Gibson Dunn lawyers are available to assist in addressing any questions you may have about executive orders and their implications for institutions of higher education. Please contact the Gibson Dunn lawyer with whom you usually work or the authors of this client alert for more information.

Introduction

New Trump administration policies require colleges and universities to take careful stock of a large swath of their operations ranging from diversity, equity, and inclusion (DEI) policies and activities, to programs for which they receive federal funding, to immigration policies, to government contracts, to how they are combatting antisemitism, to their involvement with China. Here we briefly summarize the executive actions likely to most significantly affect higher education. These issues will continue to develop as the President and executive agencies implement the articulated policy agendas, and we will provide updates as warranted.

You can find more information on recent administrative actions on our Presidential Transition Hub, here.

Diversity, Equity & Inclusion

In his inauguration address, President Trump vowed to “forge a society that is colorblind and merit based” and “end the government policy of trying to socially engineer race and gender into every aspect of public and private life.” His administration has taken numerous actions since then to curb government contractors’ and grantees’ DEI programs. Colleges and universities that receive federal grant funding or that serve as government contractors should review their programs to determine any risk exposure related to DEI programs in light of the executive orders described below. They also should consider coordinating closely with their contracting and grant officers to prevent any misunderstandings. Relevant executive actions include:

- Executive Order 14173, “Ending Illegal Discrimination and Restoring Merit-Based Opportunity,” rescinded several executive orders, including Executive Order 11246, which imposed affirmative action obligations on federal contractors in addition to non-discrimination requirements. In place of the prior affirmative action requirements, federal contracts and grants now will be required to include (1) a clause requiring the recipient to agree that compliance “with applicable Federal anti-discrimination laws” is a “material” term of the contract or grant, and (2) a certification that the contractor or grant recipient “does not operate any programs promoting DEI that violate any applicable Federal anti-discrimination laws.” Failure to comply with these new obligations may trigger False Claims Act liability, which can come with substantial penalties. The order also requires the Office of Federal Contract Compliance Programs to “immediately cease” “[a]llowing or encouraging Federal contractors” to engage in “workforce balancing based on race, color, sex, sexual preference, religion, or national origin.” Finally, the order directs the Attorney General to develop a report identifying up to nine civil compliance investigations of higher education endowments over $1 billion, among other entities, and to issue guidance to “all institutions of higher education that receive Federal grants or participate in the Federal student loan assistance program … regarding the measures and practices required to comply with Students for Fair Admissions, Inc. v. President and Fellows of Harvard College.”

- Executive Order 14151, “Ending Radical and Wasteful Government DEI Programs and Preferencing,” directs agencies to review federal grantees who received funding since January 20, 2021 to advance DEI or environmental justice programs. Colleges and universities should review any programs funded by government grants to determine if any of them may be perceived as advancing DEI or environmental justice goals, including research grants.

Note that a group of higher education officials, including university diversity officers, recently sued the Trump administration to challenge these executive orders, and the U.S. District Court for the District of Maryland has preliminarily enjoined the implementation of specific provisions within these executive orders.[1]

Federal agencies have begun taking steps to implement these directives.

- The Attorney General issued a memorandum stating that “the Department of Justice’s Civil Rights Division will investigate, eliminate, and penalize illegal DEI and DEIA preferences, mandates, policies, programs, and activities in the private sector and in educational institutions that receive federal funds.” It clarifies in a footnote that the memorandum addresses programs that “discriminate, exclude, or divide individuals based on race or sex.” On the other hand, it does not prohibit observances that “celebrate diversity, recognize historical contributions, and promote awareness without engaging in exclusion or discrimination,” citing Black History Month and International Holocaust Remembrance Day as examples.

- The Department of Education published a letter clarifying the nondiscrimination obligations of schools and other entities that receive federal funding from the Department. It criticized admissions and financial aid policies based on race, as well as programming, such as race-based graduation ceremonies and facilities. The letter states that the SFFA v. Harvard, which related to admissions decisions, applies more broadly to “prohibit[] covered entities from using race in decisions pertaining to admissions, hiring, promotion, compensation, financial aid, scholarships, prizes, administrative support, discipline, housing, graduation ceremonies, and all other aspects of student, academic, and campus life.” In particular, it cautions against using students’ personal essays and extracurriculars as a “means of determining or predicting a student’s race and favoring or disfavoring such students.” It encourages reporting of any use of race by educational institutions to the Department’s Office of Civil Rights. Colleges and universities have 14 days—until February 28, 2025—to comply with the Department’s understanding of the law as described in the letter.

For more information on these and other executive actions related to DEI issues, you can find analysis by Gibson Dunn’s DEI Task Force here.

Anti-Semitism on Campus

President Trump campaigned on a promise to address antisemitism on college campuses. His administration acted upon that promise beginning with an executive order signed on Day One and followed by a host of actions taken by the White House and various agencies. Relevant executive branch actions include:

- Executive Order 14188, “Additional Measures to Combat Anti-Semitism,” directs executive branch agencies to identify all civil and criminal authorities under their jurisdiction to combat anti-Semitism and encourages the Attorney General to pursue cases through the Department’s civil-rights enforcement authorities. It also directs the secretaries of State, Education, and Homeland Security to recommend ways to familiarize higher education institutions with the grounds for inadmissibility so institutions can “monitor for and report activities by alien students and staff relevant to those grounds” so that those reports lead “to investigations, and, if warranted, actions to remove such aliens.”

- To advance the executive order’s purposes, on February 5, the Department of Justice released a memorandum establishing a joint task force to combat “antisemitic acts of terrorism and civil rights violations in the homeland.” The memorandum notes that the task force’s priorities include “investigating and prosecuting acts of terrorism, antisemitic civil rights violations, and other federal crimes committed by Hamas supporters in the United States, including on college campuses.”

- Pursuant to the executive order, the Department of Education already has launched investigations into five universities for tolerating “widespread anti-Semitic harassment” in violation of Title XI.

In addition to these executive branch actions, Gibson Dunn expects the House Committee on Education and Workforce’s new chairman, Tim Walberg (R-MI-5), to continue to focus on college and university responses to the antisemitism on campus. On February 13, Chairman Walberg sent a letter to Columbia University requesting disciplinary records for antisemitic incidents on campus, writing, “Columbia’s continued failure to address the pervasive antisemitism that persists on campus is untenable, particularly given that the university receives billions in federal funding.”

Gender-Related Issues & Title IX

President Trump has issued several executive orders regarding gender, some of which will affect how colleges and universities are evaluated for compliance with civil rights law, including Title IX. Relevant executive actions include:

- Executive Order 14168, “Defending Women from Gender Ideology Extremism and Restoring Biological Truth to the Federal Government,” defines “sex” as “an individual’s immutable biological classification as either male or female.” The order has two main effects: (1) it directs federal agencies to enforce “the freedom to express the binary nature of sex and the right to single-sex spaces in workplaces and federally funded entities” which may lead to enforcement actions against entities that do not provide “single-sex spaces” such as bathrooms or if they take disciplinary action against employees for “express[ing] the binary nature of sex”; and (2) it directs federal agencies to ensure that funds awarded via federal grants do not promote “gender ideology.”

- Executive Order 14201, “Keeping Men Out of Women’s Sports,” which directs the Secretary of Education to “prioritize Title IX enforcement actions against educational institutions [] that deny female students an equal opportunity to participate in sports and athletic events by requiring them, in the women’s category, to compete with or against or to appear unclothed before males.” The Department of Education is expected to provide guidance on how schools must alter their sports programs.

Federal Grants and Contracts

Institutions of higher education that receive federal funding should monitor Trump administration actions that may delay the release of those funds. Government delays in fulfilling funding obligations may impede institutions’ ability to operate programs that rely on federal funding.

- In late January, the Office of Management and Budget issued a memorandum (before rescinding it) that some interpreted as freezing funding for all “financial assistance programs and supporting activities,” but OMB then clarified that the freeze applied only to discretionary payments for specific programs involving immigration, foreign aid, DEI programs, and gender issues that were already ordered paused via executive orders. Days after the memorandum was rescinded, a federal district judge in Washington, DC granted a temporary restraining order on behalf of the plaintiffs and ordered that the White House is “enjoined from implementing, giving effect to, or reinstating under a different name the directives in [the memorandum] with respect to the disbursement of Federal funds under all open awards” and that the White House “must provide written notice of the court’s temporary restraining order to all agencies to which [the memorandum] was addressed.”[2]

- Institutions also may find that competition process for new contracts also is on hold, which may affect institutions that provide services to the federal government. The General Services Administration, the Department of Energy, and likely other executive branch agencies have halted all new contracting awards with certain exceptions.

Immigration

Recent executive orders regarding immigration policy may affect institutions of higher learning. There has been concern that such orders may lead to immigration enforcement on campuses and legal action against institutions with undocumented students or staff. The orders may also affect the ability of students and staff to enter or remain in the United States. Relevant executive actions include:

- Executive Order 14159, “Protecting the American People Against Invasion,” directs the Attorney General and Secretary of Homeland Security to set immigration enforcement priorities based on public safety. The order also authorizes state and local law enforcement to perform immigration functions and to take lawful actions to ensure “sanctuary” jurisdictions do not receive federal funds.

- Acting Secretary of DHS Bejamine Huffman issued a directive advancing this EO, rescinding the Biden Administration’s guidelines for immigration enforcement actions near “sensitive” areas, including schools. It is possible that immigration enforcement actions will take place on college campuses.

- Executive Order 14161, “Protecting the United States from Foreign Terrorists and Other National Security and Public Safety Threats,” directs the Secretary of State to ensure that all aliens seeking admission to, or already present in, the United States are “vetted and screened to the maximum degree possible” to ensure they “do not bear hostile attitudes towards [the U.S.’s] citizens, culture, government, institution, or founding principles” or “advocate for, aid, or support designated foreign terrorists or other threats to our national security.”

For more information on these and other Executive Orders related to immigration, you can find analysis by Gibson Dunn’s Immigration Task Force here.

Vaccines

Conclusion

The issues discussed in this client alert are rapidly evolving. Gibson Dunn’s Executive Order Tracker analyzes executive orders in real time as they are announced. Gibson Dunn lawyers are available to assist in addressing any questions you may have about executive orders and their implications for institutions of higher education. Please contact the Gibson Dunn lawyer with whom you usually work or the authors of this client alert for more information.

[1] National Association of Diversity Officers in Higher Education v. Trump, Case 1:25-cv-00333-ABA (D. Md. Feb. 3, 2025).

[2] See National Council of Nonprofits v. Office of Management and Budget, No. 1:25-cv-00239 (D. D.C. Feb. 5, 2022).

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Congressional Investigations, Public Policy, Administrative Law & Regulatory, Energy Regulation & Litigation, Labor & Employment, or Government Contracts practice groups, or any of the following:

Michael D. Bopp – Chair, Congressional Investigations Practice Group,

Washington, D.C. (+1 202.955.8256, mbopp@gibsondunn.com)

Stuart F. Delery – Co-Chair, Administrative Law & Regulatory Practice Group,

Washington, D.C. (+1 202.955.8515, sdelery@gibsondunn.com)

Eugene Scalia – Co-Chair, Administrative Law & Regulatory Practice Group,

Washington, D.C. (+1 202.955.8673, dforrester@gibsondunn.com)

Helgi C. Walker – Co-Chair, Administrative Law & Regulatory Practice Group,

Washington, D.C. (+1 202.887.3599, hwalker@gibsondunn.com)

Matt Gregory – Partner, Administrative Law & Regulatory Practice Group,

Washington, D.C. (+1 202.887.3635, mgregory@gibsondunn.com)

Andrew G.I. Kilberg – Partner, Administrative Law & Regulatory Practice Group,

Washington, D.C. (+1 202.887.3759, akilberg@gibsondunn.com)

Tory Lauterbach – Partner, Energy Regulation & Litigation Practice Group,

Washington, D.C. (+1 202.955.8519, tlauterbach@gibsondunn.com)

Amanda H. Neely – Of Counsel, Public Policy Practice Group,

Washington, D.C. (+1 202.777.9566, aneely@gibsondunn.com)

Jason C. Schwartz – Co-Chair, Labor & Employment Group,

Washington, D.C. (+1 202.955.8242, jschwartz@gibsondunn.com)

Katherine V.A. Smith – Co-Chair, Labor & Employment Group,

Los Angeles (+1 213.229.7107, ksmith@gibsondunn.com)

Mylan L. Denerstein – Co-Chair, Public Policy Group,

New York (+1 212.351.3850, mdenerstein@gibsondunn.com)

Zakiyyah T. Salim-Williams – Partner & Chief Diversity Officer,

Washington, D.C. (+1 202.955.8503, zswilliams@gibsondunn.com)

Molly T. Senger – Partner, Labor & Employment Group,

Washington, D.C. (+1 202.955.8571, msenger@gibsondunn.com)

Blaine H. Evanson – Partner, Appellate & Constitutional Law Group,

Orange County (+1 949.451.3805, bevanson@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

Jake Shields, Michael Dziuban and Danilo Risteski are the authors of “Assessing PE Risk After Mass. False Claims Act Amendments” [PDF] published by Law360 on February 28, 2025.

Gibson Dunn is a leader in royalty finance, including royalty monetizations and synthetic royalty financing transactions. With an interdisciplinary team bringing together expertise in M&A, licensing, finance, intellectual property, FDA regulatory matters and tax matters, Gibson Dunn has extensive experience representing buyers and sellers of royalty entitlements, including academic institutions, biotechnology and pharmaceutical companies and royalty acquisition funds. This breadth of experience provides valuable insight and commercial perspective that can be critical to an efficient and successful royalty financing transaction.

The Gibson Dunn team has represented clients in royalty finance transactions with a total aggregate value of approximately $8 Billion. Since 2020, Gibson Dunn has completed (representing either company/seller or fund/buyer) nearly 30% of the royalty finance transactions entered into by the most active funds in the space.

As a leading firm in the royalty finance space, we are using our resources and market knowledge to compile and curate all royalty finance transactions that have occurred since January 1, 2020. If you are aware of a transaction that is not appropriately reflected below, please email GibsonDunnRoyaltyTracker@gibsondunn.com with the applicable details.

We are pleased to provide you with the February edition of Gibson Dunn’s monthly U.S. bank regulatory update. Please feel free to reach out to us to discuss any of the below topics further.

KEY TAKEAWAYS

- On February 18, 2025, President Trump signed Executive Order 14215 titled, “Ensuring Accountability for All Agencies,” in an effort to subject independent agencies, including the federal financial services regulatory agencies, to significant political control across activities including rulemaking, legal interpretations, enforcement priorities and expenditures. See our Client Alert on the Executive Order here.

- Acting Chairman Hill announced that the FDIC is “actively reevaluating [its] supervisory approach to crypto-related activities,” including replacing Financial Institution Letter (FIL) 16-2022 requiring FDIC-supervised institutions to notify the FDIC prior to engaging in any crypto-related activities and “providing a pathway for institutions to engage in crypto- and blockchain-related activities.”

- The federal financial services regulatory agencies’ leadership, agendas and regulatory priorities under the new administration remain in flux as leadership teams continue to take shape.

- Russell Vought, the Director of the Office of Management and Budget, was named Acting Director of the Consumer Financial Protection Bureau (CFPB) pending the confirmation of former director of the Federal Deposit Insurance Corporation (FDIC) Board, Jonathan McKernan. Almost immediately, Acting Director Vought directed CFPB staff to “stand-down.”

- Treasury Secretary Scott Bessent designated Rodney Hood, former Chairman of the National Credit Union Administration Board, as the Acting Comptroller of the Currency, pending the confirmation of Jonathan Gould. Gould was previously the Senior Deputy Comptroller and Chief Counsel of the Office of the Comptroller of the Currency (OCC).

- Acting Comptroller Hood and Acting Director Vought join Acting Chairman Travis Hill as directors of the FDIC Board, which has reached its statutory limit of three directors from the same political party. The two remaining FDIC Board seats remain vacant. Matthew Reed was promoted to Acting General Counsel of the FDIC.

- President Trump announced Brian Quintenz as his nominee for Chairman of the Commodity Futures Trading Commission (CFTC). Quintenz is a former CFTC Commissioner during the first Trump administration. Quintenz was also nominated to take the seat of Commissioner Christy Goldsmith Romero, who announced she would step down from the CFTC upon Quintenz’s confirmation, leaving Commissioner Kristin Johnson as the only Democrat on the CFTC’s five-person Commission.

- The administration has not yet announced an intent to designate anyone to the role of Vice Chair for Supervision of the Federal Reserve Board following the Federal Reserve Board’s January 6, 2025 announcement that Vice Chair for Supervision Michael Barr will step down from the position effective February 28, 2025. Recall the Federal Reserve Board’s announcement indicated that it did “not intend to take up any major rulemakings until a vice chair for supervision successor is confirmed.”

DEEPER DIVES

Russell Vought Directs CFPB Employees to “stand-down.” Russell Vought assumed the role as Acting Director of the CFPB only days after President Trump fired former CFPB Director Rohit Chopra and designated Treasury Secretary Bessent as Acting Director. As Acting Director, Bessent directed staff to halt most work and suspended the effective date of all final rules that had not taken effect, consistent with President Trump’s January 20, 2025 executive memorandum ordering “all executive departments and agencies” to implement a regulatory freeze. Upon assuming the Acting Director role, Vought expanded the freeze to cover supervision and examination activities and cut the CFPB’s next funding request to zero. In a court filing on February 24, 2025, the Justice Department stated that Vought had “made no ‘decision to eliminate the CFPB.’” On February 11, 2025, President Trump announced Jonathan McKernan as his nominee for CFPB Director.

- Insights. Among the federal financial services regulatory agencies, it seems that the CFPB has been an epicenter of change during President Trump’s first month—with three different agency heads in as many weeks and two separate stop-work orders—reflecting a shift in the CFPB’s priorities. In his February 27, 2025 nomination hearing before the Senate Banking Committee, McKernan was critical of the CFPB, stating that the agency “suffers from a crisis of legitimacy” that “must be corrected.” McKernan committed to taking “all steps necessary to implement and enforce the federal consumer financial laws” by centering the CFPB’s “regulation on real risks to consumers and by focusing its enforcement on bad actors.” McKernan’s nomination as CFPB Director also clears a path for his return to the FDIC Board, where he had served as a director since January 5, 2023—McKernan would have been unable to continue to serve as a member of the FDIC Board if a member of the same political party were confirmed as CFPB Director.

President Trump Seeks to Expand Oversight of Independent Financial Regulatory Agencies. On February 18, 2025, President Trump signed Executive Order 14215 titled, “Ensuring Accountability for All Agencies.” The Executive Order (EO) requires independent regulatory agencies to “submit for review all proposed and final significant regulatory actions to the Office of Information and Regulatory Affairs (OIRA) within the Executive Office of the President before publication in the Federal Register,” as traditional executive branch agencies have done for decades. The EO also directs the Office of Management and Budget (OMB) to review agencies’ obligations for alignment with presidential priorities and “adjust such agencies’ apportionments,” requires agencies to establish a White House Liaison and regularly consult and coordinate with the White House, and provides that the President and Attorney General will provide authoritative legal interpretations for the entire executive branch. Although the EO exempts the Board of Governors of the Federal Reserve System’s (Federal Reserve) “conduct of monetary policy,” it expressly applies to the Federal Reserve’s “conduct and authorities directly related to its supervision and regulation of financial institutions.” The EO also applies to other federal financial services regulatory agencies by reference to 44 U.S.C. § 3502(5), which includes the Federal Reserve, CFTC, FDIC, the Federal Housing Finance Agency, the Securities and Exchange Commission, CFPB and the OCC. (For up-to-date information on executive orders and other significant announcements made by the new administration, please visit our Executive Order Tracker. For additional insights, please visit our resource center, Presidential Transition: Legal Perspectives and Industry Trends.)

- Insights. The EO indicates that the White House intends to play an increased role in shaping financial regulatory policy by subjecting the federal financial services regulatory agencies to significant political control across activities including rulemaking, legal interpretations, enforcement priorities and expenditures. The EO’s requirement that the Attorney General interpret the law for the executive branch implies that independent agencies may need to consult with the Justice Department before issuing regulations or guidance, and potentially before taking enforcement action, which may slow the pace of agency action in both the regulatory and enforcement space. Additionally, the OMB Director’s (Russell Vought) authority to shape independent agency expenditures could allow him to order nonenforcement of regulations or defunding programs that are inconsistent with the President’s policy preferences, and shift the focus of financial regulators toward the administration’s political priorities.

Federal Bank Regulatory Agencies Revisit Crypto-Related Activities. On February 5, 2025, in conjunction with the FDIC’s announcement that it was making additional disclosure of FDIC correspondence with banks and noting “that requests from … banks [to pursue crypto- or blockchain-related activities] were [previously] almost universally met with resistance,” Acting Chairman Hill made clear that the FDIC is “actively reevaluating [its] supervisory approach to crypto-related activities,” including replacing Financial Institution Letter (FIL) 16-2022 and “providing a pathway for institutions to engage in crypto- and blockchain-related activities.” On February 12, 2025, Federal Reserve Board Governor Waller gave a speech illustrating an openness to increased bank participation in the crypto industry. In his speech, Governor Waller called for a “regulatory and supervisory framework that addresses stablecoin risks directly, fully, and narrowly” so that banks and non-banks alike can issue regulated stablecoins. He also addressed the impact of fragmentation—from a technical perspective, in use cases, and in regulatory approach—on the potential growth of stablecoins.

- Insights. The federal banking agencies, with the support of Congress, have been very clearly signaling they will revisit their approach to crypto-related activities, potentially starting with addressing the permissibility of at least some of the five crypto-asset activities highlighted in the interagency policy sprint, in particular crypto custody activities; activities involving payments, including stablecoins; and the facilitation of customer purchases and sales of crypto-assets (perhaps using finder authority). The federal banking agencies also seem poised to continue to support tokenization of traditional financial assets. Increased acceptance of more forms of digital assets, blockchain-related activities and tokenization into the banking system should be met with the requisite evolution of BSA/AML programs. In addition, the historic web of U.S. federal and state (as well as non-U.S.) regulatory requirements will necessitate careful consideration to minimize friction. In that regard, this is an area where global coordination will be critical for industry participants.

OTHER NOTABLE ITEMS

Speech by Governor Bowman on Changes to Federal Reserve Supervision. On February 17, 2025, Federal Reserve Board Governor Bowman gave remarks before the ABA’s Conference for Community Bankers. In her remarks, Governor Bowman reiterated consistent themes of greater accountability and transparency in bank supervision; increased focus on safety and soundness, as opposed to operational risk; streamlined de novo banking applications; and a comprehensive review and modernization of banking laws. Specifically, she noted that “non-core and non-financial risks” like information technology, operational risk, internal controls and governance have been “over-emphasized” and, while important, “should not drive the overall assessment of a firm’s condition,” particularly “at the expense of more material financial risks.” According to Governor Bowman, where those non-core non-financial risks are over-emphasized, it creates an “odd mismatch between financial condition and overall supervisory condition.”

Speech by Vice Chair for Supervision Barr on Risks and Challenges for Bank Regulation and Supervision. On February 20, 2025, Vice Chair for Supervision Barr gave a speech titled “Risks and Challenges for Bank Regulation and Supervision.” In somewhat contrasting remarks to those of Governor Bowman, Vice Chair for Supervision Barr outlined seven specific risks that he foresees ahead: “(1) maintaining and finishing post-financial crisis reforms; (2) maintaining the credibility of the stress test; (3) maintaining credible, consistent supervision; (4) encouraging responsible innovation; (5) addressing cyber and third-party risk; (6) risks in the nonbank sector; and (7) climate risk.”

Federal Reserve and OCC Release 2025 Stress Test Scenarios. On February 5, 2025, the Federal Reserve released its 2025 stress test scenarios. Consistent with its December 23, 2024 announcement and the December 24, 2024 suit challenging the legality of the current the stress testing framework, the Federal Reserve indicated in its announcement that it plans intends to “take steps soon to reduce the volatility of stress test results and begin to improve model transparency in the 2025 stress test” and “begin the public comment process on its comprehensive changes to the stress test this year.” The Federal Reserve also released two hypothetical elements to explore “how banks would react to credit and liquidity shocks in the non-bank financial institution sector during a severe global recession.” On February 13, 2025, the OCC announced the release of economic and financial market scenarios for use in the upcoming stress tests for covered institutions. This year’s baseline scenario features moderate economic growth; the severely adverse scenario considers the impact of an increase in “the U.S. unemployment rate [of] nearly 5.9 percentage points, to a peak of 10 percent,” accompanied by severe market volatility and a collapse in asset prices, including a 33% decline in home prices and a 30% decline in commercial real estate prices.

FDIC Abandons Defense of Administrative Law Judges. On February 24, 2025, the FDIC filed a notice in the United States District Court for the District of Kansas stating that the FDIC will not continue to defend the use of administrative law judges under 5 U.S.C. § 7521 in that case. CBW Bank (CBW) had sought declaratory and injunctive relief from the FDIC on the basis that the FDIC’s administrative proceeding against CBW was unlawful. In its notice, the FDIC stated that the decision was based on the Acting Solicitor General’s decision that “the multiple layers of removal restrictions for administrative law judges in 5 U.S.C. § 7521 do not comport with the separation of powers and Article II.” The FDIC is still seeking dismissal of the case on other grounds. The case is CBW Bank v. FDIC, 2:24-cv-02535.

FDIC Seeks to Modernize Customer Identification Program (CIP) Requirements. On February 7, 2025, Acting Chairman Hill sent a letter to FinCEN urging FinCEN to “align” CIP requirements “with modern financial services practices.” Acting Chairman Hill’s letter notes that fintechs often collect only the last four digits of a customer’s social security or tax identification number from the customer while requesting the rest of the identifiers from a trusted third party, and proposes that banks should be able to onboard customers in a similar fashion.

Chair Powell Addresses Basel III During Semiannual Monetary Policy Report. On February 11, 2025, Chair Powell testified before the Senate Banking Committee. Responding to questions from the Committee, Chair Powell reiterated the Federal Reserve’s commitment to working with new FDIC and OCC leadership towards “completing Basel III Endgame” “fairly quickly,” noting that he expects that the final rule’s top-line number will be “somewhere in [the] area” of capital neutral because “Basel III was not supposed to be an exercise in raising capital in U.S. banks.” In his testimony, Chair Powell revealed that the Federal Reserve is removing the concept of “reputational risk” as a factor in the manual utilized by the Federal Reserve for account access for master accounts.

Speeches by Governor Bowman on Bank Regulation and Supervision. On February 5, 2025 and February 11, 2025, Federal Reserve Board Governor Bowman gave a speech titled “Bank Regulation in 2025 and Beyond.” In her speech, Governor Bowman outlined her views of bank regulation and supervision in 2025. She emphasized the importance of (1) tailoring both a regulatory and supervisory approach based on a firm’s size, business model, risk profile and complexity, (2) a “problem-focused approach” to regulation and (3) innovation in the bank system. As examples of “problems” warranting regulatory changes, Bowman cited the erosion of U.S. Treasury market liquidity, the lack of transparency in stress testing and an increase in check fraud.

Speech by Vice Chair for Supervision Barr on Crisis Management. On February 25, 2025, Vice Chair for Supervision Barr gave a speech titled “Managing Financial Crises.” In his speech, Barr reflected on strategies employed in the spring of 2023 when SVB and Signature Bank failed and outlined five key principles for managing a financial crisis: (1) the response must be forceful enough to convince the market and public of the will to overcome the crisis; (2) a response must be proportionate so that it does not suggest conditions are worse than perceived; (3) leaders need to made decisions despite high levels of uncertainty; (4) the response must be clearly communicated, both internally and to the public; and (5) crisis responders must remain accountable for their decisions.

Speech by Governor Bowman on Community Banking. On February 27, 2025, Federal Reserve Board Governor Bowman gave a speech titled “Community Banking.” In her speech, Governor Bowman touched on familiar themes affecting community banks, among others that “overregulation and unnecessary rules and guidance imposed on smaller and community banks create disproportionate burdens on these banks, eventually eroding the viability of the community banking model.”

Speech by Governor Barr on Artificial Intelligence. On February 18, 2025, Vice Chair for Supervision Barr gave a speech titled “Artificial Intelligence: Hypothetical Scenarios for the Future.” In his speech, Vice Chair for Supervision Barr addressed how banks and bank regulators can best harness the benefits of AI while minimizing the risks and highlighted the importance of (1) institutions and regulators understanding AI, (2) remaining agile and flexible, (3) monitoring any concentration in economic and political power that results from the development of AI, (4) deliberately setting up AI governance, (5) monitoring the risk introduced in finance, and (6) monitoring how AI, and its adoption at nonbanks and banks, alters the banking landscape.

Congress Continues to Investigate Debanking. On February 5 and 6, 2025, the Senate Banking Committee and House Financial Services Subcommittee on Oversight and Investigations held further hearings on debanking.

FDIC Updates Public Report of PPE Notices. On February 19, 2025, the FDIC updated the public list of companies that have submitted notices for a primary purpose exception under the FDIC’s brokered deposit rule. Although the FDIC had originally committed to updating the public list, it had done so only rarely since it was created in 2022.

OCC Announces Withdrawal from Global Regulatory Climate Change Group. On February 11, 2025, the OCC announced its withdrawal from the Network of Central Banks and Supervisors for Greening the Financial System, stating that its participation “extends well beyond the OCC’s statutory responsibilities and does not align with [its] regulatory mandate.” The OCC announcement follows similar announcements by the Federal Reserve on January 17, 2025 and the FDIC on January 21, 2025.

The following Gibson Dunn lawyers contributed to this issue: Jason Cabral, Ro Spaziani, and Rachel Jackson.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work or any of the member of the Financial Institutions practice group:

Jason J. Cabral, New York (212.351.6267, jcabral@gibsondunn.com)

Ro Spaziani, New York (212.351.6255, rspaziani@gibsondunn.com)

Stephanie L. Brooker, Washington, D.C. (202.887.3502, sbrooker@gibsondunn.com)

M. Kendall Day, Washington, D.C. (202.955.8220, kday@gibsondunn.com)

Jeffrey L. Steiner, Washington, D.C. (202.887.3632, jsteiner@gibsondunn.com)

Sara K. Weed, Washington, D.C. (202.955.8507, sweed@gibsondunn.com)

Ella Capone, Washington, D.C. (202.887.3511, ecapone@gibsondunn.com)

Sam Raymond, New York (212.351.2499, sraymond@gibsondunn.com)

Rachel Jackson, New York (212.351.6260, rjackson@gibsondunn.com)

Zack Silvers, Washington, D.C. (202.887.3774, zsilvers@gibsondunn.com)

Karin Thrasher, Washington, D.C. (202.887.3712, kthrasher@gibsondunn.com)

Nathan Marak, Washington, D.C. (202.777.9428, nmarak@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

From the Derivatives Practice Group: The CFTC Division of Enforcement has issued an advisory opinion that explains how the Division will evaluate a company’s or individual’s self-reporting, cooperation, and remediation when recommending enforcement actions to the Commission.

New Developments

- CFTC Commissioner Christy Goldsmith Romero to Step Down from the Commission and Retire from Federal Service. On February 26, Commissioner Christy Goldsmith Romero announced she is stepping down from the Commission and will retire from federal service. Commissioner Romero extended gratitude towards President Biden for her nomination, the U.S. senate for its unanimous confirmation, and her current and former staff and CFTC for their public service. [NEW]

- CFTC Releases Enforcement Advisory on Self-Reporting, Cooperation, and Remediation. On February 25, the CFTC’s Division of Enforcement issued an Advisory on how the Division will evaluate a company’s or individual’s self-reporting, cooperation, and remediation when recommending enforcement actions to the Commission and establishes the factors the Division will consider. This marks the first time the Division will use a matrix to determine the appropriate mitigation credit to apply. Commissioner Kristin N. Johnson released a statement that “any effort to adopt new reporting processes, particularly processes that require inter-division guidelines and infrastructure, must be consistent with the mandates of [the CFTC]” and consequently, that she does not support the Advisory. [NEW]

- SEC Announces Cyber and Emerging Technologies Unit to Protect Retail Investors. On February 20, the SEC announced the creation of the Cyber and Emerging Technologies Unit (“CETU”). According to the SEC, CETU will focus on combatting cyber-related misconduct and is intended to protect retail investors from bad actors in the emerging technologies space. CETU, led by Laura D’Allaird, replaces the Crypto Assets and Cyber Unit and is comprised of approximately 30 fraud specialists and attorneys across multiple SEC offices. The SEC noted that CETU will utilize the staff’s substantial fintech and cyber-related experience to combat misconduct as it relates to securities transactions in the following priority areas: fraud committed using emerging technologies, such as artificial intelligence and machine learning; use of social media, the dark web, or false websites to perpetrate fraud; hacking to obtain material nonpublic information; takeovers of retail brokerage accounts; fraud involving blockchain technology and crypto assets; regulated entities’ compliance with cybersecurity rules and regulations; and public issuer fraudulent disclosure relating to cybersecurity.

- Acting Chairman Pham Announces Brian Young as Director of Enforcement. On February 14, the CFTC Acting Chairman Caroline D. Pham today announced Brian Young will serve as the agency’s Director of Enforcement. Young has been serving in an acting capacity since January 22, and previously was the Director of the Whistleblower Office. He is a distinguished federal prosecutor with nearly 20 years of service at the Department of Justice, including Acting Director of Litigation for the Antitrust Division and Chief of the Litigation Unit for the Fraud Section of the Criminal Division, and has successfully tried some of the most high-profile criminal fraud and manipulation cases in the CFTC’s markets.

- Trump Plans to Pick Brian Quintenz to Lead CFTC. On February 11, several mainstream news sources began to report that U.S. President Donald Trump plans to nominate Brian Quintenz, the head of policy at Andreessen Horowitz’s a16z crypto arm, as Chairman of the CFTC. Quintenz previously served as a commissioner for the CFTC during the first Trump administration.

New Developments Outside the U.S.

- IOSCO concludes Thematic Review on Technological Challenges to Effective Market Surveillance. On February 19, IOSCO published a Thematic Review on the status of implementation of its recommendations on Technological Challenges to Effective Market Surveillance issued in 2013. The IOSCO Assessment Committee conducted the review and assessed the consistency of outcomes arising from the implementation of its recommendations by market authorities in 34 IOSCO member jurisdictions. According to IOSCO, the review found that most market authorities have implemented the recommendations and have made significant progress in addressing technological challenges to market surveillance, particularly in more complex markets. However, IOSCO noted the following concerns: some regulators lack the necessary organizational and technical capabilities to conduct effective surveillance of their markets in the midst of rapid technological developments; the absence of regular review of the surveillance capabilities of market authorities; difficulties with regard to the collection and comparison of data across venues in markets with multiple trading venues; and the inability of many regulators to map their cross-border surveillance capabilities.

- ESMA Proposes Guidelines on Product Supplements. On February 18, ESMA published a Consultation Paper (“CP”)asking for input on Guidelines on supplements that introduce new types of securities to a base prospectus. The aim of the guidelines is to harmonize the supervision of so-called ‘product supplements’ across national competent authorities as approaches to supervision in this area have diverged in the past. [NEW]

- The ESAs Provide a Roadmap Towards the Designation of CTPPs under DORA. On February 18, the European Supervisory Authorities (“ESAs”) announced advancements of the implementation of the pan-European oversight framework of critical Information and Communication Technology (“ICT”) third-party service providers (“CTPPs”) with the objective to designate the CTPPs and to start the oversight engagement this year. The competent authorities are required to submit Registers of Information on ICT third-party arrangements they received from financial entities by April 30, 2025. [NEW]

- ESMA Consults on the Criteria for the Assessment of Knowledge and Competence Under MiCA. On February 17, ESMA launched a consultation on the criteria for the assessment of knowledge and competence of crypto-asset service providers’ (“CASPs”) staff giving information or advice on crypto-assets or crypto-asset services. ESMA is seeking stakeholder inputs about, notably: the minimum requirements regarding knowledge and competence of staff providing information or advice on crypto-assets or crypto-asset services; and organizational requirements of CASPs for the assessment, maintenance and updating of knowledge and competence of the staff providing information or advice. ESMA said that the guidelines aim to ensure staff giving information or advising on crypto-assets or crypto-asset services have a minimum level of knowledge and competence, enhancing investor protection and trust in the crypto-asset markets. ESMA indicated that it will consider all comments received by April 22, 2025.

- ASIC Updates Technical Guidance on OTC Derivative Transaction Reporting. The Australian Securities and Investments Commission (“ASIC”) has updated its technical guidance on OTC derivatives reporting under ASIC Derivative Transaction Rules (Reporting) 2024. The guidance includes ASIC’s observations on, and the industry’s experience with, reporting under the 2024 rules since their commencement on October 21, 2024. It also responds to the industry’s requests for additional clarifications. The key updates include: emphasizing reporting entities’ responsibilities to create unique product identifier codes for accurate reporting; recognizing circumstances when ‘effective date’ and ‘event timestamp’ are reported on a back-dated basis; and clarifying certain aspects of ‘block trade’ reporting. The updated technical guidance is available on ASIC’s derivative transaction reporting webpage.

- ESMA Launches a Common Supervisory Action with NCAs on Compliance and Internal Audit Functions. On February 14, ESMA launched a Common Supervisory Action (“CSA”) with National Competent Authorities (“NCAs”) on compliance and internal audit functions of undertaking for collective investment in transferable securities (“UCITS”) management companies and Alternative Investment Fund Managers (“AIFMs”) across the EU. The CSA will be conducted throughout 2025 and aims to assess to what extent UCITS management companies and AIFMs have established effective compliance and internal audit functions with the adequate staffing, authority, knowledge, and expertise to perform their duties under the AIFM and UCITS Directives.

- ESMA Consults on Amendments to Settlement Discipline. On February 13, ESMA launched a consultation on settlement discipline, with the objective of improving settlement efficiency across various areas. ESMA is consulting on a set of proposals to amend the technical standards on settlement discipline that include: reduced timeframes for allocations and confirmations, the use of electronic, machine-readable allocations and confirmations according to international standards, and the implementation of hold & release and partial settlement by all central securities depositories.

- ESMA Consults on Revised Disclosure Requirements for Private Securitizations. On February 13, ESMA launched a consultation on revising the disclosure framework for private securitizations under the Securitization Regulation (“SECR”). The consultation proposes a simplified disclosure template for private securitizations designed to improve proportionality in information-sharing processes while ensuring that supervisory authorities retain access to the essential data for effective oversight. The new template introduces aggregate-level reporting and streamlined requirements for transaction-specific data, reflecting the operational realities of private securitizations.

- Geopolitical and Macroeconomic Developments Driving Market Uncertainty. On February 13, ESMA published its first risk monitoring report of 2025, setting out the key risk drivers currently facing EU financial markets. ESMA finds that overall risks in EU securities markets are high, and market participants should be wary of potential market corrections.

- ESMA Appoints Birgit Puck as new Chair of the Markets Standing Committee. On February 11, ESMA appointed Birgit Puck, Finanzmarktaufsicht, as a new Chair of the Markets Standing Committee.

New Industry-Led Developments

- ISDA and FIA Response to IOSCO on Pre-Hedging Consultation. On February 21, ISDA and FIA responded to the International Organization of Securities Commissions (“IOSCO”)’s consultation report on pre-hedging. In the response, the associations highlight that an appropriate, consistent and well-understood framework for pre-hedging is important for safe and efficient markets. The associations also noted the importance of not cutting across existing industry codes, including the FX global code, the precious metal code and the Financial Markets Standards Board’s standard for large trades, as market participants already have policies, procedures and institutional frameworks in place to comply with them. [NEW]

- ISDA and AFME Response to FCA on Transparency of Enforcement Decisions. On February 17, ISDA and the Association for Financial Markets in Europe (“AFME”) responded to the UK Financial Conduct Authority’s (“FCA”) consultation on greater transparency of enforcement decisions. The FCA’s proposal, which gives it the ability to publicly name firms at the start of an investigation, continues to cause trepidation across the industry. In the response, ISDA and AFME highlight concerns that the current proposals are harmful to UK competitiveness and growth and suggest a broader interpretation of the existing exceptional circumstances test could be used to meet the FCA’s objectives. [NEW]

- ISDA Responds to FCA on Improving the UK Transaction Reporting Regime. On February 14, ISDA submitted a response to the FCA’s discussion paper (DP) 24/2 on improving the UK transaction reporting regime. In the response, ISDA indicated its support for the use of the unique product identifier in place of the international securities identification numbering system. ISDA also highlighted its opinion on the importance of aligning to global standards and similar reporting regimes, reducing duplicative reporting and using existing technology and data standards, such as the Common Domain Model and ISDA’s Digital Regulatory Reporting initiative.

The following Gibson Dunn attorneys assisted in preparing this update: Jeffrey Steiner, Adam Lapidus, Marc Aaron Takagaki, Hayden McGovern, and Karin Thrasher.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s Derivatives practice group, or the following practice leaders and authors:

Jeffrey L. Steiner, Washington, D.C. (202.887.3632, jsteiner@gibsondunn.com)

Michael D. Bopp, Washington, D.C. (202.955.8256, mbopp@gibsondunn.com)

Michelle M. Kirschner, London (+44 (0)20 7071.4212, mkirschner@gibsondunn.com)

Darius Mehraban, New York (212.351.2428, dmehraban@gibsondunn.com)

Jason J. Cabral, New York (212.351.6267, jcabral@gibsondunn.com)

Adam Lapidus – New York (212.351.3869, alapidus@gibsondunn.com )

Stephanie L. Brooker, Washington, D.C. (202.887.3502, sbrooker@gibsondunn.com)

William R. Hallatt , Hong Kong (+852 2214 3836, whallatt@gibsondunn.com )

David P. Burns, Washington, D.C. (202.887.3786, dburns@gibsondunn.com)

Marc Aaron Takagaki , New York (212.351.4028, mtakagaki@gibsondunn.com )

Hayden K. McGovern, Dallas (214.698.3142, hmcgovern@gibsondunn.com)

Karin Thrasher, Washington, D.C. (202.887.3712, kthrasher@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.

The First Omnibus Package proposes to scale back sustainability reporting obligations under the CSRD as well as due diligence obligations under the CSDDD. According to the European Commission, it aims to prevent regulatory uncertainty, avoid unnecessary compliance costs, and provide companies with a clear, realistic and manageable path towards transition, which meets their sustainability obligations.

Since the announcement by the President of the European Commission, Ursula von der Leyen, on November 8, 2024, of a “drasti[c] reduc[tion] [of] administrative, regulatory and reporting burdens” in the EU, there has existed persistent speculation about a potential reform. In particular, there have been questions as to what proposals the European Commission might make to amend two of the European Union’s flagship Sustainability Directives: the Corporate Sustainability Reporting Directive (CSRD)[1] and the Corporate Sustainability Due Diligence Directive (CSDDD)[2], both of which we have previously reported on here and here, as well as here. This week, on February 26, 2025, the European Commission presented its proposal in the form of the “First Omnibus Package”.[3]

In this client alert, we set out our initial analysis of the proposed amendments in the First Omnibus Package and the implications for in-scope businesses. We consider proposed amendments to (i) CSRD Reporting; and (ii) to the CSDDD obligations and enforcement regime.

As the legislative process unfolds, we will continue to monitor and report on any new developments.

1. Executive Summary

The First Omnibus Package is split into two separate proposals: (i) a Postponement Directive[4] to delay certain reporting obligations and due diligence obligations, and (ii) an Amendment Directive[5] to revise key elements of the EU’s sustainability reporting and due diligence frameworks.

The European Commission’s proposals must still be submitted to the European Parliament and the Council as part of the ordinary legislative process (Level 1 legislation).

It is expected that the Postponement Directive is less controversial and, therefore, likely to be adopted faster to ensure that companies are not required to implement reporting or due diligence obligations that may potentially soon be revised or lifted. This is highlighted in Article 3 of the Postponement Directive which requires the Member States to adopt laws implementing the Directive into force by December 31, 2025.

The Amendment Directive, in contrast, will most likely cause lengthy negotiations. It seeks to adjust the CSRD’s scope, reporting requirements, and assurance obligations and narrows the due diligence measures required under the CSDDD to reduce complexity and improve consistency with other EU legislation.

Overall, the most significant changes proposed by the First Omnibus Package, compared with the original texts, are as follows:

CSRD Reporting

- For the CSRD, entry into application is generally postponed by two years (except for public interest entities to which it already applies for financial year 2024), i.e. applying first to reporting on financial years 2027 (in 2028) onwards. Furthermore, an additional requirement of 1,000 employees is supposed to reduce the in-scope undertakings by approx. 80 %. The threshold for reporting on non-EU parent companies is increased to a net turnover of EUR 450 million of these non-EU companies in the EU.

- It is further proposed to significantly reduce the data points under the EU Sustainability Reporting Standards (ESRS). Also, no additional sector-specific reporting standards shall be adopted.

- Taxonomy reporting is limited to undertakings with an EU net turnover exceeding EUR 450 million and more than 1,000 employees, also expected to result in a reduction of in-scope undertakings by approximately 80 %. Also, the reporting templates shall be drastically simplified, leading to a reduction of data points by almost 70 %.

CSDDD

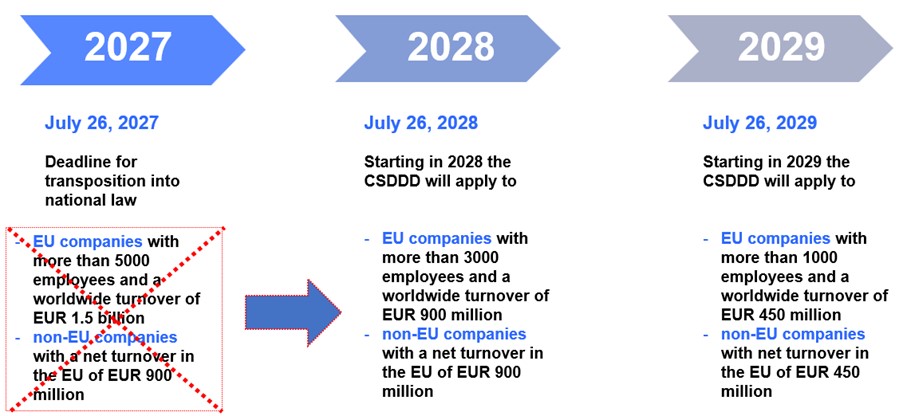

- For the CSDDD, entry into application will be postponed by one year, i.e. it shall apply to the first group of companies mid-2028. The in-scope companies remain unchanged.

- With explicit reference to the German Supply Chain Due Diligence Act (SCDDA) as an example, due diligence obligations are significantly reduced. In particular, they will generally be limited to companies’ own operations and direct business partners, unless there is “plausible information” suggesting adverse impacts by indirect business partners.

- There is no longer a (harmonized) requirement that a company can be held liable for damages in case of non-compliance with the CSDDD, but the various national civil liability regimes shall apply.

- Also, the original obligation for EU Member States regarding representative actions by trade unions or NGOs is revoked.

- Obligations regarding Climate Transition Plans will be limited to an adoption; to “put into effect” is no longer required.

The proposed amendments in the First Omnibus Package first and foremost will most probably give enterprises more time to prepare for CSRD reporting and CSDDD compliance. It is, however, too early to rely on the proposed amendments in substance. Generally, it can be expected that CSRD and taxonomy reporting requirements will be substantially reduced. While it will make sense to monitor the new definition of in-scope entities, the substantive reporting requirements are still subject of further discussion. Regarding CSDDD, companies should not overlook the fact that the remaining obligations will still involve considerable effort and require thorough preparation until the implementation of the CSDDD. Companies subject to already existing supply chain laws in countries such as Germany and France, can attest to the extensive demands these obligations impose.

2. CSRD Reporting

The proposed amendments in the First Omnibus Package will significantly change when and to what extent companies need to disclose information in the context of the CSRD, including which companies will be required to report. In the following, we (a) will discuss changes in the area of sustainability reporting; (b) changes regarding taxonomy disclosures; and (c) will address the implications of conflicts between the suggested amendments and already transposed legislation in the EU Member States.

(a) Proposed Amendments relating to Sustainability Reporting

The First Omnibus Package proposes amendments to the CSRD, the Directive on the Annual Financial Statements, Consolidated Financial Statements and Related Reports of Certain Types of Undertakings (Accounting Directive)[6], and the Directive on Statutory Audits of Annual Accounts and Consolidated Accounts (Audit Directive)[7]. These amendments will significantly change the requirements for sustainability reporting companies have to adhere to.

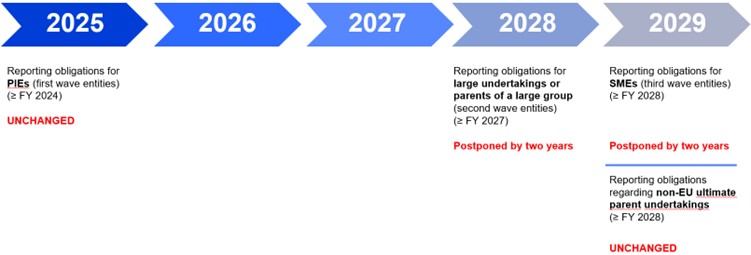

Two-Year Delay for Companies to Start Reporting, No Retroactive Effect for PIEs Reporting in 2025

The Commission’s Postponement Directive proposes a two-year delay for companies that are not yet obliged to report under the CSRD.

- This affects large undertakings and parent undertakings of a large group not classified as public interest entities (PIEs) which would have reported for the first time in 2026 for the financial year 2025. Under the Postponement Directive, their reporting obligation will not start until 2028 for financial years beginning on or after January 1, 2027 (“second wave entities”).

- It also applies to listed small and medium-sized enterprises (SMEs), originally set to report for the financial year 2026, whose reporting will be deferred to financial years starting in 2028 (“third wave entities”).

- Notably, however, this delay does not affect companies already subject to CSRD reporting obligations, such as public interest entities reporting for the first time this year for financial years starting in 2024 (“first wave entities”).

- Furthermore, the European Commission has not proposed delaying reporting obligations regarding non-EU ultimate parent undertakings under Article 40a Accounting Directive.

|

Significant Reduction of Scope of Application

As part of its Amendment Directive, the Commission proposes to significantly narrow the scope of the CSRD. The reporting obligation is now limited to large companies or the parent company of a large group with more than 1,000 employees and either a net turnover of more than EUR 50 million or a balance sheet total of more than EUR 25 million. As a result, around 80 % of companies previously expected to be in scope will no longer be subject to mandatory sustainability reporting. This major shift excludes large undertakings with up to 1,000 employees (including PIEs from the first wave and large companies from the second wave) as well as all listed SMEs (previously part of the third wave). By eliminating the distinction between listed and non-listed undertakings, the proposal aligns with the Capital Markets Union’s goal of enhancing the attractiveness of EU-regulated markets as a financing source. Notably, the exclusion of large PIEs is part of the Amendment Directive and not the Postponement Directive, thus unlikely creating a retroactive effect for companies already reporting this year (namely large undertaking public interest entities with more than 500 employees).

With regard to reporting on non-EU ultimate parent companies, the new Article 40a of the Accounting Directive raises the net turnover threshold for non-EU undertakings from EUR 150 million to EUR 450 million, increases the EU branch threshold from EUR 40 million to EUR 50 million, and limits the requirement to report on their ultimate non-EU parent to large subsidiary undertakings as defined in the Amendment Directive.

The previously leaked proposal to raise the net turnover threshold for EU undertakings to EUR 450 million was scrapped in the official draft. Instead, the revised scope locks in the existing thresholds, while adding a 1,000-employee requirement. As the Commission states, “this revised threshold would align the CSRD more closely with the CSDDD“, signaling a decisive move toward streamlining EU sustainability regulations and drastically narrowing the number of affected companies.

Voluntary Reporting Standards and Strengthened Value-Chain Cap

As part of its Amendment Directive, the Commission introduces a new voluntary reporting standard for companies no longer subject to mandatory CSRD reporting. Based on the voluntary sustainability reporting standard for non-listed micro, small and medium enterprises (VSME) by EFRAG, these new standards will be adopted as a delegated act, with a Commission recommendation to follow soon.

The Commission also envisioned the new standards to act as a shield for companies no longer in scope of the CSRD (e.g. companies with up to 1,000 employees) that are part of the value chain of a reporting entity. When reporting on their value chain, companies may not request information beyond that described in the new voluntary reporting standards. This way, the European Commission hopes to substantially reduce the trickle-down effect.

It should be noted, however, that the Delegated Act to provide for these standards will not be adopted until after the Amendment Directive enters into force. Drafting the VSME, for example, took about two years due to public consultation. Therefore, while a delegated act as a non-legislative level 2 instrument is not as time-consuming as a Level 1 legislative act, there is a possibility that the new standards will not enter into force until 2028. By then, large in-scope companies are already required to publish their sustainability statements.

Further Simplifications and Cost Reductions

The Amendment Directive introduces several additional measures to ease reporting burdens under the current legal regimes. One important measure is the planned revision of the European Reporting Standards (ESRS) to substantially reduce the number of required data points and improve consistency across EU legislation, at the latest six months after the entry into force of the Amendment Directive. While a revision is likely less time-consuming than a new draft, it can be expected that the European Commission will need at least 1.5 years to finalize the legislative process for the respective delegated act. Nevertheless, we expect the revision to significantly limit the reporting burden on companies.

Additionally, the Amendment Directive eliminates the Commission’s empowerment to adopt sector-specific reporting standards, preventing an increase in prescribed data points for reporting undertakings and ending a state of uncertainty as these standards were meanwhile delayed.

Another significant simplification with a crucial impact on reporting costs is the removal of the reasonable assurance standard whose adoption was initially envisaged for 2028. In addition, instead of a binding obligation to adopt sustainability assurance standards by 2026, the European Commission will issue targeted assurance guidelines, allowing for a more flexible response to emerging issues and avoiding unnecessary compliance burdens.

(b) Proposed Amendments to Taxonomy Reporting

While the proposed directives do not provide for explicit changes to the EU Taxonomy Directive, the Omnibus proposal does provide for changes to the Accounting Directive and the Taxonomy Delegated Regulations which will affect the EU Taxonomy reporting requirements.

Mandatory Taxonomy Reporting Thresholds

The proposal introduces a new threshold for mandatory taxonomy reporting. Only large undertakings with an EU net turnover exceeding EUR 450 million and more than 1,000 employees will be required to report their alignment with the EU Taxonomy. This change is expected to result in approximately 80 % of companies no longer being required to report their alignment against the EU Taxonomy. The significant reduction in the number of companies subject to mandatory reporting aims to alleviate the compliance burden on smaller and mid-sized enterprises.

Simplification of the Reporting Templates

The European Commission plans to amend the Taxonomy Disclosures Delegated Act and the Taxonomy Climate and Environmental Delegated Acts to drastically simplify the reporting templates. This simplification will lead to a reduction of data points by almost 70 %, significantly easing the reporting burden for companies. Furthermore, companies will be exempt from assessing the taxonomy-eligibility and alignment of their economic activities that are not financially material for their business, such as those not exceeding 10 % of their total EU turnover, capital expenditure, or total assets. This targeted materiality approach – similar to the reporting approach under the ESRS – ensures that companies focus their reporting efforts on the most relevant and impactful areas of their business.

Voluntary Taxonomy Reporting for large Companies below Threshold

For large companies that have more than 1,000 employees but an EU net turnover below EUR 450 million, the proposal prescribes voluntary taxonomy reporting. These companies will not be obligated to report their alignment with the EU Taxonomy but may choose to do so if they find it beneficial. This voluntary approach allows companies to communicate their sustainability efforts without the pressure of mandatory disclosures, potentially attracting investments by showcasing their progress towards sustainability goals.

Partial Taxonomy-Alignment Reporting

The proposal also introduces the option for companies that have made progress towards sustainability targets but only meet certain EU Taxonomy requirements to voluntarily report on their partial taxonomy-alignment. This flexibility is designed to encourage companies to disclose their sustainability efforts even if they do not fully meet all the criteria of the EU Taxonomy. The Omnibus proposal mandates the European Commission to develop delegated acts to ensure standardization in terms of the content and presentation of this partial alignment reporting, providing clear guidelines for companies to follow.

Simplification of the “Do No Significant Harm” Criteria

Lastly, the Commission seeks to simplify the most complex “Do No Significant Harm” (DNSH) criteria for pollution prevention and control related to the use and presence of chemicals. These criteria apply horizontally to all economic sectors under the EU Taxonomy. The proposed simplifications aim to make it easier for companies to comply with the DNSH requirements without compromising environmental standards. The public consultation invites stakeholders to provide feedback on two alternative options for simplifying these criteria, ensuring that the final amendments reflect the needs and concerns of the business community.

(c) Conflict with Already Transposed Member States Legislation

Certain EU Member States (Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia, Sweden) have already transposed the current version of the CSRD, thereby implementing the “old” thresholds, reporting requirements and timelines. We provide regular updates on the status of transposition of the CSRD in our monthly ESG Updates. This raises the question whether companies in these jurisdictions have to comply with the current version of CSRD legislation. Technically, these laws apply, and Member States are, in principle, not prevented from introducing stricter requirements than those provided for by an EU Directive.

However, we would expect that, as a first step, the reporting obligations for all entities other than public interest entities will be suspended before they come into effect under the Postponement Directive. As stated above, we expect that the Postponement Directive will be adopted rather quickly. Article 3 of that Directive requires Member States to implement laws necessary to comply with the two-year delay before December 31, 2025, i.e., before the reporting obligations for any undertakings and groups other than public interest entities apply. Even if national legislators fail to transpose the Postponement Directive in time, we would expect that national authorities will refrain from enforcing the requirements under the current CSRD laws against such entities with a view to the discussion on the Omnibus proposal.

Regarding the scope of sustainability reporting for already in-scope public interest entities, the assessment is less straight forward. The proposed changes to the scope of application, the reporting requirements and other substantial issues are covered in the Amendment Directive which is expected to take more time until it enters into force. There is no clear answer as to how EU Member States will handle this issue. While they could decide to refrain from enforcing reporting obligations until the Amendment Directive has been approved, it is also possible for them to insist on compliance with their national laws until that date.

In this context, it should also be noted that some EU Member States already have imposed more strict reporting requirements, opting for so-called “gold-plating” in the area of sustainability reporting. Therefore, it is possible that after the Amendment Directive enters into force, some EU Member States will require more detailed reporting than stipulated at EU level. However, we consider this risk to be low in light of the strong resistance from EU Member States, e.g. Germany, France and others who have warned of too much bureaucracy and an unreasonable reporting burden on companies and explicitly supported the European Commission’s plan to simplify sustainability reporting.

3. The CSDDD

While there are many proposed changes with respect to the CSDDD, as outlined below, the companies defined as “in scope” have remained the same, i.e. there have been no changes to the thresholds. We note, however, that it is proposed to delete the review clause on inclusion of financial services in the scope of the CSDDD.

CSDDD’s extraterritorial reach to U.S. based companies has recently been challenged in a letter signed by several members of the U.S. House of Representatives to the U.S. Treasury Secretary and Director of the National Economic Council and may become a negotiating topic in U.S.-EU trade negotiations.

(a) Proposed Amendments to the CSDDD

Postponement of Application for One Year

According to the proposed Postponement Directive the deadline for EU Member States to transpose the CSDDD into national law will be postponed by one year to July 26, 2027. Consequently, the first entry into application of the CSDDD obligations will also start one year later, on July 26, 2028. In other words, there will no longer be a separate timeline for entry into application for the largest EU and non-EU companies as originally foreseen:

|

Narrowing the Scope in Companies’ Supply Chains

Explicitly inspired by the German SCDDA, obligations in the supply chain will be narrowed, to companies’ own operations and direct business partners. Companies will only be required to assess adverse impacts of indirect business partners if there is “plausible information” suggesting that adverse impacts have arisen or may arise there. Without such knowledge, an in-scope company will not be obliged to proactively review the supply chain further downstream. The European Commission explains that this change “[r]eliev[es] companies from the obligation to systematically conduct in-depth assessments of adverse impacts that occur or may occur in often complex value chains at the level of indirect business partners …”.[8]

In connection with limited obligations in the supply chain, the Amendment Directive also proposes to limit the information that in-scope companies may request from their SME and small midcap business partners (i.e. companies with less than 500 employees) to the information specified in the CSRD voluntary sustainability reporting standards.

Further, the reduction of obligations within the supply chain is also reflected in the proposed amendments to stakeholder engagement. Companies will be able to limit their engagement to “relevant” stakeholders in certain areas of the due diligence process, i.e. with workers, their representatives and individuals and communities whose rights or interests are or could be directly affected by the products, services and operations of the company, its subsidiaries and its business partners, and that have a link to the specific stage of the due diligence process being carried out.

Companies shall ensure compliance with due diligence standards focusing on human rights and the environment further down supply chains through their codes of conduct (“contractual cascading”).

Private and Public Enforcement

In terms of private and public enforcement, the Amendment Directive provides for three notable proposed changes:

Firstly, in terms of private enforcement, it is significant that the requirement for harmonized EU-wide civil liability regime for damages will be abolished. Thus, private enforcement is deferred to the civil liability regime of each EU Member State, which need to ensure that, if companies are held liable in case of non-compliance with the due diligence requirements under the CSDDD, the injured parties will have a right to full compensation. Further, national law is left to define whether its civil liability provisions override otherwise applicable rules of the third country where any harm occurs.

Secondly, it is also highly notable that the obligations for EU Member States regarding representative actions by trade unions or NGOs are revoked. National law will be able to support both actions brought directly by injured parties or representative actions to reflect different rules and traditions in EU Member States.