The Ninth Circuit’s ruling against the importer defendant further opens the door for the government and private relators to police customs and tariff compliance through the FCA.

Overview

In April, Gibson Dunn published a Client Alert forecasting increased False Claims Act (FCA) enforcement of customs violations in the wake of President Trump’s new tariff regime. That alert previewed a pending case in the Ninth Circuit with jurisdictional implications for such uses of the FCA. The Ninth Circuit recently ruled against the importer defendant, further opening the door for the government and private relators to police customs and tariff compliance through the FCA and raising the stakes for importers and others in the import chain.

Case Summary

On June 23, 2025, the Ninth Circuit upheld an almost $26 million jury verdict against a pipe importer in a case alleging customs duty evasion under the FCA. In the case, Island Industries, Inc. (Island) alleged that its competitor Sigma Corporation (Sigma) made two types of false statements on customs forms to avoid antidumping duties. Island alleged that Sigma: (1) declared that antidumping duties did not apply to its imported products; and (2) described its products as “steel couplings” to customs officials but marketed them to customers as “welded outlets.”[1] The United States declined to intervene. At trial, a jury sided with Island and awarded an over $8 million verdict. The trial judge tripled the verdict and awarded penalties, as mandated by the FCA, resulting in almost $26 million in damages and civil penalties.[2]

On appeal, Sigma argued that the civil penalties provision of the Tariff Act, 19 U.S.C. § 1952, “displaces the FCA” as the sole mechanism for recovering antidumping duties an importer has fraudulently avoided paying.[3] Sigma also argued that it could not be liable under the FCA because it “had no obligation to pay antidumping duties” under the statute.[4] Sigma also challenged, in the Court of International Trade (CIT), a Department of Commerce ruling that its “welded outlets” fell within the scope of the relevant antidumping order. As a result, on appeal the Ninth Circuit was confronted not only with a question about whether a key element of the FCA was satisfied, but also with whether it had jurisdiction over the case at all—or whether, alternatively, the case “needed to be initiated in the CIT and then appealed (if at all) to the Federal Circuit.”[5]

The Ninth Circuit held as follows:

- Relators can bring FCA actions for customs duties violations in federal district court. Although under long-standing Ninth Circuit precedent[6] an FCA suit filed by the United States to recover damages for the improper avoidance of customs duties must be brought in the CIT, “a relator is not the United States” for purposes of that requirement—meaning there is “no jurisdictional obstacle” to such FCA actions brought by relators in federal district court.[7]

- The civil penalties provision of the Tariff Act is not the sole mechanism for recovering fraudulently avoided customs duties. Importers who improperly avoid customs duties are also subject to FCA liability. Neither statute’s text identifies it as the exclusive remedy for such conduct, and the statutes’ statutory and legislative histories suggest Congress “specifically intended the two statutes to coexist.”[8]

- An “obligation” to pay money to the government is an essential element of a reverse false claims action to recover customs duties, and the obligation begins at the time of import.[9] Sigma argued it had no obligation to pay antidumping duties because the amount owed had yet to be fixed and was thus contingent. The Court found that Sigma “became liable for antidumping duties when it imported its welded outlets . . . even though the amount due was not yet fixed through liquidation.”[10] This holding tracks the text of the FCA and prior caselaw interpreting the definition of “obligation.”[11]

- Consistent with the Supreme Court’s SuperValu decision, courts evaluating evasion of customs duties claims should evaluate the FCA’s scienter element from the defendant’s subjective point of view. The Court thus rejected Sigma’s argument that it lacked scienter because it would have been objectively reasonable for Sigma to believe that it did not owe antidumping duties.[12] The Court clarified that Sigma could not “escape liability by arguing that an objectively reasonable person could have believed that the statements [Sigma] submitted to the government were true.[13]

Implications

The Ninth Circuit’s ruling likely will encourage FCA enforcement of customs violations—by both the federal government and private relators. Particularly in the Ninth Circuit, which has jurisdiction over a number of the largest ports of entry in the United States, private relators may be further emboldened to pursue FCA cases against importers and others in the import chain, including in declined cases. Moreover, the Ninth Circuit’s decision highlights that importers accused of improperly avoiding customs duties face the twin risks of an enforcement action under the FCA and a separate one for civil penalties under the Tariff Act––which, in cases of fraud or gross negligence, can result in civil fines that are four times the value of the imported merchandise or the amount of the avoided duties.[14] Finally, the relator in the Sigma case was the defendant’s competitor—highlighting the risk that competitors may be incentivized to file qui tam suits against each other where they perceive (accurately or not) that they are being disadvantaged by violations of customs rules by others.

Given the sheer size of the import market in this country and the current elevated levels of custom duties, the risks for importers are enormous. Thus, as we wrote in April, companies should ensure they have robust compliance mechanisms to prevent, detect, and remedy customs violations—not only their own violations, but those of their upstream and downstream business partners.

[1] Island Indus., Inc. v. Sigma Corp., No. 22-55063, 2025 WL 1730271 (9th Cir. June 23, 2025).

[2] 31 U.S.C. § 3729(a)(1).

[3] Sigma Corp., at *18.

[4] Id. at *22.

[5] Id. at *16.

[6] See United States v. Universal Fruits & Vegetables Corp., 370 F.3d 829, 836 & n.13 (9th Cir. 2004) (holding that proper “venue” for a FCA case based on customs duties brought by the United States is the CIT); but see United States v. Universal Fruits & Vegetables Corp., 30 C.I.T. 706, 711 (2006) (the CIT is “not vested with the authority to grant Plaintiff’s claim for damages and penalties pursuant to the FCA”).

[7] Sigma Corp., at *16-17.

[8] Id. at *20-21.

[9] 31 U.S.C. § 3729(a)(1)(g).

[10] Sigma Corp., at *23.

[11] See 31 U.S.C. 3729(b)(3) (“obligation” means “established duty, whether or not fixed”); United States ex rel. Lesnik v. ISM Vuzem d.o.o., 112 F.4th 816, 821 (9th Cir. 2024) (“‘fixed’ referred to the amount of an obligation, not whether any obligation existed”).

[12] Sigma Corp., at *25.

[13] Id.

[14] 19 U.S.C. § 1592(c)(1).

Gibson Dunn lawyers regularly counsel clients on the False Claims Act issues and are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s False Claims Act/Qui Tam Defense or International Trade Advisory & Enforcement practice groups:

False Claims Act/Qui Tam Defense:

Washington, D.C.

Jonathan M. Phillips – Co-Chair (+1 202.887.3546, jphillips@gibsondunn.com)

Stuart F. Delery (+1 202.955.8515,sdelery@gibsondunn.com)

F. Joseph Warin (+1 202.887.3609, fwarin@gibsondunn.com)

Jake M. Shields (+1 202.955.8201, jmshields@gibsondunn.com)

Gustav W. Eyler (+1 202.955.8610, geyler@gibsondunn.com)

Lindsay M. Paulin (+1 202.887.3701, lpaulin@gibsondunn.com)

Geoffrey M. Sigler (+1 202.887.3752, gsigler@gibsondunn.com)

Joseph D. West (+1 202.955.8658, jwest@gibsondunn.com)

San Francisco

Winston Y. Chan – Co-Chair (+1 415.393.8362, wchan@gibsondunn.com)

Charles J. Stevens (+1 415.393.8391, cstevens@gibsondunn.com)

New York

Reed Brodsky (+1 212.351.5334, rbrodsky@gibsondunn.com)

Mylan Denerstein (+1 212.351.3850, mdenerstein@gibsondunn.com)

Denver

John D.W. Partridge (+1 303.298.5931, jpartridge@gibsondunn.com)

Ryan T. Bergsieker (+1 303.298.5774, rbergsieker@gibsondunn.com)

Monica K. Loseman (+1 303.298.5784, mloseman@gibsondunn.com)

Dallas

Andrew LeGrand (+1 214.698.3405, alegrand@gibsondunn.com)

Los Angeles

James L. Zelenay Jr. (+1 213.229.7449, jzelenay@gibsondunn.com)

Nicola T. Hanna (+1 213.229.7269, nhanna@gibsondunn.com)

Jeremy S. Smith (+1 213.229.7973, jssmith@gibsondunn.com)

Deborah L. Stein (+1 213.229.7164, dstein@gibsondunn.com)

Dhananjay S. Manthripragada (+1 213.229.7366, dmanthripragada@gibsondunn.com)

Palo Alto

Benjamin Wagner (+1 650.849.5395, bwagner@gibsondunn.com)

International Trade Advisory & Enforcement:

United States:

Ronald Kirk – Co-Chair, Dallas (+1 214.698.3295, rkirk@gibsondunn.com)

Adam M. Smith – Co-Chair, Washington, D.C. (+1 202.887.3547, asmith@gibsondunn.com)

Stephenie Gosnell Handler – Washington, D.C. (+1 202.955.8510, shandler@gibsondunn.com)

Donald Harrison – Washington, D.C. (+1 202.955.8560, dharrison@gibsondunn.com)

Christopher T. Timura – Washington, D.C. (+1 202.887.3690, ctimura@gibsondunn.com)

Matthew S. Axelrod – Washington, D.C. (+1 202.955.8517, maxelrod@gibsondunn.com)

David P. Burns – Washington, D.C. (+1 202.887.3786, dburns@gibsondunn.com)

Nicola T. Hanna – Los Angeles (+1 213.229.7269, nhanna@gibsondunn.com)

Courtney M. Brown – Washington, D.C. (+1 202.955.8685, cmbrown@gibsondunn.com)

Amanda H. Neely – Washington, D.C. (+1 202.777.9566, aneely@gibsondunn.com)

Samantha Sewall – Washington, D.C. (+1 202.887.3509, ssewall@gibsondunn.com)

Michelle A. Weinbaum – Washington, D.C. (+1 202.955.8274, mweinbaum@gibsondunn.com)

Asia:

Kelly Austin – Denver/Hong Kong (+1 303.298.5980, kaustin@gibsondunn.com)

David A. Wolber – Hong Kong (+852 2214 3764, dwolber@gibsondunn.com)

Fang Xue – Beijing (+86 10 6502 8687, fxue@gibsondunn.com)

Qi Yue – Beijing (+86 10 6502 8534, qyue@gibsondunn.com)

Europe:

Attila Borsos – Brussels (+32 2 554 72 10, aborsos@gibsondunn.com)

Patrick Doris – London (+44 207 071 4276, pdoris@gibsondunn.com)

Michelle M. Kirschner – London (+44 20 7071 4212, mkirschner@gibsondunn.com)

Penny Madden KC – London (+44 20 7071 4226, pmadden@gibsondunn.com)

Benno Schwarz – Munich (+49 89 189 33 110, bschwarz@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

A recent declination of prosecution for a private equity firm provides a first look at how timely voluntary self-disclosure, extensive cooperation, and proactive remediation can mitigate the risk of criminal and civil penalties for acquirors when discovering violations of national security-related laws by acquirees, including those related to economic sanctions and export controls.

Executive Summary

On June 16, 2025, the Department of Justice’s (DOJ) National Security Division (NSD) Counterintelligence and Export Control Section and the U.S. Attorney’s Office for the Southern District of Texas (SDTX) announced the first-ever declination against an acquirer and its affiliates under NSD’s Voluntary Self Disclosures in Connection with Acquisitions Policy (the “M&A Policy”). The current version of the M&A Policy, promulgated in March 2024 as part of revisions to NSD’s Enforcement Policy for Business Organizations (the “NSD Enforcement Policy”), is aimed at incentivizing acquiring companies to make timely disclosures of misconduct uncovered during the M&A process, cooperate with subsequent investigations, and quickly remediate the behavior at issue.

The declination was part of a broader set of resolutions, including a non-prosecution agreement (NPA) with the acquired company and a plea agreement with the acquired company’s former chief executive officer (CEO), that was coordinated between DOJ and other agencies, including the Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the Commerce Department’s Bureau of Industry and Security (BIS).

These resolutions follow the DOJ Criminal Division’s May 12, 2025 announcement of its new approach to white collar and corporate enforcement, as discussed in our prior client alert. The Criminal Division’s announced priorities highlight national security-related offenses, including sanctions evasion, as a key area of focus. These resolutions, reached during the Biden Administration but announced during the Trump Administration, offer an example of how DOJ, in coordination with other federal agencies, enforces such priorities in the M&A context. The resolutions also demonstrate the substantial benefits that can be obtained by acquirors, and potentially acquirees, if they promptly discover potential wrongdoing, make timely voluntary self-disclosures, carry out swift remedial action, and cooperate with subsequent action by authorities.

Background

According to the resolution documents, after acquiring Texas-based Unicat Catalyst Technologies LLC (Unicat), private equity firm White Deer Management LLC (White Deer) discovered that Unicat’s co-founder and former CEO Mani Efran had conspired to violate U.S. economic sanctions by directing the company to offer bids and conduct sales to customers in Iran, Syria, Venezuela, and Cuba over the course of roughly seven years. This directive resulted in 23 illegal sales of chemical catalysts used in oil refining and steel production.

In addition to the illicit sales, some of which also violated export control laws, Efran and others made false statements in export documents and financial records regarding the locations and identities of customers, deceived some Unicat employees regarding the legality of conducting business with customers subject to sanctions, and falsified invoices to reduce tariffs on catalysts imported from China. In total, Unicat generated about $3.33 million in revenue from unlawful sales and caused a loss to the United States of nearly $1.66 million in taxes, duties, and fees. Under Efran’s leadership, Unicat made representations and warranties that the company was following U.S. sanctions and export control laws during acquisition negotiations. In June 2021, after Unicat had been acquired by White Deer, Unicat’s new leadership discovered dealings with a customer based in Iran, a comprehensively sanctioned jurisdiction. The company immediately cancelled the pending transaction, and, over the next month, directed outside counsel to launch an investigation. After determining there were possible criminal violations by Unicat employees related to multiple transactions, both companies made multiple voluntary self-disclosures to the U.S. government, including DOJ, OFAC, and BIS. A total of approximately ten months had passed between Unicat’s September 2020 acquisition and the voluntary self-disclosures of the misconduct.

Declination of Prosecution Pursuant to the M&A Policy

DOJ’s declination was made pursuant to NSD’s M&A Policy, a part of its NSD Enforcement Policy. The policy, most recently updated in March 2024, offers protections for acquiring companies against criminal prosecution for misconduct they uncover during, or shortly after, an acquisition. Specifically, these protections apply when an acquiror 1) concludes a “lawful, bona fide acquisition of another company;” 2) makes a timely and voluntary self-disclosure to NSD of potential violations of criminal laws by the acquired entity that bear on the national security of the United States; 3) unreservedly cooperates with any NSD investigation; and 4) “timely and appropriately remediates the misconduct.” When an acquiror qualifies for protections, NSD “generally” will not seek a guilty plea while there will be a presumption that it will decline to prosecute. Furthermore, the M&A Policy indicates that while NSD will not automatically extend a similar presumption to the acquired company, it will ascribe credit for self-disclosure by the acquiror, and it will separately examine whether the acquiree meets any of the requirements to be given benefits under the NSD Enforcement Policy.

According to the declination letter, several factors in this case influenced DOJ’s determination that White Deer’s voluntary self-disclosure warranted a declination. Specifically, DOJ highlighted that:

- the acquisition of Unicat was lawful and bona fide;

- there was no legal requirement for the acquirors to divulge any discovered misconduct;

- the disclosure was still timely despite occurring ten months after the Unicat acquisition due to a number of factors, including an investment strategy where White Deer sought to merge Unicat with another company it didn’t purchase until months later, delays to post-acquisition integration efforts stemming from the COVID-19 pandemic, the immediate cancellation of a deal with an Iranian customer by new leadership after learning of it (thereby reducing the potential for additional national security harm), and the rapid disclosure to NSD, which occurred only one month after White Deer became aware of potential violations and before their full extent was understood;

- the provision of “exceptional and proactive” cooperation to the government, characterized by quickly finding and disclosing all relevant facts, identifying relevant electronic records on employee and agent personal devices and messaging accounts, providing foreign records in accordance with applicable law, and agreeing to ongoing assistance with government investigations and prosecutions; and

- the redress of the misconduct within a year of becoming aware of it, including by firing and disciplining employees involved in it and creating and deploying a compliance and internal controls regime effective at preempting analogous future issues.

The declination letter also noted that prosecution was declined in spite of “aggravating factors at the acquired entity,” such as the involvement of senior management in the wrongdoing, since the source of those aggravating factors had since been removed.

In DOJ’s announcement of the resolution, Assistant Attorney General for National Security John A. Eisenberg highlighted that the decision to “decline prosecution of the acquiror and extend a non-prosecution agreement to the acquired entity…reflects the National Security Division’s strong commitment to rewarding responsible corporate leadership.”

Multiple Resolutions Involving Coordination Among Agencies

While DOJ declined to prosecute acquiror White Deer, DOJ did require that acquiree Unicat enter a Non-Prosecution Agreement (NPA) and forfeit $3,325,052.10, the value of the company’s revenue earned in connection with the violations of sanctions and export control laws. In the NPA, DOJ emphasized certain facts that made the agreement appropriate despite the existence of aggravating factors, including Unicat receiving credit for White Deer’s timely voluntary self-disclosure under the M&A Policy, Unicat’s extensive and proactive cooperation with DOJ’s investigation, including a thorough internal investigation, and its wide-ranging remediation efforts, including creation of a new compliance program.

Notably, DOJ coordinated this resolution with OFAC and BIS, with Unicat agreeing to pay $3,882,797 in administrative penalties to OFAC as part of a corresponding settlement for violations of sanctions laws, and $391,183 in administrative penalties to BIS as part of a similar settlement for violations of export control laws. OFAC allowed for the entire NPA forfeiture payment to count towards its penalty, requiring payment of a residual sum of $557,745, while BIS allowed for the payment to OFAC to be put towards the balance owed to it. OFAC noted that while the maximum statutory civil penalty for the matter was $8,035,626, the settlement amount reflected credit for actions including, but not limited to, voluntary self-disclosure, cooperation with investigations, and remedial measures after discovery of the misconduct, and was the appropriate penalty despite “egregious” violations by former Unicat leadership, employees, and representatives.

Unicat also agreed to pay $1,655,189.57 in restitution to the Department of Homeland Security, Customs and Border Protection (CBP) for tariff avoidance violations, while the former CEO, Mani Erfan, consented to a money judgement of $1,600,000 as part of a guilty plea to charges of conspiring to violate sanctions and conspiring to commit money laundering.

Key Takeaways

Acquirors Have New Guidance to Help Mitigate Criminal Risks

This first-ever declination under the M&A Policy provides important guidance to businesses that frequently acquire other entities on steps to take to mitigate the risk of government enforcement associated with criminal violations of national security laws by acquirees. By uncovering and making a timely voluntary self-disclosure of any misconduct, offering proactive and extensive cooperation to the government, and undertaking prompt effective remediation, acquirors may be able to secure favorable outcomes, such as the declination of prosecution, even where aggravating factors are present. In addition, credit for meeting the requirements of the M&A Policy by the acquiror can extend to the company it acquired, another potentially significant benefit of taking advantage of the policy.

Coordinated Multi-Agency Resolutions

The varied resolutions reached in this case provide an illustrative example of how various government agencies are coordinating their efforts to enforce national security-related laws. DOJ reached distinct resolutions, including a declination, an NPA, and a plea agreement, not only with the companies involved, but also with at least one culpable employee. In addition, DOJ coordinated with OFAC and BIS to reach parallel administrative settlements, with OFAC citing similar factors as DOJ when justifying the penalties it imposed. This case demonstrates that companies can expect violations of national security laws, especially those related to economic sanctions and exports controls, to prompt enforcement action by multiple government stakeholders.

Navigating the Administration’s Enforcement Priorities

Enforcement of national security laws has been announced as a key area of focus for the DOJ. In the context of this enforcement environment, these resolutions provide a roadmap for steps acquiring companies can take to mitigate enforcement risk during the M&A process, including maintaining robust diligence throughout the process, and, in cases where wrongdoing is discovered, being prepared to respond swiftly and transparently.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. For additional information about how we may assist you, please contact the Gibson Dunn lawyer with whom you usually work, the authors, or the following leaders and members of the firm’s Sanctions & Export Enforcement, National Security, and International Trade Advisory & Enforcement practice groups:

United States:

Matthew S. Axelrod – Co-Chair, Washington, D.C. (+1 202.955.8517, maxelrod@gibsondunn.com)

Adam M. Smith – Co-Chair, Washington, D.C. (+1 202.887.3547, asmith@gibsondunn.com)

Ronald Kirk – Dallas (+1 214.698.3295, rkirk@gibsondunn.com)

Stephenie Gosnell Handler – Washington, D.C. (+1 202.955.8510, shandler@gibsondunn.com)

Donald Harrison – Washington, D.C. (+1 202.955.8560, dharrison@gibsondunn.com)

Christopher T. Timura – Washington, D.C. (+1 202.887.3690, ctimura@gibsondunn.com)

David P. Burns – Washington, D.C. (+1 202.887.3786, dburns@gibsondunn.com)

Nicola T. Hanna – Los Angeles (+1 213.229.7269, nhanna@gibsondunn.com)

Courtney M. Brown – Washington, D.C. (+1 202.955.8685, cmbrown@gibsondunn.com)

Amanda H. Neely – Washington, D.C. (+1 202.777.9566, aneely@gibsondunn.com)

Samantha Sewall – Washington, D.C. (+1 202.887.3509, ssewall@gibsondunn.com)

Michelle A. Weinbaum – Washington, D.C. (+1 202.955.8274, mweinbaum@gibsondunn.com)

Karsten Ball – Washington, D.C. (+1 202.777.9341, kball@gibsondunn.com)

Hugh N. Danilack – Washington, D.C. (+1 202.777.9536, hdanilack@gibsondunn.com)

Mason Gauch – Houston (+1 346.718.6723, mgauch@gibsondunn.com)

Chris R. Mullen – Washington, D.C. (+1 202.955.8250, cmullen@gibsondunn.com)

Sarah L. Pongrace – New York (+1 212.351.3972, spongrace@gibsondunn.com)

Anna Searcey – Washington, D.C. (+1 202.887.3655, asearcey@gibsondunn.com)

Audi K. Syarief – Washington, D.C. (+1 202.955.8266, asyarief@gibsondunn.com)

Scott R. Toussaint – Washington, D.C. (+1 202.887.3588, stoussaint@gibsondunn.com)

Lindsay Bernsen Wardlaw – Washington, D.C. (+1 202.777.9475, lwardlaw@gibsondunn.com)

Shuo (Josh) Zhang – Washington, D.C. (+1 202.955.8270, szhang@gibsondunn.com)

Asia:

Kelly Austin – Denver/Hong Kong (+1 303.298.5980, kaustin@gibsondunn.com)

David A. Wolber – Hong Kong (+852 2214 3764, dwolber@gibsondunn.com)

Fang Xue – Beijing (+86 10 6502 8687, fxue@gibsondunn.com)

Qi Yue – Beijing (+86 10 6502 8534, qyue@gibsondunn.com)

Dharak Bhavsar – Hong Kong (+852 2214 3755, dbhavsar@gibsondunn.com)

Arnold Pun – Hong Kong (+852 2214 3838, apun@gibsondunn.com)

Europe:

Attila Borsos – Brussels (+32 2 554 72 10, aborsos@gibsondunn.com)

Patrick Doris – London (+44 207 071 4276, pdoris@gibsondunn.com)

Michelle M. Kirschner – London (+44 20 7071 4212, mkirschner@gibsondunn.com)

Penny Madden KC – London (+44 20 7071 4226, pmadden@gibsondunn.com)

Irene Polieri – London (+44 20 7071 4199, ipolieri@gibsondunn.com)

Benno Schwarz – Munich (+49 89 189 33 110, bschwarz@gibsondunn.com)

Nikita Malevanny – Munich (+49 89 189 33 224, nmalevanny@gibsondunn.com)

Melina Kronester – Munich (+49 89 189 33 225, mkronester@gibsondunn.com)

Vanessa Ludwig – Frankfurt (+49 69 247 411 531, vludwig@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

This update provides a summary of the key features of the regime as currently set out in the Draft Regulations.

The Dubai International Financial Centre Authority (DIFCA) has published a draft of the Variable Capital Company Regulations (the Draft Regulations) for public consultation, proposing a novel corporate structure aimed at enhancing the DIFC’s attractiveness as a jurisdiction for structuring investment platforms, including for family offices, asset holding, and private investment purposes.

The new regime introduces the Variable Capital Company (VCC), which offers a flexible framework for segregating assets and liabilities through the creation of “Cells” within a single legal entity.

The consultation process remains ongoing, and the final form of the regulations may change depending on feedback received. This update provides a summary of the key features of the regime as currently set out in the Draft Regulations.

Background and Context

The DIFC currently offers a limited cell regime under its existing Protected Cell Company framework, which is available only to certain types of investment companies. However, this framework does not include features such as segregated cells (described below). The proposed VCC regime introduces a more versatile and commercially attractive vehicle, offering structuring options that go beyond what is currently available under the DIFC’s existing framework.

Similar vehicles are available in only a few other jurisdictions, such as Singapore and Mauritius, which have implemented their own VCC regimes in recent years. By introducing a comparable structure, the DIFC aims to enhance its competitiveness and appeal to global investors, family offices, and asset managers seeking flexible and cost-effective structuring options.

Overview of the VCC Structure

A VCC is a private company that may be established in the DIFC either with one or more Segregated Cells or Incorporated Cells (each, a Cell) but not both, which may hold assets and liabilities separately from those of the VCC and other Cells. A VCC may have any number of Segregated Cells or Incorporated Cells, or none, in each case as provided for in its Articles of Association. This allows for ring-fencing of liabilities and targeted investment structuring.

Notably:

- A Segregated Cell does not have separate legal personality but is treated as segregated for asset and liability purposes.

- An Incorporated Cell is itself a private company with separate legal personality but cannot own shares in other Cells or the VCC.

The VCC structure is modelled to appeal to family offices, private funds, and other investment vehicles seeking to consolidate multiple investments within a single corporate structure, while maintaining legal separation between them.

Qualifying Criteria

Applicants must satisfy one of the following conditions:

- The VCC will be controlled by GCC Persons, Registered Persons or Authorised Firms; or

- It is established, or continued in the DIFC for purposes of holding legal title to, or controlling, one or more GCC Registrable Assets;

- It is established for a Qualifying Purpose, defined to include Aviation Structures (persons having the sole purpose of facilitating the owning, financing, securing, leasing or operating an interest in aircrafts), Crowdfunding Structures (persons established for the purpose of holding the asset(s) invested through a crowdfunding platform), Intellectual Property Structures (persons established for the sole purpose of holding intellectual property for commercial purposes), Maritime Structures (persons having the sole purpose of facilitating the owning, financing, securing, chartering, managing or operating of an interest in maritime vessels or maritime units), Structured Financing (persons having the sole purpose of holding assets to leverage and/or manage risk in financial transactions), or Secondaries Structures (vehicles facilitating the transfer of investment assets to secondary investors); or

- It is established or continued in the DIFC has a Director that is an Employee of a Corporate Service Provider and that Corporate Service Provider has an arrangement with the DIFC Registrar pursuant to the relevant provisions in the Draft Regulations.

Key Features

1. Regulatory Oversight

- VCCs are subject to the DIFC Companies Law and other Relevant Laws, unless otherwise provided.

- The DFSA must authorise any VCC providing financial services.

- The license of the VCC established for a Qualifying Purpose shall be restricted to the activities specific to the Qualifying Purpose stated in its application to incorporate or continue in the VCC in the DIFC, or any other permitted purpose shall be restricted to the activity of Holding Company. A VCC shall not be permitted to employ any employees.

2. Share Capital and Distributions

- VCCs may issue and redeem shares based on the net asset of the company or individual Cells.

- Cellular distributions must relate solely to the assets and liabilities of the relevant Cell, and must not impact other Cells or the VCC’s general assets.

3. Asset Segregation and Liability Protection

- Officers may incur personal liability if they breach their duties regarding segregation and disclosure of cell identity in transactions.

- The regulations include detailed provisions governing the consequences of unlawful inter-Cell transfers and creditor protections.

- Each transaction with third parties must clearly specify the relevant Cell and limit recourse accordingly.

4. Conversions, Mergers, and Transfers

The framework allows for:

- Conversion of existing DIFC companies into VCCs and vice-versa;

- Transfer of incorporated cells between VCCs, subject to Registrar approval and creditor protection mechanisms;

- Merger or consolidation of Segregated Cells, with prior written notice and creditor opt-out rights.

5. Licensing and Naming

- VCCs must end their names with “VCC Limited” or “VCC Ltd.”

- Segregated Cells and Incorporated Cells must have unique identifiers (e.g., “VCC SC” or “VCC IC”).

- Licences are limited to the specific activities of the Qualifying Purpose, though VCCs controlled by Qualifying Applicants may be licensed for broader purposes.

6. Shareholder Transparency and AML Compliance

- VCCs must maintain separate registers of shareholders for each Cell.

- Ultimate beneficial ownership disclosure obligations apply in line with DIFC UBO Regulations.

7. Fees and Incorporation Process

The proposed incorporation and licensing fees are aligned with the DIFC’s broader cost-efficient regime:

- USD 100 for incorporation;

- USD 1,000 for an annual licence;

- USD 300 for lodging a Confirmation Statement.

Key Topics

Some of the key topics included in the consultation paper include questions around:

- the scope and breadth of the proposed qualifying-requirements test, including whether proprietary investment access is too wide or too narrow;

- appropriateness of allowing both Segregated Cells and Incorporated Cells within a single regime, and the implications of prohibiting a VCC from having both types concurrently; and

- adequacy of creditor-protection measures, notice, publication and court-application rights on conversion of a VCC into a standard DIFC company and vice versa.

Practical Implications

The proposed introduction of the VCC regime provides a robust framework for private clients and investment entities to achieve structural and operational flexibility within a regulated DIFC environment. Key advantages include:

- Legal segregation of assets/liabilities for risk mitigation.

- Simplified investment platform management.

- Suitability for private wealth structuring, crowdfunding, and secondary market transactions.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. For additional information about how we may assist you, please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Mergers & Acquisitions or Private Equity practice groups, or the authors:

Andrew Steele – Abu Dhabi (+971 2 234 2621, asteele@gibsondunn.com)

Omar Morsy – Dubai (+971 4 318 4608, omorsy@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

As discussed below, the Conference concluded with a political declaration in which more than 170 States have called for urgent action to protect the ocean.

The 2025 UN Ocean Conference (UNOC3) took place in Nice, France, between 9 and 13 June, bringing together over 15,000 participants, including more than 60 Heads of State and Government,[1] and generating considerable publicity. The overarching theme of UNOC3—the third conference of its kind—was “[a]ccelerating action and mobilizing all actors to conserve and sustainably use the ocean”, supporting the delivery of the UN’s Sustainable Development Goal 14 (SDG 14).[2] SDG 14, “Life below water”, comprises 10 global targets focused on the conservation and sustainable use of the ocean, seas and marine resources for sustainable development.[3]

As detailed in this alert, UNOC3 concluded with a political declaration in which more than 170 States have called for urgent action to protect the ocean—including the expansion of marine protected areas (MPAs) and the decarbonization of maritime transport.[4] Other key developments included progress towards the entry into force of the “Agreement on the Conservation and Sustainable Use of Marine Biological Diversity of Areas beyond National Jurisdiction” (BBNJ Agreement), as several State Parties ratified the BBNJ Agreement during UNOC3. States also committed to progress negotiations (which began in 2022) of an internationally binding global plastics treaty, as well as joined calls for an outright ban, moratorium or precautionary pause on deep-sea mining.

Several of the international law matters discussed in this alert may impact global commerce and trade. If you would like to learn more about these developments—i.e., how they may relate to doing business and how to prepare—please contact Charline Yim and Stephanie Collins.

1. Background

The UN Ocean Conferences were established to advance SDG 14—part of the UN’s 2030 Agenda for Sustainable Development—as well as to enhance the implementation of international law as reflected in the UN Convention on the Law of the Sea (UNCLOS). The UN Ocean Conferences bring together governments, civil society, the scientific community, and the private sector—similar to the annual Conference of the Parties (COP) in the climate change context, which are held pursuant to the United Nations Framework Convention on Climate Change (UNFCCC). Previous Ocean Conferences have taken place in 2017 (New York) and 2022 (Lisbon).

UNOC3 had three main priorities: (i) work towards the successful completion of ocean-related multilateral processes to raise the level of ambition for ocean protection; (ii) mobilize funding for SDG 14 and support the development of a blue economy; and (iii) strengthen and better disseminate marine science knowledge for better policymaking.

Notably, one week prior to UNOC3, the European Commission (Commission) published the “European Ocean Pact” (Ocean Pact),[5] which was presented at the UNOC3 by Commission President Ursula von der Leyen. The Ocean Pact brings together the EU’s policies and actions related to the ocean and creates a coordinated plan for ocean management. It is built around six priorities: (i) protecting and restoring ocean health; (ii) boosting the competitiveness of the EU sustainable blue economy; (iii) supporting coastal and island communities, and outermost regions; (iv) advancing ocean research, knowledge, skills and innovation; (v) enhancing maritime security and defence; and (vi) strengthening EU ocean diplomacy and international ocean governance.

To achieve the Ocean Pact’s targets, by 2027, the Commission expects to present the “Ocean Act”, building on a revised Maritime Spatial Planning Directive. According to the Commission, the Ocean Act will establish a single framework to facilitate the implementation of the Ocean Pact’s key objectives. To aid implementation, the Commission will also set up a high-level Ocean Board, bringing together representatives from various ocean-related sectors.

2. Nice Ocean Action Plan

UNOC3 culminated in a political declaration, titled “Our ocean, our future: united for urgent action” (Nice Ocean Action Plan or Declaration).[6] Describing the importance of conserving the ocean and its ecosystems, the Declaration recalled the 2024 advisory opinion of the International Tribunal for the Law of the Sea on the request for an advisory opinion submitted by the Commission of Small Island States on Climate Change and International Law (previously reported on here). The tribunal concluded in that advisory opinion that anthropogenic greenhouse gas emissions constitute “pollution of the marine environment” as defined under UNCLOS, triggering certain positive obligations on States under UNCLOS. The Declaration also refers to the UNFCCC and the temperature goals of the Paris Agreement,[7] as well as to the importance of implementing the Convention on Biological Diversity and its Protocols, amongst other international agreements.

Amongst other issues, under the Declaration, States commit to the expansion of MPAs. The Declaration also reiterates the importance of increasing scientific knowledge on deep-sea ecosystems and recognises the work of the International Seabed Authority, created under UNCLOS, to progress rules and regulations in relation to deep-sea mining activities in the “Area” (i.e., the seabed and ocean floor and subsoil thereof, beyond the limits of national jurisdiction).

In addition, the Declaration calls for decisive action to ensure sustainable fisheries—and encourages member states of the World Trade Organization to deposit instruments of acceptance of the Agreement on Fisheries Subsidies 2022, which was designed to curb subsidies contributing to overfishing.

The Declaration also addresses the role of the private sector, referring to the importance of attracting investment to support a sustainable ocean-based economy, including through blue bonds and blue loans. The Declaration encourages the active and meaningful involvement of banks, insurers, and investors.

The Declaration further sets out over 800 voluntary commitments by governments, scientists, UN agencies, and civil society,[8] including the Commission’s announcement of an EUR 1 billion investment to support ocean conservation, science, and sustainable fishing.[9]

3. BBNJ Agreement

One of the principal objectives of UNOC3 was to accelerate progress of the entry into force of the BBNJ Agreement.[10] The BBNJ Agreement was adopted in 2023, with the aim of ensuring the conservation and sustainable use of marine biological diversity of areas “beyond national jurisdiction”, for the present and in the long term, through effective implementation of the relevant provisions of UNCLOS, as well as international cooperation and coordination.[11] It includes provisions addressing marine genetic resources and the fair and equitable sharing of benefits, and measures such as area-based management tools (including MPAs). It also includes an obligation to conduct Environmental Impact Assessments for planned activities before they are authorised, in areas beyond national jurisdiction.

60 States must ratify the BBNJ Agreement for it to enter into force. Over the course of UNOC3, 19 additional States ratified the BBNJ Agreement, bringing the total number to 50 as at Friday, 13 June 2025.[12]

4. Global Plastics Treaty

At UNOC3, there was also progress on the negotiation of a global plastics treaty (which we have previously reported on here). By way of context, the negotiation process for the treaty was launched in 2022, at the request of the UN Environment Assembly, which called for urgent action to end plastic pollution globally. Since then, several negotiation rounds have taken place—with the most recent round in South Korea in December 2024, concluding without a final agreement. The draft treaty[13] includes measures that would target the entire life cycle of plastic—from upstream production to downstream waste—and includes both mandatory and voluntary provisions. Private actors have contributed to the negotiation process.

At UNOC3, representatives from over 95 States[14] signed a declaration reaffirming their common ambition to end plastic pollution. Titled the “Nice call for an ambitious treaty on plastics”, the declaration is structured around five points which the signatories consider “key to reach an agreement”: (i) adoption of a global target to reduce production and consumption of primary plastic polymers; (ii) establishment of a legally binding obligation to phase-out the most problematic plastic products and chemicals of concern, by supporting the development of a global list of these products and substances; (iii) improvement, through a binding obligation, of the design of plastic products and ensure they cause minimal impact to the environment and human health; (iv) inclusion of a financial mechanism that supports its effective implementation; and (v) commitment to an effective and ambitious treaty that can evolve over time.[15]

Commitment towards the achievement of an international legally binding instrument on plastic pollution is also referenced in the Nice Ocean Action Plan, discussed in Section 2 above.[16]

The next round of negotiations for a global plastics treaty will take place in Geneva in August 2025.

5. Deep-Sea Mining

Deep-sea mining was another focus of UNOC3. In addition to the commitments in the Declaration, a number of States at UNOC3 joined calls for an outright ban, moratorium or precautionary pause on deep-sea mining during, bringing the total to 37. The States include Canada, France, Germany, Mexico, Spain and the United Kingdom.[17] In parallel, a number of major financial institutions announced that they would not fund deep-sea mining projects.[18]

This development comes just six weeks after President Trump issued an executive order granting concessions for seabed mining titled “Unleashing America’s Offshore Critical Minerals and Resources”.[19] The executive order states that the US has a “core national security and economic interest” in developing and extracting mineral resources.[20] The US sent non-participating observers to UNOC3 from the President’s Environmental Advisory Task Force.[21]

6. Observations

UNOC3 addressed a wide range of ocean-related issues, including the sustainable blue economy, the environment, climate change, social development and the use of ocean resources. The discussions and resolutions at UNOC3, as reported on above, may evolve into binding international instruments on ocean governance and management in the near future. Further, UNOC3 generated a significant degree of international media attention, which may signal the start of a more high-profile positioning of ocean-related issues on the international political stage. We will continue to monitor and report on developments in this space.

[1] See ‘UN Ocean Summit in Nice closes with wave of commitments’, United Nations News, 13 June 2025, <https://news.un.org/en/story/2025/06/1164381>, last accessed 24 June 2025.

[2] i.e., to “conserve and sustainably use the oceans, seas and marine resources for sustainable development”. See ‘2025 UN Ocean Conference’, United Nations, 9 June 2025, <https://sdgs.un.org/conferences/ocean2025>, last accessed 24 June 2025.

[3] See ‘Life Below Water’, The Global Goals, undated, <https://www.globalgoals.org/goals/14-life-below-water/>, last accessed 24 June 2025.

[4] See ‘UN Ocean Summit in Nice closes with wave of commitments’, United Nations News, 13 June 2025, <https://news.un.org/en/story/2025/06/1164381>, last accessed 24 June 2025.

[5] See Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, The European Ocean Pact, COM(2025) 281 final, 5 June 2025, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=COM:2025:281:FIN, last accessed 24 June 2025.

[6] ‘Our ocean, our future: united for urgent action’, United Nations Ocean Conference 2025 Resolution, 13 June 2025, <https://docs.un.org/en/A/CONF.230/2025/L.1> last accessed 24 June 2025; ‘Nice Conference Adopts Declaration Underscoring Vital Importance of Ocean to Life on Our Planet, Essential Role in Mitigating Climate Change’, United Nations, 13 June 2025, here, last accessed 24 June 2025.

[7] Namely, to limit the temperature increase to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius. See ‘United Nations Framework Convention on Climate Change’, United Nations, Treaty Series, vol. 1771, No. 30822, 9 May 1992, <https://treaties.un.org/doc/publication/unts/volume%202303/volume-2303-a-30822.pdf> last accessed 24 June 2025; see also ‘Report of the Conference of the Parties on its twenty-first session’, Paris Agreement, Article 2, p. 22 <https://docs.un.org/en/FCCC/CP/2015/10/Add.1>, last accessed 24 June 2025.

[8] See ‘UN Ocean Summit in Nice closes with wave of commitments’, United Nations News, 13 June 2025, <https://news.un.org/en/story/2025/06/1164381>, last accessed 24 June 2025.

[9] See ‘Commission adopts Ocean Pact with €1 billion to protect marine life and strengthen blue economy’, European Commission, 11 June 2025, https://commission.europa.eu/news-and-media/news/commission-adopts-ocean-pact-eu1-billion-protect-marine-life-and-strengthen-blue-economy-2025-06-11_en, last accessed 24 June 2025.

[10]See ‘UN Ocean Summit in Nice closes with wave of commitments’, United Nations News, 13 June 2025, <https://news.un.org/en/story/2025/06/1164381>, last accessed 24 June 2025; see also ‘Beyond borders: Why new ‘high seas’ treaty is critical for the world’, United Nations News, 19 June 2023, <https://news.un.org/en/story/2023/06/1137857>, last accessed 24 June 2025.

[11] See ‘Agreement under the United Nations Convention on the Law of the Sea on the Conservation and Sustainable Use of Marine Biological Diversity of Areas Beyond National Jurisdiction’, United Nations, 2023, <https://www.un.org/bbnjagreement/sites/default/files/2024-08/Text%20of%20the%20Agreement%20in%20English.pdf>, last accessed 24 June 2025.

[12] See ‘UN Ocean Summit in Nice closes with wave of commitments’, United Nations News, 13 June 2025, <https://news.un.org/en/story/2025/06/1164381>, last accessed 24 June 2025.

[13] See ‘Revised draft text of the international legally binding instrument on plastic pollution, including in the marine environment’, United Nations, 28 December 2023, <https://wedocs.unep.org/bitstream/handle/20.500.11822/44526/RevisedZeroDraftText.pdf>, last accessed 24 June 2025.

[14] Antigua and Barbuda, Armenia, Australia, Barbados, Benin, Burundi, Cabo Verde, Cambodia, Canada, Chile, Colombia, Comoros, Congo, Cook Islands, Costa Rica, Côte d’Ivoire, Democratic Republic of the Congo, Djibouti, Dominican Republic, Ecuador, Eswatini, European Union whose Member States are Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden; Fiji, Gabon, Gambia, Georgia, Ghana, Grenada, Guatemala, Guinea, Guinea-Bissau, Honduras, Iceland, Israel, Jamaica, Liberia, Madagascar, Malawi, Maldives, Marshall Islands, Mauritania, Mauritius, Mexico, Micronesia, Monaco, Mozambique, Namibia, New Zealand, Norway, Panama, Papua New Guinea, Peru, Philippines, Republic of Moldova, Saint Kitts and Nevis, São Tomé and Principe, Senegal, Seychelles, Sierra Leone, Solomon Islands, Sri Lanka, Switzerland, Togo, Tuvalu, Ukraine, United Kingdom, Uruguay, Vanuatu, Zimbabwe.

[15] See ‘The Nice wake up call for an ambitious plastics treaty’, United Nations Ocean Conference, 10 June 2025, here, last accessed 24 June 2025.

[16] See ‘Our ocean, our future: united for urgent action’, United Nations Ocean Conference 2025 Resolution, 13 June 2025, <https://docs.un.org/en/A/CONF.230/2025/L.1> last accessed 24 June 2025, p. 4.

[17] See ‘UN Ocean Conference Shines a Light on the Deep Sea: Now, Time for Action’, Deep Sea Conservation Coalition, 13 June 2025, <https://deep-sea-conservation.org/un-ocean-conference-shines-a-light-on-the-deep-sea-now-time-for-action/>, last accessed 24 June 2025.

[18] BNP Paribas, Crédit Agricole and Groupe Caisse des Dépôts announced their rejection of deep sea mining, which now means that 24 financial institutions exclude deep sea mining in some form. See ‘Three Major French Investors Reject Deep Sea Mining’, Deep Sea Mining Campaign, 17 June 2025, <https://dsm-campaign.org/french-investors-reject-dsm/> , last accessed 24 June 2025.

[19] ‘Unleashing America’s Offshore Critical Minerals and Resources’, The White House, 24 April 2025, <https://www.whitehouse.gov/presidential-actions/2025/04/unleashing-americas-offshore-critical-minerals-and-resources/>, last accessed 24 June 2025.

[20] ‘Unleashing America’s Offshore Critical Minerals and Resources’, The White House, 24 April 2025, <https://www.whitehouse.gov/presidential-actions/2025/04/unleashing-americas-offshore-critical-minerals-and-resources/>, last accessed 24 June 2025.

[21] See ‘US Skips UN Ocean Conference after rejecting Development Goals’, Bloomberg, June 2025, here, last accessed 24 June 2025.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Geopolitical Strategy & International Law and ESG: Risk, Litigation, & Reporting practice groups:

Charline O. Yim – New York (+1 212.351.2316, cyim@gibsondunn.com)

Stephanie Collins – London (+44 20 7071 4216, scollins@gibsondunn.com)

Robert Spano – Co-Chair, ESG and Geopolitical Strategy & International Law Groups,

London/Paris (+33 1 56 43 13 00, rspano@gibsondunn.com)

Rahim Moloo – Co-Chair, Geopolitical Strategy & International Law Group,

New York (+1 212.351.2413, rmoloo@gibsondunn.com)

Patrick W. Pearsall – Co-Chair, Geopolitical Strategy & International Law Group,

Washington, D.C. (+1 202.955.8516, ppearsall@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Join us for a 40-minute briefing covering several M&A practice topics. This program is part of a series of quarterly webcasts designed to provide quick insights into emerging issues and practical advice on how to manage common M&A problems. Partner Rob Little, global Co-Chair of the firm’s M&A Practice Group, will act as moderator.

Topics to be discussed:

- Tariff-related due diligence in M&A transactions

- The impact of the Department of Justice’s new Data Security Program on M&A transactions

- Privilege ownership in purchase agreements

- New developments in case law governing advance notice bylaws

MCLE CREDIT INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 0.5 credit hour, of which 0.5 credit hour may be applied toward the areas of professional practice requirement. This course is approved for transitional/non-transitional credit.

Attorneys seeking New York credit must obtain an Affirmation Form prior to watching the archived version of this webcast. Please contact CLE@gibsondunn.com to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 0.5 hour in the General Category.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

PANELISTS:

Christopher T. Timura is a partner in the Washington D.C. office of Gibson, Dunn & Crutcher LLP and a member of the firm’s International Trade, White Collar Defense and Investigations, and ESG Practice Groups. Chris helps clients solve problems that arise at the intersection of U.S. national security, foreign policy, and international trade regulation. His clients span sectors and range from start-ups to Global 500 companies. He is regularly ranked in Chambers Global and U.S.A. guides for his work and is a regular speaker and writer on the policy drivers, trends, and impacts of evolving international trade policy and regulation.

Stephenie Gosnell Handler is a partner in Gibson Dunn’s Washington, D.C. office, where she is a member of the International Trade and Privacy, Cybersecurity, and Data Innovation practices. She advises clients on complex legal, regulatory, and compliance issues relating to international trade, cybersecurity, and technology matters. Stephenie ’s legal advice is deeply informed by her operational cybersecurity and in-house legal experience at McKinsey & Company, and also by her active duty service in the U.S. Marine Corps. Stephenie is regularly recognized for her excellence in the field, most recently being named to Financier Worldwide Magazine’s Power Players: Foreign Investment & National Security 2025 – Distinguished Advisers report.

Michelle M. Gourley is a Partner in the Orange County office of Gibson, Dunn & Crutcher and is a member of the firm’s Mergers and Acquisitions and Private Equity Practice Groups. Ms. Gourley is a corporate transactional lawyer whose experience includes advising both strategic companies and private equity clients (including their portfolio companies) in connection with public and private merger transactions, stock and asset sales, joint ventures, strategic partnerships, and other complex corporate transactions. Ms. Gourley works with clients across a wide range of industries, and has extensive experience working with life sciences companies (pharma and medical device) and media, technology and entertainment companies.

Mark H. Mixon Jr. is Of Counsel in the New York office of Gibson, Dunn & Crutcher and is a member of the firm’s Litigation and Securities Litigation Practice Groups. Mark is a general corporate and commercial litigator who represents individual and corporate clients in complex, high-stakes business and corporate governance disputes, including commercial breach of contract actions, corporate-control litigation, disputes related to directors’ and controlling stockholders’ fiduciary duties, stockholder derivative and securities litigation, M&A-related litigation, and antitrust and competition matters. He frequently litigates in the Delaware Court of Chancery, where he clerked for the Honorable J. Travis Laster, the Honorable Tamika R. Montgomery-Reeves, and the Honorable Donald F. Parsons, Jr. Mark has been recognized in Best Lawyers: Ones to Watch in America™ (2024, 2025).

Robert B. Little is a partner in Gibson, Dunn & Crutcher’s Dallas office. He is a Global Co-Chair of the Mergers and Acquisitions Practice Group and a member of the firm’s Executive Committee. Rob is consistently recognized for his leadership and strategic work with clients, having been named among the nation’s top M&A lawyers by Chambers USA every year for more than a decade. Rob’s practice focuses on corporate transactions, including mergers and acquisitions, securities offerings, joint ventures, investments in public and private entities, and commercial transactions. He also advises business organizations regarding matters such as securities law disclosure, corporate governance, and fiduciary obligations. In addition, he represents investment funds and their sponsors along with investors in such funds. Rob has represented clients in a variety of industries, including energy, retail, technology, infrastructure, transportation, manufacturing, and financial services.

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

We are pleased to provide you with Gibson Dunn’s ESG update covering the following key developments during May 2025. Please click on the links below for further details.

- State Street Global Advisors (SSGA) launches sustainability engagement and voting service

On May 7, 2025, SSGA launched a new opt-in Sustainability Stewardship Service. The Sustainability Stewardship Service was created for clients seeking to prioritize engagement with portfolio companies on sustainability issues. The service incorporates sustainability considerations in proxy voting and engagement in line with SSGA’s 2025 Sustainability Stewardship Service Proxy Voting and Engagement Policy, and across certain key topics, including climate change, nature, human rights, and diversity. The service is available globally to SSGA’s institutional separately managed account clients. The new Sustainability Stewardship Service is in addition to SSGA’s existing proxy voting choice program, which provides eligible clients the option to choose a third-party proxy voting policy (rather than continuing to have SSGA vote in accordance with SSGA’s proxy voting policy).

- The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) publishes its first short-term climate scenarios

The NGFS short-term climate scenarios, released on May 7, 2025, provide the first publicly available framework for central banks and other financial institutions to analyze the potential near-term impact of climate change and climate policies on the economy and the financial sector. The scenarios examine how extreme weather events, climate policies, economic trends, and sectoral shifts may affect economies and financial systems over the next five years.

- EU-UK Summit leads to commitment on Emissions Trading Scheme (ETS)

On May 19, 2025, the UK Prime Minister met with the President of the European Council and the President of the European Commission at the inaugural UK-EU Summit and unveiled a Common Understanding that reframes post-Brexit engagement. The UK and EU committed to negotiate a full link between the UK ETS and the EU ETS, coupled with mutual exemption from each side’s Carbon Border Adjustment Mechanism (CBAM), the carbon tax on imported goods. The sectors that are expected to be covered are electricity generation, industrial heat generation (excluding the individual heating of houses), industry, domestic and international maritime transport, and domestic and international aviation. The parties further agreed to explore UK participation in EU electricity trading platforms and to intensify cooperation on hydrogen, carbon capture, use and storage, and decarbonized gases, bolstering North Sea renewables, energy security and future innovation. The EU Commission will now seek out an EU Council mandate. The UK’s consultation on CBAM closes on July 3, 2025.

- UK Government launches two consultations on biodiversity net gain (BNG)

On May 28, 2025 the Department for Environment, Food & Rural Affairs (DEFRA) launched two parallel consultations on expanding England’s mandatory BNG regime. The first consultation seeks views on applying a minimum 10% BNG requirement to nationally significant infrastructure projects, which is scheduled to commence in May 2026. This is aimed at ensuring that major infrastructure projects improve biodiversity during the course of their development (i.e., a net gain). The second consultation addresses how BNG operates for minor, medium, and brownfield developments. The reforms are intended to reduce costs for builders while delivering the Environment Act 2021’s biodiversity targets. Both consultations close on July 24, 2025.

- UK Government launches Emerging Markets and Developing Economies Investor Taskforce (Taskforce)

On May 15, 2025, the UK government launched its Taskforce, an industry-led forum designed to channel UK private capital into climate-aligned opportunities across Latin America, Asia, Africa and the Caribbean. The Taskforce unites 15 major financial services firms, including insurers, pension funds, asset managers, banks, investment consultants and development finance institutions, with His Majesty’s Treasury and the Foreign, Commonwealth and Development Office. Its mandate is to explore the recommendations of “The UK as a Climate Finance Hub” report into opportunities, such as tailored products, capacity-building, and regulatory reform. The Institutional Investors Group on Climate Change will serve as the Secretariat of the Taskforce.

Other highlights:

- On May 16, 2025, the UK Government published comprehensive guidance on embedding gender equality, disability, and social inclusion (GEDSI) across all UK International Climate Finance (ICF) programmes. The publication establishes mandatory minimum standards such as requirements to conduct a GEDSI analysis to assess and mitigate risks of exacerbating inequalities and comply with UK legal obligations on equality and non-discrimination. It also sets an overarching ambition that every new ICF intervention be, at a minimum, “GEDSI-empowering.”

- On May 16, 2025, the UK Government opened an independent review of greenhouse gas removals (GGRs) and issued a Call for Evidence inviting views from all stakeholders on how engineered and nature-based GGR options can help deliver the UK’s statutory net zero goals. The Call for Evidence closed on June 20, 2025.

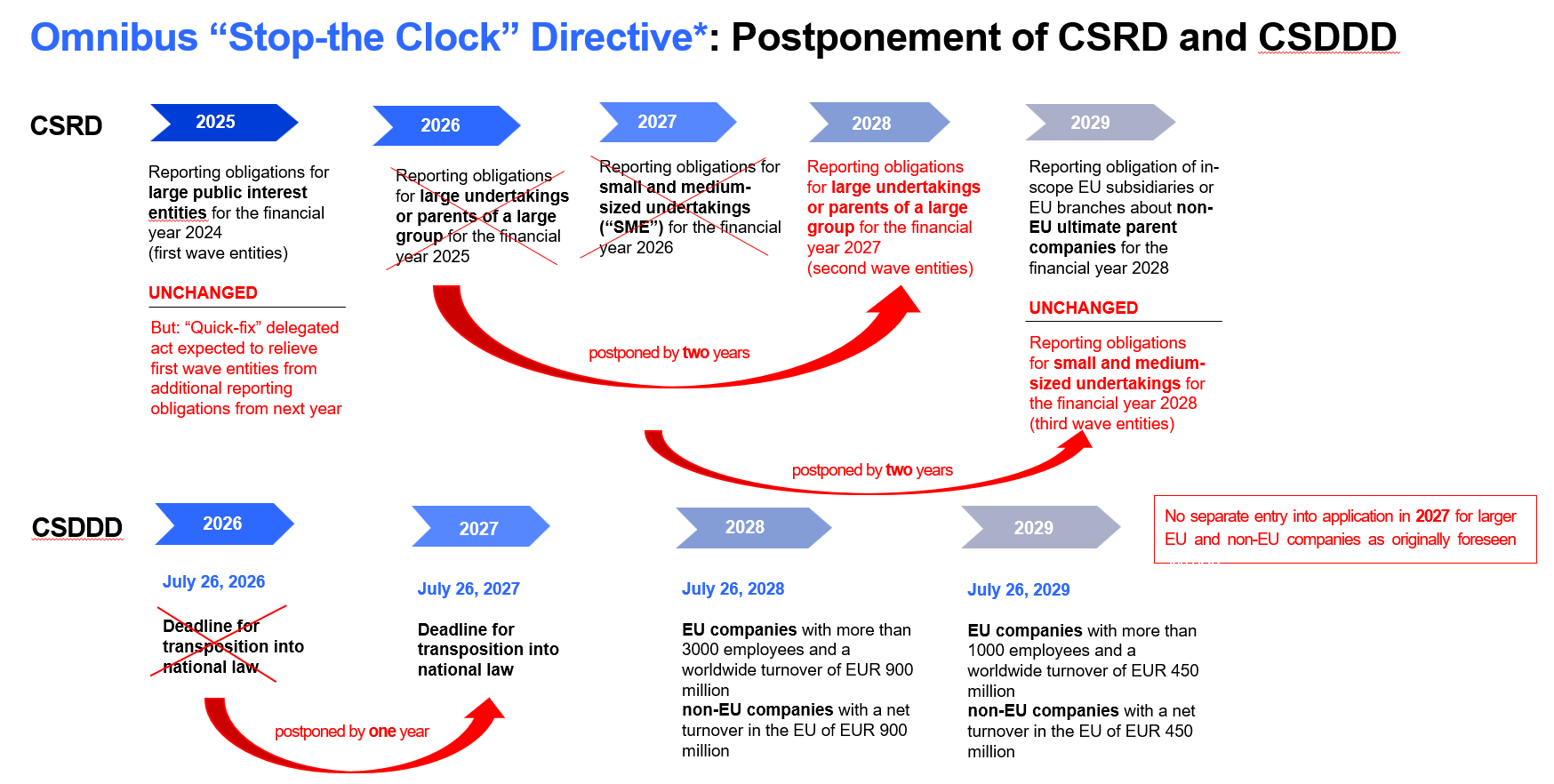

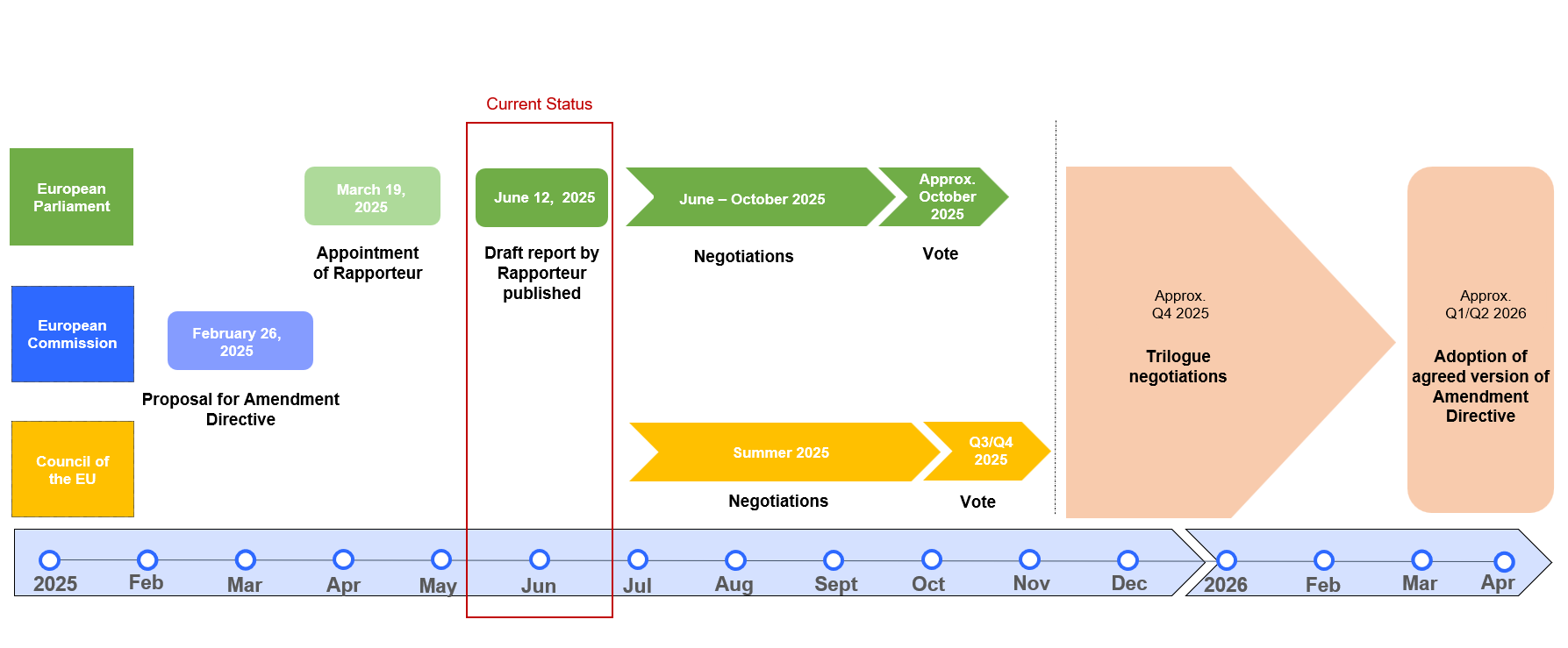

- Omnibus Simplification Package (CSRD, CSDDD): New Proposals by European Parliament’s lead rapporteur, Jörgen Warborn, and by the European Council and related discussions; Status update on ESRS revision

The legislative process on the Omnibus Simplification Package is moving further along:

The European Parliament’s lead rapporteur, Jörgen Warborn, published his draft report on June 12, 2025. Inter alia, he suggests deleting the requirement for companies to file mandatory climate transition plans in the Corporate Sustainability Due Diligence Directive (CSDDD) and raising the threshold for both, the CSDDD and the Corporate Sustainability Reporting Directive (CSRD), to companies with more than 3,000 employees and EUR 450 million in net turnover. For a more detailed analysis of the report by the European Parliament’s lead rapporteur, please see our client alert of June 18, 2025. It is expected that the European Parliament will vote on the proposed amendments in October 2025.

On June 23, 2025, the Council of the EU issued a press release briefly outlining its position on the Omnibus Simplification Package. Regarding the CSRD, the Council of the EU introduces a worldwide net turnover threshold of over EUR 450 million, in addition to the European Commission’s proposal to raise the employee threshold to 1,000 employees.

Regarding the CSDDD, the Council of the EU proposes increasing the applicability threshold to more than 5,000 employees and a worldwide net turnover exceeding EUR 1.5 billion. It maintains the proposed limitation of the CSDDD’s due diligence requirements to the company’s own operations, those of its subsidiaries, and those of its direct business partners, but it intends to shift the focus from an entity-based approach to a risk-based one and the companies should now only conduct a more general scoping exercise instead of a comprehensive mapping exercise. The Council of the EU suggests limiting the companies’ obligation to adopt a climate transition plan and postpones this obligation by two years. The Council of the EU also suggests postponing the CSDDD’s transposition deadline by one further year, pushing it back to July 26, 2028 and maintains the European Commission’s proposal to remove the EU harmonised liability regime.

On June 23, 2025, a status report on the revision of the European Sustainability Reporting Standards (“ESRS”) has been published by the European Financial Reporting Advisory Group (EFRAG). According to this report, it is intended to reduce the number of mandatory data points by 50 % or even more. In addition, the ESRS shall, inter alia, be aligned with the International Sustainability Standards Board (ISSB) Standards, there shall be a clear distinction and separation of mandatory and non-mandatory data points and the General Disclosure section (ESRS 2) shall be “drastically reduced” to avoid duplication.

Meanwhile, the EU Ombudsman, Teresa Anjinho, has launched an inquiry into the European Commission’s process for drafting the Omnibus Simplification proposal. While the Commission defends the expedited process as necessary to reduce complexity and implementation costs for companies facing CSRD reporting obligations in 2026, non-governmental organizations have filed complaints alleging insufficient stakeholder engagement and undue influence by fossil fuel interests. The Commission maintains that it used a staff working document—a shorter internal analysis intended to justify urgent proposals in lieu of full impact assessments—based on prior input from CSRD, CSDDD, and EU Taxonomy workstreams. It further cites stakeholder roundtable discussions conducted in February 2025 as a means of collecting targeted feedback on implementation hurdles and points to Directorate-General for Financial Stability, Financial Services, and Capital Markets Union-led outreach, including technical workshops and a stakeholder request mechanism, as evidence of broader engagement across sectors.

Furthermore, the European Central Bank (ECB) issued a statement in which it warned that reducing the scope of the CSRD could lead to systematic and unquantifiable bias due to unverifiable and selective voluntary disclosures. The ECB also opposed excluding financial institutions from the CSDDD, arguing this would weaken risk management and legal clarity. Additionally, it criticized the weakened requirements for implementing climate transition plans, warning that this may lead to increased litigation risks and regulatory fragmentation.

- Discussion on entire elimination of the EU’s CSDDD

German Chancellor Friedrich Merz called for a full elimination of the EU’s CSDDD, arguing that a postponement is insufficient, and that the directive imposes excessive regulatory burdens on businesses. This statement followed the German government’s plans in its coalition agreement to eliminate Germany’s own human rights and environmental supply chain due diligence law, the Supply Chain Act. A spokesperson for the German government later softened Merz’s statement and clarified that the goal should be to “streamline” and “de-bureaucratize” the directive rather than eliminate it entirely.

French President Emmanuel Macron echoed Merz’s original stance, explaining that the directive should be taken “off the table” to improve European competitiveness against the U.S. and China.

Belgium and Denmark strongly rejected the proposal, emphasizing the importance of maintaining and strengthening ethical standards in support of Europe’s green transition and calling for smarter, more digitalized, and manageable requirements that align with a competitive business environment.

In the meantime, also the European Parliament’s lead rapporteur Jörgen Warborn emphasized that while the CSDDD must remain in force to avoid a fragmented regulatory landscape across member states, the European Commission’s current simplification proposals do not go far enough.

- Corporate Climate Risk: German Court Breaks New Ground in decision on lawsuit brought by Peruvian farmer against German Energy Company

On May 28, 2025, the Higher Regional Court of Hamm, Germany, issued a long-awaited decision in the lawsuit brought by a Peruvian farmer against German multinational energy company RWE AG (RWE), marking a milestone in climate litigation.

The plaintiff claimed that RWE’s historical greenhouse gas emissions had significantly contributed to the melting of Andean glaciers, posing a threat of flooding to his property. Although the court dismissed the claim – finding the risk of damage in this specific case too low – it acknowledged in principle that major corporate emitters can be held liable for climate-related harm.

This ruling is significant: For the first time, a German appellate court explicitly recognized the potential for civil liability in transboundary climate claims. While the judgment sets a high bar for causation and imminence of harm, it underscores the evolving legal landscape in ESG and climate-related litigation.

- CSRD / Omnibus “Stop-the-clock” Directive transposition update

Since our last update, Denmark, Estonia, Finland, Hungary, Latvia, Lithuania, Luxembourg, Poland and Sweden have started the legislative process to transpose the Stop-the-Clock Directive into national law. Notably, Luxembourg has started the process even though it has not completed the transposition of the CSRD.

An overview of the current transposition status of CSRD into national laws and the “Stop-the-clock” process under the Omnibus Simplification Package can be found here.

Other highlights:

- On May 22, 2025, the European Parliament agreed to the European Commission’s proposal to introduce a 50-tonne threshold to the CBAM, which would exempt 90% of importers—primarily small and medium-sized enterprises—from the scope of CBAM rules.

- On May 27, 2025, the EU Council approved proposed amendments to a regulation on carbon dioxide (CO2) emissions standards for new passenger cars and vans. The amendments provide that compliance with specific emissions fleet targets of car manufacturers for the three years 2025, 2026, and 2027 will no longer be assessed annually, but on the basis of the average performance of each manufacturer over these three years, giving car manufacturers more time and flexibility to comply with CO2 targets and, thus, avoiding significant penalties.

- Recent developments in the Trump Administration’s litigation of laws and regulations addressing climate change and ESG

Following the Trump Administration’s April 8th Executive Order setting forth limits on certain state climate-related initiatives, on April 30, 2025, the Trump Administration filed lawsuits against Hawaii and Michigan seeking to prevent the states from pursuing climate change lawsuits against fossil fuel companies. The Administration’s complaints indicate that the United States filed the lawsuits to ensure the states do not interfere with the Clean Air Act or the Trump Administration’s interpretation of the federal government’s “exclusive authority over interstate and foreign commerce, greenhouse gas regulation, and national energy policy.” The next day, Hawaii filed suit against oil and gas companies in Hawaii Circuit Court alleging that the state suffered harm as a result of the companies’ misrepresentations regarding the impact of fossil fuel products on the climate and sea levels, asserting various causes of action, including negligence, public nuisance, failure to warn, and civil aiding and abetting.

On May 1, 2025, the Trump Administration filed similar lawsuits against the states of New York and Vermont alleging that their climate Superfund laws are preempted by the Clean Air Act and foreign affairs doctrine, violate the Constitution’s limits on extraterritorial regulation, and violate the Foreign Commerce Clause and Interstate Commerce Clause. The complaints allege that the laws, which were enacted in 2024, force out-of-state fossil fuel companies to fund state climate change adaptation projects and attempt “to usurp the power of the federal government by regulating national and global emissions of greenhouse gases” in violation of federal law. Various other cases have been brought challenging these laws.