Corporate Resolutions 2023 Year-End Update

Client Alert | March 7, 2024

In 2023, the U.S. Department of Justice heavily favored plea agreements over non-prosecution agreements and deferred prosecution agreements to resolve corporate criminal cases.

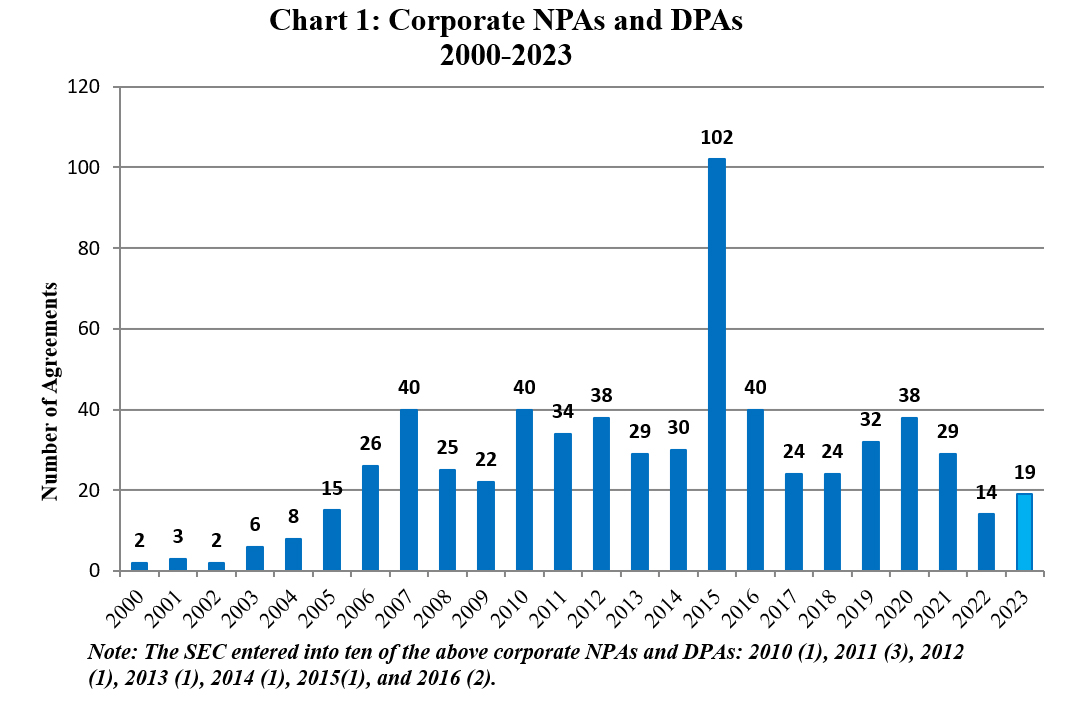

In 2023, the U.S. Department of Justice (“DOJ”) continued its recent trend of resolving fewer cases using corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”).[1] DOJ overwhelmingly favored corporate guilty pleas last year, with a total of 48 plea agreements compared to 19 NPAs and DPAs publicized by year-end.

In this client alert, we: (1) report key statistics regarding corporate resolutions, including an analysis of NPAs, DPAs, and Corporate Enforcement Policy (“CEP”) disgorgement from 2000 through the present and of corporate guilty pleas between 2022 and 2023; (2) assess recent developments in DOJ and SEC enforcement policy and priorities; (3) survey recent developments in DPA regimes abroad; and (4) summarize the agreements from July 31, 2023[2] through December 31, 2023.

Chart 1 below reflects the NPAs and DPAs that Gibson Dunn has identified through public-source research from 2000 through the end of 2023. Of the 19 total agreements in 2023, there were 12 DPAs and seven NPAs. The SEC, consistent with its trend since 2016, did not enter into any NPAs or DPAs in 2023.

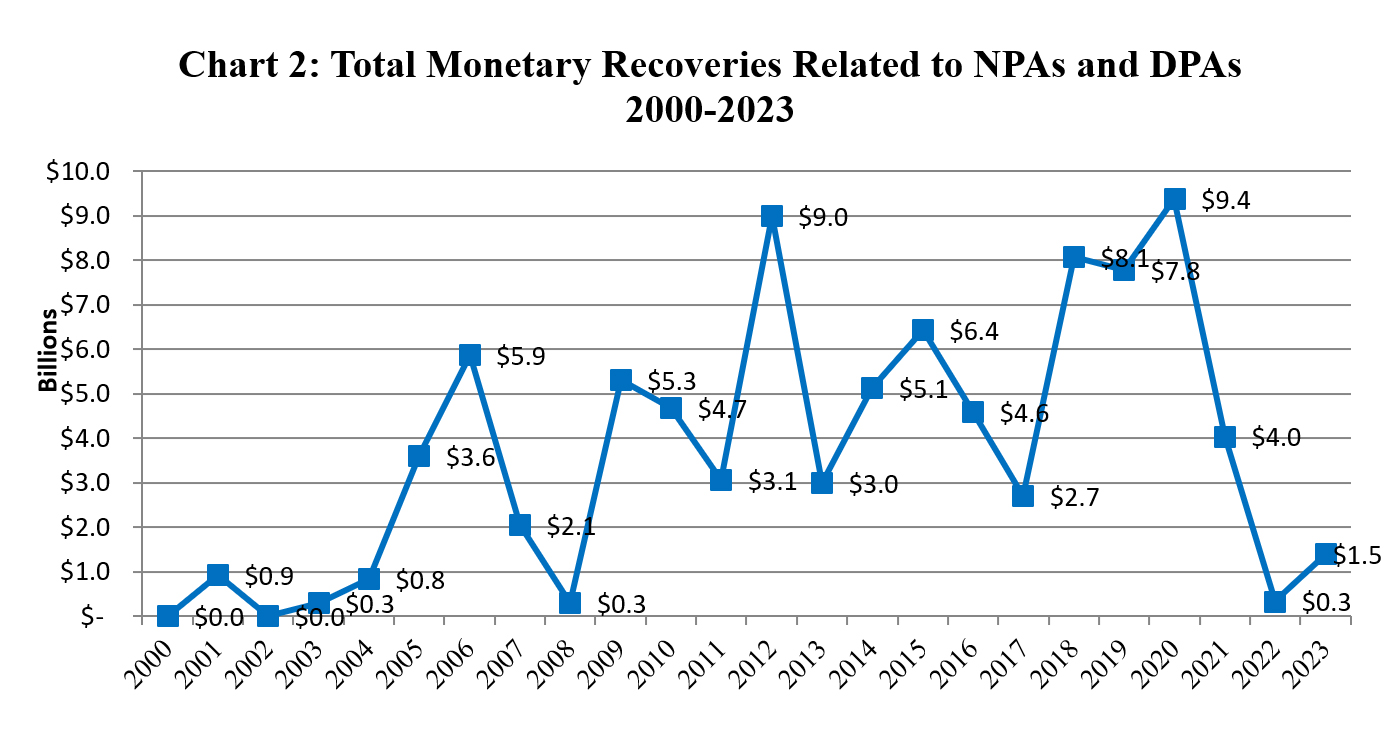

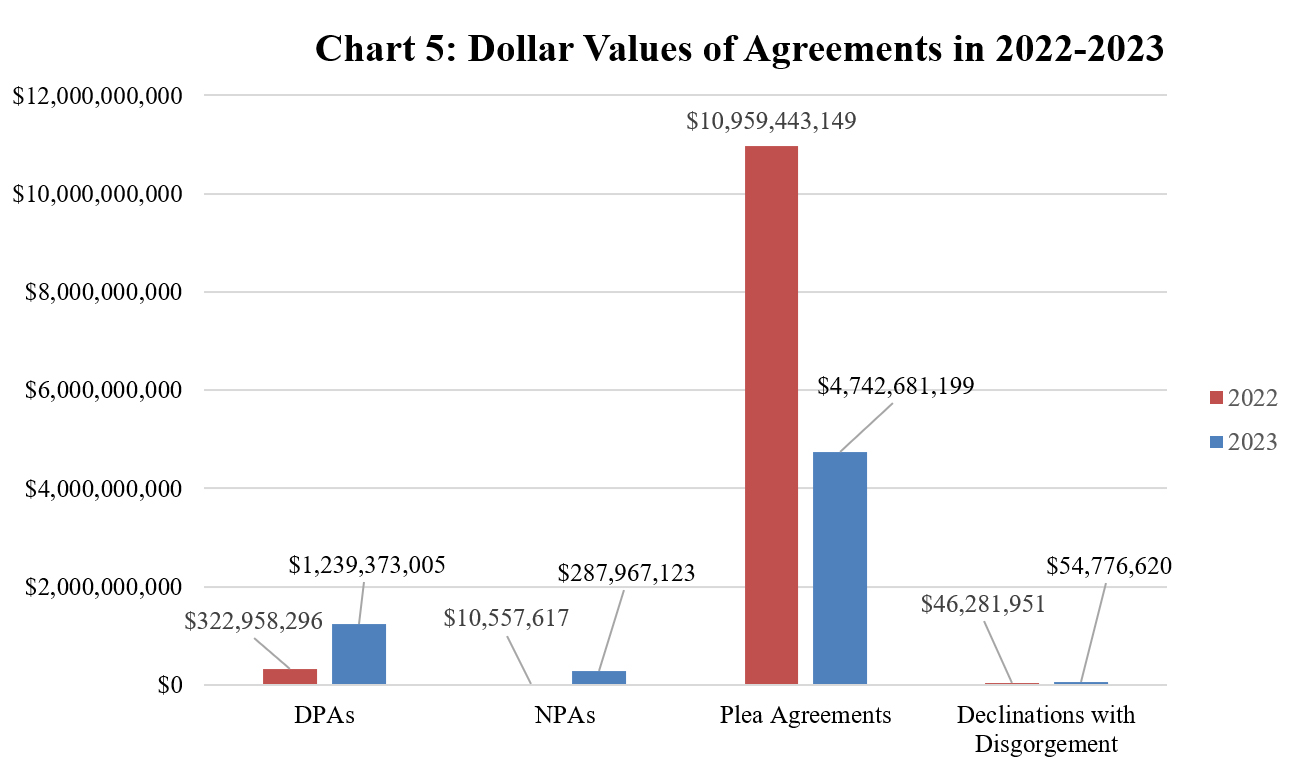

Chart 2 reflects total monetary recoveries related to publicly available NPAs and DPAs from 2000 through the end of 2023. At approximately $1.5 billion, 2023 recoveries associated with DPAs and NPAs are higher than those in 2022; however, with the exception of 2022, they remain strikingly low compared to recoveries in the years following the 2008 economic recession, with the next-lowest recovery occurring in 2017, at approximately $2.7 billion. At $4.7 billion, recoveries associated with plea agreements in 2023 far outstripped those associated with NPAs and DPAs.

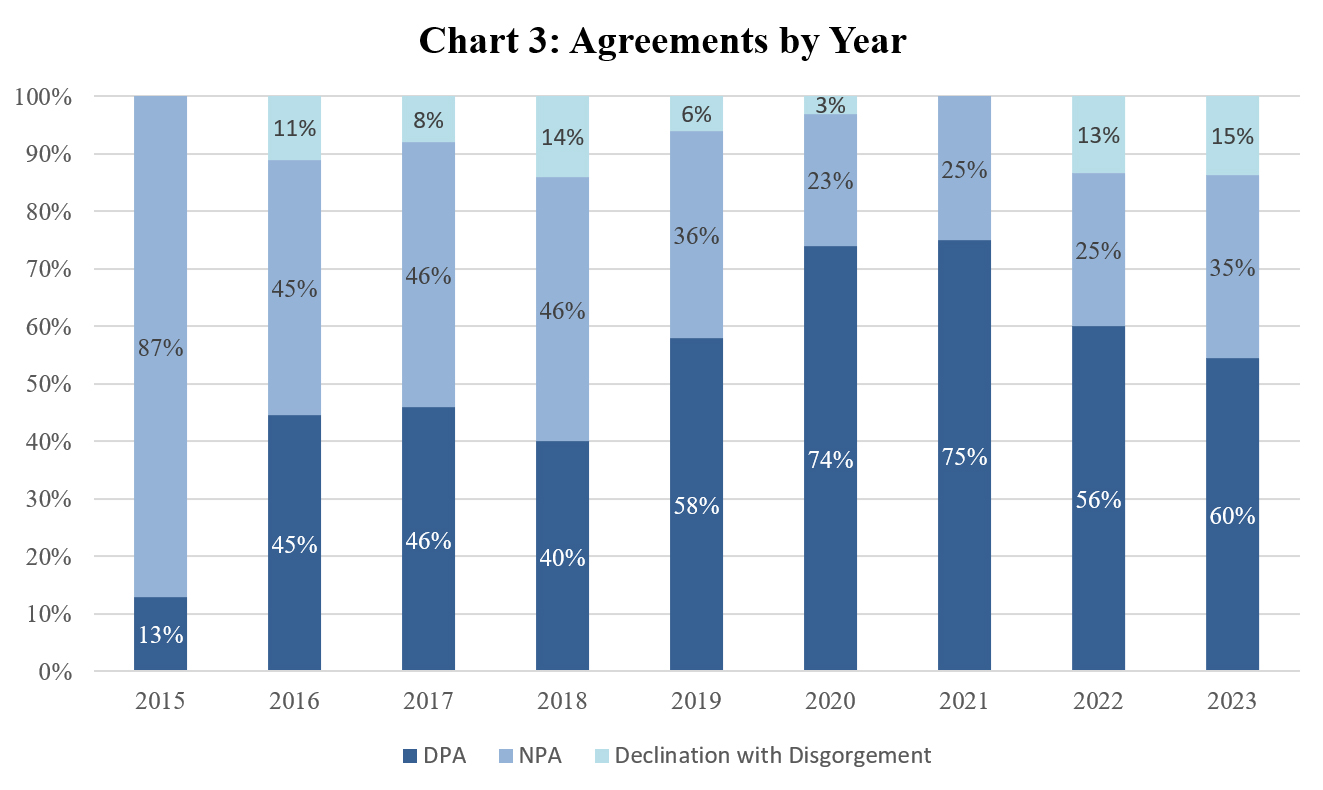

Chart 3 reflects the relative mix of NPAs, DPAs, and declinations-with-disgorgement since DOJ first began issuing the latter agreements under the then-FCPA Pilot Program in 2016. In 2023, DOJ has issued three public declinations-with-disgorgement pursuant to its Corporate Enforcement Policy, the highest number since 2018, when it issued four such resolution letters.

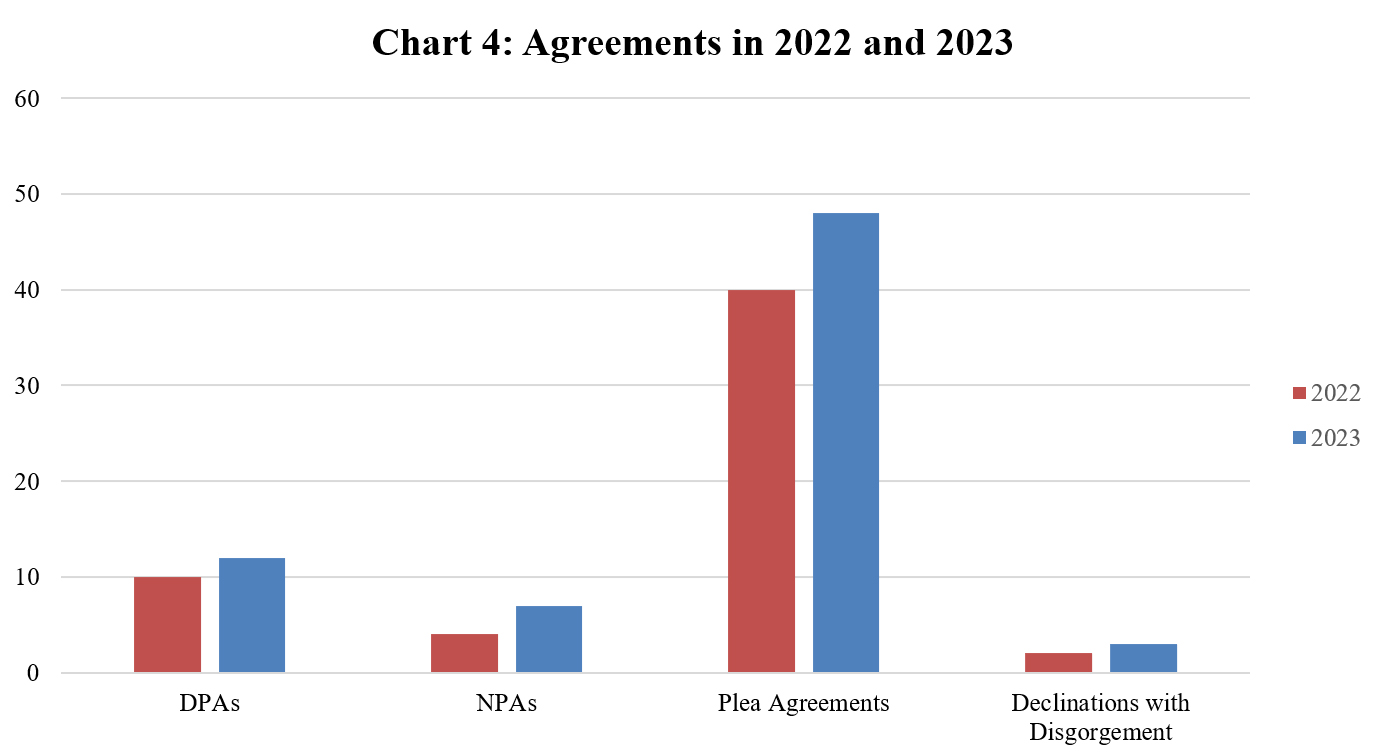

Charts 4 and 5 below focus on 2022 and 2023, and show the numbers of DPAs, NPAs, plea agreements, and declinations‑with‑disgorgement in those years, as well as recoveries associated with each category of agreement.[3] These charts illustrate well a recent statement by Acting Assistant Attorney General Nicole Argentieri in November 29, 2023, that DOJ has “been using all options when it comes to the appropriate form of our resolutions, including CEP declinations, non-prosecution agreements, deferred prosecution agreements, and guilty pleas.”[4]

It is too early to tell whether an increased use of guilty pleas may be contributing to the relative decline in NPAs and DPAs. We do note, however, that 2022 and 2023 included several high-dollar-value, parent company-level guilty pleas, suggesting that DOJ could be increasingly pursuing guilty pleas in more complex cases. Indeed, in 2022 and 2023, all of the resolutions with recoveries over $1 billion were guilty pleas; there has not been a DPA involving recoveries of $1 billion or more since 2021. Enforcement activity is variable, however, with the natural lifecycles of investigations sometimes yielding what appear to the public to be burst of activity followed by periods of relative quiet. Thus, while we can note, for example, that DOJ Antitrust concluded eight public NPAs and DPAs in 2020-21 compared to three in 2022-23, and that the U.S. Attorney’s Office for the Central District of California entered into five public NPAs and DPAs in 2020-21 and none in 2022-23, it is difficult to say whether these statistics signal any kind of shift in focus or standards or if they simply illustrate the natural ebb and flow of enforcement actions.

The form, structure, and elements of corporate resolutions continues to evolve. More than 20 years ago, Gibson Dunn led the dramatic shift to NPAs and DPAs from corporate pleas. The explosion of policy initiatives by DOJ will shape the landscape in the coming years. What is particularly noteworthy is the range of U.S. Attorneys’ offices prosecuting corporate cases from Mississippi to North Dakota to Oregon. Historically, corporate prosecutions were concentrated in the biggest DOJ offices or Main Justice units, but it is now routine that any one of the 93 U.S. Attorneys’ offices feel empowered to prosecute corporations.

Continued Developments in DOJ Corporate Enforcement Policy

Corporate Enforcement Landscape in 2023

In the final months of 2023, DOJ continued to emphasize that corporate enforcement is in an “era of expansion and innovation” when discussing its corporate enforcement policies, priorities, and actions over the past year.[5]

DOJ continued to make clear that the intersection of national security and corporate crime is one area of significant expansion. In September 21, 2023 remarks, Principal Associate Deputy Attorney General (“PADAG”) Marshall Miller reiterated DOJ’s increased corporate enforcement efforts in the national security realm and cautioned that, for companies who operate in parts of the world controlled by autocracies, “the message is simple: national security laws must rise to the top of your compliance risk chart.”[6] In an address on October 4, 2023, Deputy Attorney General (“DAG”) Monaco similarly described the “rapid expansion of national security-related corporate crime” as the “biggest shift in corporate criminal enforcement” that she has seen in her time in government.[7] PADAG Miller further reinforced this viewpoint in an address on November 28, 2023, stating that DOJ was “seeing national security dimensions in more familiar areas of corporate crime” and noting that “intellectual property theft and international corruption, for example, interrupt supply chains, divert disruptive technologies to dark places, and fuel the misdeeds of rogue nation-states.”[8] PADAG Miller used the occasion to highlight that DOJ was “surging resources to address the challenge – adding more than 25 new corporate crime prosecutors to our National Security Division and increasing by 40% the number of prosecutors in the Criminal Division’s Bank Integrity Unit.”[9]

DOJ also emphasized that it has developed new tools and remedies to punish and deter wrongdoing. As DAG Monaco noted in October 4, 2023 remarks, DOJ has recently announced resolutions that “include divestiture of lines of business, specific performance as part of restitution and remediation, and tailored compensation and compliance requirements.”[10] For example, DAG Monaco pointed to the DPAs with pharmaceutical companies Teva and Glenmark as the first time that DOJ required divestiture as part of a corporate criminal resolution, as both companies were required to divest business lines that allegedly were central to the companies’ price-fixing conspiracy.[11] DAG Monaco cited the Suez Rajan resolution as another example in which the Department employed specific performance as a remedy—the company was required to transport nearly one million barrels of contraband Iranian crude oil to the United States, where it now is subject to civil forfeiture proceedings.[12] On November 29, 2023, Acting AAG Argentieri highlighted DOJ’s use of data analytics to identify potential corporate misconduct.[13] Acting AAG Argentieri also made clear that while DOJ has “been using all options when it comes to the appropriate form of our resolutions,” it will “not hesitate to require a guilty plea where the circumstances warrant it, particularly where the nature and circumstances of the offense are especially egregious.”[14]

Both DAG Monaco and Acting AAG Argentieri have also touted early successes of the Department’s pilot program on Compensative Incentives and Clawbacks, which was announced in March 2023 and detailed in a prior Gibson Dunn client alert.[15] DAG Monaco described the pilot program as “already bearing fruit,” pointing to the recent resolutions with Albemarle and Corficolombiana which included incentive requirements pursuant to the pilot program’s requirement that companies include compliance-promoting criteria in their compensation systems.[16] In the Albemarle resolution, the company received credit for proactively withholding future bonuses of employees who engaged in misconduct in the form of an offset against its criminal monetary penalty equal to the amount of the bonuses that were withheld.[17] Corficolombiana agreed to implement compliance criteria in its compensation and bonus system.[18]

In the final months of 2023, DOJ underscored also the Department’s continued “innovation” in the realm of voluntary self-disclosure, including a new uniform safe harbor policy for disclosures made following mergers and acquisitions, which we cover in more detail in the next section of this report.[19] PADAG Miller made clear that DOJ has placed a “new and enhanced premium on voluntary self-disclosure” throughout 2023.[20] Specifically, he highlighted the Department’s aim for consistency and transparency with its uniform roll-out of a single voluntary self-disclosure policy across U.S. Attorneys’ Offices, discussed in further detail in our 2023 Mid-Year Corporate Resolutions Update.[21] In her address on November 29, 2023, Acting AAG Argentieri explained that these policies encouraging companies to voluntarily self-disclose misconduct serve another valuable purpose—namely, allowing DOJ “to build stronger cases against culpable individuals more quickly.”[22] In support, she cited the fact that 14 individuals had been charged in connection with the Fraud Section’s 2023 corporate resolutions and declinations with disgorgement.[23]

Announcement of Consumer Protection Branch Voluntary Disclosure Policy

On March 3, 2023, DOJ publicly released a voluntary self-disclosure policy for the Consumer Protection Branch (“CPB”) of the Civil Division. The policy, dated February 2023, is designed to encourage companies to voluntarily self-disclose to the CPB “potential violations of federal criminal law involving the manufacture, distribution, sale, or marketing of products regulated by, or conduct under the jurisdiction of, the Food and Drug Administration (FDA), the Consumer Product Safety Commission (CPSC), the Federal Trade Commission (FTC), or the National Highway Traffic Safety Administration (NHTSA),” and also to disclose “potential misconduct involving failures to report to, or misrepresentations to, those agencies.”[24] The policy states that as long as there are no aggravating actors, CPB will not seek a corporate guilty plea for disclosed conduct if the company has: (1) voluntarily self-disclosed directly to CPB; (2) fully cooperated as described in JM § 9-28.700; and (3) timely and appropriately remediated the criminal conduct as described in U.S.S.G. § 8B2.1(b)(7), “including providing restitution to identifiable victims and improving its compliance program to mitigate the risk of engaging in future illegal activity.”[25] In addition, the policy provides that “CPB will not require the imposition of an independent compliance monitor for a cooperating company that voluntarily self-discloses the relevant conduct if, at the time of resolution, the company also demonstrates that it has implemented and tested an effective compliance program as described in U.S.S.G. § 8B2.1.”[26] This new policy likely will trigger more corporate self-disclosures and may be the fodder for more NPAs and DPAs.

Announcement of M&A Safe Harbor Policy

On October 4, 2023, in remarks at the Society of Corporate Compliance and Ethics’ Annual Compliance & Ethics Institute, DAG Monaco announced that, for the first time, DOJ has adopted a uniform safe harbor policy for voluntary disclosures that companies make in the context of mergers and acquisitions (“M&A”).[27] This new M&A Safe Harbor Policy is the latest in a series of DOJ updates that are aimed at incentivizing voluntary self-disclosures. DAG Monaco explained that DOJ seeks to incentivize acquiring companies to “timely disclose misconduct uncovered during the M&A process” by clarifying timelines and conduct necessary to achieve a presumption of declination for an acquired entity’s misconduct.[28]

The new Mergers & Acquisitions Safe Harbor Policy applies department-wide to conduct discovered and disclosed by an acquiring company during the M&A process—whether before or after closing. Under the policy, acquiring companies will receive the presumption of a declination if they promptly and voluntarily disclose misconduct discovered in bona-fide, arms-lengths M&A transactions, provided that they cooperate with DOJ, timely and “fully remediate” the misconduct, and make appropriate restitution and disgorgement.[29] DAG Monaco explained that, “[to] ensure predictability,” DOJ was setting “clear timelines” for the disclosure and remediation. Specifically, under the policy, companies have a baseline of six months from the date of closing to disclose misconduct discovered at the acquired entity (regardless of whether the misconduct was discovered pre- or post-acquisition) and a baseline of one year from the date of closing to fully remediate the misconduct.[30] However, these deadlines are subject to a reasonableness analysis dependent on the facts, circumstances, and complexity of a particular transaction. For example, DAG Monaco explained that DOJ could extend these deadlines in certain circumstances and that “companies that detect misconduct threatening national security or involving ongoing or imminent harm can’t wait for a deadline to self-disclose.”[31] Under the policy, aggravating factors at the acquired company also will not impact the acquiring company’s ability to receive a declination.[32] Depending on the circumstances, the acquired entity may also qualify for voluntary self-disclosure benefits, including potentially a declination.[33]

Creation of the International Corporate Anti-Bribery Initiative

In a November 29, 2023 keynote address at the 40th International Conference on the Foreign Corrupt Practices Act (“FCPA”), Acting AAG Argentieri emphasized DOJ’s continued coordination with foreign authorities on investigations that involve misconduct in multiple countries.[34] Acting AAG Argentieri announced the creation of the International Corporate Anti-Bribery initiative (“ICAB”)—a new initiative intended to build on and deepen DOJ’s partnerships with foreign enforcement authorities. ICAB, which will be led by three prosecutors with corruption experience, seeks to strengthen DOJ’s ability to identify, investigate, and prosecute foreign bribery offenses in certain targeted regions.[35]

Continued Developments in SEC Corporate Enforcement Policy

Culture of Proactive Compliance

In addition to the developments in DOJ enforcement policy described above, the SEC also provided insight into its corporate enforcement policies, priorities, and actions over the past year.[36]

In an October 24, 2023 address at the New York City Bar Association’s Compliance institute, SEC Enforcement Director, Gurbir Grewal, provided guidance on how compliance professionals, who “serve as the first lines of defense against misconduct,” can work to create a “culture of proactive compliance.”[37] Director Grewal explained that proactive compliance requires three components: (1) education, (2) engagement, and (3) execution. He first explained that compliance professionals must educate themselves “about the law and [relevant] external developments,” such as new actions, examination priorities, or SEC rules, with a particular focus on “emerging and heightened risk areas.”[38] Director Grewal stated that compliance professionals must “really engage” with their company’s business units and seek to understand “their activities, strategies, risks, financial incentives, counterparties, sources of revenue and profits.”[39] Director Grewal then noted that proactive compliance also requires effective implementation of meaningful policies and procedures, through “leadership, training, constant oversight and the right tone at the top.”[40] He stressed the importance of self-reporting, adding that, if compliance officials were to detect a securities violation, “the best thing to do would be to self-report and cooperate.”[41]

Director Grewal also addressed the issue of Chief Compliance Officer (“CCO”) liability, which he referred to as “the proverbial elephant that shows up in any room where a regulator like me is speaking to those working in compliance.”[42] Director Grewal emphasized that the SEC does “not second-guess good faith judgments of compliance personnel made after reasonable inquiry and analysis.”[43] He explained that the SEC generally brings enforcement actions against CCOs where: (1) they affirmatively participated in misconduct unrelated to their compliance role or responsibilities; (2) they misled regulators; or (3) there was a “wholesale failure” by the CCO in carrying out their compliance responsibilities.[44] As an example of the first category, Director Grewal cited the case of Steven Teixeira, the Chief Compliance Officer of a U.S. unit of a Chinese international payment processing company, LianLian Global.[45] The SEC charged Teixeira with insider trading based on allegations that he “traded based on material nonpublic information that he surreptitiously obtained from his girlfriend’s laptop about upcoming mergers and acquisitions in which her employer was involved” and then traded on that information.[46] For the second category, Director Grewal pointed to the SEC’s case against Meredith Simmons.[47] Ms. Simmons was charged with “aiding and abetting and causing a firm’s books and records violation when she provided backdated and factually inaccurate compliance review memos to the SEC, falsely claiming that she created the memos contemporaneously with the reviews”[48] while acting in her capacity of CCO for a New York-based hedge fund.[49] Director Grewal described the “wholesale failure” cases as “rare,” noting that such cases generally involved “no education, no engagement and no execution.”[50]

International Developments

As noted in previous updates (see, e.g., our 2021 Year-End Update), several countries outside the United States have developed DPA-like regimes in the past several years. In particular, such agreements have now been used by enforcement agencies in Brazil (see our 2019 Year-End Update for details), Canada (see our 2018 Mid-Year Update for details), France (see our 2019 Year-End and 2020 Mid-Year Updates for details), Singapore, and the United Kingdom (see our 2014 Year-End Update for details), with varying degrees of frequency. Notably, Canada saw its second-ever DPA-like agreement (known as a remediation agreement) in 2023, and following a two-year hiatus on DPAs in the UK, 2023 saw its first-ever use by an enforcement entity other than the Serious Fraud Office.

United Kingdom

In a significant development, on December 5, 2023, the UK’s Crown Prosecution Service (“CPS”) entered into its first-ever DPA with a corporate entity. Previously, DPAs had only been used by the UK’s Serious Fraud Office (“SFO”). Entain plc, a London-headquartered global online sports betting and gaming business, entered into the DPA with the CPS to resolve allegations that Entain had failed to prevent bribery by its third-party suppliers and employees in Turkey, in violation of Section 7 of the UK Bribery Act (Failure to Prevent Bribery).[51] The alleged offenses took place from July 2011 to December 2017 in Turkey, leading to an investigation by HM Revenue and Customs.[52] Entain has since exited its business from Turkey and significantly strengthened its global compliance controls. According to the CPS, the full statement of facts will be published after any criminal proceedings against individuals are completed.

As part of the agreement, Entain agreed to pay a total of £615 million ($782.9 million as of the time of this writing).[53] This figure includes a financial penalty and disgorgement of profits of £585 million, payment of CPS’s costs of £10 million, and a charitable payment of £20 million.[54] In the court’s approval of the agreement, Entain was credited for its “extensive cooperation” with the investigation.[55] And in determining that a DPA was an appropriate resolution, the court considered the disproportionate consequences (e.g., Entain potentially losing its licenses in other jurisdictions) that the company might have suffered if the company had been criminally prosecuted instead.[56]

Although it is the first time that the CPS has utilized this resolution mechanism, the Entain DPA is the second-largest corporate criminal settlement in UK history, surpassed in value only by the SFO’s DPA with Airbus in 2020, which we discussed in our 2020 Mid-Year Update. It remains to be seen whether CPS will expand its use of DPAs in corporate criminal proceedings, but companies facing criminal charges in the UK will undoubtedly look to the Entain DPA as a test case going forward.

France

After a quiet first few months of the year, France’s prosecuting agencies entered into multiple DPA-like agreements (known as convention judiciaire d’intérêt public, or “CJIPs”) since May 2023.

On May 15, 2023, Guy Dauphin Environnement (“GDE”), a recycling and waste management company, entered into a CJIP with the French National Prosecutor’s Office (“PNF”) to resolve allegations of public corruption related to the construction of a landfill.[57] The PNF alleged that GDE attempted to influence a local government council’s decision regarding the landfill by inviting the president of the council and his chief of staff to lunches and dinners, and by considering the appointment of the president of the council to GDE’s supervisory board, among other favors.[58] Under the CJIP, GDE agreed to pay a fine of €1.23 million (approximately USD $1.35 million) and spend three years implementing a compliance program supervised by the French Anti-Corruption Agency.[59]

Additionally, on May 15, 2023, Bouygues Bâtiment Sud Est, an engineering, construction, and real estate development firm, and its subsidiary Linkcity Sud Est, a real estate developer, entered into a CJIP with the PNF to resolve allegations that the companies benefited from irregularities in the awarding of several public procurement contracts. Specifically, the companies allegedly provided employees of the Hospital of Annecy Genevoi, a state-owned entity, with restaurant invitations and concert tickets in connection with the award of several construction projects, and several procurement selection criteria were allegedly disregarded throughout the contract process as a result of these favors.[60] As part of the CJIP, Bouygues Bâtiment Sud Est and Linkcity Sud Est agreed to pay a fine of €7.96 million (approximately USD $8.7 million) and submit to the supervision of the French Anti-Corruption Agency for a three-year period for purposes of developing the companies’ compliance program.[61]

On June 27, 2023, Technip UK Limited, a subsidiary of TechnipFMC plc, and Technip Energies France SAS, a subsidiary of Technip Energies NV—all global providers of oil and gas services, entered into a CJIP with the PNF to resolve allegations of bribery and corruption of foreign public officials between 2008 and 2012 related to Technip’s subsea projects in Africa.[62] Under the CJIP, Technip UK and Technip Energies France agreed to pay fines of €154.8 million and €54.1 million, respectively, for a total of €208.9 million (approximately $227.5 million as of this writing).[63]

On October 11, 2023, Acieries Hachette et Driout, a steel mill in Saint-Dizier, France, signed a CJIP with the financial prosecutor of the Tribunal judiciaire de Belfort.[64] According to the financial prosecutor, an investigation revealed that Acieries Hachette et Driout produced checks to another company as a bribe to ensure that this company would sell Hachette’s steel products to Cryostar, an industrial equipment supplier in the medical and industrial gas, natural gas, hydrogen, and clean energy fields. Acieries Hachette et Driout was instructed to pay €1.2 million in fines to settle the allegations.

On November 28, 2023, the Seves Group SARL and Sediver SAS signed a CJIP with the Financial Public Prosecutor at the Paris judicial court.[65] According to the allegations, the two companies fraudulently obtained public contracts in the Democratic Republic of Congo as part of several projects to modernize electrical infrastructure. These companies obtained these contracts by paying Fichtner, a company appointed by the World Bank to manage the infrastructure rehabilitation program. The scheme was then reproduced in Algeria, Nigeria, and Libya. The World Bank had been investigating this program since January 2015. Sediver self-reported the scheme to the Financial Public Prosecutor in Nanterre in April 2017. The CJIP imposes a fine of more than €13 million and requires the implementation of a compliance program under the supervision of the French Anti-Corruption Agency for a term of three years.

On November 29 2023, the Marseille prosecutor’s office validated three CJIPs entered into with companies of the Omnium development group.[66] An investigation had been opened into SEMIVIM (a “bailleur social,” which is a local company that develops then rents housing at moderate rates, and often is treated like a governmental service) in the city of Martigues, under suspicion of bribery in the allocation of construction projects during a public bidding process. The Société d’isolation et de peinture Omnium, Sud est étanchéité, and Entreprise Ventre, three companies of the Omnium group, were accused of bribing an employee of SEMIVIM to secure these projects. One of the Omnium executives admitted that the company was awarded a construction project called “Paradis Saint Roch” as a result of his participation in this scheme. The companies were indicted in May 2022 on counts of corruption of a person charged with a public service mission, influence-peddling on a person charged with a public service mission, concealment of favoritism, and concealment of illegal taking of interests. The companies of the Omnium group must pay a public interest fine of €1,700,000. A three-year compliance program must also be established under the control of the French Anti-Corruption Agency. And the CJIP requires payments of €125,000 to SEMIVIM and €125,000 to the municipality of Martigues in compensation for their damages. The investigation into other actors in the bribery scheme is ongoing.

Finally, on December 4, 2023, the French National Financial Prosecutor’s Office validated a CJIP with ADP Ingénierie, a company of Groupe ADP.[67] ADP operates three Paris airports and 26 international airports, and ADP Ingénierie provides engineering for airport development projects. The agreement terminates the investigations relating to bribery in contracts concluded by ADP Ingénierie in Libya in 2007 and 2008, and in the Emirate of Fujairah in 2011. To settle the allegations, the company agreed to pay a fine of €14.6 million under the terms of the CJIP. The also CJIP provides that ADP International and its subsidiaries are subject to a compliance program of two years managed by an independent Integrity Compliance Officer (not by the French Anti-Corruption Agency), and ADP SA agreed to implement improvements to its group-wide compliance program.

Canada

On May 17, 2023, the Public Prosecution Service of Canada (PPSC) announced that Ultra Electronics Forensic Technology Inc. (UEFTI), a 3D imaging and automated ballistic identification company, had entered into a remediation agreement with the PPSC earlier in the year, to resolve allegations of public corruption related to the bribing of government officials in the Philippines. UEFTI allegedly attempted to bribe the two officials to win a contract with the Philippine National Police for a ballistic identification system.[68]

As part of the four-year remediation agreement, UEFTI agreed to pay a penalty of C$6,593,178 (approximately USD $4.9 million); a surcharge of C$659,318 (approximately USD $492,000); and forfeiture of C$3,296,589 (approximately USD $2.5 million). UEFTI must also cooperate in any future investigations related to the conduct and submit to the supervision of an external auditor for a four-year term, paid for by UEFTI.[69]

2023 Agreements Since Mid-Year Update

The remainder of this alert summarizes corporate resolutions from July 31, 2023 to December 31, 2023. The appendix at the end of the alert provides key facts and figures regarding these resolutions, along with links to the resolution documents themselves (where available).

Albemarle Corporation (NPA)

On September 28, 2023, Albemarle Corporation (“Albermarle”), a specialty chemicals manufacturing company, entered into a three-year NPA with the U.S. Department of Justice’s Criminal Division, FCPA Section, and the U.S. Attorney’s office for the Western District of North Carolina.[70] The agreement resolved allegations of a bribery conspiracy involving public officials in Vietnam, Indonesia, and India from 2009 through 2017.[71] The government alleged that the company conspired to pay bribes to government officials through its third-party sales agents and subsidiary employees, in exchange for obtaining and retaining chemical catalyst business with state-owned refineries worth approximately $98.5 million.[72] According to the agreement, Albermarle self-reported the conduct 16 months after learning of the misconduct but the government did not view the disclosure as “reasonably prompt” under the Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy and the U.S. Sentencing Guidelines.[73]

In connection with the agreement, Albemarle agreed to pay a total of $218.4 million, including $98.2 million in penalties.[74] Albemarle also agreed to pay another $98.5 million in forfeiture of the proceeds of the alleged violation, of which DOJ credited $81.9 million on account of the company’s agreement to pay $103.6 million in disgorgement and prejudgment interest to resolve a parallel investigation by the SEC.[75] The agreement imposes additional corporate obligations on the Company, including a requirement to self-report evidence or allegations of conduct that may constitute a violation of the FCPA anti-bribery or accounting provisions, and to modify its compliance program to ensure it maintains an effective system of internal accounting controls and a rigorous anti-corruption compliance program, but does not impose an independent monitor.

Amani Investments, LLC (Guilty Plea)

On January 19, 2023 Amani Investments, LLC, (“Amani”), a registered Money Service Business and operator of kiosks that exchanged U.S. currency for Bitcoin, entered into a plea agreement with the U.S. Attorney’s Office for the Eastern District of California to resolve allegations that Amani violated the federal Bank Secrecy Act, which requires money services businesses to report each transaction involving more than $10,000 in currency via a Currency Transaction Report (“CTR”).[76] According to the agreement, on multiple occasions Amani exchanged over $10,000 in U.S. currency for Bitcoin without filing a CTR, resulting in more than $1,000,000 in unreported transactions.[77]

Pursuant to the agreement, Amani agreed to forfeit a 2019 Mercedes-Benz, several gold coins, approximately 0.041836 Bitcoin, a Bitcoin Casascius coin (a physical coin that contains a Bitcoin redemption code), and $1,000,000 in U.S. currency.[78] The parties also agreed that the government would recommend to the court a two- to three-level reduction in the computation of the applicable offense level for sentencing purposes if Amani clearly demonstrates acceptance of responsibility for its conduct including by meeting with and assisting the probation officer in the preparation of the pre-sentence report, being truthful and candid with the probation officer, and not otherwise engaging in conduct that constitutes obstruction of justice.[79] Amani expressly reserved the right to argue that it is unable to pay a fine, and that no fine be imposed.[80]

In sentencing Amani, the court accepted the agreed-upon forfeiture order proposed by the parties.[81] The court also sentenced Amani to 36 months of probation.[82] Neither the plea agreement nor judgment contained any heightened compliance or reporting requirements.

Aylo Holdings S.à.r.l. (DPA)

On December 21, 2023, Aylo Holdings S.à.r.l. (formerly known as “MindGeek S.à.r.l.”) and its subsidiaries (collectively referred to as “MindGeek”) entered into a DPA with the United States Attorney’s Office for the Eastern District of New York to resolve allegations that MindGeek, which operated and maintained websites through which third parties could post and distribute pornographic videos, engaged in “unlawful monetary transactions” from 2017 to 2020.[83] Such transactions included receiving payments for hosting videos from certain content providers despite having indications that those providers engaged in sex trafficking and misled numerous actresses to participate in pornographic films by luring the actresses with advertisements for “modeling” jobs and only later revealing the true nature of the work.[84] According to DOJ’s allegations, those content providers proceeded to misrepresent to their victims that the films would not be posted online and, in some cases, would pressure women into participating with threats of legal action, “outing,” or canceling their flights home if they failed to perform.[85]

The DPA requires MindGeek, which did not self-disclose its conduct to DOJ, to pay a total monetary penalty of $1,844,953—including a $974,692 criminal fine and $870,261 in forfeiture—and to pay compensation to the individuals who were defrauded, or otherwise a victim of sex trafficking by the content providers at issue, and had their images posted on websites owned, operated, or controlled by MindGeek.[86] MindGeek also agreed to undergo a three-year monitorship by an independent compliance monitor with expertise in screening and monitoring illegal content for online platforms.[87]

Banque Pictet et Cie SA (DPA)

On December 4, 2023, the U.S. Department of Justice announced that Banque Pictet et Cie SA (“Banque Pictet”), a bank based in Switzerland, entered into a three-year DPA with the U.S. Attorney’s Office for the Southern District of New York, resolving allegations that the bank conspired with U.S. taxpayers to hide $5.6 billion in assets from the IRS in undeclared bank accounts.[88] This alleged conspiracy involved the bank helping U.S. taxpayers hide assets, sometimes through intermediaries, and then to repatriate assets to the United States to avoid discovery by U.S. authorities.[89] The alleged undeclared assets of U.S. taxpayers totaled approximately $5.6 billion across 1,637 bank accounts, and taxpayers allegedly evaded approximately $50.6 million in U.S. taxes through the conspiracy.[90] The bank also allegedly circumvented a Qualified Intermediary Agreement that the bank had signed with the IRS in April 2002 to ensure that U.S. securities held by the bank were subject to appropriate tax withholding.

Banque Pictet agreed to pay a total of approximately $122.9 million to the U.S. Treasury, which included approximately $31.8 million in restitution, $52.2 million in forfeiture, and a $39 million penalty.[91] Additionally, the bank agreed to provide annual reports attesting to its continuing compliance with the terms of the DPA and providing specific updates regarding its performance of the DPA’s terms. Among other terms, the DPA requires: continued cooperation with DOJ and the Internal Revenue Service, including compliance with requirements of the Program for Non-Prosecution Agreements or Non-Target Letters for Swiss Banks (the “Swiss Bank Program”),[92] a self-disclosure program announced by the Tax Division of DOJ in 2013, and under which a total of 84 banks self-disclosed misconduct in exchange for NPAs. The DPA also includes a requirement to close relevant accounts, a prohibition on opening additional violative accounts, and self-reporting of violations of other U.S. criminal laws during the DPA’s term.[93]

Binance (Guilty Plea)

Binance is the world’s largest crypto currency exchange by trading volume and it is an overseas, non U.S. company. On November 21, 2023, Binance reached a settlement to resolve a multi-year investigation with DOJ, the Commodity Futures Trading Commission (“CFTC”), the U.S. Department of Treasury’s Office of Foreign Asset Control (“OFAC”), and the Financial Crimes Enforcement Network (“FinCEN”).[94] Gibson Dunn represented Binance in this resolution.

Although Binance is a non-U.S. company, the enforcers alleged that it historically had U.S. users on its platform. As a result, the enforcers alleged that Binance needed to register as a foreign-located money services business and maintain an adequate anti-money laundering (“AML”) program under U.S. law because it did business “wholly or in substantial part” within the United States.[95]

Prior to the Binance resolution, resolutions with cryptocurrency exchanges generally involved U.S. exchanges, which are prohibited from providing financial services to persons in jurisdictions subject to sanctions regulated by OFAC.[96] As a non-U.S. person, Binance could do business in sanctioned jurisdictions.[97] However, because Binance’s platform historically had both U.S. users and users from sanctioned jurisdictions, enforcers alleged that Binance used a “matching engine [. . .] that matched customer bids and offers to execute cryptocurrency trades.”[98] The failure to have sufficient controls on the matching engine meant that it would “necessarily cause” transactions between U.S. users and users subject to U.S. sanctions.[99] Enforcers took the position that these transactions violated U.S. civil and criminal sanctions law because the International Emergency Economic Powers Act (“IEEPA”) prohibits, among other things, “causing” a violation of sanctions by another party.[100] In other words, by pairing trades between a historical U.S. user and person from a sanctioned jurisdiction, Binance was causing the U.S. person to violate their sanctions obligations. This resolution illustrates the breadth of U.S. jurisdiction to police sanctions offenses, even against non-U.S. companies.

Criminally, Binance pled guilty to (1) conspiracy to conduct an unlicensed money transmitting business, in violation of 18 U.S.C. § 1960 and 31 U.S.C. § 5330 for failure to register,[101] (2) failure to maintain an effective anti-money laundering program, in violation of 31 U.S.C. §§ 5318(h), 5322,[102] and (3) violating the International Emergency Economic Powers Act, 50 U.S.C. § 1701 et seq.[103] Binance also entered into parallel civil settlements with FinCEN (failure to register, AML program) and OFAC (sanctions).[104] Further, Binance also entered into a settlement with the CFTC for violating various sections of the Commodities Exchange Act.[105]

As part of the resolution, which binds the entire DOJ Criminal and National Securities Divisions, Binance agreed to pay $4.3 billion to the U.S. government over an approximately 18-month period.[106] Binance also agreed to continue with certain compliance enhancements and agreed to a three-year DOJ monitorship.[107]

Centera Bioscience (Guilty Plea)

On October 30, 2023, Centera Bioscience (d/b/a Nootropics Depot), an Arizona-based marketer and distributor of pharmaceutical drugs, entered into a plea agreement with the U.S. Attorney’s Office for the District of New Hampshire, to resolve allegations that Centera Bioscience distributed misbranded drugs into interstate commerce that had not been approved by the Food and Drug Administration (FDA).[108] According to the plea agreement, Centera Bioscience “sold multiple drugs, including tianeptine, phenibut, adrafinil, and racetam drugs” on Nootropicsdepot.com and other online platforms between April 2018 and December 2021 in violation of 21 U.S.C. § 331(a), which prohibits introducing adulterated or misbranded drugs into interstate commerce.[109] These misbranded drugs were distributed throughout the United States, including in New Hampshire where the charges were brought, even though the FDA has not approved any of these drugs for use in the United States. The Company’s CEO, Paul Eftang, also pleaded guilty to the same offense.

As part of the plea agreement, Centera Bioscience agreed to forfeit $2.4 million and forfeit all drugs that had been seized in connection with this matter by the FDA and Customs and Border Protection.[110] The company also agreed to a term of three years of probation. Sentencing has been scheduled for February 5, 2024.

Corporación Financiera Colombiana SA (DPA)

On August 10, 2023, Corporación Financiera Colombiana SA (“Corficolombiana”) entered into a three-year DPA with the U.S. Department of Justice’s Criminal Division’s Fraud Section and the U.S. Attorney’s Office for the District of Maryland to resolve allegations that the Company had conspired to offer and pay more than $23 million in bribes to high-ranking Colombian government officials to win a contract to construct and operate a highway toll road known as the Ocaña-Gamarra Extension, in violation of the FCPA.[111]

Pursuant to the DPA, Corficolombiana agreed to pay a criminal penalty of $40.6 million.[112] However, the DPA also includes a provision allowing the Company to credit up to half of that criminal penalty against the amount assessed against the company and its subsidiary, Estudios y Proyectos del Sol S.A.S. (“Episol”), by Colombia’s Superintendencia de Industria y Comercio (“SIC”), for violations of Colombian laws related to the same conduct, so long as the company and Episol drop their appeals of the SIC resolution.[113] In addition, Corficolombiana will pay over $40 million in disgorgement and prejudgment interest as part of a resolution of the SEC’s parallel investigation.[114] The company has implemented, and agreed to continue to implement, compliance policies and procedures to prevent and detect violations of the FCPA and other applicable anti-corruption laws, including implementing compliance criteria in its compensation and bonus system.[115] During the DPA’s term, Corficolombiana is also required to provide periodic reports regarding its compliance program and to self-report any evidence or allegations of further violations of FCPA anti-bribery or accounting provisions.[116]

Freepoint Commodities LLC (Guilty Plea)

On December 14, 2023, Freepoint Commodities LLC (“Freepoint”) entered into a three-year DPA with the DOJ’s Criminal Division Fraud Section and the U.S. Attorney’s Office for the District of Connecticut, to resolve allegations that Freepoint was involved in a corrupt scheme to pay bribes to Brazilian government officials in violation of anti-bribery provisions of the FCPA.[117] DOJ separately charged three individuals in relation to the alleged bribery scheme, including a Freepoint senior oil trader and agent.[118]

According to the DPA, from approximately 2012 and continuing through 2018, Freepoint employees and agents agreed to pay approximately $3.9 million to Eduardo lnnecco, a Brazilian oil and gas broker working as an agent for various energy trading companies including Freepoint.[119] Payments were allegedly made for the purpose of bribing Brazilian foreign officials to secure improper commercial advantages to obtain business from Petrobras, a Brazilian state-owned and state-controlled oil company.[120] Freepoint allegedly earned over $30 million in connection with the conduct at issue.[121]

Freepoint received cooperation credit despite its “limited” and “reactive” cooperation in early phases of the investigation.[122] Freepoint did not receive voluntary disclosure credit but received credit based on efforts to cooperate with the investigation, conducting internal analyses of the alleged conduct, and committing to enhance its compliance programs.[123] In light of the cooperation efforts, Freepoint’s criminal penalty was set at $68 million which reflected a discount of 15% off the bottom of the U.S. Sentencing Guidelines fine range, and forfeiture of over $30 million.[124] Freepoint has also agreed to disgorge more than $7.6 million to the Commodity Futures Trading Commission (“CFTC”) in a related matter which will be credited up to 25% of the forfeiture amount against disgorgement.[125]

Freepoint agreed to continue cooperating with DOJ in any ongoing or future criminal investigation relating to the conduct at issue, and to report evidence of any other conduct that would violate U.S. antibribery provisions.[126] It also agreed to continue implementing an effective corporate compliance program and report progress annually to the Fraud Section and the U.S. Attorney’s Office for the District of Connecticut for the term of the agreement, with a possible extension of an additional year if the Fraud Section and Office determine that Freepoint knowingly violates any provision of the agreement or fails to fulfill all obligations.[127]

GDP Tuning LLC and Custom Auto of Rexburg LLC (Guilty Plea)

On August 23, 2023, GDP Tuning LLC and Custom Auto of Rexburg LLC (d/b/a Gorilla Performance), and the companies’ owner, Barry Pierce (collectively, “Gorilla Performance Parties”), entered into a plea agreement with the U.S. Attorney’s Office for the District of Idaho and the Department of Justice’s Environment and Natural Resources Division to resolve allegations that Gorilla Performance Parties had conspired to violate the Clean Air Act (“CAA”).[128] The defendants admitted to purchasing and selling tuning devices and software that tampered with vehicles’ onboard diagnostic systems for emissions. These devices allowed vehicle owners to remove vehicle emissions control equipment without the vehicles’ on-board diagnostic systems detecting the removal and activating “limp mode,” which substantially reduces vehicles’ speeds. Such monitoring devices in vehicles are required under the CAA.[129]

Gorilla Performance Parties agreed to pay $1 million in criminal fines in total and to not manufacture, sell, or install devices that defeat vehicles’ emissions controls.[130] The defendants also agreed not to commit future violations of the CAA or other federal, state, or local laws or environmental regulations.[131] The maximum financial penalty is $500,000 or twice the gross gain, on the approximately $14 million in revenue the defendants received from the scheme.[132] The plea agreements also include five years of probation.[133] As of the date of this publication, the defendants had not been sentenced.

Glenmark Pharmaceuticals Inc., USA (DPA) and Teva Pharmaceuticals USA, Inc. (DPA)

On July 31, 2023, Glenmark Pharmaceuticals Inc., USA (“Glenmark”) entered into a three-year DPA with DOJ Antitrust Division resolving allegations of conspiracy to fix prices of pravastatin, a cholesterol drug, and other generic drugs sold in the United States in violation of the Sherman Act, 15 U.S.C. § 1.[134] Glenmark was charged with conspiring with Teva Pharmaceuticals, whose DPA was announced the same day and is discussed below, among other companies.

Glenmark agreed to a $30 million criminal penalty. The agreement notes that DOJ and Glenmark agreed to a penalty below the relevant Guidelines fine range due to Glenmark’s inability to pay a higher monetary penalty without substantially jeopardizing its continued viability.[135] In addition to the penalty, the agreement requires that Glenmark divest its pravastatin drug line—the Glenmark and Teva DPAs are the first to use the remedy of divestiture.[136] The company has implemented, and agreed to continue to implement, compliance policies and procedures to prevent and detect antitrust violations.[137] During the DPA’s term, Glenmark is required to provide periodic reports regarding its compliance program.[138]

Approximately one month later, on August 21, 2023, Teva Pharmaceuticals USA, Inc. (“Teva”) entered into a three-year DPA with DOJ Antitrust Division also resolving allegations of conspiracy to fix prices of pravastatin and other generic drugs sold in the United States in violation of the Sherman Act, 15 U.S.C. § 1.[139]

Teva agreed to a $225 million criminal penalty and to donate $50 million worth of certain medications to humanitarian organizations.[140] According to DOJ’s press release, this is the largest penalty to date for a domestic antitrust cartel.[141] In addition to the penalty, like the Glenmark DPA, the agreement requires Teva to divest its pravastatin drug line.[142] Unlike the Glenmark DPA, the agreement requires Teva to retain a monitor to facilitate, oversee, and report on the divestiture.[143] Teva’s DPA is particularly notable for its express discussions of both (1) the fact that a guilty plea would result in mandatory exclusion from federal programs and the collateral impact that a guilty plea would have on customers and employees; and (2) the fact that the DPA represents the parent company’s second such agreement, Teva having entered into a DPA in 2016 to resolve FCPA charges.[144] The DPA states that although DOJ “generally disfavors multiple deferred prosecution agreements, the resolution here is appropriate given that the matters at issue in the 2016 resolution did not involve recent or similar types of misconduct; the same personnel, officers, or executives; or the same entities; and in light of the extraordinary remedial measures required.”[145] This reflects the more nuanced approach to “recidivism” articulated in the 2023 revisions to DOJ’s Corporate Enforcement Policy, discussed in our 2023 Mid-Year Update.

H&D Sonography LLC (DPA)

On August 15, 2023, H&D Sonography LLC (“H&D”), a New Jersey-based diagnostic testing company, entered into a three-year DPA with the U.S. Attorney’s Office for the District of New Jersey to resolve allegations that H&D conspired to violate the federal Anti-Kickback Statute by overpaying physicians for office space in return for increased diagnostic test referrals.[146] According to the DPA, from January 2015 to December 2018, H&D subleased space in physicians’ offices for the purpose of conducting diagnostic tests.[147] H&D allegedly paid the physicians for more hours than it used, at times paying more than the offices’ monthly rents.[148] According to the government, in return for these payments the physicians referred patients to H&D, which then billed Medicare for the tests.[149]

The DPA does not impose any criminal penalties or restitution on H&D, nor does it impose a monitor. Concurrently with the DPA, H&D and its owners agreed to a $95,000 civil settlement to resolve allegations that H&D’s Medicare billing violated the False Claims Act.[150] The settlement states that $75,000 of the settlement amount is restitution.[151]

HealthSun Health Plans, Inc. (Declination with Disgorgement)

On October 25, 2023, DOJ’s Fraud Section issued a CEP declination to HealthSun Health Plans, Inc. (“HealthSun”).[152] The HealthSun declination is one of three CEP declinations issued by DOJ in 2023.[153] According to the declination letter, the government’s investigation found evidence that from approximately 2015 to 2020, HealthSun’s former Director of Medicare Risk Adjustment Analytics submitted, and caused HealthSun to submit to the U.S. Department of Health and Human Services’ Centers for Medicare & Medicaid Services (“CMS”), false and fraudulent information to increase reimbursements to HealthSun for certain Medicare Advantage enrollees.[154] DOJ alleged that CMS made approximately $53 million in overpayments to HealthSun because of HealthSun’s conduct. DOJ stated that it had declined to prosecute the case based on an assessment of the factors in the Corporate Enforcement and Voluntary Disclosure Policy, including HealthSun’s timely and voluntary self-disclosure of the misconduct, full and proactive cooperation, and timely and appropriate remediation.[155] According to the declination letter, HealthSun’s cooperation included producing information about all individuals involved in the misconduct and information obtained from imaging several business and personal cell phones; and its remediation included reporting and correcting the false information submitted to CMS and implementing and testing a risk-based Medicare Advantage compliance program.

In connection with the declination, HealthSun agreed to disgorge the approximately $53 million that DOJ alleged CMS overpaid.[156] In connection with the alleged scheme, the company’s former Director of Medicare Risk Adjustment Analytics has been charged with conspiracy to commit health care fraud, as well as wire fraud and major fraud against the United States.[157]

Lifecore Biomedical, Inc. (Declination with Disgorgement)

On November 16, 2023, DOJ’s Fraud Section and the United States Attorney’s Office for the Northern District of California informed Lifecore Biomedical, Inc. (“Lifecore”) that they were declining to prosecute the company for alleged bribes paid to Mexican government officials in violation of the FCPA.[158] According to the declination letter, Lifecore’s former subsidiary Yucatan Foods L.P. (“Yucatan”) owned and operated Procesadora Tanok S. de R.L. de C.V. (“Tanok”).[159] Yucatan and Tanok allegedly paid bribes to Mexican government officials before and after Lifecore acquired Tanok and Yukatan on December 1, 2018.[160] Specifically, the government alleged that individuals from the companies used a third party to pay approximately $14,000 in bribes to a Mexican government official to secure a wastewater discharge permit.[161] Tanok employees and agents also allegedly paid a third party approximately $310,000 to prepare fraudulent manifests while knowing that a portion of the funds were being used to bribe Mexican officials to sign the manifests.[162]

During Lifecore’s pre-acquisition diligence, a Yucatan officer involved in the misconduct took steps to conceal the misconduct from Lifecore and its auditor.[163] Once Lifecore discovered the misconduct during its post-acquisition integration, it conducted an internal investigation and voluntarily disclosed the conduct to DOJ.[164] Lifecore subsequently divested itself of the legacy Yucatan and Tanok business.[165]

The government stated in its declination letter that the financial benefit attributable to the alleged conduct was $1,286,060, and that Lifecore had incurred $879,555 in expenses by constructing a wastewater treatment plant and paying Mexican regulators the duties it owed.[166] Lifecore has agreed to disgorge the remaining $406,505.[167] Lifecore also agreed to continue to cooperate with the government’s ongoing investigation and to require any successor-in-interest to agree to the obligations in the letter, including continued cooperation with the government.[168]

New Orleans Steamboat Company (Guilty Plea)

On August 16, 2023, the New Orleans Steamboat Company (“NOSC”) entered into a plea agreement with the U.S. Attorney’s Office for the Eastern District of Louisiana, resolving allegations that it violated the Clean Water Act by discharging excess ballast material into the Inner Harbor Navigation Canal in New Orleans.[169] The allegations arose out of a 2019 incident in which a former NOSC employee notified the Louisiana State Police Hazmat Hotline that he had captured a video of NOSC employees and supervisors dumping a black, unknown waste material from the M/V City of New Orleans into the Inner Harbor Navigation Canal.[170] In exchange for NOSC’s guilty plea, the U.S. Attorney’s Office agreed it would not bring any other charges against NOSC or any related companion entity that operates out of the same office as NOSC arising from or related to the alleged conduct.[171]

Following the hearing, NOSC was sentenced to a $50,000 fine—the maximum penalty for the violation, one year probation, and a $400 special assessment fee.[172]

Nomura Securities International, Inc. (NPA)

On August 22, 2023, Nomura Securities International, Inc. (“NSI”), a U.S.-based broker-dealer subsidiary of Japanese financial services firm Nomura Holdings, entered into an NPA with the U.S. Attorney’s Office for the District of Connecticut.[173] The NPA resolved allegations that, from approximately 2009 to 2013, NSI, through its employees, engaged in a scheme to defraud its customers by making fraudulent misrepresentations in the purchase and sale of residential mortgage-backed securities.[174] NSI traders allegedly took “secret and unearned compensation from NSI customers” by misrepresenting certain pricing information in trades—for example, by lying to the buyer about the seller’s asking price.[175] NSI also allegedly took steps to conceal the fraudulent conduct from its customers and from employees who did not participate in the scheme.[176]

Pursuant to the NPA, NSI agreed to pay a penalty of $35 million and $807,718 in restitution to impacted customers.[177] The restitution amount credits NSI for remediation payments of $20,125,615 previously made to impacted customers in connection with NSI’s related settlement agreement with the SEC in 2019.[178] The agreement does not contain a requirement for NSI to retain an independent compliance monitor, both because NSI represented that it had taken steps to improve its compliance program to “prevent and detect violations of the securities fraud statutes and other applicable anti-fraud laws,” and because “certain structural changes in the secondary market for [residential mortgage-backed securities]” made it less likely that the relevant conduct would occur again.[179] However, the agreement does impose an ongoing obligation on NSI to self-report “any evidence or allegation of a criminal violation of U.S. federal law.”[180]

NuDay (Guilty Plea)

On September 8, 2023, NuDay entered into a plea agreement with the U.S. Attorney’s Office for the District of New Hampshire, to resolve three counts of failure to file export information, in violation of 13 U.S.C. § 305.[181] According to the plea agreement, NuDay, a New Hampshire-based nonprofit, made over 100 shipments of humanitarian goods to Syria between May 2018 and December 2021 while Syria was subject to sanctions.[182] NuDay allegedly claimed in shipping documents that these shipments were of nominal value to keep them below the $2,500 threshold, above which NuDay would have been required to file an Electronic Export Information through the Automated Export System maintained by the Census Bureau and U.S. Customs and Border Protection.[183] In reality, the value of some of NuDay’s shipments exceeded the threshold, with one of NuDay’s shipments valued at more than $8.3 million.[184] According to the agreement, NuDay used two companies to transport the goods: AJ Worldwide Services transported shipments from the United States to Turkey, and Safir Forwarding shipped them from Turkey to Syria.[185] As the exporting company, NuDay bore responsibility for providing AJ Worldwide Services with truthful information about the value of the goods and their ultimate destination for reporting to the United States Department of Commerce.[186] The plea agreement states that NuDay falsely informed AJ Worldwide Services that the final destination for the shipments was Turkey, rather than identifying the destination as Syria, which would have required an export license.[187]

In the plea agreement, NuDay and the government agreed on a recommended fine of $25,000 and five years of probation.[188] They also stipulated that the founder of NuDay, Nadia Alawa, and her family will have no further involvement with the organization.[189] On December 28, 2023, NuDay was sentenced to five years of probation, the maximum penalty for an organizational defendant.[190] NuDay was also ordered to pay a $25,000 fine.[191]

Pro-Mark Services, Inc. (NPA)

On October 30, 2023, the U.S. Department of Justice announced that Pro-Mark Services, Inc. (“Pro-Mark”) entered into a three-year NPA with the Department of Justice, Antitrust Division, and the U.S. Attorney’s Office for the District of North Dakota, resolving allegations concerning the award of federal construction contracts amounting to $70 million.[192] The agreement required the company to pay a criminal penalty of $949,000.[193]

Secor, Inc. & Matthew Castle (Guilty Plea)

On November 9, 2023, Secor, Inc. (“Secor”), a federal halfway house that contracted with the Federal Bureau of Prisons (“BOP”) to house inmates, entered into a plea agreement with the U.S. Attorney’s Office for the Western District of Virginia, to resolve allegations that Secor made materially false statements to the U.S. Bureau of Prisons (“BOP”) and committed wire fraud.[194] Secor’s former president and director, Matthew Castle pleaded guilty to the same charges.[195] According to the plea agreement, in 2018, Secor entered into a contract with the BOP that allowed some of the offenders under the care of Secor to be assigned to “home confinement,” meaning certain offenders would live at an approved residence not owned by Secor.[196] BOP agreed to pay Secor a per diem rate for offenders who resided at Secor’s facilities and a different per diem rate for those on home-confinement.[197] Under the terms of the contract, Secor was required to outfit home-confinement offenders with GPS monitoring equipment, and Secor personnel were required to personally visit each offender’s residence on at least a monthly basis to ensure the offender was living at their assigned residence and in accordance with applicable rules. In reality, according to its plea agreement, Secor did not issue the GPS monitoring equipment to many of the home-confinement offenders for whom it was required and failed to conduct requisite home visits.[198] Meanwhile, on multiple occasions, Castle completed BOP documentation certifying that he had conducted the required visits and noted no issues, according to his plea agreement.[199] Castle and Secor filed monthly invoices with the BOP for reimbursement, which BOP paid on the basis of Secor’s and Castle’s representations and contractual obligations.[200]

In connection with their plea agreements, Secor and Castle agreed to jointly and collectively pay $208,105 in restitution.[201] Secor agreed to serve one- to five-years’ probation, to be determined at sentencing, to pay $25,000 in criminal fines, and to forfeit $40,000.[202] Castle agreed to pay $5,000 in criminal fines and serve a term of imprisonment of 12-21 months, to be determined at sentencing.[203] Sentencing is currently scheduled to take place in March 2024.[204]

Sinister Manufacturing Company, Inc. (Guilty Plea)

On August 1, 2023, diesel parts manufacturer Sinister Manufacturing Company, Inc. (“Sinister Diesel”) entered into a plea agreement with the U.S. Attorney’s Office for the Eastern District of California and the Environmental Crimes Section of the Environmental and Natural Resources Division to resolve allegations that Sinister Diesel had conspired to violate the Clean Air Act and defraud the United States and violated the Clean Air Act by tampering with the monitoring device of an emissions control system of a diesel truck.[205] According to the plea agreement, Sinister Diesel manufactured and sold so-called “delete kits” that enabled diesel truck owners to disable and override emissions controls required by the U.S. Environmental Protection Agency (“EPA”).[206] The agreement also describes conduct to evade regulatory action, including conducting phone-only sales, removing violative products from the company’s website, and partnering with at least one other company to bundle products that together would allow “deleted” trucks to run without emissions controls.[207]

The district court sentenced Sinister Diesel on November 14, 2023 and entered judgment on November 17, 2023, imposing a $500,000 criminal fine ($250,000 for each count).[208] Separately, Sinister Diesel agreed to pay an additional $500,000 under a civil consent decree for a total fine of $1 million.[209] The district court sentenced Sinister Diesel to a three-year probational term, subject to Sinister Diesel’s compliance with the consent decree and no further violations of federal and state environmental laws.[210] Additionally, pursuant to the civil consent decree, Sinister Diesel agreed to—among other things—refrain from selling devices designed override a car’s emissions controls;[211] cease providing technical support and warranty coverage for such products;[212] implement a compliance program;[213] and make annual disclosures to the EPA and DOJ for four years regarding progress of its compliance measures.[214] The consent decree also includes a detailed table of fines for future violations of its prohibitions, including a fine of at least $500,000 for transferring intellectual property in violation of its terms.[215]

Suez Rajan Limited (Guilty Plea) and Empire Navigation Inc. (DPA)

On March 16, 2023, Suez Rajan Limited (“Suez Rajan”), a Marshall Islands shipping company, entered into a plea agreement with the U.S. Attorney’s Office for the District of Columbia to resolve allegations that Suez Rajan conspired to violate the IEEPA, which empowers the U.S. president to impose economic sanctions on foreign countries, including Iran.[216] According to the agreement, Suez Rajan violated U.S. sanctions on Iran by facilitating the illicit sale and transport of Iranian oil. Specifically, Suez Rajan used a chartered vessel to transport Iranian-origin crude oil to China and sought to obfuscate the origin of the crude oil by engaging in ship-to-ship transfers and masking the locations and identities of the vessels involved.[217] Suez Rajan pleaded guilty to one count of conspiracy to violate IEEPA.[218]

In the plea agreement, Suez Rajan and the government agreed to a sentence of three years of corporate probation and a fine of almost $2.5 million.[219] In addition, pursuant to a separate three-year DPA, Empire Navigation Inc., the operating company of the chartered vessel carrying the contraband cargo, agreed to cooperate and transport the Iranian oil to the United States as well as pay a separate $2.5 million fine. The cargo is now subject to a civil forfeiture action in the U.S. District Court for the District of Columbia.[220] As noted above, DOJ has recently touted this resolution as a rare case in which specific performance was required by the resolution.[221]

The Suez Rajan case is the first-ever criminal resolution involving a company that violated sanctions by facilitating the illicit sale and transport of Iranian oil.[222]

Tysers Insurance Brokers Ltd. and H.W. Wood Ltd. (DPAs)

On November 20, 2023, two UK reinsurance brokers—Tysers Insurance Brokers Ltd. and H.W. Wood Ltd. (collectively, “brokers”)—each entered into a three-year DPA with the U.S. Department of Justice in the Southern District of Florida.[223] The agreements settle charges of conspiracy to violate the anti-bribery provisions of the FCPA between 2013 and 2017.[224] The government alleges the brokers engaged in a scheme to bribe government officials in Ecuador through intermediaries, in an amount totaling approximately $2.8 million, to obtain and retain business with state-owned insurance companies.[225]

In connection with its DPA, Tysers agreed to pay a $36 million criminal penalty and $10.5 million in forfeiture.[226] H.W. Wood agreed that the appropriate fine under the U.S. Sentencing Guidelines would be $22.5 million in criminal penalties and $2.3 million in forfeiture.[227] However, due to H.W. Wood’s inability to pay that amount, the company agreed with DOJ to a reduced criminal penalty of $508,000 and no forfeiture amount.[228] In analyzing the company’s inability to pay, DOJ looked to the company’s financial condition and alternative sources of capital, among other factors included in DOJ’s Inability to Pay Guidance,[229] and concluded that paying a criminal penalty greater than $508,000 would “substantially threaten the continued viability” of H.W. Wood.[230] The agreements impose corporate obligations on the brokers, including a requirement to self-report any evidence or allegation of conduct that may constitute a violation of the FCPA anti-bribery provisions, and to modify its compliance program to ensure it maintains an effective system of internal accounting controls and a rigorous anti-corruption compliance program, but do not impose an independent monitor.[231] Both companies received cooperation and remediation credit of 25% off the bottom of the applicable U.S. Sentencing Guidelines fine range.[232]

View, Inc. (Guilty Plea)

On March 14, 2023, View, Inc., a California window manufacturing company with operations in Mississippi, entered into a plea agreement with the U.S. Attorney’s Office for the Northern District of Mississippi to resolve allegations that it negligently discharged wastewater into a Publicly Owned Treatment Works (POTW) without a permit, in violation of the Clean Water Act.[233] View, Inc.’s alleged unpermitted wastewater discharges allegedly accounted for approximately 40% of the relevant POTW’s permitted capacity.[234] The plea agreement does not contain an agreed‑upon penalty recommendation to the court nor does it contain recommendations for any other consequence.[235] The agreement states that the government will not charge View, Inc., former officers, directors, or employees with other offenses relating to the same charge.

On August 18, 2023, View, Inc. was sentenced to pay a $3 million fine and a community service payment to DeSoto County Regional Utility Authority of $450,000, in addition to a three‑year period of probation.[236] The judgment also notes that View, Inc. will enter into a separate, but related, civil Agreed Order with the Mississippi Commission on Environmental Quality, and under that agreement is expected to pay a civil penalty of $1.5 million.[237]

VIP Healthcare Solutions, Inc. (Guilty Plea)

On October 17, 2023, VIP Healthcare Solutions, Inc. (“VIP Healthcare”) entered into a plea agreement with the U.S. Attorney’s Office for the District of Puerto Rico and pleaded guilty along with the company’s secretary and president. The agreement resolved allegations that VIP Healthcare, which managed a diagnostic and treatment center in the Municipality of Cataño, falsely certified the truth and accuracy of information in its 2020 Paycheck Protection Program (PPP) loan application.[238] According to the agreement, among other things, the application falsely claimed that the company’s secretary owned 85% of the company and failed to list the company president as an owner.[239] According to the plea agreement, the parties agreed to a recommended sentence of two years of probation and a fine, but it does not recommend a specific fine amount.[240] On January 17, 2024, the court sentenced VIP Healthcare to two years’ probation but did not impose a fine.[241]

Western River Assets, LLC and River Marine Enterprises, LLC (Guilty Plea)

On October 17, 2023, Western River Assets, LLC and River Marine Enterprises, LLC entered into plea agreements with the U.S. Attorney’s Office for the Southern District of West Virginia, to resolve allegations that the two entities violated the Refuse Act of 1899, 33 U.S.C. §§ 407 and 411, which penalize discharge of refuse into navigable waters.[242] According to the plea agreements, Western River Assets owned a towboat, the M/V Gate City, and moored it along the West Virginia Shore of the Big Sandy River between 2010 and January 2018.[243] River Marine Enterprises operated the towboat during that time period.[244] On December 5, 2017, the Coast Guard issued an Administrative Order after an inspection, requiring the sole owner of the two companies, David K. Smith, to remove all oil and hazardous substances from the M/V Gate City by January 31, 2018.[245] On around January 10, 2018, before the contractors engaged by River Marine Enterprises were able to remove the oil and other substances, the M/V Gate City sank, discharging oil and other substances into the Big Sandy River.[246] The government alleged that as a direct result of the sinking and the spill, the City of Kenova closed its municipal drinking water intake for three days, and multiple regulatory agencies expended money and other resources to respond to the spill.[247]

According to the agreements, Western River Assets and River Marine Enterprises could each face a maximum fine of $200,000, probation for up to five years, and an order of restitution.[248] The agreements do not contain a recommended sentence.[249] The sentencing has yet to occur, but a sentencing hearing is scheduled on February 26, 2024.[250] Smith was charged with the same violation and also pleaded guilty on October 17, 2023.[251] He could face imprisonment for no less than one month and no more than a year, a fine up to $100,000, and supervised release for one year.[252]

Zona Roofing LLC (Guilty Plea)

On November 20, 2023, Zona Roofing LLC (“Zona”) entered into a plea agreement, through its owner and principal Yilbert Segura (“Segura”), with the U.S. Attorney’s Office for the District of New Jersey.[253] Zona was charged with two counts of Willful Violation of Occupational Safety and Health Administration (“OSHA”) standards by failing to provide fall protection and fall protection training to employees engaged in the replacement of a residential roof, resulting in the death of an employee.[254]

As part of the plea agreement, Zona, through Segura, was sentenced to five years’ probation, and ordered to pay $75,000 in restitution.[255] Additionally, Zona was ordered to comply with special conditions outlined in the Agreement, which require Zona to provide fall training and procedures to all employees and follow enhanced safety provisions for future construction projects.[256]

Z&L Properties (Guilty Plea)

On August 17, 2023, Z&L Properties Inc., (“Z&L Properties”), a California-based subsidiary of a Chinese property development company, entered into a plea agreement with the U.S. Attorney’s Office for the Northern District of California to resolve allegations that Z&L Properties conspired to commit and did commit honest services wire fraud.[257]

Although the plea agreement itself is sealed, a four-page Criminal Information alleges that between November 2018 and January 2020, Z&L Properties executives approved or paid bribes to a former member of the San Francisco Department of Public Works and another individual, including in the form of food, drink, transportation, and lodging during a trip to China in 2018 and thereby conspired to defraud the public of its right to honest services.[258] According to the Information, the purpose of these payments was to influence the official to act favorably with respect to Z&L Properties’ requests for city approvals needed to complete one of the company’s construction projects.[259]

On October 16, 2023, the court sentenced Z&L Properties to pay a $1 million fine, and to implement an anti-corruption compliance program as set out in the plea agreement.[260]

Appendix

The chart below summarizes the agreements concluded by DOJ from July 2023 through December 2023. The complete text of each publicly available agreement in hyperlinked in the chart.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA, DPA, or guilty plea, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in resolution agreements.

| U.S. Deferred Prosecution Agreements, Non-Prosecution Agreements, and Plea Agreements August-December 2023 | |||||||

| Company | Agency | Alleged Violation | Type | Monetary Recoveries | Monitoring & Reporting | Term of Agreement (Months) | |

| Albemarle Corporation | W.D. N.C. | FCPA | NPA | $218,509,663 | No monitor | 36 | |

| Amani Investments, LLC | E.D. Cal; U.S. Postal Inspection Service; FBI; IRS; DEA | Bank Secrecy Act; Conspiracy to avoid filing currency transaction reports. | Guilty Plea | $1,000,000 (and other assets) | N/A | N/A | |

| Aylo Holdings, S.a.r.l. | E.D.N.Y. | Unlawful Monetary Transactions (18 U.S.C. 1957) | DPA | $1,844,953 | 36 month compliance monitor | 36 | |

| Banque Pictet et Cie SA | S.D.N.Y. | Tax Evasion | DPA | $122,900,000 | No monitor | 36 | |

| Binance Holdings Limited | DOJ.; W.D. Wash; CFTC; FinCEN; OFAC | AML | Guilty Plea | $4,316,126,163 | 3-year independent compliance consultant | N/A | |

| Centera Bioscience | D. N.H. | Distribution of misbranded drugs | Guilty Plea | $2,400,000 | 3-years’ probation | N/A | |

| Corporación Financiera Colombiana SA | DOJ Fraud.; D. Md. | FCPA | DPA | $80,600,000 | No monitor | 36 | |

| Empire Navigation Inc. | D.D.C.; DOJ NSD | Trade Sanctions/IEEPA/Export Controls | DPA | $2,500,000 | No | 36 | |

| Freepoint Commodities LLC | D. Conn; DOJ Fraud | FCPA | DPA | $98,551,150 | No monitor | 36 | |

| GDP Tuning LLC; Custom Auto of Rexburg LLC | D. Idaho; DOJ Environmental Crimes Section, EPA Criminal Enforcement | Clean Air Act | Guilty Plea | $1,000,000 | 5 years’ probation | N/A | |

| Glenmark Pharmaceuticals Inc., USA | DOJ, Antitrust Division | Sherman Antitrust Act | DPA | $30,000,000 | Self-reporting | 36 | |

| H&D Sonography | D.N.J. | Anti-Kickback Statute | DPA | $95,000 | No monitor | 36 | |

| H.W. Wood Ltd | S.D. Fl | FCPA | DPA | $508,000 | No monitor | 36 | |

| HealthSun Health Plans, Inc. | DOJ Fraud | False Claims; Wire Fraud | Declination with Disgorgement | $53,170,115 | No monitor | N/A | |

| Lifecore Biomedical, Inc. | DOJ Fraud; N.D. Cal. | FCPA | Declination with Disgorgement | $406,505 | No monitor | N/A | |

| New Orleans Steamboat Co. | E.D. La.; EPA; DOT | Clean Water Act | Guilty Plea | $50,400 | N/A | N/A | |

| Nomura Securities International, Inc. | D. Conn.; DOL | Securities Fraud | NPA | $55,933,332 | No monitor | 12 | |

| NuDay | D. N.H. | Export Controls | Guilty Plea | $25,000 | No monitor | N/A | |

| Oregon Tool, Inc. | D. Or. | AML | NPA | $1,724,803 | No monitor | N/A | |

| Pro-Mark Services, Inc. | DOJ, Antitrust Division; D. N.D. | Conspiracy to defraud the United States | NPA | $949,000 | No monitor | 36 | |

| River Marine Enterprises | S.D. WV; EPA | Discharge of refuse into navigable waters | Guilty plea | Pending | N/A | N/A | |