Ever since President Trump announced that he would create a Department of Government Efficiency (DOGE), clients have raised questions regarding how it would be established, what powers it would have, and how its work could affect their operations.

Gibson Dunn previously addressed some of those questions in a December 6, 2024 client alert based on information available at the time. Now that President Trump has taken office, more details are coming to light. In one of his first acts as president, on January 20, 2025, Trump signed an executive order titled “Establishing and Implementing the President’s ‘Department of Government Efficiency’” (the Order),[1] which brings additional clarity regarding some of the key questions about DOGE and raises others, as discussed below. In addition, recent administration actions, such as freezing (and subsequently unfreezing) federal spending and deferred resignation offers to federal employees suggest that the DOGE is having an impact.[2]

I. Formal Establishment of DOGE as USDS

Initially, then President-elect Trump said DOGE would operate from outside the government. Much ink was spilled on whether DOGE would be a federal advisory committee (FAC) governed by the Federal Advisory Committee Act (FACA), a non-profit entity, or some other kind of non-governmental organization. With the Order, however, he has established DOGE as a federal government entity operating out of the Executive Office of the President (EOP). The Order renames the U.S. Digital Service, an existing government entity also established by presidential directive, as the U.S. DOGE Service. For the sake of clarity, this Alert will refer to the new U.S. DOGE Service as “USDS” and the former U.S. Digital Service by its full name.

The U.S. Digital Service appears to have been an attractive office to replace with DOGE for several reasons. As a matter of optics, using the USDS as a vehicle for DOGE minimizes perception that this is an entirely new office. The office comes with an established funding stream.[3] And the U.S. Digital Service was part of the Office of Management and Budget, with which DOGE is working closely both to gather information across the government and to implement recommendations.

The U.S. Digital Service’s mission to improve federal government technology also aligns with at least some of DOGE’s goals. President Obama created the U.S. Digital Service after private sector technology experts saved HealthCare.gov in the wake of its failed initial launch.[4] Its purpose was to import “private sector best practices to the Federal Government.”[5] Its projects have included improvements to SSA.gov, building COVID-19 vaccine finder tools, simplifying VA.gov, and improving government technology procurement.[6] According to the Order, the purpose of the new USDS is to “implement the President’s DOGE Agenda, by modernizing Federal technology and software to maximize governmental efficiency and productivity.”

II. USDS Personnel

Although the Order offers some insight into USDS personnel, it also raises new questions.

A. USDS Leadership

Originally, Elon Musk and Vivek Ramaswamy were announced as the co-leads of DOGE, and Bill McGinley was announced as General Counsel. Ramaswamy and McGinley have both recently departed the team. Musk continues to lead DOGE, but his exact role is unclear. The Order establishes a USDS Administrator who will report to the White House Chief of Staff. It is possible Musk could fill that role, but no such public announcement has been made.

The White House recently did announce that Musk is serving as a special government employee (SGE). SGEs are often required to file financial disclosures and comply with federal employee criminal conflict of interest rules. In addition, the Federal Acquisition Regulation imposes conflict-of-interest restrictions that prohibit the award of contracts that arise out of an SGE’s activity where the SGE is in a position to influence the award, or another conflict of interest is determined to exist.[7] The head of the contracting agency may grant an exception to this policy only if there is “a most compelling reason to do so, such as when the Government’s needs cannot reasonably be otherwise met.”[8] Musk’s continued leadership of his companies, including government contractors SpaceX and Tesla, could raise significant conflict of interest concerns.

B. DOGE Employees and DOGE Teams

The Order instructs each federal agency to establish a DOGE Team of at least four employees selected by agency leaders in consultation with the USDS Administrator. This directive facially applies to both executive agencies and independent agencies like the Federal Trade Commission, Federal Communications Commission, Securities and Exchange Commission, and others. The Order specifies that these DOGE Team members may include SGEs.

The Order also establishes within USDS the U.S. DOGE Service Temporary Organization. This organization will terminate on July 4, 2026 and is tasked with advancing the President’s 18-month DOGE agenda. At this point it is unclear what unique purpose the temporary organization may fulfill as compared to the USDS, but the temporary status may make it easier to hire temporary employees or volunteers. The head of a temporary organization may appoint employees into the excepted service of the civil service, exempting them from some federal employee hiring requirements.[9] The head of a temporary organization also may accept volunteer services as well as detailees from government departments or agencies.[10]

The role of the current 230 U.S. Digital Service employees is unclear, and they are reportedly being reinterviewed.[11]

III. USDS Activities

The Order tasks the USDS administrator with a “Software Modernization Initiative to improve the quality and efficiency of government-wide software, network infrastructure, and information technology (IT) systems.” Priorities of this initiative include inter-operability between agencies, data integrity, and responsible data collection. The Order instructs agency heads to “ensure USDS has full and prompt access to all unclassified agency records, software systems, and IT systems.”

Another executive order titled “Hiring Freeze” tasks USDS with working with the OMB Director to produce a plan to reduce the size of the federal workforce, and effectuates a freeze on hiring federal civilian employees.[12] In support of that goal, on January 28, 2025, the administration offered federal employees a deferred resignation option.[13] The subject of the email, “Fork in the Road” was the same as that used by Elon Musk in a similar email to Twitter employees, suggesting Musk’s involvement with the resignation offer.[14]

Other recent administration actions appear to be advancing the DOGE agenda, as well. The General Services Administration, the Department of Energy, and likely other executive branch agencies have halted all new contracting awards with certain exceptions.[15] OMB issued a memorandum (before rescinding it) that some interpreted as freezing funding for all “financial assistance programs and supporting activities,” but OMB then clarified that the freeze applied only to discretionary payments for specific programs involving immigration, foreign aid, DEI programs, and gender issues that were already ordered paused via executive orders.[16]

IV. Transparency Requirements

Housing DOGE in the EOP may mean it is subject to fewer transparency requirements than it would have been as a federal advisory committee. As a government office, FACA disclosure requirements likely do not apply. Whether the Freedom of Information Act (FOIA) applies to the new USDS’s records remains an open question. The Order states that the USDS “shall be established in the Executive Office of the President.” As OMB is part of the EOP, it’s not clear whether the Order means to pull the USDS out of OMB. OMB is subject to FOIA and so is the EOP, except for any part of the EOP “whose sole function is to advise and assist the President.”[17] The Order states that the USDS Administrator “shall report to the White House Chief of Staff” suggesting the administration could argue that the USDS exists to advise and assist the president and is therefore exempt from FOIA. Hence, it is possible that the USDS will not be subject either to FACA’s or FOIA’s transparency requirements.

The U.S. Digital Service was subject to the Federal Records Act and Presidential Records Act according to its own privacy policy.[18] It remains to be seen if the Trump administration will amend that policy.

V. Challenges to DOGE

Minutes after Trump was inaugurated, public interest groups sued the administration seeking to enjoin DOGE from conducting its business.[19] The lawsuits were premised on the argument that DOGE is in fact a FAC and it is violating FACA requirements regarding its establishment, records preservation, and public access. Committees composed wholly of federal government employees, such as the original U.S. Digital Service, are not subject to FACA.[20] If DOGE is comprised solely of government employees and not private sector advisors as initially contemplated, FACA likely will not apply to it. If advisors remain outside the government, it is possible that a court could determine that some of the USDS activities fall under FACA.[21]

DOGE—or, now, USDS—is already having an impact, although it will take months or years to understand the full implications of its actions. Gibson Dunn will continue to monitor USDS’s activities and help clients understand their effect on the U.S. government, businesses, and individuals.

[1] Exec. Order, Establishing and Implementing the President’s “Department of Government Efficiency,” (Jan. 20, 2025), available here.

[2] Christ Megerian, Zeke Miller, and Lisa Mascaro, Trump White House Rescinds Memo Freezing Federal Money After Widespread Confusion, Associated Press (Jan. 29, 2025) https://apnews.com/article/donald-trump-pause-federal-grants-aid-6d41961940585544fa43a3f66550e7be; Scott Neuman, Trump Wants to Cut the Federal Workforce, NPR (Jan. 31, 2025), here.

[3] The U.S. Digital Service receives funding from the Information Technology Oversight and Reform account along with the Office of the Federal Chief Information Office. In recent years, the funds in this account have come from the American Rescue Plan Act.

[4] The White House Office of the Press Secretary, Fact Sheet: Improving and Simplifying Digital Services (Aug. 11, 2014), https://obamawhitehouse.archives.gov/the-press-office/2014/08/11/fact-sheet-improving-and-simplifying-digital-services.

[5] U.S. Digital Service, How We Work, https://www.usds.gov/how-we-work (last visited Jan. 21, 2025).

[6] U.S. Digital Service, Our Projects, https://www.usds.gov/projects (last visited Jan. 21, 2025).

[7] 48 CFR § 3.601.

[8] 48 CFR § 3.602.

[9] 5 U.S.C. § 3161.

[10] 5 U.S.C. § 3161(i).

[11] Natalie Alms, U.S. Digital Service Employees are Being Re-interviewed Under DOGE Transition, NextGov/FCW (Jan. 22, 2025), here.

[12] Exec. Order, Hiring Freeze, (Jan. 20, 2025), available here.

[13] Off. of Pers. Mgmt., Fork in the Road, https://www.opm.gov/fork.

[14] Garrett Haake and Amanada Terkel, Trump Administration Offers Roughly 2 Million Federal Worker a Buyout to Resign, NBC News (Jan. 28, 2025), here.

[15] Memorandum from Stephen Ehikian, Acting Adm’r. and Deputy Adm’r., Gen. Serv. Admin. to GSA Acquisition Workforce et al. (Jan. 24, 2025), here.

[16] Memorandum from Matthew J. Vaeth, Acting Dir. Off. Mgmt. and Budget to Heads of Exec. Dep’t and Agencies (Jan. 27, 2025), here; OMB Q&A Regarding Memorandum M-25-13 (Jan. 28, 2025), here.

[17] Meyer v. Bush, 981 F.2d 1288, 1291 n.1 (D.C. Cir. 1993) (quoting H.R. Rep. No. 1380, 93d Cong., 2d Sess. 14 (1974)).

[18] U.S. Digital Service, U.S. Digital Service Privacy Policy, https://www.usds.gov/privacy (last visited Jan. 22, 2025).

[19] Complaint, Am. Pub. Health Ass’n v. Off. Mgmt. Budget, No. 1:25-cv-00167 (D.D.C. Jan. 20, 2025); Complaint, Jerald Lentini v. Dep’t Gov. Efficiency, No. 1:25-cv-00166 (D.D.C. Jan. 20, 2025); Complaint, Public Citizen Inc. v. Donald Trump, No. 1:25-cv-164 (D.D.C. Jan 20, 2025); Ctr. for Biological Diversity v. Off. Mgmt Budget, No. 25-165 (D.D.C. Jan 20, 2025).

[20] 5 U.S.C. § 1001(2)(B)(i).

[21] FACA provides that the term “advisory committee” excludes “a committee that is composed wholly of full-time, or permanent part-time, officers or employees of the Federal Government.” 5 U.S.C. § 1001(2)(B)(i).

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Public Policy, Administrative Law & Regulatory, Energy Regulation & Litigation, Labor & Employment, or Government Contracts practice groups, or the following in Washington, D.C.:

Michael D. Bopp – Co-Chair, Public Policy Practice Group,

(+1 202.955.8256, mbopp@gibsondunn.com)

Stuart F. Delery – Co-Chair, Administrative Law & Regulatory Practice Group,

(+1 202.955.8515, sdelery@gibsondunn.com)

Tory Lauterbach – Partner, Energy Regulation & Litigation Practice Group,

(+1 202.955.8519, tlauterbach@gibsondunn.com)

Amanda H. Neely – Of Counsel, Public Policy Practice Group,

Washington, D.C. (+1 202.777.9566, aneely@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

We are pleased to share with you the Gibson Dunn 2024 Legal Retrospective Report, a comprehensive collection of our thought leadership and insights on the most significant legal developments of the past year. This report highlights our expert analysis on key judicial decisions, regulatory trends, and legislative shifts across the depth of our practices. As a corollary to our real-time updates, we hope this compendium will serve as a valuable resource in assimilating changes that transpired in 2024, and the shape of the legal landscape entering the new year. Looking to 2025, we remain dedicated to providing you practical guidance to navigate rapidly evolving circumstances, and to address the impact of legal developments on your business, operations, and strategic planning.

Our content is always intended as a touchstone to engage with our clients – thank you, and we eagerly anticipate continuing these critical conversations in the year ahead!

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Leading practitioners from our Los Angeles, Orange County, San Francisco, and Palo Alto offices hosted Gibson Dunn’s annual complimentary MCLE briefing, offering 10 hours of CLE credit, including specialty subjects such as Ethics, Elimination of Bias, Competence, and the new Technology and Civility requirements.

The three-day program featured discussions on key developments at the United States Supreme Court and SEC, labor and employment trends, litigating in the press, the use of AI by legal professionals, and new tools to promote civility, among other relevant topics.

Recordings, materials, and CLE details are available below.

For any questions regarding the program or future events, please contact LAEvents@gibsondunn.com. For inquiries about CLE accreditation, please reach out to cle@gibsondunn.com.

Imposter Syndrome in the Legal Profession

PANELISTS:

- Tiaunia Henry

- Miguel Loza Jr.

- James Keshavarz

The Constitution, Homelessness, and the Supreme Court: Post Grants Pass Victory

PANELISTS:

- Theane Evangelis

- Bradley J. Hamburger

- Jesse Sharf

SEC and Other Developments for Public Companies and Investment Advisers

PANELISTS:

- Michael A. Titera

- Kevin Bettsteller

- Lauren M. Assaf-Holmes

Supreme Court Roundup

PANELISTS:

- Lauren M. Blas

- Samuel Eckman

The Pitfalls of Litigating in the Press

PANELISTS:

- Michael H. Dore

- Abbey A. Barrera

- Wesley Sze

Enough Already! New Tools to Reduce Incivility

PANELISTS:

- Presiding Justice Brian S. Currey

- Poonam G. Kumar

Latest Trends & Hot Topics in CA Labor & Employment

PANELISTS:

- Cynthia Chen McTernan

- Megan Cooney

MCLE CREDIT INFORMATION:

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 6.0 credit hours, of which 0.25 credit hour may be applied toward the Elimination of Bias requirement, 1.0 credit hour may be applied toward the Wellness Competence requirement, 1.0 credit hour may be applied toward the Ethics requirement, 1.0 credit hour may be applied toward the Civility in the Legal Profession requirement, and 2.75 credit hours may be applied toward the General Practice requirement.

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 6.0 credit hours, of which 2.0 credit hours may be applied toward Ethics and Professionalism, 1.0 credit hour may be applied toward Law Practice Management, and 3.0 credit hours may be applied toward Areas of Professional Practice. These courses are approved for transitional/non-transitional credit.

Neither the Connecticut Judicial Branch nor the Commission on Minimum Continuing Legal Education approve or accredit CLE providers or activities. It is the opinion of this provider that this activity qualifies for up to 6.0 hours toward your annual CLE requirement in Connecticut, including 3.25 hours of ethics/professionalism.

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Josiah Bethards, Michael Cannon, Matt Donnelly and Alissa Fromkin Freltz are the authors of “Lessons From the First Years of Tax Credit Transfers” [PDF] published by Tax Notes Federal on January 27, 2025.

The memorandum could have implications for companies—including those in the technology sector—confronting questions relating to privacy, data, cybersecurity, and artificial intelligence.

On January 20, 2025, President Trump issued an executive memorandum ordering “all executive departments and agencies” to implement a regulatory freeze. This memorandum follows similar regulatory freeze memoranda issued by the Office of Management and Budget (OMB) on behalf of the president at the beginning of the Biden Administration in 2021 and issued by OMB on behalf of the president at the beginning of the Trump Administration in 2017. The memorandum:

- Places a moratorium on the issuance, proposal, or publication of any new “rules” or “regulatory actions”, pending review by President Trump’s appointees;

- Directs executive departments and agencies to immediately withdraw for review any rules sent to the OFR but not yet published in the Federal Register; and

- Directs executive departments and agencies to consider postponing for 60 days the effective dates for any rules that have been published in the Federal Register or otherwise issued which have not taken effect.

The issuance of a regulatory freeze is not unusual for a new administration. However, the scope of President Trump’s memorandum—against the backdrop of the frenetic regulatory activity of the post-2024 election Biden administration—means that this memorandum may carry meaningful impact for a number of regulations that companies are already taking steps to comply with. Several of the rule moratoria could have implications for companies—including those in the technology sector—confronting questions relating to privacy, data, cybersecurity, and artificial intelligence (AI). For example, two potentially significant rules appear to be in procedural limbo as a result of the order:

- The U.S. Commerce Department’s Bureau of Industry and Security’s (BIS) connected vehicles final rule, which bans certain imports and sales of vehicles from China (including Hong Kong) and Russia, as well as key hardware and software components, based on identified “undue or unacceptable risks” to U.S. national security and the safety and security of U.S. persons, was published in the Federal Register on January 16, 2025 and goes into effect on March 17, 2025.

- The Commerce Department’s Information and Communications Technology and Services Supply Chain (ICTS) final rule, which permits the Secretary of Commerce to prohibit ICTS transactions or impose mitigation measures for ICTS transactions involving “persons owned by, controlled by, or subject to the jurisdiction or direction of foreign adversaries” posing certain “undue or unacceptable risks,” was published in the Federal Register on December 6, 2024 and goes into effect on February 4, 2025. Again, while both rules are directionally consistent with the Trump administration’s approach to China, it is possible their implementation could be delayed for review and potential modification under the regulatory freeze order.

The application of the regulatory freeze memorandum is complicated in practice. For example, the Department of Justice’s (DOJ) bulk U.S. sensitive personal data final rule, which seeks to ensure that U.S. persons’ sensitive personal data cannot be legally sold to foreign adversaries by preventing specified “countries of concern” and “covered persons” from obtaining in “covered data transactions” bulk sensitive personal data of U.S. persons and U.S. government-related data, was published in the Federal Register on January 8, 2025 and goes into effect on April 8, 2025. Under the regulatory freeze memorandum, DOJ may postpone the effective date for 60 days to review the rule. DOJ could also pursue notice and comment rulemaking to further delay the effective date, modify, or withdraw the rule. However, because the underlying statutory authority for the rule was the International Emergency Economic Powers Act (IEEPA), which grants the executive broad rulemaking authority and is not subject to the rulemaking requirements of the Administrative Procedures Act (APA), DOJ was not required to engage in rulemaking in the first place. Accordingly, DOJ and President Trump have more authority to modify, withdraw, or issue a new rule without formal rulemaking. While the rule is directionally consistent with the Trump administration’s tough-on-China stance, the future of this rule is uncertain and it is possible the rule could be delayed to allow the administration to review its specific provisions.

Below are two charts that cover some of the most relevant recent rulemaking in the areas of data privacy, cybersecurity, and AI, analyzed to reflect the impact of the regulatory freeze memorandum. The first chart focuses on rules issued by executive agencies led by cabinet secretaries. The second chart focuses on rules issued by independent agencies. The extent to which independent agencies are subject to the regulatory freeze memorandum is likely to be subject to litigation. Some independent agencies have taken steps consistent with the order set out in the memorandum, but it is not yet fully clear whether all independent agencies will view themselves as bound to do so. The scope of presidential authority over such agencies is expected to be an area of focus in this administration. For more detailed analysis of the implications of the Trump administration’s actions on independent agencies, please see our client alert here.

|

Executive Agencies Led By Cabinet Secretaries |

|||||

|

Agency |

Regulation |

Status |

Published in Federal Register? |

Change Post Regulatory Freeze of January 20, 2025 |

Prognosis |

|

DOJ |

Bulk Sensitive Personal Data Rule |

Final Rule: issued December 27, 2024 Effective date: April 8, 2025 (pending conclusion of Congressional review under Congressional Review Act) |

Yes: January 8, 2025 |

Finalized, but DOJ may postpone the effective date for 60 days to review. Government could pursue notice and comment for further delay of effective date, modification, or withdrawal of rule. Because rule issued under IEEPA, no rulemaking was required in the first place. President has more authority to modify, withdraw, or issue new rule without formal rulemaking. |

Uncertain. May be delayed. |

|

DoC |

Connected Vehicles Rule |

Final Rule: issued January 14, 2025 Effective date: March 17, 2025 |

Yes: January 16, 2025 |

Finalized, but DoC may postpone the effective date for 60 days to review. Government could pursue notice and comment for further delay of effective date, modification, or withdrawal of rule. Because rule issued under IEEPA, no rulemaking was required in the first place. President has more authority to modify, withdraw, or issue new rule without formal rulemaking. |

Uncertain. May be delayed. |

|

DoC |

IaaS NPRM |

NPRM |

Yes: January 29, 2024 |

Because not a final rule, to move forward, must be reviewed and approved by department or agency head appointed by President Trump. |

Uncertain. Unlikely to move forward in current form. |

|

DoC |

ICTS Regulations |

Final Rule: issued December 5, 2024 Effective date: February 4, 2025 |

Yes: December 6, 2024 |

Finalized, but DoC may postpone the effective date for 60 days to review. Government could pursue notice and comment for further delay of effective date, modification, or withdrawal of rule. Because rule issued under IEEPA, no rulemaking was required in the first place. President has more authority to modify, withdraw, or issue new rule without formal rulemaking. |

Uncertain. Unlikely to be delayed given the effective date. |

|

DoC |

ICTS Licensing Procedures Regulations |

ANPRM |

Yes: March 29, 2021 |

To move forward, must be reviewed and approved by department or agency head appointed by President Trump. |

Uncertain. Unlikely to move forward in current form. |

|

DoC |

AI Diffusion Rule |

Interim Final Rule Effective date: January 13, 2025 Deadline for comments: May 15, 2025 |

Yes: January 15, 2025 |

Since the IFR is already in effect, the regulatory freeze memorandum likely will have little impact on this rule. DoC/BIS are not able to delay the effective date for 60 days because the IFR is already in effect. However, DoC/BIS (with Trump-appointed leadership) may revise the IFR and replace it with a non-interim final rule in response to any comments received before May 15, 2025. |

Companies should take steps now to prepare to comply with the new regulations. The IFR is likely to face significant critique during the public comment period. Implementation will require coordination and cooperation among U.S. allies and may face pushback from countermeasures from affected countries and entities. Final rule likely to include changes. For more information about this IFR, please see Gibson Dunn client alert here. |

|

DoD / GSA / NASA |

Federal Acquisition Regulation: Controlled Unclassified Information |

Proposed Rule Deadline for comments: March 17, 2025 |

Yes: January 15, 2025 |

DoD/GSA/NASA could postpone deadline for comments on proposed rule, but the regulatory freeze memorandum is unlikely to have material impact. Unclear if proposed rule deemed to raise “substantial questions of law, fact, or policy.” Because not a final rule, to move forward, must be reviewed and approved by department or agency head appointed by President Trump. |

Likely to move forward in some form. |

|

DHS/ CISA |

Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA) Reporting Requirements |

Proposed Rule Deadline for comments: June 3, 2024 |

Yes: April 4, 2024 |

Because not a final rule, to move forward, must be reviewed and approved by department or agency head appointed by President Trump. |

There is significant uncertainty regarding the role that CISA will play in the Trump Administration, and it appears unlikely that these rules will move forward as proposed. However, because CIRCIA requires CISA to promulgate regulations implementing the statute’s covered cyber incident and ransom payment reporting requirements for covered entities, we may see revised regulations from CISA under the Trump Administration. |

|

Independent Agencies |

|||||

|

Agency |

Regulation |

Status |

Published in Federal Register? |

Impact if Regulatory Freeze Memorandum Were To Apply |

Prognosis |

|

FTC |

COPPA Rule |

Final Rule: issued January 16, 2025 Effective date: 60 days after publication in the Federal Register |

No: as of February 3, 2025 |

Since the rule is final but not yet published in the Federal Register, it could be subject to a regulatory freeze, if a majority of the Commissioners so decide. |

Uncertain. See Gibson Dunn client alert here for more information about the COPPA Rule. |

|

FTC |

Negative Option Rule (“Click to Cancel”) |

Final Rule: issued October 16, 2024 Effective dates: January 14, 2025 for some provisions; May 14, 2025 for most of the rule. |

Yes: November 15, 2024 |

The final rule has not fully taken effect. |

Currently pending a challenge in 8th Circuit. Gibson Dunn represents challengers consisting of an individual company and seven trade associations. The parties are currently briefing the merits of the rule challenge. |

|

FTC |

Non-Compete Rule |

Final Rule: issued April 23, 2024 Effective date: September 4, 2024 (but rule vacated by district court; the rule is not currently in effect) |

Yes: May 7, 2024 |

Since the final rule is published in the Federal Register and has been vacated, the regulatory freeze memorandum does not impact the rule. |

A district court set aside (vacated) the rule nationwide on August 20, 2024. FTC’s appeal of that decision is currently pending in the Fifth Circuit. The rule remains invalid, pending the resolution of the appeal. A separate district court granted a preliminary injunction applicable only to the plaintiff in that case. FTC’s appeal of that decision is currently pending the Eleventh Circuit. |

|

FTC |

Premerger Notification; Reporting and Waiting Period Requirements (Hart-Scott-Rodino (HSR) Rules) |

Final Rule: issued October 10, 2024 Effective date: February 10, 2025 |

Yes: November 12, 2024 |

The FTC and/or DOJ may postpone the effective date for 60 days to review. |

The rule is currently being challenged in the United States District Court for the Eastern District of Texas. See here for more information. |

|

FCC |

CALEA Declaratory Ruling and NPRM |

Declaratory Ruling Adopted: January 15, 2025 Released: January 16, 2025 NPRM Adopted: January 15, 2025 Released: January 16, 2025 |

Declaratory Ruling: No, as of February 3, 2025 NPRM: No, as of February 3, 2025 |

Declaratory Ruling: “Declaratory ruling” is a term used by the FCC. Courts have generally concluded that FCC declaratory rulings are “declaratory orders” under the APA, and thus adjudications.[1] Therefore, an FCC declaratory ruling would likely not be in scope, as the regulatory freeze memorandum covers “rules” under APA section 551(4), not adjudications under APA section 554(e). NPRM: Because not a final rule, to move forward, must be reviewed and approved by department or agency head appointed by President Trump. |

Uncertain. In the waning days of the Biden administration, prior to assuming the Chairmanship, then FCC Chair-Nominee Brendan Carr issued a statement criticizing the Declaratory Ruling and Notice of Proposed Rulemaking, which was approved by the Commission’s Democrats on a party-line basis (3-2). How Chair Carr approaches the future of the Declaratory Ruling and NPRM remains to be seen. |

|

CFPB |

Request for Information Regarding the Collection, Use, and Monetization of Consumer Payment and Other Personal Financial Data |

Notice and request for information: issued January 10, 2025 Comments must be received on or before April 11, 2025 |

Yes: January 15, 2025 |

If the regulatory freeze were to apply, to move forward, the rule must be reviewed and approved by a department or agency head appointed by President Trump. |

Uncertain. As of February 1, 2025, President Trump removed Rohit Chopra, as Director of the CFPB. Treasury Secretary Scott Bessent has been designated as the Acting Director of the CFPB. On February 3, 2025, Secretary Bessent directed CFPB staff to stop all rulemaking and suspend the effective dates of rules not yet in effect. He also directed staff to stop any activity related to enforcement matters, litigation, and public communications. |

|

CFPB |

Required Rulemaking on Personal Financial Data Rights (Section 1033 of the Consumer Financial Protection Act Rule) |

Final Rule: issued October 22, 2025 Effective date: January 17, 2025 Compliance dates: beginning April, 2026 |

Yes: November 18, 2024. |

Since the final rule is published in the Federal Register and has gone into effect, the regulatory freeze memorandum does not impact the rule. |

Uncertain. It is unclear whether CFPB leadership appointed by President Trump will seek to revise or rescind this rule. The issuance of a rule of some kind is required by statute. There is speculation that the CFPB may decide to keep the rule in place given the length of time it took to develop and its issuance under the statutory mandate. Alternatively, new leadership could elect to engage in notice and comment rulemaking either to reconsider certain aspects of the rule or to rescind it and issue a new rule. There is also some reporting that this rule may be a target for congressional review under the Congressional Review Act.[2] However, if Congress were to enact a joint resolution of disapproval, the CFPB could not reissue a rule “in substantially the same form” as the current rule.[3] Treasury Secretary Scott Bessent has been designated as the Acting Director of the CFPB. On February 3, 2025, Secretary Bessent directed CFPB staff to stop all rulemaking and suspend the effective dates of rules not yet in effect. He also directed staff to stop any activity related to enforcement matters, litigation, and public communications. |

[1] See, e.g., City of Arlington, Tex. v. F.C.C., 668 F.3d 229, 241 & n.44 (5th Cir. 2012), aff’d, 569 U.S. 290 (2013); see also Emily S. Bremer, Declaratory Orders, Final Report to the Administrative Conference of the United States at 15 (Oct. 30, 2015).

[2] Katherine Hapgood, CFPB in Senate Banking Republican crosshairs for Congressional Review Act, PoliticoPro (Jan. 31, 2025), https://subscriber.politicopro.com/article/2025/01/cfpb-in-senate-banking-republican-crosshairs-for-congressional-review-act-00201742l.

[3] 5 U.S.C. § 801(b)(2).

Gibson Dunn lawyers are available to assist in addressing any questions you may have about these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Artificial Intelligence or Privacy, Cybersecurity & Data Innovation practice groups:

Artificial Intelligence:

Keith Enright – Palo Alto (+1 650.849.5386, kenright@gibsondunn.com)

Cassandra L. Gaedt-Sheckter – Palo Alto (+1 650.849.5203, cgaedt-sheckter@gibsondunn.com)

Vivek Mohan – Palo Alto (+1 650.849.5345, vmohan@gibsondunn.com)

Robert Spano – London/Paris (+33 1 56 43 13 00, rspano@gibsondunn.com)

Eric D. Vandevelde – Los Angeles (+1 213.229.7186, evandevelde@gibsondunn.com)

Frances A. Waldmann – Los Angeles (+1 213.229.7914,fwaldmann@gibsondunn.com)

Privacy, Cybersecurity, and Data Innovation:

United States:

Ashlie Beringer – Co-Chair, Palo Alto (+1 650.849.5327, aberinger@gibsondunn.com)

Ryan T. Bergsieker – Denver (+1 303.298.5774, rbergsieker@gibsondunn.com)

Gustav W. Eyler – Washington, D.C. (+1 202.955.8610, geyler@gibsondunn.com)

Cassandra L. Gaedt-Sheckter – Palo Alto (+1 650.849.5203, cgaedt-sheckter@gibsondunn.com)

Svetlana S. Gans – Washington, D.C. (+1 202.955.8657, sgans@gibsondunn.com)

Lauren R. Goldman – New York (+1 212.351.2375, lgoldman@gibsondunn.com)

Stephenie Gosnell Handler – Washington, D.C. (+1 202.955.8510, shandler@gibsondunn.com)

Natalie J. Hausknecht – Denver (+1 303.298.5783, nhausknecht@gibsondunn.com)

Jane C. Horvath – Co-Chair, Washington, D.C. (+1 202.955.8505, jhorvath@gibsondunn.com)

Martie Kutscher Clark – Palo Alto (+1 650.849.5348, mkutscherclark@gibsondunn.com)

Kristin A. Linsley – San Francisco (+1 415.393.8395, klinsley@gibsondunn.com)

Timothy W. Loose – Los Angeles (+1 213.229.7746, tloose@gibsondunn.com)

Vivek Mohan – Palo Alto (+1 650.849.5345, vmohan@gibsondunn.com)

Rosemarie T. Ring – Co-Chair, San Francisco (+1 415.393.8247, rring@gibsondunn.com)

Ashley Rogers – Dallas (+1 214.698.3316, arogers@gibsondunn.com)

Sophie C. Rohnke – Dallas (+1 214.698.3344, srohnke@gibsondunn.com)

Eric D. Vandevelde – Los Angeles (+1 213.229.7186, evandevelde@gibsondunn.com)

Benjamin B. Wagner – Palo Alto (+1 650.849.5395, bwagner@gibsondunn.com)

Debra Wong Yang – Los Angeles (+1 213.229.7472, dwongyang@gibsondunn.com)

Europe:

Ahmed Baladi – Co-Chair, Paris (+33 (0) 1 56 43 13 00, abaladi@gibsondunn.com)

Kai Gesing – Munich (+49 89 189 33-180, kgesing@gibsondunn.com)

Joel Harrison – Co-Chair, London (+44 20 7071 4289, jharrison@gibsondunn.com)

Lore Leitner – London (+44 20 7071 4987, lleitner@gibsondunn.com)

Vera Lukic – Paris (+33 (0) 1 56 43 13 00, vlukic@gibsondunn.com)

Lars Petersen – Frankfurt/Riyadh (+49 69 247 411 525, lpetersen@gibsondunn.com)

Robert Spano – London/Paris (+44 20 7071 4000, rspano@gibsondunn.com)

Asia:

Connell O’Neill – Hong Kong (+852 2214 3812, coneill@gibsondunn.com)

Jai S. Pathak – Singapore (+65 6507 3683, jpathak@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

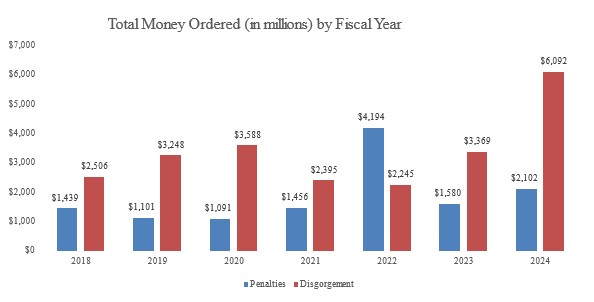

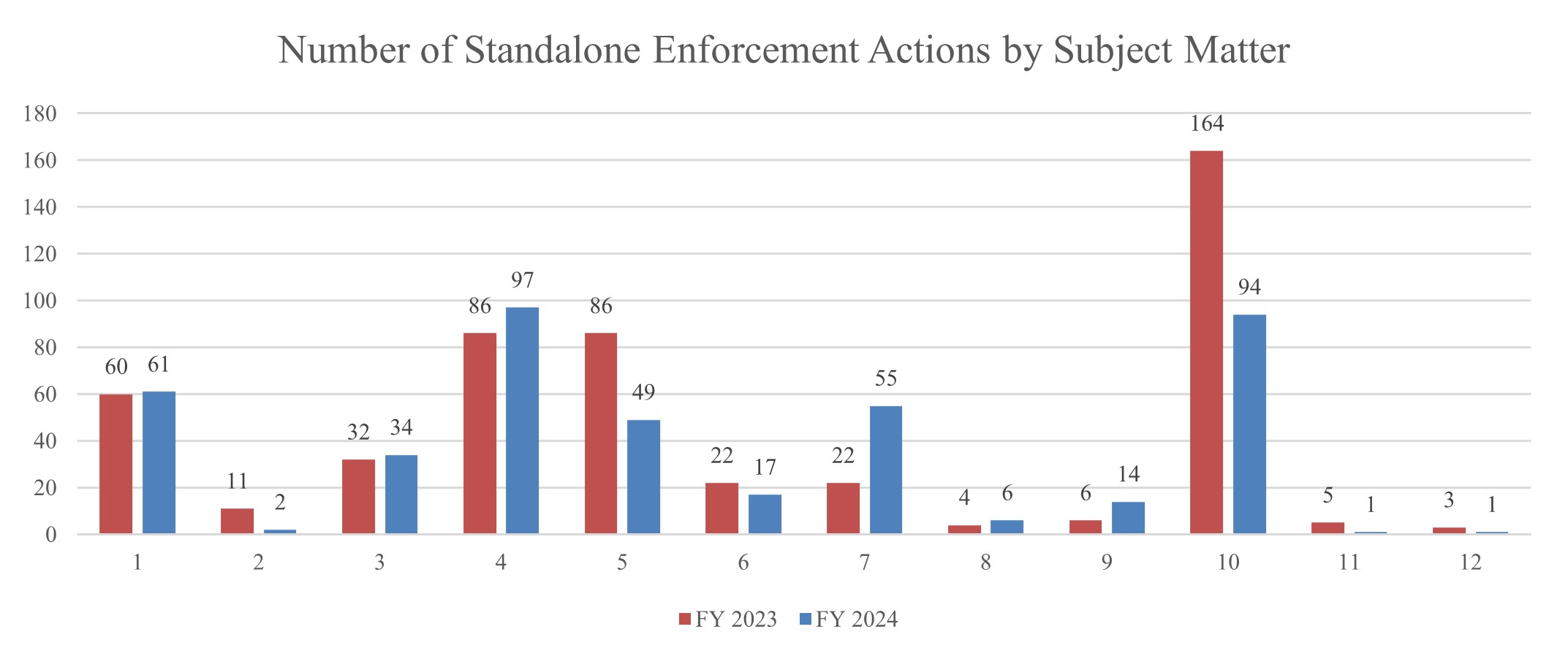

This update provides an overview of key FCPA and other international anti-corruption enforcement, litigation, and policy developments from 2024, as well as our observations and analysis regarding the trends we are seeing from this activity.

There is substantial change afoot in Washington, and these are still early days, but whether enforcement of the Foreign Corrupt Practices Act (FCPA) will decline in a second Trump Administration remains to be seen. It is notable that predictions of FCPA underenforcement proved unfounded during the President’s first term. From what we encounter in our daily work on behalf of our clients, the statute’s dual enforcement groups at the U.S. Department of Justice (DOJ) and Securities and Exchange Commission (SEC) remain committed and are riding the wave of a busy 2024, with dozens of prosecutions, numerous important policy announcements, and a record four-for-four showing in criminal trials. Moreover, international partners continue to enforce their foreign corruption statutes with increasing vigor. As the size of our annual update portends, there continues to be much to discuss regarding the FCPA and related international anti-corruption developments.

Gibson Dunn has maintained its industry-leading expertise in this space by virtue of the complex, cutting-edge anti-corruption challenges we have had the privilege of helping our clients navigate day in and day out for the past several decades. We were honored to continue our streak in 2024 of being ranked Number 1 in the Global Investigations Review “GIR 30” ranking of the world’s top investigations practices for the seventh consecutive year and the ninth time in the last ten years.

For additional analysis on anti-corruption enforcement and related developments from 2024, we invite you to register here and join us for our upcoming complementary webcast presentation on February 27, 2025: “2024 Year-End FCPA Update.” As usual, CLE credit will be offered.

OVERVIEW OF THE FCPA & OTHER U.S. LAWS TARGETING FOREIGN CORRUPTION

The FCPA’s anti-bribery provisions make it illegal to offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with corrupt intent, for the purpose of obtaining or retaining business. These provisions apply to “issuers,” “domestic concerns,” and those acting on behalf of issuers and domestic concerns, as well as to “any person” who acts while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d) (typically referring to companies whose shares are listed on a national exchange). In this context, foreign issuers whose American Depositary Receipts (ADRs) or American Depositary Shares (ADSs) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has “accounting provisions” that apply to issuers and in some cases those acting on their behalf, and that are comprised of two core components. First, the books-and-records provision requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Second, the FCPA’s internal accounting controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in resolution negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a transaction that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal accounting controls deficiency.

Further, as discussed in our 2023 Year-End FCPA Update, in December 2023 the United States enacted the Foreign Extortion Prevention Act (FEPA). FEPA explicitly criminalizes the “demand side” of foreign bribery by prohibiting the receipt of corrupt payments by foreign officials, which the FCPA does not do. However, the practical impact of FEPA remains to be seen given that DOJ has long been prosecuting foreign officials for their receipt of bribes under the money laundering statute, as noted immediately below.

Finally, prosecutors from the FCPA Unit of DOJ (and, to a lesser extent, enforcers from the SEC’s FCPA Unit as to violations of the securities laws) frequently charge non-FCPA offenses such as money laundering, mail and wire fraud, Travel Act violations, securities fraud, tax violations, and even false statements, in addition to or instead of FCPA charges. The most prevalent among these “FCPA-related” charges, in the criminal context, is money laundering—a generic term used as shorthand for statutory provisions, including 18 U.S.C. § 1956, that generally criminalize conducting or attempting to conduct a transaction involving proceeds of “specified unlawful activity” or transferring funds to or from the United States, in either case to promote the carrying on of specified unlawful activity; to conceal or disguise the nature, location, source, ownership or control of the proceeds; or to avoid a transaction reporting requirement. “Specified unlawful activity” includes over 200 enumerated U.S. crimes and certain foreign crimes, including the FCPA, fraud, and corruption offenses under the laws of foreign nations. Although this has not always been the case, in recent history DOJ has frequently deployed the money laundering statutes to charge “foreign officials” who are not themselves subject to the FCPA. It is not unusual for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering, particularly if the recipient is employed by a state-owned enterprise. As noted above, at least for activity post-dating the passage of FEPA in December 2023, DOJ now has another prosecutorial tool to wield in its international anti-corruption enforcement efforts.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

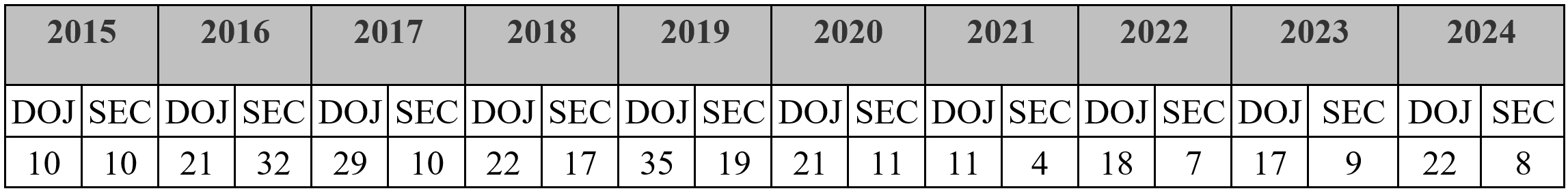

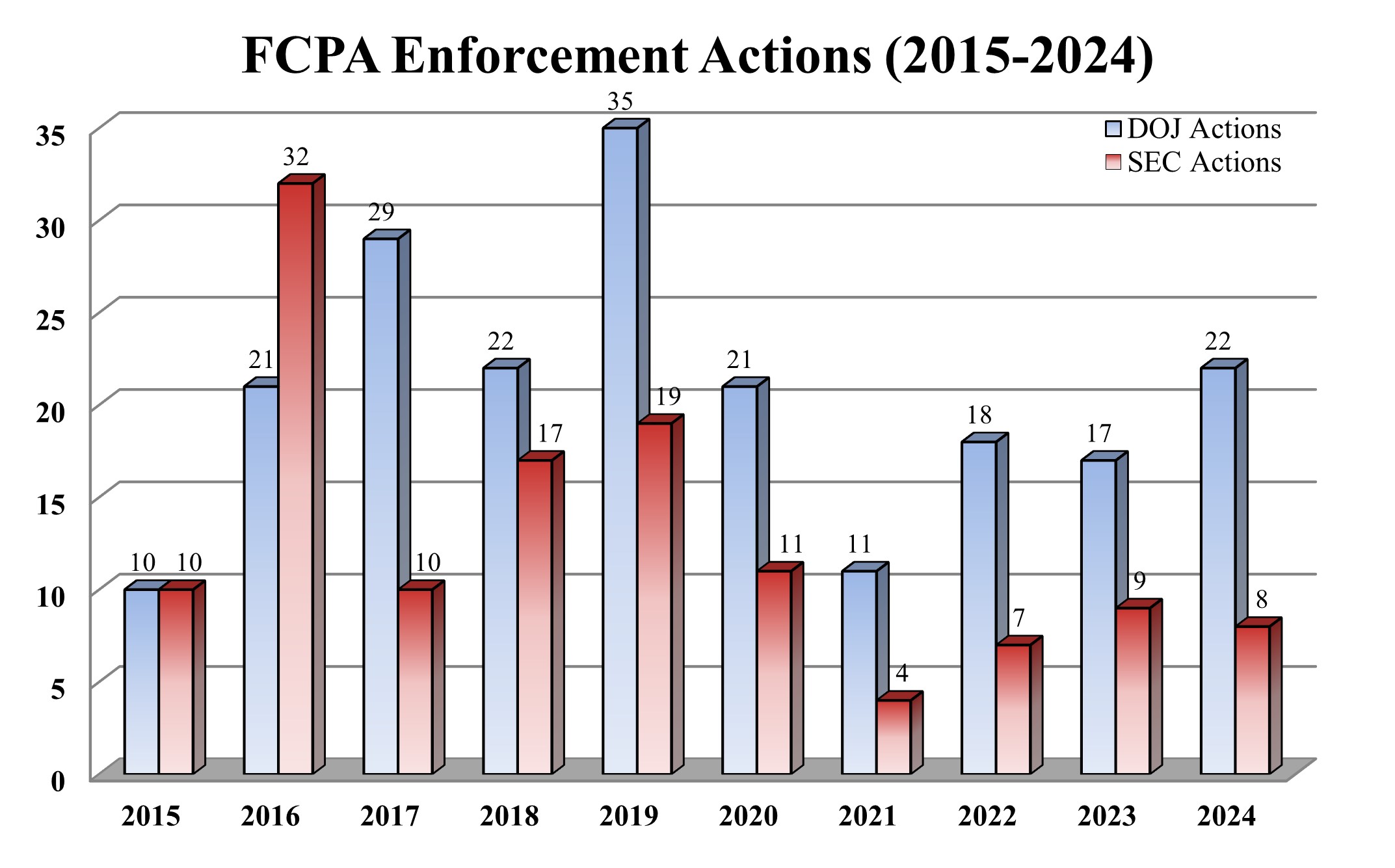

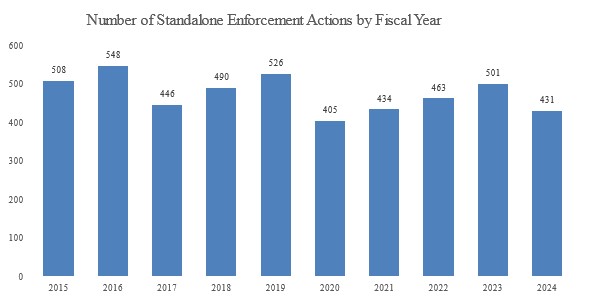

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s dual enforcers, in each of the past 10 years.

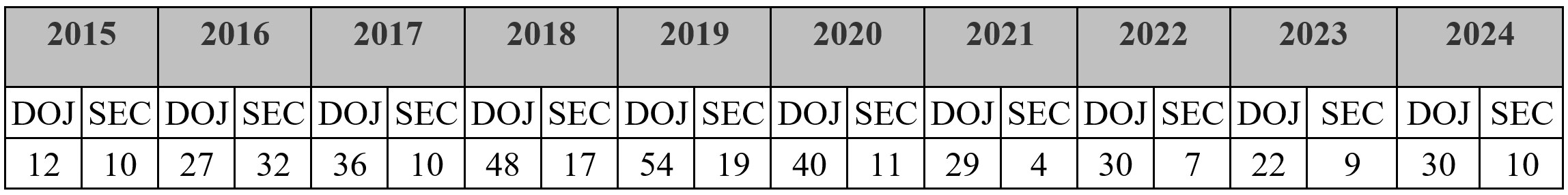

Of course, as regular readers of these pages know, and as mentioned above, a substantial proportion of U.S. anti-corruption enforcement actions are predicated on “FCPA-related” charges arising from the same corruption investigations by the same prosecutors but not charged under the FCPA itself. Examples of “FCPA-related” charges include wire and mail fraud, securities fraud, tax offenses, and most significantly money laundering. Although this is predominantly a criminal phenomenon, 2024 saw two rare “FCPA-related” charges filed by the SEC in the Adani case discussed below. The below table and graph illustrate the past 10 years of FCPA plus FCPA-related enforcement activity.

KEY 2024 FCPA-RELATED ENFORCEMENT DEVELOPMENTS

As our longtime readers know, we endeavor in these pages not only to describe the year’s individual FCPA and related enforcement actions, but also to discern patterns, themes, and trends in this enforcement activity. With respect to 2024, we have identified seven developments of note:

- DOJ reaches subsidiary-only resolutions with parent compliance guarantees;

- DOJ further defines the poles in Corporate Enforcement Policy credit;

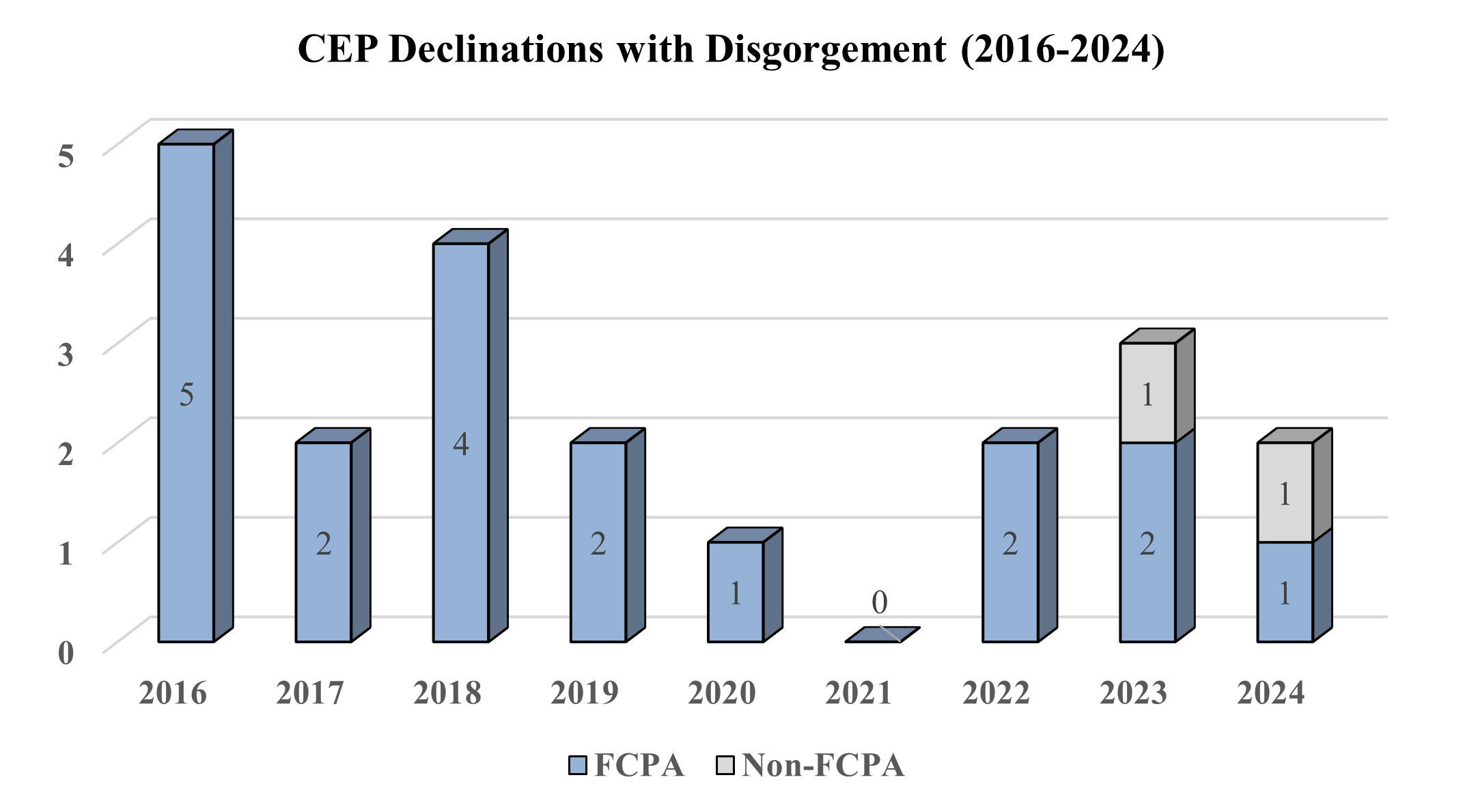

- DOJ FCPA “declinations with disgorgement” continue as a trickle;

- Rounding out the SEC FCPA enforcement docket;

- Individual FCPA enforcement actions come in bunches;

- Not quite “FCPA-related,” but still worthy of mention; and

- DOJ’s FCPA Unit runs the table, going four-for-four at trial.

1. DOJ Reaches Subsidiary-Only Resolutions with Parent Compliance Guarantees

FCPA practitioners well understand that a key term in any criminal resolution negotiation is the defendant corporate entity or entities. Although there are many variations, one common approach that developed over the years was for the subsidiary(ies) most involved in the conduct to plead guilty, and for the parent company to enter into a deferred or non-prosecution agreement, at least where there was some alleged involvement by the parent. This approach allowed DOJ to secure the most serious form of resolution as to the most culpable corporate entity, while allowing the company (as a whole) to avoid the potentially dire collateral impacts that can accompany a guilty plea at the parent level.

Historically, DOJ has frequently insisted in FCPA cases upon at least some form of criminal resolution with the parent entity, even where the misconduct was principally concentrated in subsidiary businesses. There are certainly exceptions to this rule, notably including a three-subsidiary combination resolution Gibson Dunn negotiated to spare parent company Hewlett-Packard Company from criminal enforcement as described in our 2014 Mid-Year FCPA Update. But the exception crept ever closer to the rule in 2024, as fully one-third of FCPA corporate criminal prosecutions did not involve a parent-level defendant. Still, as described below, the parent companies were required to sign on to the subsidiary resolutions to guarantee the compliance and reporting obligations that typically accompany FCPA resolutions would be applied across the corporate enterprise and not only the subsidiary.

McKinsey and Company Africa (Pty) Ltd.

The most recent example of this phenomenon is DOJ’s resolution with the South African subsidiary of the multinational business consultant McKinsey & Company. On December 5, 2024, DOJ announced a deferred prosecution agreement with McKinsey and Company Africa arising from allegations that, between 2012 and 2016, the entity conspired to violate the FCPA’s anti-bribery provisions by agreeing to make corrupt payments to officials of two state-owned companies in South Africa. The South African McKinsey entity allegedly partnered with local South African consulting firms qualified under the Broad-based Black Economic Empowerment Act while knowing that those firms would use a portion of their fees to pay the purported bribes in exchange for confidential information about competitors and for steering contracts toward sole source awards to McKinsey rather than competitive tenders. In a related matter announced the same day, DOJ unsealed a December 2022 plea agreement with Vikas Sagar, the McKinsey partner allegedly at the center of the corruption scheme, pursuant to which Sagar agreed to plead guilty to one count of conspiracy to violate the FCPA’s anti-bribery provisions.

To resolve the corporate matter, the McKinsey South Africa entity entered into a three-year deferred prosecution agreement and agreed to pay a criminal fine of approximately $123 million, which reflects a 35% discount applied from the fifth percentile of the U.S. Sentencing Guidelines range for the company’s cooperation and remediation. Although it is now DOJ policy to impose forfeiture in addition to a criminal fine in non-issuer cases such as this, as discussed in our 2023 Year-End FCPA Update, DOJ did not do so here as McKinsey had already disgorged all revenues from the affected contracts to South African authorities. DOJ also agreed to credit up to half of the criminal fine against penalties McKinsey paid to South African authorities in a forthcoming resolution, providing the penalty is paid within 12 months. Finally, although not a party to the criminal case, parent McKinsey & Company co-signed the subsidiary resolution, agreeing to fulfill the cooperation, compliance program enhancement, self-reporting, and other compliance-related obligations across the whole of McKinsey’s global operations for the three-year term of the subsidiary’s deferred prosecution agreement. McKinsey’s FCPA resolution was followed less than 10 days later with a separate, larger criminal resolution arising from McKinsey’s consulting work in the opioids industry, announced on December 13, 2024.

Telefónica Venezolana C.A.

Working backward through the year, the second example of a subsidiary-only criminal resolution in 2024 was announced on November 8, when Telefónica Venezolana, the Venezuelan subsidiary of the Spain-based international telecommunications company Telefónica S.A., entered into a deferred prosecution agreement with DOJ to resolve allegations of bribery associated with a 2014 currency auction. According to DOJ, Telefónica Venezolana used a consultant to receive preferential access to the auction to exchange U.S. dollars for Venezuelan bolivars, knowing that the consultant would bribe Venezuelan government officials controlling access to the currency exchange. Telefónica Venezolana allegedly concealed its payments to the consultant by purchasing equipment at inflated prices from suppliers that entered into the consulting agreements on Telefónica’s behalf.

To resolve the matter, Telefónica Venezolana agreed to enter into a three-year deferred prosecution agreement alleging a conspiracy to violate the FCPA’s anti-bribery provisions and to pay a criminal fine of $85.26 million. Although not named as a defendant, parent Telefónica S.A. agreed to extend the subsidiary’s cooperation and compliance enhancement obligations for the three-year term to the full Telefónica enterprise. Notably, although parent Telefónica S.A. is a U.S. ADR issuer whose Brazilian subsidiary (also an ADR issuer) entered into a separate SEC FCPA resolution in 2019 as described in our 2019 Year-End FCPA Update, there was no parallel SEC resolution associated with the 2024 Venezuelan matter. Although it is not unusual for a listed company to resolve civil FCPA charges with the SEC and not criminal FCPA charges with DOJ, given the lower burden of proof and broader accounting theories available to the SEC, we are not familiar with any example of an issuer or its affiliate resolving with DOJ and not the SEC in an FCPA matter. It is presently unclear if Telefónica S.A. will enter into an SEC resolution associated with the Venezuela matter.

Raytheon Company

The third and final example of a subsidiary-only criminal FCPA resolution from 2024 was that with global defense contractor Raytheon. On October 16, 2024, DOJ and SEC announced parallel resolutions relating to allegations that, between 2012 and 2016, Raytheon authorized nearly $2 million in corrupt payments to a high-level official of the Qatari Air Force to secure air defense contracts through an alleged “sham subcontractor,” and failed to disclose these subcontractor payments as required by the Arms Export Control Act (AECA) and International Traffic in Arms Regulations (ITAR). The SEC additionally alleged that over a longer period Raytheon paid more than $30 million to a Qatari-based agent, who was a relative of the Qatari Emir, under circumstances that presented elevated corruption risk.

To resolve the criminal FCPA, AECA, and ITAR allegations, Raytheon entered into a three-year deferred prosecution agreement and agreed to pay a $230.4 million criminal fine plus approximately $36.7 million in forfeiture, though up to $7.4 million of the forfeiture amount was credited against the SEC resolution. In the SEC matter, parent company RTX Corporation consented to a cease-and-desist proceeding alleging FCPA anti-bribery, books-and-records, and internal controls violations, and agreed to pay $49.1 million in disgorgement and prejudgment interest plus a civil penalty of $75 million, though $22.5 million of that penalty is offset against the criminal fine. And in a separate but coordinated matter, Raytheon resolved allegations of major fraud against the United States in a second deferred prosecution agreement and civil False Claims Act settlement alleging that the company provided inaccurate pricing data to the U.S. Department of Defense associated with foreign defense contracts. In total, and coupled with an earlier consent decree reached with the State Department, Raytheon and RTX agreed to pay nearly $1 billion to resolve the FCPA and non-FCPA charges, and also agreed to retain a compliance monitor jointly focused on anti-corruption and government contracts pricing compliance. But in contrast to the SEC resolution, parent RTX is not a defendant in either of the criminal resolutions and agreed only to adhere to the compliance- and disclosure-related obligations of its subsidiary Raytheon.

2. DOJ Further Defines the Poles in Corporate Enforcement Policy Credit

2024 marks the second year of FCPA resolutions since the January 2023 release of the DOJ Criminal Division’s updated Corporate Enforcement and Voluntary Self-Disclosure Policy (Corporate Enforcement Policy), first covered in our 2022 Year-End FCPA Update and further tracked in our 2023 Year-End FCPA Update. Under the current Corporate Enforcement Policy, DOJ may grant up to a 50% discount from the criminal fine for cooperation and remediation in a case that was not self-disclosed by the defendant company, and up to a 75% discount if the matter does qualify as a voluntary disclosure but nonetheless warrants criminal prosecution as opposed to a “declination with disgorgement.” These discount percentages are up from 25% and 50%, respectively, available under prior DOJ guidance. Further, the January 2023 Corporate Enforcement Policy provides enhanced guidance as to whether the cooperation and remediation discount is applied from the bottom of the U.S. Sentencing Guidelines range as was typical pre-Corporate Enforcement Policy, or a higher point-of-departure if the corporate defendant has a relevant history of “prior misconduct.”

In announcing the Corporate Enforcement Policy, DOJ made clear that the maximum-available discount is not the default, and that companies will start from zero and have to build the case for a discount based on their cooperation and remediation. The first two years of application have borne this out, as the “perfect score” of 50% / 75% remains elusive and the range of discounts in FCPA matters have varied from as low as 10% to as high as 45%. Moreover, the “other half” of the equation—whether the discount is taken from the bottom of the Guidelines range or from a higher point of departure—has varied significantly as well, with five companies receiving a discount from the bottom of the range and six companies receiving the discount from a higher point, ranging from the 5th to the 30th percentile.

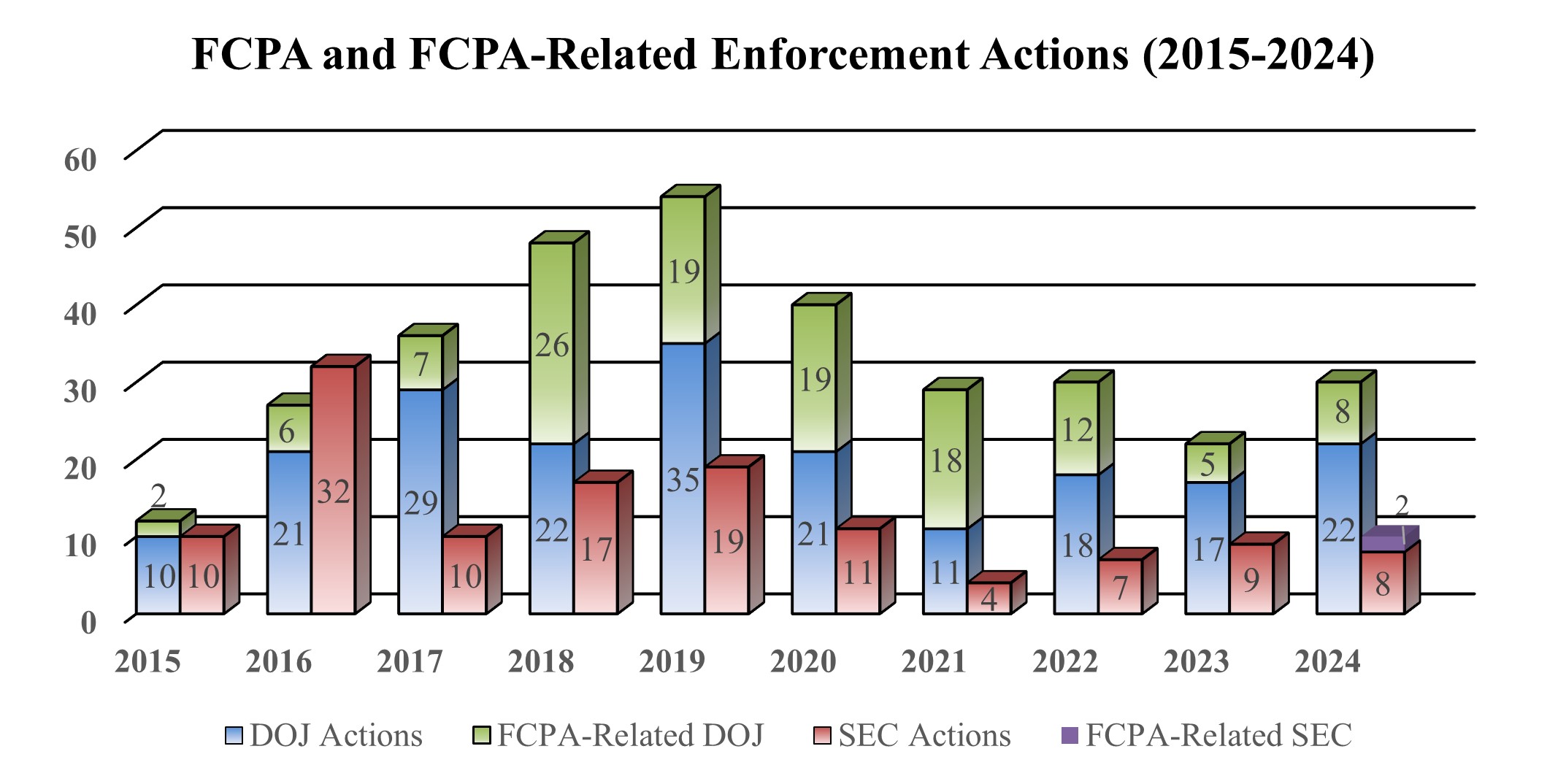

Focusing on 2024, there were eight corporate criminal resolutions, outside of the “declination with disgorgement” with Boston Consulting Group described below. As shown in the below chart, the Corporate Enforcement Policy “discounts” ranged from 10% to 45% and the point of departure ranged from the bottom of the Guidelines range to the 30th percentile. The average “effective Corporate Enforcement Policy discount,” adjusting for both the discount percentage and point of departure, was 19%, resulting in an average effective savings of $23,262,861.

A table summarizing the Corporate Enforcement Policy discount details across the eight non-declination DOJ corporate FCPA resolutions of 2024 is below, followed by an analysis of four resolutions that illustrate the poles of cooperation and remediation credit offered by DOJ: AAR Corp. (45%) and SAP SE (40%) at the high-end, and Trafigura (10%) and BIT Mining (10%) at the low-end. We also analyze a fifth resolution that illustrates the impact of the point of departure, as Gunvor’s 25% cooperation and remediation discount was effectively reduced to 2.5% by virtue of the discount being taken from the 30th percentile of the Guidelines range.

|

Company |

Date |

Resolution Type |

Criminal Fine |

Discount % |

Guidelines Point of Departure |

Effective CEP Discount |

|

SAP SE |

01/10/24 |

DPA |

$118,800,000 |

40% |

10th percentile |

34% |

|

Gunvor S.A. |

03/01/24 |

Guilty Plea |

$374,560,071 |

25% |

30th percentile |

2.5% |

|

Trafigura Beheer B.V. |

03/29/24 |

Guilty Plea |

$80,488,040 |

10% |

5th percentile |

5.5% |

|

Raytheon Co. |

10/16/24 |

DPA |

$230,400,000 |

20% |

20th percentile |

4% |

|

Telefónica Venezolana C.A. |

11/08/24 |

DPA |

$85,260,000 |

20% |

5th percentile |

16% |

|

BIT Mining Ltd.* |

11/18/24 |

DPA |

$54,000,000 |

10% |

Bottom |

10% |

|

McKinsey & Co. Africa (Pty) Ltd |

12/05/24 |

DPA |

$122,850,000 |

35% |

5th percentile |

32% |

|

AAR CORP. |

12/19/24 |

NPA |

$26,393,029 |

45% |

Bottom |

45% |

* BIT Mining’s criminal fine was reduced to $10 million based on a demonstrated inability to pay the fine amount.

AAR CORP.

The highest cooperation and remediation discount of 2024, tied for the highest in the two-year history of the current Corporate Enforcement Policy, goes to Illinois-based aviation services company AAR. On December 19, 2024, DOJ and the SEC announced joint FCPA enforcement actions alleging that, between 2015 and 2020, AAR made nearly $8 million in payments to agents while knowing that a portion of those fees would be provided to government officials in Nepal and South Africa to obtain confidential bidding information, preferential payment terms, and otherwise to influence the contract award processes for state-owned airlines in each country.

To resolve the SEC charges, AAR consented to a cease-and-desist order finding that the company violated the FCPA’s anti-bribery, books-and-records, and internal controls provisions and agreed to pay $29.2 million in disgorgement plus prejudgment interest. No penalty was imposed due to the criminal resolution. To resolve DOJ’s allegations, AAR entered a non-prosecution agreement with an 18-month term and agreed to pay a $26.4 million criminal fine plus forfeiture, although the forfeiture amount was offset by the SEC’s disgorgement order. The criminal fine reflected a 45% Corporate Enforcement Policy discount taken from the bottom of the applicable Guidelines range, based on AAR’s cooperation, remediation, lack of criminal history, and, most notably as discussed below, the company’s self-reporting of the conduct in question.

AAR reported the alleged conduct in question to DOJ and the SEC promptly after becoming aware of press reports of a local corruption investigation concerning the Nepalese conduct and before being contacted by either agency. Still, DOJ did not credit the self-report as a “voluntary disclosure” for Corporate Enforcement Policy purposes because of the press reports and because, unbeknownst to AAR, “an independent source” already had reported the Nepalese conduct to the government. Thus, the report did not occur “prior to an imminent threat of disclosure or government investigation” as required by the Corporate Enforcement Policy and Section 8C2.5(g)(1) of the Sentencing Guidelines. Still, DOJ stated that it “gave significant weight” to the self-reporting in its determination of the form of resolution (i.e., non-prosecution agreement), cooperation and remediation credit awarded (i.e., 45%), and term of post-resolution reporting (i.e., 18 months). Notably, the only other 45% Corporate Enforcement Policy discount awarded by DOJ in an FCPA case to date likewise involves an “imperfect voluntary disclosure,” as covered in our discussion of the Albemarle case in our 2023 Year-End FCPA Update.

Separate from the company, two individuals were prosecuted in 2024 for their alleged involvement in the AAR corruption scheme. Related to Nepal, Deepak Sharma, a former executive of a U.S.-based AAR subsidiary, pleaded guilty on August 1, 2024 to a one-count information charging conspiracy to violate the FCPA’s anti-bribery provisions and also settled related SEC charges on December 19, 2024. Sharma agreed to disgorge nearly $131,000 in compensation allegedly tied to the corrupt conduct, plus nearly $54,000 in prejudgment interest thereon, in connection with the SEC resolution and sentencing in the criminal case has yet to be scheduled. Separately, a third-party agent of AAR’s allegedly involved in the South African corruption, Julian Aires, pleaded guilty to a one-count information charging conspiracy to violate the FCPA’s anti-bribery provisions on July 15, 2024, and like Sharma there is currently no sentencing date set.

SAP SE

The other high-flier in 2024 FCPA Corporate Enforcement Policy discounts was German software company and U.S. ADS issuer SAP, which on January 10, 2024 reached joint FCPA resolutions with DOJ and the SEC arising from an alleged bribery scheme covering multiple countries. According to the criminal charging documents, between 2013 and 2018, SAP made payments to agents in South Africa and Indonesia while knowing that portions of those payments would be passed on to officials associated with multiple different governmental bodies in each country, as well as knowingly falsified certain records relating to additional third-party payments in South Africa with no identified business purpose. The SEC charging document additionally alleges public corruption in Ghana, Kenya, Malawi, and Tanzania, as well as an improper gift provided to a government official in Azerbaijan in 2022.

To resolve the criminal matter, SAP entered into a deferred prosecution agreement alleging conspiracy to violate both the FCPA’s anti-bribery and books-and-records provisions and agreed to pay a $118.8 million criminal fine, though $55.1 million of the fine was offset by payments made in connection with coordinated anti-corruption resolution with South African authorities as discussed below. The criminal fine reflects (i) a 40% discount applied from (ii) the 10th percentile of the applicable Guidelines fine range to reflect SAP’s cooperation and remediation, as well as its prior criminal and regulatory history. Regarding the first point, DOJ praised SAP for its prompt and thorough cooperation, as well as remediation that included withholding compensation from certain potentially culpable employees and managers, which additionally netted SAP a $109,000 fine reduction pursuant to DOJ’s Compensation Incentives and Clawbacks Pilot Program. Regarding the second point, DOJ contended the enhanced Guidelines departure point was warranted based on SAP’s prior FCPA resolution with the SEC in 2016 covered in our 2016 Mid-Year FCPA Update, as well as an export controls-related non-prosecution agreement with DOJ’s National Security Division in 2021. To resolve the SEC matter, SAP consented to the entry of a cease-and-desist order alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions and agreed to pay approximately $98.5 million in disgorgement plus prejudgment interest, with an offset of about $59.5 million against the civil resolution with South African authorities.

Trafigura Beheer B.V.

At the low-end of the Corporate Enforcement Policy discount scale, DOJ announced an FCPA resolution with Swiss commodities trader Trafigura on March 28, 2024. According to DOJ, between 2003 and 2014, Trafigura participated in a conspiracy to make nearly $20 million in corrupt payments to officials of Petróleo Brasileiro S.A. – Petrobras (Petrobras) to obtain contracts and improper business advantages from the Brazilian state-owned oil company. This resolution represents yet another in a long string of FCPA prosecutions arising from the long-running “Operation Car Wash” (Lava Jato) investigation in Brazil, which we have been following in these updates for years. Specific to Trafigura, we covered a guilty plea to money laundering conspiracy charges by former Petrobras oil trader Rodrigo Berkowitz, a recipient of the alleged bribes, in our 2020 Year-End FCPA Update.

To resolve the instant corporate criminal matter, Trafigura pleaded guilty to one count of conspiracy to violate the FCPA’s anti-bribery provisions and agreed to pay a total of approximately $127 million, consisting of an $80.5 million criminal fine and $46.5 million in forfeiture. The company will receive an offsetting credit for up to one-third of the criminal fine, or about $26.8 million, for amounts paid to Brazilian authorities to resolve allegations related to the same conduct. The criminal fine reflects a 10% discount from the 5th percentile of the Guidelines range, for an effective discount of 5.5%. The slightly enhanced point of departure was based on a 2006 guilty plea to false statements in connection with the importation of oil to the United States and a 2010 conviction in the Netherlands relating to export and environmental law violations in Côte d’Ivoire. The relatively low 10% cooperation credit appears to be based on DOJ’s assertions that early in the investigation Trafigura “failed to preserve and produce certain documents and evidence in a timely manner,” and then later “was slow to exercise disciplinary and remedial measures” and took positions in resolution negotiations that “caused significant delays and required [DOJ] to expend substantial efforts and resources to develop additional admissible evidence.” Notably, Trafigura changed counsel during resolution negotiations.

Trafigura also was convicted of charges arising from a separate alleged corruption scheme in Angola following a criminal trial in Switzerland as described in our international section below.

BIT Mining Ltd.

The other low-end, 10% cooperation and remediation score awarded in 2024 comes from a joint DOJ / SEC FCPA resolution with Chinese cryptocurrency mining firm BIT Mining, announced on November 18. According to the charging documents, during a prior incarnation when it was known as 500.com and focused on the gaming industry, the company made between $2 and $2.5 million in corrupt payments to Japanese parliamentary members in an ultimately-unsuccessful effort to open an integrated resort with gambling and other entertainment options in Japan. Separately, on the same day DOJ unsealed an indictment charging the company’s former CEO, Zhengming Pan, with FCPA bribery and books-and-records violations associated with the conduct.

To resolve the corporate criminal charges, BIT Mining entered into a three-year deferred prosecution agreement with DOJ and agreed to pay a $10 million criminal fine, which was substantially reduced from the Guidelines-calculated fine of $54 million based on the company’s demonstrated inability to pay. Although less relevant given the inability-to-pay reduction, the $54 million calculation included only a 10% cooperation and remediation discount, with DOJ stating that although BIT Mining engaged in some cooperation and remediation, it was “reactive and limited in degree and impact.” To resolve the SEC’s parallel investigation, the company consented to the issuance of a cease-and-desist order alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions and assessing a $4 million civil penalty. DOJ agreed to credit the SEC civil penalty against the $10 million criminal fine, such that BIT Mining will only pay $10 million in total.

For his part, Pan has not appeared before the Court to answer the indictment and may be in China.

Gunvor S.A.

The largest FCPA resolution of 2024 was announced by DOJ on March 1, 2024, with Swiss commodities trader Gunvor. According to DOJ, between 2012 and 2020, Gunvor representatives authorized nearly $100 million in corrupt payments through third-party agents for the benefit of high-ranking officials of Ecuadorian state-owned oil company Petroecuador in exchange for lucrative sole-source oil contracts. The corporate resolution followed guilty pleas to FCPA and FCPA-related charges entered by former Petroecuador official Nilsen Arias Sandoval, former Gunvor consultants Antonio Pere Ycaza and Enrique Pere Ycaza, and former Gunvor employee Raymond Kohut, as discussed in our 2021 and 2022 Year-End FCPA Updates.

To resolve the corporate matter, Gunvor agreed to plead guilty to one count of conspiracy to violate the FCPA’s anti-bribery provisions and to pay a criminal fine of more than $374.5 million plus forfeiture of more than $287.1 million. The $661 million resolution amount is not entirely for DOJ, however, as up to one quarter of the criminal fine (about $93.6 million) may be credited against related anti-corruption resolutions with each of Swiss and Ecuadorian authorities, for a total offset of up to $187.3 million, provided these payments are made within a year of the DOJ resolution. The criminal fine reflects a 25% discount for cooperation and remediation, but that discount was applied from the 30th percentile of the Guidelines range based on Gunvor’s “history of misconduct,” thus reducing the “effective discount” to 2.5%. Gunvor’s “prior misconduct” included an international corruption-related resolution with Swiss authorities concerning a scheme to bribe officials in the Republic of Congo and Cote d’Ivoire (discussed in our 2019 Year-End FCPA Update). This is illustrative of a developing trend where corporations’ prior non-U.S. legal resolutions are negatively impacting DOJ’s Sentencing Guidelines calculations. Gunvor’s is the highest Guidelines point-of-departure imposed in an FCPA matter since publication of the updated Corporate Enforcement Policy in January 2023, although not nearly as high as the 75th percentile applied against ABB in its third FCPA resolution discussed in our 2022 Year-End FCPA Update.

3. DOJ FCPA “Declinations with Disgorgement” Continue as a Trickle

In April 2016, DOJ rolled out an “FCPA Pilot Program” (the FCPA-specific predecessor to the current, Criminal Division-wide Corporate Enforcement Program) that provided significantly greater transparency regarding the Division’s expectations for voluntary self-disclosures, cooperation, and remediation in FCPA investigations to receive mitigation credit. Under these programs, a company that timely and voluntarily self-discloses FCPA-related misconduct before DOJ becomes aware of it, fully cooperates in the ensuing investigation, and appropriately remediates the misconduct may be eligible for a declination of criminal prosecution. However, a condition of such a “declination” is that the company disgorge illicit profits from the misconduct and admit to a public recitation of facts, leading us to coin the term “declination with disgorgement” to distinguish these from “true declinations” where the company persuades DOJ to take no enforcement action.

DOJ came out of the gate strong with five “declinations with disgorgement” in the first year of the then-FCPA Pilot Program, as discussed in our 2016 Year-End FCPA Update. But over the years, this favorable prosecutorial resolution tool has been deployed rather infrequently, which is all the more notable considering that DOJ has rejected several candidates that did voluntarily self-disclose FCPA-related conduct because the company reportedly (i) did not specify the conduct in sufficient detail during the initial disclosure call (ABB, discussed in our 2022 Year-End FCPA Update), (ii) delayed the self-report such that it was no longer “prompt” (Albemarle, discussed in our 2023 Year-End FCPA Update), or (iii) disclosed the conduct only after DOJ was already aware of it through other means (AAR, discussed above). In the first nine years of these DOJ disclosure programs, there have been only 19 “declinations with disgorgement” issued in FCPA matters as set forth in the below bar chart, as well as two in the past two years by the Fraud Section on charges unrelated to the FCPA.

The only FCPA-related “declination with disgorgement” of 2024 was reached with global consulting firm Boston Consulting Group, Inc. on August 27, 2024. According to the letter agreement, between 2011 and 2017, BCG paid approximately $4.3 million in commissions to a consultant to help the firm obtain contracts with two agencies of the Angolan government, allegedly while knowing that portions of those commissions would be used to improperly influence officials of these government agencies. BCG was required to disgorge $14.4 million in profits from the relevant contracts, but due to its prompt voluntary disclosure, cooperation in the ensuing investigation, and effective remediation (including clawing back equity and withholding bonuses and other compensation from culpable partners), the company was not criminally prosecuted.

4. Rounding Out the SEC FCPA Enforcement Docket