On February 28, 2023, the UK’s Competition & Markets Authority (“CMA”) released draft Guidance on the application of the UK’s antitrust laws to environmental sustainability agreements between competitors.[1]

The Guidance recognizes that “environmental sustainability is a major public concern” and that antitrust law enforcement should not “unnecessarily or erroneously deter[]” businesses from collaborating to address the challenges posed by climate change.[2] To that end, the Guidance provides a framework for applying competition rules to “environmental sustainability agreements,” defined as “agreements or concerted practices between competitors and potential competitors which are aimed at preventing, reducing or mitigating the adverse impact that economic activities have on environmental sustainability or assessing the impact of their activities on environmental sustainability.”[3]

The Guidance outlines three standards for assessing environmental sustainability agreements under UK antitrust laws. First, the Guidance provides examples of agreements that are unlikely to raise antitrust concerns. These include agreements to:

- Further environmental sustainability goals that require complementary skills or resources from multiple firms to achieve;

- Create sustainability-related industry standards;

- Share information about “the environmental sustainability credentials of suppliers … or customers”; and

- Withdraw or phase out non-sustainable products or processes.[4]

Second, the Guidance describes agreements that could violate antitrust laws because they have the “object” of restricting competition.[5] An agreement has the “object” of restricting competition when, for example, it involves price fixing, market or consumer allocation, or limitations on output, quality, or innovation. Such agreements are subject to increased scrutiny because they “are assumed by their very nature to be harmful to the proper functioning of normal competition.”[6]

Where an environmental sustainability agreement does not restrict competition by object, it will raise antitrust concerns only “if it has an appreciable negative effect on competition.”[7] The Guidance provides a non-exhaustive list of factors to consider when determining if an agreement has such an effect on competition, including the market coverage of the agreement and market power of the participating companies; the extent to which the agreement limits the freedom of action of the parties; whether non-parties may participate in agreed-upon conduct; whether the agreement involves the sharing of competitively sensitive information; and whether the agreement is likely to lead to an appreciable increase in price or reduction in output, product variety, quality, or innovation.[8]

Third, the Guidance recognizes an exemption for agreements that would otherwise violate the antitrust laws when “the benefits of the agreement outweigh the competitive harm.”[9] To qualify under this exemption, participants will need to demonstrate that the agreement meets the following four conditions:

- The agreement must contribute certain benefits, namely improving production or distribution or promoting technical or economic progress;

- The agreement and any restrictions on competition within the agreement must be indispensable to the achievement of those benefits;

- Consumers must receive a fair share of the benefits; and

- The agreement must not eliminate competition in respect to a substantial part of the products concerned.[10]

The CMA’s draft Guidance follows in the wake of the Japan Fair Trade Commission’s announcement of similar draft guidance in January.[11] Last year, the European Commission (“EC”) for the European Union also announced that it would develop new guidelines for potential antitrust exemptions for environmental sustainability collaborations within agricultural production markets.[12] The EC’s new Horizontal Guidelines, set to replace its prior Guidelines later this year, devote a chapter to outlining the EC’s regulatory approach to environmental sustainability agreements.[13] As with the CMA’s draft Guidance, the EC’s Horizontal Guidelines are not limited to a particular industry and detail the standards for evaluating environmental sustainability collaborations, including whether they restrict competition by object or have appreciable negative effects on competition.[14] These developments reflect a growing recognition that “collaboration is needed to battle climate change,” particularly because “[f]irst movers may find themselves at a competitive disadvantage.”[15]

The guidance has inspired debate about how to approach similar environmental collaborations under U.S. antitrust laws. For example, last year, nineteen state Attorneys General issued a letter to the CEO of Blackrock, Inc. raising antitrust concerns about the firm’s commitment to ESG initiatives in its investment decisions.[16] In response, the Attorneys General of sixteen other states and the District of Columbia issued their own letter to Congress touting the benefits of ESG and criticizing the efforts of their peers to frame ESG collaborations as antitrust violations.[17] Although the Federal Trade Commission (“FTC”) and DOJ Antitrust Division have not issued guidance on the subject, the Chair of the FTC recently indicated “there is no such thing” as an ESG “exemption” from U.S. antitrust laws.[18]

Given the uncertain landscape in the United States and the promulgation of new guidance on environmental collaboration abroad, multinational companies should seek legal advice on how to minimize potential antitrust risks before entering into similar environmental sustainability agreements.

________________________

[1] U.K. CMA, Draft Guidance on the Application of the Chapter I Prohibition in the Competition Act 1998 to Environmental Sustainability Agreements (Feb. 28, 2023), available here.

[2] Id. ¶¶ 1.1-1.2, 1.5.

[3] Id. ¶¶ 1.5, 2.1.

[4] Id. ¶ 3.4, 3.9, 3.11, 3.15.

[5] Id. ¶ 4.3.

[6] Id. ¶ 4.4-4.6.

[7] Id. ¶ 4.12.

[8] Id. ¶ 4.14.

[9] Id. ¶ 5.1.

[10] Id. ¶ 5.2.

[11] See Charles McConnell, JFTC Consults on Draft Sustainability Guidelines, Global Competition Rev. (Jan. 17, 2023), available at https://globalcompetitionreview.com/article/jftc-consults-draft-sustainability-guidelines.

[12] See European Commission, Sustainability Agreements in Agriculture – Guidelines on Antitrust Derogation, available at https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13305-Sustainability-agreements-in-agriculture-guidelines-on-antitrust-derogation_en. The EU’s new guidelines are expected to be released in late 2023. See id.

[13] See European Commission, Chapter 9: Sustainability Agreements, Draft Revised Horizontal Guidelines, available here.

[14] See id. ¶¶ 548, 551-54, 555-60.

[15] Matteo Gasparini, Knut Haanes, and Peter Tufano, When Climate Collaboration Is Treated as an Antitrust Violation, Harvard Bus. Rev. (Oct. 17, 2022), available at https://hbr.org/2022/10/when-climate-collaboration-is-treated-as-an-antitrust-violation.

[16] See Ltr. from Nineteen Attorneys General to Laurence D. Fink, CEO, BlackRock, Inc. (Aug. 4, 2022), available here.

[17] See Ltr. from Seventeen Attorneys General to Sen. Sherrod Brown, et al. (Nov. 21, 2022), available here.

[18] Senate Judiciary Committee, Subcommittee on Competition Policy, Antitrust, and Consumer Rights, Hearing, “Oversight of Federal Enforcement of the Antitrust Laws” (September 20, 2022), available at https://www.judiciary.senate.gov/meetings/oversight-of-federal-enforcement-of-the-antitrust-laws.

The following Gibson Dunn lawyers prepared this client alert: Scott Hammond, Mike Murphy, Ali Nikpay, Christian Riis-Madsen, Perlette Jura, Jeremy Robison, Rachel Levick, Stéphane Frank, Sarah Akhtar, and Nicholas Fuenzalida.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Antitrust and Competition, Environmental, Social & Governance, or Environmental Litigation and Mass Tort practice groups:

Antitrust and Competition Group:

Scott D. Hammond – Washington, D.C. (+1 202-887-3684, [email protected])

Jeremy Robison – Washington, D.C. (+1 202-955-8518, [email protected])

Rachel S. Brass – Co-Chair, San Francisco (+1 415-393-8293, [email protected])

Stephen Weissman – Co-Chair, Washington, D.C. (+1 202-955-8678, [email protected])

Ali Nikpay – Co-Chair, London (+44 (0) 20 7071 4273, [email protected])

Christian Riis-Madsen – Co-Chair, Brussels (+32 2 554 72 05, [email protected])

Environmental, Social and Governance (ESG) Group:

Susy Bullock – London (+44 (0) 20 7071 4283, [email protected])

Elizabeth Ising – Washington, D.C. (+1 202-955-8287, [email protected])

Perlette M. Jura – Los Angeles (+1 213-229-7121, [email protected])

Ronald Kirk – Dallas (+1 214-698-3295, [email protected])

Michael K. Murphy – Washington, D.C. (+1 202-955-8238, [email protected])

Selina S. Sagayam – London (+44 (0) 20 7071 4263, [email protected])

Environmental Litigation and Mass Tort Group:

Stacie B. Fletcher – Washington, D.C. (+1 202-887-3627, [email protected])

Daniel W. Nelson – Washington, D.C. (+1 202-887-3687, [email protected])

Rachel Levick – Washington, D.C. (+1 202-887-3574, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

This past year marked an important turning point for the Court, with Judges Anthony Cannataro, Madeline Singas, and Shirley Troutman joining as new members on the seven-member bench. Then, in Summer 2022, Chief Judge Janet DiFiore abruptly resigned, leaving a surprising, additional vacancy. The Court designated Judge Cannataro to be acting Chief Judge until the vacancy could be filled.

To fill the seat, Democratic Governor Kathy Hochul nominated Justice Hector LaSalle, the Presiding Justice of the Appellate Division, Second Department (the busiest state appellate court in the nation). His nomination was quickly opposed by some in light of his prosecutorial background and a perception that his judicial rulings were overly conservative. The State Senate rejected his nomination in a largely party-line vote, with Democrats opposing his nomination—the first time New York legislators have rejected a governor’s nomination for chief judge. The vacancy remains to be filled.

The Court’s jurisprudence nonetheless continued along previous trends during this period. Judges Cannataro and Singas (like their predecessors) often voted with Judges DiFiore and Garcia to form a majority, while Judges Wilson and Rivera continued to author numerous, lengthy dissents. Judge Troutman (like her predecessor, Judge Fahey) appears poised to emerge as a potential swing vote. Although the Court in previous years was not perceived as particularly ideological, its rulings have been increasingly fractured along often-predictable voting lines. It remains to be seen if this trend will continue after a new chief judge is confirmed.

The Court also continued its trend of reviewing a reduced number of cases. The Court nevertheless issued significant opinions on a wide array of issues, from fantasy sports to electoral redistricting, insurance, mortgage-backed securities, and tort law.

The New York Court of Appeals Round-Up & Preview summarizes key opinions, primarily in civil cases, issued by the Court over the past year and highlights a number of cases of potentially broad significance that the Court will hear during the coming year. The cases are organized by subject.

To view the Round-Up, click here.

Gibson Dunn’s New York office is home to a team of top appellate specialists and litigators who regularly represent clients in appellate matters involving an array of constitutional, statutory, regulatory, and common-law issues, including securities, antitrust, commercial, intellectual property, insurance, First Amendment, class action, and complex contract disputes. In addition to our expertise in New York’s appellate courts, we regularly brief and argue some of the firm’s most important appeals, file amicus briefs, participate in motion practice, develop policy arguments, and preserve critical arguments for appeal. That is nowhere more critical than in New York—the epicenter of domestic and global commerce—where appellate procedure is complex, the state political system is arcane, and interlocutory appeals are permitted from the vast majority of trial-court rulings.

Our lawyers are available to assist in addressing any questions you may have regarding developments at the New York Court of Appeals, or any other state or federal appellate courts in New York. Please feel free to contact any member of the firm’s Appellate and Constitutional Law practice group, or the following lawyers in New York:

Mylan L. Denerstein (+1 212-351-3850, [email protected])

Akiva Shapiro (+1 212-351-3830, [email protected])

Seth M. Rokosky (+1 212-351-6389, [email protected])

Please also feel free to contact the following practice group leaders:

Thomas H. Dupree Jr. – Washington, D.C. (+1 202-955-8547, [email protected])

Allyson N. Ho – Dallas (+1 214-698-3233, [email protected])

Julian W. Poon – Los Angeles (+ 213-229-7758, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

Given the rapidly evolving events, we have established a Distressed Banks Resource Center to provide resources and regular updates to our clients. The latest developments are available below and at the Resource Center.

A New Paradigm. Silicon Valley Bridge Bank, N.A. – the successor-in-interest to Silicon Valley Bank – posted a website notice on Tuesday stating that it has “fully stepped into the shoes of the former Silicon Valley Bank”. The notice further advised that all loans will now be administered by the new Silicon Valley Bridge Bank, N.A. and existing credit commitments will be honored. The website also contained a link to a 75 page “Transfer Agreement” between the FDIC, as receiver for Silicon Valley Bank (the state chartered now-defunct bank) and Silicon Valley Bridge Bank, N.A. (the federally-chartered new bank) that appears to transfer various assets and liabilities to the bridge bank to enable it to operate in the ordinary course in a manner similar to the predecessor bank for domestic operations. Additionally, Silicon Valley Bridge Bank CEO Tim Mayopoulos issued a statement asking depositors to return to SVB, affirming that depositors have full access to their money and that all new and existing deposits are fully protected by the FDIC (even beyond the typical $250,000 limit).[1] The website clarified that Silicon Valley Bridge Bank is not under FDIC receivership.

All of this implements a new paradigm that replaces the receivership model from the past weekend with a “fully functioning” bank that seeks to continue operations in the ordinary course. The Deposit Insurance Bank of Santa Clara that was established Friday, and the other trappings of FDIC receivership, are gone.

While Signature Bridge Bank, N.A.’s website does not contain similar documentation, its operations on Monday and Tuesday appeared to be in the ordinary course, with Signature Bridge Bank appearing to fund its loan obligations and process loan facility amendments and renewals, and its employees providing standard services.

What About Loan Covenants Regarding Deposits? A top question resulting from the new bridge bank paradigm is whether the bridge banks will enforce covenants under which borrowers promised to hold many or all of their deposits in the lender’s bank. The FDIC issued a Financial Institution Letter FIL -10-2023 emphasizing that it has the ability to enforce all contracts held in receivership[2] and, in a separate letter, stated that the bridge bank intends to enforce such contracts[3]. Notwithstanding such guidance, given the novel issues of public policy, it remains to be seen whether, in fact, SVB borrowers who moved deposits to other institutions will now be expected by the FDIC and Silicon Valley Bridge Bank to move those deposits back to Silicon Valley Bridge Bank, particularly given that it appears that regulators are pursuing the potential sale of SVB loans to third parties, as discussed below.

Will Letters of Credit issued by SVB be honored? The Financial Institution Letter issued by the FDIC states that “The bridge bank is performing under all failed bank contracts and expects all counterparties to similarly fulfill their contractual obligations.” These bank contracts would presumably include the letters of credit issued by SVB and Signature Bank.

What Happens to Derivatives? All Qualified Financial Contracts of each of SVB and Signature Bank have been transferred to the applicable bridge bank established by the FDIC. The definition of “Qualified Financial Contract” includes, but is not limited to derivatives (e.g., swaps, options, forwards, etc.), repurchase, reverse repurchase, and securities lending transactions. As a result, the applicable bridge bank is now the counterparty to derivatives entered into with SVB and Signature Bank. Payments and collateral calls under derivatives contracts should function as normal between the counterparty and the applicable bridge bank entities of SVB and Signature Bank, as noted in the Financial Institution Letter mentioned above.

Given that derivatives contracts are often heavily negotiated, the terms of any derivatives trading documentation and the special provisions in 12 U.S.C. § 1821 should be reviewed to understand your specific rights with respect to your derivatives.

Cayman Islands Depositors. While the UK branch of SVB has been purchased by HSBC, there is no word on the fate of SVB’s Cayman branch, which is outside of the U.S. receivership and treated separately under Cayman law. Those with deposits in SVB’s Cayman branch may be continuing to experience challenges with the transfer of funds out of accounts. There is no indication from the Cayman regulators that they have taken possession of the Cayman branch, though they have the authority to do so. There also is an MOU between the Cayman regulators and the FDIC related to their ongoing cooperation and information sharing for the supervision and resolution of banks with branches in Cayman. Today’s FDIC guidance states that, “All vendors providing services, except for the Cayman Islands Branch, should continue to provide such services.” We note that unless Silicon Valley Bridge Bank is connected to SWIFT, it cannot accept foreign wire transfers.

SVB All or Nothing Sale Off the Table? On the heels of yesterday’s Wall Street Journal report that a second auction round for SVB would be held, several national media outlets reported Tuesday that five top U.S. private equity firms are reviewing SVB books in order to potentially bid for purchasing SVB loans. In addition, SVB Financial Group, the parent company, hired Alvarez & Marsal as restructuring advisor and appointed William Kostouros of Alvarez & Marsal as Chief Restructuring Officer. Mr. Kostrouos previously served in an identical capacity for Washington Mutual. SVB Financial also disclosed that it is exploring strategic alternatives for itself, as well as SVB Securities (the investment bank) and SVB Capital (the investment management arm), with potentially a management buy-out being explored for SVB Securities. Accordingly, it is unclear whether a second auction for SVB will in fact be held, or whether the auction will be for separate businesses and loan portfolios of SVB Financial. Media reports also indicate that a group of creditors is organizing to represent their interests with respect to holdings in SVB Financial’s bonds, which in total have $3.4 billion in face value of which reportedly over $1.5 billion has traded hands since Friday.

Signature Bank Bid Process. Bloomberg reports that the FDIC has opened a virtual data room for third parties to conduct due diligence in anticipation of potential bidding to purchase, presumably in part or all of, Signature Bank.

Capitol Hill Updates. Senate Banking Committee Chairman Sherrod Brown said his committee plans to hold a hearing, though they are still deciding on witnesses. Similarly, House Financial Services Committee Chairman Patrick McHenry said today that his committee would be talking with SVB and regulators to understand what led to the bank’s failure. Separately, Senator Warren and Rep. Katie Porter have introduced companion bills to re-impose heightened regulations on small- and medium-sized banks.[4]

Government Investigations Reportedly Begin. Multiple media sources report that the SEC and Justice Department have opened investigations into events surrounding SVB’s failure, while at least one state regulator (Massachusetts) has announced a formal investigation into stock trading by SVB executives prior to the bank’s failure. The Federal Reserve is also investigating both its internal oversight procedures as well as risk management at SVB, according to media sources. Fed Chairman Jerome Powell stated in a Monday press release, “The events surrounding Silicon Valley Bank demand a thorough, transparent, and swift review by the Federal Reserve.”

Public Company Disclosure Issues. Publicly traded companies should be aware that responding to questions from investors about the extent of their exposure to a bank in receivership, or now in a ‘bridge bank,’ could implicate the federal securities laws’ selective disclosure rules, such as Regulation FD, and the administration of their insider trading policies. Any of such companies that have banking relationships with banks that have failed should consider whether a Current Report on Form 8-K is appropriate to address potential exposure risk, and whether an update to the company’s risk factors or other disclosures is appropriate with the company’s next periodic filing.

This document is for informational purposes only and does not, and is not intended to, constitute legal advice or create an attorney-client relationship. You should contact a Gibson Dunn attorney directly to see if they are able to provide legal advice with respect to a particular legal matter.

_________________________

[1] https://www.svb.com/news/company-news/update-from-silicon-valley-bridge-bank-ceo

[2] https://www.fdic.gov/news/financial-institution-letters/2023/fil23010.html

[3] https://www.svb.com/globalassets/bridge-bank/fdic-confirmation-that-bridge-bank-open-and-operating-new.pdf

[4] https://www.scribd.com/document/631425862/Warren-Porter-bank-bill#

Gibson Dunn’s multidisciplinary task force members are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, or the following members of the firm’s *** Distressed Bank Working Group:

Ed Batts – Mergers & Acquisitions, Palo Alto (+1 650-849-5392, [email protected])

Michael D. Bopp – Public Policy, Washington, D.C. (+1 202-955-8256, [email protected])

Reed Brodsky – Litigation and Securities Enforcement, New York (+1 212-351-5334, [email protected])

Andrew L. Fabens – Capital Markets, New York (+1 212-351-4034, [email protected])

Roscoe Jones, Jr. – Public Policy, Washington, D.C. (+1 202-887-3530, [email protected])

Jin Hee Kim – Global Finance, New York (+1 212-351-5371, [email protected])

Jeffrey C. Krause – Business Restructuring, Los Angeles (+1 213-229-7995, [email protected])

David C. Lee – Global Finance, Orange County (+1 949-451-3842, [email protected])

Monica K. Loseman – Securities Litigation, Denver (+1 303-298-5784, [email protected])

Mary Beth Maloney – Securities and Restructuring Litigation, New York (+1 212-351-2315, [email protected])

Amanda H. Neely – Public Policy, Washington, D.C. (+1 202-777-9566, [email protected])

Tina Samanta – Securities Enforcement, New York (+1 212-351-2469, [email protected])

Victoria Shusterman – Real Estate, New York (+1 212-351-5386, [email protected])

Jeffrey L. Steiner – Global Financial Regulatory, Washington, D.C. (+1 202-887-3632, [email protected])

Charles V. Walker – Mergers & Acquisitions, Houston (+1 346-718-6671, [email protected])

Lori Zyskowski – Securities Regulation/Corporate Governance, New York (+1 212-351-2309, [email protected])

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

The rapid collapse of Silicon Valley Bank, Signature Bank and distress at others, continues to create uncertainty in the global economic economy. Customers and counterparties worldwide—including funds, portfolio companies, and individuals—are facing unique legal and operational challenges as a result. Companies are working to overcome disruptions in their daily business operations and to mitigate short- and long-term risks amidst the bank failures.

These bank failures present a highly fluid and complex situation. In addition, each customer account loan or other relationship is subject to specific contractual arrangements between the customer and the bank that should be individually reviewed. Gibson Dunn is equipped to provide strategic counsel and advise clients on how to best approach many of the key issues. We can assist in addressing specific questions, including by executing a comprehensive approach to guide clients.

Gibson Dunn has created a multidisciplinary task force to assist our clients. To provide real time and accurate information, we are closely monitoring the guidance issued by government finance and banking officials as well aggregating information collected from our cross sector of relationships. Please feel free to reach out to any of the individuals with whom you have an existing relationship at Gibson Dunn with questions or concerns. To receive our ongoing regular communications to our clients and friends addressing issues raised by the banking crises, as they arise, please contact us at [email protected].

Given the rapidly evolving circumstances, we have established a Distressed Banks Resource Center to provide resources and regular updates to our clients. The latest “Atmosphere Situation Report” and “Depositor/Debtor Specific Issues Report” are available at the Resource Center and included below for your convenience.

(A) Atmosphere Situation Report

Government Response (US): The Department of the Treasury, FDIC and Federal Reserve announced multiple actions on Sunday, March 12, 2023 including:

- Depositors of Silicon Valley Bank (“SVB”) will be made whole and have access to their funds as of Monday, March 13, 2023, through establishment of a newly created “bridge bank,” Silicon Valley Bank N.A. A bridge bank is a chartered national bank that operates under a board appointed by the FDIC. Former Fannie Mae head Tim Mayopoulos has been named the CEO of the bridge bank.

- Depositors of Signature Bank will also be made whole, with access to funds on March 13, 2023. The FDIC established a bridge bank, Signature Bridge Bank, N.A. for this purpose. The former CEO of Fifth Third, Greg Carmichael, has been named the CEO of the bridge bank.

- The FDIC issued a second update to its FAQ on Monday for SVB (fdic.gov/resources/resolutions/bank-failures/failed-bank-list/silicon-valley-faq.pdf) and for Signature Bank (www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/signature-ny-faq.html) with more specific details on how these bridge banks would operate. Among other things in the FAQs, the FDIC advises any borrower from either bank to continue making payments and direct any questions to the bridge bank or FDIC loan representatives. Language in a prior update to the FAQs was deleted relating to loan set-offs, presumably since all SVB and Signature Bank deposits have been guaranteed in full by the US Government.

- A Bank Term Funding Program (“BTFP”) created by the Federal Reserve will provide loans of up to one year to banks, credit unions and other eligible depository institutions that pledge qualifying assets. Collateral will be valued at par. The Treasury will make up to $25 billion from the Exchange Stabilization Fund available to backstop the BFTP.

- Michael Barr, one of the architects of the Dodd-Frank Act, will lead a review of the supervision and regulation of SVB.

Market Updates:

- The SVB and Signature bridge banks were open and functioning on Monday, with staff at each bank returning communications. That said, it has been reported that SVB funding transfer completions were episodic, presumably due to the high volume of customer requests. Multiple users have reported long hold times and electronic bank interface delays amid heavy traffic.

- No buyer has been announced as of Monday afternoon for the U.S. portion of SVB or for Signature Bank. The Wall Street Journal reported Monday that with the absence of a buyer for SVB after an initial FDIC auction round closed on Sunday, the FDIC intends to re-launch a second auction under which the FDIC will have additional authority for flexibility in negotiating sale terms because SVB’s failure now has been deemed a systemic threat to the financial system. The same report stated that none of the ‘largest U.S. banks’ submitted a bid in the initial auction. CNBC reported earlier on Monday that PNC had submitted an indication of interest to acquire SVB but was not proceeding. It is unknown whether other potential bidders existed in the first auction round. Separately, HSBC purchased Silicon Valley Bank UK Limited (“SVB UK”), the UK affiliate of SVB, for £1. All SVB UK deposits are backed by HSBC.

- While it will take time to evaluate the many events of last week, certain details are emerging. Reuters reports that SVB’s Wednesday announcement of the sale of its available for sale (AFS) securities came after Moody’s the prior week informed SVB of an impending credit downgrade. In turn, SVB then liquidated approximately $21 billion of AFS securities, resulting in a $1.8 billion loss. To offset that, SVB concurrently announced a $500 million investment from General Atlantic conditioned upon SVB first raising a planned $1.75 billion, which never came to fruition.

Capitol Hill Updates: House Financial Services Committee Chairman Patrick McHenry released a statement dubbing the failure as “the first Twitter fueled bank run.” He called for calm. Ranking Member Maxine Waters has told the press that the Committee is working on a bipartisan basis to hold a hearing as soon as possible.

- Eighteen Democratic House members signed a letter to Treasury Secretary Yellen, FDIC Chair Martin Gruenberg, Federal Reserve Chair Jerome Powell, and Acting Comptroller Michael Hsu urging swift action to protect depositors, calling on Congress to increase the FDIC deposit insurance limit of $250,000, and clarifying that they did not believe regulators should bail out the bank’s shareholders.

- Some House Democrats and Senators including Sens. Bernie Sanders and Elizabeth Warren already have started calling for substantial legislative reforms, including reinstatement of some of the Dodd-Frank Act rules rolled back in 2018.

- The Biden administration has been providing briefings to Capitol Hill over the last several days. They provided a bipartisan, bicameral briefing Sunday evening and met with Senate Banking Committee Republicans (who said they had not received the invitation to the previous briefing) on Monday.

- Senate Majority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries have said they plan to examine the Bank’s failure. They did not say which congressional committees they would tap to lead that investigation.

SEC Response Update: Yesterday (March 12, 2023) SEC Chair Gary Gensler released the following statement, “In times of increased volatility and uncertainty, we at the SEC are particularly focused on monitoring for market stability and identifying and prosecuting any form of misconduct that might threaten investors, capital formation, or the markets more broadly. Without speaking to any individual entity or person, we will investigate and bring enforcement actions if we find violations of the federal securities laws.” Gurbir Grewal, the SEC Director of Enforcement spoke today (Monday, March 13, 2023) at the annual Securities Industry and Financial Markets Association Conference but did not specifically address the bank failures; though he did note the SEC’s focus on enhancing the public trust by focusing on the failures of those parties in gatekeeping functions.

(B) Depositor/Debtor Specific Issues Report

What Happens to Money in Deposit Accounts: Deposit accounts are cash accounts and may be labeled as an “operating account” or a “money market deposit account” (sometimes labeled as an “MMDA account”). Note that the money market deposit account is distinct from the Money Market Mutual Fund Accounts described below. The funds in deposit accounts will be fully paid, even for balances in excess of the standard $250,000 FDIC limit.

What Happens to Money in Cash Sweep Money Market Mutual Fund Accounts: Cash sweep accounts can be structured in a variety of ways. In the case of SVB, it appears that many of their customers are subject to one of their various cash sweep programs. For this category of accounts (the “SVB Cash Sweep Accounts”), the “cash sweep” program involves regular (usually daily or next day) cash sweeps from customer deposit accounts into an SVB ‘Omnibus Account’ which is then used to purchase money market mutual fund securities on behalf of the customers. Companies seeking return of these assets, whether in cash or in kind, may need to submit a proof of claim to the FDIC if it appears that the cash value of such assets are not readily available via the online portal. In addition, Companies desiring to liquidate securities in connection with such return should consider any potential negative tax implications.

What Happens to Money in ‘Asset Management’ Accounts: These are securities brokerage accounts advised by Silicon Asset Management (an affiliate of SVB) where the securities are physically held by US Bank as custodian and segregated by client name on the custodian’s books. These accounts should not be part of the receivership or the bank estate. The custodian of these investment accounts may be contacted directly for more information on how to transfer those accounts from the SAM managed program to another advisor.

What Happens to Money in Intrafi/Promontory Interfinancial Network Accounts: Some SVB customers have an arrangement with Intrafi (formerly known as Promontory Interfinancial Network), where cash held in an SVB deposit account above the $250,000 FDIC insured limit is swept into a syndicate of other banks, each holding less than $250,000 of the customer’s deposits. Cash deposits that were swept into syndicated banks through Intrafi should not be part of the receivership or the bank estate.

Can I Draw on Existing Credit and Loan Facilities?: On Friday, the FDIC suggested it would not be honoring drawdowns on loans and credit facilities loans with Silicon Valley Bank, N.A. (i.e., the bridge bank). However, as of Monday we understand that at least some borrowers have been able to draw on lines of credit at SVB and Signature.

What is the Status of Wires Out of SVB that I Sent Before the Receivership Was in Place?: If you have a pending wire request out of SVB that has not yet been honored, the expectation is that those funds will be honored without further action by the directing party. At this time it does not appear necessary to terminate wires submitted last week but not processed before the receivership and reinitiate new requests.

What Will Happen to Deposits and External Wires Into SVB: External wires that arrive in your SVB account after Friday should be available through the bridge bank. Public statements from financial regulators suggest that 100% protection will apply so long as the bridge bank is accepting deposits.

What Are My Payment Obligations, If Any, on My SVB Loans?: The FDIC has instructed in their FAQs that Debtors to SVB continue to pay on their loans and remain subject to the loan terms. The FDIC appears to be operating the bridge bank in quasi-ordinary course without regard to the more limited receivership arrangements previously announced by the FDIC.

What Do I Do About Loan Defaults or Waiver? For loans with covenants requiring deposit accounts to be maintained at SVB, it is not expected that FDIC will enforce such covenants, but when those loans are sold, it is unknown what the loan acquirer may request of each borrower. For example, a buyer could request that borrower establish its accounts with the buyer or establish deposit account control agreements in connection with secured loans. In addition, as borrowers under loans with SVB consider withdrawing funds, care should be taken to review existing loan arrangements with SVB, as many of them require minimum levels of cash and cash equivalents to be maintained with SVB.

This document is for informational purposes only and does not, and is not intended to, constitute legal advice or create an attorney-client relationship. You should contact a Gibson Dunn attorney directly to see if they are able to provide legal advice with respect to a particular legal matter.

Gibson Dunn’s multidisciplinary task force members are available to assist in addressing any questions you may have regarding these developments. If you wish to discuss any of the matters set out above, please contact the Gibson Dunn lawyer with whom you usually work, or any member of Gibson Dunn’s Accounting Firm Advisory, Business Restructuring/Distressed Investing, Capital Markets, Derivatives, Financial Institutions, Global Financial Regulatory, Global Finance, Investment Funds, Private Equity, Public Policy, Real Estate, Securities Enforcement, Securities Litigation and Tax teams.

© 2023 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice. Please note, prior results do not guarantee a similar outcome.

Although the number of securities lawsuits filed this year remained steady compared to 2021, we have seen many notable developments in securities law. This year-end update provides an overview of the major developments in federal and state securities litigation since our last update in September 2022:

- The Supreme Court is set to hear a blockbuster case that will shape whether and how shareholders can establish standing to bring claims under Sections 11 and 12 of the Securities Act when a company sells its shares in a direct listing. The Supreme Court has also heard, or will hear, administrative law cases that will impact securities litigation. Several cases pending at the circuit court level may have wide-ranging effects on securities litigation as well.

- We review a number of significant developments in Delaware corporate law, including the Court of Chancery’s clarification of directors’ oversight duties, and the Delaware General Assembly’s expansion of Section 102(b)(7) of the Delaware General Corporation Law to include exculpation of officers for personal liability arising from breaches of the duty of care. We also provide an update on the status of mandatory federal forum provisions in the Ninth and Seventh Circuits and in the State of California.

- We examine developments in federal securities litigation involving special purpose acquisition companies. Although the market for SPAC IPOs has cooled relative to 2021, litigation arising out of SPAC transactions remains active, and courts have started to rule on motions to dismiss in SPAC-related shareholder lawsuits, with several recent decisions finding plaintiffs’ allegations to be sufficient to move forward.

- We examine environmental, social, and corporate governance (“ESG”) developments. Although too early to identify definitive trends in this area, we survey the types of ESG allegations that are being filed and report on notable decisions.

- We continue to monitor the emergence of a potential circuit split regarding whether the Supreme Court’s 2019 decision in Lorenzo allows scheme liability under Rule 10b-5(a) and (c) without alleging dissemination and based solely on the same conduct as Rule 10b-5(b) misrepresentation claims. As discussed in our 2022 Mid-Year Securities Litigation Update, a number of courts have grappled with the effects of Lorenzo. In particular, the Second Circuit in SEC v. Rio Tinto provided much needed clarity for district courts within the Second Circuit. Since then, district courts in the Southern District of New York have evaluated scheme liability under Rio Tinto, but there have been no further opinions discussing the scope of Lorenzo in the other circuits.

- We again survey securities-related litigation arising out of the coronavirus pandemic, including securities class actions alleging that defendants made false claims about the efficacy of their COVID-19 vaccines, treatments, and tests. Although many cases involving false claims about pandemic and post-pandemic prospects are either moving into the motion to dismiss stage or have recently been dismissed, a handful of new cases have also been filed.

- We review developments regarding Omnicare’s falsity of opinions standard, as rulings by various circuit and district courts shed light on the boundaries of liability for false or misleading statements of opinion as well as omissions.

- Finally, we address several other notable developments in the federal courts, including:

- the Ninth Circuit upholding the dismissal of a securities class action after reaffirming its standard for non-actionable “puffery”;

- the First Circuit’s further guidance as to when statements regarding a product may be materially misleading under the PSLRA; and

- the Ninth Circuit becoming the second circuit court in less than a year to hold that social media posts can count as “soliciting” the purchase of a security under the Securities Act.

I. Filing And Settlement Trends

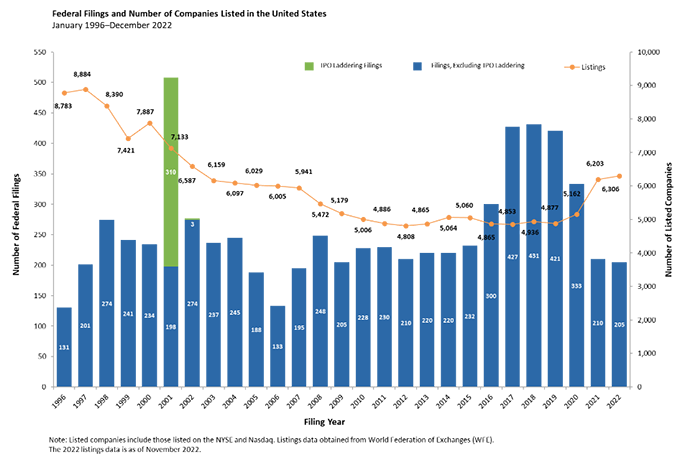

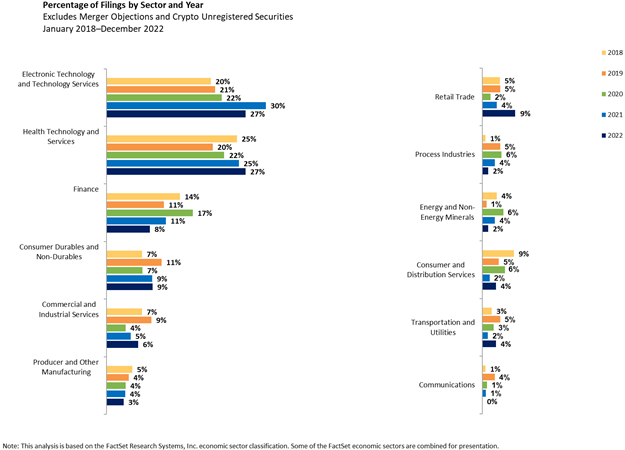

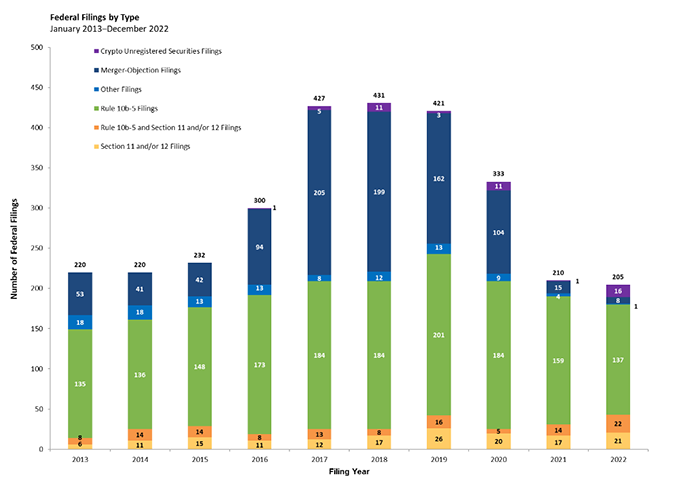

Data from a recently released NERA Economic Consulting (“NERA”) study shows federal securities litigation filing trends that began in earnest in 2020 continued through 2022. For the third consecutive year, federal class-action filings decreased after a steady upward trend in 2017-2019. As in 2021 and 2020, the decline in the number of merger-objection cases filed (down to eight from the peak of 205 in 2017) drove the decrease in the total number of new federal class actions filed in 2022 (down to 205 from the peak of 431 in 2018). For the second year in a row, the “Electronic Technology and Technology Services” and “Health Technology and Services” sectors represented over half of all filings (54%). In notable contrast to prior years, however, the number of crypto unregistered securities cases increased considerably, from just one in 2021 to 16 in 2022.

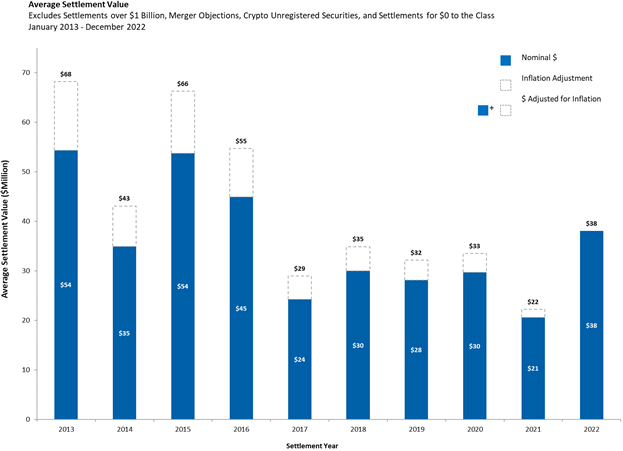

After declining to $8 million in 2021, the median settlement value of federal securities class actions in 2022—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—increased to $13 million, which is consistent with the trend seen from 2018-2020 ($13, $12, and $13 million, respectively). Concomitantly, average settlement values—also excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—also increased in 2022 (to $38 million, up from $21 million in 2021).

A. Filing Trends

Figure 1 below reflects the federal filing rates in 2022 (all charts courtesy of NERA). 205 federal cases were filed last year, which is less than half the number of federal filings in the each of the peak years (2017-2019). Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

B. Mix Of Cases Filed In 2022

1. Filings By Industry Sector

As shown in Figure 2 below, the distribution of non-merger objection and non-crypto unregistered securities filings in 2022 was largely consistent with 2021. For the second year in a row, the “Electronic Technology and Technology Services” and “Health Technology and Services” sectors accounted for more than 50% of all filings. And after declining in 2021, “Finance” filings declined again (down to 8%), reaching a low watermark in recent years. Conversely, “Retail Trade” filings increased from 4% to 9%, the high watermark in recent years.

Figure 2:

2. Merger Cases

As shown in Figure 3 below, eight merger-objection cases were filed in federal court in 2022. This represents a 47% year-over-year decrease from 2021, and a 92% year-over-year decrease from 2020. This figure is significantly lower than in 2016, when the Delaware Court of Chancery effectively put an end to the practice of disclosure-only settlements in In re Trulia Inc. Stockholder Litigation, 29 A.3d 884 (Del. Ch. 2016), which helped drive the increase in merger-objection filings between 2015 and 2017.

Figure 3:

C. Settlement Trends

As reflected in Figure 4 below, the average settlement value—excluding merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class—nearly doubled from 2021 to 2022, reaching $38 million. $38 million is also the highest average settlement value since 2016.

Figure 4:

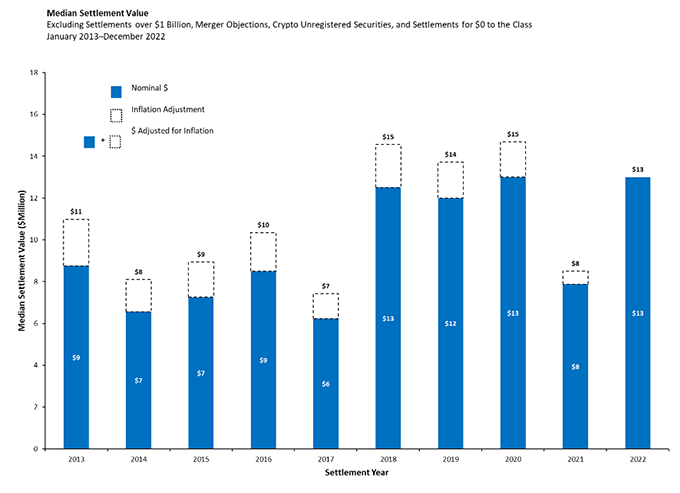

Turning to median settlement value, Figure 5 shows an increase from $8 million in 2021 to $13 million in 2022. This marks a return to the consistency of 2018 to 2020, when median settlement value remained $12-13 million. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 5:

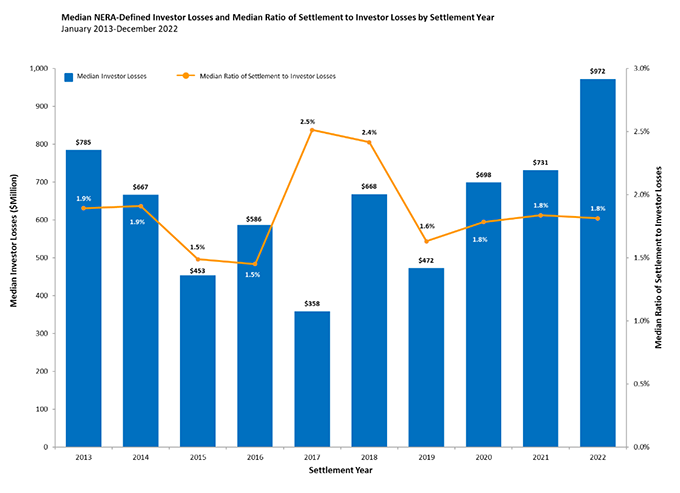

Finally, as shown in Figure 6, Median NERA-Defined Investor Losses increased in 2022, rising to $972 million from $731 million in 2021. Although Median NERA-Defined Investor Losses reached their highest level in a decade, the Median Ratio of Settlement to Investor Losses held steady for the third straight year at 1.8%.

Figure 6:

II. What To Watch For In The Supreme Court

The Supreme Court is set to hear a blockbuster case that is expected to shape whether and how shareholders can establish standing to bring claims under Sections 11 and 12 of the Securities Act when a company sells its shares in a direct listing. The Supreme Court has also heard, or will hear, administrative law cases that will impact different aspects of securities litigation. Several cases pending at the circuit court level may have wide-ranging effects on securities litigation as well.

A. The Supreme Court Takes On Slack v. Pirani

The case arises out of the New York Stock Exchange’s (“NYSE”) rule, introduced in 2018, that allows companies to go public through a direct listing. Id. at 944. In a traditional initial public offering (“IPO”), all of the shares initially sold to the public during the contractual lock-up are newly issued shares that are registered under a single registration statement. Id. at 943. In a direct listing, however, the company does not typically issue new shares. Id. at 944. Instead, only those shares that do not qualify for an exemption are registered for resale under the registration statement; existing shareholders may publicly sell unregistered shares pursuant to an exemption from registration. Id. So, while an investor who purchases shares during the contractual lock-up period following an IPO generally knows that the purchased shares were registered under the registration statement, an investor who purchases shares following a direct listing may not know if the purchased shares were registered or unregistered. Id.

In June 2019, Slack was one of the first companies to go public through a direct listing. Id. Over half of the shares that were available for resale to the public were unregistered shares held by existing shareholders. Id. Plaintiff bought shares on the day of the direct listing as well as on later dates. Id. He subsequently brought claims under Sections 11 and 12 of the Securities Act, alleging that the registration statement and prospectus Slack issued in connection with the direct listing omitted material information that rendered Slack’s required disclosures misleading. Id. at 944–45.

Sections 11 and 12 of the Securities Act provide a private right of action for alleged misstatements in a registration statement or prospectus by plaintiffs who purchased “such security.” 15 U.S.C. §77k(a) (Section 11); 15 U.S.C. §77l(a)(2) (Section 12). Under well-settled precedent, including from the Ninth Circuit, plaintiffs must be able to plead and prove that the shares they purchased were registered under the registration statement being challenged. Courts have long recognized that in cases with multiple registration statements (such as when a company issues a secondary offering), it is often impossible for plaintiffs to plead and prove their shares were registered under a specific registration statement because of the difficulty of determining the origin of the shares they purchased. Pirani, 13 F.4th at 946. Based on this well-established precedent, Slack argued plaintiff lacked standing because he admitted that he could not plead and prove that the shares he bought after Slack’s direct listing were registered. Id. at 948.

In a split decision, the Ninth Circuit held that “Slack’s unregistered shares sold in a direct listing are ‘such securities’ within the meaning of Section 11 because [by virtue of NYSE rules] their public sale cannot occur without the only operative registration in existence,” and thus “[a]ny person who acquired Slack shares through its direct listing could do so only because of the effectiveness of its registration statement.” Id. at 947. The court further noted that “[b]ecause this case involves only one registration statement,” it “does not present the traceability problem identified by [the Ninth Circuit] in cases with successive registrations.” Id. Judge Miller dissented, arguing that the majority improperly based its holding on the text of NYSE rules instead of the text of the statutes at issue; that there was no principled distinction between successive-registration cases and this one; and that the majority’s reliance on policy arguments was improper. Id. at 952–53 (Miller, J., dissenting).

In its petition for certiorari before the Supreme Court, Slack argued that all seven circuits to have considered the issue have uniformly held that “such security” means a share registered under the registration statement that is challenged by the plaintiff as misleading. Petition for Writ of Certiorari at 3–4. Slack also explained how this interpretation of the statutory language reflects the balancing of policy objectives that Congress implemented in the statutory scheme—namely, that while “Sections 11 and 12 impose ‘virtually absolute’ liability, ‘even for innocent misstatements,’” these statutes “are ‘limited in scope’ because they severely curtail the class of shareholders who may sue.” Id. at 28 (quoting Herman & MacLean v. Huddleston, 459 U.S. 375, 381–82 (1983)). And “Section 10 of the Exchange Act, by contrast, ‘is a “catchall” antifraud provision’ that permits any shareholder to sue, but ‘requires a plaintiff to carry a heavier burden to establish a cause of action.’” Id. Slack also warned that following the Ninth Circuit’s policy-based reasoning would mark a significant departure from precedent and undermine the stability of the securities markets and the efficiency of the capital-formation process.

The Supreme Court granted the petition for a writ of certiorari. Gibson Dunn represents Slack in this litigation. The case will be argued on April 17, 2023, by Thomas Hungar, a Gibson Dunn partner in the Washington, D.C. office.

B. Potential Circuit Split After Lee v. Fisher

On December 12, 2022, the Ninth Circuit heard oral argument en banc in Lee v. Fisher, No. 21-15923, a case that could create a circuit split between the Ninth and Seventh Circuits. The issue is whether investors can file derivative suits in federal court when a company has a forum-selection clause in its bylaws that mandates such cases be filed in Delaware state court. Prior to granting en banc review, the original Ninth Circuit panel affirmed the district court’s ruling that the forum-selection clause was enforceable, precluding a claim under Section 14(a) of the Exchange Act. See Lee v. Fisher, 34 F.4th 777, 782 (9th Cir. 2022). That decision created a circuit split, as the Seventh Circuit had recently held that a similar forum-selection clause was not enforceable. Seafarers Pension Plan v. Bradway, 23 F.4th 714, 724 (7th Cir. 2022).

In Lee, plaintiff brought a derivative action against The Gap, Inc. 34 F.4th at 779. Although Gap’s bylaws contained a forum-selection clause that required any derivative action to be brought in the Delaware Court of Chancery, plaintiff brought a derivative suit in a federal district court in California, alleging a Section 14(a) violation. Id.

The three-judge panel held that the forum-selection clause was enforceable. First, it did so because Supreme Court precedent favors enforcement of such clauses absent “extraordinary circumstances.” Id. at 780 (quoting Atl. Marine Constr. Co. v. U.S. Dist. Ct. for W. Dist. of Tex., 571 U.S. 49, 52 (2013)). Second, in considering whether the forum-selection clause would contravene strong public policy, the court held that neither the Exchange Act’s anti-waiver provision, 15 U.S.C. § 78cc(a), nor its exclusive federal jurisdiction provision, 15 U.S.C. § 78aa, was reason enough to overcome the strong federal policy in favor of enforcing forum-selection clauses. Id. at 781.

Gibson Dunn will continue to monitor developments on this issue.

C. Update On Arkansas Teachers Retirement System v. Goldman Sachs

Continuing our coverage of Goldman Sachs Group Inc. v. Arkansas Teacher Retirement System, 141 S. Ct. 1951 (2021), which dealt with the standard for considering evidence of price impact, we have a brief update on the case.

In our 2021 Year-End Securities Litigation Update, we covered In re Goldman Sachs, No. 16-250, when the case was heard on remand to the Second Circuit. There, the Second Circuit in turn remanded the case to the Southern District of New York with instructions on how to assess price impact, and the district court certified the class for the third time. Defendants appealed the class certification decision, setting up another showdown in the Second Circuit. Over several months in 2022, the parties and over 50 amici filed briefs. Oral argument was held on September 21, 2022 before Judges Sullivan, Chen, and Wesley. The Second Circuit has yet to issue a decision, but one is expected soon.

We will continue to follow the case and other developments in this area. We anticipate that the Second Circuit’s upcoming opinion will address the extent to which a mismatch between the challenged statement and corrective disclosure can undermine the evidence of price impact in cases based on the inflation-maintenance theory, and we will report on significant matters in future updates.

D. The Supreme Court Is Again Being Asked To Decide On The Constitutionality Of The CFPB

On October 19, 2022, the Fifth Circuit decided Community Financial Services Association of America v. Consumer Financial Protection Bureau, 51 F.4th 616 (5th Cir. 2022) (“CFSA”), which does not deal with securities litigation directly, but is an interesting challenge in the administrative law space and could be consequential to agencies who have faced or currently face structural challenges, like the Securities and Exchange Commission.

In CFSA, trade associations representing payday lenders sought to block the CFPB from implementing a “Payday Lending Rule.” Id. at 623. The rule would limit lenders’ ability to withdraw payments from a borrower’s account without first obtaining permission in cases where two attempts to withdraw payments from the account had already failed due to lack of sufficient funds. Id. at 625. The trade associations challenged the rule on two grounds: first, that the CFPB acted arbitrarily and capriciously and so exceeded its statutory authority; and second, that the rule is invalid because the CFPB’s funding structure is unconstitutional. Id. at 623.

The CFPB’s funding structure is considered unique among the federal agencies. In response to the 2008 financial crisis, Congress sought to ensure that the CFPB would be independent and insulated from partisanship. Instead of periodic congressional appropriations, the Bureau “receives funding directly from the Federal Reserve, which is itself funded outside the appropriations process.” Id. at 624. The Fifth Circuit held that the CFPB’s funding structure is unconstitutional because it violates the separation of powers and the Appropriations Clause. Id. at 635. The court held that Congress does not just cede direct control over the CFPB’s budget by insulating it from annual appropriations, it also ceded indirect control by providing it with self-determined funding from a source that is itself outside the appropriations process. This “double insulation from Congress’s purse strings [] is ‘unprecedented’ across the government.” Id. at 639. The court also held that the agency’s funding structure also violated the Appropriations Clause, which requires money to be drawn “from the Treasury … in Consequences of Appropriations made by law.” Id. at 640. Because the agency is not funded through an appropriation of Congress, it violates the Appropriations Clause.

On the issue of remedy, the Fifth Circuit used the dichotomy established in Collins v. Yellen, 141 S. Ct. 1761 (2021), as the framework. There, the Supreme Court clarified the difference between agency actions that involve a Government actor’s exercise of lawfully possessed powers and those that do not. CFSA, 51 F.4th at 642. For actions that fall into the latter group, a plaintiff must prove that the challenged action actually inflicted harm. The Fifth Circuit found that the unconstitutional funding scheme fell into the latter half of Collins; it also found that Plaintiff-Appellants succeeded in showing a linear nexus between the challenged funding scheme and the rule. Id. at 643. It reasoned, “without [the agency’s] unconstitutional funding, the Bureau lacked any other means to promulgate the rule.” Id. Accordingly, the court held that the Bureau’s Payday Lending Rule was to be vacated as the product of an unconstitutional funding scheme. Id.

The CFPB appealed the Fifth Circuit’s decision to the Supreme Court. We will report on further developments in future Updates.

E. Update On Securities And Exchange Commission v. Cochran

As previewed in our 2022 Mid-Year Securities Litigation Update, on November 7, 2022, the Supreme Court heard oral argument in Securities and Exchange Commission v. Cochran, No. 22-448. The case involves the question of whether requiring plaintiffs to bring constitutional challenges to an agency’s structure through that agency’s administrative proceedings prior to any such challenge in federal court violates due process. After nearly three hours of argument in Cochran and its companion case, the Supreme Court seemed receptive to opening up federal courts to Constitutional challenges of agencies outside of their internal process.

This case could have significant implications for defendants in enforcement proceedings before these types of agencies in part because it could permit defendants to pause enforcement proceedings to adjudicate their constitutional challenge separately in court.

In Cochran, attorneys from Gibson Dunn submitted amicus briefs supporting Cochran in the Supreme Court on behalf of Raymond J. Lucia, Sr., George R. Jarkesy, Jr., and Christopher M. Gibson, and in the Fifth Circuit on behalf of the Texas Public Policy Foundation. Attorneys from Gibson Dunn represented petitioners Lucia and Raymond J. Lucia Companies, Inc. in their successful challenge to the constitutionality of the SEC’s administrative law judge appointments.

III. Delaware Developments

A. Case Law Surrounding Corporate Oversight Duties Continues To Develop

In recent years, there have been several developments regarding duty of oversight claims—often called Caremark claims. As we reported in our 2017 Year-End Securities Litigation Update and 2019 Mid-Year Securities Litigation Update, a Caremark claim generally seeks to hold directors personally accountable for damages to a company arising from their failure to properly monitor or oversee the company’s major business activities and compliance programs. See In re Caremark Int’l Inc. Derivative Litig., 698 A.2d 959, 968 (Del. Ch. 1996). There are generally two types of Caremark claims: (1) that the directors utterly failed to implement any reporting or information systems or controls; and (2) having implemented such a system or controls, the directors consciously failed to monitor or oversee its operations, thus preventing themselves from being informed of risks or issues (a “red-flags” claim).

In a recent case, the Delaware Court of Chancery once again reaffirmed that plaintiffs must clear a high bar to adequately plead Caremark claims. On June 30, 2022, the Delaware Court of Chancery dismissed Caremark claims because it found that the board had implemented a reporting system for a “mission critical” risk and made good faith efforts to monitor risk. City of Detroit Police & Fire Ret. Sys. ex rel. NiSource, Inc. v. Hamrock, 2022 WL 2387653 (Del. Ch. June 30, 2022). Plaintiffs had asserted claims under both prongs of Caremark after a company experienced pipeline explosions. Id. at *1. The court dispensed with the prong-one Caremark claim, determining that the board had made good-faith efforts to establish a committee to oversee and report on safety policies. Id. at *15–17. The court noted that the committee met “five times a year, receiv[ed] extensive reports from senior executives, and regularly report[ed] on safety risks to the full [b]oard.” Id. at *15.

The court also rejected plaintiffs’ theories advanced under Caremark’s second prong. To that end, the court rejected plaintiffs’ argument that the board’s “regrettable” timeline to achieve regulatory compliance was a violation of positive law, reasoning instead that determining how to comply with regulations is “a legitimate business decision for the [b]oard to make.” Id. at *18–19. The court also rejected plaintiffs’ theory that the board ignored red flags related to violations of pipeline safety laws because the alleged red flags were either “too attenuated” from the explosions or the board did not know about the red flags. Id. at *26. For example, the court noted that it was not reasonable to infer that record-keeping violations at one company subsidiary put the board on notice of record-keeping violations at another subsidiary, which allegedly contributed to the pipeline explosion. Id. at *25.

The duty of oversight continues to be an active area of development in Delaware courts. In particular, as we discuss in a client alert dated February 3, 2023, the Delaware Court of Chancery held for the first time that corporate officers owe a duty of oversight.

We will report on further developments in this space in our next Update.

B. Delaware General Assembly Permits Officer Exculpation For Duty Of Care Claims

Since the Delaware General Assembly adopted Section 102(b)(7) of the Delaware General Corporation Law in 1986, corporations have been permitted to eliminate personal liability of directors for monetary damages arising out of breaches of the fiduciary duty of care. Following a recent amendment to Section 102(b)(7), corporations may now limit personal liability of a range of corporate officers specifically identified in the statute. Like director exculpation, Section 102(b)(7) allows corporations to eliminate officer liability arising from direct stockholder claims for duty of care breaches, and it does not allow corporations to eliminate officer liability arising from duty of loyalty claims. Unlike director exculpation, officers may still be personally liable for derivative claims brought on behalf of the corporation.

Although the statutory amendment was effective August 1, 2022, officer exculpation under Section 102(b)(7) is not self-executing. Thus, to eliminate officer liability, a corporation must amend its certificate of incorporation, which requires approval from both the board of directors and the corporation’s stockholders. Once adopted, an exculpation provision only eliminates personal liability for conduct occurring after it is approved by stockholders and the amended certificate of incorporation is filed and accepted by the Delaware Secretary of State.

C. Non-Delaware Courts Contend With The Application Of Forum Selection Bylaws To Federal Securities Claims

State and federal courts around the country continue to grapple with the enforceability of mandatory forum selection bylaws adopted by Delaware corporations. Readers will recall that, in Salzberg v. Sciabacucchi, 227 A.3d 102, 133-34 (Del. 2020), the Delaware Supreme Court held that mandatory federal forum provisions were prima facie valid under Delaware law, but indicated that fact-specific enforceability of such provisions would likely be decided by courts in other jurisdictions. A growing number of courts across the country have done just that.

As discussed above, the Ninth Circuit at least temporarily eliminated a potential circuit split by granting en banc review in Lee, 34 F.4th 777. In April 2022, the California Court of Appeal, First Appellate District, issued its decision in Wong v. Restoration Robotics, Inc., 78 Cal. App. 5th 48, 80 (2022), affirming the trial court’s dismissal of Securities Act claims for inconvenient forum and finding that defendant’s federal forum provision was valid and enforceable. Following the Delaware Supreme Court’s decision in Salzberg, the California trial court dismissed the case on forum non conveniens grounds pursuant to the federal forum provision, concluding that plaintiff failed to show the provision was unenforceable, unconscionable, unjust, or unreasonable. Wong, 78 Cal. App. 5th at 60. The Court of Appeal affirmed, finding that Salzberg had settled the question of validity and that enforcement of the provision would not be “outside reasonable expectations” of the company’s stockholders. Id at 76-80. The decision in Wong is the first California Court of Appeal decision enforcing the federal forum provision of a Delaware corporation.

D. Court Of Chancery Confirms De-SPAC Mergers Are Subject To Entire Fairness

In January 2022, the Delaware Court of Chancery issued a decision that called into question (at least at the pleadings phase of the case) the fairness of a de-SPAC transaction. See In re MultiPlan Corp. S’holders Litig., 268 A.3d 784, 812 (Del. Ch. 2022). One year later, on January 4, 2023, the court did so again, this time emphasizing its view that “[t]he duties owed by the fiduciaries of a SPAC organized as a Delaware corporation are no different” from other corporations. Delman v. GigAcquisitions3, LLC, — A.3d —, 2023 WL 29325, at *16 (Del. Ch. Jan. 4, 2023). Although these decisions arise in the context of a particular (and relatively new) form of transaction, they draw on traditional principles of fiduciary duty to reach the result.

The dispute in Delman unfolded against the backdrop of the court’s opinion in Multiplan, where the court relied on “well-worn fiduciary principles” to hold that the entire fairness standard applies to a de-SPAC transaction. In re MultiPlan., 268 A.3d at 792. The court reasoned that the sponsor was conflicted because it would lose its investment in the SPAC if it did not consummate a merger before its deadline, meaning its preference for a value-decreasing merger over no merger was not shared with public stockholders. Id. at 813.

In Delman, the court applied the same principles and reached the same conclusion. 2023 WL 29325, at *16. Pursuant to the transaction at issue in Delman, as in many SPAC transactions, stockholders received a three-quarters warrant and one post-IPO share, with the option to redeem the share for $10.10 regardless of whether they voted for or against a proposed merger. Id. at *3, *6. After the de-SPAC closed and the price of the surviving company’s stock dropped to $6.57 per share, plaintiff alleged, among other things, that the SPAC had interfered with stockholders’ redemption rights by misstating the proposed merger consideration that stockholders would receive. Id. at *16 n.170, *21.

Echoing its decision in Multiplan, the court denied the company’s motion to dismiss, reasoning that the SPAC structure created a conflict between the sponsor and shareholders. Id. at *1. As before, the court found it conceivable that the sponsor was conflicted because it would receive a large return—20% of the post-IPO equity—even if the merger was bad for stockholders. Id. at *16. It further found the sponsor had an incentive to encourage stockholders not to redeem, because redemptions would decrease the merger’s likelihood of success and value to the sponsor. Id. Finally, the court rejected defendants’ argument that the stockholders’ favorable vote ratified the transaction, reasoning that their “voting interests were decoupled from their economic interests,” as the warrants would be worthless if no merger went through. Id. at *19.

After Delman, Delaware courts may review stockholder challenges to de-SPAC transactions under corporate law’s most onerous standard, entire fairness, which increases the chances that stockholder plaintiffs in such disputes will be entitled to discovery and potentially trial over the fairness of the transaction to the SPAC stockholders.

In a slightly different fact pattern, plaintiff in Laidlaw v. GigAcquisitions2, LLC, No. 2021-0821 (Del. Ch.) (“Gig2”), alleged that the failure to disclose was in relation to the financing structure of the de-SPAC transaction. The Gig2 plaintiff contended that defendants breached their fiduciary duty by omitting or intentionally burying in the proxy statement key details of the purported dilutive effect of the de-SPAC transaction on public stockholders’ shares. ECF No. 1 at 10. This omission and obfuscation, plaintiff alleged, impaired the public stockholders’ ability to make an informed decision on whether or not to exercise their redemption rights. Id. at 31. In this way, the plaintiff tried to analogize to In re Multiplan, asking the court to apply entire fairness. The Gig2 defendants countered that all the necessary disclosures regarding the dilutive effects of the transaction either could be found in the proxy statement or else could be gleaned by other information contained in the proxy. ECF No. 14 at 25. The defendants accused the plaintiff of making vague claims regarding the inadequacy of the disclosures in order to benefit from the In re MultiPlan decision. Id. at 2. In this way, the defendants attempted to distinguish this case from In re MultiPlan. The court’s decision on the defendants’ motion to dismiss is pending.

E. Delaware Supreme Court Cross-Designates Superior Court Judges To Help Reduce Court Of Chancery’s Workload

As the Court of Chancery’s workload has ballooned in recent years due to an expansion of its jurisdiction in 2016, Chief Justice Collins J. Seitz, Jr. sought to lighten the load by cross-designating certain Superior Court judges to preside over some Court of Chancery cases.

In February, the Chief Justice issued an order cross-designating five judges from the Superior Court’s sophisticated Complex Commercial Litigation Division (CCLD) to hear breach-of-contract cases filed in the Court of Chancery under Section 111 of the Delaware General Corporation Law. See In re Designation of Actions Filed Pursuant to 8 Del. C. § 111 (Feb. 23, 2023). Section 111 previously gave the Court of Chancery jurisdiction over stock sales by corporations, but in 2016, the Delaware General Assembly expanded that jurisdiction to include a broader range of transactions involving stock. H.B. 371, 148th Gen. Assemb. (Del. 2016).

Noting that “the Court[ of Chancery’s] ever-increasing caseload poses continued challenges,” the Chief Justice’s order will allow CCLD judges to hear Section 111 cases “for a trial period of one year.” Per the order, the Superior Court judges may sit in these cases when assigned by the Chancellor and President Judge of the Superior Court.

IV. Federal SPAC Litigation

In 2022, there were 102 closed de-SPAC transactions, a number that is almost half the 199 de-SPACs that closed in 2021. While the market for SPAC offerings has cooled relative to 2021, litigation arising out of SPAC transactions remains active.

Plaintiffs in In re CCIV/Lucid Motors Sec. Litig., 2023 WL 325251, at *4 (N.D. Cal. Jan. 11, 2023), are common stockholders of a SPAC called Churchill Capital Corporation IV (“CCIV”) who sued CCIV for alleged misrepresentations made by Lucid Motors—the company with which CCIV merged—prior to the de-SPAC transaction. Defendants filed a motion to dismiss on several grounds, including that plaintiffs lacked Section 10(b) standing. To that end, defendants asserted “that to have Section 10(b) standing, plaintiffs must allege the defendant made misrepresentations about the security actually purchased or sold by the plaintiffs.” Id. Defendants’ rule rested on “four bases:” “(i) consistency with Blue Chip [Stamps v. Manor Drug Stores, 421 U.S. 723 (1975)], (ii) precedence set by the Second Circuit, (iii) other supporting caselaw, and (iv) the need to construe the statute narrowly.” Id.

The courted rejected defendants’ standing rule but ultimately dismissed the complaint on materiality grounds. See id. at *11. With respect to defendants’ standing arguments, the court first concluded that Blue Chip did not “limit standing beyond the purchaser-seller rule”—i.e., that a party must be one or the other to have standing. See id. at *6. Next, the court distinguished the Second Circuit’s “two key decisions,” Ontario Public Service Employees Union Pension Trust Fund v. Nortel Networks Corporation, 369 F.3d 27 (2d Cir. 2004), and Menora Mivtachim Insurance Ltd. v. Frutarom Industries Ltd., 54 F.4th 82 (2d Cir. 2022), and declined defendants’ invitation to adopt the Second Circuit’s approach. See id. at *7 (noting the Second Circuit is “the only circuit court to address the standing issue at bar”). It found Blue Chip more instructive than Nortel and Nortel more “compelling” than Menora. Id. at *7-8. At bottom, the court concluded that although it could “appreciate the simplicity of the Nortel and Menora rule regarding standing,” the rule was “inconsistent with Supreme Court precedent and the policy considerations with respect to standing.” Id. at *9. The court also distinguished the cases defendants cited from outside the Second Circuit, noting, among other things, that several “appl[ied] Nortel with little or no commentary on the Second Circuit’s reasoning.” Id. at *8. Finally, the court disagreed that defendants’ rule was needed to comport with the requirement that Section 10(b) standing be construed “narrowly.” Id. at *9. Nonetheless, the court dismissed plaintiffs’ pleading on materiality grounds but gave plaintiffs an opportunity to amend. See Id. at *11.

V. ESG Civil Litigation

For the past several years, a growing number of lawsuits have been filed against public companies or their boards related to the companies’ environmental, social, and governance (“ESG”) disclosures and policies. These lawsuits can target a number of different ESG-related issues, and have had varying levels of success surviving past the pleading stage. While it may be too early to identify definitive trends in this area, this section surveys the types of ESG claims that are being filed and reports on notable decisions.

A. Greenwashing/Climate Change

Fagen v. Enviva Inc., No. 8:22-cv-02844 (D. Md. Nov. 3, 2022): In this action, plaintiffs alleged that Enviva misled investors by claiming to be an environmentally sustainable producer of wood pellets, while actually engaging in clear-cutting (which is a cheaper, but less sustainable, method of production). ECF No. 1 at 2–3. The complaint claims that Enviva made a number of statements about its sustainability performance in press releases, filings, and earnings calls, including that “sustainability remains the foundation of our business.” Id. at 5–21. In October 2022, an analyst published a report purporting to use geodata from Enviva disclosures to tie Enviva to clear-cutting. Id. at 22–23. The stock allegedly fell 13% on this news. Id. at 25. On February 2, 2023, the court approved the parties’ stipulated schedule, which provides that any motion to dismiss is due by June 2, 2023. ECF Nos. 28-29.

In re Danimer Scientific, Inc. Securities Litigation, No. 21-cv-02708 (E.D.N.Y. May 14, 2021): In this action, plaintiffs alleged that Danimer Scientific, Inc., a bioplastics company, misled investors by stating that its primary product was 100% biodegradable. ECF No. 44 at 2–3. When an article published in The Wall Street Journal claimed that the product’s ability to biodegrade was exaggerated, the company’s stock price allegedly dropped. Id. at 11–13. The motion to dismiss is fully briefed and pending before the court.

B. #MeToo/Workplace Harassment