From the Derivatives Practice Group: This week, the CFTC initiated review of certain sports-related events contracts. This week, the CFTC initiated review of certain sports-related events contracts.

New Developments

- CFTC and the Bank of England Comment on Report on Initial Margin Transparency and Responsiveness in Centrally Cleared Markets. On January 15, the Basel Committee on Banking Supervision (“BCBS”), the Bank for International Settlements’ Committee on Payments and Market Infrastructures (“CPMI”) and the International Organization of Securities Commissions (“IOSCO”) published the final report Transparency and responsiveness of initial margin in centrally cleared markets – review and policy proposals and the accompanying cover note Consultation feedback and updated proposals. This report is the culmination of work undertaken by BCBS, CPMI, and IOSCO, co-chaired by the Bank of England and the Commodity Futures Trading Commission. [NEW]

- CFTC Announces Review of Nadex Sports Contract Submissions. On January 14, the CFTC notified the North American Derivatives Exchange, Inc. (“Nadex”) d/b/a Crypto.com it will initiate a review of the two sports contracts that were self-certified and submitted to the CFTC on Dec. 19, 2024. As described in the submissions, the contracts are cash-settled, binary contracts. The CFTC determined the contracts may involve an activity enumerated in CFTC Regulation 40.11(a) and section 5c(c)(5)(C) of the Commodity Exchange Act. As required under CFTC Regulation 40.11(c)(1), the CFTC has requested that Nadex suspend any listing and trading of the two sports contracts during the review period. [NEW]

- CFTC Announces Departure of Clearing and Risk Director Clark Hutchison. On January 15, the CFTC announced Division of Clearing and Risk Director Clark Hutchison will depart the agency Jan. 15. Mr. Hutchison has served as director since July 2019. [NEW]

- CFTC Staff Issues Advisory Regarding the Compliance Date for Certain DCO Reporting Requirements. On January 10, the CFTC’s Division of Clearing and Risk (“DCR”) announced it issued a staff advisory regarding the compliance date for certain daily reporting requirements for registered derivatives clearing organizations (“DCOs”). The requirements were amended in August 2023. The compliance date for the amended requirements is February 10, 2025. According to the advisory, DCR will not expect any DCO to comply with the amended requirements until December 1, 2025, so long as the DCO continues to comply with the previous version of the requirements.

- CFTC Announces Departure of Enforcement Director Ian McGinley. On January 10, the CFTC announced that Division of Enforcement Director Ian McGinley will depart the agency on January 17, 2025. Mr. McGinley has served as Director of Enforcement since February 2023.

- Chairman Rostin Behnam Announces Departure from CFTC. On January 7, Chairman Rostin Behnam announced that he will be stepping down from his position as Chairman on January 20 and that his final day at the CFTC will be Friday, February 7.

New Developments Outside the U.S.

- The EBA and ESMA Analyze Recent Developments in Crypto-Assets. On January 16, ESMA and the European Banking Authority (“EBA”) published a Joint Report on recent developments in crypto-assets, analyzing decentralized finance (“DeFi”) and crypto lending, borrowing and staking. This publication is the EBA and ESMA’s contribution to the European Commission’s report to the European Parliament and Council under Article 142 of the Markets in Crypto-Assets Regulation. EBA and ESMA find that DeFi remains a niche phenomenon, with value locked in DeFi protocols representing 4% of all crypto-asset market value at the global level. The report also sets out that EU adoption of DeFi, while above the global average, is lower than other developed economies (e.g. the US, South Korea). [NEW]

- EU Funds Continue to Reduce Costs. . On January 14, ESMA published its seventh market report on the costs and performance of EU retail investment products, showing a decline in the costs of investing in key financial products. This report aims at facilitating increased participation of retail investors in capital markets by providing consistent EU-wide information on cost and performance of retail investment products. [NEW]

- ESMA Launches Selection of the Consolidated Tape Provider for Bonds. On January 3, ESMA announced the launch of the first selection procedure for the Consolidated Tape Provider (“CTP”) for bonds. Entities interested to apply are encouraged to register and submit their requests to participate in the selection procedure by February 7, 2025. The CTP aims to enhance market transparency and efficiency by consolidating trade data from various trading venues into a single and continuous electronic stream. This consolidated view of market activity is intended to help market participants to access accurate and timely information and make better-informed decisions, leading to more efficient price discovery and trading.

New Industry-Led Developments

- ISDA and GFXD Respond to FCA on Future of SI Regime. On January 10, ISDA and the Global Foreign Exchange Division (“GFXD”) of the Global Financial Markets Association (“GFMA”) responded to questions from the UK Financial Conduct Authority (“FCA”) on the future of the systematic internalizer (“SI”) regime. In the response, ISDA and GFXD support the proposal that firms are no longer required to identify themselves as SIs for derivatives trading and provide input on the consequences of this requirement falling away. ISDA and GFXD do not believe there will be any impact for reporting, best execution or on market structure. [NEW]

The following Gibson Dunn attorneys assisted in preparing this update: Jeffrey Steiner, Adam Lapidus, Marc Aaron Takagaki, Hayden McGovern, and Karin Thrasher.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Derivatives practice group, or the following practice leaders and authors:

Jeffrey L. Steiner, Washington, D.C. (202.887.3632, jsteiner@gibsondunn.com)

Michael D. Bopp, Washington, D.C. (202.955.8256, mbopp@gibsondunn.com)

Michelle M. Kirschner, London (+44 (0)20 7071.4212, mkirschner@gibsondunn.com)

Darius Mehraban, New York (212.351.2428, dmehraban@gibsondunn.com)

Jason J. Cabral, New York (212.351.6267, jcabral@gibsondunn.com)

Adam Lapidus – New York (212.351.3869, alapidus@gibsondunn.com )

Stephanie L. Brooker, Washington, D.C. (202.887.3502, sbrooker@gibsondunn.com)

William R. Hallatt , Hong Kong (+852 2214 3836, whallatt@gibsondunn.com )

David P. Burns, Washington, D.C. (202.887.3786, dburns@gibsondunn.com)

Marc Aaron Takagaki , New York (212.351.4028, mtakagaki@gibsondunn.com )

Hayden K. McGovern, Dallas (214.698.3142, hmcgovern@gibsondunn.com)

Karin Thrasher, Washington, D.C. (202.887.3712, kthrasher@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Class actions remain an active and evolving area of litigation, and we expect that trend to continue in 2025.

This update previews several important issues for class-action practitioners in the year ahead, including significant circuit splits, a noteworthy petition before the Supreme Court regarding Rule 23’s “ascertainability” requirement, and developments in mass arbitration.

I. Circuit Splits to Watch in 2025

Class action-related issues continue to percolate through the federal courts of appeals, with several circuit splits that deepened in 2024 growing potentially ripe for Supreme Court review. This section highlights circuit splits on standing in class actions, personal jurisdiction, and standards for expert evidence at the class-certification phase.

A. Standing in Class Actions

Courts continue to grapple with how Article III standing principles affect class actions. As summarized in the Fifth Circuit’s recent decision in Chavez v. Plan Benefit Services, Inc., 108 F.4th 297 (5th Cir. 2024), the courts of appeals have taken varying approaches to implementing Article III requirements in class actions, including: (1) the “standing” approach, and (2) the “class certification” approach. Id. at 308-11.

Under the “standing” approach—adopted by the Second, Seventh, and Eleventh Circuits—named plaintiffs must establish Article III standing for themselves and absent class members before courts can proceed to a Rule 23 certification analysis. Chavez, 108 F.4th at 309-11. Although the specific approach varies somewhat by circuit, it generally requires class representatives to show they have the “same interest[s] and “same injur[ies]” as the putative class. Id. at 311.

By contrast, under the “class certification” approach—adopted by the First, Third, Fourth, Sixth, and Tenth Circuits—courts include these standing questions as part of “the Rule 23 inquiry.” Id. at 312. According to the Fifth Circuit, courts following this approach do so to separate Article III’s standing requirements with Rule 23’s requirements, and thus focus on “the relationship between the class representative and the passive class members.” Id. at 309.

There remain important questions about how to square these approaches with the Supreme Court’s insistence that Article III principles apply equally in class actions. As the Fifth Circuit observed, the Supreme Court has “caution[ed] against dispensing standing ‘in gross’ in a class-action context”—and emphasized that plaintiffs must always “demonstrate standing for each claim that they press and for each form of relief that they seek.” Id. at 307 (quoting TransUnion, LLC v. Ramirez, 594 U.S. 413, 431 (2021)); see also TransUnion, 594 U.S. at 431 (“Every class member must have Article III standing in order to recover individual damages.”). But it seems we will have to wait before there is more clarity on this issue: although the defendants in Chavez filed a petition for a writ of certiorari, the Supreme Court denied the petition in December. So at least for now, the split will persist—though it may only be a matter of time before the Supreme Court provides guidance.

B. Personal Jurisdiction in FLSA Collective Actions

We previously addressed a circuit split on the issue of personal jurisdiction in collective actions under the Fair Labor Standards Act (FLSA), specifically regarding whether out-of-state plaintiffs can join an FLSA action filed in a state where the defendant is not subject to general personal jurisdiction. This circuit split stems from competing interpretations of the Supreme Court’s decision in Bristol-Myers Squibb Co. v. Superior Court, 582 U.S. 255 (2017), which addressed personal jurisdiction in mass actions, but did not explicitly address FLSA collective actions.

Since the Supreme Court decided Bristol-Myers Squibb, the Third, Sixth, and Eighth Circuits have held that the jurisdictional analysis in Bristol-Myers Squibb, which requires a “claim-by-claim personal jurisdiction analysis” in mass actions, also applies to FLSA collective actions. Fischer v. Fed. Express Corp., 42 F.4th 366, 375 (3d Cir. 2022); Canaday v. Anthem Cos., Inc., 9 F.4th 392, 397 (6th Cir. 2021); Vallone v. CJS Sols. Grp., LLC, 9 F.4th 861, 865 (8th Cir. 2021). By contrast, only the First Circuit has declined to follow that line of decisions and instead has held that courts need not have personal jurisdiction over every opt-in plaintiff in FLSA cases. See Waters v. Day & Zimmerman NPS, Inc., 23 F.4th 84, 93 (1st Cir. 2022).

The First Circuit’s decision is the clear outlier among the circuits, with the momentum in favor of the majority approach adopted by more and more circuits. For example, this past year, in Vanegas v. Signet Builders, Inc., 113 F.4th 718 (7th Cir. 2024), the Seventh Circuit joined the majority of circuits in holding that opt-in plaintiffs must each satisfy personal jurisdiction requirements to participate in FLSA collective actions. Id. at 724. The court explained that an FLSA collective action is like a mass action because it is a “consolidation of individual cases, brought by individual plaintiffs.” Id. at 725.

While it remains unsettled whether the same rule applies to absent class members in Rule 23 class actions, the growing agreement among the circuits suggests that companies should expect their home jurisdictions to be the preferred venue for plaintiffs filing nationwide collective actions—meaning jurisdictional defenses will remain an important consideration when defending such actions in other forums.

C. Standards for Expert Evidence at Class Certification

Parties often rely on expert evidence when litigating class-certification motions, and one important question that practitioners routinely confront is to what extent the admissibility of such expert evidence should affect the class-certification analysis. We earlier previewed a developing circuit split on the intersection between Daubert admissibility analysis and class certification. On one side of the split, the Third, Fifth, and Seventh Circuits require a full Daubert analysis and a finding that expert evidence is admissible before it can support class certification. In re Blood Reagents Antitrust Litig., , 186-88 (3d Cir. 2015); Prantil v. Arkema Inc., 986 F.3d 570, 575-76 (5th Cir. 2021); Am. Honda Motor Co. v. Allen, 600 F.3d 813, 815-16 (7th Cir. 2010). On the other side of the split, the Eighth Circuit has applied a more flexible approach for examining expert evidence regarding class certification. In re Zurn Pex Plumbing Prods. Liab. Litig., 644 F.3d 604, 611-14 (8th Cir. 2011).

This circuit split is poised to persist into 2025, with no clear consensus emerging. The Sixth and Ninth Circuits entered the fray this past year, with the Sixth Circuit joining the majority and the Ninth Circuit apparently siding with the minority:

- In In re Nissan North America, Inc. Litigation, 122 F.4th 239 (6th Cir. 2024), the Sixth Circuit reasoned that “[i]f expert testimony is insufficiently reliable to satisfy Daubert, it cannot prove that the Rule 23(a) prerequisites have been met in fact through acceptable evidentiary proof.” at 253 (internal quotation marks omitted); see In re Nissan N. Am., Inc. Litig., 122 F.4th 239, 253 (6th Cir. 2024) (“[t]he Supreme Court requires parties to ‘satisfy through evidentiary proof’ that they ‘in fact’ meet the elements” of Rule 23). The Sixth Circuit therefore held that where expert evidence is “material to class certification,” it must satisfy Daubert. Nissan, 122 F.4th at 253.

- By contrast, the Ninth Circuit recently held that plaintiffs may rely on evidence that is not admissible to support class certification and that a district court need conduct only a “limited” Daubert analysis at the class-certification stage, even if an expert’s model is not “fully developed.” Lytle v. Nutramax Labs., Inc., 99 F.4th 557, 570-71, 576-77 (9th Cir. 2024). The Ninth Circuit based its holding on the “temporal focus of the class certification inquiry,” reasoning that “class action plaintiffs are not required to actually prove their case” at class certification, but rather “must show that they will be able to prove their case through common proof at trial.” at 570. Notably, the holding in Lytle appears at odds with Olean Wholesale Grocery Coop., Inc. v. Bumble Bee Foods LLC, 31 F.4th 651 (9th Cir. 2022) (en banc), in which the Ninth Circuit held en banc that plaintiffs “may use any admissible evidence” to satisfy their burden at class certification (id. at 665 (emphasis added)) and that defendants “may challenge the reliability of an expert’s evidence under Daubert” when opposing class certification (id. at 665 n.7).

The defendants in Lytle petitioned for a writ of certiorari, asking the Supreme Court to rule on whether a district court may rely on inadmissible expert evidence to certify a class under Rule 23. As argued in the petition, the less stringent approach described in Lytle is particularly dangerous because it “allows putative class counsel to choose what evidentiary standard applies,” and “expert testimony that is less developed receives less scrutiny.” Nutramax Labs., Inc. v. Lytle, No. 24-576, 2024 WL 4904592, at *15 (U.S. Nov. 21, 2024). The petition remains pending.

The Supreme Court previously expressed doubt that Daubert was not applicable to expert testimony at the class-certification stage. See Wal-Mart Stores, Inc. v. Dukes, 564 U.S. 338, 354 (2011). Until the Supreme Court provides clarification, parties and practitioners should carefully consider their approach to relying on and opposing expert evidence at the class-certification stage, particularly in jurisdictions like the Eighth or Ninth Circuits (or those that have yet to address the role of Daubert at class certification). Given the possibility for Supreme Court review, litigants should ensure that their own expert evidence satisfies Daubert, consider mounting Daubert challenges to opposing expert evidence to preserve claims of error, and ask courts to make clear findings regarding admissibility of expert evidence to best position their cases for review in the event the Supreme Court decides this issue.

II. Ascertainability at the Supreme Court

The Supreme Court continues to receive cert petitions that raise interesting and recurring issues in the class-action space. There is one such petition pending on an oft-litigated issue: whether Rule 23 embodies an “ascertainability requirement” that obliges plaintiffs to offer “objective criteria” by which class members are “readily identifiable” in reference to objective criteria. As discussed in last year’s article, courts have taken different approaches to ascertainability, with no clear consensus among the circuits.

The pending cert petition seeks review of the Fourth Circuit’s decision in Career Counseling, Inc. v. AmeriFactors Financial Group, LLC, 91 F.4th 202 (4th Cir. 2024), which reaffirmed that Rule 23 contains an ascertainability requirement. The case involves a putative class action alleging that a company sent unsolicited fax advertisements to 59,000 recipients in violation of the Telephone Consumer Protection Act (TCPA). The district court denied class certification, holding that the putative class failed to satisfy Rule 23’s implicit threshold requirement of ascertainability. Id. at 207. Specifically, the district court reasoned that the individuals eligible for class membership were not “readily identifiable” because only those who received the advertisements through “stand-alone” fax machines (rather than online fax services) could maintain a TCPA claim, and there was no way to readily identify those with stand-alone fax machines. Id. In affirming the denial of class certification, the Fourth Circuit rejected the plaintiffs’ argument that there is no implicit ascertainability requirement under Rule 23. Id. at 209.

The plaintiffs filed a cert petition that asks the Supreme Court to settle whether “administrative feasibility” stands as a distinct prerequisite to class certification, or instead sits as one of several prudential factors for courts to consider in their Rule 23(b)(3) superiority analysis. See Career Counseling v. Amerifactors Fin. Grp., No. 24-86, 2024 WL 3569079, at *11 (U.S. July 19, 2024). This is the latest of several cert petitions to have raised this question in the past few years; although the Supreme Court has not taken the question up yet, this is certainly an issue that many are eagerly watching.

III. Continued Judicial Scrutiny of Dispute-Resolution Agreements and Evolving Strategies to Manage Mass Arbitration Risk

Mass arbitration is becoming one of the largest legal threats to companies, with a sophisticated plaintiff’s bar implementing novel strategies to take advantage of arbitration agreements to exert settlement pressure on defendants. We see no signs of this trend slowing in 2025, and companies have responded to this threat with dispute-resolution provisions that encourage the efficient resolution of individual disputes—all the while disincentivizing plaintiff’s attorneys from initiating “mass arbitration” campaigns that benefit no one other than themselves.

Courts have begun to review these efforts to curb the risk of exploitative mass arbitration. In Heckman v. Live Nation Entertainment, Inc., 120 F.4th 670 (9th Cir. 2024), the court has declined to enforce an arbitration agreement based on its conclusion that the arbitration provider’s rules were “internally inconsistent, poorly drafted, and riddled with typos,” and that “counsel struggled to explain the Rules at oral argument.” Id. at 677-78.

The court determined that defendants’ “market dominance” in the ticket services industries supported a finding that the contract was adhesive, further supporting a finding of unconscionability. Id. at 682. The court also ruled that a provision permitting unilateral modification of the terms without prior notice rendered the clause “procedurally unconscionable” under California law. Id. at 682-83.

As to substantive unconscionability, the court expressed three concerns. First, the defendant’s “bellwether” process—which would bind future claimants to a single arbitrator’s ruling on the validity of the delegation clause in both bellwether and non-bellwether cases—effectively deprived the non-bellwether claimants of their right to be heard or otherwise participate in proceedings that could affect their rights. Id. at 684-85. Second, the arbitration rules also restricted discovery and the evidence that could be presented. Id. at 685-86. And third, the claimants were bound by what the court viewed as a functionally “asymmetrical” appeal provision, leaving them without a right to appeal any denial of injunctive relief. Id. at 686.

Heckman did not reach several types of clauses that have been used to address “mass arbitration” abuses such as pre-dispute informal dispute resolution clauses, individualized arbitration demand requirements, cost-splitting provisions, and fee-shifting for frivolous claims. And courts already have upheld “batching” clauses post-Heckman. See, e.g., Kohler v. Whaleco, Inc., 2024 WL 4887538, at *9 (S.D. Cal. Nov. 25, 2024) (post-Heckman decision holding that batching provision in arbitration agreement did not make delegation clause unconscionable). Given the rapidly evolving case law and differing approaches to the review of arbitration provisions, companies should analyze their clauses on a regular basis.

Gibson Dunn attorneys are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work in the firm’s Class Actions, Litigation, or Appellate and Constitutional Law practice groups, or any of the following lawyers:

Theodore J. Boutrous, Jr. – Los Angeles (+1 213.229.7000, tboutrous@gibsondunn.com)

Christopher Chorba – Co-Chair, Class Actions Practice Group, Los Angeles

(+1 213.229.7396, cchorba@gibsondunn.com)

Theane Evangelis – Co-Chair, Litigation Practice Group, Los Angeles

(+1 213.229.7726, tevangelis@gibsondunn.com)

Lauren R. Goldman – Co-Chair, Technology Litigation Practice Group, New York

(+1 212.351.2375, lgoldman@gibsondunn.com)

Kahn A. Scolnick – Co-Chair, Class Actions Practice Group, Los Angeles

(+1 213.229.7656, kscolnick@gibsondunn.com)

Bradley J. Hamburger – Los Angeles (+1 213.229.7658, bhamburger@gibsondunn.com)

Michael Holecek – Los Angeles (+1 213.229.7018, mholecek@gibsondunn.com)

Lauren M. Blas – Los Angeles (+1 213.229.7503, lblas@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

We are pleased to provide you with Gibson Dunn’s ESG update covering the following key developments during December 2024. Please click on the links below for further details.

- Institutional Shareholder Services Inc. (ISS) announces updates to voting guidelines for 2025

On December 17, 2024, proxy advisor ISS released its 2025 Proxy Voting Guidelines updates for the U.S., Canada, and the Americas. These guidelines will apply to shareholder meetings held on or after February 1, 2025. United States updates included additional guidance on poison pills, special purpose acquisition company extension proposals, and natural capital and community impact assessment shareholder proposals. Regarding such shareholder proposals, ISS now considers whether the company’s current disclosure is aligned with “relevant, broadly accepted reporting frameworks” when considering its recommendations related to environmental or community impact assessment proposals. ISS explained that the change is in response to frameworks on biodiversity and nature-related risks such as the Taskforce on Nature-related Financial Disclosures and the Kunming-Montreal Global Biodiversity Framework. Updates for Canada related to director independence, board gender and racial/ethnic diversity, the presence of a former chief executive or financial officer on the audit or compensation committee, pay-for-performance, and article and bylaw amendments. Updates to the Americas policies consisted of board structure and compensation plan proposals.

- International Court of Justice (ICJ) concludes hearings on obligations of states to address climate change

Between December 2 and December 13, 2024, the ICJ held hearings to determine the responsibilities states have under international law to combat climate change. The proceedings involved participation from 96 countries and 11 regional organizations. Smaller island nations called for consequences for high-emitting states that fail to meet their climate-related obligations. In contrast, China pressed the ICJ to favor existing frameworks on climate change such as the Paris Agreement rather than creating new legal obligations. The United States pushed back against the approach of “common but differentiated responsibilities” among states, arguing that international treaties such as the Paris Agreement are not legally binding. Based upon the hearings, the ICJ is expected to publish its advisory opinion, which, while not binding, has authoritative value and may inform subsequent legal proceedings.

- UK Sustainability Disclosure Technical Advisory Committee (TAC) issues final recommendations on International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards

On December 18, 2024, the Financial Reporting Council (FRC), in its role as Secretariat to the TAC, published the TAC’s recommendations to the Secretary of State for Business and Trade on the use of the first two IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board. The TAC recommended the endorsement of the use of Sustainability Disclosure Standards IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and S2 (Climate-related Disclosures), subject to small amendments, including extending the “climate first” reporting relief to two years. It was also suggested that guidance be developed on how entities can align IFRS S1 with existing disclosure requirements.

- Financial Markets Standards Board (FSMB) publishes Transparency Draft Statement of Good Practice (SoGP) on the governance of Sustainability-Linked Products (SLPs) for consultation

On December 17, 2024, the FMSB published an SoGP on the governance of SLPs and invited comments by February 21, 2025. The SoGP aims to codify good practices for the governance of SLPs and support the adoption of consistent governance approaches across asset classes and jurisdictions. The SoGP is stated to apply to service providers or users of SLPs in wholesale financial markets. The SoGP comprises six “Good Practice Statements,” including that borrowers or issuers (Users) of SLPs should outline the strategic objectives of their transaction, their internal processes for measuring outcomes, and their appetite for pre-execution external review. In addition, Users should take measures to mitigate material risks including conflicts of interest, and have robust and clearly defined governance processes for the approval of SLPs which demonstrate a consistent internal approach to these approvals.

- UK Government Consultation on Implementing the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)

On December 16, 2024, the Department for Transport published a consultation on implementing the UN’s CORSIA in the UK. Established by the International Civil Aviation Organization, this global initiative seeks to offset carbon dioxide (CO2) emissions from international aviation by requiring airlines to purchase emissions units for growth beyond 85% of 2019 levels. The UK Government has already begun implementing CORSIA, starting with the incorporation of the requirement to monitor, report, and verify CO2 emissions (known as MRV) into UK law through the Air Navigation (CORSIA) Order 2021. Amendments may be required to UK legislation, including the Air Navigation (CORSIA) Order 2021 and the Greenhouse Gas Emissions Trading Scheme Order 2020, to integrate CORSIA’s offsetting provisions, compliance penalties, and reporting requirements. The consultation includes two policy options for the interaction between CORSIA and the UK ETS. The consultation closes on February 10, 2025.

- UK Government sets out plan for “new era of clean electricity”

On December 13, 2024, the UK Government announced the Clean Power 2030 Action Plan, a series of reforms to the UK’s energy system. The goals of the reforms include bringing down energy costs and protecting consumers from price volatility, expediting decisions on planning permission for critical energy infrastructure, and expanding the renewables auction process to stop delays and increase the number of projects completed. The Action Plan was devised with the advice of the National Energy System Operator to achieve the target of “Clean Power 2030.” The aim is that by 2030, clean sources will produce at least as much power as the UK consumes in total over the year, and at least 95% of total power generated in the UK.

- Financial Conduct Authority (FCA) publishes quarterly consultation for its Handbook, including adjustments to the anti-greenwashing rule

On December 6, 2024, the FCA published CP24/26, a quarterly consultation proposing minor amendments to its Handbook. The changes include adjustments to the anti-greenwashing rule and Sustainability Disclosure Requirements, and updates to reflect the latest UK Corporate Governance Code. Feedback is invited by January 13, 2025, for most chapters, and by January 27, 2025, for the Corporate Governance Code updates.

- FCA’s new “naming and marketing” sustainability rules come into force

On December 2, 2024, the FCA’s “naming and marketing” sustainability rules came into force. The package of measures is designed to provide investors with more information when making decisions. In particular, the guiding principles require a fund that uses sustainability-related terms in its name to have sustainability characteristics. As mentioned in our September update, the FCA is offering temporary flexibility, until 5 p.m. on April 2, 2025, for some funds to comply with the rules.

- UK Emissions Trading Scheme (UK ETS) Authority issues consultation on expanding the UK ETS to the maritime sector

On November 28, 2024, the UK ETS Authority issued a consultation seeking input on a number of proposals to expand the UK ETS to the maritime sector from 2026. The consultation closes on January 23, 2025.

- Cutting back on EU ESG legislation on the horizon: Omnibus Simplification Package?

The president of the European Commission, Ms. Ursula von der Leyen, in a press conference in Budapest recently mentioned her intention to cut back the obligations under the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), the Sustainable Finance Disclosure Regulation, the Regulation on Deforestation-free Products, and the Taxonomy Regulation by a so-called Omnibus Regulation, stating that “the content of the laws is good—we want to maintain it and we will maintain it—but the way we get there, the questions we are asking, the data points we are collecting, is too much—often redundant, often overlapping—so our task is to reduce this bureaucratic burden without changing the correct content of the laws.” The Omnibus Regulation is part of the EU Commission’s efforts to strengthen the EU’s economic competitiveness. The “tentative agenda for forthcoming Commission meetings” published on December 4, 2024, also mentions an “Omnibus simplification package” for the meeting on February 26, 2025, to be published by Executive Vice-President Stéphane Séjourné.

No further details regarding the substance are public yet.

- CSRD transposition continues to stutter

As of the end of 2024, nine EU member states and EEA states had not yet transposed the CSRD into national law—namely, the Netherlands, Luxembourg, Germany, Spain, Portugal, Austria, Cyprus, Malta, and Iceland. This will generally mean that CSRD reporting (based on the European Sustainability Reporting Standards (ESRS)) will not apply in these states for financial year 2024 (mainly relevant for certain listed and regulated entities); if transposed in the course of 2025, it will likely still be possible to provide for application for financial year 2025 (based on the analysis of the Institute of Auditors in Germany (IDW) [original German only] on retroactive effects; to be verified under each relevant law). Financial year 2025 is typically relevant for in-scope subsidiaries of U.S. and other non-EU groups. It remains to be seen whether the indicated omnibus simplification package by the EU addressed above will provide for a further postponement of the reporting requirements as suggested by the German cabinet members. An overview of the current status of the transposition of the CSRD into national laws can be found here.

- German government seconds plans for EU Sustainability Omnibus Regulation

In response to the EU Commission’s plan to simplify administrative procedures and sustainability reporting requirements, certain cabinet members of the German government—notably including vice chancellor Robert Habeck of the Green Party—sent a letter to the EU Commission dated December 17, 2024 supporting such an endeavor. In the letter, the cabinet members highlighted the burden of sustainability reporting requirements for companies and made several (drastic) proposals for simplification measures, including a two-year postponement of the reporting requirements for large companies that do not qualify as public-interest entities, an increase in the thresholds for these companies to €450 million in revenue and 1,000 employees, analogous to the CSDDD, a reduction of data points contained in the European Sustainability Reporting Standards (ESRS), and targeted measures to reduce the trickle-down effect on companies in the value chain. In a letter dated January 2, 2025 [original German only], the German Chancellor Olaf Scholz expressly supported the request by the cabinet members and the intended omnibus regulation.

- European Financial Reporting Advisory Group (EFRAG) releases Voluntary Sustainability Reporting Standard for non-listed micro-, small-, and medium-sized undertakings (SMEs) and adds explanations to its ESRS Q&A Platform

On December 17, 2024, EFRAG published its Voluntary Reporting Standard for SMEs (VSME). The VSME shall provide guidance to companies that are not in scope of the CSRD but wish to standardize their reporting of sustainability information to access sustainable financing. In 2025, EFRAG plans to issue additional digital tools, support guides, and outreach initiatives to facilitate market acceptance and uptake of the VSME.

Furthermore, EFRAG released additional explanations on its ESRS Q&A Platform. The updates include answers to questions on mapping of sustainability matters to topical disclosures, the use of secondary data for social topics, and restrictions due to national regulations. The latest compilation of explanations can be found here and here.

- EU Council adopts regulation on packaging and packaging waste

The Council of the European Union formally adopted a new regulation on packaging and packaging waste on December 16, 2024, thereby concluding the legislative process. The new rules require EU member states to reduce the amount of plastic packaging waste and introduce overall packaging reduction targets of 5% by 2030, 10% by 2035, and 15% by 2040. Among other things, certain types of single-use plastic packaging shall be banned by 2030, including very lightweight plastic carrier bags.

- European Securities and Markets Authority (ESMA) publishes Q&As on guidelines on funds’ names using ESG or sustainability-related terms

On December 13, 2024, ESMA announced its publication of Q&As relating to its guidelines on funds’ names using ESG or sustainability-related terms. The guidelines have applied to alternative investment fund managers and UCITS management companies since November 2024. Amongst other matters, the Q&As confirm: (i) investment restrictions relating to the exclusion of companies do not apply to investments in European green bonds; and (ii) investment funds may not be meaningfully investing in sustainable investments if they contain less than 50% of sustainable investments.

- Regulation on ESG rating activities published in the Official Journal

On December 12, 2024, Regulation (EU) 2024/3005 on the transparency and integrity of ESG rating activities was published in the Official Journal of the European Union. The Regulation introduces a regulatory regime for ESG rating providers operating in the EU. The Regulation entered into force on January 2, 2025 and will apply from July 2, 2026.

- Switzerland plans to require disclosure of detailed roadmaps for achieving net-zero target by 2050 and to align reporting with international standards

On December 6, 2024, the Swiss government launched a consultation on proposed amendments to the Ordinance on Climate Disclosures, which requires large companies and financial institutions to report climate-related factors. With the amendment, Switzerland plans to establish minimum requirements for net-zero roadmaps (formerly called “transition plans”) to align with Switzerland’s Climate and Innovation Act targeting net-zero greenhouse gas (“GHG”) emissions by 2050. The amendments also propose that reporting shall be done in accordance with an internationally recognized standard or the sustainability reporting standard used in the European Union.

- EU Parliament approves delay of EU Deforestation Regulation (EUDR) applicability

Following the EU Council’s decision to extend the application timeline for the EUDR until December 30, 2025, for large- and medium-sized companies, and until June 30, 2026, for micro and small companies (see our October 2024 ESG Update), the EU Parliament has confirmed the postponement.

- New York passes law creating new climate superfund

On December 26, 2024, Governor Kathy Hochul of New York signed into law the “Climate Change Superfund Act.” The law requires certain fossil fuel companies to pay into a climate superfund that is intended to fund infrastructure investments deemed to be related to climate resilience, such as coastal protection and flood mitigation systems. The law applies to companies that extracted or refined enough oil and gas between 2000 and 2018 to produce more than one billion tons of covered GHG emissions when consumed, and will require the companies to pay $75 billion into the superfund over 25 years, with each company’s payment proportionate to its attributed emissions.

- U.S. House Judiciary Committee releases report on “climate cartel” and opens investigation into Net Zero Asset Managers Initiative (NZAM)

On December 20, 2024, members of the U.S. House Judiciary Committee sent letters to 60 U.S. asset managers requesting information about their involvement with the Glasgow Financial Alliance for Net Zero (GFANZ) and Net Zero Asset Managers initiatives (NZAM). The letters, which were signed by Representatives Jim Jordan (R-Ohio) and Thomas Massie (R-Kentucky), claimed that the funds have colluded with climate activists to “impose left-wing environmental, social, and governance (ESG)-related goals, which may violate U.S. antitrust law.” The letters requested information regarding how the asset managers’ membership in GFANZ and NZAM has changed the companies’ engagement strategies and voting policies.

Previously, on December 13, 2024, the U.S. House Judiciary Committee released a new report as part of its probe into whether asset management funds and activists are part of a “climate cartel” colluding to engage in climate activism. The report claims that asset managers such as BlackRock, Inc. (BlackRock) and State Street Global Advisors were concerned that joining an industry climate initiative could create the perception of collusion and draw regulatory scrutiny.

- Biden administration sets new 2035 U.S. climate goal

On December 19, 2024, the outgoing Biden administration announced a new goal to reduce U.S. greenhouse gas (GHG) emissions by 61-66% below 2005 levels by 2035. This goal builds off the target set by President Biden in 2021 under the Paris Agreement to reduce GHG emissions by 50-52% by 2030. The new target is intended to keep the United States on a path to reach net zero GHG emissions economy-wide by 2050. The Biden administration is submitting this target to the United Nations Climate Change secretariat as the United States’ next Nationally Determined Contribution (NDC) under the Paris Agreement.

- Canada releases inaugural sustainability disclosure standards, announces new 2035 climate goal, and plans to introduce supply chain due diligence legislation

On December 18, 2024, the Canadian Sustainability Standards Board (CSSB) published its inaugural Canadian Sustainability Disclosure Standards (CSDSs). CSDS 1 establishes general requirements for the disclosure of material sustainability-related financial information, and CSDS 2 focuses on disclosure of material information on critical climate-related risks and opportunities. Both CSDSs are closely aligned with the global International Financial Reporting Standards but included additional transition relief. Reporting under the CSDSs is currently voluntary, and CSSB plans to provide resources to facilitate its implementation. The CSDS exposure drafts initially proposed a two-year delay for Scope 3 GHG disclosures, but feedback on the exposure drafts prompted the CSSB to extend the transition relief by an additional year in the final standards.

On December 16, 2024, the Canadian Department of Finance released its 2024 Fall Economic Statement, which included a commitment to introduce legislation to help eradicate forced labor from Canada’s supply chains through new due diligence requirements. According to the report, the Canadian government intends to introduce legislation that would require “government entities and businesses to scrutinize their international supply chains for risks to fundamental labour rights and take action to resolve these risks.” The statement indicates that a new oversight agency would be created to ensure compliance.

On December 12, 2024, the Canadian government announced a new goal to reduce GHG emissions by 45-50% by 2035 compared to a 2005 baseline. This target follows the goal to reach net zero GHG emissions by 2050 under the Canadian Net-Zero Emissions Accountability Act, and its 2030 target to reduce emissions by 40-45% compared to a 2005 baseline. However, the target fell below the 50-55% 2035 target recommended by the Net-Zero Advisory Body. This new target will form the basis of Canada’s upcoming NDC under the Paris Agreement.

- Indiana Public Retirement System to replace BlackRock due to ESG investing policies

On December 13, 2024, the board of trustees for the Indiana Public Retirement System (INPRS) voted unanimously to replace BlackRock as the manager of its portfolio due to BlackRock’s alleged “ESG focused agenda.” The INPRS board will now select another firm to manage the state’s pension funds portfolio.

- U.S. Internal Revenue Service (IRS) and U.S. Department of Treasury (Treasury) issue final investment tax credit regulations for energy property

As summarized in our alert, on December 12, 2024, the IRS and Treasury published final regulations in the Federal Register on the investment tax credit for energy property.

- BlackRock updates its 2025 U.S. stewardship expectations and voting guidelines

BlackRock published its new proxy voting guidelines, effective January 2025, which softened prior expectations related to racial and gender diversity on boards. In previous years, BlackRock had recommended that boards aspire to at least 30% diversity of their members and consider gender, race, and ethnicity when evaluating board composition. The 2025 guidelines no longer explicitly expect 30% diversity, but instead note that “[m]any S&P 500 companies” have reported benefits from current diversity levels, that “more than 98% of S&P 500 firms have diverse representation” of 30% or greater. BlackRock notes that it may vote against members of the nominating/governance committee if an S&P 500 company is not in line with market norms. The 2025 guidelines also no longer ask boards to consider gender, race, and ethnicity when evaluating board composition and instead ask boards to disclose “[h]ow diversity, including professional and personal characteristics, is considered in board composition, given the company’s long-term strategy and business model,” noting that personal characteristics may include gender, race, and ethnicity, as well as disability, veteran status, LGBTQ+, and cultural, religious, national, or Indigenous identity.

In case you missed it…

The Gibson Dunn Workplace DEI Task Force has published its updates for December summarizing the latest key developments, media coverage, case updates, and legislation related to diversity, equity, and inclusion, including a December 11, 2024 decision by the U.S. Fifth Circuit Court of Appeals to vacate the Nasdaq board diversity disclosure rules.

- Japan Exchange Group, Inc. (JPX) launches new tool to reduce information gathering burden

On December 26, 2024, the Japan Exchange Group, Inc. and JPX Market Innovation & Research, Inc. launched the JPX Sustainability Information Search Tool. This tool aims to enhance Tokyo Stock Exchange (TSE) listed companies’ disclosure of sustainability-related information by providing a centralized platform where TSE listed companies can access links to publications from Prime Market-listed companies, such as annual securities reports, integrated reports, and websites, across 38 ESG topics. The tool is currently in its beta phase and is available only to TSE listed companies.

- China establishes corporate sustainability disclosure standards

On December 17, 2024, the Chinese Ministry of Finance in conjunction with nine other departments, unveiled the Basic Guidelines for Corporate Sustainability Disclosure (the Basic Standards). The Basic Standards aim to standardize ESG disclosures across the nation and guide businesses in aligning their sustainability practices with global ESG expectations while addressing local priorities like climate change and rural development. ESG reporting in China will become mandatory for large, listed companies by 2026, with full implementation expected by 2030. The framework includes overarching principles, specific standards for ESG themes, and practical application guidelines, and emphasizes transparency, investor-focused reporting, and phased adoption to ease the transition, particularly for smaller firms. Enterprises may implement the Basic Standards on a voluntary basis before the mandatory compliance requirements take effect.

- South Korea introduces new green finance guidelines

On December 12, 2024, the Financial Services Commission, the Ministry of Environment, and the Financial Supervisory Service in South Korea introduced administrative guidelines on green finance, building upon the K-taxonomy framework established in 2021. These guidelines set clear criteria for financial companies to assess and support green economic activities, aiming to promote green financing and address greenwashing concerns. While adoption is voluntary, financial institutions are encouraged to implement the guidelines to ensure a smooth and efficient supply of green finance. The guidelines also outline internal control standards and provide mechanisms for financial companies to assist businesses in meeting green finance criteria. Revisions to the guidelines are expected as updates to the K-taxonomy are finalized, ensuring alignment with evolving sustainability standards.

- Hong Kong Institute of Certified Public Accountants (HKICPA) publishes HKFRS Sustainability Disclosure Standards

On December 12, 2024, the HKICPA published the HKFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and HKFRS S2 Climate-related Disclosures (HKFRS SDS) with an effective date of August 1, 2025. Fully aligned with the International Financial Reporting Standards – Sustainability Disclosure Standards (ISSB Standards), the HKFRS SDS establish a standardized framework to enhance the consistency and comparability of corporate sustainability reports.

- Hong Kong launches roadmap on sustainability disclosure

On December 10, 2024, the Hong Kong Government launched a roadmap for sustainability disclosure (the Roadmap) outlining its approach to integrating the ISSB Standards for publicly accountable entities (e.g., listed issuers, regulated financial institutions) (PAEs). The Roadmap sets a clear path for large PAEs to fully adopt the ISSB Standards by 2028. The Roadmap also emphasizes the creation of a comprehensive ecosystem to support sustainability disclosures, focusing on assurance, data quality, technology, and the development of skills and competencies.

- Australia issues First Nations Clean Energy Strategy

On December 6, 2024, the Australian Government released the First Nations Clean Energy Strategy (the Strategy) following extensive public consultation and stakeholder engagement. The Strategy provides a national framework to guide investment, shape policy, and empower First Nations people to self-determine their participation in and benefits from Australia’s clean energy transition. Spanning five years, the framework aims to foster collaboration among governments, industry, and communities to create opportunities for First Nations people to make informed choices and achieve social and economic benefits through the energy transition.

- New Zealand Financial Markets Authority (FMA) presents its review on climate-related disclosures

On December 4, 2024, the FMA released a report detailing key insights from its review of New Zealand’s first mandatory climate statements. The FMA examined 70 climate statements prepared for reporting periods ending on December 31, 2023, January 31, 2024, and March 31, 2024. While the FMA observed variability in the quality of the disclosures across the 70 statements reviewed, it noted that the submissions were generally aligned with expectations. The FMA affirmed its commitment to reviewing climate statements using a broadly educative and constructive regulatory approach.

- Monetary Authority of Singapore (MAS) introduces good disclosure practices for retail ESG funds

On December 4, 2024, the MAS published an Information Paper on Good Disclosure Practices for Retail ESG Funds (Information Paper). The Information Paper sets out good disclosure practices that retail ESG Funds may adopt in their adherence with the disclosure and reporting guidelines for Retail ESG Funds contained in Circular No. CFC 02/2022, which came into effect on January 1, 2023. The Information Paper emphasizes the importance of defining ESG terms, clearly outlining the use of ESG metrics, disclosing risks, and explaining any involvement with ESG indices or engagement activities. It encourages fund managers to adopt these practices in their offer documents, reports, and marketing materials, with the goal of improving the overall quality of ESG fund disclosures.

The following Gibson Dunn lawyers prepared this update: Lauren Assaf-Holmes, Ash Aulak*, Mitasha Chandok, Becky Chung, Martin Coombes, Ferdinand Fromholzer, Kriti Hannon, Elizabeth Ising, Saad Khan*, Michelle Kirschner, Sarah Leiper-Jennings, Vanessa Ludwig, Johannes Reul, Antonia Ruddle*, Meghan Sherley, and QX Toh.

*Ash Aulak, Saad Khan, and Antonia Ruddle are trainee solicitors in London and are not admitted to practice law.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Environmental, Social and Governance practice group:

ESG Practice Group Leaders and Members:

Susy Bullock – London (+44 20 7071 4283, sbullock@gibsondunn.com)

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, eising@gibsondunn.com)

Perlette M. Jura – Los Angeles (+1 213.229.7121, pjura@gibsondunn.com)

Ronald Kirk – Dallas (+1 214.698.3295, rkirk@gibsondunn.com)

Michael K. Murphy – Washington, D.C. (+1 202.955.8238, mmurphy@gibsondunn.com)

Robert Spano – London/Paris (+33 1 56 43 13 00, rspano@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Gibson Dunn lawyers are monitoring the recommendations and are available to discuss the implications for your business or assist in preparing a public comment for submission to the CLRC.

California has long had antitrust and unfair competition laws, including the Cartwright Act,[1] Unfair Competition Law,[2] and Unfair Practices Act.[3] In August 2022, the California Legislature directed the California Law Revision Commission (the CLRC) to recommend potential changes to these laws.[4] The CLRC created eight working groups, received public comments, and held hearings. On January 13, 2025, the staff of the California Law Revision Commission recommended extensive changes to California’s antitrust laws, including: (1) adopting a law on unilateral anticompetitive conduct by a company, (2) revising the state process for merger review, and (3) expanding private plaintiffs’ ability to sue while restricting available defenses.

The staff recommendations are submitted to the CLRC’s commissioners, who will ultimately decide whether to recommend revisions to the legislature. Typically, the CLRC will make a tentative recommendation within 2–3 months and then open a period of public comment on those recommendations. The CLRC’s final recommendations across a wide range of laws have historically been enacted into law over 90% of the time.[5] Gibson Dunn attorneys are monitoring these recommendations and are available to discuss the implications for your business or assist in preparing a public comment for submission to the CLRC.

Staff Report’s Recommendations for Change

First, the staff recommended adopting a law to reach unilateral acts by a single company. Currently, California’s Cartwright Act is similar to Section 1 of the federal Sherman Act, which prohibits anticompetitive agreements between two or more entities, but the Cartwright Act contains no provision analogous to the unilateral conduct provisions of Section 2 of the Sherman Act, which prohibits monopolization and attempts to monopolize. The CLRC staff recommended adopting such an analogue, though they rejected wholesale adoption of Section 2, on the view that it had developed too many “jurisprudential limitations that can undermine effective enforcement.”[6] The CLRC staff instead preferred a bespoke, and more enforcement-friendly, standard that modifies the general federal standard with express language rejecting certain limitations that have arisen out of federal case law. While the staff did not enumerate these modifications, they may include provisions restricting a company’s ability to refuse to deal with competitors,[7] easing the requirements for predatory pricing claims,[8] and eliminating the requirement that plaintiffs define and prove a relevant market.[9] The staff also recommended “integrating elements” of an “abuse of dominance” standard—the prevailing standard used in European competition enforcement—to further “challenge dominant companies’ conduct that defy a ready application” of federal law.[10]

Second, the CLRC staff made two recommendations for changing merger law. The staff recommended that California adopt its own regime for premerger notification and merger approval and that the regime prohibit mergers that create an “appreciable risk” of lessening competition – a standard that would go beyond the prevailing federal test.[11] If adopted, this would reduce the burden on the California Attorney General in challenging mergers and allow for challenges based on alleged harm to “labor, innovation, and other nonprice elements”—even though the Mergers and Acquisitions Working Group recognized such a change “could impose significant burdens” and may be unnecessary as courts could “adjust . . . with no change in the relevant antitrust statutes.”[12]

Third, the CLRC staff noted a number of other potential changes that, if adopted, would give more plaintiffs standing to bring antitrust claims, ease their burden in doing so, and restrict the defenses available to defendants. These include adopting a “proximate cause” test to determine standing under the Cartwright Act; eliminating the Cartwright Act’s limitation to tying claims involving only commodities and services; precluding defendants from offering business justifications for tying; codifying that resale price maintenance in California is per se illegal; and “strengthen[ing] laws on information sharing by competitors.”[13]

Notably, the CLRC staff recommended against adopting certain changes, including advising against laws specific to technology companies, preferring general changes.

Takeaways

If adopted, the CLRC staff’s proposed changes would proscribe conduct that was previously lawful under both federal and state law and encourage competition lawsuits to be filed under California law. The proposed revisions to California’s merger laws would expand the role of California’s Attorney General in investigating mergers. Merging parties could face increased burden associated with pre-merger filings, longer merger reviews, and potentially inconsistent outcomes under federal and state review. If enacted into law, these changes thus would expand potential liability; enhance the risk of facing investigations, enforcement actions, or private lawsuits; and complicate or frustrate potential acquisitions and other deals.

Furthermore, the California Assistant Attorney General has previously threatened to “reinvigorat[e] criminal prosecutions under the Cartwright Act.”[14] The proposed Cartwright Act revisions from the staff memo could embolden an aggressive enforcement agenda and provide new ground for prosecutors to test new theories, including those beyond federal antitrust law.

Because the CLRC’s recommendations historically have been adopted into law at a high rate, companies should think carefully about how the staff’s proposed changes may affect their businesses and whether to provide comments for the CLRC to consider before issuing a final recommendation to the legislature. Attorneys from Gibson Dunn are available to help in preparing a public comment for submission to the CLRC or to the legislature as they consider potential bills, to discuss how these proposed changes may apply to your business, or to address any other questions you may have regarding the issues discussed in this update.

[1] Bus. & Prof. Code §§ 16700 – 16770.

[2] Bus. & Prof. Code §§ 17200 – 17210.

[3] Bus. & Prof. Code §§ 17000 – 17101.

[4] 2022 Cal. Stat. Res. Ch. 147 (ACR 95). Specifically, the legislature asked the CLRC to study: (1) Whether the law should be revised to outlaw monopolies by single companies; (2) Whether the law should be revised in the context of technology companies; and (3) Whether the law should be revised in any other fashion such as approvals for mergers and acquisitions and any limitation of existing statutory exemptions to the state’s antitrust laws. Id.

[5] Cal. L. Revision Comm’n, https://clrc.ca.gov/ (last visited Jan. 15, 2025).

[6] Memorandum, Initial Recommendations for ACR 95 Questions, Cal. L. Revision Comm’n (Jan. 13, 2025) at 5 [henceforth “Staff Memo”].

[7] Memorandum, Single-Firm Conduct Working Group, Cal. L. Revision Comm’n (Jan. 25, 2024), at 7, 13, 17.

[8] Id. at 6, 13, 17 (8(iii)).

[9] Id. at 18.

[10] Staff Memo at 8.

[11] Id. at 12.

[12] Id.; see also Memorandum, California Antitrust Law and Mergers, Cal. L. Revision Comm’n (May 28, 2024), at 20.

[13] Id. at 13.

[14] Bonnie Erslinger, Top Calif. Antitrust Atty Says Criminal Cases On The Horizon, Law360, Mar. 6, 2024 https://www.law360.com/california/articles/1810754. Criminal penalties under the Cartwright Act can be quite strong: fines of up to the greater of $1 million or twice the pecuniary gain or loss for corporations and fines of up to the greater of $250,000 or twice the pecuniary gain or loss and up to three years imprisonment for individuals. Bus. & Prof. Code § 16755(a).

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s Antitrust and Competition, Mergers and Acquisitions, or Private Equity practice groups in California:

Antitrust and Competition:

Rachel S. Brass – San Francisco (+1 415.393.8293, rbrass@gibsondunn.com)

Christopher P. Dusseault – Los Angeles (+1 213.229.7855, cdusseault@gibsondunn.com)

Caeli A. Higney – San Francisco (+1 415.393.8248, chigney@gibsondunn.com)

Julian W. Kleinbrodt – San Francisco (+1 415.393.8382, jkleinbrodt@gibsondunn.com)

Samuel G. Liversidge – Los Angeles (+1 213.229.7420, sliversidge@gibsondunn.com)

Daniel G. Swanson – Los Angeles (+1 213.229.7430, dswanson@gibsondunn.com)

Jay P. Srinivasan – Los Angeles (+1 213.229.7296, jsrinivasan@gibsondunn.com)

Chris Whittaker – Orange County (+1 949.451.4337, cwhittaker@gibsondunn.com)

Mergers and Acquisitions:

Candice Choh – Century City (+1 310.552.8658, cchoh@gibsondunn.com)

Matthew B. Dubeck – Los Angeles (+1 213.229.7622, mdubeck@gibsondunn.com)

Abtin Jalali – San Francisco (+1 415.393.8307, ajalali@gibsondunn.com)

Ari Lanin – Century City (+1 310.552.8581, alanin@gibsondunn.com)

Stewart L. McDowell – San Francisco (+1 415.393.8322, smcdowell@gibsondunn.com)

Ryan A. Murr – San Francisco (+1 415.393.8373, rmurr@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Comments on the Front-of-Package Proposed Rule must be submitted to FDA by May 16, 2025.

On January 14, 2025, the U.S. Food and Drug Administration (FDA) published a much-anticipated proposed rule that, if finalized, will require front-of-package (FOP) nutrition labeling for foods (FOP Proposed Rule). The proposed rule is the culmination of almost two decades of consideration by FDA and Congress of whether and in what form to require an abbreviated FOP nutrition disclosure on food packages, with the stated goal of aiding consumers in making healthier choices.[2] FDA’s development of the approach set forth in the proposed rule included focus groups and experimental testing of various formats, including a Guideline Daily Amount (GDA) format resembling the industry-developed Facts Up Front (FUF) scheme.[3]

The proposed rule contains provisions that have been hotly contested by both the food industry and health advocates and is expected to face significant administrative and constitutional challenges if finalized by the incoming Trump administration. Comments on the Front-of-Package Proposed Rule should be submitted to Docket No. FDA-2024-N-2910 by the deadline of 120 days after the publication, on May 16, 2025.

Here are five things to know about the FOP Proposed Rule:

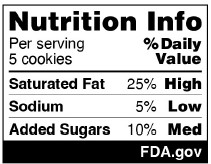

- Introducing the “Nutrition Info” Panel: The FOP Proposed Rule introduces a new black-and-white “Nutrition Info” panel that will appear on the front of food packages. The Nutrition Info panel, shown below, provides the serving size of the food and the per-serving percent Daily Value (DV) of three nutrients: saturated fat, sodium, and added sugars. Characterizations of each of these three nutrients will be included as “Low” (5% DV or less), “Med” (6% to 19% DV), or “High” (20% DV or more). The panel will also include an attribution to “FDA.gov,” intended to increase consumer credibility and trust.[4]

|

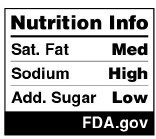

FDA also allows for a smaller version of the Nutrition Info panel for foods in smaller packages with less than 40 square inches to present the Nutrition Facts label in tabular fashion. This smaller format includes only the “Low,” “Med,” or “High” characterizations for the three nutrients to limit, without the serving size (or disclosure that the characterization is based on serving size) or percent DVs for each:[5]

|

Similar to FDA’s current regulations for Nutrition Facts, FDA proposes to exempt foods in packages with a total surface area of less than 12 square inches from bearing the Nutrition Info box.[6] The FOP Proposed Rule also includes special formats for certain types of foods, including packages that contain separately packaged foods intended to be eaten individually, such as variety packs; foods with Nutrition Facts labeling for two or more population groups, for both per serving and per individual unit amounts, and for the food “as packaged” and “as prepared;” foods sold from bulk containers; and, game meats.[7]

- “High,” “Med,” “Low”: Following its testing of various schemes, FDA has chosen to propose a black-and-white Nutrition Info panel (i.e, rather than a red/yellow/green traffic light schema) that includes characterizations of the levels of nutrients to limit, rather than presenting plain numerical data. FDA justified this approach based on scientific literature showing that consumers struggled to understand numeric values in current nutrition labeling when making choices about food.[8] FDA stated that its “Low” and “High” characterizations are consistent with its historical approach for thresholds for “low” and “high” claims for sodium and saturated fats. While there are no current regulations on “medium” nutrient content claims, the agency is establishing “Med” to refer to products that fall between the “Low” and “High” categories.[9] Consistent with this approach, FDA also proposes amendments to its regulations to provide for low sodium and low saturated fat nutrient content claims in line with current nutrition science and the updated Daily Reference Value (DRV) for sodium in the 2016 Nutrition Facts label final rule.[10]

- Who is Subject to the FOP Proposed Rule?: FDA proposes to require all foods currently marketed to people ages 4 and older – the population FDA considers to constitute the general population for nutrition labeling – to comply with the Nutrition Info box requirements, unless specific exemptions apply.[11] The proposed rule includes exemptions for, among others, foods in packages with a total surface area of less than 12 square inches; packages marketed as gifts containing a variety or assortment of foods; and, unit containers in multiunit retail food packages.[12]

- When Does the FOP Nutrition Labeling Requirement Go into Effect?: If the proposed rule is finalized as published, it would require manufacturers to add a Nutrition Info box to packaged food products three years after the final rule’s effective date (for businesses with $10 million or more in annual food sales) and four years after the effective date (for businesses with less than $10 million in annual food sales). However, before the rule can be finalized, FDA must review any comments on the proposed rule and issue a final rule. This process can take anywhere from one to several years, depending on the number and nature of comments received and agency (and broader administration) priorities.

- Making America Healthy Again?: Similar to other recently issued FDA guidance and regulations, it is unclear whether the FOP Proposed Rule will be finalized following the change in administration. Nutrition and transparency in food labeling are also priorities of anticipated leadership for FDA and the U.S. Department of Health and Human Services (HHS) under the incoming Trump administration. It remains to be seen whether FOP nutrition labeling will feature as part of FDA’s food regulatory priorities moving forward.

Interested parties should submit comments to the docket. The FOP Proposed Rule is scheduled to be published in the Federal Register on January 16, 2025. Comments on the FOP Proposed Rule should be submitted to Docket No. FDA-2024-N-2910 by the deadline of 120 days after the publication, on May 16, 2025. Gibson Dunn is prepared to help interested parties consider the implications of this proposed rule, if finalized, including through regulatory counseling, FDA and legislative engagement, and litigation.

[1] FDA, “Food Labeling: Front-of-Package Nutrition Information,” available at https://www.federalregister.gov/public-inspection/2025-00778/food-labeling-front-of-package-nutrition-information (last accessed Jan. 14, 2025) (FOP Proposed Rule). The FOP Proposed Rule is scheduled to be published in the Federal Register on Thursday, January 16, 2025.

[2] See id., Part III.B-D.

[3] See id., Part III.D.2-3.

[4] Id., Part I.A, V.B, V.B.2, V.B.5.

[5] Id. Part V.E.5.

[6] Id. Part V.F.2.

[7] Id. Part V.E.1-4, 6-7.

[8] Id., Part III.A, D.2-3.

[9] Id., Part IV.B.3.

[10] Id., Part V.G.

[11] Id., Part V.A.

[12] Id., Part V.F.1-4.

[13] Regulations.gov, Docket No. FDA-2024-N-2910.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s FDA & Health Care practice group:

Gustav W. Eyler – Washington, D.C. (+1 202.955.8610, geyler@gibsondunn.com)

Katlin McKelvie – Washington, D.C. (+1 202.955.8526, kmckelvie@gibsondunn.com)

John D. W. Partridge – Denver (+1 303.298.5931, jpartridge@gibsondunn.com)

Jonathan M. Phillips – Washington, D.C. (+1 202.887.3546, jphillips@gibsondunn.com)

Carlo Felizardo – Washington, D.C. (+1 202.955.8278, cfelizardo@gibsondunn.com)

Wynne Leahy – Washington, D.C. (+1 202.777.9541, wleahy@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

E.M.D. Sales, Inc. v. Carrera, No. 23-217 – Decided January 15, 2025

Today, the Supreme Court unanimously held that the preponderance-of-the-evidence standard, rather than the more demanding clear-and-convincing-evidence standard, governs Fair Labor Standards Act exemptions.

“[T]he public interest in Fair Labor Standards Act cases does not fall entirely on the side of employees. Most legislation reflects a balance of competing interests. So it is here. Rather than choose sides in a policy debate, this Court must apply the statute as written and as informed by the longstanding default rule regarding the standard of proof.”

Justice Kavanaugh, writing for the Court

Background:

The Fair Labor Standards Act (FLSA) generally requires employers to pay employees a minimum hourly rate, 29 U.S.C. § 206(a), and overtime to employees who work over 40 hours per week, id. § 207(a). But the Act exempts many classes of workers from these requirements. Id. § 213.

Sales representatives for E.M.D. Sales Inc., a food-distribution company that delivers to grocery stores, sued E.M.D. under the FLSA, claiming that they were entitled to overtime pay. In response, E.M.D. argued that the plaintiffs were exempt from the FLSA because they were “employed . . . in the capacity of outside salesm[e]n.” 29 U.S.C. § 213(a)(1). The district court, applying Fourth Circuit precedent, ruled that E.M.D. had not shown by clear and convincing evidence that the plaintiffs were outside salesmen. After the Fourth Circuit affirmed, E.M.D. successfully petitioned for a writ of certiorari, explaining that the Fourth Circuit’s approach conflicted with decisions from the Fifth, Sixth, Seventh, Ninth, Tenth, and Eleventh Circuits.

Issue:

Does the FLSA require employers to prove by clear and convincing evidence, or merely by a preponderance of the evidence, that employees are exempt from the Act’s minimum-wage or overtime-pay requirements?

Court’s Holding:

Employers invoking a FLSA exemption need satisfy only the ordinary preponderance-of-the-evidence standard, not the more demanding clear-and-convincing-evidence standard.

What It Means:

- The Court’s holding brings the Fourth Circuit, which had been alone in requiring proof by clear and convincing evidence, in line with other circuits, and will make it far easier for employers to prove that employees are exempt from the FLSA’s overtime-pay or minimum-wage requirements.

- By correcting course, the Court’s opinion not only changes the likely outcome of FLSA cases turning on whether their employees are exempt, but also relieves employers of the chill of costly litigation and encourages productive use of exempt employees.

- The Court rejected the policy arguments in favor of a more demanding standard of proof. As the Court explained, the FLSA is no more significant, in terms of public policy, than any number of other important statutes under which the preponderance standard applies.

- More broadly, the Court emphasized that the preponderance-of-the-evidence standard is the presumptive standard of proof for all civil statutes. A more demanding standard applies only where (1) Congress speaks clearly to displace that presumption, (2) the Constitution requires it, or (3) the government seeks to take unusual coercive action against an individual.

The Court’s opinion is available here.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding developments at the U.S. Supreme Court. Please feel free to contact the following practice group leaders:

Appellate and Constitutional Law Practice