2021 Year-End Securities Enforcement Update

Client Alert | January 19, 2022

I. Introduction: Themes and Notable Developments

A. A New Administration Leverages a Traditional Playbook

With the confirmation of Chair Gary Gensler in April and the appointment of Enforcement Division Director Gurbir Grewal in June, the latter half of 2021 provided greater insight into the ways in which heightened enforcement under this Administration will impact market participants and the implications for clients going forward. In speeches in the latter half of 2021, Director Grewal and Chair Gensler outlined their enforcement priorities. While many of their themes echo the messages of prior Democratic administrations, certain points this Commission has chosen to emphasize could have outsized impact on public companies, SEC-registered firms and their executives and outside professionals.

- Remedies – Director Grewal expressed the intention to escalate the sanctions the Commission would demand in both negotiated resolutions and litigated enforcement actions. While the remedies are not new, the focus on expanding the magnitude and frequency of sanctions reflects not just desire to increase the amount of particular sanctions, but also the breadth of parties and circumstances that would trigger a demand for certain sanctions.

- Penalties – Picking up on a theme articulated by then-Acting Chair Caroline Crenshaw earlier this year (and discussed in our Mid-Year Alert [link: https://www.gibsondunn.com/2021-mid-year-securities-enforcement-update/]), Director Grewal warned of the likelihood of increased penalties generally, and in particular, in circumstances where, in the Commission’s view, penalties have been insufficient to deter perceived misconduct based in part on previous enforcement actions against other actors in the same industry. Director Grewal was particularly pointed on the diminished relevance of prior settlements when negotiating current settlements. As Director Grewal bluntly stated, “You should not expect comparable cases to be the beginning and end of our analysis.”[1]

- Bars – Director Grewal has also signaled an intention to pursue officer and director bars, including in cases in which an individual defendant was not an officer or director of a public company. As Grewal explained, in determining whether to recommend pursuing a bar, the Enforcement Division would consider whether the individual is simply “likely to have an opportunity to become an officer and director of a public company in the future.”[2] In at least one recent example, in a litigated enforcement case, the Commission is seeking officer and director bars against individuals who are, according to the complaint, not employed by public companies.[3]

- Admissions – In Director Grewal’s words, “When it comes to accountability, few things rival the magnitude of wrongdoers admitting that they broke the law. . . . Admissions, given their attention-getting nature, also serve as a clarion call to other market participants to stamp out and self-report the misconduct to the extent it is occurring in their firm.”[4] Not long after that speech, the Commission announced a settled enforcement action that contained admissions to regulatory recordkeeping violations.[5] Notably, violation of such regulatory provisions does not give rise to private rights of action. It will remain to be seen to what extent the Commission seeks admissions in other circumstances.

- Recidivism – Director Grewal emphasized that “recidivism” would be a potentially significant factor in the assessment of appropriate resolutions. In Grewal’s words, “When a firm repeatedly violates our laws or rules, they should expect to be penalized more harshly than a first-time offender might be for the same conduct.”[6] As discussed below, this position raises significant concerns about the applicability of the term “recidivist” in the context of securities enforcement.

- Gatekeepers – In separate speeches, both Chair Gensler and Director Grewal emphasized a focus on gatekeepers – lawyers, auditors, accountants, bankers and investment advisers – who play a variety of roles in the securities industry, capital markets, and public company financial reporting and disclosure. As Chair Gensler articulated his perspective in a message to such gatekeepers, “You occupy positions of trust. Though you represent your clients, you also have an important role in upholding the law, which protects investors and our markets. You can often be the first lines of defense. That’s particularly true when a client is getting close to crossing the line.”[7] Director Grewal made a similar point in separate remarks, “Encouraging your clients to play in the grey areas or walk right up to the line creates significant risk. It’s when companies start testing those lines that problems emerge and rules are broken. . . . That’s why gatekeepers will remain a significant focus for the Enforcement Division, as evidenced by some of our recent actions.”[8]

Our Take – It is not surprising that the Enforcement Division under this Administration would emphasize seeking greater sanctions, particularly penalties, in enforcement actions. Perhaps notable is that this Administration has not articulated new remedies, just more of the existing ones without any guiding principles. The lack of transparency regarding when admissions will be demanded, whether voluntary disclosure or cooperation will impact that determination, or even why admissions are needed, is notable. An absence of guidelines may very well lead to a lack of consistency. It remains to be seen whether the Enforcement Division is able to execute on such vision if the demand for such sanctions also results in an increase in the Commission’s litigation caseload. While remedies such as penalties can often be negotiated to a resolution, other remedies, such as bars and admissions, can be far more consequential for individuals and entities. As a result, an effort to flex a regulatory muscle by demanding greater remedies may ultimately run up against a resource constraint on the ability to litigate cases.

Arguably of greater potential impact is the emphasis on conceptual themes, such as recidivism and gatekeepers. The concept of recidivism, for example, can easily be misapplied in the regulatory context. In any large, diversified enterprise with thousands of employees engaged in a highly regulated business, it is almost inevitable that over time a number of securities law violations will occur, often comprised of unintentional mistakes. Violations can arise for an unlimited number of different reasons, including individual misconduct, growth and diversification of the business, prevailing industry practice, emerging risks, acquisitions, and evolving regulatory interpretations and standards of enforcement. Trying to apply a label such as “recidivist” in this context can not only be inappropriate, but also leave parties exposed to the rhetorical judgments of regulators as to what constitutes recidivism.

Similarly, defining a wide range of professionals as “gatekeepers” and then cautioning them on the risks of advising clients acting in the “grey areas” suggests a vision of advisers (lawyers, accountants, financial advisers) that is inconsistent with their roles. Many areas of the law are grey, especially those subject to agency discretion and interpretation, and it is precisely in the grey areas that clients should be reaching out to their advisers and most need advice. The Commission has long articulated a position of not pursuing enforcement actions against professional advisers, particularly counsel, on the basis of advice, but rather only for participation in misconduct that rises to the level of a direct or secondary violation. One hopes that the recent rhetoric about the focus on gatekeepers does not signal a departure from decades of Commission practice in this area.

B. A Look at – and Behind – the Numbers

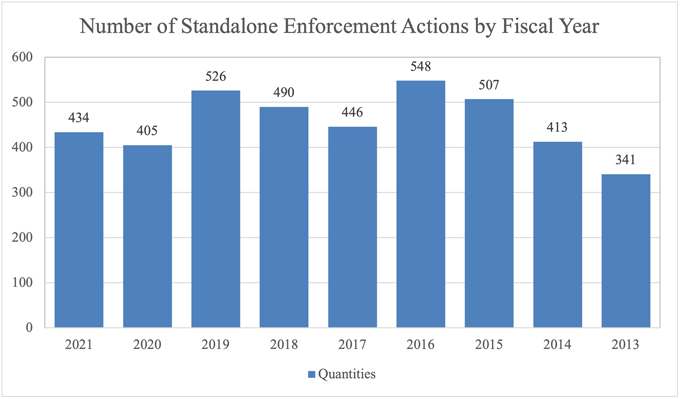

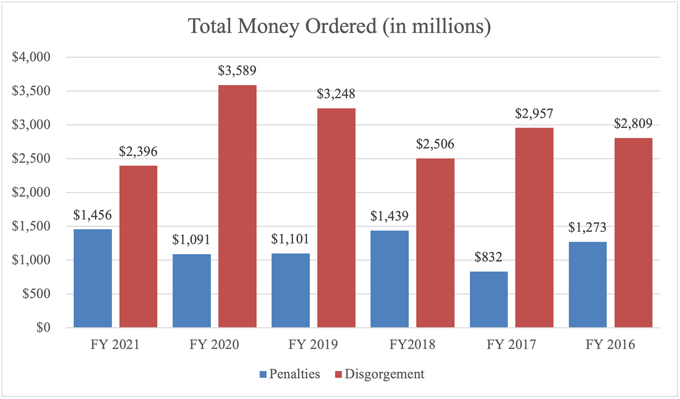

The enforcement statistics for fiscal 2021 reflected a 7% year-over-year increase in standalone actions, from 405 in 2020 to 434 in 2021. However, to put this number in perspective, 2020 saw a substantial decrease in enforcement actions due to the pandemic. Thus, the 434 standalone enforcement actions for fiscal 2021 represented a decline of more than 17% from the 526 enforcement actions in 2019. The distribution of actions was consistent with prior years, with the majority of cases involving broker-dealers and investment advisers, securities offerings, and public company financial reporting. Financial remedies ordered in fiscal 2021 represented an increase in penalties (from $1.09 billion in 2020 to $1.46 billion in 2021), but a decrease in disgorgement ordered (from $3.59 billion in 2020 to $2.40 in 2021).[9]

One must always exercise caution when drawing conclusions about enforcement trends from such metrics, particularly in light of the pandemic and in a year of transition in administrations. In particular, given the close of the fiscal year on September 30 and the extended pipeline through which enforcement actions ultimately receive formal approval, the impact of this administration on metrics such as the number of cases and size of financial remedies are more likely to be measurable in future years. With that in mind, below are graphical representations of the metrics over recent years.

C. SPACs

The SEC continued its focus on Special Purpose Acquisition Companies (“SPACs”) in the second half of 2021. Multiple enforcement actions came on the heels of pronouncements by senior SEC officials earlier last year concerning the risks posed by the explosion of SPAC initial public offerings, including a potential misalignment of interests and incentives between SPAC sponsors and shareholders. For example, in July, the SEC announced a partially settled enforcement action against a SPAC, the SPAC sponsor, and the CEO of the SPAC, as well as the proposed merger target and the former CEO of the target for misstatements in a registration statement and amendments concerning the target’s technology and business risks.[10] Please see our prior client alert [link: https://www.gibsondunn.com/sec-fires-shot-across-the-bow-of-spacs/] on this subject for an analysis of the lessons learned from the matter.

In December, the SEC also provided an update to an action originally filed in July[11] against a publicly traded company’s founder and former CEO.[12] The Commission’s complaint filed in July alleged that the company’s former CEO encouraged investors to follow him on social media to get “accurate information” about the company “faster than anywhere else,” but, instead, he allegedly misled investors about the company’s technological advancements, products, in-house production capabilities, and commercial achievements. In its December update, the SEC announced that the company agreed to settle the action. Without admitting or denying the SEC’s findings, the company agreed to cease and desist from future violations, to certain voluntary undertakings, to pay $125 million in penalties, and to continue cooperating with the SEC’s ongoing litigation and investigation.

D. Commissioner and Senior Staffing Update

In the waning days of 2021, one of the two Republican-appointed members of the Commission, Commissioner Elad Roisman, announced that he would leave the SEC by the end of January 2022.[13] The departure will reduce the normally five-member Commission to four members until a replacement is appointed, and will leave Commissioner Hester Peirce as the lone Republican-appointed Commissioner for the time being. Commissioners Roisman and Peirce have been reliable dissenting voices at the Commission in the last year, and we would expect to see continued dissent from Commissioner Peirce notwithstanding the loss of her fellow-Republican Commissioner ally.

In the second half of 2021, Chair Gensler and Enforcement Director Grewal continued building out the senior staff of the Commission. Notable appointments included:

- In July, Daniel Kahl was appointed Acting Director of the Division of Examinations, succeeding Peter Driscoll.[14] Kahl joined the SEC in 2001 as a staff attorney, and most recently served as Deputy Director for Division of Examinations. He also served as an attorney for FINRA, the Investment Adviser Association, and the North American Securities Administrators Association.

- In August, Sanjay Wadhwa was named Deputy Director of the Division of Enforcement.[15] Wadhwa has worked for the SEC for 18 years, most recently as the Senior Associate Director of Enforcement for the New York Regional Office.

- In September, Dan Berkovitz was appointed SEC General Counsel, succeeding John Coates.[16] Berkovitz was previously a Commissioner of the Commodity Futures Trading Commission (CFTC). Mr. Berkovitz has previous experience in private practice and an extensive public service career, including as General Counsel for the CFTC, a senior staff attorney for the U.S. Senate Permanent Subcommittee on Investigations, and Deputy Assistant Secretary in the Department of Energy’s Office of Environmental Management.

- In early November, Nicole Creola Kelly was named Chief of the SEC Office of the Whistleblower.[17] Kelly is a 20-year veteran of the SEC, most recently serving as Senior Special Counsel in the Office of General Counsel. She was also previously Counsel to SEC Chair Mary Jo White and former SEC Commissioner Kara M. Stein.

- In November, Daniel Gregus was appointed Director of the Chicago Regional Office.[18] He had previously served as acting co-director of the Chicago office. Gregus has spent 28 years with the SEC in varying roles, including as Associate Director of the National Clearance and Settlement Examination Program and Associate Regional Director for the Broker-Dealer and Exchange Examination Program in the Chicago office. Prior to joining the SEC, Mr. Gregus was in private practice.

- Also in November, the SEC announced the appointment of Haoxiang Zhu as Director of Division of Trading and Markets.[19] Zhu joins the SEC from academia, most recently holding the post of Professor at the MIT Sloan School of Management. He also previously served as an academic expert for the CFTC and Bank for International Settlements. Mr. Zhu is a member of the Federal Reserve Bank of Chicago’s Working Group on financial markets.

- In December, Judge James Grimes was named the SEC’s Chief Administrative Law Judge, succeeding Brenda Murray.[20] Judge Grimes previously spent 13 years at the Department of Justice, serving as a trial attorney and senior litigation counsel in the Civil Division. He previously served with the Navy Judge Advocate General (JAG) Corps, representing service members in courts-martial and representing the government before military appellate courts.

- Also in December, William Birdthistle was appointed Director of Division of Investment Management.[21] Before joining the SEC, Mr. Birdthistle was a Professor of Law at Chicago-Kent College of Law, where his research focused on investment funds, securities regulation, and corporate governance. He also previously worked in private practice as a corporate associate for five years.

E. Whistleblower Awards

The SEC’s whistleblower program remains a significant source of incoming information for the SEC and, as has been true for many years, the significant recovery associated with whistleblower awards continues to grow. As of year-end 2021, the SEC has awarded approximately $1.2 billion to 236 individuals since issuing its first award in 2012.

In August, Chair Gensler responded to criticism regarding amendments to the whistleblower rules that were previously adopted in September 2020 and acknowledged that there were concerns regarding whether the amendments would have the effect of chilling whistleblowers from coming forward.[22] In response, Chair Gensler directed his staff to prepare potential revisions to the rules to address those concerns. Interim rules were instituted in order to ensure that whistleblowers “with claims pending” while the amended rules are being considered “are not disadvantaged.”[23] In response, Commissioners Peirce and Roisman issued a strongly worded statement disagreeing with the Commission’s action to “substantively ignore [Commission rules] while proposed amendments are formulated and considered,” calling the course of action “unwise and . . . a troubling and counterproductive precedent.”[24] As of the end of 2021, the interim rules remain in place and the Commission is moving forward with proposed revisions to the whistleblower rules.

Also in the second half of the year, the Commission announced that not all tips are good tips. In September, the SEC barred two individuals from the whistleblower award program, each of whom had filed hundreds of award applications that the SEC described as “frivolous” and did not contribute to any successful enforcement action.[25] The bars were issued pursuant to the 2020 amendments to the Whistleblower Program Rules, which were designed to allow the whistleblower program to operate more effectively and efficiently and to focus on good faith whistleblower submissions.

Significant whistleblower awards granted during the second half of this year included:

- Two awards in July, including a payment of more than $1 million to a whistleblower who provided “valuable” information and ongoing assistance, which led to an SEC enforcement action;[26] and an award of nearly $3 million to a whistleblower who alerted the SEC to previously unknown conduct and then provided “substantial” additional assistance, which led to a successful enforcement action.[27]

- Four awards in August, including awards totaling more than $4 million to four whistleblowers in two separate enforcement proceedings, each of whom were described as providing “high-quality information that made an important contribution” to the success of the underlying enforcement action;[28] awards totaling more than $3.5 million to three individuals in two separate enforcement proceedings, one of whom was awarded approximately $2 million for alerting SEC staff to an ongoing fraud, prompting the opening of an investigation;[29] awards of nearly $6 million to two whistleblowers in separate enforcement proceedings, one of whom was awarded more than $3.5 million for reporting new information that caused the SEC to expand an existing investigation into a new geographic area, while the other whistleblower was awarded more than $2.4 million for alerting the SEC to previously unknown conduct, prompting the opening of the investigation;[30] and awards totaling approximately $2.6 million to five whistleblowers in three separate enforcement proceedings who provided information, developed either from the whistleblower’s independent knowledge or the whistleblower’s independent analysis, which “substantially” contributed to a successful enforcement action.[31]

- Three awards in September—including a notable award of approximately $110 million, consisting of an approximately $40 million award in connection with an SEC case and an approximately $70 million award arising out of related actions by another agency—for providing “significant” independent analysis that “substantially advanced” the investigations.[32] This award stands as the second-highest award in the program’s history, following the over $114 million whistleblower award the SEC issued in October 2020. Additional awards in September included payments totaling approximately $11.5 million to two whistleblowers, one of whom was awarded nearly $7 million in recognition of the fact that the whistleblower was the initial source that caused the staff to open the investigation into hard-to-detect violations and thereafter provided substantial assistance, while the second whistleblower, by comparison, submitted information after the investigation was already underway and had delayed reporting for several years after becoming aware of the wrongdoing;[33] and an award of approximately $36 million to a whistleblower who provided what the SEC described as “crucial information” on an illegal scheme, which “significantly” contributed to the success of an SEC enforcement action, as well as actions by another federal agency.[34]

- Two awards in October, including awards totaling approximately $40 million to two whistleblowers, one of whom received approximately $32 million for providing information that caused the opening of the investigation and exposed difficult-to-detect violations, as well as ongoing assistance, while the other whistleblower received approximately $8 million for providing new information during the course of the investigation, but waited several years to report to the Commission;[35] and a payment of more than $2 million to a whistleblower who provided information that led to a successful related action by the U.S. Department of Justice.[36]

- Two awards in November, including awards totaling more than $15 million to two whistleblowers, one of whom received more than $12.5 million for alerting Commission staff to a fraudulent scheme and prompted the opening of an investigation;[37] and awards totaling approximately $10.4 million to seven whistleblowers who provided information and assistance in three separate covered actions.[38]

- An award in December of nearly $5 million to a whistleblower who provided information and assistance that led to the success of a covered action, resulting in the return of millions of dollars to investors.[39]

II. Public Company Accounting, Financial Reporting, and Disclosure Cases

Public company accounting and disclosure cases continued to comprise a significant portion of the SEC’s cases in the latter half of 2021, and included a range of actions concerning earnings management, revenue recognition, impairments, internal controls, and disclosures concerning financial performance.

A. Financial Reporting Cases

In July, the SEC announced a complaint against the former CEO and CFO of a network infrastructure company for alleged accounting fraud.[40] From January 2017 to January 2019, the SEC alleged that the executives secretly caused the company to issue nearly $23 million in convertible notes, each of which required complex analyses under GAAP, but instead masked the convertible notes as conventional promissory notes by creating fake copies and forging board signatures to mislead internal and external auditors. Additionally, from early 2016 to November 2018, the executives allegedly inflated company revenues more than 100% by recording revenues from purportedly completed construction projects for which the infrastructure company had yet to complete the work. The SEC also alleged that the executives misappropriated $5.4 million from the company for personal use, including salary increases, luxury cars, private jet services, and unauthorized cash payments. The litigation is ongoing, and the SEC is seeking permanent injunctions, penalties, and officer and director bars against the executives. The U.S. Attorney’s Office for the Southern District of New York also brought criminal charges against the two executives.

Also in July, the SEC announced a settled action against a specialty leather retailer and its former CEO for accounting, reporting, and control failures related to the retailer’s inventory tracking system which could not accurately support the retailer’s inventory accounting methodology.[41] The SEC alleged that the inventory tracking system resulted in misleading financial statements which, for years, impacted the company’s calculations for income, profits, and inventory. According to the SEC, the CEO was aware of the inventory tracking system’s shortcomings and did not adequately remedy them, nor institute additional proper accounting controls to ensure that inventory was recorded in accordance with GAAP. Without admitting or denying the allegations, the retailer and the CEO agreed to cease and desist from future violations and pay a combined penalty of $225,000.

In September, the SEC instituted a settled action against a multinational food company and two former employees for negligently misreporting the company’s financial results.[42] The SEC alleged that, for multiple years, the food company’s procurement division caused the company to prematurely recognize discounts from suppliers, which reduced the company’s reported cost of goods sold. The SEC further alleged that the food company’s internal controls relating to accounting for supplier contracts were ineffective, and it alleged that the individual respondents, who had overseen the procurement division, should have known about the accounting misstatements. Without admitting or denying the allegations, the food company agreed to pay a $62 million civil penalty, which recognized the company’s cooperation and remedial control improvements; one employee consented to a cease-and-desist order and paid disgorgement and a $300,000 civil penalty; and the other employee consented to a permanent injunction, a $100,000 civil penalty, and a five-year ban from serving as an officer or director of a public company.

In December, the SEC instituted a settled action against a dialysis provider and three former executives for improperly calculating and reporting revenue adjustments related to actual and expected payments from patients’ health insurance providers.[43] The SEC alleged that, from 2017 to 2018, the company manipulated its revenues through accounting adjustments of the difference between what the company anticipated a patient’s insurance might pay for medical treatment and the actual payment received. The three executives were alleged to have orchestrated a scheme to determine these adjustments not based on the actual difference between expected and received payment for each patient, but rather, based on mathematical calculations to achieve pre-determined revenue figures in any given period. Furthermore, the adjustments were not reported until they were needed to meet financial targets. The executives were also alleged to have misled the company’s outside auditor in order to conceal this accounting practice. Without admitting or denying wrongdoing, the company agreed to resolve the action in a judgment with a permanent injunction and a $2 million fine. Litigation against the executives remains ongoing, and also includes an allegation of making false statements to the company’s auditors.

B. Disclosure Cases

In June, the SEC instituted a settled action against a publicly traded provider of title and escrow services, alleging disclosure controls violations related to a cybersecurity vulnerability that exposed sensitive customer information.[44] The SEC alleged that the issuer’s information security personnel discovered a vulnerability that exposed a large number of customers’ personally identifiable information, but waited several months to escalate and remediate it. Because information about the incident had not been escalated to senior management, the issuer filed an inaccurate Form 8-K about the incident. According to the SEC, the issuer failed to maintain adequate disclosure controls designed to ensure that all available, relevant information concerning the vulnerability was analyzed for disclosure. Without admitting or denying the findings, the issuer agreed to a cease-and-desist order and to pay approximately $490,000 in civil penalties.

In July, the SEC announced settled actions against a medical diagnostics company and two executives related to allegedly misleading statements regarding the company’s ability to produce COVID-19 tests and personal protective equipment (“PPE”) in order to boost its declining stock price.[45] The SEC alleged that the company issued a series of press releases touting the immediate availability of PPE for sale, and that it would be developing a COVID-19 test which would be “available soon.” The SEC alleged that, in fact, the company was insolvent, and this prevented it both from developing the COVID-19 test and purchasing or importing PPE for retail sale. Without admitting or denying the findings, the company and executives consented to a permanent injunction from future violations and combined penalties of $185,000. The two executives also consented to officer and director bars for three and five years each.

In August, the SEC announced a complaint against the former CEO of a private technology company, alleging that the CEO inaccurately claimed that the company had achieved strong and consistent revenue and customer growth in order to push it to a “unicorn” valuation of over $1 billion.[46] According to the SEC, the CEO misrepresented the value of numerous customer deals to investors and altered or created invoices to make it appear that customers had been billed at higher amounts than they actually had. The SEC’s litigation against the former CEO remains ongoing, and the U.S. Attorney’s Office for the Northern District of California announced criminal charges against the CEO stemming from the same conduct.

Also in August, the SEC instituted a settled action against a U.K.-based company that provides publishing and other services to schools and universities, alleging that the company made misleading statements and omissions to investors about a cyber breach.[47] The order alleged that, in 2018, the company experienced a breach that resulted in the theft of millions of student records, including email addresses and dates of birth. According to the Commission, the company’s disclosures referred to a data privacy incident as a mere hypothetical risk, when, in fact, the breach had already occurred. Moreover, the company issued a media statement that misstated or omitted certain details about the breach. The SEC alleged that the company failed to maintain disclosure controls and procedures designed to ensure that those responsible for making disclosure determinations were adequately informed about the breach. Without admitting or denying the SEC’s findings, the publisher agreed to cease and desist from future violations and to pay a $1 million civil penalty.

In September, the SEC filed a complaint against the principals of a subprime automobile finance company for allegedly misleading investors about the loans which backed its $100 million offering.[48] The SEC alleged that the principals inflated the value of these asset-backed securities by including loans that were not eligible in the securitization vehicle, extending loan repayment dates without borrower knowledge to adjust the performance of the securitization vehicle, and forgiving payments from delinquent borrowers without disclosing this fact to investors. The SEC is seeking permanent injunctions, officer and director bars, disgorgement, and civil penalties, and the litigation against the principals remains ongoing.

In November, the SEC announced a settled action against an oilfield services company and its former CEO for allegedly failing to properly disclose the CEO’s executive perks and stock pledges.[49] The SEC alleged that the CEO caused the company to incur over $380,000 worth of personal and travel expenses and failed to disclose to company personnel that he had pledged all his company stock in private real estate transactions. The company also failed to properly disclose over $47,000 in unpaid perks to the CEO. The CEO agreed to pay over $195,000 in civil fines, and both the CEO and the company agreed to cease and desist from further violations, without admitting or denying any wrongdoing.

Also in November, the SEC instituted a settled action against an exchange-traded product (“ETP”), which seeks to track the changes in the spot price of crude oil, and its general partner, a commodity pool operator, alleging that they misled investors about limitations imposed by the ETP’s sole futures commission merchant and broker.[50] In the wake of the April 2020 shake-up of the oil market brought on by pandemic-related lockdowns, the ETP received record investor inflows while the ETP’s sole futures broker informed the ETP that it would not execute any new oil futures positions. The SEC alleged that the ETP and its general partner did not fully disclose the character and nature of this limitation to investors until one month after it was first imposed. Without admitting or denying the SEC’s findings, the ETP and its general partner agreed to pay a $2.5 million fine to settle the SEC action and a parallel action brought by the CFTC.

C. Auditor Independence

In August, the SEC instituted a settled action against a Big Four accounting firm and three of its current or former audit partners for conduct which allegedly violated auditor independence rules in connection with the accounting firm’s pursuit to serve as the independent auditor for a public company.[51] The SEC also instituted a settled action against the public company’s then-Chief Accounting Officer for his role in the alleged misconduct. The SEC alleged that the accounting firm partners solicited and received confidential competitive intelligence regarding the public company’s audit committee and independent auditor selection process from the public company’s then-Chief Accounting Officer. This information allegedly caused both the public company and the accounting firm to commit reporting violations because the accounting firm would no longer be able to exercise objective and impartial judgment after the audit engagement began. Without admitting or denying the findings, the accounting firm and its current and former partners agreed to cease and desist from future violations. Additionally, the accounting firm agreed to pay a $10 million civil fine and institute controls to prevent future violations, including regular reporting to the SEC. The individual partners agreed to monetary penalties between $15,000 and $50,000, and agreed to a suspension from appearing or practicing before the SEC for periods of one to three years. The Chief Accounting Officer, without admitting or denying the allegations, agreed to a civil fine of $51,000 and a two-year suspension from appearing or practicing before the SEC.

III. Investment Advisers

In the second half of 2020, the SEC instituted a number of actions against investment advisers. We discuss notable cases below.

A. Complex Products

The SEC, in connection with the SEC’s Exchange Traded Product (“ETP”) initiative, filed a settled action in July against a dual-registered broker-dealer and investment adviser,, alleging historic compliance failures related to the sale of a volatility-linked ETP.[52] According to the SEC, the ETP was designed to track short-term volatility expectations in the market, and the product’s issuer told the company that it was not appropriate to hold the product for an extended period. The SEC alleged that while the company prohibited the solicitation of the product entirely for brokerage accounts, it allowed more experienced financial advisors who managed client portfolios on a discretionary basis to buy the ETP after mandatory training. Further, the SEC alleged that although the registrant had adopted a concentration limit on volatility-linked ETPs, it did not implement a system to monitor or enforce that limit. Finally, the SEC alleged that certain financial advisers misunderstood the appropriate use of the ETP, failed to take sufficient steps to understand the risks of holding onto the ETP for an extended period, and ended up holding the product too long. Without admitting or denying the SEC’s findings, the company agreed to a cease-and-desist order, censure, disgorgement of $112,000, and a civil penalty of $8 million.

B. Material Misrepresentations

In July, the SEC announced a settled action against the subsidiary of an association which keeps records for employer-sponsored retirement plans (“ESPs”) and advises clients on whether to roll over their ESPs into individually managed accounts.[53] The SEC and the New York Attorney General’s Office brought parallel actions that were simultaneously settled in July. According to the SEC, the subsidiary made inaccurate and misleading statements to its clients by representing that its advisers acted in the client’s best interest and as fiduciaries. Further, the SEC alleged that the subsidiary and its employees failed to adequately disclose their conflicts of interest when they made certain recommendations to the clients. Without admitting or denying the SEC’s findings, the subsidiary agreed to a cease-and-desist order, to be censured, disgorgement, and a civil penalty totaling $97 million.

In September, the SEC announced a settled action against the CEO and chief portfolio manager of an advisory firm based on allegations of misrepresentations of the performance of funds managed by the firm.[54] According to the SEC, the executives inflated net asset values and the performance of funds by recording non-binding transactions and fraudulent fees in books and records. The SEC further alleged that the CEO waived monthly management fees owed to the firm to make it seem as if the funds were achieving better results. These allegedly inflated results were then used in promotional materials sent to investors. Without admitting or denying the SEC’s allegations, the CEO agreed to be barred from the securities industry and to pay over $5 million in disgorgement, and a penalty of almost $300,000. The chief portfolio manager, also without admitting or denying the allegations, agreed to a limitation on activities in the securities industry for at least three years, and to pay a penalty of $50,000.

In November, the SEC announced that it prevailed in a jury trial against a hedge fund adviser and his investment firm for allegedly reaping profits from making false statements to drive down the price of a pharmaceutical company.[55] The SEC alleged that the hedge fund had established a short position in the pharmaceutical company, and then made a series of false statements to shake investor confidence in the company and lower its stock price. These statements included that the pharmaceutical company’s investor relations firm had told the hedge fund adviser that the company’s most profitable drug was nearly obsolete and that the pharmaceutical company had engaged in a risky transaction with an unaudited shell company in an effort to reduce the size of its balance sheet. These statements and the ultimate decline in stock price allegedly resulted in more than $1.3 million in profits from the short position. The jury found the hedge fund and its adviser guilty of fraudulent misrepresentations; remedies will be determined at a later date.

In December, the SEC announced a settled action against an investment adviser regarding improper calculation of management fees, which is an area the SEC continues to be focused on, and appears to be expanding into the private fund adviser space.[56] According to the SEC, the investment adviser failed to adequately offset portfolio company fees against management fees paid to the company, despite promising clients it would do so in the relevant governing documents. This allegedly led to clients overpaying millions in additional management fees. The SEC also claimed the adviser made inconsistent statements to clients about how management fees would be calculated. Without admitting or denying the SEC’s allegations, the investment adviser agreed to pay a $4.5 million penalty to settle the action.

C. Misuse of Client Funds

In July, the SEC filed an action against an individual trader at an asset management firm. According to the SEC, from January 2015 through April 2021, the individual traded stock in his family members’ accounts before or during the time periods when his employer’s advisory clients were executing large orders for the same stock.[57] The SEC alleges that the trader would then close out the just-established positions in his relatives’ accounts before the client accounts completed their executions. The SEC alleged the individual conducted a front-running scheme that violated the antifraud provisions of the federal securities laws and is seeking disgorgement, penalties, and injunctive relief. The U.S. Attorney’s Office for the Southern District of New York also brought criminal charges against the trader. Litigation remains ongoing.

The SEC also filed an action in July against the CEO of several real estate investment trusts (“REITs”) and his wholly-owned investment advisory firm.[58] The SEC alleged that the CEO took money from two REITs he founded, put it into a third REIT he had founded, and later caused the same two REITs to enter into money-losing transactions with the third REIT to benefit himself and the third REIT. According to the SEC, the CEO also made misrepresentations to the boards of the two REITs that resulted in a payment to him, and he also misled investors by causing those REITs to make false and misleading statements in their public filings. The SEC alleged violations by the CEO of various federal antifraud provisions and is seeking disgorgement, penalties, permanent injunctions, and industry, penny stock, and officer and director bars against the CEO.

In October, the SEC filed am action against a former New Jersey-based financial adviser, alleging that he misappropriated several million dollars from client accounts.[59] According to the SEC, the adviser used those funds to pay off balances in credit card accounts held by his wife and parents, caused checks to be drawn on his clients’ and customers’ accounts, and used client funds to purchase gold coins and other precious metals, buy luxury goods, and make electronic fund transfers to himself. The SEC’s complaint alleged violations of the antifraud provisions of the federal securities laws and is seeking injunctive relief, disgorgement, and civil penalties. The U.S. Attorney’s Office for the District of New Jersey has also filed criminal charges against him.

D. Implementation of Form CRS

In July, the SEC announced settled actions against 21 investment adviser firms and 6 broker-dealer firms based on allegations that the firms failed to timely file and deliver their client or customer relationship summaries (Form CRS) to their retail investors.[60] In June 2019, the SEC adopted Form CRS and required SEC-registered investment adviser and broker-dealer firms to take the following actions: file these forms with the SEC, begin delivering them to prospective and new retail investors by June 2020, deliver them to existing retail investor clients or customers by July 2020, and prominently post the form on their websites. The SEC alleged that these 27 firms missed the regulatory deadlines and did not comply until they were reminded at least twice over the course of several months by the appropriate regulatory authority. Without admitting or denying the SEC’s findings, the firms all agreed to be censured, to a cease-and-desist order, and to pay civil penalties varying from $10,000 to $97,523.

E. Ineffective Information Barriers

In November, the SEC announced a settled action against a management consulting firm’s wholly-owned registered investment adviser.[61] The adviser’s advisory clients were limited to current and former employees of the consulting firm. According to the SEC, the adviser directed the purchase and sale of securities in companies that the consulting firm previously had advised, or currently was advising. The SEC alleged that the adviser did not maintain adequate policies and procedures to prevent investment decisions from utilizing material nonpublic information obtained through the firm’s consulting work. Without admitting or denying the SEC’s findings, the affiliate agreed to a cease-and-desist order and to pay $18 million to settle the action.

IV. Broker-Dealers

Although not as numerous as prior years, there were nevertheless notable cases involving the conduct of broker-dealers in the latter half of 2021.

A. Financial Reporting and Recordkeeping

In August, the SEC announced a settled action against an investment firm, its principal, and its trader for allegedly providing erroneous order-marking information on sale orders, causing the fund’s brokers to mismark the sales as “long,” and failing to borrow or locate shares prior to executing the sales.[62] The firm and its personnel also allegedly engaged in dealer activity without registering with the SEC. Without admitting or denying the findings, the parties each agreed to cease-and-desist orders, disgorgement fees, and penalties totaling $7.9 million.

In September, the SEC instituted an action against a school district and its former Chief Financial Officer, alleging that they misled investors who purchased $28 million in municipal bonds.[63] According to the SEC’s complaint and order, the district and CFO provided investors with misleading budget projections indicating the district could cover its costs and would end the fiscal year with a general fund balance of approximately $19.5 million, when in fact the district ended the year with a negative balance of several million dollars. The CFO agreed to pay a $28,000 penalty. The district also agreed to settle with the SEC and consented, without admitting or denying any findings, to engage an independent consultant to evaluate its policies and procedures related to its municipal securities disclosures.

B. Unfair Dealings

In August, the SEC instituted a settled action against a broker-dealer and its former CEO for allegedly engaging in unfair dealing in connection with a municipal bond tender offer.[64] The SEC’s orders alleged that the broker-dealer recommended to a county that it attempt to reduce the amount of its outstanding debt service expense through a tender offer for bonds it had issued years earlier. According to the orders, the broker-dealer allegedly purchased millions of dollars of the county’s outstanding bonds, sold them to an affiliated entity, and tendered the bonds back to the county at a price that the broker-dealer recommended without disclosing to the county that the affiliate had acquired bonds to be tendered, or the resulting conflict of interest. Without admitting or denying the SEC’s findings, the broker-dealer and CEO agreed to pay nearly $400,000 in disgorgement and civil penalties.

In September, and as a continuing part of an industry-wide series of investigations originating nearly five years ago, the SEC announced that a broker-dealer agreed to resolve allegations that it engaged in unfair dealing in municipal bond offerings.[65] According to the SEC’s order, the broker-dealer allegedly allocated bonds intended for institutional customers and dealers to parties known in the industry as “flippers,” who then resold the bonds to other broker-dealers at a profit. In addition, the SEC alleged that where an issuer had instructed the broker-dealer to place retail customer orders first, it violated those instructions by allocating bonds to flippers ahead of orders for retail customers, and improperly obtained bonds for its own inventory. Without admitting or denying the findings, the broker-dealer consented to pay more than $800,000 in penalties and disgorgement. Among multiple agreements, two employees consented to pay civil penalties of $25,000 and $30,000.

In September, the SEC brought an action against a municipal adviser and its two principals, alleging that they violated their duties by engaging in unregistered municipal advisory activities.[66] According to the SEC, these actions are the first-ever SEC cases enforcing Municipal Securities Rulemaking Board (“MSRB”) Rule G-42 on the duties of non-solicitor municipal advisers. The SEC’s complaint specifically alleged that the principals entered into an impermissible fee-splitting arrangement with their former employer and did not adequately disclose to their clients the conflicts of interest associated with the illicit arrangement or their relationship with the underwriting firm. The SEC also alleged that all three parties engaged in municipal advisory activities when they were not registered with the SEC or MSRB. One principal consented, without admitting or denying any findings, to pay a $26,000 penalty. The SEC has not announced a settlement with respect to the other two principals.

Also in September, the SEC brought an action against a former managing director and head of fixed income trading at a broker-dealer, alleging that the individual engaged in unauthorized trading in fixed income securities and illegally obtained fictitious commission income.[67] The conduct came to light after the allegedly illegal trading resulted in the broker-dealer’s bankruptcy in 2019. The SEC’s complaint alleged that the individual engaged in unauthorized speculative trading in U.S. Treasury securities; incurred millions of dollars in losses for the firm; and obtained commission income based on fictitious commission payments from fabricated customers. The individual agreed to settle the SEC’s action by consenting to a permanent injunction and to pay disgorgement and a civil penalty in amounts to be determined at a later date. In a parallel action, the U.S. Attorney’s Office announced criminal charges for related misconduct.

In October, the SEC announced an order alleging that a financial services group raised funds on behalf of state-owned entities in Mozambique through two bond offerings and a syndicated loan, and that these proceeds were used to fund a hidden debt scheme, pay kickbacks to investment bankers along with their intermediaries, and bribe foreign government officials.[68] The SEC’s order also alleged that the company failed to properly address significant and known risks concerning bribery. The SEC announced that the financial services group agreed to pay $475 million in disgorgement and penalties.

Relatedly, a London-based subsidiary of a Russian bank also agreed to settle SEC allegations in October related to its alleged role in misleading investors in the second bond offering.[69] According to the SEC’s order, the Russian bank and financial services group’s offering materials failed to disclose Mozambique’s debt and the risk of default on bonds. The financial services group agreed to pay nearly $100 million in disgorgement and penalties, and the U.S. Department of Justice imposed a $247 million criminal fine. Without admitting or denying the findings, the Russian bank agreed to pay $6.4 million in disgorgement and penalties.

C. Internal Policies and Procedures

In August, the SEC instituted three settled actions against eight investment advisers and broker-dealers, alleging that the firms failed to create and maintain adequate cybersecurity policies and procedures in violation of the Safeguards Rule of Regulation S-P.[70] In all three cases, unauthorized third parties gained access to email accounts, resulting in the exposure of customer data for periods of more than one year. The Commission alleged that, in two of the cases, the firms violated the Safeguards Rule by failing to adopt and implement enhanced data security measures in a timely manner after discovering the account-takeovers. In the press release announcing the actions, the SEC stressed that “[i]t is not enough to write a policy requiring enhanced security measures if those requirements are not implemented or are only partially implemented, especially in the face of known attacks.” Without admitting or denying the SEC’s allegations, each firm agreed to cease and desist from future violations, to be censured, and to pay financial penalties totaling $750,000 (across all firms).

In October, the SEC announced a conclusion to its allegations that a clearing agency did not have adequate risk management policies within its Government Securities Division.[71] In an order, the SEC alleged that the agency failed to comply with rules requiring it to have reasonably designed policies and procedures for holding sufficient qualifying liquid resources to meet the financial obligations created by the potential failure of a large participant. According to the order, the agency did not conduct a required analysis of the reliability of its liquidity arrangements, failed to conduct required due diligence of its liquidity providers, and failed to adhere to rules requiring it to have reasonably designed policies and procedures for maintaining and periodically reviewing its margin coverage. The clearing agency agreed to pay an $8 million penalty to settle the SEC’s allegations.

In December, the SEC announced a settled action against a broker-dealer subsidiary of a financial services company, alleging failures by the broker-dealer and its employees to maintain and preserve written communications.[72] The company admitted that its employees, managing directors and other senior supervisors had communicated about securities business matters on their personal devices, using text messages, WhatsApp, and personal email accounts, and that the majority of these records were not surveilled nor preserved by the firm as required by the federal securities laws. The company also acknowledged that its failure to capture and retain these records deprived the SEC staff of timely access to evidence and potential sources of information in other investigations. The company admitted certain facts set forth in the SEC’s order and agreed to pay a $125 million penalty and implement improvements to its compliance policies and procedures. The CFTC brought a parallel proceeding against the firm and related entities, similarly alleging that the firms’ recordkeeping violated CFTC requirements.[73] The firm agreed to pay a $75 million penalty and implement remedial measures.

V. Cryptocurrency and Other Digital Assets

The Commission continued to bring enforcement actions in the area of digital assets throughout 2021. As in 2020, these actions were based primarily on alleged failures to comply with the requirement to register an offering of assets deemed to be securities or allegations of fraud in the offer and sale of digital assets. Significant uncertainty remains around exactly how the Commission will approach the regulation of crypto assets going forward.

A. Significant Developments

As has been true for several years, the Commission has continued to struggle with how to define the ever-expanding collection of products in the digital asset space. Emblematic of that question is an enforcement action from this summer, along with a follow-on statement from two Commissioners.

In July, the SEC instituted a settled action against the U.K.-based operator of a website for failing to disclose compensation it received from issuers of the digital assets it profiled.[74] Each profile included links to the token issuer’s websites and a “trust score” that the website stated reflected its evaluation of the “credibility” and “operational risk” for each digital token offering. In the press release announcing the action, the SEC noted that many of the profiles were published after the Commission issued a 2017 advisory warning that promoters of virtual tokens classified as securities must disclose any compensation received in exchange for the promotion.[75] Without admitting or denying the SEC’s findings, the operator of the website agreed to pay $43,000 in disgorgement and a penalty of approximately $155,000.

Interestingly, Commissioners Peirce and Roisman took the unusual step of issuing a public statement after the above-described action, concurring in the result, but expressing their continued disappointment that the settlement with the operator “did not explain which digital assets touted by [the operator] were securities, an omission which is symptomatic of our reluctance to provide additional guidance about how to determine whether a token is being sold as part of a securities offering or which tokens are securities.”[76] They continued that “[t]here is a decided lack of clarity for market participants around the application of securities laws to digital assets and their trading . . . [and that despite some guidance m]arket participants have difficulty getting a lawyer to sign off that something is not a securities offering or does not implicate the securities laws; they also cannot get a clear answer, backed by a clear Commission-level statement, that something is a securities offering.”[77] One proposal put forth by the two Commissioners, which was previously proposed by Commissioner Peirce,[78] is to offer a safe harbor of sorts, which would allow for token offerings to occur subject to a set of tailored protections for token purchasers.

While clarity on this issue is still forthcoming, there remains a groundswell of support from the digital asset community for further clarification on digital asset topics outside anecdotal and incremental progress toward regulatory standards posed by each new enforcement matter.

B. Registration Cases

In August, the SEC instituted a settled action against a company for operating a web-based trading platform that facilitated the buying and selling of digital assets without registering as a national securities exchange.[79] The order alleged that the company’s internal communications expressed a desire to be “aggressive” in making new digital assets available for trade, including assets that might be considered securities under the Howey test. The SEC determined that some of these digital assets were investment contracts, thereby constituting securities. Without admitting or denying the SEC’s findings, the company agreed to the entry of a cease-and-desist order and agreed to pay disgorgement of approximately $8.5 million and a civil penalty of $1.5 million.

In September, the Commission instituted a settled action against two U.S. media companies that conducted both an unregistered offering of common stock and an unregistered offering of digital coins, as well as a third company that participated only in the stock offering.[80] The SEC alleged that the two companies involved in the coin offering promoted the coins to the general public through their websites and social media platforms. Because the coins were allegedly marketed as an investment opportunity with a likelihood of significant returns, the Commission alleged that they constituted securities. Without admitting or denying the findings, these two companies agreed to a cease-and-desist order, to pay disgorgement of over $434 million on a joint and several basis, and to each pay a civil penalty of $15 million. The third company agreed to a cease-and-desist order, to pay disgorgement of more than $52 million, and to pay a civil penalty of $5 million. The companies also agreed not to participate in any offering of a digital asset security, to assist SEC staff in the administration of a distribution plan, and to publish notice of the SEC’s order on their public websites and social media channels.

The SEC’s enforcement activities extended beyond unregistered offerings to consider the substance of attempted registrations of digital assets deemed securities. In November, the Commission instituted proceedings against a Wyoming-based company in connection with allegedly incomplete and misleading registration forms.[81] The effectiveness of the company’s registration of two digital tokens as securities remains stayed pending the completion of the proceedings. The order alleged that the “Form 10” registration forms submitted by the company lacked material information about the tokens and about the company’s business practices, including audited financial statements. The SEC further alleged that certain inconsistent statements rendered the Form 10 misleading. In the press release announcing the action, the SEC stressed that all issuers of securities “must provide the information necessary for investors to make informed decisions.”

C. Fraud Cases

In August, the SEC instituted a settled action against two Florida men and their Cayman Islands decentralized finance (“DeFi”) company in connection with their unregistered sales of two types of digital tokens.[82] In offering and selling the tokens, the company stated that it would use investor assets to purchase income-generating “real world” assets, such as car loans. The order alleged that the company misrepresented its business practices by claiming to have purchased these loans. The SEC alleged that, although the men controlled another company that owned car loans, the DeFi company never acquired any ownership interest in those loans. Instead, the Commission alleged that the men used personal funds and funds from the other company they controlled to make principal and interest payments for the DeFi company. The respondents, without admitting or denying the findings, consented to a cease-and-desist order that included over $12 million in disgorgement and $125,000 penalties for each of the men. Additionally, prior to the order, the respondents funded contracts that allowed those who held tokens to redeem their tokens and receive all principal and interest owed.

In September, the SEC filed an action against an online cryptocurrency lending platform, its founder, its top U.S. promoter, and the promoter’s affiliated company in connection with approximately $2 billion of unregistered sales of investments in their “Lending Program.”[83] The lending platform, with the help of its promoter, allegedly represented that it would generate high returns on its customers’ investments by using a proprietary “volatility software trading bot.” Instead, the complaint alleged, the company transferred investor funds to digital wallets controlled by the company, its founder, its promoter, and others. The complaint further alleged that the company misled investors by failing to disclose commissions paid to promoters around the world. The SEC previously reached settlements with two individuals in a related action for promoting the lending program, and the company’s top U.S. promoter pled guilty to criminal charges brought by the Department of Justice. The litigation remains ongoing.

In November, the SEC filed an action against a California individual for allegedly conducting two unregistered securities offerings and misappropriating investor funds.[84] The SEC found that he had raised over $3.6 million in Bitcoin from these offerings by promising an extremely high rate of return on the investments through, among other activities, fulfillment of social media marketing orders and “cryptocurrency trading and advertising arbitrage.” The complaint alleges that he used at least $1 million of investor funds to pay personal expenses and, despite representations to the contrary, prevented investors from withdrawing their funds. The U.S. Attorney’s Office for the Northern District of California has also brought criminal charges against the individual. The litigation remains ongoing.

In December, the SEC filed an action against a Latvian citizen for allegedly conducting two fraudulent offerings, one involving the sale of unregistered digital tokens as part of an ICO and the other involving the investment of digital assets in a cloud mining company.[85] In the former, the individual claimed users of the token could store their digital assets in a secure digital wallet and then spend them “like any other debit card,” but the complaint alleges that all of these claimed products and services were fictitious. In the latter, the individual claimed that investors would receive a daily “automatic payout” from a cloud mining program, but the complaint similarly alleges that these services never existed. The complaint alleges that the individual used fictitious names, phone numbers, addresses, and online profiles to market both offerings and misappropriated nearly all funds raised from each. The litigation remains ongoing.

VI. Insider Trading

In addition to a significant uptick in insider trading enforcement actions in the second half of 2021, an indication that the SEC has reinvigorated its focus on insider trading cases, the SEC suffered a rare trial loss (after the alleged tipper defendant settled[86]) in a previously discussed insider trading case.

In December 2020, the SEC brought a case against a mortgage broker accused of being tipped by his brother-in-law, who was corporate controller at an IT company whose stock and options were traded by the broker.[87] The case went to trial in late 2021, and after the close of the SEC’s case, the defense moved, as is typical, for a Rule 50 Judgment as a Matter of Law. Surprisingly, and without the defense presenting any portion of its case, the court granted the defense’s motion and dismissed the case.[88] The SEC’s case was built around circumstantial evidence of what it characterized as “highly suspicious trading,” but the judge concluded that neither the timing nor the manner of the trading nor the communications between the brothers-in-law were suspicious. Despite surviving all pre-trial motions to dismiss the case, the judge concluded that he was having trouble finding “any circumstantial evidence that would justify a finding that [the broker] got insider information and took some action on it.” Whether the SEC will file an appeal remains an open question, but as of yet, no appeal has been filed.

Below is an overview of insider trading enforcement actions brought in the second half of 2021. Of particular note are two cases alleging insider trading against corporate outsiders who obtained material nonpublic information through unauthorized computer systems access.

A. Cases Arising from Unauthorized Computer Systems Access

In July, the SEC filed an action against a foreign national who was allegedly selling stolen “insider trading tips” to individual investors on the dark web.[89] According to the SEC’s complaint, beginning in December 2016, the individual obtained stolen order-book data from a securities trading firm as well as pre-release earnings reports of publicly traded companies and subsequently sold that information to investors. The SEC’s complaint is seeking injunctive relief, disgorgement, and civil penalties. The U.S. Attorney’s Office for the Southern District of New York filed parallel criminal charges against the individual.

In December, the SEC filed an action against five Russian nationals for allegedly trading based on stolen corporate earnings announcements obtained by hacking into the systems of two U.S.-based filing agent companies.[90] According to the allegations in the SEC’s complaint, one of the individuals hacked into the filing agents’ systems and fed the earnings information to his associates, who then used 20 different brokerage accounts located around the world to make trades before over 500 corporate earnings announcements. According to the SEC, the trades occurred between 2018 and 2020 and netted at least $82 million in profits. The SEC complaint further alleged that the defendants shared the profits by funneling them through a Russian information technology company in which some of the individuals were involved as founders and directors. The SEC’s complaint seeks civil penalties, disgorgement, and injunctive relief. The U.S. Attorney’s Office for the District of Massachusetts filed parallel criminal charges against all five individuals and announced that one of the individuals has been extradited to the United States from Switzerland.

B. Other Insider Trading Cases

In July, the SEC filed an action against three individuals with insider trading related to stock purchases in advance of an announcement by a beverage company that it was pivoting its business to focus on blockchain technology.[91] The SEC’s complaint alleged that an insider at the company provided confidential information related to the planned changes to his friend, who then subsequently passed that information on to another friend, who ultimately purchased 35,000 shares that resulted in profits of over $160,000 when the information was made public. The SEC’s complaint seeks permanent injunctions and civil penalties against all three individuals, and an officer and director ban for the company insider. The SEC also revoked the registration of the company’s securities as part of the action. Two of the individuals involved in the case are currently in litigation with the SEC over an alleged market manipulation scheme. The two individuals pled guilty to criminal charges in a parallel action brought in relation to the alleged market manipulation scheme.

In August, the SEC filed an action against a former employee of a biopharmaceutical company with insider trading based on trades made in advance of the company’s announcement that it would be acquired by a major pharmaceutical company.[92] The SEC’s complaint alleged that the former employee, then the head of business development at the biopharmaceutical company, purchased short-term, out-of-the-money options of a similar pharmaceutical company after learning that his company was getting acquired by a large pharmaceutical company at a significant premium. The SEC’s complaint alleged that the employee made the purchase just minutes after learning that the investment bankers had listed the similar company as a comparable company in their discussions with his company over valuations. The SEC’s complaint alleged that the trading netted the former employee profits of just over $100,000, and seeks injunctive relief, a civil penalty, and an officer and director bar for the employee. A motion to dismiss in the case was recently denied, and litigation is ongoing.[93]

Also in August, the SEC filed an action against three former software engineers and two of their associates with insider trading.[94] The SEC alleged that a former employee and two associates made trades based on confidential, nonpublic information about subscriber growth at the former employee’s streaming media company. The SEC’s complaint alleges that the former employees had passed along confidential information about subscriber growth, which was a key metric reported alongside their company’s quarterly earnings, to their close acquaintances, who traded the stock in advance of the key earnings releases. The SEC’s complaint alleged that the trades netted approximately $3 million in profits. All five individuals consented to judgments that impose various injunctive relief and civil penalties, including, for one of the software engineers, an officer and director ban. The U.S. Attorney’s Office for the Western District of Washington filed parallel criminal charges against two of the software engineers and the two associates.

In September, the SEC announced a settlement with a leading alternative data provider company and its co-founder based on allegations that it engaged in deceptive practices and made material misrepresentations about how its alternative data was derived.[95] The SEC alleged that the co-founder, in order to induce companies to share their data, made assurances to those companies that their data would be aggregated and anonymized prior to being fed into a statistical model. However, the SEC alleged that for approximately four years, the company used non-aggregated and non-anonymized data to alter its model-generated estimates of app performance to make them more valuable to the trading firms that it sold the estimates to. The SEC also alleged that the company further misrepresented to their trading firm customers that it generated the estimates in a way that was consistent with the consents they obtained from their data-providing clients and that they had effective internal controls to prevent the misuse of confidential data and to ensure compliance with federal securities laws. The SEC alleged that the company and its co-founder were aware that the trading firm customers were making investment decisions based on the estimates, and in fact touted how closely their data correlated with the companies’ true performance and provided guidance to the trading firms as to how they could use the estimates to trade ahead of upcoming earnings announcements. As part of the settlement agreement, neither the company nor the co-founder admitted any wrongdoing. However, both consented to a cease-and-desist order that included a $10 million penalty for the company and a $300,000 penalty for the co-founder. The settlement also included a three-year public company officer and director ban for the co-founder.

Also in September, the SEC brought an action against a former IT manager at a pharmaceutical company with insider trading based on four trades made just prior to public announcements that were allegedly based on material nonpublic information shared with him by a former colleague at the company.[96] The SEC’s complaint alleged that the manager used nonpublic information on the company’s earnings, drug approvals, and a pending merger with a major pharmaceutical company to place highly profitable options trades. The SEC alleged that the manager made over $8 million in combined profits and avoided losses, and shared some of his profit with the former colleague in the form of overseas cash payments. The manager consented to a judgment which enjoined him from violating the alleged provisions and barred him from acting as an officer or director of a public company, with civil penalties in an amount to be determined by the court. The U.S. Department of Justice, Fraud Section, announced parallel criminal charges against the manager.

In September, the SEC brought an action against a quantitative analyst who worked at two prominent asset management firms for allegedly perpetuating a years-long front-running scheme that generated at least $8.5 million in profits.[97] The SEC alleged that the analyst used information he had about his firm’s securities orders to place similar orders just before the firm on nearly 3,000 occasions, taking advantage of the price movements caused by the firm’s trades. The SEC’s complaint alleges that the analyst utilized his wife’s brokerage account to make the trades. The SEC’s complaint seeks disgorgement plus interest, civil penalties, and injunctive relief. The U.S. Attorney’s Office for the Southern District of New York filed parallel criminal charges against the analyst.

Also in September, the SEC brought an action against a compliance analyst, who was a foreign national working at an overseas office of an investment bank, for allegedly placing trades in advance of corporate events involving the investment bank’s clients.[98] The SEC’s complaint alleges that the individual used his position as a compliance analyst to place trades in advance of at least 45 events involving the investment bank’s clients. The SEC alleged that the individual took steps to avoid detection, including only placing relatively small trades and using multiple U.S.-based brokerage accounts held in his parent’s name. The SEC obtained an emergency court freezing the individual’s assets. The trades allegedly generated more than $471,000 in gains. The SEC is seeking injunctive relief, disgorgement, and a civil penalty, and has also named the individual’s parents as relief defendants in the action.

In November, the SEC brought an action against a partner at a global management consulting firm for insider trading.[99] The SEC alleged that the partner purchased out-of-the-money call options of a company after he learned that one of the consulting firm’s clients would be acquiring the company. According to the SEC’s complaint, the partner sold the options the morning of the acquisition announcement, just days before they were set to expire, for profits totaling over $450,000. The SEC also alleged that the partner violated his firm’s policies by failing to pre-clear the trades. The SEC’s complaint seeks injunctive relief and a civil penalty. The U.S. Attorney’s Office for the Southern District of New York filed parallel criminal charges against the partner.

In December, the SEC brought an action against a medical school alleging insider trading in the securities of a biotechnology company in advance of that company’s announcement of positive drug trial results for its flagship drug candidate.[100] The SEC alleged that the professor entered into a consulting relationship with the biotechnology company to serve as its lead clinical investigator for the drug trial, and that, through his role, he learned material nonpublic information about the drug trial results. The complaint alleged that upon learning of the positive results, the professor purchased over 8,000 shares of the company’s stock, which, upon release of the drug trial results, rose approximately 300% and generating gains of over $130,000. The SEC reached a settlement with the professor that, if approved by the court, provides for a permanent injunction and a civil penalty in an amount to be determined by the court at a later date. The U.S. Attorney’s Office for the Northern District of Illinois announced parallel criminal charges against the professor.

VII. Market Manipulation

There were three alleged market manipulation schemes that were the focus of SEC enforcement actions during the second half of 2021.

In September, the SEC, in two separate complaints, commenced actions against four people and five entities in an allegedly fraudulent microcap operation that generated more than $10 million in profits.[101] The SEC also sought an order to freeze the assets of seven of the defendants and one relief defendant. According to the SEC’s first complaint, one of the individuals and his son allegedly acquired millions of shares in U.S. publicly traded microcap companies, disguised their control over the companies, and then dumped their shares into the public markets in violation of the securities laws. The SEC alleged that, while concealing their holdings in the companies, they allegedly engaged in manipulative trading and generated artificial demand for the stock by making misleading statements to investors. According to the SEC’s second complaint, two associates of the individual and his son allegedly used their roles as officers or majority shareholders at several of the microcap companies to hide the individual’s control, while simultaneously helping him and his son acquire and then sell millions of the companies’ shares. The SEC also alleged that one of the associates made false and misleading statements in response to subpoenas issued by the SEC and during a subsequent interview. The SEC is seeking injunctive relief, disgorgement and civil penalties against all of the parties. The SEC is also seeking penny stock bars against three of the non-entity defendants, conduct-based injunctions against the individual and his son, and officer and director bars against the two company-insider associates.