2020 Year-End FCPA Update

Client Alert | January 12, 2021

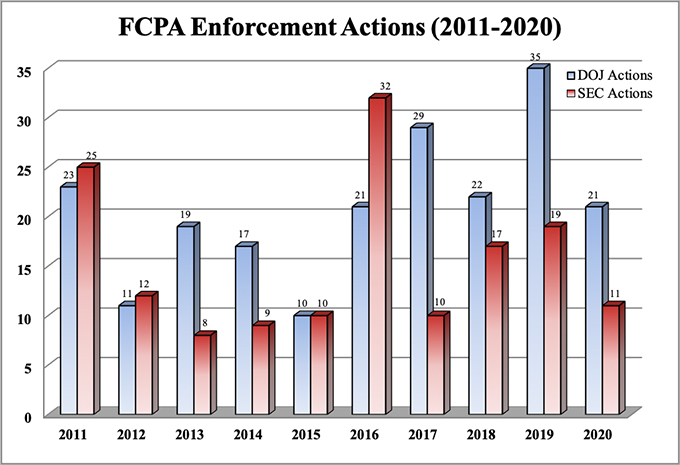

Recovering from a relatively slow start to the year, due in no small part to the global pandemic, the U.S. Foreign Corrupt Practices Act (“FCPA”) Units of the U.S. Department of Justice (“DOJ”) and Securities and Exchange Commission (“SEC”) closed the year with a bang. With 32 combined FCPA enforcement actions, 51 total cases including ancillary enforcement, and a record-setting $2.78 billion in corporate fines and penalties (plus billions more collected by foreign regulators), 2020 marks another robust year in the annals of FCPA enforcement.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2020, as well as the trends we see from this activity. We at Gibson Dunn are privileged to help our clients navigate these challenges daily and are honored again to have been ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices, the fourth time we have been so honored in the last five years. For more analysis on the year in anti-corruption enforcement, compliance, and corporate governance developments, please view or join us for our complimentary webcast presentations:

- 11th Annual Webcast: FCPA Trends in the Emerging Markets of Asia, Russia, Latin America, India and Africa on January 12 (view materials; recording available soon);

- FCPA 2020 Year-End Update on January 26 (to register, Click Here); and

- 17th Annual Webcast: Challenges in Compliance and Corporate Governance (date to be announced).

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) or American Depository Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

Foreign corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of DOJ have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent among these “FCPA-related” charges is money laundering—a generic shorthand term for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain “specified unlawful activities,” including corruption under the FCPA or laws of foreign nations, through the U.S. banking system. DOJ now frequently deploys the money laundering statutes to charge “foreign officials”—most often, employees of state-owned enterprises, but occasionally political or ministry figures—who are not themselves subject to the FCPA. It is thus increasingly commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations. DOJ has even used these foreign officials to cooperate in ongoing investigations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, during each of the past 10 years.

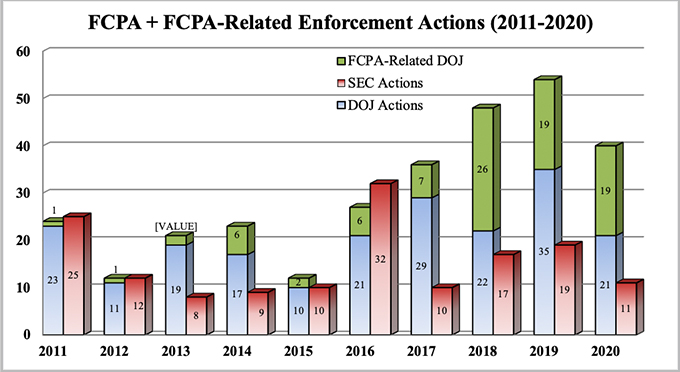

|

The regularity of non-FCPA charges brought by DOJ FCPA Unit prosecutors was noted by the OECD Working Group on Bribery, which published a thorough Phase 4 report on the United States in November 2020. It praised the United States for “further increas[ing] its strong enforcement of the [FCPA] [and] maintaining its prominent role in the fight against transnational corruption,” noting in particular that “U.S. enforcement authorities have made broad use of other statutes and offences to prosecute payments to foreign government officials and intermediaries either in addition to or instead of FCPA charges.” With 19 such actions in 2020 (vs. 21 FCPA cases), thus continues what has matured into a multi-year trend of substantial extra-FCPA enforcement by DOJ.

|

2020 FCPA + FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not merely to report on each of the year’s FCPA enforcement actions, but more so to distill the thematic trends that we see stemming from these individual events. For 2020, we have identified five key enforcement trends that we believe stand out from the rest:

- Yet another high-water mark for corporate FCPA financial penalties;

- The CFTC dives into FCPA waters;

- The cautionary tale of Beam Suntory;

- No FCPA-related monitorships in 2020; and

- Spotlight on Latin America.

Yet Another High-Water Mark for Corporate FCPA Financial Penalties

For all of the fears expressed by some with respect to our 45th President—Donald J. Trump has been recorded as openly hostile to the FCPA—one that did not come to pass was diminishment of enforcement of the FCPA. Put simply, the modern era of FCPA enforcement largely has been indifferent to shifting political winds.

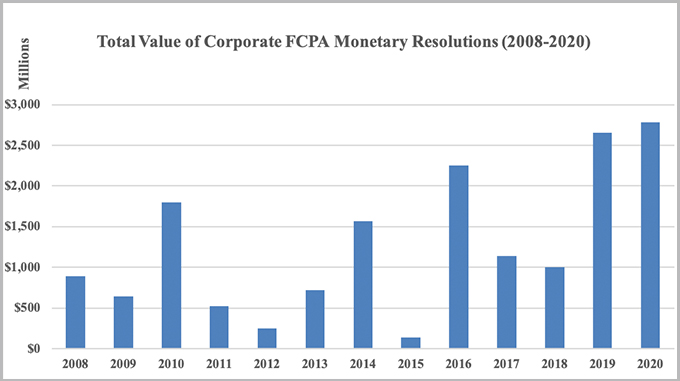

As just one measure of this phenomenon, one year ago we reported in these pages that corporate fines in FCPA cases had topped $2.5 billion for the first time in the history of the statute. In large part, this was because the record for highest single corporate FCPA resolution was set twice over in 2019—first, with the $850 million resolution with Mobile TeleSystems PJSC in March 2019, only to be outdone months later with the $1 billion resolution with Telefonaktiebolaget LM Ericsson in December 2019 (both covered in our 2019 Year-End FCPA Update). In 2020, the aggregate and individual records fell yet again.

Our readership is familiar with the long-running corruption investigation related to Malaysian sovereign wealth fund 1Malaysia Development Berhad (“1MDB”). From a massive civil forfeiture action seeking to recover allegedly misappropriated funds, to criminal FCPA actions against Malaysian businessperson Low Taek Jho (“Jho Low”) and former bankers Tim Leissner and Roger Ng Chong Hwa, even to charges under the Foreign Agents Registration Act (“FARA”) against individuals allegedly trying to lobby the Trump Administration on Jho Low’s behalf, the 1MDB scandal has resulted in significant enforcement activity and scrutiny over the last several years. Collectively, the former bankers and Jho Low allegedly participated in the diversion of more than $2.7 billion from 1MDB, between 2009 and 2014 and in connection with three separate bond offerings, for the illicit purposes of making payments to officials of state-owned investment funds of Malaysia and the UAE and embezzlement for their own personal benefit. Now added to the 1MDB enforcement list is the largest monetary corporate FCPA resolution ever. On October 22, 2020, global financial institution The Goldman Sachs Group Inc. reached a multi-billion dollar coordinated resolution in connection with the same core allegations with the SEC, DOJ, other U.S. authorities, as well as authorities in Singapore, the United Kingdom, and Hong Kong.

On the U.S. enforcement front, Goldman Sachs resolved the criminal case by entering into a three-year deferred prosecution agreement with DOJ alleging conspiracy to violate the FCPA’s anti-bribery provisions, while its Malaysian subsidiary pleaded guilty to one count of conspiracy to violate the anti-bribery provisions. The criminal penalty was calculated at $2.315 billion, but after a variety of offsets for payments to other regulators—domestic and foreign—Goldman Sachs agreed to pay $1.263 billion to DOJ. To resolve the civil case with the SEC, the bank consented to the entry of a cease-and-desist order charging anti-bribery, books-and-records, and internal controls violations, and agreed to pay a $400 million civil penalty, bringing the total FCPA financial resolution to $1,663,088,000. The SEC also ordered disgorgement of $606 million, but fully credited the amount against payments Goldman Sachs made under an earlier settlement in Malaysia pursuant to which the bank agreed to a $2.5 billion payment, as well as a guarantee of the return of $1.4 billion of 1MDB assets seized by authorities around the world.

Goldman Sachs also reached parallel resolutions with the Federal Reserve ($154 million), New York State Department of Financial Services ($150 million), UK Financial Conduct Authority ($63 million) and Prudential Regulation Authority ($63 million), Singaporean authorities ($122 million), and Hong Kong Securities and Futures Commission ($350 million). All told, total payments under the various resolutions exceed $5 billion.

In addition to Goldman Sachs and the Airbus and Novartis FCPA resolutions covered in our 2020 Mid-Year FCPA Update, two other 2020 corporate FCPA enforcement actions that topped the $100 million mark in combined penalties and disgorgement include:

- Herbalife Nutrition Ltd. – On August 28, 2020, DOJ and the SEC announced a combined $123 million FCPA resolution with U.S.-based global nutrition company Herbalife. According to the charging documents, over several years employees of Herbalife subsidiaries in China allegedly provided improper benefits, including cash, gifts, travel, and hospitality, to influence government officials in a variety of regulatory matters. To resolve the SEC investigation, Herbalife consented to the entry of an administrative cease-and-desist order charging FCPA accounting violations and agreed to pay more than $67 million in disgorgement and prejudgment interest. Herbalife also entered into a deferred prosecution agreement with DOJ and agreed to pay $55 million in criminal penalties to resolve a charge of conspiracy to violate the books-and-records provision of the FCPA. Herbalife received full credit for its cooperation and remediation, including steps to enhance its anti-corruption compliance program and accounting controls and take disciplinary actions against employees involved in the conduct. Herbalife will self-report on the status of its compliance program for a three-year period. Gibson Dunn represented Herbalife in connection with the joint resolutions.

- J&F Investimentos S.A. – On October 14, 2020, the SEC and DOJ announced a combined $155 million FCPA resolution with private Brazilian-based holding company J&F Investimentos S.A. and its affiliated global meat and protein producer and ADS-issuer JBS, S.A. J&F pleaded guilty to a single charge of conspiracy to violate the FCPA’s anti-bribery provisions based on allegations that over many years, millions in payments were made to high-level Brazilian officials, including high-ranking executives at state-owned banks and a state-controlled pension fund, to obtain hundreds of millions of dollars of financing and approval for a corporate merger. The SEC brought FCPA accounting charges against JBS and two of its executives: brothers Joesley and Wesley Batista. To resolve the criminal case, J&F agreed to a total fine of $256,497,026, but will pay only $128,248,513 (50%) of that to DOJ, with an offsetting credit applied against agreements in Brazil pursuant to which J&F agreed to pay approximately $3.2 billion. To resolve the SEC’s civil allegations, JBS agreed to pay $26.8 million in disgorgement and the Batistas agreed to pay civil penalties of $550,000 each. J&F and JBS will report on compliance and remedial measures for a three-year term.

Together with the other enforcement activity from 2020, corporate fines in FCPA cases reached a new height of $2.78 billion. A chart tracking the total value of corporate FCPA monetary resolutions by year, since the advent of blockbuster fines brought in with the 2008 Siemens resolution, follows:

Our Corporate FCPA Top 10 list currently reads as follows:

|

No. |

Company* |

Total Resolution |

DOJ Component |

SEC Component |

Date |

|

1 |

Goldman Sachs** |

$1,663,088,000 |

$1,263,088,000 |

$400,000,000 |

10/22/2020 |

|

2 |

Ericsson |

$1,060,570,432 |

$520,650,432 |

$539,920,000 |

12/06/2019 |

|

3 |

Mobile TeleSystems |

$850,000,000 |

$750,000,000 |

$100,000,000 |

03/06/2019 |

|

4 |

Siemens AG*** |

$800,000,000 |

$450,000,000 |

$350,000,000 |

12/15/2008 |

|

5 |

Alstom S.A. |

$772,290,000 |

$772,290,000 |

— |

12/22/2014 |

|

6 |

KBR/Halliburton |

$579,000,000 |

$402,000,000 |

$177,000,000 |

02/11/2009 |

|

7 |

Teva |

$519,000,000 |

$283,000,000 |

$236,000,000 |

12/22/2016 |

|

8 |

Telia**** |

$483,103,972 |

$274,603,972 |

$208,500,000 |

09/21/2017 |

|

9 |

Och-Ziff |

$412,000,000 |

$213,000,000 |

$199,000,000 |

09/29/2016 |

|

10 |

BAE Systems***** |

$400,000,000 |

$400,000,000 |

— |

02/04/2010 |

* Our figures do not include the 2018 FCPA case against Petróleo Brasileiro S.A. – Petrobras (“Petrobras”), even though some sources have reported the resolution as high as $1.78 billion, because the first-of-its kind resolution negotiated by Gibson Dunn offset the vast majority of payments against a shareholders’ class action lawsuit and foreign regulatory proceeding, leaving only $170.6 million fairly attributable to the DOJ / SEC FCPA resolution.

** Goldman Sachs’s U.S. FCPA resolutions were coordinated with numerous authorities in the United States, United Kingdom, Singapore, Hong Kong, and Malaysia, with total payments under the various resolutions exceeding $5 billion.

*** Siemens’s U.S. FCPA resolutions were coordinated with a €395 million ($569 million) anti-corruption settlement with the Munich Public Prosecutor.

**** Telia’s U.S. FCPA resolutions were coordinated with resolutions in the Netherlands and Sweden for a combined total of $965.6 million.

***** BAE pleaded guilty to non-FCPA conspiracy charges of making false statements and filing false export licenses, but the alleged false statements concerned the existence of the company’s FCPA compliance program, and the publicly reported conduct concerned alleged corrupt payments to foreign officials.

The CFTC Dives into FCPA Waters

Our readers well know that as the prominence of international anti-corruption enforcement has grown, so too has the number of enforcers from around the world taking an active participation interest. Meetings with regulators are now coordinated across global time zones rather than a question of meeting at the Bond Building or at the SEC. But even as the waters of international anti-corruption enforcement were already crowded, a new entrant just caught its first big wave: the U.S. Commodity Futures Trading Commission (“CFTC”).

As covered in our 2019 Year-End FCPA Update, on March 6, 2019 the CFTC published an advisory on self-reporting and cooperation for “violations involving foreign corrupt practices,” and the same day the Enforcement Division Director delivered remarks announcing the CFTC’s intent to bring enforcement actions stemming from foreign bribery. Almost overnight, multiple companies then announced investigations by the CFTC with a potential foreign bribery nexus. And it did not take long for the first to reach a resolution.

On December 3, 2020, DOJ and the CFTC announced their first coordinated foreign corruption resolution, with Vitol Inc., the U.S. affiliate of one of the world’s largest energy trading firms. DOJ charged an alleged conspiracy to violate the FCPA’s anti-bribery provisions through payments to government officials in Brazil, Ecuador, and Mexico over a period of several years. To resolve the criminal case, Vitol entered into a deferred prosecution agreement and agreed to a $135 million fine, but will pay only $90 million of that to DOJ, with an offsetting credit applied to $45 million paid as part of a leniency agreement with Brazil’s Federal Public Ministry (“MPF”).

But perhaps most notable about the resolution is that, in a first-of-its-kind action, Vitol also consented to a cease-and-desist order by the CFTC for “manipulative and deceptive conduct” under the Commodity Exchange Act (“CEA”). According to the CFTC, Vitol paid the alleged bribes to state oil companies in Brazil, Ecuador, and Mexico in order to obtain preferential treatment, access to trades with the oil companies, and confidential information, including (in Brazil) specific prices at which Vitol understood it would win a particular bid or tender. The CFTC order, which also alleges that Vitol attempted to manipulate two oil benchmarks through separate trading activity, requires Vitol to pay more than $95 million in civil monetary penalties and disgorgement. However, so as not to impose duplicative penalties, the CFTC order provides a $67 million offsetting credit for the FCPA criminal fine, leaving Vitol to pay approximately $28.8 million.

Two former oil traders also were charged with FCPA and FCPA-related charges for their roles in the alleged criminal conspiracy. Javier Aguilar—a Mexican citizen, U.S. resident, and former Vitol oil trader—was charged in an indictment unsealed on September 22 with FCPA and money laundering conspiracy counts. Aguilar allegedly paid $870,000 to officials of Ecuador’s state-owned oil company, Petroecuador, in exchange for a contract to purchase $300 million in fuel oil. Aguilar pleaded not guilty in October 2020 and awaits trial in the Eastern District of New York. And on November 30, DOJ unsealed the February 2019 guilty plea of Rodrigo Garcia Berkowitz, a former oil trader of Petróleo Brasileiro S.A. (“Petrobras”), to money laundering conspiracy. Garcia Berkowitz allegedly accepted money from commodity trading companies, including Vitol, in exchange for directing Petrobras business to the companies, and also helped the companies determine the highest price they could charge to Petrobras and still win the bids. Berkowitz awaits sentencing.

The Cautionary Tale of Beam Suntory

In our 2018 Mid-Year FCPA Update, we reported on what appeared to be a rather modest FCPA resolution between the SEC and Chicago-based spirits producer Beam Suntory, Inc. The allegations were that senior executives at Beam’s Indian subsidiary directed efforts by third parties to make improper payments to increase sales, process license and label registrations, obtain better positioning on store shelves, and facilitate distribution. The SEC cited Beam’s voluntary disclosure—reportedly spawned by a series of proactive investigations initiated in the wake of competitor Diageo plc’s 2011 FCPA enforcement action in India—and reached what seemed like a favorable result for Beam, including a relatively modest combined penalty and disgorgement figure of just over $8 million. But there was mention of an ongoing DOJ investigation, with which Beam continued to cooperate. That investigation came to a less favorable end in 2020.

On October 27, 2020, DOJ announced its own, separate resolution with Beam arising from what appears to be substantially the same course of conduct in India with the lead corrupt payment allegation being a 1 million rupee (~ $18,000) payment to a senior government official in exchange for a license. The result was a deferred prosecution agreement on FCPA anti-bribery, internal controls, and books-and-records charges with a criminal fine of $19,572,885, none of which was credited against the prior SEC resolution.

Unlike the SEC, DOJ did not give Beam voluntary disclosure credit because it contended that the disclosure occurred only after a former employee sent a whistleblower complaint that copied U.S. and Indian authorities. DOJ further did not provide Beam with full cooperation credit, citing “positions taken by the Company that were not consistent with full cooperation, as well as significant delays caused by the Company in reaching a timely resolution and its refusal to accept responsibility for several years.” Finally, in support of a criminal internal controls charge (knowing and willful failure to implement and maintain internal controls), DOJ cited at length what it perceived to be an inadequate investigative response by certain in-house counsel to numerous red flags from audit reports and outside counsel opinions regarding the risks that third parties were paying bribes on Beam’s behalf. In one cited email, an in-house counsel allegedly wrote: “Beam Legal believes it is critical to approach a compliance review with the understanding that a U.S. regulatory regime should not be imposed on our Indian business and that acknowledges India customs and ways of doing business.” DOJ’s citation to and reliance on internal audit reports as evidence of internal controls breakdowns is troubling. Internal audit is, by definition, one of the lines of defense in a corporate control environment. Using it as a sword against a corporation is unfortunate and will lead to process changes within a corporation.

Had DOJ credited Beam’s voluntary disclosure and cooperation under the FCPA Corporate Enforcement Policy, and credited the penalty previously imposed by the SEC under the “Anti-Piling On” Policy, Beam’s criminal fine could have been less than $9 million rather than the more than $19.5 million fine imposed.

If one thing is clear it is that the public record does not disclose the full background and there surely is another side to the story. Nonetheless, Beam stands as a cautionary tale worthy of further study on subjects ranging from investigative response to red flags, to the challenges of educating business personnel on the need to conduct business in a compliant manner even in challenging markets, to the risks of unilaterally settling with one regulator while another investigation continues.

No FCPA Compliance Monitorships in 2020

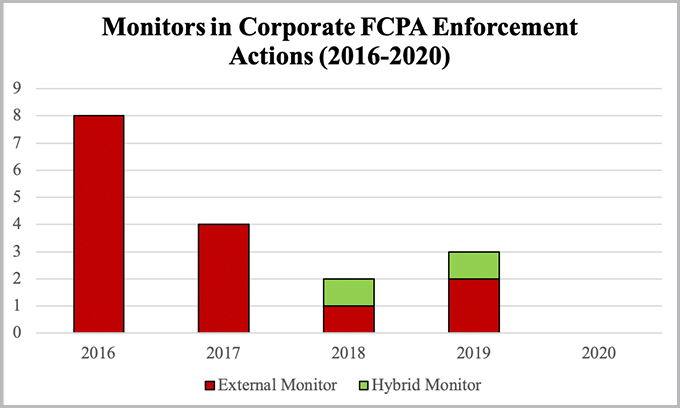

Post-resolution oversight mechanisms long have been a mainstay of corporate FCPA enforcement. Early in the modern era of FCPA enforcement, it was commonplace for DOJ and/or the SEC to impose external compliance monitors in corporate FCPA resolutions. In more recent years, we observed a trend of the government employing a more diverse mix of post-resolution mechanisms, including requiring corporate self-assessments, which a company conducts itself and submits the findings of to the government (as covered in our 2009 and 2012 Year-End FCPA Updates), to using a “hybrid” approach whereby a company retains a monitor for part of the post-resolution period followed by a self-assessment period (as discussed in our 2014 Year-End FCPA Update).

Even as the frequency and mix of the different types of obligations have changed over time, it is rare to see a year go by without a single corporate monitor being imposed. In 2020, however, despite an overall record year in corporate FCPA fines and several large individual corporate resolutions, not a single FCPA-related monitorships was imposed. What may be the driving force for this shift is adherence to DOJ’s 2018 guidance concerning compliance monitors, covered in our 2018 Year-End FCPA Update. The “Benczkowski Memorandum” signaled that “the imposition of a monitor will not be necessary in many corporate criminal resolutions.” Among the considerations that should be taken into account in deciding whether to require a monitor are the company’s remediation efforts as well as the potential cost of a monitor and its impact on the company’s operations.

As can be seen from the following chart, which tallies the frequency of external monitors in corporate FCPA enforcement actions over the last five years, monitors are becoming relatively rarer oversight mechanisms in these cases.

Spotlight on Latin America

A headline from nearly 15 years ago, in our 2007 Year-End FCPA Update, read “China, China, China” to highlight the dramatic uptick in FCPA enforcement actions spawning from one of the world’s leading and most challenging economies. Then, five years ago, in our 2016 Year-End FCPA Update, we commented that it was “Still China, China, China . . . But Don’t Forget About Latin America,” to highlight that while China still remained the most prevalent situs of FCPA enforcement activity, Latin America was emerging as the new risk capital of anti-corruption compliance. That trend has continued, with more than 60% of the 51 FCPA and FCPA-related enforcement actions brought or announced in 2020 involving allegations of misconduct in Central or South America. Highlights not covered elsewhere include:

- Sargeant Marine, Inc. (“SMI”), a Florida-based asphalt company, on September 21, 2020 pleaded guilty to FCPA conspiracy related to its alleged conduct in several South American countries, including most prominently Brazil. DOJ alleged that SMI offered and paid bribes to officials in Brazil, Venezuela, and Ecuador in order to secure business contracts to provide asphalt to state-owned oil companies Petrobras, Petróleos de Venezuela, S.A. (“PDVSA”), and EP Petroecuador. The criminal penalty, reflecting a 25% discount off the bottom of the Sentencing Guidelines range for SMI’s cooperation and remediation, was $90 million, but DOJ reduced the penalty to $16.6 million by applying its “Inability to Pay” Policy. Relatedly, seven individuals have been charged in connection with the investigation of corrupt practices in the Latin American asphalt procurement market, including SMI part-owner and senior executive Daniel Sargeant; SMI traders Jose Tomas Meneses and Roberto Finocchi, SMI consultants Luiz Eduardo Andrade and David Diaz, and former PDVSA officials Hector Nuñez Troyano and Daniel Comoretto.

- On December 16, DOJ announced a superseding indictment bringing money laundering and money laundering conspiracy charges against two new defendants allegedly involved in corruption relating to Venezuela’s state-run currency exchanges: former National Treasurer of Venezuela Claudia Patricia Diaz Guillen and her husband, Adrian Jose Velasquez Figueroa. As covered in our 2018 Year-End FCPA Update, Diaz Guillen’s predecessor, former National Treasurer of Venezuela Alejandro Andrade Cedeno, pleaded guilty to money laundering after allegedly accepting bribes from Globovision news network mogul Raul Gorrin Belisario, who was indicted in August 2018, in exchange for conducting foreign exchange transactions on Gorrin’s behalf at artificially high government rates. According to the superseding indictment, when Diaz Guillen succeeded Andrade Cedeno as National Treasurer, she also succeeded him as Gorrin Belisario’s access point to Venezuela’s government currency exchanges, and she and her husband began accepting bribes from Gorrin to continue the scheme.

- On November 24, Venezuelan businessperson Natalino D’Amato became the latest defendant to face charges stemming from DOJ’s investigation of Venezuelan “pay for play” corruption. From 2015 to 2017, D’Amato allegedly bribed officials of multiple PDVSA subsidiaries to secure inflated supply contracts for D’Amato’s businesses. The PDVSA subsidiaries allegedly transferred over $160 million into Florida-based accounts controlled by D’Amato, and D’Amato allegedly paid out over $4 million of those funds in bribes to PDVSA officials. D’Amato now faces 11 counts of money laundering, money laundering conspiracy, and engaging in transactions involving criminally derived property.

- On August 6, DOJ unsealed an indictment against Jose Luis De Jongh Atencio, a new defendant in a separate branch of the Venezuela “pay for play” scheme detailed in our 2020 Mid-Year FCPA Update. Juan Manuel Gonzalez Testino and Tulio Anibal Farias-Perez pleaded guilty in May 2019 and February 2020, respectively, to FCPA charges for bribing officials of PDVSA subsidiary Citgo Petroleum Corporation in exchange for Citgo supply contracts. De Jongh, a former Citgo procurement officer and manager, allegedly was a recipient of those bribes. According to the indictment, De Jongh accepted Super Bowl, World Series, and concert tickets, in addition to approximately $2.5 million in payments used to purchase property in Texas. De Jongh was charged with money laundering and conspiracy to commit money laundering.

- Alexion Pharmaceuticals, Inc., a Boston-headquartered pharmaceutical company, settled an SEC-only cease-and-desist proceeding on July 2, 2020 arising from alleged violations of the FCPA’s accounting provisions primarily associated with the alleged bribery of Turkish and Russian officials to influence regulatory treatment and prescriptions for the company’s primary drug. The SEC also alleged that employees of Alexion’s subsidiaries in Brazil and Colombia created or directed third parties to create inaccurate records concerning payments that were used to cover employee personal expenses, though no bribery was alleged in these areas. Without admitting or denying the SEC’s findings, Alexion agreed to $17.98 million in disgorgement and prejudgment interest, as well as a $3.5 million penalty. Alexion earlier reported that DOJ had closed its five-year inquiry into the same conduct without any enforcement action.

- World Acceptance Corporation (“WAC”), a South Carolina-based consumer loan company, on August 6, 2020 agreed to resolve FCPA charges with the SEC arising from alleged misconduct in Mexico between 2010 and 2017. According to the settled cease-and-desist order, employees of WAC’s former Mexican subsidiary paid more than $4 million to Mexican government officials and union officials to secure the ability to make loans to government employees and then ensure those loans were repaid. To resolve these charges, and without admitting or denying the findings, WAC consented to the entry of an administrative order finding violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions and paid $19.7 million in disgorgement and prejudgment interest, as well as a $2 million civil penalty. Although the SEC order does not mention a voluntary self-disclosure, DOJ did recognize WAC’s voluntary disclosure, cooperation, and remediation in issuing a public declination pursuant to the FCPA Corporate Enforcement Policy.

Rounding Out the 2020 FCPA and FCPA-Related Enforcement Docket

Additional 2020 FCPA and FCPA-related enforcement actions not covered elsewhere in this update or our 2020 Mid-Year FCPA Update include:

Deck Won Kang

On December 17, 2020, New Jersey resident and contractor to Korea’s Defense Acquisition Program Administration (“DAPA”) Deck Won Kang pleaded guilty to one count of violating the FCPA’s anti-bribery provisions. According to the charging document, DAPA solicited bids in connection with contracts to upgrade the Korean Navy’s fleet, and Kang paid $100,000 to a DAPA procurement official to obtain non-public information to help Kang’s companies secure and retain the contracts. Kang also has been sued in New Jersey state court by DAPA. The civil proceedings are ongoing, and Kang is scheduled to be sentenced on the FCPA charge in April 2021 in the District of New Jersey.

Jeremy Schulman

In a matter that appears to have arisen out of an FCPA investigation, DOJ’s FCPA Unit announced on December 3, 2020 the indictment of Maryland attorney Jeremy Schulman on charges stemming from an alleged six-year conspiracy to misappropriate Somali sovereign assets held in accounts with U.S. financial institutions that had been frozen since the beginning of Somalia’s 1991 civil war. According to the charging documents, Schulman and his co-conspirators allegedly forged paperwork purporting to show that Schulman acted on the authority of the Central Bank of Somalia in repatriating these assets, which materials Schulman then presented to banks with requests to recover the frozen funds. Schulman and his co-conspirators learned the locations of the frozen assets from a former Governor of Somalia’s Central Bank, who was appointed as an advisor to the Transitional Government of Somalia’s President after the alleged conspiracy began; however, neither Schulman nor the former Governor were authorized to recover the funds. Schulman allegedly obtained control of approximately $12.5 million of the frozen Somali funds using his forged documents; his law firm retained approximately $3.3 million and the rest was remitted to the Somali government. Schulman now faces 11 counts of bank, mail, and wire fraud and money laundering, as well as associated conspiracy counts.

Foreign Adoption Corruption

We reported in our 2019 Year-End FCPA Update on FCPA charges against Ohio-based adoption agent Robin Longoria, alleging that she and other U.S. adoption agents bribed Ugandan probation officers to recommend that certain children be placed into orphanages, then bribed Ugandan judges and court personnel to grant guardianship of these children to the adoption agency’s clients. On August 17, 2020, DOJ announced the indictment of three alleged co-conspirators, U.S. citizens Debra Parris and Margaret Cole, and Ugandan citizen Dorah Mirembe. The charges, which include FCPA bribery, visa fraud, mail fraud, money laundering, and false statements, relate to alleged corrupt payments to process international adoptions without following the correct procedures in Uganda (Parris and Mirembe) and Poland (Parris and Cole). Although Mirembe is a Ugandan citizen, for purposes of applying the FCPA she is alleged to be an “agent” of a “domestic concern”—the Ohio-based adoption agency to which she provided services. Parris and Cole have pleaded not guilty, while Mirembe has yet to be arraigned. Longoria is scheduled to be sentenced in January 2021.

Although this could be dismissed as a confined fact pattern, this is not the first time the FCPA Unit has brought charges related to corruption in international adoptions. In February 2014, DOJ announced charges against four former employees of an adoption agency (Alisa Bivens, James Harding, Mary Mooney, and Haile Ayalneh Mekonnen) for, among other things, allegedly conspiring to pay bribes to Ethiopian officials to facilitate adoptions. In August 2017, Mooney, Harding, and Bivens were sentenced—Mooney to 18 months, 3 years of supervised release, and $223,946 in restitution; Harding to 12 months, 3 years supervised release, and $301,224 in restitution; and Bivens to one year probation and $31,800 in restitution. Although they were not charged with FCPA violations (possibly because the foreign “officials” at issue included a teacher at a government school and a head of a regional ministry for women’s and children’s affairs), the DOJ FCPA Unit was involved in the prosecution.

2020 YEAR-END FCPA-RELATED ENFORCEMENT LITIGATION

Following the initiation of an FCPA or FCPA-related action, the lifecycle of criminal and civil enforcement proceedings can take years to wind through the courts. A selection of prior-year matters that saw enforcement litigation developments during 2020 follows.

Second Circuit Affirms Chi Ping Patrick Ho’s FCPA and Money Laundering Convictions

We reported in our 2018 Year-End FCPA Update on the trial conviction of Hong Kong businessman Chi Ping Patrick Ho arising from his alleged participation in two separate corruption schemes in Chad and Uganda. On December 29, 2020, the U.S. Court of Appeals for the Second Circuit affirmed all of the convictions in an important precedential opinion authored by the Honorable Richard J. Sullivan.

With respect to the FCPA charges, the Second Circuit rejected Ho’s argument that the evidence was insufficient to establish that he was acting on behalf of a “domestic concern” under § 78dd-2, where he had been an officer of a Virginia-based NGO but claimed the beneficiary of the scheme was a foreign business subject to § 78dd-3. The Court held § 78dd-2 does not require that a U.S. entity be the beneficiary of corruption, but rather only that the defendant act on behalf of a domestic concern to procure corrupt business “for . . . any person,” which may include a foreign entity. The Court further held that it is permissible for the Government to charge a defendant both with acting on behalf of a domestic concern under § 78dd-2 and with being “any person other than . . . a domestic concern” under § 78dd-3, as the two provisions are not mutually exclusive and the same person could fit both definitions where, as here, multiple courses of conduct are charged.

As or perhaps even more important, with respect to the money laundering charges, the Court held that a wire transfer from Hong Kong to Uganda, which passed through a correspondent U.S.-dollar bank account in New York, was sufficient on the facts to constitute a monetary transaction “to” or “from” the United States (rather than “through” the United States as Ho argued). Since the vast majority of the world’s U.S.-dollar transactions pass through correspondent banking accounts in New York, this is an expansive decision that could give DOJ global reach over U.S.-dollar denominated corruption anywhere, even with only the most fleeting of connections to the United States. With precedent (including Second Circuit precedent) pointing in the other direction, this is a hotly contested aspect of the money laundering statutes and ripe for further review. Less controversially, the Court also held that an FCPA violation under § 78dd-3 may serve as a “specified unlawful activity” pursuant to the money laundering statutes.

José Carlos Grubisich Motion to Dismiss Denied

In our 2019 Year-End FCPA Update, we covered the arrest of Jose Carlos Grubisich, former CEO and board member of Brazilian petrochemical company and U.S. ADS-issuer Braskem S.A., on FCPA and related charges as he arrived at JFK Airport for vacation (unaware of a sealed indictment). After four months of preventive detention, and after bail was initially denied, Grubisich was released to home detention with the onset of the COVID-19 pandemic—though only after he posted a $30 million bond with $10 million cash bail. Grubisich thereafter filed a motion to dismiss the charges on, among other things, statute-of-limitations grounds because he left his role as CEO in 2008. Judge Raymond J. Dearie of the U.S. District Court for the Eastern District of New York denied the motion in a Memorandum and Order dated October 12, 2020, concluding that although the motion “raise[d] issues that may warrant critical attention after an evidentiary record has been established,” the arguments were fact-based and improper to resolve in a motion to dismiss.

PDVSA-Related Guilty Pleas

In our 2020 Mid-Year FCPA Update, we reported that Lennys Rangel, the procurement head of a PDVSA majority-owned joint venture, and Edoardo Orsoni, the former general counsel of PDVSA, had been charged with conspiracy to commit money laundering in connection with the alleged receipt of more than a million dollars each in cash and property in exchange for favorable treatment in PDVSA bidding processes. On August 11 and August 25, 2020, respectively, Rangel and Orsoni pleaded guilty. Both await 2021 sentencing dates.

Mark T. Lambert Sentenced

In our 2019 Year-End FCPA Update, we covered the trial conviction of Mark T. Lambert, former president of Transport Logistics International Inc. (“TLI”), on FCPA and wire fraud counts associated with an alleged scheme to pay more than $1.5 million in bribes to an affiliate of Russia’s State Atomic Energy Corporation. On October 28, 2020, DOJ announced that Lambert had been sentenced to 48 months in prison and a $20,000 fine (which matched the four-year term to which the government official bribe recipient, Vadim Mikerin, was sentenced in 2015). Lambert has noticed an appeal to the Fourth Circuit, while his former co-president at TLI, Daren Condrey, is scheduled for sentencing in 2021, nearly six years after his 2015 guilty plea.

Corpoelec Defendants Receive 40% Reductions in Prison Sentences for Substantial Cooperation in the Prosecution of Others

As outlined in our 2019 Year-End FCPA Update, on June 24, 2019, Jesus Ramon Veroes and Luis Alberto Chacin Haddad each pleaded guilty to FCPA conspiracy charges arising from an alleged scheme to pay bribes to senior officials at Venezuela’s state-owned electric company, Corporación Eléctrica Nacional, S.A. (“Corpoelec”), in exchange for the award of contracts worth $60 million. Shortly thereafter, the Honorable Cecilia Altonaga of the U.S. District Court for the Southern District of Florida sentenced each defendant to 51 months of imprisonment. But on October 13, 2020, Judge Altonaga approved prosecutors’ request to reduce by nearly two years Chacin’s and Veroes’ respective sentences, finding that the two had provided prosecutors detailed information about the bribery and money laundering scheme at issue, which resulted in the indictment of Luis Alfredo Motta Dominguez and Eustiquio Jose Lugo Gomez, respectively the President and Procurement Director of Corpoelec.

Probationary Sentence in Petrobras Corruption Case

As reported in our 2019 Year-End FCPA Update, Brazilian citizen Zwi Skornicki pleaded guilty in early 2019 to a single count of FCPA bribery conspiracy in connection with a scheme to pay $55 million to officials of Petrobras and the Brazilian Workers’ Party. On August 4, 2020, the Honorable Kiyo Matsumoto of the U.S. District Court for the Eastern District of New York sentenced Skornicki, 70, to 18 months of probation, which the Court allowed Skornicki to serve remotely from Brazil. In addition, Skornicki will have to pay a $50,000 fine. In issuing the sentence, Judge Matsumoto noted that he had considered a six-month prison sentence Skornicki had served in Brazil, and the $25 million fine he had already paid in Brazil. Judge Matsumoto also acknowledged Skornicki’s age and the increased risk of travel in light of the ongoing COVID-19 pandemic in allowing Skornicki to complete his probation remotely.

Alstom Defendants Sentenced to Time Served

In our 2019 Year-End FCPA Update, we described that, following the trial conviction of former Alstom executive Lawrence Hoskins, DOJ unsealed charges against former Alstom Indonesia Country President Edward Thiessen and Regional Sales Manager Larry Puckett. Both Thiessen and Puckett had entered into plea agreements years prior, but their agreements remained non-public until their cooperation completed with testimony at Hoskins’s trial. On July 20, 2020, the Honorable Janet Bond Arterton of the U.S. District Court for the District of Connecticut sentenced Thiessen to time served and a $15,000 fine, noting in part that Thiessen had cooperated extensively with U.S. prosecutors, including by providing trial testimony against Hoskins. Earlier in the year, Judge Arterton similarly sentenced Puckett to time served. Finally, another former Alstom executive, David Rothschild, who had pleaded guilty in November 2012, was similarly sentenced to time served on July 27, 2020.

2020 YEAR-END FCPA-RELATED POLICY DEVELOPMENTS

Two SEC Commissioners Rebuff Extensive Use of Internal Controls Provision

We observe often that the SEC employs aggressive theories of liability by utilizing the FCPA’s accounting provisions (most recently in our 2019 Year-End FCPA Update). Although not in a foreign corruption case, the FCPA defense bar took note when, in November 2020, SEC Commissioners Hester M. Peirce and Elad L. Roisman issued a statement disapproving of the SEC’s settled action with Andeavor LLC. The SEC Staff alleged that Andeavor had violated the FCPA’s internal controls provision—though the case involved alleged insider trading, not foreign bribery. Insider trading cases typically are brought under Exchange Act Section 10(b) and Rule 10b-5 thereunder, which “would have required finding that Andeavor acted with scienter despite the steps it took to confirm that it did not possess material nonpublic information.” Sounding in many of the themes presented by expansive civil FCPA internal controls cases, the Staff alleged that Andeavor used an “abbreviated and informal process” leading to an internal controls failure.

Commissioners Peirce and Roisman highlighted that the FCPA “requires not ‘internal controls’ but ‘internal accounting controls.’” And they noted that although Andeavor was “unprecedented” in applying the internal controls provision to insider trading compliance, the SEC has resolved other recent matters based on theories of deficient internal controls that “go well beyond the realm of ‘accounting controls.’” Although this viewpoint was not sufficient to carry a majority, and the settlement was approved, the articulate dissent of Commissioners Peirce and Roisman provides a roadmap for advocates and is worthy of continued monitoring.

SEC Approves Amendments to Whistleblower Program Rules

On September 23, 2020, the SEC approved a set of amendments to the rules governing its whistleblower program, which, according to the SEC, are meant to “provide greater clarity to whistleblowers and increase the program’s efficiency and transparency.” Significant changes to the rules include:

- Revising the definition of “whistleblower” to cover only those individuals who report information in writing to the SEC, consistent with the U.S. Supreme Court’s 2018 decision in Digital Realty Trust v. Somers;

- Procedural changes designed to facilitate more efficient resolution of frivolous claims and to allow the SEC to bar individuals who have filed false or frivolous claims from participating in the program;

- Clarifying that deferred prosecution agreements, non-prosecution agreements, and SEC settlements not resolved through administrative or judicial proceedings are among the resolutions eligible for whistleblower awards;

- Providing interpretive guidance explaining the “independent analysis” expected of whistleblowers in order to be eligible for awards; and

- Amendments to the award determination process, which allow the SEC to revise small awards upward and further clarify the scope of the SEC’s discretion in determining awards.

- These rules became effective 30 days later, on October 23, 2020. For additional details regarding these revisions, please see our separate Client Alert, “SEC Amends Whistleblower Rules.”

DOJ Issues First FCPA Opinion Procedure Release in Six Years (20-01)

By statute, DOJ must provide a written opinion at the request of an issuer or domestic concern stating whether DOJ would prosecute the requestor under the anti-bribery provisions for prospective (not hypothetical) conduct it is considering. Published on DOJ’s FCPA website, these releases once provided valuable insights into how DOJ interprets the FCPA, although only parties who join in the requests may rely upon them authoritatively. But although such releases were once a staple of these semi-annual updates, they have fallen out of use in recent years (until 2020, the last one had issued in 2014).

On August 14, 2020, DOJ released its first FCPA opinion procedure release in nearly six years (and its 62nd overall). The requestor was a U.S.-based multinational investment advisor. In 2017, the requester sought to acquire assets from a foreign subsidiary—identified as “Country A Office”—of a foreign bank that was majority owned by a foreign government. To facilitate the transaction, the requester engaged a different foreign subsidiary—identified as “Country B Office”—of the aforementioned bank and a local investment firm. Upon completion of the transaction, Country B Office requested a fee of $237,500, which equaled 0.5% of the face value of the purchased assets, for services rendered in connection with the transaction.

DOJ’s opinion concluded that, as the facts were presented by the requester and assuming that the Country B Office is an instrumentality of a foreign government, it would not bring an enforcement action based on payment of the fee. DOJ found persuasive that the fee would be paid to a government entity and not an individual. DOJ’s conclusion also was aided in part by a certification by Country B Office’s chief compliance officer that the fee would be used for general corporate purposes and not be diverted to any individual government officials or other entities. Finally, DOJ’s conclusion rested in part on the same chief compliance officer’s certification that Country B Office provided legitimate services and that the fee was commercially reasonable.

DOJ’s conclusion breaks no new ground and is consistent with prior opinion releases that did not apply the FCPA to payments to government entities. That DOJ relied in part on the compliance officer’s certification that such a diversion did not occur further supports the importance of documenting sound compliance efforts to address corruption-related risks.

2020 YEAR-END KLEPTOCRACY FORFEITURE ACTIONS

The second half of 2020 saw continued activity in the Kleptocracy Asset Recovery Initiative spearheaded by DOJ’s Money Laundering and Asset Recovery Section (“MLARS”) Unit, which uses civil forfeiture actions to freeze, recover, and, in some cases, repatriate the proceeds of foreign corruption.

On July 15, 2020, DOJ filed a civil complaint in the U.S. District Court for the District of Maryland seeking the forfeiture of a Potomac mansion owned by former Gambian President Yahya Jammeh. The complaint alleges the property was purchased with $3.5 million obtained through the embezzlement of public funds and solicitation of bribes while Jammeh was in power from 1994 to 2017.

On August 6, 2020, DOJ filed two civil forfeiture complaints in the U.S. District Court for the Southern District of Florida seeking to seize commercial property linked to Ukrainian oligarchs Igor Kolomoisky and Gennadiy Boholiubov. On December 30, 2020, DOJ filed a third complaint in the Southern District of Florida, seeking to seize additional property linked to the pair. The complaints allege that Kolomoisky and Boholiubov used front companies to buy office buildings in Louisville, Dallas, and Cleveland—with a combined value of more than $60 million—with funds allegedly embezzled from Ukrainian lender PrivatBank. The complaints further allege that businesspeople Uriel Laber and Mordechai Korf helped the oligarchs acquire the properties.

Finally, with further 1MDB-related developments, on September 16, 2020 DOJ announced that it is seeking an additional $300 million linked to funds allegedly misappropriated from 1MDB. The assets include funds held in escrow in the United Kingdom linked to money misappropriated from 1MDB through a joint venture with PetroSaudi, as well as four dozen promotional movie posters allegedly purchased by Malaysian film producer Riza Aziz with money traceable to funds misappropriated from 1MDB. The complaint followed a recent settlement between DOJ and Aziz over another $60 million in assets linked to 1MDB, announced on September 2, 2020. To date, the United States has sought forfeiture of more than $2.1 billion in assets associated with 1MDB, and has recovered almost $1.1 billion of that amount.

2020 YEAR-END PRIVATE CIVIL LITIGATION

As we have been reporting for many years, although the FCPA does not provide for a private right of action, civil litigants continue to pursue a variety of causes of action in connection with FCPA-related conduct, with varying degrees of success. A selection of matters with developments during the second half of 2020 follows.

Select Shareholder Lawsuits

- Glencore PLC – On July 31, 2020, the Honorable Susan D. Wigenton of the U.S. District Court for the District of New Jersey dismissed a complaint filed against Glencore and certain executives alleging that the defendants made false and/or misleading statements and failed to disclose facts relating to alleged bribery schemes in the Democratic Republic of Congo, Venezuela, and Nigeria. The Court dismissed the suit on forum non conveniens grounds, concluding that the plaintiff’s choice of forum was accorded less deference because Glencore did not have offices or subsidiaries in the forum and the alleged conduct giving rise to the plaintiff’s claims allegedly occurred in foreign nations. An amended complaint was not filed after the ruling and the case has been closed.

- Tenaris S.A. – On October 9, 2020, the Honorable Raymond J. Dearie of the U.S. District Court for the Eastern District of New York granted in part and denied in part Tenaris’s motion to dismiss a putative securities fraud class action, in which shareholders alleged that the company’s public filings and employee codes of conduct were materially misleading in light of bribery allegations that became public in 2018. In connection with what became known as the “Notebooks” case, Tenaris’s CEO was charged in 2018 by an Argentine court with bribery in connection with alleged bribes paid to Argentinian government officials in return for their lobbying of the Venezuelan government to prevent the nationalization of the asset of Tenaris’s Venezuelan subsidiary. Although the court dismissed some claims relating to statements contained in the company’s code of ethics, Judge Dearie held that the plaintiffs’ assertions with regard to statements in the code of conduct, as well as references to the code in the company’s filings, were actionable. Tenaris filed its answer to plaintiffs’ amended complaint on December 1, 2020.

- Ternium S.A. – In another U.S. civil lawsuit arising from the Argentinian “Notebooks” scandal, on September 14, 2020, the Honorable Pamela K. Chen of the U.S. District Court for the Eastern District of New York dismissed a shareholder suit against Ternium, a Luxembourg steel product manufacturer, as well as individual officers and a director. In ruling on Ternium’s motion to dismiss, the court agreed with the defendants’ position that their statements regarding the relevant transaction did not create a duty to disclose the alleged bribery, explaining that the statements “‘accurately report[ed] income derived from illegal sources’ . . . without ‘attribut[ing] [the transaction’s] success to a particular cause’ . . . thereby relieving Ternium of any obligation to disclose the bribery scheme.” Judge Chen subsequently dismissed the case with prejudice on November 17, 2020, after plaintiffs failed to file an amended complaint.

- Sociedad Química y Minera de Chile SA (“SQM”) – On November 11, 2020, Chilean mining company SQM announced its agreement to pay $62.5 million to resolve a class action lawsuit brought by investors in March 2017, following SQM’s $30 million settlement with DOJ and the SEC to resolve related foreign bribery charges covered in our 2017 Mid-Year FCPA Update. The investors sued the company for not disclosing the alleged bribery scheme in its securities filings, against which SQM had argued that revelations of the alleged fraud did not cause statistically significant negative reactions in its stock price. The parties briefed summary judgment earlier this year, but settled before a decision was reached by the court. On December 18, 2020, the court held a hearing and preliminarily approved the settlement agreement but set a schedule for briefing in support of the settlement and a settlement conference for 2021.

Select Civil Fraud / RICO Actions

- Harvest Natural Resources, Inc. – As reported most recently in our 2020 Mid-Year FCPA Update, in February 2018 now-defunct Houston energy company Harvest Natural Resources filed suit in the U.S. District Court for the Southern District of Texas alleging RICO and antitrust violations against various individuals and entities affiliated with the Venezuelan government and PDVSA. In late 2018, Harvest voluntarily dismissed the case as to all defendants except Rafael Darío Ramírez Carreño, Venezuela’s former Minister of Energy and former President of PDVSA. Chief Judge Lee H. Rosenthal then granted a default $1.4 billion judgment in the action against Ramírez after he failed to appear. Upon Ramírez’s later appearance and motion to vacate the default judgment, Judge Rosenthal reopened the case and vacated the default judgment but denied his motion to dismiss. On August 26, 2020, Harvest filed a notice voluntarily dismissing Ramírez from the case, which Judge Rosenthal granted, thereby dismissing Ramírez and concluding all pending litigation.

Select Employment Lawsuits

- Landec Corp. – On September 2, 2020, Ardeshir Haerizadeh, a former Landec subsidiary executive, sued the company in California state court alleging that Landec unfairly terminated and attempted to make him a scapegoat in connection with an internal investigation into potential bribery in Mexico. In January 2020, Landec disclosed in a securities filing that it had identified potential FCPA violations by recently acquired company Yucatan Foods, a Los Angeles-based guacamole maker founded by Haerizadeh. Landec said in the filing that the potential misconduct began before the acquisition, which was completed in late 2018 for approximately $80 million, and that the company had made a disclosure to DOJ and the SEC. Since the initial complaint filing, Landec has filed an answer and cross-complaint, to which Haerizadeh has not yet responded.

Select Arbitration-Related Litigation

- Petrobras – On July 16, 2020, the U.S. Court of Appeals for the Fifth Circuit upheld an international arbitration award requiring Petrobras to pay more than $700 million to offshore drilling company Vantage Drilling International for terminating a contract allegedly procured through bribery. The underlying allegations and associated FCPA resolutions—which arose out of Brazil’s Operation Car Wash—were covered in our 2018 Year-End FCPA Update. In July 2018, an internal arbitration tribunal issued the award in favor of Vantage, finding that Petrobras breached the parties’ contract. Petrobras later filed a motion to vacate the arbitration award in the U.S. District Court for the Southern District of Texas, arguing that the award violated U.S. public policy. The Fifth Circuit affirmed the district court’s confirmation of the award, agreeing with the arbitration tribunal’s findings that Petrobras had knowingly ratified the contract with Vantage after Petrobras became aware of the bribery allegations.

Select Anti-Terrorism Act Suits

- Certain Pharmaceutical and Medical Device Companies – On July 17, 2020, the Honorable Richard J. Leon of the U.S. District Court for the District of Columbia dismissed a lawsuit brought by U.S. service members and their families in late 2017, alleging that a number of pharmaceutical and medical device companies violated the Anti-Terrorism Act (“ATA”) and state laws. According to the suit, the defendants purportedly bribed officials at the Iraqi Ministry of Health, which was controlled by the terrorist group Jaysh al-Mahdi (“JAM”), and JAM used these funds and medical goods to perpetuate attacks against the plaintiffs. Judge Leon ruled that the Court lacked personal jurisdiction over the foreign defendants, because all of the alleged conduct occurred outside of the United States, and further held that the plaintiffs did not adequately plead a violation under the ATA with respect to any defendants because: (1) plaintiffs did not “establish the substantial connection between defendants and JAM necessary for proximate causation”; (2) defendants could not have aided and abetted a foreign terrorist organization because JAM is not designated as such; and (3) plaintiffs did not show that the defendants provided substantial assistance to the attacks. On August 14, 2020, the plaintiffs filed a notice of appeal to the U.S. Court of Appeals for the D.C. Circuit.

- Certain Defense Contractors and Telecommunications Companies – On December 27, 2019, U.S. citizens who were killed or wounded in Taliban terrorist attacks while serving in Afghanistan, and their family members, brought a suit in the U.S. District Court for the District of Columbia against American and foreign defense contractors, and international telecommunications companies, under the ATA. The lawsuit accuses the companies of providing material support to and aiding and abetting terrorist attacks against Coalition forces by paying “protection money” to the Taliban. According to the complaint, at least one defendant used funds from the World Bank’s International Finance Corporation to make the payments, and also allegedly “went beyond financing,” engaging in “active coordination” by deactivating its cellular network at night at the request of the Taliban, thereby hindering Coalition intelligence-gathering efforts. The defendants filed motions to dismiss in late April 2020, which were rendered moot by an amended complaint filed on June 5, 2020, that included additional U.S. company defendants. On September 10, 2020, the contractors filed separate motions to dismiss the amended complaint, arguing that the plaintiffs failed to state a claim and/or on jurisdictional grounds. The Court has yet to rule as of the date of this publication.

2020 YEAR-END INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

Multilateral Development Banks

MDBs signal long-term shift to prevention, not just investigative work

Officials from various MDBs’ anti-corruption teams have made public statements recently in which they have signaled that their respective institutions are shifting away from the traditional investigate-after-the-fact model of compliance to a more proactive and preventive approach focusing on due diligence and ongoing monitoring of bank-financed projects. For example, the Head of the African Development Bank’s (“AfDB”) integrity and anticorruption unit, Alan Bacarese, recently highlighted the AfDB’s emphasis of “proactive integrity reviews” in major AfDB-financed projects. As part of this initiative, the AfDB took the extraordinary step of embedding an anti-corruption official in the project from the outset, with the stated purpose of avoiding any procurement problems before they evolve into sanctionable misconduct. Bacarese explained: “We’re not in the business of investigating and debarring – although that is part of our mandate. We are as interested, if not more interested, in working with companies and working with our colleagues within the bank to bring good business ethics into development finance.”

Other MDBs have echoed this approach. For her part, the chief compliance officer of the European Bank for Reconstruction and Development, Lisa Rosen, recently remarked that she believes that it was incorrect to think the key tool in the fight against corruption in MDB-financed projects is “the investigation and debarment function of MDBs.” She suggested, instead, that prevention is more effective. Laura Profeta, the Inter-American Development Bank’s anti-corruption chief similarly remarked in the context of the COVID-19 pandemic that her team had developed “a very intense focus on the prevention side of our work.”

World Bank Announces Prospective Shift in Process for Evaluating Corporate Compliance Programs

The World Bank’s Integrity Vice Presidency (“INT”) recently announced that, for a period of several months, it been developing what it described as a “major initiative” to improve its processes for evaluating a company’s compliance efforts. The apparent aim of the program is to ensure that companies receive “the kind of mitigation credit they deserve if they have a compliance program.” As part of this effort, the office of the Integrity Compliance Officer (“ICO”) will work collaboratively with INT before a sanction is imposed as part of a settlement agreement to determine the breadth, scope, and effectiveness of a company’s compliance program, which could in turn result in a reduction in the proposed debarment period and/or post-debarment obligations. The proposed initiative will represent a shift in the current paradigm, in which the ICO typically becomes involved in a matter after settlement to work with debarred companies to improve their compliance programs.

Europe and the Former CIS

United Kingdom

SFO 2020 Deferred Prosecution Agreement Guidance

On October 23, 2020, the UK Serious Fraud Office (“SFO”) published guidance on its approach to deferred prosecution agreements (“DPAs”) and how it engages with companies when a DPA is possible. As discussed in our separate Client Alert, “The UK Serious Fraud Office 2020 Deferred Prosecution Agreement Guidance: Something Old and Something New,” the underlying statute creating DPAs is clear that a party need not admit guilt, and this new guidance also makes plain that this is unnecessary. The DPA Code of Practice remains in force as the lead document for consideration in connection with DPAs. Aspects of the new guidance not already in the DPA Code of Practice can be found in other guidance or in judgments given by the court in prior DPAs. As such, the guidance does not provide significant new insights but is instead a consolidation of other source material.

Former Unaoil executive sentenced for paying bribes to win $1.7 billion worth of contracts

As covered in our 2019 Year-End and 2020 Mid-Year FCPA Updates, Monaco-based oil services company Unaoil has been at the center of a developing cluster of anti-corruption enforcement that has grown to include enforcement activity on both sides of the Atlantic.

On October 8, 2020, Basil Al Jarah, Unaoil’s former Iraqi partner, was sentenced to 40 months’ imprisonment. Al Jarah pleaded guilty in July 2019 to five offenses of conspiracy to give corrupt payments in excess of $17 million to public officials at the South Oil Company and Iraqi Ministry of Oil. Co-conspirators Stephen Whiteley and Ziad Akle were found guilty in July 2020 of one and two counts, respectively, of conspiring to give corrupt payments. Akle was sentenced to five years’ imprisonment and Whiteley to three years’ imprisonment. Another individual, Paul Bond, faces retrial in January 2021.

Russia

On December 8, 2020, the Prosecutor General’s Office of the Russian Federation reported that in 2020 the overall damage from corruption offenses claimed in initiated criminal cases in the country exceeded 45 billion rubles (~$612 million), down from 55.5 billion rubles (~$850 million) reported for 2019. As of October 2020, Russian prosecutors had filed 6.6 billion rubles (~$102 million) worth of civil damage recovery claims linked to corruption offenses. The Prosecutor General’s Office reported a total recovery of more than 2.3 billion rubles (~$35.7 million) in corruption-related damages through criminal and civil proceedings.

Russian authorities also reported a number of high-profile corruption cases initiated against officials at the governor and deputy governor levels, many of them involving fraud and embezzlement related to contracts with entities affiliated with government officials. Against this backdrop of reported steady progress of anti-corruption enforcement, Russian authorities have faced significant criticism in connection with the suspected poisoning of Alexei Navalny, a high-profile anti-corruption activist and opposition leader. On August 20, 2020, Navalny fell violently ill during a flight from Siberia to Moscow and was rushed for treatment to a hospital in Germany.

As we reported in our 2020 Mid-Year FCPA Update, numerous arrests were made in connection with a scheme involving senior Deposit Insurance Agency (“DIA”) officials allegedly taking kickbacks from contractors tasked with bank restructurings. In the second half of 2020, more information has come to light regarding the scheme. With the Russian Central Bank invoking a zero-tolerance policy for corrupt banks, many banks have seen their licenses revoked. Under Russian law, the DIA would then take control and contract with companies to handle all aspects of the bankruptcy. But to be hired, contractors allegedly had to pay a substantial bribe—and after the banks’ assets were up for auction, they were sold at well below fair market value. DIA officials allegedly accumulated billions of rubles. Since these findings came to light, the DIA has been forbidden from handling new bailouts, and the Federal Antimonopoly Service has pushed for the passage of a law requiring increased transparency in DIA operations.

Ukraine

President Volodymyr Zelensky’s anti-corruption efforts were dealt a major blow recently when the Constitutional Court of Ukraine (“CCU”) struck down a key anti-corruption initiative signed into law by President Zelensky a year ago. In a ruling made public on October 28, 2020, the CCU held, among other things, that Ukraine’s National Agency on Corruption Prevention may not seek criminal lability for government officials, including judges, for failing accurately to report all of their assets and explain their sources. This is not the first time the CCU has struck down such a law—the version signed into law by President Zelensky was passed in response to the CCU striking down an earlier iteration. The revised version of the law was declared unconstitutional partly because it gave anti-corruption officials authority over judges, which the CCU found to interfere with the judiciary’s independence. As a result of the CCU’s ruling in October, more than 100 corruption investigations had to be closed. The Ukrainian parliament, however, quickly responded on December 4, 2020, by passing another version of the law, which attempts to address some of the CCU’s concerns by decreasing penalties and increasing thresholds for criminal liability.

Uzbekistan

On September 11, 2020, Switzerland and Uzbekistan announced the signing of an agreement for the return of funds seized in connection with a money laundering investigation against Gulnara Karimova, the daughter of former President Islam Karimov, who has been imprisoned since 2017. The framework agreement provides for the return to Uzbekistan of $131 million, which were confiscated from Swiss bank accounts held by Karimova, conditional on ensuring transparency and appropriate monitoring of the funds’ use. The details of the restitution are set to be agreed upon under a second agreement, but the framework agreement makes clear that the restituted funds “shall be used for the benefit of the people of Uzbekistan.” The $131 million comprises part of the approximately $880 million that Swiss authorities froze in 2012 in connection with criminal proceedings against Karimova. The framework agreement also will apply to the restitution of any of the remaining frozen funds.

The Americas

Argentina

In the second half of 2020, proceedings continued in connection with the “Notebooks” scandal reported in our prior updates, related to former President Cristina Fernández de Kirchner and her administration. In November 2020, a federal judge acquitted Fernández in one corruption trial after determining that the notebooks—belonging to the chauffeur of a high-ranking official in Fernández’s administration and allegedly describing various bribes the chauffeur delivered to Fernández and others—were inadmissible. Appeals are ongoing. The acquittal came shortly after Fernández’s former top aide, a key witness and the uncle of one of the prosecutors involved, was found murdered.

Another longstanding investigation with Argentinian touchpoints saw developments in the second half of the year. In connection with investigations of corruption involving international soccer federation officials, in October 2020 the Swiss Office of the Attorney General announced the seizure of $40 million from Argentinians Nicolás Leoz and Eduardo Deluca, respectively the former president and secretary general of the South American Football Confederation (“CONMEBOL”), who were accused of exploiting their positions to unlawfully enrich themselves. The case against Leoz ended with his death in August 2019; Deluca was convicted of aggravated criminal mismanagement in 2019. Swiss authorities concluded that the funds were unlawfully acquired and should be returned to CONMEBOL.

Brazil

In Brazil, the years-long Operation Car Wash continued as Brazilian prosecutors extended existing investigations, launched new phases, and brought additional suits.

In November 2020, federal prosecutors filed suit against oil trading company Trafigura and several individuals related to alleged bribes paid to Petrobras executives in return for favorable treatment on 31 deals dating to 2012 and 2013. The Federal Public Ministry (“MPF”) is seeking to recover a minimum of R$403 million, and has sought to freeze up to R$1 billion of the named parties’ assets. Several of the people named in the complaint previously were named in other bribery actions or signed leniency agreements with the government.

On December 3, 2020, the Operation Car Wash task force announced that Vitol Inc. had entered into a leniency agreement with the MPF, agreeing to pay approximately $45 million to Petrobras as damages in connection with alleged bribes in exchange for favorable treatment and bidding advantages. The agreement, which needs to be approved by the MPF’s Chamber to Combat Corruption, also will require Vitol to adopt certain transparency measures and to report on compliance-, corruption-, and money laundering-related risks. This resolution was coordinated with Vitol’s U.S. resolutions with DOJ and the CFTC noted above.

In August 2020, Brazilian enforcement authorities announced a “technical cooperation agreement” that articulates principles and procedures for joint action against corruption and aims to promote more effective cooperation among Brazil’s public agencies executing leniency agreements, which have been a significant tool in recent corruption investigations. Brazil’s Comptroller-General’s Office, Attorney General’s Office, Ministry of Justice and Public Security, and Federal Court of Accounts executed the agreement. The agreement provides, among other things, that Brazil’s Comptroller-General’s Office and federal Attorney General’s Office will negotiate leniency agreements under Brazil’s Anti-Corruption Law, and that they must share information after the agreements’ execution. The MPF has not executed the agreement, and the MPF’s 5th Chamber issued a Technical Note advising against execution on the grounds that the agreement unconstitutionally limits the role of the MPF in negotiating and executing leniency agreements, among other critiques.

Colombia

Colombia continued to deal with the impact of investigations related to Brazilian construction company Odebrecht S.A. In October 2020, Colombia’s highest administrative court upheld a Bogotá Chamber of Commerce award nullifying an Odebrecht consortium’s contract for a billion-dollar highway construction—a project that also led to ICC claims and an investment treaty dispute—because of corruption. Relatedly, the Odebrecht-related indictment of Juan Carlos Granados Becerra, former governor of Boyacá and recently elected magistrate judge on the National Commission for Judicial Discipline, has been indefinitely postponed. Just days before the hearing, Granados revoked the power of the attorney representing him, forcing a delay due to his lack of representation.

On the legislative front, Colombia’s Congress introduced Bill 341/20 on October 27, 2020, seeking to create more stringent corporate transparency requirements and tackle corruption by creating a beneficial ownership registry. The bill intends to bring Colombia in line with international recommendations, which recognize that transparency regarding “beneficial owners” (i.e., natural persons with more than 5% ownership of a company) is important to efforts to counter corruption, money laundering, and terrorism financing. If passed, the bill will standardize and streamline reporting across government agencies in the country.

Ecuador

In September 2020, a three-judge panel of Ecuador’s National Court of Justice ratified former President Rafael Correa’s eight-year prison sentence for breaking campaign finance laws. As reported in our 2020 Mid-Year FCPA Update, Correa was found guilty of bribery and corruption and sentenced in absentia in April 2020. The sentence also required $14.7 million of reparations to the state and stripped Correa’s citizenship rights. The decision effectively blocks Correa’s efforts to participate in Ecuador’s 2021 election as a vice presidential candidate.

El Salvador

In November 2020, the El Salvadoran Attorney General executed more than 20 raids on government offices in response to alleged improper spending of emergency pandemic funds by the administration of President Nayib Bukele, including allegedly overpaying relatives for medical equipment and, in some instances, improperly making payments to companies not specializing in medical equipment.

Guatemala