2020 Mid-Year Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements

Client Alert | July 15, 2020

Stay-at-home orders have not prevented a significant number of corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”) in the first half of 2020. At 17 agreements to date plus one NPA addendum, the year is on pace to match 2019 levels, which reflected an increase from the preceding two years. In this client alert, the 22nd in our series on NPAs and DPAs, we: (1) report key statistics regarding NPAs and DPAs from 2000 through the present; (2) consider the drop in NPAs in 2020; (3) summarize 2020’s publicly available corporate NPAs and DPAs; (4) survey the latest developments in international DPA regimes, and finally (5) outline some key considerations for companies poised to conclude NPA and DPA negotiations, including cross-border considerations and possible post-resolution consequences.

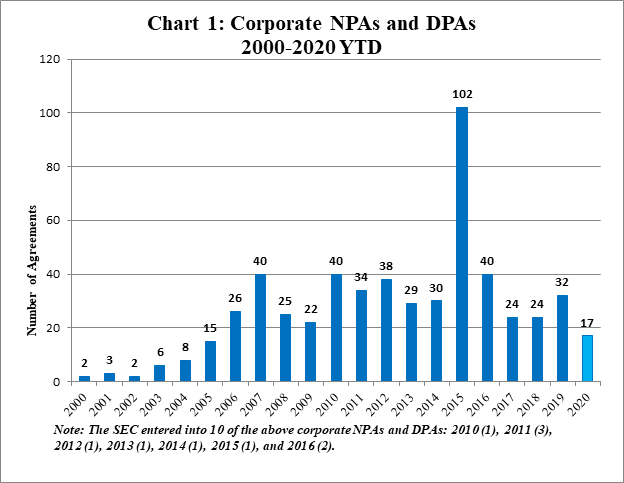

NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly DOJ. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences, both direct and collateral, that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally—a DPA, unlike an NPA, is formally filed with a court along with charging documents—both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program and—on occasion—cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified approximately 550 agreements initiated by the United States Department of Justice (“DOJ”), and 10 initiated by the U.S. Securities and Exchange Commission (“SEC”).

Chart 1 below shows all known corporate NPAs and DPAs from 2000 through 2020 to date. In 2020, DOJ also entered into one public NPA addendum.

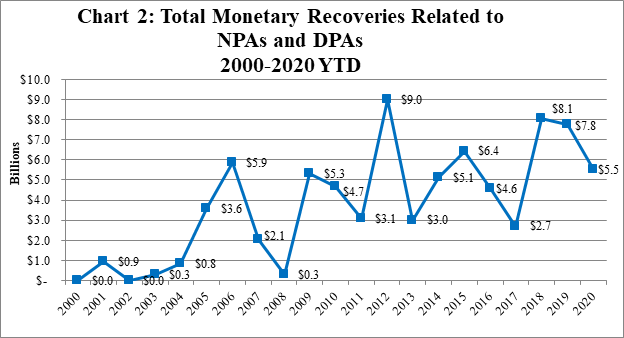

Chart 2 reflects total monetary recoveries related to NPAs and DPAs from 2000 through 2020 to date. At approximately $5.5 billion, recoveries associated with NPAs and DPAs thus far in 2020 have already outpaced the nearly $4.7 billion in recoveries from the same period in 2019. Total recoveries so far in 2020 also are already about 1.1 times the annual average recoveries of approximately $4.8 billion in the 2005-2019 period. Depending on developments in the second half of this year, total recoveries for 2020 could well outstrip last year’s total of approximately $7.8 billion in recoveries.

DOJ’s Application of NPAs and DPAs

The Justice Manual Principles of Federal Prosecution of Business Organizations (the “Justice Manual”) describes NPAs and DPAs as an “important middle ground between declining prosecution and obtaining the conviction of a corporation.”[1] This application especially holds in situations “where the collateral consequences of a corporate conviction for innocent third parties would be significant.”[2] NPAs and DPAs can “help restore the integrity of a company’s operations and preserve the financial viability of a corporation that has engaged in criminal conduct, while preserving the government’s ability to prosecute a recalcitrant corporation that materially breaches the agreement.”[3]

Although DOJ’s Corporate Enforcement Policy articulates a presumption that a company will receive a declination under certain circumstances, DOJ has not provided public guidance regarding the factors that are likely to result in an NPA rather than a DPA. Historically, however, NPAs generally have been reserved for cases where companies have cooperated; in certain statutory schemes—notably FCPA, tax and, more recently, sanctions enforcement—where companies have self-disclosed; where companies engaged in less facially egregious conduct than might merit a DPA; and—more recently—where the company’s misconduct is also addressed by resolutions in other countries, and DOJ wishes to avoid “piling on.” Penalty and forfeiture amounts also tend to be lower for NPAs than for DPAs, but final payment amounts may be negotiated after deciding on a resolution vehicle, and the lower values may be a product of multiple factors, most notably the nature of the underlying allegations.

NPAs dating back to 2000 show a nearly even split between voluntary self-disclosure and non-disclosure cases, including the 80 NPAs negotiated pursuant to the Swiss Bank Program, for which voluntary self-disclosure was a prerequisite (banks already under investigation by DOJ Tax were expressly precluded from participating in the program).[4] Since 2000, there have been approximately 290 DOJ NPAs. If the 80 Swiss Bank NPAs are removed from the total, only approximately 45 of 210 (or 21%) cite voluntary disclosure as a reason supporting the NPA.

In contrast, approximately 45 of 255 known DOJ DPAs since 2000 cite voluntary disclosure as a factor. In recent years, in particular, DPAs have very seldom credited voluntary disclosure; since 2015, there have been only three DPAs that did so, with one involving a case where DOJ was already aware of the self-disclosed conduct, but the disclosing company resolved to disclose and implemented remedial measures before becoming aware of DOJ’s investigation.

2020 in Context

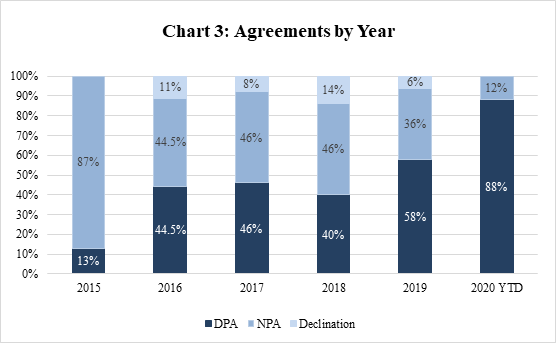

Fifteen of 17 resolutions to date this year have been DPAs (excluding an NPA addendum). As illustrated in Chart 3 below, if the trend continues, the uptick in DPAs compared to NPAs signals a sharp decline in the percentage of NPAs on an annual basis. Since 2016, the number of DPAs and NPAs have been roughly even each year. In 2015, there was a spike in the percentage of NPAs due to the 80 NPAs negotiated that year under the DOJ Tax Program.[5] Like the first half of 2020, 2019 saw a lower than average distribution of NPAs. Deciphering prosecutorial decision-making is more art than science, but the heavy slate of DPAs this year nevertheless invites the question of why we are seeing fewer NPAs.

2015 calculated including the 80 Swiss Bank Program NPAs. With the Swiss Bank NPAs removed, the 2015 percentages are 59% DPAs, and 41% NPAs.

One possibility is that voluntary disclosure is becoming a more central factor not only to achieving a declination, but also to obtaining an NPA.[6] With no voluntary disclosures announced to date in 2020, it would appear that NPAs in 2020 have not been replaced with declinations earned under DOJ’s Corporate Enforcement Policy. Nevertheless, there are certain cases that would appear—at least, from an outsider’s perspective—to have been strong contenders for NPAs in previous years.

The Propex Derivatives matter, for example, which resulted in a DPA this year, is in many ways comparable to the Merrill Lynch Commodities Inc. (“MLCI”) matter, resolved last year through an NPA. Both Propex and MLCI were accused of “spoofing,” i.e., creating a false impression of increased supply or demand by placing orders on the market that they intended to cancel before execution.[7] Neither company voluntarily self-disclosed conduct, but both received credit for cooperating with DOJ’s investigation.[8] Propex engaged an independent compliance consultant to evaluate its compliance program, and thereafter “undertook a significant enhancement of its compliance program and internal controls.”[9] MCLI also engaged in remedial measures, but without engaging an independent third party.[10] The Propex matter also had a significantly lower recovery amount than the MLCI matter, with an overall combined criminal penalty, disgorgement, and victim compensation value of $1 million, compared to MCLI’s $25 million.[11] In the Propex case, the company was tipped to the trading activity of the culpable trader, conducted an internal investigation, and allowed the trader to continue trading, although the trader made materially false statements in connection with that internal investigation.[12] It is difficult to say how heavily the unique facts of this case versus the lack of self-disclosure tipped the scales toward a DPA, but it is noteworthy that the facts could force a DPA, when—if Propex had only self-disclosed and earned more remediation credit—it would have been entitled to a presumption of a declination.[13]

The first half of 2020 could also, of course, simply be an anomalous half-year—many of the DPAs negotiated in 2020 involved high-profile misconduct and/or cited the presence of significant aggravating circumstances.[14] And three of the DPAs were negotiated with DOJ Antitrust, which—until the 2019 announcement of its DPA policy, discussed in greater detail in our alert linked here—was fairly parsimonious with DPAs and had expressly stated that it disfavors NPAs in antitrust cases.[15] Time will tell whether 2020 sees a true trend of favoring DPAs over NPAs.

2020 Agreements to Date

Airbus SE (DPA)

On January 31, 2020, France-based airplane manufacturer Airbus SE (“Airbus”) agreed to pay combined penalties of $3.9 billion to authorities in France, the United Kingdom, and the United States to resolve foreign bribery and export control charges.[16] The Airbus DPA also will be discussed in detail in Gibson Dunn’s forthcoming FCPA 2020 Mid-Year Update. The multi-jurisdictional investigation focused on allegations that, between 2008 and 2015, Airbus used third-party business partners to make improper payments to Chinese government officials, as well as nongovernment airline executives.[17] Additional allegations focused on payments to officials in Ghana, Indonesia, Malaysia, Sri Lanka, and Taiwan.[18] In the United States, the government also asserted that Airbus violated the Arms Export Control Act (“AECA”) and the International Traffic in Arms Regulations (“ITAR”) by failing to disclose political contributions, commissions or fees to the government in relation to the sale or export of defense articles and services to a foreign country.[19]

In the United States, Airbus entered into a DPA with DOJ to resolve an alleged conspiracy to violate the anti-bribery provisions of the Foreign Corrupt Practices Act (“FCPA”) and a second conspiracy to violate AECA and ITAR.[20] Pursuant to the DPA, Airbus agreed to a criminal fine of $2.3 billion, of which DOJ credited approximately $1.8 billion in payments to the French government pursuant to a parallel agreement.[21] Airbus ultimately paid over $527 million to DOJ for the FCPA and ITAR charges.[22] The Company entered a separate $10 million consent agreement with the U.S. Department of State’s Directorate of Defense Trade Controls (“DDTC”) regarding the alleged ITAR violations, pursuant to the State Department’s authority to enforce export controls.[23] Five million dollars of that sum was suspended on the condition that Airbus use the money to enact remedial compliance measures,[24] and DOJ credited the other $5 million toward the DOJ ITAR penalty.[25] In a separate civil agreement, Airbus also forfeited a bond worth €50 million traceable to the proceeds of the ITAR-related conduct.[26]

Airbus received credit for cooperating with the U.S. investigation and for taking remedial measures.[27] These measures included “separating and taking disciplinary action against former employees” involved in the alleged misconduct and enhancing its compliance program and internal controls.[28] The DPA also considered that the Company had entered into substantial resolutions with the UK Serious Fraud Office (“SFO”) and the French government’s Paquet National Financier (“PNF”).[29] Airbus received voluntary disclosure credit in relation to the alleged ITAR and AECA violations, along with credit for cooperation and remedial measures, but did not receive disclosure credit for the FCPA-related conduct because Airbus disclosed it after the SFO’s investigation became public.[30]

The Airbus resolution is also significant for what it highlights about the extent of cross-jurisdictional coordination between enforcement authorities. Outside of the United States, Airbus agreed to pay $1.09 billion pursuant to a DPA with the UK’s SFO, and over $2.2 billion pursuant to a Judicial Public Interest Agreement (“CJIP”) with the PNF.[31] The resolution with the SFO is that agency’s largest DPA to date and follows an indictment of Airbus on five counts of failing to prevent bribery under Section 7 of the Bribery Act of 2010.[32] The agreement with PNF resolved a range of charges including bribery, misuse of corporate assets, breach of trust, conspiracy to defraud, money laundering, and forgery.[33]

Increased cross-border coordination is a trend that has been growing as other countries’ enforcement regimes have continued to evolve. Assistant Attorney General Brian A. Benczkowski noted in announcing the Airbus resolution that “the Department will continue to work aggressively with our partners across the globe to root out corruption, particularly corruption that harms American interests.”[34] The DPA itself yields a notable mix of takeaways regarding coordination between sovereigns. On the one hand, DOJ premised its FCPA territorial jurisdiction on allegations that employees and agents of Airbus sent emails while in the United States and hosted foreign officials’ luxury travel at U.S. locations.[35] On the other hand, the DPA contains, among the relevant considerations for the agreement, an explicit recognition by DOJ of the limits of U.S. jurisdiction: “the Company is neither a U.S. issuer nor a domestic concern, and the territorial jurisdiction over the corrupt conduct is limited; in addition, although the United States’ interests are significant enough to warrant a resolution, France’s and the United Kingdom’s interests over the Company’s corruption-related conduct, and jurisdictional bases for a resolution, are significantly stronger, and thus the [U.S. government has] deferred to France and the United Kingdom to vindicate their respective interests as those countries deem appropriate[.]”[36] It will be interesting to follow whether future cross-jurisdictional resolutions (or even U.S.-only resolutions) contain similar statements about the limits of U.S. territorial jurisdiction or its narrower prosecutorial interests under the FCPA.

Alcon Pte Ltd (DPA)

On June 25, 2020, Alcon Pte Ltd—a former subsidiary of Novartis AG, a Switzerland-based global pharmaceutical company, and a current subsidiary of Alcon Inc., an independent multinational eye care company after its spin-off from Novartis in April 2019—entered into a three-year DPA with DOJ’s Fraud Section and the U.S. Attorney’s Office for the District of New Jersey.[37] The agreement resolved allegations that, from 2011 through 2014, Alcon Pte Ltd conspired to violate the books and records provisions of the FCPA by providing inappropriate economic benefits to Vietnamese healthcare professionals (“HCPs”).[38]

DOJ gave full credit to Alcon Pte Ltd for its cooperation, as well as Alcon Inc.’s and Novartis AG’s cooperation, with the investigation. The DPA stated that all three entities engaged in significant remedial measures, including terminating high-level executives of Alcon Pte Ltd and disciplining certain other Alcon employees, terminating the relationship with the third-party distributor, and implementing enhanced anti-corruption policies and procedures.[39] In connection with the DPA, Alcon Pte Ltd agreed to pay a penalty of $8.925 million.[40]

Alutiiq International Solutions (NPA)

On June 8, 2020, government contractor Alutiiq International Solutions, LLC (“AIS”) entered into a three-year NPA with the DOJ Fraud Section to resolve an investigation into an alleged kickback and fraud scheme tied to a multimillion-dollar U.S. government construction contract administered by the General Services Administration (“GSA”). According to the NPA, a former AIS manager received kickbacks from a subcontractor in exchange for steering work to the subcontractor.[41] The former AIS manager also allegedly billed GSA for services purportedly provided by an on-site superintendent, when there was no superintendent on site.[42] Prior to reaching the NPA with AIS, the government sought, and in May 2019 obtained, an indictment in federal court in the District of Columbia charging the former AIS manager with one count of conspiracy to violate the Anti-Kickback Act and four counts of wire fraud.[43] The former manager’s trial is scheduled for December 7, 2020.[44]

The NPA requires AIS to implement and maintain a number of corporate compliance measures, including among other measures a corporate compliance policy related to fraud, anti-corruption, procurement integrity, and anti-kickback laws, periodic risk-based reviews of the company’s compliance policies and procedures related to the relevant laws, and periodic training concerning the relevant laws.[45] Additionally, AIS has agreed to self‑report to the Fraud Section annually regarding its remediation efforts and implementation of enhanced compliance measures and internal controls.[46]

As part of the NPA, AIS has agreed to pay over $1.2 million in victim compensation payments to GSA.[47] The agreement incorporates a unique factor due to the status of AIS’s parent corporation, Afognak, as an Alaska Native Corporation. In reaching the NPA, DOJ considered the fact that almost all of Afognak’s 1,200 shareholders reside in or descend from two Alaska Native villages that qualify as distressed communities, and that “Afognak uses the entire amount of its net income for the benefit of its shareholders,” including by providing social programs and support such as elder benefits and education assistance.[48] This resolution highlights the significance of demonstrable collateral consequences.

Apotex Corporation (DPA)

On May 7, 2020, Apotex Corporation (“Apotex”), a generic pharmaceutical company, entered into a three-year DPA with DOJ’s Antitrust Division and the United States Attorney’s Office for the Eastern District of Pennsylvania.[49] DOJ alleged that from May 2013 through at least December 2015, Apotex conspired to fix the price of pravastatin, a generic cholesterol medication.[50] This resolution is the latest in a broader DOJ antitrust investigation into the generic pharmaceutical industry, which since mid‑2019 has resulted in DPAs with three other companies (including Sandoz, Inc., discussed further below), and which in late June 2020 resulted in filed charges against a fifth company.[51]

According to the terms of the DPA, Apotex agreed to cooperate in DOJ’s ongoing antitrust investigation into the generics industry.[52] The cooperation obligations set forth in the DPA are rigorous and include producing documents and using “best efforts to secure” the cooperation of “Covered Individuals”—defined as “Apotex’s current officers, directors, and employees as of the date of the signature of th[e] Agreement.”[53] Cooperation of the Covered Individuals includes not only producing documents and attending interviews, but also “participating in affirmative investigative techniques, including but not limited to making telephone calls, recording conversations, and introducing law enforcement officials to other individuals,” and testifying in judicial proceedings.[54] Apotex also agreed to continue implementing a compliance program, although the agreement does not set forth the particulars of that program.[55]

Under the DPA, Apotex agreed to pay a monetary penalty of $24.1 million.[56] In another nod to the broader context surrounding DOJ’s investigation, the DPA does not contain a provision for restitution, but rather notes “the availability of civil causes of action, and civil cases already filed against Apotex,” including a multi‑district litigation consolidated in the U.S. District Court for the Eastern District of Pennsylvania.[57] This is a notable example of DOJ leaving the pursuit of certain potential remedies up to private litigants.

The three-year DPA is subject to a one‑year extension in the event of breach.[58] However, Apotex must continue to cooperate with DOJ until “all investigations and prosecutions, whether of former employees of the Company or other individuals or entities, arising out of the conduct described in th[e] Agreement are concluded, whether or not they are concluded within the three-year period” of the DPA.[59] Although DPAs often impose cooperation obligations beyond the terms of the agreements themselves, in this context the inclusion of this language suggests that this particular DOJ antitrust investigation into the generic pharmaceuticals industry may continue for years.

Bank Hapoalim B.M. (DPA and NPA)

In late April 2020, Bank Hapoalim B.M. (“BHBM” or the “Bank”), an Israeli bank, entered into a DPA with the DOJ Tax Division and the U.S. Attorney’s Office for the Southern District of New York,[60] and an NPA with the Money Laundering and Asset Recovery Section of the U.S. Department of Justice and the United States Attorney’s Office for the Eastern District of New York.[61] Along with related agreements with the Board of Governors of the Federal Reserve System and the New York State Department of Financial Services, the April 30, 2020 DPA and NPA had total payments of approximately $904 million.

The DPA resolved allegations that the Bank conspired with U.S. taxpayers to hide assets and income in offshore accounts to evade federal income tax obligations.[62] As part of the three-year DPA, BHBM consented to the filing of a one-count information alleging that it violated federal tax laws by conspiring with U.S. customers to: (1) defraud the United States with respect to taxes; (2) file false federal tax returns; and (3) commit tax evasion.[63] In particular, the government alleged that employees of BHBM and its subsidiary Bank Hapoalim (Switzerland) Ltd. (“BHS”) helped U.S. customers open and maintain accounts with false names and identification, enabled taxpayers to evade U.S. reporting requirements for earnings on securities, provided “hold mail” services to avoid correspondence on undeclared accounts entering the United States, offered back-to-back loans to enable U.S. customers to access funds in the United States that were held in offshore accounts, and processed wire transfers or issued checks of less than $10,000 to avoid scrutiny.[64] The DPA required BHBM to pay a monetary penalty in the amount of $100,811,584, restitution in the amount of $77,877,099, and forfeiture in the amount of $35,696,929.[65] BHBM’s Swiss subsidiary, BHS, concurrently entered into a plea agreement requiring it to pay a $138,998,399 monetary penalty, $138,908,073 in restitution, and $124,628,449 in forfeiture.[66]

Although the government credited the Bank’s internal investigation, its provision of client‑identifying information to the government, and its broader cooperation in the government’s ongoing investigations, it noted that the Bank’s initial cooperation had been, in the government’s view, “deficient.”[67] Additionally, the penalties reflect deductions “in partial credit” for payments made to the Board of Governors of the Federal Reserve System and the New York State Department of Financial Services in concurrent resolutions.[68] Pursuant to the Federal Reserve cease‑and‑desist order, BHBM agreed to pay a penalty in the amount of $37.35 million.[69] Under the New York DFS consent order, BHBM and BHS agreed to pay a penalty of $220 million for violation of the New York Banking Law.[70]

The DPA is the second-largest DOJ Tax resolution to date, and also the second‑largest resolution overall thus far in 2020 (as measured by total amounts paid). Compared to the two other recent tax resolutions—HSBC Private Bank (Suisse) SA and Mizrahi Tefahot Bank (both discussed in our Year-End 2019 NPA/DPA Update)—the BHBM resolution is unique for its sheer monetary size, the parallel resolutions with the Federal Reserve and the New York DFS, and that the BHBM resolution included a guilty plea by a BHBM subsidiary.

BHBM also entered into an NPA to resolve allegations that it had assisted in laundering $20 million in bribes and kickbacks to soccer officials with Fédération Internationale de Football Association (“FIFA”).[71] The government alleged that employees of the Bank conspired with sports marketing executives and soccer officials to make bribe payments to soccer officials in exchange for broadcasting rights to soccer matches.[72] The three-year NPA required the Bank to pay a penalty of $9,329,995 and forfeit $20,733,322.[73]

In the NPA, the Bank received credit for its “exemplary” cooperation, and the NPA noted the government’s determination that “an independent compliance monitor is unnecessary.”[74] The NPA described the Bank’s “extensive” internal investigation as well as its “extensive” remedial measures, including that it will exit the private banking business outside of Israel; its closure of its Latin American subsidiary and representative offices throughout Latin America; its closure of its Miami, Florida branch; and its closure of BHS and surrender of BHS’s banking license.[75] The Bank did not receive voluntary self‑disclosure credit in the NPA.[76]

Bradken Inc. (DPA)

On June 15, 2020, Bradken, Inc. (“Bradken”), a steel supplier for submarines, entered into a three‑year DPA with the U.S. Attorney’s Office for the Western District of Washington to resolve allegations that a former Bradken employee defrauded the U.S. Navy in connection with Bradken’s provision of high-yield steel castings for use in Navy submarines.[77] According to the DPA, for 30 years, Bradken produced steel castings that had failed lab tests and did not meet the Navy’s standards.[78] The former employee allegedly falsified test results to hide that the steel had failed the tests.[79] Although Bradken’s management was not aware of the fraud until May 2017, the government alleged that when Bradken initially disclosed the conduct, it made misleading statements to the Navy that suggested that the discrepancies were not the result of fraud.[80]

The DPA credited Bradken for promptly undertaking remedial measures, including separating the employee responsible for the conduct, upgrading equipment, creating new quality control positions, and implementing new processes to enhance monitoring and control of product quality.[81] In addition, Bradken’s Board of Directors has created an Audit and Risk Committee responsible for reviewing risk and compliance processes across the company, and Bradken has agreed to provide anti-fraud training for all new employees when they are hired, followed by annual retraining.[82]

In addition to the DPA, Bradken entered into a compliance agreement with the Navy and signed a separate settlement agreement to resolve False Claims Act claims with DOJ, acting on behalf of the Navy.[83] The latter resolution agreement required Bradken to pay $10,896,924, of which $5,448,462 was restitution.[84] In this way, the Bradken DPA is a notable example of DOJ’s application of its own policy discouraging “piling on” in situations where the same conduct can be addressed by multiple DOJ components.[85]

The Bradken DPA is notable for other reasons. For example, it required Bradken to agree to a specific methodology for calculating, under the U.S. Sentencing Guidelines (“USSG”), the applicable fine range that would be used to sentence Bradken in the event it is convicted following a breach of the DPA.[86] DPAs often instead frame the USSG calculation as a matter of what the government believes the company should owe at the time of the agreement, without limiting the amount that would satisfy a later criminal penalty in the event of a breach. The Bradken DPA also required the company to publish a public statement in the Casteel Reporter, a trade publication published by the Steel Founder’s Society of America, to “educate other government contractors” on compliance issues.[87]

Chipotle Mexican Grill Inc. (DPA)

On April 21, 2020, DOJ’s Consumer Protection Branch and the U.S. Attorney’s Office for the Central District of California entered into a DPA with Chipotle Mexican Grill Inc., relating to outbreaks of foodborne illness that allegedly affected more than 1,000 people between 2015 and 2018.[88] This resolution is the result of an investigation conducted by the Food and Drug Administration (“FDA”) Office of Criminal Investigations.[89]

As part of the three-year DPA, Chipotle agreed to the filing of a two-count information charging the company with “adulterating food and causing food to become adulterated while held for sale after shipment” in violation of the Federal Food, Drug, and Cosmetic Act (“FDCA”).[90] According to the DPA, Chipotle faced “at least five food safety incidents” at its restaurants, which were the result of store-level managers allowing employees to work while sick and failing to store food at the appropriate temperatures, and which the DPA states contributed to outbreaks at five Chipotle locations between 2015 and 2018.[91]

As part of the resolution, Chipotle agreed to pay $25 million in criminal penalties over the course of four installments.[92] Typically, installment payments occur in situations in which a company demonstrates—according to a set of factors set forth in Criminal Division guidance[93]—an inability to pay the full penalty immediately. The Chipotle DPA does not provide the context of the installment payments in this instance.

DOJ listed several factors on which it based the resolution, including remedial measures Chipotle has taken to improve safety at its restaurants.[94] Such remedial measures include the development of new food safety practices and the creation of an internal corporate function focused on food safety and comprising independent food safety experts who regularly audit Chipotle’s practices and report to corporate officers.[95]

Under the DPA, Chipotle has agreed to extensive internal auditing of its food safety procedures both company-wide and at the five specific restaurant locations at issue, including via a “root cause analysis” related to the five outbreaks, a review of its current compliance with federal and state food safety laws, an evaluation of its approach to food safety audits, a review of its existing training policies and procedures for all hourly staff, and a “Hazard Analysis Critical Control Point” plan for each affected restaurant.[96] The company has also agreed to document all findings in a “comprehensive report” to the U.S. Attorney’s Office, DOJ-CPB, and the FDA, to be completed within six months of the filing of the DPA.[97]

In addition to imposing the largest fine for a food safety case, this DPA contains some provisions notable among DPAs. For example, this DPA provides that if “any Chipotle officer or employee at or senior to the rank of Field Leader (or functional equivalent) . . . knowingly violates or fails to perform any of defendant’s obligations under this agreement . . . the Government may declare this agreement breached,” relieving the government of all obligations.[98] A typical DPA breach provision requires failure by the company to comply with the agreement’s obligations, rather than by individual officers or employees.[99] Whether this feature of the Chipotle agreement signals a broader shift in policy remains to be seen.

Florida Cancer Specialists & Research Institute LLC (DPA)

On April 30, 2020, Florida Cancer Specialists & Research Institute LLC (FCS), a Florida oncology group, entered into a DPA with the DOJ Antitrust Division.[100] This resolution marks just the second major DPA entered into by the Antitrust Division since the Division’s announcement in July 2019 of a new policy making DPAs available in criminal antitrust investigations.[101]

The agreement resolves allegations that, starting in 1999, FCS conspired not to compete with other companies to provide chemotherapy and radiation treatments to cancer patients in Southwest Florida.[102] The resolution came as part of a larger investigation into market allocation and other anticompetitive conduct in the oncology industry, which is being conducted by the Antitrust Division and the FBI’s Tampa Field Office.[103]

Under the 44-month DPA[104] FCS agreed to pay a $100 million criminal penalty plus interest.[105] FCS agreed to pay the $100 million sum in five installments, beginning June 1, 2020 and ending on December 31, 2023.[106] FCS may additionally prepay the sum in full or in part at any time.[107] FCS further agreed to cooperate fully with the Antitrust Division’s ongoing investigation into the oncology industry, and to maintain an effective compliance program designed to prevent and detect criminal antitrust violations within any of FCS’s operations, including those of corporate affiliates and subsidiaries—although like other antitrust DPAs discussed in this update, the FCS DPA does not set forth particular requirements the company’s compliance program must satisfy.[108] Additionally, the agreement includes a provision under which FCS agreed not to enforce any noncompete agreements with its current or former oncologists or other employees who, during the term of the DPA, open or join an oncology practice in Southwest Florida.[109]

In a notable development, DOJ’s Antitrust Division published a “Q&A” document along with the DPA, noting the Division’s considerations in support of the resolution. Chief among those considerations were the significant collateral consequences that could redound to patients were FCS to be convicted and thus excluded from participation in Federal healthcare programs.[110] The Division specifically pointed to potential negative consequences for FCS’s “current and future patients, including patients enrolled in ongoing clinical trials, its employees, and cancer research generally.”[111] While DOJ often discusses specific corporate resolutions in speeches as examples of enforcement priorities, it is highly unusual for DOJ to issue this sort of “Q&A” document as an interpretive guide to a particular resolution. This move may signal a desire by DOJ Antitrust to explain its approach to DPAs in a context in which the Department has only recently started using them with any frequency. Of particular note are two questions and answers included in the Q&A: the fifth question regarding whether the FCS matter is “related to the generic pharmaceutical investigation” (to which DOJ responded that it is a separate investigation); and the sixth question inquiring as to the status of DOJ’s investigation into the oncology industry (to which DOJ responded that “FCS’[s] charge and DPA are the first in an ongoing investigation”).[112]

Industrial Bank of Korea (DPA)

On April 20, 2020, the U.S. Attorney’s Office for the Southern District of New York (“SDNY”) announced that the Industrial Bank of Korea (“IBK”) agreed to a two-year DPA to resolve allegations that IBK violated the Bank Secrecy Act (“BSA”).[113] Specifically, the government alleged that IBK willfully failed to establish, implement, and maintain an adequate anti-money laundering (“AML”) program at its New York branch (“IBKNY”).[114] The charges accompanying the DPA alleged that, as a result of IBK’s failure to administer an effective anti-money laundering program at IBKNY, a U.S. citizen and various co-conspirators, including several Iranian nationals, were able to transfer more than $1 billion from IBK accounts through U.S. financial institutions, including IBKNY, in violation of U.S. sanctions against Iran.[115] In 2016, the U.S. citizen was named in a 47-count indictment charging conspiracy to violate IEEPA, unlawful provision of services to Iran, money laundering, and conspiracy to commit money laundering.[116] At the time the DPA with IBKNY was concluded, the individual was in custody in the Republic of South Korea for tax violations of Korean tax law and had not yet entered a plea in the U.S. proceedings.[117] The individual’s son was sentenced in December 2018 to 30 months in prison for conspiring with the individual to commit money laundering in the same course of conduct.[118] Notably, the DPA did not include IEEPA charges.

Under the DPA, IBK agreed to pay a $51 million penalty and implement remedial measures related to its BSA, AML, and economic sanctions compliance programs.[119] IBK is required to provide SDNY with semiannual self‑reports for the duration of the agreement, describing the status of IBK’s implementation of remedial measures and its compliance with Office of Foreign Assets Control regulations.[120] IBK must also provide SDNY, upon request, with records and other documents relating to any matters described in its reports, and SDNY will have the right to interview any employee of IBK concerning any matters described in the reports.[121] Finally, IBK is required under the agreement to notify SDNY of any deficiencies or failings in its BSA/AML compliance program that any U.S. Federal or State regulators identify.[122]

In conjunction with the DPA, the New York Department of Financial Services announced a consent order with IBK, which included a separate $35 million penalty,[123] and the New York Attorney General announced an NPA, with respect to the same conduct.[124] The consent order requires compliance monitoring and oversight similar to that imposed by the federal DPA.[125]

NiSource, Inc. (DPA)

On February 26, 2020, NiSource, Inc. entered into a DPA with the U.S. Attorney’s Office for the District of Massachusetts over gas explosions that occurred on September 13, 2018 in various locations in Massachusetts, killing one person, injuring 22 others, and damaging several homes and businesses.[126] The DPA did not impose a criminal penalty on the parent company.[127]

NiSource is the parent company of Bay State Gas Company, doing business as Columbia Gas of Massachusetts (“CMA”).[128] CMA agreed to plead guilty to violating the Natural Gas Pipeline Safety Act’s minimum safety standards.[129] In particular, the government alleged that CMA failed to implement procedures to ensure the safe operation of the gas lines that ultimately exploded.[130] The plea agreement imposed on CMA a criminal fine of $53,030,116.[131]

As part of the three-year DPA, NiSource agreed to use reasonable best efforts to sell CMA or CMA’s gas distribution business and to cease and desist from any and all gas pipeline and distribution activities in the District of Massachusetts.[132] NiSource agreed to forfeit and pay a monetary penalty to the government equal to the total amount of any profit or gain from its sale of CMA and to implement and adhere to a series of recommendations the National Transportation Safety Board made following the explosions.[133] In this way, the NiSource DPA is a notable example of the compliance recommendations of an agency that itself does not have enforcement authority forming the basis of the compliance obligations imposed by a DPA. In this instance, that dynamic may be attributable to the fact that the underlying events had public safety consequences that fell within a particular agency’s expertise. This dynamic both allows DOJ to rely on such expertise to shape expectations for corporate behavior and gives additional weight to agency determinations that would otherwise only be advisory in nature.

Novartis Hellas S.A.C.I.

On June 25, 2020, DOJ announced a DPA with Novartis Hellas S.A.C.I. (“Novartis Greece”), a subsidiary of Novartis AG.[134] Novartis Greece’s three-year DPA with DOJ’s Fraud Section and the U.S. Attorney’s Office for the District of New Jersey resolved allegations that between 2012 and 2015, Novartis Greece provided improper benefits to employees of state-owned and state-controlled hospitals and clinics in Greece and, in connection with these activities, conspired to violate the FCPA’s anti-bribery and books and records provisions.[135]

The DPA stated that Novartis Greece received full credit for its and Novartis AG’s cooperation with the investigation. It also noted that Novartis Greece and Novartis AG engaged in remedial measures, such as implementing revised and enhanced policies and procedures and enhancing controls relating to sponsorships to international medical congresses and Phase IV studies.[136] Novartis Greece agreed to pay a penalty of $225 million in connection with the DPA.[137]

Pentax Medical Company (DPA)

On April 7, 2020, Pentax of America, Inc., known as Pentax Medical Company (“Pentax”), entered into a DPA with the U.S. Attorney’s Office for the District of New Jersey and the Consumer Protection Branch (“CPB”) of DOJ.[138] The three-year DPA resolved allegations concerning the distribution of misbranded medical devices in interstate commerce in violation of the FDCA.[139] As part of the resolution, Pentax agreed to pay a $40 million criminal fine and forfeit $3 million.[140]

According to the criminal complaint accompanying the DPA, Pentax allegedly shipped four types of endoscopes for 18 months without FDA-approved instructions for use.[141] The complaint charges that Pentax deliberately opted not to use FDA-approved instructions for cleaning its endoscopes, which required additional cleaning time, to avoid losing business.[142]

The government also alleged that Pentax failed to file timely reports of two infections associated with the endoscopes.[143] In relevant part, the FDCA requires that medical device manufacturers file adverse events reports “within thirty (30) days of receiving or becoming aware of information that reasonably suggests” that the manufacturer’s device “may have caused or contributed to a death or serious injury.”[144] Pentax allegedly failed to file adverse-events reports related to two incidents within the 30‑day window because its employees allegedly misunderstood the reporting requirements.[145]

Pentax received full credit for its cooperation, which included: (1) conducting a thorough internal investigation, (2) making regular factual presentations to the government, (3) proactively identifying issues and facts that were likely of interest to the government, (4) advising the government on facts and issues outside the focus of its investigation, and (5) collecting, organizing, and analyzing voluminous evidence and information for the government.[146] Pentax did not receive credit for voluntary self‑disclosure.[147]

The DPA requires Pentax to conduct, within six months of the DPA’s effective date, an audit of its instructions for use of endoscopic devices and its medical device reporting procedures, in order to determine compliance with FDA requirements.[148] The company must submit written audit findings to the FDA.[149] Pentax also must enhance its compliance training and maintain an effective compliance program.[150] Furthermore, the presidents of Pentax and the Lifecare Division of its parent, Hoya Corporation (“Hoya”), must annually certify, based on a review of Pentax’s compliance measures, that those measures satisfy the requirements of the DPA.[151] Hoya’s board of directors also must annually certify that the Pentax compliance program is effective.[152] Finally, Pentax must meet annually with the U.S. Attorney’s Office for the District of New Jersey, CPB, and the FDA to discuss the Company’s compliance with the DPA.[153]

The Pentax DPA is the larger of the two FDCA resolutions thus far in 2020 (the other being the Chipotle DPA, analyzed above). The combination of these resolutions makes 2020 the first year since 2016 with more than one FDCA-focused resolution, and together the Pentax and Chipotle DPAs represent more than twice the total recoveries associated with FDCA-focused resolutions between 2016 and the present.

Practice Fusion Inc. (DPA)

On January 27, 2020, Practice Fusion, Inc. (“Practice Fusion”), a health information technology developer based in San Francisco, entered into a three-year DPA with the U.S. Attorney’s Office for the District of Vermont.[154] The DPA, together with separate resolution agreements with DOJ’s Civil Division and various states, resolved criminal and civil investigations of alleged violations of the Anti-Kickback Statute, 42 U.S.C. § 1320a-7b, and the civil False Claims Act, 31 U.S.C. § 3729, relating to Practice Fusion’s electronic health records software.[155] Specifically, the government alleged that Practice Fusion solicited and received kickbacks from pharmaceutical companies, including one that manufactured opioids, in return for using its software to influence physician prescribing behavior for those companies’ products.[156] Practice Fusion allegedly also caused its users to submit false claims for federal incentive payments by misrepresenting the capabilities of its software.[157]

As part of the resolution, Practice Fusion agreed to pay a total of $145 million. The payment includes (1) a criminal fine of $25,398,300, (2) forfeiture of $959,700, and (3) a civil sum of $118,642,000.[158] The Practice Fusion agreement states that the company was not required to retain an independent compliance monitor because of its “belated cooperation,” remedial efforts, agreement to appoint an oversight organization, implementation of extensive compliance obligations, and agreement to self-report to the U.S. Attorney’s Office.[159] Nevertheless, the “oversight organization” described by the agreement looks very much like a compliance monitor, with DOJ retaining the right to veto the company’s selection of the oversight organization; the organization being charged with “providing reasonable assurance that Practice Fusion establishes and maintains compliance systems, controls and processes reasonably designed, implemented and operated to ensure” compliance with the DPA; and the oversight organization providing regular reports simultaneously to the Board of Directors of Practice Fusion, and to DOJ.[160]

The DPA credited Practice Fusion for its internal investigation, regular presentations to the government, production of documents, agreement to accept responsibility, and sharing of additional evidence and information.[161] Practice Fusion also undertook remedial efforts, including making relevant modifications to its electronic records.[162] The DPA also describes what the government viewed as Practice Fusion’s initial lack of cooperation, stating that the company initially did not (1) voluntarily self-disclose wrongdoing or potential areas of concern, (2) identify individual wrongdoers, (3) disclose facts unknown to the government, or (4) accept responsibility for any wrongdoing on behalf of the company or its employees.[163] Furthermore, Practice Fusion initially maintained its innocence and sought to limit document productions in response to subpoenas.[164]

The Practice Fusion DPA contains an additional provision rarely, if ever, seen in corporate resolutions. In an apparent effort to emphasize the need for transparency and acceptance of responsibility in connection with the opioid crisis, the DPA requires Practice Fusion to publish documents related to its allegedly unlawful conduct on a publicly available website.[165] The DPA requires that the documents include “the communications, presentations, contracts, negotiations, analyses, and reports agreed to by the [government] as reflecting the relevant communications.”[166] The website currently contains over 400 documents.

Propex Derivatives Pty Ltd (DPA)

On January 21, 2020, Propex Derivatives Pty Ltd (“Propex”), a proprietary trading firm headquartered in Australia, entered into a DPA with the DOJ Fraud Section to resolve charges under the anti-spoofing statute, 7 U.S.C. §§ 6c and 13. The government alleged that, for almost four years, a Propex trader placed “thousands of large-volume orders to buy and sell” certain futures contracts while intending, at the time of the orders, to cancel them before execution (i.e., “spoofing”).[167]

The three-year DPA required a payment by Propex totaling $1 million, which included (1) a criminal monetary penalty of $462,271, (2) disgorgement of $73,429, and (3) victim compensation of $464,300.[168] In a parallel proceeding, the CFTC similarly resolved spoofing allegations with Propex for identical corresponding amounts of civil penalties, disgorgement, and restitution, respectively, and with crediting of those amounts by the amounts paid to DOJ.[169] The Propex DPA is fairly unique in imposing disgorgement in both the criminal and civil contexts. In parallel DOJ/SEC investigations, for example, the SEC often claims disgorgement and DOJ focuses on criminal penalties.

Propex received credit from DOJ for its cooperation, which included (1) voluntarily making a foreign-based employee available for an interview, (2) producing foreign documents, and (3) collecting and producing voluminous evidence and information.[170] The company also provided information regarding individuals involved in the conduct at issue.[171] Propex agreed to report annually to the Fraud Section regarding remediation and compliance measures.[172] Propex did not receive voluntary self‑disclosure credit from DOJ.[173]

Sandoz Inc. (DPA)

On March 2, 2020, New Jersey-based pharmaceutical company Sandoz Inc. entered into a DPA with DOJ’s Antitrust Division to resolve four criminal conspiracy charges related to the alleged suppression of competition in the generic drug market.[174]

Under the three-year DPA, Sandoz agreed to pay $195 million and to continuing cooperation.[175] In setting forth the rationale for a negotiated resolution, the DPA noted that a conviction of Sandoz would likely result in the company’s mandatory exclusion from all federal healthcare programs, which would lead to significant negative consequences for the company’s workforce.[176] The agreement also considered Sandoz’s timely and continuing cooperation.[177]

This DPA represents the third of four DPAs (the fourth being the Apotex DPA, discussed above) arising from the same DOJ antitrust investigation of the generic pharmaceutical industry. We detailed two of the DPAs stemming from this investigation in last year’s update. The Sandoz DPA contains provisions similar to those in the Apotex DPA concerning the lack of a need for restitution in light of available private civil causes of action, and concerning the various forms of cooperation expected by DOJ from the company and “Covered Individuals.”[178]

Union Bancaire Privée, UBP SA (NPA Addendum)

On January 2, 2020, Union Bancaire Privée, UBP SA (“UBP”), a private bank headquartered in Switzerland, entered into an addendum to a January 6, 2016 NPA with DOJ.[179] The original NPA, which was part of the Swiss Bank Program established by DOJ on August 29, 2013, arose from UBP’s disclosure of its cross-border business for U.S.-related accounts.[180] The addendum is unusual, but not unprecedented—Bank Lombard Odier & Co Ltd. signed a similar addendum in July 2018, which we covered in our 2018 Year-End Update.

After entering into the 2016 NPA—which required UBP to disclose all of its U.S.-related accounts that were open between August 1, 2008 and December 31, 2014—UBP and DOJ agreed that the population of accounts should have included 97 additional accounts.[181] UBP acknowledged that it was, or should have been, aware of many of these additional accounts at the time it signed the NPA.[182] DOJ, in turn, acknowledged the company’s full cooperation under the Swiss Bank Program, including its assistance in making requests under applicable treaties for records related to the newly identified accounts.[183]

To account for the incomplete information provided to DOJ prior to execution of the NPA, UBP agreed to pay an additional sum of $14 million.[184] The total amount paid by UBP under the NPA and the addendum is $201,767,000.[185] The addendum did not otherwise alter the terms of the 2016 NPA.[186]

Wells Fargo & Company/Wells Fargo Bank, N.A. (DPA)

In February 2020, Wells Fargo & Company, and its subsidiary, Wells Fargo Bank, N.A., agreed to pay $3 billion to resolve allegations that the Bank used so-called “cross-sell[ing]” sales practices to provide banking accounts and financial products to customers under false pretenses or without their consent.[187] The government alleged that the conduct occurred between 2002 and 2016 and took place primarily at Wells Fargo’s Community Bank, then the organization’s largest business unit and the one responsible for managing everyday banking products—such as checking and savings accounts, debit cards, and bill payment services—for individuals and small businesses.[188]

The criminal investigation focused on allegations of false bank records and identity theft associated with the sales practices discussed above. The investigation resulted in a three-year DPA.[189] The DPA required Wells Fargo to pay $3 billion, although the agreement specified that “[t]he amount remitted shall be the Criminal Penalty less any amounts Wells Fargo pays to resolve the Parallel Actions, such that Wells Fargo will pay a total of $3,000,000,000 to resolve this criminal investigation as well as both Parallel Actions.” The “Parallel Actions” were the civil action brought in 2018 by DOJ’s Civil Division and the U.S. Attorney’s Office for the Central District of California,[190] along with a separate enforcement proceeding brought by the U.S. Securities and Exchange Commission.[191] Of the $3 billion obligation imposed on the Bank, $500 million will be paid to the SEC.[192] The DPA is notable in that it simply states a criminal penalty amount without setting forth the government’s view of the appropriate penalty calculation under the U.S. Sentencing Guidelines—an approach more commonly seen in NPAs.

The DPA detailed several relevant considerations, including the long duration and seriousness of the alleged sales practices, offset by Wells Fargo’s acceptance of responsibility and its cooperation.[193] The Bank’s cooperation included commissioning an independent internal investigation that resulted in public findings, collecting and analyzing extensive data, and affording the government access to evidence and witnesses.[194] The Bank also received credit for previous resolutions of regulatory and civil actions regarding related allegations, including the Jabbari and Hefler class action resolutions, settlements with the Consumer Financial Protection Bureau (“CFPB”), the Office of the Comptroller of the Currency (“OCC”), and the City of Los Angeles, and resolutions with Attorneys General of the 50 states and the District of Colombia.[195] The DPA also noted Wells Fargo’s remedial measures, including reconstitution of its board of directors, significant management turnover including the CEO, enhancement of its compliance program and internal controls, and “[s]ignificant work to identify and compensate” customers who may have been subject to the alleged conduct.[196]

International DPA Developments

In the past few years, we have followed the global trend of countries adopting and developing DPA frameworks. As prior Mid-Year and Year-End Updates have discussed (see, e.g., our 2019 Year-End Update), several countries have implemented DPA or DPA-like regimes and have begun resolving cases using these agreements. An expanding list of countries, including Canada, France, Singapore, and the United Kingdom, allow for DPA or DPA-like agreements. Allowing for DPAs or similar agreements has also been proposed in Australia,[197] Ireland,[198] Poland,[199] and Switzerland.[200]

United Kingdom

The United Kingdom was the first country outside of the U.S. to implement a formal corporate DPA program.[201] Since the UK introduced its DPA program in 2014 through Schedule 17 of the Crime and Courts Act 2013,[202] the SFO has entered into seven DPAs with corporations: Standard Bank (2015); Sarclad (2016); Rolls-Royce (2017); Tesco (2017); Serco Geografix (2019); Guralp Systems (2019); and Airbus (2020). The Serious Fraud Office has entered into one DPA in 2020, the January Airbus DPA discussed above, and it also—just last week—received approval in principle to enter into its second DPA of the year, with G4S Care and Justice Services (UK) Ltd (“G4S C&J”).[203]

G4S Care and Justice Services (UK) Ltd

On July 10, 2020, the SFO announced that it received approval in principle to enter into a DPA with G4S C&J, a government services company, to resolve allegations that it misled the UK Ministry of Justice regarding the company’s profits from its electronic monitoring services contracts between 2011 and 2013.[204] Final approval of the settlement is expected at a July 17, 2020 hearing at the Southwark Crown Court.[205] If approved, the DPA will require G4S C&J to pay a financial penalty of £38,513,227 (about $48.4 million) and to reimburse the SFO’s costs of £5,952,711 (about $7.5 million).[206] These payments supplement £121.3 million (about $152.3 million) in compensation that G4S C&J already paid to the UK Ministry of Justice as part of a 2014 civil settlement.[207]

The SFO cited a number of factors that contributed to its decision to offer G4S C&J a DPA, including the company’s (1) disclosure of materials related to the underlying conduct; (2) substantial, “albeit delayed,” cooperation; (3) remedial efforts; and (4) agreement to undertake “an extensive programme of review, assessment, and reporting on its internal controls, policies, and procedures.”[208] Notably, G4S Plc has agreed to guarantee G4S C&J’s, its wholly-owned subsidiary’s, performance under the program review.[209]

This case was run in parallel to the SFO’s Serco Geografix investigation, which resulted in a July 2019 DPA resolving similar allegations. We covered the Serco Geografix DPA in our 2019 Year-End Update.

SFO Corporate Compliance Guidance

In January 2020, the SFO also released internal guidance on evaluating corporate compliance programs that provides additional guidance regarding when a DPA is appropriate.[210] In considering a DPA, the SFO evaluates the organization’s current compliance program.[211] However, the SFO guidance also acknowledges that a DPA may still be appropriate if an organization does not yet have a fully effective compliance program because the DPA can impose further improvements.[212] In such cases, the DPA will likely require a monitor to allow the prosecutor to assess the expected reforms while the DPA is in force.[213] The SFO guidance is similar to the Justice Manual, which also urges prosecutors to consider the adequacy and effectiveness of the corporation’s compliance program at the time of a charging decision.[214]

Canada

In Canada, Remediation Agreements (“RA”)—often referred to as DPAs—were introduced as part of the omnibus Budget Implementation Act, 2018, No. 1; the bill passed the House of Commons and Senate in June 2018 and received royal assent soon thereafter.[215] Though Canada has yet to enter into an RA, there was high-level consideration of its use for SNC-Lavalin, and alleged pressure by Prime Minister Justin Trudeau on then-Minister of Justice and Attorney General Jody Wilson-Raybould to offer SNC-Lavalin an RA rather than continue prosecution of the Quebec-based construction giant.[216] In late 2019, SNC-Lavalin pleaded guilty to fraud related to actions in Libya and did not receive an RA.[217]

In January 2020, Canada’s Director of Public Prosecutions published guidance on RAs in the Public Prosecution Service of Canada Deskbook, Section 3.21.[218] This guidance includes factors, which are drawn from statute, to be considered for evaluating the public interest in pursuing an RA.[219] The guidance explains that “an RA may only be considered in relation to a listed offence where there is a reasonable prospect of conviction” and “should only be applied in cases where a prosecution is viable.”[220] Accordingly, “a full law enforcement investigation must be undertaken.”[221] After the investigation has been reviewed by Crown counsel, “if Crown counsel is of the view that an invitation to negotiate an RA should be considered, Crown counsel shall recommend to the Chief Federal Prosecutor (‘CFP’) that consent of the [Attorney General] should be sought.”[222] In the contrary situation, “if Crown counsel is of the view that an invitation to negotiate an RA is not appropriate, Crown counsel shall notify the CFP in writing, who will in turn notify the Deputy [Director of Public Prosecutions] by providing a basic overview of the case and the reasons why an RA is not recommended.”[223] Though this guidance provides some additional detail about the prosecutorial process relevant to an RA, there is little explanation of how the factors might be weighed specifically as to an RA. Until Canadian prosecutors actually negotiate and enter into an RA, this area remains in flux.

France

France introduced Conventions Judiciaire d’Intérêt Public—that is, Judicial Public Interest Agreements (“CJIPs”)—under its 2016 anti-corruption law, Sapin II.[224] France’s Ministry of Justice has entered 11 CJIPs since late November 2017,[225] when it announced the first CJIP with HSBC Private Bank Suisse SA.[226] Two of these, including the Airbus enforcement matter discussed above, were concluded this year. On January 31, 2020, Airbus entered into a CJIP and agreed to pay a public interest fine of approximately €2 billion,[227] of a total combined global resolution value of about €3.6 billion,[228] to France. On May 11, 2020, Swiru Holding AG, a private equity company, agreed to pay a public interest fine of €1.4 million for alleged tax evasion in connection with the purchase of a French villa.[229]

On June 2, 2020, the French Ministry of Justice released a circular concerning CJIPs, which included discussion of the appropriateness of entering into a CJIP.[230] The circular indicated the need for prosecutors to proceed on a case-by-case basis when considering whether to offer a CJIP, with relevant factors including the company’s prior legal record, voluntary self-disclosure, and degree of cooperation with the investigation by managers.[231] These factors expressly reference and draw from Deputy Attorney General Sally Quillian Yates’s memorandum to all prosecutors regarding Individual Accountability for Corporate Wrongdoing (commonly known as the “Yates Memo”).[232]

Singapore

In March 2018, the Singapore Parliament passed the Criminal Justice Reform Act, which amended the Criminal Procedure Code to allow for DPAs.[233] Singapore has yet to publicly enter into a DPA.

DPA/NPA Post-Resolution Considerations

The term of a DPA or NPA is often a challenging time for companies. DPAs and NPAs typically bring with them substantial continuing disclosure and compliance obligations—with the possibility of further investigation and a DPA or NPA extension if the company fails to meet them—and the risk of follow-on litigation and additional enforcement actions abroad and domestically. We summarize here some of the key considerations of which companies should be mindful as they approach the end of an investigation and develop strategies for satisfying post-resolution compliance requirements.

Cross-Border Considerations

In recent years, NPAs and DPAs increasingly form part of complex global settlements involving international conduct and multiple coordinating enforcement jurisdictions. There are notable advantages to coordinating settlements across jurisdictions if the underlying conduct at issue is cross-border. For example, DOJ will often take into account fines paid to other international regulators when determining the appropriate monetary penalty for an NPA or DPA. Since 2018, the Justice Manual has included a policy on the coordination of parallel proceedings, which states that DOJ attorneys should “coordinate with and consider the amount of fines, penalties, and/or forfeiture paid to other federal, state, local, or foreign enforcement authorities that are seeking to resolve a case with a company for the same misconduct.”[234] This is informally known as the policy against “piling on,” and it has been expressly applied in several recent resolutions. In 2018, when Brazil-based Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) entered into an NPA with DOJ to resolve allegations of FCPA violations; for example, DOJ credited the payments Petrobras made to the SEC and Brazil’s Misterio Publico Federal (“MPF”), reducing the penalty amount by 90%.[235] Similarly, in 2019, TechnipFMC plc (“Technip”) entered into a DPA with DOJ and agreed to pay a total criminal fine of over $296 million, but DOJ credited approximately $214 million that Technip agreed to pay to Brazilian authorities.[236]

In high-stakes cases, where multiple jurisdictions may be interested in pursuing an enforcement action, companies should carefully consider—involving local counsel, if appropriate—the pros and cons of voluntarily disclosing conduct locally, and encouraging a coordinated global settlement. The recent Airbus settlement is an illustrative example of a coordinated cross-border resolution. As discussed in greater detail above, on January 31, 2020, Airbus entered into parallel, multi-jurisdictional settlements with DOJ, the French government’s Paquet National Financier (“PNF”), and the UK’s Serious Fraud Office (“SFO”), valued at over $3.9 billion. In imposing a criminal penalty of more than $2.3 billion, DOJ credited nearly $1.8 billion of the over $2.2 billion in penalties imposed on Airbus by the PNF.[237] The Airbus settlement is both the largest international bribery settlement to date, and the largest DPA to date for the SFO.[238]

However, differing practices across jurisdictions, including varying degrees of protection for communications between attorneys and their clients, may also make negotiating with multiple regulators more complex. International DPA regimes vary from the U.S. in that DPAs are often only available to legal entities, limited to specific offenses, and subject to substantial oversight by the judiciary. Additionally, international regulators may impose restrictions on cooperating corporations that make negotiations in the U.S. more difficult. For example, in 2019, the SFO published new guidance on the steps companies should take to receive cooperation credit in the SFO’s charging decisions.[239] The guidance outlines similar steps to those set forth in the Justice Manual’s Principles of Federal Prosecution of Business Organizations, with a few key differences. The SFO Guidance indicates that a company may not obtain cooperation credit unless it waives privilege over witness accounts, notes, and transcripts obtained during the course of the company’s investigation.[240] In contrast, the Justice Manual states that prosecutors should not ask for privilege waivers in corporate prosecutions.[241] It remains to be seen how this difference will play out in joint investigations by DOJ and the SFO, and whether companies can cooperate effectively in both countries without foregoing cooperation credit from either agency. Facially, they could put tremendous pressure on companies to waive privilege over sensitive internal investigation material in the United States to fully comply with UK cooperation expectations. Waiver of privilege could have significant consequences in any follow-on civil litigation.

Disclosure Obligations

DPAs and NPAs commonly create a standing requirement to disclose details about newly uncovered evidence of potential violations of law. Traditionally, these provisions required only disclosure of “credible evidence” of statute-specific violations, and nearly every DPA or NPA since 2011—including every FCPA-related DPA or NPA—has included some variation of this reporting requirement, which can lead to additional criminal investigations and the unraveling of the existing agreement.[242]

Over the last few years, the standard obligation to disclose has been increasingly broadened from a requirement to report only “credible evidence” of violations of the relevant statute, to disclosure of “any evidence or allegation” of all potential criminal activity no matter how unrelated to the conduct underpinning the agreement, and whether or not based in a credible allegation. For example, this year’s Bank Hapoalim’s NPA requires the company to disclose “any evidence or allegation of a violation of U.S. federal law.”[243] For Pentax Medical Co., “any credible evidence of criminal conduct or serious wrongdoing by, or criminal investigations of, the Company [and its affiliates]” would trigger the reporting requirement.[244] Depending on how this language is interpreted, it could represent an expansive—and cumbersome—intrusion into the province of companies’ compliance functions. Rather than relying on companies to self-report truly relevant matters after reasonable follow-up, DOJ increasingly is asking for all reports so that it can decide for itself what is relevant and what is not.

Fortunately, there continues to be some variety in these terms, suggesting that DOJ has not coalesced around a single approach, and there is still room for negotiation. Recent FCPA-related DPAs and NPAs, for example, contain a provision requiring disclosure of “any evidence or allegations,” but only of FCPA-related violations,[245] and the historic “credible evidence” construction does still exist in some cases—including, notably, the DOJ Antitrust DPAs issued this year.[246] Broad disclosure obligations can be a minefield for companies given the potential for follow-on investigations and continued government inquiry into areas that previously were left to companies to investigate in the first instance, and companies should pay careful attention to these terms as investigations approach resolution.

Compliance Obligations

In 2020, DOJ has continued its practice of requiring companies entering into DPAs and NPAs to undertake compliance program enhancements. Often, as is typical of FCPA resolutions, the agreements dictate lengthy and detailed benchmark requirements for corporate compliance.[247] To enforce these requirements, DOJ has relied heavily on self-reporting, which typically involves a company providing detailed annual reports regarding remedial actions taken. Continuing a downward trend in the last several years, DOJ has not imposed any independent compliance monitors so far this year. In the Practice Fusion matter, however, the U.S. Attorney’s Office for the District of Vermont required retention of an “oversight organization.”[248] The U.S. Attorney’s Office for the District of Massachussetts also required an “in-house” monitor in connection with a subsidiary plea agreement related to the NiSource DPA described above.[249]

On June 1, 2020, DOJ released updated guidance on the “Evaluation of Corporate Compliance Programs” (the “Update”), instructing prosecutors on how to assess corporate compliance programs when conducting an investigation, in making charging decisions, and in negotiating resolutions. This updates earlier guidance from DOJ’s Fraud Section published in February 2017 (covered in our 2017 Mid-Year FCPA Update) and revised in April 2019 and June 2020. Assistant Attorney General Benczkowski noted that the Update “reflects additions based on [DOJ’s] own experience and important feedback from the business and compliance communities.”[250] Companies should expect to be evaluated against these standards throughout a self-reporting or monitoring period. For a more detailed analysis of the Update, see Gibson Dunn’s client alert on this subject.

Extensions

DPAs and NPAs typically give DOJ sole discretion to extend the resolution, including any monitorships or self-reporting obligations, for months or even years.[251] Most recently, DOJ extended the monitorship of the Brazilian construction giant Odebrecht SA, which pleaded guilty to conspiring to violate U.S. foreign bribery laws in 2016.[252] As part of its plea agreement, Odebrecht SA agreed to retain an independent compliance monitor for three years and adopt and implement a compliance and ethics program. The monitorship was set to expire in February 2020. However, in January 2020, DOJ found that the company had failed to satisfy its compliance and ethics obligations and extended the monitorship until November 2020.[253] While this occurred in the context of a plea agreement rather than an NPA or DPA, as discussed in our 2018 Year-End Update, extensions are similarly likely to occur in an NPA or DPA context.

Shareholder Litigation

DPAs and NPAs often lead to shareholder litigation in which the company’s ability to present a defense is severely limited by factual admissions in the DPA or NPA—admissions that the company is usually bound not to contest. We analyzed the implications of DPAs and NPAs for state civil litigation in detail in our 2014 Mid-Year Update. In the context of shareholder litigation, 2020 brought a breath of fresh air: in Smallen v. The Western Union Co.,[254] the Tenth Circuit affirmed the dismissal of securities fraud claims against Western Union despite the admissions in a DPA because “[a]lthough the complaint may give rise to some plausible inference of culpability on the part of Defendants,” plaintiffs had failed to plead “particularized facts giving rise to the strong inference of scienter required to state a claim under the [Private Securities Litigation Reform Act].”[255] Despite the admissions in the DPA, the court held that the plaintiff had pleaded “very few particularized allegations, if any, showing Defendants made their statements with either intent to defraud investors or conscious disregard of a risk shareholders would be misled.”[256]

APPENDIX: 2020 Non-Prosecution and Deferred Prosecution Agreements to Date

The chart below summarizes the agreements concluded by DOJ in 2020 to date. The SEC has, to date, not entered into any NPAs or DPAs in 2020. The complete text of each publicly available agreement is hyperlinked in the chart.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA or a DPA, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in settlement agreements.

| U.S. Deferred and Non-Prosecution Agreements in 2020 to Date | ||||||

| Company | Agency | Alleged Violations | Type | Monetary Recoveries | Monitoring & Reporting | Term of DPA/ NPA (months) |

| Airbus SE | DOJ Fraud; DOJ NSD; D.D.C. | FCPA; AECA; ITAR | DPA | $582,628,702 | Yes | 36 |

| Alcon Pte Ltd | DOJ Fraud; D.N.J. | FCPA | DPA | $8,925,000 | Yes | 36 |

| Alutiiq International Solutions | DOJ Fraud | Major fraud against the United States | NPA | $1,259,444 | Yes | 36 |

| Apotex Corporation | DOJ Antitrust | Antitrust | DPA | $24,100,000 | No | 36 |

| Bank Hapoalim B.M. | DOJ Tax; S.D.N.Y. | Tax | DPA | $874,270,533 | Yes | 36 |

| Bank Hapoalim B.M. | DOJ MLARS; E.D.N.Y. | AML | NPA | $30,063,317 | Yes | 36 |

| Bradken Inc. | W.D. Wash.; DOJ Civil | Major fraud against the United States | DPA | $10,896,924 | No | 36 |

| Chipotle Mexican Grill Inc. | C.D. Cal.; DOJ CPB | FDCA | DPA | $25,000,000 | Yes | 36 |

| Florida Cancer Specialists & Research Institute LLC | DOJ Antitrust | Antitrust | DPA | $100,000,000 | No | 44 |

| Industrial Bank of Korea | S.D.N.Y. | BSA | DPA | $86,000,000 | Yes | 24 |

| NiSource, Inc. / Columbia Gas of Massachusetts | D. Mass. | Natural Gas Pipeline Safety Act | DPA | $53,030,116 | No | 36 |

| Novartis Hellas S.A.C.I. | DOJ Fraud; D.N.J. | FCPA | DPA | $337,800,000 | Yes | 36 |

| Pentax of America, Inc. | D.N.J.; DOJ CPB | FDCA | DPA | $43,000,000 | Yes | 36 |

| Practice Fusion Inc. | D. Vt. | Anti-Kickback Statute | DPA | $145,000,000 | Yes | 36 |

| Propex Derivatives Pty Ltd | DOJ Fraud | Commodities violations (7 U.S.C. §§ 6c and 13) | DPA | $1,000,000 | Yes | 36 |

| Sandoz Inc. | DOJ Antitrust; E.D. Pa. | Antitrust | DPA | $195,000,000 | No | 36 |

| Union Bancaire Privée, UBP SA | DOJ Tax | Tax | NPA addendum | $14,000,000 | No | 48 (in original NPA) |

| Wells Fargo & Company / Wells Fargo Bank, N.A. | W.D.N.C.; C.D. Cal. | Falsification of bank records; identity theft | DPA | $3,000,000,000 | No | 36 |

______________________

[1] U.S. Dep’t of Justice, Justice Manual § 9-28.200.B.

[2] U.S. Dep’t of Justice, Justice Manual § 9-28.1100.B.

[4] Joint Statement by DOJ and the Swiss Federal Department of Finance, § I.A (“This Program does not apply to individuals and shall not be available to any Swiss Bank as to which the Tax Division has authorized a formal criminal investigation concerning its operations (Category 1 Bank) as of the date of the announcement of this Program.”) (Aug. 29, 2013).

[5] See our 2015 Mid-Year and Year-End Updates for a discussion of this program.