2023 Year-End Securities Enforcement Update

Client Alert | February 6, 2024

Aggressive enforcement reflected in continuing trend of escalating enforcement actions and monetary relief, as well as expanding reach of securities laws.

I. Introduction: Enforcement Results and Notable Developments

In our year-end 2022 and mid-year 2023 updates, we noted that the Commission’s Division of Enforcement has maintained its agenda of persistent enforcement activity including ongoing sweeps, expansive remedies (including increased penalties and high numbers of officer and director bars), and aggressive rulemaking. These trends have continued through the end of 2023, marking a particularly active Commission under Chair Gary Gensler’s leadership.

A. 2023 Enforcement Results

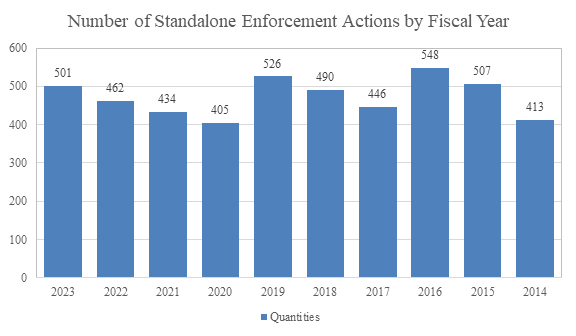

The enforcement statistics for fiscal year 2023 reflect that the Commission filed a total of 501 stand-alone enforcement actions last year, an eight percent increase over fiscal year 2022, though short of the SEC’s five-year high mark in fiscal year 2019[1]:

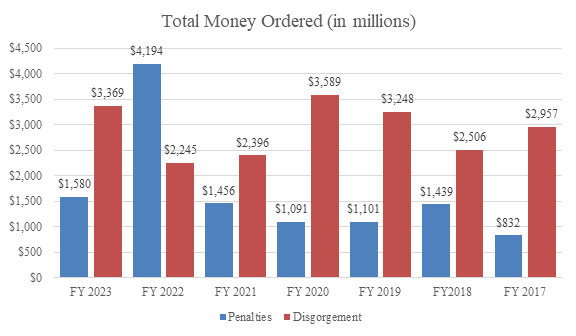

The Commission obtained orders for $4.949 billion in financial remedies in fiscal year 2023, second only to the Commission’s record-breaking 2022. In 2023, the SEC recovered over twice as much in disgorgement as compared to penalties, consistent with its general pattern. These statistics were inverted in 2022, primarily due to the significant penalties (without disgorgement) that the Commission recovered in its industry-wide settlements with broker-dealers (and one affiliated investment adviser) relating to alleged recordkeeping violations in connection with employee use of off-channel platforms for business communications.

Notably, in 2023, the SEC also obtained 133 officer and director bars—the highest number obtained in a decade.[2]

The distribution of actions across subject matter was generally consistent with prior years, with the majority of cases involving public company financial reporting, broker-dealers and investment advisers, and securities offerings.[3] The SEC brought 62 stand-alone actions against investment advisers (17% of actions in 2023) reflecting a sustained focus on investment adviser regulation and enforcement, albeit down from the prior year (26% of actions in 2022).[4] The percentage of stand-alone enforcement actions relating to securities offerings reflected a substantial increase over the prior year (33% of actions in 2023, compared to 23% of actions in 2022) and there were modest increases year-over-year in the areas of issuer reporting (17% of actions in 2023, compared to 16% of actions in 2022) and broker-dealer enforcement (12% of actions in 2023, compared to 10% of actions in 2022).[5] There was a decrease in the percentage of stand-alone actions relating to insider trading in 2023 (6% of actions in 2023, compared to 9% of actions in 2022) although it continues to remain a focus area for the SEC.[6] See Sections II (Public Company Accounting, Financial Reporting, and Disclosure), III (Investment Advisers), IV (Broker-Dealers), V (Cryptocurrency and Other Digital Assets), and VI (Insider Trading), infra, for our discussions of significant actions in these areas in the second half of 2023.

B. Continued Focus on Cryptocurrency Coming to an End?

The past year continued to be an active year for the Commission with respect to its enforcement efforts over crypto asset securities. In the second half of 2023, the SEC brought two novel settled actions relating to the unregistered offerings of crypto asset securities in the form of NFTs.[7] On the heels of its earlier actions against two prominent crypto platforms alleging that they failed to register as securities exchanges and broker-dealers,[8] the SEC filed an action against a third platform in November.[9] It also filed complaints against various other crypto exchanges, all for allegedly not registering with the Commission.[10]

While the SEC has described its efforts as “addressing the alleged rampant noncompliance in the crypto asset intermediary space,”[11] the SEC has explicitly declined rulemaking in this area. In his December 2023 statement denying a petition for rulemaking by one of the crypto platforms against which the Commission had filed a complaint, Chair Gensler reiterated the Commission’s intent to continue to rely on the investment contract test articulated in SEC v. Howey in 1946 as the basis for its crypto enforcement efforts.[12] Chair Gensler’s statement also discussed the need for the Commission to “maintain discretion regarding rulemaking priorities” despite the unprecedented—with the exception of the Dodd-Frank era—scale and breadth of rulemaking during his tenure.[13] In their dissent, Commissioners Peirce and Uyeda—who have previously criticized the Commission’s substantial rulemaking activity—noted the need to address “issues presented by new technologies and other innovations” by hearing from “a wide range of market participants and other interested parties.”[14]

It remains to be seen whether the Commission will prevail in its interpretation of the Howey test as applied to digital assets. In October, the court in SEC v. Ripple Labs declined to allow the SEC to appeal the court’s July 2023 ruling (discussed in our mid-year alert as a “landmark legal victory for the cryptocurrency industry”),[15] and later that month, the SEC dropped its aiding and abetting claims against two Ripple executives.[16] The Ripple case is scheduled to go to trial in April 2024, and motions to dismiss in other significant cases are currently pending.[17] In the meantime, enforcement activity in this area—particularly against major market participants—may be slowing down as the industry awaits the outcome of the litigations. See Section V, infra, for our discussion of significant crypto enforcement activity in the second half of 2023.

C. What Is Not an Internal Controls Violation?

In early 2023, the SEC brought an enforcement action against a public company alleging that its failure to adequately analyze certain employment-related issues amounted to securities law violations. Specifically, the SEC alleged that the company’s failure to “collect and analyze employee complaints of workplace misconduct” amounted to an internal controls violation, even though it found no misstatement relating to such complaints.[18]

In the second half of the year, the SEC brought an additional controls case against a public company relating to its stock buyback program. The SEC specifically alleged that the company’s use of Rule 10b5-1 plans that included “accordion” provisions—which gave the company flexibility on when it could buy back stock—reflected that the company had “insufficient accounting controls”; for this controls violation, the company paid a sizeable $25 million penalty.[19] In their dissent, Commissioners Peirce and Uyeda noted that “[w]e do not have the authority to tell companies how to run themselves, but we now routinely use Section 13(b)(2)(B) to do just that” and further noted that the company’s alleged failures had nothing to do with accounting controls as required by the statute.[20] In 2020, the Commission brought a similar case (with a similar $20 million penalty) alleging violations of Section 13(b)(2)(B) of the Exchange Act in connection with a stock buyback—in that case, the allegation was that the company’s process to assess whether it was in possession of material non-public information at the time of the buyback was inadequate.[21] And in that case, Commissioner Peirce also issued a strongly worded dissent noting simply that “the Order does not articulate any securities law violations.”[22]

Perhaps in response to the drumbeat of dissents by Republican-appointed commissioners in these internal controls matters, Chair Gensler recently defended the Commission’s focus on corporate governance in remarks before the American Bar Association, referring to the “critical role that corporate governance plays to protect investors and facilitate capital formation” and noting that while “Congress conceived the SEC primarily as a disclosure-based agency,” corporate governance principles have long appeared in the federal securities laws.[23] Chair Gensler described the SEC’s recent rulemaking initiatives relating to corporate governance, which have focused on executive compensation clawbacks, limitations on stock buyback plans, transparency in proxy voting, and shortening the deadlines for beneficial ownership reporting, and concluded his remarks by noting that the SEC’s projects “follow Congress’s vision that a federal regulator, the SEC, play a role alongside state law in addressing corporate governance-related issues—to align incentives and build trust in the markets.”[24]

The recent cases and comments illustrate both the Commission’s continuing emphasis on scrutinizing stock buybacks, and more broadly, on using all available tools to bring general corporate governance issues within the purview of the securities laws.

D. Recordkeeping and Whistleblower Protection

In keeping with the emphasis on “conduct that undermines oversight of the securities industry,”[25] fiscal year 2023 was a very significant year for the SEC’s continued industry-wide sweep relating to off-channel business communications and for its whistleblower program.

Recordkeeping

In August and September 2023, the SEC announced settled charges against 21 broker-dealers and investment advisers, resulting in combined penalties of $368 million for the alleged failure to maintain and preserve off-channel communications.[26] The Fall 2023 settlements follow 19 earlier settlements, for a total of approximately $1.5 billion in penalties for alleged recordkeeping violations, and more are expected to come in 2024. Each of the settlements involved admissions, improvements to policies and procedures, and most notably, undertakings to retain independent compliance consultants. One of the firms in the September 2023 announcement self-reported to the SEC—the third firm so far to do so out of 40 firms that agreed to settle charges in the sweep.

In September, the SEC additionally announced settled orders against two credit rating agencies for failure to preserve electronic records.[27] Both agencies allegedly failed to retain or preserve text messages and other electronic communications that employees used relating to how credit ratings were determined. As with the broker-dealer and investment advisers, both agencies admitted to the SEC’s recordkeeping findings, and agreed to retain independent compliance consultants in addition to paying civil penalties for $4 million and $6 million. In announcing the settlement, the Commission emphasized the “critical gatekeeping function” of ratings agencies.

Whistleblower Protection

As we reported in our mid-year alert, the Commission awarded a record-breaking $279 million to two whistleblowers in May 2023 in one case. Overall, the Commission received over 18,000 whistleblower tips in 2023, reflecting a substantial 50% increase over the—at the time record-breaking—number of tips it received in 2022.[28] Significant awards in the second half of the year included the following:

- Awards totaling more than $104 million in August to seven whistleblowers, representing the fourth-largest payout in the SEC whistleblower program’s history.[29] The seven whistleblowers included two sets of joint claimants and three single claimants, all of whom provided information that prompted or significantly contributed to the SEC investigation and related actions by another agency.

- An award of $18 million in August to a whistleblower who, after initially reporting conduct internally, provided information and subsequent cooperation that prompted an SEC investigation and respective enforcement action.[30]

- An award of $28 million in December to seven whistleblowers, composed of a single claimant and two sets of joint claimants.[31] The single claimant and first set of joint claimants were credited with providing “significant and detailed information early in the investigation,” while the second set of joint claimants provided “new, but more limited, information later in the investigation.”

Additionally, enforcement activity and ongoing sweeps reflect the Commission’s aggressive position that agreements with employees and clients that contain confidentiality provisions, but do not provide exceptions for whistleblowing, are a violation of the Dodd-Frank whistleblower protection rule. In January 2024, the SEC brought settled charges with a penalty of $18 million—a record penalty for a purported violation of the whistleblower protection rule—against a broker-dealer for entering into settlement agreements with clients that did not contain whistleblowing carveouts.[32] Three months earlier, in September 2023, the SEC brought three settled actions for purported violations of the rule including: (1) an Order with a registered investment adviser for entering into employee confidentiality agreements that did not contain a whistleblowing carveout, and for entering into employee release agreements that required employees to affirm they had not filed complaints with a government agency;[33] and (2) an Order with a privately held energy and technology company for entering into employee separation agreements that required employees to waive rights to monetary whistleblower awards.[34]

In recent remarks before the New York City Bar Association’s Compliance Institute, Director of Enforcement Gurbir Grewal described these recent actions and noted that the message is that the Commission “take[s] compliance with [the Whistleblower Protection Rule] very seriously, and so should each of you who work in a compliance function or advise companies.”[35] In discussing both the recent whistleblower and recordkeeping actions, Director Grewal further expanded that it is the Commission’s expectation that employees working in a compliance function (i) educate themselves and are aware of SEC Orders “and the violative language cited by the Commission”; (ii) engage with personnel in different business units “to learn about their activities, strategies, risks, financial incentives, counterparties, and sources of revenues and profits”; and (iii) execute and implement effective policies.[36]

E. Senior Staffing Update

At the end of the year, the SEC named Dean C. Metry as the Commission’s Chief Administrative Law Judge, replacing James E. Grimes who had served in the position for two years.[37] Metry has 22 years of experience as an Administrative Law Judge, most recently as the Associate Chief Judge of the Office of Medicare Hearings and Appeals for the U.S. Department of Health and Human Services, and before that as an Administrative Law Judge for the Department of Homeland Security and the Social Security Administration. Metry also served four years in the Navy Judge Advocate General Corps as trial counsel and a summary courts martial officer.

In September, George Botic was appointed to a term as a Board Member of the Public Company Accounting Oversight Board (PCAOB), replacing outgoing Board member Duane DesParte.[38] Botic most recently served as the Director of the PCAOB’s Division of Registration and Inspections, and has also held other roles at PCAOB including Director of the Office of International Affairs, special advisor to former Chair James R. Doty, and Deputy Director of the Registration and Inspections Division.

There were several changes at the senior staff level and in regional leadership, including within the Division of Examination, Media Relations and Speechwriting, and office and regional directors:

- In July, Natasha Vij Greiner and Keith E. Cassidy were named interim Acting Co-Directors of the Division of Examinations while Division Director Richard Best took extended medical leave.[39] Greiner concurrently serves as a Deputy Director of the Division, the National Associate Director of the Investment Adviser/Investment Company (IA/IC) examination program, and the Associate Director of the Home Office IA/IC examination program. Cassidy concurrently serves as a Deputy Director of the Division of Examinations at large and the National Associate Director of the Division’s Technology Controls Program.

- In October, Stephanie Allen replaced Aisha Johnson as the SEC’s Director of Media Relations and Speechwriting.[40] In this capacity, she will lead media relations for the Office of Public Affairs and serve as the primary spokesperson for the SEC and Chair Gensler. Allen previously served as the Executive Director of the Ludwig Institute for Shared Economic Prosperity and the Director of Strategic Communications and Marketing at Promontory Financial Group, an IBM Company.

- In November, Kate E. Zoladz was named Regional Director of the Los Angeles Office after serving as the Acting Co-Director since June 2023 and as the Associate Regional Director for Enforcement since October 2019.[41]

- In December, Daniel R. Gregus left his position as Director of the Chicago Regional Office after leading the Chicago office since 2021 and serving for longer than 30 years at the SEC.[42] For the time being, Vanessa Horton and Kathryn Pyszka will serve as Acting Co-Directors of the regional office.

II. Public Company Accounting, Financial Reporting, and Disclosure

A. Financial Reporting

In September, the SEC charged a ridesharing platform with violations of Section 13(a) of the Exchange Act and Rule 13a-1 for failing to disclose in its 10-K a related person transaction involving a large shareholder’s sale of approximately 2.6% of the company’s shares in the weeks prior to the company’s IPO.[43] The Commission alleged that the shareholder declined to sign a lockup agreement and instead informed the company that it wanted to sell a substantial portion of its shares before the IPO. This transaction required approval of the company’s board of directors, which initially declined the transaction based on concerns that the shareholder’s affiliation with one of the directors could result in material, nonpublic information being imputed to the shareholder. The company later approved a transaction—set-up by an investment advisor for which the director served as an employee—in which the shareholder would ultimately sell its shares at a pre-IPO discount to an unaffiliated investor. For his help with facilitating the sale, the director received millions of dollars of compensation from the investment advisor that arranged the deal. The company settled the charges without admitting or denying the Commission’s findings, and agreeing to pay a civil monetary penalty of $10 million.

Also in September, the SEC charged a telecommunication and internet provider with failing to disclose material information about unsupported adjustments the company made in several filings.[44] The Commission alleged that the company began to notice a discrepancy between two key operational systems that caused a mismatch between actual expenses based on invoices and calculations of what should be paid under existing contracts. Despite the company’s knowledge of the issue, it allegedly failed to implement adequate policies and procedures to provide reasonable assurance that the cost of revenue reflected in the company’s financial statements was based on adequate support. The Commission further alleged that the company made unsupported adjustments to its financial results that lowered its cost of revenue by more than $35 million, without disclosing material facts about the adjustments. The Commission determined not to impose civil monetary penalties based on the company’s self-reporting and cooperation.

In the same month, the SEC also announced settled charges against a consumer products company and its former CEO for fraud and reporting violations.[45] The Commission alleged that the company pulled sales forward into earlier quarters without adequate disclosure and engaged in accounting practices that were inconsistent with GAAP while overriding its internal accounting controls, giving the misleading appearance that the company had achieved sales growth in line with its targets. Both the company and the CEO settled the charges without admitting or denying the SEC’s findings, agreeing to pay civil penalties of $12.5 million and $110,000, respectively.

Later in September, the SEC charged an owner and operator of distributed solar energy assets with violating antifraud, proxy, and reporting provisions of the federal securities laws.[46] According to the Commission, the company’s revenue projections, featured in public filings ahead of a SPAC merger, were misleading because the sales pipeline consisted almost entirely of speculative sales opportunities, including sales to potential customers with whom the company had little or no contact, customers to whom the company could not legally sell its products, and stale sales opportunities. The company agreed to pay a civil penalty of $11 million without admitting or denying the SEC’s findings.

At the end of September, the SEC filed a complaint against the former chief commercial officer (CCO) and former CFO of a telecommunications company for allegedly violating the antifraud provisions and other provisions of the federal securities laws.[47] According to the Commission, the CCO, former CFO, and controller engaged in a fraudulent scheme by allegedly recognizing revenue from customers’ non-binding purchase orders, allowing the company to materially overstate its revenue. The Commission seeks injunctive relief, disgorgement and prejudgment interest, civil penalties, and officer and director bars against the former CCO and former CFO. The complaint also seeks to order the former CFO to reimburse the company for compensation pursuant to Section 304 of the Sarbanes-Oxley Act. The controller settled the charges, agreeing to an officer and director bar, an accountant bar, and to be subject to future proceedings to determine any monetary relief. In a parallel action, the U.S. Attorney’s Office for the Southern District of New York announced criminal charges against the CCO and former CFO.

In December, the SEC announced settled fraud charges against a publicly traded UAE-based energy company, the company’s former CEO, and its interim CEO, who previously served as chief strategy officer.[48] The SEC order alleged that the NASDAQ-traded company, before and after it went public through a special-purpose acquisition transaction, from 2018 to early 2021, misstated between 30 and 80 percent of its revenues in SEC filings related to its offer and sale of up to $500 million of securities. To this end, the company allegedly created false invoices that inflated its revenues from UAE-based oil facilities by over $70 million over three years. The SEC also alleged that the former and interim CEOs knew, or were reckless in not knowing, of the conduct. The company settled the charges, which alleged violations of the antifraud, proxy statement, reporting, and book-and-records provisions of the federal securities laws, and agreed not to issue the $500 million in securities and to pay a $5 million penalty without admitting or denying the SEC’s findings. The company further announced a restatement of its audited 2018 to 2020 financial statements. The former and interim CEOs also settled their respective charges without admitting or denying the SEC’s findings, and each agreed to a $100,000 civil penalty and a permanent officer and director bar.

Also in December, the SEC filed charges against three related companies and their CEO with engaging in a multi-year scheme causing the defendants to allegedly report materially false and misleading financial statements.[49] According to the complaint, the CEO allegedly booked billions of dollars’ worth of fictitious transactions, primarily through the Nigerian subsidiaries of his companies, and ultimately misrepresented to investors that the companies had hundreds of millions of dollars in cash balances, and used the inflated financial statements to facilitate the sale of two subsidiaries to U.S.-listed public companies at grossly inflated values. The SEC further alleged that the CEO and defendant companies created fake bank statements, falsified general ledgers, and submitted forged and fabricated documents to their auditors to facilitate the scheme. The complaint seeks permanent injunctions, disgorgement, civil penalties, an officer and director bar, and a clawback, pursuant to Section 304 of the Sarbanes-Oxley Act, of the CEO’s bonuses and profits obtained from the issuance of the defendant companies’ stock.

B. Public Statements and Disclosures

In July, the SEC announced settled charges on a neither admit nor deny basis against a “smart” window manufacturer and its former CFO for allegedly failing to disclose $28 million in projected warranty-related liabilities to address a defect in the company’s product; the SEC filed a complaint against the company’s former CFO relating to the conduct.[50] In a series of reports and statements filed with the Commission, the company included liabilities related to its costs to manufacture replacements for defective windows, but allegedly failed to include related shipping and installation costs in its accrued liabilities. The Commission did not enforce a civil penalty against the company based in part on the company’s self-reporting, remedial measures, and cooperation; its complaint against the former CFO is pending, and seeks permanent injunctions, civil penalties, and an officer and director bar.

In September, the SEC filed settled charges against a manufacturer of hydrogen fuel cell electric vehicles, the company’s CEO, and the company’s managing director of its European subsidiary.[51] The SEC’s order alleged that the company exaggerated the status of its dealings with potential customers and suppliers to create the appearance that vehicle sales were imminent. The complaint further alleged that shortly before the company’s IPO via a SPAC, the company claimed to have sold its first hydrogen electric vehicle and posted a misleading video on social media that allegedly gave the misleading impression that the depicted vehicle ran on hydrogen. The company and the officer defendants agreed to pay civil penalties of $25 million, $100,000 and $200,000, respectively, without admitting or denying the charges.

Also in September, the SEC charged six officers, directors, and major shareholders of public companies for failing to timely report information about their holdings and transactions in company stock, and against five publicly traded companies for contributing to, or failing to report, their insiders’ filing issues.[52] The Commission used data analytics to identify the charged insiders as filing Form 4 and Schedules 13D and 13G reports late, with some filings delayed by years. Without admitting or denying the findings, the six individuals and five public companies agreed to pay civil penalties.

In October, the SEC filed a complaint against a software company and its chief information security officer alleging fraud and internal control failures related to cybersecurity risks.[53] The SEC alleged that the company—which was a victim of a two-year-long cyberattack and data breach—misled investors about the adequacy of its cybersecurity abilities, even though it was allegedly aware of related weaknesses and increasing risks of cyberattacks. The SEC’s complaint seeks injunctive relief, disgorgement, and civil penalties, as well as an officer and director bar against the chief information security officer. The complaint is notable in that it represents the first time the SEC has filed fraud charges against a chief information security officer, which is a position that does not have accounting or financial reporting responsibility.

In November, the SEC filed a complaint against former co-CEOs of a private technology services startup for violating the antifraud provisions of the federal securities laws by misleading investors about the company’s finances.[54] The Commission alleged that the co-CEOs made material misrepresentations and falsified documents concerning the company’s cash position and historical financial performance while raising money from investors, including by creating and providing investors with falsified bank records and a fake audit report. The co-CEOs agreed to the entry of a partial judgment imposing permanent and conduct-based injunctions and an officer and director bar, but reserving the issues of disgorgement, prejudgment interest, and a civil penalty for further determination by the court. The U.S. Attorney’s Office for the Eastern District of California announced parallel criminal charges as well.

In December, the SEC filed a complaint charging the former CEO and co-founder of a medical device startup with defrauding investors of approximately $41 million and making false and misleading statements about one of the company’s key medical device products.[55] The Commission alleged that the former CEO knew, or was reckless in not knowing, that one of the components of one of the company’s medical devices, which was implanted into patients’ bodies, was non-functional. The SEC also alleged that the former CEO misrepresented to investors that the medical device had been approved by the FDA and that it was the only effective device of its kind on the market. According to the complaint, the former CEO also made false and misleading statements to investors about the company’s historical revenues, revenue projections, and business model. The complaint seeks permanent injunctions, disgorgement plus prejudgment interest, a civil penalty, and an officer and director bar. The U.S. Attorney’s Office for the Southern District of New York filed criminal charges against the former CEO as well.

C. Auditors and Accountants

In September, the SEC settled charges against a former accounting firm partner for improper professional conduct involving the firm’s quality control system for its assurance practice.[56] Similar to the allegations underlying an earlier SEC settlement in June with the accounting firm,[57] the SEC alleged that the former partner failed to sufficiently address and remediate deficiencies in the firm’s quality control system, primarily in connection with the increase in audits of special purpose acquisition companies (SPACs) beginning in 2020, which had been identified by the firm and in inspections by the Public Company Accounting Oversight Board (PCAOB). The former partner also allegedly failed to implement sufficient monitoring procedures to detect audit deficiencies. Without admitting or denying the allegations, the former partner agreed to pay a civil penalty of $75,000, and to forgo holding a leadership position at a registered public accounting firm for a period of three years.

Also in September, the SEC filed an action charging an accounting firm and its professional services firm with violating the auditor independence laws and aiding and abetting their clients’ violations of the federal securities laws.[58] The SEC’s complaint alleges that the firms improperly included indemnification provisions in engagement letters for more than 200 audits, reviews, and exams, including after the firm’s senior partners were allegedly notified that inclusion of indemnification provisions in engagement letters rendered the firm not independent. The complaint seeks a permanent injunction, disgorgement, and a civil monetary penalty against the firms.

III. Investment Advisers

A. Misaligned Interests

In August, the SEC filed a settled action against a fund administrator for causing its client to violate provisions of the Advisers Act relating to a fraud against a private fund and its investors.[59] The SEC alleged that the fund administrator, based on materially false and misleading statements from its client—an investment adviser charged separately with fraud by the SEC in 2022—sent investors account statements that materially overstated the value of their investments, which had suffered significant losses as a result of trading by the adviser. The fund administrator agreed, without admitting or denying the SEC’s findings, to pay a penalty and disgorgement totaling more than $122,000. The SEC considered remedial actions undertaken by the fund administrator in determining to accept its offer of settlement. The matter is notable as a follow on investigation of a service provider to a registered investment adviser for causing the adviser’s previously settled violations. The settlement is consistent with the SEC’s increased focus on the use of service providers by registered investment advisers, including its pending rule proposal “Outsourcing by Investment Advisers”.

In September, the SEC filed a settled action against an investment advisory firm and its owner for allegedly allocating profitable securities trades to favored accounts, including the firms’ own accounts, while allocating a disproportionate amount of unprofitable trades to disfavored clients.[60] The SEC found that the firm and its owner received at least $2.7 million in profits from the alleged “cherry-picking” scheme and that the owner made false and misleading statements to clients and prospective clients about the firm’s trading practices. Without admitting or denying the SEC’s findings, the firm and its owner agreed to pay more than $3 million in civil penalties and disgorgement.

Also in September, the SEC filed a settled action against an investment adviser for alleged breaches of fiduciary duty that it owed to private funds that it advised.[61] The SEC alleged that the firm failed to consider whether a fee acceleration agreement—which enabled the investment adviser to receive accelerated monitoring fees from a portfolio company when the company was sold—was in its clients’ best interests. The investment adviser further allegedly transferred expiring funds into a new private fund, thereby locking up investor money for 11 years without client permission, and loaned money to private funds managed by an affiliated adviser without the clients’ knowledge, and without considering the clients’ best interests. Without admitting or denying the SEC’s findings, the investment adviser agreed to pay a civil penalty of $1.6 million.

In November, the SEC filed a complaint against an individual—serving as both the president and chief compliance officer of an investment adviser—for his involvement in an alleged multiyear fraud that concealed losses of over $350 million from investors.[62] The SEC’s complaint alleges that the defendant misled investors through sham documents to believe that their investments were diversified, and then funneled their investments to a single sub-adviser that incurred heavy losses. The complaint further alleges that the defendant separately caused hedge funds under his firm’s advisement to incur heavy losses resulting from highly illiquid investments. The SEC’s complaint seeks a permanent injunction, disgorgement, civil penalties, and an officer and director bar. The U.S. Attorney’s Office for the District of New Jersey announced parallel criminal charges.

Also in November, the SEC filed an action against a real estate investment company, its CEO, and several entities controlled by the CEO, for allegedly engaging in a scheme to misappropriate $35 million of investor funds.[63] The SEC separately alleged that the CEO and an entity under his control attempted to manipulate, and profit from, a certain corporation’s stock by, after first buying 72,000 call options in the corporation for well under the stock price, falsely stating in a press release that they would purchase a majority stake in the corporation at a price per share well over the then-current trading price. The SEC’s complaint seeks permanent injunctive relief, the appointment of a receiver, disgorgement, a civil penalty, and temporary restraining orders and asset freezes.

B. Disclosure Issues

In August, the SEC announced settled charges against an investment adviser, its parent company, and their majority owner and founder, an individual, with breaching fiduciary duties by disadvantaging a client in order to obtain $20 million in rescue financing in 2019.[64] That client, an exchange-traded fund (“ETF”) tracking an index of cannabis companies, had been funded by a broker-dealer since 2018. The ETF’s founder and investment adviser were allegedly aware of funding options from other lenders that would been more beneficial to the ETF, but nonetheless failed to inform the ETF’s trustees about these options in order to keep the ETF’s business with its initial broker-dealer. According to the SEC, the investment adviser had separate financing contracts with the broker-dealer and allegedly did not want to risk losing those contracts. Without admitting or denying the SEC’s findings, the investment adviser and its parent company agreed to pay, jointly and severally, a penalty of $4 million, and the founder agreed to a $400,000 penalty, an associational bar under the Advisers Act, a prohibition under the Investment Company Act with the ability to reapply after three years, and to comply with certain undertakings.

In September, the SEC charged an alternative investment platform with failing to disclose critical information to investors in an asset-backed securities offering.[65] The platform allegedly made multiple offerings, to a single foreign borrower, to finance loans for the deconstruction of ships, despite allegedly learning that the borrower’s collateral—certain ships—for earlier loans were either “broken up” or missing entirely. The platform later determined that the borrower had stolen the deconstruction proceeds for several ships, leaving investors with millions of dollars in losses. Without admitting or denying the SEC’s findings, the platform agreed to disgorgement and civil monetary penalties totaling approximately $1.9 million.

Later in September, the SEC filed a settled action against an investment adviser and its principal for disclosure and compliance violations with respect to conflicts of interest.[66] According to the SEC, the investment adviser and its principal advised certain clients to invest in three companies in which the principal had decision-making authority and significant ownership interests. The SEC further alleged that the investment adviser and its principal failed to disclose to clients that their investments would be temporarily used for purposes such as funding the adviser’s payroll and to repay loans owed to the principal or to other affiliated companies. Without admitting or denying the SEC’s findings, the investment adviser and its principal agreed to pay, jointly and severally, a civil penalty of $250,000. The SEC considered remedial actions undertaken by the adviser and its principal, including promptly repaying certain debts totaling $1.65 million, in determining to accept its offer of settlement.

Also in late September, the SEC filed settled charges against an investment adviser related to undisclosed conflicts of interest involving a cash sweep program—through which one of the adviser’s affiliated custodians transferred clients’ uninvested cash into interest-earning accounts—and receipt of revenue-sharing payments from third-party custodians.[67] According to the SEC, from at least September 2016 to January 2021, the adviser did not inform clients that it helped set the fee that its affiliate custodian received for operating the cash sweep program, which reduced the amount of interest paid to those clients. Additionally, from at least January 2016 through August 2019, the adviser allegedly received custodial support payments from some third-party custodians based on assets held in certain funds, but failed to disclose that there were more favorable options available for use by clients that would not have resulted in payments to the adviser. Without admitting or denying the SEC’s findings, the adviser agreed to pay a civil penalty and disgorgement totaling over $18 million.

In October, the SEC filed settled charges against an investment adviser relating to its description of investments that composed a significant portion of a publicly traded fund it advised.[68] The SEC’s order alleged that the adviser inaccurately described a company in which it made significant investments in multiple, publicly available reports filed with the SEC, and that the adviser allegedly stated that the company paid a higher interest rate than was actually the case. Without admitting or denying the SEC’s findings, the adviser agreed to pay a $2.5 million penalty. In determining to accept the adviser’s offer of settlement, the SEC considered cooperative and remedial actions undertaken by the adviser, including voluntarily covering losses associated with the investment and revising its disclosures promptly after discovering the errors and before the SEC began its investigation.

C. Anti-Money Laundering and ESG

In September, the SEC filed two settled actions against an investment adviser for allegedly failing to develop an Anti-Money Laundering (“AML”) program for its mutual funds, and by making materially misleading misstatements about its Environmental, Social, and Governance (“ESG”) process.[69] Regarding the alleged AML program deficiency, the SEC alleged that the investment adviser failed to establish and implement AML policies specific to its mutual funds’ business, to design reasonable transaction-monitoring policies to detect money laundering activities, and to conduct AML training specific to its mutual funds. In the second action, the SEC alleged that the investment adviser failed to implement certain research requirements as part of its global ESG Integration Policy from August 2018 until late 2021, contrary to what it allegedly led investors to believe through certain public statements. Without admitting or denying the SEC’s findings, the firm agreed to pay civil penalties totaling over $25 million to resolve the AML and ESG actions. In determining to accept the investment adviser’s settlement offer, the SEC considered the adviser’s cooperation throughout the investigation, including its provision of detailed factual summaries and substantive presentations to the Commission.

D. Miscellaneous Advisory Issues: Fees, Custody Rule, and Marketing Rule

In August, the SEC filed a settled action against two investment advisers for allegedly overcharging investment advisory accounts more than $26.8 million in advisory fees from at least 2002 through December 2022.[70] According to the SEC, the advisers failed to enter agreed-upon reduced advisory rates into their billing systems and failed to adopt and implement written compliance policies and procedures reasonably designed to prevent overbilling. The advisers paid affected accountholders approximately $40 million, including interest, to reimburse them for the overcharged fees and agreed, without admitting or denying the SEC charges, to pay a $35 million civil penalty.

In September, the SEC filed settled actions against nine investment advisers for allegedly advertising hypothetical performance to the general public on their websites without timely adopting or implementing related policies and procedures designed to ensure that the advertised hypothetical performance was relevant to investors’ objectives and financial situations.[71] The SEC additionally alleged that two of the advisers failed to maintain required copies of their advertisements. Without admitting or denying the SEC’s findings, each of the charged firms agreed to pay civil penalties ranging from $50,000 to $175,000.

Also in September, the SEC filed settled actions against five investment advisers for allegedly failing to comply with requirements related to the safekeeping of client assets.[72] The SEC charged three of the advisers with also failing to timely update SEC disclosures regarding audits of their private fund clients’ financial statements. The SEC alleged that each of the advisers failed to have audits performed, deliver audited financials to investors in a timely manner, ensure a qualified custodian maintained client assets, promptly file amended Forms ADV to reflect they had received audited financial statements, and/or properly describe the status of its financial statement audits for multiple years when filing its Form ADV. Without admitting or denying the findings, the advisers agreed to pay civil penalties ranging from $50,000 to $225,000.

IV. Broker-Dealers

A. Trading Issues

In July, the SEC filed an action against a U.S. Army financial counselor for defrauding, among others, the survivors and loved ones of U.S. military service members who died during active duty service.[73] According to the SEC, the financial counselor directed the survivors and loved ones to transfer their benefits into brokerage accounts he managed outside of his official duties with the U.S. Army and, in connection with the brokerage accounts, incurred commissions and losses, both realized and unrealized, of more than $5 million from November 2017 through January 2023. The SEC alleges that the financial counselor engaged in unauthorized trading and recommended excessive trades and higher risk strategies that did not match customers’ investment profiles. The SEC’s complaint alleges violations of the anti-fraud provisions of the federal securities laws and Regulation Best Interest, and seeks permanent injunctions, disgorgement, and civil penalties.

B. Recordkeeping and Filing Issues

In July, the SEC filed settled charges against a broker-dealer for allegedly failing to file Suspicious Activity reports (SARs) from 2009 to 2019.[74] During the relevant period, with respect to suspicious activity where no suspect was identified, the broker-dealer allegedly only reported such activity for transactions of $25,000 or greater—which is the proper reporting threshold for national banks, but not for broker-dealers, which must report all suspicious activity at or above the $5,000 threshold regardless of whether a suspect has been identified—and as a result allegedly failed to file hundreds of required SARs. Without admitting or denying the SEC’s findings, the firm agreed to pay a $6 million penalty. The SEC considered the firm’s cooperation and immediate remedial actions, which included updates to policies, procedures, and automated surveillance systems, when agreeing to the settlement.

In addition to the swath of off-channel communications recordkeeping cases discussed in Section I, supra, in August, the SEC filed settled charges against a broker-dealer firm for allegedly violating recordkeeping requirements in connection with firm expenses related to its underwriting business.[75] According to the SEC’s order, from at least 2009 to May 2019, the broker-dealer failed to review or verify the method it used to calculate and record indirect underwriting expenses associated with its work as an underwriter. Without admitting or denying the SEC’s findings, the broker-dealer agreed to pay a civil penalty of $2.9 million.

Also in August, the SEC filed settled charges against a broker-dealer for allegedly failing to establish an anti-money laundering surveillance program with respect to certain transactions until September 2020, and as a result allegedly failing to file at least 461 SARs associated with microcap and penny stock security trades.[76] Without admitting or denying the alleged facts, the broker-dealer agreed to pay a $1.5 million penalty.

Also in September, the SEC filed settled charges against a broker-dealer for alleged violations of Rule 200(g) of Regulation SHO.[77] According to the SEC’s order, the broker-dealer, as a result of a coding error in the firm’s automatic trading system, incorrectly marked millions of orders for a period of five years, denoting that some short sales were long sales and vice versa, which resulted in the provision of inaccurate data to regulators. Without admitting or denying the findings, the broker-dealer agreed to pay a $7 million penalty, remediate the coding error, and review the firm’s programming and coding logic involved in processing transactions.

C. Information Barriers and MNPI

In September, the SEC filed a complaint against a broker-dealer for allegedly making false and misleading statements and omissions regarding information barriers that impacted the use of customer information.[78] According to the complaint, the broker-dealer and its affiliates operated two distinct types of businesses, “customer-facing trade execution services” that generated materially non-public information (MNPI) regarding trade orders and executions, and “proprietary trading operations” intended to prevent the misuse of MNPI. The SEC’s complaint alleges that although the broker-dealer purported to maintain information barriers, the firm allegedly failed to safeguard a database containing all post-trade information generated from customer orders, including customer-identifying information and other material non-public information, from around January 2018 to April 2019. The SEC further alleges that the broker-dealer misled customers about the adequacy of the information barriers, and overstated the controls and processes it had in place to secure institutional customers’ post-execution trade data. The SEC is seeking disgorgement and civil penalties.

V. Cryptocurrency and Other Digital Assets

A. Cryptocurrency Platforms and Networks

In August, the SEC announced a settled action against a crypto asset trading platform and its co-founder and former CEO based on allegations that they operated an unregistered national securities exchange, broker, and clearing agency.[79] According to the SEC’s order, the company—which allegedly provided services to U.S. investors in connection with crypto assets that were offered and sold as securities—and its co-founder and former CEO directed issuers of crypto assets made available on the platform to delete problematic statements that might lead to scrutiny from regulators. Without admitting or denying the SEC’s allegations, the defendants agreed to disgorgement and a civil penalty totaling approximately $24 million. The platform’s foreign affiliate also agreed to settle charges that it failed to register as a national securities exchange.

In November, the SEC filed a complaint against a cryptocurrency trading platform—which had already agreed in February 2023 to pay $30 million in disgorgement and civil penalties to settle an SEC action involving an alleged failure to register a cryptocurrency asset—for operating as an unregistered securities exchange, broker, dealer, and clearing agency.[80] According to the complaint, since at least September 2018, the cryptocurrency trading platform has made hundreds of millions of dollars by facilitating the buying and selling of cryptocurrency asset securities. The complaint also alleges that the cryptocurrency trading platform’s business practices, internal controls, and recordkeeping practices, including the alleged comingling of customer money and cryptocurrency assets with its own, posed risks to customers and deprived investors of required protections. The litigation is ongoing and the SEC seeks disgorgement and penalties.

In January 2024, the SEC moved to drop charges that it initially brought against a cryptocurrency company and individual defendants based on what the SEC alleged was a fraudulent scheme to sell cryptocurrency asset securities to U.S. investors.[81] The SEC brought its initial charges against the defendants in 2023, and had also obtained a temporary asset freeze, restraining order, and other emergency relief against them. However, several months later, the defendants moved for sanctions against the SEC, arguing that Commission counsel presented false and misleading evidence when pursuing its restraining order, which defendants further argued had severely disrupted their business. The court issued the SEC a show cause order, but the SEC moved for dismissal, asking the court to decline sanctions and to do nothing more than dismiss the initial charges without prejudice.

B. Non-Fungible Tokens (“NFTs”) and Other Products

In August, the SEC charged a media and entertainment company with conducting an unregistered offering of crypto asset securities in the form of purported non-fungible tokens (NFTs) from October to December 2021.[82] According to the SEC’s order, the company encouraged investors to view the NFTs as an investment into the business, and emphasized that investors would profit and receive tremendous value if the business was successful. The SEC’s order alleged that the NFTs were investment contracts and therefore allegedly qualified as securities that were not exempt from registration. Without admitting or denying the SEC’s findings, the media and entertainment company agreed to pay disgorgement and a civil penalty totaling over $5.5 million. The company further agreed to destroy all NFTs in its possession or control, publish notice of the order on its websites and social media channels, and eliminate any royalties it might receive from future secondary market transactions. In determining to accept the company’s settlement offer, the Commission considered remedial actions through which the company repurchased approximately $7.7 million worth of NFTs from investors.

In September, the SEC settled charges against a fintech company that provides cryptocurrency asset-related financial products and services for failing to register the offers and sales of its retail cryptocurrency lending product.[83] According to the SEC’s order, from March 2020 to March 2022, the company allowed U.S. investors to tender U.S. dollars in exchange for a promise to pay interest, and the company converted this cash into cryptocurrency assets, pooled the cryptocurrency assets, and controlled how the assets were used to generate income, which purportedly qualified as the offer and sale of securities that were not exempt from registration. The SEC did not impose civil penalties due to the company’s cooperation and prompt remedial actions, including its voluntary decision to cease offering accounts to new investors and asking existing investors to withdraw funds shortly after the SEC announced charges against a similar cryptocurrency asset investment product.

Also in September, the SEC charged a company with conducting an unregistered offering of cryptocurrency asset securities in the form of purported NFTs.[84] According to the order, the company offered and sold cryptocurrency asset securities to the public in an unregistered offering that was not exempt from registration, violating Sections 5(a) and 5(c) of the Securities Act. Without admitting or denying the allegations, the company agreed to pay a civil penalty of $1 million as well as to publish notice of the settlement on its website and social media channels and destroy all NFTs in its possession.

VI. Insider Trading

In July, the SEC filed a complaint charging a multi-billionaire investor with allegedly obtaining material nonpublic information regarding portfolio companies of a biotechnology investment fund where he was the principal investor, and then allegedly tipping that information to his then-girlfriend and two of his private pilots.[85] The SEC also brought charges against the three individuals who allegedly traded on the information and reaped over $545,000 in combined profits. The SEC alleges that the investor informed his girlfriend, along with the two pilots, about clinical trial results regarding a separate company, and that he provided this information to his two pilots “as a substitute for a formal retirement plan” and loaned them each $500,000 to execute the trades. The three individuals soon thereafter allegedly traded on this material nonpublic information and allegedly profited more than $373,000 in total. The SEC’s complaint remains pending in the Southern District of New York; the investor recently pled guilty to parallel criminal charges.[86]

In August, the SEC filed a second round of insider-trading charges against a former broker who had settled separate insider trading charges last year regarding a data-analytics company’s prospective acquisition.[87] The latest indictment, filed in the Southern District of New York, alleged that the defendant used two Cayman Islands-based entities to purchase 23,000 shares of the data-analytics company’s stock prior to its acquisition announcement, which ultimately resulted in almost $400,000 in ill-gotten profits. The former broker, without admitting or denying the allegations, agreed to pay an approximately $1.2 million civil penalty to settle the charges, and the two offshore entities, which were named as relief defendants, agreed to disgorgement.

In September, the SEC filed a complaint charging three siblings with illegal trading based on inside information about an equipment rental company’s offer to acquire a storage company.[88] According to the SEC’s complaint filed in the Central District of California, one brother learned about the acquisition as an accounting manager for the storage company. He then allegedly bought shares of the storage company and encouraged his brother and sister to do the same, and the three siblings realized combined profits of $650,000. The brother who created the scheme, without admitting or denying the allegations, agreed to a to-be-determined civil penalty, disgorgement, and a five-year officer and director bar. The U.S. Attorney’s Office for the Central District of California also announced securities fraud charges against that brother. The remaining siblings consented to paying monetary fines and disgorgement totaling over $340,000, and the second brother agreed to a five-year officer and director bar.

Also in September, the SEC filed an action against a former analyst for a major investment firm and an international investment bank, as well as three others, charging insider trading.[89] The SEC’s complaint alleges that the analyst used his work at the two financial institutions to learn about merger and acquisition transactions as well as strategic partnerships prior to their public announcements, and tipped material nonpublic information about at least six of these transactions to his childhood friend in exchange for a share of what ended up being $322,000 of illegal profits. The analyst also allegedly tipped four of the transactions to one of his college friends, resulting in $113,000 in profits, and that friend then tipped information about at least two transactions to another college friend, resulting in $25,000 in profits. The U.S. Attorney’s Office for the Southern District of New York announced parallel criminal charges. Both investigations are ongoing.

Looking ahead, enforcement of insider trading may increase in 2024 depending on how the Commission’s “shadow trading” theory—reflecting the use of inside information in one company to buy stocks in a different company with potential to be impacted by the information—fares at trial in the case of SEC v. Panuwat, Case Number 3:21-cv-06322, currently scheduled to begin in March 2024 in the U.S. District Court for the Northern District of California.

[1] SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2023 (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-234.

[2] Id.

[3] Id.

[4] Compare Addendum to SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2023 (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-234, with Addendum to SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2022 (Nov. 15, 2022), available at https://www.sec.gov/news/press-release/2022-206.

[5] Id.

[6] Id.

[7] SEC Press Release, SEC Charges LA-Based Media and Entertainment Co. Impact Theory for Unregistered Offering of NFTs (Aug. 28, 2003), available at https://www.sec.gov/news/press-release/2023-163; SEC Press Release, SEC Charges Creator of Stoner Cats Web Series for Unregistered Offering of NFTs (Sept. 13, 2023), available at https://www.sec.gov/news/press-release/2023-178.

[8] SEC Press Release, SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency (June 6, 2023), available at https://www.sec.gov/news/press-release/2023-102; SEC Press Release, SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao (June 5, 2023), available at https://www.sec.gov/news/press-release/2023-101.

[9] SEC Press Release, SEC Charges Kraken for Operating as an Unregistered Securities Exchange, Broker, Dealer, and Clearing Agency (Nov. 20, 2023), available at https://www.sec.gov/news/press-release/2023-237.

[10] See, e.g., SEC Press Release, SEC Charges Crypto Trading Platform Beaxy and its Executives for Operating an Unregistered Exchange, Broker, and Clearing Agency (Mar. 29, 2023), available at https://www.sec.gov/news/press-release/2023-64; SEC Press Release, SEC Charges Crypto Asset Trading Platform Bittrex and its Former CEO for Operating an Unregistered Exchange, Broker, and Clearing Agency (Apr. 17, 2023), available at https://www.sec.gov/news/press-release/2023-78; SEC Press Release, SEC Charges Crypto Entrepreneur Justin Sun and His Companies for Fraud and Other Securities Law Violations (Mar. 22, 2023), available at https://www.sec.gov/news/press-release/2023-59.

[11] SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2023 (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-234.

[12] SEC Statement, Statement on the Denial of a Rulemaking Petition Submitted on behalf of Coinbase Global Inc. (Dec. 15, 2023), available at https://www.sec.gov/news/statement/gensler-coinbase-petition-121523; see also SEC v. W.J. Howey Co., 328 U.S. 293 (1946).

[13] SEC Statement, Statement on the Denial of a Rulemaking Petition Submitted on behalf of Coinbase Global Inc. (Dec. 15, 2023), available at https://www.sec.gov/news/statement/gensler-coinbase-petition-121523.

[14] SEC Statement, Statement Regarding Denial for Petition for Rulemaking (Dec. 15, 2023), available at https://www.sec.gov/news/statement/peirce-uyeda-petition-121523.

[15] Jonathan Stempel, US SEC Cannot Appeal Ripple Labs Decision, Judge Rules, Reuters (Oct. 4, 2023), https://www.reuters.com/legal/us-sec-cannot-appeal-ripple-labs-decision-judge-rules-2023-10-04/.

[16] Jody Godoy, US SEC Drops Claims Against Two Ripple Labs Executives, Reuters (Oct. 19, 2023), https://www.reuters.com/markets/us/sec-dropping-claims-against-ripple-executives-court-filing-2023-10-19/.

[17] Sec. and Exch. Comm’n. v. Ripple Labs Inc., No. 1:20-cv-10832 (S.D.N.Y.).

[18] SEC Press Release, Activision Blizzard to Pay $35 Million for Failing to Maintain Disclosure Controls Related to Complaints of Workplace Misconduct and Violating Whistleblower Protection Rule (Feb. 3, 2023), available at https://www.sec.gov/news/press-release/2023-22.

[19] SEC Press Release, Charter Communications to Pay $25 Million Penalty for Stock Buyback Controls Violations (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-235.

[20] SEC Statement, The SEC’s Swiss Army Statute: Statement on Charter Communications, Inc. (Nov. 14, 2023), available at https://www.sec.gov/news/statement/peirce-uyeda-statement-charter-communications-111423#_ftn6.

[21] SEC Press Release, SEC Charges Andeavor for Inadequate Controls Around Authorization of Stock Buyback Plan (Oct. 15, 2020), available at https://www.sec.gov/news/press-release/2020-258.

[22] SEC Statement, The SEC Levels Up: Statement on In re Activision Blizzard (Feb. 3, 2023), available at https://www.sec.gov/news/statement/peirce-statement-activision-blizzard-020323.

[23] SEC Speech, “They Are Merely the Agents”: Prepared Remarks before the American Bar Association (Dec. 7, 2023), available at https://www.sec.gov/news/speech/gensler-prepared-remarks-american-bar-association-231207.

[24] Id.

[25] SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2023 (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-234.

[26] SEC Press Release, SEC Charges 10 Firms with Widespread Recordkeeping Failures (Sept. 29, 2023), available at https://www.sec.gov/news/press-release/2023-212; SEC Press Release, SEC Charges 11 Wall Street Firms with Widespread Recordkeeping Failures (Aug. 8, 2023), available at https://www.sec.gov/news/press-release/2023-149.

[27] SEC Press Release, SEC Charges Two Credit Rating Agencies, DBRS and KBRA, with Longstanding Recordkeeping Failures (Sept. 29, 2023), available at https://www.sec.gov/news/press-release/2023-211.

[28] SEC Press Release, SEC Announces Enforcement Results for Fiscal Year 2023 (Nov. 14, 2023), available at https://www.sec.gov/news/press-release/2023-234.

[29] SEC Press Release, SEC Awards Whistleblower More Than $104 Million to Seven Whistleblowers (Aug. 4, 2023), available at https://www.sec.gov/news/press-release/2023-147.

[30] SEC Press Release, SEC Awards Whistleblower More Than $18 Million (Aug. 25, 2023), available at https://www.sec.gov/news/press-release/2023-161.

[31] SEC Press Release, SEC Awards More Than $28 Million to Seven Whistleblowers (Dec. 22, 2023), available at https://www.sec.gov/news/press-release/2023-257.

[32] SEC Press Release, J.P. Morgan to Pay $18 Million for Violating Whistleblower Protection Rule (Jan. 16, 2024), available at https://www.sec.gov/news/press-release/2024-7.

[33] SEC Press Release, SEC Charges D. E. Shaw with Violating Whistleblower Protection Rule (Sept. 29, 2023), available at https://www.sec.gov/news/press-release/2023-213.

[34] SEC Press Release, SEC Charges Privately Held Monolith Resources for Using Separation Agreements that Violated Whistleblower Protection Rules (Sept. 8, 2023), available at https://www.sec.gov/news/press-release/2023-172.

[35] SEC Speech, Remarks at New York City Bar Association Compliance Institute (Oct. 24, 2023), available at https://www.sec.gov/news/speech/grewal-remarks-nyc-bar-association-compliance-institute-102423.

[36] Id.

[37] SEC Press Release, Dean C. Metry Named Chief Administrative Law Judge at SEC (Dec. 22, 2023), available at https://www.sec.gov/news/press-release/2023-259.

[38] SEC Press Release, SEC Appoints George Botic to the Public Company Accounting Oversight Board (Sept. 27, 2023), available at https://www.sec.gov/news/press-release/2023-202.

[39] SEC Press Release, SEC Names Natasha Vij Greiner and Keith E. Cassidy Interim Acting Co-Directors of the Division of Examinations (July 25, 2023), available at https://www.sec.gov/news/press-release/2023-137.

[40] SEC Press Release, SEC Names Stephanie Allen as Director of Media Relations and Speechwriting (Oct. 4, 2023), available at https://www.sec.gov/news/press-release/2023-218.

[41] SEC Press Release, SEC Names Kate E. Zoladz as Regional Director of Los Angeles Office, available at https://www.sec.gov/news/press-release/2023-241.

[42] SEC Press Release, Daniel R. Gregus, Director of the Chicago Regional Office, to Depart the SEC (Dec. 7, 2023), available at https://www.sec.gov/news/press-release/2023-246.

[43] SEC Press Release, SEC Charges Lyft with Failure to Disclose Board Member’s Financial Interest in Private Shareholder’s Pre-IPO Stock Transaction (Sept. 18, 2023), available at https://www.sec.gov/news/press-release/2023-182.

[44] SEC Press Release, SEC Charges GTT Communications for Disclosure Failures (Sept. 25, 2023), available at https://www.sec.gov/news/press-release/2023-195.

[45] SEC Press Release, SEC Charges Newell Brands and Former CEO for Misleading Investors About Sales Performance (Sept. 29, 2023), available at https://www.sec.gov/news/press-release/2023-210.

[46] SEC Press Release, SEC Charges Electric Vehicle Co. for Misleading Revenue Projections Ahead of SPAC Merger (Sept. 28, 2023), available at https://www.sec.gov/news/press-release/2023-208.

[47] SEC Press Release, SEC Charges Former Pareteum Executives with Accounting and Disclosure Fraud (Sept. 28, 2023), available at https://www.sec.gov/news/press-release/2023-205.

[48] SEC Press Release, SEC Charges UAE-Based Brooge Energy and Former Executives with Fraud (Dec. 22, 2023), available at https://www.sec.gov/news/press-release/2023-256.

[49] SEC Press Release, SEC Charges Tingo Mobile Founder, Three Companies with Massive Fraud and Obtains Emergency Relief (Dec. 19, 2023), available at https://www.sec.gov/news/press-release/2023-254.

[50] SEC Press Release, SEC Charges “Smart” Window Manufacturer, View Inc., with Failing to Disclose $28 Million Liability (July 3, 2023), available at https://www.sec.gov/news/press-release/2023-126.

[51] SEC Press Release, SEC Charges Hydrogen Vehicle Co. Hyzon Motors and Two Former Executives for Misleading Investors (Sept. 26, 2023), available at https://www.sec.gov/news/press-release/2023-200.

[52] SEC Press Release, SEC Charges Corporate Insiders for Failing to Timely Report Transactions and Holdings (Sept. 27, 2023), available at https://www.sec.gov/news/press-release/2023-201.

[53] SEC Press Release, SEC Charges SolarWinds and Chief Information Security Officer with Fraud, Internal Control Failures (Oct. 30, 2023), available at https://www.sec.gov/news/press-release/2023-227.

[54] SEC Press Release, SEC Charges Former Co-CEOs of Tech Start-Up Bitwise Industries for Falsifying Documents While Raising $70 Million From Investors (Nov. 9, 2023), available at https://www.sec.gov/news/press-release/2023-233.

[55] SEC Press Release, SEC Charges Former CEO of Medical Device Startup Stimwave with $41 Million Fraud (Dec. 19, 2023), available at https://www.sec.gov/news/press-release/2023-255.

[56] SEC Press Release, SEC Charges National Office Partner at Marcum for Causing Widespread Quality Control Deficiencies (Sept. 12, 2023), available at https://www.sec.gov/news/press-release/2023-174.

[57] SEC Press Release, SEC Charges Audit Firm Marcum LLP for Widespread Quality Control Deficiencies (June 21, 2023), available at https://www.sec.gov/news/press-release/2023-114.

[58] SEC Press Release, SEC Charges International Accounting Firm Prager Metis with Hundreds of Auditor Independence Violations (Sept. 29, 2023), available at https://www.sec.gov/news/press-release/2023-214.

[59] SEC Press Release, Fund Administrator Charged For Missing Red Flags (Aug. 7, 2023), available at https://www.sec.gov/news/press-release/2023-148.

[60] SEC Press Release, SEC Charges Connecticut Advisory Firm GlennCap and its Owner with Cherry-Picking (Sept. 14, 2023), available at https://www.sec.gov/news/press-release/2023-180.

[61] SEC Press Release, SEC Charges Private Equity Fund Adviser American Infrastructure Funds for Breaching Its Duties (Sept. 22, 2023), available at https://www.sec.gov/news/press-release/2023-193.

[62] SEC Press Release, SEC Charges President/CCO of Prophecy Asset Management Advisory Firm with Multi-Year Fraud (Nov. 2, 2023), available at https://www.sec.gov/news/press-release/2023-231.

[63] SEC Press Release, SEC Charges Phoenix-Area Real Estate Fund Adviser Jonathan Larmore with $35 Million Fraud (Nov. 29, 2023), available at https://www.sec.gov/news/press-release/2023-242.

[64] SEC Press Release, SEC Charges New Jersey-Based ETF Manager for Fraudulent Conduct and Bars Founder (Aug. 1, 2023), available at https://www.sec.gov/news/press-release/2023-144.

[65] SEC Press Release, SEC Charges Alternative Investment Platform YieldStreet for Misleading Investors (Sept. 12, 2023), available at https://www.sec.gov/news/press-release/2023-175.

[66] SEC Press Release, SEC Charges Advisory Firm Bruderman Asset Management and its Principal for Failing to Disclose Misuse of Investment Funds (Sept. 26, 2023), available at https://www.sec.gov/news/press-release/2023-197.

[67] SEC Press Release, SEC Charges California Advisory Firm AssetMark for Failing to Disclose Multiple Financial Conflicts (Sept. 26, 2023), available at https://www.sec.gov/news/press-release/2023-199.

[68] SEC Press Release available at https://www.sec.gov/news/press-release/2023-226.

[69] SEC Press Release, Deutsche Bank Subsidiary DWS to Pay $25 Million for Anti-Money Laundering Violations and Misstatements Regarding ESG Investments (Sept. 25, 2023), available at https://www.sec.gov/news/press-release/2023-194.

[70] SEC Press Release, Wells Fargo Settles with SEC for Charging Excessive Advisory Fees (Aug. 25, 2023), available at https://www.sec.gov/news/press-release/2023-159.

[71] SEC Press Release, SEC Sweep into Marketing Rule Violations Results in Charges Against Nine Investment Advisers (Sept. 11, 2023), available at https://www.sec.gov/news/press-release/2023-173.

[72] SEC Press Release, SEC Charges Five Advisory Firms for Custody Rule Violations (Sept. 5, 2023), available at https://www.sec.gov/news/press-release/2023-168.

[73] SEC Press Release, SEC Charges Former Army Financial Counselor Who Defrauded Gold Star Family Members (July 7, 2023), available at https://www.sec.gov/news/press-release/2023-127.

[74] SEC Press Release, SEC Charges Merrill Lynch and Parent Company for Failing to File Suspicious Activity Reports (July 11, 2023), available at https://www.sec.gov/news/press-release/2023-128; Merrill Lynch, Exchange Act Release No. 97872, (July 11, 2023), https://www.sec.gov/files/litigation/admin/2023/34-97872.pdf.

[75] SEC Press Release, SEC Charges Citigroup Global Markets Inc. With Recordkeeping Failures concerning Underwriting Expenses, available at https://www.sec.gov/news/press-release/2023-165 (Aug. 29, 2023); Citigroup Global Markets Inc., Exchange Act Release No. 98238 (Aug. 29 2023), https://www.sec.gov/files/litigation/admin/2023/34-98238.pdf.

[76] SEC Press Release, SEC Charges Archipelago Trading Services with Failing to File Suspicious Activity Reports (Aug. 29, 2023), available at https://www.sec.gov/news/press-release/2023-164; Archipelago Trading Services, Inc., Exchange Act No. 98234 (Aug. 29, 2023), https://www.sec.gov/files/litigation/admin/2023/34-98234.pdf.

[77] SEC Press Release, SEC Charges Citadel Securities for Violating Order Marking Requirements of Short Sale Regulations (Sept. 22, 2023), available at https://www.sec.gov/news/press-release/2023-192; Citadel Securities LLC, Exchange Act Release No. 98482 (Sept. 22, 2023), https://www.sec.gov/files/litigation/admin/2023/34-98482.pdf.

[78] SEC Press Release, SEC Charges Virtu for False and Misleading Disclosures Relating to Information Barriers (Sept. 12, 2023), available at https://www.sec.gov/news/press-release/2023-176; Complaint, SEC v. Virtu, No. 1:23-cv-8072 (S.D.N.Y., Sept. 12, 2023), https://www.sec.gov/files/litigation/complaints/2023/comp-pr2023-176.pdf.

[79] SEC Press Release, Crypto Asset Trading Platform Bittrex and Former CEO to Settle SEC Charges for Operating an Unregistered Exchange, Broker, and Clearing Agency (Aug. 10, 2023), available at https://www.sec.gov/news/press-release/2023-150.

[80] SEC Press Release, Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges (Feb. 9, 2023), available at https://www.sec.gov/news/press-release/2023-25; SEC Press Release, SEC Charges Kraken for Operating as an Unregistered Securities Exchange, Broker, Dealer, and Clearing Agency (Nov. 20, 2023), available at https://www.sec.gov/news/press-release/2023-237.

[81] Casey Wagner, SEC moves to drop DEBT Box case, for now, after sanctions threats, Blockworks Inc. (Jan. 30, 2024), available at https://blockworks.co/news/sec-sanctions-debt-box; Motion to Dismiss, Sec. and Exch. Comm’n. v. Digital Licensing Inc., (d/b/a “DEBT Box”), et al., Case No. 2:23-cv-00482-RJS (Jan. 31, 2024).

[82] SEC Press Release, SEC Charges LA-Based Media and Entertainment Co. Impact Theory for Unregistered Offering of NFTs (Aug. 28, 2023), available at https://www.sec.gov/news/press-release/2023-163.

[83] SEC Press Release, Linus Financial Agrees to Settle SEC Charges of Unregistered Offer and Sale of Securities (Sept. 7, 2023), available at https://www.sec.gov/news/press-release/2023-171.

[84] SEC Press Release, SEC Charges Creator of Stoner Cats Web Series for Unregistered Offering of NFTs (Sept. 13, 2023), available at https://www.sec.gov/news/press-release/2023-178.

[85] SEC Press Release, SEC Charges Investor Joseph C. Lewis and Associates with Insider Trading (July 26, 2023), available at https://www.sec.gov/news/press-release/2023-138.

[86] Corinne Ramey, British Billionaire Joe Lewis Pleads Guilty to U.S. Insider Trading, Wall Street Journal (Jan. 24, 2024), https://www.wsj.com/finance/investing/british-billionaire-joe-lewis-pleads-guilty-to-insider-trading-9a8c6475.

[87] SEC Press Release, SEC Charges Florida Investment Adviser a Second Time for Insider Trading (Aug. 2, 2023), available at https://www.sec.gov/news/press-release/2023-145.

[88] SEC Press Release, SEC Charges Three Southern California Siblings with Insider Trading (Sept. 27, 2023), available at https://www.sec.gov/news/press-release/2023-203.

[89] SEC Press Release, SEC Charges Former Financial Industry Analyst and Three Others with Insider Trading (Sept. 28, 2023), available at https://www.sec.gov/news/press-release/2023-204.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Securities Enforcement practice group, or the following authors:

Mark K. Schonfeld – Co-Chair, New York (+1 212.351.2433, mschonfeld@gibsondunn.com)

David Woodcock – Co-Chair, Dallas (+1 214.698.3211, dwoodcock@gibsondunn.com)

Tina Samanta – New York (+1 212.351.2469, tsamanta@gibsondunn.com)

Lauren Cook Jackson – Washington, D.C. (+1 202.955.8293, ljackson@gibsondunn.com)

Timothy M. Zimmerman – Denver (+1 303.298.5721, tzimmerman@gibsondunn.com)

*Lauren Hernandez and Jerelyn Luther are recent law graduates in the Denver and New York offices respectively and not admitted to practice law.

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.