- Executive Summary

On Monday, December 6, 2021, the Biden-Harris Administration released the United States Strategy on Countering Corruption (the “Strategy”),[1] the first of its kind. The Strategy culminates a months-long process set in motion when President Biden declared that the U.S. Government’s efforts against corruption represent a “core United States national security interest.” As the Administration explained in a June 3, 2021 National Security Study Memorandum, “corruption threatens United States national security, economic equity, global anti-poverty and development efforts, and democracy itself.”

The Strategy seeks to broaden and energize the Government’s anti-corruption efforts by focusing on a range of policy and enforcement strategies coordinated across executive branch agencies. While many of the goals and programs described in the Strategy have been discussed for years by U.S. Government officials, the Strategy signals that the White House is elevating the priority of anti-corruption policy and enforcement efforts above those seen in recent years. Ultimately, while the Strategy is an important affirmation of an anti-corruption agenda for the Administration, time will be needed to assess its impact on reducing corruption globally, its stated goal. From an enforcement perspective, the Administration’s significant emphasis on combating corruption strongly points toward increased action, which echoes recent U.S. Department of Justice (“DOJ”) pronouncements pledging a renewed focus on corporate criminal enforcement. For the private sector, these developments emphasize the importance of implementing and monitoring corporate anti-corruption compliance programs.

The Strategy announced this week identifies five “pillars” on which the Administration intends to build its evolving anti-corruption efforts:

- Modernizing, coordinating, and resourcing U.S. Government efforts to fight corruption;

- Curbing illicit finance;

- Holding corrupt actors accountable;

- Preserving and strengthening the multilateral anti-corruption architecture; and

- Improving diplomatic engagement and leveraging foreign assistance to advance policy goals.

As detailed below, the Strategy has the potential to impact, among other programs, (1) DOJ’s enforcement activities, (2) the U.S. Government’s overarching anti-money laundering regime, and (3) the Administration’s anti-corruption work abroad—both on its own and through multilateral initiatives in conjunction with the European Union and other foreign governments.

- Background: The United States Strategy on Countering Corruption

The Strategy outlines in broad terms the Administration’s plan for the U.S. Government to tackle corruption—including through increased coordination among federal agencies, foreign governments, multinational entities, and non-governmental organizations; increased funding for established U.S. anti-corruption enforcement activities; the integration of enhanced anti-corruption practices into various federal programs; and the creation of new, targeted initiatives. The Strategy highlights deficiencies in the U.S. Government’s current approach, such as the inability of officials to timely access information regarding beneficial ownership of shell companies and insufficient information-gathering regarding U.S. real estate transactions, as well as successful practices that the Administration will continue and expand. The Strategy includes both initiatives that can and will be executed through federal agencies and plans that the Administration aspires to implement but that depend on congressional legislation or agreement with foreign governments.

The Strategy comprises five overarching parts, or pillars, each divided into two to five strategic objectives.

Pillar One – Modernizing, Coordinating, and Resourcing U.S. Government Efforts to Better Fight Corruption. In addition to improving data collection and information sharing among federal agencies, this pillar outlines new initiatives within federal agencies, such as new anti-corruption teams in the Treasury and Commerce Departments and a new beneficial ownership data system for use by law enforcement as part of the Administration’s support of Financial Crimes Enforcement Network (“FinCEN”) authorities. This Pillar also reveals the Administration’s plans to integrate anti-corruption practices into its other priorities, as by placing new conditions on foreign aid to fight the COVID-19 pandemic and to counter climate change.

Pillar Two – Curbing Illicit Finance. This pillar describes initiatives to improve the U.S. anti-money laundering regime, including its coordination with U.S. allies and other partners. For example, because billions of dollars in criminal proceeds are reported to be laundered through the U.S. real estate market, the Strategy announces that the Treasury will issue reporting requirements for “those with valuable information regarding real estate transactions.” In a similar vein, the Treasury will consider reviving a 2015 proposed rulemaking that would prescribe minimum standards for anti-money laundering programs and reporting requirements for certain investment advisors. Federal agencies also are ordered to consider ways to increase policing of professionals and service providers, such as lawyers, accountants, and trust and company service providers (“TCSPs”), who have frequently been alleged to play key roles in facilitating money laundering.

Pillar Three – Holding Corrupt Actors Accountable. This pillar lays out the White House’s vision for scaling up efforts to enforce anti-money laundering and other criminal and civil anti-corruption laws. The Strategy places a renewed focus on efforts to counter kleptocracy, such as the Treasury’s pilot Kleptocracy Assets Recovery Rewards program, which would make payments to individuals who provide information that leads to the recovery of stolen assets linked to foreign government corruption held at U.S. financial institutions. This pillar surveys the Administration’s plan to continue targeting the tools used by corrupt actors to scrutinize “the demand side of bribery”—by using diplomatic and foreign assistance programming to enforce and enact legislation in countries where bribery is prevalent. This plan also includes the launch of a new Democracies Against Safe Havens initiative to coordinate international efforts to eradicate safe havens for illicit funds. Further, this pillar previews that, following the priorities for anti-money laundering and counter-terrorism financing policies FinCEN issued in June 2021, FinCEN plans to regulate how financial institutions should incorporate anti-corruption measures into their risk-based anti-money laundering programs.

Pillar Four – Preserving and Strengthening the Multilateral Anti-Corruption Architecture. As this pillar describes, the Administration plans to work with allies and partners to more effectively implement multilateral treaties and frameworks for combatting corruption. Domestically, this pillar also lays out initiatives to improve the resilience of security and defense institutions. For example, the Department of Defense will elevate and prioritize funds for institutional capacity-building activities, aligned with NATO’s Building Integrity program. In particular, the U.S. Government and other donor countries will collaborate with international financial institutions and multilateral trust funds to strengthen anti-corruption efforts in their programs and allocation systems.

Pillar Five – Improving Diplomatic Engagement and Leveraging Foreign Assistance Resources to Advance Policy Goals. The final pillar outlines the Administration’s objectives for making anti-corruption efforts a key component of its foreign policy. For example, it will launch initiatives to reduce transnational corruption, such as a new Anti-Corruption Solutions through Emerging Technology program, which will engage government, civil society, and private sector actors to collaborate on tracking, developing, improving, and applying new and existing technological anti-corruption solutions. To further develop ways to respond quickly to emerging areas of risk, the U.S. Government also will launch two new response funds: (1) the Anti-Corruption Response Fund implemented by USAID to support, test, and pilot anti-corruption programming; and (2) the Global Anti-Corruption Rapid Response Fund implemented by DOJ and the State Department to enable expert advisors to consult with and assist foreign anti-corruption counterparts.

- DOJ Anti-Corruption Enforcement

The Strategy emphasizes that “aggressive enforcement action” is crucial to root out widespread corruption. The Strategy plans to expand criminal and civil law enforcement activities under the Foreign Corrupt Practices Act (“FCPA”) and other statutes, to increase coordination across the U.S. Government (and with foreign government partners and private actors), and to develop and implement new tools to broaden U.S. regulators’ reach. Responsibility for implementing these core components of the Strategy will naturally fall on DOJ, the SEC and other enforcement authorities.

Increased Enforcement: Given the Strategy’s focus on “vigorous enforcement,” the coming years likely will see a renewed DOJ focus on complex investigations into foreign bribery, misuse of cryptocurrency, and money laundering, among other areas. The uptick in investigations may arise through cross-referral of corruption matters between U.S. Government agencies and from other countries—as the Strategy calls on the U.S. Government to rely on greater cross-border cooperation in detecting, tracking, and investigating corruption schemes. The Strategy also contemplates greater cooperation with partner countries through joint investigations and coordinated prosecutions.

Increased Public-Private Coordination: In addition to prioritizing cooperation within the U.S. Government and with partner countries, the Strategy elevates the importance of coordination across various public and private institutions—with the goal of deepening and broadening anti-corruption enforcement capabilities and impact. As an example, the Strategy outlines enhanced collaboration among the U.S. Government and foreign policy partners to identify industries, financial channels, geographic areas, and governmental institutions and officials for increased scrutiny.

The Strategy focuses on expanding successful asset recovery programs that rely on individual whistleblowers. For example, the Strategy highlights DOJ’s existing “Kleptocracy Asset Recovery Initiative,” which since 2010 has facilitated the recovery of more than $1.7 billion in corruption proceeds by targeting the associates of corrupt foreign regimes. Building on this work, the Strategy introduces a new pilot Kleptocracy Asset Recovery Rewards Program, funded pursuant to the FY21 National Defense Authorization Act, that will create concrete financial incentives for reporting proceeds of foreign bribery. Treasury will run the pilot program and “provide payments to individuals for information leading to the identification and recovery of stolen assets linked to foreign government corruption held at U.S. financial institutions.”

Development of New Anti-Corruption Tools: The Strategy recognizes the need for new tools to broaden the reach of anti-corruption enforcement activities. In particular, the Strategy emphasizes the Administration’s commitment to working with allies and partners on “enacting legislation criminalizing the demand side of bribery” and enforcing such laws here and abroad—in the “countries where the bribery occurs.” Among the legislative fixes under consideration is an amendment to the FCPA to expand its application to foreign persons and government officials directly involved in bribery schemes—a perennial proposal that may finally find greater traction among lawmakers.

- Enhancements to the U.S. Anti-Money Laundering Regime

In the name of combating corruption, the White House is signaling strongly through the Strategy that it intends to push forward several long-standing recommendations for enhancing the U.S. anti-money laundering regime. These recommendations focus on financial gatekeepers, corporate transparency, and industry-specific initiatives.

Gatekeepers—Overview: The Strategy’s most controversial area of AML enhancements is the potential extension of mandatory compliance and reporting requirements to non-financial institution professional service providers. These include lawyers, accountants, trust and company service providers, incorporators, registered agents, and nominees, who are “gatekeepers” to the U.S. and international financial system.

The lack of mandatory AML requirements for gatekeepers has long been an area of discussion and past and current proposed legislation, but has faced objections from self-regulating professions, especially the legal profession, on the basis that regulations would not deter lawyers who knowingly facilitate money laundering and that reporting requirements would undermine traditional expectations of client confidentiality. Because the extension of mandatory AML requirements to gatekeeper professions would require legislative amendment to the Bank Secrecy Act (“BSA”), the Strategy explains that the White House will work with Congress as necessary to try to secure additional authorities.

Corporate Transparency: The Strategy highlights that FinCEN will continue efforts already underway to establish a beneficial ownership database as required by the Corporate Transparency Act. Doing so not only would meet the congressional mandate, but also answer the call of law enforcement, prosecutors, and the Financial Action Task Force to allow timely access to adequate, accurate, and current beneficial ownership information to federal agencies and financial institutions. Gibson Dunn published a detailed summary of the 2020 AML Act here and further analysis of the Corporate Transparency Act here.

Real Estate: The Strategy announces that FinCEN will move forward with applying permanent AML regulations to the real estate industry. In conjunction with the Strategy, FinCEN published an advance notice of proposed rulemaking on December 8, 2021 requesting public comment on effective methods to collect and report information relevant to preventing money laundering through real estate purchases in the United States.

Investment Advisors: The Strategy reveals the Biden Administration’s intent to re-examine a proposed rule, originally published in 2015, to require registered investment advisors to implement Bank Secrecy Act/anti-money laundering programs and to report suspicious activity. Imposing AML requirements on registered investment advisors, which work closely with private equity funds and hedge funds, would address a gap in the U.S. AML regime identified by the FATF and bring the United States closer to the legal regimes of other financial-center jurisdictions. Gibson Dunn published a client alert discussing the 2015 proposed rule in detail.

Antiquities and Art Dealers: The Strategy notes FinCEN’s recent actions with respect to dealers in arts and antiquities. FinCEN will submit a report to Congress later this year, as required by the 2020 AML Act, on facilitation of money laundering, terrorism finance, and other illicit financial dealings through trade in works of art. Further, FinCEN solicited public comment in September 2021 on an advance notice of proposed rulemaking as the first step to implementing the recent amendment to the BSA to extend the definition of financial institution to include dealers in antiquities.

In sum, most of the proposals in the Strategy have been the subject of debate and proposed rulemaking for several years, but have languished due to a lack of clear administration priorities or resources (or both). The Strategy renews efforts in this area, which may result in substantial expansions to the U.S. AML regime.

- Anti-Corruption and National Security

The Strategy was published on the eve of the Summit for Democracy, an effort to bolster cooperation among like-minded democracies. This Summit was timed to coincide with International Anti-Corruption Day (December 9) and International Human Rights Day (December 10). More than 100 countries were invited to the Summit, but China and Russia were not among the invitees.

In the lead-up to the Summit, U.S. officials clarified that they consider corruption a threat to democracy. Treasury Secretary Janet Yellen and USAID Administrator (and former UN Ambassador) Samantha Power wrote in a joint editorial in the Washington Post that corruption has made democratic decline possible: “Autocrats use public wealth to maintain their grip on power, while in democracies, corruption rots free societies from within.”

To address the transnational nature of corrupt financial flows, the Strategy highlights action taken by the Office of Foreign Assets Control (“OFAC”) to freeze the assets of foreign officials who have engaged in major schemes to embezzle public funds and corrupt public procurement. OFAC has imposed asset-freezing sanctions and visa restrictions on more than 200 foreign officials since Executive Order 13818, which was issued on December 20, 2017, implementing the Global Magnitsky Act.

The Strategy highlights the United States’ intent to increase multilateral cooperation in levying economic sanctions and visa restrictions to curtail corruption. The Strategy also notes the close cooperation between the United States and the United Kingdom on the United Kingdom’s Global Anti-Corruption Sanctions. On December 2, 2021, Australia’s Parliament adopted the Autonomous Sanctions Amendment, granting sanctions authority similar to the U.S. Global Magnitsky Act by unanimous vote.

- Recent European Union Anti-Corruption and AML Actions

The Biden Administration prioritized talks with the EU regarding the joint fight against corruption from the very beginning during its first months in office. As part of the EU-U.S. summit on June 15, 2021, the parties—in a joint statement—stated that the EU resolves to “lead by example at home” by implementing “concrete actions to […] fight corruption.”

The Treaty on the Functioning of the EU recognizes corruption as a “euro-crime,” among the particularly serious crimes with a cross-border dimension for which minimum rules on the definition of criminal offences and sanctions may be established (TFEU Art. 83.1). With the adoption of the Stockholm Program in 2010, the European Commission (in close cooperation with the Council of Europe Group of States against Corruption) has been given a political mandate to measure efforts in the fight against corruption and develop a comprehensive EU anti-corruption policy. The European Commission has, however, not made meaningful progress since then. Currently, the anti-corruption laws of the 27 member states—including their extraterritorial reach—vary across the EU, and the EU has not yet adopted any harmonization measures to change this.

Cross-Border Enforcement: Over the past decade, we have seen increasing cooperation among U.S. enforcement agencies and their counterparts in Europe and worldwide. We expect this to continue and grow in the years to come. One of the most evident examples of this trend is an investigation that led to parallel settlements between a European company and the authorities in the United States, France, and the United Kingdom in January 2020. As part of the global settlement, the company agreed to pay combined penalties of more than $3.9 billion to resolve foreign bribery charges, making this settlement the largest anti-corruption settlement to date.

New Anti-Money Laundering Regulations: During the past few years, the EU has significantly increased its fight against money laundering. Most notably, the EU member states had to implement into their national laws the changes introduced by Directive (EU) 2018/843 on preventing the use of the financial system for money laundering or terrorist financing (the Fifth Anti-Money Laundering Directive) by January 10, 2020. As a result, many economic players were subjected to new or enhanced AML requirements—including private financial institutions, cryptocurrency traders, real estate agencies, and notaries. The Directive is intended to bring more transparency to the ultimate beneficial owners of legal entities, including foreign associations, and expands the number of individuals entitled to inspect transparency registers. It also increases reporting obligations of so-called “obliged persons.” Further, the Directive sets stricter standards with respect to customer due diligence requirements (i.e., know-your-customer requirements).

Continuing this trend, on July 20, 2021, the European Commission presented an ambitious package of legislative proposals to strengthen the EU’s anti-money laundering and countering the financing of terrorism (“AML/CFT”) rules. The package consists of four legislative proposals: a regulation establishing a new EU AML/CFT authority; a regulation on AML/CFT containing directly applicable rules, including in the areas of customer due diligence and beneficial ownership; a sixth directive on AML/CFT; and a revision of the 2015 Regulation on Transfers of Funds to trace transfers of crypto-assets (Regulation 2015/847/EU).

- Conclusion

The Strategy may well reflect an inflection point in the anti-corruption enforcement landscape under the Biden Administration, particularly when viewed in conjunction with Deputy Attorney General Lisa Monaco’s pronouncements in October 2021 on corporate criminal enforcement. These Administration initiatives and public statements are an important reminder of the value of actively reviewing corporate anti-corruption compliance programs, both to prevent violations and to obtain mitigation in a self-disclosure or enforcement context. In terms of its focus, specificity of effort, and call for cross-government coordination, the Strategy may reflect real change in the coming years of the Administration. The commitment to increased coordination between U.S. agencies as well as with foreign law counterparts, the focus on the demand side along with the supply side of bribery, and the use of anti-money laundering tools to combat corrupt financial flows, point toward a heightened enforcement environment in the near term. Companies, senior executives, and industry participants should expect an intensifying regulatory and enforcement anti-corruption landscape in the United States and abroad.

___________________________

[1] The White House, United States Strategy on Countering Corruption (Dec. 6, 2021), https://www.whitehouse.gov/wp-content/uploads/2021/12/United-States-Strategy-on-Countering-Corruption.pdf.

The following Gibson Dunn lawyers assisted in preparing this client update: Patrick F. Stokes, Stephanie L. Brooker, Adam M. Smith, John D. W. Partridge, Richard W. Grime, Michael S. Diamant, M. Kendall Day, Kelly S. Austin, Courtney M. Brown, David P. Burns, John W.F. Chesley, Benno Schwarz, Linda Noonan, Brendan Stewart, Samantha Sewall, Andreas Dürr, Victoria Granda, Katharina E. Humphrey, Nealofar S. Panjshiri, and Lindsay Bernsen Wardlaw.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. We have more than 110 attorneys with anti-corruption and FCPA experience, including a number of former federal prosecutors and SEC officials, spread throughout the firm’s domestic and international offices. Please contact the Gibson Dunn attorney with whom you work, or any of the following:

Washington, D.C.

F. Joseph Warin (+1 202-887-3609, [email protected])

Richard W. Grime (+1 202-955-8219, [email protected])

Patrick F. Stokes (+1 202-955-8504, [email protected])

Judith A. Lee (+1 202-887-3591, [email protected])

David Debold (+1 202-955-8551, [email protected])

Michael S. Diamant (+1 202-887-3604, [email protected])

John W.F. Chesley (+1 202-887-3788, [email protected])

Daniel P. Chung (+1 202-887-3729, [email protected])

Stephanie Brooker (+1 202-887-3502, [email protected])

David P. Burns (+1 202-887-3786, [email protected])

M. Kendall Day (+1 202-955-8220, [email protected])

Adam M. Smith (+1 202-887-3547, [email protected])

Oleh Vretsona (+1 202-887-3779, [email protected])

Christopher W.H. Sullivan (+1 202-887-3625, [email protected])

Courtney M. Brown (+1 202-955-8685, [email protected])

Jason H. Smith (+1 202-887-3576, [email protected])

Ella Alves Capone (+1 202-887-3511, [email protected])

Pedro G. Soto (+1 202-955-8661, [email protected])

New York

Zainab N. Ahmad (+1 212-351-2609, [email protected])

Matthew L. Biben (+1 212-351-6300, [email protected])

Reed Brodsky (+1 212-351-5334, [email protected])

Joel M. Cohen (+1 212-351-2664, [email protected])

Lee G. Dunst (+1 212-351-3824, [email protected])

Mark A. Kirsch (+1 212-351-2662, [email protected])

Alexander H. Southwell (+1 212-351-3981, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Karin Portlock (+1 212-351-2666, [email protected])

Denver

Robert C. Blume (+1 303-298-5758, [email protected])

John D.W. Partridge (+1 303-298-5931, [email protected])

Ryan T. Bergsieker (+1 303-298-5774, [email protected])

Laura M. Sturges (+1 303-298-5929, [email protected])

Los Angeles

Nicola T. Hanna (+1 213-229-7269, [email protected])

Debra Wong Yang (+1 213-229-7472, [email protected])

Marcellus McRae (+1 213-229-7675, [email protected])

Michael M. Farhang (+1 213-229-7005, [email protected])

Douglas Fuchs (+1 213-229-7605, [email protected])

San Francisco

Winston Y. Chan (+1 415-393-8362, [email protected])

Thad A. Davis (+1 415-393-8251, [email protected])

Charles J. Stevens (+1 415-393-8391, [email protected])

Michael Li-Ming Wong (+1 415-393-8333, [email protected])

Palo Alto

Benjamin Wagner (+1 650-849-5395, [email protected])

London

Patrick Doris (+44 20 7071 4276, [email protected])

Charlie Falconer (+44 20 7071 4270, [email protected])

Sacha Harber-Kelly (+44 20 7071 4205, [email protected])

Michelle Kirschner (+44 20 7071 4212, [email protected])

Matthew Nunan (+44 20 7071 4201, [email protected])

Philip Rocher (+44 20 7071 4202, [email protected])

Steve Melrose (+44 20 7071 4219, [email protected])

Paris

Benoît Fleury (+33 1 56 43 13 00, [email protected])

Bernard Grinspan (+33 1 56 43 13 00, [email protected])

Munich

Benno Schwarz (+49 89 189 33-110, [email protected])

Michael Walther (+49 89 189 33-180, [email protected])

Mark Zimmer (+49 89 189 33-130, [email protected])

Hong Kong

Kelly Austin (+852 2214 3788, [email protected])

Oliver D. Welch (+852 2214 3716, [email protected])

São Paulo

Lisa A. Alfaro (+5511 3521-7160, [email protected])

Fernando Almeida (+5511 3521-7093, [email protected])

Singapore

Joerg Bartz (+65 6507 3635, [email protected])

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

This program will provide a comprehensive overview of spoofing and manipulation in the commodities and derivatives markets under the Commodity Exchange Act and other authorities. The panelists, all highly experienced lawyers in this area, will discuss the recent Department of Justice (DOJ) criminal prosecutions for spoofing and market manipulation, and the overlapping and often coordinated investigations conducted simultaneously by the Commodity Futures Trading Commission (CFTC) and other domestic and foreign regulators. We will also explore the strategies used by the government to investigate and prosecute spoofing and other market manipulation cases.

Topics will include:

- Overview of commodities and derivatives spoofing and market manipulation

- Recent CFTC, DOJ and other agency developments and trends

- Government investigation and prosecution strategies

- Internal monitoring, protection, and training

View Slides (PDF)

PANELISTS:

David Burns is a partner in the Washington, D.C. office and co-chair of the firm’s National Security Practice Group. He served in senior positions in both the Criminal Division and National Security Division of the U.S. Department of Justice. Most recently, he served as Acting Assistant Attorney General of the Criminal Division, where he led more than 600 federal prosecutors who conducted investigations and prosecutions involving securities fraud, health care fraud, FCPA violations, public corruption, cybercrime, intellectual property theft, money laundering, Bank Secrecy Act violations, child exploitation, international narcotics trafficking, human rights violations, organized and transnational crime, gang violence, and other crimes, as well as matters involving international affairs and sensitive law enforcement techniques.

Joel M. Cohen is a partner in the New York office and co-chair of the firm’s global White Collar Defense and Investigations Practice Group. He is also a member of the Securities Litigation, Class Actions and Antitrust & Competition Practice Groups. He has been lead or co-lead counsel in 24 civil and criminal trials in federal and state courts, and he is equally comfortable in leading confidential investigations, managing crises or advocating in court proceedings. Mr. Cohen’s experience includes all aspects of FCPA/anticorruption issues, in addition to financial institution litigation and other international disputes and discovery.

Jeffrey L. Steiner is a partner in the Washington, D.C. office, co-chair of the firm’s Derivatives Practice, and co-chair of the firm’s Digital Currencies and Blockchain Technology Practice. He advises financial institutions, dealers, hedge funds, private equity funds, and others on compliance and implementation issues relating to CFTC, SEC, the Dodd-Frank Act, and other banking rules and regulations. He also helps clients to navigate through cross-border issues resulting from global derivatives requirements. He has been recognized by Chambers Global and Chambers USA as an international leading lawyer for his work in derivatives, and was named a Cryptocurrency, Blockchain and Fintech Trailblazer.

Darcy C. Harris is a litigation associate in the New York office. She is a member of the firm’s Securities Enforcement, Securities Litigation, and White Collar Defense and Investigations Practice Groups. Her practice focuses on complex commercial litigation, internal and regulatory investigations, securities litigation, and white collar defense. She has represented clients across a variety of industries, including financial services, insurance, accounting and auditing, healthcare, real estate, consumer goods, media and entertainment, and non-profit.

Amy Feagles is an associate in the Washington, D.C. office. She is a member of the firm’s White Collar Defense and Investigations, and Antitrust and Competition Practice Groups. Her practice encompasses internal investigations, regulatory and criminal investigations, and complex commercial litigation across a range of industries, including financial services, government contracting, healthcare, and international shipping.

Jaclyn Neely is an associate in the New York office. She is a member of the firm’s White Collar Defense and Investigations, Securities Enforcement, Anti-Money Laundering, and Litigation Practice Groups. She represents major multinational corporations, financial institutions, and others in criminal, regulatory, and internal investigations, with a focus on anti-corruption and anti-money laundering issues.

MCLE CREDIT INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 1.0 credit hour, of which 1.0 credit hour may be applied toward the areas of professional practice requirement.

This course is approved for transitional/non-transitional credit. Attorneys seeking New York credit must obtain an affirmation form prior to watching the archived version of this webcast. Please contact [email protected] to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 1.0 hour.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

Following on from the recent launch of our Global Financial Regulatory Practice Group, please join us for the inaugural webcast from our global team, where we will be discussing the latest legal and regulatory developments while identifying key themes and trends across the major financial centers in relation to:

- Environmental, Social and Governance (ESG)

- Culture and conduct in financial services

- Digital assets/cryptocurrencies

We will discuss the supervisory and enforcement approaches and priorities currently being taken by global regulators, including those across the Asia-Pacific region, on these issues and provide views on best practices for managing compliance requirements and the new regulatory risks for firms and their senior management. In addition, the team will bring their predictions for the future of regulatory policy, supervision and enforcement based on their extensive experience in these areas with the key global regulators.

View Slides (PDF)

MODERATOR:

Kelly Austin: The Partner-in-Charge of Gibson Dunn’s Hong Kong office, a Co-Chair of the Firm’s Anti-Corruption & FCPA Practice, and a member of the Firm’s Executive Committee. Her practice focuses on government investigations, regulatory compliance and international disputes. She has extensive expertise in government and corporate internal investigations, including those involving the Foreign Corrupt Practices Act and other anti-corruption laws, and anti-money laundering, securities, and trade control laws. She also regularly guides companies on creating and implementing effective compliance programs.

PANELISTS:

William Hallatt: is a partner in the Hong Kong office and Co-Chair of the firm’s Global Financial Regulatory Practice Group. Mr. Hallatt’s practice includes internal and external regulatory investigations involving high-stakes enforcement matters brought by key financial services regulators, including the Hong Kong Securities & Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA), covering issues such as IPO sponsor conduct, anti-money laundering and terrorist financing compliance, systems and controls failures, and cybersecurity breaches. He has led the financial industry response on a number of the most significant regulatory change issues in recent years, working closely with major regulators, including the SFC, HKMA, Hong Kong Insurance Authority (IA) and the Monetary Authority of Singapore (MAS), together with leading industry associations, including the Asia Securities Industry & Financial Markets Association (ASIFMA) and the Alternative Investment Management Association (AIMA).

Michelle M Kirschner: is a partner in the London office and Co-Chair of the firm’s Global Financial Regulatory Practice Group. Ms. Kirschner advises a broad range of financial institutions and fintech businesses on areas such as systems and controls, market abuse, conduct of business and regulatory change management, and she conducts internal investigations and reviews of corporate governance and systems and controls in the context of EU and UK regulatory requirements and expectations.

Thomas Kim: former Chief Counsel and Associate Director of the SEC’s Division of Corporation Finance, and a former Counsel to the SEC Chairman, is a partner in the Washington D.C. office. He is a member of the firm’s Securities Regulation and Corporate Governance Practice Group. Mr. Kim advises a broad range of clients on SEC enforcement investigations involving disclosure, registration and auditor independence issues. Because of his SEC experience on the question of what is a security, Mr. Kim has advised many cryptocurrency companies on whether their particular digital assets constitute securities.

Matthew Nunan: former Head of Department for Wholesale Enforcement at the UK Financial Conduct Authority (FCA), is a partner in the London office. He is a member of the firm’s Dispute Resolution Group. When at the FCA, Mr. Nunan oversaw a variety of investigations and regulatory actions including LIBOR-related misconduct, insider dealing, and market misconduct matters, many of which involved working extensively with non-UK regulators and prosecuting authorities including the DOJ, SEC, CFTC, and others. Mr. Nunan also was Head of Conduct Risk for Europe, Middle East and Africa at a major global bank. He specializes in financial services regulation and enforcement, investigations and white collar defense.

Jeffrey Steiner: former special counsel at the U.S. Commodity Futures Trading Commission (CFTC), is a partner in the Washington D.C. office. He is Co-Chair of the firm’s Derivatives Practice and Digital Currencies and Blockchain Technologies Practice. Mr. Steiner advises a range of clients on regulatory, legislative, enforcement and transactional matters related to OTC and listed derivatives, commodities and securities. He also advises clients, including exchanges, financial institutions and fintech firms, on matters related to digital assets and cryptocurrencies.

MCLE CREDIT INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 1.5 credit hour, of which 1.5 credit hour may be applied toward the areas of professional practice requirement. This course is approved for transitional/non-transitional credit.

Attorneys seeking New York credit must obtain an Affirmation Form prior to watching the archived version of this webcast. Please contact [email protected] to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 1.5 hour.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

Related Webcast: Global Regulatory Developments and What to Expect Across the Globe (US/UK/EU)

Following on from the recent launch of our Global Financial Regulatory Practice Group, please join us for the inaugural webcast from our global team, where we will be discussing the latest legal and regulatory developments while identifying key themes and trends across the major financial centers in relation to:

- Environmental, Social and Governance (ESG)

- Culture and conduct in financial services

- Digital assets/cryptocurrencies

We will discuss the supervisory and enforcement approaches and priorities currently being taken by global regulators on these issues and provide views on best practices for managing compliance requirements and the new regulatory risks for firms and their senior management. In addition, the team will bring their predictions for the future of regulatory policy, supervision and enforcement based on their extensive experience in these areas with the key global regulators.

View Slides (PDF)

MODERATOR:

Stephanie Brooker: former Director of the Enforcement Division at the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) and a former federal prosecutor, is a partner in the Washington, D.C. office. She is Co-Chair of the firm’s White Collar Defense and Investigations, the Financial Institutions, and the Anti-Money Laundering Practice Groups. Ms. Brooker also previously served as the Chief of the Asset Forfeiture and Money Laundering Section in the U.S. Attorney’s Office for the District of Columbia. She has been named a National Law Journal White Collar Trailblazer and a Global Investigations Review Top 100 Women in Investigations. She handles a wide range of white collar matters, including representing financial institutions, multi-national companies, and individuals in connection with criminal, regulatory, and civil enforcement actions. She routinely handles complex cross-border investigations.

PANELISTS:

William Hallatt: is a partner in the Hong Kong office and Co-Chair of the firm’s Global Financial Regulatory Practice Group. Mr. Hallatt’s practice includes internal and external regulatory investigations involving high-stakes enforcement matters brought by key financial services regulators, including the Hong Kong Securities & Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA), covering issues such as IPO sponsor conduct, anti-money laundering and terrorist financing compliance, systems and controls failures, and cybersecurity breaches. He has led the financial industry response on a number of the most significant regulatory change issues in recent years, working closely with major regulators, including the SFC, HKMA, Hong Kong Insurance Authority (IA) and the Monetary Authority of Singapore (MAS), together with leading industry associations, including the Asia Securities Industry & Financial Markets Association (ASIFMA) and the Alternative Investment Management Association (AIMA).

Michelle M Kirschner: is a partner in the London office and Co-Chair of the firm’s Global Financial Regulatory Practice Group. Ms. Kirschner advises a broad range of financial institutions and fintech businesses on areas such as systems and controls, market abuse, conduct of business and regulatory change management, and she conducts internal investigations and reviews of corporate governance and systems and controls in the context of EU and UK regulatory requirements and expectations.

Thomas Kim: former Chief Counsel and Associate Director of the SEC’s Division of Corporation Finance, and a former Counsel to the SEC Chairman, is a partner in the Washington D.C. office. He is a member of the firm’s Securities Regulation and Corporate Governance Practice Group. Mr. Kim advises a broad range of clients on SEC enforcement investigations involving disclosure, registration and auditor independence issues. Because of his SEC experience on the question of what is a security, Mr. Kim has advised many cryptocurrency companies on whether their particular digital assets constitute securities.

Matthew Nunan: former Head of Department for Wholesale Enforcement at the UK Financial Conduct Authority (FCA), is a partner in the London office. He is a member of the firm’s Dispute Resolution Group. When at the FCA, Mr. Nunan oversaw a variety of investigations and regulatory actions including LIBOR-related misconduct, insider dealing, and market misconduct matters, many of which involved working extensively with non-UK regulators and prosecuting authorities including the DOJ, SEC, CFTC, and others. Mr. Nunan also was Head of Conduct Risk for Europe, Middle East and Africa at a major global bank. He specializes in financial services regulation and enforcement, investigations and white collar defense.

Jeffrey Steiner: former special counsel at the U.S. Commodity Futures Trading Commission (CFTC), is a partner in the Washington D.C. office. He is Co-Chair of the firm’s Derivatives Practice and Digital Currencies and Blockchain Technologies Practice. Mr. Steiner advises a range of clients on regulatory, legislative, enforcement and transactional matters related to OTC and listed derivatives, commodities and securities. He also advises clients, including exchanges, financial institutions and fintech firms, on matters related to digital assets and cryptocurrencies.

MCLE CREDIT INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 1.5 credit hour, of which 1.5 credit hour may be applied toward the areas of professional practice requirement. This course is approved for transitional/non-transitional credit.

Attorneys seeking New York credit must obtain an Affirmation Form prior to watching the archived version of this webcast. Please contact [email protected] to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 1.5 hour.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

Related Webcast: Global Regulatory Developments and What to Expect Across the Globe (Asia Pacific)

We previously reported on the introduction by certain Democrat members of Congress of proposed legislation (H.R.4777, Nondebtor Release Prohibition Act of 2021 (the “NRPA”)) to amend the Bankruptcy Code to prohibit non-consensual third party releases and provide for the dismissal of bankruptcy cases filed after the implementation of a divisional merger transaction (such as the so-called “Texas two-step” transaction). Recently, the House Judiciary Committee voted 23-17 to recommend that the NRPA be considered by the full House of Representatives. A full House vote has not yet been scheduled. The analogous Senate version of the NRPA (S.2497) is still being considered by the Senate Judiciary Committee.

Gibson Dunn lawyers are available to assist with any questions you may have regarding these issues. For further information, please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Business Restructuring and Reorganization practice group, or the following authors:

Michael J. Cohen – New York (+1 212-351-5299, [email protected])

Michael A. Rosenthal – New York (+1 212-351-3969, [email protected])

Matthew J. Williams – New York (+1 212-351-2322, [email protected])

Please also feel free to contact the following practice leaders:

Business Restructuring and Reorganization Group:

David M. Feldman – New York (+1 212-351-2366, [email protected])

Scott J. Greenberg – New York (+1 212-351-5298, [email protected])

Robert A. Klyman – Los Angeles (+1 213-229-7562, [email protected])

© 2021 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

A main area of focus for public companies this past annual reporting season was the new human capital disclosure requirement for annual reports on Form 10-K. This client alerteviews disclosure trends among S&P 500 companies and provides practical considerations for companies as we head into 2022 and the second year of discussing human capital resources and management.

I. Background on the New Requirements

On August 26, 2020, the U.S. Securities and Exchange Commission (the “Commission”) adopted amendments to Items 101, 103 and 105 of Regulation S-K, which became effective as of November 9, 2020.[1] Among other things, these amendments added human capital resources as a disclosure topic under Item 101, which addresses what companies must include in the “Business” section of their Form 10-K. As amended, Item 101(c) requires a registrant to describe its human capital resources “to the extent material to the understanding of that registrant’s business taken as a whole.”[2] Specifically, the human capital disclosure must include “the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction and retention of personnel).”[3] Prior to this amendment, Item 101(c) required the registrant to disclose only the number of persons employed by the registrant.

Consistent with the Commission’s stated desire to implement a more “principles-based” disclosure system,[4] the new rules did not define “human capital” or elaborate on specific requirements for human capital disclosures beyond the few examples provided in the rule text. This lack of specific line item requirements was criticized by Democratic Commissioner Caroline Crenshaw, who stated that “I would have supported today’s final rule if it had included even minimal expansion on the topic of human capital to include simple, commonly kept metrics such as part time vs. full time workers, workforce expenses, turnover, and diversity. But we have declined to take even these modest steps.”[5] As discussed below, following the change in presidential administration, the Commission has indicated that it plans to revisit the human capital disclosure requirements and potentially adopt more prescriptive rules in the future.[6]

To understand how companies have responded to the current disclosure requirements, we conducted a survey of the substance and format of human capital disclosures made by the 451 S&P 500 companies that filed an annual report on Form 10-K between the date the new requirements became effective, November 9, 2020, and July 16, 2021.[7] As is to be expected from principles-based rules, companies provided a wide variety of human capital disclosures,[8] with no uniformity in their depth or breadth. The next three sections highlight our observations from this survey.[9]

II. Disclosure Topics

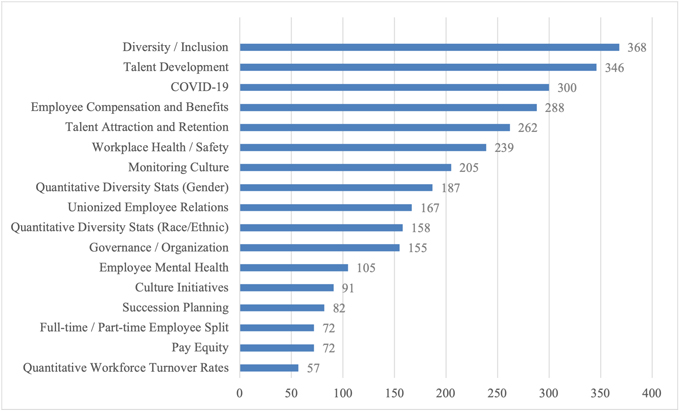

Our survey breaks down companies’ human capital disclosures into 17 topics, each of which is listed in the following chart, along with the number of companies that discussed the topic. Each topic is described more fully in the sections following the chart.

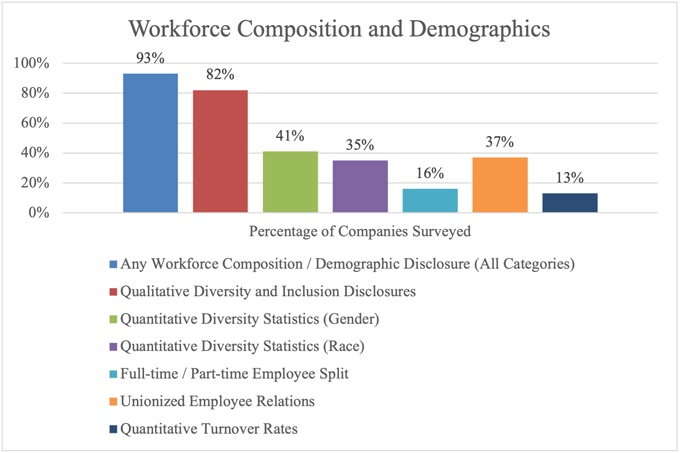

A. Workforce Composition and Demographics

Of the 451 companies surveyed, 419, or 93%, included disclosures relating to workforce composition and demographics in one or more of the following categories:

- Diversity and inclusion. This was the most common type of disclosure, with 82% of companies including a qualitative discussion regarding the company’s commitment to diversity, equity, and inclusion. The depth of these disclosures varied, ranging from generic statements expressing the company’s support of diversity in the workforce to detailed examples of actions taken to support underrepresented groups and increase the diversity of the company’s workforce. Many companies also included a quantitative breakdown of the gender or racial representation of the company’s workforce: 41% included statistics on gender and 35% included statistics on race. Most companies provided these statistics in relation to their workforce as a whole, while a subset (21%) included separate statistics for different classes of employees (e.g., managerial, vice president and above, etc.) and/or for their boards of directors. Some companies also included numerical goals for gender or racial representation—either in terms of overall representation, promotions, or hiring—even if they did not provide current workforce diversity statistics.

- Full-time / part-time employee split. While most companies provided the total number of full-time employees, only 16% of the companies surveyed included a quantitative breakdown of the number of full-time versus part-time employees the company employed. Similarly, we saw a number of companies that provided statistics on the number of seasonal employees and/or independent contractors.

- Unionized employee relations. 37% of the companies surveyed stated that some portion of their employees was part of a union, works council, or similar collective bargaining agreement. These disclosures generally included a statement providing the company’s opinion on the quality of labor relations, and in many cases, disclosed the number of unionized employees. While never expressly required by Regulation S-K, as a result of disclosure review comments issued by the Division of Corporation Finance over the years and a decades-old and since-deleted requirement in Form 1-A, it has been a relatively common practice to discuss collective bargaining and employee relations in the Form 10-K or in an IPO Form S-1, particularly since the threat of a workforce strike could be material.

- Quantitative workforce turnover rates. Although a majority of companies discussed employee turnover and the related topics of talent attraction and retention in a qualitative way (as discussed in Section II.B. below), less than 13% of companies surveyed provided specific employee turnover rates (whether voluntary or involuntary).

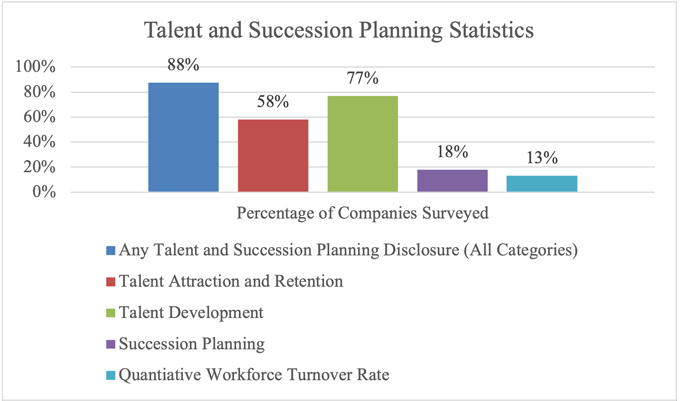

B. Recruiting, Training, Succession

395, or 88%, of the companies surveyed included disclosures relating to talent and succession planning in one or more of the following categories:

- Talent Attraction and Retention. These disclosures were generally qualitative and focused on efforts to recruit and retain qualified individuals. While providing general statements regarding recruiting and retaining talent were relatively common, with 58% of companies including this type of disclosure, quantitative measures of retention, like workforce turnover rate, were uncommon, with less than 13% of companies disclosing such statistics (as noted above).

- Talent Development. The most common type of disclosure in this area related to talent development, with 77% of companies including a qualitative discussion regarding employee training, learning, and development opportunities. This disclosure tended to focus on the broader workforce rather than specifically on senior management. Companies generally discussed training programs such as in-person and online courses, leadership development programs, mentoring opportunities, tuition assistance, and conferences, and a minority also disclosed the number of hours employees spent on learning and development.

- Succession Planning. Only 18% of companies surveyed addressed their succession planning efforts, which may be a function of succession being a focus area primarily for executives rather than the human capital resources of a company more broadly.

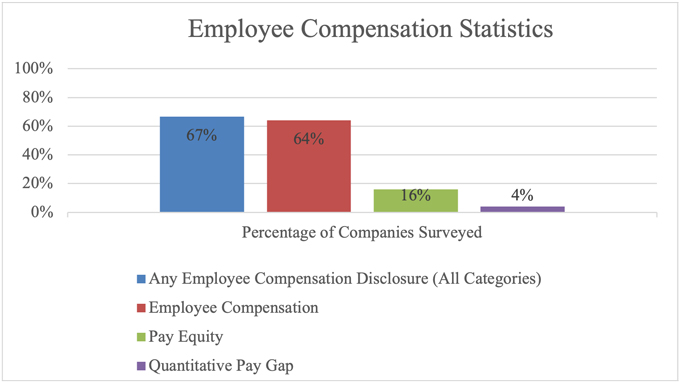

C. Employee Compensation

Of the companies surveyed, 300, or 67%, included disclosures relating to employee compensation. Most of those companies, or 64% of companies surveyed, included a qualitative description of the compensation and benefits program offered to employees. However, only 16% of companies surveyed addressed pay equity practices or assessments, and even fewer companies (4% of companies surveyed) included quantitative measures of the pay gap between diverse and non-diverse employees or male and female employees.

D. Health and Safety

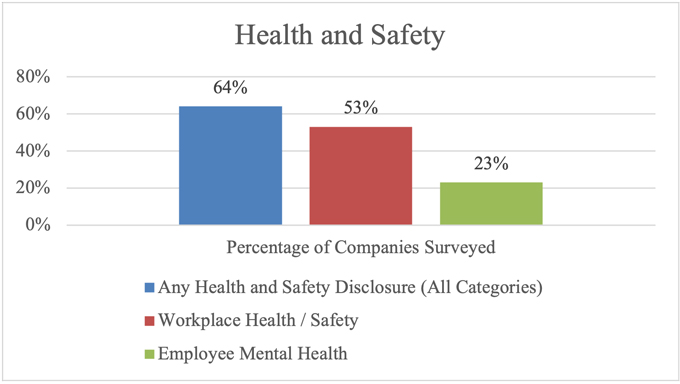

Of the companies surveyed, 288, or 64%, included disclosures relating to health and safety in one or both of the following categories:

- Workplace health and safety. 53% of companies surveyed included qualitative disclosures relating to workplace health and safety, typically with statements around the company’s commitment to safety in the workplace generally and compliance with applicable regulatory and legal requirements. However, only 12% of companies surveyed provided quantitative disclosures in this category, generally focusing on historical and/or target incident or safety rates or investments in safety programs. These disclosures generally were more prevalent among industrial and manufacturing companies, as discussed in Section G below. Many companies also provided disclosures on safety initiatives undertaken in connection with COVID-19, which is discussed separately below.

- Employee mental health. In connection with disclosures about standard benefits provided to employees, or additional benefits provided as a result of the pandemic, 23% of companies disclosed initiatives taken to support employees’ mental or emotional health.

E. Culture and Engagement

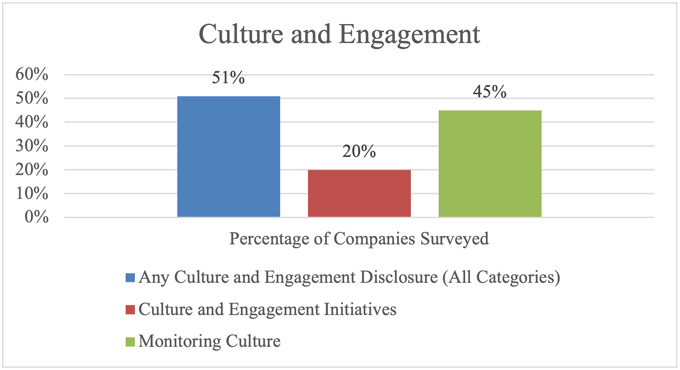

In addition to the many instances where companies mentioned a general commitment to culture and values, 229, or 51%, of the companies surveyed discussed specific initiatives they were taking related to culture and engagement in one or more of the following categories:

Culture and engagement initiatives. Only 20% of companies surveyed included specific disclosures relating to practices and initiatives undertaken to build and maintain their culture and values. These disclosures most commonly discussed company efforts to communicate with employees (e.g., through town halls, CEO outreach, trainings, or conferences and presentations) and to recognize employee contributions (e.g., awards programs and individualized feedback). Many companies also discussed culture in the context of the diversity-related initiatives to help foster an inclusive culture.

- Monitoring culture. Disclosures about the ways that companies monitor culture and employee engagement were much more common, with 45% of companies providing such disclosure. Companies generally disclosed the frequency of employee surveys used to track employee engagement and satisfaction, with some reporting on the results of these surveys, sometimes measured against prior year results or industry benchmarks.

F. COVID-19

A majority of companies (67% of those surveyed) included information regarding COVID-19 and its impact on company policies and procedures or on employees generally. COVID-19-related topics addressed ranged from work-from-home arrangements and safety protocols taken for employees who worked in person to additional benefits and compensation paid to employees as a result of the pandemic and contributions made to organizations supporting those affected by the pandemic.

G. Human Capital Management Governance and Organizational Practices

A minority of companies (34% of those surveyed) addressed their governance and organizational practices (such as oversight by the board of directors or a committee and the organization of the human resources function).

III. Industry Trends

One of the main rationales underlying the adoption of principles-based—rather than prescriptive—requirements for human capital disclosures is that the relative significance of various human capital measures and objectives varies by industry. This is reflected in the following industry trends that we observed:[10]

- Finance Industries (Asset Management & Custody Activities, Consumer Finance, Commercial Banks and Investment Banking & Brokerage). For the 34 companies in the Finance Industries, a majority included quantitative diversity statistics regarding race (61%) and gender (70%). Most companies also included qualitative disclosures regarding employee compensation (70%), and, compared to other industries discussed below, a relatively higher number discussed pay equity (35%) and quantified their pay gap (17%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, unionized employee relations, quantitative workforce turnover rates, and succession planning (in each case less than 20%).

- Technology Industries (E-Commerce, Internet Media & Services, Hardware, Software & IT Services and Semiconductors). For the 68 companies in the Technology Industries, 66% discussed talent development and training opportunities and 58% discussed talent attraction, recruitment, and retention. Relatively uncommon disclosures among this group included part-time and full-time employee statistics (7%), quantitative workforce turnover rates (16%), workplace health and safety measures (23%), culture initiatives (19%), and quantitative pay gap (2%).

- Manufacturing Industries (Industrial Machinery & Goods, Auto Parts, Automobiles, and Appliance Manufacturing). For the 21 companies in the Manufacturing Industries, 85% of the companies discussed their workplace health and safety measures. Other common disclosures included those related to COVID-19 (66%), unionized employee relations (52%), employee training and development (80%), and employee compensation (57%). Relatively uncommon disclosures among this group included those relating to corporate governance, part-time and full-time employee statistics, quantitative measures of diversity like race, ethnicity or gender workforce statistics, quantitative workforce turnover rates, employee mental health, culture initiatives, succession planning, pay equity or quantitative measures of the pay gap (in each case less than 25%).

- Travel Industries (Airlines and Cruise Lines). For the 8 companies in the Travel Industries, all but one discussed COVID-19, and all 8 companies discussed their unionized employee relations. Other common disclosures related to diversity and inclusion (87%), talent development (62%), and employee compensation (62%). None of the companies in this group discussed pay equity or provided quantitative workforce turnover rates or pay gap analysis.

- Retail Industries (Food Retailers & Distributors and Multiline and Specialty Retailers & Distributors). Of the 22 companies in this Retail Industries category of our survey, 36% included disclosures related to part-time and full-time employee statistics. Relatively uncommon disclosures among this group included quantitative workforce turnover rates, employee mental health, culture initiatives, pay equity, and quantitative pay gap analysis (in each case less than 20%).

- Aerospace & Defense Industry. For the 10 companies in the Aerospace & Defense Industry, all but one included a disclosure regarding talent development and training, and 80% of the companies also discussed talent attraction and retention. Other common disclosures include those related to COVID-19 (60%), qualitative discussion of diversity and inclusion (70%), unionized employee relations (60%), workplace health and safety measures (70%), and qualitative discussion of employee compensation (60%). Uncommon disclosures for companies in this group related to part-time and full-time employee statistics, quantitative workforce turnover rates, employee mental health, culture initiatives, pay equity or quantitative measures of the pay gap (in each case 10% or less).

- Food & Beverage Industries (Agricultural Products, Alcoholic Beverages, Non-Alcoholic Beverages, Processed Foods, Meat, Poultry & Dairy). For the 17 companies in the Food & Beverage Industries, the most common disclosures included those related to qualitative discussions on diversity and inclusion (94%), workplace health and safety measures (70%), and talent development and training (82%). Less than 20% of the companies in this group included disclosures related to part-time and full-time employee statistics, quantitative workforce turnover rates, succession planning (none of the companies in this group included this type of disclosure), pay equity, or quantitative measures of the pay gap.

- Personal Goods Industries (Apparel, Accessories & Footwear, Household & Personal Products, Toys and Sporting Goods). For the 13 companies in the Personal Goods Industries, the most common disclosures were those related to a qualitative discussion on diversity and inclusion (92%), quantitative diversity statistics about gender (61%), COVID-19 (61%), talent attraction and retention (61%), talent development (76%), employee compensation (61%), and corporate governance and organization (61%). Relatively uncommon disclosures for companies in this group include quantitative workforce turnover rates (7%), employee mental health (23%), culture initiative (23%), pay equity (15%), and the quantitative pay gap (0%).

- Biotechnology & Pharmaceutical Industry. For the 18 companies in the Biotechnology & Pharmaceutical Industry, 100% included a qualitative discussion of diversity and inclusion, with many including workforce diversity statistics for race (55%) or gender (50%). Other common disclosure topics for this industry were COVID-19 (72%), workplace health and safety measures (66%), monitoring culture (61%), talent development (77%), and employee compensation (72%). Less than 25% of the companies in this industry included disclosures regarding part-time and full-time employee statistics, quantitative workforce turnover rate, culture initiative, succession planning, or quantitative pay gap measures.

- Health Care Industries (Drug Retailers, Health Care Delivery, Health Care Distributors, and Medical Equipment & Supplies). For the 37 companies in the Health Care Industries, the most common disclosures were those related to COVID-19 (67%), qualitative discussion of diversity and inclusion (86%), diversity workforce statistics of gender (56%) (statistics about race were only disclosed by 43% of this group), workplace health and safety (59%), talent development and training (83%), and employee compensation (70%). The least common disclosures, with less than 20% each, included quantitative workforce turnover rates, culture initiatives, succession planning, pay equity, and quantitative pay gap measures.

- Building Industries (Building Products & Furnishings, Engineering & Construction Services, and Home Builders). For the 11 companies in the Building Industries, the most common disclosures were those related to COVID-19 (63%), workplace health and safety (54%), talent attraction and retention (72%), talent development (72%), and employee compensation (54%). The least common disclosures, with 10% or less of the companies in this group including such disclosures, were part-time and full-time employee statistics, quantitative workforce turnover rate, employee mental health, culture initiatives, pay equity (0%) and quantitative pay gap measures (0%).

- Hotel Industries (Casinos & Gaming, Hotels & Lodging, and Leisure Facilities). Of the 9 companies in the Hotel Industries, 100% included COVID-19-related disclosure. Disclosures of over 80% of companies in this group include in their annual report a qualitative discussion on diversity and inclusion, unionized employee relations, and employee compensation. Relatively uncommon disclosures include those related to governance and corporate organization, quantitative diversity statistics regarding race and gender, quantitative workforce turnover rates, culture initiatives, monitoring culture, succession planning, pay equity, and quantitative pay gap (in each case less than 25%).

- Utilities Industries (Electric Utilities and Power Generators, Gas Utilities & Distributors, and Water Utilities). For the 26 companies in the Utilities Industries, the most common disclosures included those related to COVID-19 (69%), qualitative discussion regarding diversity and inclusion (88%), unionized employee relations (88%), workplace health and safety (88%) and workforce training (80%). Relatively uncommon disclosures among this group included part-time and full-time employee statistics, quantitative workforce turnover rate, employee mental health, culture initiatives, pay equity, and quantitative pay gap (in each case less than 20%).

- Electrical Equipment Industry (Electric & Electrical Equipment (excluding computer or similar technology equipment)). For the 18 companies in the Electrical Equipment Industry, the most common disclosures include qualitative discussion regarding diversity (83%), workplace health and safety (83%), and employee training (89%). The least common disclosures included part-time and full-time workforce statistics, employee mental health, culture initiatives, succession planning, pay equity, and quantitative pay gap measures (in each case less than 25%).

- Oil & Gas Industry. For the 21 companies in the Oil & Gas Industry, the most common disclosures included corporate governance and organization measures (57%), COVID-19 (71%), qualitative discussion of diversity (95%), workplace health and safety measures (80%), talent acquisition and retention (80%), talent development and training (80%), and employee compensation (76%). The least common disclosures for the Oil & Gas Industry, in each case less than 20%, were part-time and full-time workforce statistics, unionized workforce relations, quantitative workforce turnover rates, culture initiatives, pay equity, and quantitative pay gap measures (0% for this disclosure).

- Real Estate Industry. For the 24 companies in the Real Estate Industry, the most common disclosures included those related to COVID-19 (70%), qualitative discussion of diversity (79%), monitoring culture (67%), talent development (79%), and employee compensation (75%). Relatively uncommon disclosures among this group included unionized workforce relations, quantitative workforce turnover rates, succession planning, pay equity and quantitative pay gap (in each case less than 20%).

- Insurance and Professional Industries (Insurance and Professional & Commercial Services). For the 28 companies in the Insurance and Professional Industries, the disclosures with over 70% of occurrence each were those related to qualitative discussions of diversity, talent development and training and employee compensation. The disclosures with a less than 25% rate of inclusion were related to unionized employee relations, employee mental health, succession planning, and the pay gap.

IV. Disclosure Format

The format of human capital disclosures in companies’ annual reports varied greatly.

Word Count. The length of the disclosures ranged from 10 to 2,180 words, with the average disclosure consisting of 797 words and the median disclosure consisting of 765 words.

Metrics. While the disclosure requirement specifically asks for a description of “any human capital measures or objectives that the registrant focuses on in managing the business” (emphasis added), our survey revealed that approximately 25% of companies determined not to include any quantitative metrics in their disclosure beyond headcount numbers. Given the materiality threshold included in the requirement and the fact that it is focused on what is actually used to manage the business, this is not a surprising result. It was common to see companies identify important objectives they focus on, but omit quantitative metrics related to those objectives. For example, while 82% of companies discussed their commitment to diversity, equity, and inclusion, only 41% and 35% of companies disclosed quantitative metrics regarding gender and racial diversity, respectively.

Graphics. Although the minority practice, approximately 25% of companies surveyed also included charts or other graphics, which were generally used to present statistical data, such as diversity statistics or breakdowns of the number of employees by geographic location.

Categories. Most companies organized their disclosures by categories similar to those discussed above and included headings to define the types of disclosures presented.

V. Comment Letter Correspondence

Often times comment letter correspondence from the staff of the Division of Corporation Finance (the “Staff”) helps put a finer point on disclosure requirements like this one that are relatively open-ended and give companies broad discretion to decide what to disclose. While there have been approximately two dozen comment letters published that address the new human capital requirements, the letters we have seen so far shed relatively little light on how the Staff believes the new requirements should be interpreted. Rather, the comment letters, all of which involved reviews of registration statements, were generally issued to companies whose disclosures about employees were limited to the bare-bones items companies have discussed historically, such as the number of persons employed and the quality of employee relations. From these companies, the Staff simply sought a more detailed discussion of the company’s human capital resources, including any human capital measures or objectives upon which the company focuses in managing its business. In other words, similar to historical Staff comment practices generally in the context of the first year of new disclosure requirements, the Staff targeted “low-hanging fruit,” basically just asking companies that disclosed nothing in response to the new requirements to provide responsive disclosure. Based on our review of the responses to those comment letters, we have not seen a company take the position that a discussion of human capital resources was immaterial and therefore unnecessary.

VI. Conclusion

The principles-based nature of the new human capital requirements predictably resulted in companies providing a wide variety of disclosures, with significant differences in depth and breadth. Companies’ responses to the new requirements underscore some of the potential advantages and disadvantages of principles-based rulemaking. On one hand, the largely principles-based requirements gave each company wide latitude to tailor its discussion to its own circumstances and to highlight the measures and objectives focused on by its management team. The resulting disclosures seemed to provide insight into how each company views its human capital resources and manages that aspect of its business. On the other hand, the general lack of prescriptive requirements limited the comparability of disclosures from one company to another and failed to facilitate quantitative analyses of companies’ human capital resources. While some would argue that precluding surface-level quantitative comparisons across companies is a virtue of the new rule, others, including SEC Chair Gensler, favor more specificity. On August 18, 2020 Chair Gensler tweeted: “Investors want to better understand one of the most critical assets of a company: its people. I’ve asked staff to propose recommendations for the Commission’s consideration on human capital disclosure…. This could include a number of metrics, such as workforce turnover, skills and development training, compensation, benefits, workforce demographics including diversity, and health and safety.”[11]

Until the Commission proposes and adopts new rules governing the disclosure of human capital management, however, we expect the wide variance in Form 10-K human capital disclosures to continue. As companies prepare for the upcoming Form 10-K reporting season, they should consider the following:

- Confirming (or reconfirming) that the company’s disclosure controls and procedures support the statements made in human capital disclosures so that they are reliable, consistent, and appropriately updated, and that there is a robust verification process in place. While many companies have historically provided information like this in other contexts (e.g., hiring brochures and company websites), given the potential liability attached to disclosures in SEC filings, more rigorous controls will likely need to be put in place to ensure the accuracy and completeness of the information.

- Confirming (or reconfirming) that the human capital disclosures included in the Form 10-K remain appropriate and relevant. In this regard, companies may want to compare their own disclosures against what their industry peers did this past year as well as against any internal reporting frameworks (such as the human capital information that is regularly reported to senior management and the board or a committee).

- Setting expectations internally that these disclosures likely will evolve. Companies should expect to develop their disclosure over the course of the next couple of annual reports in response to peer practices, regulatory changes and investor expectations, as appropriate. The types of disclosures that are material to each company may also change in response to current events.

- Addressing in the upcoming disclosure the progress that management has made with respect to any significant objectives it has set regarding its human capital resources as investors are likely to focus on year-over-year changes and the company’s performance versus stated goals.

- Ensuring consistency across disclosures by being mindful of other human capital disclosures the company has already made and what the company has already said about its human capital in other filings or voluntary statements in sustainability reports, investor outreach, college campus recruiting materials or elsewhere (e.g., how is the composition of the company’s workforce described in the CEO pay ratio disclosure?).

- Addressing significant areas of focus highlighted in engagement meetings with investors and other stakeholders. In a 2020 survey, 64% of institutional investors surveyed said they planned to focus on human capital management when engaging with boards (second only to climate change, at 91%).[12]

- Addressing, to the extent material, the effect that return-to-work policies, vaccine mandates, or other COVID-related policies may have on the workforce.

- Revalidating the methodology for calculating quantitative metrics and assessing consistency with the prior year. Former Chairman Clayton commented that he would expect companies to “maintain metric definitions constant from period to period or to disclose prominently any changes to the metrics.”

_____________________________

[1] See, A Double-Edged Sword? Examining the Principles-Based Framework of the SEC’s Recent Amendments to Regulation S-K Disclosure Requirements, available here.

[2] See, 17 C.F.R. § 229.101(c)(2)(ii).

[4] See, Modernizing the Framework for Business, Legal Proceedings and Risk Factor Disclosures, available at https://www.sec.gov/news/public-statement/clayton-regulation-s-k-2020-08-26.

[5] See, Regulation S-K and ESG Disclosures: An Unsustainable Silence, available at https://www.sec.gov/news/public-statement/lee-regulation-s-k-2020-08-26.

[6] Commission Chair Gary Gensler’s Spring 2021 Unified Agenda of Regulatory and Deregulatory Actions (the “Spring 2021 Reg Flex Agenda”) shows “Human Capital Management Disclosure” as being in the proposed rule stage. Available here.

[7] Our survey captured the following information: company industry, word count of relevant disclosure, category of information covered (e.g., diversity, workplace safety, etc.), and types of metrics included.

[8] See Considerations for Preparing your 2020 Form 10-K, available at https://www.gibsondunn.com/wp-content/uploads/2021/02/considerations-for-preparing-your-2020-form-10-k.pdf; Amit Batish et al., Human Capital Disclosure: What Do Companies Say About Their “Most Important Asset”?, The Harvard Law School Forum on Corporate Governance, May 18, 2021; Marc Siegel et al., How do you value your social and human capital?; Andrew R. Lash et al., Variety of Approaches to New Human Capital Resources Disclosure in 10-K Filings, The Harvard Law School Forum on Corporate Governance, Dec. 13, 2020.