Decided May 18, 2023

Twitter, Inc. v. Taamneh, No. 21-1496

Gonzalez v. Google LLC, No. 21-1333

Today, a unanimous Supreme Court rejected claims that social-media companies could be held liable under the Anti-Terrorism Act for allegedly not doing “enough” to remove terrorist-related content from their services. In light of that ruling, the Court declined to address whether plaintiffs’ claims were barred by Section 230 of the Communications Decency Act.

Background: Under the Anti-Terrorism Act (ATA) a United States national who is injured by an “act of international terrorism” may recover treble damages. 18 U.S.C. § 2333(a). Victims may also seek recovery from “any person who aids and abets, by knowingly providing substantial assistance, or who conspires with the person who committed such an act of international terrorism.” Id. § 2333(d)(2).

In Twitter, Inc. v. Taamneh, family members of a victim of the 2017 ISIS shooting at the Reina nightclub in Istanbul, Turkey, sued Facebook, Twitter, and Google under the ATA for aiding and abetting the attack. Plaintiffs did not allege that the terrorists who carried out the attack used the companies’ services or that the companies were aware of any specific ISIS accounts tied to the attack. Despite the extensive measures the companies take to block and remove terrorist accounts and terrorist content, plaintiffs alleged that the companies violated the ATA by not doing more.

The district court rejected plaintiffs’ claims, because (1) plaintiffs failed to plausibly allege that the defendants assisted committing the particular attack at issue and (2) it is not enough to allege that the defendants provided general assistance to a terrorist organization. The Ninth Circuit reversed, holding that allegations that a defendant assisted a “broader campaign of terrorism” are enough, even absent allegations that the defendant assisted the particular attack at issue.

Gonzalez v. Google LLC involves substantially similar allegations asserted by family members and the estate of a victim of the 2015 ISIS attacks in Paris. The trial court dismissed plaintiffs’ claims as barred by Section 230 of the Communications Decency Act of 1996, 47 U.S.C. § 230(c)(1), which protects websites and other “interactive computer service” providers from claims based on third-party content, and the Ninth Circuit affirmed.

Issues:

Taamneh: Whether a defendant that provides generic, widely available services to all its numerous users and “regularly” works to detect and prevent terrorists from using those services “knowingly” provided substantial assistance under Section 2333 merely because it allegedly could have taken more “meaningful” or “aggressive” action to prevent such use.

Gonzalez: Whether Section 230 applies to recommendations of third-party content.

Court’s Holdings:

Taamneh: No. Section 2333 requires allegations that the defendant consciously, voluntarily, and culpably participated in the terrorist act at issue in such a way as to help make it succeed.

Gonzalez: Given the overlap with the allegations in Taamneh, the Court declined to address the Section 230 issue and instead remanded for consideration in light of Taamneh.

“[T]he fundamental question of aiding-and-abetting liability [is]: Did defendants consciously, voluntarily, and culpably participate in or support the relevant wrongdoing? … [T]he answer in this case is no.”

Justice Thomas, writing for the Court

Gibson Dunn represented Meta Platforms, Inc. as Respondent Supporting Petitioner in Taamneh and Amicus in Gonzalez.

What It Means:

- In Taamneh, the Court refused to expand aiding-and-abetting liability under Section 2333(d)(2) beyond the traditional, common-law understandings of aiding and abetting.

- Liability under Section 2333(d)(2) is limited to defendants who “consciously and culpably” participate in the specific act of international terrorism that injured the plaintiffs. Although that requirement does not always demand “a strict nexus,” “the more attenuated the nexus, the more courts should demand that plaintiffs show culpable participation though intentional aid that substantially furthered the tort.”

- Today’s opinion also underscores that providing goods or services to the general public should not itself give rise to aiding-and-abetting liability, even if the provider may become aware that its goods or services are being put to illicit ends. As the Court emphasized, imposing liability based on an alleged failure to act requires the plaintiff to make a heightened showing of assistance and scienter.

- The Court also concluded that “[t]he mere creation of” social-media services “is not culpable.”

- The Court’s decision to vacate and remand in Gonzalez without addressing Section 230 returns questions about the scope, interpretation, and application of Section 230 to the courts of appeals, which have developed an extensive body of cases construing and applying Section 230 since the statute was enacted in 1996.

The Court’s opinion is available here and here.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding developments at the Supreme Court. Please feel free to contact the following practice leaders:

Appellate and Constitutional Law Practice

| Thomas H. Dupree Jr. +1 202.955.8547 tdupree@gibsondunn.com |

Allyson N. Ho +1 214.698.3233 aho@gibsondunn.com |

Julian W. Poon +1 213.229.7758 jpoon@gibsondunn.com |

| Lucas C. Townsend +1 202.887.3731 ltownsend@gibsondunn.com |

Bradley J. Hamburger +1 213.229.7658 bhamburger@gibsondunn.com |

Brad G. Hubbard +1 214.698.3326 bhubbard@gibsondunn.com |

Related Practice: Litigation

| Reed Brodsky +1 212.351.5334 rbrodsky@gibsondunn.com |

Theane Evangelis +1 213.229.7726 tevangelis@gibsondunn.com |

Veronica S. Moyé +1 214.698.3320 vmoye@gibsondunn.com |

| Helgi C. Walker +1 202.887.3599 hwalker@gibsondunn.com |

Related Practice: Media, Entertainment and Technology

| Scott A. Edelman +1 310.557.8061 sedelman@gibsondunn.com |

Kevin Masuda +1 213.229.7872 kmasuda@gibsondunn.com |

Benyamin S. Ross +1 213-229-7048 bross@gibsondunn.com |

Related Practice: Privacy, Cybersecurity and Data Innovation

| Ahmed Baladi +33 (0)1 56 43 13 50 abaladi@gibsondunn.com |

S. Ashlie Beringer +1 650.849.5327 aberinger@gibsondunn.com |

Jane C. Horvath +1 202.955.8505 jhorvath@gibsondunn.com |

| Alexander H. Southwell +1 212.351.3981 asouthwell@gibsondunn.com |

Related Practice: White Collar Defense and Investigations

| Stephanie Brooker +1 201.887.3502 sbrooker@gibsondunn.com |

Nicola T. Hanna +1 213.229.7269 nhanna@gibsondunn.com |

Chuck Stevens +1 415.393.8391 cstevens@gibsondunn.com |

| F. Joseph Warin +1 202.887.3609 fwarin@gibsondunn.com |

Decided May 18, 2023

Andy Warhol Foundation for the Visual Arts v. Goldsmith, No. 21-869

Today, the Supreme Court held 7-2 that the fact that a secondary work of art that incorporates copyrighted source material conveys a distinct meaning or message is not sufficient to render the secondary work transformative for purposes of the fair use analysis.

Background: Photographer Lynn Goldsmith licensed a black and white photograph of Prince to Vanity Fair for use as an artist’s reference in its November 1984 issue. The artist Vanity Fair chose, Andy Warhol, cropped the photograph, silkscreened it onto multiple canvases, and layered each canvas with different brightly colored paints. In all, Warhol created four drawings and 12 silkscreens from the photograph, one of which Vanity Fair ultimately published. After Prince’s death in 2016, the Andy Warhol Foundation licensed one of Warhol’s other silkscreened Prince images to Condé Nast for a special tribute issue. When Goldsmith asserted that Warhol’s image infringed her copyright, the Foundation sued her for a declaration that Warhol’s Prince series was protected under the fair use doctrine. Goldsmith countersued for copyright infringement. The district court held that the images were protected fair use because Warhol transformed Goldsmith’s original photograph to convey a different meaning. The Second Circuit reversed, cautioning that the addition of new meaning was not necessarily transformative.

Issue: Is a work of art sufficiently transformative for purposes of the fair use doctrine when it conveys a different meaning or message from the source material?

Court’s Holding:

No. That a work of art adds a new meaning or message to the source material is not sufficient to render that work transformative—courts must also consider the purpose and commercial nature of both the source material and the secondary work.

“Many secondary works add something new. That alone does not render such uses fair.”

Justice Sotomayor, writing for the Court

What It Means:

- The decision is the first time the Supreme Court has addressed fair use in the context of visual art. The Court addressed only the first fair use factor, namely, “the purpose and character of the use, including whether such use is of a commercial nature or is for nonprofit educational purposes.” 17 U.S.C. § 107(1). For this factor, the Court confirmed that uses that have a further purpose or different character can be “transformative,” but clarified that the degree of difference must be balanced against the commercial nature of the use.

- The Court explained that if the secondary use shares the same or similar purpose as the source material and is of a commercial nature, the factor is likely to weigh against fair use “absent some other justification for copying.” Slip op. 20. For example, the purpose of Warhol’s Soup Can series was “to comment on consumerism rather than advertise soup,” and thus served “a completely different purpose” than the original Campbell’s Soup label. Id. at 27. Here, in contrast, “portraits of Prince used to depict Prince in magazine stories about Prince . . . share substantially the same purpose” and “the copying use is of a commercial nature.” Id. at 12–13.

- The Court limited its holding in Campbell v. Acuff-Rose Music, Inc., 510 U. S. 569 (1994), which upheld fair use in the context of musical parody. The Court explained that Campbell “cannot be read to mean that § 107(1) weighs in favor of any use that adds some new expression, meaning or message.” Slip op. 28. By limiting the availability of the fair use defense for secondary works that merely claim some further purpose or different character, the Court thus placed a premium on incentivizing and protecting original creation.

- The Court’s decision could create new avenues to allege infringement by secondary works that build on or reference other works, although the Court emphasized that its analysis was “limit[ed]” to Warhol’s “commercial licensing of Orange Prince to Condé Nast.” Slip op. 21.

The Court’s opinion is available here.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding developments at the Supreme Court. Please feel free to contact the following practice leaders:

Appellate and Constitutional Law Practice

| Thomas H. Dupree Jr. +1 202.955.8547 tdupree@gibsondunn.com |

Allyson N. Ho +1 214.698.3233 aho@gibsondunn.com |

Julian W. Poon +1 213.229.7758 jpoon@gibsondunn.com |

| Lucas C. Townsend +1 202.887.3731 ltownsend@gibsondunn.com |

Bradley J. Hamburger +1 213.229.7658 bhamburger@gibsondunn.com |

Brad G. Hubbard +1 214.698.3326 bhubbard@gibsondunn.com |

Related Practice: Intellectual Property

| Kate Dominguez +1 212.351.2338 kdominguez@gibsondunn.com |

Y. Ernest Hsin +1 415.393.8224 ehsin@gibsondunn.com |

|

| Josh Krevitt +1 212.351.4000 jkrevitt@gibsondunn.com |

Jane M. Love, Ph.D. +1 212.351.3922 jlove@gibsondunn.com |

Related Practice: Fashion, Retail and Consumer Products

| Howard S. Hogan +1 202.887.3640 hhogan@gibsondunn.com |

Decided May 18. 2023

Amgen Inc. et al. v. Sanofi et al., No. 21-757

Today, the Supreme Court unanimously held that the Patent Act’s enablement requirement is satisfied only when a patent’s specification allows persons skilled in the art to make and use the full scope of the invention without more than a “reasonable” amount of experimentation under the circumstances.

Background: Amgen and Sanofi produce antibody medications to treat high LDL cholesterol. In 2011, each party obtained a patent covering the specific antibody used in its drugs. The antibodies in the drugs work by preventing a protein from interfering with the body’s natural regulation of LDL cholesterol. In 2014, Amgen obtained two patents that covered not only 26 specifically listed antibodies by their amino acid sequences, but also the “entire genus” of antibodies that performs this function—a claim that arguably covers millions of antibodies. Amgen then sued Sanofi for patent infringement.

Sanofi argued that the relevant claims were invalid because they did not satisfy the enablement requirement of the Patent Act, which requires a patent specification to describe “the manner and process of making and using” the invention in such a way “as to enable any person skilled in the art to which it pertains . . . to make and use the same.” 35 U.S.C. § 112(a). According to Sanofi, the claims for the antibodies beyond the 26 specifically listed essentially required scientists to engage in a trial-and-error process of discovery. After lengthy proceedings, the district court agreed, and the Federal Circuit affirmed.

Issue: Where a patent claims an entire class of processes, machines, manufactures, or compositions of matter, must the patent specification enable a person skilled in the art to make and use the entire class?

Court’s Holding:

Yes. To satisfy the Patent Act’s enablement requirement, a patent’s specification must enable the full scope of the invention as defined by the patent’s claims, subject to a reasonable amount of adaptation or experimentation.

“[T]he specification must enable the full scope of the invention as defined by its claims. The more one claims, the more one must enable.”

Justice Gorsuch, writing for the Court

What It Means:

- The Patent Act’s enablement requirement is not satisfied when a patent claims a broad class but its specification requires undue experimentation or trial-and-error discovery to make and use the entire class.

- The Court stopped short of requiring that a patent specification need always describe with particularity how to make and use every embodiment within a claimed class. In some cases, it may be sufficient to provide an example that discloses a general quality running through the class.

- The Court stated that a specification is not necessarily inadequate simply because it involves some measure of adaptation or testing, but such experimentation must be reasonable. Reasonableness will depend on the nature of the invention and the underlying art, meaning that courts will likely make this determination on a case-by-case basis.

- Overall, the decision reinforces the enablement requirement as a defense to patent-infringement claims, and will likely incentivize more detailed specifications in patent applications.

The Court’s opinion is available here.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding developments at the Supreme Court. Please feel free to contact the following practice leaders:

Appellate and Constitutional Law Practice

| Thomas H. Dupree Jr. +1 202.955.8547 tdupree@gibsondunn.com |

Allyson N. Ho +1 214.698.3233 aho@gibsondunn.com |

Julian W. Poon +1 213.229.7758 jpoon@gibsondunn.com |

| Lucas C. Townsend +1 202.887.3731 ltownsend@gibsondunn.com |

Bradley J. Hamburger +1 213.229.7658 bhamburger@gibsondunn.com |

Brad G. Hubbard +1 214.698.3326 bhubbard@gibsondunn.com |

Related Practice: Intellectual Property

| Kate Dominguez +1 212.351.2338 kdominguez@gibsondunn.com |

Y. Ernest Hsin +1 415.393.8224 ehsin@gibsondunn.com |

|

| Josh Krevitt +1 212.351.4000 jkrevitt@gibsondunn.com |

Jane M. Love, Ph.D. +1 212.351.3922 jlove@gibsondunn.com |

Unfair business practices encompass fraud, misrepresentation, and oppressive or unconscionable acts or practices by businesses, often against consumers. In California, individuals and specified governmental agencies are authorized to bring civil actions for unfair competition and to recover civil penalties or injunctive relief pursuant to the Unfair Competition Law (UCL) under Business and Professions Code Section 17200.

California’s Government Code authorizes the Attorney General, as a head of a state department, to investigate and prosecute actions concerning certain matters, including UCL violations. It also equips the Attorney General with certain investigatory tools, including pre-litigation subpoena power, to effectuate enforcement of the law.

Among the agencies authorized to prosecute UCL actions are city attorneys of cities with populations in excess of 750,000 and county counsel of any county within which a city has a population in excess of 750,000, as well as (in the case of San Francisco) city attorneys of a city and county. Although certain county counsel and city attorneys can bring UCL actions, prior to the passage and enactment of AB 2766, these entities were not afforded the same tools as the Attorney General and district attorneys to investigate possible unfair competition cases. AB 2766, enacted on January 1, 2023, amended Section 16759 of the Business and Professions Code to extend these same investigatory powers to city and county attorneys who are also authorized to bring UCL claims (subject to certain requirements).

Sponsors and supporters of the bill cited increased reports of consumer fraud and price gouging during the COVID-19 pandemic, which they claimed demonstrated a need for greater enforcement of California’s consumer protection laws.

Pre-Existing Relevant Law

There is a constellation of statutes that are relevant to enforcement of the UCL.

Business and Professions Code Section 17200 defines “unfair competition” to include any unlawful, unfair, or fraudulent business act or practice and any unfair, deceptive, untrue, or misleading advertising, and any act prohibited by the False Advertising Law, Business and Professions Code Section 17500 et seq. Accordingly, the UCL is a tool for enforcement relating to a wide range of consumer-facing business activity.

Government Code Section 11181 authorizes the heads of each state department to make investigations and prosecute actions concerning matters relating to the business activities and subjects under their jurisdiction; violations of any law or rule or order of the department; and such other matters as may be provided by law. In order to effectuate these investigations and actions, the law provides the heads of these departments with certain investigatory powers. Among these powers is the ability to promulgate interrogatories; the ability to issue subpoenas for the attendance of witnesses and the production of certain documents, testimony, or other materials, and the ability to inspect and copy those same documents and materials. With regard to the UCL specifically, the relevant “state department head” is the Attorney General.

But the Attorney General is not the only entity authorized to prosecute violations of the UCL. Under Business and Professions Code Section 17204, in addition to the Attorney General, actions under the UCL may be brought by a district attorney, a city attorney or county counsel, or an individual person who has suffered injury in fact and has lost money or property as a result of the unfair competition. In the case of city attorneys and county counsels of counties and cities with populations smaller than 750,000, consent from the district attorney is required to bring an action under the UCL. In counties and cities with populations larger than that number, no such consent is required. Thus, the only city attorneys with authority to independently bring actions under the UCL are those in San Jose, San Diego, and Los Angeles, and the only county counsel are those in San Diego County, Los Angeles County, and Santa Clara County (as the cities of San Diego, Los Angeles, and San Jose all have populations over 750,000).

In order to facilitate their investigation of violations of the UCL, district attorneys are granted the same investigative powers given to the Attorney General pursuant to Section 16759 of the Business and Professions Code, subject to certain safeguards. In particular, district attorneys’ investigations under this section must abide by the procedures laid out in the relevant sections of Government Code and are subject to the California Right to Financial Privacy Act.

Changes to the Law Under AB 2766

AB 2766 extended the same investigatory powers granted to the Attorney General and the district attorneys to the city attorneys and county counsel which are already authorized to bring UCL claims when these entities reasonably believe that there may have been a violation of the UCL.

Specifically, the new law:

- Grants all of the powers that are granted to the Attorney General as the head of a state department to make investigations and prosecute actions regarding unfair competition laws (commencing with Business and Professions Code Section 17200) to the city attorney of any city having a population in excess of 750,000, to the county counsel of any county within which a city has a population in excess of 750,000, or to a city attorney of a city and county, when the city attorney or county counsel reasonably believes that there may have been a violation of the unfair competition laws;

- Makes any action brought by a city attorney or county counsel pursuant to the bill, like an action brought by the Attorney General or district attorney, subject to the provisions of the “California Right to Financial Privacy Act” set forth in existing law; and

- Clarifies that court orders sought pursuant to the bill shall be sought in the superior court of the county in which the district attorney, city attorney, or county counsel, who is seeking the order and authorized to bring an action pursuant to the bill, holds office.

AB 2766 amended Business and Professions Code section 16759—which previously provided district attorneys with pre-litigation investigatory authority for potential UCL actions—to expressly provide city attorneys and county counsel in large jurisdictions with the same pre-litigation investigative authority for suspected UCL violations. Based on the law’s population requirements, AB 2677 applies to legal authorities in San Diego City and County, Los Angeles City and County, Santa Clara County and San Jose, and San Francisco (which co-sponsored the bill).

Arguments For And Against AB 2766

AB 2766 garnered substantial support on both the Senate and Assembly floors (29 in favor versus 9 against and 57 in favor versus 15 against, respectively). This section will detail some highlights of the discourse regarding the bill in the Legislature prior to its passage.

Proponents of the law argued that “AB 2766 will bolster consumer protection enforcement efforts” and will “[e]nsur[e] a robust consumer protection investigatory framework to protect businesses that play by the rules.” Further, it will “ensure consistency in the UCL for those empowered to enforce [it].”

Opponents argued that the bill—particularly the subpoena power—”potentially infring[es] on the judicial due process rights of businesses, organizations and individuals in California,” and “makes businesses vulnerable to baseless fishing expeditions and political maneuvers, as standard necessary (sic) to issue a pre-litigation subpoena is disturbingly low.”

Supporters of the bill claimed that opponents’ concerns about overreaching were unfounded, as “important safeguards exist under current law to protect against overreach by a prosecutor,” which also apply under AB 2766. Specifically, the city attorneys and county counsels with new investigative authority are subject to the same parameters currently applied to district attorneys’ use of these investigatory powers in Section 16759, including the procedures laid out in the Government Code, and will also be subject to the California Right to Financial Privacy Act. This Act protects the confidential relationship between financial institutions and their customers by, in part, providing more procedural safeguards with respect to subpoenaing financial records. In addition, these city attorneys and county counsel are only granted these expanded investigatory powers when the city attorney or county counsel “reasonably believes that there may have been a violation of [the UCL].” Further, the recipient of the subpoena can refuse to comply, leaving it up to the prosecutor to go to court to compel production.

Potential Impacts of AB 2766

Proponents of AB 2766 claimed that complaints of UCL violations rose during the pandemic, necessitating the bolstering of UCL enforcement measures. In response, Assembly Member Brian Maienschein (D-San Diego) authored the bill after “work[ing] with numerous attorneys to identify solutions to strengthening consumer protection laws in California.” The bill was co-sponsored by the City and County of San Francisco, City of San Diego, County of Los Angeles, and County of Santa Clara.

Exactly how widely the new powers granted under the bill will be operationalized remains to be seen, but there are many indications from attorneys in the co-sponsoring cities and counties that they intend to use them widely. Following Governor Gavin Newsom’s signing of AB 2766 in September 2022, many public prosecutors lauded the legislation and publicly forecasted their offices’ plans to use the new investigative powers once the law took effect. Said San Francisco City Attorney David Chiu:

“During the pandemic we saw a troubling surge in price gouging, consumer fraud, and unfair business practices,” said San Francisco City Attorney David Chiu. “As our office continues to pursue bad actors that seek to defraud the public, this new law will give us more tools to better protect consumers and workers.”

Then-Los Angeles City Attorney Mike Feuer echoed this sentiment, stating:

“Time and again, we’ve successfully fought for hard-working Angelenos who’ve been ripped off—sometimes devastated—by unlawful business practices. Our office will be all the more impactful now that we have this key investigative tool, allowing us to get to the heart of scams and put a stop to them even faster.”

Acting Los Angeles County Counsel Dawyn Harrison, Santa Clara County Counsel James R. Williams, and San Diego City Attorney Mara W. Elliott also released similar statements.

Indeed, the San Francisco and San Diego City Attorneys’ offices have already begun utilizing their investigative powers in a highly public context—openly touting their initiation of an investigation into a home title locking business, which the city attorneys allege to be deceptive and predatory. Not only did the San Francisco City Attorney issue a press release proudly proclaiming that “[t]he subpoena [it issued] reflects an early use of city attorney’s authority under Assembly Bill 2766”–it coupled the announcement with a clear indication that the office was seeking to use its new power immediately to stop, and not just investigate, the target’s conduct, which the office labeled as “a scam, plain and simple.”

It is impossible to say with certainty that AB 2766 will result in increased numbers of UCL prosecutions by public prosecutors, as county counsel have possessed the power to prosecute UCL violations since the passage of SB 709 in 1991 and city attorneys since the passage of SB 1725 in 1974. However, AB 2766 is aligned with a general push toward broader power to prosecute and enforce the UCL since the advent of the statute. Most recently, the Supreme Court of California confirmed that local prosecutors’ power to enforce the UCL goes beyond their territorial jurisdictions, in lockstep with that of the Attorney General. (Abbott Lab’ys v. Superior Ct. of Orange Cnty. (2020) 9 Cal. 5th 642, 661.) Because of the relationship between Sections 17200 and 16759 of the Business and Professions Code, the new investigatory powers of city and county attorneys under AB 2766 also likely extend outside of local prosecutors’ jurisdictions, granting them the authority to investigate conduct that occurred elsewhere. This combination of greater authority to investigate UCL offenses, more expansive jurisdictional reach, and early signals from newly empowered city and county attorneys following the passage of AB 2766, point to the potential for a pronounced rise in aggressive UCL investigations by public prosecutors—particularly by city attorneys in California’s largest cities, which are already known for their frequent use of affirmative enforcement lawsuits on behalf of consumers.

The following Gibson Dunn lawyers prepared this client alert: Winston Chan, Michael Farhang, Douglas Fuchs, Nicola T. Hanna, Meredith Spoto, Chuck Stevens, Eric D. Vandevelde, Benjamin Wagner, and Debra Wong Yang.

Gibson Dunn has more than 250 white collar lawyers around the globe who are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any member of the firm’s U.S. White Collar Defense and Investigations or Anti-Corruption and FCPA practice groups below:

White Collar Defense and Investigations Group – United States:

Los Angeles

Michael H. Dore (+1 213-229-7652, mdore@gibsondunn.com)

Michael M. Farhang (+1 213-229-7005, mfarhang@gibsondunn.com)

Diana M. Feinstein (+1 213-229-7351, dfeinstein@gibsondunn.com)

Douglas Fuchs (+1 213-229-7605, dfuchs@gibsondunn.com)

Nicola T. Hanna – Co-Chair (+1 213-229-7269, nhanna@gibsondunn.com)

Poonam G. Kumar (+1 213-229-7554, pkumar@gibsondunn.com)

Marcellus McRae (+1 213-229-7675, mmcrae@gibsondunn.com)

Eric D. Vandevelde (+1 213-229-7186, evandevelde@gibsondunn.com)

Debra Wong Yang (+1 213-229-7472, dwongyang@gibsondunn.com)

Meredith K. Spoto (+1 213-229-7060, mspoto@gibsondunn.com)

San Francisco

Winston Y. Chan (+1 415-393-8362, wchan@gibsondunn.com)

Charles J. Stevens – Co-Chair (+1 415-393-8391, cstevens@gibsondunn.com)

Michael Li-Ming Wong (+1 415-393-8333, mwong@gibsondunn.com)

Palo Alto

Benjamin Wagner (+1 650-849-5395, bwagner@gibsondunn.com)

Washington, D.C.

Stephanie Brooker – Co-Chair (+1 202-887-3502, sbrooker@gibsondunn.com)

Courtney M. Brown (+1 202-955-8685, cmbrown@gibsondunn.com)

David P. Burns (+1 202-887-3786, dburns@gibsondunn.com)

John W.F. Chesley (+1 202-887-3788, jchesley@gibsondunn.com)

Daniel P. Chung (+1 202-887-3729, dchung@gibsondunn.com)

M. Kendall Day (+1 202-955-8220, kday@gibsondunn.com)

David Debold (+1 202-955-8551, ddebold@gibsondunn.com)

Michael S. Diamant (+1 202-887-3604, mdiamant@gibsondunn.com)

Gustav W. Eyler (+1 202-955-8610, geyler@gibsondunn.com)

Richard W. Grime (+1 202-955-8219, rgrime@gibsondunn.com)

Scott D. Hammond (+1 202-887-3684, shammond@gibsondunn.com)

George J. Hazel (+1 202-887-3674, ghazel@gibsondunn.com)

Judith A. Lee (+1 202-887-3591, jalee@gibsondunn.com)

Adam M. Smith (+1 202-887-3547, asmith@gibsondunn.com)

Patrick F. Stokes – Co-Chair (+1 202-955-8504, pstokes@gibsondunn.com)

Oleh Vretsona (+1 202-887-3779, ovretsona@gibsondunn.com)

F. Joseph Warin – Co-Chair (+1 202-887-3609, fwarin@gibsondunn.com)

Amy Feagles (+1 202-887-3699, afeagles@gibsondunn.com)

David C. Ware (+1 202-887-3652, dware@gibsondunn.com)

Ella Alves Capone (+1 202-887-3511, ecapone@gibsondunn.com)

Nicholas U. Murphy (+1 202-777-9504, nmurphy@gibsondunn.com)

Melissa Farrar (+1 202-887-3579, mfarrar@gibsondunn.com)

Nicole Lee (+1 202-887-3717, nlee@gibsondunn.com)

Jason H. Smith (+1 202-887-3576, jsmith@gibsondunn.com)

Pedro G. Soto (+1 202-955-8661, psoto@gibsondunn.com)

New York

Zainab N. Ahmad (+1 212-351-2609, zahmad@gibsondunn.com)

Reed Brodsky (+1 212-351-5334, rbrodsky@gibsondunn.com)

Mylan L. Denerstein (+1 212-351-3850, mdenerstein@gibsondunn.com)

Barry R. Goldsmith (+1 212-351-2440, bgoldsmith@gibsondunn.com)

Karin Portlock (+1 212-351-2666, kportlock@gibsondunn.com)

Mark K. Schonfeld (+1 212-351-2433, mschonfeld@gibsondunn.com)

Orin Snyder (+1 212-351-2400, osnyder@gibsondunn.com)

Alexander H. Southwell (+1 212-351-3981, asouthwell@gibsondunn.com)

Brendan Stewart (+1 212-351-6393, bstewart@gibsondunn.com)

Denver

Kelly Austin – Co-Chair (+1 303-298-5980, kaustin@gibsondunn.com)

Ryan T. Bergsieker (+1 303-298-5774, rbergsieker@gibsondunn.com)

Robert C. Blume (+1 303-298-5758, rblume@gibsondunn.com)

John D.W. Partridge (+1 303-298-5931, jpartridge@gibsondunn.com)

Laura M. Sturges (+1 303-298-5929, lsturges@gibsondunn.com)

Houston

Gregg J. Costa (+1 346-718-6649, gcosta@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

Gibson Dunn is pleased to announce the establishment of its Child and Forced Labor Risks Global Task Force to help our clients prevent illegal child and forced labor in their workforce, evaluate their supply chains, and respond to investigations and litigation arising from illegal child labor and forced labor allegations.

Governments around the world are increasing their scrutiny of illegal child labor and forced labor. In the United States, the Department of Labor and Congress have recently launched investigations of companies’ child labor policies and compliance practices that pose substantial legal, financial, and reputational risks for those companies. Congress also has enacted statutes to prevent forced labor globally and recently questioned several companies regarding allegations of forced labor in their supply chains. In Europe, laws combating modern slavery and child labor are emerging across individual jurisdictions, with potential for additional legislation that will impose mandatory human rights and due diligence obligations on certain corporations with a European commercial footprint. Similarly, governments in the Asia Pacific region are grappling with ways to address the issue through a combination of legislation and enforcement.

The Gibson Dunn team offers holistic compliance and response strategies to help our clients implement best-of-class policies related to forced labor and illegal child labor and to ensure they are prepared to respond effectively to civil, criminal, or congressional investigations or litigation relating to alleged forced labor or illegal child labor in their workforce or their supply chains.

Working together, our Labor and Employment, White Collar Defense and Investigations, Congressional Investigations, Crisis Management, Public Policy, Environmental Social Governance (ESG), Securities Regulation and Corporate Governance, Transnational Litigation, International Trade, and Litigation practice groups provide a range of services to root out and prevent forced labor and illegal child labor in clients’ workforce and help clients emerge stronger after investigations and enforcement actions.

This document is for informational purposes only and does not, and is not intended to, constitute legal advice or create an attorney-client relationship. You should contact a Gibson Dunn attorney directly to see if they are able to provide legal advice with respect to a particular legal matter.

Gibson Dunn’s multidisciplinary Child Forced Labor Risks Global Task Force (ChildLaborTaskForce@gibsondunn.com) members are available to assist clients in their efforts to prevent illegal child labor in their own and their suppliers’ workforce and to guide clients through government investigations and litigation based on allegations of illegal child labor or forced labor. Please contact the Gibson Dunn lawyer with whom you usually work, the Task Force, or any of the following authors for additional information about how we may assist you.

Congressional Investigations and Public Policy:

Michael D. Bopp – Washington, D.C. (+1 202-955-8256, mbopp@gibsondunn.com)

Roscoe Jones, Jr. – Washington, D.C. (+1 202-887-3530, rjones@gibsondunn.com)

Amanda H. Neely – Washington, D.C. (+1 202-777-9566, aneely@gibsondunn.com)

Environmental Social Governance (ESG):

Susy Bullock – London (+44 (0) 20 7071 4283, sbullock@gibsondunn.com)

Perlette Michèle Jura – Los Angeles (+1 213-229-7121, pjura@gibsondunn.com)

Robert Spano – London (+44 (0) 20 7071 4902, rspano@gibsondunn.com)

International Trade:

Adam M. Smith – Washington, D.C. (+1 202-887-3547, asmith@gibsondunn.com)

Christopher T. Timura – Washington, D.C. (+1 202-887-3690, ctimura@gibsondunn.com)

Labor and Employment:

Eugene Scalia – Washington, D.C. (+202-955-8210, escalia@gibsondunn.com)

Jason C. Schwartz – Washington, D.C. (+1 202-955-8242, jschwartz@gibsondunn.com)

Katherine V.A. Smith – Los Angeles (+1 213-229-7107, ksmith@gibsondunn.com)

Litigation and Transnational Litigation:

Perlette Michèle Jura – Los Angeles (+1 213-229-7121, pjura@gibsondunn.com)

William E. Thomson – Los Angeles (+1 213-229-7891, wthomson@gibsondunn.com)

Securities Regulation and Corporate Governance:

Lori Zyskowski – New York (+1 212-351-2309, lzyskowski@gibsondunn.com)

White Collar Defense and Investigations:

Michael S. Diamant – Washington, D.C. (+1 202-887-3604, mdiamant@gibsondunn.com)

Oliver D. Welch – Hong Kong (+852 2214 3716, owelch@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

On May 12, 2023, the German lawmaker passed a law protecting those who report violations around the workplace (the “Whistleblower Protection Act”, or “Act”). As an essential part of the Act, companies with 50 employees or more in Germany must establish internal reporting channels for this purpose.

I. Background

The new law implements the EU Whistleblower Directive 2019/1937 (“Directive”), which was due to be transformed into national law by December 17, 2021. Like most other EU member states, Germany was late in implementing the law.[1]

With regard to the scope, the German lawmaker goes far beyond the Directive in that almost all kinds of violations can be subject to protected whistleblowing. This even includes actions that are not illegal, but deemed to be an “abuse”, because they are directed against the “purpose” of legal provisions.

II. Main Obligations

Under the Act, there are three kinds of whistleblowing: (i) internal reporting within an organization, (ii) external reporting to a special government agency, and (iii) public disclosure. The latter is only permissible if external reporting has not proven successful or in several other cases, i.e., if there is an urgent threat to public interests. Unfortunately, as mandated by the Directive, the Act does not stipulate a priority of internal over external reporting. However, employees are explicitly enhanced to do so, and employers are supposed to promote internal over external reporting.

Companies with 50 or more employees in Germany have to offer internal reporting lines for whistleblowers and set up properly (yet not necessarily full-time) staffed functions to deal with such reports. The company can outsource such tasks to an external partner or – as will often be the case – defer to its centralized group reporting scheme as long as the local entity remains responsible for remediation measures.[2] There is a transition rule for companies between 50 and 249 employees: Their obligation to set up internal reporting lines is deferred until December 17, 2023.

Neither internal nor external reporting lines have to provide for anonymous reports, but should handle them nevertheless.

III. Identity Protection, Non-Retaliation

The internal reporting cell has to protect (i.e. not disclose) the identity of good-faith whistleblowers, not even to the company’s management, unless the whistleblower consents or a public authority asks for it. The person being subject to the report enjoys a similar, yet weaker disclosure protection.

Whistleblowers acting in good faith must not be retaliated against in any way because of their report. Such retaliation could consist in, e.g., dismissal, pay cut, relocation, or other disadvantages by the employer.

If there has been a retaliation against the whistleblower, they can claim damages from the parties responsible for the retaliation (typically the employer).

In order to help the whistleblower procedurally, the Act presumes that any disadvantage after the report is presumed to be retaliation. This presumption can be rebutted, and employers should carefully document their personnel measures against whistleblowers in order to be able to prove that the measure is based on other reasons than the whistleblowing.[3]

Finally, good-faith whistleblowers shall not be legally liable for retrieving the information they report, unless the access or use of said information was a criminal act in itself. Even trade secrets may be disclosed, if it is necessary to lance the report.

IV. Companies’ Responses and Next Steps

Any company with 50 employees or more in Germany now has to check whether they have adequate reporting lines in place and properly staffed functions to handle whistleblower reports. Companies with 50 to 249 employees do not have to install the reporting lines until December 17, 2023.

Other than the Directive, the German lawmaker expressly acknowledges centralized reporting lines to be in line with the Act. This is good news for multinational organizations, after the EU Commission fervently contested that such centralized systems were in line with the Directive. It remains to be seen whether the EU Commission accepts those local laws that allow centralized reporting lines.

Multinational organizations operating companies with more than 50 entities in multiple EU member states are well advised to assess the requirements of the respective local implementation laws. In light of the leeway granted to the EU member states in implementing the Directive, individual provisions may vary significantly across the EU member states.

HR departments should carefully prepare and document any measure against employees that might be perceived as retaliation in case the employees have launched a whistleblower report. If the employers can provide sound reasons for their decision, they should be able to rebut the statutory presumption contained in the Act.

Violations of the obligations contained in the Act carry a fine of up to € 50,000.

__________________________

[1] See https://www.whistleblowingmonitor.eu/ for an overview of the implementation status across the EU members states.

[2] See https://www.gibsondunn.com/wp-content/uploads/2022/02/Zimmer-Humphrey-Petzen-Ja-bitte-Meldesysteme-nach-der-Whistleblower-Richtlinie-der-EU-Betriebs-Berater-02-2022.pdf.

[3] See https://www.gibsondunn.com/hilfe-fur-hinweisgeber-beweislastumkehr-nach-%c2%a7-36-ii-hinschg-rege/.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact the Gibson Dunn lawyer with whom you usually work, any member of Gibson Dunn’s Labor and Employment or White Collar Defense and Investigations teams in Germany, or the following authors in Munich:

Katharina Humphrey (+49 89 189 33 217, khumphrey@gibsondunn.com)

Mark Zimmer (+49 89 189 33 230, mzimmer@gibsondunn.com)

Corporate Compliance / White Collar Matters

Ferdinand Fromholzer (+49 89 189 33 270, ffromholzer@gibsondunn.com)

Kai Gesing (+49 89 189 33 285, kgesing@gibsondunn.com)

Markus Nauheim (+49 89 189 33 222, mnauheim@gibsondunn.com)

Markus Rieder (+49 89 189 33 260, mrieder@gibsondunn.com)

Benno Schwarz (+49 89 189 33 210, bschwarz@gibsondunn.com)

Finn Zeidler (+49 69 247 411 530, fzeidler@gibsondunn.com)

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

On May 12, 2023, the IRS and Treasury issued Notice 2023-38 (the “Notice”) (here), which provides initial guidance for developers and investors seeking to qualify projects for the domestic content bonus credit available under sections 45, 45Y, 48, and 48E (the “Domestic Content Bonus Credit”).[1] Although not explicit, the Notice also provides guidance regarding the receipt of full “direct pay” amounts for projects beginning construction after 2023.

The Inflation Reduction Act of 2022 (the “IRA”)[2] provided for an enhanced or “bonus” credit in respect of certain qualified facilities, energy projects, and energy storage technologies if a taxpayer certifies that the steel, iron, or manufactured products that are components of such a facility, project or technology were produced in the United States (the “Domestic Content Requirement”).[3] The IRA also made credits under sections 45, 45Y, 48 and 48E refundable for certain tax-exempt entities.[4] Beginning in 2024, however, these refunds (so-called “direct pay”) are subject to phaseout for projects that do not meet the Domestic Content Requirement; specifically, a 10-percent haircut applies to projects begun in 2024, a 15-percent haircut for projects begun in 2025, and projects begun in 2026 and after would be wholly ineligible for refunds, in each case unless the IRS makes an exception to the requirement.[5]

The Notice provides rules on which taxpayers may, subject to limitations discussed below, rely for determining whether projects will meet the Domestic Content Requirement. Before providing a number of practical observations regarding the guidance in the Notice, the Alert covers the following:

- Background. Increased tax credits are available with respect to certain energy generation (e.g., wind, solar) and storage projects that satisfy the Domestic Content Requirement.

- Domestic Content Requirement.

- Manufactured Products vs. Steel/Iron Components. The Domestic Content Requirement applies differently for (i) manufactured products and (ii) steel or iron components of a project. The Notice provides helpful guidance for determining whether a particular component is a manufactured product or a steel or iron component, including a useful safe harbor that applies to certain types of projects.

- Determining Whether Domestic Content Requirement Satisfied. Once a component has been categorized as either a manufactured product or a steel or iron component, the Notice provides guidance for determining whether the Domestic Content Requirement is satisfied with respect to the relevant project. The rules for manufactured products are particularly complicated and may be challenging to satisfy.

- Certification and Substantiation. In addition to meeting substantive requirements, taxpayers seeking to satisfy the Domestic Content Requirement must meet detailed certification and substantiation requirements.

Background

A taxpayer is eligible to claim a Domestic Content Bonus Credit in respect of projects that meet the Domestic Content Requirement under sections 45 and 45Y (the “PTC”) and sections 48 and 48E (the “ITC”) if the taxpayer timely certifies to the IRS that the applicable requirements have been satisfied. For PTC projects, if the Domestic Content Bonus Credit is available, the amount of the section 45 or 45Y credit is increased by a maximum of 10 percent, and for ITC projects, the amount of the section 48 or 48Y credit is increased by 10 percentage points.[6]

Under current law, the PTC is claimed in respect of the production of electricity from qualified energy resources (e.g., wind and solar) at a qualified facility during the 10-year period beginning on the date on which the project was placed in service. For zero-emission energy projects that begin construction after 2024, the PTC will transition to a new technology-neutral credit under section 45Y . The current ITC is claimable in respect of the basis of certain energy property (e.g., wind, solar, and energy storage property). Like the PTC, for zero-emission energy projects that begin construction after 2024, the ITC will transition to a new technology-neutral ITC under section 48E.

Domestic Content Requirement

The Domestic Content Requirement applies differently with respect to two different categories of components: (1) steel or iron components, which are subject to a more stringent test, and (ii) “Manufactured Products” (defined as any item produced as a result of a manufacturing process).[7]

Application of the Domestic Content Requirement is a two-step process:

- In the first step, each article, material, or supply that is directly incorporated into a project (each, a “Project Component”) is categorized to determine whether that Project Component must meet either the Steel or Iron Requirement or the Manufactured Products Requirement (each as defined below).

- In the second step, each Project Component is analyzed to determine whether it satisfies the Steel or Iron Requirement or the Manufactured Products Requirement, as applicable.

Step one is applied by first analyzing Project Components that are made primarily of steel or iron. If a steel or iron Project Component is both (i) a construction material and (ii) “structural in function” (e.g., towers (wind facilities) or photovoltaic module racking (solar facilities)), the component is subject to the Steel or Iron Requirement. The Notice provides a non-exhaustive list of steel or iron items that are not “structural in function” (and therefore not subject to the Steel or Iron Requirement): nuts, bolts, screws, washers, cabinets, covers, shelves, clamps, fittings, sleeves, adapters, tie wire, spacers and door hinges. Any Project Components that are Manufactured Products (i.e., those Project Components that are not steel or iron Project Components and that underwent a manufacturing process) are subject to the Manufactured Products Requirement.

In a very welcome development, the Notice provides a safe harbor for applying step one to certain identified and commonly analyzed Project Components. The list of Project Components covers only limited categories of projects and does not include all Project Components that may comprise those projects. These classifications nevertheless provide helpful guidance that should permit taxpayers to make strategic sourcing decisions pending the publication of regulations. These safe harbor classifications are outlined in Table 2 of the Notice, which is reproduced immediately below.

|

Applicable Project |

Applicable Project Component |

Categorization |

|

Utility-scale photovoltaic system |

Steel photovoltaic module racking |

Steel/Iron |

|

Pile or ground screw |

Steel/Iron |

|

|

Steel or iron rebar in foundation (e.g., concrete pad) |

Steel/Iron |

|

|

Photovoltaic tracker |

Manufactured Product |

|

|

Photovoltaic module (which includes the following Manufactured Product Components, if applicable: photovoltaic cells, mounting frame or backrail, glass, encapsulant, backsheet, junction box (including pigtails and connectors), edge seals, pottants, adhesives, bus ribbons, and bypass diodes) |

Manufactured Product |

|

|

Inverter |

Manufactured Product |

|

|

Land-based wind facility |

Tower |

Steel/Iron |

|

Steel or iron rebar in foundation (e.g., spread footing) |

Steel/Iron |

|

|

Wind turbine (which includes the following Manufactured Product Components, if applicable: the nacelle, blades, rotor hub, and power converter) |

Manufactured Product |

|

|

Wind tower flanges |

Manufactured Product |

|

|

Offshore wind facility |

Tower |

Steel/Iron |

|

Jacket foundation |

Steel/Iron |

|

|

Wind tower flanges |

Manufactured Product |

|

|

Wind turbine (which includes the following Manufactured Product Components, if applicable: the nacelle, blades, rotor hub, and power converter) |

Manufactured Product |

|

|

Transition piece |

Manufactured Product |

|

|

Monopile |

Manufactured Product |

|

|

Inter-array cable |

Manufactured Product |

|

|

Offshore substation |

Manufactured Product |

|

|

Export cable |

Manufactured Product |

|

|

Battery energy storage technology |

Steel or iron rebar in foundation (e.g., concrete pad) |

Steel/Iron |

|

Battery pack (which includes the following Manufactured Product Components, if applicable: cells, packaging, thermal management system, and battery management system) |

Manufactured Product |

|

|

Battery container/housing |

Manufactured Product |

|

|

Inverter |

Manufactured Product |

Once each Project Component has been categorized at step one, in the second step each Project Component is analyzed to determine whether it satisfies the Steel or Iron Requirement or the Manufactured Products Requirement.

Steel or Iron Requirement

The “Steel or Iron Requirement” is satisfied with respect to a Project Component if all manufacturing processes with respect to the Project Component (other than metallurgical processes involving refinement of steel additives) take place in the United States.[8]

Manufactured Products Requirement

The “Manufactured Products Requirement” is satisfied if a statutory percentage (ranging from 20 percent to 55 percent, as discussed below) of the total costs of the Project Components that are Manufactured Products are attributable to (i) “U.S. Manufactured Products” or (ii) “U.S. Components” (each as defined below).[9]

Application of the Manufactured Products Requirement is a five-step process:

- First, each Project Component that is a Manufactured Product must be separated into those Project Components for which all of the manufacturing processes take place in the United States, and those Project Components that do not.

- Second, each Project Component must be separated into its individual direct components. A component that is “directly” incorporated into a Project Component is referred to in the Notice as a “Manufactured Product Component.” The safe harbor in Table 2 of the Notice (reproduced above) lists certain “Manufactured Product Components” of specified Manufactured Products.

- Third, for Project Components manufactured in the United States as determined at step one, it must be determined whether each “Manufactured Product Component” of such Project Component is “of U.S. origin” (in the case of manufactured components, “regardless of the origin of its subcomponents”). Project Components satisfying step 3 are “U.S. Manufactured Products.”

- Fourth, for Project Components that are not U.S. Manufactured Products, it must be determined which (if any) “Manufactured Product Components” of such Project Component are mined, produced, or manufactured in the United States. Any such Manufactured Product Components are “U.S. Components.”

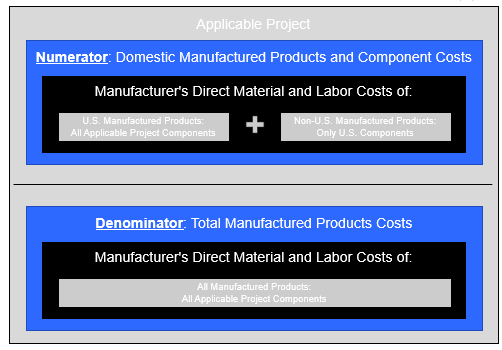

- Fifth, and finally, the costs of the U.S. Manufactured Products and the U.S. Components for the project must be divided by the total cost of the Project Components that are Manufactured Products to reach a percentage that is compared to the applicable statutory percentage (discussed below). If the percentage determined at step 5 equals or exceeds the applicable statutory percentage, the project satisfies the Manufactured Products Requirement.

In computing the “costs” included in the numerator and the denominator of the fraction at step 5, only direct material costs and labor costs that were paid or incurred by the manufacturer (i.e., the person that performed the manufacturing process that produced the relevant component or product) are included.[10] In computing the cost of any U.S. Component that is incorporated into a Manufactured Product that also includes Manufactured Product Components not manufactured in the United States, the taxpayer only may include the costs to produce or acquire the specific U.S. Component, and must exclude any other direct materials or direct labor costs related to the Manufactured Product.

Further, installation and other project-site costs (including direct costs and labor costs of incorporating the Project Components into a project) are excluded.

Statutory Percentages

For PTC and ITC projects beginning construction before 2025, the statutory percentage is 20 percent for offshore wind facilities and 40 percent for all other projects.

For PTC projects that begin construction in 2025, the percentage is 45 percent (27.5 percent for offshore wind), increasing to 50 percent in 2026 (35 percent for offshore wind) and 55 percent in 2027 and thereafter (45 percent for offshore wind in 2027 and 55 percent thereafter).

For ITC projects, the statutory percentage remains 40 percent (20 percent for offshore wind), although a recent report from the Joint Committee on Taxation states that this was not Congress’s intent and that a technical correction may be necessary to conform the statutory percentage increases for the ITC to that of the PTC.[11]

Retrofitted Projects

Consistent with long-standing guidance, the Notice allows a project to qualify as originally placed in service even if it contains some used property, as long as the fair market value of the used property is no more than 20 percent of the total value of the project (the “80/20 Rule”). This calculation is made by adding the cost of the new property to the value of the used property. The cost of the new property includes all costs properly included in the depreciable basis of the new property.

If a project meets the 80/20 Rule and is placed in service after 2022, the project is eligible for the Domestic Content Bonus Credit as long as the new property in the project meets the Domestic Content Requirement and the taxpayer otherwise complies with the requirements in the Notice.

Certification and Substantiation

The Notice also provides that a “taxpayer” reporting a Domestic Content Bonus Credit must provide a statement to the IRS certifying, as of the date the project is placed in service, that the project satisfies the Steel or Iron Requirement and the Manufactured Products Requirement and provides details concerning both the contents of the certification and its submission. In addition, the Notice makes clear that taxpayers claiming the Domestic Content Bonus Credit must maintain records substantiating compliance with the applicable requirements.

Observations

Substantiating U.S. Component costs may be challenging as component manufacturers may be unwilling to disclose such pricing information or their own margins, and even where third-party manufacturers are willing to disclose this type of information, it is unclear what documentation or evidence, if any, is needed to substantiate a third-party manufacturer’s determination of its costs.

Moreover, for those Project Components not described in the safe harbor in Table 2 of the Notice (which has been reproduced above), taxpayers likely will face uncertainty as to whether the more exacting Steel or Iron Requirement or the less exacting Manufactured Products Requirement should apply to those individual Project Components. For example, the Notice provides that the Steel or Iron Requirement applies to materials that are “structural in function” and are made “primarily of steel or iron” but fails to provide rules for determining whether a component is “primarily” made of steel or iron and does not provide a precise definition for what constitutes a construction material that is “structural in function.” Similarly, although the Notice makes clear that mere assembly does not constitute manufacturing, the Notice provides limited practical guidance on how to draw the distinction between manufacturing and assembly—a crucial distinction both for purposes of determining whether a component constitutes a Manufactured Product and for purposes of determining whether Project Components are U.S. Manufactured Products.

The Notice provides that a “taxpayer” reporting a Domestic Content Bonus Credit must make the required certification on IRS Form 8835 (Renewable Electricity Product Credit) or IRS Form 3468 (Investment Credit), or other applicable form, but does not indicate, in the case of a credit transfer under section 6418, which taxpayer must make the certification. Instructions for taxpayers with 2023 short years provide (here) that only transferors of credits need to file these source credit forms, but the Notice does not provide this level of guidance.

While the ITC is calculated on a property-by-property basis, the Domestic Content Requirement is determined on an “energy project” basis, which is defined as “a project consisting of one or more energy properties that are part of a single project.” The IRS and Treasury have not yet provided any guidance regarding what constitutes a “single project” for purposes of this definition; however, the statutory language tracks certain language in Notice 2018-59 (concerning commencement of construction), and it would be helpful if the IRS were to confirm that the “single project” definition in Notice 2018-59 applies for these purposes.

Moreover, both the Notice and Notice 2023-29 (concerning energy community bonus credits, discussed in an earlier Gibson Dunn alert here) observe that bonus credits are available with respect to “qualified property for which a valid irrevocable election under section 48(a)(5) has been made to treat such qualified property as energy property under section 48” (i.e., the ITC in lieu of PTC election). However, neither notice mentions the availability of bonus credits with respect to a specified clean hydrogen production facility for which an ITC is irrevocably elected under section 48(a)(15). While bonus credits are not available if the clean hydrogen PTC is elected under 45V (or the carbon capture and sequestration credit under section 45Q is claimed with respect to the facility), the bonus credits are apparently available if the ITC is elected for such facility. It would be helpful for the IRS and Treasury to confirm that bonus credits are available for taxpayers that elect the ITC for projects under section 48(a)(15) in the same manner as taxpayers that elect the ITC for projects under section 48(a)(5).

Effective Date

The IRS and Treasury expect to issue proposed regulations addressing the Domestic Content Requirement that would apply to taxable years ending after May 12, 2023. The Notice provides that taxpayers may rely on the rules provided in the Notice with respect to projects on which construction begins before the date that is ninety days after the date of publication of those forthcoming proposed regulations.

____________________________

[1] Unless indicated otherwise, all section references are to the Internal Revenue Code of 1986, as amended (the “Code”), and all “Treas. Reg. §” references are to the Treasury Regulations promulgated under the Code.

[2] As was the case with the so-called Tax Cuts and Jobs Act, the Senate’s reconciliation rules prevented Senators from changing the formal name of the Act. Thus, the formal name of the Inflation Reduction Act is “An Act to provide for reconciliation pursuant to title II of S. Con. Res. 14.”

[3] For purposes of this Notice, the United States includes the States, the District of Columbia, the Commonwealth of Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Commonwealth of Northern Mariana Islands.

[4] Tax-exempt entities for these purposes include any organizations exempt from tax imposed by subtitle A of the Code, state and local governments, the Tennessee Valley Authority, Indian tribal governments, any Alaska Native Corporation, and rural electric cooperatives.

[5] The IRA authorizes the IRS to provide exceptions to the direct pay phaseout if (i) the inclusion of steel, iron, or manufactured products that are produced in the United States either increases the overall costs of construction of projects by more than 25 percent or (ii) there are either insufficient materials of these types produced in the United States or the materials produced in the United States are not of satisfactory quality.

[6] In the case of projects subject to prevailing wage and apprenticeship requirements, failure to satisfy those requirements reduces the bonus credits amount to 2 percent (for PTC projects) or 2 percentage points (for ITC projects).

[7] For purposes of this Notice, a “manufacturing process” is the application of processes to alter the form or function of materials or of elements of a product in a manner adding value and transforming those materials or elements so that they represent a new item functionally different from the functionality that would result from mere assembly of the elements or materials.

[8] The Steel or Iron Requirement applies in a manner consistent with Section 661.5(b) and (c) of title 49 of the Code of Federal Regulations (the “CFR”). 49 CFR §§ 661.1 through 661.21 (also known as the “Buy America” requirements).

[9] The Manufactured Products Requirement applies in a manner consistent with 49 CFR § 661.5(d).

[10] Direct costs are defined by reference to Treas. Reg. § 1.263A-1(e)(2)(i).

[11] Joint Committee on Tax’n, Description of Energy Tax Law Changes Made by Public Law 117-169, JCX 5-23 (April 17, 2023), at n. 201.

This alert was prepared by Josiah Bethards, Emily Brooks, Mike Cannon, Matt Donnelly, Alissa Fromkin Freltz*, Duncan Hamilton, Kathryn Kelly, and Simon Moskovitz.

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. To learn more about these issues, please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Tax or Power and Renewables practice groups, or the following authors:

Tax Group:

Michael Q. Cannon – Dallas (+1 214-698-3232, mcannon@gibsondunn.com)

Matt Donnelly – Washington, D.C. (+1 202-887-3567, mjdonnelly@gibsondunn.com)

Kathryn A. Kelly – New York (+1 212-351-3876, kkelly@gibsondunn.com)

Josiah Bethards – Dallas (+1 214-698-3354, jbethards@gibsondunn.com)

Emily Risher Brooks – Dallas (+1 214-698-3104, ebrooks@gibsondunn.com)

Duncan Hamilton– Dallas (+1 214-698-3135, dhamilton@gibsondunn.com)

Simon Moskovitz – Washington, D.C. (+1 202-777-9532 , smoskovitz@gibsondunn.com)

Power and Renewables Group:

Gerald P. Farano – Denver (+1 303-298-5732, jfarano@gibsondunn.com)

Peter J. Hanlon – New York (+1 212-351-2425, phanlon@gibsondunn.com)

Nicholas H. Politan, Jr. – New York (+1 212-351-2616, npolitan@gibsondunn.com)

*Alissa Fromkin Freltz is an associate working in the firm’s Washington, D.C. office who currently is admitted to practice only in Illinois and New York.

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

What Comes Next? Looking Forward By Looking Back

On April 28, 2023:

- The Board of Governors of the Federal Reserve System (“Federal Reserve”) released the results of its review of the supervision and regulation of Silicon Valley Bank (“SVB”);

- The Federal Deposit Insurance Corporation (“FDIC”) released its report detailing an internal review of the agency’s supervision of Signature Bank (“Signature”);

- The New York State Department of Financial Services released its review of its supervision and closure of Signature; and

- The Government Accountability Office released its preliminary review of the federal banking agencies’ actions related to the failures of SVB and Signature.

The reports in part assign, and in part accept, blame for the failures of SVB and Signature to the institutions’ boards of directors and management and the agencies’ own missteps in their oversight of the institutions through their supervisory and regulatory authorities. The Federal Reserve’s report is also critical of its own tailoring approach in response to the 2018 Economic Growth, Regulatory Relief, and Consumer Protection Act (“EGRRCPA”).

Rather than summarize the reports’ details of the events leading up to the failures of SVB and Signature, which have been extensively covered, we examine the federal banking agencies’ expected collective response to the recent failures of SVB, Signature, and First Republic Bank, self-liquidation of Silvergate Bank, resulting financial distress across the financial markets broadly, and volatility experienced by similarly sized regional banks acutely. We also examine relevant considerations for FinTechs or other financial services or technology companies that partner with banks for the delivery of innovative financial products and services.

The expected response will shape and shift the regulatory landscape going forward for institutions of all sizes and their partners, and could result in significant changes to the regulatory and supervisory oversight of those institutions and related supervisory expectations and processes. In that regard, there are two takeaways from the reports:

- We can look forward to the expected regulatory response by looking back at the fundamental risk management principles codified in the Dodd-Frank Act and the changes made to the alignment of those principles under EGRRCPA. The more immediate impact will be felt through the supervisory process and quickly evolving supervisory expectations because proposed rulemakings could take “several years” to effect (as Vice Chair for Supervision Barr acknowledges in his cover letter).

- All relevant stakeholders should be actively engaged in the rulemaking process, both to facilitate a thoughtful approach to proposed regulation that weighs the costs and benefits of proposed actions, and to help design an adjusted and balanced framework that promotes safety and soundness and resolvability, provides clarity, reduces complexity and, equally as important, does not diminish banks’ critical role as financial intermediaries or create unintended harmful consequences to the broader economy.

I. Background: Dodd-Frank and EGRRCPA

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) established enhanced prudential standards for bank holding companies and foreign banking organizations with total consolidated assets of $50 billion or more and nonbank financial companies designated by the Financial Stability Oversight Council for supervision by the Federal Reserve. Under the Dodd-Frank Act, those enhanced prudential standards include enhanced risk-based and leverage capital, liquidity, risk management and risk committee requirements, a requirement to submit a resolution plan, single-counterparty credit limits, supervisory and company-run stress testing requirements, and other prudential standards that the Federal Reserve determines are appropriate.

However, EGRRCPA subsequently raised the minimum asset threshold for application of enhanced prudential standards from $50 billion to $250 billion in total consolidated assets, while (i) providing the Federal Reserve discretion in determining whether an institution with assets of $100 billion or more must be subject to such standards and (ii) enabling a more “tiered” and “tailored” enhanced prudential standards regime for large banks. In 2019, the Federal Reserve issued a final rule establishing four categories for determining the applicability and stringency of prudential standards:

- Category I (U.S. global systemically important bank holding companies (“U.S. G-SIBs”));

- Category II (banking organizations with $700 billion or more in total consolidated assets or $75 billion or more in cross-jurisdictional activity);

- Category III (banking organizations with $250 billion or more in total consolidated assets or $75 billion or more in weighted short-term wholesale funding, nonbank assets, or off-balance sheet exposure and that do not meet the criteria for Category I or II); and

- Category IV (banking organizations with at least $100 billion in total consolidated assets and that do not meet the criteria for Category I, II, or III).

The Federal Reserve’s visual depicting the current framework is available here.

II. A Return to Post-Dodd-Frank Act Principles of Oversight and Supervision (or More)?

Vice Chair for Supervision Barr’s cover letter, the Federal Reserve’s report, and the other agencies’ reports forecast expected adjustments to the regulatory framework to align it more closely with the fundamental risk management principles codified in the Dodd-Frank Act, to the extent not limited by or inconsistent with legislative changes made under EGRRCPA. The expected response echoes statements made by Vice Chair for Supervision Barr and other federal banking agency leaders in speeches and other settings, including Congressional testimony, some of which pre-date the most recent bank failures and disruptions in the markets and broader economy. The federal bank regulatory agencies under the Biden administration have signaled for some time their desire to re-align Dodd-Frank Act risk management principles of oversight and supervision—at least to the extent not limited by changes made under EGRRCPA—and the agencies’ reports reaffirm that. Large banks (i.e., banks with total assets of $100 billion or more) should expect an acceleration in the number and scope of proposals that modify the regulatory framework, including proposals that push down certain elements currently applicable only to U.S. G-SIBs.

Vice Chair for Supervision Barr’s cover letter to the Federal Reserve’s report highlights expected regulatory initiatives that are clearly put forth and of likely immediacy for institutions with $100 billion or more in total consolidated assets: capital, liquidity, resolvability, and stress testing. It will be important that any proposals not simply be reflexive but, instead, be thoughtfully designed, provide clarity, assess the costs and benefits, and minimize potential downside to the broader economy.

- Capital. Vice Chair for Supervision Barr states in his cover letter to the report “this experience has emphasized why strong bank capital matters,” highlights the need “to bolster resiliency” and confirms the Federal Reserve is “going to evaluate how to improve [its] capital requirements in light of lessons learned from SVB.” He then adds that “[s]ome steps already in progress include the holistic review of our capital framework [and] implementation of the Basel III endgame rules.” These echo prior statements and remarks for the need to strengthen capital requirements by Barr, including as far back as his nomination hearing before the Senate Banking Committee, as well as similar statements made by Acting Comptroller Hsu and FDIC Chairman Gruenberg in different contexts. As Barr has previously noted, large institutions should expect those enhanced regulatory capital requirements to align with the final set of Basel III standards aimed at “further strengthen[ing] capital rules by reducing reliance on internal bank models and better reflect risks from a bank’s trading book and operational risks”[1] and any proposal should be expected to follow shortly. Barr’s cover letter also suggests the Federal Reserve “should require a broader set of firms to take into account unrealized gains or losses on available-for-sale securities, so that a firm’s capital requirements are better aligned with its financial positions and risk.” As with prior rulemakings, any proposal, if and when finalized, would be implemented with appropriate phase-in periods and likely would take “several years” to take effect, as noted by Barr himself.

- Liquidity. Vice Chair for Supervision Barr’s cover letter indicates the Federal Reserve is “also going to evaluate how [the Federal Reserve] supervise[s] and regulate[s] liquidity risk, starting with the risks of uninsured deposits,” adding that “liquidity requirements and models should better capture the liquidity risk of a firm’s uninsured deposit base” and the Federal Reserve “should re-evaluate the stability of uninsured deposits and the treatment of held to maturity securities in … standardized liquidity rules and in a firm’s internal liquidity stress tests.” He then adds the Federal Reserve “should … consider applying standardized liquidity requirements to a broader set of firms.” He concludes that “[a]ny adjustments to [the] liquidity rules would … have appropriate transition rules, and thus would not be effective for several years.”

- Resolvability. Vice Chair for Supervision Barr’s cover letter also indicates that, following on the October 14, 2022 Advance Notice of Proposed Rulemaking (“ANPR”) issued by the Federal Reserve and FDIC, the federal banking agencies will plan to propose a long-term debt requirement for large banks that are not U.S. G-SIBs. The earlier ANPR was issued to explore whether and how to strengthen resolution-related standards applicable to large banking organizations (i.e., Category II and Category III banking organizations under the tailoring rules). The ANPR considered whether large banking organizations should be subject to resolution requirements similar to those required of U.S. G-SIBs, including total loss-absorbing capacity, long-term debt, clean-holding company requirements, and related requirements.