilty of bribery and corruption and sentenced in absentia to eight years imprisonment in April. Correa was one of 20 people, including his former vice president, accused of accepting $8 million in bribes in exchange for government contracts between 2012 and 2016. Correa has expressed interest in running for office in 2021, but the court’s sentence bars him from political office for 25 years.

Mexico

In February 2020, former Petróleos Mexicanos (“PEMEX”) CEO Emilio Lozoya Austin was arrested in Spain on a Mexican warrant for tax fraud and bribery charges associated with his alleged acceptance of more than $10 million in bribes from Odebrecht. A Spanish court agreed to extradite Lozoya to Mexico in early July. Additionally, in June 2020, Mexican prosecutors announced an investigation into a former project coordinator at PEMEX’s refinement subsidiary, Mario Alberto García Duarte, regarding alleged unexplained increases in wealth while managing contract awards to Odebrecht.

Asia

China

In January 2020, during the Fourth Plenary Session of the 19th Central Commission for Discipline Inspection, President Xi Jinping reiterated that enforcement authorities will continue to focus on combating corruption in state-owned enterprises, the financial sector, and in the healthcare sector. In the months that followed, anti-graft agencies announced several investigations, arrests, and convictions of high-level government officials at state-owned enterprises and international organizations. In May, Zhao Zhengyong, Shaanxi province’s former governor and Communist Party secretary, pleaded guilty to accepting more than $100 million in bribes, and related to the same case anti-graft authorities expelled He Jiuchang, the former chairman of one of the country’s largest oil refiners, from the Communist Party. And in January, Meng Hongwei, the former president of Interpol, was sentenced to 13 1/2 years in prison for accepting more than $2 million in bribe payments.

We also continue to see enforcement actions against high-profile executives in the financial sector. In February, the former head of state-owned China Development Bank, Hu Huaibang, was arrested for accepting bribes. In May, Chinese authorities indicted Sun Deshun, the former president of a Chinese bank, on charges of accepting bribe payments in exchange for using his position to benefit others. Authorities also have commenced multiple enforcement actions against executives of Shandong-based Hengfeng Bank following the government’s approval of a $14.21 billion bailout of the distressed lender; in December, former chairman Jiang Xiyun was sentenced to death for corruption, accepting bribes, and embezzling $108 million of the bank’s stock. Xiyun’s successor, Cai Guohua, is currently on trial for similar charges after allegedly amassing significant amounts in illicit gains during his tenure at the bank.

More recently, in June, several central government agencies issued a joint notice regarding the government’s 2020 enforcement priorities in the healthcare sector. The notice indicates that, by year-end, enforcement authorities will begin to target corruption related to academic conferences, donations, and research collaborations between doctors and pharmaceutical companies.

India

In March 2020, the newly appointed federal anti-corruption watchdog “Lokpal” opened its doors to receiving complaints with the announcement of formal procedures for complaint submissions. The Lokpal has since received 1,426 complaints, of which it claims it has disposed of 1,200. The precise nature of these cases remains unclear, as does detailed information regarding the Lokpal’s actions in response to allegations of corruption.

In February, India’s Ministry of Corporate Affairs introduced the Companies (Auditor’s Report) Order, 2020, which is intended to strengthen the corporate governance and audit framework for Indian companies. Per the order, statutory auditors must, in the course of drafting the auditor’s annual report, disclose whether they have considered any whistleblower complaints received by the company. Companies must therefore disclose details of whistleblower complaints to their statutory auditors. The order does not provide further detail on the meaning of “whistleblower complaint,” or on the level of detail companies must disclose. The order initially applied to audits of the 2019-2020 financial year; however, due to the COVID-19 pandemic, implementation has been deferred to the 2020-2021 financial year.

In May, the State Vigilance and Anti-Corruption Bureau of Himachal Pradesh arrested the state’s senior health official, Ajay Kumar Gupta, after an audio recording surfaced purportedly showing Gupta asking a supplier of COVID-19 protective equipment for a bribe. The state’s leader of the ruling Bharatiya Janata Party resigned in the days following the arrest, and opposition lawmakers in the state have called for a high-level impartial probe into allegations that party leaders may be involved in the misconduct.

Indonesia

As reported in our 2019 Year-End FCPA Update, Indonesia passed legislation in late 2019 that significantly weakened the powers of the country’s anti-corruption agency, the Corruption Eradication Commission (“KPK”). In the months that have followed, anti-corruption watchdogs have cited a decrease in investigations, arrests, and enforcement actions by the KPK as evidence of the agency’s weakened powers and independence under the new law.

Now in light of the COVID-19 pandemic, lawmakers and activists have called on the KPK to take action against corruption related to the public health emergency. In response, the KPK has created a task force to oversee certain sectors of the government’s response that are perceived to be prone to corruption, and KPK Chairman Firli Bahuri warned in April that those found guilty of corruption relating to the country’s COVID-19 relief funds may face the death penalty.

Malaysia

In February 2020, AirAsia CEO Tony Fernandes and AirAsia Group Chairman Kamarudin Meranun stepped down from their positions following bribery allegations that surfaced in connection with Airbus’s multi-billion dollar global bribery settlement with French, U.S., and UK authorities discussed above. The allegations relate to Airbus’s alleged $50 million sponsorship of a Formula 1 racing team jointly owned by two unnamed AirAsia executives. Malaysia’s Anti-Corruption Commission (“MACC”) has opened an investigation into the allegations and is reportedly working with UK authorities to gather evidence. Both executives have denied wrongdoing, and AirAsia has denied making any purchase decisions on the basis of the Airbus sponsorship.

The collapse of Malaysia’s ruling political coalition in February and the swearing in of new Prime Minister Muhyiddin Yassin has sown doubt over the government’s pursuit of enforcement actions against high-level officials in connection with the 1MDB scandal. The new government is allied with former Prime Minister Najib Razak’s political party, United Malays National Organisation (“UMNO”), and drew sharp criticism over prosecutors’ decision in May to enter into a settlement with Najib’s stepson, Riza Aziz, for his role in the scandal. Under the settlement, Riza agreed to return overseas assets worth more than $107 million; he had been charged with laundering $248 million from the government investment fund. High-profile enforcement actions against Najib and his wife, Rosmah Mansor, continue to progress. As reported in our 2019 Year-End FCPA Update, Najib faces 42 charges of corruption, abuse of power, and money laundering in five criminal cases linked to the 1MDB scandal. Prosecutors concluded the first trial against Najib in early June, and a verdict is expected in July.

South Korea

In December 2019 and January 2020, the National Assembly passed two amendments to The Act on Preventing Bribery of Foreign Public Officials in International Business Transactions. The amendments give enforcement authorities the power to conduct wiretaps in foreign bribery cases, and raise the maximum penalties for individuals and corporations convicted of foreign bribery.

In February 2020, former Korean President Lee Myung-Bak was sentenced by the Seoul High Court to a jail term of 17 years, plus more than $15 million in fines and forfeiture, associated with his March 2018 arrest on multiple charges of corruption, including bribery, embezzlement, tax evasion, and abuse of power as discussed in our 2018 Mid-Year FCPA Update.

Vietnam

In late December 2019, a Vietnamese court sentenced former Minister of Information and Communications Nguyen Bac Son to life in prison after finding him guilty of accepting $3 million in bribes from state telecommunications firm MobiFone Telecommunications Corporation in connection with MobiFone’s acquisition of digital television service Audio Visual Global JSC (“AVG”). At the trial, former MobiFone chairman Le Nam Tra confessed to accepting bribe payments from AVG, and to making payments to Son to gain his support for the acquisition. An appeals court upheld Son’s life sentence in April. The case, which also resulted in the convictions of several MobiFone and AVG executives, is part of a broader anti-corruption campaign spearheaded by Vietnamese President and Communist Party General Secretary Nguyen Phu Trong.

Middle East and Africa

Ghana

Part of the allegations related to Airbus’s multibillion dollar resolution, discussed above, involve a campaign to sell the C-295 military vehicle to the Ghanaian government. This allegedly involved payments made through various consultants to influence “Individual 1” to use his political weight in the country to secure purchase of several C-295 aircraft. A special prosecutor in Ghana has announced a formal investigation into the matter, and public reports suggest that “Individual 1” could be John Dramani Mahama, who served as Vice President of Ghana from 2009 to 2012 and as President when John Atta Mills passed away in July 2012. Mahama denies wrongdoing.

Israel

On May 24, 2020, Israeli Prime Minister Benjamin Netanyahu made his first in-court appearance in the landmark corruption trial stemming from three separate allegations of wrongdoing made by the Israeli Attorney General’s office (covered most recently in our 2019 Year-End FCPA Update). Proceedings currently are adjourned until July, but due to the current pandemic and other extenuating circumstances, the prosecution may not begin its case-in-chief for many months. Netanyahu maintains that he is innocent.

The following Gibson Dunn lawyers assisted in preparing this client update: F. Joseph Warin, John Chesley, Christopher Sullivan, Richard Grime, Patrick Stokes, Reuben Aguirre, Claire Aristide, Claire Chapla, Austin Duenas, Andreas Dürr, Helen Elmer, Julie Hamilton, Daniel Harris, Patricia Herold, Amanda Kenner, Derek Kraft, Kate Lee, Nicole Lee, Taonga Leslie, Allison Lewis, Lora MacDonald, Andrei Malikov, Megan Meagher, Jesse Melman, Steve Melrose, Caroline Monroy, Erin Morgan, Alexander Moss, Jaclyn Neely, Virginia Newman, Ning Ning, Nick Parker, Liesel Schapira, Emily Seo, Jason Smith, Pedro Soto, Laura Sturges, Karthik Ashwin Thiagarajan, Grace Webster, Oliver Welch, Ralf van Ermingen-Marbach, Jeffrey Vides, Oleh Vretsona, Alina Wattenberg, Dillon Westfall, Brian Yeh, and Caroline Ziser Smith.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. We have more than 110 attorneys with FCPA experience, including a number of former federal prosecutors and SEC officials, spread throughout the firm’s domestic and international offices. Please contact the Gibson Dunn attorney with whom you work, or any of the following:

Washington, D.C.

F. Joseph Warin (+1 202-887-3609, fwarin@gibsondunn.com)

Richard W. Grime (+1 202-955-8219, rgrime@gibsondunn.com)

Patrick F. Stokes (+1 202-955-8504, pstokes@gibsondunn.com)

Judith A. Lee (+1 202-887-3591, jalee@gibsondunn.com)

David Debold (+1 202-955-8551, ddebold@gibsondunn.com)

Michael S. Diamant (+1 202-887-3604, mdiamant@gibsondunn.com)

John W.F. Chesley (+1 202-887-3788, jchesley@gibsondunn.com)

Daniel P. Chung (+1 202-887-3729, dchung@gibsondunn.com)

Stephanie Brooker (+1 202-887-3502, sbrooker@gibsondunn.com)

M. Kendall Day (+1 202-955-8220, kday@gibsondunn.com)

Stuart F. Delery (+1 202-887-3650, sdelery@gibsondunn.com)

Adam M. Smith (+1 202-887-3547, asmith@gibsondunn.com)

Christopher W.H. Sullivan (+1 202-887-3625, csullivan@gibsondunn.com)

Oleh Vretsona (+1 202-887-3779, ovretsona@gibsondunn.com)

Courtney M. Brown (+1 202-955-8685, cmbrown@gibsondunn.com)

Jason H. Smith (+1 202-887-3576, jsmith@gibsondunn.com)

Ella Alves Capone (+1 202-887-3511, ecapone@gibsondunn.com)

Pedro G. Soto (+1 202-955-8661, psoto@gibsondunn.com)

New York

Zainab N. Ahmad (+1 212-351-2609, zahmad@gibsondunn.com)

Matthew L. Biben (+1 212-351-6300, mbiben@gibsondunn.com)

Reed Brodsky (+1 212-351-5334, rbrodsky@gibsondunn.com)

Joel M. Cohen (+1 212-351-2664, jcohen@gibsondunn.com)