We are pleased to provide you with Gibson Dunn’s ESG update covering the following key developments during June 2024.

- Integrity Council for the Voluntary Carbon Markets (ICVCM) announces it has approved its first ever set of carbon-crediting methodologies

On June 6, 2024, the ICVCM announced its first ever set of carbon-crediting methodologies that meet its high-integrity Core Carbon Principles (CCP). The CCPs set a global benchmark for high-integrity carbon credits, enabling the market to maximize its potential to tackle rising greenhouse gas emissions. The CCP label is designed to help buyers identify carbon credits that meet rigorous standards and can now be used on an estimated 27 million carbon credits. The CCPs are designed to build trust in the ICVCM and enable the market to maximize its potential to tackle rising greenhouse gas emissions, unlocking private finance for climate solutions. However, carbon credits generated using CCP-approved methodologies must ensure projects make a genuine impact on emissions.

- World Business Council for Sustainable Development (WBCSD) launches initiative to bridge the gap between corporate sustainability commitments and policy engagement

On June 19, 2024, the WBCSD launched the Positive Policy Engagement (PPE) workstream. The PPE workstream was created with the intention of bridging the gap between corporate sustainability commitments and policy engagement. It is estimated that around 58% of the world’s largest corporations have climate commitments that are undermined by their policy influence strategies. The need to narrow this gap is highlighted by investor expectations on corporate climate lobbying statements. The PPE aims to provide tools to ensure that corporate policy and advocacy engagement positively and proactively support climate, nature and equity goals, facilitating greater transparency in corporate policy engagement to achieve net-zero ambitions.

- Network for Greening the Financial System (NGFS) issues the second edition of its Guide on climate-related disclosure for central banks

On June 19, 2024, the NGFS published the second edition of its Guide on climate-related disclosure for central banks (Guide). The Guide expands upon the first edition published in December 2021 and calls for central banks to lead by example by disclosing their climate-related risks and opportunities. NGFS believes that this will enable greater transparency and facilitate the transition to a climate and nature friendly economy. The Guide presents a range of disclosure options organized around four areas: governance, strategy, risk management and metrics, and targets. The NGFS acknowledges that there is no ‘one-size-fits-all’ solution in respect to disclosure, instead distinguishing between foundational (‘baseline’) and complementary (‘building block’) recommendations relating to more detailed information that central banks could disclose. By not applying a one-size-fits-all approach, central banks are given greater flexibility on the scope and depth of their climate related disclosures. Although nature-related implications for central banks have not been considered in this Guide, the NGFS will be exploring the possibility of later publication of a supplementary addendum on nature-related disclosures.

- The Taskforce on Nature-related Financial Disclosures (TNFD) and the European Financial Reporting Advisory Group (EFRAG) have jointly published a mapping of the correspondence between the European Sustainability Reporting Standards (ESRS) and recommended disclosures and metrics

The TNFD and EFRAG have released a map that assembles the ESRS with the TNFD’s recommended disclosures. The mapping effectively demonstrates that all 14 TNFD disclosures are integrated into the ESRS, facilitating rates at which companies can meet the Corporate Sustainability Reporting Directive requirements. The rationale is to establish some consistency and uniformity between the ESG standards set by the ESRS and recommendations by the TNFD. Notable considerations are the alignment of concepts, definitions, and approaches to materiality, as these center on nature-related consequences and risks. Furthermore, the TNFD’s LEAP mechanism for assessing nature-related hazards aligns with the ESRS materiality assessments. The correspondence works to increase transparency and provide comprehensive data for sustainable development.

- The International Sustainability Standards Board (ISSB) delivers further harmonization of the sustainability disclosure landscape as it embarks on new work plan

The ISSB has boosted the sustainability disclosure landscape through the strategic implementation of new collaborations with the Global Reporting Initiative, Greenhouse Gas Protocol, Carbon Disclosure Project, Transition Plan Taskforce, and the Taskforce on Nature-related Financial Disclosure. This was facilitated with the aim of enhancing and consolidating global sustainability reporting. More than 20 jurisdictions are currently in the process of adopting ISSB standards. The latest publications demonstrate the ISSB’s objectives of implementing transition plan disclosures and augmenting greenhouse gas emissions reporting in conjunction with the Greenhouse Gas Protocol.

- UK Supreme Court rules that local authorities must consider downstream gas emissions when weighing planning approval

On June 20, 2024, the UK Supreme Court ruled that authorities must examine the climatic consequences arising from the combustion of oil from new wells. Despite the ruling not prohibiting proposals of new oil well constructions, a key consideration for the future is in relation to downstream emissions. These are not direct by-products of on-site procedures but are formed due to oil extraction activities. This judgment determined that it will be critical for companies to assess the potential consequences for Scope 3 emissions when burning oil from planned construction projects. In case you missed it…

- English High Court rules that the process by which the government’s climate change plans were adopted was unlawful

On May 3, 2024, the High Court ruled that the UK government had fallen through with its plans for the implementation of a net-zero strategy, subsequently leading to a breach of the UK Climate Change Act. The plaintiffs (Friends of the Earth, ClientEarth, and Good Law Project), argued that the revised plan published in March 2023, and titled the ‘Carbon Budget Delivery Plan’, had unjustifiably attributed the success of the project to the implementation of uncertain technologies. It was submitted that the UK government must produce an updated plan within 12 months to ensure that carbon budgets and emission targets are adequately set and met. This is in line with the government’s pledge to cut greenhouse gas emissions within five years and by over 68% by 2030.

- European Supervisory Authorities (ESAs) publish final reports on greenwashing

On June 4, 2024, three ESAs (European Banking Authority, European Insurance and Occupational Pensions Authority, and European Securities and Markets Authority (ESMA)) published final reports on greenwashing within the financial sector. The ESMA’s Final Report (Final Report) follows its Progress Report on May 31, 2023 and comes after the European Commission requested involvement from ESAs on greenwashing supervision and risks of sustainable financial policies in May 2022. The Final Report finds that National Competent Authorities (NCAs) have taken steps to prioritize the supervision of sustainability-related claims and that only a limited number of actual or potential occurrences of greenwashing have been detected. The Final Report also states that existing EU rules are sufficient in capturing greenwashing as a form of miscommunication or misconduct, but that greenwashing can be further addressed through acting on infringements of a range of specific sustainability-related requirements recently introduced in the EU. The Final Report notes that ESMA will publish an opinion setting out how the EU regulatory framework may be improved for the ‘investors’ journey’ and will continue to monitor its supervisory progress on greenwashing risks.

- EU Council adopts its position on the “Green Claims Directive”, which aims to address greenwashing

On June 17, 2024, the EU Council adopted its position on the proposed Directive on Substantiation and Communication of Explicit Environmental Claims, commonly referred to as the ‘Green Claims Directive’ aimed at combatting greenwashing and ensuring consumers have reliable information when making environmental choices. The directive aims to set minimum requirements for the substantiation, communication and verification of explicit environmental claims made by companies about their products and services. The new proposal targets explicit environmental claims and environmental labels that companies use voluntarily when marketing their greenness. It also applies to existing and future environmental labelling schemes, both public and private. Companies should use clear criteria and the latest scientific evidence to substantiate their claims and labels, with a focus on clarity and ease of understanding. Acknowledging the importance of existing national and regional public labelling schemes, ministers agreed on the possibility of establishing new schemes and exempting those regulated by EU or national law from third-party verification, provided the latter meet EU standards. The Council’s position will serve as the foundation for negotiations with the European Parliament, aiming to finalize the directive in line with the European Green Deal’s goal of achieving climate neutrality by 2050.

- EU Council approves new Nature Restoration Law

On June 17, 2024, the European Environmental Council approved the Nature Restoration Law, a regulation setting a legally binding target to preserve 20% of the EU’s land and seas by 2030. The regulation is a key part of the EU Biodiversity Strategy which is geared towards restoring degraded ecosystems, particularly prioritizing Natura 2000 protected areas. The regulation is particularly targeted towards supporting (i) pollinator populations, (ii) forest, agricultural, marine and urban ecosystems, and (iii) river connectivity. The aim is to ensure at least 90% of ecosystems are restored by 2050. Member states will be required to submit their National Restoration Plans within two years and will be required to monitor and report on their progress. In case you missed it…

- French Agency for Ecological Transition (ADEME) publishes an updated version of its Anti-Greenwashing Guide

In April 2024, the French Agency for Ecological Transition published an updated version of its Anti-Greenwashing Guide (Guide). The Guide sets out (i) how to identify greenwashing, (ii) the main anti-greenwashing methods, and (iii) how important it is for brands to avoid greenwashing, particularly when promoting their services, products and/or sustainable development approaches. The Guide advises that to safeguard against greenwashing, companies should establish that they have adequate knowledge of the ecological advantages of their products prior to advertisement. ADEME also provides concrete guidelines for companies to follow and highlights limited scenarios where certain ecological and sustainable development arguments may apply.

- EU Council approves Net-Zero Industry Act (NZIA)

On May 27, 2024 the EU Council adopted the NZIA, a regulation which, by focusing on developing the EU’s manufacturing capacity for clean technologies, aims to (i) speed up progress to the EU’s 2030 energy and climate targets and create high-quality jobs, (ii) strengthen the competitiveness and resilience of net-zero technologies manufacturing, reducing the reliance on highly concentrated imports, and (iii) improve the conditions for setting up net-zero projects in Europe and in so doing attract foreign direct investments into the EU. The NZIA supports strategic net zero technologies, including solar technologies, onshore wind, geothermal energy and biogas, with the aim of the EU’s manufacturing capacity of such technologies meeting at least 40% of the EU’s annual requirements by 2030.

- Federal District Court dismisses ExxonMobil’s (Exxon) lawsuit against activist investors

On June 17, 2024, the U.S. District Court for the Northern District of Texas dismissed Exxon’s lawsuit against Arjuna Capital concerning a shareholder proposal that was submitted for Exxon’s 2024 annual proxy statement and withdrawn, finding that Arjuna Capital’s covenant not to submit any other climate or greenhouse gas shareholder proposals to Exxon mooted any actual and ongoing controversy between the parties and removed the court’s power to adjudicate the dispute. More detail regarding the litigation is available in our January and May ESG alerts.

- More than 20 U.S. regulatory agencies publish updated climate adaptation plans

On June 20, 2024, the White House announced that nearly two-dozen U.S. regulatory agencies had published updated Climate Adaptation Plans, designed to enhance the resiliency of each agency’s resources, operations, employees, and facilities against the impacts of climate change. Some key actions outlined in the various plans include retrofitting and upgrading federal buildings, establishing procedures to support continuous operations, and encouraging climate-smart supply-chain sourcing.

- City of Baltimore sues PepsiCo, Coca-Cola, and others for plastic pollution

On June 20, 2024, the Mayor of Baltimore announced that the city was bringing a landmark lawsuit against plastic manufacturing companies as well as Frito Lay, PepsiCo, and Coca-Cola. In its complaint, the city describes health and environmental harms from single-use plastics and related costs and includes allegations of false claims, failure to warn, defective design, deceptive practices, and other violations of various state and local laws, including the Maryland Illegal Dumping and Litter Control Law. The city seeks criminal penalties and compensatory damages, among other relief.

- Canada amends Competition Act to target corporate “greenwashing”

On June 20, 2024, Canada passed a series of amendments to the Competition Act that address corporate “greenwashing,” among other matters. The amendments increase the potential scrutiny for environmental claims by bringing them within the scope of deceptive marketing practices. Under the newly amended law, public representations about a product’s environmental benefits or mitigations need to be based on an “adequate and proper test,” and public representations about the beneficial impact of a business or business activity must be “based on adequate and proper substantiation in accordance with internationally recognized methodology.” Importantly, the burden for demonstrating a statement’s validity is on the person making the representation. The Amendments accordingly introduce significant risk for companies operating in Canada when they make environmental claims. On July 4, 2024, the Competition Bureau Canada published a release following “a large number of requests” and indicated it would be providing guidance for the new provisions “on an accelerated basis” following public consultation.

- U.S. Supreme Court stays U.S. Environmental Protection Agency’s (EPA) application of the Clean Air Act’s “Good Neighbor” provision

As summarized in our alert, on June 27, 2024, the U.S. Supreme Court granted a stay sought by Ohio and several other applicants to suspend the EPA’s federal plan applying the Clean Air Act’s “Good Neighbor” provision as it applied to such states. The provision required states located “upwind” to reduce their emissions to account for pollution they may export to any “downwind” states. As a result of the stay, only 11 states are currently subject to the federal plan.

- Asia Pacific Loan Market Association (APLMA) publishes Model Provisions for Green Loans

On June 3, 2024, the APLMA announced the publication of its Model Provisions for Green Loans (Model Provisions) to bring clarity to green loan classification in the APAC loan markets. Green loans are defined by the APLMA as loans made available exclusively to finance or refinance eligible green projects, although an exhaustive definition of “green” has yet to be released in the market. The APLMA recommends that the Model Provisions are used by entities as a negotiation starting point rather than as mandatory guidelines. The Model Provisions are also intended to be adapted for different green loan structures in the APAC loan markets and have been designed for use in the APLMA’s recommended forms of facility agreement where the loan or facility in question is to be marketed as a ‘green facility’ or ‘green loan’. In particular, the Model Provisions recommend appointing a ‘green loan coordinator’, a detailed declassification mechanism, optional external reviews of annual green loan reports, and specific green loan reporting requirements. The APLMA has advised that it is keeping the Model Provisions under review as the market develops.

- China announces plan to introduce a carbon footprint management system by 2027

On June 5, 2024, China’s Ministry of Ecology and Environment announced a plan to implement a comprehensive product carbon footprint management system by 2027. Product carbon footprint is the measurement of the total greenhouse gas emissions generated by a product during its lifecycle. The planned system aims to track and reduce carbon emissions across various industries to meet climate goals and align with international standards. The Chinese government aims to create a preliminary national system for product carbon footprint labelling and authentication, with a focus on electricity, coal, and fuel oils. The first target is to develop calculation guidelines for approximately 100 key high-emitting products such as coal, steel, lithium batteries and natural gas by 2027, expanding to 200 products by 2030. This effort in producing a comprehensive database and providing analytics tools is part of China’s broader strategy to engage in the development of international product carbon footprint rules by 2030 and achieve carbon neutrality by 2060.

- Singapore and the Bank for International Settlements (BIS) collectively develop a blueprint for a climate risk platform for financial authorities

On June 12, 2024, the BIS Innovation Hub Singapore Centre and the Monetary Authority of Singapore (MAS) announced the development of a blueprint for a climate-risk platform for financial authorities known as Project Viridis (Blueprint). By using natural language processing to extract climate data from corporate disclosures, the climate-risk platform aims to integrate regulatory and climate data to help financial authorities identify, monitor, and manage climate-related financial risks. The development of such a platform is aimed at enhancing global financial stability by enabling more effective climate risk analysis. The Blueprint outlines the key features and metrics necessary for a climate-risk platform, including data on financed emissions, physical risk exposure, and forward-looking climate assessments.

- Hong Kong publishes its legislative-focused hydrogen development plan

On June 17, 2024, Hong Kong’s Environment and Ecology Bureau announced its Strategy of Hydrogen Development (Hydrogen Strategy) to develop hydrogen energy as part of its climate change efforts, aiming for carbon neutrality and international competitiveness. The ‘Inter-departmental Working Group on Using Hydrogen as Fuel’ (Working Group), established in 2022, is also integrated into the Hydrogen Strategy. The Working Group is responsible for studying the development and commercialization of various hydrogen energy technologies and exploring future hydrogen regulatory frameworks, and has already given agreement-in-principle to 14 hydrogen projects, including cross-boundary hydrogen transportation and supply facilities. The Hydrogen Strategy addresses topics such as technology, infrastructure, and public acceptance to create a supportive environment for hydrogen energy in Hong Kong. Legislative amendments will be introduced by 2025 to regulate hydrogen use, and the Hong Kong government plans to align hydrogen standards with international practices by 2027. The Hydrogen Strategy forms part of Hong Kong’s ambitions to promote regional cooperation, investment, and its expansion into a demonstration base for hydrogen energy development.

- Australia releases its Sustainable Finance Roadmap

On June 19, 2024, Australia’s Department of the Treasury published its Sustainable Finance Roadmap (Roadmap), setting out its vision to implement key sustainable finance reforms and related measures to help with its transition to a net-zero economy. The key initiatives include (i) mandatory climate-related finance disclosures for large businesses with a progressive rollout from January 1, 2025, (ii) the development of a sustainable finance taxonomy by the Australian Sustainable Finance Institute by the end of 2024 to guide private capital towards sustainable activities, and (iii) the establishment of a sustainable investment labelling regime to take effect in 2027. These reforms aim to ensure transparency, investor confidence and the mobilization of private capital. There is also an additional focus by the Australian government to integrate nature-related finance objectives and enhance greenwashing supervision. The Roadmap forms part of the Australian government’s wider Sustainable Finance Strategy which was first announced in November 2023.

- Malaysia launches new certification program in sustainability and responsible investment

On June 20, 2024, Malaysia’s Securities Industry Development Corporation (SIDC), part of Malaysia’s Securities Commission, launched a new certification program: the Certified Capital Market Professional in Sustainable and Responsible Investment (CCMP-SRI). The CCMP-SRI aims to raise competency standards among professionals in the capital market to meet a growing demand for sustainable and responsible investment products. Notably, sustainable investments in Malaysia surged from seven Sustainable and Responsible Investment (SRI) funds worth RM 1.46 billion in 2020 to 68 SRI funds worth RM 7.7 billion in 2023. The program addresses critical sustainability concepts, practices, and strategies, ensuring graduates’ abilities to lead in the sustainable investment industry by understanding financial performance and the broader impact of investments on society and the environment. The CCMP-SRI was also developed to align with the SIDC’s Industry Competency Framework to meet the evolving landscape of sustainable investment while contributing to Malaysia’s sustainability goals.

- Australia reverses decision on its disclosure standards to extend beyond climate-related financial disclosures

On June 26, 2024, the Australian Accounting Standards Board (AASB) decided to reverse its October 2023 decision to limit the scope of the draft Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information (Australian Standards) to climate-related financial disclosures so that the Australian Standards will now incorporate references to general sustainability. The decision has been taken to re-align the proposed Australian Standards with the International Sustainability Standard Board’s two global baseline standards on general sustainability (IFRS S1) and climate (IFRS S2) following significant pushback from investors, sustainable finance bodies and non-profit organizations. The AASB’s next board meeting is scheduled for mid-July 2024, with the aim for the draft Australian Standards to be finalized by the end of August 2024. The current plan is for large entities in Australia with the highest emission levels to be subject to disclosures obligations from January 2025, with mandatory reasonable assurance on all climate-related disclosures to begin in the fourth year of an entity reporting on such disclosures. In case you missed it…

- Japan’s Financial Services Agency (JFSA) proposes implementing mandatory sustainability disclosures from 2027

On May 1, 2024, the Working Group on Sustainability Disclosure (Reporting) and Assurance established by the JFSA (Working Group), proposed two timelines for mandatory sustainability disclosure and assurance requirements for all companies listed on the Tokyo Stock Exchange, including foreign companies. This follows the Sustainability Standards Board of Japan issuing three Exposure Drafts of the Sustainability Disclosure Standards on March 21, 2024, which are modelled after the ISSB’s sustainability disclosure standards (as reported in our April 2024 update). Under the Working Group’s proposal, ‘Prime’ Tokyo-listed companies with a market capitalization of ¥ 3 trillion or more would issue their first sustainability report for the fiscal year ending March 2027, whilst those with a market capitalization of ¥ 1 trillion would begin reporting for the fiscal year ending March 2028. The JFSA is also considering pushing this timeline back by one year. A deadline for finalization of this reporting timeline remains under discussion and has yet to be announced.

- Hong Kong Monetary Authority (HKMA) extends the green and sustainable finance grant scheme to include transition bonds

On May 10, 2024, the extension of the HKMA’s Green and Sustainable Finance Grant Scheme (GSF Grant Scheme) for three additional years until 2027 came into effect, following its inclusion in Hong Kong’s 2024-25 budget. Initially launched in May 2021, the GSF Grant Scheme has since provided subsidies to eligible bond issuers and loan borrowers for more than 340 green and sustainable debt instruments in Hong Kong, totaling approximately US$ 100 billion. The extension includes the HKMA’s updated Guidelines on the GSF Grant Scheme which expand it to cover transition bonds and loans that seek to support industries transitioning towards decarbonization. The HKMA will continue to administer and update the GSF Grant Scheme over time based on market developments and industry feedback. Please let us know if there are other topics that you would be interested in seeing covered in future editions of the monthly update. Warmest regards, Susy Bullock Elizabeth Ising Perlette M. Jura Ronald Kirk Michael K. Murphy Selina S. Sagayam Chairs, Environmental, Social and Governance Practice Group, Gibson Dunn & Crutcher LLP For further information about any of the topics discussed herein, please contact the ESG Practice Group Chairs or contributors, or the Gibson Dunn attorney with whom you regularly work.

The following Gibson Dunn lawyers prepared this update: Lauren Assaf-Holmes, Ayshea Baker, Alex Eldredge*, Natalie Harris, Elizabeth Ising, Nathan Marak, and Selina S. Sagayam.

*Alex Eldredge, trainee solicitor in the London office, is not admitted to practice law.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Environmental, Social and Governance practice group:

Environmental, Social and Governance (ESG):

Susy Bullock – London (+44 20 7071 4283, sbullock@gibsondunn.com)

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, eising@gibsondunn.com)

Perlette M. Jura – Los Angeles (+1 213.229.7121, pjura@gibsondunn.com)

Ronald Kirk – Dallas (+1 214.698.3295, rkirk@gibsondunn.com)

Michael K. Murphy – Washington, D.C. (+1 202.955.8238, mmurphy@gibsondunn.com)

Selina S. Sagayam – London (+44 20 7071 4263, ssagayam@gibsondunn.com)

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

An overview of the incoming rules on preventing sexual harassment as well as the steps the Labour government has taken and intends to take under the Employment Rights Bill.

In our last publication “What Employers Can Expect in the UK under the New Labour Government“ on 8 July 2024, we outlined the extensive reforms the newly formed Labour government had proposed to employment law during the General Election campaign and the potential consequences of these anticipated developments for employers. As expected, the Labour government has since published its Employment Rights Bill on 10 October 2024 (the “Bill”), providing a more fulsome insight into how its self-proclaimed “New Deal for Working People” will impact employers.

The publication of the Bill on 10 October 2024 means the Labour government has delivered on its commitment to put legislation before Parliament on its “Plan to Make Work Pay” within 100 days of entering office. Yet, while the Bill provides a broad framework for an eventual overhaul of the employment landscape, the measures outlined in the draft legislation do not require employers to make the immediate and wide-reaching changes to policies and procedures which might have been foreseen based on signals prior to the General Election. In fact, a significant number of original proposals have been omitted from the Bill – including, crucially, the proposed shift to a two-part framework of employment status – with the Labour government pledging to implement its further proposals after concluding extensive reviews and consultations with stakeholders. The consultation process is expected to begin in 2025, which means that the majority of reforms will not take effect until 2026. As such, the real scope and scale of the proposed reforms will not become fully clear until far later in the lifetime of this Parliament.

More pressing for employers will be changes to the law on preventing sexual harassment which were introduced by the previous Conservative government and which come into force on 26 October 2024.

A brief overview of the incoming rules on preventing sexual harassment as well as the steps the Labour government has taken and intends to take under the Employment Rights Bill is provided below, with more detailed information on each topic available by clicking on the links.

1. Incoming New Rules for October 2024 (view details)

We consider the new legal duty coming into force on 26 October 2024 which requires employers to take reasonable steps to prevent sexual harassment in the workplace (which is expected to extend to sexual harassment by clients, customers and other third parties), as well as the practical steps employers can take to ensure compliance.

2. Employment Reform Proposals under the Bill (view details)

We review the proposed reforms to the employment law landscape under the Bill, including:

- Workforce Changes: we summarise the changes proposed to enhance the “Day One” rights available to employees and to protect employees from unfair dismissal. We also summarise the proposals to restrict the controversial practice of dismissing and re-hiring employees as a means of unilaterally changing terms of employment.

- Discrimination, Diversity, Equity and Inclusion: we outline the measures which would impose further obligations upon employers to strengthen whistleblower rights; to address the gender pay gap; to extend the gender pay gap regime to include race and disability; and to support employees going through the menopause.

- Working Arrangements: we consider the changes proposed to employers’ abilities to engage workers on “zero hours” contracts and the potential enhancements to the right to flexible working. We also consider the proposals to negotiate pay arrangements in specific sectors and to strengthen trade unions.

3. Upcoming Employment Reviews (view details)

We outline the further reforms we expect the Labour government to implement following the successful passage of the Bill, based on the commitments made under its “Plan to Make Work Pay”. These further developments include comprehensive reviews of: (i) employment status; (ii) parental and carers’ leave; (iii) the processes and regulations under the Transfer of Undertakings (Protection of Employment) Regulations 2006 (SI 2006/246) (“TUPE”); and the potential new right of employees to collectively raise grievances about workplace conduct with the Advisory, Conciliation and Arbitration Service (“ACAS”).

We will provide further updates as and when the Labour government publishes more details on the implementation of the changes proposed both under the Bill and through the related upcoming consultations. In the meantime, we will continue to work with our clients to navigate the potential developments explored below.

APPENDIX

Workplace Harassment

Our last publication noted that the previous Conservative government had introduced the Worker Protection (Amendment of Equality Act 2010) Act 2023, under which employers would be required to take “reasonable steps” to prevent sexual harassment in the workplace. Since coming to power, the Labour government has reaffirmed its support for this new duty, which is due to come into force on 26 October 2024.

This new duty creates a positive and anticipatory legal obligation on employers. It will require employers to prevent sexual harassment in the workplace, which guidance suggests will cover sexual harassment by clients, customers and other third parties. Under the new rules, the Employment Tribunal will have the power to uplift compensation for harassment by a maximum of 25% where an employer is found to have breached this duty – an uplift which could prove extremely costly for defaulting employers given the levels of compensation which can be awarded for discriminatory harassment.

In its updated technical guidance, the Equality and Human Rights Commission has provided guidelines on the reasonable steps employers can take to identify risks and prevent sexual harassment including: (i) developing effective anti-harassment policies; (ii) adopting a zero-tolerance approach; (iii) conducting risk assessments; (iv) training staff on dealing with potential incidents; and (v) monitoring complaints and outcomes.

We note that the Bill expands this obligation on employers to require them to take “all reasonable steps” to prevent sexual harassment in the workplace. In addition, the Labour government has codified the obligation on employers to prevent sexual harassment by third parties. Following the passage of the Bill, those amendments will therefore raise the compliance bar even higher on employers.

2. Employment Reform Proposals under the Bill

Workforce Changes

Unfair Dismissal

In our last publication, we outlined the Labour government’s intention for a form of unfair dismissal protection to become a “Day One” right for employees. Currently, employees with less than two years of continuous service do not benefit from protection against unfair dismissal, except in certain limited circumstances.

The Labour government has now made protection from unfair dismissal a “Day One” right in the Bill, removing the two-year qualifying period. Helpfully, employers will continue to be able to operate probation periods to assess new hires by providing a (yet to be determined) period during which the Labour government has promised that there will be a “lighter-touch” process for dismissals. A consultation on the length of this initial period is expected in 2025, however, the Labour government has indicated a preference of nine months. The nature and scope of the lighter-touch process for dismissals during the initial period, and safeguards to provide stability and security for businesses and employees, will be addressed as the Bill makes its way through Parliament. As a requirement for the dismissal process during the initial period, the Labour government has suggested the need for a meeting with the employee outlining the employer’s concerns. We stress that the Labour government does not expect the reforms to unfair dismissal to come into effect any sooner than Autumn 2026, until which time the current two-year qualifying period will continue to apply. This extended time period will allow employers to prepare and adapt to the new regime.

Dismissal and Re-Engagement

We had previously summarised the Labour government’s commitment to ending the practice known as “fire and rehire” (where the employee is dismissed and offered re-employment on less favourable terms) as a lawful means of imposing unilateral changes to employees’ contractual terms of employment.

The Bill renders this practice an unfair dismissal, apart from in certain limited circumstances. As the Bill currently reads, employers will continue to be able to engage in this practice (subject to further safeguards) if: (i) the variation to the terms of employment could not reasonably have been avoided, or (ii) reducing or eliminating financial difficulties which are impacting the employer’s ability to carry on the business as a going concern are the reason for the variation. These carve outs are intended to ensure that businesses can restructure to remain viable where business or workforce demands necessitate it.

Day One Rights

In addition to protection against unfair dismissal, the Labour government has acted on its promise to give employees the below basic rights from the first day of employment:

- Parental, paternity and bereavement leave:

- Paternity and parental leave (which are currently subject to a 26-week and a one-year qualifying period respectively) will become “Day One” rights.

- Statutory sick pay:

- Under current rules, an employee is only entitled to statutory sick pay if they earn at least the lower earnings limit (£123 in 2024/25). The Bill removes this lower earnings limit requirement, allowing all employees to be entitled to statutory sick pay. The Labour government intends to consult in the near future on the right level of statutory sick pay for low earners.

- The current 3-day waiting period for statutory sick pay is also removed by the Bill, making the entitlement to statutory sick pay a “Day One” right (as it was temporarily during the COVID-19 Pandemic). Businesses should be aware of the potential financial burden that the introduction of statutory sick pay as a “Day One” right will bring.

Discrimination, Diversity, Equity and Inclusion

Whistleblowing

The Bill also classifies sexual harassment as a protected disclosure, meaning that whistleblowing protections are now extended to disclosures relating to sexual harassment. Protections will be granted where an employee makes such a disclosure because of relevant failures to protect against sexual harassment by an employer and the employee reasonably believes there is a public interest concern to the disclosure. Protections extend to unfair dismissal and being subjected to detriment, as a result of the disclosure.

Equality Action Plans

Regulations will require employers with more than 250 employees to develop, publish and implement action plans on how to address gender pay gaps and support employees going through the menopause. The Labour government has furthermore signalled the current gender equal pay regime will be expanded to cover ethnicity and disability pay gaps, with the widened system to be enforced by a Regulatory Enforcement Unit. These measures will be implemented through the Government’s Equality (Race and Disability Bill), with consultations on this legislation expected in due course and a draft bill to be published during this parliamentary session.

Working Arrangements

Engagement of Casual and/or Low Paid Workers

Before the election, the previous Conservative government had planned to implement a new statutory right to a predictable working pattern to limit the controversial practice of “zero hours” contracts. This right would have come into force last month but has now been superseded by the Labour government’s draft legislation.

Under the Bill, workers on “zero hours” contracts will have the right to a contract that guarantees the number of hours they regularly work based on a twelve-week reference period. Any such terms offered will need to be responsive to changing working patterns. If more hours become regular over time, employers must use subsequent reference periods to amend the workers’ contracts accordingly (and the Labour government has committed to consult with employers and workers to ensure any subsequent reference periods are reasonable and proportionate). The Bill also provides that employers must give workers reasonable notice of any change in shifts or working time, with compensation that is proportionate to the notice given for any shifts cancelled, moved or curtailed.

Sector Pay Arrangements

As anticipated, the Bill empowers the Secretary of State to establish specific pay arrangements in the school support and adult social care sectors, including creating statutory negotiating bodies with powers to broker fair pay, terms and conditions, and training standards within those sectors.

Right to Flexible Working

Expanding on the newly introduced right to request flexible working, the Bill makes flexible working the default for all workers from “Day One”. Where an employer refuses a flexible working application, the Bill requires the employer to state the grounds for refusing the application and to explain the basis on which the decision is considered to be reasonable. The specified grounds on which employers can refuse applications include: (i) cost; (ii) meeting customer demand; (iii) inabilities to reorganise work or recruit additional staff; (iv) detrimental impacts on quality or performance; (v) insufficiencies in the proposed arrangements; and (vi) planned structural changes.

Trade Unions

The Labour government has committed to repealing legislation introduced by its predecessor government aimed at restricting trade union activity, including the Strikes (Minimum Service Levels) Act 2023. With the aim of further strengthening trade union protections, the Bill simplifies the trade union recognition process by removing the requirement for a potential trade union to prove there is likely to be majority support for recognition. It introduces extended rights of access for trade union officials, as well as requiring employers to inform employees of their right to join trade unions.

As we have noted, the Labour government has slowed the pace of its proposed overhaul of the employment landscape to embark on comprehensive reviews of various measures which were contemplated under the original “Plan to Make Work Pay” but which have been omitted from the Bill in part or in full. While the Labour government has indicated these reviews will start from Autumn 2024, we expect this process to take several years given the number of stakeholders who will provide input on the proposals. In any event, a brief overview of the reviews which we believe will be of interest to our clients is provided below.

Employment Status

One of the most significant pledges under the original “Plan to Make Work Pay” was the proposed shift towards a single status of “worker” and a simplified two-part framework of employment status. Given the complicated implications of this proposal, the Labour government has indicated there will be a long review period prior to implementation.

As part of this review, the Labour government will also consult on how to strengthen protections for the self-employed, including through a potential right to written contract.

Parental Leave

Alongside the measures outlined above to make parental leave a “Day One” right, the Labour government intends to hold a full review of the parental leave system to facilitate this reform.

Carers’ Leave

The Labour government plans to assess the potential benefits of introducing paid carers’ leave against the potential impact on small businesses.

TUPE

The Labour government intends to holistically examine the TUPE regulations and strengthen existing rights and protections under TUPE.

Collective Grievances

The Labour government plans to consult with ACAS on enabling employees to raise collective grievances about conduct in the workplace.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Labor and Employment practice group, or the following authors in London:

James A. Cox (+44 20 7071 4250, jcox@gibsondunn.com)

Georgia Derbyshire (+44 20 7071 4013, gderbyshire@gibsondunn.com)

Olivia Sadler (+44 20 7071 4950, osadler@gibsondunn.com)

Finley Willits (+44 20 7071 4067, fwillits@gibsondunn.com)

*Josephine Kroneberger, a trainee solicitor in the London office, is not admitted to practice law.

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

From the Derivatives Practice Group: The CFTC announced that it has taken a no-action position with respect to KalshiEX LLC and related parties regarding swap-data reporting and recordkeeping regulations.

New Developments

- CFTC Staff Issues Supplemental Letter Regarding No-Action Position Related to Reporting and Recordkeeping Requirements for Fully Collateralized Binary Options. On October 4, the CFTC’s Division of Market Oversight and the Division of Clearing and Risk announced they have taken a no-action position regarding swap data reporting and recordkeeping regulations in response to a request from KalshiEX LLC, a designated contract market, and Kalshi Klear LLC, a derivatives clearing organization, to modify CFTC Letter No. 21-11 to cover transactions cleared through Kalshi Klear LLC. According to the announcement, the divisions will not recommend the CFTC initiate an enforcement action against KalshiEX LLC, Kalshi Klear LLC, or their participants for failure to comply with certain swap-related recordkeeping requirements and for failure to report to swap data repositories data associated with binary option transactions executed on or subject to the rules of KalshiEX LLC and cleared through Kalshi Klear LLC, subject to the terms and conditions in the no-action letter. [NEW]

- US Appeals Court Clears Kalshi to Restart Elections Betting. On October 2, the U.S. Court of Appeals for the D.C. Circuit upheld the D.C. District Court’s order that permitted KalshiEX LLC to list contracts that allow Americans to bet on election outcomes. The Court said that the CFTC did not show how the agency or the public interest would be harmed by the “event” contracts. The CFTC’s motion was denied “without prejudice to renewal should more concrete evidence of irreparable harm develop during the pendency of appeal.”

- CFTC’s Division of Clearing and Risk Announces Staff Roundtable Discussion on New and Emerging Issues in Clearing. On September 27, the CFTC announced that the Division of Clearing and Risk will hold a public roundtable on October 16, to discuss existing, new, and emerging issues in clearing. The roundtable will be held in the Conference Center at CFTC’s headquarters at Three Lafayette Centre, 1155 21st Street N.W., Washington, D.C. The roundtable will include participants from derivatives clearing organizations, futures commission merchants (“FCM”), FCM customers, end-users, custodians, proprietary traders, public interest groups, state regulators, and others. The goal of the roundtable is to gather information and receive expert input from a wide variety of stakeholder groups. Topics to be covered include the custody and delivery of digital assets, digital assets and margin, full collateralization, 24/7 trading, non-intermediated clearing with margin, and conflicts of interest related to vertically integrated entities.

- CFTC Requests Public Comment on a Rule Certification Filing by KalshiEX LLC. On September 26, the CFTC requested public comment on a rule certification filing by KalshiEX LLC, which would amend its rulebook to include rules for a request for quote functionality and amendments to its prohibited transactions rule. The CFTC previously stayed KalshiEX LLC’s filing because, according to the CFTC, the submission presents novel or complex issues that require additional time to analyze and is potentially inconsistent with the Commodity Exchange Act or the CFTC’s regulations. Comments must be submitted on or before October 28, 2024.

- CFTC Staff Extends No-Action Position for Certain Reporting Obligations Under the Ownership and Control Reports Final Rule. On September 25, the CFTC’s Division of Market Oversight (“DMO”) issued a no-action letter that extends the current no-action position for reporting obligations under the ownership and control reports final rule (“OCR Final Rule”). The OCR Final Rule, approved in 2013, requires the electronic submission of trader identification and market participant data for special accounts and volume threshold accounts through Form 102 and Form 40. DMO said that it is extending its no-action position to address continuing compliance difficulties associated with certain ownership and control reporting obligations identified by reporting parties and market participants. The position extends DMO’s position under CFTC Letter No. 23-14, stating that DMO will not recommend the CFTC commence an enforcement action for non-compliance with certain obligations. These obligations include, among others, the timing of ownership and control report form filings; certain information required to be reported regarding trading account controllers and volume threshold account controllers on Form 102; the reporting threshold that triggers the reporting of a volume threshold account on Form 102; the filing of refresh updates for Form 102; and responses to certain questions on Form 40. The no-action position will remain in effect until the later of the applicable effective date or compliance date of a CFTC action, such as a rulemaking or order, addressing such obligations.

- CFTC Announces Four Orders Granting Whistleblower Awards – Marking the Most in a Single Day. On September 23, the CFTC announced awards totaling approximately $4.5 million for whistleblowers who, collectively, provided information that led to the success of multiple enforcement actions brought by the CFTC and another authority. The four orders granting awards, to a total of seven whistleblowers, are the most the CFTC has issued on a single day.

New Developments Outside the U.S.

- ESMA Publishes Its First Annual Report on EU Carbon Markets. On October 7, ESMA published the 2024 EU Carbon Markets report, providing details and insights into the functioning of the EU Emissions Trading System market. The report indicates that prices in the EU ETS have declined since the beginning of 2023; emission allowance auctions remain significantly concentrated, with 10 participants buying 90% of auctioned volumes, reflecting a preference by most EU ETS operators to source allowances from financial intermediaries; and the vast majority of emission allowance trading in secondary markets takes place through derivatives, reflecting the annual EU ETS compliance cycle where non-financial sector firms hold long positions (for compliance purposes) while banks and investment firms hold short positions. The report builds on ESMA’s 2022 report on the trading of emission allowances, mandated in the context of rising energy prices and a three-fold increase of emission allowances’ prices in 2021. [NEW]

- ESMA Launches New Consultations Under the MiFIR Review. On October 3, ESMA launched two consultations on transaction reporting and order book data under the Markets in Financial Instruments Regulation (“MiFIR”) Review. ESMA is seeking input on the amendments to the regulatory technical standards (“RTS”) for the reporting of transactions and to the RTS for the maintenance of data relating to orders in financial instruments.

- Joint UK Regulators Issue Press Release on the End of LIBOR. On October 1, the Bank of England published a joint press release with the FCA and the Working Group on Sterling Risk-Free Reference Rates on the end of LIBOR. On September 30, the remaining synthetic LIBOR settings were published for the last time and LIBOR came to an end. All 35 LIBOR settings have now permanently ceased. The Working Group has met its objective of finalizing the transition away from LIBOR and will be wound down effective as of October 1. Market participants are encouraged to continue to ensure they use the most robust rates for the relevant currency and should ensure their use of term risk-free reference rates are limited and remain consistent with the relevant guidance on best practice on the scope of use.

- ESAs Appoint Director to Lead their DORA Joint Oversight. On October 1, the European Supervisory Authorities appointed Marc Andries to lead their new joint Directorate in charge of oversight activities for critical third-party providers established by the Digital Operational Resilience Act (“DORA”). In his role as DORA Joint Oversight Director, Marc Andries will be responsible for implementing and running an oversight framework for critical third-party service providers at a pan-European scale, contributing to the smooth operations and stability of the EU financial sector.

- ESMA 2025 Work Programme: Focus on Key Strategic Priorities and Implementation of New Mandates. On October 1, ESMA published its 2025 Annual Work Programme (AWP). A significant portion of ESMA’s work in 2025 will comprise policy work to facilitate the implementation of the large number of mandates received in the previous legislative cycle, and the preparation of new mandates, such as the European Green Bonds and the ESG Rating Providers Regulations.

- ESMA Announces Next Steps for the Selection of Consolidated Tape Providers. On September 30, ESMA announced it will launch the selection procedure for Consolidated Tapes Providers (“CTPs”) bonds on January 3, 2025. In June 2025, ESMA will launch the selection procedure for the CTP for shares and Exchange-Traded Funds with the objective to adopt a reasoned decision on the selected applicant by the end of 2025.

- SFC and HKMA Publish Conclusions on Enhancements to OTC Derivatives Reporting Regime for Hong Kong. On September 26, the Securities and Futures Commission and the Hong Kong Monetary Authority jointly published conclusions on proposed enhancements to the over-the-counter (“OTC”) derivatives reporting regime for Hong Kong, indicating that they will mandate (i) the use of unique transaction identifiers, (ii) the use of unique product identifiers and (iii) the reporting of critical data elements beginning on September 29, 2025.

New Industry-Led Developments

- ISDA Submits Paper to ESMA on MIFIR Post-Trade Transparency. On October 8, ISDA submitted a paper to ESMA, in which it outlined its views on the scope of OTC derivatives post-trade transparency in the revised MiFIR. The paper outlines ISDA’s view on the treatment of certain interest rate derivatives, index credit default swaps and securitized derivatives. ISDA indicated that it is anticipating the publication of ESMA’s consultation paper on the revised regulatory technical standards, covering OTC derivatives, later in 2024 or in the first quarter of 2025. [NEW]

- ISDA, FIA Respond to BoE Consultations on CCP Recovery and Resolution. On October 4, ISDA and FIA submitted a joint response to two Bank of England (“BoE”) consultations on central counterparty (“CCP”) recovery and resolution: the BoE’s power to direct a CCP to address impediments to resolvability ; and the BoE’s approach to determining commercially reasonable payments for contracts subject to a statutory tear up in CCP resolution. In response to the BoE’s consultation on its power to direct a CCP to address impediments to resolvability, the associations said that they welcome the clarity provided on the timescales the BoE would follow when using its power to address impediments to resolvability. However, the response notes that the BoE should more explicitly set out whether and how it would consider informing clearing members ahead of using this power. In response to the BoE’s consultation on its approach to determining commercially reasonable payments for contracts subject to statutory tear up in CCP resolution, the associations expressed caution on the proposed approach, which they indicated could result in placing too much reliance on the CCP’s own rules and arrangements to generate commercially reasonable prices for contracts subject to tear up. The response highlights that in a situation where the BoE would have to use its power to tear up contracts – i.e., after a failed auction – there might not exist a clear price for those contracts. [NEW]

- ISDA Responds to UK FCA Consultation on DTO and PTRRS. On September 30, ISDA responded to Financial Conduct Authority (“FCA”) consultation CP24/14 on the derivatives trading obligation (“DTO”) and post-trade risk reduction services (“PTRRS”). In the response, ISDA highlights its support for including certain overnight index swaps based on the US Secured Overnight Financing Rate within the classes of derivatives subject to the DTO and expanding the list of PTRRS exempted from the DTO and other obligations.

- ISDA Publishes Results of Survey on AT1 Treatment in DRM Model On September 27, ISDA published a survey of its members on the development of the dynamic risk management (“DRM”) model. The survey sought to understand the accounting and regulatory treatment of Alternative Tier 1 (“AT1”) financial instruments and to contribute this information to the development of the International Accounting Standards Board’s DRM model. The survey shows that for balance sheet classification under International Financial Reporting Standards, the majority of respondents classify their AT1s as equity; the majority of respondents include their AT1s for interest rate risk in the banking book (“IRRBB”) as equivalent to financial liabilities; and there is strong desire for the inclusion of AT1s in the current net open position.

- ISDA Publishes Updated Best Practices for Confirming Reference Obligations or Standard Reference Obligations. On September 25, ISDA published updated Best Practices for Single-name Credit Default Swaps regarding Reference Obligations or Standard Reference Obligations. The document sets out suggested best practices for confirming the Reference Obligation or Standard Reference Obligations for single-name Credit Default Swaps and is an update to the Best Practice Statement that was published by ISDA on November 18, 2014.

- Joint Trade Association Issues Statement on EMIR 3.0 Effective Implementation Dates. On September 23, ISDA, the Alternative Investment Management Association, the European Banking Federation, the European Fund and Asset Management Association and FIA sent a letter urging the European Commission and European supervisory authorities to clarify that market participants are not required to implement the European Market Infrastructure Regulation (“EMIR 3.0”) Level 1 provisions prior to the date of application of the associated Level 2 regulatory technical standards (“RTS”). In the letter, the associations state that they are seeking clarification to avoid firms being required to implement the requirements of EMIR 3.0 twice—first, to comply with the Level 1 provisions once EMIR 3.0 enters into force and then when the associated Level 2 RTS becomes applicable.

The following Gibson Dunn attorneys assisted in preparing this update: Jeffrey Steiner, Adam Lapidus, Marc Aaron Takagaki, Hayden McGovern, and Karin Thrasher.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Derivatives practice group, or the following practice leaders and authors:

Jeffrey L. Steiner, Washington, D.C. (202.887.3632, jsteiner@gibsondunn.com)

Michael D. Bopp, Washington, D.C. (202.955.8256, mbopp@gibsondunn.com)

Michelle M. Kirschner, London (+44 (0)20 7071.4212, mkirschner@gibsondunn.com)

Darius Mehraban, New York (212.351.2428, dmehraban@gibsondunn.com)

Jason J. Cabral, New York (212.351.6267, jcabral@gibsondunn.com)

Adam Lapidus – New York (212.351.3869, alapidus@gibsondunn.com )

Stephanie L. Brooker, Washington, D.C. (202.887.3502, sbrooker@gibsondunn.com)

William R. Hallatt , Hong Kong (+852 2214 3836, whallatt@gibsondunn.com )

David P. Burns, Washington, D.C. (202.887.3786, dburns@gibsondunn.com)

Marc Aaron Takagaki , New York (212.351.4028, mtakagaki@gibsondunn.com )

Hayden K. McGovern, Dallas (214.698.3142, hmcgovern@gibsondunn.com)

Karin Thrasher, Washington, D.C. (202.887.3712, kthrasher@gibsondunn.com)

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

The rulemaking changes represent the first major overhaul of the HSR premerger notification requirements in its 45-year history, and are slated to take effect 90 days from when it is published in the Federal Register, likely sometime in January 2025.

On October 10, 2024, the Federal Trade Commission, with concurrence from the Department of Justice, announced the release and upcoming implementation of changes to the Premerger Notification and Report Form (the “HSR Form”) and associated instructions, as well as to the premerger notification rules implementing the Hart-Scott Rodino (“HSR”) Act.[1] The rulemaking changes represent the first major overhaul of the HSR premerger notification requirements in its 45-year history, and are slated to take effect 90 days from when it is published in the Federal Register, likely sometime in January 2025. While notably less expansive and onerous than initially contemplated, the FTC’s changes, detailed below, nevertheless broadly affect all filings for HSR-reportable deals. Companies seeking clearance for mergers in the U.S. will need to expend more time and effort to prepare HSR filings, as they now will be required to provide both additional narrative data about the merger and any overlapping products or services between the merging parties and more documents and financial data than previously required. The information requested will provide U.S. agencies with more insight on the proposed transaction and associated antitrust earlier in the process, creating more inroads for the agencies to justify expanded “Second Request” investigations. The updated HSR rules do not change who has to file, and no change has been made to the method for accepting filings, though the FTC noted that a new electronic filing system is in development and that it will propagate further rulemaking detailing this initiative when it is ready.[2]

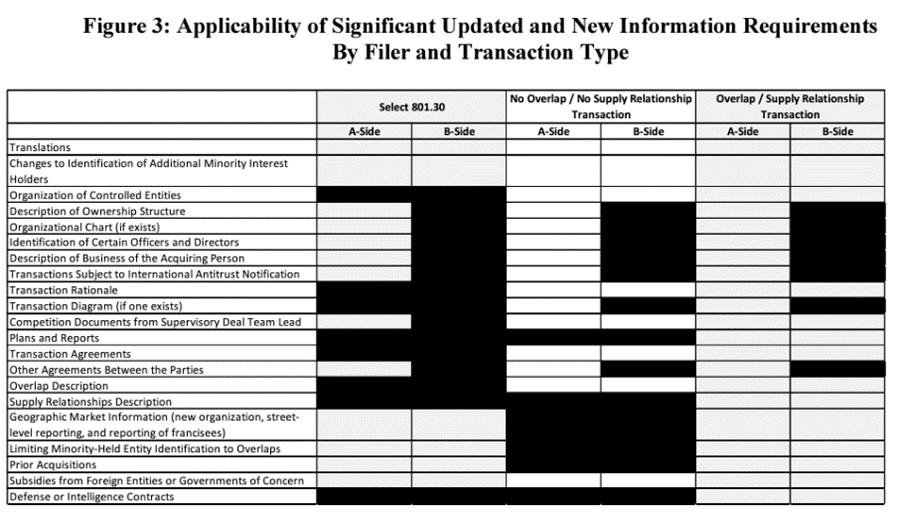

The most significant changes to the HSR filing requirements include:

Additional 4(c)/(d) Documents. The new rules expand the scope of required so-called 4(c) and 4(d) documents. The new rules require documents not only created by or for officers and directors of the filer, but also those created by or for the “supervisory deal team lead,” defined as a single individual who has “primary responsibility for supervising the strategic assessment of the deal, and who would not otherwise qualify as a director or officer.”[3] The rules also now require the inclusion of certain ordinary course business documents from all filers, namely any periodic plans and reports that discuss market shares, competition, competitors, or markets of any overlapping product or service that were shared with the Chief Executive Officer or the Board.[4] The document requirement excludes ad hoc reports and is limited to only those documents created within one year of filing. The relevant products and services in scope are those that both the acquiring and acquired persons produce, sell, or are known to be developing.

Transaction and Competitive Overlap Details. Under the new rules, the acquirer will be required to make additional disclosures on the details of the transaction, including a short description of the operating businesses within the acquiring person, other antitrust jurisdictions besides the U.S. where the parties have filed or will file, and any pre-existing diagrams of the deal structure for the transaction.[5] All filing parties will be required to supply transaction rationales, but for acquired persons, a brief description of the transaction rationale is sufficient so long as it is accurate and does not conflict without explanation with stated rationales in documents submitted with the HSR Filing.[6] All filing parties will be required to identify the entities they control that generate revenue for overlapping NAICS codes between the parties, as well as more detailed narrative and geographic information for those overlap businesses.[7]

Prior Acquisitions. The rules expand existing reporting requirements on prior acquisitions, most notably extending the requirement to acquired persons.[8] Both acquirers and acquired persons will be required to note acquisitions for the past 5 years, excluding as de minimis any acquisitions of entities with less than $10 million in total assets and annual net sales in the year prior to the acquisition. The rules also require including transactions in which the filer acquired substantially all of the assets of a business and not merely acquisitions of voting securities or non-corporate interest. This change aligns with the U.S. antitrust agencies’ focus in the December 2023 Merger Guidelines on “roll-up strategies” by acquirers.

Other Affiliations. The new rules require additional information related to the outside affiliations of the filers and their officers and directors. Filers are already required under Item 6(c) of the HSR rules to list as minority ownership any holdings of greater than 5% but less than 50% where there are NAICS code overlaps with the filers. The updated rules eliminate the alternative option for filers just to list all minority holdings, and now must specifically identify only those with potential competitive overlap products or services.[9] The rules will also require the acquiring person to disclose the board and corporate affiliations that each officer and director holds with other entities outside of the filing company, where those entities are in the same industry as the target.[10] The rules include a short lookback period to include affiliations that ended within 3 months of the filing, and exempt non-profit organizations with political or religious purposes. Officer and director affiliations will only be required for acquirer entities that either have responsibility for the reported overlap products and those that indirectly or directly control or are controlled by those entities. The agencies continue to closely monitor companies for new potential officer/director interlocks under Section 8 of the Clayton Act or avenues of improper coordination under Section 1 of the Sherman Act, and through these additional disclosures will be more armed to investigate concerns resulting from the transaction and potential pre-existing concerns separate from the transaction.[11]

Vertical Supply Relationships. The FTC will now require the parties to identify any supplier relationships between the acquirer and acquired persons or any other person that the parties know or believe competes with either party.[12] The rules establish a de minimis exception for lines of business that account for less than $10 million in revenue, but note that parties must include in their calculations the value of goods they supply to themselves in internal transfers for competitive overlap products.[13] Filers will need to include a brief description of the product or service sold or licensed, and list associated revenues for that supply relationship for the most recent fiscal year.

The new rules will exclude some of these new obligations for “select 801.30 transactions,” defined as those acquisitions that “do not result in the acquisition of control to which § 801.30 applies [such as tender offers] and where there is no agreement or contemplated agreement between any entity within the acquiring and acquired person.”[14] The rules also limit additional information requests in some cases for transactions where there are no competitive overlaps:

Additional Key Takeaways

Companies contemplating or pursuing transactions will need to be prepared for additional time and burden under the new rules, and should begin to consider how they will approach the filing early in the deal process. In particular, companies should expect that it will take more time to prepare a filing that complies with the new requirements, and take that into account when negotiating timing terms. The additional volume and scope of information contained in HSR filings also raise the possibility of enhanced scrutiny of transactions generally, and more quickly after the filing is completed.

One potentially positive development: in conjunction with announcing the final rule, the FTC announced the planned reinstatement of early termination of the statutory 30-day waiting period following an HSR filing, which could shorten deal timelines for certain merging parties.

Firms considering transactions should continue to proactively consult with antitrust counsel early in the transaction process to identify and mitigate risk.

Gibson Dunn attorneys are closely monitoring these developments and are available to discuss these issues as applied to your particular business. Please reach out to your Gibson Dunn contacts in the Antitrust and Competition group if you have questions about how the updated rules may affect your M&A plans and how best to prepare. If you are interested in challenging the final rule as Gibson Dunn successfully accomplished against the FTC’s non-compete rule in Ryan, LLC v. FTC, please reach out to your Gibson Dunn contacts in the Administrative Law and Regulatory Practice group.

[1] https://www.ftc.gov/news-events/news/press-releases/2024/10/ftc-finalizes-changes-premerger-notification-form?utm_source=govdelivery

[2] Premerger Notification; Reporting and Waiting Period Requirements, Action: Final Rule (“Final Rule”). October 10, 2024, available at https://www.ftc.gov/system/files/ftc_gov/pdf/p110014hsrfinalrule.pdf, pg.178

[3] Final Rule, pg. 204

[4] Final Rule, pg. 279

[5] Final Rule, pgs. 256-257

[6] Final Rule, pg. 262

[7] Final Rule, pgs. 342-343

[8] Final Rule, pg. 349

[9] Final Rule, pg. 345

[10] Final rule, pg. 248

[11] See In the Matter of QEP Partners, August 16, 2023, https://www.ftc.gov/news-events/news/press-releases/2023/08/ftc-acts-prevent-interlocking-directorate-arrangement-anticompetitive-information-exchange-eqt

[12] Final Rule, pg. 326

[13] Final Rule, pg. 331

[14] Final Rule, pg. 201

[15] Final Rule, pg. 156

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Antitrust and Competition, Administrative Law and Regulatory, Mergers and Acquisitions, or Private Equity practice groups:

Antitrust and Competition:

Rachel S. Brass – San Francisco (+1 415.393.8293, rbrass@gibsondunn.com)

Jamie E. France – Washington, D.C. (+1 202.955.8218, jfrance@gibsondunn.com)

Sophia A. Hansell – Washington, D.C. (+1 202.887.3625, shansell@gibsondunn.com)

Kristen C. Limarzi – Washington, D.C. (+1 202.887.3518, klimarzi@gibsondunn.com)

Joshua Lipton – Washington, D.C. (+1 202.955.8226, jlipton@gibsondunn.com)

Michael J. Perry – Washinton, D.C. (+1 202.887.3558, mjperry@gibsondunn.com)

Cynthia Richman – Washington, D.C. (+1 202.955.8234, crichman@gibsondunn.com)

Stephen Weissman – Washington, D.C. (+1 202.955.8678, sweissman@gibsondunn.com)

Administrative Law and Regulatory:

Stuart F. Delery – Washington, D.C. (+1 202.955.8515, sdelery@gibsondunn.com)

Eugene Scalia – Washington, D.C. (+1 202.955.8673, dforrester@gibsondunn.com)

Helgi C. Walker – Washington, D.C. (+1 202.887.3599, hwalker@gibsondunn.com)

Mergers and Acquisitions:

Robert B. Little – Dallas (+1 214.698.3260, rlittle@gibsondunn.com)

Saee Muzumdar – New York (+1 212.351.3966, smuzumdar@gibsondunn.com)

George Sampas – New York (+1 212.351.6300, gsampas@gibsondunn.com)

Private Equity:

Richard J. Birns – New York (+1 212.351.4032, rbirns@gibsondunn.com)

Ari Lanin – Los Angeles (+1 310.552.8581, alanin@gibsondunn.com)

Michael Piazza – Houston (+1 346.718.6670, mpiazza@gibsondunn.com)

John M. Pollack – New York (+1 212.351.3903, jpollack@gibsondunn.com)

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Partner Benjamin Rapp (Munich and Frankfurt) and associate Daniel Reich (Frankfurt) are the authors of “Steuerliche Zweifelsfragen bei der ertragsteuerlichen Organschaft im Fall von Bilanzierungsfehlern“ (Tax issues in the case of accounting errors in the fiscal unity for income tax purposes), published by Der SteuerBerater in its October 2024 issue. The article examines how accounting errors can affect profit-and-loss transfer agreements in the context of tax groups and highlights different views on how to deal with accounting errors from a German commercial and tax law perspective.

This edition of Gibson Dunn’s Federal Circuit Update for September 2024 summarizes the current status of petitions pending before the Supreme Court and recent Federal Circuit decisions concerning the level of skill of a person of ordinary skill in the art, patent eligibility under 35 U.S.C. § 101, indefiniteness, and the party presentation principle.

Federal Circuit News

Noteworthy Petitions for a Writ of Certiorari:

There was a potentially impactful petition filed before the Supreme Court in September 2024:

- Norwich Pharmaceuticals Inc. v. Salix Pharmaceuticals, Ltd. (US No. 24-294): The question presented is “[w]hether 35 U.S.C. § 271(e)(4)(A) requires courts to issue injunctive orders that are broader in scope than the underlying infringement, thereby delaying FDA approval of generic drug applications for indications that have not been found to infringe any valid patent.”

We provide an update below of the petitions pending before the Supreme Court, some of which were summarized in our August 2024 update:

- In Zebra Technologies Corporation v. Intellectual Tech LLC (US No. 24-114), the Court requested a response to the petition, which is due October 16, 2024. The question presented is “[w]hether a party has Article III standing to assert a claim for patent infringement against an accused infringer who has the ability to obtain a license from a third party.”

- The Court denied the petitions in United Therapeutics Corp. v. Liquidia Technologies, Inc. (US No. 23-1298), Chestek PLLC v. Vidal (US No. 23-1217), and Cellect LLC v. Vidal (US No. 23-1231).

Federal Circuit En Banc Petitions:

EcoFactor, Inc. v. Google LLC, No. 2023-1101 (Fed. Cir. Sept. 25, 2024): The Federal Circuit granted Google’s petition for rehearing en banc as to the admissibility of EcoFactor’s damages expert assigning a per-unit royalty rate to the three licenses in evidence.

We summarized the original panel opinion in our June 2024 update.

Upcoming Oral Argument Calendar

The list of upcoming arguments at the Federal Circuit is available on the court’s website.

Key Case Summaries (September 2024)