On January 10, 2020, the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice released for public comment draft Vertical Merger Guidelines, which would replace the Non-Horizontal Merger Guidelines originally published by the agencies in 1984.

Vertical mergers combine two or more companies that operate at different levels of the same supply chain. According to the draft Vertical Merger Guidelines, the principles and analytical framework used to assess horizontal mergers also apply to vertical mergers, and thus, the new guidelines are intended to be read in conjunction with the agencies’ 2010 Horizontal Merger Guidelines. Common issues such as defining relevant product and geographic markets, evaluating entry considerations, treatment of a failing firm, and partial ownership acquisitions are addressed in the Horizontal Merger Guidelines, while the draft Vertical Merger Guidelines address distinct considerations raised by vertical mergers.

The draft Vertical Merger Guidelines do not appear to signal an intent to increase scrutiny of vertical mergers or a change in enforcement priorities. Rather, FTC Chairman Joseph Simons and Assistant Attorney General Makan Delrahim emphasized that the new guidelines are intended to more accurately describe current agency practice and provide greater transparency on how the agencies approach vertical mergers.

The Commission vote to publish the draft Vertical Merger Guidelines was 3-0-2, with Commissioners Rebecca Kelly Slaughter and Rohit Chopra abstaining. Public comments on the draft can be submitted to the agency by February 11, 2020. Although the guidelines may be modified after public comments are received, major changes are unlikely. If they are finalized without major changes, these guidelines are likely to govern the agencies’ analysis, practice, and enforcement decisions with respect to vertical mergers for years to come.

Highlights

- Related Products and Relevant Markets: The draft guidelines describe how for analytical purposes the agencies normally will identify one or more relevant markets in which a vertical merger may substantially lessen competition. The agencies also will identify one or more “related products” – that is, products or services that are “vertically related to the products or services in the relevant market and to which access by the merged firm’s rivals affects competition in the relevant market.” A “related product” could be an input, a means of distribution, or access to customers.

- Safe Harbor: The draft guidelines state that the agencies are unlikely to challenge a vertical merger where the parties to the merger have less than 20 percent share in the relevant market and the related product is used in less than 20 percent of the relevant market. The agencies stress that these thresholds are not bright line rules. Mergers involving shares above these thresholds do not necessarily raise competitive concerns, and shares below these thresholds might raise competitive concerns, depending on the circumstances.

- Unilateral Effects: The draft guidelines outline two ways in which vertical mergers could have unilateral anticompetitive effects – that is, ways in which the merger could increase the ability or incentive of the merged firm to increase prices or reduce output on its own. First, a vertical merger could allow the merged firm to weaken a competitor by foreclosing that rival from or raising the rival’s costs to access a related product, such as a necessary input or distribution channel. Second, a vertical merger could diminish competition by giving the merged firm access to competitively sensitive information of its upstream or downstream rivals, causing the merged firm to moderate its competitive response.

- Coordinated Effects: The draft guidelines also explain how a vertical merger could make a market more vulnerable to coordination by weakening or eliminating a maverick firm that would otherwise thwart anticompetitive coordination. Alternatively, according to the draft guidelines, a vertical merger might facilitate anticompetitive coordination by giving the merged firm access to competitively sensitive information.

- Elimination of Double Marginalization: When two vertically related firms merge, the merged firm is often able to profitably reduce its downstream prices. The draft guidelines acknowledge that this reduction, called the elimination of double marginalization (“EDM”), benefits both the merged firm and buyers of the downstream product or service. The draft guidelines put the burden on the merging parties to demonstrate whether and how the merger eliminates double marginalization, but states that the agencies will not challenge a merger if the net effect of the EDM means the merger is not likely to be anticompetitive.

- Efficiencies: The draft guidelines acknowledge that to the extent a vertical merger combines complementary assets, it has the potential to create other efficiencies that may benefit consumers. The agencies will evaluate those claimed efficiencies using the approach outlined in the Horizontal Merger Guidelines.

Potential Implications

As noted above, the release of draft Vertical Merger Guidelines does not signal increased enforcement of the antitrust laws with respect to vertical mergers. The 1984 Non-Horizontal Merger Guidelines were widely considered to be woefully out of date and did not reflect modern antitrust analysis. The draft guidelines reflect the agencies’ effort to provide merging parties and their representatives with greater transparency as to the analytical framework they use today.

For example, much of the agencies’ recent enforcement regarding vertical mergers focused on allegations that the vertical merger would foreclose rivals, although that theory is not discussed in the 1984 Guidelines. The draft guidelines include for the first time a description of how vertical mergers can harm competition by enabling the merged firm to foreclose rivals from necessary supply or distribution channels or raise its rivals costs for those products or services. This reflects DOJ’s theory of harm in its unsuccessful challenge of AT&T’s merger with Time Warner, where it alleged that the acquisition would provide AT&T with the ability and incentive to raise the cost of Time Warner programming to its competitors (other video programming distributors).

In discussing the theories regarding foreclosure and raising rivals costs, the draft guidelines introduce the term “related product.” According to the draft guidelines, for example, an input or distribution channel is “related” if a rival’s access to that product or service affects competition in the relevant market. It does not appear that the agencies intend the “related product” concept to support a separate theory of harm. Rather, it is discussed solely in the context of the foreclosure and raising rivals costs theories It remains to be seen how the agencies will identify related products in practice, and in particular how they will determine whether access to a potentially related product affects competition in the relevant market.

The draft guidelines also eliminate some theories outlined in the 1984 Non-Horizontal Merger Guidelines, including the theory that a vertical merger could raise barriers to entry by effectively requiring new rivals to simultaneously enter the upstream and downstream markets. The draft guidelines also eliminate reference to vertical mergers harming competition by enabling the merged firm to evade rate regulation.

As noted above, the draft guidelines provide a potentially useful “safe harbor” for cases in which the merged firm has less than 20 percent share of the relevant market and the related product is used in less than 20 percent of the relevant market. This threshold, however, is substantially lower than the safe harbor applied by the European Commission, which is unlikely to challenge a vertical merger if the merged firm has less than 30 percent share in the relevant and related markets.

The draft Vertical Merger Guidelines do not reference remedies and it is not clear whether or how these new guidelines will impact the agencies’ consideration of remedies. Even when vertical mergers have the potential to harm competition, they also often yield substantial efficiencies. Historically, the agencies have sought to resolve concerns with vertical mergers while preserving those efficiencies. In its 2011 Policy Guide to Remedies, the DOJ stated that it would consider tailored conduct remedies to prevent potential harms of vertical mergers while still allowing efficiencies to be realized. In 2018, however, the DOJ withdrew the 2011 Guide, leaving in place the 2004 Policy Guide, which strongly disfavors conduct remedies in favor of structural remedies like divestiture.

Gibson, Dunn & Crutcher lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn attorney with whom you work in the Antitrust and Competition Practice Group, or the following authors:

Kristen C. Limarzi – Washington, D.C. (+1 202-887-3518, [email protected])

Adam Di Vincenzo – Washington, D.C. (+1 202-887-3704, [email protected])

Please also feel free to contact any of the following practice group leaders and members:

Antitrust and Competition Group:

Washington, D.C.

D. Jarrett Arp (+1 202-955-8678, [email protected])

Adam Di Vincenzo (+1 202-887-3704, [email protected])

Scott D. Hammond (+1 202-887-3684, [email protected])

Kristen C. Limarzi (+1 202-887-3518, [email protected])

Joshua Lipton (+1 202-955-8226, [email protected])

Richard G. Parker (+1 202-955-8503, [email protected])

Cynthia Richman (+1 202-955-8234, [email protected])

Jeremy Robison (+1 202-955-8518, [email protected])

Chris Wilson (+1 202-955-8520, [email protected])

New York

Eric J. Stock (+1 212-351-2301, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Los Angeles

Daniel G. Swanson (+1 213-229-7430, [email protected])

Samuel G. Liversidge (+1 213-229-7420, [email protected])

Jay P. Srinivasan (+1 213-229-7296, [email protected])

Rod J. Stone (+1 213-229-7256, [email protected])

San Francisco

Rachel S. Brass (+1 415-393-8293, [email protected])

Dallas

Veronica S. Lewis (+1 214-698-3320, [email protected])

Mike Raiff (+1 214-698-3350, [email protected])

Brian Robison (+1 214-698-3370, [email protected])

Robert C. Walters (+1 214-698-3114, [email protected])

Brussels

Peter Alexiadis (+32 2 554 7200, [email protected])

Attila Borsos (+32 2 554 72 11, [email protected])

Jens-Olrik Murach (+32 2 554 7240, [email protected])

Christian Riis-Madsen (+32 2 554 72 05, [email protected])

Lena Sandberg (+32 2 554 72 60, [email protected])

David Wood (+32 2 554 7210, [email protected])

Munich

Michael Walther (+49 89 189 33 180, [email protected])

Kai Gesing (+49 89 189 33 180, [email protected])

London

Patrick Doris (+44 20 7071 4276, [email protected])

Charles Falconer (+44 20 7071 4270, [email protected])

Ali Nikpay (+44 20 7071 4273, [email protected])

Philip Rocher (+44 20 7071 4202, [email protected])

Deirdre Taylor (+44 20 7071 4274, [email protected])

Hong Kong

Kelly Austin (+852 2214 3788, [email protected])

Sébastien Evrard (+852 2214 3798, [email protected])

© 2020 Gibson, Dunn & Crutcher LLP

Attorney Advertising: The enclosed materials have been prepared for general informational purposes only and are not intended as legal advice.

I. Introduction: Themes and Notable Developments

A. Behind and Beyond the Enforcement Numbers

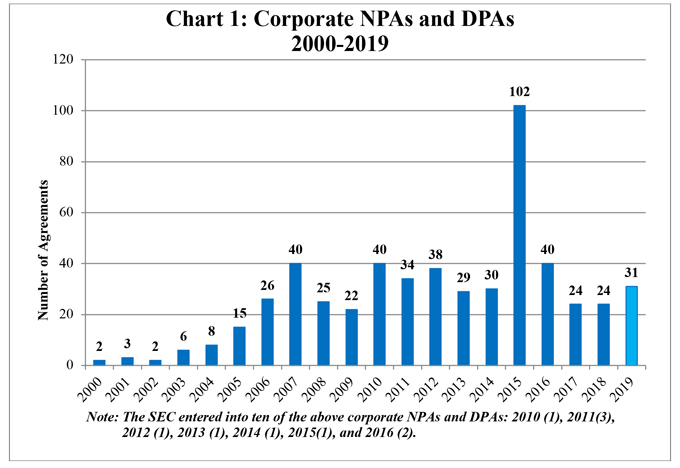

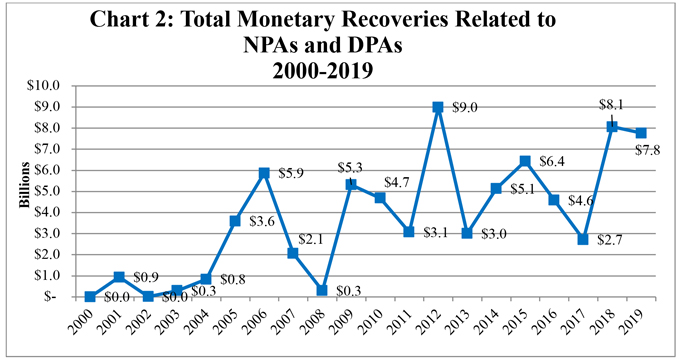

This year, the SEC’s review of the performance of the Enforcement Division has de-emphasized the statistics and focused more on qualitative measures of its performance. As Chairman Clayton noted in his December testimony to the Senate Banking Committee, “purely quantitative measures alone cannot adequately measure the effectiveness of Enforcement’s work, which can be evaluated better by assessing the nature, quality and effects of each of the Commission’s enforcement actions with an eye toward how they further the agency’s mission.”[1]

With that said, this fiscal year saw a spike in the number of enforcement actions – the number of standalone enforcement actions increased to 526 from 490 the prior year, and the amount of financial remedies obtained also increased to $4.3 billion from $3.9 billion the prior year. However, an unstated reason to avoid focus on statistical metrics could be that looking behind the numbers reveals that the increase is attributable to a one-time Mutual Fund Share Class Disclosure Initiative, a group of cases in which investment advisers were encouraged to self-report issues associated with the selection of fee-paying mutual fund share classes when a lower or no-cost share class of the same fund was available. Consequently, the apparent increase is more likely an anomaly than a trend.[2]

As in prior years under this administration, the SEC’s Enforcement Division this year continued to focus on cases impacting retail investors and on cyber-related cases, including initial coin offerings and other digital assets. Given this current administration continues for at least another year, one should not expect dramatic changes in the focus of the Enforcement Division next year.

After several years of a freeze on hiring, during which staffing numbers declined due to attrition, this year’s budget did provide the Enforcement Division with additional hiring authority. However, although headcount for Enforcement (as well as the Commission generally) increased slightly from the prior year, staffing is still well below its peak in 2016.

One positive trend note to look for in the coming year is an increased focus on reducing the duration of investigations. The Enforcement Division’s Annual Report notes that on average investigations that result in enforcement actions take an average of two years, and that the more complex accounting and disclosure cases take an average of three years. This does not include investigations that do not result in any enforcement action, which can remain open even longer, leaving those subject to investigations in an indefinite state of uncertainty. While it is encouraging that the Enforcement Division is taking steps to shorten the duration of investigations, it will remain to be seen whether the Commission is able to achieve any meaningful success in this regard.

B. Insider Trading Developments

On December 30, 2019, the Second Circuit issued a significant opinion in United States v. Blaszczak that heightens the risk of investigation and prosecution in certain types of insider trading cases.[3] In Blaszczak, a Center for Medicare & Medicaid Services (“CMS”) employee, a “political intelligence” hedge fund consultant, and two hedge fund employees were charged in an insider trading scheme whereby confidential “predecisional” CMS information regarding planned changes to medical reimbursement rates was allegedly disclosed via the consultant to the hedge fund employees, who then directed their hedge fund to short stocks of healthcare companies that would be hurt by the reimbursement rate changes. After trial, a jury verdict found the defendants not guilty of insider trading under Title 15 (the Securities Exchange Act provision prohibiting securities fraud), which required that the defendants knew that the tipper received a personal benefit, but found the defendants guilty under Title 18 (a criminal securities fraud provision added in the 2002 Sarbanes-Oxley Act to the wire fraud statute), which did not require a personal benefit to the tipper. On appeal, the Second Circuit considered two primary issues: (1) whether the requirement in insider trading cases brought under Title 15 that the tipper receive a personal benefit and the tippee have knowledge of that personal benefit applied to the Title 18 criminal securities fraud provision; and (2) whether confidential predecisional government information constituted government “property,” a necessary element for the convictions.

Reasoning that the Securities Exchange Act and Sarbanes-Oxley securities fraud provisions were rooted in different purposes, the Second Circuit refused to extend the Title 15 personal benefit requirement to the Title 18 securities fraud and wire fraud provisions. In addition, the Second Circuit, in a 2-1 decision, held that confidential government information may constitute government “property,” analogizing it to “confidential business information” that the Supreme Court had previously held to be property. The Second Circuit therefore affirmed the convictions. Blaszczak heightens the risk of DOJ investigation and prosecution in the subset of insider trading cases where there is limited-to-no-evidence of personal benefit to the tipper or the downstream tippee’s knowledge of the personal benefit. The decision makes it more likely that prosecutors will routinely bring Title 18 securities fraud and wire fraud charges in conjunction with Title 15 charges, especially given the continually evolving case law regarding what constitutes a “personal benefit.” Blaszczak also heightens the risk of both SEC and DOJ investigations in cases involving trading while in possession of a wide range of confidential executive agency information, whether obtained directly from a government employee or, as was the case in Blaszczak, from a consultant with access to government employees.

For further information on the Blaszczak decision and its implications, please see our separate Client Alert, “United States v. Blaszczak: Second Circuit Ruling Heightens Risks of Insider Trading Investigations and Prosecutions.”

C. Legislative Developments

On December 9, 2019, the US House of Representatives overwhelmingly passed the Insider Trading Prohibition Act (the “Act”), 410 to 13, which, if enacted, would codify a ban on insider trading. See H.R. 2534 116th Cong. § 16A. The Act amends the Securities Exchange Act of 1934 (15 U.S.C. § 78a et seq.), the securities fraud provisions of which courts have previously interpreted to prohibit insider trading. The Act, which is currently pending in

the Senate, largely adopts existing insider trading caselaw and theories of liability. In its current form, the Act does not amend the criminal securities fraud provision 18 U.S.C. § 1348, which, similar to the Securities Exchange Act, courts have interpreted to prohibit insider trading.

Section (a) of the Act would prohibit trading securities while aware of “material, nonpublic information relating to [a security], or any nonpublic information… that has, or would reasonably be expected to have, a material effect on the market price of [the security]” if the person “knows, or recklessly disregards, that such information has been obtained wrongfully” or that the transaction “would constitute a wrongful use of such information.” Id. § 16A(a). Section (b) would prohibit anyone who would be prohibited from trading under section (a) from “communicat[ing] material, nonpublic information relating to such security…to any other person if” (1) the other person trades “any security. . . to which such communication relates” or “communicates the information to another person who makes or causes such a purchase, sale, or entry,” and (2) “the purchase, sale, or entry . . . is reasonably foreseeable.” Id. § 16A(b).

The Act applies to information that is “obtained wrongfully” or where use would be “wrongful.” It clarifies that “trading while aware of material, nonpublic information . . . or communicating material nonpublic information. . . is wrongful only if the information has been obtained by, or its use would constitute. . . (A) theft, bribery, misrepresentation, or espionage (through electronic or other means); (B) a violation of any Federal law protecting computer data or the intellectual property or privacy of computer users; (C) conversion, misappropriation, or other unauthorized and deceptive taking of such information; or (D) a breach of any fiduciary duty, a breach of a confidentiality agreement, a breach of contract, a breach of any code of conduct or ethics policy, or a breach of any other personal or other relationship of trust and confidence for a direct or indirect personal benefit (including pecuniary gain, reputational benefit, or a gift of confidential information to a trading relative or friend).” Id. § 16A(c)(1). In addition, the Act has a “knowledge requirement” mandating that the person “was aware, consciously avoided being aware, or recklessly disregarded that such information was wrongfully obtained, improperly used, or wrongfully communicated,” although the person is not required to know “whether any personal benefit was paid or promised.” Id. § 16A(c)(2).

This is not the first time Congress has considered a statutory definition of insider trading. Advocates of such legislation argue that a statutory definition will bring clarity to an area of the law developed through decades of judicial interpretation of a general anti-fraud statute. However, since the House bill, like similar prior attempts a legislation, generally seeks to embody existing legal theories, critics argue that such attempts do little to simplify a complex and nuanced set of issues and actually risks adding vagueness and uncertainty. Moreover, despite significant support for the bill in the House, there appears to be little enthusiasm in the Senate for pursuing such legislation, particularly in the final months before the next election.

D. Litigation Developments

Looming over the Enforcement Division in the coming year will a case before the Supreme Court which presents the question of whether the SEC is authorized to pursue one of its mainstay remedies — disgorgement of so-called ill-gottten gains — in enforcement actions in federal district court. There is no statute which expressly authorizes the SEC to obtain disgorgement in these federal enforcement actions, unlike in administrative proceedings where there is specific authority for the SEC to seek disgorgement. Rather, the securities laws enumerate certain statutorily defined penalties that the SEC may recover in appropriate circumstances. Nevertheless, historically, federal courts have ordered disgorgement as an equitable remedy. In its 2017 decision in Kokesh, the Supreme Court held that the remedy of disgorgement constituted a penalty and therefore was subject to the 5-year statute of limitations on penalties. The Enforcement Division estimates that as of the end of the 2019 fiscal year, the 5-year statute of limitations put beyond the SEC’s reach $1.1 billion in alleged ill-gotten gains. In a footnote to the Kokesh decision, the Court noted that the case did not present, and the Court would not decide, whether the SEC is authorized to obtain disgorgement.

In November, the Supreme Court granted certiorari in Liu v. SEC, in which a defendant in an enforcement action was ordered to pay disgorgement as part of a final judgment entered by the district court. Before appealing to the Ninth Circuit, the Supreme Court decided Kokesh. The appellant argued to the Ninth Circuit that, in light of the decision in Kokesh that disgorgement is a penalty, and there is no statutory authorization for the SEC to seek disgorgement as a penalty, the SEC lacks authority to seek disgorgement. The Ninth Circuit affirmed the District Court’s disgorgement order based on pre-Kokesh precedent and the fact that Kokesh had expressly declined to address the question. The issue is now squarely before the Supreme Court. If the Supreme Court disallows disgorgement, the SEC’s enforcement program will be significantly weakened, that is, unless Congress steps in with a legislative solution to authorize the disgorgement remedy expressly.

E. Commissioners and Senior Staffing Update

During the latter half of 2019, there were a number of leadership changes, several of which reflect the advancement of lawyers with many years of experience in the Division of Enforcement to positions of senior leadership.

On July 8, Allison Lee was sworn in as the fifth Commissioner, bringing the Commission back to its full complement of five Commissioners. As we noted in our Mid-Year Alert, Commissioner Lee replaces prior Democratic Commissioner Kara Stein. Commissioner Lee previously served at the Commission for over a decade, including as counsel to Commissioner Stein, as well as a Senior Counsel in the Complex Financial Instruments Unit of the Division of Enforcement.

A change in the other Democratic Commissioner, Robert Jackson, also appears to be on the horizon. For several months there have been reports that Commissioner Jackson would be stepping down soon to return to teaching at NYU Law School. (Although Commissioner Jackson’s term formally ended in June 2019, Commissioners may continue for another 18 months.) According to media reports shortly before the end of the year, Senator Chuck Schumer proposed to the White House that Caroline Crenshaw, an attorney currently working for Commissioner Jackson, be nominated as his replacement. Crenshaw has been employed at the SEC since 2013, and, like Commissioner Lee, previously worked under Democratic commissioner Kara Stein. Crenshaw is also a judge advocate in the U.S. Army Judge Advocate General’s Corps.[4]

Other changes in the senior staffing of the Commission include:

- In September, Monique Winkler was appointed Associate Regional Director in the SEC’s San Francisco Office. As Associate Regional Director, Ms. Winkler oversees the Enforcement program for the San Francisco Office. Ms. Winkler has worked at the SEC since 2008, including working in the Enforcement Division’s Public Finance Abuse Unit.

- In October, Katharine Zoladz was appointed Associate Regional Director in the SEC’s Los Angeles Office. As Associate Regional Director, Ms. Zoladz, co-heads the Enforcement program for the Office, along with Associate Regional Director Alka Patel. Ms. Zoladz has worked at the SEC since 2010, including working in the Asset Management Unit.

- In November, Chief Administrative Law Judge Brenda Murray retired after 50 years of federal service, including 25 years as Chief Administrative Law Judge.

- In December, Kristina Littman was appointed Chief of the Enforcement Division’s Cyber Unit. Ms. Littman has worked at the SEC since 2010, including working in the Enforcement Division’s Market Abuse Unit and Trial Unit, and most recently, as counsel to Chairman Clayton.

F. Whistleblower Awards and Cases

The SEC’s whistleblower program continues to provide significant financial awards to whistleblowers. As of the end of 2019, the SEC has awarded a total of approximately $390 million to 71 individual whistleblowers. This is a reminder of the powerful financial incentive the program provides to would-be whistleblowers. In fiscal year 2019, the SEC received over 5,200 whistleblower tips. The size of whistleblower payments, in addition to the volume of tips coming through the whistleblower office, emphasize the importance of a company’s response to internal complaints from employees who could become whistleblowers. Maintaining a record of investigating internal complaints can put a company in a position to respond to SEC inquiries if and when the government comes calling.

In the second half of 2019, the SEC granted several whistleblower awards that were significant, though not on the scale of the largest awards that have been awarded since the program began. As always, the Commission discloses little substantive information on the basis for the award. In July, the SEC announced a $500,000 award to an overseas whistleblower whose reporting helped the Commission bring a successful enforcement action.[5] In August, the SEC awarded over $1.8 million to a whistleblower whose cooperation included giving sworn testimony and reviewing documents, among other assistance in an investigation of conduct committed overseas.[6] And in November, the SEC awarded collectively $260,000 to three whistleblowers—themselves harmed investors—who jointly provided a tip that led to an enforcement action alleging a scheme targeting retail investors.[7]

The Commission also brought another action for violation of the anti-retaliation provision of the whistleblower law. In November, the SEC amended its complaint in a pending enforcement action against an online auction portal and its CEO to add allegations that the defendants unlawfully sought to prohibit investors from reporting misconduct to the SEC and other governmental agencies.[8] In its original complaint against the company and its CEO, the SEC had alleged that the defendants engaged in a fraudulent securities offering based on false statements to investors and had misappropriated over $6 million of investor proceeds. According to the amended complaint, the defendants attempted to resolve investor allegations of wrongdoing by conditioning the return of investor money on the investors signing agreements prohibiting them from reporting potential securities law violations to law enforcement, including the SEC. The complaint is pending in the U.S. District Court for the Southern District of New York.

G. Emerging Interest in Use of Big Data by Investment Managers

For years now we have been counseling clients on managing the regulatory and compliance risks arising from the use of alternative data or big data in portfolio management. The procurement and use of such data raises a number of potential compliance issues – both under the securities laws as well as data privacy laws – not unlike the risks presented by the use of other third party data sources such as expert networks. Years before regulators and prosecutors began bringing insider trading cases based on the use of expert networks, the SEC’s Compliance Examination program had begun asking investment advisers about their use of expert networks and the policies and procedures advisers employed to promote compliance with the securities laws. This year we have observed the SEC’s Examination staff adding to certain of their request lists requests for information about the adviser’s use of alternative data and related compliance policies and procedures. The Examination staff can use such information to learn about the various forms of alternative data managers are using, understand the range of compliance and diligence practices being employed, potentially formulate guidance in the form of a risk alert, or, in certain cases, refer matters to Enforcement for further investigation. The Examination staff’s heightened scrutiny also mirrors interest from other regulators, legislators and the media in this fast-evolving and potentially risky area. In sum, the focus of the Examination staff on fund managers’ use of alternative data emphasizes the importance of having in place policies and procedures for the on-boarding of big data providers, training of investment professionals in the risks, and ongoing monitoring of such providers on a periodic basis.

H. Cryptocurrency

In the latter half of 2019, the SEC continued its cyber focus, bringing multiple enforcement actions in the cryptocurrency space, in large part centered on initial coin offerings (“ICOs”). Commissioner Peirce has been critical of the Commission’s approach to crypto-related issues, and has advocated for clarifying regulation rather than a “parade of enforcement actions” as a means to provide guidance to the market. In a speech in November 2019, Commissioner Peirce argued that, “the lack of a workable regulatory framework has hindered innovation and growth.” In particular, Commissioner Peirce advocated a “non-exclusive safe harbor period within which a token network could blossom without the full weight of the securities laws crushing it before it becomes functional.” It remains to be seen whether these views will influence that regulatory approach to offerings of crypto-currencies and other digital assets.[9] In the meantime, the parade marches on, as the discussion of recent cases below reflects.

In September, the SEC settled an action against a blockchain technology company for allegedly conducting an unregistered ICO.[10] According to the SEC, the company failed to register the ICO—which had raised several billion dollars’ worth of digital assets between June 2017 and June 2018—as a securities offering and did not otherwise seek an exemption from registration requirements, in violation of the registration provisions of the federal securities laws. Without admitting or denying the SEC’s findings, the company agreed to pay a $24 million civil penalty and to a cease-and-desist order.

A few weeks later, the SEC announced an emergency action against a mobile messaging company and its subsidiary in connection with an alleged unregistered ICO.[11] The SEC filed a complaint against the two companies in the Southern District of New York alleging that they failed to register their securities—digital tokens called “Grams”—and therefore also failed to provide investors with information about their investments. The SEC sought and obtained a temporary restraining order in order to stop the then-ongoing ICO. The litigation remains pending; the parties are currently engaged in discovery and additional briefing is due in January. The Court has ordered that the companies refrain from the offering, selling, or distribution of Grams until conclusion of the preliminary injunction hearing, which has been scheduled for mid-February 2020.

In December, the SEC filed another action in the Southern District of New York, charging the founder of a digital-asset issuer and the issuer itself with defrauding investors in connection with an ICO.[12] The complaint alleges that the founder conducted a fraudulent unregistered securities offering, making misrepresentations to investors and failing to create a functional platform for online shopping profiles as promised would be done with funds raised in the ICO. The founder also allegedly misappropriated funds from the ICO for his own personal use, according to the SEC. The founder and company have not yet answered the SEC’s complaint.

Also in December, the SEC brought settled charges against a blockchain technology company for failing to register an ICO that began after the Commission’s 2017 DAO Report was issued.[13] The company allegedly sold unregistered digital tokens to investors in the U.S. and through foreign resellers without placing restrictions on resale to U.S. investors. In settling the charges without admitting or denying the findings, the company agreed to a $250,000 penalty, a cease-and-desist order, and to return funds used to purchase tokens to investors who submit a claim.

II. Public Company Cases

A. Accounting Fraud and Internal Controls

The SEC brought several accounting fraud cases involving filed complaints against public companies and executives in the second half of 2019. Notably, several of the Commission’s actions against individuals were not settled, thus adding to the Enforcement Division’s litigation docket for the coming year.

In July, the SEC filed a complaint in federal court in Chicago alleging that the former CEO and two former sales executives of an engine manufacturing company had committed accounting fraud by overstating the company’s revenues by nearly $25 million.[14] According to the SEC, the executives fraudulently recorded revenue on sales that were not yet complete, that the customer had not agreed to accept, and for which the company falsely inflated the price. The executives allegedly worked to conceal the fraud by misleading and withholding key information from the company’s accountants and outside auditor. The complaint sought permanent injunctions and penalties, as well as disgorgement and prejudgment interest from one of the sales executives and an officer-and-director bar and clawback of incentive-related compensation from the CEO.

In September, the SEC filed a complaint in federal court in Indianapolis charging two former executives of a trucking company with accounting fraud, books and records violations, and reporting violations.[15] The complaint alleged that the former president and COO and former CFO participated in a scheme to buy and sell trucks at prices much higher than their fair market value, leading to the company overstating its income and earnings per share. According to the complaint, the executives tried to conceal the alleged overvaluing by lying to the company’s auditor about whether the prices were determined independently and their roles in the transactions. The SEC is seeking injunctions, monetary penalties, and officer-and-director bars. The company settled related accounting fraud charges in April 2019.

The SEC in November charged a biotech company and three former executives with antifraud, reporting, books and records, and internal control violations for allegedly misstating revenue and attempting to cover it up.[16] The complaint alleged that the company’s former CEO and COO entered into undisclosed side arrangements with distributors that allowed the distributors to return product and conditioned payment obligations on end-user sales, leading to the company prematurely recognizing sales revenue and overstating revenue growth. According to the SEC, the two former executives, along with the CFO, covered up this arrangement for years, including by misleading outside auditors and lawyers. The company agreed to settle for a $1.5 million penalty, without admitting or denying wrongdoing; the litigation against the executives remains pending.

In early December, the SEC charged a brand-management company and three of its former executives with accounting fraud.[17] According to the complaint, the former CEO and COO created fictitious revenue that caused the company to meet or beat analysts’ estimates for two quarters and allowed the executives to profit substantially on stock sales. In related charges, the SEC alleged that the company recognized false revenue and manipulated its earnings; concealed distressed finances of licensees; and failed to recognize more than $239 million in impairment charges for three brands. And it alleged that the company and its former CFO caused the company to overstate its net income by hundreds of millions of dollars by failing to recognize certain losses, disclose transactions to temporarily improve licensees’ finances, and test for impairment. Without admitting or denying the allegations, the company agreed to pay a $5.5 million penalty, while the former COO agreed to a permanent officer-and-director bar as well as disgorgement and prejudgment interest of more than $147,000 and a penalty to be determined later, and the former CFO agreed to disgorgement and prejudgment interest of almost $50,000 and a penalty of $150,000. The litigation against the former CEO remains ongoing.

B. Misleading Disclosures

In addition to the accounting-related cases discussed above, the SEC also pursued cases based on misleading disclosures made by public companies in the latter half of the year.

Misleading Metrics

In August, the SEC announced settled charges against a publicly-traded real estate investment trust and simultaneously filed a complaint against four former executives, alleging that over a two-year period they fraudulently adjusted a certain non-GAAP metric in an effort to hit the company’s growth targets.[18] The complaint alleged that the executives misled investors and analysts by manipulating the company’s same property net operating income (SP NOI) metric in various ways, including by only selectively recognizing income, incorporating income the company had said was excluded, and making the company’s growth appear stronger by lowering the prior year’s SP NOI. The company paid a $7 million penalty to settle the charges without admitting or denying liability. Two of the executives also agreed to partial judgments with monetary relief to be determined in the future.

In September, the SEC announced settled fraud charges against an information and media analytics firm and its former CEO for allegedly overstating revenue and misstating certain performance metrics after entering into a series of non-monetary transactions.[19] According to the SEC’s orders, the company—at the direction of the CEO—was negotiating for and exchanging sets of data without cash consideration and then recognizing inflated revenue on those non-monetary transactions based on the fair value of the data, which itself was increased. As part of the alleged scheme, the SEC contended that both the company and CEO misled investors by making false statements about the company’s customer base and product, and that the CEO lied to accountants in an effort to exceed revenue targets for seven consecutive quarters. Without admitting or denying the SEC’s findings, the company and CEO agreed to settle for a combined penalty of $5.7 million, with the CEO also reimbursing the company $2.1 million in incentive-based compensation and profits from stock sales.

Executive Perks

In September, the SEC settled actions against an automobile manufacturer, its former CEO, and its former director relating to charges that the company made false financial disclosures when it omitted disclosure of approximately $140 million in executive benefits.[20] The SEC alleged that the company’s CEO, with substantial assistance from the charged director and others in the company, worked to conceal more than $90 million in executive compensation from disclosure. The individuals also allegedly made efforts to increase the CEO’s retirement account by approximately $50 million each year. Without admitting or denying the charges, the company agreed to a $15 million civil penalty and, along with the individuals charged, agreed to cease and desist from future violations of the anti-fraud provisions of federal securities laws. In addition, the company’s CEO agreed a $1 million civil penalty and a 10-year officer and director bar while the director settled charges for a $100,000 penalty, a five-year officer and director bar, and a five-year suspension from practicing or appearing before the Commission as an attorney.

Other Disclosures and Omissions

In July, the SEC settled charges with a social media platform relating to allegations that the company made misleading disclosures regarding the risk of misuse data.[21] Specifically, the SEC alleged that for approximately two years, the company framed its data misuse disclosure as a hypothetical, staying that “data may be improperly accessed, used or disclosed,” when the company allegedly knew that a third-party had misused its users’ data. Without admitting or denying the allegations, the company agreed to pay $100 million to settle the action.

In September, the SEC announced it had settled charges with a Silicon Valley-based issuer for allegedly failing to disclose a revenue management scheme in violation of the antifraud and reporting provisions of the federal securities laws.[22] The SEC alleged the issuer misled investors when it engaged in a scheme to “pull-in” sales to the current quarter in order to meet publicly-issued revenue guidance. The practice allegedly concealed from investors a decline in consumer demand, a loss of market share, and reduced future sales. Without admitting or denying the charges, the issuer agreed to pay a $5.5 million.

Also in September, the SEC announced settled charges against a pharmaceutical company for allegedly failing to disclose or accrue for losses relating to a Department of Justice (“DOJ”) investigation into the company’s classification of its largest revenue and profit generating product.[23] The DOJ investigation began in 2014 and lasted nearly two years. The SEC’s complaint alleged that before October 2016 when it announced a $465 million settlement with the DOJ, the company did not adequately disclose to investors the potential losses caused by the investigation. Without admitting or denying the SEC’s allegations, the company agreed to a $30 million penalty.

On the same day, the SEC settled charges against a Michigan-based automaker and its parent company for allegedly misleading investors about the number of new vehicles sold to U.S. consumers each month.[24] The SEC alleged that between 2012 and 2016, the automaker falsely reported uninterrupted monthly year-over-year sales growth in company press releases. The SEC alleged that the company’s growth streak had been broken in September 2013 and the company inflated vehicle sales by reporting fake sales and by reporting older sales as current ones. Without admitting or denying the charges, the two companies agreed to jointly and severally pay a $40 million civil penalty.

C. Private Company Cases

Finally, the SEC brought the following financial reporting and disclosure cases against private companies in the second half of 2019:

In September, the SEC announced it settled charges against a multinational direct-to-consumer sales company relating to allegedly false and misleading statements about the company’s business model in China.[25] The SEC alleged that between 2012 and 2018, the company’s quarterly and annual SEC filings inaccurately described the company’s payment structure in China as different from that used in other countries, when in fact the compensation paid in China was similar to that paid in other countries. This description, the SEC alleged, prevented investors from fully evaluating the risk to the company’s stock. Without admitting or denying the SEC’s charges, the company agreed to pay a $20 million penalty and to cease and desist from future violations of the antifraud and reporting provisions of the federal securities laws.

In November, the SEC filed amended fraud charges against four former executives of a private healthcare advertising company relating to misleading disclosures about the company’s success.[26] The SEC’s amended complaint, filed in federal court in Chicago, alleges that the four former executives violated the antifraud provisions of the federal securities laws by misrepresenting the company’s successes by manipulating third-party studies on its product and by overstating the company’s revenue in its 2015 and 2016 financial statements by $14.3 million and $30 million, respectively. The SEC alleges that these misleading disclosures allowed the company to raise approximately $487 from a private offering. The SEC is seeking disgorgement, penalties, injunctive relief, and officer and director bars. The U.S. Attorney’s Office for the Northern District of Illinois and Fraud Section of the Department of Justice announced parallel criminal charges against the four former executives and against two former employees not named in the SEC action.

III. Investment Advisers and Funds

In a November 2019 speech, Enforcement Co-Director Stephanie Avakian, outlined issues in the investment adviser area that are drawing investigative interest from the Enforcement Division.[27] Not surprisingly, the Enforcement Division views as a success its Share Class Selection Disclosure Initiative as it has resulted in 95 enforcement actions. (Commissioner Peirce has not been as complimentary and has questioned the merits of such aggregation of cases.[28]). Following on the conflict and disclosure themes of the Initiative, Director Avakian explained that the Commission is investigating other circumstances in which an investment adviser may be conflicted by financial incentives that may affect the adviser’s recommendations to clients. As examples, Director Avakian cited revenue sharing, cash sweep arrangements, and unit investment trusts (UITs) as circumstances that may present conflicts of interest and therefore are a growing focus of the Commission’s enforcement efforts. In each of these circumstances, the adviser’s financial interest could be impacted by investment choices for the client. In addition, Director Avakian discussed the Enforcement Division’s recently announced Teachers Initiative to examine the compensation and sales practices of third-party administrators of teacher retirement plans to identify potential conflicts of interest. In closing, Director Avakian emphasized that advisory firms should be proactive in identifying potential conflicts and ensuring adequate disclosure to clients. The enforcement actions discussed below from the latter half of 2019 reflect the Commission’s focus advisers’ identification, management and disclosure of conflicts of interest.

In July, the SEC instituted a settled action against a Massachusetts-based investment adviser and its principal based on allegations that the company failed to disclose to clients conflicts of interest in connection with recommendations to invest in certain securities.[29] According to the SEC, the company concealed the substantial financial incentives offered to it by the company in which it invested client money, resulting in over $7 million in client investments over the course of approximately two years. The SEC further alleged that the investment adviser and its principal concealed this arrangement in its regulatory filings. Additionally, the principal misused investor funds for his personal benefit. Without admitting or denying the findings in the SEC’s order, the company and the principal agreed to pay over $1 million in disgorgement and prejudgment interest, as well as a $275,000 penalty, and the principal agreed to a permanent bar from the securities industry.

In September, the SEC filed suit in federal district court in Illinois against an Illinois-based hedge fund adviser, as well as its top two executives, charging the defendants with violations of the antifraud provisions of the federal securities laws.[30] The SEC’s complaint alleges that the defendants manipulated valuation models, which artificially inflated the value of its investments, and in turn resulted in misstatements of historical performance and caused investors to overpay fees. Moreover, the SEC alleges that its exam staff discovered the valuation problems, but the defendants then endeavored to hide their actions from the company auditor and investors. The SEC seeks permanent injunctions and civil penalties.

In November, the SEC filed suit in federal district court in New York against a New York-based investment adviser in connection with its alleged concealment of losses and its sale of $60 million in bogus loan assets.[31] The SEC’s complaint alleges that the investment adviser falsified its records to hide the fact that there was no repayment of defaulted loans and that any supposed new loans were fictitious. The SEC further alleges that the firm induced clients into buying these false new loan assets by providing clients with doctored documents, including a forged credit agreement. In connection with settlement, the SEC revoked the firm’s registration and the firm’s assets are preliminarily frozen. Any future monetary relief, including but not limited to disgorgement, will be determined at a later date.

In December, the SEC filed suit in federal district court in Sacramento, California against a California-based investment adviser firm and its owner in connection with their alleged defrauding of hundreds of retirees by recommending certain investments without disclosing their conflicts of interest.[32] According to the SEC’s complaint, by concealing any conflicts of interest, the firm and its owner were able to reap millions of dollars in compensation and other benefits. Further, the firm owner had a radio show, in which he touted his expertise and simultaneously hid past charges brought against him by the SEC, with the effect of misleading prospective investors. The SEC’s complaint seeks injunctions, as well as disgorgement and civil penalties.

IV. Brokers and Financial Institutions

A. Rule Violations and Internal Systems Deficiencies

In the latter half of 2019, the SEC brought a number of cases against broker-dealers relating to inadequate SEC rule compliance and failures of internal systems.

In August, the SEC brought settled charges against a New York City headquartered broker-dealer for deficient review of over-the-counter (“OTC”) securities in violation of Rule 15c2-11, which requires that a broker-dealer have a reasonable basis for believing that information made available by the issuer of the securities is accurate.[33] The SEC’s order alleged that the broker-dealer made markets in OTC securities while delegating responsibility for rule compliance to a compliance associate who had no formal training or trading experience, resulting in allegedly deficient reviews. Without admitting or denying the SEC’s findings, the broker-dealer agreed to a penalty of $250,000.

In September, the SEC announced charges against two broker-dealers for providing the SEC with incomplete and deficient securities trading information known as “blue sheet data.”[34] The SEC’s order alleged that both broker-dealers provided blue sheet submissions which reflected millions of inaccurate or missing entries over a period of several years, largely due to undetected coding errors. The broker-dealers admitted the findings in the SEC’s orders and agreed to censures and penalties of $2.7 million and $1.95 million respectively to settle the charges.

In December, the SEC brought settled charges with two trading firms for rule violations in connection with a tender offer.[35] Specifically, the SEC’s orders alleged that the trading firms violated the “short tender rule” in connection with a partial tender offer by tendering more shares than their net long positions in the security. The SEC’s orders alleged that, because the tender offer was oversubscribed, the trading firms’ actions resulted in the firms unfairly receiving shares in the offer at the expense of other tender offer participants. Without admitting or denying the findings, the trading firms agreed to pay disgorgement and penalties totaling approximately $300,000 and $200,000 respectively.

Finally, as part of its ongoing initiative into American Depositary Receipt (“ADR”) practices (resulting in settlements exceeding $431 million), the SEC in December announced settled charges against a multi-national financial services firm relating to the handling of ADRs—U.S. securities that represent foreign shares of a foreign company and require corresponding foreign shares to be held in custody at a depositary bank.[36] The SEC’s order alleged that the firm borrowed ADRs from other brokers when it should have known that those brokers did not own the corresponding foreign shares required to support the ADRs. Without admitting or denying the findings, the firm agreed to pay nearly $4 million in disgorgement, interest, and penalties. The SEC’s order noted that the settlement represented the SEC’s fourteenth enforcement action relating to ADRs.

B. Retail Investors

As part of its ongoing focus on protecting retail investors, in September 2019, the SEC brought settled charges against three subsidiaries of a national financial services firm for charging excessive fees and commissions on retail accounts.[37] The SEC’s order alleged that the firm (i) did not perform reviews of advisory accounts that had no trading activity for at least one year, resulting in unsuitable advisory fees being charged to these accounts; and (ii) misapplied pricing data to certain unit investment trusts (“UITs”) in advisory accounts, resulting in excess fees charged on UITs. The SEC’s order also alleged with respect to UITs that the firm made unsuitable recommendations to sell UITs prior to maturity (and to then purchase new UITs), resulting in excess commissions being charged to retail customers. Without admitting or denying the findings, the firm agreed to pay approximately $12 million in disgorgement to retail investors, and also agreed to a $3 million penalty. The SEC’s order noted that it took into account remedial efforts and cooperation undertaken by the firm.

V. Insider Trading, Market Manipulation and Regulation FD

A. Insider Trading

In the second half of 2019, the SEC brought a number of insider trading cases and won a trial on insider trading charges relating to a previously-filed complaint.

In July, the SEC brought insider trading charges against a former accountant of a life sciences company and her close friend, seeking injunctive relief along with disgorgement and penalties.[38] The complaint alleges that the accountant leaked confidential revenue information to the friend in exchange for extravagant gifts, while the friend purchased securities using accounts held by several associates to conceal his identity. The scheme was discovered using advanced trading analytics software. The matter is being litigated, and parallel charges were filed by the U.S. Attorney’s Office for the Southern District of New York.

In August, the SEC charged an investment banking analyst with insider trading, alleging that the analyst purchased securities after learning about a potential transaction his employer was advising on.[39] The complaint alleges that the analyst reaped nearly $100,000 in profits, and seeks disgorgement of the gains, plus penalties and injunctive relief. The matter is being litigated, and parallel charges were filed by the U.S. Attorney’s Office for the Southern District of New York.

In August, an Atlanta federal court jury returned a verdict finding a New Jersey based securities broker liable for insider trading in advance of three transactions relating to charges that the SEC brought in 2016.[40] The broker was found guilty of violating Sections 10(b) and 14(e) of the Securities Exchange Act of 1934, as well as Rules 10b-5 and 14e-3. The jury held that the broker received information surrounding each transaction from an employee at an accounting firm, traded on the information, and passed it to a friend of his to do the same. The employee and the other trader were also charged, but previously settled their cases.[41]

In December, the SEC announced a settlement with a former United States congressman, his son, and his friend.[42] The trio were charged with insider trading, and previously pleaded guilty to related criminal charges. The defendants agreed to disgorgement and injunctive relief, and the former congressman was permanently barred from acting as an officer or director of a public company.

Also in December, the SEC charged a ring of five friends who are accused of repeatedly trading on confidential earnings information of a Silicon Valley cloud-computing company.[43] The group allegedly procured the information from one member’s IT administration position at the company, who used his credentials to access and pass along the information. The group used “carefully tailored cash withdrawals” to avoid detection, but were discovered using SEC data analysis tools. The matter is being litigated, and parallel charges have been filed by the U.S. Attorney for the Northern District of California. Notably in the criminal case, two of the individuals have been charged with violating 18 U.S.C. § 1348, a relatively recent securities fraud provision added by the Sarbanes-Oxley Act in 2002.[44] This charge may become more routine following the Second Circuit’s recent majority opinion in United States v. Blaszczak, which held that there is no “personal benefit” requirement in insider trading cases charged under this provision. This result is different from charges under the traditional Section 10(b) of the Exchange Act, where in Dirks v. SEC, the Supreme Court had held that tippers are only liable where they breach a fiduciary duty to the company’s shareholders, and they only breach such a duty where they “personally will benefit, directly or indirectly, from [their] disclosure. Absent some personal gain, there has been no breach of duty to stockholders.”

B. Market Manipulation

In November, a New York federal court jury found a Ukrainian trading firm and two individuals liable for their roles in an unlawful trading scheme.[45] The SEC originally filed the complaint in March 2017. The evidence demonstrated that the defendants engaged in a “layering scheme” involving placing and canceling orders to artificially adjust a stock price. They also engaged in cross-market manipulation by buying and selling stocks to impact options prices. The jury found all three defendants liable on all counts.

C. Regulation FD

In August, the SEC announced settled charges against a Florida-based pharmaceutical company relating to violations of Regulation FD based on its alleged sharing of material, nonpublic information with sell-side research analysts without also disclosing the same information to the public.[46] The SEC’s order alleged that on two separate occasions in 2017, the company selectively shared material information with analysts about the company’s interactions with the FDA, and that at the time of these disclosures, the company did not have policies or procedures regarding compliance with Regulation FD. The pharmaceutical company consented to the SEC’s order without admitting or denying the findings and was ordered to pay a penalty of $200,000 and cease and desist from future violations.

________________________

[1] Testimony of Chairman Jay Clayton before the U.S. Senate Committee on Banking, Housing, and Urban Affairs (Dec. 10, 2019), available at https://www.banking.senate.gov/imo/media/doc/Clayton%20Testimony%2012-10-191.pdf.

[2] See D. Michaels, Focus on Sale of Higher-Fee Mutual Funds Fuels 30-Year High for SEC Enforcement Actions, Wall St. J. (Nov. 6, 2019), available at https://www.wsj.com/articles/focus-on-sale-of-higher-fee-mutual-funds-fuels-30-year-high-for-sec-enforcement-actions- 11573043400.

[3] 2019 WL 7289753 (2d Cir. Dec. 30, 2019).

[4] Reuters, Exclusive: White House expected to nominate SEC lawyer for Democratic commissioner seat – sources (Dec. 20, 2019), available at https://www.reuters.com/article/us-usa-sec-nominations-exclusive/exclusive-white-house-expected-to-nominate-sec-lawyer-for-democratic-commissioner-seat-sources-idUSKBN1YO2CN.

[5] SEC Press Release, SEC Awards Half-Million Dollars to Overseas Whistleblower (July 23, 2019), available at https://www.sec.gov/news/press-release/2019-138.

[6] SEC Press Release, SEC Awards More Than $1.8 Million to Whistleblower (Aug. 29, 2019), available at https://www.sec.gov/news/press-release/2019-165.

[7] SEC Press Release, SEC Awards Over $260,000 to Whistleblowers for Their Help in Spotting Securities Fraud (Nov. 15, 2019), available at https://www.sec.gov/news/press-release/2019-238.

[8] SEC Press Release, SEC Charges Issuer and CEO with Violating Whistleblower Protection Laws to Silence Investor Complaints (Nov. 4, 2019), available at https://www.sec.gov/news/press-release/2019-227.

[9] Commissioner Hester M. Peirce, Broken Windows: Remarks Before the 51st Annual Institute on Securities Regulation (Nov. 4, 2019), available at https://www.sec.gov/news/speech/peirce-broken-windows-51st-annual-institute-securities-regulation.

[10] SEC Press Release, SEC Orders Blockchain Company to Pay $24 Million Penalty for Unregistered ICO (Sept. 30, 2019), available at https://www.sec.gov/news/press-release/2019-202.

[11] SEC Press Release, SEC Halts Alleged $1.7 Billion Unregistered Digital Token Offering (Oct. 11, 2019), available at https://www.sec.gov/news/press-release/2019-212.

[12] SEC Press Release, SEC Charges Founder, Digital-Asset Issuer With Fraudulent ICO (Dec. 11, 2019), available at https://www.sec.gov/news/press-release/2019-259.

[13] SEC Press Release, Issuer Settles Unregistered ICO Charges, Agrees to Return Funds and Register Tokens (Dec. 18, 2019), available at https://www.sec.gov/news/press-release/2019-267.

[14] SEC Press Release, SEC Charges Engine Manufacturing Company Executives with Accounting Fraud (July 19, 2019), available at www.sec.gov/news/press-release/2019-137.

[15] SEC Press Release, SEC Charges Trucking Executives with Accounting Fraud (Dec. 5, 2019), available at www.sec.gov/news/press-release/2019-253.

[16] SEC Press Release, SEC Charges Biotech Company and Executives with Accounting Fraud (Nov. 26, 2019), available at www.sec.gov/news/press-release/2019-243.

[17] SEC Press Release, SEC Charges Iconix Brand Group and Former Top Executives with Accounting Fraud (Dec. 5, 2019), available at www.sec.gov/news/press-release/2019-251.

[18] SEC Press Release, SEC Charges Brixmor Property Group Inc. and Former Senior Executives with Accounting Fraud (Aug. 1, 2019), available at www.sec.gov/news/press-release/2019-143.

[19] SEC Press Release, SEC Charges Comscore Inc. and Former CEO with Accounting and Disclosure Fraud (Sept. 24, 2019), available at www.sec.gov/news/press-release/2019-186.

[20] SEC Press Release, SEC Charges Nissan, Former CEO, and Former Director with Fraudulently Concealing from Investors More than $140 Million of Compensation and Retirement Benefits (Sept. 23, 2019), available at https://www.sec.gov/news/press-release/2019-183.

[21] SEC Press Release, Facebook to Pay $100 Million for Misleading Investors About the Risks It Faced From Misuse of User Data (July 24, 2019), available at https://www.sec.gov/news/press-release/2019-140.

[22] SEC Press Release, SEC Charges Silicon Valley-Based Issuer With Misleading Disclosure Violations (Sept. 16, 2019), available at https://www.sec.gov/news/press-release/2019-175.

[23] SEC Press Release, Mylan to Pay $30 Million for Disclosure and Accounting Failure Relating to EpiPen (Sept. 27, 2019), available at https://www.sec.gov/news/press-release/2019-194.

[24] SEC Press Release, Automaker to Pay $40 Million for Misleading Investors (Sept. 27, 2019), available at https://www.sec.gov/news/press-release/2019-196.

[25] SEC Press Release, Herbalife to Pay $20 Million for Misleading Investors (Sept. 27, 2019), available at https://www.sec.gov/news/press-release/2019-195.

[26] SEC Press Release, SEC Charges Former Top Executives of Healthcare Advertising Company With $487 Million Fraud (Nov. 25, 2019), available at https://www.sec.gov/news/press-release/2019-241.

[27] Speech, What You Don’t Know Can Hurt You (Nov. 5, 2019), available at https://www.sec.gov/news/speech/speech-avakian-2019-11-05.

[28] Speech, Reasonableness Pants (May 8, 2019), available at https://www.sec.gov/news/speech/speech-peirce-050819.

[29] SEC Press Release, SEC Charges Investment Adviser With Fraud (July 1, 2019), available at https://www.sec.gov/news/press-release/2019-115.

[30] SEC Press Release, SEC Charges Hedge Fund Adviser and Top Executives With Fraud (Sept. 30, 2019), available at https://www.sec.gov/news/press-release/2019-201.

[31] SEC Press Release, SEC Revokes Registration of Adviser Engaged in $60 Million Fraud (Nov. 26, 2019), available at https://www.sec.gov/news/press-release/2019-244.

[32] SEC Press Release, SEC Charges Recidivist Investment Adviser With Defrauding Retirees (Dec. 19, 2019), available at https://www.sec.gov/news/press-release/2019-274.

[33] SEC Press Release, SEC Charges Broker-Dealer with Violations of Gatekeeping Provisions Aimed at Protecting Investors (Aug. 14, 2019), available at https://www.sec.gov/news/press-release/2019-151.

[34] SEC Press Release, Two Broker-Dealers to Pay $4.65 Million in Penalties for Providing Deficient Blue Sheet Data (Sept. 16, 2019), available at https://www.sec.gov/news/press-release/2019-177.

[35] SEC Press Release, SEC Charges Broker-Dealers With Illicitly Profiting in Partial Tender Offer (Dec. 18, 2019), available at https://www.sec.gov/news/press-release/2019-268.

[36] SEC Press Release, Jefferies to Pay Nearly $4 Million for Improper Handling of ADRs (Dec. 9, 2019), available at https://www.sec.gov/news/press-release/2019-256.

[37] SEC Press Release, Raymond James Agrees to Pay $15 Million for Improperly Charging Retail Investors (Sept. 17, 2019), available at https://www.sec.gov/news/press-release/2019-151.

[38] SEC Press Release, SEC Charges Accountant and Friend in $6.2 Million Insider Trading Scheme (Jul. 10, 2019), available at https://www.sec.gov/news/press-release/2019-126.

[39] SEC Press Release, SEC Charges Investment Banking Analyst with Insider Trading (Aug. 12, 2019), available at https://www.sec.gov/news/press-release/2019-149.

[40] SEC Press Release, SEC Wins Jury Trial Against Broker Charged with Insider Trading (Aug. 14, 2019), available at https://www.sec.gov/news/press-release/2019-152.

[41] SEC Litig. Rel. No. 24554, SEC Obtains Final Judgment Against Former Accounting Firm Partner (Aug. 2, 2019), available at https://www.sec.gov/litigation/litreleases/2019/lr24554.htm.

[42] SEC Press Release, Former Congressman and Two Others Settle Insider Trading Charges (Dec. 9, 2019), available at https://www.sec.gov/news/press-release/2019-257.

[43] SEC Press Release, Silicon Valley IT Administrator and Friends Charged in Multimillion Dollar Insider Trading Ring (Dec. 17, 2019), available at https://www.sec.gov/news/press-release/2019-261.

[44] DOJ Press Release, Two South Bay Residents Indicted For Securities Fraud Relating To Palo Alto Networks, Inc. (Dec. 17, 2019), available at https://www.justice.gov/usao-ndca/pr/two-south-bay-residents-indicted-securities-fraud-relating-palo-alto-networks-inc.

[45] SEC Press Release, SEC Wins Jury Trial in Layering, Manipulative Trading Case (Nov. 12, 2019), available at https://www.sec.gov/news/press-release/2019-236.

[46] SEC Press Release, SEC Charges TherapeuticsMD With Regulation FD Violations (Aug. 20, 2019), available at https://www.sec.gov/news/press-release/2019-156.

The following Gibson Dunn lawyers assisted in the preparation of this client update: Mark Schonfeld, Tina Samanta, Amy Mayer, Jaclyn Neely, Zoey Goldnick, Erin Galliher, Zachary Piaker, Brandon Davis.

Gibson Dunn is one of the nation’s leading law firms in representing companies and individuals who face enforcement investigations by the Securities and Exchange Commission, the Department of Justice, the Commodities Futures Trading Commission, the New York and other state attorneys general and regulators, the Public Company Accounting Oversight Board (PCAOB), the Financial Industry Regulatory Authority (FINRA), the New York Stock Exchange, and federal and state banking regulators.

Our Securities Enforcement Group offers broad and deep experience. Our partners include the former Director of the SEC’s New York Regional Office, the former head of FINRA’s Department of Enforcement, the former United States Attorneys for the Central and Eastern Districts of California, and former Assistant United States Attorneys from federal prosecutors’ offices in New York, Los Angeles, San Francisco and Washington, D.C., including the Securities and Commodities Fraud Task Force.

Securities enforcement investigations are often one aspect of a problem facing our clients. Our securities enforcement lawyers work closely with lawyers from our Securities Regulation and Corporate Governance Group to provide expertise regarding parallel corporate governance, securities regulation, and securities trading issues, our Securities Litigation Group, and our White Collar Defense Group.

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work or any of the following:

Securities Enforcement Practice Group Leaders:

Richard W. Grime – Washington, D.C. (+1 202-955-8219, [email protected])

Barry R. Goldsmith – New York (+1 212-351-2440, [email protected])

Mark K. Schonfeld – New York (+1 212-351-2433, [email protected])

Please also feel free to contact any of the following practice group members:

New York

Zainab N. Ahmad (+1 212-351-2609, [email protected])

Matthew L. Biben (+1 212-351-6300, [email protected])

Reed Brodsky (+1 212-351-5334, [email protected])

Joel M. Cohen (+1 212-351-2664, [email protected])

Lee G. Dunst (+1 212-351-3824, [email protected])

Mary Beth Maloney (+1 212-351-2315, [email protected])

Alexander H. Southwell (+1 212-351-3981, [email protected])

Avi Weitzman (+1 212-351-2465, [email protected])

Lawrence J. Zweifach (+1 212-351-2625, [email protected])

Tina Samanta (+1 212-351-2469, [email protected])

Washington, D.C.

Stephanie L. Brooker (+1 202-887-3502, [email protected])

Daniel P. Chung (+1 202-887-3729, [email protected])

Stuart F. Delery (+1 202-887-3650, [email protected])

Patrick F. Stokes (+1 202-955-8504, [email protected])

F. Joseph Warin (+1 202-887-3609, [email protected])

San Francisco

Winston Y. Chan (+1 415-393-8362, [email protected])

Thad A. Davis (+1 415-393-8251, [email protected])

Charles J. Stevens (+1 415-393-8391, [email protected])

Michael Li-Ming Wong (+1 415-393-8234, [email protected])

Palo Alto

Michael D. Celio (+1 650-849-5326, [email protected])

Paul J. Collins (+1 650-849-5309, [email protected])

Benjamin B. Wagner (+1 650-849-5395, [email protected])

Denver

Robert C. Blume (+1 303-298-5758, [email protected])

Monica K. Loseman (+1 303-298-5784, [email protected])

Los Angeles

Michael M. Farhang (+1 213-229-7005, [email protected])

Douglas M. Fuchs (+1 213-229-7605, [email protected])

On December 18, 2019, the staffs of the Division of Swap Dealer and Intermediary Oversight (“DSIO”),[1] the Division of Market Oversight (“DMO”)[2], and the Division of Clearing and Risk (“DCR”)[3] of the Commodity Futures Trading Commission (“CFTC”) each released no-action letters (collectively, the “CFTC Letters”) that provide relief to market participants in connection with the industry-wide initiative to transition swaps that reference the London Interbank Offered Rate (“LIBOR”) and other interbank offered rates (“IBORs”) to swaps that reference alternative risk-free reference rates.[4]

The CFTC Letters respond to a request by the Alternative Reference Rates Committee (“ARRC”)[5] on behalf of its members subject to certain CFTC regulations to address issues that will result from amendments made by market participants to their swap documentation to either (i) include fallback language to address what will happen when LIBOR or another IBOR ceases to exist (or is deemed to be non-representative by the benchmark administrator or relevant authority in a jurisdiction) (“Fallback Amendment”) or (ii) convert LIBOR and other IBOR-linked uncleared swaps to an alternative reference rate, like SOFR, prior to the cessation of such IBORs (“Replacement Rate Amendment”).[6] The amendments to swap documentation would likely be viewed as material amendments that would trigger the same requirements as “new” swaps, meaning that each swap may trigger uncleared margin, clearing, business conduct and other requirements and should be analyzed accordingly. The ARRC sought clarification and relief from such requirements so that market participants could make such amendments without facing costly and onerous requirements applied to their existing swaps.

The CFTC Letters provide helpful relief to swap market participants with respect to the LIBOR transition in connection with several areas, including the swap dealer de minimis exception, uncleared swap margin, swap dealer business conduct standards, swap trading relationship documentation, portfolio reconciliation, confirmations, eligible contract participants (“ECPs”), the end-user clearing exception, clearing and trade execution requirements; however, the relief in the CFTC Letters does not cover certain requirements (e.g., there is no relief for reporting requirements),[7] and there are some areas of uncertainty that remain and are likely to impact certain swap market participants.

In this alert we discuss, for the relief granted in each of the CFTC Letters, the issue, no-action relief position, as well as the impacts and remaining areas of concern and uncertainty that may require further consideration and analysis.

I. DSIO Letter

A. Scope of Relief

The DSIO Letter applies to the amendment of uncleared swaps that reference USD LIBOR, another IBOR or other reference rates that are phased-out or become impaired[8] (collectively, “Impaired Reference Rates” or “IRRs”). DSIO notes that defining IRRs in this manner will permit a market participant to make more than one amendment to the same swap or portfolio of swaps before settling on “an alternative benchmark that adequately meets the counterparties’ commercial needs.”[9] The amendments may be achieved by (i) adherence to a protocol issued by the International Swaps and Derivatives Association (“ISDA”), (ii) contractual amendment between counterparties or (iii) execution of new contracts in replacement of and immediately upon termination of existing contract(s) (i.e., “contract tear-ups”).

DSIO limits the scope of relief to amendments of legacy uncleared swaps that reference an IRR solely to “(i) include new fallbacks to alternative reference rates triggered only by permanent discontinuation of an IRR or determination that an IRR is non-representative by the benchmark administrator or the relevant authority in a jurisdiction; or (ii) accommodate the replacement of an IRR” (each, a “Qualifying Amendment”); however, a Qualifying Amendment does not include any amendment that (i) extends the maximum maturity of a swap or portfolio of swaps, or (ii) increases the total effective notional amount of a swap or the aggregate total effective notional amount of a portfolio of swaps.[10] DSIO recognizes that Qualifying Amendments may require a number of ancillary changes to existing trade terms to conform to different market conventions used for the alternative reference rate (e.g., reset dates, fixed/floating leg payment dates, day count fractions, etc.).

B. No-Action Positions, Potential Concerns and Other Considerations

1) Swap Dealer De Minimis Calculation

Issue: Entities that actively manage their swap dealing activities to stay below the swap dealer de minimis threshold of $8 billion may be reluctant to transition away from IRRs voluntarily and early if amendments and modifications made to accommodate either a Fallback Amendment or a Reference Rate Amendment will need to be included in the calculation.

No-action position: DSIO provides no-action relief to any person that excludes a swap from the swap dealer de minimis calculation that references an IRR solely to the extent that such swap would be included as a consequence of a Qualifying Amendment.[11]