Ashley Johnson and Jennafer Tryck are the authors of “Dueling Calif. Rulings Offer Insight On 401(k) Forfeiture Suits” [PDF] published by Law360 on July 17, 2024.

Adam Smith, David Wolber, Dharak Bhavsar and Anna Searcey are the authors of “Sanctions Considerations for Non-Governmental Organisations” [PDF] published by Global Investigations Review on June 20, 2024.

This article was first published on Global Investigations Review in June 2024; for further in-depth analysis, please visit GIR “The Guide to Sanctions – 5th Edition.”

Ryan Murr, Karen Spindler, Todd Trattner, Marina Szteinbok and Artin Au-Yeung are the authors of “Delaware Court of Chancery Opines on Meaning of ‘Commercially Reasonable Efforts’ in Pharmaceutical Earn-Out Provision” [PDF] published by the Deal Lawyers in its May-June 2024 issue.

Robert Blume and John Partridge are the authors of “FCPA Liability: Minimizing Third-Party Risk” [PDF] published by Practical Law The Journal in its May 2024 issue.

Michelle Kirschner, Jeffrey Steiner and Sara Weed are the authors of “Risks And Promises Of AI In The Financial Services Industry” [PDF] published by Law360 on June 13, 2024.

Katharina Humphrey and Julian Reichert are the authors of “EU Directive Significantly Strengthens Enviro Protection” [PDF] published by Law360 on June 10, 2024.

New York partners Shukie Grossman, Co-Chair of our Investment Funds Practice Group, and Sean McFarlane and associate Kate Timmerman participated in a keynote interview with Buyouts for its 2024 Secondaries Special Report and discussed the increasing popularity of the secondaries market—including current trends, challenges, and regulatory scrutiny—and shared their outlook for the short and long term.

Shukie noted that “…because GP-leds have become so interesting, many sponsors that have traditionally focused on raising buyout funds are now raising separate funds dedicated to investing in these vehicles. That is testament to the popularity of GP-leds, and as we see more dedicated capital raised, we can look forward to deployment driving more activity in this area.”

Regarding the evolution of GP-led secondaries transactions, Sean observed that “[w]here historically RWI only covered standard fundamental representations and maybe a few knowledge-qualified reps for portfolio companies, today’s buyers’ market has driven demand for better protections. Insurance has provided a solution to streamline processes.”

“We expect the GP-led market to become busier after a volatile few years, with more players entering the market and doing more sophisticated deals, both in terms of deal constructs and the documentation required,” Kate predicted.

The full article is available here [PDF].

Douglas Fuchs, Eric Vandevelde, Matt Aidan Getz, Lindsay Laird and Jesse Schupack are the authors of “Petitioners and AG Bonta Ask California Supreme Court to Review Constitutionality of Death Penalty” [PDF] published by the Daily Journal on May 31, 2024.

Amir Tayrani is the author of “All Roads Lead to Dallas: FTC Non-Compete Rule Set to Face Its First Legal Test in the Northern District of Texas” [PDF] published by Truth on the Market on May 23, 2024.

Six Gibson Dunn lawyers contributed to the Chambers and Partners Transfer Pricing 2024 guide. Sanford Stark, Saul Mezei, Terrell Ussing and Anne Devereaux authored the Introduction to the guide and the U.S. chapter. Sandy Bhogal and Bridget English authored the U.K. chapter. Sanford Stark also served as the guide’s Contributing Editor. The guide was published in May 2024.

Reed Brodsky, Benjamin Wagner, Mark Schonfeld, David Woodcock and Michael Nadler are the authors of “SEC Successfully Prosecutes Novel ‘Shadow Trading’ Theory at Trial” [PDF] published by Insights: The Corporate & Securities Law Advisor in its June 2024 issue.

Michael Diamant, George Hazel and Kristen Limarzi are the authors of “How to Avoid and Resolve Pitfalls During a Monitorship’s Life Cycle” [PDF] published by the Global Investigations Review on May 9, 2023.

Jane Love and Robert Trenchard are the authors of “Double-Patenting Ruling Shows Terminal Disclaimers’ Value” [PDF] published by Law360 on May 8, 2024.

Sébastien Evrard, Connell O’Neill, Nick Hay and Katie Cheung are the authors of “Why competition law and data privacy are coming to a crossroads in the Asia-Pacific Region” [PDF].

This article was first published by Global Competition Review in April 2024; for further in-depth analysis, please visit the GCR Asia-Pacific Antitrust Review.

Seth Rokosky is the co-author of “Recent Commercial Cases of Interest in the New York Court of Appeals” [PDF] published by the New York State Bar Association’s Commercial and Federal Litigation Section Newsletter in its April 2024 issue.

Singapore partner Paul Tan, Hong Kong of counsel Alex Wong and Singapore associates Jonathan Lai and Viraen Vaswani are the authors of “Top 10 Issues in Arbitration Clauses in Singapore and Hong Kong” [PDF] published by Dispute Resolution Journal in its May-June 2024 issue.

Brussels managing director Nicholas Banasevic, London partner Robert Spano and Palo Alto partner Vivek Mohan are the authors of “What does the EU Digital Markets Act mean for the tech sector?” [PDF] published by the Daily Journal on April 17, 2024.

A recent global survey of dealmakers by BCG and Gibson Dunn reveals a striking consensus: conducting environmental, social, and governance (ESG) due diligence is now indispensable for M&A transactions.

Dealmakers say that the insights gained from these assessments are crucial not only for mitigating risks but also for preserving and enhancing deal value. Although Europe has spearheaded more stringent ESG regulations, dealmakers in all surveyed countries, including those in the US, recognize the importance of performing such assessments before closing a deal.

“The Payoffs and Pitfalls of ESG Due Diligence” report was authored by Jens Kengelbach, Jana Herfurth, Dominik Degen, Dirk Oberbracht, Ferdinand Fromholzer, and Jan Schubert. Download the report here.

About the Survey

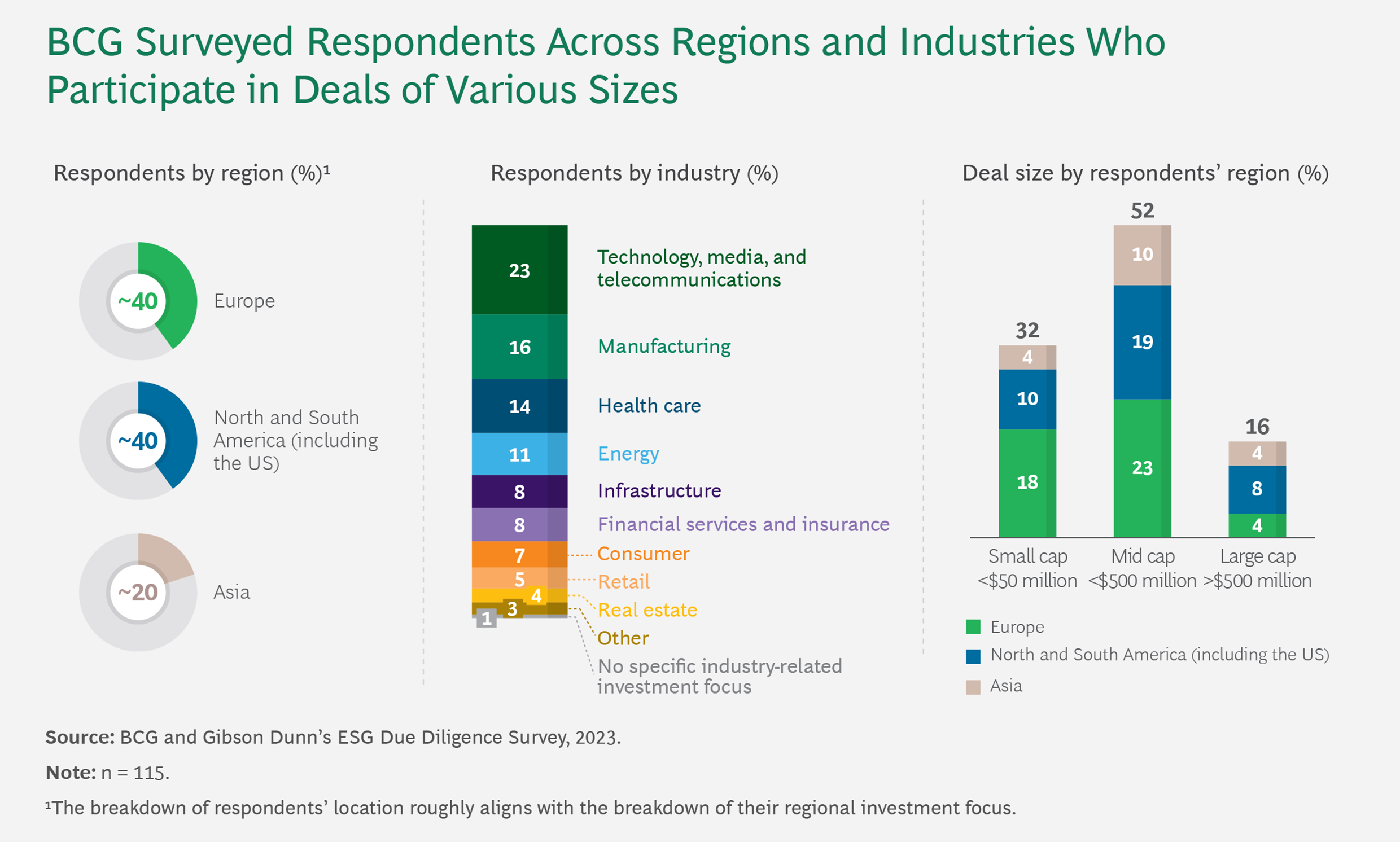

To understand the prevailing ESG due diligence practices in M&A transactions, BCG and Gibson Dunn surveyed 115 dealmakers in Europe, North and South America (including in the US), and Asia. The dealmakers are in various industries and participate in different deal sizes. (See the exhibit below.) The survey participants, who hold positions ranging from managers to roles in the C-suite, have been personally involved in deals during the past three years and are familiar with ESG due diligence practices. Approximately two-thirds of the respondents are corporate executives, while the others are from private equity or venture capital firms or financial institutions.

Website © 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. The report linked above is © 2024 Boston Consulting Group with details included in the report.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Los Angeles partner James Zelenay and Denver associate José Madrid are the authors of “Supreme Court decisions and cyber-fraud focus drive record-setting FCA enforcement in 2023” [PDF] published by the Daily Journal on April 8, 2023.

Paris partner Ahmed Baladi and associate Thomas Baculard are the authors of “Artificial intelligence and the GDPR” [PDF] published by Financier Worldwide in its April 2024 issue.