As we write, Attorney General Pamela Bondi is putting her stamp on corporate criminal enforcement through the issuance of memoranda directing prosecutors to focus effort and resources on cases involving transnational corporate organizations, drug cartels, and terrorism. In this alert, we survey negotiated corporate criminal resolutions in 2024 and offer thoughts about how the trends observed in 2024 will change in the wake of the Attorney General’s February 5, 2025 memoranda to the U.S. Department of Justice (“DOJ”).

Changes Following Attorney General Bondi’s February 5, 2025 Memoranda

In the first day of her tenure as Attorney General of the United States, Attorney General Bondi issued a number of directives to federal prosecutors to guide their effort and focus in the coming years. Those memoranda will shape efforts in this area for the next four years, if not longer. Gibson Dunn issued a more detailed analysis of the impacts of these directives, from which we synthesize a few headline points:

- DOJ’s stated investigative and charging priorities are now immigration enforcement; human trafficking and smuggling; transitional criminal organizations (“TCOs”), cartels, gangs; and protecting law enforcement.[1] Attorney General Bondi elevated the leadership of two task forces (one focused on MS-13, and the other on human trafficking) to the Office of the Attorney General, in a clear signal of where DOJ’s new priorities lie.[2]

- Resources devoted to certain other enforcement efforts were redirected, such as disbanding the Foreign Influence Task Force[3] and limiting criminal charges under the Foreign Agents Registration Act and 18 U.S.C. § 951 “to more traditional espionage by foreign government actors.”[4]

- For other areas, the practical implications of the announcements may be less apparent. For example, the Attorney General’s requirement that the Foreign Corrupt Practices Act (“FCPA”) Unit prioritize investigations of foreign bribery that “facilitates” cartels and TCOs, including human smuggling and narcotics and firearms trafficking, and to “shift focus away from investigations and cases that do not have such a connection” may signal a reduced emphasis on FCPA enforcement, insofar as the FCPA unit brought very few such cases historically. However, it is also possible that this is more a measure to ensure that investigations into cartels and TCOs are not stymied by DOJ red tape, consistent with the subsection’s heading, “Removing Bureaucratic Impediments to Aggressive Prosecutions.” Indeed, the new guidance also suspends, for new FCPA and Foreign Extortion Act matters relating to cartels and TCOs, the Justice Manual’s requirements for Criminal Division approval, and it also allows U.S. Attorneys’ Offices seeking to bring FCPA charges in cartel- or TCO-related cases to proceed with only 24 hours’ notice to the Fraud Section–both actions that permit greater, but not unfettered, leeway to pursue this subset of FCPA cases much more aggressively than ever before.[5]

- Similarly, the immediate, practical impact from disbanding the National Security Division’s (“NSD”) Corporate Enforcement Unit is also likely to be small, insofar as the unit was already thinly staffed.[6]

- Despite their number, the recent DOJ memoranda may signal that the pendulum will swing away from extensive DOJ policies and guidance. Although it does not single out corporate criminal enforcement, the Attorney General’s prohibition on guidance documents that “violate the law when they are issued without undergoing the rulemaking process” but nevertheless “purport to have a direct effect on the rights and obligations of private parties”[7] may well lay the groundwork for revisiting DOJ-issued guidance from the past four years–including guidance around corporate enforcement and compliance.

- Finally, in a development directly relevant to some types of corporate criminal resolutions, except in limited circumstances, “settlements should not be used to require payments to third-party, non-governmental organizations that were neither victims nor parties to the law suits”[8]—as did some of the resolutions in 2024 surveyed below.

Notwithstanding these pronouncements signaling an intended departure from the policies and priorities of the Biden administration, we note that DOJ has proceeded to resolve several significant criminal matters in the early days of the Trump administration. For example, on January 27, 2025, online cryptocurrency exchange and trading platform, KuCoin, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of New York for operating an unlicensed money servicing business (“MSB”) and failure to implement an Anti-Money Laundering (“AML”) program. In addition to servicing approximately 1.5 million users in the United States as an unlicensed MSB and futures commission merchant, KuCoin allegedly transmitted billions of dollars in suspicious proceeds due to the lack of an AML program. The plea agreement stipulates forfeiture of $184.5 million, representing the fees paid by U.S. users; a criminal fine of $112.9 million; and a two-year probationary term, during which KuCoin will exit the U.S. market. Notably, the forfeiture amount is lower than one might anticipate based on DOJ’s prior position that companies could be required to forfeit all funds transmitted by U.S., or potentially all, users. It is difficult to say whether this signals the influence of the new Administration or is a product of the specific fact pattern and nuances of the negotiation that pre-dated the change in guard.

Similarly, on February 6, 2025, Brink’s Global Services USA, Inc. (“Brink’s), a cash handling company, announced that it had entered into a two-year non-prosecution agreement with the U.S. Attorney’s Office for the Southern District of California to resolve charges of knowingly operating an unlicensed money transmitting business and failing to maintain an effective AML program. According to the NPA, Brink’s was required to register with FinCEN as a money transmitting business because, on several occasions between 2019 and 2020, it transported both U.S. dollars and other currencies to and from the U.S., totaling approximately $50.4 million, and exceeded the limited “currency transporter exemption” to the registration requirement by failing to adequately identify the source of funds and ultimate destination of funds it transported. Under the NPA, Brink’s agreed to forfeit $25 million, which reflected credit for Brink’s’s acceptance of responsibility and implementing a new AML compliance program. The NPA also credited civil penalties Brink’s would pay pursuant to a parallel consent order with FinCEN.

Survey of Negotiated Corporate Criminal Resolutions in 2024

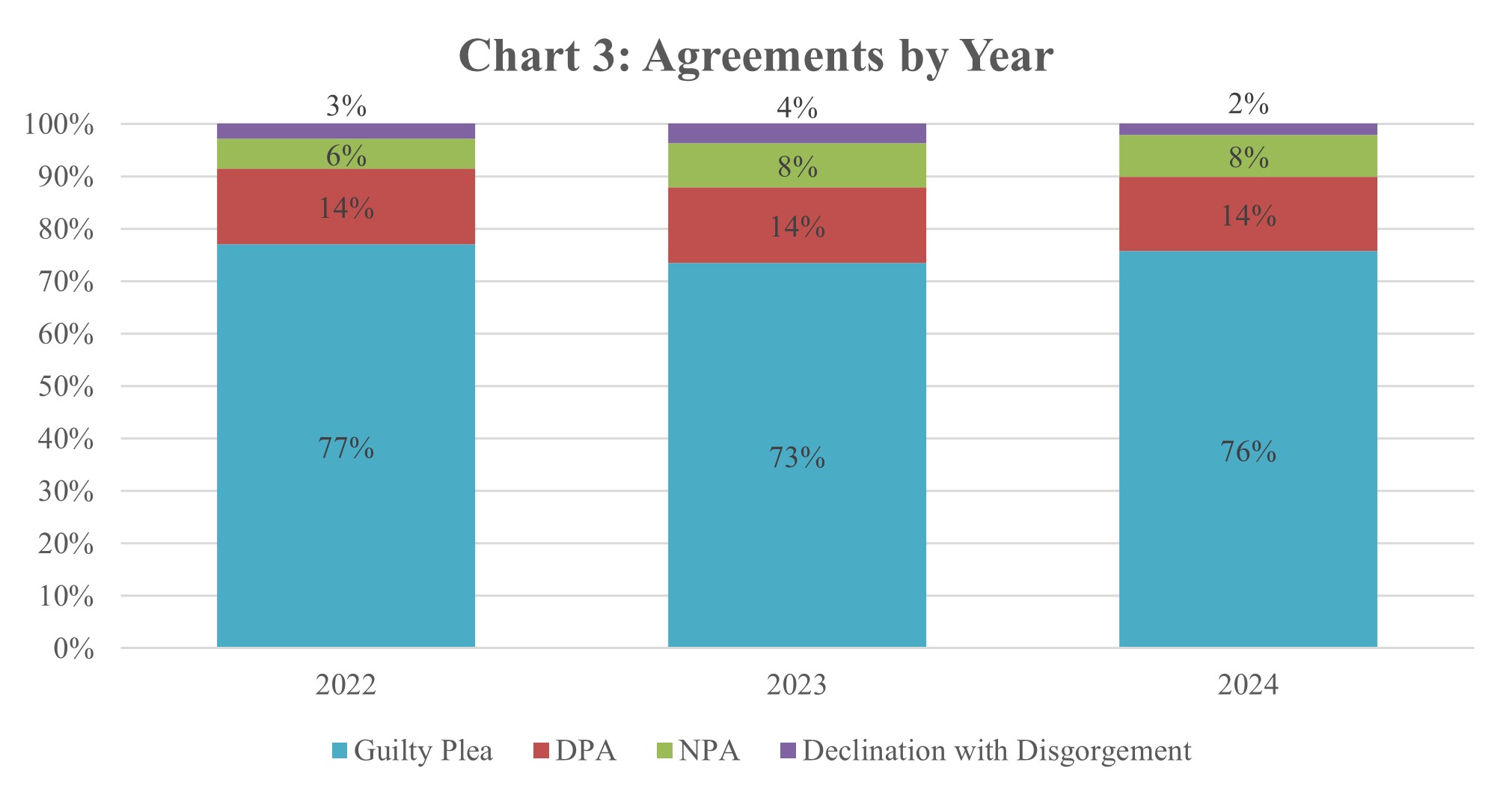

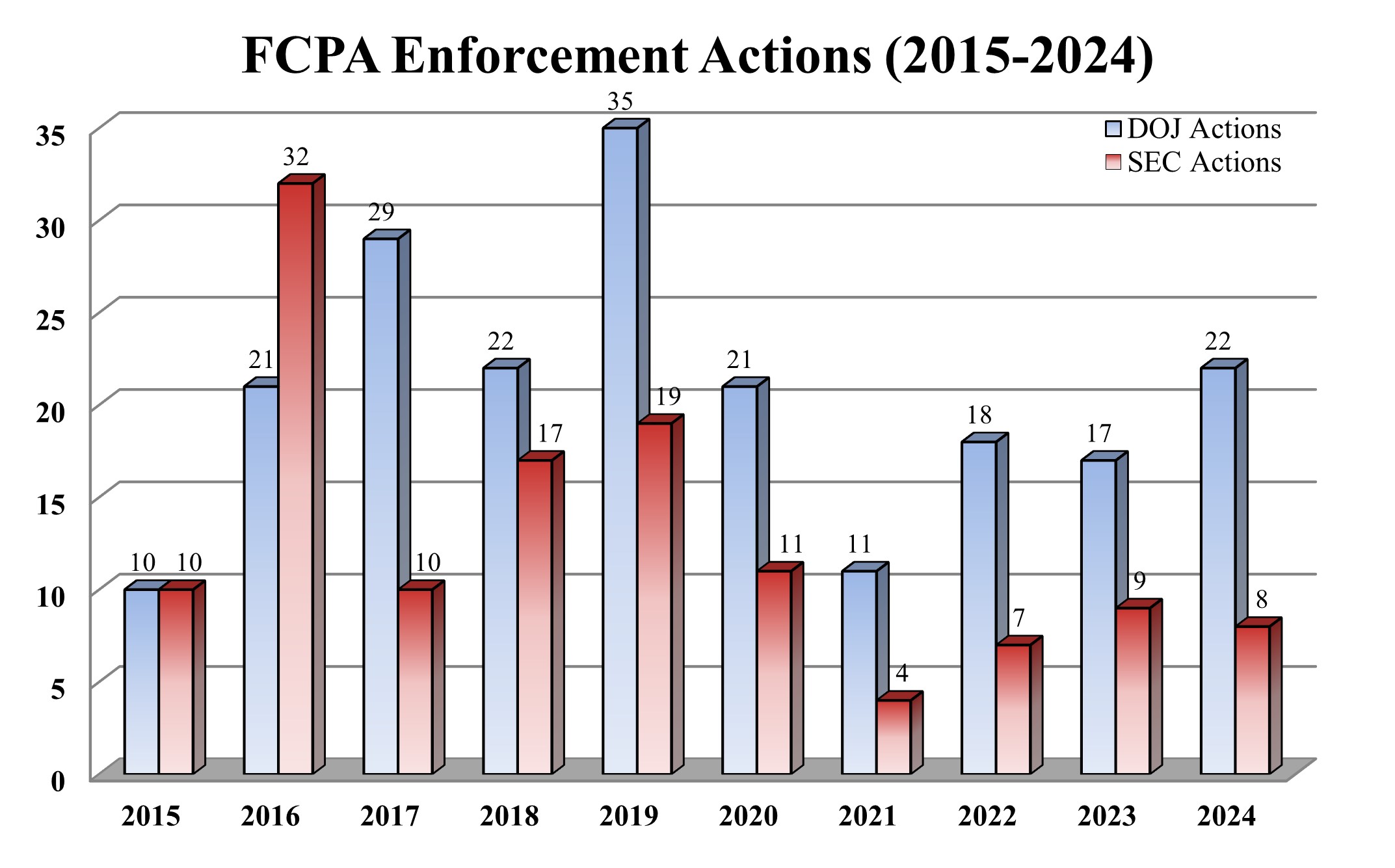

In 2024, DOJ continued its multi-year trend of resolving fewer cases using corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”).[9] Indeed, the relative proportion of resolution types has not changed appreciably in the past three years (as shown in Chart 3 below). DOJ overwhelmingly favored corporate guilty pleas last year, with a total of 75 plea agreements publicized by year-end, compared to 22 NPAs and DPAs, as well as two declinations with disgorgement. The language and substance of these corporate resolutions reflected the intentionality of application of enforcement priorities and detailed policies put forward by DOJ; for example, many resolutions contained express language addressing specific considerations under DOJ’s Corporate Enforcement and Voluntary Self-Disclosure Policy. As detailed below, many updates in the corporate enforcement arena centered around incentivizing voluntary disclosure and whistleblowing. This included pilot programs and policies by several prominent U.S. Attorneys’ Offices. And while prosecutions of corporate fraud-related offenses continued apace in 2024, no corporate criminal resolution involved cartels (in any sense), transnational criminal organizations, or human trafficking. Across the board, U.S. Attorneys’ Offices continued to play an important role in the vast majority of corporate criminal resolutions, a role that Attorney General Bondi’s initial directives suggest may increase further in 2025.

In this client alert, we: (1) report key statistics regarding corporate resolutions, including an analysis of NPAs, DPAs, and Corporate Enforcement and Voluntary Self-Disclosure Policy (“CEP” or “Corporate Enforcement Policy”) declinations from 2000 through 2024 and of corporate guilty pleas between 2022 and 2024, based on data compiled by Gibson Dunn; (2) assess developments in DOJ enforcement policy and priorities in 2024; (3) summarize the 99 agreements in 2024; and (4) survey recent developments in DPA-like regimes abroad.

Key Statistics

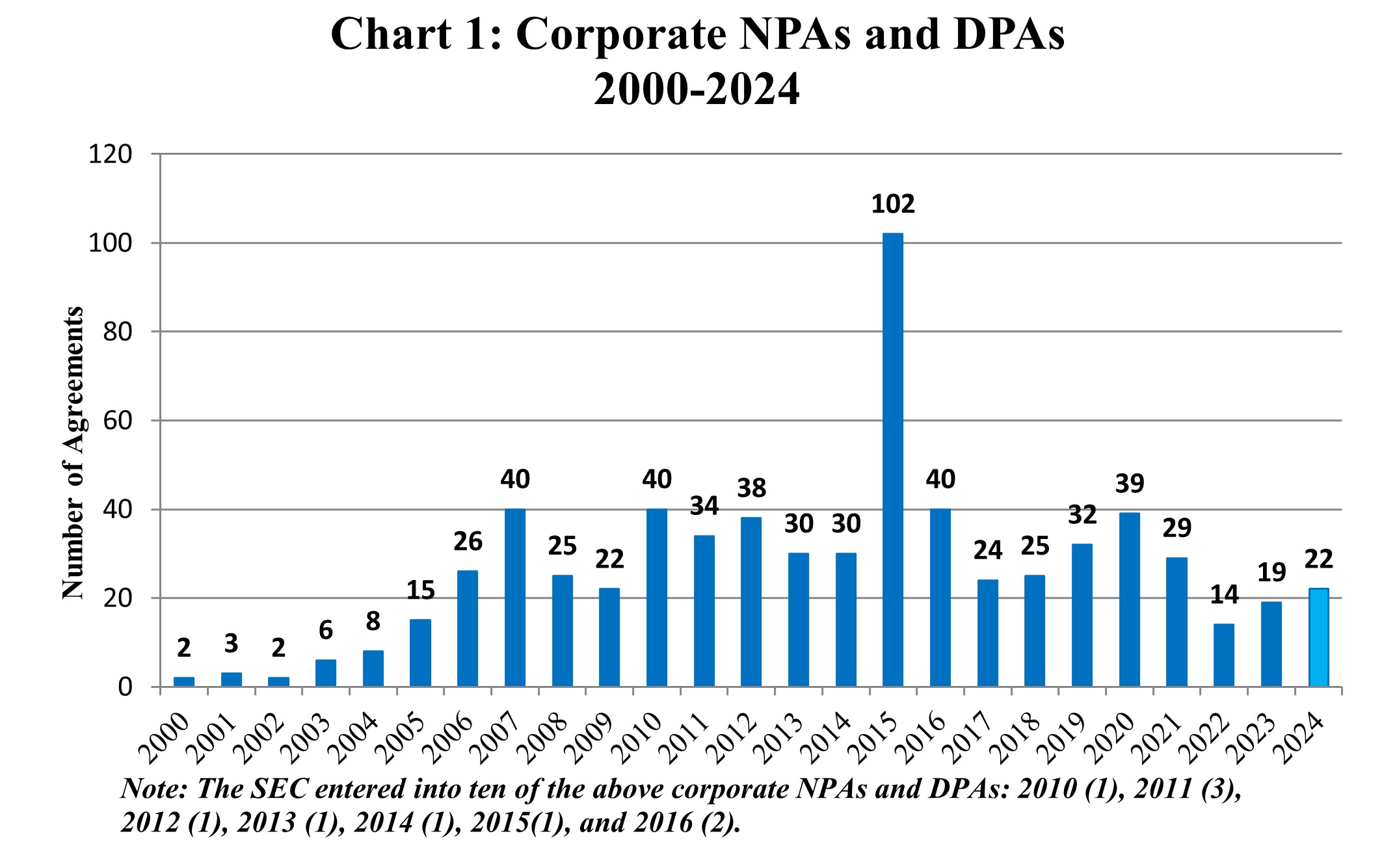

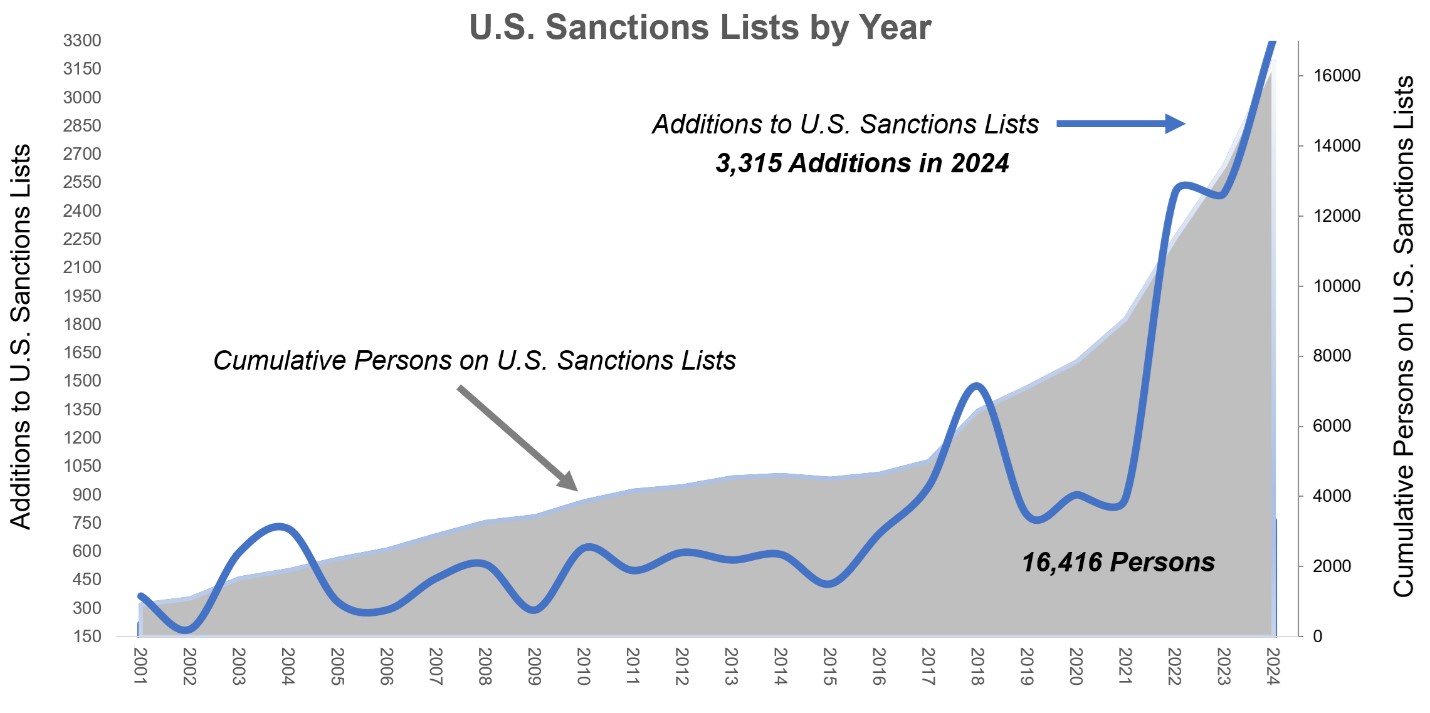

Chart 1 below reflects the NPAs and DPAs that Gibson Dunn has identified through public-source research from 2000 through the end of 2024. Of the 22 total agreements in 2024, there were 14 DPAs and eight NPAs. The SEC, consistent with its trend since 2016, did not enter any NPAs or DPAs in 2024.

|

Chart 2 reflects total monetary recoveries related to publicly available NPAs and DPAs from 2000 through the end of 2024. At approximately $2.6 billion, 2024 recoveries associated with DPAs and NPAs are higher than those in 2023 and continue their upward trend, although they rank as the 16th lowest of our 25 years of annual totals.

Chart 3 reflects the relative mix of NPAs, DPAs, declinations-with-disgorgement and guilty pleas since we began tracking the latter in 2022.

|

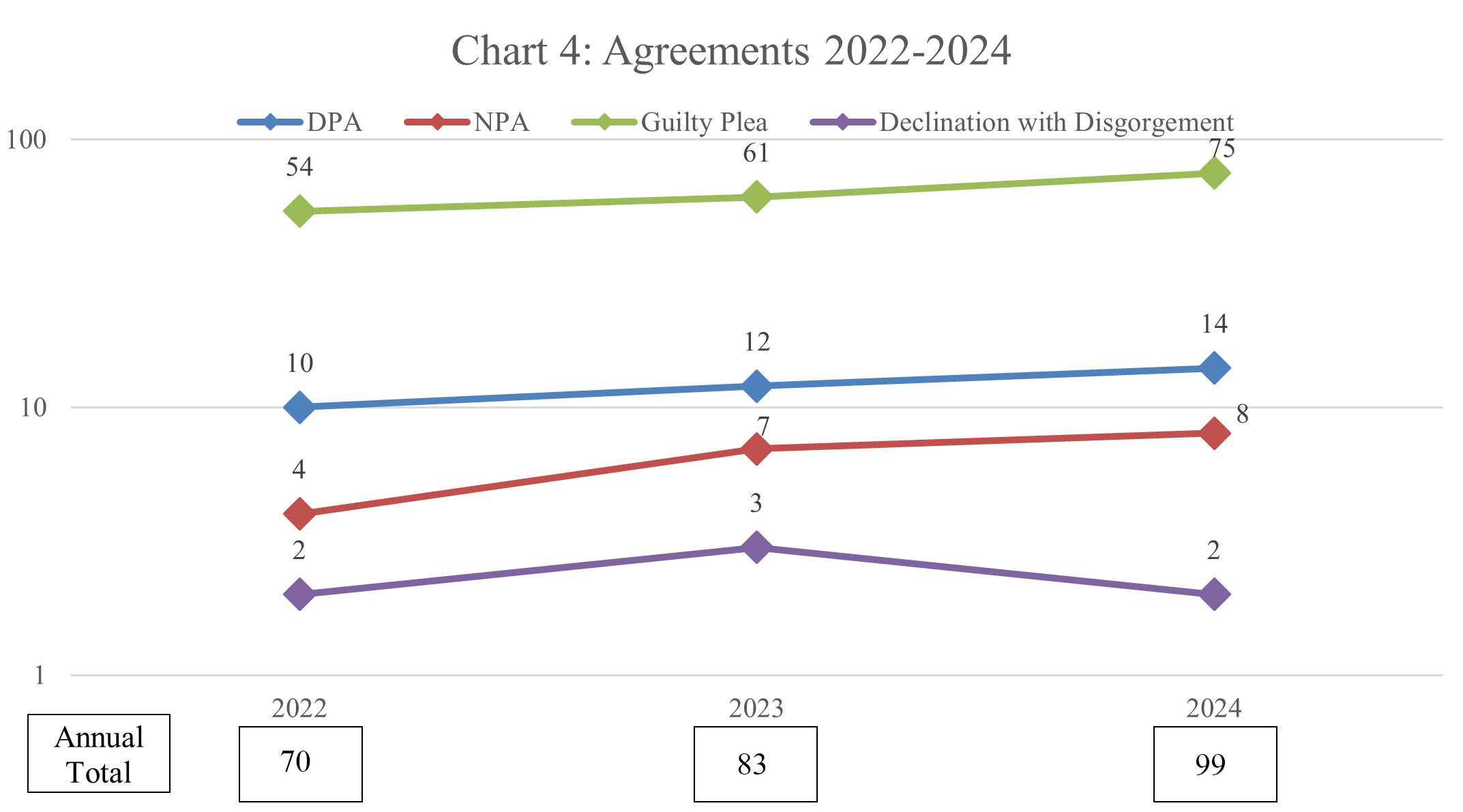

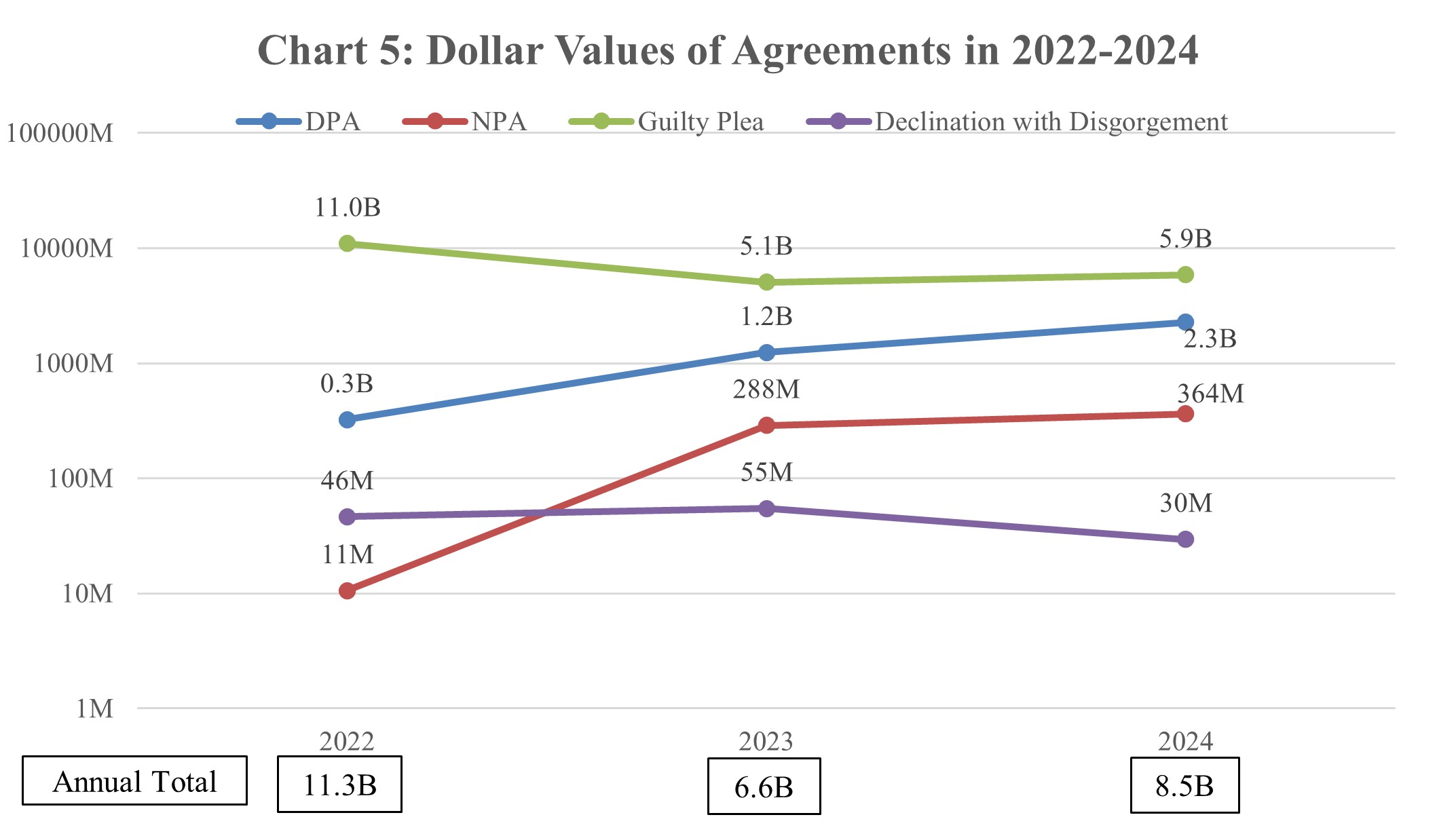

Charts 4 and 5 below focus on 2022 through 2024, and show the numbers of DPAs, NPAs, plea agreements, and declinations with disgorgement in those years, as well as recoveries associated with each category of agreement.[10] These charts illustrate that while DOJ has used all forms of resolution, the relative proportion of guilty pleas to other forms of resolution has not changed significantly in the three years we have tracked plea agreements. Consistent with the higher number of plea agreements relative to other forms of resolution, recoveries associated with guilty pleas have also always been highest. At $5.9 billion, recoveries associated with plea agreements in 2024 more than doubled those associated with NPAs and DPAs but did not outpace them as significantly as in recent years.

|

[Values shown on a logarithmic scale.]

|

[Values shown on a logarithmic scale.]

Although it would be impossible to determine with certainty the root cause of the relative decline in NPAs and DPAs that began around 2022, the shift coincided with significant updates announced in the September 2022 Monaco Memorandum (which we analyzed in depth in our October 3, 2022 publication) that broadened policies on voluntary self-disclosure and signaled a meaningful pivot in prosecutors’ charging assessments.

We note a few statistics and possible trends, although it is difficult to say whether they reflect any shift in focus or standards or are a function of the natural ebb and flow of enforcement actions—nor can we predict the prospective impact of the incoming administration’s priorities on them.

- Since 2022, all “blockbuster” resolutions involving criminal penalties and forfeiture totaling $1 billion or more across parallel criminal and civil settlements involved plea agreements—with three in that category in 2022, one in 2023, and two in 2024. Looking back over time, we note at least seven NPAs and DPAs involving criminal penalties of $1 billion or more, between 2009 and 2020.

- On the other end of the penalty spectrum, the only two publicly available corporate resolutions in 2024 that explicitly cited timely voluntary self-disclosure were both declinations with disgorgement—and both resolved by the Fraud Section of DOJ’s Criminal Division. Historically, voluntary self-disclosure of misconduct had been a significant feature of many NPAs and DPAs, although—consistent with the announcement and expansion of the CEP—the numbers of NPAs and DPAs citing voluntary disclosure as a factor have declined significantly since 2016.

- Indeed, every one of the corporate declinations or declinations with disgorgement publicly announced pursuant to the CEP since 2016 has involved the Fraud Section.

- Despite DOJ first expanding the predecessor to the Corporate Enforcement Policy to reach beyond the Foreign Corrupt Practices Act (“FCPA”) in 2018, and later underscoring that it applied to all corporate criminal matters in 2023, the Fraud Section was involved in approximately one-third (67) of all (194) DPAs, NPAs, and declinations announced since 2018. That percentage held even after the past three years’ relative decline in DPAs, NPAs and declinations, with the Fraud Section involved in 22 of the 67 total such agreements.

- For plea agreements, a similar distinction goes to environmental-related prosecutions. Of the 190 corporate guilty pleas publicly announced from 2022-2024, 50 (slightly more than one-fourth) involved DOJ’s Environmental Natural Resources Division and/or the Environmental Protection Agency. Of the guilty pleas related to enforcement of environmental laws and regulations, almost 20 percent involved tampering or disengagement of monitoring devices designed to detect or prevent pollution, and over 10 percent involved the improper release of oily bilgewater.

- DOJ’s Antitrust Division had eight public NPAs and DPAs in 2020-21, three in 2023, and none in 2022 and 2024. But in 2022-2024, it also entered 13 plea agreements. Of these plea agreements, 11 were tied to schemes previously publicly disclosed.

- Precisely 50% (344) of all 688 corporate DPAs, NPAs, and declinations issued under the CEP in our 25 years of data involve an allegation or charge of fraud of some sort, ranging from bank or mail fraud to FCPA violations. Since we began tracking plea agreements in 2022, the percentage is slightly lower at 29%, i.e., 74 of the total 252 negotiated corporate resolutions—40 of which were guilty pleas.

- U.S. Attorneys’ Offices continue to play an important role in corporate prosecutions, which were historically concentrated in the biggest DOJ offices or Main Justice units. 93% of 2024’s 99 corporate negotiated resolutions involved a U.S. Attorney’s Office.

- Monitoring obligations, whether in the form of an independent monitor or self-reporting, have continued to feature in corporate resolutions at approximately the same rate over the past three years. As a percentage, 23%-46% of all publicly reported DPAs, NPAs, and declinations for which data is available for each year between 2022 and 2024 included a monitoring obligation: 25% in 2022, 23% in 2023, and 46% in 2024. While these percentages reflect a steep decline from the prior three years, which ranged from 59%-73% (59% in 2019, 73% in 2020, and 69% in 2021), monitorships and self-reporting are by no means extinct.

- In 2024, nine corporate resolution agreements were also signed by parent companies that were not defendants in the proceedings. In these resolutions, the parent company typically agreed to provisions relating to payment, continued cooperation, and compliance enhancements, but certain agreements went farther, requiring specific guarantees or collateral and subjecting the parent to sanctions for any breach of the agreement.

The evolution in form, structure, and elements of corporate resolutions will no doubt continue. More than 20 years ago, Gibson Dunn led the dramatic shift toward increased use of NPAs and DPAs in corporate cases and has recently been at the forefront of monitoring and addressing the apparent shift back toward plea agreements.

2024 Developments in DOJ Corporate Enforcement Policy

Many of DOJ’s policy updates and pilot programs in 2024 centered around incentivizing voluntary disclosure, including by individuals. For business organizations, these initiatives further underscore the need for companies to revisit compliance program elements relating to reporting misconduct and whistleblower protections and may alter the calculus around their own voluntary self-disclosure decisions. Specifically, these initiatives would encourage business organizations to revisit their compliance programs to ensure that they get first notice of issues that may be externally reported, and also to ensure that they investigate reports sufficiently speedily and effectively to allow for timely corporate self-disclosure assessments.

With that said, the policy memoranda issued by Attorney General Bondi on February 5, 2025, cast doubt on whether DOJ will continue to prioritize voluntary disclosure and other corporate criminal enforcement initiatives to the same degree moving forward, as DOJ reorients toward immigration and transnational criminal organizations.[11]

Criminal Division’s Pilot Program on Voluntary Self-Disclosure for Individuals

On April 15, 2024, DOJ’s Criminal Division announced a new Pilot Program on Voluntary Self-Disclosure for Individuals (“the Individuals VSD Pilot Program”). While not directly applicable to corporations, this program is likely to affect the design of corporate compliance programs. The Individuals VSD Pilot Program aims to incentivize individual participants in certain types of criminal conduct involving corporations to voluntarily self-disclose information about the criminal conduct in exchange for an NPA, subject to certain conditions. Specifically, under the Individuals VSD Pilot Program, culpable individuals may receive an NPA if they (1) voluntarily, (2) truthfully, and (3) completely self-disclose original information about misconduct in certain high-priority enforcement areas that was otherwise unknown to the Department; (4) fully cooperate and provide substantial assistance against those who are equally or more culpable; and (5) forfeit any ill-gotten gains and compensate victims. The program is notably not available to Chief Executive Officers, Chief Financial Officers, or their equivalents, nor to individuals reporting violent crimes or who have prior felony convictions for crimes involving fraud or dishonesty.

The applicable “high priority” enforcement areas articulated in 2024 include schemes involving financial institutions, including money laundering; related to the integrity of financial markets involving financial institutions, investment advisors or funds, or public or large private companies; foreign corruption schemes, including violations of the FCPA or Foreign Extortion Prevention Act; healthcare fraud and kickback schemes; federal contract fraud schemes; and domestic corruption schemes involving bribes or kickbacks paid by or through public or private companies.

Going forward, it seems likely that these priorities may shift toward immigration and transnational criminal organizations, consistent with Attorney General Bondi’s memorandum on charging, plea negotiations, and sentencing.[12]

Criminal Division’s Corporate Whistleblower Awards Pilot Program

Several months later, the Criminal Division formally announced another, parallel pilot program, the Corporate Whistleblower Awards Pilot Program, effective immediately upon its announcement on August 1—although Principal Deputy Assistant Attorney General (then-Acting Assistant Attorney General) Nicole M. Argentieri had initially previewed the program in March at the American Bar Association’s 39th National Institute on White Collar Crime.

As we described in greater detail in our prior alert, under this pilot program, a whistleblower who provides the Criminal Division with original and truthful information about corporate misconduct that leads to a forfeiture exceeding $1 million may be eligible for a monetary award, from a portion of that forfeiture. To qualify, the information provided must relate to certain “high priority” enforcement areas including (1) certain crimes involving financial institutions, (2) foreign corruption involving company misconduct, (3) domestic corruption involving company misconduct, or (4) healthcare fraud schemes involving private insurance plans.

Although corporate entities are not themselves eligible for an award under the program, the pilot program guidance clarifies that companies that voluntarily self-report within 120 days of receiving a whistleblower report internally may be eligible for a presumption of declination under the Criminal Division’s Corporate Enforcement Policy, provided that the company reports to the DOJ before the DOJ contacts the company.

According to the 2024 Justice Department, this new program aims to fill important gaps in the existing federal whistleblower programs run by the SEC, CFTC, and FinCEN by seeking original information not covered by those programs. The Program also aims to complement and strengthen the DOJ’s existing voluntary self-disclosure programs for individuals and companies. In the keynote address at the December 2024 Practicing Law Institute’s White Collar Crime 2024 Program, the former Principal Associate Deputy Attorney General stated that the program has received more than 250 tips “many of which appear to identify criminal conduct we didn’t know about.”[13]

Various U.S. Attorneys’ Offices Announce Voluntary Self-Disclosure Pilot Programs

As of this publication, 12 U.S. Attorneys’ Offices have announced their own, separate individual whistleblower or voluntary self-disclosure pilot programs.[14] The programs are similar to one another and to the DOJ Criminal Division’s pilot program in some respects and generally allow a prosecutor to enter an NPA with an individual who (1) reports misconduct not previously known to the office, (2) voluntarily discloses the misconduct, without government inquiry or imminent threat of disclosure, (3) provides substantial assistance and full cooperation, (4) completely and truthfully discloses all criminal conduct in which the individual participated, and (5) agrees to forfeit proceeds and pay restitution to victims.[15]

However, the devil is in the details, and the offices stand out for their differences more than their cohesion. For example, the Central District of California contemplates DPAs in addition to NPAs, while the Northern District of Illinois offers no guarantee of an NPA but rather “maintains the discretion to determine on a case-by-case basis” whether an individual “merits” an NPA (though time will tell whether this is merely a semantic difference, as surely all offices will employ their discretion to determine whether their respective standards have been met).[16] Individuals are eligible to participate in all offices’ programs, with certain common exclusions, such as: (1) federal elected officials or law enforcement officers and, in some offices’ programs, state-elected equivalents; (2) the CEO and, in some offices’ programs, the CFO or Chief Compliance Officer; (3) individuals with felony convictions or, in some offices’ programs, histories of certain types of misconduct.[17] In the Southern District of Texas, business organizations are also eligible to participate in the program.[18]

Although a U.S. Attorney’s Office is subject to jurisdictional and DOJ policy limits on what misconduct it may charge, the types of criminal conduct that qualify for each office’s program also vary significantly. Fraud or control failures involving public or private companies are common, if not universal, among the pilot programs, as is state or local bribery.[19] The District of New Jersey and the Northern District of Illinois programs cover anything not specifically excluded.[20] Most districts exclude misconduct that would be prosecuted by Main Justice such as FCPA violations, violations of campaign finance laws, federal tax offenses, or federal environmental offenses, but in the Eastern District of New York and Northern District of California, nothing is explicitly excluded.[21] Where misconduct could arguably be charged in one of many districts, one could easily imagine a savvy whistleblower and their counsel forum shopping for the program where they stand the best or most certain chance of reaping rewards.

Looking ahead, Attorney General Bondi’s February 6, 2025, policy memoranda appear to signal her intention to empower U.S. Attorneys’ Offices to investigate and prosecute cases with less direct involvement by Main Justice, which could make these programs increasingly important—to the extent they continue.

DOJ Updates Its Evaluation of Corporate Compliance Programs Guidance

As we analyzed in depth in our contemporaneous update, on September 23, 2024, the Criminal Division announced relatively modest revisions to its Evaluation of Corporate Compliance Programs (“ECCP”) guidance, focusing on the following three areas: (1) evaluation and management of risk related to new technologies, such as artificial intelligence (“AI”); (2) further emphasis on the role of data analysis; and (3) whistleblower protection and anti-retaliation. Among these, the Department’s changes in its approach to AI were the most significant, underscoring DOJ’s continued focus on the misuse of technology in criminal conduct and reflecting DOJ’s current expectations as companies tailor their compliance programs to both identify and manage the risks posed by AI. Other key takeaways from the revisions include that in adopting a tailored, risk-based approach, companies should (1) assess whether their use of technology falls within the scope of this guidance; (2) ensure new technologies are as transparent as possible; (3) continuously monitor and revise their compliance programs to keep up with rapid technological developments; (4) allocate the resources at their disposal to identifying and mitigating risks posed by technology; and (5) revisit their approach to compliance reporting to account for the probability of increased activity following DOJ’s recent launch of several new whistleblowing and anti-retaliation programs.

Antitrust Guidelines for Collaboration Among Competitors Withdrawn

On December 11, 2024, the DOJ Antitrust Division and Federal Trade Commission (“FTC”) withdrew longstanding guidelines for collaboration among competitors.[22] Issued in April 2000, the guidelines provided substantive guidance on the types of collaborations and factors that the Division would be more or less likely to view as anticompetitive. The withdrawal notice explained that technological and jurisprudential developments have rendered the guidelines unreliable and stated that the Division is “committed to vigorous antitrust enforcement on a case-by-case basis” going forward. Although the withdrawal is not a criminal enforcement policy, the notice stated that the guidelines “risk[ed] creating safe harbors that have no basis” in law. It also cited “artificial intelligence” and “algorithmic pricing models” as examples of new technologies that the guidelines had not addressed,[23] both of which may be relevant to traditional areas of antitrust criminal enforcement such as price fixing, bid rigging, and market allocation.[24]

2024 Resolutions

This portion of the alert summarizes publicly available corporate resolutions from January 1, 2024 through December 31, 2024. While most are listed alphabetically below, the 14 guilty pleas relating to allegations of tampering with pollution control devices on diesel trucks in violation of the Clean Air Act, which were extracted by the Environmental Crimes Section of DOJ’s Environment and Natural Resources Division and various U.S. Attorneys’ Offices, are grouped together toward the end, for ease of reference. The appendix provides key facts and figures regarding all 99 resolutions, along with links to the resolution documents themselves (where available).

AAR CORP. (NPA)

On December 19, 2024, AAR CORP., a publicly traded aviation services company based in Illinois, entered into an 18-month NPA with DOJ’s Fraud Section and the U.S. Attorney’s Office for the District of Columbia to resolve DOJ’s investigation into an alleged conspiracy to violate the FCPA’s anti-bribery provisions.[25] According to the NPA, between 2015 and 2020, AAR allegedly conspired to pay bribes to government officials in Nepal and South Africa to obtain and retain business with state-owned airlines.[26] As a result of the scheme, AAR reportedly obtained nearly $24 million in profits.[27] Pursuant to the NPA, AAR agreed to pay a $26.4 million criminal penalty and to forfeit at least $18.6 million in proceeds traceable to the offense; however, DOJ agreed to credit disgorgement paid pursuant to AAR’s parallel SEC resolution against the forfeiture amount.[28] According to the NPA, the penalty reflected a 45% discount below the bottom of applicable Guidelines range, and DOJ credited AAR for self-reporting the potential violations to the DOJ and SEC and cooperating with both agencies throughout their multi-year investigations.[29] AAR’s self-report did not qualify as a “voluntary self-disclosure,” however, because media outlets in Nepal and South Africa published several English-language articles reporting potential irregularities in the relevant contracts prior to the company’s disclosure and an independent source reported the alleged Nepal misconduct to U.S. prosecutors 12 days prior to the company’s self-disclosure.[30]

DOJ also charged two individuals in connection with their involvement in these alleged bribery schemes. Deepak Sharma, a former AAR subsidiary executive, pleaded guilty in the District of Columbia on August 1, 2024 to a conspiracy to violate the FCPA for his role in the Nepal scheme and settled related SEC charges on December 19, 2024. Julian Aires, a third-party agent of AAR, pleaded guilty in the District of Columbia on July 15, 2024 to a conspiracy to violate the FCPA for his role in the South Africa scheme.[31]

To resolve parallel SEC charges, AAR consented to a cease-and-desist order finding that the company had violated the FCPA’s anti-bribery and accounting provisions and agreed to pay $29.2 million in disgorgement plus prejudgment interest.[32] In sum, after offsets, AAR agreed to payments totaling approximately $55.6 million.

Advoque Safeguard LLC (Guilty Plea)

On October 24, 2024, Advoque Safeguard LLC, a protective equipment manufacturer, together with three individual defendants, entered a guilty plea for conspiracy to introduce or deliver for introduction into interstate commerce a misbranded device with intent to defraud or mislead pursuant to a plea agreement with the United States Attorney’s Office for the District of Massachusetts.[33] The government alleged that Advoque Safeguard conspired to ship N95 facemasks, misbranded as National Institute of Occupational Safety and Health (NIOSH)-approved while not meeting NIOSH filtration standards.[34] Pursuant to the plea agreement, the parties agreed to recommend a criminal fine of $700,000 to be paid within 120 days and probation of one year.[35] Sentencing has not yet occurred.

Akua Mosaics, Inc. (Guilty Plea)

On March 19, 2024, Akua Mosaics, Inc. (“Akua Mosaics”) entered into a plea agreement with the U.S. Attorney’s Office for the District of Puerto Rico to resolve charges alleging that Akua Mosaics conspired to defraud the U.S. by smuggling and importing porcelain mosaic tiles manufactured in China in violation of 18 U.S.C. §§ 371, 545.[36] The government alleged that from 2021 through about June 2022, Akua Mosaics and its president conspired with a Chinese citizen and resident to ship the Chinese-manufactured tiles to Malaysia, causing the boxes to be labeled “Made in Malaysia,” and then shipping those tiles to Puerto Rico.[37]

In connection with the agreement, Akua Mosaics and its president, also charged in the same case, face a maximum penalty of five years in prison, a $250,000 fine, a three-year term of supervised release, and $1,090,000 in restitution.[38] Pursuant to the agreement, Akua Mosaics agreed to pay restitution of $1,090,000, and a recommendation that no fine be imposed. In related actions, the Chinese national with which the company and president allegedly conspired was arrested in April 2023 in the Northern District of California while attempting to leave the U.S., pleaded guilty to participation in the conspiracy, and was sentenced in September 2023 to four months in prison.[39]

Al’s Asphalt Paving Company, Inc. (Guilty Plea)

On January 31, 2024, Al’s Asphalt Paving Company, Inc. (“Al’s Asphalt”), a provider of asphalt paving services, entered into a plea agreement with the DOJ Antitrust Division.[40] The agreement resolved allegations involving bid rigging, in which Al’s Asphalt and other companies coordinated, and conspired to coordinate, bid prices, resulting in non-competitive bids from March 2013 through as late as June 2019 U.S.C. § 1.[41] Al’s Asphalt’s plea agreement was part of a broader investigation conducted by the DOJ Antitrust Division, which has resulted in nine guilty pleas by companies and executives in the Michigan asphalt-paving services industry, and in which DOJ has coordinated with the Department of Transportation Office of the Inspector General and the U.S. Postal Service Office of Inspector General.[42] This scheme allegedly involved at least $3.6 million in commerce attributable to Al’s Asphalt.[43] On July 31, 2024, the U.S. District Court for the Eastern District of Michigan sentenced the company, imposing a criminal penalty of $795,662, to be paid in installments over the course of five years.[44]

AM/NS Calvert, LLC (Guilty Plea)

On July 23, 2024, AM/NS Calvert, LLC (“AM/NS”), a steel plant owner and operator, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Alabama and the Environmental Crime Section of the Department of Justice.[45] The plea agreement resolved allegations that, from approximately February 2014 through April 2017, AM/NS’s acid regeneration plant was not using caustic solution required by its Clean Air Act permit, in violation of the Clean Air Act.[46] In October 2024, AM/NS was sentenced to three years of probation and a $750,000 fine.[47] The plea agreement also requires AM/NS to comply fully with the terms of a separate, related settlement agreement with the U.S. Environmental Protection Agency’s Office of Debarment and Suspension.[48]

Amigos Mexican Cuisine & Cantina LLC (Guilty Plea)

On November 27, 2023 (though publicly filed on April 29, 2024), Amigos Mexican Cuisine & Cantina LLC (“Amigos Mexican”) entered into a plea agreement with the U.S. Attorney’s Office for the District of Oregon to resolve allegations that the company stole federal funds intended to help small businesses during the COVID-19 pandemic.[49] According to the agreement, over the course of about one year, Amigos Mexican allegedly submitted five fraudulent loan applications to steal more than $759,000 from three COVID-19 pandemic relief programs: the Paycheck Protection Program, Economic Injury Disaster Loan program, and the Restaurant Revitalization Fund. The company’s owners allegedly transferred these funds into personal accounts for personal expenditures.[50] Pursuant to the agreement, Amigos Mexican agreed to pay a fine of $200,000, as well as $759,100 in restitution to the Small Business Administration.[51] In a separate civil proceeding, the company was ordered to pay $1.6 million to resolve a related False Claims Act allegation.[52]

AMVAC Chemical Corp. (Guilty Plea)

On May 24, 2024, AMVAC Chemical Corp. (“AMVAC”), a pesticide manufacturer, entered into a plea agreement with the Environmental Crimes Section of the U.S. Department of Justice’s Environment and Natural Resource Division and the U.S. Attorney’s office for the Southern District of Alabama, to resolve Resource Conservation and Recovery Act (“RCRA”) transportation violation charges.[53] The plea agreement resolved allegations that AMVAC knowingly transported hazardous waste without a required hazardous waste manifest.[54] The government alleged that AMVAC imported tens of thousands of used containers of a pesticide called “Thimet” without labeling the containers as containing hazardous waste.[55] On October 25, 2024, the court sentenced AMVAC to a fine of $400,000 and a three-year probation period where AMVAC will be required to fund and develop an Environmental Compliance Plan (“ECP”), the recommended sentence provided in the agreement.[56] Pursuant to the agreement, the ECP shall be developed and administered by a third-party environmental auditor.

Asphalt Specialists LLC (Guilty Plea)

On January 30, 2024, Asphalt Specialists LLC (“Asphalt Specialists”), a provider of asphalt paving services, entered into a plea agreement with the DOJ Antitrust Division.[57] The agreement was part of a broader investigation into anticompetitive behavior in the asphalt paving industry[58] and resolved allegations involving bid rigging, in which Asphalt Specialists and other companies (including Al’s Asphalt, supra) coordinated, and conspired to coordinate, bid prices, resulting in non-competitive bids from March 2013 through as late as May 2021 in violation of the Sherman Act, 15 U.S.C. § 1.[59] This scheme allegedly involved at least $23,465,114 in commerce attributable to Asphalt Specialists.[60] On August 15, 2024, the U.S. District Court for the Eastern District of Michigan sentenced Asphalt Specialists, imposing a criminal penalty of $6.5 million, as recommended by the government, to be paid over the course of six years.[61]

Austal USA (Guilty Plea)

On August 26, 2024, Austal USA LLC (“Austal USA”), a Navy shipbuilder, entered into a plea agreement resolving allegations regarding securities fraud and obstruction of a federal audit with the U.S. Attorney’s office for the Southern District of Alabama and DOJ’s Fraud Section.[62] The agreement resolved allegations that Austal reported false financial results to investors, lenders, and its auditors.[63] The government alleged Austal USA artificially suppressed an accounting metric known as “estimate at completion” (“EAC”) in relation to its construction of multiple combat ships that Austal USA was building for the U.S. Navy, overstating profitability and earnings in its public financial statements.[64] Under the plea agreement, Austal USA agreed that an approximately $73,572,680 criminal fine was appropriate, but, due to Austal USA’s inability to pay, the plea agreement proposed a criminal fine of $24,000,000 and a three-year probation period during which Austal USA will undergo an independent compliance monitorship.[65] The plea agreement provided up to a 100% credit against the fine for payments made by Austal USA toward a parallel settlement with the SEC in federal court relating to violations of the antifraud provisions of the Securities Exchange Act of 1934.[66] Austal USA’s parent company, Austal Limited was not a defendant in the action though Austal Limited still consented to engage in remedial measures required in the probation.[67]

Aventura Technologies, Inc. (Guilty Plea)

On March 19, 2024, Aventura Technologies, Inc. (“Aventura”), a security and surveillance hardware and software manufacturer, pled guilty in the Eastern District of New York to mail and wire fraud conspiracy, 18 U.S.C. §§ 1341, 1343, and illegal importation, 18 U.S.C. § 1349.[68] Aventura admitted to a more than decade-long, $112 million scheme to purchase Chinese-made security equipment and resell it, while representing that the equipment was U.S.-made.[69] From 2006 to November 2019, Aventura imported and then resold the Chinese-made equipment to the U.S. government and military and other overseas private and public customers, earning over $20 million in government contracts.[70] Aventura actively concealed the equipment’s origins, including by working with Chinese suppliers to label equipment as “Made in USA” and with an American flag, and by showing visitors both a fake lab and fake classified building at the company’s facility on Long Island.[71] The company also falsely represented that it was a woman-owned small business.[72]

Under the guilty plea, Aventura agreed to dissolve itself following sentencing and to three years’ probation, to provide continued federal court jurisdiction during the state-law corporate dissolution process.[73] It also agreed to forfeit over $3 million in assets and 7,000 items of merchandise.[74] Seven individual defendants had previously pled guilty, including to charges of wire fraud conspiracy.[75]

Avin International Ltd & Kriti Ruby Special Maritime Enterprise (Guilty Plea)

On December 23, 2024, shipping companies Avin International Ltd (“Avin”) and Kriti Ruby Special Maritime Enterprise (“Kriti Ruby SME”) entered into a plea agreement with the U.S. Attorney’s Offices for the District of New Jersey and the Middle District of Florida and with the Environmental Crimes Section of DOJ’s Environment and Natural Resources Division.[76] The agreement resolved multiple counts arising from allegations that Avin and Kriti Ruby SME violated the Act to Prevent Pollution from Ships, failed to maintain records, falsified records, and obstructed justice. Specifically, between May 2022 and September 2022, crew members of an oil tanker, which was commercially operated and managed by Avin and owned by Kriti Ruby SME, allegedly knowingly bypassed required pollution prevention equipment by discharging oily waste from the vessel into the sea during port calls in New Jersey and Florida.[77] According to the agreement, crew members allegedly failed to record the discharges in the vessel’s oil record book and were directed to conceal the equipment used to conduct the transfers before inspection by the United State Coast Guard.[78]

In connection with the agreement, Avin and Kriti Ruby SME were ordered to pay a criminal fine of $3,375,000, of which $1,250,000 will be designated as a community service payment to the National Fish and Wildlife Foundation.[79] The companies were sentenced to five-year terms of probation during which they must adopt and implement environmental compliance plans, retain the services of an independent third-party auditor to perform external audits, and fund a court-appointed monitor.[80]

BIT Mining Ltd. (DPA)

On November 18, 2024, BIT Mining Ltd. (“BIT Mining”), which operated as a cryptocurrency mining company based in the Cayman Islands and was formerly known as 500.com Ltd., agreed to enter into a three-year DPA to resolve an investigation by the Fraud Section of DOJ’s Criminal Division and the U.S. Attorney’s Office for the District of New Jersey into alleged violations of the anti-bribery and books-and-records provisions of the FCPA.[81] In particular, DOJ alleged one count of conspiracy to violate the anti-bribery and books-and-records provisions, and one count of violating the books-and-records provisions.[82] The allegations stemmed from the company’s alleged participation in a 2017-2019 scheme to pay $1.9 million in bribes to Japanese government officials and the company’s consultants to win a contract to open a resort and casino in Japan.[83]

The Justice Department also announced on November 18, 2024 that an indictment had been unsealed charging the company’s former CEO with FCPA violations for his alleged role in the scheme.[84] In connection with the DPA, BIT Mining acknowledged that an appropriate criminal penalty would be $54 million.[85] Based on its proven inability to pay this amount, however, the parties agreed to a criminal penalty of $10 million; DOJ also agreed to credit up to $4 million against the civil penalty BIT Mining had agreed to pay the SEC to resolve a parallel investigation into the same conduct.[86] In addition, BIT Mining agreed to continued cooperation, any appropriate enhancements to its compliance program, and periodic reporting to the government regarding remediation and the implementation of compliance measures during the DPA’s three-year term.[87]

The parallel SEC resolution, which alleged approximately $2.5 million in improper payments, charged BIT Mining with violations of the anti-bribery, books-and-records, and internal controls provisions of the FCPA, and imposed a $4 million civil penalty.[88]

BNL Technical Services, LLC (Guilty Plea)

On October 22, 2024, BNL Technical Services, LLC (“BNL”), a small business that provides engineering support for environmental remediation and renewable energy projects, entered into a plea agreement to resolve allegations of bank fraud with the U.S. Attorney’s Office for the District of Eastern Washington.[89] The government alleged that BNL applied for and received a $493,865 loan in April 2020 as part of the Paycheck Protection Program (“PPP”) even though its employee pay and benefits were already being covered by Department of Energy and other federal sources including the Veterans Administration.[90] In August 2021, BNL, through its sole owner Wilson Pershing Stevenson III, requested and was granted forgiveness of the $493,865 PPP loan, by falsely certifying the loan proceeds had been used for eligible uses and business expenses.[91] BNL agreed to pay restitution of $493,865, no additional fine, and a $400 special assessment fee.[92] The agreement included no probation, reporting, or monitor because BNL was no longer a going concern. In exchange, the government agreed to dismiss all remaining indictment counts against BNL, and to dismiss a pending indictment against Wilson Pershing Stevenson III with prejudice.[93] Sentencing is scheduled for March 11, 2025.[94]

Boston Consulting Group (Declination with Disgorgement)

On August 27, 2024, the Fraud Section of DOJ’s Criminal Division issued a “declination with disgorgement” letter to U.S.-based consulting firm Boston Consulting Group, Inc. (“BCG”) for violations of the FCPA’s anti-bribery provisions.[95]

The declination requires that BCG continue to cooperate with the investigation and disgorge more than $14.4 million.[96] The declination letter cited several factors favorable to BCG, including the absence of aggravating factors such as executive management involvement or significant profit, as well as the company’s voluntary and timely self-disclosure, full and proactive cooperation, and substantial remediation efforts, which included terminating employees in Portugal involved in the misconduct, requiring them to forfeit their equity in the company, and withholding bonuses.[97] The declination also credited BCG for significant improvements to its compliance program and internal controls.[98]

Boyd Farm LLC (Guilty Plea)

On June 27, 2024, Boyd Farm, LLC entered into a plea agreement with the U.S. Attorney’s Office for the Eastern District of Virginia to resolve allegations of unlawfully discharging a pollutant in violation of the Clean Water Act.[99] Between 2017 and 2019, Boyd Farm used excavators and other earthmoving equipment to pull vegetation, grub stumps and grade land at three sites in Virginia’s Piedmont region, which left behind debris that made its way into wetlands and streams at the properties.”[100] Boyd Farm was sentenced to pay a fine of $300,000 and serve a year of probation.[101]

Brazos Urethane, Inc. (DPA)

On February 7, 2024, Brazos Urethane, Inc. (“Brazos Urethane”), a commercial building contractor, entered into a three-year DPA with the U.S. Attorney’s Office for the Western District of Wisconsin.[102] The agreement resolved allegations that the company conspired to defraud the United States in connection with the company’s contract with the Federal Bureau of Prisons (“BOP”) to replace roofs on buildings of a correctional facility in Oxford, Wisconsin.[103] The government alleged that Brazos Urethane illegally dumped asbestos-containing materials at a site used to house workers in violation of its contract, which was valued at over $3.9 million.[104] After the Wisconsin Department of Natural Resources discovered the illegal dumping, the government alleged that Brazos Urethane falsely claimed to have completed the cleanup when in reality, it had merely pushed the waste further into the woods.[105] According to the agreement, Brazos Urethane acknowledged its responsibility and received full credit for its cooperation, which included two separate debriefings of all relevant facts, as well as ongoing remediation.[106]

In connection with the agreement, Brazos Urethane agreed to pay a monetary penalty of $300,000 and enhance its compliance and ethics program and internal controls.[107] The agreement did not require restitution because Brazos Urethane had already paid approximately $480,000 to remediate the dump site.[108] However, three months later, on May 6, 2024, the parties amended the DPA, agreeing that the payment “should not be considered a monetary fine because the Court has not initiated any action against the defendant in this case,” seeking to reclassify the payment as restitution, and petitioning the court to transfer it from the clerk of court to the Bureau of Prisons,[109] a motion which the court granted on May 20.[110]

Cambridge International Systems, Inc. (Guilty Plea)

On April 16, 2024, Cambridge International Systems, Inc. (“Cambridge”), a defense contractor, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of California to resolve allegations of conspiracy to commit bribery of, among others, a former Naval Information Warfare Center employee, in violation of 18 U.S.C. § 201.[111] According to the agreement, from 2014-2019, Cambridge allegedly provided jobs to the employee’s family and friends, meals, and sports tickets, in exchange for awarding Cambridge two contracting jobs worth over $132 million.[112] Pursuant to the agreement, Cambridge agreed to forfeit $1,672,102.23, representing the total paid to date under the awarded contracts, and the government agreed to recommend a fine “at the low end of the advisory guideline range recommended by the Government at sentencing.”[113] The agreement did not recommend the court to impose any term of probation.[114]

On September 24, 2024, Cambridge was sentenced to two years of probation and $2.25 million in fines, in addition to the $1.67 million in forfeitures.[115] As part of the condition of the probation, the court ordered the company to set up a fund valued at $250,000 to benefit the family of a slain employee.[116]

CBM SAS, CBM NA, and CBM U.S. (NPA)

On July 8, 2024, CBM SAS, together with its wholly-owned subsidiaries CBM NA and CBM US (collectively “CBM”), an international bus parts supplier, entered into a two-year non-prosecution agreement with the U.S. Attorney’s Office for the Southern District of New York.[117] The agreement resolved allegations that CBM engaged in a scheme to defraud U.S. transit authority customers through false and misleading statements about the sources of contracted-for bus parts from about 2010 to April 2021.[118] Although CBM did not receive credit for voluntary disclosure, to account for “CBM’s significant and early cooperation,” the monetary penalty the company ultimately agreed to pay reflects a 50% discount off the bottom of the U.S. Sentencing Guidelines fine range.[119]

According to the agreement, CBM is required to pay $463,243.41 in forfeiture to the United States, representing its profits from the scheme, and pay a fine of $1,500,000.[120] In addition, CBM has agreed to pay restitution to victims who submit claims, and to hold $2,000,000 in escrow to account for any victim restitution claims made directly to CBM.[121] At the conclusion of the NPA’s term, CBM must revert unclaimed funds up to $438,859.52 to the Crime Victims Fund, which is administered by DOJ’s Office for Victims of Crime.[122] For the duration of the agreement, CBM also must cooperate with the United States, report any violations of U.S. law, and continue its ongoing efforts to implement and maintain an adequate compliance program.[123]

Cerebral, Inc. (NPA)

On November 4, 2024, Cerebral, Inc. (“Cerebral”), an online mental healthcare company, entered into a 30-month NPA with the U.S. Attorney’s Office for the Eastern District of New York.[124] The agreement resolved allegations that Cerebral had improperly promoted distribution of controlled substances through its telehealth services from 2019 through 2022, in violation of 21 U.S.C. §§ 841 and 846.[125] The government alleged that Cerebral, which provided telehealth and prescription treatment for ADHD and other conditions through its app, deliberately pushed prescriptions of controlled substances to increase its revenue and patient retention.[126] The government also alleged that the company’s risk diversion controls were insufficient.[127] While Cerebral did not self-report the conduct, it cooperated with the investigation and took remedial measures including removing its CEO, halting use of prescription metrics for individual employees, and ceasing prescription of controlled substances, among other steps.[128] In consideration of these remedial measures, no independent monitor was imposed by the agreement.

Pursuant to the NPA, Cerebral will forfeit $3,652,000 in profits.[129] The NPA also assessed a fine of $2,922,000 (accounting for an aggregate discount of 20 percent in consideration of Cerebral’s timely cooperation). The fine is deferred for the term of the NPA because Cerebral is financially unable to pay and will be waived at the end of the agreement’s term unless Cerebral’s financial position has changed.[130]

Covetrus North America LLC (Guilty Plea)

On February 12, 2024, Covetrus North America LLC (“Covetrus”), a prescription drug company, entered into a plea agreement with the U.S. Attorney’s Office for the Western District of Virginia to resolve allegations of criminal drug misbranding in connection with the sale of veterinary prescription drugs.[131] Pursuant to the plea agreement, Covetrus agreed to pay a $1,000,000 fine to the Virginia Department of Health Professions and approximately $21,534,091 in forfeiture, representing the total value of misbranded prescription drugs.[132] The company was further sentenced to one year of probation and an additional $1,000,000 criminal penalty.[133] Covetrus also agreed to implement a corporate compliance program, and to annual reporting and certification of compliance for a period of two years.[134]

Cruise, LLC (DPA)

On November 15, 2024, Cruise, LLC (“Cruise”) entered into a DPA with the U.S. Attorney’s Office for the Northern District of California to resolve allegations that it violated Section 1519 of Title 18 of the United States Code by submitting a false report to a federal agency to obstruct justice.[135] Specifically, Cruise allegedly provided a false record to National Highway Traffic Safety Administration (“NHTSA”) with the intent to impede, obstruct, or influence the investigation of a crash involving one of Cruise’s autonomous vehicles.[136] Pursuant to the DPA, Cruise agreed to pay a $500,000 monetary penalty; adopt various remedial, review, and audit measures; and submit annual self-reports during the DPA’s three-year term.[137] DOJ credited Cruise’s cooperation, including sharing privileged documents pursuant to a limited waiver of privilege, and remediation, including terminating responsible employees and revamping the company’s safety and incident response protocols.

Defyned Brands (Guilty Plea)

On January 12, 2024, Defyned Brands (also known as 5 Star Nutrition LLC), a product development, brand marketing, and multi-channel retail company, entered into a plea agreement with DOJ Civil Division’s Consumer Protection Branch and the U.S. Attorney’s Office for the Western District of Texas.[138] Defyned pleaded guilty to three counts of distributing misbranded dietary supplements—workout supplements Epivar, Alpha Shredded and Laxobolic—in interstate commerce in violation of the federal Food, Drug and Cosmetic Act (“FDCA”), from September 2018 to July 2020.[139] The products were allegedly misbranded because they contained ingredients mislabeled as dietary ingredients or not listed on the product label.[140] In connection with the agreement, Defyned agreed to forfeit $4.5 million composed of 90 monthly payments of $50,000, and agreed to implement specific compliance program measures and to satisfy related reporting requirements for a term of three years.[141]

Dlubak Glass Company (Guilty Plea)

On December 2, 2024, Dlubak Glass Company entered into a plea agreement with the U.S. Attorney’s Office for the Northern District of Texas and DOJ’s Environmental Crimes Section.[142] The government alleged that the Company made materially false statements to the Texas Commission on Environmental Quality regarding its crushed cathode ray tube glass, which is subject to stringent environmental regulations.[143] Specifically, Dlubak allegedly represented that the crushed glass contained no lead, when in fact, the glass contained materials that have significant levels of lead.[144] Pursuant to the plea arrangement, the parties agreed that an appropriate sentence for Dublak would be four years’ probation and a $100,000 fine, and Dlubak would be required to appoint an Environmental Compliance Officer within 30 days of sentencing.[145] Arraignment is scheduled for April 3, 2025.

Domermuth Environmental Services, LLC (Guilty Plea)

On July 16, 2024, Domermuth Environmental Services, LLC (“DES”), a Tennessee-based petroleum spill clean-up company, entered into a guilty plea with the U.S. Attorney’s Office for the Eastern District of Tennessee to resolve allegations that DES knowingly discharged pollutants into navigable waters without a permit in violation of the Federal Water Pollution Control Act.[146] The government alleged that in 2018, petroleum-contaminated wastewater spilled on an outdoor concrete pad at DES’s processing facility.[147] Employees attempted to manage the spill by using absorbent pads and then pumping the contaminated water over a retaining wall into a patch of vegetation, but this water eventually flowed into a shallow ditch and discharged into the Holston River, a navigable waterway.[148] Pursuant to the agreement, the government recommended that DES be sentenced to three years’ probation and a $50,000 criminal fine, reflecting a downward departure of two levels due to the nature and quantity of substance involved.[149] The Honorable Thomas Varlan sentenced DES to the agreed terms on December 12, 2024.[150]

Eagle Renovations LLC (Guilty Plea)

On April 18, 2024, Eagle Renovations LLC (“Eagle Renovations”), a real estate company, pleaded guilty to one count wire fraud in the U.S. District Court in Dayton, Ohio in connection with an investigation into the misuse of COVID-relief program funds.[151] Eagle Renovations admitted to improperly applying for rental assistance through a federally funded CARES Act program in October and November 2020.[152] Eagle Renovations allegedly applied for funds through the program for at least seven properties, including some that were not inhabited or where the amount paid was “well in excess of what would be needed to cover any actual monthly rent.”[153] Reportedly, Eagle Renovations received about $70,875 through the program and paid back approximately $40,000.[154] As of the time of this publication, the plea agreement remains under seal.

On August 26, 2024, Eagle Renovations was sentenced to five years of probation and ordered to pay $24,150 restitution.[155]

eBay Inc. (DPA)

On January 10, 2024, eBay Inc. (“eBay”) entered into a three-year DPA with the U.S. Attorney’s Office for the District of Massachusetts.[156] In connection with the agreement, eBay agreed to pay a $3 million penalty, retain an independent compliance monitor, and make certain compliance enhancements.[157]

Endo Health Solutions Inc. (Guilty Plea)

In connection with the chapter 11 cases of global pharmaceutical manufacturer Endo International plc, a Gibson Dunn-led secured creditor group negotiated a multi-agency economic settlement with the federal government resolving approximately $8 billion in asserted claims, including several billion dollars of disputed tax claims, FDCA claims, and healthcare claims, in exchange for a single net present value payment of $200 million paid upon emergence of Endo’s business from chapter 11 in April 2024.[158] This global resolution included a misdemeanor guilty plea made shortly after emergence by non-successor debtor Endo Health Solutions Inc., which was negotiated with the DOJ’s Consumer Protection Branch to resolve alleged violations of the FDCA, and a stipulated unsecured claim in the form of $1.086 billion in criminal fines and an additional $450 million criminal forfeiture, which was deemed fully satisfied (along with all other federal claims) by the aforementioned global economic settlement payment.[159]

Envigo RMS LLC and Envigo Global Services Inc. (Guilty Plea)

On June 3, 2024, Envigo RMS LLC (“Envigo RMS”) and Envigo Global Services Inc. (“Envigo Global”), two related companies involved in dog breeding operations, pleaded guilty with the U.S. Attorney’s Office for the Western District of Virginia and the Environmental Crimes Section of DOJ’s Environment and Natural Resources Division to conspiracy to violate the Animal Welfare Act and Clean Water Act.[160] The plea agreement resolved allegations that Envigo RMS failed to provide adequate veterinary care, adequate staffing, and safe and sanitary living conditions for the dogs housed at its breeding facility, and that Envigo Global failed to properly treat its wastewater or safely dispose of it.[161] The companies agreed to criminal fines—$11 million for Envigo RMS and $11 million for Envigo Global, for a total fine of $22 million—along with $6.5 million in payments to non-governmental organizations, a $7 million commitment to improving their facilities and personnel, five years’ probation, and a compliance monitor to submit reports every six months during a five-year term.[162] On October 24, 2024, Envigo RMS and Envigo Global were sentenced in accordance with the agreement.[163]

Environmental Resources Inc. (Guilty Plea)

On August 15, 2024, Environmental Resources, Inc. DBA Easy Rooter Plumbing, a Nevada company providing waste removal services, entered a plea agreement with the DOJ’s Environmental and Natural Resources Division and the U.S. Attorney’s Office for the District of Nevada, tied to a group plea deal with its co-defendant Matthew Thurman, pursuant to which the company pleaded guilty to a single count of knowingly violating a Clean Water Act pretreatment standard by illegally discharging grease waste and wastewater into the local publicly owned treatment works.[164] The plea agreement resolves allegations that the company and its owner collected grease wastes from food-service businesses and pumped them down manholes or into the grease traps of other customers.[165] Consistent with the agreement, on December 10, 2024, Environmental Resources, Inc. was sentenced to three years of probation and a $680,000 fine, for which the company was solely liable.[166] The owner was sentenced to two years in prison, one year of supervised release, and ordered to pay a $680,000 fine.[167]

Evans Concrete, LLC (Guilty Plea)

On April 2, 2024, Evans Concrete, LLC, a concrete sales company, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Georgia and the DOJ Antitrust Division, pursuant to which it pleaded guilty to conspiracy in restraint of trade in violation of the Sherman Act.[168] The plea agreement resolved allegations that Evans Concrete, from 2011-2013, knowingly entered into and engaged in a conspiracy to suppress and eliminate competition by fixing prices, rigging bids, and allocating specific jobs for sales of ready-mix concrete.[169] The government alleged that Evans Concrete and its co-conspirators agreed on pricing levels for ready mix concrete jobs in Statesboro, Georgia and allocated specific ready-mix concrete jobs in Statesboro, and that the conspirators used a third party to facilitate the transfer of information to one another to conceal the conspiracy.[170] Previously, in 2021, the government entered into a DPA with one of the co-conspirators, Argos USA, LLC, which had started cooperating with the government in 2020 and agreed to pay more than $20 million in criminal penalties in a DPA in 2021.[171] Evans Concrete paid a fine of over $2.7 million, and the court imposed one year of probation.[172]

Evoqua Water Technologies (NPA)

On May 13, 2024, Evoqua Water Technologies Corp. (“EVOQUA”) entered into a two-year NPA with the U.S. Attorney’s Office for the District of Rhode Island to resolve securities fraud charges relating to the company’s revenue recognition and statements to auditors.[173] The government alleged that between 2016 and 2018, EVOQUA booked revenue from purported sales of products where the receiving revenue was not reasonably assured, the products had not shipped to customers in the quarter the revenue was recognized, and/or the component parts had not been completed.[174] The government further alleged that these bookings caused the company to make misstatements in its financial statements and annual and quarterly SEC filings.[175]

In connection with the agreement, EVOQUA agreed to pay $8.5 million in criminal penalties and monitoring, reporting and compliance obligations for a two-year period.[176] The government did not impose an independent monitor because of EVOQUA’s acquisition by another company, EVOQUA’s remedial improvements to its compliance program and internal controls, and its agreement to enhance its compliance program.[177] The company also entered into a March 2023 resolution with the SEC for the same conduct and paid a civil penalty of $8.5 million.[178]

Family Dollar Stores, LLC (Misdemeanor Guilty Plea)

On February 26, 2024, Family Dollar Stores, LLC (“Family Dollar Stores”), a subsidiary of the retail company, entered into a plea agreement involving a misdemeanor offense with DOJ’s Consumer Protection Branch and the U.S. Attorney’s Office for the Eastern District of Arkansas.[179] The agreement resolved allegations that the subsidiary violated a strict liability misdemeanor provision of the Federal Food, Drug, and Cosmetic Act (“FDCA”) related to the adulteration of food, cosmetics, drugs, and devices.[180] The government alleged that a distribution center in West Memphis, Arkansas fell into a state of disrepair in 2019 and had rodent activity as a result that led to adulterated product being shipped in interstate commerce.[181]

In connection with the agreement, the subsidiary agreed to pay a fine of $200,000, a special assessment of $125, and forfeiture of $41.5 million.[182] The agreement notes the company’s extensive cooperation and significant remedial efforts, including the voluntary recall of affected products, retention of a third-party FDA expert to develop standard operating procedures for handling and storage of FDA-regulated products, and the appointment of experienced legal and compliance leaders to oversee the enhanced compliance program including food safety, among other measures. The DOJ credited the company’s development, implementation and maintenance of effective corporate compliance measures, and the Company agreed to self-report on its progress to DOJ for a period of three years.[183]

Fidelity Development Group LLC

On September 16, 2024, Fidelity Development Group LLC (“Fidelity”), a real estate development company, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Ohio.[184] Although the agreement remains under seal, according to a press release, the agreement resolved allegations that Fidelity violated the Clean Air Act by failing to inspect for the presence of asbestos before renovating a building.[185] The government alleged that in 2015 or 2016, Fidelity purchased the property and began renovations without conducting or acquiring an asbestos survey, despite an April 2020 asbestos survey that identified more than 12,000 linear feet of friable asbestos pipe wrap insulation in the building.[186]

On January 16, 2025, Fidelity pleaded guilty to the charge.[187] News sources claiming to have reviewed the plea agreement report that it includes a $100,000 fine and that the company expects to receive a two-year sentence of organizational probation.[188] Sentencing is scheduled for March 4, 2025.[189]

Frame, Inc. (Guilty Plea)

On February 22, 2024, Frame, Inc., a construction service company operating in West Virginia and Florida, entered into a plea agreement with the U.S. Attorney’s Office for the Northern District of West Virginia to resolve allegations of conspiracy to commit wire fraud.[190] Frame, Inc. was contracted by EMCOR Facilities Services, Inc. to provide repair services at U.S. Postal Service (USPS) facilities within a 150-mile radius of Charleston, West Virginia.[191] While Frame, Inc. was permitted to use subcontractors for this work, certain disclosure and maximum mark-up requirements applied.[192] The government alleged that Frame, Inc. committed wire fraud when it submitted bills for supposed services with rates above what was being charged by the subcontractors (including above maximum mark-up limits), after many times certifying that Frame, Inc. conducted the work, when in fact, a subcontractor had been used.[193] Pursuant to the agreement, Frame agreed to pay restitution of $187,286 and agreed that it is debarred from future federal government contracts.[194] According to a DOJ press release announcing the plea agreement, Frame also agreed to dissolve the corporation.[195] The court did not impose any additional penalties at sentencing.[196]

Gremex Shipping S.A. de C.V. (Guilty Plea)

On October 30, 2024, Gremex Shipping S.A. de C.V. (“Gremex”), a Mexican corporation that managed ships, entered into a plea agreement with the U.S. Attorney’s Office for the with the Northern District of Florida and DOJ’s Environmental Crimes Section.[197] The agreement resolved one felony charge of violation of the Act to Prevent Pollution from Ships (APPS) through the illegal discharge of bilge waste, and one charge of providing false records to the U.S. Coast Guard to conceal the illegal discharge.[198] In particular, the plea agreement resolved allegations that Gremex discharged oily bilge water without first removing the oil from the bilge water via an oil water separator, as required by international treaty.[199] Gremex was further alleged to have failed to adequately document its oily water discharges in its oil record book.[200] As part of its plea, Gremex agreed to pay a $1.75 million fine, to serve a four-year term of probation, and to fund and implement a detailed environmental compliance plan that includes retention of an independent third-party auditor to execute a prescribed audit plan.[201] Gremex also consented to the imposition of a court-appointed monitor for the duration of probation.[202] At the time of publication, sentencing had not yet occurred.

Gunvor (Guilty Plea)

On March 1, 2024, Gunvor, S.A. (“Gunvor”), a commodities trading company, entered into a plea agreement with U.S. Department of Justice’s Criminal Division, Fraud and Money Laundering and Asset Recovery Section (“MLARS”), and the U.S. Attorney’s Office for the Eastern District of New York.[203] The agreement resolved allegations that Gunvor paid bribes to Ecuadorean government officials to secure business with Ecuador’s state-owned oil company between 2012 and 2020.[204] The government alleged that Gunvor, through Gunvor Singapore, paid more than $97 million to brothers Antonio Pere and Enrique Pere knowing that a portion of the payments were intended as bribes for Ecuadorian officials.[205] The Pere brothers had previously pleaded guilty to conspiracy to commit money laundering, as had a former Gunvor employee and former senior official at Ecuador’s state-owned oil company.[206] The Pere brothers also pleaded guilty to conspiracy to violate the FCPA.[207]

In connection with the agreement, Gunvor agreed to pay a criminal penalty of over $374 million and forfeiture of approximately $287 million, for a total of $661 million, with credit of up to one quarter of the criminal fine for the amounts of any resolutions within one year of the agreement, with Swiss and/or Ecuadorian authorities, related to the same conduct.[208] Swiss authorities announced a parallel resolution for approximately $98 million simultaneously with the U.S. plea agreement, and in June 2024, Gunvor resolved with Ecuadorian authorities for $93.6 million.[209] DOJ cited Gunvor’s cooperation and remediation as mitigating factors, and also considered a separate bribery resolution with Swiss authorities for actions contemporaneous with, but unrelated to, the conduct at issue that also involved alleged flaws in Gunvor’s internal controls.[210] Gunvor’s penalty reflects a discount of 25 percent from the 30th percentile of the applicable Sentencing Guidelines range.[211]

DOJ determined that an independent compliance monitor was not necessary based on Gunvor’s remediation and the state of its compliance program, but Gunvor is required to annually report on remediation and compliance measures during the agreement’s three-year term.[212]

See our 2024 Year-End FCPA Update for additional details and analysis.

Hexamed Business Solutions LLC and Trinity Champion Healthcare Partners LLC (Guilty Plea)

On April 3, 2024, Hexamed Business Solutions LLC (“Hexamed”) and Trinity Champion Healthcare Partners LLC (“Trinity”), both “Managed or Management Service Organizations” (“MSOs”) operated by Med Left LLC, a pharmacy marketer, pleaded guilty to conspiracy to commit concealment money laundering in the U.S. District Court for the Northern District of Texas.[213] The charges, brought by the U.S. Attorney’s Office for the Northern District of Texas, relate to an alleged patient referral scheme involving Med Left and Next Health, a pharmacy and laboratory services company.[214] According to the indictment, from about September 1, 2013, through at least October 2018, Next Health and several doctors allegedly agreed to split profits on prescriptions filled at pharmacies owned by Next Health.[215] NextHealth allegedly identified the industry’s most profitable prescriptions and then paid physicians to prescribe those medications through NextHealth pharmacies.[216] The scheme allegedly involved granting doctors “ownership” of specific pharmacies for a nominal fee.[217] From about September 1, 2013 through February 1, 2017, bribes and kickbacks were allegedly paid to referring physicians under the guise that the payments were legitimate returns on investment from the physicians’ ownership in the pharmacies.[218] Beginning in February 2017, doctors who no longer wanted to be invested in the pharmacies or were not offered the chance to buy-in, were instead allegedly paid bribes and kickbacks through MSOs operated by Med Left, such as Hexamed and Trinity.[219] The prescribing pharmacy would allegedly track each prescription by doctor by profit, send the proceeds to Med Left, and then Med Left would pay kickbacks to physicians through Hexamed and Trinity.[220] From about February 2017 through about October 2019, bribes and kickbacks were allegedly paid to physicians under the guise that the payments were legitimate returns on investment in the MSOs.[221]

As part of the plea agreements, Trinity and Hexamed agreed to pay fines not exceeding $10,000 and to forfeit funds seized from each entity’s bank account, amounting to $9,172.20 and $13,929.46, respectively.[222] Both companies agreed to pay a mandatory special assessment of $400 prior to sentencing.[223] The court accepted the companies’ guilty plea on November 14, 2024, but sentencing has not occurred at the time of this writing.[224]

JDM Supply (Guilty Plea)

On September 30, 2024, JDM Supply, LLC (“JDM Supply”), a manufacturing company, entered into a plea agreement with the U.S. Attorney’s Office for the District of Massachusetts relating to alleged conspiracy to introduce or deliver for introduction into interstate commerce a misbranded device with intent to defraud or mislead, in violation of the FDCA.[225] The government alleged that JDM conspired to ship N95 facemasks, misbranded as National Institute of Occupational Safety and Health-approved N95 respirators, to hospitals in Massachusetts.[226] Pursuant to the plea agreement, JDM Supply agreed to one year of probation and faces a maximum fine upon sentencing of $3,800,000.[227] A sentencing hearing is scheduled for March 25, 2025.[228]

KBC Capital (Guilty Plea)

On July 31, 2024, KBC Capital, LLC (“KBC Capital”), an after-market firearm accessory manufacturer and distributor, entered into a plea agreement with the U.S. Attorney’s Office for the District of Massachusetts, in which it agreed to plead guilty to 26 counts of transferring a firearm in violation of the National Firearms Act (“NFA”).[229] The government alleged that from about 2017 to September 2023, KBC Capital was responsible for illegally transferring firearm suppressors (i.e., silencers) to Massachusetts residents, noting that making gunshots harder to hear impedes law enforcement response to shootings.[230] KBC Capital admitted to the underlying facts and agreed to pay a fine of $260,000 and to three years of probation to resolve the charges.[231] The probation requirement also included an agreement to cease marketing of firearms accessories.

KVK Research Inc. (Guilty Plea) and KVK Tech Inc. (DPA)

On March 6, 2024, generic pharmaceutical manufacturer KVK Research Inc. (“KVK Research”) entered into a plea agreement with DOJ’s Consumer Protection Branch and the U.S. Attorney’s Office for the Eastern District of Pennsylvania.[232] The criminal information charged KVK Research and its corporate affiliate, KVK Tech Inc. (“KVK Tech”) with two misdemeanor counts of introducing adulterated drugs into interstate commerce in violation of the Federal Food, Drug and Cosmetic Act (FDCA) and recommended forfeiture of $1 million. Pursuant to the plea agreement, KVK Research agreed to this forfeiture amount and to pay a criminal fine of $750,000.[233]

In pleading guilty, KVK Research admitted that from 2011 to 2013, it introduced into interstate commerce at least 62 batches of adulterated hydroxyzine tablets, which were manufactured with an active pharmaceutical ingredient made at a foreign facility for which KVK Research had not sought authorization from the FDA.[234] In addition to the monitor imposed on KVK Tech, the plea agreement imposes quarterly reporting obligations on KVK Research to DOJ regarding remediation and implementation of the compliance measures established in the plea agreement.[235]