2021 Mid-Year Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements

Client Alert | July 22, 2021

The change in presidential administration has not detoured the institutional momentum of the use of non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”) in the first half of 2021.[1] Eighteen agreements have been executed to date, which is in line with recent mid-year marks.

In this client alert, the 24th in our series on NPAs and DPAs, we:

- report key statistics regarding NPAs and DPAs from 2000 through the present;

- consider the effect of the COVID-19 pandemic on NPAs and DPAs;

- analyze the effect of the Department of Justice’s (“DOJ’s”) 2020 corporate compliance program guidelines;

- survey the latest developments in corporate whistleblower programs;

- discuss notable DPA conclusions;

- outline key legislative developments;

- summarize 2021’s publicly available corporate NPAs and DPAs; and finally

- outline some key international developments affecting NPAs and DPAs.

One fundamental trend is clear: The NPA/DPA vehicles are being utilized by a broad swath of DOJ and U.S. Attorneys’ Offices. This underscores the broad acceptance of these agreements as a path to resolve complicated fact patterns.

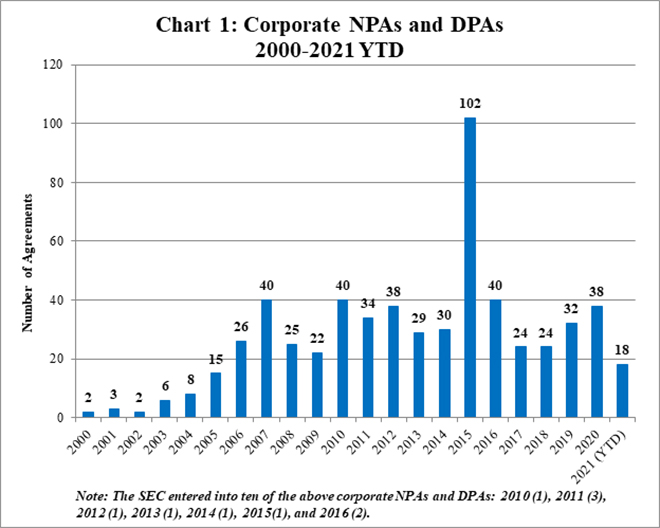

Chart 1 below shows all known corporate NPAs and DPAs from 2000 through 2021 to date. Despite the COVID-19 pandemic, 2020 saw a total of 38 corporate DPAs and NPAs—reflecting an uptick from each of 2018 and 2019, and the highest number on record in a single year since 2016. Often on the eve of a DOJ administration change, agreements are entered because organizations fear the deal terms might change. Although 2021 to date lags slightly behind 2020 in terms of the number of agreements as of the mid-year mark, 2021 is on pace to be another active year in this space.

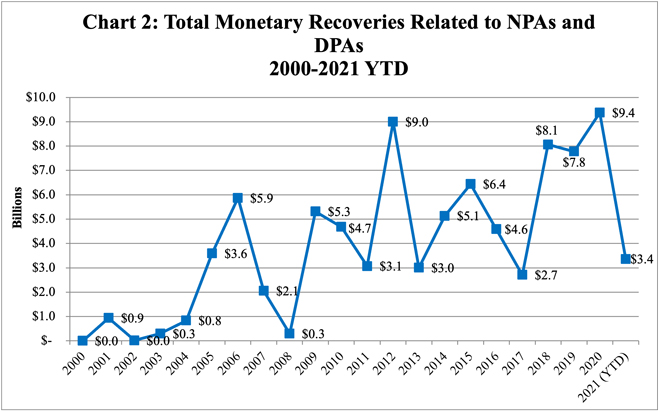

Chart 2 reflects total monetary recoveries related to NPAs and DPAs from 2000 through 2021 to date. The $9.4 billion in total monetary recoveries related to NPAs and DPAs in 2020 was the highest annual amount in history. At approximately $3.4 billion, recoveries associated with NPAs and DPAs thus far in 2021 slightly lag behind the amount recovered at this time in both 2020 (~$5.6 billion) and 2019 (~$4.7 billion) though the numbers are in line with the average recovery at the midpoint over the last 10 years. Total recoveries so far in 2021 are still more than 50 percent (57%) of the full annual average recoveries of approximately $5.9 billion in the last decade. Depending on developments in the second half of this year, total recoveries for 2021 could show a return to more typical levels, rather than a continuation of the increases in recent years.

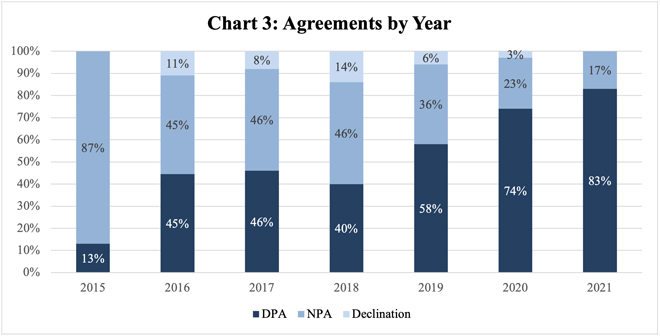

Fifteen of the 18 agreements thus far in 2021 have been DPAs, reflecting a continuation of the trend toward DPAs as illustrated in Chart 3 below and discussed in both our 2020 Mid-Year Update and 2020 Year-End Update. Although the trend toward DPAs could signal a shift toward requiring self-disclosure to achieve an NPA, this year’s NPAs highlight the importance of fact-specific circumstances and mitigating factors: self-disclosure alone is not dispositive.

Only three companies have received NPAs to date in 2021: SAP SE (“SAP”), Avnet Asia Pte. Ltd. (“Avnet Asia”), and United Airlines, Inc. (“United”). Of the three, only SAP received voluntary self-disclosure credit. Notably, two of the three NPAs, involving SAP and Avnet Asia, involved DOJ’s National Security Division (“NSD”), which introduced a new voluntary disclosure policy in late 2019 that provides for a presumption toward NPAs for participating companies. Although Avnet Asia did not receive voluntary self-disclosure credit, the language of the NPA suggests that it may have made a self-disclosure to DOJ after prosecutors initiated their own investigation.

A second emerging trend in 2021 that appears to be consistent with 2020 is a steep decline in compliance monitors. Only one of the 18 agreements to date, the DPA with State Street Corporation (“State Street”), imposes an independent corporate monitor. Similarly, in 2020, only 2 out of 38 resolutions imposed an independent monitor or independent auditor. In contrast, in 2019, 7 out of 31 resolutions imposed some form of an independent compliance monitor.

Time will tell whether, under the Biden Justice Department, these trends will continue to hold true for the remainder of the year and beyond.

Key Developments in 2021 to Date

Enforcement in the Year of COVID-19 and Beyond

As the legal world progresses toward normalcy after an unprecedented 18 months, the mid-year mark of 2021 provides an opportunity to look back at how the COVID-19 pandemic has affected government enforcement efforts, and whether the unique legal risks facing companies managing COVID-19 will be reflected in enforcement activity going forward.

Although a dip in overall enforcement was expected by many at the start of the pandemic, that theory is not supported by the statistics. With the long gestation period of most corporate enforcement cases, the full impact of COVID-19, if any, might not be quantifiable until a later date. Nor does the broader enforcement landscape in 2020 reflect a significant downward trend. First, DOJ’s Civil Frauds Section reported 922 total new matters in 2020, the highest number since the Civil Division began reporting that statistic in 1987, and a 15% increase from 2019.[2] Meanwhile, DOJ Antitrust reported 20 new criminal antitrust matters filed in 2020, which, while a decrease from the 26 new matters filed in 2019, is up from the 18 filed in 2018, and is generally consistent with a 10-year downward trend in criminal antitrust enforcement.[3] If any enforcement arm can be said to have reported a significant dip in enforcement during the pandemic year, it is the SEC, which disclosed 715 new enforcement actions filed in 2020—a 17% decrease from 2019, a 13% decrease from 2018, a 5% decrease from 2017, and the lowest number on record since 2013.[4] However, although new enforcement actions were down, the SEC set a high-water mark for total financial remedies in 2020 of $4.68 billion.[5] Overall statistics from the first half of 2021 are not yet publicly available, but early signs indicate that at least DOJ is continuing its “[h]istoric level of enforcement.”[6]

Still, although the numbers may not reflect an annual dip in enforcement activity, the pandemic at least temporarily disrupted the work of government enforcement arms, as it did for much of the corporate world. For example, in the SEC’s 2020 Annual Report, the then-Enforcement Division Director cited the unique challenges of adapting to telework for the Commission, and stated that “in the early months . . . many of us spent the bulk of our time focused on learning and guiding our staff how to effectively do our job remotely. But we moved past that initial period of uncertainty and ultimately achieved a remarkable level of success, including bringing more than 700 enforcement cases during the fiscal year.”[7]

The more significant effects of the pandemic from an enforcement perspective will be forward looking—namely, how will the unique legal risks created in the last year shift enforcement priorities? As early as May 2020, the SEC had announced a “Coronavirus Steering Committee” to identify and respond to COVID-related legal risks.[8] And DOJ also made it clear that monitoring the use of significant public funds doled out by COVID-19 response programs such as the Paycheck Protection Program and Coronavirus Aid, Relief, and Economic Security Act would be a priority.[9] The then-Principal Deputy Assistant Attorney General said “we will energetically use every enforcement tool available to prevent wrongdoers from exploiting the COVID-19 crisis.”[10]

The results of those priorities are still taking shape. Thus far, DOJ’s publicly disclosed COVID-related enforcement efforts, while significant, have seemingly focused on individual defendants.[11] For example, in a May 2021 announcement by DOJ of charges brought in connection with an alleged nationwide COVID-related fraud scheme, which allegedly resulted in losses exceeding $143 million, all of the 14 defendants charged were individuals.[12] DOJ has yet to reach a public NPA or DPA with any company for criminal fraud related to COVID-19, although, as discussed in our 2020 Year-End Update, DOJ has entered into a pair of DPAs relating to price-gouging consumers of personal protective equipment. In light of DOJ’s interest in prosecuting COVID-19 related fraud cases and the corporate nature of the Paycheck Protection Program, it is likely that the lack of any publicly disclosed corporate resolutions to date reflects the greater complexity and longer timeline involved in investigating and prosecuting corporate cases.

That enforcement agencies are interested in pursuing COVID-related fraud by corporations, as well as individuals, is reflected in the SEC’s enforcement efforts throughout 2020 (described in our 2020 Year-End Securities Enforcement Update). At the very end of 2020, for example, the SEC brought its first settled charges (though not a DPA or NPA) with a company in response to a different COVID-related risk—misleading disclosures about the effects of the pandemic on a company’s financial condition—with The Cheesecake Factory Incorporated, which Gibson Dunn covered in a client alert.[13] More corporate COVID-related resolutions may follow, as investigations commenced in the last year reach their conclusions. We will continue to follow how enforcement involving COVID-related conduct develops.

June 2020 Corporate Compliance Program Guidance in Practice

In June 2020, DOJ updated the Criminal Division’s guidance on the “Evaluation of Corporate Compliance Programs,” a development Gibson Dunn discussed in a prior client alert and in our 2020 Year-End Update. Although DOJ has not commented officially on the guidance since the new administration took office, resolutions from the first half of 2021 may provide a window into how the updated guidance is playing out in practice.

The June 2020 guidance emphasized DOJ’s commitment to fact-specific resolutions by calling for “a reasonable, individualized determination in each case.”[14] That emphasis has made its way into several negotiated terms relating to specific corporate compliance programs so far in 2021, in some instances continuing a trend started in 2020 in the immediate wake of the updated guidance. Although DOJ often uses the same template as a starting point in many of its resolutions to detail the requirements for corporate compliance programs, context-specific requirements are appearing in resolutions.

For example, the Epsilon DPA follows the trend of fact-specific resolutions, adding a category for “Consumer Rights” not found in the compliance program requirements incorporated in other resolutions.[15] In light of DOJ’s allegation that employees at Epsilon sold customer data to clients that were engaging in consumer fraud, the Epsilon DPA requires Epsilon to provide individual customers with processes to both request the individual’s data that Epsilon may sell to clients and to request that Epsilon not sell the individual’s data at all.[16]

By contrast, the SAP NPA alleges that SAP acquired various companies but “made the decision to allow these companies to continue to operate as standalone entities, without being fully integrated into SAP’s more robust export controls and sanctions compliance program,” and despite “[p]re-acquisition due diligence . . . [that] identified that th[e] . . . companies lacked comprehensive export control and sanctions compliance programs, policies, and procedures.”[17] Because of this allegation, and given that M&A due diligence was a focus of the June 2020 guidance, SAP’s NPA requires it to audit newly acquired companies within 60 days of acquisition and inform DOJ about any potential violations.[18] This requirement is much more stringent than DOJ’s 2008 Opinion Release (discussed in our 2008 Mid-Year Update) regarding FCPA diligence in the context of M&A transactions.[19]

Additionally, both of the above agreements contain a provision for the continued monitoring and testing of the corporate compliance programs. The June 2020 guidance emphasizes that companies’ risk assessments should be based on “continuous access to operational data and information across functions,” as opposed to just providing a “snapshot in time.”[20] The Epsilon DPA provides for “periodic reviews and testing” of the company’s compliance policies, while the SAP NPA provides for continued maintenance and enhancement of its internal controls.[21] In line with the previous sections, each of these provisions is fact-specific: Epsilon must review its protection of consumer data; and SAP, its export controls and sanctions compliance programs.[22]

In sum, it appears that the June 2020 guidance from DOJ on corporate compliance programs has had its intended effect: DOJ and U.S. Attorneys’ Offices are, at least in some instances, tailoring the programs for individualized situations, and other foci of the June 2020 guidance are making their way into resolutions. Moving forward, we expect to see more agreements tailored to the individual circumstances of each company, drawing on the principles articulated in the June 2020 guidance.

Developments in Whistleblower Programs

On February 23, 2021, the SEC announced a $9.2 million award to a whistleblower who provided information that led to a successful DPA or NPA with the DOJ.[23] The order redacted information that would identify the type of agreement and fraud.[24] This marks the first SEC whistleblower award based on a DPA or NPA since amendments that expanded eligibility under the Whistleblower Rules[25] to include whistleblowers whose information leads to a DPA or NPA took effect in December 2020.[26] According to the award order, the whistleblower previously provided “significant information” about an ongoing fraud that resulted in DOJ charges.[27] The information facilitated “a large amount of money to be returned to investors harmed by the fraud.”[28]

The SEC whistleblower amendments reflect the recent expansion of whistleblower provisions in other contexts, in particular the anti-money laundering (“AML”) and antitrust areas. We covered two key developments in this regard—the passage of the Anti-Money Laundering Act of 2020, and the passage of the Criminal Antitrust Anti-Retaliation Act of 2020, here and here, respectively. With more avenues for government agencies to issue awards to people who report potential violations, we can expect to see an uptick in enforcement activity in the relevant areas.

DPA Conclusions

The first half of 2021 saw three notable DPA conclusions, with MoneyGram International, Inc. (“MoneyGram”), Standard Chartered Bank (“Standard Chartered”), and Zimmer Biomet (“Zimmer”) each released from very old and frequently extended DPAs entered into in 2012. Both the MoneyGram and Standard Chartered DPAs have been the subject of multiple extensions, as we noted in a prior client alert, and reflect the challenges companies often face even after a resolution is reached. On April 20, 2021, MoneyGram’s monitor certified that the company’s AML compliance program was “reasonably designed and implemented to detect and prevent fraud and money laundering and to comply with the Bank Secrecy Act.”[29] On May 4, 2021, DOJ and MoneyGram jointly filed a status report, stating that the parties were not seeking a further extension of the DPA.[30] The DPA terminated on May 10, 2021.

Standard Chartered reached the end of its monitorship, which was introduced in the 2014 amendment of its DPA, as scheduled in March 2019.[31] In April 2019, however, Standard Chartered agreed to a further amended DPA to resolve additional allegations, described in our 2019 Year-End Update. The 2019 amended DPA did not impose a monitor on Standard Chartered.[32] In May 2021, DOJ acknowledged that Standard Chartered had “complied with its obligations under the 2019 DPA,” and the DPA terminated.[33]

Zimmer’s DPA, which terminated in February 2021, related to pre-acquisition conduct by Biomet, Inc. (“Biomet”).[34] Biomet entered into the 2012 DPA in connection with allegations that it had violated the anti-bribery and accounting provisions of the FCPA.[35] Those allegations related to improper payments Biomet and its subsidiaries made between 2000 and 2008 in China, Argentina, and Brazil.[36] As part of its 2012 DPA, Biomet agreed to be subject to a monitor for 18 months.[37] The monitor was extended, however, after Biomet discovered additional potentially improper activities in Mexico and Brazil. In 2017, Zimmer entered into a new DPA with the DOJ relating to alleged violations of the FCPA’s internal controls provisions, under which it acknowledged that Biomet had failed to comply with the terms of the 2012 DPA.[38] As part of the 2017 DPA, Zimmer agreed to appoint a monitor for three years.[39] That monitorship concluded in August 2020, and its conclusion was followed by the termination of the DPA in February 2021.

Legislative Developments

In January, Congressman Gary Palmer of Alabama introduced the Settlement Agreement Information Database Act of 2021.[40] If passed, the Act would require Executive agencies to submit any information regarding settlement agreements to a public database.[41] The bill defines a “settlement agreement” broadly¾it includes any agreement, including a consent decree that (1) “is entered into by an Executive agency,” and (2) “relates to an alleged violation of Federal civil or criminal law.”[42] The submission must include the specific violations that provide the basis for the action, the settlement amount and classification as a civil penalty or criminal fine, a description of any data or methodology used to justify the agreement’s terms, the length of the agreement, and other identifying factors.[43] An agency is exempt from filing a submission if the agreement is subject to a confidentiality provision or if the information could be withheld under the Freedom of Information Act (“FOIA”).[44] The bill passed the House on January 5, 2021 and was referred to the Senate Committee on Homeland Security and Governmental Affairs.[45] The bill echoes a reporting requirement imposed on DOJ via a provision in the National Defense Authorization Act, whereby DOJ is now required to report to Congress annually on DPAs and NPAs concerning the Bank Secrecy Act.[46] We covered that development in more detail in our Year-End 2020 Update.

Congressman Palmer introduced the new bill after DOJ did not respond to an April 2020 FOIA request and subsequent administrative appeal in September 2020.[47] The FOIA request, which Professor Jon Ashley of the University of Virginia School of Law made to DOJ, sought all DPAs and NPAs entered into by the government since 2009 for the law school’s Corporate Prosecution Registry.[48] The registry houses more than 3,500 agreements, but Professor Ashley and some members of Congress believe that more agreements exist that have not been disclosed.[49] The bill follows Congressman Jamie Raskin’s August 2020 request to DOJ that it release a full list of all NPAs and DPAs since 2009—a call that has gone unanswered to date.[50] Although some observers believe that DOJ already has its own centralized “database” of agreements that could all be disclosed at once, in reality, the varying requirements for Main Justice involvement in and approval of different types of investigations and prosecutions[51] could mean that non-public agreements have been entered into by U.S. Attorneys’ Offices, for example, without being formally reported to DOJ. Gibson Dunn does not believe that a master database exists. To our knowledge, there is no regulatory or policy obligation for the various DOJ units, including the U.S. Attorneys’ Offices, to report these resolutions.

2021 Agreements to Date

Amec Foster Wheeler Energy Limited (DPA)

On June 24, 2021, Amec Foster Wheeler Energy Limited (“AFWEL”) entered into a three-year DPA with the Fraud Section and the U.S. Attorney’s Office for the Eastern District of New York.[52] The DPA stated that AFWEL engaged in a conspiracy to violate the anti-bribery provision of the FCPA in connection with the use of a third-party sales agent in Brazil.[53] The DPA imposed a penalty of approximately $18.4 million, which will be offset by amounts to be paid to UK and Brazilian authorities pursuant to parallel resolutions.[54]

The DPA granted AFWEL full cooperation credit and did not impose a monitor.[55] Under the terms of the agreement, AFWEL must report annually to DOJ on its compliance program.[56] The AFWEL DPA is one of two FCPA-related DPAs announced during the first half of this year. The other resolution involved Deutsche Bank AG (see below). Both companies were represented by Gibson Dunn.

Argos USA LLC (DPA)

On January 4, 2021, Argos USA LLC (“Argos”), a Georgia-based producer and supplier of ready-mix concrete, entered into a three-year DPA with the DOJ Antitrust Division for participation in a conspiracy to fix prices, rig bids, and allocate markets in and around the Southern District of Georgia.[57] The sole count against Argos alleged that employees of Argos and other ready-mix concrete companies coordinated and issued price-increase letters to customers, allocated jobs in coastal-Georgia, charged fuel surcharges and environmental fees, and submitted non-competitive bids to customers in a conspiracy lasting from 2010 until July 2016.[58]

According to the DPA, Argos, through its employees, conspired with others in violation of the Sherman Act, 15 U.S.C. § 1 from around October 2011 to July 2016, after they acquired the assets of a concrete supplier in Southern Georgia and in doing so employed two individuals also charged in the conspiracy.[59] Argos agreed to pay more than $20 million in a criminal penalty.[60] As part of the DPA, Argos also has agreed to cooperate in the Division’s ongoing criminal investigation and prosecution of others involved in the conspiracy.[61] The company has implemented and agreed to maintain a compliance and ethics program designed to prevent and detect antitrust violations, submit annual reports to the Division regarding remediation and implementation of its program, and to periodically review its compliance program and make adjustments as needed.[62]

Argos was the second company to be charged in this investigation, following Evans Concrete, LLC.[63] An indictment was also returned for the former Argos employees and two other individuals.[64]

Avanos Medical, Inc. (DPA)

On July 6, 2021, Avanos Medical, Inc. (“Avanos”) entered into a three-year DPA with the Fraud Section of DOJ’s Criminal Division, the Consumer Protection Branch (“CPB”) of DOJ’s Civil Division, and the U.S. Attorney’s Office for the Northern District of Texas.[65] The DPA resolved allegations that Avanos violated the Food, Drug, and Cosmetic Act (“FDCA”) by fraudulently misbranding surgical gowns.[66] In particular, the government alleged that Avanos’s labeling and branding of the gowns as compliant with a 2012 version of an AAMI standard for barrier protection was false and misleading.[67]

The DPA granted Avanos full cooperation credit and noted the company’s “extensive remedial measures,” including changes to its manufacturing process, devotion of additional resources to its compliance function, creation of “a stand-alone Compliance Committee of the Board of Directors,” and appointment of a full-time Chief Ethics and Compliance Officer “who reports directly to the CEO.”[68] The DPA also recognized Avanos’s spinoff of its surgical gown business in 2018, and cited that development as one of the reasons for which DOJ “determined that an independent compliance monitor was unnecessary.”[69] Avanos did not receive voluntary disclosure credit.[70]

Under the DPA, Avanos will pay a total of $22,228,000, comprised of $12.6 million in fines, $8,939,000 in compensation to purchasers of the gowns who “were directly and proximately harmed” by the company’s alleged conduct, and $689,000 in disgorgement.[71] The compensation to purchasers will be administered by a Victim Compensation Claims Administrator selected from a list of three candidates to be proposed by Avanos.[72]

Avnet Asia Pte. Ltd. (NPA)

On January 21, 2021, Avnet Asia Pte. Ltd. (“Avnet”), a Singapore distributor of electronic components and software, entered into a two-year NPA with the U.S. Attorney’s Office for the District of Columbia and DOJ NSD to resolve allegations related to alleged criminal conspiracies carried out by former employees.[73] Specifically, Avnet admitted in the NPA that two former employees (including a separately indicted sales account manager) engaged in two distinct conspiracies—one between 2007 and 2009, the other between 2012 and 2015—to violate U.S. export laws by shipping U.S. power amplifiers to Iran and China.[74] In the NPA, Avnet accepted responsibility for the acts of its employees and further admitted that neither the company nor any of its employees had applied for an export license from U.S. authorities.[75]

As part of the NPA, Avnet agreed to pay a $1.5 million financial penalty, to continue cooperating with any investigations concerning the underlying conduct, to provide all unprivileged documents pertaining to relevant investigations, and to make current and former employees available for interviews and testimony.[76] Avnet further agreed to implement a compliance program aimed at detecting and preventing violations of U.S. export laws and economic sanctions, and to provide updates on its compliance with such laws and sanctions on two occasions during the NPA’s term (at 10 and 20 months after the NPA’s execution).[77]

DOJ credited Avnet for its cooperation during the investigation (including disclosing the results of internal investigations and producing relevant documents) and for its significant remediation efforts (including substantial improvements to its export compliance program).[78] Avnet did not receive voluntary disclosure credit because it did not disclose the underlying misconduct prior to the commencement of the government’s investigation.[79] Relatedly, the U.S. Department of Commerce announced on January 29, 2021 that Avnet had agreed to pay an additional $1.7 million as part of a $3.2 million resolution of violations of the Export Administration Regulations.[80]

Bank Julius Baer & Co. Ltd. (DPA)

On May 27, 2021, Bank Julius Baer & Co. Ltd. (“BJB”), a Swiss bank with international operations, entered into a three-year DPA with DOJ’s Money Laundering and Asset Recovery Section (“MLARS”) and the United States Attorney’s Office for the Eastern District of New York.[81] DOJ alleged that from approximately February 2013 through May 2015, BJB conspired with sports marketing executives to launder through the United States at least $36 million in bribes to soccer officials in exchange for broadcasting rights to soccer matches, including the World Cup.[82]

Under the DPA, BJB agreed to pay a monetary penalty of approximately $43.32 million and forfeit $36.37 million.[83] DOJ stated that it reached this resolution with BJB based on a number of factors, including BJB’s 2016 DPA with DOJ which resolved allegations of “criminal violations relating to [BJB’s] efforts to [assist] U.S. taxpayers in evading U.S. taxes.”[84]

BJB received a 5% reduction off the bottom of the applicable U.S. Sentencing Guidelines fine range for its significant efforts to remediate its compliance program.[85] DOJ specifically acknowledged BJB’s three-year, $112 million AML initiative and “Know Your Client” upgrade launched in 2016; a large-scale AML transaction monitoring and risk management program launched in 2018; and the Bank’s 2019 initiative aimed at strengthening globally the Bank’s risk managements and risk tolerance framework.[86] BJB did not receive voluntary disclosure credit or cooperation credit.[87] The DPA noted the government’s determination that the appointment of an independent compliance monitor to oversee the remediation of BJB’s AML program by Swiss authorities made appointment of an additional monitor unnecessary.[88]

Berlitz Languages, Inc. (DPA) and Comprehensive Language Center, Inc. (DPA)

On January 19, 2021, Berlitz Languages, Inc. (“Berlitz”) and Comprehensive Language Center, Inc. (“CLCI”) entered into two separate, three-year DPAs with the DOJ Antitrust division for charges relating to a conspiracy to defraud the United States through non-competitive bidding processes in 2017[89] in connection with a multi-million dollar contract with the National Security Agency (“NSA”) to provide foreign language training services.[90] DOJ charged the companies with a conspiracy to defraud by “impending, impairing, obstructing, and defeating competitive bidding” in violation of 18 U.S.C. § 371.[91] Specifically, the companies facilitated providing false and misleading bid information to the NSA.[92]

In 2017, the NSA issued a bidding process to award up to three contracts spanning from 2017 until 2022 to provide foreign language training programs in six different locations across the United States.[93] NSA awarded the contracts to Berlitz and CLCI, along with another third-party company, in 2017, which entitled each to bid on individual delivery orders later awarded in December 2017.[94] To qualify for awards of delivery orders, the company had to be deemed “technically acceptable,” by having a facility in the location in which it could conduct the foreign language training.[95] The DPA alleged that the two companies conspired with each other to fraudulently obtain the contracts and delivery orders by falsely representing CLCI’s ability to perform and to suppress competition between Berlitz and CLCI.[96] Specifically, the companies admitted to falsely and misleadingly claiming that CLCI could perform services at a facility in Odenton, Maryland when that facility was owned and operated by Berlitz.[97] In exchange, CLCI then agreed to not bid against Berlitz when Berlitz bid on delivery orders calling for training in or near Odenton, Maryland.[98]

Under the DPA, the companies agreed to pay criminal penalties of around $140,000 each and agreed that they were jointly and severally liable to pay victim compensation to the NSA of approximately $57,000.[99] As part of the DPA, the companies admitted to participating in the alleged conspiracy, agreed to cooperate in any related investigation or prosecution, and implemented or agreed to implement and maintain compliance controls and a compliance and ethics program designed to prevent and detect fraud and antitrust violations.[100] The companies also agreed to periodically review the program and make adjustments as needed.[101]

The Boeing Company (DPA)

On January 7, 2021, The Boeing Company (“Boeing”) and the DOJ Fraud Section, as well as the U.S. Attorney’s Office for the Northern District of Texas, entered into a three-year DPA to resolve a criminal charge of conspiracy to defraud the Federal Aviation Administration’s (“FAA’s”) Aircraft Evaluation Group regarding an aircraft part called the Maneuvering Characteristics Augmentation System (“MCAS”) that affected the flight control system of the Boeing 737 MAX.[102] Pursuant to the DPA, Boeing agreed to pay approximately $2.5 billion, which includes a $243.6 million penalty and $1.77 billion in compensation to Boeing’s airline customers, and to establish a $500 million crash-victim beneficiaries fund.[103]

The DPA acknowledged Boeing’s remedial measures, including creating an aerospace safety committee of the Board of Directors to oversee Boeing’s policies and procedures governing safety and its interactions with the FAA and other government agencies and regulators,[104] and awarded partial credit for cooperation.[105]

Colas Djibouti SARL (DPA)

On February 17, 2021, Colas Djibouti SARL (“Colas Djibouti”)—a French concrete contractor and wholly owned subsidiary of French civil engineering company, Colas SA—entered into a DPA with the U.S. Attorney’s Office for the Southern District of California to resolve allegations concerning Colas Djibouti’s sale of contractually non-compliant concrete used to construct U.S. Navy airfields in the Republic of Djibouti.[106] Specifically, DOJ alleged that Colas Djibouti (1) knowingly provided substandard concrete for use on U.S. Navy airfield construction projects pursuant to contracts between Colas Djibouti and the U.S. Navy and (2) submitted documents and claims containing false representations about the composition and characteristics of the concrete to the United States.[107]

Under the terms of the DPA, Colas Djibouti agreed to plead to a one-count information of conspiracy to commit wire fraud under 18 U.S.C § 1349 and to pay approximately $10 million in restitution, a fine of $2.5 million, and forfeiture in the amount of $8 million (to be credited to the $10 million owed in restitution).[108]

In connection with the same underlying conduct, Colas Djibouti simultaneously agreed to a $3.9 million settlement of civil allegations that it violated the False Claims Act.[109] Under the terms of the settlement agreement, Colas Djibouti agreed to cooperate with any DOJ investigation of other individuals and entities not covered by the DPA and settlement agreement in connection with the underlying conduct.[110] Colas Djibouti agreed to encourage its former directors, officers, and employees to give interviews and testimony, and to furnish DOJ with non-privileged documents and records related to any investigation of the underlying conduct.[111] The civil settlement credited approximately $1.9 million of Colas Djibouti’s payment as restitution under the DPA and obligated Colas Djibouti to make a net payment of approximately $1.9 million.[112]

Deutsche Bank AG (DPA)

On January 8, 2021, Deutsche Bank AG (“Deutsche Bank”) entered into a three-year DPA and agreed to pay approximately $123 million in criminal penalties, disgorgement, and victim compensation to resolve FCPA and commodities fraud investigations.[113] The resolution was coordinated with the SEC.

The FCPA investigation concerned payments to consultants.[114] The commodities investigation related to allegations that Deutsche Bank precious metals traders placed orders with the intent to cancel the orders prior to execution.[115]

The Bank received full credit for cooperating with the investigation, including making detailed factual presentations and producing extensive documentation.[116] The DPA also acknowledged remedial measures taken by the Bank, including “conducting a robust root cause analysis and taking substantial steps to remediate and address the misconduct, including significantly enhancing its internal account controls, its anti-bribery and anti-corruption program, and its Business Development Consultants [] program on a global basis.”[117]

Epsilon Data Management LLC (DPA)

On January 19, 2021, marketing company Epsilon Data Management LLC (“Epsilon”) entered into a 30-month DPA with DOJ CPB and the U.S. Attorney’s Office for the District of Colorado to resolve a criminal charge for conspiracy to commit mail and wire fraud.[118] The government alleged that from July 2008 to July 2017, employees in Epsilon’s direct-to-consumer unit (“DTC”) sold over 30 million consumers’ information to individuals engaged in fraudulent mass-mailing schemes.[119]

Under the DPA, Epsilon agreed to pay $150 million, with $127.5 million dedicated to a victims’ compensation fund.[120] Epsilon also agreed to select, and cover the costs of, an independent claims administrator to distribute monies from the fund.[121] The agreement stated that DOJ was not requiring Epsilon to pay a criminal forfeiture amount because of the “facts and circumstances of th[e] case” and the company’s agreement to pay the victims’ compensation amount.[122]

The DPA noted the substantial enhancements Epsilon had already made to its compliance program and internal controls.[123] Epsilon further agreed to enhance its compliance program and internal controls to safeguard consumer data and prevent its sale to individuals engaged in fraudulent marketing campaigns.[124] Epsilon also agreed to cooperate fully in any related matters.[125]

The DPA stated that Epsilon received full credit for its “extensive cooperation,” which included (1) a “thorough and expedited internal investigation,” (2) regular government presentations, (3) facilitating employee interviews, and (4) analyzing and organizing “voluminous evidence.”[126] Epsilon also received credit for its extensive remedial measures, including (1) separating employees known to be involved in the alleged conduct, (2) terminating relationships with the individuals who carried out the fraudulent mailing schemes, (3) dissolving the DTC, (4) investing in additional legal and compliance resources, and (5) updating company policies and procedures.[127] The DPA further credited Epsilon for having no prior criminal history.[128] Epsilon did not receive voluntary disclosure credit.[129]

DOJ determined that an independent compliance monitor was unnecessary “based on Epsilon’s remediation and the state of its compliance program, the fact that the Covered Conduct concluded in 2017,” and the company’s agreement to report annually on the implementation of its compliance program.[130]

On June 14, 2021, the U.S. District Court for the District of Colorado unsealed an indictment charging two former Epsilon employees with conspiracy to commit and the substantive commission of mail and wire fraud in connection with conduct that was the subject of the Epsilon DPA.[131] The indictment alleges that the two individuals sold consumer lists to mass-mailing fraud schemes that invited consumers to engage in false “sweepstakes” and “astrology” solicitations.[132] The unsealing of the indictment coincided with DOJ announcing its DPA with KBM Group LLC (see below) to resolve nearly identical charges.[133]

KBM Group LLC (DPA)

On June 14, KBM Group LLC (“KBM”) entered into a 30-month DPA with the U.S. Attorney’s Office for the District of Colorado and DOJ CPB to resolve allegations that it sold millions of consumers’ information to individuals and entities engaged in elder fraud schemes.[134] DOJ alleged that KBM sold consumer lists to mass-mailing fraud schemes that invited consumers to engage in false “sweepstakes” and “astrology” solicitations.[135] A court in the same district earlier this year approved a similar agreement between the DOJ and Epsilon Data Management LLC to resolve parallel allegations.[136] The court approved the KBM DPA on June 29.[137]

Under the DPA, KBM will pay $42 million, $33.5 million of which will go to a victims’ compensation fund.[138] The DPA requires KBM to select, and cover the costs of, an independent claims administrator to distribute the victim compensation monies.[139] KBM also must implement compliance measures to safeguard consumer data and prevent its sale to perpetrators of fraudulent marketing schemes.[140] The compliance program requirements in KBM’s DPA are nearly identical to those in Epsilon’s, with the exception that KBM’s DPA explicitly requires the company to ensure that both senior and middle management reinforce and abide by the compliance code.[141] KBM’s agreement, like Epsilon’s, also requires annual compliance reporting and cooperation with the government in its ongoing investigations.[142]

The DOJ granted KBM nearly identical credit to that provided under Epsilon’s DPA, including full credit for its cooperation, its “significant remedial measures,” and lack of prior criminal history.[143] Additionally, the DPA credited KBM for its removal of terminated clients’ data from the KBM database and its revision of employee commission plans and co-op member agreements to align with the new compliance measures.[144]

The DOJ announced its filing of the DPA with KBM alongside the unsealing of an indictment charging two former Epsilon employees with mail and wire fraud in connection with a mass-mailing fraud scheme.[145]

PT Bukit Muria Jaya (DPA)

On January 17, 2021, PT Bukit Muria Jaya (“BMJ”)¾a global cigarette paper supplier based in Indonesia¾entered into an 18-month DPA with DOJ NSD and the U.S. Attorney’s Office for the District of Columbia to resolve allegations of conspiracy to commit bank fraud in connection with the shipment of BMJ products to North Korea.[146] DOJ alleged that BMJ customers in North Korea falsified paperwork and misled U.S. banks into processing payments in violation of U.S. sanctions.[147] According to DOJ, BMJ accepted payments from third parties, at the request of its North Korean customers, that were unrelated to the sales transactions, thereby taking the transactions outside the ambit of U.S. banks’ sanctions monitoring systems and leading the banks to process transactions it would have otherwise rejected.[148] BMJ also entered a settlement with the U.S. Treasury’s Office of Foreign Assets Control (“OFAC”) for the same underlying conduct, with OFAC determining that BMJ’s violations were “non-egregious.”[149]

Under the DPA, BMJ agreed to pay a $1.5 million penalty and implement a compliance program designed to prevent and identify violations of U.S. sanctions.[150] BMJ also agreed to report semi-annually on the status of its compliance improvements.[151] The 18-month DPA can be extended by up to one year if BMJ knowingly violates the terms of the agreement.[152]

In setting forth the rationale for the terms of the resolution, the Gibson Dunn-negotiated DPA credited BMJ for its (1) willingness to accept responsibility under U.S. law, (2) remediation efforts and comprehensive improvement of its compliance program, and (3) ongoing cooperation.[153] The agreement also noted that BMJ’s revenue from the sales in question constituted less than 0.3% of the company’s total sales revenue during that same period.[154]

Just six months prior to BMJ’s agreement, the DOJ imposed its first-ever corporate resolution for violations of the 2016 sanctions regulations concerning North Korea.[155] The BMJ DPA suggests that DOJ’s effort in this regard will proceed regardless of the transactions’ value to the entity. In announcing the BMJ DPA, Acting U.S. Attorney for the District of Columbia Michael R. Sherwin highlighted this point by stating that “[w]e want to communicate to all those persons and businesses who are contemplating engaging in similar schemes to violate U.S. sanctions on North Korea . . . . We will find you and prosecute you.”[156]

Rahn+Bodmer Co. (DPA)

On February 10, 2021, the oldest private bank in Zurich, Switzerland, Ranh+Bodmer Co. (“R+B”), entered into a three-year DPA with DOJ’s Tax Division and the United States Attorney’s Office for the Southern District of New York.[157] The DPA resolves allegations that from 2004 until 2012 R+B conspired to help U.S. account holders evade U.S. tax obligations, file false federal tax returns, and otherwise defraud the Internal Revenue Service (“IRS”) by hiding hundreds of millions of dollars in offshore bank accounts at R+B.[158] The DPA is the latest of over 90 resolutions since 2013 with Swiss banks involving tax evasion allegations.

Under the DPA, R+B agreed to make payments totaling $22 million.[159] Specifically, R+B agreed to pay (1) $4.9 million in restitution, representing the “approximate gross pecuniary loss to the [IRS]” resulting from R+B’s participation in the conspiracy; (2) $9.7 million in forfeiture, representing the approximate gross fees that R+B earned on its undeclared U.S.-related accounts between 2004 and 2012; and (3) $7.4 million in penalties, including a 55% discount for cooperation.[160] DOJ stated that it reached this resolution with R+B based on a number of factors, including that R+B conducted a “thorough internal investigation”; “provided a substantial volume of documents” to DOJ; and implemented remedial measures to “protect against the use of its services for tax evasion in the future.”[161] The agreement also requires R+B to disclose information consistent with the Department’s Swiss Bank Program relating to accounts closed between January 1, 2009, and December 31, 2019.[162]

SAP SE (NPA)

On April 29, 2021, SAP SE (“SAP”), a German software corporation, entered into an NPA with DOJ NSD and agreed to disgorge $5.14 million.[163] SAP also entered into concurrent administrative agreements with the Department of Commerce’s Bureau of Industry and Security and OFAC.[164] In voluntary disclosures to these three agencies, SAP acknowledged violations of the Export Administration Regulations and the Iranian Transactions and Sanctions Regulations.[165]

The conduct covered by the NPA involved SAP’s alleged export of software to Iranian end users. Between 2010 and 2017, SAP and overseas partners released U.S.-origin software, upgrades and patches, to users located in Iran in over 20,000 instances.[166] SAP’s Cloud Business Group companies separately permitted over 2,000 Iranian users access to U.S.-based cloud services in Iran.[167] Certain SAP senior managers were aware that the company did not have geolocation filters sufficient to identify and block the Iranian downloads, but SAP failed to institute remedial controls.[168]

According to the NPA, SAP received full credit for its timely voluntary disclosure, as well as credit for extensive cooperation with the government.[169] The company also received credit for spending more than $27 million on remediation efforts, including implementing GeoIP blocking, deactivating violative users of cloud services based in Iran, transitioning to automated sanction screening, auditing and suspending partners that sold to Iran-affiliated customers, and implementing other internal and export controls.[170]

The SAP resolution is one of the first of its kind focused on the provision of cloud services, and as such may now serve as a benchmark for future government enforcement actions—and compliance and remediation expectations—in this space.

State Street Corporation (DPA)

On May 13, 2021, State Street Corporation (“State Street”) entered into a new two-year DPA with the U.S. Attorney’s Office for the District of Massachusetts and agreed to pay a $115 million criminal penalty to resolve charges that it conspired to commit wire fraud by engaging in a scheme to defraud a number of the bank’s clients.[171] According to the DPA, State Street overcharged by over $290 million for expenses related to the bank’s custody of client assets.[172]

Between 1998 and 2015, according to the DPA, eight former bank executives omitted information about charges from client invoices and misled customers who raised concerns about the expenses.[173] Specifically, the former bank executives allegedly “conspired to add secret markups to ‘out-of-pocket’ (OOP) expenses charged to the bank’s clients while letting clients believe that State Street was billing OOP expenses as pass-through charges on which the bank was not earning a profit.”[174] An example of an OOP expense would be fees for interbank messages sent via the Society of Worldwide Interbank Financial Telecommunication (SWIFT) system.[175]

In addition to the $115 million criminal penalty, State Street also agreed to continue to “cooperate with the U.S. Attorney’s Office in any ongoing investigations and prosecutions relating to the conduct, to enhance its compliance program, and to retain an independent compliance monitor for a period of two years.”[176]

Unrelatedly, State Street saw the extension in March 2021 of a 2017 DPA. State Street’s 2017 DPA resolved allegations that it engaged in a scheme to defraud customers by applying extra commissions to billions of dollars’ worth of securities trades.[177] The most recent extension, which runs through September 3, 2021, was described in a joint filing as necessary because the COVID-19 pandemic and the resignation of the monitor (who took a position with the SEC) delayed completion of the monitor’s work.[178]

With the new DPA and the recent extension of the 2017 DPA, State Street is now subject to two concurrent DOJ-imposed monitorships. The new monitor will assess and make recommendations in a way that does not duplicate the efforts of the 2017 monitor, the DPA states.[179] Further, the terms of the agreement specify that State Street may choose to retain the same monitor under the new agreement instead of appointing a separate person.[180]

Swiss Life Holding AG (DPA)

On May 14, 2021, Swiss Life Holding AG (“Swiss Life Holding”), Swiss Life (Liechtenstein) AG, Swiss Life (Singapore) Pte. Ltd., and Swiss Life (Luxembourg) S.A. entered into a three-year DPA with DOJ’s Tax Division and the United States Attorney’s Office for the Southern District of New York.[181] The DPA resolves allegations that from 2005 to 2014, Swiss Life conspired with U.S. taxpayers and others to conceal from the IRS more than $1.452 billion in assets and income through the use of offshore Private Placement Life Insurance (“PPLI”) policies (colloquially known as “insurance wrappers”) and related policy investment accounts in banks around the world.[182] According to the allegations in the DPA, Swiss Life was identified as the owner of the policy investment accounts, rather than the U.S. policyholder and/or ultimate beneficial owner of the assets, thereby allowing U.S. taxpayers to hide undeclared assets and income through the insurance wrapper policies.[183]

Swiss Life Holding agreed to pay approximately $77.3 million to resolve the charges.[184] This sum included (1) $16,345,454 in restitution, representing the approximate unpaid taxes resulting from the Swiss Life Entities’ participation in the conspiracy; (2) $35,782,375 in forfeiture, representing the approximate gross fees (not profits) that the Swiss Life Entities earned on the relevant transactions; and (3) $25,246,508 in penalties, including a 50% discount for cooperation.[185]

DOJ stated that the penalty accounted for the extensive internal investigation conducted by Swiss Life, which included the review of over 1,500 hard-copy PPLI policy files, and production to DOJ of a substantial volume of documents and client-related data derived from that investigation.[186] The DPA noted that Swiss Life took additional measures to assist in the sharing of documents and information with DOJ consistent with the insurance-confidentiality and data privacy laws in the jurisdictions in which Swiss Life’s PPLI carriers operate, including preparing a Tax Information Exchange Agreement request to the Liechtenstein authorities.[187] In addition, Swiss Life conducted extensive outreach to current and former U.S. clients to confirm historical tax compliance, and to encourage disclosure to the IRS when policyholders’ historical tax compliance issues had not yet been resolved.[188]

United Airlines, Inc. (NPA)

On February 25, 2021, United Airlines, Inc. (“United”) entered into a three-year NPA with DOJ (Fraud Section, Criminal Division) to resolve a criminal investigation into an allegedly fraudulent scheme carried out by former United employees in connection with United’s fulfilment of contracts to deliver mail internationally for the U.S. Postal Service (“USPS”).[189] According to the Statement of Facts, United delivered mail internationally pursuant to International Commercial Air (“ICAIR”) contracts with USPS.[190] Under the terms of these ICAIR contracts, United was required to (1) take barcode scans of mail upon taking possession of the mail and upon delivering the mail overseas, and (2) provide these scans to USPS.[191] Rather than providing USPS with scans based on the actual movement of mail, United admitted that, between 2012 and 2015, it provided USPS with automated scans based on projected delivery times.[192] Submission of these automated scans violated the terms of United’s ICAIR contracts and prompted USPS to make millions of dollars in payments that United was not entitled to under the ICAIR contracts.[193] United further admitted that certain former employees knew the data being transmitted to USPS violated the terms of the ICAIR contracts and engaged in efforts to conceal the automated scan data, which, if discovered, would have subjected United to financial penalties under the ICAIR contracts.[194]

As part of the resolution, United agreed to pay $17.2 million in criminal penalties and disgorgement.[195] Under the NPA, United agreed to continue cooperating with the Fraud Section, strengthen its compliance program, and submit yearly reports to the Fraud Section regarding its remediation efforts and implementation of policies and controls aimed at deterring and detecting fraud surrounding United’s government contracts.[196]

The NPA credited United for cooperating with the Fraud Section’s investigation by producing documents, making employees available for interviews, and giving a factual presentation to DOJ.[197] The NPA also noted United’s extensive remedial action after learning about the underlying misconduct, including removing the principal manager of the alleged scheme, hiring outside advisors to evaluate United’s government contracting compliance policies, instituting an independent “Government Contracts Organization” that reported directly to the United Legal Department, implementing training for employees with duties related to government contracts, and prohibiting automation of and restricting access to flight configuration data to prevent future manipulation of data provided to USPS.[198] In light of the isolated nature of the alleged misconduct and United’s remedial improvements, the Fraud Section determined that an independent compliance monitor was unnecessary.[199]

In connection with the same underlying conduct, United entered into a separate False Claims Act settlement with DOJ (Civil Division, Fraud Section, Commercial Litigation Branch) on February 25, 2021.[200] United agreed to pay $32.1 million as part of the civil settlement.[201]

International DPA Developments

As prior Mid-Year and Year-End Updates have discussed (see, e.g., our 2020 Year-End Update), France and the United Kingdom also have robust DPA or DPA-like frameworks. The UK’s Serious Fraud Office (“SFO”) has entered into 12 DPAs since 2015,[202] and France’s prosecuting agencies have entered into 12 DPA-like agreements (called convention judiciaire d’intérêt public, or “CJIP”) since 2017.[203] France and the United Kingdom together produced four DPA-like agreements in the first half of 2021, and DPA developments in the United Kingdom sparked discussion regarding individual prosecution related to DPAs.

France – Bolloré SE

On February 26, 2021, France’s National Financial Prosecutor’s Office (“PNF”) announced that the Judicial Court of Paris approved a €12 million (about $14.5 million) CJIP with French transport company Bolloré SE and its parent company Financière de l’Odet to resolve allegations of corruption in Togo.[204] PNF alleged that Bolloré paid €370,000 (almost $450,000) to Togolese president Faure Gnassingbé between 2009 and 2011 to secure tax benefits and a contract to manage the Port of Lomé.[205] As part of the CJIP, Bolloré agreed to enhance its compliance program and pay up to €4 million in costs related to the French Anti-Corruption Agency’s (AFA) monitoring and audit of Bolloré over the next two years.

On the same day that the Judicial Court of Paris approved the corporate resolution, the court dismissed the plea bargains that three Bolloré executives had entered into with PNF to resolve allegations related to the same conduct.[206] The court ordered the three executives to stand trial because the allegations against them “seriously undermined economic public order” and the sovereignty of Togo.[207] This is the first time a French court has considered—let alone rejected—plea deals alongside a CJIP, so it remains to be seen whether this development will chill the negotiation of further CJIPs or create more reluctance among individuals implicated in PNF investigations to seek resolutions in parallel with the negotiation of CJIPs.[208]

United Kingdom

Amec Foster Wheeler Energy Limited

On the same day that DOJ and the SEC announced their resolutions with Amec Foster Wheeler Energy Limited, and Amec Foster Wheeler Limited, respectively, the SFO announced that it had “agreed [to] a Deferred Prosecution Agreement in principle with Amec Foster Wheeler Energy Limited.”[209] The DPA relates to the use of third-party agents in five countries in the period before AMEC plc acquired Foster Wheeler AG in November 2014, and prior to Wood’s acquisition of the resulting combined company in October 2017.[210] The SFO DPA, and the parallel DPA with DOJ, collectively call for total payments of $177 million and include fines and disgorgement.[211] On July 1, 2021, the Crown Court at Southwark, sitting at the Royal Courts of Justice, gave final approval of the DPA.[212] Under the UK DPA, AFWEL will pay approximately £103 million.[213]

Two Anonymous DPAs with Companies for UK Bribery Act Offenses

On July 20, 2021, the SFO announced final court approval of two separate DPAs with two UK-based companies for bribery offenses.[214] According to the SFO’s press release, the two companies will pay a total of £2,510,065 (over $3.4 million) in disgorgement of profits and financial penalties.[215] The SFO did not disclose the names of the companies, citing legal restrictions on reporting under the Contempt of Court Act 1981.[216] The publicly available information regarding these two DPAs will therefore be limited until the restrictions have been lifted and the DPAs are published. However, the SFO did state that the companies “either actively participated in or failed to prevent the rolling use of bribes to unfairly win contracts,” and the companies will be obligated to report on their compliance programs at regular intervals during the two-year term of the DPAs.[217]

Further UK Developments

DPAs continue to be in the spotlight more broadly in the United Kingdom. On May 4, 2021, the media reported that the SFO (which declined to comment) was ending a criminal investigation into individuals associated with Airbus SE (“Airbus”) 16 months after Airbus agreed to pay combined penalties of $3.9 billion to authorities in France, the United Kingdom, and the United States to resolve foreign bribery and export control charges (as summarized in our 2020 Mid-Year Update).[218] Similarly, in April 2021, the SFO’s prosecution of two former executives of Serco Georgrafix Ltd. (“Serco”) ended in a directed verdict of not guilty after the revelation that the SFO had failed to disclose evidence to the defense.[219] Serco, a leading provider of outsourced services to governments, entered into a DPA with the SFO in July 2019 and agreed to pay a penalty of £19.2 million (about $24 million) and to reimburse the SFO’s investigation costs of £3.7 million (over $4.6 million) to resolve allegations of fraud and false accounting (as discussed in our 2019 Year-End Update). The Serco case is not the first acquittal in recent years among SFO prosecutions against individuals; in fact, the SFO has yet to successfully prosecute individuals following a DPA.[220] This trend may undermine or at least shape the SFO’s efforts to enter into DPAs in the future, to the extent it leads corporations to question the SFO’s ability to secure a conviction if forced to prove its case in court.

APPENDIX: 2021 Non-Prosecution and Deferred Prosecution Agreements to Date

The chart below summarizes the agreements concluded by DOJ in 2021 to date. The SEC has not entered into any NPAs or DPAs in 2021. The complete text of each publicly available agreement is hyperlinked in the chart.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA or a DPA, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in settlement agreements.

U.S. Deferred and Non-Prosecution Agreements in 2021 to Date | ||||||

| Company | Agency | Alleged Violation | Type | Monetary Recoveries | Monitoring & Reporting | Term of NPA/DPA (months) |

| Amec Foster Wheeler Energy Limited | DOJ Fraud; E.D.N.Y. | Conspiracy to violate the FCPA | DPA | $41,139,287 | Yes | 36 |

| Argos USA LLC | DOJ Antitrust | Price-fixing conspiracy | DPA | $20,024,015 | Yes | 36 |

| Avanos Medical, Inc. | DOJ Fraud; DOJ CPB; N.D. Tex. | FDCA | DPA | $22,228,000 | Yes | 36 |

| Avnet Asia Pte. Ltd | D.D.C.; DOJ NSD | Export controls – conspiracy to violate the International Emergency Economic Powers Act | NPA | $1,508,000 | Yes | 24 |

| Bank Julius Baer & Co. Ltd. | DOJ MLARS; E.D.N.Y. | AML | DPA | $79,688,400 | Yes | 36 |

| Berlitz Languages, Inc. | DOJ Antitrust | Bid rigging | DPA | $203,984 | Yes | 36 |

| The Boeing Company | DOJ Fraud; N.D. Texas | Fraud | DPA | $2,513,600,000 | Yes | 36 |

| Colas Djibouti SARL | S.D. Cal.; DOJ Civil | FCA | DPA | $14,500,000 | No | 24 |

| Comprehensive Language Center, Inc. | DOJ Antitrust | Bid rigging | DPA | $196,984 | Yes | 36 |

| Deutsche Bank AG | DOJ Fraud; MLARS; E.D.N.Y. | FCPA | DPA | $124,796,046 | Yes | 36 |

| Epsilon Data Management, LLC | DOJ CPB; D. Colo. | Mail and wire fraud | DPA | $150,000,000 | Yes | 30 |

| KBM Group, LLC | DOJ CPB; D. Colo. | Mail and wire fraud | DPA | $42,000,000 | Yes | 30 |

| PT Bukit Muria Jaya | D.D.C.; DOJ NSD | Bank fraud | DPA | $1,561,570 | Yes | 18 |

| Rahn+Bodmer Co. | S.D.N.Y.; DOJ Tax | Fraud, false tax return filings, and tax evasion | DPA | $22,000,000 | No | 36 |

| SAP SE | DOJ NSD; D. Mass. | Export controls | NPA | $8,430,000 | Yes | 36 |

| State Street Corporation | D. Mass. | Wire fraud | DPA | $211,575,000 | Yes | 24 |

| Swiss Life Holding AG | S.D.N.Y.; DOJ Tax | Fraud, false tax return filings, and tax evasion | DPA | $77,374,337 | No | 36 |

| United Airlines, Inc. | DOJ Fraud | Fraud | NPA | $49,458,102 | No | 36 |

__________________________

[1] NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly DOJ. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences, both direct and collateral, that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally—a DPA, unlike an NPA, is formally filed with a court along with charging documents—both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program and—on occasion—cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified nearly 600 agreements initiated by DOJ, and 10 initiated by the U.S. Securities and Exchange Commission (“SEC”).

[2] Fraud Statistics – Overview, October 1, 1986 – September 30, 2020, U.S. Dep’t of Justice (Jan. 14, 2021), https://www.justice.gov/opa/press-release/file/1354316/download.

[3] Criminal Enforcement Trends Charts Through Fiscal Year 2020, U.S. Dep’t of Justice, Antitrust Div. (Nov. 23, 2020), https://www.justice.gov/atr/criminal-enforcement-fine-and-jail-charts.

[4] 2020 Annual Report, Div. of Enf’t, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/files/enforcement-annual-report-2020.pdf, at 16; Year-by-Year SEC Enf’t Statistics (2005 – 2014), U.S. Sec. & Exch. Comm’n, https://www.sec.gov/news/newsroom/images/enfstats.pdf.

[5] 2020 Annual Report, Div. of Enf’t, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/files/enforcement-annual-report-2020.pdf.

[6] Press Release, U.S. Dep’t of Justice, Justice Department Takes Action Against COVID-19 Fraud (Mar. 26, 2021), https://www.justice.gov/opa/pr/justice-department-takes-action-against-covid-19-fraud (hereinafter “DOJ COVID Press Release”).

[7] Id.

[8] Stephen Peiken, Co-Director, Div. of Enf’t, “Keynote Address: Securities Enforcement Forum West 2020” (May 12, 2020), https://www.sec.gov/news/speech/keynote-securities-enforcement-forum-west-2020.

[9] Ethan P. Davis, Principal Deputy Assistant Attorney General, “Principal Deputy Assistant Attorney General Ethan P. Davis delivers remarks on the False Claims Act at the U.S. Chamber of Commerce’s Institute for Legal Reform” (June 26, 2020), https://www.justice.gov/civil/speech/principal-deputy-assistant-attorney-general-ethan-p-davis-delivers-remarks-false-claims.

[10] Id.

[11] DOJ COVID Press Release, supra note 6.

[12] Press Release, DOJ Announces Coordinated Law Enforcement Action to Combat Health Care Fraud Related to COVID-19 (May 26, 2021), https://www.justice.gov/opa/pr/doj-announces-coordinated-law-enforcement-action-combat-health-care-fraud-related-covid-19.

[13] Gibson Dunn, SEC Brings First Enforcement Action Against a Public Company for Misleading Disclosures About the Financial Impacts of the Pandemic (Dec. 7, 2020), https://www.gibsondunn.com/sec-brings-first-enforcement-action-against-a-public-company-for-misleading-disclosures-about-the-financial-impacts-of-the-pandemic/.

[14] U.S. Dep’t of Justice, Crim. Div., Evaluation of Corporate Compliance Programs (Updated June 2020) at 1, https://www.justice.gov/criminal-fraud/page/file/937501/download (hereinafter “Compliance Program Update”).

[15] United States v. Epsilon Data Mgmt., LLC, No. 21-cr-06 (D. Colo. Jan. 19, 2021), at C-5 (hereinafter “Epsilon DPA”).

[16] Id.

[17] SAP NPA, Attach. A at 8.

[18] SAP NPA, Attach. B at 2.

[19] See U.S. Dep’t of Justice, Foreign Corrupt Practices Act Review, Op. Release No. 08-02 (June 13, 2008), https://www.justice.gov/sites/default/files/criminal-fraud/legacy/2010/04/11/0802.pdf.

[20] Compliance Program Update at 3.

[21] Epsilon DPA, at C-5; SAP NPA, at B-1.

[22] Id.

[23] Press Release, U.S. Sec. and Exch. Comm’n, SEC Awards More Than $9.2 Million to Whistleblower for Successful Related Actions, Including Agreement with DOJ (Feb. 23, 2021), https://www.sec.gov/news/press-release/2021-31 (hereinafter “Whistleblower Press Release”).

[24] Id.

[25] 17 C.F.R. § 240.21F.

[26] Whistleblower Press Release; Order Determining Whistleblower Award Claim, Release No. 91183 (Feb. 23, 2021), at 2, https://www.sec.gov/rules/other/2021/34-91183.pdf.

[27] Order Determining Whistleblower Award Claim, Release No. 91183 (Feb. 23, 2021), at 2, https://www.sec.gov/rules/other/2021/34-91183.pdf.

[28] Id.

[29] Gov’t Amended Unopposed Mot. to Dismiss the Crim. Info. with Prejudice, United States v. MoneyGram Int’l, Inc., No. 12-CR-291 (M.D. Pa. June 9, 2021), ¶ 11.

[30] Id. ¶ 12.

[31] See Amended Deferred Prosecution Agreement, United States v. Standard Chartered Bank, No. 12-cr-262 (D.D.C. Apr. 9, 2019), ¶ 19.

[32] Id.

[33] See Mot. to Dismiss with Prejudice, United States v. Standard Chartered Bank, No. 12-cr-262 (D.D.C. May 4, 2021), ¶ 4; Minute Order, United States v. Standard Chartered Bank, No. 12-cr-262 (D.D.C. May 4, 2021).

[34] Press Release, U.S. Dep’t of Justice, Zimmer Biomet Holdings Inc. Agrees to Pay $17.4 Million to Resolve Foreign Corrupt Practices Act Charges (Jan. 12, 2017), https://www.justice.gov/opa/pr/zimmer-biomet-holdings-inc-agrees-pay-174-million-resolve-foreign-corrupt-practices-act; Deferred Prosecution Agreement, United States v. Zimmer Biomet Holdings, Inc., No. 12-cr-80 (Jan. 12, 2017), https://www.justice.gov/opa/press-release/file/925171/download (hereinafter “Zimmer DPA”).

[35] Deferred Prosecution Agreement, Biomet, Inc., No. 12-cr-80 (Mar. 26, 2012), https://www.justice.gov/sites/default/files/criminal-fraud/legacy/2012/03/30/2012-03-26-biomet-dpa.pdf (hereinafter “Original Biomet DPA”).

[36] Press Release, U.S. Dep’t of Justice, Zimmer Biomet Holdings Inc. Agrees to Pay $17.4 Million to Resolve Foreign Corrupt Practices Act Charges (Jan. 12, 2017), https://www.justice.gov/opa/pr/zimmer-biomet-holdings-inc-agrees-pay-174-million-resolve-foreign-corrupt-practices-act.

[37] Original Biomet DPA at 27.

[38] Press Release, U.S. Dep’t of Justice, Zimmer Biomet Holdings Inc. Agrees to Pay $17.4 Million to Resolve Foreign Corrupt Practices Act Charges (Jan. 12, 2017), https://www.justice.gov/opa/pr/zimmer-biomet-holdings-inc-agrees-pay-174-million-resolve-foreign-corrupt-practices-act.

[39] Id.

[40] Settlement Agreement Information Database Act of 2021, H.R. 27, 117th Congress (as passed by House, Jan. 5, 2021).

[41] Id.

[42] Id. at § 307(a)(3).

[43] Id. at § 307(b)(1)(A).

[44] Id. at § 307(b)(1)(B).

[45] Id.

[46] See Nat’l Defense Auth. Act, Pub. L. No. 16-283, § 6311 (Jan. 1, 2021).

[47] See Biden Justice Department Refusing to Release Corporate Deferred and Non Prosecution Agreement Database, Corporate Crime Reporter (June 23, 2021), https://www.corporatecrimereporter.com/news/200/biden-justice-department-refusing-to-release-corporate-deferred-and-non-prosecution-agreement-database/.

[48] Id.

[49] Id.

[50] Id.

[51] See generally Justice Manual § 9-2.000 – Authority of the U.S. Attorney in Criminal Division Matters / Prior Approvals, https://www.justice.gov/jm/jm-9-2000-authority-us-attorney-criminal-division-mattersprior-approvals (last visited July 2, 2021).

[52] Press Release, U.S. Dep’t of Justice, Amec Foster Wheeler Energy Limited Agrees to Pay Over $18 Million to Resolve Charges Related to Bribery Scheme in Brazil (June 25, 2021), https://www.justice.gov/opa/pr/amec-foster-wheeler-energy-limited-agrees-pay-over-18-million-resolve-charges-related-bribery.

[53] Id.

[54] Id.

[55] Id.; Deferred Prosecution Agreement, United States v. Amec Foster Wheeler Energy Limited, No. 21-CR-298 (KAM) (E.D.N.Y. June 25, 2021), at 5 (hereinafter “AFWEL DPA”).

[56] Id. at 12.

[57] Press Release, U.S. Dep’t of Justice, Ready-Mix Concrete Company Admits to Fixing Prices and Rigging Bids in Violation of Antitrust Laws (Jan. 4, 2021), https://www.justice.gov/opa/pr/ready-mix-concrete-company-admits-fixing-prices-and-rigging-bids-violation-antitrust-laws (hereinafter “Argos Press Release”).

[58] Id.

[59] Deferred Prosecution Agreement, United States v. Argos USA LLC, No. 4:21-CR-0002-RSB-CLR (S.D. Ga. Jan. 4, 2021), at 24–25 (hereinafter “Argos DPA”).

[60] Id. at 7.

[61] Id. at 5.

[62] Id. at 9; Argos Press Release, supra note 57.

[63] Argos Press Release, supra note 57.

[64] Id.

[65] Deferred Prosecution Agreement, United States v. Avanos Medical, Inc., No. 3:21-cr-00307-E (N.D. Tex. July 7, 2021), at 1 (hereinafter, “Avanos DPA”).

[66] Id. ¶ 1; Dep’t of Justice, Office of Public Affairs, Avanos Medical Inc. to Pay $22 Million to Resolve Criminal Charge Related to the Fraudulent Misbranding of Its MicroCool Surgical Gowns (July 8, 2021), https://www.justice.gov/opa/pr/avanos-medical-inc-pay-22-million-resolve-criminal-charge-related-fraudulent-misbranding-its.

[67] Avanos DPA, supra note 65, Attach. A ¶¶ 6–31.

[68] Avanos DPA, supra note 65, ¶ 4(e).

[69] Id. ¶ 4(g).

[70] Id. ¶ 4(a).

[71] Id. ¶¶ 9–13.

[72] Id. ¶ 17.

[73] Press Release, U.S. Dep’t of Justice, Chinese National Charged with Criminal Conspiracy to Export US Power Amplifiers to China (Jan. 29, 2021), https://www.justice.gov/opa/pr/chinese-national-charged-criminal-conspiracy-export-us-power-amplifiers-china (hereinafter “Avnet Press Release”); Non-Prosecution Agreement, Avnet Asia Pte. Ltd. (Jan. 21, 2021), at 1 (hereinafter “Avnet NPA”).

[74] Avnet Press Release; Avnet NPA, at 13–14, 17–21.

[75] Avnet Press Release; Avnet NPA, at 1.

[76] Avnet NPA, at 3–4.

[77] Id. at 5.

[78] Id. at 2–3.

[79] Id. at 3.

[80] Avnet Press Release.

[81] Deferred Prosecution Agreement, United States v. Bank Julius Baer & Co. Ltd., No. 21cr273 (PKC) (E.D.N.Y. May 27, 2021) (hereinafter “BJB DPA”); Press Release, U.S. Dep’t Justice, Bank Julius Baer Agrees to Pay More than $79 Million for Laundering Money in FIFA Scandal (May 27, 2021), https://www.justice.gov/opa/pr/bank-julius-baer-agrees-pay-more-79-million-laundering-money-fifa-scandal (hereinafter “BJB Press Release”).

[82] BJB Press Release, supra note 81.

[83] Id.

[84] Id.

[85] BJB DPA, supra note 81, at 5.

[86] Id.

[87] Id. at 4.

[88] Id. at 6.

[89] Press Release, U.S. Dep’t of Justice, Foreign-Language Training Companies Admit to Participating in Conspiracy to Defraud the United States (Jan. 19, 2021), https://www.justice.gov/opa/pr/foreign-language-training-companies-admit-participating-conspiracy-defraud-united-states (hereinafter “Berlitz-CLCI Press Release”); Deferred Prosecution Agreement, United States v. Berlitz Languages, Inc., No. 21-51-FLW (D.N.J. Jan. 19, 2021) at 3 (hereinafter “Berlitz DPA”); Deferred Prosecution Agreement, United States v. Comprehensive Language Center, Inc., No. 21-50-FLW (D.N.J. Jan. 19, 2021) at 3 (hereinafter “CLCI DPA”).

[90] Id.

[91] Berlitz-CLCI Press Release, supra note 89.

[92] Id.

[93] Berlitz DPA, supra note 89 at 22.

[94] Id. at 23.

[95] Id.

[96] Id.

[97] Id. at 24.

[98] Id.

[99] Berlitz-CLCI Press Release, supra note 89.

[100] Berlitz-CLCI Press Release, supra note 89; Berlitz DPA, supra note 89 at 11; CLCI DPA, supra note 89 at 10.

[101] Id.

[102] Deferred Prosecution Agreement, United States v. The Boeing Company (N.D. Tex. Jan. 7, 2021) (hereinafter “Boeing DPA”); Press Release, U.S. Dep’t of Justice, Boeing Charged with 737 Max Fraud Conspiracy and Agrees to Pay over $2.5 Billion (Jan. 7, 2021), https://www.justice.gov/opa/pr/boeing-charged-737-max-fraud-conspiracy-and-agrees-pay-over-25-billion (hereinafter “Boeing Press Release”).

[103] Boeing DPA.

[104] Id.

[105] Id.

[106] Press Release, U.S. Dep’t of Justice, Concrete Contractor Agrees to Settle False Claim Act Allegations for $3.9 Million (Feb. 17, 2021), https://www.justice.gov/opa/pr/concrete-contractor-agrees-settle-false-claims-act-allegations-39-million (hereinafter “DOJ Colas Djibouti Press Release”); Press Release, U.S. Dep’t of Justice, U.S. Attorney’s Office for the Southern District of California, U.S. Navy Concrete Contractor in Djibouti Admits Fraudulent Conduct and Will Pay More than $12.5 Million (Feb. 17, 2021), https://www.justice.gov/usao-sdca/pr/us-navy-concrete-contractor-djibouti-admits-fraudulent-conduct-and-will-pay-more-125 (hereinafter “SDCA Colas Djibouti Press Release”).

[107] SDCA Colas Djibouti Press Release.

[108] Deferred Prosecution Agreement, United States v. Colas Djibouti SARL, No. 21-cr-00280 (S.D. Cal. Feb. 17, 2021), at ¶¶ 7–9; SDCA Colas Djibouti Press Release.

[109] DOJ Colas Djibouti Press Release.

[110] Settlement Agreement, Colas Djibouti, https://www.justice.gov/opa/press-release/file/1368556/download, at 6 (hereinafter “Colas Djibouti Settlement Agreement”).

[111] Id.

[112] DOJ Colas Djibouti Press Release.

[113] Press Release, U.S. Dep’t of Justice, Deutsche Bank Agrees to Pay over $130 Million to Resolve Foreign Corrupt Practices Act and Fraud Case (Jan. 8, 2021), https://www.justice.gov/opa/pr/deutsche-bank-agrees-pay-over-130-million-resolve-foreign-corrupt-practices-act-and-fraud.

[114] Id.

[115] Id.

[116] Deferred Prosecution Agreement, United States v. Deutsche Bank Aktiengesellschaft, No. 20-00584 (E.D.N.Y. Jan. 8. 2021).

[117] Id.

[118] Press Release, U.S. Dep’t of Justice, Marketing Company Agrees to Pay $150 Million for Facilitating Elder Fraud Schemes (Jan. 27, 2021), https://www.justice.gov/opa/pr/marketing-company-agrees-pay-150-million-facilitating-elder-fraud-schemes (hereinafter “Epsilon Press Release”).

[119] Id.

[120] Id.

[121] Id.

[122] Epsilon DPA, supra note 15, at 9.

[123] Id. at 5.

[124] Id. at 13–14.

[125] Id. at 6.

[126] Id. at 4.

[127] Id. at 4–5.

[128] Id. at 6.

[129] Id. at 4.

[130] Id. at 5.

[131] Press Release, U.S. Dep’t of Justice, Justice Department Recognizes World Elder Abuse Awareness Day; Files Case Against Marketing Company and Executives Who Knowingly Facilitated Elder Fraud (June 15, 2021), https://www.justice.gov/opa/pr/justice-department-recognizes-world-elder-abuse-awareness-day-files-cases-against-marketing (hereinafter “KBM Press Release”).

[132] Id.

[133] Id.

[134] Id.

[135] Id.

[136] Joint Notice of Agreement and Mot. for Deferral of Prosecution at 4–5, United States v. KBM Group, LLC, No. 21-cr-198 (D. Colo. June 14, 2021) (hereinafter “KBM Motion for DPA”).

[137] Order, United States v. KBM Group, LLC, No. 21-cr-198 (D. Colo. June 29, 2021).

[138] KBM Motion for DPA, supra note 136 at Ex. 1, ¶ 7.

[139] Id. ¶ 14.

[140] KBM Press Release, supra note 131.

[141] Compare KBM Motion for DPA, supra note 136, at Ex. 1 Attach. C-1–C-6, with Epsilon DPA, supra note 122, at Ex. 1 Attach. C-1–C-6.

[142] KBM Motion for DPA, supra note 136, at 2, Ex. 1 Attach. D.

[143] Compare KBM Motion for DPA, supra note 136, at Ex. 1, ¶ 4(d), with Epsilon DPA, supra note 122, at 4–6.

[144] KBM Motion for DPA, supra note 136, at Ex. 1, ¶ 4(d).

[145] KBM Press Release, supra note 131.

[146] Press Release, U.S. Dep’t of Justice, Indonesian Company Admits to Deceiving U.S. Banks in Order to Trade with North Korea, Agrees to Pay a Fine of More Than $1.5 Million (Jan. 17, 2021), https://www.justice.gov/opa/pr/indonesian-company-admits-deceiving-us-banks-order-trade-north-korea-agrees-pay-fine-more-15 (hereinafter “BMJ Press Release”).

[147] Id.

[148] United States v. PT Bukit Muria Jaya, No. 21-cr-14 (D.D.C. Jan. 14, 2021), at Attach. A, 7 (hereinafter “BMJ DPA”).

[149] Enf’t Release, U.S. Dep’t of Treasury, OFAC Settles with PT Bukit Muria Jaya for Its Potential Civil Liability for Apparent Violations of the North Korea Sanctions Regulations (Jan. 14, 2021), at 1, https://home.treasury.gov/system/files/126/20210114_BMJ.pdf.

[150] BMJ Press Release, supra note 146.

[151] BMJ DPA, supra note 148, at 10–12.

[152] Id. at 2.