New York partner Mark Schonfeld, of counsel Gregory Merz and associate Chris Hamilton are the authors of “How Biz Development Cos. Can Mitigate Regulatory Risks,” [PDF] published by Law360 on May 11, 2020.

Munich associate Johanna Hauser is the co-author of “Die virtuelle Hauptversammlung” [PDF] published in the issue 13/2020 of the German publication NZG (New Journal for Corporate Law), together with Cornelius Simons (Cornell). The article focuses on current questions in connection with the convocation and holding of virtual general meetings under the rules of the new legislation due to the COVID-19 pandemic.

The COVID-19 pandemic is undoubtedly the biggest public health crisis of our times. Like many other countries, the UK Government has exercised broad powers and passed new laws that impact how we do business and interact as a society.

To address the pandemic, the Government announced several sweeping regulations and ushered through the Coronavirus Act 2020. These actions have a broad impact on law, public policy and daily life, impacting areas including health, social welfare, commerce, trade, competition, employment and the free movement of people.

Join our team of Gibson Dunn London lawyers, led by partner and former Lord Chancellor Charlie Falconer QC, for a discussion of these changes and to answer your questions on how they will affect British businesses and community, including the impact on new and ongoing business relationships.

In this webinar we will cover:

- Current plans to ease the lockdown restrictions

- An introduction to the data protection aspects of contact tracing apps

- The UK Government’s Future Fund initiative, which aims to provide liquidity and investment to high-growth companies

We want to hear from you about the impacts the current measures and conditions are having on your business and the legal issues you are facing. We therefore welcome suggested topics, as well as questions in advance of each webinar, to ensure that we can address issues relevant to your business.

PANELISTS:

Charlie Falconer QC: An English qualified barrister and Gibson Dunn partner. Former UK Lord Chancellor and first Secretary of State for Justice, he spent 25 years as a commercial barrister, and became a QC in 1991.

Matt Aleksic: An associate in the Litigation and International Arbitration practice groups of Gibson Dunn. Experience in a wide range of disputes, including commercial litigation, international arbitration and investigations.

Sarika Rabheru: An Associate in Gibson Dunn’s Employment team. Specializes in employment.

Ciarán Deeny: An associate in Gibson Dunn’s Mergers & Acquisitions and Private Equity teams. A broad range of corporate transactional experience, with a primary focus on private equity and private M&A in Europe, the Middle East and North Africa.

Overview

On May 7, 2020, the European Commission (the “Commission”) announced an action plan of measures designed to pursue what will likely constitute a fundamental reshaping of how rules relating to anti-money laundering (“AML”) and counter-terrorist financing (“CTF”) are implemented, overseen and enforced in the EU (the “Action Plan”). The Action Plan was published alongside further clarification regarding the identification of high-risk third countries that have strategic deficiencies in their national AML and CTF regimes.

This alert focuses on the rationale and key components of the Action Plan.

Background

In July 2019, the Commission published a “package” of AML communications, in which a number of weaknesses were identified in relation to the EU’s AML and CTF framework (the “Anti-Money Laundering Package”). In a report published amongst the suite of documents, the Commission pointed to a number of deficiencies evident from recent money laundering scandals in the banking sector. In particular, a key issue flagged in relation to the cases analysed in the report was that of cross-border payments and transfers, which present a challenge where there is insufficient harmonisation of national supervisory frameworks, standards and capabilities across the EU.

This fragmentation results from several historic factors, including the EU’s use of Directives relating to money laundering rather than directly applicable Regulations (leaving decisions on implementation to Member States) and a measure of divergence inherent in the Member States’ various approaches to the regulation of businesses generally, and sectors of key AML risk in particular, such as the financial and gambling sectors. There has been long-standing criticism of the EU’s lack of co-ordinated action on AML, including from the European Banking Federation (the “EBF”), which has called the EU’s framework “ineffective” and in need of “critical review”.[1]

Following the Anti-Money Laundering Package, the Commission was invited by the European Parliament and Council to investigate what steps could be taken to achieve “a more harmonised set of rules, better supervision, including at EU level, as well as improved coordination among Financial Intelligence Units”. The Action Plan is the Commission’s response to this challenge and is intended to be the first step on the path to creating a comprehensive framework to combat money laundering and terrorist financing across Europe.

The Action Plan

The Action Plan is structured on the basis of six “pillars”. The holistic aim of these is to (i) improve the overall fight against money laundering; and (ii) strengthen the EU’s global role in this sphere. Once implemented, it is hoped that this will result in greater harmonization of rules across the EU, with better supervision and improved co-ordination between the competent authorities of the various Member States. The Action Plan is described as aiming to “shut down any remaining loopholes and remove any weak links in the EU’s rules”.[2]

The Action Plan sets out the Commission’s intended actions over the next 12 months, including the proposal of a new harmonized set of rules in Q1 2021 (there are no changes to EU law at this point). A new EU level supervisory body will be proposed at around the same time.

The six pillars are discussed below.

Effective application of the rules

The Commission has stated that it will, of course, continue to closely monitor the implementation of EU rules by Member States to ensure that the national rules are in line with the highest possible standards. In parallel, the Action Plan encourages the European Banking Authority (the “EBA”)[3] to make full use of its recently heightened role to tackle money laundering and terrorist financing.

The EBA separately announced on May 7, 2020, in response to the publication of the Action Plan, that it stands ready to support the Commission’s considerations through the consultation (on which, please see “The Action Plan consultation” below), whilst using its powers to lead, coordinate and monitor the EU financial sector’s fight against money laundering and terrorist financing.

Single EU rulebook

As noted above, there is a degree of variation in the ways in which Member States currently apply the EU AML and CTF rules. Key areas of divergence identified include the list of entities subject to national rules, customer due diligence requirements, internal controls and reporting obligations.

The Commission announced that a more harmonized set of rules will be proposed in Q1 2021. A Q&A, published with the Action Plan, does not express a definitive view on whether the Action Plan will lead to a new Regulation – the Commission instead indicates that this will be “subject to a thorough analysis to ensure that [it] reaches as high a level of harmonization as possible”.

EU-level supervision

Oversight of AML and CTF regimes is currently conducted at a national level, which leads to significant differences in the way that the rules are supervised. Therefore, in Q1 2021, the Commission will formally propose to establish a supervisor at the EU level.

The Q&A provides that the role and scope of this EU-level supervision – as well as the supervisory body that should be tasked with carrying out this role – will be proposed following a thorough assessment of all options. This will also include consideration of feedback received in the open public consultation launched in connection with the Action Plan.

Whilst criminal enforcement of AML offences introduced in response to EU legislation has historically been undertaken at a Member State level (where competence to do so lies), the Commission has said that it is also critical to build capacity at EU level to investigate and prosecute financial crime. It noted that Europol has stepped up its efforts in order to tackle economic and financial crime with the new European Economic and Financial Crimes Centre, which should become operational in the course of 2020. Amongst other things, this will concentrate all financial intelligence and economic crime capabilities in a single entity within Europol.

Co-ordination and support mechanism for Member States’ Financial Intelligence Units

The Commission was keen to point out that Financial Intelligence Units in Member States play a critical role in identifying transactions and activities that could be linked to criminal activities.

However, it noted in the Q&A that several Financial Intelligence Units have not complied with their obligation to exchange information with other Financial Intelligence Units. Additionally, some Financial Intelligence Units have not managed to engage in a meaningful dialogue by giving quality feedback to private entities, as required by AML legislation. The Action Plan lays the groundwork for the creation of an EU support and coordination mechanism for these Units. The Commission will formally propose to establish this mechanism to help further coordinate and support the work of these units in Q1 2021.

Enforcing EU-level criminal law provisions and information exchange

The Commission notes that judicial and police co-operation, on the basis of EU instruments and institutional arrangements, is essential to ensure the proper exchange of information. It also points to the role that the private sector can play in combating money laundering and terrorist financing, indicating that it will issue guidance on the role of public-private partnerships to clarify and enhance information sharing.

The EU’s global role

The EU plays an important role on the world stage in shaping international standards in the fight against money laundering and terrorist financing and is actively involved in the Financial Action Task Force (“FATF”). The Commission is determined to step up its efforts so that the EU acts as a “single global actor in this area”. In particular, the Commission has stated that the EU will adjust its approach to third countries with strategic deficiencies in their AML and CTF regimes that pose significant threats to the “single market”. It specifically points to the new methodology issued alongside the Action Plan as giving the EU the right tools to do so.

New methodology to identify high-risk third countries

At the same time as it published the Action Plan, the Commission published a new methodology to identify high-risk third countries that have strategic deficiencies in their national AML and CTF regimes, which pose significant threats to the EU’s financial system.

The goal is to provide more clarity and transparency in the process of identifying these third countries. The key new elements concern: (i) the interaction between the EU and FATF listing process; (ii) enhanced engagement with third countries; and (iii) reinforced consultation of Member States experts.

Updated list of high risk countries

The Commission has a legal obligation to identify high-risk third countries with strategic deficiencies in their AML and CTF regimes. The Commission revised its list on May 7, 2020. It states that the new list is now “better aligned” with the lists published by the FATF.

Countries added to the list are: the Bahamas, Barbados, Botswana, Cambodia, Ghana, Jamaica, Mauritius, Mongolia, Myanmar, Nicaragua, Panama and Zimbabwe.

Countries which have been de-listed are: Bosnia-Herzegovina, Ethiopia, Guyana, Lao People’s Democratic Republic, Sri Lanka and Tunisia.

The Commission amended the list by means of a Delegated Regulation, which will now be submitted to the European Parliament and Council for approval within one month (with a possible one-month extension). The Regulation listing third countries – and therefore applying new protective measures – applies as of October 1, 2020. This is to ensure that all stakeholders have time to prepare appropriately. The de-listing of countries, however, will enter into effect 20 days after publication of the Delegated Regulation in the Official Journal.

The UK position

The transition period for the UK’s departure from the EU is currently set to end on December 31, 2020. There is a great deal of uncertainty surrounding what, if any, agreement will be made between the remaining EU Member States and the UK.

A key question is whether the UK will choose to separately implement any changes brought about under the Action Plan, given that these will occur after the end of the Brexit transition period. Any arrangements reached with the remaining EU Member States will likely require the UK to maintain a degree of “equivalence” (broadly, retaining legal and regulatory frameworks substantially similar to those of the EU); in relation to AML and CTF, this is likely to align with the interests of British industry, and in particular its financial sector.

The consultation on the Action Plan is open for comment until July 29, 2020. This is run via the Commission’s online portal. A number of key topics that may be of interest include (i) what regulatory provisions need to be harmonised (for example, whether record keeping should be covered); (ii) which body should exercise the EU supervisory powers (for example, the EBA or a new EU centralised agency); and (iii) what powers this EU supervisor should have. It is expected that the financial sector, and other sectors that stand to be significantly impacted, will participate actively in this consultation.

Looking ahead

The Action Plan is clearly ambitious and speaks to an obvious need. The initial industry-level response has been very positive – the EBF, for example, indicated that it is “greatly encouraged”.[4] As discussed above, there has been considerable discussion for some time about the significant issues posed by the varying implementation, supervision and enforcement of AML and CTF frameworks across the Member States of the EU. Key to the effectiveness of any new harmonized regime overseen at EU level will be the extent to which the EU supervisory body will be endowed with enforcement and investigative powers, including the power to commence or instruct competent authorities at national level to commence investigations, and the degree to which it will be able to foster information sharing and policy alignment across Member States, and with third countries.

To date, Member States have maintained control over the creation of offences and criminal enforcement in relation to EU AML legislation. As a result, the law in this area has historically been something of a “patchwork quilt” across the EU, with each Member State adopting its own approach to implementation, through the filter of the peculiarities of its own criminal law, using the domestic criminal and regulatory authorities already in place. This presents a significant hurdle to efforts to secure EU-level harmonization of the law, supervision and enforcement in the field of AML/CTF. As such, if the Action Plan is to fulfil its ambitions, it will require innovation, creativity and flexibility from both the Commission and Member States. However, the prize for such efforts would be significantly enhanced coherence and efficiency in AML regulation across Europe, to the advantage of both European society and European business.

_____________________

[1] “Lifting the spell of dirty money – EBF blueprint for an effective EU framework to fight money laundering”, EBF, March 2020

[2] European Commission press release, “Commission steps up fight against money laundering and terrorist financing”, May 7, 2020

[3] From January 1, 2020, the EBA has had a clear legal duty to contribute to preventing the use of the financial system for the purposes of money laundering and terrorist financing and to lead, coordinate and monitor the AML/CFT efforts of all EU financial services providers and competent authorities.

[4] Press release: “EBF supports new EU plans to fight money laundering”, European Banking Federation, May 7, 2020

Gibson, Dunn & Crutcher’s lawyers are available to assist in addressing any questions you may have regarding these developments. If you would like to discuss this alert in greater detail, please contact the Gibson Dunn lawyer with whom you usually work, any member of the firm’s White Collar Defence and Investigations or Financial Institutions practice groups, or the following authors:

Patrick Doris – London (+44 (0)20 7071 4276, [email protected])

Michelle M. Kirschner – London (+44 (0)20 7071 4212, [email protected])

Gregory A. Campbell – London (+44 (0)20 7071 4236, [email protected])

Sacha Harber-Kelly – London (+44 (0)20 7071 4205, [email protected])

Penny Madden QC – London (+44 (0)20 7071 4226, [email protected])

Allan Neil – London (+44 (0)20 7071 4296, [email protected])

Philip Rocher – London (+44 (0)20 7071 4202, [email protected])

Martin Coombes – London (+44 (0)20 7071 4258, [email protected])

Chris Hickey – London (+44 (0)20 7071 4265, [email protected])

Steve Melrose – London (+44 (0)20 7071 4219, [email protected])

Finn Zeidler – Frankfurt (+49 69 247 411-530, [email protected])

Stephanie Brooker – Washington, D.C. (+1 202-887-3502, [email protected])

M. Kendall Day – Washington, D.C. (+1 202-955-8220, [email protected])

F. Joseph Warin – Washington, D.C. (+1 202-887-3609, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

Gibson Dunn’s lawyers regularly counsel clients on issues raised by the COVID-19 pandemic, and we are working with many of our clients on their response to COVID-19. The following is a round-up of today’s client alerts on this topic prepared by the Gibson Dunn team. Our lawyers are available to assist with any questions you may have regarding developments related to the outbreak. As always, for additional information, please feel free to contact the Gibson Dunn lawyer with whom you usually work, or any member of the firm’s Coronavirus (COVID-19) Response Team.

GLOBAL OVERVIEW

COVID-19: UK Financial Conduct Authority Expectations on Financial Crime and Information Security

The UK Financial Conduct Authority (“FCA”) has issued statements to financial services firms outlining its expectations on: (i) financial crime systems and controls; and (ii) information security, during the COVID-19 pandemic. These are further examples of the FCA requiring firms to take steps to prevent and/or limit harm to consumers and the market more generally in this challenging period. This client alert summaries these two statements and the steps that financial services firms should be taking to ensure continued compliance with their regulatory obligations.

Read more

Nasdaq Provides Temporary Exemption from Certain Shareholder Approval Requirements in Response to COVID-19

On May 4, 2020, the SEC announced (available here) that it has immediately approved proposed rule changes by The Nasdaq Stock Market LLC (“Nasdaq”) that provide listed companies with a temporary exception from certain shareholder approval requirements under the Nasdaq Rules (the “Rules”) through and including June 30, 2020 (available here).

Read more

SEC Releases COVID-19 FAQs to Provide Guidance on Disclosure Requirements and Form S-3

The SEC Division of Corporation Finance staff (the “Staff”) has released a list of FAQs on COVID-19 for registrants (available here) that provides guidance on required disclosures under the SEC’s COVID-19 Order and the application of such order to Form S-3 filings. The FAQs and responses provided by the Staff as of May 5, 2020 are summarized below—please follow the link above to read the full text of the FAQs.

Read more

Dubai partners Hardeep Plahe and Fraser Dawson, of counsel Hanna Chalhoub and associate Thomas Barker are the authors of “The impact of Covid-19 on Mena M&A,” [PDF] published by Asian-mena Counsel, Volume 17 Issue 5, in May 2020.

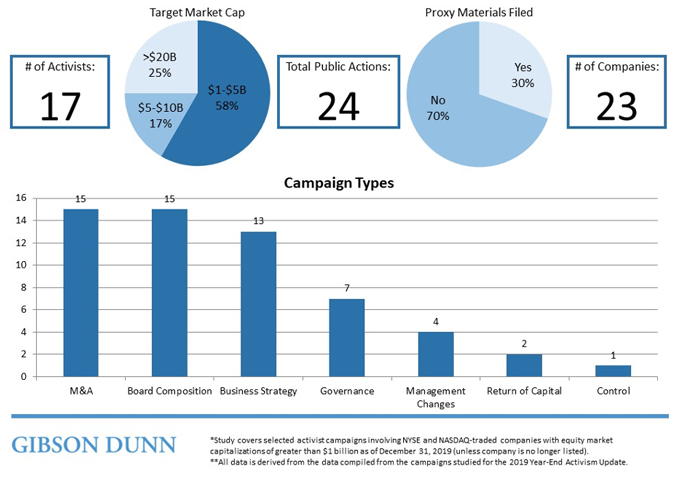

This Client Alert provides an update on shareholder activism activity involving NYSE- and Nasdaq-listed companies with equity market capitalizations in excess of $1 billion and below $100 billion (as of the last date of trading in 2019) during the second half of 2019. Announced shareholder activist activity declined relative to the second half of 2018. The number of public activist actions (24 vs. 40), activist investors taking actions (17 vs. 29) and companies targeted by such actions (23 vs. 34) each decreased substantially. The slowdown was in contrast to the first half of 2019, during which period shareholder activism activity was robust. On a full-year basis, however, 2019 represented a slowdown in activism versus 2018, as reflected in the number of public activist actions (75 vs. 98), activist investors taking actions (49 vs. 65) and companies targeted by such actions (64 vs. 82).

Despite the overall decline in shareholder activism activity, certain trends continued unabated. During the period spanning July 1, 2019 to December 31, 2019, two of the 23 companies targeted by activists—Instructure, Inc. and Occidental Petroleum Corporation—were the subject of multiple campaigns. The activism campaign launched by activist Carl Icahn against Occidental Petroleum Corporation was supported by activist Krupa Global Investments. In addition, certain activists launched multiple campaigns during the second half of 2019: Carl Icahn, Elliott Management, Land & Buildings, Sachem Head Capital Management and Starboard Value. These five activists represented 42% of the total public activist actions that began during the second half of 2019.

By the Numbers – H2 2019 Public Activism Trends

Additional statistical analyses may be found in the complete Activism Update linked below.

The rationales for activist campaigns during the second half of 2019 remained consistent with those in the first half of 2019. Over both periods, M&A, board composition and business strategy represented the most frequent rationales animating shareholder activism campaigns. These three rationales collectively reflected approximately 75% of activism campaigns during each time period (noting that many campaigns have multiple rationales), with other rationales (governance, management changes, return of capital and change of control) representing the minority. M&A (which includes advocacy for or against spin-offs, acquisitions and sales) and board composition were each a motivator for activist activity in the case of 63% of campaigns (as compared to 55% and 67%, respectively, in the first half of 2019). M&A and board composition were followed by business strategy (54% of campaigns, as compared to 51% in the first half of 2019). On the other hand, advocacy for changes in governance (29% of campaigns in the second half of 2019), managerial changes (17% of campaigns), return of capital (8% of campaigns) and attempts to take corporate control (4% of campaigns) represented less frequently cited rationales for activist campaigns. Proxy solicitation occurred in 29% of the campaigns, representing a significant increase relative to the first half of 2019, in which 15% of campaigns featured activists filing proxy materials. (Note that the above-referenced percentages total over 100%, as certain activist campaigns had multiple rationales.)

The diminution in shareholder activism activity brought with it a decline in publicly filed settlement agreements. Only five such settlements were filed during the review period, which is the lowest number observed for a half-year-period since 2014. Those settlement agreements that were filed had many of the same features noted in prior reviews, however, including voting agreements and standstill periods as well as non-disparagement covenants and minimum and/or maximum share ownership covenants. Expense reimbursement provisions were included in approximately half of those agreements reviewed, which is consistent with historical trends. We delve further into the data and the details in the latter half of this Client Alert.

Though not covered in this Client Alert, we note that early indications suggest that the COVID-19 pandemic has caused a decline in shareholder activism activity during the first half of 2020. However, some activists may see opportunities in market dislocation to increase pressure on certain targets and/or to increase their positions in certain companies opportunistically. These trends may be borne out in both the types of targets on which activists focus as well as in the rationales for the campaigns that activists launch. We will analyze these trends in detail during our next shareholder activism update.

We hope you find Gibson Dunn’s 2019 Year-End Activism Update informative. If you have any questions, please do not hesitate to reach out to a member of your Gibson Dunn team.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this publication. For further information, please contact the Gibson Dunn lawyer with whom you usually work, or any of the following authors in the firm’s New York office:

Barbara L. Becker (+1 212.351.4062, [email protected])

Dennis J. Friedman (+1 212.351.3900, [email protected])

Richard J. Birns (+1 212.351.4032, [email protected])

Eduardo Gallardo (+1 212.351.3847, [email protected])

Saee Muzumdar (+1 212.351.3966, [email protected])

Daniel Alterbaum (+1 212.351.4084, [email protected])

Jessica L. Bondy (+1 212.351.3802, [email protected])

Please also feel free to contact any of the following practice group leaders and members:

Mergers and Acquisitions Group:

Jeffrey A. Chapman – Dallas (+1 214.698.3120, [email protected])

Stephen I. Glover – Washington, D.C. (+1 202.955.8593, [email protected])

Jonathan K. Layne – Los Angeles (+1 310.552.8641, [email protected])

Securities Regulation and Corporate Governance Group:

Brian J. Lane – Washington, D.C. (+1 202.887.3646, [email protected])

Ronald O. Mueller – Washington, D.C. (+1 202.955.8671, [email protected])

James J. Moloney – Orange County, CA (+1 949.451.4343, [email protected])

Elizabeth Ising – Washington, D.C. (+1 202.955.8287, [email protected])

Lori Zyskowski – New York (+1 212.351.2309, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

The UK Financial Conduct Authority (“FCA”) has issued statements to financial services firms outlining its expectations on: (i) financial crime systems and controls; and (ii) information security, during the COVID-19 pandemic. These are further examples of the FCA requiring firms to take steps to prevent and/or limit harm to consumers and the market more generally in this challenging period. This client alert summaries these two statements and the steps that financial services firms should be taking to ensure continued compliance with their regulatory obligations.

Financial crime systems and controls

In its statement to firms, the FCA noted that criminals are already taking advantage of the COVID-19 pandemic to conduct fraud and exploitation scams through a variety of methods (including cyber-enabled fraud). The FCA flagged the importance of firms remaining vigilant to new types of fraud and amending their control environment where necessary to respond to new threats (including ensuring the timely reporting of suspicious activity reports).

Risk appetite

Firms should not address any current operational issues faced during the COVID-19 crisis by changing their risk appetite. For example, firms should not change or switch-off current transaction monitoring triggers/thresholds or sanctions screening systems, for the sole purpose of reducing the number of alerts generated to address operational issues.

Flexibility relating to ongoing customer due diligence reviews

The FCA does, however, acknowledge that firms may need to prioritise or reasonably delay some activities, whilst still operating within the anti-money laundering legislative framework. For example, this may involve, in some cases, delaying ongoing customer due diligence (“CDD”) reviews. This is subject to two important caveats:

- when there are delays, the firm has accepted these on a “risk basis” (such as delaying CDD reviews of customers posing a lower risk); and

- a clear plan is in place to return to the “business as usual” review process as soon as possible.

The FCA specifically flags that challenges of detecting terrorist financing still exist and firms must not, therefore, weaken their controls to detect such high-risk activity.

Decisions to amend controls to take account of the current circumstances should be clearly risk-assessed, documented and go through the appropriate governance process.

Client identity verification

Firms are still expected to comply with their obligations under money laundering legislation relating to client identity verification. They are reminded, in light of current travel restrictions, that such legislation, together with the Joint Money Laundering Steering Group guidance, allows for client identity verification to be carried out remotely. They also give indications of certain safeguards and additional checks which can help with verification. For example, firms can ask clients to submit digital photos or videos for comparison with other forms of identification gathered as part of the onboarding process

The FCA is, however, keen to point out that this does not constitute flexibility of the requirements – this is something already provided for under the anti-money laundering legislative framework and associated guidance.

Information security

Linked to the FCA’s concerns prompting the above statement on financial crime, the FCA has also issued a statement with respect to firms’ information security.

Changes to the “threat landscape”

The unprecedented circumstances caused by coronavirus have required firms to change their ways of working at some speed and have changed the threat landscape faced by many financial services firms. As more people are working from home, online systems are becoming increasingly mission-critical and cyber criminals are taking advantage of the situation for their own gain.

Managing the increased risk

Firms are expected to prioritise information security and ensure that adequate controls are in place to manage cyber threats and respond to major incidents. This may include implementing enhanced monitoring to protect end points, information and firm critical processes (including, but not limited to, video conferencing software).

Firms should “proactively manage the increased risks”. Amongst other things, they should be:

- vigilant to the potential increase in security breaches or cyber-attacks;

- ensuring that they continue to have appropriate governance and oversight arrangements in place; and

- ensuring that necessary regulatory notifications are made.

Ongoing areas of regulatory focus

Information security and financial crime are two areas on which the FCA has focused for some time prior to the COVID-19 pandemic. For example, there is an ongoing FCA consultation on operational resilience (published in December 2019), under which cyber security is a key theme.

Further, there are no indications of the FCA’s interests in these area waning. For example, the FCA Business Plan 2020/2021 provides that the FCA will start to implement changes to how it reduces financial crime. These include making greater use of data to identify firms or areas that are potentially vulnerable. It warns that it will continue to take enforcement action where it uncovers serious misconduct, particularly where there is a high risk of money laundering.

________________________

Gibson Dunn’s lawyers are available to assist with any questions you may have regarding developments related to the COVID-19 outbreak. For additional information, please contact your usual contacts or any member of the Firm’s Coronavirus (COVID-19) Response Team, or the following authors:

Authors: Michelle Kirschner, Martin Coombes and Chris Hickey

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

In the current distressed environment of the oil and gas industry, there has been a great deal of discussion about, consideration of, and even implementation planning for, significantly reducing or even “shutting in” production. Join the Chair of Gibson Dunn’s Oil & Gas Practice Group, Michael P. Darden, as he discusses how and why this reduction or shut-in of production may occur and the consequences thereof, and provides a comprehensive examination of potential pitfalls and suggested courses of action.

View Slides (PDF)

PANELISTS:

Michael P. Darden is Partner-in-Charge of the Houston office of Gibson, Dunn & Crutcher, chair of the firm’s Oil & Gas practice group, and a member of the firm’s Energy and Infrastructure and Mergers and Acquisitions practice groups. Before joining Gibson Dunn, Mr. Darden served as the global chair of the oil and gas transactions practice and co-chair of the global oil and gas industry team at Latham & Watkins as well as the firmwide chair of the global oil and gas practice at Baker Botts. Mr. Darden is Board Certified in Oil and Gas Law by the Texas Board of Legal Specialization.

MCLE INFORMATION:

This program has been approved for credit in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 1.0 credit hour, of which 1.0 credit hour may be applied toward the areas of professional practice requirement. This course is approved for transitional/non-transitional credit.

Attorneys seeking New York credit must obtain an Affirmation Form prior to watching the archived version of this webcast. Please contact Victoria Chan (Attorney Training Manager) at [email protected] to request the MCLE form.

Gibson, Dunn & Crutcher LLP certifies that this activity has been approved for MCLE credit by the State Bar of California in the amount of 1.0 hour.

California attorneys may claim “self-study” credit for viewing the archived version of this webcast. No certificate of attendance is required for California “self-study” credit.

Gibson Dunn’s lawyers regularly counsel clients on issues raised by the COVID-19 pandemic, and we are working with many of our clients on their response to COVID-19. The following is a round-up of today’s client alerts on this topic prepared by the Gibson Dunn team. Our lawyers are available to assist with any questions you may have regarding developments related to the outbreak. As always, for additional information, please feel free to contact the Gibson Dunn lawyer with whom you usually work, or any member of the firm’s Coronavirus (COVID-19) Response Team.

GLOBAL OVERVIEW

COVID-19 Oversight and Investigations: Navigating Legal and Communications Challenges Webcast (May 8, 2020)

This unique webcast offers the combined insights of Gibson Dunn, world-class crisis communications firm Brunswick, and Ashley Callen, Deputy Staff Director of the House Oversight and Reform Committee. They will discuss the onslaught of COVID-19 related oversight and investigations, including how to manage and address the interplay of legal, reputational and communications challenges.

Read more

Corporate/M&A in Times of the Corona Crisis – Specific Consequences of the Pandemic for the German Transaction Business

After almost two months of social and economic lockdown and with Germany only very recently taking its first tentative steps on the road towards the “new normal” and re-opening the economy, this second instalment of our German corporate client update on “Corporate/ M&A in Times of the Corona Crisis” takes stock and provides an overview of the early reactions in the German M&A market, likely future trends and key battles to be fought in the German transactional arena as the business community slowly gets to grip with the Corona pandemic: In the first sub-section, we focus on the increasing importance that distressed M&A transactions and, in particular, the framework and specific rules provided by German insolvency or restructuring laws (like e.g. the insolvency contestation rules and the insolvency administrator’s right to potentially reject continued performance under business acquisition agreements) are likely to assume as certain enterprises and industry sectors will struggle to overcome the expected economic challenges. This is complemented in a second sub-section by an analysis of the likely impact of COVID-19 on the interpretation of existing and drafting of future business acquisitions agreements, common clauses such as MAE clauses, other contractual or statutory remedies, as well as more commercial issues related to evaluation matters and the determination and adjustment of the purchase price. The overview is completed in a third sub-section by a brief summary of the early reactions and discernible trends in the German market for W&I insurances.

Read more

Developments in the Sports Betting Landscape in the United States During the COVID-19 Pandemic

The world of sports betting, like many other industries, has been impacted by the COVID-19 pandemic in significant ways. One major disrupting force has been the widespread cancellation of live sporting events. On March 11, 2020, in light of the spread of COVID-19, the National Basketball Association halted play “until further notice”, and Formula 1 and the PGA Tour followed suit the next day. By the end of March, play in Major League Baseball, the Premier League, the Champions League, the National Hockey League, the 2020 Tokyo Olympics and March Madness had been suspended, postponed or cancelled. Without live sports, participants in the sports betting market have less to wager on. Likewise, the operations of brick-and-mortar casinos and sportsbook operators have been upended by the pandemic. Virtually all casinos in the United States have faced closures for some period of time as a result of the pandemic, whether pursuant to state or municipal “stay at home” orders or other limitations on the operation of businesses deemed “non-essential”, voluntary suspensions of tribal gaming operations, or other voluntary closures.

Read more

Investor Communications by Private Equity and Real Estate Fund Managers in Light of COVID-19

As COVID-19 continues to spread throughout the globe, the ultimate effect on businesses and financial markets remains uncertain. At the same time, certain risks and disruptions to operations and performance have materialized, and investment advisers should consider their disclosure obligations and determine appropriate steps in communicating evolving circumstances to investors. This alert offers practical guidance for the managers of private equity and real estate funds weighing such considerations.

Read more

New York Moratorium on Residential and Commercial Evictions Extended Through August 20, 2020

On May 7, 2020, New York Governor Andrew Cuomo announced that the state’s moratorium on residential and commercial COVID-19-related evictions will be extended through August 20 and that new rent relief measures will be imposed. Executive Order 202.8, which established the eviction moratorium, was signed by Governor Cuomo on March 20, 2020. Among other measures, the order placed a stay on all residential and commercial evictions. This provision of the order, which was set to expire next month, will be extended an additional 60 days through August 20. In addition to extending the eviction moratorium, Governor Cuomo announced two additional measures to protect renters.

Read more

COVID-19 United Kingdom Weekly Webinar (May 11, 2020)

The COVID-19 pandemic is undoubtedly the biggest public health crisis of our times. Like many other countries, the UK Government has exercised broad powers and passed new laws that impact how we do business and interact as a society. To address the pandemic, the Government announced several sweeping regulations and ushered through the Coronavirus Act 2020. These actions have a broad impact on law, public policy and daily life, impacting areas including health, social welfare, commerce, trade, competition, employment and the free movement of people.

Join our team of Gibson Dunn London lawyers, led by partner and former Lord Chancellor Charlie Falconer QC, for a discussion of these changes and to answer your questions on how they will affect British businesses and community, including the impact on new and ongoing business relationships. This webinar will cover current plans to ease the lockdown restrictions; an introduction to the data protection aspects of contact tracing apps; and the UK Government’s Future Fund initiative, which aims to provide liquidity and investment to high-growth companies.

Read more

In this second part of our German corporate law Client Updates on corporate law issues and the M&A business in Germany in times of the Corona crisis, we provide an overview of various tendencies and trends that will influence the German transaction business beyond and partially irrespective of the specific legislative steps taken in response to the pandemic.[1] Such consequences arise, on the one hand, for company acquisitions which have not yet been completed in full and which were signed before the current economic and social restrictions came into effect and will, therefore, by their very nature not contain any provisions specifically designed to deal with the pandemic and, on the other hand, for future transactions in which the parties, at least, have an opportunity to address such pandemic-related or general economic distortions in their transaction documents.

Section 1 (M&A in Times of Financial Distress) gives a general overview of selected provisions of German insolvency law which will be of increasing importance for business acquisitions in cases where either the seller or the target company operates under financial distress or close to insolvency. Particular emphasis is put on (i) the application of rules that give the insolvency administrator an election right to either reject or continue to perform partly unfulfilled mutual contracts to company acquisition agreements in insolvency cases and (ii) the rules on insolvency contestation (Insolvenzanfechtung).

Section 2 (COVID-19 and M&A Transactions in Germany) then deals with selected topics in which COVID-19 and the economic distortions resulting from the pandemic will have an impact on the conduct of the parties and the interpretation of existing as well as the recommended structure and design of future transaction documents, both now and going forward, and beyond the above cases of urgent financial distress.

Finally, Section 3 (W&I Insurance in Times of COVID-19) deals with the specialist domain of W&I insurance as a popular structuring tool of M&A practice, because this is an area where an early market reaction by insurers to the crisis is already discernible and potential parties to a W&I insurance contract should be aware of these gradual shifts in market expectations and practices.

________________________

TABLE OF CONTENTS

1 M&A in Times of Financial Distress

2 COVID-19 and M&A Transactions in Germany

3 W&I Insurance in Times of COVID-19

________________________

1. M&A in Times of Financial Distress

The cross-sectoral economic effects of the Corona crisis are likely to lead to an increased number of transactions in the medium term where the seller or the target companies, but in certain cases also the purchaser, are operating under distress or the threat of impending insolvency. This trend should apply irrespective of the German Act on the Temporary Suspension of the Insolvency Filing Obligation and Liabililty Limitation of Corporate Body in cases of Insolvency caused by the COVID-19 Pandemic (“Gesetz zur vorübergehenden Aussetzung der Insolvenzantragspflicht und zur Begrenzung der Organhaftung bei einer durch die COVID-19-Pandemie bedingten Insolvenz“ – COVInsAG) that recently entered into force.[2]

This kind of crisis scenario makes the initial planning and structuring of M&A transactions, as well as the later implementation thereof, particularly challenging for the parties: Both sides are forced to make an informed risk assessment on a potential insolvency of their contract partner and/or the target involved and then settle on a structure that best prevents or mitigates such risk. The possible privileges accorded by the COVInsAG, if applicable, will be of particular interest to the parties. If the seller is in distress, the purchaser should, for instance, evaluate up front whether it might be preferable in terms of legal certainty to acquire the target in the framework of a “pre-packaged deal” in subsequent insolvency proceedings. To the extent, however, that either the seller and/or its main creditors do not consent to this approach, the purchaser is only left with the choice of either not proceeding with the desired transaction or trying to mitigate the risks of a later seller insolvency to the largest extent possible.

If German insolvency law is applicable to one of the contract parties, either due to the fact that the “center of main interest” (COMI), which is used to determine the applicable insolvency law, is in Germany or because there would be an option of opening German secondary insolvency proceedings (Sekundärinsolvenzverfahren) on the basis of the target’s German operations, the contracting parties are, in particular, faced with two main risks triggered by a later insolvency: On the one hand, the insolvency administrator (or in case of debtor-in-possession proceedings, the insolvent contract party itself) could choose to reject the continued performance of the enterprise sale and transfer agreement (“Acquisition Agreement“) if this mutual agreement at the time of the opening of insolvency proceedings has not yet been completely fulfilled by at least one of the two contract parties. On the other hand, the insolvency administrator might under certain circumstances decide to contest either the Acquisition Agreement itself and/or individual completion acts or actions thereunder.

Under both scenarios, the solvent counterparty (typically, the purchaser) could be faced with significant disadvantages including a near-total loss of its own performance actions already rendered (payment of purchase price) while, at the same time, either not receiving title and ownership in the target or facing a restitution and unraveling of an already occurred transfer of ownership.

1.1 Rejection Risk of Mutually Unfulfilled Contracts and Potential Safeguards

If insolvency proceedings are opened over the estate of a contract party (seller) at a time when the Acquisition Agreement has not yet been fully performed by, at least, one of its parties, the insolvency administrator is entitled to choose whether or not to continue to perform under the agreement (§§ 103 et seq. of the Insolvency Code (Insolvenzordnung – InsO). If the insolvency administrator elects non-performance and contract rejection, the mutual obligation not yet fully performed or satisfied become unenforceable. The counterclaims of the solvent contract party due to such non-performance become regular insolvency claims that must be filed to the insolvency table and which in the normal run of events are, thus, almost completely worthless in economic terms.

In the time period between the signing of the Acquisition Agreement and the closing there is significant potential for delays based on the customary closing conditions such as merger clearances(s) and other regulatory clearances, further required corporate steps such as board approvals and/or share transfer restrictions, necessary waivers of pre-emption rights, the change of the fiscal year or the termination of existing enterprise agreements (Unternehmensverträgen). Furthermore, there are many cases where the seller and the purchaser have agreed on ancillary agreements like transition services or license agreements between the seller and the target, the details of which are finally negotiated in the time window between the signing and the closing of the Acquisition Agreement. Such agreements are often a key component of the overall transaction but are also themselves subject to the risk of contract rejection by the insolvency administrator.

If the closing under the Acquisition Agreement has already taken place, i.e. the in rem transfer of title has occurred or, at least, the purchase price component owed at closing has already been paid, purchasers often feel they are on safe ground. However, since the assessment of the question whether a contract is indeed fully performed and obligations have been completely satisfied does not only take into account the performance of the mutual primary obligations (Hauptleistungspflicht) of the parties, but also any currently open ancillary obligations (Nebenpflicht), it will, in practice, be very difficult in most relevant acquisitions to argue successfully that all relevant contract obligations of one party are already fully performed. This is even more so in pending, not yet fully performed transactions concluded in times prior to the Corona pandemic where the parties would in most cases not have had reason to dig deeper into potential insolvency-related issues.

There are a number of customary clauses that may end up acting as regular barriers against a successful argument of full performance of the Acquisition Agreement even if the closing has already taken place, including purchase price adjustment clauses, earn-out agreements or purchase price retention amounts aimed at securing possible breaches of representations and warranties. As far as asset deals are concerned, but sometimes also in share deals, where certain target entities are not all owned by one central holding company, certain individual transfer acts under applicable foreign laws are often deferred at the closing date, be it because local share certificates may yet have to be handed over under mandatory local laws or because the necessary registration of an asset or share transfer in a local jurisdictions has not yet been duly made with the competent authorities. To the extent mandatory third party consent to certain transfer steps is necessary (for example, for contract assumptions or transfers), the seller is also unable to argue that the complete fulfillment of all aspects of the agreement has already occurred. There, in addition, are typical other purchaser rights such as potential claims due to breaches of representations and warranties and/or indemnities or non-compete undertakings with time limitations of often several years, as well as obligations to release or replace seller securities granted by the seller for the benefit of the targets, which the insolvency administrator is likely to use as auxiliary considerations to support his argument that the Acquisition Agreement as such has not yet been completely satisfied by at least one of the parties.

In order to avoid or mitigate these risks, the following potential safeguards (which, of course, cannot be addressed comprehensively in this context) should be considered when negotiating future transaction documents with parties in distress:

- The purchaser is particularly well-advised to document in scenarios where the seller has (urgent) liquidity needs or where the transaction could be viewed as a “fire-sale” that the purchase price negotiated and ultimately agreed on is a fair market price. Because the insolvency administrator will otherwise (be forced to) reject the continued performance of a mutually not yet fully fulfilled mutual contract if such contract is shown to be unduly disadvantageous. A competitive auction procedure or a fairness opinion may further militate against such decision by the insolvency administrator. The insolvency administrator may, furthermore, consider such contract rejection in asset deal scenarios based on the argument of individual creditors being unduly disadvantaged if the purchaser only assumes selective liabilities of the seller, because in a later insolvency it can be argued that such selective debt assumption unduly benefits creditors whose claims end up fully paid by the assuming purchaser to the detriment of the remaining creditors of the insolvent seller who will only receive the far-lower insolvency quota on their claims which the purchaser chose not to assume.

- To agree on specific insolvency-based contractual termination rights in favor of the purchaser in the time period between the signing and closing of the Acquisition Agreement in order to address a possible seller insolvency are very likely to be viewed as an impermissible circumvention of the insolvency administrator’s contract rejection right. A contractual termination right of the purchaser based on a mere deterioration of the seller’s financial position may, however, be feasible.

- To reduce the time window between signing and closing as much as possible could be a tool to minimize or mitigate the risk of a (further) deterioration in the financial position of a party in distress. To the extent legally possible and depending on the individual bargaining power in each specific case, the purchaser could also try to negotiate weather or that certain legal steps and circumstances that usually become closing conditions or closing actions can already be implemented prior to the signing of the Acquisition Agreement.

- The complete fulfillment of the contract by the purchaser can probably only be argued beyond material doubt if the purchaser pays a final one-off purchase price at closing without any additional purchase price adjustments or earn-out provisions being agreed on. As a tendency, a sale agreement with a locked-box mechanism would, therefore, appear to be the preferred choice in such crisis scenarios. From an insolvency-law perspective, it should also be considered to forfeit any attempts to negotiate purchase price retention amounts as a means of securing potential claims under representations and warranties or indemnities (even if such retention amounts are paid to an escrow account), because such structures also mean that the seller has not yet received the purchase price in full. An alternative worth exploring would be a directly enforceable bank guarantee (selbstschuldnerische Bankbürgschaft) or to take out W&I insurance to secure such claims of the purchaser.

- With a view to avoiding multiple transfer acts at closing, a share deal will often be the preferred option to an asset deal. If the parties nevertheless opt for an asset deal, the corresponding transfer acts at closing should be prepared meticulously and in detail and should all be taken on or about the closing date. In the context of movable assets, the purchaser may acquire a strongly protected position already via a retention of title (Eigentumsvorbehalt) and regarding real estate may protect itself against contract rejection by way of a recorded priority notice (Vormerkung), see §§ 106, 107 InsO. As far as acquiring rights (shares, IP, receivables) is concerned, no such expectant or inchoate rights worthy of protection (schutzfähige Anwartschaftsrechte) are granted in the context of the insolvency administrator’s election right to perform or reject contracts.

- In certain cases, the provisions in the Insolvency Code on already made partial performance (§ 105 InsO) may also help the purchaser as such partial performance do not have to be restituted as a rule. For instance, if individual transfer measures regarding certain – usually non-essential – assets in a transaction remain pending, such partial performance may be argued to exist. It would follow that the insolvency administrator usually could not reclaim or unravel the already transferred parts of the business solely based on his choice not to perform the outstanding contract as a whole. As far as business sales are concerned, such separate deal parts are, however, only assumed to exist if there is a separate partial business unit (Teilbetrieb) and the outstanding transfer act or implementation measure does not concern the “inseparable core business”.

- In cases where the conclusion of ancillary transition services agreements, license, lease or supply agreements with the insolvent seller is provided for in connection with the closing of the Acquisition Agreement, the purchaser should be aware that each of these agreements may, in turn, be subject to selective contract rejections rights of the insolvency administrator.

- The solvent party is able to achieve legal certainty on the continued fate of the mutually unfulfilled agreement by formally requesting the insolvency administrator to exercise the corresponding election right.

At the end of the day, a comfortable safeguard against the risk of potential rejection of further contract performance by the insolvency administrator will only be realistic for the purchaser if the Acquisition Agreement contains a fixed purchase price based on a locked-box transaction which is settled in full at closing. Indemnities or claims for breaches of representations and warranties could, in addition, be secured by a directly enforceable bank guarantee (selbstschuldnerische Bankbürgschaft) or W&I insurance taken out by the purchaser.

1.2 Contestation Risk and Precautionary Steps

A further possible challenge to the existence and implementation of a business acquisition lies in the risk of a later insolvency contestation (Insolvenzanfechtung). If the relevant prerequisites are met, the insolvency administrator may contest the Acquisition Agreement itself and/or individual performance acts related thereto (§§ 129 et seq. InsO). Under certain circumstances and if the contestation succeeds in the seller’s insolvency, the purchaser may have to re-transfer the performance received by him (i.e. the ownership of company assets or shares) back to the insolvent estate, while his corresponding repayment claim regarding the purchase price paid will normally only be a regular unsecured insolvency claim and, thus, be largely worthless in economic terms due to the low insolvency quota.

The contestation rights of the insolvency administrator are manifold. Under certain circumstances, however, the COVInsAG, which recently entered into force, may privilege the Acquisition Agreement and/or measures taken to implement it for a transitional period. In addition, certain general, precautionary measures are well-advised which will, at least, mitigate the risk of subsequent insolvency contestation.

1.2.1 Contestation of the Acquisition Agreement Itself

- In the first instance, the new provisions of the COVInsAG which will be in force until 30 September 2020[3] aim at suspending the obligation to file for insolvency in spite of existing illiquidity caused by COVID-19 and privilege the conduct of the corporate bodies in such scenarios. From a contestation perspective, in particular, loan agreements which provide new liquidity are privileged and exempted from later contestation for a limited period of time. However, the new law stops short of expressly declaring all agreements contestation-proof which were concluded during the period where the obligation to file for insolvency was suspended and which serve restructuring purposes. As far as the contestability of the Acquisition Agreement itself is concerned, the existing contestation rules are, therefore, likely to apply.

- When structuring and drafting the Acquisition Agreement, it is, thus, of particular importance to prevent a potential later contestation of the Acquisition Agreement based on an argument that creditors are directly disadvantaged (§ 132 InsO). This contestation option exists if the disadvantage for creditors is directly caused by the Acquisition Agreement itself, the seller was illiquid at the time of the signing of the Acquisition Agreement and the purchaser knew of these circumstances, provided that the conclusion of the Acquisition Agreement occurred in a period three months prior to the filing for insolvency or after such filing. The argument that the purchase price was set below the threshold of the fair market value can be refuted by reference to a competitive auction process. Alternatively, a fairness opinion by an independent expert can be obtained. If the purchaser does, however, assume selected but not all of the seller’s liabilities in an asset deal, a disadvantage for creditors in a later insolvency may already be seen in the fact that only the creditors of the assumed liabilities were fully satisfied by the purchaser, whereas the remaining creditors of the seller were left to settle for the much lower quota.

Any imputed knowledge of illiquidity can, in practice, be refuted by a positive confirmation of solvency in an analysis of the insolvency status prepared by an expert according to standard IDW S 11 (Analyse der Insolvenzreife nach IDW S 11). In certain cases, it may also be opportune to fix a closing date that is more than three months after the signing of the Acquisition Agreement. However, such approach runs contrary to the above suggested aim of quickly achieving full performance of the agreement in order to preempt the insolvency administrator’ election right to either reject or continue to perform under a contract which is partly still unfulfilled by both parties.

- The contestation of the Acquisition Agreement due to disadvantaging creditors with intent (§ 133 InsO) in cases of impending illiquidity (drohende Zahlungsunfähigkeit) of the seller and seller’s intention to disadvantage his creditors requires the purchaser to know of such circumstances. The purchaser can protect himself against such allegation by submitting an expert analysis of the insolvency status, which also covers impending illiquidity, as well as a restructuring expert opinion under standard IDW S 6, which concludes that the seller’s restructuring efforts have a serious expectation of being successful.

1.2.2 Contestation of Closing Actions / Performance Measures

- The newly enacted COVInsAG (§ 2 para. 1 no. 4) generally declares performance acts which are congruent in terms of time and substance to be exempt from contestation for a transitional period until 30 September 2020[4], unless the restructuring and refinancing efforts of the seller were unsuitable to remedy the crisis and the buyer knew about this. According to the wording, the privileged exemption applies without restrictions to all performance acts, i.e. a restriction to performance acts related to credit agreements is not provided for in the new law. Having said that, the official legal justification of the new law (Gesetzesbegründung) reasons that the new provision is intended to protect the performance of existing contracts with suppliers or under recurring long-term obligations against insolvency contestation rights, as the relevant counterparties would otherwise be forced to terminate the business or contractual relationship, which, in turn, would frustrate restructuring efforts. Even though there is not yet any indication for a prevailing opinion on the scope of this protection clause against contestation under the COVInsAG, there are good reasons to argue that it also covers performance actions under an Acquisition Agreement. The purchaser would, thus, be protected if he is able submit an expert opinion on the restructuring of the company which considers a successful restructuring to be likely when taking into account the transaction proceeds.

- If the privileged exemption under COVInsAG is held not to apply, the seller would again need to evidence that the seller was not illiquid at the closing date by submitting an expert analysis of the insolvency status to avoid a contestation risk under the header of contestation of congruent performance actions (§ 130 InsO – Kongruenzanfechtung von Erfüllungshandlungen).

- When attempting to avoid a contestation under the header of intentionally disadvantaging creditors through performance acts that are congruent from a temporal and substantive perspective (§ 133 para. 3 InsO – Anfechtung wegen vorsätzlicher Benachteiligung durch inhaltlich und zeitlich kongruente Erfüllungshandlungen), the solvent party may refute the allegation that actual illiquidity existed at the time the closing actions were taken by submitting an expert analysis on the insolvency status according to standard IDW S 11. The counterparty’s imputed knowledge of a debtor’s possible intent to disadvantage creditors presumed by law is likely rebutted as well, although this has not yet been confirmed by rulings of the highest court(s). An update as of closing of the expert restructuring opinion pursuant to standard IDW S 6 already obtained at signing should eliminate any remaining grounds for the insolvency administrator to justify a contestation based on intent.

- Furthermore, if the purchaser succeeds in structuring the performance of the agreement as a so-called “cash deal” (§ 142 InsO – Bargeschäft), the contestation rights of the insolvency administrator to challenge performance actions are excluded per se, with the exception of disadvantaging creditors with intent (§ 133 para. 3 InsO). In order to qualify a transaction as a cash deal, the parties must exchange performances of equivalent worth directly, i.e. in close temporal proximity. Since the exchanged performance must be objectively of equivalent value, absolute deal certainty can ultimately only be obtained by way of a valuation expert opinion. However, a competitive auction process or, if applicable, a fairness opinion might also provide meaningful indications in this regard.

The necessary temporal link permits staggered closing actions or implementation steps only to a very limited extent, even though strictly simultaneous performance (Zug-um-Zug) is not mandatory but recommended. Purchase price retention amounts to secure potential claims for breaches of representations and warranties, purchase price adjustment clauses and, especially, earn-out provisions should be avoided. If the purchaser wants to agree on and implement a “cash deal” within the meaning of insolvency law, he should, as a precaution, also consider not to include a conditional assignment of share title already in the Acquisition Agreement.

- Finally, specific issues arise if the seller also concludes further ancillary agreements either with the purchaser or the target at the closing, such as lease or tenure agreements (Miet- oder Pachtverträge), license agreements, supply agreements, transitional services agreements or the like, which, in turn, are subject to separate contestation rights.

- Unlike in the case of the insolvency administrator’s election right to either reject or continue to perform under pending contracts, the insolvency administrator cannot be forced into a timely decision on his potential contestation right. This causes considerable uncertainty for the purchaser (whilst giving the insolvency administrator strong leverage in negotiations) since the contestation right is only limited by the regular three year time limitation period under German law.

In summary, reducing the risk of possible subsequent contestation requires some effort on the part of the purchaser. In addition to a fairness opinion and an expert analysis of the insolvency status, a restructuring expert opinion in accordance with standard IDW S 6 may also be well-advised, but the purchaser will have to rely on the cooperation of the seller in this regard. The respective mutual performance actions should, in an ideal case, be agreed upon and implemented as a cash deal with a simultaneous exchange of performance actions. At least on a literal reading of the wording, the purchaser could also rely on COVInsAG to make performance actions taken during the transitional period contestation-proof if a positive expert restructuring opinion exists.

2. COVID-19 and M&A-Transactions in Germany

2.1. Acquisition Agreements in the Pre-Closing Phase

Whereas the start of 2020 was still characterized by lively M&A activities, the German market was taken by surprise in March by the speed and massive impact of the COVID-19 pandemic. For the majority of investors and companies, measures to stabilize sales and liquidity were and are still the focus of attention.

In this situation, a share purchase agreement (the “Acquisition Agreement“) already signed but not yet closed may represent a welcome influx of liquidity for the seller, while the same agreement may now be viewed as a drain on liquidity by the buyer which might no longer be welcome. Various contractual and legal provisions may play a role in this dilemma, which are outlined below and may also serve as guidelines for negotiations of Acquisition Agreements in the near future.

2.1.1 Provisions in the Acquisition Agreement

a) Termination Clauses

The respective Acquisition Agreement usually provides for a termination provision which, in principle, allows both parties to terminate the agreement if the transaction has not been completed (closing) by a certain long stop date. Also, further provisions, which frequently are agreed and allow unilateral termination before the long stop date has occurred, usually require that the closing has become impossible due to the definitive frustration of a closing condition. Not least because deal certainty is regularly a priority for both parties to an Acquisition Agreement, it seems fair to expect that a general right of termination or a termination due to the effects of COVID-19 can only in rare cases be based on the agreed upon regular termination provisions. However, even if the conditions for terminating the Acquisition Agreement are met, the actual exercise of this right will require careful review of whether such termination would, in turn, result in an obligation to pay any pre-agreed contractual penalties, break-up fees or damages to the counterparty.

b) Specific Closing Conditions: Merger Clearance and Material Adverse Change

(i) Merger Clearance

If a contractual termination right in the Acquisition Agreement is tied to the failure of closing occurring within a certain agreed-upon timeframe, the necessary analysis must consider, first and foremost, the specific closing conditions agreed in each individual case. One of the key closing conditions in this context regularly is obtaining merger clearance by the specifically named anti-trust authorities. The impact of the COVID-19 pandemic on the work of these anti-trust authorities varies greatly from jurisdiction to jurisdiction.[5] In the case of M&A transactions that have been signed but have not yet closed, the contract parties would, thus, be well-advised to examine in each case whether the originally envisaged time frame is (still) sufficient, whether and which complications and delays are possible and what measures could or even must be taken to further ongoing proceedings. Where appropriate, it is recommended to enter into timely discussions on the potential adjustment of the long stop date.

If no amicable agreement can be reached in this respect, further questions under contract law could arise: This is so because, irrespective of any statutory obligations to adjust or modify the contract (see below on § 313 of the German Civil Code (Bürgerliches Gesetzbuch, BGB), there may be contractual provisions in the Acquisition Agreement which could conceivably result in an obligation of a contracting party to agree to an adjustment of the contract. In practice, there are some cases, for instance, where a general mutual obligation to cooperate and facilitate the closing is included in the Acquisition Agreement or the severability clause provides for an obligation to agree on a fair commercial solution if unforeseen or unforeseeable contractual gaps or omissions later become apparent. Whether such provisions indeed lead to a contractual adjustment obligation of a contracting party can only be assessed on the basis of the individual provision in the relevant Acquisition Agreements.

(ii) Material Adverse Change

Another contractual provision in the Acquisition Agreement, which may lead to either a contract adjustment, potential compensation payments or even to the termination of the Acquisition Agreement, depending on the substance of the clause in question, are so-called Material Adverse Effect (MAE) or Material Adverse Change (MAC) clauses. Essentially, these are clauses which – if agreed as a closing condition or as a right of rescission – provide for a closing reservation to address the occurrence of unforeseen, material adverse developments of the target company’s business (so-called Business or Target MAC) between signing and closing, or, less frequently, with regard to the industry in which the target company operates (so-called Market MAC), which have a value-diminishing long-term impact on the target company. If such an adverse development occurs or exists, the purchaser does not have to close or complete the transaction.

Under the seller-friendly M&A market conditions prevalent in recent years, the inclusion of such clauses has become more rare. However, if the Acquisition Agreement contains a MAC clause, the issue of its interpretation will likely come more into focus now. Whether the COVID-19 pandemic and its consequences actually constitute a material adverse change event must be carefully determined on the basis of the specifically agreed clause and the details and spheres of knowledge of the parties at the time of entering into the Acquisition Agreement. Even if the MAC clause does not contain any specific wording regarding the inclusion or exclusion of epidemics or pandemics, this is only the starting point for such an analysis.

In a second step, the agreed upon exclusions then need to be assessed: In particular, it may be required to clarify whether the frequently used exclusion of general or industry-specific negative market developments is applicable here, and then again whether there might be a counter-exception in case the target company is disproportionately affected by these developments.

A further issue that needs reviewing in the specific MAC clause is the exact reference point in time for, and probability threshold of, the MAC event occurring. There will also be cases where – depending on the industry – certain adverse effects are (partly) becoming apparent already now, but have not yet (fully) materialized. In such scenarios, the outcome will depend on whether the wording of the clause only covers disadvantages that have already occurred or also – already foreseeable – future consequences.

It is also crucial by which criteria the materiality of an event is to be measured. In some cases, the parties agree on specific thresholds (e.g., a reduction of EBITDA by x%). If such materiality criterion is not defined in greater detail, this must be assessed by interpreting the agreement with specific focus on the target company.

Finally, even if a MAC event has occurred, the contractual consequences provided for in the agreement must be clarified. Withdrawal from the Acquisition Agreement or a refusal to close the deal may only be the ultima ratio. It would also be conceivable to negotiate in good faith on the adaptation of the Acquisition Agreement to the changed commercial circumstances.

2.1.2 Statutory Provisions on the refusal to Perform or the Adaptation of the Agreement

The issue whether the parties to an Acquisition Agreement may also rely on the statutory provisions in view of the COVID-19 pandemic is likely to be a matter of increasing activity for (arbitration) tribunals in the near future: In particular, the legal instruments in the event of a disruption to the basis of the transaction (Störung der Geschäftsgrundlage) pursuant to § 313 BGB are likely to be at the forefront. These rules allow the adaptation of the contract or, in case of impossibility or unreasonableness of such adaptation, the rescission of the contract, if the parties’ mutual conceptions on which the agreement was based have changed to such an extent that one party cannot reasonably be expected to adhere to the unchanged contract. With the COVID-19 pandemic, the various restrictive governmental measures to combat the spread of the virus, but also, in turn, specific governmental stabilization and support measures and, in many cases, the grave effects thereof on the business of the target company, its profitability and the assumptions in the business plan, may be seen, at a first glance, as such momentous changes arising from the COVID-19 pandemic without either of the parties having been in a position to foresee such impact or be held responsible for the consequences. However, even if the manifold economic effects resulting from the outbreak of the pandemic seem to be a textbook example of a disruption of the contractual performance obligations, the legal significance of such disruption must be analyzed in a differentiated manner and on the basis of the specific contractual agreements.