Privacy, Cybersecurity and Data Innovation co-chair Ahmed Baladi discusses GDPR enforcement actions in Europe with practice partners Vera Lukic (Paris) and Joel Harrison (London). They review enforcement actions over the past five years and anticipate future trends, look at Brexit’s impact on the GDPR and on its application in the UK, and examine issues arising from the enforcement of the e-privacy directive, with its lack of a one-stop-shop mechanism.

Previous Episode | Next Episode

HOSTS:

Ahmed Baladi is a partner in the Paris office of Gibson, Dunn & Crutcher, where he is co-chair of the firm’s Privacy, Cybersecurity and Data Innovation practice and a member of the Artificial Intelligence practice. Ahmed has developed renowned experience in a wide range of privacy and cybersecurity matters including compliance and governance programs in light of the GDPR. He regularly represents companies and corporate executives on investigations and procedures before Data Protection Authorities. He also advises a variety of clients on data breach and national security matters including handling investigations, enforcement defense and crisis management.

Joel Harrison is a partner in the London office of Gibson, Dunn & Crutcher and a member of the firm’s Privacy, Cybersecurity and Data Innovation and Technology Transactions Practice Groups. Joel advises on everything technology-related, including transactions, disputes and renegotiations, as well as regulatory issues. He also specializes in data protection and cybersecurity, advising on the full range of regulatory, transactional and contentious matters. Joel’s clients include some of the world’s leading corporations and financial institutions.

Vera Lukic is a partner in the Paris office of Gibson, Dunn & Crutcher, where she serves as a member of the Privacy, Cybersecurity and Data Innovation Practice Group. She is also a member of the Strategic Sourcing and Commercial Contracts Practice Group. She focuses on information technology, digital transactions, cybersecurity, and data privacy.

On July 27, 2023, Hong Kong’s Securities and Futures Commission (“SFC”) published a “Circular on Licensing and Registration of Depositaries of SFC-authorised Collective Investment Schemes and Related Transitional Arrangements” (the “Circular”).[1] Trustees and custodians of SFC-authorised collective investment schemes (the “relevant CIS”) will have to be licensed or registered with the SFC for the new Type 13 regulated activity (“RA 13”) from October 2, 2024.

The Circular should be read in tandem with the soon to be enacted Schedule 11 to the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission (“Schedule 11”).[2] Together, the Circular and Schedule 11 provide guidance on the SFC’s expectations regarding RA 13 licensing arrangements.

The new RA 13 regulatory regime intends to remedy what the SFC has previously described as a “patchy” approach to the regulation of depositories, whereby the SFC was unable to directly supervise depositaries. Instead, the SFC could only exercise indirect oversight through the requirements under the Product Codes.[3] The RA 13 regulatory framework was proposed by the SFC in September 2019 to fill this void left by a lack of specific, direct supervision mechanism over trustees and custodians of public funds.[4] In doing so, the new RA 13 regulatory regime will also align Hong Kong’s fund custody framework with international standards; most major jurisdictions (such as the United Kingdom and Singapore) have some form of direct regulatory powers over entities providing trustee, custodian or depositary services for public funds (at a minimum). Viewed broadly, the introduction of RA 13 is also consistent with the SFC’s focus on regulating entities providing custody services – for instance, its recent decision to regulate virtual assets custody under its new virtual assets trading platform (“VATP”) regime by requiring custody be undertaken by a wholly owned subsidiary of a licensed VATP operator.

I. Who needs a RA 13 license?

The amendments made to the Securities and Futures Ordinance (“SFO”) to introduce RA 13 define it as “providing depositary services for relevant CISs”.[5] In essence, what this means is that trustees and custodians (i.e. depositaries as defined under the amendments to the SFO) of a relevant CIS at the “top level” of the custodian chain will be required to be licensed or registered for RA 13 in order to provide the following services:

- the custody and safekeeping of the CIS property, including property held on trust by the relevant CIS (“CIS Property”); and

- the oversight of the CIS to ensure that it is operated according to scheme documents.[6]

In practice, many of these depositaries were not previously supervised by the SFC until the introduction of the new RA 13 regime. This suggests that individuals who will now be required to be licensed to undertake RA 13 activities will be subjected to direct SFC supervision for the first time, and may not be accustomed to being licensed.

II. What are the RA 13 regulatory requirements?

In the table below, we highlight the key regulatory requirements applicable to depositaries licensed for RA 13 (“RA 13 Depositaries”):

|

Capital thresholds |

RA 13 Depositaries are required to maintain a paid-up share capital of not less than $10,000,000 and a liquid capital of not less than $3,000,000.[7] |

|

Treatment of Scheme Money |

RA 13 Depositaries that hold or receive scheme money under a relevant CIS (“Scheme Money”) must deposit such Scheme Money into segregated and designated trust accounts or client accounts within three business days after receipt. Each segregated account must be established and maintained for one relevant CIS only.[8] RA 13 Depositaries must not pay Scheme Money out of the segregated account unless such payment is (i) instructed in writing, or (ii) for the purpose of meeting payment, distribution, redemption settlement, or margin requirements, or (iii) to settle any charges or liabilities on behalf of the relevant CIS, as per the scheme documents.[9] |

|

Treatment of Scheme Securities |

Similarly, an RA 13 Depositary must deposit client securities which it holds or receives when providing depositary services (“Scheme Securities”) into a segregated and designated trust account or client account. Alternatively, the RA 13 Depositary can register the Scheme Securities in the name of the relevant CIS.[10] An RA 13 Depositary can only deal with Scheme Securities in accordance with written instructions or scheme documents. It must take reasonable steps to ensure that Scheme Securities are not otherwise deposited, transferred, lent or pledged.[11] |

|

Record keeping obligations |

In line with the record keeping requirements generally applicable to licensed intermediaries, RA 13 Depositaries are required to keep accounting, custody and other records to sufficiently explain and reflect the financial position and operation of the business, and support accurate profits and loss or income statements. Specifically, RA 13 Depositaries must also account for all relevant CIS Property, and make sure that its accounting systems can trace all movements of relevant CIS Property.[12] |

|

OTCD reporting |

RA 13 Depositaries are exempted from reporting specified over-the-counter (“OTC”) derivative transactions to the Hong Kong Monetary Authority (“HKMA”) when acting as a counterparty to the OTC derivative transaction.[13] Similarly, authorized institutions need not report the OTC derivative transaction to the HKMA if the counterparty of the transaction is an RA 13 Depositary acting in its capacity as a trustee of the relevant CIS.[14] |

Further, the SFC has previously clarified that the Managers-In-Charge (“MIC”) requirements under the current licensing framework extend to RA 13 licensees.[15]

III. Are there any additional requirements applicable to specific classes of RA 13 Depositaries?

Schedule 11 sets out additional requirements applicable to specific classes of RA 13 Depositaries. In the table below, we summarize the key requirements applicable to RA 13 Depositaries authorized under the Code on Unit Trusts and Mutual Funds[16] and Code on Pooled Retirement Funds (“UT/RF RA 13 Depositaries”).[17] These are mostly RA 13 Depositaries operating Chapter 7 Funds (i.e. plain vanilla funds investing in equity and/or bunds), specialized schemes (such as hedge funds, listed open-ended funds), and pooled retirement funds.

|

Appointment and oversight of delegates or third parties |

UT/RF RA 13 Depositaries should establish internal control policies and procedures to oversee appointed delegates or third parties. These internal control policies and procedures should cover the following:

UT/RF RA 13 Depositaries should also establish appropriate contingency plans to cater for instances of breaches or insolvency of these delegates or third parties.[18] |

|

Oversight of the relevant CIS |

UT/RF RA 13 Depositaries should have oversight over the operations of the relevant CIS, and ensure that the CIS is operated or administered in accordance with the relevant constitutive documents.[19] |

|

Subscription and redemption |

UT/RF RA 13 Depositaries should monitor the relevant operators of each CIS to ensure (among other things):

|

|

Distribution payments |

UT/RF RA 13 Depositaries should supervise the relevant operators of each CIS to ensure that:

With respect to each relevant CIS, UT/RF RA 13 Depositaries should ensure that distribution proceeds are transferred according to the operator’s instruction on a timely basis into a designated and segregated or omnibus bank account.[21] |

|

Custody and safekeeping of CIS Property |

UT/RF RA 13 Depositaries can adopt the safeguards to ensure the safekeeping of CIS Property:

|

Notwithstanding the above, there are specific requirements applicable to RA 13 Depositaries authorized under the Code on Real Estate Investment Trusts (“REIT RA 13 Depositaries”).[23] These are RA 13 Depositaries operating closed-ended funds primarily investing in real estate. REIT RA 13 Depositaries are under a fiduciary duty to hold assets of Real Estate Investment Trusts (“REIT”) on trust for the benefit of the unitholders of the REIT. While the requirements applicable to UT/RF RA 13 Depositaries summarized above are generally applicable to REIT RA 13 Depositaries, Schedule 11 tailors some of these requirements to account for the unique features and product structure of REITs. The key modifications are summarized as follows:

|

Cash flow monitoring and cash reconciliation |

Under the Code on Real Estate Investment Trusts (“REIT Code”), the management company of a REIT bears the obligation to manage cash flows. Schedule 11 modifies the custody requirements – which require UT/RF RA 13 Depositaries to carry out cash reconciliation of CIS Property daily – to instead require REIT RA 13 Depositaries to ensure that the management company has put in place proper cash flow management policies and controls, and supervise the implementation of such policies and controls. |

|

Custody and safekeeping of CIS Property |

REIT RA 13 Depositaries should ensure that all REIT assets (including the title documents of REIT-owned real estate) are properly segregated and held for the benefit of the unitholders in accordance with the REIT Code and the constitutive document of the REIT. Where the REIT RA 13 Depositary considers it in the interests of the REIT for certain assets of the REIT to be held by the management company on behalf of the REIT, the REIT RA 13 Depositary should make sure that the management company has established proper safeguards and controls to properly segregate REIT assets. Additionally, the REIT RA 13 Depositary must maintain on-going oversight and control over the relevant assets. |

IV. What are the next steps?

The SFC has begun accepting licensing applications for RA 13 since July 27, 2023. Depositaries are reminded to submit RA 13 applications on or before November 30, 2023. The RA 13 regime will take effect on October 2, 2024.

_____________________________

[1] “Circular on Licensing and Registration of Depositaries of SFC-authorised Collective Investment Schemes and Related Transitional Arrangements” (July 27, 2023), published by the SFC, available at https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=23EC32

[2] The final text of Schedule 11 can currently be found at Appendix C, “Consultation Conclusions on Proposed Amendments to Subsidiary Legislation and SFC Codes and Guidelines to Implement the Regulatory Regime for Depositaries of SFC-authorised Collective Investment Schemes” (March 24, 2023), published by the SFC, available at https://apps.sfc.hk/edistributionWeb/api/consultation/conclusion?lang=EN&refNo=22CP1

[3] Namely, the Code on Unit Trusts and Mutual Funds, the Code on Open-Ended Fund Companies, the Code on Real Estate Investment Trusts, and the Code on Pooled Retirement Funds.

[4] “Consultation Paper on the Proposed Regulatory Regime for Depositaries of SFC-authorised Collective Investment Schemes” (September 27, 2019) (“2019 Consultation Paper”), published by the SFC, available at https://apps.sfc.hk/edistributionWeb/api/consultation/openFile?lang=EN&refNo=19CP3

[5] Section 3, “Securities and Futures Ordinance (Amendment of Schedule 5) Notice 2023” (March 20, 2023), available at https://www.gld.gov.hk/egazette/pdf/20232712/es22023271262.pdf

[6] “Scheme document” refers to (i) the trust deed constituting or governing the relevant CIS if the CIS is constituted in the form of a trust, (ii) the documents governing the formation or constitution of the relevant CIS if the CIS is constituted in any other form other than a trust, or (iii) other documents setting out the requirements relating to (a) the custody and safekeeping of any CIS Property, or (b) the oversight of the operations of the relevant CIS.

[7] Amended Schedule 1 of the Securities and Futures (Financial Resources) Rules, set out under section 10 of the “Securities and Futures (Financial Resources) (Amendment) Rules 2023” (March 20, 2023), available at https://www.gld.gov.hk/egazette/pdf/20232712/es22023271256.pdf

[8] Amended rule 10B of the Securities and Futures (Client Money) Rules, set out under section 7 of the “Securities and Futures (Client Money) (Amendment) Rules 2023” (“CMR Amendment Rules”) (March 20, 2023), available at https://www.legco.gov.hk/yr2023/english/subleg/negative/2023ln055-e.pdf

[9] Amended rule 10C of the of the Securities and Futures (Client Money) Rules, set out under section 7 of the CMR Amendment Rules

[10] Amended rule 9B of the Securities and Futures (Client Securities) Rules, set out under section 6 of the “Securities and Futures (Client Securities) (Amendment) Rules 2023” (“CSR Amendment Rules”) (March 20, 2023), available at https://www.legco.gov.hk/yr2023/english/subleg/negative/2023ln054-e.pdf

[11] Amended rules 9C and 10A of the Securities and Futures (Client Securities) Rules, set out under sections 6 and 7 of the CSR Amendment Rules respectively

[12] Amended rule 3A of the Securities and Futures (Keeping of Records) Rules, set out under section 5 of the “Securities and Futures (Keeping of Records) (Amendment) Rules 2023” (“KKR Amendment Rules) (March 20, 2023), available at https://www.legco.gov.hk/yr2023/english/subleg/negative/2023ln057-e.pdf

[13] Amended rule 10 of the Securities and Futures (OTC Derivative Transactions – Reporting and Record Keeping Obligations) Rules, set out under section 4 of the “Securities and Futures (OTC Derivative Transactions – Reporting and Record Keeping Obligations) (Amendment) Rules 2023” (“OTCD Amendment Rules”) (March 20, 2023), available at https://www.legco.gov.hk/yr2023/english/subleg/negative/2023ln061-e.pdf

[14] Amended rule 11 of the Securities and Futures (OTC Derivative Transactions – Reporting and Record Keeping Obligations) Rules, set out under section 5 of the OTCD Amendment Rules

[15] Paragraph 26, 2019 Consultation Paper. The SFC’s MIC requirements are listed in the “Circular to Licensed Corporations Regarding Measures for Augmenting the Accountability of Senior Management” (December 16, 2016), available at https://apps.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=16EC68, and the related Frequently Asked Questions published by the SFC (last updated on January 26, 2022), available at https://www.sfc.hk/en/faqs/intermediaries/licensing/Measures-for-augmenting-senior-management-accountability-in-licensed-corporations

[16] “Code on Unit Trusts and Mutual Funds” (January 1, 2019), published by the SFC, available at https://www.sfc.hk/-/media/EN/assets/components/codes/files-current/web/codes/section-ii-code-on-unit-trusts-and-mutual-funds/section-ii-code-on-unit-trusts-and-mutual-funds.pdf

[17] “Code on Pooled Retirement Funds” (December 2021), published by the SFC, available at https://www.sfc.hk/-/media/EN/assets/components/codes/files-current/web/codes/code-on-pooled-retirement-funds/code-on-pooled-retirement-funds.pdf?rev=9badf81950734ee08c799832be6ff92b

[18] Section 6, Schedule 11

[19] Section 8, Schedule 11

[20] Section 9, Schedule 11

[21] Section 11, Schedule 11

[22] See section 14, Schedule 11 for the full list of safeguards.

[23] “Code on Real Estate Investment Trusts” (August 2022), published by the SFC, available at https://www.sfc.hk/-/media/EN/files/COM/Reports-and-surveys/REIT-Code_Aug2022_en.pdf?rev=572cff969fc344fe8c375bcaab427f3b

The following Gibson Dunn lawyers prepared this client alert: William Hallatt, Emily Rumble, and Jane Lu.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact any member of Gibson Dunn’s Global Financial Regulatory team, including the following members in Hong Kong:

William R. Hallatt (+852 2214 3836, whallatt@gibsondunn.com)

Emily Rumble (+852 2214 3839, erumble@gibsondunn.com)

Arnold Pun (+852 2214 3838, apun@gibsondunn.com)

Becky Chung (+852 2214 3837, bchung@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

The Financial Times recognized Gibson Dunn at the Europe Innovative Lawyer Awards 2023. The firm was selected as overall winner in the Responsible Business category for our work securing the release of Nazanin Zaghari-Ratcliffe from illegal detention in Iran. The firm was also recommended in the Private Capital category for our work advising KKR on its purchase of a minority stake in the fiber network spin-off of Telenor, and in connection with our work on behalf of a German client that was seeking to sell to a private equity buyer, in which our lawyers cut the time required to draft the legal “fact book” from weeks to three days. In addition, the firm was also recognized in the Supporting Refugees and Migrants category as part of the Afghan Pro Bono Initiative. The awards were presented on September 21, 2023.

The German weekly FOCUS recognized Gibson Dunn’s Frankfurt and Munich offices in its annual special issue, “Law and Advice.” The firm is recommended as “Top-Wirtschaftskanzlei 2023″ (top commercial law firm) in the Compliance, Corporate Law, and Mergers & Acquisitions categories. The feature was published on September 16, 2023.

Los Angeles partner Tiaunia Henry was honored at CenterForce’s 2023 Diversity, Equity & Inclusion Impact Awards with the DEI Leadership Award. CenterForce’s Driving Diversity in Law & Leadership Summit and Awards program took place on September 21, 2023 and recognized exceptional leaders throughout Los Angeles for their unwavering commitment to championing diversity, equity and inclusion. Tiaunia was also featured in a panel titled “Pulse Check: Benchmarking DEI Post Pandemic and What Does Success Look Like.”

Tiaunia has been an active member of the LA Area Diversity Committee since joining the firm in 2007. She has served as Co-Chair of Gibson’s LA Area Diversity Committee since 2012 and as Chair of the Affinity Groups for Black attorneys and Women of Color in Los Angeles as well as being actively involved in the Los Angeles Parenting Group. Tiaunia is also responsible for one of the Firm’s most successful diversity programs. She worked closely with Gibson’s Global Diversity Team to spearhead and launch the Diverse Perspectives in the Law Speaker Series, a firmwide program that explores our diverse attorneys’ experiences in navigating issues around race and inclusion throughout their lives and how it has shaped their careers in the legal profession.

Gibson Dunn antitrust practitioners discuss the proposed changes to the DOJ-FTC Merger Guidelines, along with potential implications for the HSR merger review process. The speakers also share practical advice and considerations for M&A going forward.

PANELISTS:

Christopher M. Wilson is a partner in the Antitrust and Competition Practice Group of Gibson Dunn. Mr. Wilson assists clients in navigating DOJ, FTC, and international competition authority investigations as well as private party litigation involving complex antitrust and consumer protection issues. Prior to joining Gibson Dunn, Mr. Wilson served in the Antitrust Division of the DOJ where he investigated and litigated high-profile merger matters.

Kristen Limarzi is a partner in the Antitrust and Competition Practice Group of Gibson Dunn. Her practice focuses on representing clients in merger and non-merger investigations before the DOJ, FTC, and foreign antitrust enforcers. Prior to joining Gibson Dunn, Ms. Limarzi served as a top enforcement official in the Antitrust Division of the DOJ, where she was a member of the small team of attorneys and economists from the Antitrust Division and the FTC that revised the Horizontal Merger Guidelines in 2010.

Zoë Hutchinson is an associate in the Antitrust and Competition Practice Group of Gibson Dunn. Ms. Hutchinson’s practice focuses on counseling clients on antitrust risk in proposed mergers, acquisitions, joint ventures and other business transactions. She has counseled clients across multiple industries including healthcare and life sciences, oil & energy, waste, technology and social media, and consumer goods.

MCLE CREDIT INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 1.0 credit hour, of which 1.0 credit hour may be applied toward the areas of professional practice requirement. This course is approved for transitional/non-transitional credit.

Attorneys seeking New York credit must obtain an Affirmation Form prior to watching the archived version of this webcast. Please contact CLE@gibsondunn.com to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 1.0 hour.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

The National Law Journal named Theane Evangelis as an Employment Law Trailblazer for her work on “the first and only successful challenge to California’s AB5.” The report was published on September 5, 2023.

Theane Evangelis is Co-Chair of the firm’s global Litigation Practice Group. She has served as lead counsel in a wide range of bet-the-company appellate, constitutional, class action, labor and employment, media and entertainment, and crisis management matters in trial and appellate courts across the country.

Starting January 1, 2024, California will be broadening its already expansive prohibitions on employee non-compete agreements. Senate Bill (SB) 699, signed into law on September 1, 2023, added Section 16600.5 to the Business & Professions Code, which expands California’s existing restrictions on non-competes to agreements created out-of-state and creates new enforcement rights for employees to challenge non-compete clauses.

California’s Business and Professions Code section 16600 currently voids contracts that restrain an employee from engaging in a lawful profession, trade, or business of any kind. State courts have historically applied Section 16600 to bar agreements made in California restricting post-employment competition, with limited exceptions.[1]

Section 16600.5 will prohibit enforcement of any contract previously forbidden under Section 16600 “regardless of where and when the contract was signed.” Plaintiffs may capitalize on this broad phrasing to argue that the new law should apply retroactively to any contract with non-compete provisions, and courts will likely have to clarify whether California’s presumption against retroactivity applies.[2] The new law will further bar “an employer or former employer from attempting to enforce a contract that is void regardless of whether the contract was signed and the employment was maintained outside of California.”[3] Employers that enter into a contract that is void or attempt to enforce a contract forbidden by Section 16600 will have committed a civil violation. The expanded restrictions are intended to (i) respond to an increasingly remote talent market, in which “California employers increasingly face the challenge of employers outside of California attempting to prevent the hiring of former employees”; and (ii) to preserve the state’s “competitive business interests” by “protecting the freedom of movement of persons whom California-based employers wish to employ to provide services in California, regardless of the person’s state of residence.”[4]

It remains to be seen how broadly Section 16600.5 will apply in practice, and whether jurisdictional challenges may limit its effect within and outside California. For example, employees who recently moved to California may cite Section 16600.5 in California courts to try to invalidate non-competes that they previously agreed to, even if such clauses were legally negotiated out-of-state with a non-California employer. Alternatively, remote workers employed in other states by California employers may try to invoke the provision in their local jurisdictions to invalidate non-competes formed outside of California, even if the employee never set foot in California. Of course, this raises the question of whether a non-California court will find Section 16600.5 to apply to an employee outside California. Section 16600.5 also raises the question of whether a California court has the authority to rule a non-compete is unenforceable even if the agreement complies with the law of the state in which it was made or has already been held enforceable by a non-California court. Employers should monitor whether and to what extent courts apply judicial principles of comity and extraterritoriality in adjudicating these types of cases.[5]

Employers should also be aware that the law authorizes employees, former employees, and prospective employees to seek injunctive relief, actual damages, or both, and entitles a prevailing plaintiff to recover reasonable attorneys’ fees and costs. But employers who prevail in litigation over restrictive covenants are not entitled under the new law to recover their fees against the losing individuals. Employers with ties to California are encouraged to review their employee agreements in light of this new law.

_____________________________

[1] Statutory exceptions to Section 16600 include restrictive covenants in the sale or dissolution of corporations, partnerships, and limited liability corporations. See Cal. Bus. & Prof. Code §§ 16601, 16602, 16602.5.

[2] Cal. Civ. Code, § 3; Evangelatos v. Super. Ct., 44 Cal. 3d 1188, 1208 (1988) (holding that a statute will not be applied retroactively unless it contains “an express retroactivity provision” or it is “very clear from extrinsic sources that the Legislature . . . must have intended a retroactive application”).

[3] 2023 Cal. S.B. No. 699 (2023-2024 Regular Session).

[4] Id. §§ 1 (d) & (f).

[5] See, e.g., Advanced Bionics Corp. v. Medtronic, Inc., 29 Cal. 4th 697, 706–07 (2002), as modified (Mar. 5, 2003) (applying the comity principle to reason that while “California has a strong interest in protecting its employees from noncompetition agreements” under section 16600, “[a] parallel action in a different state presents sovereignty concerns that compel California courts to use judicial restraint when determining whether they may properly issue a TRO against parties pursuing an action in a foreign jurisdiction.”); Ward v. United Airlines, Inc., 986 F.3d 1234, 1240 (9th Cir. 2021) (discussing the breadth of the extraterritoriality principle).

The following Gibson Dunn lawyers prepared this client alert: Tiffany Phan, Joseph Rose, Jason C. Schwartz, Katherine V. A. Smith, Stephen Weissman, and Yekaterina Reyzis.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Antitrust and Competition or Labor and Employment practice groups, or the following authors and practice leaders:

Tiffany Phan – Los Angeles (+1 213-229-7522, tphan@gibsondunn.com)

Joseph R. Rose – San Francisco (+1 415-393-8277, jrose@gibsondunn.com)

Rachel S. Brass – Co-Chair, Antitrust & Competition, San Francisco (+1 415-393-8293, rbrass@gibsondunn.com)

Stephen Weissman – Co-Chair, Antitrust & Competition, Washington, D.C. (+1 202-955-8678, sweissman@gibsondunn.com)

Jason C. Schwartz – Co-Chair, Labor & Employment Group, Washington, D.C.

(+1 202-955-8242, jschwartz@gibsondunn.com)

Katherine V.A. Smith – Co-Chair, Labor & Employment Group, Los Angeles

(+1 213-229-7107, ksmith@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Gibson Dunn has advised Zensho Holdings Co., Ltd., Japan’s premier food service company based on sales, on its acquisition of The Snowfox Group, a multi-channel international Japanese food service platform, for $621 million. The Snowfox Group’s global brands include Snowfox, Bento, Taiko and YO! in North America and the United Kingdom.

The Gibson Dunn M&A team was led by Scott Jalowayski, Till Lefranc, and Michelle Gourley. Rachel Brass, Sébastien Evrard, and Steve Pet advised on competition aspects, Carrie LeRoy advised on intellectual property, and Sandy Bhogal advised on tax. Joanne Hughes, Jordan Rex, Dominic Kinsky, and Luisa de Belgique advised on corporate aspects.

New York partner Mylan Denerstein and associate Lee Crain are authors of “Accessing the Courts: Why New York Should Eliminate the Dreaded, Needless and Unduly Complex ‘Certificate of Conformity” [PDF] published by the New York Law Journal on September 6, 2023.

We are pleased to provide you with the next edition of Gibson Dunn’s digital assets regular update. This update covers recent legal news regarding all types of digital assets, including cryptocurrencies, stablecoins, CBDCs, and NFTs, as well as other blockchain and Web3 technologies. Thank you for your interest.

Enforcement Actions

United States

On August 23, the Manhattan U.S. Attorney’s Office brought charges in the Southern District of New York against two developers of Tornado Cash, Roman Storm and Roman Semenov. Tornado Cash is a crypto application that obscures the source of assets transferred through it. Prosecutors allege that more than $1 billion was laundered through Tornado Cash, including hundreds of millions by North Korea’s Lazarus Group. Charges include conspiracy to engage in money laundering, conspiracy to violate U.S. sanctions targeting North Korea, and conspiracy to operate an unlicensed money transmitting business. Storm was arrested and released after posting bond. Also on August 23, the Office of Foreign Asset Control (OFAC) sanctioned Semenov and eight Ethereum addresses allegedly controlled by Semenov. Law360; Forbes; Indictment

- SEC Brings First Enforcement Actions Alleging NFTs Are Securities

On August 28, the U.S. Securities and Exchange Commission (SEC) issued an order simultaneously filing and settling charges against Impact Theory, LLC, a Los Angeles-based media company, related to its sales of non-fungible tokens (NFTs). Applying the Howey test, the SEC concluded that Impact Theory’s KeyNFTs were investment contracts primarily because Impact Theory’s marketing statements promised “tremendous value” and “massive” appreciation. As part of a settlement of the charges, the SEC ordered Impact Theory to disgorge over $5 million. SEC Commissioners Hester Pierce and Mark Uyeda issued a joint dissent from the order, arguing in part that the tokens were not investment contracts because they were not shares of the company and did not generate any type of dividend for purchasers. Order; Law360; CoinWire

Weeks later, on September 13, the SEC issued an order simultaneously filing and settling charges against Stoner Cats 2 LLC (SC2), alleging an unregistered securities offering in the form of profile-picture NFTs. The order states that SC2 raised approximately $8 million from the sale of around 10,000 NFTs to finance the animated web series Stoner Cats, starring Mila Kunis and Ashton Kutcher. In an accompanying press release, the SEC stated that the offering led “investors to expect profits because a successful web series could cause the resale value of the Stoner Cats NFTs in the secondary market to rise.” SC2 agreed to pay a $1 million fine and destroy all remaining NFTs in its possession. Commissioners Pierce and Uyeda dissented from this order as well, arguing that “the Stoner Cats NFTs are not that different from Star Wars collectibles sold in the 1970s” and that the order “carries implications for creators of all kinds.” Order; Press Release; CoinDesk

- CFTC Charges DeFi Platforms Over Crypto Derivatives

On September 7, the Commodity Futures Trading Commission (CFTC) issued orders simultaneously filing and settling charges against three decentralized finance (DeFi) trading platforms—Opyn, Inc., ZeroEx (0x), Inc., and Deridex, Inc.—for offering digital asset derivatives trading. The orders require Opyn, ZeroEx, and Deridex to pay civil penalties of $250,000, $200,000, and $100,000, respectively, and “cease and desist from violating the Commodity Exchange Act (CEA) and CFTC regulations.” The companies were all said by the CFTC to have cooperated in the investigation, getting a reduced penalty as a result. “The DeFi space may be novel, complex, and evolving, but the Division of Enforcement will continue to evolve with it and aggressively pursue those who operate unregistered platforms that allow U.S. persons to trade digital asset derivatives,” said Director of Enforcement Ian McGinley. Release; CoinDesk

- LBRY to Appeal Ruling That It Violated U.S. Securities Law

On September 7, crypto file-sharing protocol LBRY filed a notice of appeal of a New Hampshire federal court’s decision that it failed to register the sale of its native LBRY tokens (LBC) with the SEC. The court’s final judgment ordered LBRY to pay a $111,614 civil penalty and barred it from participating in any unregistered crypto securities offerings in the future. “LBRY is appealing the [court’s] decision because it is unjust and incorrect,” said CEO Jeremy Kauffman. LBRY previously indicated that it would shut down following the July 11 ruling. Notice of Appeal; CoinDesk; CoinTelegraph

- Former FTX Executive Ryan Salame Pleads Guilty Ahead of Bankman-Fried Trial

On September 7, former top FTX executive Ryan Salame pleaded guilty to one count of conspiracy to operate an unlicensed money transmitting business and one count of conspiracy to make unlawful political contributions and defraud the Federal Election Commission. Salame faces a maximum of 10 years in prison. He also has agreed to forfeit up to $1.5 billion and make restitution of $5.6 million to FTX debtors. His sentencing is set for March 6, 2024. This plea comes less than one month before Sam Bankman-Fried, co-founder of FTX, is set to go to trial on October 2. Salame’s attorney previously told prosecutors he would invoke his Fifth Amendment rights against self-incrimination if called as a witness against Bankman-Fried at trial. CNN; Reuters; New York Times

- Former OpenSea Head of Product Receives Three-Month Prison Sentence for NFT Insider Trading

On August 23, Nate Chastain, the former Head of Product at OpenSea, the NFT trading platform, was sentenced to three months in prison for making around $50,000 by trading NFTs that he knew would be featured on the OpenSea homepage. In May, he was convicted by a jury of wire fraud and money laundering in what is considered the first insider-trading case involving digital assets. Prosecutors had sought a two-year prison sentence, but U.S. District Judge Jesse Furman imposed a shorter sentence based on Chastain’s limited profits. Judge Furman also sentenced Chastain to 200 hours of community service following his imprisonment, a $50,000 fine, and forfeiture of 15.98 ether. Reuters; Crypto News

Regulation and Legislation

United States

- Treasury and IRS Propose Tax-Reporting Rules for Crypto Industry

On August 25, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) released controversial proposed regulations governing tax-reporting requirements for the crypto industry. The long-awaited regulations would broaden the definition of “broker” to encompass digital asset trading platforms, payment processors, wallet providers, and “some” DeFi platforms. Under the proposed regulations, starting on January 1, 2025, these entities would be subject to similar tax reporting rules as brokers for securities and other financial instruments. The proposal exempts crypto miners from these requirements. The proposed regulations are open for public comment until October 30. The proposed regulations were criticized by Chairman Patrick McHenry (R-NC) of the House Financial Services Committee as “an attack on the digital asset ecosystem.” Treasury; IRS; Axios; WSJ

- FASB Announces New Bitcoin Accounting Rules

On September 6, the Financial Accounting Standards Board (FASB) announced forthcoming accounting rules under which companies that hold or invest in cryptocurrencies will be required to report their holdings at fair value. This would allow companies to recognize gains and losses in cryptocurrencies immediately, as they would with other financial assets. This change is widely seen as an improvement over the current practice of treating cryptocurrencies as indefinite-lived intangible assets. The forthcoming rules include other requirements as well, including that companies must make a separate entry in their financial statements for cryptocurrencies. The accounting rules will be mandatory for all companies—public and private—for fiscal years beginning after December 15, 2024, including interim periods within those years. WSJ; Bloomberg

International

- UK Crypto Firms Can Apply for Extra Time to Comply with New Restrictions on Crypto Promotions

On September 7, the UK’s Financial Conduct Authority (FCA) announced that UK crypto firms could be given an extra three months to implement new restrictions on crypto promotions. The “[t]ough new rules designed to make the marketing of cryptoasset products clearer and more accurate” are set to take effect on October 8, but can be delayed until January 2024 for otherwise compliant firms to develop the right technical setup. The FCA said that it still intends to take enforcement action against overseas or unregulated firms that continue to unlawfully market to UK consumers starting October 8. Release; CoinDesk

- Travel Rule Regulation Goes into Force in the UK for Crypto Asset Firms

On September 1, a new rule requiring crypto firms in the UK to comply with the Financial Action Task Force’s Travel Rule went into effect. The UK Travel Rule requires UK-based Virtual Asset Service Providers (VASPs) to collect, verify, and share information on domestic and cross-jurisdictional transactions. According to an FCA statement, crypto businesses domiciled in the UK are required to “comply with the rule when sending or receiving a cryptoasset transfer to a firm that is in the UK, or any jurisdiction that has implemented the Travel Rule.” If information is missing or incomplete, businesses must make a risk-based assessment before releasing the cryptoassets to the beneficiary. FCA Statement; The Block

Civil Litigation

United States

- D.C. Circuit Vacates SEC Denial of Grayscale Bitcoin ETF as Arbitrary and Capricious

On August 29, the U.S. Court of Appeals for the D.C. Circuit ruled that the SEC will have to take another look at Grayscale Investments’ application to list a bitcoin exchange-traded product (ETP), because the SEC’s rejection of the submission was “arbitrary and capricious” and thus violated the Administrative Procedure Act. The three-judge panel’s unanimous ruling was authored by Judge Neomi Rao (a President Trump appointee) and was joined by Judges Edwards and Srinivasan (President Carter and Obama appointees, respectively). The court concluded that the SEC “failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s” proposed spot product, and rejected every rationale offered by the SEC for treating bitcoin spot ETPs differently than comparable bitcoin futures products. “In the absence of a coherent explanation,” the court concluded, “this unlike regulatory treatment of like products is unlawful.” The court’s ruling requires the SEC to reconsider Grayscale’s application, but it does not require the SEC to approve the application. Opinion; Law360; Barron’s

- Federal Court Dismisses Uniswap Class Action

On August 30, U.S. District Court Judge Katherine Polk Failla dismissed a class action suit brought against Uniswap and its developers and investors by users claiming that they lost money on scam tokens sold on the Uniswap platform. In dismissing the claims, Judge Failla reasoned in part that “the identities of the Scam Token issuers are basically unknown and unknowable” due to Ethereum’s “decentralized nature,” and that the plaintiffs’ claims therefore were akin to “attempting to hold an application like Venmo or Zelle liable for a drug deal that used the platform to facilitate a fund transfer.” Judge Failla also rejected the plaintiffs’ claims that Uniswap was liable for the losses under the Securities Exchange Act of 1934, refusing to “stretch the federal securities laws to cover the conduct alleged.” In rejecting the securities-law claims, Judge Failla stated in passing that ether and bitcoin are “crypto commodities,” potentially suggesting that she believes those assets are not subject to the securities laws at all. Judge Failla also is presiding over the SEC’s enforcement action against Coinbase. Opinion; Fortune; Bitcoinist

- New York Federal Court Holds that Electronic Fund Transfer Act Does Not Apply to Certain Crypto Transactions

On August 11, Judge Lewis J. Liman dismissed a claim asserting that the Electronic Fund Transfer Act (EFTA) applies to cryptocurrency transactions. In Yuille v. Uphold HQ, Inc., No. 1:22-cv-07453 (S.D.N.Y. Aug. 11, 2023 ), a Michigan retiree sued Uphold HQ, a crypto trading platform and wallet provider, after a hacker drained $5 million from his account. The plaintiff argued in part that Uphold HQ failed to meet the requirements of the EFTA, which imposes obligations on financial institutions to expeditiously investigate and correct errors related to electronic fund transfers. Earlier this year, a different judge in separate suit against Uphold held that the term “electronic funds transfer” in the EFTA was capacious enough to include crypto transactions. Rider v. Uphold HQ Inc., 2023 WL 2163208 (S.D.N.Y. Feb. 22, 2023) (Cote, J.). Instead of resolving that issue, Judge Liman held that the plaintiff’s transactions fell outside the EFTA because his crypto wallet was not an “account,” which is defined under the Act to include only accounts “established primarily for personal, family, or household purposes.” Judge Liman held that the plaintiff’s crypto wallet account was instead established primarily for profit-making purposes. Opinion; Law360

- Gemini Earn Customers Could Recover All Funds in New Proposed Renumeration Scheme

On September 13, bankrupt crypto lender Genesis and its parent company Digital Currency Group (DCG) filed a new proposed remuneration plan. Genesis and DCG stated that, under the proposal, over 230,000 creditors who used Gemini’s Earn program “are estimated to recover approximately 95-110% of their claims.” Gemini Earn was an investment program implemented by crypto exchange Gemini with financing from Genesis. Gemini Earn customers were affected when Genesis was forced to freeze withdrawals and its lending arm—Genesis Global Holdco LLC—filed for bankruptcy in January 2023. DCG hopes to file an amended version of the proposed plan by October 6, and solicit votes by December 5. On September 15, Gemini issued a statement criticizing the proposed plan as “misleading at best and deceptive at worst.” Gemini stated that “[r]eceiving a fractional share of interest and principal payments over seven years from an incredibly risky counterparty . . . is not even remotely equivalent to receiving the actual cash and digital assets owed today by Genesis to the Gemini Lenders.” Proposed Agreement; CoinTelegraph; CoinDesk; Gemini Filing

Speaker’s Corner

United States

- Former SEC Chair Says Spot Bitcoin ETF Approval Is ‘Inevitable’

On September 1, former SEC chair Jay Clayton appeared on CNBC Television to discuss the SEC’s deferral of bitcoin ETP applications: “It is clear that bitcoin is not a security. It is clear that bitcoin is something that retail investors want access to, institutional investors want access to, and, importantly, some of our most trusted providers who are fiduciaries or have duties of best interest want to provide this product to the retail public. So I think [spot bitcoin ETP] approval is inevitable,” Clayton told CNBC. Clayton’s comments follow a federal court’s ruling in Grayscale v. SEC (discussed above) that there was no justification for the SEC to allow bitcoin futures-based ETPs but deny spot bitcoin ETPs. CNBC; The Block; Grayscale Opinion

- SEC Chair Gary Gensler Testifies Before Senate Banking Committee

On September 12, SEC Chair Gary Gensler testified before the Senate Banking Committee in an SEC oversight hearing. In his prepared testimony, Gensler maintained his stance that most cryptocurrencies qualify as securities that should be regulated by the SEC: “As I’ve previously said, without prejudging any one token, the vast majority of crypto tokens likely meet the investment contract test.” Gensler also reiterated his strong criticism of the crypto industry: “I’ve never seen a field that’s so rife with misconduct,” said Gensler. “It’s daunting.” The most substantive discussion on digital assets came during questioning from Senator Cynthia Lummis (R-WY), who expressed concerns over Gensler issuing an SEC staff bulletin that would require companies to report customer crypto assets on their balance sheets. Also during the hearing, Chairman Sherrod Brown (D-OH) was highly critical of the crypto industry. “The problems we saw at FTX are everywhere in crypto—the failure to provide real disclosure, the conflicts of interest, the risky bets with customer money that was supposed to be safe,” said Brown. Brown also praised the SEC’s approach to regulating crypto: “I’m glad the SEC is using its tools to crack down on abuse and enforce the law.”

Gensler is scheduled to testify next before the House Financial Services Committee on September 27. These scheduled appearances follow mounting criticism from lawmakers over the SEC’s approach to regulating crypto, which they argue prioritizes enforcement over providing clear guidance. Sept. 12 Prepared Testimony; Sept. 12 Hearing; CryptoSlate; CryptoNews

International

- Chinese Central Bank Official Says China’s Digital Yuan Must Be Available in All Retail Scenarios

During a trade forum in Beijing on September 3, Changchun Mu, the head of the digital currency research institute at the People’s Bank of China, said that an essential step for the development of China’s digital yuan “is to use digital yuan as the payment tool for all retail scenarios.” Although the digital yuan is being tested in pilot regions across China, it remains far from achieving widespread adoption. “In the short term, we can start by unifying QR code standards on a technical level to achieve barcode interoperability,” Mu added. Mu’s comments follow the Chinese central bank’s pledge last year to push for universal QR payment codes. The use of QR code payment systems, dominated by WeChat Pay and Alipay, is already widespread in China. The Block; CoinTelegraph

Other Notable News

- SEC Defers Decisions on All Bitcoin ETFs

On August 31, the SEC delayed until October its decisions on all pending applications for a spot bitcoin exchange-traded product, which have been filed by BlackRock, Grayscale Investments, and others. The SEC’s decisions come days after Grayscale won a key victory over the SEC (discussed above), which many have viewed as clearing a path for the long-awaited product. Bloomberg; CoinDesk; PiOnline

- Visa to Use Solana and USDC Stablecoin to Boost Cross-Border Payments

On September 5, Visa announced that it has expanded its stablecoin settlement capabilities with Circle’s USDC stablecoin to the Solana (SOL) blockchain. According to its statement, Visa is one of the first major financial institutions to use the Solana network at scale for settlements. “By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we’re helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury,” said Cuy Sheffield, head of crypto at Visa, in a statement. CoinDesk; The Block

- Vitalik Buterin Co-Authors Paper on Regulation-Friendly Tornado Cash Alternative

On September 9, Ethereum co-founder Vitalik Buterin published a research paper that he co-authored with Ethereum core developer Ameen Soleimani, researcher Jacob Illum from blockchain analytics firm Chainalysis, and academics Matthias Nadler and Fabian Schar. The paper proposes a privacy protocol called Privacy Pools. The core idea of the proposal is to allow users to publish a zero-knowledge proof, demonstrating that their funds do not originate from unlawful sources, without publicly revealing their entire transaction graph. The authors argue that this proposal, if implemented, could allow financial privacy and regulation to co-exist. SSRN; The Block

- FTX, BlockFi, and Genesis Claimant Data Breached in Cyberattack

On August 25, Kroll LLC, announced that cybercriminals exposed data belonging to claimants in the FTX, BlockFi, and Genesis Global Holdco bankruptcies following a sophisticated cyberattack directed against Kroll employees. Kroll stated that a cybercriminal targeted a cell phone account belonging to one of its employees “in a highly sophisticated ‘SIM swapping’ attack.” Law360; CoinDesk

- Ant Group Launches Overseas Blockchain Brand ZAN

On September 8, Ant Group—the owner of the world’s largest mobile payment platform, Alipay—launched ZAN, a new blockchain service aimed at Hong Kong and overseas markets. According to the official press release, ZAN “comprises of a full suite of blockchain application development products and services for both institutional and individual Web3 developers.” ZAN will also provide “a series of technical products, including electronic Know-Your-Customer (eKYC), Anti-Money Laundering (AML) and Know-Your-Transactions (KYT), to help Web3 businesses build up their capabilities in customer identity authentication, security protection and risk management.” Press Release; CoinTelegraph; The Block

The following Gibson Dunn lawyers prepared this client alert: Ashlie Beringer, Stephanie Brooker, Jason Cabral, M. Kendall Day, Jeffrey Steiner, Sara Weed, Ella Capone, Grace Chong, Chris Jones, Jay Minga, Nick Harper, Apratim Vidyarthi, Alexis Levine, Zachary Montgomery, and Tin Le.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s FinTech and Digital Assets practice group, or the following:

FinTech and Digital Assets Group:

Ashlie Beringer, Palo Alto (650.849.5327, aberinger@gibsondunn.com)

Michael D. Bopp, Washington, D.C. (202.955.8256, mbopp@gibsondunn.com

Stephanie L. Brooker, Washington, D.C. (202.887.3502, sbrooker@gibsondunn.com)

Jason J. Cabral, New York (212.351.6267, jcabral@gibsondunn.com)

Ella Alves Capone, Washington, D.C. (202.887.3511, ecapone@gibsondunn.com)

M. Kendall Day, Washington, D.C. (202.955.8220, kday@gibsondunn.com)

Michael J. Desmond, Los Angeles/Washington, D.C. (213.229.7531, mdesmond@gibsondunn.com)

Sébastien Evrard, Hong Kong (+852 2214 3798, sevrard@gibsondunn.com)

William R. Hallatt, Hong Kong (+852 2214 3836, whallatt@gibsondunn.com)

Martin A. Hewett, Washington, D.C. (202.955.8207, mhewett@gibsondunn.com)

Michelle M. Kirschner, London (+44 (0)20 7071.4212, mkirschner@gibsondunn.com)

Stewart McDowell, San Francisco (415.393.8322, smcdowell@gibsondunn.com)

Mark K. Schonfeld, New York (212.351.2433, mschonfeld@gibsondunn.com)

Orin Snyder, New York (212.351.2400, osnyder@gibsondunn.com)

Jeffrey L. Steiner, Washington, D.C. (202.887.3632, jsteiner@gibsondunn.com)

Eric D. Vandevelde, Los Angeles (213.229.7186, evandevelde@gibsondunn.com)

Benjamin Wagner, Palo Alto (650.849.5395, bwagner@gibsondunn.com)

Sara K. Weed, Washington, D.C. (202.955.8507, sweed@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Asian Legal Business named Gibson Dunn the “Tax and Trusts Firm of the Year” at the ALB Hong Kong Law Awards 2023. The awards recognize the exceptional performance of private practitioners and in-house counsel in Hong Kong. The awards were presented on September 15, 2023.

Gibson, Dunn & Crutcher’s Hong Kong office provides an extensive range of U.S., Hong Kong and English legal advice to global and Asia-based clients. We offer our clients all the advantages of deep local expertise combined with the strengths of a global firm. Our lawyers handle some of the most challenging and complex transactions, regulatory matters and disputes across Asia. Lawyers in the office have lived and worked in the region for many years and possess an in-depth understanding of Hong Kong’s legal and business culture. The Hong Kong team works closely with our Beijing and Singapore offices to provide complete and seamless legal services throughout Asia.

Gibson, Dunn & Crutcher LLP is pleased to announce that Kavita Davis has joined its Global Finance Practice Group as a partner in the London office.

Kavita focuses on cross-border debt finance matters, and has significant experience in advising on leveraged buyouts representing sponsors, including sponsors focusing on infrastructure transactions. She received her B.A., LL.B. (Hons) from the W.B. National University of Juridical Sciences in India, and is admitted as a solicitor in England and Wales.

Federico Fruhbeck, Co-Chair of Gibson Dunn’s Projects and Infrastructure Practice Group and Head of Private Equity in Europe, said: “Our lawyers know Kavita well, having worked closely with her on complex cross-border deals. Her practice has a great number of synergies with groups around the firm, as is evident, for example, with her significant experience representing sponsor clients in private equity acquisitions in the infrastructure, industrial and real assets space.” Doug Horowitz, Co-Chair of Gibson Dunn’s Global Finance Practice Group added: “Beyond being especially well known in the global infrastructure finance world, Kavita’s broad finance skill set allows her to be immediately impactful to our clients around the globe with English law finance needs.”

Penny Madden, Co-partner in charge of Gibson Dunn’s London office, said: “We are excited to welcome Kavita to the firm and to the London office. Over the last few years we have attracted fantastic talent to join our growing transactional practices in London, and her arrival strengthens our finance bench, allowing us to expand our offering to clients around the globe.”

Kavita noted: “It is a fantastic time to be joining Gibson Dunn’s growing finance practice and the firm’s focus on infrastructure transactions was a particular draw.”

Kavita’s hire follows a period of growth for Gibson Dunn’s Finance Practice Group over the past year, including with the arrivals of partners Doug Horowitz and Jin Hee Kim in New York; Frederick Lee in Dallas; Chad Nichols in Houston/New York; Ben Shorten and Trinh Chubbock in London; and Darko Adamovic in Paris. Her arrival also complements the strategic build out of the Projects and Infrastructure Practice Group, with high profile hires including Federico Fruhbeck, Alice Brogi, Rob Dixon, Wim De Vlieger, Till Lefranc and Isabel Berger in London; and Marwan Elaraby, Renad Younes, Laleh Shahabi, Jade Chu and Samuel Ogunlaja in the UAE.

Over the last two weeks, both the House of Commons and the House of Lords have considered the Economic Crime and Corporate Transparency Bill (“the Bill”). The government has described the Bill as the most significant reform of the identification doctrine in more than 50 years and the proposals have been welcomed by the UK’s Serious Fraud Office.

Although there is an outstanding point of contention for corporate criminal liability reform relating to the scope of the failure to prevent fraud offence, and in particular, whether it should be limited to large organisations, or expanded to non-micro organisations, the Bill is now in the final stages of its passage through Parliament and some commentators have indicated it could receive royal assent before the end of this year.

|

Key Takeaways

|

The identification principle – the current position

With the exception of a small number of specific offences, including the existing failure to prevent offences under the Bribery Act 2010 and the Criminal Finances Act 2017, in order for a corporate entity to be held criminally liable for the actions of an individual, that individual must be the “directing mind and will” of the corporate entity. This is called the “identification principle”.

The leading case on the identification principle is Tesco Supermarkets Ltd v Nattrass,[1] which states that one has to identify “those natural persons who by the memorandum and articles of association or as a result of action taken by the directors, or by the company in general meeting pursuant to the articles, are entrusted with the exercise of the powers of the company”, also referred to as the primary rule of attribution.

The principle has been narrowly applied and prosecutors have had difficulty satisfying the test in a number of high profile cases including The Serious Fraud Office v Barclays PLC and Barclays Bank PLC.[2] In that case, Davis LJ found that despite the defendants being senior executive directors and two of those defendants being on the board, their actions could not be attributed to Barclays because they had not been delegated entire authority to complete the relevant acts. Davis LJ noted that the “status” of an individual is a relevant consideration, but the focus should be on the particular authority bestowed by the company for the performance of the particular function in question.

The Barclays case and others like it have triggered debate about whether the identification principle, now over fifty years old, is fit for purpose when dealing with large multinational companies with complex management structures. As it stands, smaller companies with simpler structures are more exposed to criminal prosecution given the relative ease in demonstrating which individuals control and direct the company’s actions. This has prompted concern that larger companies are not being held to account for criminal wrongdoing carried out on their behalf. The proposals to reform corporate criminal liability laws, discussed below, seek to address these difficulties.

Proposed reforms

1. New approach to “attributing criminal liability for economic crimes to certain bodies”

Rather than relying on the identification principle, under the new legislation, the corporate entity will be liable for actions committed by a “senior manager” acting within the actual or apparent scope of their authority.

“Senior manager” is defined as an individual who plays a significant role in:

- the making of decisions about how the whole or a substantial part of the activities of the body corporate or partnership are to be managed or organised, or

- the actual managing or organising of the whole or a substantial part of those activities.[3]

This definition is adopted from the Corporate Manslaughter and Corporate Homicide Act 2007. The Explanatory Notes to the Corporate Manslaughter and Corporate Homicide Act 2007 state that this covers both individuals in the direct chain of management, and those in, for example, strategic or regulatory compliance roles.[4] The practical impact is that the pool of potential employees whose criminal conduct could be attributed to a corporate body is widened potentially very substantially.

At this stage, the reforms to the way in which liability is attributed to an organisation will only apply to economic crimes specified in the Bill, such as offences relating to fraud, bribery, theft, false accounting and concealing criminal property.[5] However, whilst the current focus is on economic crimes (which reportedly make up over 40% of crime in the UK[6]), the government has “committed in the Economic Crime Plan 2 and the Fraud Strategy to introduce reform of the identification principle to all criminal offences in due course”.[7]

The explanatory notes to amendments made by the House of Lords following the third reading in July 2023 state that the Bill “ensures that criminal liability will not attach to an organisation based and operating overseas for conduct carried out wholly overseas, simply because the senior manager concerned was subject to the UK’s extraterritorial jurisdiction: for instance, because that manager is a British citizen […] However, certain offences, regardless of where they are committed, can be prosecuted against individuals or organisations who have certain close connections to the UK. Any such test will still apply to organisations when the new rule applies”.[8]

The reform of the identification principle is intended to make it easier for authorities to pursue corporates for primary fraud and bribery offences rather than just failure to prevent offences. Although “senior manager” is now defined, it will still be subject to judicial interpretation and the courts may favour a narrow interpretation, as in The Serious Fraud Office v Barclays PLC and Barclays Bank PLC.[9] The government has also concluded in its Impact Assessment that whilst the reforms to the identification principle are expected to increase the number of corporate prosecutions, the number of additional cases is expected to be low.[10]

2. Failure to prevent fraud

In addition to broadening the general scope for corporate criminal liability, a new corporate offence of failure to prevent fraud will also be introduced. This new offence borrows from both the existing offences of failure to prevent bribery under the Bribery Act 2010 and failure to prevent the facilitation of tax evasion under the Criminal Finances Act 2017.

Under the new offence, if they meet specific criteria, large corporates and partnerships will be held criminally liable where:

- a specified fraud offence is committed by an employee or agent (such as fraud by false representation, fraud by abuse of position or fraud by failing to disclose information); and

- the offence benefits the organisation.

The prosecution must establish both limbs of the offence set out above. However the company will have a defence if it can show it either had “reasonable procedures” in place to prevent the fraud, or that it was not reasonable to have relevant procedures at all. This is said to place a lesser burden on organisations than the requirement to have “adequate procedures” under the Bribery Act 2010.[11] As with the Bribery Act and the Criminal Finances Act there is a requirement for the government to issue “guidance about procedures that relevant bodies can put in place to prevent persons associated with them from committing fraud offences”.[12] This has not yet been issued but it is likely to include detailed policies, procedures and training.

The House of Lords disagreed with the House of Commons that the failure to prevent fraud offence should only apply to large organisations. They voted to amend the Bill so that the offence applies to “non-micro organisations” which satisfy two or more of the following conditions in a financial year: (i) turnover of more than £632,000 and less than £36 million; (ii) a balance sheet total of more than £316,000 and less than £18 million; and (iii) more than 10 but less than 250 employees.[13] In support of this amendment, Lord Garnier referred to the fact there is no exemption for small and medium enterprises for the offence of failure to prevent bribery and proposed that only the very smallest and newest commercial organisations should be exempted from the failure to prevent regime.[14] The Commons rejected these amendments on Wednesday 13 September and the Bill has been returned to the Lords for further consideration.

Extraterritorial reach

The failure to prevent fraud offence has wide extraterritorial effect, applying to a body corporate or a partnership wherever they are incorporated or formed.[15] The government factsheet summarising the failure to prevent fraud offence explains that: “if an employee commits fraud under UK law, or targeting UK victims, their employer could be prosecuted, even if the organisation (and the employee) are based overseas”.[16]

Impact

The failure to prevent fraud offence is making headlines and will inevitably need to be given serious consideration by large organisations. The new legislation is designed to close “loopholes that have allowed organisations to avoid prosecution in the past”.[17]

The government believes that the changes will “result in a deterrent effect where increased awareness and corporate liability may deter would-be fraudsters”. [18] Perhaps most compellingly, the government intends that the legislation will create cultural change and encourage the development of an anti-fraud culture within organisations.[19]

Post-legislative scrutiny of the Bribery Act 2010 identified a changing and improved corporate anti-bribery culture following the introduction of the failure to prevent bribery offence. The government hopes that the proposed changes will have a similar impact for fraud and will promote a corporate culture in which fraud detection and prevention are encouraged.[20]

It is not clear how many prosecutions the failure to prevent fraud offence will give rise to – the Serious Fraud Office (“SFO”) has only prosecuted two corporations for failure to prevent bribery since the Bribery Act came into force in 2011.[21] On the other hand, the offence of failure to prevent bribery has featured in nine of the twelve deferred prosecution agreements (“DPAs”) entered into since DPAs were introduced in February 2014. The SFO is likely to take a similar approach to prosecuting failure to prevent fraud offences.

Practical steps

In anticipation of the Economic Crime and Corporate Transparency Act coming into force, we have set out some practical steps to be considered:

- Risk assessments: carry out and document appropriate risk assessments, identifying relevant fraud risks.

- Reasonable policies and procedures: identify and update relevant existing policies or introduce new policies to ensure the new offences are taken into account and to mitigate the fraud risks identified in the risk assessment.

- Reporting: ensure appropriate channels are in place for reporting suspicions of fraud.

- Identification of potential senior managers: identify which individuals and roles may fall into the definition of “senior manager”. Ensure those individuals receive adequate training on fraud risk and applicable policies and procedures and are appropriately monitored.

- Raising awareness within the company: provide adequate training to employees to embed fraud policies and procedures and ensure that employees are aware of appropriate channels for reporting suspicions of fraud. Records of this training should be retained.

- Ongoing monitoring: procedures should be put in place for the ongoing monitoring of fraud risk, compliance with relevant policies and procedures (including the effectiveness of fraud detection processes), and the conduct of individuals. Companies should monitor and review their effectiveness on a regular basis to ensure that necessary improvements are made when required.

Whilst the timeline for the Bill receiving royal assent and being implemented is uncertain, it is important to understand the proposed changes and how to prepare for their implementation. The reforms demonstrate a cultural change and appetite for greater scrutiny of corporate entities. It will be interesting to see how they are used by law enforcement authorities once the Bill is passed.

Irrespective of the final content of the Bill, there is no doubt that it is a significant change for the corporate criminal liability landscape within the UK.

_____________________________

[1] [1972] AC 153.

[2] [2018] EWHC 3055 (QB).

[3] https://bills.parliament.uk/publications/51963/documents/3729.

[4] https://www.legislation.gov.uk/ukpga/2007/19/section/1/notes?view=plain.

[5] https://bills.parliament.uk/publications/51963/documents/3729.

[6] https://www.gov.uk/government/publications/fraud-strategy/fraud-strategy-stopping-scams-and-protecting-the-public.

[7] https://www.gov.uk/government/publications/economic-crime-and-corporate-transparency-bill-2022-factsheets/factsheet-identification-principle-for-economic-crime-offences.

[8] https://hansard.parliament.uk/lords/2023-06-27/debates/EF8264AF-6478-470E-8B37-018C4B278F6E/EconomicCrimeAndCorporateTransparencyBill.

[9] [2018] EWHC 3055 (QB).

[12] Section 203 of the Bill https://bills.parliament.uk/publications/51963/documents/3729.

[13] https://publications.parliament.uk/pa/bills/cbill/58-03/0363/220363.pdf.

[14] https://hansard.parliament.uk/Lords/2023-09-11/debates/181F85C9-5619-4DAF-BD42-327C0DAF036F/EconomicCrimeAndCorporateTransparencyBill.

[15] https://bills.parliament.uk/publications/52462/documents/3896.

[16] https://www.gov.uk/government/publications/economic-crime-and-corporate-transparency-bill-2022-factsheets/factsheet-failure-to-prevent-fraud-offence.

[17] https://www.gov.uk/government/publications/economic-crime-and-corporate-transparency-bill-2022-factsheets/factsheet-failure-to-prevent-fraud-offence.

[19] https://bills.parliament.uk/publications/50688/documents/3279.

[20] https://bills.parliament.uk/publications/50688/documents/3279.

[21] https://bills.parliament.uk/publications/50688/documents/3279.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact the Gibson Dunn lawyer with whom you usually work, any member of Gibson Dunn’s White Collar Defense and Investigations practice group, or the following authors in London:

Michelle M. Kirschner (+44 20 7071 4212, mkirschner@gibsondunn.com)

Matthew Nunan (+44 20 7071 4201, mnunan@gibsondunn.com)

Allan Neil (+44 20 7071 4296, aneil@gibsondunn.com)

Patrick Doris (+44 20 7071 4276, pdoris@gibsondunn.com)

Maria Bračković (+44 20 7071 4143 mbrackovic@gibsondunn.com)

Amy Cooke (+44 20 7071 4041, acooke@gibsondunn.com)

Rebecca Barry (+44 20 7071 4086, rbarry@gibsondunn.com)

We have seen many notable developments in securities law during the first half of 2023 across a number of different areas. This update provides an overview of those major developments in federal and state securities litigation since our 2022 Year-End Securities Litigation Update:

- We discuss major Supreme Court decisions from October Term 2022, and preview several significant grants of certiorari. In addition, we examine circuit court-level developments that may end up before the Supreme Court.

- We review significant developments in Delaware corporate law, including a number of decisions concerning fiduciary duties in the context of a merger or acquisition, and the intersection of Unocal, Schnell, and Blasius when board action implicates the stockholder franchise.

- We examine developments in federal securities litigation involving special purpose acquisition companies (“SPACs”). As fewer SPAC IPOs and de-SPAC transactions occur, relative to the peak in 2021, we have also seen fewer new SPAC-related cases filed. Earlier SPAC-related litigation continues to proceed through courts—we discuss a proposed class action settlement and two recent decisions on statutory standing.

- We examine developments in securities litigation involving environmental, social, and corporate governance (“ESG”) allegations.

- We survey litigation in the cryptocurrency space as courts continue to grapple with the application of securities laws to cryptocurrencies.

- We discuss the shareholder activism landscape, including recent proxy battles and new SEC regulations related to shareholder proposals and proxy elections that could potentially encourage shareholder activists going forward.

- We continue to monitor the emergence of a potential circuit split regarding the Supreme Court’s 2019 decision in Lorenzo, which allows scheme liability under Rule 10b-5(a) and (c) even if the disseminator did not “make” the statement within the meaning of Rule 10b-5(b). As discussed in our 2022 Mid-Year Securities Litigation Update, a number of courts have grappled with the effects of Lorenzo. In particular, the Second Circuit in SEC v. Rio Tinto provided some clarity for district courts within the Circuit by finding that “something extra” is required beyond misstatements for there to be scheme liability. A recent district court opinion in California, however, acknowledged that the Ninth Circuit has not adopted Rio Tinto.

- Finally, we discuss the Second Circuit’s long-awaited decision in Arkansas Teacher Retirement System v. Goldman Sachs Group, Inc., and a district court’s application of Goldman Sachs Group, Inc. v. Arkansas Teacher Retirement System in denying class certification in part.

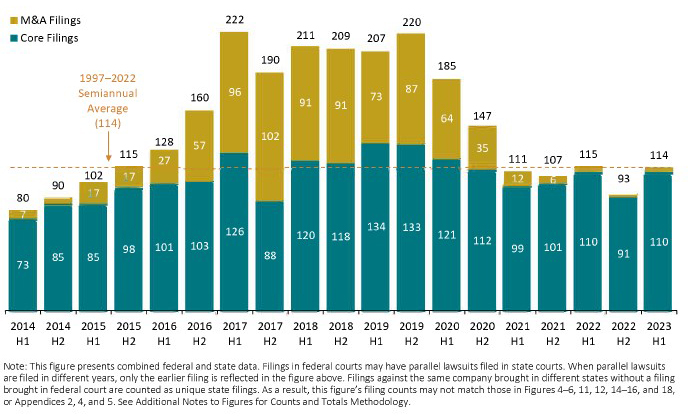

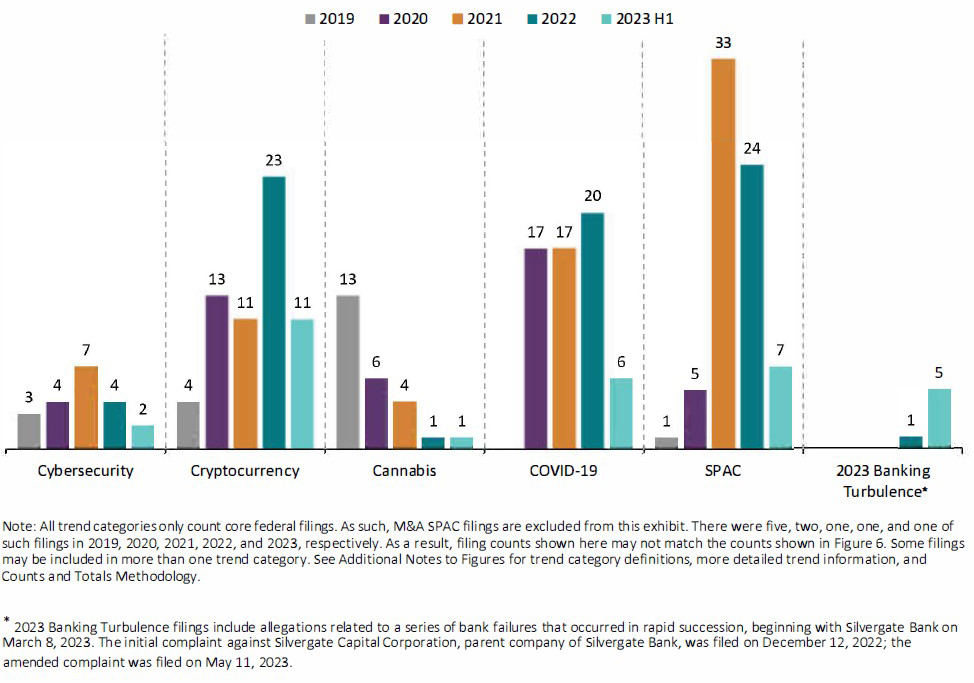

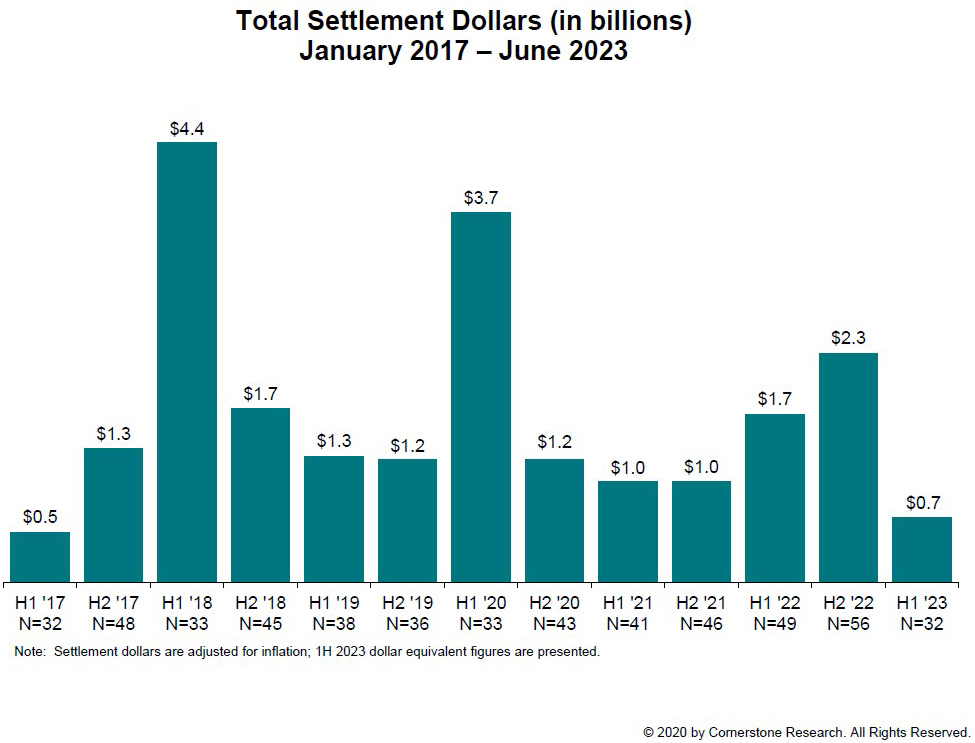

I. Filing and Settlement Trends

With thanks to analysis from Cornerstone Research, new filings have increased from 93 total securities class action filings in the first half of 2022 to 114 filings in the first half of 2023. Although the median value of settlements has increased compared to the same period in 2022, the number and total value of settlements are lower than any year since 2017. SPAC-, COVID-19-, and cryptocurrency-related filings continue to be a focus, even as the nature of such suits continues to evolve.

A. Filing Trends