2021 Year-End FCPA Update

Client Alert | January 25, 2022

On the heels of a record-setting 2020, the year 2021 saw a more modest pace of Foreign Corrupt Practices Act (“FCPA”) enforcement, particularly as it relates to corporate actions. The inevitable slowdown from any changeover in presidential administrations, combined with the lingering impacts of the global pandemic, undoubtedly contributed to this phenomenon. But with the Biden Administration doubling down on the strategic importance of global anti-corruption enforcement, and with continuing robust FCPA-related enforcement against individuals, we fully anticipate a return to substantial corporate FCPA enforcement in the years to come.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2021, as well as the trends we see from this activity. Gibson Dunn has the privilege of helping our clients navigate anti-corruption-related challenges every day, and we are honored to have been ranked again this year Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices—Gibson Dunn’s fourth consecutive year and sixth in the last seven years to have been so honored. For more analysis on anti-corruption enforcement and related developments over the past year, we invite you to join us for our upcoming complimentary webcast presentations:

- “FCPA 2021 Year-End Update” on February 1, 2022 (to register, Click Here)

- “Corporate Compliance and U.S. Sentencing Guidelines” on March 30, 2022 (to register, Click Here)

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depositary Receipts (“ADRs”) or American Depositary Shares (“ADSs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

International corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of the Department of Justice (“DOJ”) have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Without question, the most prevalent amongst these “FCPA-related” charges is money laundering—a generic term used as shorthand for statutory provisions that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity, to conceal or disguise the nature, location, source, ownership or control of the proceeds, or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent years, DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is now commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

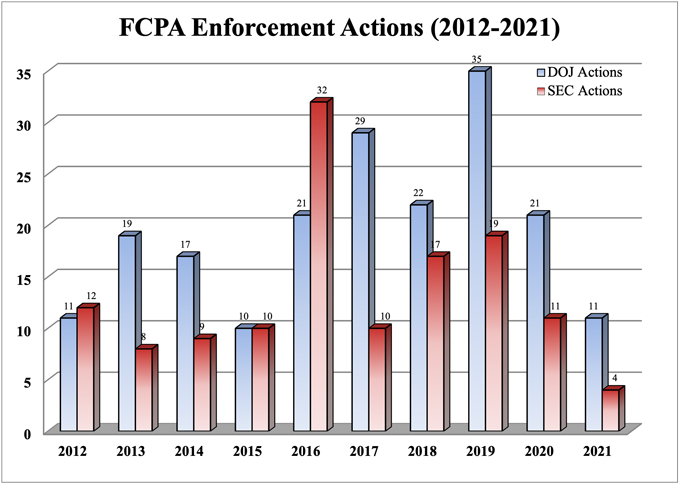

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the Securities and Exchange Commission (“SEC”), the statute’s dual enforcers, during the past 10 years.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||||

|

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

|

11 |

12 |

19 |

8 |

17 |

9 |

10 |

10 |

21 |

32 |

29 |

10 |

22 |

17 |

35 |

19 |

21 |

11 |

11 |

4 |

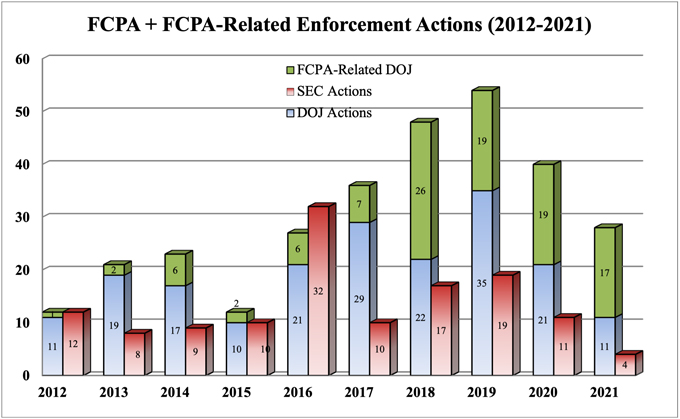

But as our readers know, the number of FCPA enforcement actions represents only a piece of the robust pipeline of international anti-corruption enforcement efforts by DOJ. Indeed, the increasing proportion of “FCPA-related” charges in the overall enforcement docket of FCPA prosecutors is a trend we have been remarking upon for years. In total, DOJ brought 17 such FCPA-related actions in 2021, bringing the overall anti-corruption figures for the past year to 28 cases filed or unsealed by DOJ. The past 10 years of FCPA plus FCPA-related enforcement activity is illustrated in the following table and graph.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||||

|

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

DOJ |

SEC |

|

12 |

12 |

21 |

8 |

23 |

9 |

12 |

10 |

27 |

32 |

36 |

10 |

48 |

17 |

54 |

19 |

40 |

11 |

28 |

4 |

2021 FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not merely to report on the year’s FCPA enforcement actions, but also to distill the thematic trends we see stemming from these individual events. For 2021, we have identified three key enforcement trends that we believe stand out from the rest:

- Sharp downturn in corporate FCPA enforcement actions and financial penalties;

- DOJ continues substantial FCPA and FCPA-related enforcement against individuals; and

- Biden Administration policies foreshadow a return to robust corporate anti-corruption enforcement in the coming years.

Sharp Downturn in Corporate FCPA Enforcement Actions and Financial Penalties

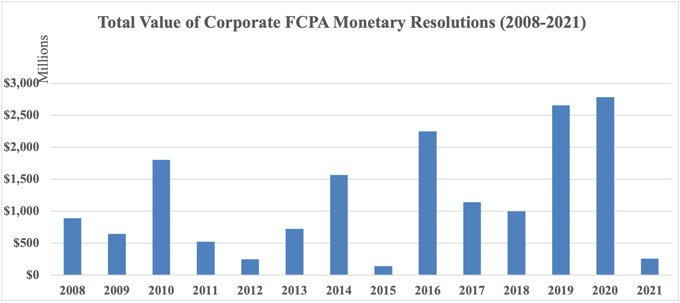

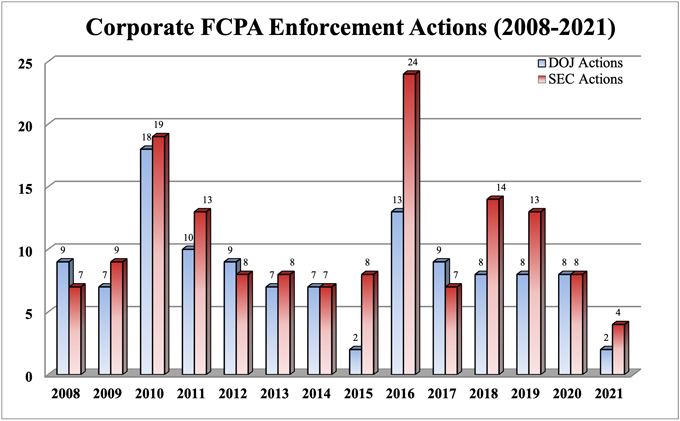

The modern era of FCPA enforcement (often described as beginning with the blockbuster Siemens resolution in 2008) may certainly be characterized by its penchant for setting enforcement records in one year, and then breaking them the next. But this overall trend has not always been linear, and indeed, frequently, there is a drop-off in cases in the years that presidential administrations change. So, it is accurate to say that corporate FCPA enforcement—after reaching new heights of penalties imposed in 2019 ($2.66 billion in corporate penalties on 21 enforcement actions) and 2020 ($2.79 billion in corporate penalties on 16 enforcement actions)—fell off the proverbial cliff in 2021 ($259.5 million on 6 enforcement actions). But we would not go nearly so far as to foretell the demise of corporate anti-corruption enforcement in the years to come. Indeed, based on what we are seeing at DOJ and the SEC, we counsel against such predictions.

The first corporate FCPA enforcement action of 2021 was with German financial institution and U.S.-issuer Deutsche Bank AG, which on January 8 reached a coordinated FCPA resolution with DOJ and the SEC to resolve allegations of internal control deficiencies and inaccurate record-keeping associated with the use of third-party business development consultants between 2009 and 2016. The DOJ allegations focused on consultants in Abu Dhabi and Saudi Arabia, each of which was allegedly known by Deutsche Bank employees to be relatives or close associates of government officials who would pass portions of their consulting payments on to the officials in exchange for business awarded to the bank. The SEC resolution additionally identified purportedly questionable consulting relationships in China and Italy.

To resolve the criminal charges, Deutsche Bank entered into a three-year deferred prosecution agreement with DOJ alleging conspiracy to violate each of the FCPA’s books-and-records and internal controls provisions, as well as a separate wire fraud conspiracy charge associated with an unrelated commodities trading scheme that was charged together with the FCPA matter. For the FCPA misconduct, the bank paid a criminal penalty of $79.6 million, which represented a 25% discount from the middle of the U.S. Sentencing Guidelines range—this was the maximum discount for cooperation (in a non-voluntary disclosure case), but the discount was taken from the middle rather than the bottom of the range because of a prior criminal antitrust resolution in 2016. To resolve the SEC charge, Deutsche Bank consented to the entry of an administrative cease-and-desist order charging FCPA accounting violations and agreed to pay $43.3 million in disgorgement and prejudgment interest. Gibson Dunn represented Deutsche Bank in these matters.

On June 25, 2021, global engineering firm Amec Foster Wheeler Ltd. (“AFW”), which during the relevant period was principally based in the UK but traded on a U.S. exchange, reached a $177 million coordinated resolution with anti-corruption authorities in Brazil, the United Kingdom, and the United States. The U.S. charging documents allege that between 2011 and 2014, an AFW subsidiary used several agents—including one that failed AFW’s due diligence process based on compliance concerns, but nonetheless continued working “unofficially” on the project—to make more than $1 million in improper payments to win a contract with state-owned oil company Petróleo Brasileiro S.A. (“Petrobras”).

On the U.S. front, to resolve the SEC’s investigation, AFW consented to the entry of an administrative cease-and-desist order charging FCPA bribery and accounting violations and ordering $22.76 million in disgorgement and prejudgment interest. To resolve a criminal FCPA bribery conspiracy charge, a UK subsidiary of AFW entered into a three-year deferred prosecution agreement with DOJ and agreed to a criminal penalty of $18.375 million. Both the SEC and DOJ applied offsetting credits for payments to authorities in Brazil and the UK in connection with the coordinated resolution, bringing the total due to the SEC to $10.13 million and $7.66 million to the United States. The Petrobras-related allegations were only a part of a larger anti-corruption resolution reached by the UK AFW subsidiary and the SFO, which as described in our UK section below imposed the USD-equivalent of $142.7 million in penalties and disgorgement for alleged improper payments in India, Malaysia, Nigeria, and Saudi Arabia, as well as Brazil, as part of its own, separate three-year deferred prosecution agreement. The U.S. resolutions, which were coordinated by Gibson Dunn, acknowledged AFW’s cooperation and remediation by applying the maximum available 25% discount from the bottom of the U.S. Sentencing Guidelines range and not requiring an independent compliance monitor.

The third corporate FCPA enforcement action of 2021, and the only one that was resolved solely with civil SEC charges, was with WPP Plc, the world’s largest advertising group and an ADS issuer. On September 24, 2021, the SEC announced that WPP consented to the entry of a cease-and-desist order charging FCPA bribery and accounting violations, and agreed to pay $10.1 million in disgorgement, $1.1 million in prejudgment interest, and an $8 million civil penalty, without admitting or denying the SEC’s allegations.

According to the SEC’s charging document, prior to 2018, WPP deployed a global growth strategy by which it entered markets through acquisitions of smaller advertising agencies, frequently with an “earn-out provision” that deferred a portion of the purchase price pending the accomplishment of future financial goals, which in many cases the acquired agency’s founder stayed on to achieve. These newly acquired agencies and their founders were the focus of this enforcement action, with the SEC alleging improper payments in Brazil, China, India, and Peru. A DOJ investigation reportedly is ongoing, and it is not clear whether additional charges are forthcoming.

Closing out the year in corporate FCPA enforcement, on October 19, 2021 Swiss financial institution and ADR issuer Credit Suisse Group AG agreed to an FCPA resolution with the SEC and a related non-FCPA, wire fraud resolution with DOJ. The DOJ and SEC allegations concern the same Mozambique loan bribery and kickback scheme that we first reported in our 2019 Year-End FCPA Update, wherein we described FCPA and FCPA-related charges against three Credit Suisse bankers, two former Mozambican government officials and a business consultant, as well as two Lebanese former executives of a UAE shipbuilding company. The allegations are that between 2013 and 2016, the defendants structured three syndicated loan and securities offerings worth $2 billion involving Mozambican state-owned entities, from which at least $200 million was allegedly misappropriated for bribes and kickbacks to the scheme participants.

To resolve the SEC’s charges, Credit Suisse consented to an administrative cease-and-desist proceeding alleging violations of the FCPA’s accounting provisions, as well as fraud-based securities violations, and agreed to pay combined disgorgement and prejudgment interest of $34 million plus a $65 million civil penalty. To resolve the criminal investigation, Credit Suisse entered into a three-year deferred prosecution agreement with DOJ concerning, and a UK subsidiary pleaded to, wire fraud charges, and agreed to pay a cumulative criminal fine of $247.5 million, plus $10.34 million in criminal forfeiture. After applying a variety of offsets, Credit Suisse ultimately agreed to pay $99 million to the SEC, $175 million to DOJ, and $200 million to the UK Financial Conduct Authority (“FCA”) in a related resolution. The bank also agreed to forgive $200 million in debt owed by the Government of Mozambique, which the prosecutors and regulators considered, together with Credit Suisse’s remediation and cooperation efforts, in setting the $475 million combined resolution amount.

DOJ Continues Substantial FCPA and FCPA-Related Enforcement Against Individuals

DOJ filed or unsealed FCPA or FCPA-related charges against 25 individual defendants in 2021, which may be grouped as follows.

Ecuadorian Police Pension Fund Defendants

On March 2, 2021, DOJ announced the arrest of Ecuadorian citizens John Luzuriaga Aguinaga and Jorge Cherrez Miño for their alleged roles in a long-running bribery scheme involving the Instituto de Seguridad Social de la Policia Nacional (“ISSPOL”), Ecuador’s public police pension fund. DOJ alleges that from 2014 to 2020, Cherrez, an investment advisor with operations in Florida and Panama, paid more than $2.6 million in bribes to ISSPOL officials, including now-former ISSPOL Risk Director Luzuriaga, in exchange for the right to manage ISSPOL funds. Two-and-a-half months later, on May 19, 2021, Ecuadorian investment company manager Luis Alvarez Villamar pleaded guilty to money laundering conspiracy for his role in accepting funds from Cherrez in connection with the ISSPOL corruption scheme. Luzuriaga is currently scheduled for trial on money laundering charges in the Southern District of Florida in February 2022, and Cherrez is considered a fugitive on his pending FCPA bribery and money laundering charges.

Additional PDVSA (Citgo) Charges

For years, we have been covering a multi-faceted corruption investigation by DOJ with the common nucleus being Venezuelan state-owned oil company Petróleos de Venezuela S.A. (“PDVSA”). One of the investigation strands has involved a pay-to-play corruption scheme at Citgo Petroleum Corporation, PDVSA’s U.S. subsidiary, as covered most recently in our 2020 Year-End FCPA Update. On March 12, 2021, DOJ unsealed money laundering conspiracy charges initially filed two years earlier against another defendant, former Citgo buyer Laymar Giosse Pena-Torrealba. According to the charging documents, Pena-Torrealba accepted bribes from Juan Manuel Gonzalez (who himself pleaded guilty in May 2019) in exchange for helping Gonzalez’s companies to secure contracts with Citgo. Pena-Torrealba pleaded guilty to one count of money laundering conspiracy and was sentenced in November 2021 to three years of probation.

Additional PetroEcuador Charges

We also have been reporting for several years now on a multi-agency investigation into alleged corruption at Ecuador’s state-owned oil company, Empresa Publica de Hidrocarburos del Ecuador (“PetroEcuador”). This has included coordinated charges brought by DOJ and the Commodity Futures Trading Commission (“CFTC”) against energy trading firm Vitol, Inc., as well as several of its traders, as covered in our 2020 Year-End FCPA Update. On April 6, 2021, DOJ unsealed an August 2020 criminal complaint against Canadian citizen Raymond Kohut, a now-former employee of a different Swiss energy trading firm. According to the charges, two Asian state-owned entities contracted to provide loans to PetroEcuador backed by periodic oil deliveries, and Kohut’s employer negotiated with the Asian entities to market and sell those oil products. Starting in 2012, Kohut and his co-conspirators allegedly made more than $22 million in corrupt payments to PetroEcuador officials to award contracts to the Asian entities under favorable terms so that Kohut’s company could then enter related, advantageous trading agreements with the Asian entities. Kohut and his co-conspirators allegedly met to discuss the conspiracy in Florida, and some of the payments flowed through New York correspondent bank accounts. Kohut pleaded guilty to a single count of money laundering on April 6, 2021, and awaits sentencing.

Additional Odebrecht-Related Charges

The blockbuster multinational anti-corruption resolution with Odebrecht S.A. in 2016, first covered in our 2016 Year-End FCPA Update, continues to be a recurring source of FCPA and FCPA-related charges against individual defendants. On May 20, 2021, DOJ unsealed money laundering charges against Austrian citizens and bank executives Peter Weinzierl and Alexander Waldstein. The indictment alleges that Weinzierl and Waldstein moved more than $170 million through a series of fraudulent transactions and sham agreements from Odebrecht’s New York bank accounts, through Weinzierl’s and Waldstein’s Austrian bank, into accounts at an Antiguan bank allegedly used by Odebrecht as a slush fund used to pay bribes to Brazilian, Mexican, and Panamanian officials. Weinzierl was arrested on May 25, 2021 in the United Kingdom, where he is currently undergoing extradition proceedings. Waldstein remains at large.

Chadian Oil Rights Defendants

On May 24, 2021, DOJ announced the indictment of two diplomats from Chad—Mahamoud Adam Bechir and Youssouf Hamid Takane—Bechir’s wife Nouracham Bechir Niam, and the founder of a Canadian energy company, Naeem Riaz Tyab, all on FCPA or FCPA-related charges stemming from an alleged bribery scheme relating to the award of oil rights in the Republic of Chad. According to the indictment, while serving in Washington, D.C. as Chad’s Ambassador to the United States and Canada and Deputy Chief of Mission, respectively, Bechir and Takane collectively solicited and accepted $2 million in bribes, plus corporate shares, in exchange for awarding Tyab’s company oil rights worth tens of millions of dollars. Bechir’s wife Niam was allegedly brought into the scheme when Tyab received legal advice not to enter a consulting contract with a company owned by Bechir, and so instead, entered into substantially the same consulting contract with a company owned by Niam, in addition to awarding Niam substantial shares in Tyab’s company. Tyab and Niam were both charged with conspiracy to violate the FCPA, and all four defendants were charged with conspiracy to commit money laundering.

The indictment was initially handed down in February 2019, shortly before Tyab was arrested in New York City. According to court documents, Tyab immediately began cooperating and pleaded guilty in April 2019. But the case remained sealed as DOJ sought to obtain custody of the other three defendants. More than two years later, in May 2021, DOJ acknowledged that its efforts to arrest the other defendants were unlikely to be successful in the near term and moved to unseal the indictment. Further illustrating the long tail of these corruption cases, Tyab’s company—Griffiths Energy International Inc.—pleaded guilty to violations of Canada’s Corruption of Foreign Public Officials Act in 2013 as covered in our 2013 Year-End FCPA Update. Bechir, Takane, and Niam all remain at large, and Tyab is currently scheduled to be sentenced in February 2022.

Bolivian Military Equipment Defendants

Also in May 2021, DOJ announced charges against five individuals in an alleged pay-to-play bribery scheme involving the sale of tactical defense equipment to the Bolivian Ministry of Defense. DOJ alleges that Bryan Berkman, the owner of Bravo Tactical Solutions LLC, his father Luis Berkman, and his business associate Philip Lichtenfeld, all conspired to make over $600,000 in corrupt payments to former Bolivian Minister of Government Arturo Carlos Murillo Prijic and his former Chief of Staff Sergio Rodrigo Mendez Mendizabal in exchange for a $5.6 million contract to supply tear gas and other non-lethal riot equipment to the Ministry of Defense. Four of the five defendants have pleaded guilty—Bryan Berkman and Lichtenfeld to FCPA conspiracy charges and Luis Berkman and Mendez to money laundering conspiracy charges. Murillo is currently set for a May 2022 trial date on a superseding eight-count money laundering indictment.

Nigeria Oil Contract Defendant

On July 26, 2021, DOJ filed a criminal information charging Anthony Stimler, a former West Africa-based oil trader for a Swiss commodity trading and mining firm, with one count each of conspiracy to violate the FCPA’s anti-bribery provisions and money laundering conspiracy. According to the charging document, between 2007 and 2018, Stimler participated in a scheme to bribe employees of the state-owned Nigerian National Petroleum Corporation to obtain contracts for more lucrative grades of oil on better delivery schedules for the commodity trading firm. Stimler has pleaded guilty and is cooperating with DOJ on the ongoing investigation of Stimler’s former employer.

CASA Corruption Defendant

On August 4, 2021, DOJ announced the arrest of Florida businessman Naman Wakil on charges that between 2010 and 2017 he allegedly bribed officials of both PDVSA and Venezuelan state-owned food company Corporación de Abastecimiento y Servicios Agrícola (“CASA”) to secure approximately $250 million in contracts for his companies. Wakil faces substantive and conspiracy FCPA and money laundering charges. He has pleaded not guilty and is currently set for a November 2022 trial date.

Ericsson Djibouti Defendant

On September 8, 2021, DOJ announced the unsealing of a June 2020 FCPA and money laundering conspiracy indictment of former Telefonaktiebolaget LM Ericsson Horn of Africa Account Manager Afework Bereket. According to the indictment, between 2010 and 2014, Bereket participated in a scheme to pay approximately $2.1 million to two high-ranking officials in Djibouti’s executive branch and one employee of a Djibouti state-owned telecommunications company to secure a €20.3 million contract with the state-owned entity. The indictment further alleges that Bereket concealed the bribes by entering a sham consulting contract with a company owned by the spouse of one of the officials, and concealing that ownership interest from others at Ericsson. As first reported in our 2019 Year-End FCPA Update, in 2019, Ericsson entered into an FCPA resolution with DOJ and the SEC that included the Djibouti scheme. Bereket remains at large.

CLAP Corruption Defendants

On October 21, 2021, DOJ announced a money laundering indictment returned against five defendants stemming from alleged corruption involving Comité Local de Abastecimiento y Producción (“CLAP”), a Venezuelan state-owned and state-controlled food and medicine distribution program. The indictment alleges a scheme involving a staggering $1.6 billion in food and medicine contracts obtained by Colombian businessmen Alvaro Pulido Vargas, Emmanuel Enrique Rubio Gonzalez, and Carlos Rolando Lizcano Manrique, and Venezuelan businesswoman Ana Guillermo Luis obtained through corrupt payments to the then-governor of Venezuelan State Táchira, Jose Gregorio Vielma-Mora. All five defendants are considered fugitives. Pulido—who additionally faces money laundering charges stemming from a separate pay-to-play scheme described in our 2019 Year-End FCPA Update—along with Rubio and Vielma-Mora also were sanctioned by the Office of Foreign Assets Control in 2019 for alleged CLAP-related corruption.

Egyptian Coal Sale Defendant

On November 3, 2021, DOJ charged Frederick Cushmore Jr., the now-former Head of International Sales for a Pennsylvania-based coal mining company, with one count of conspiracy to violate the FCPA’s anti-bribery provisions. According to the criminal information, between 2016 and 2020, Cushmore and others at his company engaged an Egyptian sales agent to secure $143 million in coal contracts with an Egyptian state-owned company, knowing that the agent would provide a portion of his $4.8 million in commissions to officials at the state-owned entity. The information further alleges that Cushmore and others used encrypted messaging applications and commercial email accounts in an effort to avoid detection of their corruption scheme. Cushmore is currently scheduled to be sentenced in the Western District of Pennsylvania in March 2022, but the limited information available publicly suggests additional charges may be forthcoming, which would likely impact that sentencing date.

Biden Administration Policies Foreshadow Return to Robust Corporate Anti-Corruption Enforcement in the Coming Years

As noted above, there may be a slowdown in government enforcement actions that takes place with any change in presidential administrations. Although most prosecutors and enforcement lawyers at DOJ and the SEC are career attorneys who holdover across administrations, the senior political leadership often changes, and that can cause a delay in necessary approvals or willingness to move more significant cases forward until new leadership is in place. This is particularly true for high-profile enforcement activities such as corporate FCPA actions. If there was any lingering doubt, further tempering overreliance on last year’s comparatively low corporate FCPA enforcement rate, the Biden Administration took several notable steps in 2021 that lead us to anticipate a return to robust corporate enforcement in the years to come.

Biden Administration Announces U.S. Strategy on Countering Corruption

On June 3, 2021, the White House published a National Security Study Memorandum that identifies “countering corruption as a core United States national security interest.” The memorandum emphasizes the significant costs of corruption, estimated at between two and five percent of global GDP, as well as its associated impacts on less tangible (but equally important) societal goods, such as rule of law, inequality, trust in government, and national security. The memorandum directed the National Security Advisor and Assistants to the President for Economic Policy and Domestic Policy to conduct a review across numerous government agencies to devise a comprehensive anti-corruption strategy report and recommendations within 200 days.

On December 6, 2021, the Biden Administration released its first-ever “United States Strategy on Countering Corruption.” This 38-page Strategy Memorandum is structured around five “pillars”: (1) “modernizing, coordinating, and resourcing U.S. Government efforts to fight corruption”;

(2) “curbing illicit finance”; (3) “holding corrupt actors accountable”; (4) “preserving and strengthening the multilateral anti-corruption architecture”; and (5) “improving diplomatic engagement and leveraging foreign assistance to advance policy goals.” The Strategy Memorandum further emphasizes that the Biden Administration will pursue “aggressive enforcement action” in support of its anti-corruption objectives through enforcement of the FCPA and other statutes by U.S. enforcers in coordination with foreign law enforcement partners. It also suggests that the Biden Administration will seek additional tools to broaden the reach of its anti-corruption enforcement powers, including through enhanced legislation to target the “demand side” of bribery. The Strategy Memorandum further recognizes the need for increased coordination and synergy between the U.S.’s anti-corruption and anti-money laundering efforts and to address “deficiencies in the U.S. anti-money laundering regime” through the extension of regulatory compliance and reporting requirements to non-financial institution “gatekeepers,” such as lawyers, accountants, and trust and company service providers.

For additional details regarding the Strategy Memorandum, please consult our recent Client Alert, “U.S. Strategy on Countering Corruption Signals Focus on Enforcement.” And for further details on the Biden Administration’s overall approach to anti-corruption enforcement, please consult our Client Alert “Big Changes Afoot for FCPA and Anti-Bribery Enforcement?“

Deputy Attorney General Announces Changes to DOJ Criminal Enforcement Policies

In a sign of an increasingly tough approach to corporate enforcement generally, on October 28, 2021, Deputy Attorney General Lisa O. Monaco announced that DOJ is modifying certain corporate criminal enforcement policies. Specifically, these policy changes: (1) restore prior guidance concerning the need for corporations to provide non-privileged information about all individuals involved in misconduct (not just those substantially involved) in order to receive cooperation credit; (2) require prosecutors to consider a corporation’s full criminal, civil, and regulatory record in making charging decisions (not just conduct related to the misconduct at issue in the present case); and (3) make clear that there is no general presumption against monitorships and prosecutors are free to require the imposition of a corporate monitor whenever they determine it appropriate. Further, Monaco highlighted DOJ’s increasing scrutiny of companies that have received pretrial diversion (such as deferred or non-prosecution agreements) in the past, including to determine whether they continue their criminal conduct during the period of those agreements. Close in time to Monaco’s speech, several companies announced that DOJ is investigating breach allegations, including in the FCPA context an announcement by Telefonaktiebolaget LM Ericsson that DOJ determined the company breached its obligations under its deferred prosecution agreement covered in our 2019 Year-End FCPA Update.

Although these policy changes concern general corporate criminal enforcement, they touch closely upon corporate FCPA matters. For further details on Deputy Attorney General Monaco’s speech, please see our recent Client Alert, “Deputy Attorney General Announces Important Changes to DOJ’s Corporate Criminal Enforcement Policies.”

2021 FCPA-RELATED ENFORCEMENT LITIGATION

Following the filing of FCPA or FCPA-related charges, criminal and civil enforcement proceedings can often take years to wind through the courts. A selection of prior-year matters that saw material enforcement litigation developments during 2021 follows.

Two Alleged Fugitives Challenge Their Indictments from Abroad

A recurring theme in FCPA investigations is indictments returned and sometimes unsealed while the defendant is abroad. A frequently litigated issue that arises in these circumstances is whether the defendant is able to challenge the charges—frequently on jurisdictional grounds—from abroad without submitting themselves physically to the Court’s jurisdiction. Courts have reached differing conclusions on whether these challenges are barred by the so-called “fugitive disentitlement” doctrine, including two district court decisions from different circuit courts of appeal going in opposite directions in 2021.

On March 18, 2021, the Honorable Robert N. Scola, Jr. of the U.S. District Court for the Southern District of Florida denied a motion to enter a special appearance and challenge the indictment filed by Alex Nain Saab Moran, a joint Colombian and Venezuelan national charged with money laundering offenses in connection with a $350 million construction-related bribery scheme in Venezuela as covered in our 2019 Year-End FCPA Update. In January 2021, 18 months after the indictment was returned, Saab moved to vacate his fugitive status with leave to challenge his indictment on the grounds that he is a Venezuelan diplomat entitled to absolute immunity under the Vienna Convention on Diplomatic Relations, as well as that the indictment does not state an offense given Saab’s lack of connection to the United States. Saab’s motion followed his arrest in the Republic of Cape Verde, where he was detained as his plane stopped for refueling en route from Venezuela to Iran based on an INTERPOL “red notice” request filed by the United States.

Saab argued that the fugitive disentitlement doctrine should not apply because he was not in the United States when the indictment was returned—indeed he asserted he had not been to the United States in nearly three decades, long before the alleged criminal activity—and therefore he could not be correctly described as a fugitive who fled the charges. But Judge Scola disagreed, holding that a defendant who is aware of an indictment and does not appear in court to answer the charges is a fugitive regardless of whether they affirmatively fled the United States to avoid the charges—this concept is known in the Eleventh Circuit as “constructive flight.” The Court denied the motion for a special appearance and declined to consider the substantive motion to dismiss.

Saab has appealed the district court’s ruling, and DOJ has moved to dismiss the appeal. Meanwhile, the Republic of Cabo Verde granted the extradition request and transferred Saab to the United States, where he is now being detained pending trial. To fulfill a condition of the extradition, DOJ dismissed seven of the eight counts against Saab to ensure that the maximum term of imprisonment is consistent with Cabo Verde law.

The case of Daisy Teresa Rafoi Bleuler—a Swiss citizen and wealth manager charged with FCPA and money laundering offenses arising from the transfer of allegedly corrupt proceeds associated with a PDVSA-related bribery scheme covered in our 2019 Year-End FCPA Update—turned out very differently under Fifth Circuit law. Rafoi was arrested by Italian authorities, again on a U.S.-initiated INTERPOL red notice request, as she vacationed with family in Lake Como. As she underwent extradition proceedings, first in Italy and then in Switzerland, Rafoi filed a motion to dismiss the indictment on jurisdictional grounds.

In an opinion dated November 10, 2021, the Honorable Kenneth M. Hoyt of the U.S. District Court for the Southern District of Texas made short work of the government’s argument that Rafoi’s motion should not be heard under the fugitive disentitlement doctrine. The Court held that fugitive disentitlement is a discretionary doctrine, and found that where a foreign national challenges the applicability of U.S. law to their actions, without having affirmatively fled the United States, they should be permitted to do so from abroad. Moving to the merits of the motion to dismiss, Judge Hoyt fond that as a matter of law the indictment was deficient in alleging any action by Rafoi in the territory of the United States such as to bring her within the scope of 15 U.S.C. § 78dd-3, that she acted as an agent of U.S. persons under 15 U.S.C. § 78dd-2, or that she engaged in any financial transactions subject to U.S. jurisdiction under the money laundering statutes. Fundamentally, the Court found that neither the FCPA nor the money laundering statutes should be read so broadly as to apply to foreign nationals acting completely outside the United States, and that any other interpretation would lead to serious constitutional due process concerns under the “void for vagueness” doctrine.

On December 7, 2021, DOJ noticed an appeal to the U.S. Court of Appeals for the Fifth Circuit. We expect this appeal could lead to an important appellate court ruling on the breadth of the FCPA and money laundering statutes as applied to foreign nationals in 2022, likely to be joined by the heavily-anticipated revisitation of the Hoskins case by the Second Circuit Court of Appeals, covered in our 2020 Mid-Year FCPA Update and still pending after an August 17, 2021 argument.

Roger Ng Motion to Dismiss Denied

We reported in our 2018 Year-End FCPA Update on the indictment of former Goldman Sachs banker “Roger” Ng Chong Hwa on FCPA bribery and money laundering conspiracy charges arising from the 1Malaysia Development Berhad (“1MDB”) scandal in Malaysia. In October 2020, after being extradited to the United States to face these charges, Ng filed a comprehensive motion to dismiss, arguing: (1) the superseding indictment returned after his extradition from Malaysia violated the “rule of specialty,” which prohibits material changes to charges post-extradition; (2) venue in the Eastern District of New York was insufficiently alleged in the indictment; (3) the indictment did not meet the requirement of alleging that he was an “agent of an issuer” because the “U.S. Financial Institution #1” described in the indictment—meant to refer to Goldman Sachs—was in fact an “artificial combination” between various Goldman Sachs entities; (4) he could not have circumvented Goldman Sachs’s internal accounting controls because the alleged bribes were paid with 1MDB funds, rather than money from Goldman Sachs; (5) the money laundering count was deficient because it did not specify the particular Malaysia bribery statute alleged to have been violated as the requisite specified unlawful activity; (6) the so-called “silence provision” in Goldman Sachs’s deferred prosecution agreement—a standard term that prohibits companies from contracting the admitted statement of facts—violated his constitutional right to call witnesses in his defense; and (7) he was entitled to Brady disclosures from Goldman Sachs because the bank’s cooperation with DOJ made it a part of the “prosecution team.”

In September 2021, the Honorable Margo Brodie of the U.S. District Court for the Eastern District of New York denied Ng’s motion to dismiss in its entirety in an equally comprehensive, 160-page memorandum opinion. Trial is currently scheduled to commence in February 2022.

SEC Imposes $35,000 Civil Penalty—In a Case from 2016

We reported in our 2016 Year-End FCPA Update on the SEC’s enforcement action against former Och-Ziff CFO Joel M. Frank in which, without admitting or denying the SEC’s findings, Frank agreed to cease and desist from future violations of the FCPA’s books-and-records and internal controls provisions. The parties further agreed that Frank would pay a civil penalty, but in an unusual move left for another day the determination of the penalty amount. That other day came four-and-a-half years later, on March 16, 2021, when the SEC published a new cease-and-desist order imposing a $35,000 civil penalty. The new order also softened some of the allegations against Frank, acknowledging that he “expressed objections” regarding certain of the payments in question, while still taking the position that because Frank allegedly “had final signing authority” for all expenditures he was responsible for causing the company’s accounting violations.

Baptiste and Boncy FCPA Convictions Reversed for Ineffective Assistance of Counsel

We reported in our 2019 Year-End and then 2020 Mid-Year FCPA updates on the jury trial convictions of retired U.S. Army colonel Joseph Baptiste and businessperson Roger Richard Boncy on conspiracy to violate the FCPA and the Travel Act arising from an FBI sting simulating a bribery scheme involving Haitian port project investments, followed by the post-trial grant of a new trial to both defendants based on the ineffective assistance of Baptiste’s counsel infecting the fundamental fairness of the joint trial. DOJ appealed the new trial grants but, on August 9, 2021, the U.S. Court of Appeals for the First Circuit affirmed the district court’s ruling.

On appeal DOJ did not contest the lower court’s deficient-performance findings—which included that Baptiste’s counsel did not open discovery files or share them with his client, did not obtain independent translations of Haitian-Creole audio recordings even after learning of deficiencies in the government’s translations, and did not subpoena any defense witnesses, including experts who could have testified about Haitian law or business practices. Instead, DOJ argued that the “overwhelming” evidence against both defendants was so strong that there was no prejudice based on the deficient performance of Baptiste’s counsel, and even if there was that prejudice did not extend to Boncy, whose counsel was competent. Writing for the First Circuit panel, the Honorable O. Rogeriee Thompson disagreed and held that the focus of Fifth and Sixth Amendment rights to due process and counsel is on the fundamental fairness of the proceeding, which clearly was undermined for both defendants based on the deficient performance of one defendant’s counsel. Both cases have been remanded to the district court and a joint retrial is currently set for July 2022.

2021 FCPA-RELATED LEGISLATIVE AND POLICY DEVELOPMENTS

In addition to the enforcement developments covered above, 2021 saw numerous important developments in FCPA-related legislative and policy areas.

Congress Strengthens SEC Disgorgement Authority

On January 1, 2021, Congress passed the National Defense Authorization Act (“NDAA”) for the 60th consecutive year, overriding a presidential veto from then-President Trump. Included within the nearly 1,500 pages of omnibus legislation, at Section 6501, is an expansion of the SEC’s statutory authority to seek disgorgement. These revisions are clearly a response to recent Supreme Court decisions in Kokesh v. SEC and Liu v. SEC, both of which narrowed the scope of the SEC’s disgorgement power, which (as our readership knows) is a critical driver of the SEC’s ability to penalize corporate and individual misconduct, including in FCPA cases. The Section 6501 changes explicitly authorize the SEC to seek disgorgement in cases filed in federal court, eliminating any residual doubt after Liu. They also extend the statute of limitations from five years to ten years for SEC enforcement actions based on scienter-based claims, a change which applies to both pending cases and enforcement actions initiated after the passage of the NDAA. For further details regarding the impact of Section 6501, please consult our separate Client Alert “Congress Buries Expansion of SEC Disgorgement Authority in Annual Defense Budget.”

Congress Passes Comprehensive Anti-Money Laundering Legislation

The NDAA also included the Anti-Money Laundering Act of 2020 (“AMLA”), which enacted the most consequential set of anti-money laundering reforms since the passage of the USA PATRIOT Act in 2001. As our readership knows, U.S. enforcers increasingly use the money laundering laws to prosecute and pursue proceeds of corruption passed through the U.S. financial system. The AMLA strengthens the government’s ability to investigate and prosecute corruption-related money laundering. Specifically, to limit the practice of using shell companies to launder ill-gotten gains, the AMLA implemented beneficial ownership reporting requirements for certain U.S. entities and foreign entities registered to do business in the United States and tasked the Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) with maintaining a beneficial ownership registry of such reported information, which will be available for use by law enforcement agencies. Other changes made by the AMLA include enhancing the government’s ability to investigate money laundering, including by expanding DOJ’s authority to subpoena foreign banks with U.S.-based correspondent banking accounts. For a detailed summary of the most significant changes enacted by the AMLA, please see our separate Client Alert, “The Top 10 Takeaways for Financial Institutions from the Anti-Money Laundering Act of 2020.”

FinCEN Identifies Corruption as a Key National Priority

On June 30, 2021, FinCEN announced its first set of government-wide anti-money laundering and countering the financing of terrorism priorities, which will be updated every four years pursuant to the AMLA. FinCEN developed these priorities in consultation with federal and state regulators, law enforcement, and national security agencies. In its announcement, FinCEN explained that these priorities were meant to identify and describe the most significant money laundering and terrorist financing threats currently facing the United States to both signal FinCEN’s upcoming regulatory priorities and to provide guidance to covered institutions in developing and updating their compliance programs. Although FinCEN’s announcement stated that the priorities were listed in no particular order, it bears noting that corruption was the first priority listed. Consistent with other statements by the U.S. government in 2021, as reported herein, FinCEN identified anti-corruption as “a core national security interest of the United States,” in which anti-money laundering regulation and enforcement plays a crucial role.

New IRS Treatment of FCPA Disgorgement Payments

The U.S. Internal Revenue Service (“IRS”) has long prohibited tax deductions for fines or penalties paid to the government for unlawful conduct, including violations of the FCPA. But a question has arisen over the years as to whether disgorgement and forfeiture constitute a fine or penalty such that it is non-deductible. As covered in our 2017 Year-End FCPA Update, the IRS answered that question in the affirmative, issuing an advice memorandum opining that consistent with the Supreme Court’s decision in Kokesh v. SEC, disgorgement is equivalent to a penalty. The December 2017 Tax Cuts and Jobs Act, however, revised the Internal Revenue Code to make an exception for amounts paid to the government for restitution, remediation, or to come into compliance with the law. In January 2021, the IRS issued a finalized rule in response to this law, which sets out a multi-factored inquiry to determine whether an amount paid in disgorgement or forfeiture is deductible as restitution or remediation. The requirements are quite stringent and generally inconsistent with DOJ / SEC practice in FCPA resolutions, including a requirement that the payments must be made directly to victims rather than to the U.S. Treasury, potentially continuing to limit the ability of companies to deduct amounts paid as disgorgement or forfeiture in an FCPA enforcement action.

2021 FCPA-RELATED PRIVATE CIVIL LITIGATION

Although the FCPA does not provide for a private right of action, civil litigants have pursued a variety of causes of action in connection with FCPA-related conduct, with varying degrees of success. A selection of matters with material developments in 2021 follows.

Shareholder Lawsuits / Class Actions

- MTS – As covered in our 2019 Year-End FCPA Update, Russian telecommunications company and U.S. issuer Mobile TeleSystems PJSC (“MTS”) reached an $850 million joint FCPA resolution with the SEC and DOJ to resolve allegations of corrupt payments to the daughter of the late Uzbek president, to facilitate access to the telecommunications market in Uzbekistan. Shortly after the announcement of this settlement, a class action suit was filed against MTS and several individual defendants in the U.S. District Court for the Eastern District of New York, alleging that MTS issued false and misleading statements about the company’s inability to predict the outcome of the U.S. government’s investigations into its Uzbekistan operations, the effectiveness of the company’s internal controls and compliance systems, and its level of cooperation with U.S. regulatory agencies. On March 1, 2021, the Honorable Ann M. Donnelly dismissed the lawsuit, finding that the plaintiffs did not demonstrate that the challenged statements were false or misleading, that MTS could not have predicted the outcome of the investigation, and that its disclosures about the existence of the investigation were not insufficient. Plaintiffs have appealed the dismissal to the Second Circuit Court of Appeals, and the case is currently set for argument in March 2022.

- VEON – We covered in our 2016 Mid-Year FCPA Update an FCPA resolution by then-VimpelCom Ltd. (now VEON Ltd.) in connection with the same Uzbek fact pattern described above for MTS. VEON also found itself faced with a putative class action arising from alleged material omissions in securities filings relating to the adequacy of its internal controls, which also was dismissed in 2021. Specifically, on March 11, the Honorable Andrew L. Carter of the U.S. District Court for the Southern District of New York granted VEON’s motion to dismiss finding that the plaintiffs failed to establish that the company omitted material facts that it had a duty to disclose. This mooted the case as to lead plaintiffs, but the Court reopened the lead plaintiff appointment process, which remains ongoing.

- IFF – In 2018, following an acquisition of Israel-based Frutarom Industries Ltd, International Flavors & Fragrances, Inc. (“IFF”) disclosed that during the integration process it learned that pre-acquisition Frutarom executives had made improper payments in Russia and Ukraine, and that IFF had disclosed the matter to DOJ. Shareholders brought suit against IFF, Frutarom, and certain executives, claiming they lost millions of dollars when the news became public and IFF’s share price dropped. On March 30, 2021, the Honorable Naomi Reice Buchwald of the U.S. District Court for the Southern District of New York dismissed the lawsuit, explaining that the investors failed to show how they were misled by IFF, failed to allege improper conduct during the putative class period, and failed even to adequately allege how the payments by the Israeli company Frutarom violated U.S. law. The plaintiff shareholders have appealed aspects of the decision to the Second Circuit, with oral arguments scheduled for February 2022.

- 500.com – In 2020, shareholders brought suit against Chinese online gaming company and U.S. issuer 500.com Ltd., alleging that company executives made improper payments to Japanese government officials to secure a lucrative gaming license, and then made misrepresentations concerning the same in the company’s public filings, including filings containing the text of its code of conduct. On September 20, 2021, the Honorable Gary R. Brown of the U.S. District Court for the Eastern District of New York granted 500.com’s motion to dismiss, adopting the report and recommendation of Magistrate Judge A. Kathleen Tomlinson. The two decisions together note that only in rare circumstances have courts permitted statements in a code of conduct to survive motions to dismiss and in those rare cases, the statements were made in response to inquiries or challenges to the company’s conduct rather than general, aspirational statements about how the company expects its employees to act. Regarding the alleged misstatements or omissions unrelated to the code of conduct, Judge Tomlinson found that the plaintiff failed to allege scienter adequately and that 500.com was not obligated to disclose uncharged wrongdoing.

- OSI – As reported in our 2019 Year-End FCPA Update, OSI Systems, Inc. succeeded in dismissing a putative class action lawsuit that arose from a short-seller’s report relating to alleged corruption in connection with an Albanian scanning contract (the underlying conduct of which was declined for prosecution by DOJ and the SEC), but plaintiffs were given leave to amend. Amend they did, and on October 22, 2021, OSI agreed to a $12.5 million settlement to resolve the matter. The October 2021 settlement agreement has received preliminary approval from the Honorable Fernando M. Olguin of the U.S. District Court for the Central District of California, and a final fairness hearing is scheduled for May 2022.

- Cognizant – Another FCPA enforcement case we covered in our 2019 Year End FCPA Update that wound its way towards a private civil resolution in 2021 concerns Cognizant Technology Solutions Corporation. Following an SEC FCPA resolution and DOJ declination with disgorgement arising from an alleged bribery scheme in India, a putative class of investors sued Cognizant in the U.S. District Court for the District of New Jersey. On September 7, 2021, Cognizant reached an agreement-in-principle to a $95 million settlement of the matter, which was approved by the Honorable Esther Salas on December 20, 2021.

Civil Fraud / RICO Actions

- Samsung – We covered in our 2019 Year-End FCPA Update a DOJ FCPA resolution reached by Samsung Heavy Industries Co., Ltd. arising from alleged corruption of Petrobras officials in the “Operation Car Wash” investigation. Also in 2019, Petrobras’s U.S. subsidiary filed a RICO / common-law fraud complaint against Samsung in Texas state court, which Samsung removed to federal district court and moved to dismiss. In June 2020, the district court dismissed the complaint on statute-of-limitation grounds, but on August 11, 2021 the U.S. Court of Appeals for the Fifth Circuit revived the case, finding that when Petrobras learned (or should have learned) of the corruption allegations such as to begin the clock was a dispute of fact and that Samsung had not conclusively established that Petrobras’s claims accrued before Petrobras filed its complaint. Following the Fifth Circuit’s remand, the case is now back before the Honorable Lee H. Rosenthal of the U.S. District Court for the Southern District of Texas.

- Ericsson – In an unfiled (but still quite noteworthy) action, on May 12, 2021 Telefonaktiebolaget LM Ericsson announced that it had reach an agreement to pay competitor Nokia Corporation $97 million to settle potential damages claims arising from the events that were the subject of Ericsson’s FCPA 2019 resolution with DOJ and the SEC. That resolution, covered in our 2019 Year-End FCPA Update, resulted in more than $1 billion in fines for alleged FCPA violations in China, Djibouti, Indonesia, Kuwait, Saudi Arabia, and Vietnam. There are no public details about Nokia’s claims, but it would seem that the case was predicated on Nokia losing out on competitive bids due to Ericsson’s alleged corruption.

Whistleblower Actions

- Western Digital – On June 25, 2021, Chief Judge Richard Seeborg of the U.S. District Court for the Northern District of California granted Western Digital Corp.’s motion to dismiss a bribery-related whistleblower lawsuit for lack of jurisdiction and failure to state a claim. The lawsuit was brought by a Brazilian citizen formerly employed by Western Digital’s Brazilian subsidiary, who alleged that he was terminated in retaliation for raising bribery and tax fraud concerns in violation of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”). In dismissing the case, the Court held that Dodd-Frank’s anti-retaliation provision does not apply to overseas conduct. Moreover, the Court held that, even if the claim alleged domestic wrongdoing, the former employee “failed to allege sufficient facts to give rise to a plausible inference that he suffered adverse employment actions in retaliation for whistleblowing” given the length of time between his report and his termination and the fact that he caused the company to be victimized by a phishing scam close in time to his firing.

2021 INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

Multilateral Development Banks

U.S. Federal Court Reinforces World Bank Sovereign Immunity

In our 2016 Year-End FCPA Update, we discussed the landmark Canadian Supreme Court decision in World Bank Group v. Wallace, which concluded that the Bank had not waived its privileges and immunities by providing evidence gathered in a Bank investigation to national law enforcement authorities. On April 5, 2021, Chief Judge Beryl A. Howell of the U.S. District Court for the District of Columbia reached a similar conclusion in a lawsuit filed by businessmen Noah J. Rosenkrantz and Christopher Thibedeau against the Inter-American Development Bank (“IDB”) asserting that the internal sanctions proceedings against their company failed to comply with the sanctions procedures governing such procedures, in violation of its contractual obligations. In dismissing the lawsuit, the Court held that the IDB is immune from suit in U.S. federal court as a sovereign entity and emphasized, like the Canadian court in Wallace, that a contrary ruling would undermine the Bank’s ability to carry out its mission. The plaintiffs have appealed the dismissal to the U.S. Court of Appeals for the District of Columbia Circuit.

Europe

United Kingdom

WGPSN (Holdings)

On March 16, 2021, Scotland’s Crown Office and Procurator Fiscal Service announced that WGPSN, a subsidiary of John Wood Group PLC, agreed to pay £6.46 million to Scotland’s Civil Recovery Unit to resolve allegations that PSNA Limited, a company WGPSN had acquired, benefitted from improper payments to secure contracts in Kazakhstan. These payments were allegedly made between 2012 and 2015, all prior to WGPSN’s acquisition, and when discovered by WGPSN were voluntarily reported to Scottish authorities.

GPT Special Project Management Ltd.

On April 28, 2021, the UK Serious Fraud Office (“SFO”) announced that Airbus subsidiary GPT Special Project Management pleaded guilty to corruption in violation of section 1 of the Prevention of Corruption Act 1906 and was ordered to pay a confiscation order of £20,603,000, a fine of £7,521,920, and costs of £2,200,000. The charges arise from alleged improper payments involving the Saudi Arabian National Guard. In setting the penalty, Justice Bryan at Southwark Crown Court considered GPT’s guilty plea, the fact that it no longer is in operation, the company’s cooperation with the SFO’s investigation, and the UK government’s role in facilitating the conduct. Also relevant was the fact that parent company Airbus entered into a $3.9 billion deferred prosecution agreement in January 2020 (as covered in our 2020 Mid-Year FCPA Update).

Amec Foster Wheeler Energy Ltd.

As covered above, on June 25, 2021 Amec Foster Wheeler reached a coordinated anti-corruption resolution with UK, U.S., and Brazilian authorities. The U.S. and Brazilian cases related to only to Brazil, while the UK case brought by the SFO is broader and covers alleged corrupt payments between 1996 and 2014 in India, Nigeria, Saudi Arabia, and Malaysia, as well as Brazil. Pursuant to a three-year deferred prosecution agreement approved by Lord Justice Edis, sitting at the Royal Courts of Justice, Amec Foster Wheeler agreed to pay £103 million in connection with a 10-count indictment, including nine counts of violating Section 1 of the Criminal Law Act 1977 and Section 1 of the Prevention of Corruption Act 1906 and one count of failure to prevent bribery under Section 7 of the Bribery Act 2010.

Petrofac Ltd.

On October 1, 2021, the SFO secured the conviction of Petrofac for seven separate counts of failure to prevent bribery between 2011 and 2017. Petrofac admitted to failing to prevent former senior executives of the group’s subsidiaries from using agents to pay bribes of £32 million to win oil contracts in Iraq, Saudi Arabia, and the United Arab Emirates worth approximately £2.6 billion. Petrofac will pay a confiscation order of £22.8 million; a fine of approximately £47.2 million; and the SFO’s investigation costs of £7 million. On the same day, Petrofac’s former Global Head of Sales David Lufkin was sentenced to a two-year custodial sentence, suspended for 18 months, as a result of his January 14, 2021, guilty plea admitting to three individual counts of bribery related to corrupt offers and payments made between 2012 and 2018 to influence the award of contracts to Petrofac in the United Arab Emirates. Lufkin had previously pleaded guilty in February 2019 to 11 counts of bribery already brought by the SFO (as discussed in our 2019 Year-End FCPA Update).

Unaoil Individual Prosecutions

On February 24, 2021, the SFO secured the conviction of former SBM Offshore executive Paul Bond arising out of his role in allegedly conspiring to bribe public officials to secure oil contracts from Iraq’s South Oil Company in the years following the overthrow of Saddam Hussain in 2003. A jury found the former senior sales manager guilty on two counts of conspiracy to give corrupt payments following a retrial of his case. On March 1, 2021, Bond was sentenced to three-and-a-half years in prison, making him the fourth individual to be sentenced in the case involving Iraq’s South Oil Company, which forms part of the SFO’s broader investigation into bribery at Unaoil. As covered in our 2020 Year-End FCPA Update, Bond’s three co-defendants have been sentenced to a collective total of 11 years and four months in prison.

On June 17, 2021, the SFO secured an approximately £402,000 confiscation order by consent against former Unaoil executive Basil Al Jarah. And on November 3, 2021, Stephen Whiteley, former Vice President at SBM Offshore and Unaoil’s territory manager for Iraq, was ordered to repay criminal gains of £100,000.

In a judgement handed down on December 10, 2021, the UK Court of Appeal quashed the conviction of Ziad Akle, another Unaoil executive who was convicted in 2020 of conspiracy to give corrupt payments as covered in our 2020 Year-End FCPA Update. The Court criticized the SFO for its contact with a U.S.-based “fixer” who had offered to assist in obtaining the convictions of related parties. The Court also found that the SFO had failed to disclose material relating to that contact, which was necessary for the defense to properly bring its case. The Court refused an application for a retrial on the grounds of the SFO’s misconduct. The UK Attorney General has since announced an independent review into the matter. Bond has appealed his conviction on the same grounds as Akle.

SFO Deferred Prosecution Agreements with Two Unidentified Companies

On July 19, 2021, the SFO entered into separate deferred prosecution agreements with two UK-based companies for bribery offenses. The SFO did not identify the companies because the investigations are ongoing, but confirmed that the criminal conduct saw bribes paid in relation to multi-million pound UK contracts. The two companies will pay more than £2.5 million between them, representing disgorgement of profits along with a financial penalty, and the SFO acknowledged that both companies fully cooperated. We will report back on these agreements when the companies names are made public.

France

A bill to strengthen the fight against corruption in France was registered at the French National Assembly on October 19, 2021. The bill outlines several proposals concerning the French Anti-Corruption Agency (“AFA”), the extension of anti-corruption obligations of public and private actors, the regulation of lobbying, and negotiated justice. Among other things, the bill would extend anti-corruption obligations to subsidiaries of large foreign organizations. The text also would make companies and public entities (other than the French State) criminally liable if a lack of supervision led to the commission of one or more offenses by an employee.

Italy

After more than three years of proceedings, in March 2021 an Italian court acquitted oil companies Royal Dutch Shell and Eni SpA, as well as a number of individuals, including the Eni CEO, of charges that they paid more than $1 billion to acquire the license to an offshore block in Nigeria. Prosecutors alleged that the money was intended as bribes, while the companies successfully defended with evidence that the payment was legitimate and intended to resolve long-running disputes as to the block’s ownership.

Kyrgyzstan

On May 31, 2021, Kyrgyzstan’s State Committee for National Security announced the arrest of former Prime Minister Omurbek Babanov as part of an investigation into corruption involving a gold mine project in Kumtor. The project was operated by Canadian company Centerra Gold until the Kyrgyz government took it over, citing a new law allowing it to take control of a project for up to three months due to environmental or safety violations. The Kumtor mine accounts for more than 12% of the national economy, according to Centerra, which has denounced the Kyrgyz government’s seizure.

Norway

In our 2015 Year-End FCPA Update, we reported that several senior level officers of Norwegian fertilizer manufacturer Yara International ASA were sentenced to prison in Norway for their role in an alleged scheme to pay bribes to government officials in India, Libya, and Russia. The former chief legal officer in particular, U.S. citizen Kendrick Wallace, received a two-and-a-half year prison sentence for his role. In 2017 the Norwegian appeals court upheld Wallace’s conviction and revised his sentence to seven years, finding that his conduct had been “very central” to the alleged scheme.

Norway subsequently submitted a request for extradition of Wallace. On June 11, 2021, the Honorable Sean P. Flynn, Magistrate Judge of the U.S. District Court for the Middle District of Florida, denied the request. The Court found that “Wallace cannot be extradited because the prosecution for the offense of which extradition is sought has become barred by lapse of time according to the laws of the United States.” Specifically, the Court found that while Wallace’s crimes were committed in 2007, he was indicted in 2014, exceeding the applicable five-year statute of limitations in the United States. The DOJ provided evidence that Norway sought evidence pursuant to Mutual Legal Assistance Treaty requests—which would toll the statute of limitations in the United States pursuant to 18 U.S.C. § 3292—but the Court found the specific evidentiary showing lacking, and ordered Wallace’s release from custody.

Russia

The Russian Federation Prosecutor General’s office reported nearly 30,000 corruption-related crimes in the first nine months of 2021, a 12.7% increase as compared to the same period a year ago, with bribery accounting for more than half of all corruption-related offenses. The reported damage caused by corruption-related crimes also increased from 45 billion rubles (approximately $612 million) to 53 billion rubles (approximately $719 million). In 2020, the number of corruption-related convictions of Russian officials was at an eight-year low of just under 7,000, continuous decline from a high of approximately 11,500 in 2015, but the number of convictions stemming from large-scale bribes, defined as greater than one million rubles (approximately $13,700), has increased 12-fold since 2012.

On the legislative front, on October 1, 2021, the Russian Duma approved the National Plan For Countering Corruption through 2024. This plan prioritizes prohibiting anyone who has been fined for corrupt activities from holding government positions, improving the procedures for the submission and auditing of government employees’ asset declarations, implementing technology to combat corruption, instituting anti-corruption regulations involving the purchase of goods and services for government/municipal use, monitoring international agreements for cooperation in fighting corruption, and employing Duma deputies to participate in an inter-parliamentary organization aimed at preventing corruption.

And on the judicial front, on June 9, 2021, a Moscow court issued a decision classifying activist Alexei Navalny’s political organization, the Anti-Corruption Foundation (“ACF”), as an “extremist” movement. Under the applicable “anti-extremism” law, authorities can jail ACF members and freeze their assets, and those associated with the group cannot run for public office. On August 10, 2021, Russia’s financial watchdog—the Federal Financial Monitoring Service—also added ACF to its blacklist of groups accused of extremist activities or terrorism, which freezes the organization’s bank account and prevents ACF from opening new accounts.

Sweden

In our 2019 Year-End FCPA Update, we covered the trial acquittal in Sweden of three former Telia executives—former CEO Lars Nyberg, former deputy CEO and head of Eurasia unit Tero Kivisaari, and former general counsel for the Eurasia unit Olli Tuohimaa—on charges of bribing Uzbek’s then-first daughter Gulnara Karimova in exchange for telecommunications contracts in Uzbekistan. In February 2021, a Swedish appeals court upheld the acquittals, agreeing that Karimova, the daughter of Uzbekistan’s former president, was not a government official under Swedish law.

Switzerland

In January 2021, a Swiss court convicted Beny Steinmetz of 2019 charges (discussed in our 2019 Year-End FCPA Update) of paying bribes to the wife of former-Guinean President Lansana Conté and of related forgery to obtain a mining concession. He was sentenced to five years in prison and ordered to pay a CHF 50 million fine (~ $56.5 million).

In November 2021, three Swiss subsidiaries of Netherlands-based SBM Offshore were ordered to pay more than CHF 7 million (~ $7.6 million) for failing to prevent the bribery of public officials in Angola, Equatorial Guinea, and Nigeria between 2006 and 2012. The Office of the Attorney General of Switzerland found that these companies had entered into sham contracts with shell companies to pay more than $22 million in bribes. The Office of the Attorney General alleged that in light of the “extent and duration of the acts of corruption,” the companies’ risk assessment measures and anti-corruption controls were allegedly “either non-existent, or wholly inadequate.” This order is in addition to the more than $800 million that SBM Offshore has already paid to resolve corruption probes dating back to its 2017 FCPA resolutions reported in our 2017 Year-End FCPA Update.

Ukraine

Ukrainian President Zelensky’s focus in the first half of 2021 was on securing the release of the remainder of a $5-billion IMF loan to bolster Ukraine’s economy. After a six-week virtual mission to Ukraine in the beginning of 2021, the IMF refused to release the funds in what some viewed as an indication that Ukraine had not met the IMF’s expectations for tackling corruption. Following this refusal, in June 2021, Ukraine’s parliament, the Verkhovna Rada, passed two bills: the first reestablished the High Judicial Council, a special commission on appointing judges that will be majority-comprised of international experts; and pursuant to the second bill, public officials who fail to submit or submit false income or asset declarations could face prison sentences. Additionally, on November 8, 2021, President Zelensky signed into law amendments to legislation that provide for the independence of the anti-corruption bureau (“NABU”). Subsequently, on November 22, 2021, following a review by its Executive Board, the IMF announced that Ukrainian authorities would be allowed to draw on an additional $699 million.

The Americas

Brazil

In February 2021, President Bolsonaro disbanded Operation Car Wash, one of the most prolific anti-corruption investigations of all time and a staple of these updates for years. Operation Car Wash led to dozens of convictions, many prominent enforcement actions, and hundreds of millions of dollars in penalties within Brazil and billions of dollars globally. Still, the ripples of Operation Car Wash continued throughout the year. For example, on February 22, 2021, Korean engineering company Samsung Heavy Industries Co., Ltd. entered into a leniency agreement in Brazil to resolve allegations concerning contracts with Petróleo Brasileiro S.A. (Petrobras). Samsung Heavy Industries, as covered in our 2019 Year-End FCPA Update, previously in November 2019 entered into a deferred prosecution agreement with DOJ and agreed to pay a $75.5 million criminal fine to resolve FCPA anti-bribery conspiracy charges arising from the company’s alleged provision of $20 million to an intermediary, while knowing that some or all of that amount would be paid to officials at Petrobras. Half of the U.S. criminal fine was to be credited to a parallel resolution with Brazilian authorities. In connection with the Brazilian leniency agreement, Samsung Heavy Industries agreed to pay approximately R$ 706 million in damages to Petrobras together with R$ 106 million in fines. And on April 15, 2021, Brazil’s Supreme Court upheld a ruling annulling one of the most notable convictions resulting from Operation Car Wash—that of former President Luiz Inácio Lula da Silva, on grounds that the lower court in which Lula was tried did not have jurisdiction. The case was transferred to a federal court for retrial and, should no conviction follow, Lula will be able to run for presidential office in the upcoming 2022 election.

In August 2021, Brazil’s Federal Prosecution Service (“MPF”) filed a criminal complaint against two executives at French engineering company Doris Group over allegedly corrupt activity concerning platform vessel contracts totaling more than $200 million. The MPF also charged a former treasurer of Brazil’s Workers’ Party and two associates for active and passive money laundering. The executives allegedly paid bribes via a financial operator to a former manager of Petrobras and the former treasurer. The financial operator and Petrobras manager both signed collaboration agreements with the MPF in which they confessed to their roles in the scheme and cooperated by providing relevant documents and information.

In September 2021, a review body within the São Paulo prosecutor’s office vacated a resolution prosecutors reached with EcoRodovias in 2020. The now-nullified agreement was the culmination of a two-year bribery investigation into EcoRodovias and its subsidiaries concerning allegations that the companies engaged in a cartel that bribed public officials to obtain road concessions contracts between 1998 and 2015. In signing the 2020 agreement, EcoRodovias admitted to paying bribes and agreed to pay a fine of $113.72 million. The review body threw out the agreement due to a lack of evidence of illegal conduct.

And on October 27, 2021, Rolls Royce signed an agreement with Brazil’s Office of the Comptroller and Attorney General’s Office to pay $27.8 million to settle allegations that it bribed Brazilian public officials in connection with its contracts with Petrobras. As covered in our 2017 Mid-Year FCPA Update, the company in 2017 previously agreed to pay more than $800 million through a global resolution with the SFO, DOJ, and MPF. Under the new agreement, Brazilian officials will credit the $25.6 million that Rolls Royce paid to the MPF, leaving the company to pay another $2.2 million.

Canada

As reported in our 2019 Year-End FCPA Update, in September 2018 Canada passed legislation allowing deferred prosecution agreements for corporate offenders. In 2019, following a long-running investigation into alleged bribery of Libyan officials, engineering and construction giant SNC-Lavalin became one of the first major companies to seek such an agreement. Canadian prosecutors, however, reportedly were unwilling to negotiate with the company, and in 2021, prosecutors charged the company with several offenses, including fraud against the government. The Royal Canadian Mounted Police also arrested two former executives and charged them with fraud and forgery offenses tied to the investigation. The company has publicly stated that it is cooperating with the investigation and that prosecutors have invited it to negotiate a settlement. According to SNC-Lavalin, it is the first company to receive such an offer.

In August 2021, the Court of Appeal for Ontario threw out the bribery convictions of two former employees of Cryptometrics. As discussed in our 2019 Year-End FCPA Update, following trial in 2018, U.S. citizen Robert Barra and UK citizen Shailesh Govindia were sentenced to two-and-a-half years in prison for agreeing to bribe Indian aviation officials, including employees of Air India. But the appellate court found a “reasonable possibility” that prosecutors delayed disclosing emails they exchanged with a principal witness—the former Cryptometrics COO—and that such delay unduly impacted the trial’s fairness. The appellate court further found that the prosecution’s slow production of potentially exculpatory information, only after repeated requests from the defense, deprived the defense of the opportunity to conduct further lines of inquiry or obtain additional evidence.

Costa Rica