Antitrust Merger Enforcement Update and Outlook

Client Alert | January 29, 2020

Antitrust and competition law considerations are often important factors in planning an M&A transaction. In recent years, as overall M&A activity has continued a decade-long climb, antitrust and competition enforcers around the world have continued to scrutinize thousands of transactions for their impact on competition. In a number of cases, this scrutiny resulted in prolonged investigations, closing delays, significant divestiture remedies, litigation, and abandoned deals. Enforcers and legislators in the United States, Europe and elsewhere are considering significant overhauls to their traditional frameworks for evaluating transactions, including those involving nascent competitors and transactions in the tech and pharmaceutical sectors.

The potential legislative and policy changes on the horizon, along with the ongoing evolution of enforcement priorities and practices, are relevant across all industries and jurisdictions. Gibson Dunn’s 2020 Antitrust Merger Enforcement Update and Outlook addresses a number of important trends and enforcement priorities for firms and companies planning M&A transactions that may raise antitrust or competition law questions.

Gibson Dunn’s Antitrust and Competition Law Practice

Repeatedly recognized by Chambers and other publications as one of the top antitrust practices in the world, Gibson, Dunn & Crutcher’s worldwide Antitrust and Competition Law Practice Group numbers over 150 lawyers located throughout the United States, Europe and Asia. Our antitrust team includes former high-ranking officials from the U.S. Department of Justice (“DOJ”), the U.S. Federal Trade Commission (“FTC”), the U.S. Solicitor General’s Office and the European Commission, as well as Fellows of the American College of Trial Lawyers.

Gibson Dunn’s Antitrust and Competition Law Practice Group has extensive experience successfully representing clients in a broad range of industries in antitrust investigations of mergers conducted by enforcement agencies in the United States, Europe and other jurisdictions. Gibson Dunn’s merger clearance practice draws on its skilled competition lawyers in the United States, Europe and Asia, using its deep experience with enforcement authorities throughout the world.

Gibson Dunn takes a highly proactive approach to merger clearance and related investigations through early analysis of potential antitrust issues and engagement with regulators to efficiently obtain approval of the largest and most complex transactions. In the past several years, we have successfully assisted clients in securing clearance for transactions in a wide range of industries, including obtaining unconditional clearance for several transactions after second request investigations by the DOJ and the FTC.

In addition, no law firm has a more distinguished record of success than Gibson Dunn in handling high-stakes antitrust litigation. Our results demonstrate why the largest companies in the world call on us when the stakes are highest and when the path to success is most challenging.

_______________________

Table of Contents

The United States (DOJ and FTC)

By the Numbers: HSR Filings Increase with M&A Activity as DOJ Second Request Investigations Fall

Congress Weighs in on Merger Enforcement

Tech Acquisitions under the Microscope

Is the FTC Adopting a New Approach to Pharma and Medical Device M&A?

Vertical Mergers: New Draft Guidelines Are Published Following Controversial Cases

The DOJ Turns to Arbitration to Resolve Merger Challenge

The DOJ Updates Model Timing Agreement

Legislative Developments

Noteworthy Transactions

Failure to File

The 2019 Prohibition Decisions

Siemens/Alstom – February 2019

Wieland/Aurubis – February 2019

Tata Steel/ThyssenKrupp – June 2019Continued Focus on Procedural Infringements

The Commission’s Fine to Canon for Gun-JumpingIncreased Relevance of Internal Documents during Merger Review

_______________________

The United States (DOJ and FTC)

The DOJ and the FTC continue to be aggressive in enforcing the nation’s antitrust laws. The agencies have allocated substantial resources to reviewing mergers in specific sectors—namely tech and pharma—and have developed new guidelines for vertical mergers.

State antitrust enforcers also came to the fore in 2019, perhaps most visibly in the pending trial of the states’ challenge to T-Mobile’s proposed acquisition of Sprint. The states’ efforts to litigate this pending merger, despite its approval by the DOJ (subject to divestitures), along with multiple state AG-led antitrust investigations in the tech industry, show that state enforcers’ have an increasingly active merger enforcement docket.

Looking ahead, 2020 is an election year. Although it is far too early to speculate on how the election or its results may impact antitrust enforcement with respect to mergers, the topic of antitrust enforcement and corporate consolidation has been widely discussed on the campaign trail. Major candidates on the Democratic side have advocated strengthening antitrust enforcement. Some have co-sponsored legislation that, if passed into law, may make it far more difficult for certain mergers (particularly large mergers) to win antitrust approval. There have also been bipartisan efforts to investigate antitrust concerns in burgeoning markets, which include more investigations into so-called “killer acquisitions” where an alleged dominant firm acquires an upstart competitor.

Thus, it is safe to predict that the results of the election will influence the direction of antitrust merger enforcement, but how and to what degree remain unclear. Meanwhile, the FTC and the DOJ have been quite active on multiple fronts.

By the Numbers: HSR Filings Increase with M&A Activity as DOJ Second Request Investigations Fall

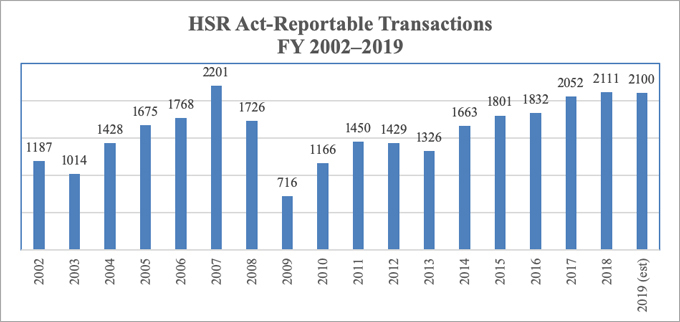

In the wake of the Great Recession of 2008, M&A activity dropped to historically low levels. In fiscal year (“FY”) 2009, the number of transactions reported to the DOJ and the FTC under the Hart-Scott-Rodino (“HSR”) Act dropped to less than one-third of the number reported in the fiscal year before the financial crisis began.[1]

In the decade that followed, U.S. economic activity and M&A volume steadily increased year-over-year. HSR filings reached decade-high levels over the past two years, indicating that M&A has fully recovered from the financial crisis.[2]

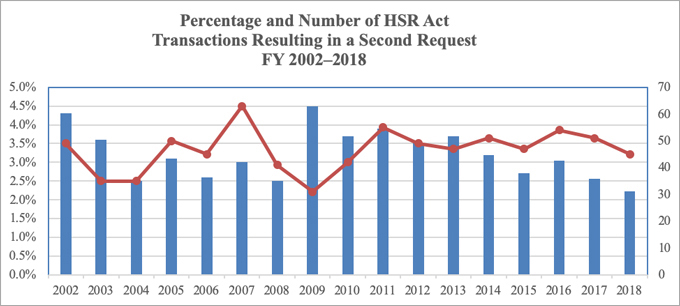

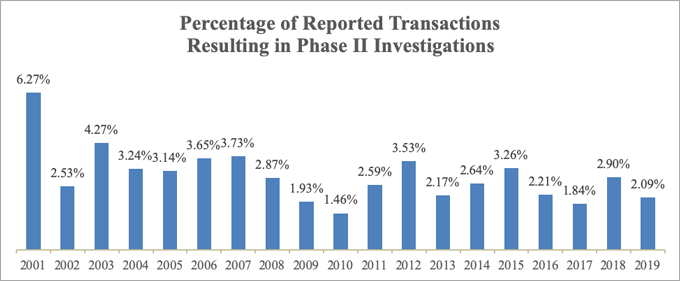

But what about the level of antitrust scrutiny? Changes in the percentage of second requests issued can serve as one proxy for the intensity of federal merger enforcement. Because they require substantial investigative resources, second requests are typically reserved for transactions that, in the agencies’ view, raise serious competition concerns.

On that score, the rate of second request investigations of HSR-reportable transactions has fallen since FY 2016. The percentage of HSR-reportable transactions subject to a second request declined to 2.2% in FY 2018, marking the second year in a row the second request rate fell under 3%. By comparison, the agencies’ second request rate averaged approximately 3.5% during the prior eight years (FY 2009 through FY 2016), and a full percentage point below the annual rate since 2002 (3.2%).

The decline is significant. Had the second request rate matched the 3.5% average in prior years, the DOJ and the FTC would have issued 74 second requests in FY 2018—that would have meant 29 (or 39%) more second requests than they actually issued (45).

There has been a particularly large decline in the rate of DOJ second requests. DOJ-issued second requests represented only 0.9% of all HSR-reportable transactions in FY 2017 and FY 2018, half the DOJ’s average rate over the prior eight fiscal years (1.8%).

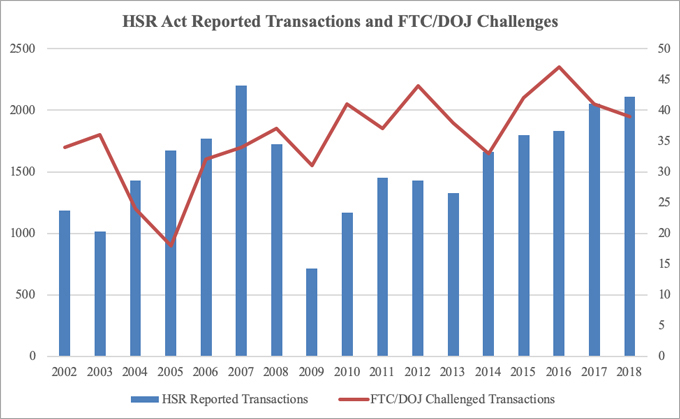

Similarly, although M&A activity has increased significantly in recent years, merger challenges have remained relatively flat. Challenges involve instances in which the agencies file a complaint in court claiming a transaction violates Section 7 of the Clayton Act, resulting in a trial, settlement, or abandonment of the deal. The number of challenges in each of the past two reported fiscal years (41 and 39, respectively) is in line with the average number of challenges per year (approximately 41) the prior eight years.[3] HSR filings, however, have increased by 15%. Thus, the agencies’ challenges have not increased at the same clip as reportable M&A activity.

To be sure, these figures are not the final word on whether antitrust scrutiny of mergers has increased or decreased, or whether a merger is more likely to receive scrutiny today than it was several years ago, or a year from now. The analysis of whether any particular merger is likely to harm competition is a fact-intensive exercise and outcomes will vary from case to case. In the aggregate, however, these figures show (i) the percentage of HSR-reportable deals that result in a second request has declined in recent years, (ii) the decline in the second request rate is particularly pronounced for the DOJ, and (iii) the number of mergers challenged by the agencies has not increased in recent years despite a marked increase in HSR-reportable M&A activity.

Congress Weighs in on Merger Enforcement

Congressional interest in antitrust enforcement and reform has been high this past year, likely in anticipation of the 2020 primaries and presidential election.

Senator and presidential candidate Elizabeth Warren (D–MA) proposed legislation that would transform merger enforcement. The bill’s most notable provisions would effectively ban “mega-mergers”—that is, mergers where either company has annual revenue of at least $40 billion; each company has annual revenue of at least $15 billion; the merged company would have more than 45% of relevant market share as a seller or more than 25% as a buyer; or where the deal would result in there being fewer than four remaining competitors with at least a 10% market share. Other presidential candidates have also put forward proposed reforms to agency merger review. Senator Amy Klobuchar has twice introduced legislation that would make it more difficult to obtain antitrust approval for contested mergers.[4]

Both bills would shift the burden of proof to defendants in large mergers to prove that their transaction is not anticompetitive and would prohibit the FTC from accepting remedies to address antitrust violations.

Although these bills have little chance of becoming law this year, depending on the results of upcoming elections, they signal attempts to fundamentally change antitrust enforcement when it comes to M&A transactions. These efforts could gain traction under a new administration. And given the bipartisan interest in antitrust enforcement and corporate consolidation generally, congressional interest in antitrust is unlikely to abate anytime soon.

Tech Acquisitions under the Microscope

Over the past year, the DOJ and the FTC launched significant antitrust investigations of U.S. tech companies. According to the DOJ’s press release, their review would examine “whether and how market-leading online platforms have achieved market power” and if such entities “are engaging in practices that have reduced competition, stifled innovation, or otherwise harmed consumers.”[5] The DOJ explained that their review would “consider the widespread concerns that consumers, businesses, and entrepreneurs have expressed about search, social media, and some retail services online.”[6] Likewise, the FTC announced its Technology Task Force as a body “dedicated to monitoring competition in U.S. technology markets, investigating any potential anticompetitive conduct in those markets, and taking enforcement actions when warranted.”[7] As part of these broader investigative efforts into the tech industry, state and federal regulators appear to be reviewing consummated acquisitions of smaller start-up tech companies.

As the FTC has noted, these recent tech investigations resemble past efforts to retrospectively review hospital mergers. In 2004, for example, the FTC filed a complaint in its administrative court challenging Evanston Northwestern’s acquisition of a competing hospital in Cook County, Illinois (Highland Park Hospital), which had been consummated four years earlier.[9] After four more years of litigation, in 2008, the FTC and the parties agreed to the imposition of remedies (short of unwinding the merger) to address the FTC’s concerns.[10]

The effort was widely credited for reinvigorating the FTC’s hospital merger enforcement program, but required years of litigation and appeals to bear fruit. The FTC and the DOJ appear to be on a more accelerated track in investigating tech mergers. FTC Chairman Joseph Simons recently remarked that this is “an important area” and that his goal is for the FTC to make decisions on how to move forward this year.[11] Attorney General William Barr has said that he would like to have the DOJ’s tech antitrust investigations completed in 2020.[12] Any effort to remedy tech mergers through litigation, however, is likely to take much more time.

The agencies’ review will include an assessment of the substantive antitrust standards applicable to nascent competitor acquisitions. Challenges to consummated mergers have relied heavily on evidence that higher prices resulted from the merger, which provided direct evidence that the merger had anticompetitive effects. The impact of tech mergers, which often involve “free” products and services, may call for novel approaches to measuring any such effects.

FTC officials have stated that new guidelines applicable to large tech companies are in the works,[13] which may shed additional light on the agencies’ approach to such issues. Recent speeches by agency officials and enforcement actions provide a few clues. For example, officials have signaled they plan to look beyond traditional price metrics in demonstrating competitive effects. In particular, Assistant Attorney General Makan Delrahim cited “decreased innovation, and reductions in quality and consumer choice” as being possible competitive harms that could support cases against such mergers.[14] A senior DOJ economist also stated that “[w]e are keeping in mind other tools in areas such as privacy, consumer protection and public safety as part of a broader review of online platforms.”[15]

Relatedly, in a potential test case for claims that a dominant incumbent harms competition by acquiring small but innovative competitors, the DOJ filed a complaint to prevent a merger between Sabre Corporation and Farelogix in August 2019.[16] The DOJ submitted that Sabre’s acquisition of Farelogix would remove a “significant and growing threat” to Sabre’s alleged market dominance in providing booking services to airlines[17] because it “has introduced new technology to the travel industry and is poised to grow significantly” absent the transaction.[18]

Unlike more traditional merger cases, in this case the target, Farelogix, is a relatively small player. Nevertheless, the DOJ alleged that “Farelogix’s market share substantially understates its competitive significance” because its “disruptive” technology will allow it to grow significantly in the future, allowing airline customers to bargain for lower prices. The DOJ asserts that Farelogix is punching above its weight, competitively speaking. Given this case’s parallels, the agencies might be considering using similar theories to police M&A across the tech sector.

Is the FTC Adopting a New Approach to Pharma and Medical Device M&A?

Although less widely publicized than its tech investigations, the FTC has also prioritized enforcement of pharmaceutical and medical device transactions. The FTC has long devoted substantial resources to scrutinizing transactions in these industries, but Commissioners’ comments in connection with several recent cases suggest the FTC is focusing on different theories of harm than it has in the past.

In November 2019, the FTC closed its investigation of Bristol-Myers Squibb Company’s acquisition of Celgene Corporation, in which the parties agreed to divest Celgene’s Otezla for $13.4 billion—the largest divestiture remedy ever obtained by either the FTC or the DOJ.[20] Despite the historic value of the divestiture, it was cleared by a slim 3-2 majority of Commissioners. The three Republican Commissioners in the majority signaled their adherence to the traditional framework, which examines potential competition between existing and pipeline treatments, and tailors remedies to address those competitive overlaps.

Commissioners Rohit Chopra and Rebecca Slaughter, the two Democrats, dissented and called for a fundamentally different approach. Commissioner Chopra said he is “deeply skeptical” that the FTC’s traditional framework “can unearth the complete set of harms to patients and innovation” from a “massive” pharmaceutical merger.[21] Commissioner Slaughter also favored taking a “more expansive approach to analyzing the full range of competitive consequences of pharmaceutical mergers.”[22]

Although the two Democrats were in the minority, the FTC appears to be casting a wider net in investigating pharmaceutical and medical device mergers. A pair of enforcement actions announced in December shed some light on the theories of competitive harms the Commissioners will be targeting under this broader approach.

First, in its investigation of Roche’s acquisition of Spark Therapeutics,[23] the FTC examined whether the transaction would “leave the incumbent with the incentive to degrade or eliminate the acquired firm’s products or services, or to delay development of a next-generation product.”[24] After a thorough Second Request investigation, the FTC unconditionally approved the deal in large part because intense competition from others to develop similar treatments was sufficient to ensure the incumbent (Roche) would retain a strong incentive to continue developing the target’s (Spark’s) pipeline treatment.

Second, the day after announcing its clearance of Roche/Spark, the FTC reached the opposite conclusion in deciding to challenge Illumina’s proposed acquisition of Pacific Bio (“PacBio”).[25] The complaint alleges the merger, if consummated, “would eliminate a nascent competitive threat that an independently owned PacBio poses to Illumina’s monopoly power.”[26] The FTC asserted each party’s internal documents “consistently and routinely refer to each other as competitors[.]” In addition to asserting that the merger was unlawful under Section 7 of the Clayton Act, the complaint alleges the merger amounted to unlawful monopolization under Section 2 of the Sherman Act. While not unprecedented, the use of Section 2 in the merger context is unusual and could foreshadow the agencies’ approach to future enforcement cases.

These and other recent FTC cases suggest the FTC is open to examining a broader range of theories. More specifically, these cases suggest the FTC is focused on the effect of mergers on the development of potentially competing early-stage pipeline treatments, even if the treatments are years away from reaching patients. The FTC will also consider whether a merger is likely to substantially lessen competition under Section 7 of the Clayton Act, and, in some cases, whether it is a means of acquiring or protecting a monopoly in violation of Section 2 of the Sherman Act.[26a]

Vertical Mergers: New Draft Guidelines Are Published Following Controversial Cases

In February 2019, the D.C. Circuit Court of Appeals affirmed the lower court’s denial of the DOJ’s request for a permanent injunction of the proposed merger between AT&T and Time Warner.[27] This ruling ended years of investigations and litigation that culminated in the first vertical merger case fully litigated by the DOJ since 1977. A group of antitrust scholars filed an amici brief asking the court to address the “proper legal standard for evaluating vertical mergers,” but the court declined to do so. Instead, it affirmed the district court’s conclusion that the DOJ had failed to demonstrate the merger would harm competition.[28]

The federal district court judge for the AT&T/Time Warner trial, Judge Richard Leon of the District Court for the District of Columbia, had another opportunity to address issues pertaining to vertical mergers during his review of the DOJ’s proposed settlement with CVS and Aetna regarding their $69 billion merger.[29] In September 2019, Judge Leon approved the DOJ’s proposed remedy, but only after overseeing prolonged trial-like proceedings on the merits of the deal that included third-party witnesses.[30] Judge Leon allowed several third parties to intervene as amici curiae and file briefs that addressed issues that were outside the scope of the Complaint or the Final Judgment,[31] such as the contention that a vertically integrated pharmacy benefit manager would harm consumers.[32]

In the end, Judge Leon ruled that the proposed settlement was “well within the reaches of the public interest.”[33] And yet, this case was a notable departure from the vast majority of Tunney Act proceedings. It is also a sign that there remains considerable uncertainty and debate regarding the treatment of mergers between vertically related entities.

On the FTC side, the Commission ruled on three mergers over the course of 2019 in which the Commissioners debated vertical issues. First, Staples Inc., the world’s largest office supply retailer, acquired Essendant Inc.,[34] the largest office products wholesale distributor in the United States. In approving this vertical transaction, the FTC agreed to a consent decree requiring Staples to restrict access to commercially sensitive information regarding Essendant’s customers, who were also Staples’s competitors.[35] The majority statement from the three Republican commissioners, including Chairman Simons, emphasized that when evaluating vertical mergers, the Commission must provide concrete evidence and theories “supported by factors” rather than “hypothetical” anticompetitive results.[36] Commissioners Chopra and Slaughter dissented, criticizing the remedy and the majority’s argument that vertical mergers are generally efficiency-enhancing and procompetitive.[37]

Second, the FTC cleared health insurer UnitedHealth’s acquisition of DaVita’s kidney dialysis centers, but Commissioners Slaughter and Chopra voiced concern that the merger would incentivize UnitedHealth to steer its insured patients to its own dialysis centers, harming competing centers.[38] While urging the FTC to challenge the transaction in court, the two Democratic Commissioners acknowledged the “significant litigation risks” of any such challenge.[39]

Third, another kidney dialysis-related merger, in which Fresenius Medical Care acquired NxStage Medical, was also approved by a split (3-2) Commission vote based on disagreements regarding the vertical aspects of the merger.[40] The three Republican Commissioners explained that foreclosure or higher costs to rivals were unlikely, based on the staff’s investigation, given the merged company’s incentive to maximize the profits of the acquired business. They also pointed to evidence of recent entry as assuaging any concern that the merger would raise entry barriers. The two Democratic Commissioners dissented, voicing the view that Fresenius would have strong profit incentives to raise rivals’ costs and foreclose access to NxStage’s machines.

In the wake of this string of vertical merger cases, the DOJ and the FTC published draft Vertical Merger Guidelines (“Draft Guidelines”) on January 10, 2020.[41] The Draft Guidelines address the analytical framework the agencies use to assess competitive harms that may result from mergers that “combine two or more companies that operate at different levels of the supply chain.”[42] The Draft Guidelines are open for public comment until February 11, 2020, and are expected to be finalized shortly thereafter.

The Draft Guidelines are a significant and much-needed update to the existing “1984 Non-Horizontal Merger Guidelines,” which no longer reflected modern agency enforcement practices or the economic tools the agencies use to evaluate vertical mergers. As such, it is the hope that, as FTC Chairman Simons has stated, the Draft Guidelines will bring “[g]reater transparency about the complex issues surrounding vertical mergers.”[43]

The Draft Guidelines do not represent a significant departure from existing agency policies or enforcement priorities. At a high level, the Draft Guidelines:

- Describe how relevant markets and newly defined related products are assessed in vertical mergers.

- Provide insight as to how the agencies evaluate market shares and concentration in conjunction with other evidence when determining whether a merger will substantially lessen competition. Specifically, the agencies:

- May look at output shares in a relevant market that uses the related products as an indicator of the competitive significance of the related products.

- Consider a safe harbor in vertical mergers where the parties’ share of the relevant market and the related product is 20% or less.

- Describe the ways in which a vertical merger could have unilateral anticompetitive effects, including by (1) allowing the merged firm to foreclose a rival from or raise a rival’s costs to a related product, and (2) enabling the merged firm to access competitively sensitive information of its upstream or downstream rivals, causing the merged firm to restrain its competitive response.

- Describe the ways in which a vertical merger could lead to anticompetitive coordinated effects by, for example, eliminating (or weakening) a disruptive “maverick” competitor or by facilitating anticompetitive coordination.

- Discuss how the elimination of double marginalization through a vertical merger can benefit both the merged firm and downstream buyers. The Draft Guidelines note that “[t]he Agencies will not challenge a merger if the net effect of elimination of double marginalization means that the merger is unlikely to be anticompetitive in any relevant market.”

- State that the agencies will consider other efficiency claims using the same approach set forth in Section 10 of the Horizontal Merger Guidelines.

Despite these provisions in the Draft Guidelines, however, there remains a degree of uncertainty on several fronts going forward.

The most significant open issue is that the Draft Guidelines do not discuss the agencies’ prevailing policies on the appropriate remedies in cases in which they conclude the vertical merger is likely to harm competition. The DOJ’s 2011 Policy Guide to Merger Remedies (“2011 Remedies Guide”) included both structural and conduct remedies for vertical mergers.[44] But in 2018, Assistant Attorney General Makan Delrahim withdrew the 2011 Remedies Guide and expressed his strong preference for structural remedies, such as divestitures, over behavioral remedies as they are easier to enforce.[45] The DOJ has voiced this position multiple times in the past two years, including during the AT&T/Time Warner trial[46] and separately.[47] One DOJ official recently signaled that revised remedy guidelines are in the works, although there is no timetable for their publication.

The FTC has also noted that it “typically disfavors behavioral remedies,” even in the vertical merger context.[48] Nevertheless, the Commission recently approved deals with behavioral remedies, including Northrop Grumman’s acquisition of Orbital ATK in mid-2018[49] and the Staples/Essendant[50] transaction in early 2019.

Finally, aside from the 20% safe harbor, the agencies do not provide specifics regarding what levels of market share or foreclosure trigger antitrust concerns, or whether concerns arise even in cases in which the merged firm’s upstream or downstream share is low. That determination will depend on the specific facts and businesses at issue.

The FTC’s two Democratic Commissioners abstained from supporting the Draft Guidelines. Although the Draft Guidelines will reflect the policy of the FTC, it remains to be seen whether the Guidelines are retained if and when there is a change in administrations.

For more on the Draft Guidelines, please review our publication on the subject.[51]

The DOJ Turns to Arbitration to Resolve Merger Challenge

On September 4, 2019, the DOJ filed a complaint challenging Novelis Inc.’s proposed acquisition of Aleris Corporation.[52] According to the complaint, Novelis and Aleris are two of four North American producers of aluminum auto body sheet metal. The DOJ alleged the merger between them would harm competition if left unremedied.

Rather than approve a remedy, however, the DOJ agreed to refer the issue of market definition to binding arbitration pursuant to the Administrative Dispute Resolution Act of 1996.[53] Under the terms, if the DOJ prevailed on its proffered (and more narrow) definition of the market, the parties would execute an agreed-upon remedy. If the parties prevailed, then the merger would proceed without any remedy.

This new arbitration approach would avoid the time and expense of proceeding through trial. It may also serve as a test case for merger matters involving disputes over core issues relating to the marketplace. As explained in a separate client alert, however, the availability of arbitration may well be limited to cases in which the issues in dispute are well-defined and discrete.[54]

The DOJ Updates Model Timing Agreement

The DOJ revised its Model Timing Agreement in December 2019. Timing agreements, which are a fixture of merger investigations involving the DOJ and the FTC, ensure that the agencies have sufficient time to evaluate a transaction prior to closing.

The revised 2019 agreement seems to further Assistant Attorney General Delrahim’s goal of shortening the time needed to complete merger reviews. The 2019 agreement removes references from the model agreement that allowed the Deputy Assistant Attorney General to authorize an extension of time for the Division if a decision is not reached within 60 days after compliance with the second request, a document search of more than 20 individuals, and depositions of more than 12 individuals for each merging party. The import of these changes remains to be seen, but it appears to alleviate the burden of complying with a second request.

_______________________

China

2019 was another very active year for China’s State Administration for Market Regulation (“SAMR”). Out of the 448 transactions reviewed, five were subject to remedies but none was prohibited. The conditional approval decisions show that the SAMR continues to rely on creative remedies such as hold-separate remedies, commitments to supply products and services on fair, reasonable and non-discriminatory terms, and the implementation of antitrust compliance mechanisms.

In addition, the SAMR has continued going after merger parties for failing to notify. On the procedural side, the SAMR’s decision in Novelis’s proposed acquisition of Aleris shows the risks in opting for a simplified decision.

Finally, 2020 is likely to be a very important year for merger enforcement. Indeed, the SAMR has published proposed amendments to the Anti-Monopoly Law for comments. The proposed changes include higher fines for merger-related conduct, in response to long-standing concerns that the current fines are too low.

Legislative Developments

Since its establishment in March 2018, the SAMR has introduced a number of legislative enactments and guidelines, which not only codify the practices of its predecessors, but also introduce notable changes to merger enforcement.

Most recently, on January 2, 2020, the SAMR released a draft amendment to the Anti-Monopoly Law (the “Draft Amendment”) for public consultation.[55] The Draft Amendment seeks to increase penalties for breaches of merger-related conduct, including gun-jumping, failure to notify reportable transactions and breach of commitments in conditionally approved cases. The increased fines for gun-jumping are notable. The current version of the Anti-Monopoly Law (“AML”) imposes a maximum fine of RMB 500,000 (approximately $72,200) for merger-related conduct. The Draft Amendment proposes to change the maximum fine to 10% of the infringing party’s turnover in the previous financial year.

The Draft Amendment now explicitly defines “control” as the ability to “exert or potentially exert a decisive influence on another undertaking’s production and operation activities or other major decisions.” Both the new fine and the definition of control are in line with the practice in the European Union.

In addition, the Draft Amendment now allows the SAMR to “stop the clock” during a merger investigation (for instance, if the transaction parties supplement their notification with additional materials) and codifies the SAMR’s ability to carry out sub-threshold investigations and to amend the turnover notification thresholds from time to time. Lastly, the Draft Amendment now explicitly states that parties are “responsible for the authenticity of their submissions.”

From a practical standpoint, the SAMR has improved the transparency of its merger review process by increasing the frequency of its publication of unconditional approvals. Since the second quarter of 2019, the SAMR has been issuing its unconditional clearance decisions on its website on a weekly, instead of monthly basis.

Noteworthy Transactions

In 2019, the SAMR reviewed a total of 448 concentrations, which represents a slight increase from 2018. Out of 448 concentrations, 443 were approved unconditionally and five were approved subject to remedies. There were no prohibited concentrations in 2019.[56] The SAMR took between seven to 17 months to complete its review of conditionally approved cases. Notably, the SAMR asked the parties in all five conditionally approved cases to withdraw and refile their notifications, allowing the SAMR to further extend its review period. Each of the conditional approvals is discussed in turn, below.

KLA-Tencor’s proposed acquisition of Orbotech.[57] On February 13, 2019, California-based semiconductor company KLA-Tencor secured the SAMR’s conditional approval of its proposed acquisition of Orbotech, an Israeli manufacturer of semiconductor equipment. The SAMR found that the parties had multiple vertical and adjacent relationships in the broader market for semiconductor equipment. In order to address the SAMR’s concerns regarding foreclosure, tying and information exchange, the parties agreed to the following remedies: (1) continue to supply semiconductor process-control equipment and services to downstream Chinese manufacturers on fair, reasonable and non-discriminatory (“FRAND”) terms; (2) not bundle or tie semiconductor process-control, deposition and etching equipment or impose unreasonable conditions in sales of such products; and (3) ensure that they do not obtain competitively sensitive information about Chinese manufacturers of deposition and etching equipment.

Cargotec’s proposed acquisition of TTS.[58] On July 5, 2019, the SAMR issued its conditional approval of Cargotec’s proposed acquisition of TTS. The parties, two Scandinavian cargo-handling equipment suppliers, had horizontal overlaps in eight product markets: hatch covers; roll-on equipment; cargo lifters; anchor winches; and the aftersales services for each of these products. The SAMR identified competition concerns in the markets for hatch covers, roll-on equipment and cargo lifters, as the parties had combined market shares between 50% and 60% in each of these markets. The SAMR imposed a range of behavioural remedies, including a hold-separate remedy. Cargotec and TTS agreed to hold their businesses separate in China for two years and to set up firewalls to ensure that the businesses are independent and do not exchange competitively sensitive information. This hold-separate remedy would automatically expire after two years. Cargotec also agreed to continuously supply the relevant products to Chinese customers and to refrain from increasing prices in China for five years.

II-VI’s proposed acquisition of Finisar.[59] On September 18, 2019, the SAMR granted its conditional approval of II-VI Incorporated’s proposed acquisition of Finisar. The parties, two photonics companies based in the United States, had horizontal overlaps in four markets, vertical relationships in three markets, and were also active in adjacent markets. To address the SAMR’s competition concerns in the market for wavelength selector switches (in which the top three players, including the parties, had a combined market share of 95%), the parties agreed to a hold-separate remedy for three years, as well as firewalls to prevent the exchange of competitively sensitive information. Moreover, the parties agreed to continue supplying wavelength selector switches to customers on FRAND terms. Unlike in Cargotec/TTS, the SAMR did not grant an automatic sunset clause; the parties in this transaction are required to apply to the SAMR to lift the commitments.

Proposed joint venture between Royal DSM and Garden Bio-Chem.[60] On October 18, 2019, the SAMR published its conditional approval decision in respect of Netherlands-based Royal DSM and China’s Zhejiang Garden Biochemical High-Tech’s (“Garden Bio-Chem”) proposed joint venture. The scope of the joint venture was limited to the production of DHC, a chemical precursor for cholesterol-based vitamin D3. The SAMR expressed concerns that the JV parties may coordinate the prices and amounts of core raw material for vitamin D3 production. The SAMR referenced the parties’ strength in the market: they are the top two suppliers of veterinary vitamin D and two out of the top three suppliers of human vitamin D in China and worldwide. The SAMR also noted that the parties had a large amount of technical knowledge and patents which further strengthened their market powers and barriers to entry. Garden Bio-Chem’s high market shares in the global and Chinese markets for lanolin cholesterol, a key ingredient in the production of vitamin D3 also gave rise to foreclosure concerns. In light of these concerns, the SAMR required a comprehensive set of behavioural remedies that would expire automatically after five years. The parties agreed to a hold-separate remedy, pursuant to which they must keep their vitamin D3 businesses completely independent, including the procurement of cholesterol needed for the JV’s production of DHC. Garden Bio-Chem also committed to supply cholesterol to vitamin D3 suppliers on FRAND terms. The parties also committed to maintain independent operations in the JV, including measures to prevent the exchange of competitively sensitive information, separation of the JV’s offices, IT systems and production facilities from those of the parent companies, independent employees, and a prohibition on the executive management of the JV from manufacturing or selling vitamin D3 and cholesterol for three years after the termination of their employment by the JV. The scope of the JV would be limited to DHC production and both the JV and the parties committed not to publicly disclose the prices of cholesterol and vitamin D3 absent a customer request or where disclosure is required by the law. Lastly, the SAMR required the JV to implement mechanisms to ensure its compliance with the various commitments.

Novelis’s proposed acquisition of Aleris.[61] In August 2018, U.S. aluminium producer, Novelis, filed a notification to SAMR under the simplified procedure regarding its proposed acquisition of rival Aleris. The SAMR initially accepted the notification, but upon the receipt of a third party’s objections, revoked its acceptance in October 2018 and asked the parties to refile under the regular procedure. More than a year after the initial filing, on December 20, 2019, the SAMR published its conditional clearance decision. The SAMR identified competition concerns in two separate markets for interior and exterior aluminium auto-body sheets in which the parties had a combined market share of 70 to 80%. The SAMR expressed concerns that the transaction may eliminate competitive constraints and narrow downstream car manufacturers’ procurement options. In addition, the SAMR expressed concerns about coordination, in light of a Novelis joint venture with one of its major competitors, which led SAMR to conclude that Novelis has been “maintaining a good cooperative relationship” with competing firms. To address these concerns, Aleris agreed to divest its interior and exterior aluminium auto-body sheet business in the European Economic Area. The combined entity would also refrain from supplying cold-rolled plates in China to any competitors that operate in the market for auto-body sheets for a period of 10 years unless the parties applied to the SAMR for an early release. This decision is a useful reminder that there is a risk of significant delays if the parties elect to file under the simplified procedure using market definitions that are too narrow.

Failure to File

The SAMR continued to proactively enforce against failures to notify reportable transactions. In 2019, the SAMR published 17 failure-to-file decisions, imposing financial penalties ranging between RMB 300,000 (approximately $43,300) to RMB 400,000 (approximately $57,800) on each infringing party.[62] In one noteworthy action, the SAMR imposed a penalty of RMB 300,000 (approximately $43,300) on each of Praxair and Nanjing Oil Refinery for failing to notify a joint venture that they established six years prior, in 2013. This decision signals to transaction parties that the SAMR’s probe is not limited to only recent joint ventures and mergers.

_______________________

The European Union

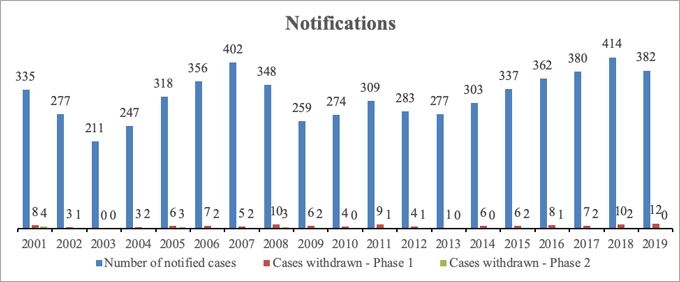

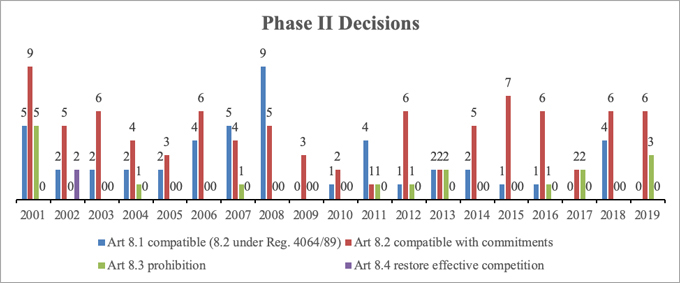

After reaching a historic high point in 2018 with 414 mergers notified to the European Commission (the “Commission”), the number of notified mergers decreased to 382 in 2019, which is more in line with the number of notified mergers in previous years.[63]

2019 also brought about a decrease in the number of Phase II investigations: eight investigations launched compared to 12 in the previous year.

Most notably, however, in 2019, the Commission issued three prohibition decisions in Phase II merger investigations, the highest number since 2001.

Another notable development in 2019 was that no Phase II mergers were cleared unconditionally under Article 8(1) (compared to four in 2018), while six Phase II mergers were cleared subject to commitments (similar to 2018).

The 2019 Prohibition Decisions

Siemens/Alstom – February 2019[64]

The Commission’s prohibition of the Siemens/Alstom merger was the most debated case in 2019 and continues to spark conversation about whether wider public interest considerations, such as creating European champions fit for competition on global markets, should factor into EU merger control.

The Commission prohibited the transaction on grounds of horizontal overlaps creating anticompetitive effects in the European markets for high-speed and very high-speed trains as well as mainline signalling systems. As part of its investigation, the Commission assessed the global competitive landscape, in particular potential competition from Chinese suppliers. However, with regard to both signalling systems and trains, the Commission concluded that the entry of Chinese competitors into Europe was highly unlikely to be a competitive constraint on the merging parties in a foreseeable future.

Furthermore, the Commission rejected the parties’ proposed divestitures, which included the grant of a license for the high-speed train businesses of the respective parties, as well as the divestiture of one of Siemens’s urban signalling businesses, Siemens’s entire on-board Automatic Train Protection (“ATP”) business, and Alstom’s ATP European Train Control System, as insufficient to alleviate the competitive concerns.

Wieland/Aurubis – February 2019[65]

Wieland’s proposed acquisition of Aurubis Rolled Products and Aurubis’s stake in Schwermetall, would have resulted in a combined market share of more than 60% of European pre-rolled strip sales. The Commission found that the proposed transaction would have enabled Wieland to raise input costs for smaller competitors—which at the time were sourcing a significant part of their pre-rolled requirements from Schwermetall—as there were no suitable alternative suppliers. Although Wieland suggested divesting two Aurubis plants, the majority of the market participants considered this remedy inadequate to address the Commission’s competition concerns, as the two plants would have lost access to the cost-competitive and high quality supplies of pre-rolled strip from Schwermetall.

Tata Steel/ThyssenKrupp – June 2019[66]

The proposed creation of a joint venture between Tata Steel and ThyssenKrupp would have combined the flat carbon steel and electrical steel activities of the second- and third-largest producers of flat carbon steel in the EEA, respectively. The creation of the joint venture was prohibited, as the Commission found it would have led to anticompetitive effects in the market for metallic coated and laminated steel products for packaging and the market for automotive hot dip galvanized steel products. According to the Commission, the merger would have established a market leader in a highly concentrated industry, resulting in reduced choice of suppliers and higher prices for metallic-coated and laminated steel products for European customers. During its investigation, the Commission considered the role of imports from third countries, but found that customers of the relevant products could not turn to imports to offset potential price increases caused by the proposed merger. Furthermore, the proposed divestures were considered insufficient, as they did not include adequate assets capable of serving the customers in the relevant geographic market.

The Ensuing Political Debate

The Commission’s prohibition of the Siemens/Alstom merger, and to some extent of the Tata Steel/ThyssenKrupp joint venture, reignited the debate of whether wider public interest considerations should be included in EU merger control.[67]

Critics of the Commission argued that the competitive position of Europe was under threat, in part due to the potential entry of giant Chinese companies sponsored by government subsidies,[68] and considered an amendment of merger rules to enable the creation of “European Champions” in response to this threat.[69] On the other hand, the Commission, as well as a number of national competition authorities and economists, argued that the EU merger review system should not be politicized, so as not to jeopardize the level playing field within the EU[70] and to avoid a risk of authorizing anti-competitive transactions.[71]

In the wake of the Commission’s prohibition of the Siemens/Alstom merger, France and Germany proposed several measures designed to help European companies succeed in competing on the global stage. This included an update of the current merger guidelines to take greater account of competition at the global level, potential future competition, and the time frame for forecasting the development of competition to give the Commission more flexibility when assessing relevant markets.

The proposal also included a potential right to refer a prohibited merger to the Council of Europe, which could override Commission decisions on grounds of public interests.[72] A similar option exists under the German merger control regime, in which the Minister of Economics can authorize a merger that was prohibited by the German antitrust authority for anticompetitive effects if the restraint of competition is outweighed by advantages to the economy as a whole resulting from the concentration, or if the concentration is justified by an overriding public interest.[73]

Commenters asserted that if it was possible for the Council to overrule competition decisions or allow for non-competition considerations to play a decisive role in vetting mergers, “Europe could find itself in a downward spiral of economic inefficiency and political arbitrariness, ushering in mistrust and internal divisions as larger Member States would ultimately be able to impose their will on those with smaller economies – hardly contributing towards strengthening its position in the global economy.”[74]

Nonetheless, the Commission acknowledges the need to address the concerns that others are not playing by the same rules and could misuse Europe’s openness against Europe’s own strategic interests. On this basis, the Commission has set out a strategy to create a more level playing field, which includes making the World Trade Organization fit for purpose and growing the EU’s arsenal of defensive tools, such as foreign investment scrutiny.[75]

Other Trends

Continued Focus on Procedural Infringements

In 2019, we saw a continuation of the Commission’s increased focus on procedural infringements of merger control rules.[76]

The Commission’s Fine to Canon for Gun-Jumping[77]

Following Canon’s acquisition of Toshiba Medical Systems Corporation (“Toshiba”) by way of a so-called “warehousing” transaction, which included as a first step the acquisition of 5% of the share capital of Toshiba with non-controlling voting rights and an option to acquire all shares in Toshiba, and the exercise of the voting rights in the second step, the Commission imposed two fines totaling €28 million on Canon for so-called gun-jumping in June 2019. Canon notified the transaction between the two steps, and the Commission cleared the transaction on September 19, 2016. Subsequently, however, the Commission initiated proceedings regarding Canon’s completion of the first step of the transaction prior to notification and clearance. In the Commission’s view, Canon was obligated to notify the transaction prior to implementing the first step, as the two steps qualified as a single, notifiable transaction. By completing the first step prior to notification and clearance, Canon had “jumped the gun” by failing to observe stand-still requirements under EU merger control rules.

The Commission fines parties for allegedly providing incorrect information in merger filings. The Commission is also pursuing monetary fines against parties who allegedly provided incorrect information in their merger filing. One fine levied in 2019 reached €52 million. The fine highlights the Commission’s continued effort to battle what it claims are procedural infringements. As Commissioner Vestager made clear, “[the Commission’s] merger assessment and decision-making depends on the Commission being sure that companies are not jumping the gun and implementing mergers without our approval[].”[79] On a practical level, the Commission’s increased focus on procedural infringements underlines the necessity for companies to ensure that sufficient procedures are in place to secure compliance with competition law in relation to a transaction and to seek competition law advice at the earliest possible stage of the process.

Increased Relevance of Internal Documents during Merger Review

In 2019, the Commission continued a trend of increasing reliance on internal documents provided by parties as part of its investigations. Already in September 2014, the then-acting deputy director-general for mergers, Carles Esteva Mosso, stated that in addition to economic submissions, “internal documents play a more important role [for difficult merger investigations] than ten years ago.”[82] By way of example, the parties were required to submit 2.7 million documents in the merger proceedings concerning Bayer/Monsanto, 800,000 documents in the Siemens/Alstom case and 400,000 documents in the merger proceedings concerning Dow/Dupont.[83]

This increases the burden on the merging parties and risks slowing down merger reviews. Furthermore, it could result in an “information overload bias,” or rather, a situation in which the quality of the Commission’s assessment declines due to the huge amount of internal documents to process under time pressure.

In January 2018, Commissioner Vestager announced that best practices on the use of internal documents would be published, but this is still pending. So far, the requests for data are only governed by the request for information provisions in the EU Merger Regulation (“EUMR”). In the same vein, the EUMR provides little guidance on the extent of legal professional privilege when dealing with document requests during merger control proceedings.

[1] A “fiscal year” or “FY” covers the period of October 1 of the prior year through September 30 of the current year. For example, FY 2018 covers October 1, 2017 through September 30, 2018. Unless otherwise noted, the figures depicted in this section were derived from the FTC and DOJ Hart-Scott-Rodino Annual Report. Fed. Trade Comm’n, Bureau of Competition, and Dep’t of Justice, Antitrust Div., Hart-Scott-Rodino Annual Report: Fiscal Year 2018 (2019), https://www.ftc.gov/system/files/documents/reports/federal-trade-commission-bureau-competition-department-justice-antitrust-division-hart-scott-rodino/fy18hsrreport.pdf.

[2] Estimate of FY 2019 HSR filings based on public FTC early termination data.

[3] These figures include challenged transactions that were not HSR-reportable.

[4] Press Release, U.S. Senator Amy Klobuchar, Klobuchar Introduces Legislation to Modernize Antitrust Enforcement and Promote Competition (Feb. 1, 2019), https://www.klobuchar.senate.gov/public/index.cfm/2019/2/klobuchar-introduces-legislation-to-modernize-antitrust-enforcement-and-promote-competition.

[5] Press Release, Dep’t of Justice, Office of Pub. Affairs, Justice Department Reviewing the Practices of Market-Leading Online Platforms (Jul. 23, 2019), https://www.justice.gov/opa/pr/justice-department-reviewing-practices-market-leading-online-platforms.

[6] Id.

[7] Press Release, Fed. Trade Comm’n, FTC’s Bureau of Competition Launches Task Force to Monitor Technology Markets (Feb. 26, 2019), https://www.ftc.gov/news-events/press-releases/2019/02/ftcs-bureau-competition-launches-task-force-monitor-technology.

[9] Complaint, In the Matter of Evanston Northwestern Healthcare Corp. and ENH Medical Grp., Inc., Comm’n File No. 0110234 (F.T.C. Feb. 10, 2004), https://www.ftc.gov/sites/default/files/documents/cases/2004/02/040210emhcomplaint.pdf.

[10] Opinion of the Commission on Remedy, In the Matter of Evanston Northwestern Healthcare Corp. and ENH Medical Grp., Inc., Comm’n File No. 0110234 (F.T.C. Apr. 28, 2008), https://www.ftc.gov/sites/default/files/documents/cases/2008/04/080428commopiniononremedy.pdf.

[11] Monica Nickelsburg, FTC chair aims to resolve Big Tech antitrust probe this year, ending investigations or taking action, GeekWire (Jan. 7, 2020, 1:23 p.m.), https://www.geekwire.com/2020/ftc-chair-aims-resolve-big-tech-antitrust-probes-year-ending-investigations-taking-action/.

[12] Rupert Steiner and Daren Fonda, Attorney General Barr Says He Wants Antitrust Investigation Into Tech Giants Finished Next Year, Barron’s (Dec. 10, 2019, 4:18 p.m.), https://www.barrons.com/articles/william-barr-tech-antitrust-investigation-online-social-media-telecom-51576012529.

[13] Julie Masson, FTC will publish antitrust guidelines for big tech, Global Competition Review (Sept. 11, 2019), https://globalcompetitionreview.com/article/usa/1197428/ftc-will-publish-antitrust-guidelines-for-big-tech.

[14] Press Release, Dep’t of Justice, Office of Pub. Affairs, Assistant Attorney General Makan Delrahim Delivers Remarks at the Federalist Society National Lawyers Convention (Nov. 14, 2019), https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-remarks-federalist-society-national.

[15] Press Release, Dep’t of Justice, Office of Pub. Affairs, Deputy Attorney General Jeffrey A. Rosen Delivers Remarks on the Review of Market-Leading Online Platforms at the American Bar Association’s 2019 Antitrust Fall Forum (Nov. 18, 2019), https://www.justice.gov/opa/speech/deputy-attorney-general-jeffrey-rosen-delivers-remarks-review-market-leading-online.

[16] Press Release, Dep’t of Justice, Office of Pub. Affairs, Justice Department Sues to Block Sabre’s Acquisition of Farelogix (Aug. 20, 2019), https://www.justice.gov/opa/pr/justice-department-sues-block-sabres-acquisition-farelogix; Complaint, United States v. Sabre Corp., et al., No. 1:19-cv-01548-UNA (D. Del. Aug. 20, 2019), https://www.justice.gov/atr/case-document/file/1196836/download.

[17] Complaint, United States v. Sabre Corp., et al., No. 1:19-cv-01548-UNA (D. Del. Aug. 20, 2019), https://www.justice.gov/atr/case-document/file/1196836/download.

[18] Press Release, Dep’t of Justice, Office of Pub. Affairs, Justice Department Sues to Block Sabre’s Acquisition of Farelogix (Aug. 20, 2019), https://www.justice.gov/opa/pr/justice-department-sues-block-sabres-acquisition-farelogix.

[20] Press Release, Fed. Trade Comm’n, FTC Requires Bristol-Myers Squibb Company and Celgene Corporation to Divest Psoriasis Drug Otezla as a Condition of Acquisition (Nov. 15, 2019), https://www.ftc.gov/news-events/press-releases/2019/11/ftc-requires-bristol-myers-squibb-company-celgene-corporation.

[21] Dissenting Statement of Commissioner Rohit Chopra, In the Matter of Bristol-Myers Squibb/Celgene, Comm’n File No. 1910061 (F.T.C. Nov. 15, 2019), https://www.ftc.gov/system/files/documents/public_statements/1554293/dissenting_statement_of_commissioner_chopra_in_the_matter_of_bristol-myers-celgene_1910061.pdf.

[22] Dissenting Statement of Commissioner Rebecca Kelly Slaughter, In the Matter of Bristol-Myers Squibb/Celgene, Comm’n File No. 1910061 (F.T.C. Nov. 15, 2019), https://www.ftc.gov/system/files/documents/public_statements/1554283/17_-_final_rks_bms-celgene_statement.pdf.

[23] Press Release, Fed. Trade Comm’n, Fed. Trade Comm’n Closes Investigation of Roche Holding AG’s Proposed Acquisition of Spark Therapeutics, Inc. (Dec. 16, 2019), https://www.ftc.gov/news-events/press-releases/2019/12/federal-trade-commission-closes-investigation-roche-holding-ags.

[24] Statement of the Fed. Trade Comm’n, In the Matter of Roche Holding/Spark Therapeutics, Comm’n File No. 1910086 (F.T.C. Dec. 16, 2019), https://www.ftc.gov/system/files/documents/public_statements/1558049/1910086_roche-spark_commission_statement_12-16-19.pdf.

[25] Press Release, Fed. Trade Comm’n, FTC Challenges Illumina’s Proposed Acquisition of PacBio (Dec. 17, 2019), https://www.ftc.gov/news-events/press-releases/2019/12/ftc-challenges-illuminas-proposed-acquisition-pacbio.

[26] Complaint, In the Matter of Illumina, Inc. and Pacific Biosciences of Cal., Inc., Comm’n File No. 1910035, at ¶ 81 (F.T.C. Dec. 17, 2019), https://www.ftc.gov/system/files/documents/cases/d9387_illumina_pacbio_administrative_part_3_complaint_public.pdf.

[26a] As of the time of this writing, the FTC mounted an unsuccessful challenge to Evonik’s proposed acquisition of fellow hydrogen peroxide manufacturer PeroxyChem, as the Honorable Timothy Kelly of the U.S. District Court for the District of Columbia rejected the FTC’s request for a preliminary injunction on January 24, 2020. Although the FTC’s response to this order remains unclear, the order provides a reminder of the value and necessity of strong advocacy even after the FTC has chosen to challenge a deal.

[27] United States v. AT&T, Inc., 916 F.3d 1029 (D.C. Cir. 2019).

[28] Id. at 1047.

[29] Press Release, Dept. of Justice, Office of Pub. Affairs, Judge Decides CVS-Aetna Final Judgment is in the Public Interest and Grants United States’ Motion (Sept. 4, 2019), https://www.justice.gov/opa/pr/judge-decides-cvs-aetna-final-judgment-public-interest-and-grants-united-states-motion.

[30] See United States v. CVS Health Corp., 407 F. Supp. 3d 45 (D.D.C. 2019).

[31] Id. at 52 (noting that “[t]hroughout this case, the Government has repeatedly asked this Court to dismiss out of hand many of amici’s objections to its proposed final judgment” because “consideration of harms that were not alleged in the complaint would aggravate constitutional difficulties that inhere in the Tunney Act” (internal quotation marks and citation omitted)).

[32] Id. at 50 (noting one amicus’s argument that the Government’s proposed divestiture remedy would be unsuccessful because the buyer—WellCare—relies on CVS for pharmacy benefit management, and CVS has the ability to deny or restrict WellCare’s access to the pharmacy benefit management and other services).

[33] Id. at 59 (internal citation and quotation marks omitted).

[34] Press Release, Fed. Trade Comm’n, FTC Imposes Conditions on Staples’ Acquisition of Essendant (Jan. 28, 2019), https://www.ftc.gov/news-events/press-releases/2019/01/ftc-imposes-conditions-staples-acquisition-office-supply.

[35] Id.

[36] Statement of Chairman Joseph J. Simons, Commissioner Noah Joshua Phillips, and Commissioner Christine S. Wilson, In the Matter of Sycamore Partners II, L.P., Staples, Inc. and Essendant Inc., Comm’n File No. 1810180 (F.T.C. Jan. 28, 2019), https://www.ftc.gov/system/files/documents/public_statements/1448328/181_0180_staples_essendant_majority_statement_1-28-19.pdf.

[37] Statement of Commissioner Rohit Chopra, In the Matter of Sycamore Partners II, L.P., Staples, Inc. and Essendant Inc., Comm’n File No. 1810180 (F.T.C. Jan. 28, 2019), https://www.ftc.gov/system/files/documents/public_statements/1448335/181_0180_staples_essendant_chopra_statement_1-28-19_0.pdf; Statement of Commissioner Rebecca Kelly Slaughter, In the Matter of Sycamore Partners II, L.P., Staples, Inc. and Essendant Inc., Comm’n File No. 1810180 (F.T.C. Jan. 28, 2019), https://www.ftc.gov/system/files/documents/public_statements/1448321/181_0180_staples_essendant_slaughter_statement.pdf.

[38] Press Release, Fed. Trade Comm’n, FTC Approves Final Order Imposing Conditions on UnitedHealth Group’s Proposed Acquisition of DaVita Medical Group (Aug. 22, 2019), https://www.ftc.gov/news-events/press-releases/2019/08/ftc-approves-final-order-imposing-conditions-unitedhealth-groups.

[39] Statement of Commissioners Rebecca Kelly Slaughter and Rohit Chopra, In the Matter of UnitedHealth Group and DaVita, Comm’n File No. 1810057 (F.T.C. June 19, 2019), https://www.ftc.gov/system/files/documents/public_statements/1529359/181_0057_united_davita_statement_of_cmmrs_s_and_c.pdf.

[40] Press Release, Fed. Trade Comm’n, FTC Approves Final Order Imposing Conditions on Merger of Fresenius Medical Care AG & KGaA and NxStage Medical, Inc. (Apr. 9, 2019), https://www.ftc.gov/news-events/press-releases/2019/04/ftc-approves-final-order-imposing-conditions-merger-fresenius.

[41] See Press Release, Fed. Trade Comm’n, FTC and DOJ Announce Draft Vertical Merger Guidelines for Public Comment (Jan. 10, 2020), https://www.ftc.gov/news-events/press-releases/2020/01/ftc-doj-announce-draft-vertical-merger-guidelines-public-comment; U.S. Dep’t of Justice and the Fed. Trade Comm’n, Draft Vertical Merger Guidelines (Jan. 10, 2020), https://www.ftc.gov/system/files/documents/public_statements/1561715/p810034verticalmergerguidelinesdraft.pdf.

[42] Press Release, Fed. Trade Comm’n, FTC and DOJ Announce Draft Vertical Merger Guidelines for Public Comment (Jan. 10, 2020), https://www.ftc.gov/news-events/press-releases/2020/01/ftc-doj-announce-draft-vertical-merger-guidelines-public-comment.

[43] Id.

[44] See Dep’t of Justice, Antitrust Div., Antitrust Div. Policy Guide to Merger Remedies at 5 (June 2011), https://www.justice.gov/sites/default/files/atr/legacy/2011/06/17/272350.pdf (noting that “a remedy that counteracts [changed incentives of the merging parties] or eliminates the merged firm’s ability to act on them may be appropriate” and that “the Division will consider tailored conduct remedies designed to prevent conduct that might harm consumers while still allowing the efficiencies that may come from the merger to be realized” and “will consider structural remedies,” particularly when the vertical integration is a small part of a larger deal); see also id. at 12 (conduct remedies); id. at 16 (transparency provisions); id. at 17 (prohibitions on restrictive contracting).

[45] Press Release, Dep’t of Justice, Office of Pub. Affairs, Assistant Attorney General Makan Delrahim Delivers Remarks at the 2018 Global Antitrust Enforcement Symposium (Sept. 25, 2018), https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-remarks-2018-global-antitrust.

[46] See United States v. AT&T Inc., 310 F. Supp. 3d 161, 217 n.30 (D.D.C. 2018) (noting that the parties spent a good deal of the trial debating the “finer points” of Turner’s self-imposed arbitration commitments to roughly 1,000 video distributors, and finding that despite the DOJ’s assertions to the contrary, the arbitration commitments were fundamentally similar “to those blessed by the FCC, DOJ, and this Court in the Comcast-NBCU merger”); id. at 241 n.51 (“[T]he Court has reason to believe that, post-merger, AT&T will honor Turner’s commitment to arbitrate . . . . In short, the commitment, made by Turner shortly after the filing of this suit, will have real-world effects. . . . Contrary to the Government’s insinuations about the reasons for the arbitration offer, moreover, the Court does not view the offer as akin to an admission by defendants that the proposed merger would lead to the anticompetitive harms that the Government posits.”)

[47] See Press Release, Dep’t of Justice, Office of Pub. Affairs, Assistant Attorney General Makan Delrahim Delivers Remarks at the Fed. Telecomms. Institute’s Conference in Mexico City (Nov. 7, 2018), https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-remarks-federal-institute (noting that “[i]f a structural remedy isn’t available, then, except in the rarest of circumstances, [the DOJ] will seek to block a merger” and that the DOJ “has a strong preference for structural remedies over behavioral ones”); see also David Hatch, DOJ’s Delrahim: We’re Committed to Structural Remedies Despite Losing AT&T Case, The Street (June 12, 2018, 6:35 p.m.), https://www.thestreet.com/investing/doj-committed-to-structural-remedies-despite-att-loss-says-delrahim-14620074 (noting that Delrahim told reporters following the DOJ’s loss in the District Court that the Antitrust Division would continue to favor structural remedies over behavioral remedies).

[48] Press Release, Fed. Trade Comm’n, FTC Imposes Conditions on Northrop Grumman’s Acquisition of Solid Rocket Motor Supplier Orbital ATK, Inc. (June 5, 2018), https://www.ftc.gov/news-events/press-releases/2018/06/ftc-imposes-conditions-northrop-grummans-acquisition-solid-rocket.

[49] Id. (noting that despite “typically disfavor[ing] behavioral remedies, given the special characteristics of the defense industry, [the FTC] accepted a remedy here”); see also Decision and Order, In the Matter of Northrop Grumman Corp. and Orbital ATK, Inc., Comm’n File No. 1810005 (F.T.C. June 5, 2015), https://www.ftc.gov/system/files/documents/cases/1810005_c-4652_northrop_grumman_orbital_decision_and_order_public_version_6-5-18.pdf (imposing information firewalls to protect competitively sensitive information from being shared within the merged firm and prohibiting the merged firm from discriminating against Northrop’s missile-system competitors in the supply of Orbital’s solid rocket motors).

[50] Press Release, Fed. Trade Comm’n, FTC Imposes Conditions on Staples’ Acquisition of Essendant (Jan. 28, 2019), https://www.ftc.gov/news-events/press-releases/2019/01/ftc-imposes-conditions-staples-acquisition-office-supply.

[51] Client Alert: U.S. Dep’t of Justice and Fed. Trade Comm’n Issue Draft Vertical Merger Guidelines, Gibson Dunn (Jan. 14, 2020), https://www.gibsondunn.com/us-department-of-justice-and-federal-trade-commission-issue-draft-vertical-merger-guidelines/.

[52] Press Release, Dep’t of Justice, Office of Pub. Affairs, Justice Department Sues to Block Novelis’s Acquisition of Aleris (Sept. 4, 2019), https://www.justice.gov/opa/pr/justice-department-sues-block-noveliss-acquisition-aleris-1.

[53] 5 U.S.C. § 571, et seq.

[54] Client Alert: DOJ’s Antitrust Division Elects Binding Arbitration to Resolve Merger Challenge, Gibson Dunn (Sept. 16, 2019), https://www.gibsondunn.com/doj-antitrust-division-elects-binding-arbitration-to-resolve-merger-challenge/.

[55] Announcement of the SAMR seeking public comment on the revised draft of the Antimonopoly Law (Draft for Public Comment) (市场监管总局就《<反垄断法>修订草案 (公开征求意见稿)》公开征求 意见的公告), State Admin. for Market Regulation (Jan. 2, 2020, 10:21 a.m.), http://www.samr.gov.cn/hd/zjdc/202001/t20200102_310120.html.

[56] Announcements of Unconditionally Approved Cases on Undertaking Concentrations (无条件批准经营者集中案件公示), State Admin. for Market Regulation, http://www.samr.gov.cn/fldj/ajgs/wtjjzajgs/.

[57] Announcement of SAMR’s Antimonopoly Review Decision to Conditionally Approve KLA-Tencor Corporation’s Share Acquisition of Orbotech Ltd. (市场监管总局关于附加限制性条件批准科天公司收购奥宝科技有限公司股权案反垄断审查决定的公告), State Admin. for Market Regulation (Feb. 20, 2019), http://gkml.samr.gov.cn/nsjg/xwxcs/201902/t20190220_290940.html.

[58] Announcement of SAMR’s Antimonopoly Review Decision to Conditionally Approve Cargotec Group’s Partial Business Acquisition of TTS Group (市场监管总局关于附加限制性条件批准卡哥特科集团收购德瑞斯集团部分业务案反垄断审查决定的公告), State Admin. for Market Regulation (July 12, 2019, 10:48 p.m.), http://www.samr.gov.cn/fldj/tzgg/ftjpz/201907/t20190712_303428.html.

[59] Announcement of SAMR’s Antimonopoly Review Decision to Conditionally Approve II-VI Incorporated’s Share Acquisition of Finisar Corporation (市场监管总局关于附加限制性条件批准高意股份有限公司收购菲尼萨股份有限公司股权案反垄断审查决定的公告), State Admin. for Market Regulation (Sept. 23, 2019, 9:38 p.m.), http://www.samr.gov.cn/fldj/tzgg/ftjpz/201909/t20190920_306948.html.

[60] Announcement of SAMR’s Antimonopoly Review Decision to Conditionally Approve New Joint Venture Between Zhejiang Garden Bio-chemical High-tech Co., Ltd. and Royal DSM N.V. (市场监管总局关于附加限制性条件批准浙江花园生物高科股份有限公司与皇家帝斯曼有限公司新设合营企业案反垄断审查决定的公告), State Admin. for Market Regulation (Oct. 18, 2019, 11:57 a.m.), http://www.samr.gov.cn/fldj/tzgg/ftjpz/201910/t20191018_307455.html.

[61] Announcement of SAMR’s Antimonopoly Review Decision to Conditionally Approve Novelis Inc.’s Share Acquisition of Aleris Corporation (市场监管总局关于附加限制性条件批准诺贝丽斯公司收购爱励公司股权案反垄断审查决定的公告), State Admin. for Market Regulation (Dec. 20, 2019, 4:07 p.m.), http://www.samr.gov.cn/fldj/tzgg/ftjpz/201912/t20191220_309365.html.

[62] Administrative Penalty Cases (行政处罚案件), State Admin. for Market Regulation, http://www.samr.gov.cn/fldj/tzgg/xzcf/.

[63] See 21 September 1990 to 31 December 2019, European Comm’n, https://ec.europa.eu/competition/mergers/statistics.pdf.

[64] See Case M.8677 – Siemens/Alstom, European Comm’n (June 2, 2019) https://ec.europa.eu/competition/mergers/cases/decisions/m8677_9376_3.pdf.

[65] See Press Release, European Comm’n, Mergers: Commission prohibits Wieland’s proposed acquisition of Aurubis Rolled Products and Schwermetall (Feb. 6, 2019), https://ec.europa.eu/commission/presscorner/detail/en/IP_19_883.

[66] See Press Release, European Comm’n, Mergers: Commission prohibits proposed merger between Tata Steel and ThyssenKrupp (June 11, 2019), https://ec.europa.eu/commission/presscorner/detail/en/IP_19_2948.

[67] See Bertold Bär-Bouyssière, Daniel Wojtczak and Moustapha Assahraoui, Antitrust Matters – November 2019: EU Industrial policy and merger control: Advancement or pitfall?, Lexology (Nov. 18, 2019), https://www.lexology.com/library/detail.aspx?g=957a86a2-b87d-4108-b3ac-b0a30c829d4d.

[68] Id.

[69] See, e.g., Jorge Valero, 19 EU countries call for new antitrust rules to create ‘European champions’, Euractiv (Jan. 9, 2019), https://www.euractiv.com/section/economy-jobs/news/19-eu-countries-call-for-new-antitrust-rules-to-create-european-champions/; A Franco-German Manifesto for a European industrial policy fit for the 21st Century, Bundesministerium für Wirtschaft und Energie and Ministère de L’économie et des finances, République Française, https://www.bmwi.de/Redaktion/DE/Downloads/F/franco-german-manifesto-for-a-european-industrial-policy.pdf%3F__blob%3DpublicationFile%26v%3D2.

[70] See, e.g., Press Release, European Comm’n, Keynote Speech by President Juncker at the EU Industry Days 2019 (Feb. 5, 2019), https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_19_870.

[71] See, e.g., EU Industrial Policy After Siemens-Alstom: Finding a new balance between openness and protection, European Political Strategy Centre, European Comm’n (Mar. 18, 2019), https://ec.europa.eu/epsc/sites/epsc/files/epsc_industrial-policy.pdf.

[72] See A Franco-German Manifesto for a European industrial policy fit for the 21st Century, Bundesministerium für Wirtschaft und Energie and Ministère de L’économie et des finances, République Française, https://www.bmwi.de/Redaktion/DE/Downloads/F/franco-german-manifesto-for-a-european-industrial-policy.pdf%3F__blob%3DpublicationFile%26v%3D2. See also Modernising EU Competition Policy, Bundesministerium für Wirtschaft und Energie, Ministère de L’économie et des finances, République Française, and Ministerstwo Przedsiębiorczości I Technologii, https://www.bmwi.de/Redaktion/DE/Downloads/M-O/modernising-eu-competition-policy.pdf?__blob=publicationFile&v=4 (inviting the Commission to consider a number of proposals on modernizing merger control).

[73] See Bertold Bär-Bouyssière, Daniel Wojtczak and Moustapha Assahraoui, Antitrust Matters – November 2019: EU Industrial policy and merger control: Advancement or pitfall?, Lexology (Nov. 18, 2019), https://www.lexology.com/library/detail.aspx?g=957a86a2-b87d-4108-b3ac-b0a30c829d4d. Other jurisdictions that allow for public interest grounds to be taken into account are Portugal and South Africa.

[74] See EU Industrial Policy After Siemens-Alstom: Finding a new balance between openness and protection, European Political Strategy Centre, European Comm’n (Mar. 18, 2019), https://ec.europa.eu/epsc/sites/epsc/files/epsc_industrial-policy.pdf.

[75] Id.

[76] The decisions follow in the wake of several other procedures concerning procedural infringements, including a €124,5 million fine to Altice in April 2018 for gun-jumping.

[77] See Case M.8179 – Canon/Toshiba Medical Sys. Corp., European Comm’n (June 27, 2019), https://ec.europa.eu/competition/mergers/cases/decisions/m8179_759_3.pdf.

[79] See Press Release, European Comm’n, Mergers: Commission fines Canon €28 million for partially implementing its acquisition of Toshiba Medical Systems Corporation before notification and merger control approval (June 27, 2019), https://ec.europa.eu/commission/presscorner/detail/en/IP_19_3429.

[82] See Carles Esteva Mosso, Acting Deputy Director-General for Mergers, Mergers and the Regulatory Environment, European Comm’n (Sept. 11, 2014), https://ec.europa.eu/competition/speeches/text/sp2014_03_en.pdf.

[83] See Report on Competition Policy 2018, European Comm’n, (July 15, 2019), https://ec.europa.eu/competition/publications/annual_report/2018/part1_en.pdf.

The following Gibson Dunn lawyers assisted in preparing this client update: Adam Di Vincenzo, Jens-Olrik Murach, Christian Riis-Madsen, Sébastien Evrard, Andrew Cline, Stevie Pearl, Tine Rasmussen, Brian Ryoo, Emily Seo, Joshua Wade, Chris Wilson and Katie Zumwalt.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work, or any member of the firm’s Antitrust and Competition practice group:

Washington, D.C.

D. Jarrett Arp (+1 202-955-8678, [email protected])

Adam Di Vincenzo (+1 202-887-3704, [email protected])

Scott D. Hammond (+1 202-887-3684, [email protected])

Kristen C. Limarzi (+1 202-887-3518, [email protected])

Joshua Lipton (+1 202-955-8226, [email protected])

Richard G. Parker (+1 202-955-8503, [email protected])

Cynthia Richman (+1 202-955-8234, [email protected])

Jeremy Robison (+1 202-955-8518, [email protected])

Brian K. Ryoo (+1 202-887-3746, [email protected])

Chris Wilson (+1 202-955-8520, [email protected])

New York

Eric J. Stock (+1 212-351-2301, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Los Angeles

Daniel G. Swanson (+1 213-229-7430, [email protected])

Samuel G. Liversidge (+1 213-229-7420, [email protected])

Jay P. Srinivasan (+1 213-229-7296, [email protected])

Rod J. Stone (+1 213-229-7256, [email protected])

San Francisco

Rachel S. Brass (+1 415-393-8293, [email protected])

Dallas

Veronica S. Lewis (+1 214-698-3320, [email protected])

Mike Raiff (+1 214-698-3350, [email protected])

Brian Robison (+1 214-698-3370, [email protected])

Robert C. Walters (+1 214-698-3114, [email protected])

Denver

Ryan T. Bergsieker (+1 303-298-5774, [email protected])

Brussels

Peter Alexiadis (+32 2 554 7200, [email protected])

Attila Borsos (+32 2 554 72 11, [email protected])

Jens-Olrik Murach (+32 2 554 7240, [email protected])

Christian Riis-Madsen (+32 2 554 72 05, [email protected])

Lena Sandberg (+32 2 554 72 60, [email protected])

David Wood (+32 2 554 7210, [email protected])

Munich

Michael Walther (+49 89 189 33 180, [email protected])

Kai Gesing (+49 89 189 33 180, [email protected])

London

Patrick Doris (+44 20 7071 4276, [email protected])

Charles Falconer (+44 20 7071 4270, [email protected])

Ali Nikpay (+44 20 7071 4273, [email protected])

Philip Rocher (+44 20 7071 4202, [email protected])

Deirdre Taylor (+44 20 7071 4274, [email protected])

Hong Kong

Kelly Austin (+852 2214 3788, [email protected])

Sébastien Evrard (+852 2214 3798, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.