Corporate Resolutions Update – 2023

Client Alert | September 8, 2023

With five publicized agreements, the U.S. Department of Justice (“DOJ”) resolved significantly fewer cases using non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”) in the first half of 2023 than in similar periods in previous years.[1] At the same time, DOJ continued to refine its corporate enforcement policy, which addresses the factors DOJ considers when evaluating whether to prosecute a company, and if so, what form of resolution—if any—to offer the organization. Through July 31, 2023, four of the top five largest corporate resolutions in terms of dollars were negotiated plea agreements, and there were a total of 28 corporate plea agreements. As DOJ very publicly evolves its corporate enforcement policy and priorities, our discussion of NPAs and DPAs would be remiss outside of the context of their counterparts – guilty pleas on the one hand, and declinations-with-disgorgement on the other. Thus, beginning with this publication, Gibson Dunn’s client alerts on NPAs and DPAs also will track these important members of the family of corporate resolutions.

In this client alert, we: (1) report key statistics regarding NPAs and DPAs from 2000 through the present; (2) report key statistics on corporate guilty pleas from 2023; (3) discuss recent policy statements regarding corporate enforcement; and (4) summarize the 33 agreements through July 31, 2023.

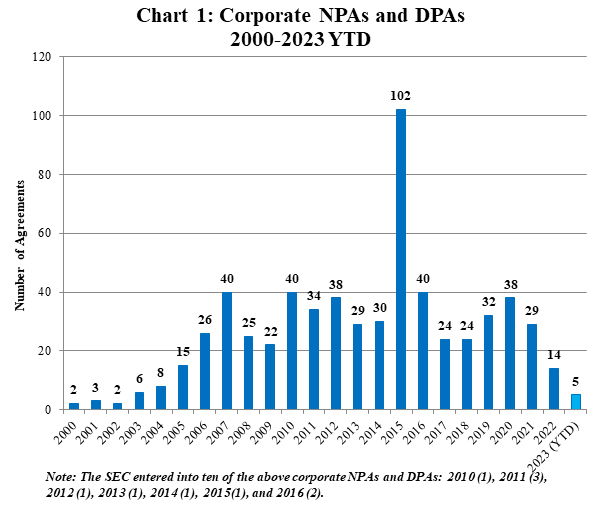

Chart 1 below reflects the NPAs and DPAs that Gibson Dunn has identified through public-source research from 2000 through the end of July. Of the five total NPAs and DPAs thus far in 2023, three are NPAs and two are DPAs. The SEC, consistent with its trend since 2016, has not entered into any NPAs or DPAs in 2023 to date.

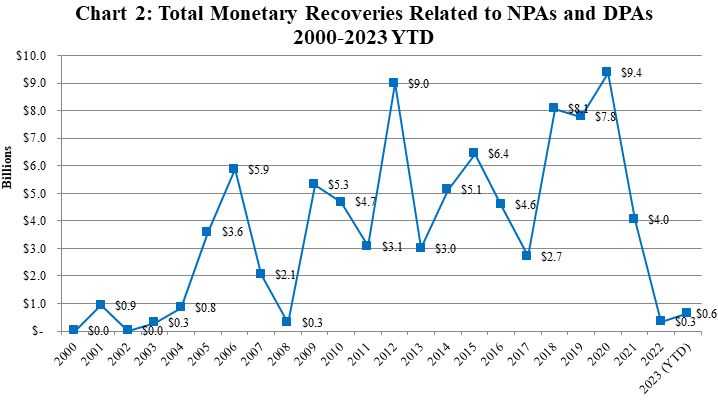

Chart 2 reflects total monetary recoveries related to NPAs and DPAs from 2000 through the end of July. At approximately $642 million, year-to-date recoveries associated with DPAs and NPAs are trending significantly higher than they were in the same period in 2022, but remain a fraction of the recoveries by mid-year in the last half-decade. For example, by this time in 2021, DOJ had recovered approximately $3.63 billion through NPAs and DPAs in the first half of the year; in 2020, the figure was approximately $6.03 billion. At the same time, we are not seeing plea agreements take up the slack; NPAs and DPAs still took the lion’s share of DOJ’s recoveries to date, at approximately 68% of the total approximately $944.6 million. The largest resolution thus far in 2023, in terms of dollar value, was a DPA.

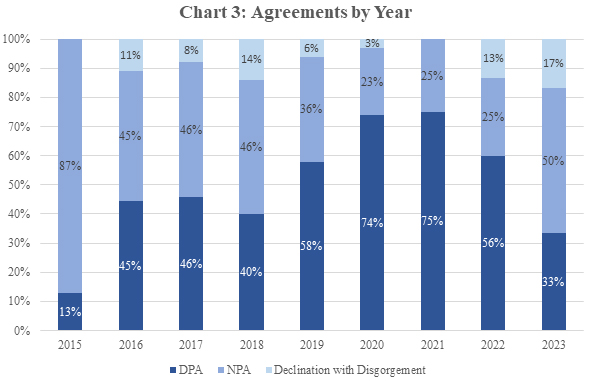

Chart 3 reflects the relative mix of NPAs, DPAs, and declinations-with-disgorgement since DOJ first began issuing the latter agreements under the then-FCPA Pilot Program in 2016. Thus far in 2023 DOJ has issued one public declination-with-disgorgement pursuant to its Corporate Enforcement Policy; DOJ had also issued one such agreement by the end of July last year.

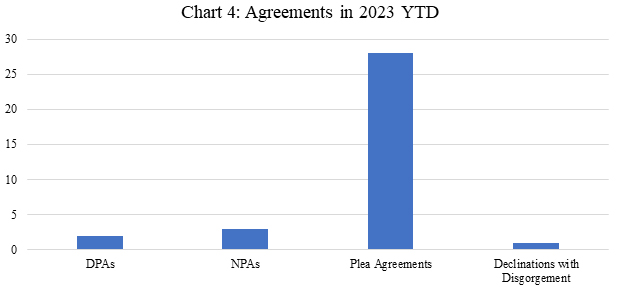

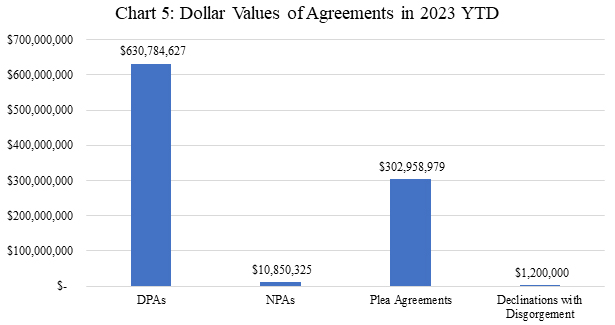

Charts 4 and 5 focus on specifically 2023 through the mid-year mark and show the numbers of DPAs, NPAs, plea agreements, and declinations-with-disgorgement in 2023 and the total dollar values associated with each type of resolution. As noted above, while plea agreements represented the majority of resolutions in terms of sheer number of agreements, DPAs dominated in terms of the dollar values of the government’s recoveries.

Continued Developments in DOJ Corporate Enforcement Policy

Introduction

On September 15, 2022, Deputy Attorney General (DAG) Lisa Monaco issued a memorandum detailing several updates to DOJ’s corporate criminal enforcement policies (the “Monaco Memorandum”).[2] She also delivered a speech on the same day expanding on the memorandum’s updates.[3] The updates addressed five key areas of corporate criminal enforcement in which DOJ planned to increase its emphasis on responsible corporate behavior:

- individual accountability;

- prior corporate misconduct;

- voluntary self-disclosures;

- compliance monitors; and

- compensation structure to promote compliance.

DAG Monaco also asked all DOJ components—i.e., divisions of Main Justice and the U.S. Attorneys’ Offices—to write voluntary self-disclosure policies and “to clarify the benefits of [corporations] promptly coming forward to self-report.”[4] These updates aimed to give businesses the tools they needed to promote responsible corporate behavior—in short, “empowering companies to do the right thing.”[5]

DOJ policies, speeches, and enforcement actions following the Monaco Memorandum and speech have continued to build on the message that DOJ will look favorably on corporations proactively identifying misconduct, voluntarily reporting it to DOJ, and driving the remediation process forward themselves. Companies failing to fully comply and cooperate will face harsher consequences. The message is clear that corporations hoping to benefit from these policies must keep their compliance, monitoring, self-disclosure, and remediation procedures robust and up-to-date.

Recent key changes, discussed below, include (1) the roll-out of a uniform voluntary self-disclosure program across U.S. Attorneys’ Offices; (2) updates to the Criminal Division’s Corporate Enforcement Policy; (3) a new DOJ pilot program on compensation incentives and clawbacks; (4) an increased focus on third-party communications platforms; and (5) a DOJ “resource surge” to address the intersection of national security and corporate crime.

A Uniform Program for Voluntary Self-Disclosure

On March 3, 2023, in a speech at the American Bar Association’s National Institute on White Collar Crime, DAG Monaco announced that, for the first time, DOJ has adopted a uniform self-disclosure policy, applicable across all 94 U.S. Attorney’s Offices, that is designed to put in place “an operative, predictable and transparent voluntary self-disclosure program” (the “USAO VSD”).[6] Under this policy, prosecutors generally will not seek a guilty plea where a company has voluntarily self-disclosed, cooperated, and remediated its misconduct, in the absence of aggravating factors.[7] Aggravating factors under the USAO VSD may include (but are not limited to) misconduct that “poses a grave threat to national security, public health, or the environment;” “is deeply pervasive throughout the company;” or “involved current executive management of the company.”[8]

The USAO VSD noticeably does not identify repeat misconduct as an aggravating factor, and indeed, DOJ officials have favorably cited the Criminal Division’s December 2022 DPA with ABB Ltd., a Swiss multinational engineering company, which settled an investigation into alleged violations of the Foreign Corrupt Practices Act (“FCPA”), as an example of leniency despite repeat misconduct.[9] ABB’s 2022 resolution was not its first DPA, and DOJ had previously articulated a strong disfavoring of successive agreements.[10] But, as Principal Associate Deputy Attorney General (PADAG) Marshall Miller noted in December 2022[11] and DAG Monaco reemphasized in March 2023,[12] DOJ nevertheless “assigned significant weight” to ABB’s efforts to self-disclose.[13] According to PADAG Miller, the company’s disclosure efforts, along with its commitment to further enhance its compliance program, “A+ cooperation” and extensive remediation, factored heavily into DOJ’s view that a DPA was the appropriate resolution. As noted by DAG Monaco, “had ABB not promptly come forward, the result would have been drastically different.”[14]

Updates to the Criminal Division’s Corporate Enforcement Policy

In a speech on January 17, 2023, then-Assistant Attorney General (AAG) for the Criminal Division, Kenneth Polite, announced revisions to the Criminal Division’s Corporate Enforcement Policy (CEP).[15] The revisions offer new incentives for companies to self-disclose misconduct. The policy revisions aim to incentivize companies to go “far above and beyond the bare minimum” when cooperating with DOJ. Department officials have further expanded and clarified the new CEP in subsequent speeches.

Clarification of Declination Policy

Like the USAO VSD that followed it, the Criminal Division’s CEP provides that a company that voluntarily self-discloses misconduct, fully cooperates with DOJ, and timely and appropriately remediates enjoys a presumption that DOJ will decline to prosecute, absent any aggravating circumstances.[16] Unlike the USAO VSD, the Criminal Division CEP has always included history of prior misconduct among the list of “aggravating circumstances” that may merit a guilty plea (others include “involvement by executive management of the company in the misconduct; a significant profit to the company from the wrongdoing; [and] egregiousness or pervasiveness of the misconduct within the company”).[17]

Before January 2023, the CEP articulated aggravating circumstances as a bar to declination.[18] After January 2023, companies that have engaged in misconduct involving any of these factors still do not enjoy the presumption of a declination, but prosecutors may, in their discretion, decline to prosecute if the company can demonstrate that it:

- Made a voluntary self-disclosure immediately upon becoming aware of the allegation of misconduct;

- Had an effective compliance program and system of internal accounting controls in place at the time of the misconduct and disclosure that enabled the identification of the misconduct and led to voluntary self-disclosure; and

- Provided extraordinary cooperation with DOJ’s investigation and undertook extraordinary remediation.[19]

Then-AAG Polite later explained in March that what constitutes “extraordinary” cooperation and remediation is subject to DOJ discretion.[20] He noted that in considering whether cooperation is “extraordinary,” DOJ evaluates the immediacy, consistency, degree, and impact of the cooperation.[21] Extraordinary remediation “includes conducting root cause analyses and taking action to prevent the misconduct from occurring, even in the face of substantial cost or pressure from the business.”[22] This can include, for example, significant organizational changes, suspensions or terminations, and recoupment of compensation.[23]

Then-AAG Polite also explained that the terms “immediate” and “extraordinary” in these revisions only apply when aggravating circumstances are present.[24] For companies without aggravating circumstances, DOJ still requires companies to voluntarily self-disclose only “within a reasonably prompt time after becoming aware of the misconduct.”[25]

DOJ has cited two recent declinations-with-disgorgement as exemplifying the Criminal Division’s current practices under the CEP. In December 2022, DOJ declined to prosecute Safran S.A., a French aerospace company, for alleged FCPA violations.[26] Safran voluntarily self-disclosed the conduct after discovering it during post-acquisition due diligence, fully cooperated, ensured remediation occurred, and disgorged ill-gotten profits.[27] Deputy Assistant Attorney General Lisa Miller pointed to the Safran declination in urging corporations to “call us before we call you.”[28] In March 2023, DOJ issued a declination-with-disgorgement to U.S.-based Corsa Coal following FCPA bribery violations.[29] Corsa fully cooperated with the investigation, remediated the misconduct by terminating a salesman involved in the scheme, disgorged a portion of the alleged ill-gotten profits (following a finding that it was unable to pay the full amount of $32.7 million), and substantially improved its compliance program and internal controls.[30]

DOJ’s message is clear that a proactive approach will best position the corporation to receive a declination under the CEP and avoid a more serious criminal resolution. A corporation that has self-identified misconduct, including conduct with aggravating circumstances present, should therefore carefully weigh the potential benefits flowing from proactively cooperating and providing DOJ with accurate information—including information otherwise unavailable to the Department.

Changes in Sentence Reductions Where Criminal Resolution is Warranted

Even where aggravating factors are too great to allow for a declination, the revised CEP provides that if a company voluntarily self-discloses, fully cooperates, and timely and appropriately remediates, the Criminal Division will accord or recommend at least 50% and up to 75% off the low end of the U.S. Sentencing Guidelines (“USSG”) fine range, except in the case of a “criminal recidivist.”[31] This is a significant increase from the previous potential maximum reduction of 50% off the Guidelines range. “Recidivist” companies that disclose, cooperate, and appropriately remediate will still be eligible for the reduction, but not off the low end of the range.[32]

The revised CEP provides for reductions even for those companies that do not voluntarily self-disclose. If such companies fully cooperate and timely and appropriately remediate, the Criminal Division will accord or recommend up to a 50% reduction off the low end of the USSG range, up from a maximum of 25% under the previous policy.[33] As in voluntary disclosure scenarios, “recidivist” companies are still eligible for this reduction, but not from the low end of the range. In his January remarks, then-AAG Polite lauded these changes as increasing the range of incentives for companies and providing prosecutors with a “greater range of options to distinguish among companies that commit crime,” but he also cautioned that a reduction of 50% will not be the new norm for companies that do not self-disclose; rather, he noted that “it will be reserved for companies that truly distinguish themselves and demonstrate extraordinary cooperation and remediation.”[34]

New DOJ Pilot Program on Compensation Incentives and Clawbacks

In an address at the ABA’s 38th Annual National Institute on White Collar Crime, DAG Monaco announced the Department’s first-ever Pilot Program on Compensation Incentives and Clawbacks, administered by the Criminal Division.[35] Then‑AAG Polite expanded on the program at the same conference the next day.[36] The two-part program, a three-year initiative that became effective March 15, 2023, fits with DOJ’s increased emphasis on corporate action in response to misconduct.

Part One requires that, as part of every criminal resolution entered into by the Criminal Division, companies shall be required to implement criteria related to compliance in their compensation and bonus systems to reward ethical behavior and to punish and deter misconduct.[37] As an example, DAG Monaco highlighted Danske’s December 2022 plea agreement, in which Danske, a Danish bank facing fraud allegations, agreed to revise its performance review and bonus system to include criteria related to compliance.[38] Part Two of the pilot program offers fine reductions for companies seeking to claw back compensation in appropriate cases.[39] These cases may include not only clawbacks from those employees who engaged in wrongdoing in connection with a given investigation, but also from those with supervisory authority over the culpable employees and who knew of, or were willfully blind to, the misconduct.[40] And the fine reductions accorded under the program equal 100% of the clawed-back compensation.[41] Moreover, even if companies are unsuccessful in clawing back compensation, prosecutors have discretion to grant a fine reduction of up to 25% of the compensation sought.[42]

The program will be in effect for three years, during which time DOJ will analyze its effectiveness. Please see our March 2023 publication on this, for further information.

Personal Devices and Communications Platforms

The Criminal Division continues to examine what revisions may be warranted to its framework for evaluating corporate compliance programs to address one of the most vexing issues facing corporate America—the use of personal devices and third-party messaging applications, including those offering ephemeral messaging.[43] The Division is focused on ensuring that DOJ can access relevant data and communications stored on these applications during investigations. In his keynote address at the ABA’s 38th Annual National Institute on White Collar Crime, then‑AAG Polite stated that DOJ will consider whether corporate policies governing these messaging applications allow business-related electronic data and communications to be preserved and accessed, along with how well companies communicate and enforce these policies.[44] If a company fails to produce data from messaging applications, prosecutors will probe the company’s ability to access such communications, whether the company stores them on corporate devices or servers, and applicable privacy laws. The company’s answers—or lack thereof—“may very well affect the offer it receives to resolve criminal liability.”[45]

Given DOJ’s increased focus on access to corporate communications, clear corporate policies regarding personal devices and third-party messaging applications, including across international borders, are becoming increasingly important, and companies would be well advised to review their corporate communications policies with an eye to preservation requirements, prohibitions on uses of off-platform communication channels, and disciplinary measures in the event of noncompliance.

Surging Resources to Address Intersection of National Security and Corporate Crime

In a May 2023 speech, PADAG Miller noted the growing link between corporate criminal enforcement and national security risks.[46] In response, DOJ is “dramatically scaling up [its] investment in fighting national security-related corporate crime.”[47] The Department will add over two dozen new prosecutors to the National Security Division (“NSD”) to focus on corporate crime, including the first-ever Chief Counsel for Corporate Enforcement. It plans to “staff[] up” the Bank Integrity Unit of the Criminal Division’s Money Laundering & Asset Recovery Section to home in on complex and cross-border sanctions cases involving financial institutions.[48] And it is issuing joint advisories with the Commerce and Treasury Departments to inform the private sector about national security-related compliance trends and expectations. For example, on July 26, 2023, those three agencies issued a “Tri-Seal Compliance Note” setting forth their respective views on voluntary self-disclosure of “potential violations of U.S. national security laws, including those governing sanctions and export controls.”[49] The document is significant not only for its detailed summaries of each agency’s self-disclosure requirements, but also for its clear statement—on behalf of all three agencies—that “[t]he benefits of VSDs are clear” and include “making companies eligible for significant mitigation.”[50]

2023 Agreements to Date

The remainder of this alert summarizes corporate resolutions through July 31, 2023. The appendix at the end of the alert provides key facts and figures regarding these resolutions, along with links to the resolution documents themselves (where available). Although we have continued to see relative consistency in the approaches taken to resolutions involving Main Justice, U.S. Attorneys’ Offices around the country continue to enter into agreements that vary widely and lack the uniformity of approach taken by Main Justice.

ABC Polymer Industries LLC (Guilty Plea)

On January 3, 2023, ABC Polymer Industries LLC (“ABC Polymer”) entered into a plea agreement with the Environment and Natural Resources Division’s Environmental Crimes Section and the U.S. Attorney’s Office for the Northern District of Alabama to resolve allegations that ABC Polymer, a manufacturer of extruded plastic products and other goods, had failed to install machine guards on the side of an equipment’s roller drums—in violation of the Occupational Health and Safety Act (“OSHA”)—leading to the death of an employee in its Alabama plant who was operating the machine.[51] OSHA requires machinery “whose operations exposes an employee to injury” to be guarded or to be designed and constructed in such a way to “prevent the operator from having any part of his [or her] body in the danger zone during the operating cycle.”[52] The agreement cited that while ABC Polymer had written policies addressing machine guards, it had trained its employees in procedures that involved lowering the guard during operations, exposing the operators to risk of injury.[53]

In connection with the plea agreement, ABC Polymer agreed to pay a criminal fine of $167,928, as well as $242,928 plus funeral expenses in restitution to the decedent’s estate.[54] ABC Polymer also agreed to serve a two-year term of probation, during which time ABC Polymer would be required to comply with an OSHA Safety Compliance Plan (“SCP”).[55] The SCP, among other things, requires ABC Polymer to designate a Safety Compliance Manager; extend a contract with its third party auditor or submit a list of qualified candidates if ABC Polymer intends to substitute a new third party auditor; maintain mechanisms for reporting safety concerns; and provide policies and training in English, Spanish, and any other language necessary to ensure all employees are able to understand.[56] Three weeks after its guilty plea, ABC Polymer was sentenced to the fine, restitution amount, and probation term set forth in the plea agreement.[57]

Aifa Seafood Inc. (Guilty Plea)

On March 8, 2023, Aifa Seafood Inc. (“Aifa”) entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Florida, to resolve allegations that Aifa violated the Lacey Act, which punishes illegal trade in fish and wildlife.[58] According to the agreement, the government alleged that Aifa engaged in false labeling of lobster imported from Haiti and bound for China, by labeling the lobster as product of the United States.[59] While the plea agreement indicates that the maximum fine Aifa could face is $500,000 per count and that Aifa could be sentenced to probation for up to five years, the agreement does not contain a recommended sentence.[60] The agreement itself also does not impose any form of reporting or monitoring requirement on Aifa.[61]

On May 23, 2023, Aifa was sentenced to a five-year term of probation, one condition of which is that it “establish and maintain an effective compliance program,” including by employing “an appropriately qualified Compliance Officer.”[62] Another condition of Aifa’s probation is that it retain an independent third‑party auditor and “fund a Court Appointed Monitor.”[63] Both the auditor and the monitor are required to submit reports to the company’s probation officer, and the monitor must submit its reports to the court as well.[64] The court sentenced Aifa to pay a $250,000 fine.[65]

American Management and Administration Corporation (Guilty Plea)

On April 13, 2023, the American Management and Administration Corporation (“AMAC”) entered a plea agreement with the U.S. Attorney’s Office for the District of Puerto Rico to resolve one count of theft of federal program funds, in relation to the alleged misappropriation of operational funds provided by the U.S. Department of Housing and Urban Development for the administration of public housing projects by Puerto Rican authorities.[66] AMAC was one of the private companies that contracted with Puerto Rican authorities to operate and maintain the public housing projects, in return for a monthly fee.[67] According to the government, AMAC knowingly and intentionally stole $3.7 million in funds from 2014 to 2022, including by diverting funds to personal bank accounts and writing checks for services not rendered.[68]

The plea agreement does not contain an agreed-upon penalty, nor does it reflect an agreement on a term of probation or impose ongoing reporting obligations.[69] Under the agreement, AMAC agreed to pay $3,712,000 in restitution.[70] At sentencing, the court imposed restitution in that amount and sentenced AMAC to three years of probation, and included as a condition of probation that AMAC report periodically to the court or its probation officer regarding its financial condition and any new investigations, litigations, or administrative proceedings commenced against AMAC.[71]

Anyclo International Inc. (Guilty Plea)

On June 12, 2023, Anyclo International Inc. (“Anyclo”), a South Korean clothing manufacturer, entered into a plea agreement with the U.S. Attorney’s Office for the District of New Jersey, to resolve charges that the company evaded customs duties on clothing it imported into the United States between 2012 and 2019.[72] According to the agreement, Anyclo prepared one accurate invoice for U.S. purchasers of the imported merchandise, and prepared another invoice for its U.S. Customs broker that falsely undervalued the goods and thus caused Anyclo to underpay customs duties.[73]

In the agreement, Anyclo and the government agreed to recommend to the court a fine of $250,000, as well as restitution of $2.05 million.[74] The parties agreed not to recommend probation to the court, and the agreement does not contain an ongoing compliance program or reporting obligation.[75] In sentencing Anyclo, the court accepted the fine recommendation but reduced the restitution amount to $1,850,000.[76] The court did not impose probation.[77]

BDF Enterprises, Inc., Michelle’s DVD Funhouse, Inc., MJR Prime LLC, and Prime Brooklyn LLC (Guilty Plea)

In January 2023, four entities, including BDF Enterprises, Inc. (“BDF”), Michelle’s DVD Funhouse, Inc., MJR Prime LLC, and Prime Brooklyn LLC separately pleaded guilty to one count each of conspiring to fix prices for DVDs and Blu-Ray discs on Amazon Marketplace, in violation of the Sherman Act, 15 U.S.C. § 1.[78] The agreements state that, from approximately October 2016 to October 2019, these Amazon Marketplace vendors and their owners colluded to sell video media at non-competitive prices to suppress and eliminate competition.[79]

Pursuant to these agreements with the Antitrust Division and the U.S. Attorney’s Office for the Eastern District of Tennessee, the companies agreed to recommended criminal fines ranging from $68,000 to $234,000.[80] The agreements did not recommend any restitution payments, in light of the availability of civil causes of action through which damages may be sought.[81] The parties also agreed to recommend that no probationary period be assessed.[82] The two individual owners of these four entities separately pleaded guilty in connection with the alleged scheme.[83]

As of the publication of this alert, only BDF has been sentenced. The court imposed a fine of $185,250, compared to the $234,000 agreed upon in BDF’s plea agreement—the result of the court applying U.S. Sentencing Guideline Section 8C3.4, which permits fine offsets for closely-held companies where one or more owners of the company have been sentenced for the same offense conduct.[84]

British American Tobacco P.L.C. (DPA)

On April 25, 2023, British American Tobacco P.L.C. (“BAT”), a UK-based corporation, entered into a three-year DPA with DOJ NSD and the U.S. Attorney’s Office for the District of Columbia,[85] resolving allegations that BAT and its Singaporean subsidiary (“BATMS”) had conspired to commit bank fraud and to violate the International Emergency Economic Powers Act (“IEEPA”), 50 U.S.C. § 1705(a), in connection with prohibited sales of tobacco products in North Korea.[86] In particular, according to the Statement of Facts attached to the DPA, in 2005 BAT purported to divest itself of a North Korean joint venture established in 2001, but instead continued to exert significant control over the entity, using it to transact business in North Korea.[87] The DPA alleges that BATMS and BAT structured transactions with this entity in a manner that obfuscated BATMS’s sales to North Korea, thereby causing U.S. banks to process improper U.S. dollar transactions for BATMS’s benefit, in violation of the bank fraud statute.[88] Some of these transactions were also made through sanctioned North Korean entities in violation of the IEEPA.[89]

As a part of the DPA, BAT agreed to joint and several liability with BATMS for over $440 million in criminal penalties and over $189.5 million in forfeiture payments.[90] The company has also implemented, and agreed to continue to implement, a corporate compliance program designed to prevent and detect violations of the Bank Secrecy Act and U.S. sanctions laws, specifically including maintaining the electronic database of SWIFT MT payment messages and documents and materials relevant to the investigation during the term of the DPA. The company must also annually report on the status of its compliance measures.[91] Additionally, if BAT breaches its obligations under the agreement, the government may extend the term of the agreement by up to one year; if, conversely, BAT demonstrates that it is no longer necessary to enforce the terms of the agreement, it may be terminated after less than three years.[92] The BAT DPA also has several related actions announced or commenced on the same day as the DPA, including a guilty plea by BATMS to the same charges, a civil action against both BAT and BATMS brought by the Department of the Treasury’s Office of Foreign Assets Control,[93] and several actions brought by DOJ against individuals alleging related conduct.[94]

Davey Tree Expert Company and Wolf Tree, Inc. (NPA)

On July 13, 2023, Davey Tree Expert Company (“Davey Tree”)—a company that provides tree-trimming services for utility companies—and its wholly-owned subsidiary, Wolf Tree, Inc. (“Wolf Tree”), jointly entered into an NPA with the U.S. Attorney’s Office for the Southern District of Georgia.[95] The agreement resolved allegations that, in connection with a tree-trimming contract for an electric utility company in Savannah, Georgia, Davey Tree and Wolf Tree illegally employed persons unlawfully in the United States.[96] The government alleged that Davey Tree and Wolf Tree provided these employees with false names and social security numbers, falsified payroll records for the employees, and paid the employees in cash in order to avoid detection.[97] One employee was allegedly killed after reporting that his supervisor was unlawfully in the United States and was hiring other undocumented individuals.[98]

Davey Tree and Wolf Tree agreed to pay $1,326,000 in restitution to the estate of the deceased employee; $21,804 in restitution to another employee for back wages; and $1,136,521 in forfeiture of the proceeds of the alleged violations.[99] The NPA also resolves civil allegations against Davey Tree and Wolf Tree, and accordingly imposes $1,500,000 in civil penalties and releases the companies from both civil and administrative liability that could otherwise be pursued by the Department of Homeland Security.[100] Although the agreement imposes cooperation obligations on Davey Tree and Wolf Tree, it does not require them to self-report to the government and it does not impose a monitor.[101]

DES International Co. Ltd. and Soltech Industry Co. Ltd. (Guilty Plea)

On March 29, 2023, DES International Co. Ltd. (“DES”) and Soltech Industry Co. Ltd. (“Soltech”), electronics companies based in Taiwan and Brunei, respectively, entered into plea agreements with the U.S. Attorney’s Office for the District of Columbia and DOJ NSD, resolving allegations of conspiracy to defraud the United States and violate the IEEPA and Iranian Transactions and Sanctions Regulations (“ITSRs”)—which restrict the trade, export, or sales of U.S.-origin goods, technology, or services to Iran.[102]

[103] According to the agreements, a sales agent of both DES and Soltech conspired and agreed with DES, Soltech, and an Iranian entity to export a U.S.-originated power amplifier and its related components, as well as cybersecurity software to the Iranian entity without a required license from the U.S. Department of the Treasury.[104] This sales agent took steps to conceal the U.S. origin of the products, such as by removing stickers with the phrase “Made in USA” from the packaging. The agent also misled the two U.S. companies exporting the goods and software to believe that the items they sold were to be used in Taiwan or Hong Kong, or used by DES or Soltech.[105]

DES and Soltech each agreed to a five-year period of corporate probation and a criminal fine of $83,769—three times the value of goods unlawfully exported to Iran—based on a consideration of several factors, including an “absence of cooperation or of any known compliance or remediation efforts,” and the lack of timely and voluntary self-disclosure.[106] At sentencing, the court imposed the penalty amounts and probation period contained in the plea agreements.[107]

Diesel Tune-Ups of RI, Inc. and M&D Transportation, Inc. (Guilty Plea)

On January 26, 2023, Diesel Tune-Ups of RI, Inc. (“Diesel Tune-Ups”) and M&D Transportation, Inc. (“M&D”) jointly entered into a plea agreement with the U.S. Attorney’s Office for the District of Rhode Island to resolve allegations that the companies conspired to violate the Clean Air Act.[108] The government alleged that between 2014 and 2019, Diesel Tune-Ups and M&D conspired among themselves and others to tamper with emission monitoring systems on diesel vehicles.[109] The alleged scheme consisted of both disabling or removing emission controls on the vehicles, and installing software in the vehicles so that the built-in monitoring systems could not detect the modifications to the controls.[110]

In the plea agreement, the parties agreed to recommend to the court that it impose a term of probation of three years.[111] As a probation condition, Diesel Tune-Ups and M&D agreed to hire a third-party independent consultant within 30 days of sentencing “to conduct an audit of all vehicles owned or operated by M&D to determine that no aftermarket emissions alterations have been made and that there has been no emissions-related tampering.”[112] No later than 60 days after sentencing, M&D must certify that all its vehicles are in compliance with the Clean Air Act’s emission-related provisions.[113] The agreement does not contain a penalty recommendation, stating instead that “[t]he parties will be free to recommend [at sentencing] whatever fine . . . they feel [is] appropriate.”[114] The agreement also explicitly states that the government and the defendants had not reached agreement on which offense level and criminal history category are appropriate for purposes of Sentencing Guidelines calculations.[115] The agreement notes that each count charged against Diesel Tune-Ups and M&D carries a maximum of $500,000 in fines.[116] Sentencing has not yet occurred in the case.

E.I. du Pont de Nemours and Company Inc. (Guilty Plea)

On April 24, 2023, E.I. du Pont de Nemours and Company Inc. (“DuPont”) entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Texas, resolving allegations that it violated the Clean Air Act by negligently releasing an extremely hazardous substance.[117] The allegations arose out of a 2014 accident that released 24,000 pounds of highly toxic, flammable gas into the air, killing four company employees, injuring others, and causing harm to surrounding areas.

The plea agreement recommends a two-year probation term, a $12 million penalty, and a $4 million community service payment to the National Fish and Wildlife Foundation (“NFWF”).[118] The agreement directs NFWF to use the community service payment for air quality-related work in areas near the western shores of Galveston Bay, Texas.[119] The agreement recommends two years of probation but does not impose a reporting obligation on DuPont.[120] The agreement also recognizes DuPont’s cooperation and prior civil settlements related to the incident at issue.[121] DuPont was sentenced on the same day as its plea, and the court imposed the penalty, community service payment, and probation term recommended in the agreement.[122]

FeelGood Natural Health Stores Ltd. (Guilty Plea)

On April 14, 2023, FeelGood Natural Health Stores Ltd. (“FeelGood”), a Canadian corporation, pleaded guilty to violating the Lacey Act, 16 U.S.C. §§ 3371-3378, which prohibits trafficking wildlife taken in violation of state wildlife protection laws. In this case, FeelGood allegedly transported and sold marine mammal products in violation of the Marine Mammal Protection Act (“MMPA”).[123] As described in the agreement, FeelGood knowingly transported and sold harp seal oil capsules in the United States as a health supplement.[124]

The agreement states that, from April 2019 to May 2021, FeelGood offered harp seal oil capsules for sale on its own webpage and through third-party marketplaces, which it then shipped either directly or via third-party distributors to the United States.[125]

The DOJ Environmental and Natural Resources Division and the U.S. Attorney’s Office for the Eastern District of Michigan, pursuant to the agreement, recommended a $20,000 fine, representing twice the gross gain that FeelGood would have realized from the illegal sales.[126] Meanwhile, FeelGood, pursuant to the agreement, recommended a $5,000 fine, representing twice the actual profits it realized as a result of the sales.[127] The parties also agreed to recommend $1,373.43 in forfeiture payments stemming from covert purchases by U.S. law enforcement, as well as a three-year probationary period, during which time FeelGood agreed to establish and maintain a compliance program, assess whether it ships any products to the United States, and seek an import license if it does.[128] Sentencing has not yet occurred.

Genotox Laboratories Ltd. (DPA)

On March 21, 2023, Genotox Laboratories Ltd. (“Genotox”) entered into an eighteen-month DPA with the U.S. Attorney’s Office for the Western District of Texas, resolving allegations that Genotox had violated the Anti-Kickback Statute (“AKS”), 42 U.S.C. §§ 1320(a)-7(b), the False Claims Act (“FCA”), 31 U.S.C. §§ 3729-3733, and the Eliminating Kickbacks in Recovery Act (“EKRA”), 18 U.S.C. § 220, by using a volume-based commission incentive structure for third-party marketers and encouraging physician orders that were not medically necessary.[129]

According to the DPA, from approximately 2014 through March 2019, and at least in some instances until October 2020, Genotox paid its independent sales representatives, who were non-bona fide employees, on a commission basis to market its toxicological testing services.[130] The commission payments were calculated based on the revenue realized from billings to insurers, including Medicare and Tricare. Even after transitioning these independent sales representatives to a fixed-rate pay structure, Genotox allegedly continued tracking employee pay against the older commission structure.[131] Additionally, Genotox allegedly used form test orders to encourage test orders for patients that billed their insurance providers at the highest reimbursement categories, even if the tests were not necessary.[132]

Genotox received full cooperation credit but it did not receive voluntary disclosure credit.[133] The DPA did not assign any criminal penalty in light of Genotox’s payment of $477,774 pursuant to a parallel Civil Settlement Agreement (“CSA”) with the Civil Fraud Section, the U.S. Attorney’s Office for the Southern District of Georgia, the Office of Inspector General for the United States Department of Health and Human Services, and a qui tam relator.[134] The CSA, in addition to the $477,774 payment, imposed an additional $415,000 payment, to be made over five years. The CSA also provides for additional payments in the event that Genotox’s revenue exceeds certain thresholds, and contemplates that total payments under the agreement could exceed $29 million. The agreement states that all of these payments by Genotox are “restitution to the United States,” and the government stated in a press release that “[t]he settlement amount was based on the company’s ability to pay,” which likely explains the payment-over-time approach reflected in the agreement and the fact that some of the payments will be contingent on Genotox’s revenues.[135] Under the agreement, the government will not pay to Genotox nearly $5 million in Medicare payments that were suspended after the underlying qui tam action was filed.[136]

Notably, with respect to the DPA, the USAO for the Western District of Texas expressly retained discretion to find Genotox in breach of the DPA in the event that it breaches the parallel five-year Corporate Integrity Agreement (“CIA”) it entered into with the U.S. Department of Health and Human Services, Office of Inspector General.[137] The CIA imposed separate compliance requirements, including the retention of an Independent Review Organization – perhaps as a result, neither the CSA nor the DPA imposed an independent compliance monitor.[138]

Great Circle (NPA)

On January 27, 2023, Great Circle, a non‑profit provider of behavioral health services based in Missouri, entered into a three‑year NPA with the U.S. Attorney’s Office for the Eastern District of Missouri, resolving allegations that Great Circle made false statements in connection with the delivery of or payment for health care benefits.[139] According to the government’s allegations, Great Circle provided federally-reimbursed residential treatment services to children in the custody of the Children’s Division of the Missouri Department of Social Services.[140] Great Circle allegedly billed for services it did not provide, as well as for services that did not conform to contractual requirements.[141]

Under the agreement, Great Circle is obligated to undertake compliance program enhancements, but is not required to self-report or submit to a monitorship.[142] Great Circle entered into a parallel civil settlement with the government, in which it agreed to pay $1,866,000; apparently in recognition of that fact, the NPA does not impose a criminal penalty.[143] The NPA does not specify whether Great Circle voluntarily disclosed the alleged conduct to the government.[144]

Greater Boston Behavioral Health LLC (Guilty Plea)

On March 13, 2023, Greater Boston Behavioral Health LLC (“GBBH”) entered into a plea agreement with the U.S. Attorney’s Office for the District of Massachusetts, to resolve allegations that GBBH violated the federal Food, Drug and Cosmetic Act (“FDCA”).[145] According to the agreement, GBBH purchased Botox® that came from foreign sources and whose labels did not contain FDCA-required language indicating that the drugs were for prescription use only and explaining certain side effects.[146]

The plea agreement reflects an agreed disposition of $2,587,142 in penalties, allocated as $657,678 in fines and $1,929,464 in forfeiture.[147] The parties also agreed that GBBH should be put on probation for three years; unlike other plea agreements and many NPAs and DPAs, however, the agreement does not impose any reporting or monitor requirements on GBBH, and does not explicitly set forth any compliance or cooperation obligations.[148] The agreement does not include voluntary self-disclosure among the Sentencing Guideline factors that the government believed the court should consider at sentencing.[149]

GBBH was sentenced on May 12, 2023; the court imposed three years of probation and the same penalty and forfeiture amounts as in the plea agreement.[150]

Ground Zero Seeds International, Inc. (Guilty Plea)

On January 4, 2023, Ground Zero Seeds International, Inc. (“GZI”) entered into a plea agreement with the U.S. Attorney’s Office for the District of Oregon, to resolve one count of misprision of felony for allegedly paying kickbacks to a former employee of another company (Jacklin Seed Company) in connection with purchases of grass seed.[151] GZI allegedly paid a total of $191,790 to a former employee of the other company between April 2015 and September 2019, concealing the payments through inflated invoices.[152] In the plea agreement, the government agreed to recommend to the court a fine of $40,000 and a one-year term of probation.[153] GZI also agreed to pay restitution of $516,000, representing sales Jacklin Seed Company lost because of the kickbacks paid to its former employee.[154] Under the terms of the agreement, the government also agreed to “make available the evidence gathered in the investigation of this matter for on-site inspection,” and GZI accepted that offer—as well as the discovery the government had provided to date in the case—”in full satisfaction of the government’s discovery obligations in th[e] case.”[155]

Following the plea agreement, the court sentenced GZI to the probation, fine, and restitution terms contained in the plea agreement.[156] The plea agreement did not impose a monitor or compliance self-reporting as a condition of probation, and neither did the court in sentencing GZI.[157]

Interunity Management (Deutschland) GmbH (Guilty Plea)

On May 5, 2023, Interunity Management (Deutschland) GmbH (“Interunity”), a German shipping operator, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of California and the DOJ Environment and Natural Resources Division, to resolve allegations that Interunity failed to maintain an accurate Oil Record Book, in violation of 33 U.S.C. § 1908.[158] The government alleged that, while in U.S. waters, a vessel operated by Interunity failed to record the transfer, discharge, and disposal of oily bilge water as required by U.S. law.[159] The government learned of the alleged conduct after a crewmember on the vessel reported to the U.S. Coast Guard via email concerning a discharge of oily bilge water by the vessel directly into the sea.[160]

The agreement contains a jointly recommended sentence of $1,250,000 in penalties, which Interunity agreed represented twice what it gained as a result of the alleged conduct.[161] The penalty is comprised of $937,500 in fines and a $312,500 “community service payment” to the NFWF.[162] As the agreement notes, NFWF is a Congressionally-created nonprofit with authority to administer community service payments that advance conservation of fish, wildlife, plants, and other natural resources.[163] This plea agreement requires the NFWF to use the community service payment for conservation efforts in or around the Tijuana River National Estuarine Research Reserve.[164]

The agreement contains a recommended probation period of four years, during which Interunity would be required to implement an Environmental Compliance Plan (“ECP”).[165] The ECP requires both a third-party auditor and a court-appointed monitor. The auditor is responsible for auditing Interunity’s vessels according to a detailed set of criteria and reporting audit findings to the government, while the court-appointed monitor is responsible for reporting to the government on the adequacy of the audits and on the relationship between the auditor and Interunity.[166] Sentencing has not yet occurred in the case.

IRB Brasil Resseguros SA (NPA)

On April 20, 2023, IRB Brasil Resseguros SA (“IRB”), a Brazilian reinsurance company listed on the Brazilian stock exchange, entered into a three-year NPA with the Fraud Section.[167] The NPA resolved allegations that IRB engaged in securities fraud in violation of 15 U.S.C. §§ 78j(b) and 78ff(a) and 17 C.F.R. § 240.10b-5.[168]

At the time of the relevant conduct, February through March 2020, 25% of IRB’s shareholders were U.S. investors.[169] According to the NPA, to counteract critical analyses of IRB’s financial position, IRB and its Chief Financial Officer (“CFO”) defrauded IRB’s investors by falsely claiming that Berkshire Hathaway Inc., an international conglomerate and well-known investment entity, was a shareholder.[170] The CFO allegedly furthered this scheme through falsified shareholder lists, fictitious emails between IRB and Berkshire Hathaway, and false oral statements.[171] Berkshire Hathaway issued a statement on March 3, 2020, disclaiming any relationship with IRB. On March 4, 2020, IRB’s stock price fell, causing significant losses to shareholders.[172] The CFO subsequently falsely claimed that his statements about Berkshire Hathaway had been in error.[173] IRB separated from the CFO that same day.

Pursuant to the NPA, IRB agreed to pay $5 million in shareholder compensation to the shareholders who sold IRB stock on March 4, 2020.[174] A Shareholder Payment Administrator is to be appointed to advise the Fraud Section on which shareholders should be compensated and in what amount. Similar to the process for selecting a corporate compliance monitor, the Fraud Section will select the Administrator from a pool of three candidates chosen by IRB.[175] While the NPA states that a criminal fine or penalty would be appropriate based on the law and facts, the agreement does not impose any additional criminal monetary penalties in light of IRB’s financial position.[176]

During the NPA’s term, IRB is obligated to provide periodic reports regarding the state of its compliance program.[177] As is typical of these agreements, the NPA’s term may be extended up to one year by DOJ or terminated early, as circumstances dictate.[178] One curiosity of this agreement is that it attaches executed versions of Attachments E and F, certifications by the company CEO and CFO that IRB’s reporting under various provisions of the NPA is accurate and complete. Presumably, because these reporting requirements apply for the life of the NPA, these certifications will be executed for a second time at the conclusion of the NPA’s term.

Kerry Inc. (Guilty Plea)

On February 3, 2023, Kerry Inc. (“Kerry”), a subsidiary of a manufacturing company headquartered in Ireland, pleaded guilty to one count of manufacturing breakfast cereal under insanitary conditions and introducing adulterated food into interstate commerce in violation of the FDCA, 21 U.S.C. § § 331(a) and 333(a)(1).[179] As of the date of this publication, the plea agreement remains under seal. However, as described in the Department of Justice, Civil Division’s Consumer Protection Branch’s press release, following Kerry’s guilty plea, from approximately June 2016 to June 2018, a Kerry facility in Illinois, which manufactures and distributes Kellogg’s Honey Smacks cereal, tested positive for salmonella 81 times.[180] According to the press release, the company failed to address the presence of salmonella, and the Director of Quality Assurance at the facility directed subordinates not to report the test results.[181] The press release states that the adulterated cereal manufactured by Kerry has been linked to over 130 cases of salmonellosis beginning in March 2018.[182]

In connection with this plea agreement, Kerry was sentenced to pay $10,488,000 in criminal monetary penalties and $8,740,000 million in forfeiture payments.[183] The former Director of Quality Assurance for the facility has also been charged with three misdemeanor counts.[184]

L5 Medical Holdings, LLC (Guilty Plea)

On July 26, 2023, L5 Medical Holdings, LLC d/b/a Pain Care Centers (“L5 Medical”), a medical practice and operator of pain clinics, entered into a plea agreement with the U.S. Attorney’s Office for the Western District of Virginia to resolve allegations related to a federal drug and health care fraud conspiracy.[185] According to the agreement, L5 Medical conspired with its owner and other physicians at the practice to use registration numbers that had been issued to others in the course of dispensing and distributing a controlled substance, and to execute a scheme to defraud government health care benefits programs.[186] The practice’s owner, a former mortgage broker, allegedly purchased pain clinics through L5 Medical in pursuit of a “recession proof” business model.[187] With the agreement, L5 Medical pleaded guilty to conspiracy to distribute and dispense fentanyl, hydrocodone, morphine, and oxycodone for non-legitimate purposes.[188]

In the agreement, L5 Medical and the government agreed to recommend restitution in the amount of $3.82 million to federal and state health care programs, as well as $250,000 in forfeiture.[189] The plea agreement did not include a recommended probation period, but it required L5 Medical to wind down or dissolve its business and to never again do business in the Western District of Virginia.[190]

Nine2Five, LLC (Guilty Plea)

On July 10, 2023, Nine2Five, LLC (“Nine2Five”), a Carlsbad, California–based importer and seller of herbal extract kratom, entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of California, to resolve allegations that Nine2Five imported kratom using false invoices stating that it was botanical soil conditioner.[191] According to the National Institutes of Health, kratom (scientific name Mitragyna speciose) is “an herbal substance that can produce opioid- and stimulant-like effects.”[192] After importing the kratom using false invoices, Nine2Five allegedly transferred $60,000 to a bank account in Indonesia for the purpose of kratom importation.[193]

The plea agreement contains a recommendation by the government that Nine2Five be placed on probation for three years.[194] No fine is recommended in the agreement because “the parties agree that it is readily ascertainable that [Nine2Five] has no ability to pay.”[195] Sentencing has not yet occurred in the case.

Onekey, LLC (Guilty Plea)

On February 2, 2023, Onekey, LLC (“Onekey”), a New Jersey construction company, and its principal, entered into plea agreements with the U.S. Attorney’s Office for the Southern District of New York, to resolve allegations that Onekey willfully violated OSHA regulations which led to a construction worker’s death.[196] The government alleged that, at a construction site in Poughkeepsie, New York, Onekey built a concrete retaining wall alongside large quantities of dirt called “surcharges,” without consulting with a qualified engineer, as required by OSHA, to see if the wall could withstand the surcharges’ weight.[197] On August 3, 2017, the wall collapsed, resulting the death of a construction worker.[198]

As of the date of this publication, the plea agreements are not publicly available. However, as described in Onekey’s Sentencing Memorandum, the plea agreement contains a recommendation that Onekey, throughout a three-year probationary period, retain a Certified Safety Professional for current and future major projects; implement a safety and health management system designed to identify, evaluate, analyze and control workplace safety and health hazards; and notify OSHA about its major projects for enhanced oversight.[199] The government did not seek restitution, because Onekey voluntarily paid for the worker’s funeral expenses and, in settlement of a civil lawsuit, paid the worker’s family $2.5 million.[200] Additionally, Onekey paid a fine of $281,583 to the Department of Labor.[201]

OneKey was sentenced on May 12, 2023; the court imposed the three years of probation with the conditions identified in the plea agreement and ordered the company to pay a $218,417 fine.[202] The company’s principal was sentenced to three months in prison and one year of supervised release.[203]

Partridge-Sibley Industrial Services, Inc. (Guilty Plea)

On January 11, 2023, Partridge-Sibley Industrial Services, Inc. (“PSI”) entered into a plea agreement with the U.S. Attorney’s Office for the Southern District of Mississippi to resolve allegations that it supervised the transportation and disposal of industrial waste to a site in Jackson, Mississippi and caused it to be taken to a discharge point that was not designated to receive such waste, in violation of the Clean Water Act.[204] The allegations stem from charges against Rebel High Velocity Sewer Services of Jackson, Mississippi (“Rebel”), namely that Rebel conspired to illegally discharge waste into the City of Jackson’s sewer system to avoid the cost of treating the waste, evade sewer usage fees, and avoid disposing of the waste at legal facilities.[205] PSI was responsible for transporting truckloads of the city’s industrial waste to Rebel for discharge.[206] After PSI transported the waste to Rebel, Rebel allegedly discharged the waste into the city’s sewer system, despite being prohibited from doing so, resulting in the illegal dispensation of millions of gallons of industrial waste.[207] PSI pleaded guilty to Count 1 of a ten-count misdemeanor Information for “negligently introducing and causing to be discharged trucked and hauled pollutants” into the city’s wastewater system.[208]

In the plea agreement, PSI and the government agreed on a $200,000 fine and a one-year term of probation.[209] Following the plea, PSI issued a statement noting that “all of the officers, managers and directors of PSI were cleared of any wrongdoing or involvement in Rebel’s illegal discharges,” and that PSI’s alleged negligence was a result of untrue representations and assurance made by Rebel.[210] The statement further clarified that none of the wastewater PSI transported was hazardous or acidic.[211] At sentencing, the court imposed the fine and probation terms recommended in the plea agreement.[212] Neither the plea agreement nor the court’s judgment contain any explicit requirement for voluntarily compliance self-reporting by PSI.

Quick Tricks Automotive Performance, Inc. and Kloud9Nine, LLC (Guilty Pleas)

On January 31, 2023, Quick Tricks Automotive Performance, Inc. (“Quick Tricks”) and Kloud9Nine, LLC (“Kloud9Nine”) entered into plea agreements with the U.S. Attorney’s Office for the Southern District of Florida to resolve allegations that, between 2018 and 2021, the companies conspired to violate the Clean Air Act by tampering with diesel emissions control devices and “tuning” onboard monitoring systems so that they would not detect the modifications.[213] Both companies were sellers of products used for such “tuning.”[214] Each plea agreement recommends the imposition of three years of probation on the respective company, but does not reflect an agreement on a recommendation for monetary consequences of the alleged conduct.[215] All parties expressly reserved the right to advocate for an appropriate fine at sentencing.[216]

On May 5, 2023, the court sentenced both Quick Tricks and Kloud9Nine to three years of probation.[217] The conditions of both companies’ probations include establishing and maintaining effective compliance programs, as well as appointing a third-party auditor and funding a court-appointed monitor.[218] The companies are required to report, within 30 days of the third-party auditors’ reports, on the companies’ efforts to address auditors’ findings.[219] The court did not impose a fine on either company.[220]

Pure Addiction Diesel Performance, LLC (Guilty Plea)

On May 30, 2023, Pure Addiction Diesel Performance, LLC (“Pure Addiction”), a Portland, Oregon–area diesel repair shop, entered into a plea agreement with the U.S. Attorney’s Office for the District of Oregon, to resolve allegations that Pure Addiction violated the Clean Air Act by “deleting” or removing emissions controls from vehicles and “tuning” onboard monitoring systems so that they would not detect the modifications.[221] The government alleged that, between 2018 and 2020, Pure Addiction removed the emissions control systems, which are designed to reduce pollutants being emitted from vehicles, and modified on-board diagnostic systems, for approximately 245 diesel vehicles.[222] Pure Addiction allegedly collected over $400,000 for performing these services.[223]

In the plea agreement, Pure Addiction and the government stipulated to a sentence of three years of probation, and as a condition of probation agreed to pay a penalty of $148,733 to the Environmental Protection Agency (“EPA”), under the terms of a separate consent agreement.[224] The agreement did not contain a stipulated restitution obligation.

Pure Addiction was ordered to pay the $148,733 fine to the EPA, and was sentenced to three years’ probation.[225] In connection with Pure Addiction’s plea, its owner and operator pleaded guilty to being an accessory to the tampering of monitoring devices and was sentenced to six months in prison.[226]

Rhode Island Beef and Veal, Inc. (Guilty Plea)

On April 4, 2023, Rhode Island Beef and Veal, Inc. (“Rhode Island Beef and Veal”), a slaughterhouse based in Johnson, Rhode Island, entered into a plea agreement with the U.S. Attorney’s Office for the District of Rhode Island, to resolve allegations that the company violated the Federal Meat Inspection Act (“FMIA”).[227] Specifically, the government alleged that the company defrauded customers by failing to comply with FMIA inspection requirements, by falsely stating that meat had passed such inspection, and by unlawfully using the Secretary of Agriculture’s official inspection mark.[228] The plea agreement is not accompanied by a statement of facts, but according to the government’s press release, Rhode Island Beef and Veal continued to mark meat as having been inspected by the U.S. Department of Agriculture (“USDA”) for over a week after the USDA served the company with a notice of suspension and withdrew its inspector.[229]

The plea agreement does not contain a recommended fine or probation period; instead, it states that the government would recommend a fine within the applicable Sentencing Guidelines range, and that the government “is free to recommend a period of probation” within that range.[230] The agreement likewise does not specify any ongoing reporting or compliance requirements as part of Rhode Island Beef and Veal’s sentence.[231] Sentencing has not yet occurred in the case.

Sterling Bancorp, Inc. (Guilty Plea)

On March 15, 2023, Sterling Bancorp, Inc. (“Sterling”), a holding company offering residential and commercial loans and retail banking services through its wholly-owned subsidiary—Sterling Bank and Trust, F.S.B.—pleaded guilty to a charge of securities fraud for filing false securities statements relating to its initial public offering (“IPO”) in 2017, and in its annual filings in 2018 and 2019.[232] According to the agreement, from 2011 to 2019, Sterling, through its founder and certain members of senior management and loan officers, knowingly falsified and hid information causing loans to be offered to unqualified borrowers, which in turn increased Sterling’s revenue through its Advantage Loan Program (“ALP”).[233] Sterling then engaged in an IPO and subsequent securities filings, in the process making materially false statements regarding the quality of the ALP.[234] Consequently, between 2017 and 2019, the Sterling’s alleged fraud caused ALP non-insider shareholders to experience approximately $69 million in losses.[235]

Although Sterling voluntarily disclosed the ALP misconduct to the Office of Comptroller of the Currency (“OCC”) following an internal investigation, Sterling did not receive any disclosure credit because it did not voluntarily and timely disclose the fraudulent conduct to the Criminal Fraud Section.[236] Sterling did receive credit, however, for fully disclosing its findings from its internal investigation, cooperating with the Fraud Section’s investigation, and demonstrating recognition and affirmative acceptance of responsibility for its conduct, such as by engaging in extensive remedial measures including terminating the ALP and reorganizing its senior management and several related departments.[237]

Pursuant to the plea agreement, Sterling agreed to pay a criminal fine of approximately $62 million, a 25% discount off of the bottom of the USSG range based on Sterling’s cooperation and remediation.[238] After crediting Sterling’s civil monetary penalty payment to the OCC, the fine amount totaled approximately $56 million.[239] Similarly, credit was given for Sterling’s class action payments and thus restitution was calculated at approximately $56.5 million.[240] Following a finding that Sterling was unable to pay the full criminal penalty and restitution without facing bankruptcy, the Fraud Section required that only approximately $27 million be paid towards restitution.[241] The plea agreement specified that a Special Master would be appointed to oversee the proper administration and disbursement of the $27 million in restitution.[242]

As part of the agreement, Sterling will also be required to enhance its compliance program and provide quarterly reports to the Fraud Section throughout a three-year probationary period, which can be extended by up to one year if Sterling breaches its obligations.[243] In sentencing Sterling, the court imposed the probationary period and restitution obligation recommended by the plea agreement.[244]

Telefonaktiebolaget LM Ericsson (Guilty Plea)

On March 2, 2023, Telefonaktiebolaget LM Ericsson (“Ericsson”), a Swedish multinational telecommunications company, pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA, 15 U.S.C. § 78dd-1, and one count of conspiracy to violate the books and records provisions of the FCPA, 15 U.S.C. §§ 78m(b)(2)(A), 78m(b)(2)(B), and 78m(b)(5).[245] These counts were previously resolved in a 2019 DPA between Ericsson, the Fraud Section, and the U.S. Attorney’s Office for the Southern District of New York, in connection with which Ericsson paid more than $1 billion in penalties and disgorgement between the DPA and a related civil settlement with the SEC.[246] This year, DOJ determined, in its sole discretion, that Ericsson had breached the DPA by failing to promptly disclose all factual evidence and information related to certain pre-DPA conduct, as required by the DPA.[247] Accordingly, Ericsson pleaded guilty to the charges deferred by the 2019 DPA and agreed to an additional penalty of approximately $206.7 million.[248]

Zeus Lines Management S.A. (Guilty Plea)

On March 24, 2023, Zeus Lines Management S.A. (“Zeus”), a Liberian vessel operator with its principal place of business in Greece, pleaded guilty to violating the Act to Prevent Pollution from Ships (“APPS”), 33 U.S.C. § 1908, and the Ports and Waterways Safety Act (“PWSA”), 46 U.S.C. § 70036(b).[249] As to the APPS violations, the plea agreement states that, on three occasions between November 2021 and February 2022, one of Zeus’s ships illegally dumped 9,544 gallons of oily bilge water directly into the ocean, rather than through required pollution-prevention apparatus, and did not accurately report this discharge.[250] The agreement therefore states that Zeus failed to maintain accurate records as to its discharge of oily bilge water, in violation of the APPS.[251]

As to the PWSA violations, according to the agreement, Zeus did not report its discovery of an inoperable inert gas system on board on February 2, 2022.[252] The system’s failure, discovered while the ship was in the Netherlands, caused the ship’s oxygen levels to drastically exceed safe levels, posing a threat of fire and explosion.[253] The agreement states that Zeus sailed to the United States to retrieve a spare part during this time, and in so doing failed to report the system failure to the U.S. Coast Guard.[254] According to the agreement, after the Coast Guard became aware of the unsafe oxygen levels, Zeus falsified records to reflect that the oxygen levels were still safe during the ship’s voyage.[255]

Pursuant to its plea agreement with the Environmental and Natural Resources Division and the U.S. Attorney’s Office for the District of Rhode Island, Zeus agreed to a recommended criminal fine of over $1.6 million and $562,500 in community service to the NFWF.[256] Additionally, the agreement recommends a four-year probationary period, which can be extended by a period of time determined by the court if Zeus violates the agreement’s terms, during which Zeus must establish an Environmental Compliance Plan for all ships sailing to the United States.[257] Zeus must name a Compliance Manager who will report directly to Zeus’s Managing Director,[258] and retain a Third Party Auditor (“TPA”) to coordinate assessments of the fleet’s environmental safety practices and submit periodic reports to DOJ.[259] Zeus must also retain a Court Appointed Monitor that will oversee the audit process and Zeus’s compliance with applicable regulations, receiving reports from the TPA.[260] The court has not yet imposed sentence on Zeus.

The ship’s captain and chief engineer also pleaded guilty to charges under the APPS and PWSA.[261]

Appendix

The chart below summarizes the agreements concluded by DOJ through July 2023. The complete text of each publicly available agreement in hyperlinked in the chart.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA, DPA, or guilty plea, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in resolution agreements.

|

U.S. Deferred Prosecution Agreements, Non-Prosecution Agreements, and Plea Agreements in 2023 YTD |

||||||

|

Company |

Agency |

Alleged Violation |

Type |

Monetary Recoveries |

Monitoring & Reporting |

Term of Agreement (Months) |

|

N.D. Ala.; DOJ ENRD |

OSHA |

Guilty Plea |

$410,856 |

Yes |

24 |

|

|

S.D. Fla. |

Lacey Act |

Guilty Plea |

$0 |

No |

N/A |

|

|

D.P.R. |

Theft of Federal Funds |

Guilty Plea |

$3,712,000 |

No |

N/A |

|

|

D.N.J. |

Entry of Goods by Means of False Statements |

Guilty Plea |

$2,300,000 |

No |

N/A |

|

|

E.D. Tenn.; DOJ, Antitrust Division |

Sherman Act |

Guilty Plea |

$234,000 |

No |

0 |

|

|

D.D.C.; DOJ NSD |

Fraud (Bank) |

DPA |

$629,891,853 |

Yes |

36 |

|

|

S.D. Ga. |

Immigration Violations |

NPA |

$3,984,325 |

No |

N/A |

|

|

D.D.C.; DOJ NSD |

IEEPA |

Guilty Plea |

$83,769 |

No |

60 |

|

|

D.R.I. |

Clean Air Act |

Guilty Plea |

$0 |

Yes |

36 |

|

|

S.D. Tex. |

Clean Air Act |

Guilty Plea |

$16,000,000 |

No |

24 |

|

|

E.D. Mich.; DOJ ENRD |

Lacey Act |

Guilty Plea |

$21,373 |

Yes |

36 |

|

|

W.D. Tex.; S.D. Ga. |

Anti-Kickback Statute |

DPA |

$892,784 |

No |

18 |

|

|

E.D. Mo. |

Fraud (Healthcare) |

NPA |

$1,866,000 |

No |

36 |

|

|

D. Mass. |

FDCA |

Guilty Plea |

$2,587,142 |

No |

36 |

|

|

D. Or. |

Misprision of Felony |

Guilty Plea |

$556,000 |

No |

12 |

|

|

S.D. Cal.; DOJ ENRD |

Failure to Maintain an Accurate Oil Record Book |

Guilty Plea |

$1,250,000 |

Yes |

48 |

|

|

DOJ Fraud |

Fraud (Securities) |

NPA |

$5,000,000 |

Yes |

36 |

|

|

Kerry Inc. |

DOJ CPB; C.D. Ill. |

FDCA |

Guilty Plea |

$19,228,000 |

Unknown |

Unknown |

|

W.D. Va. |

Healthcare fraud |

Guilty Plea |

$4,070,000 |

No |

N/A |

|

|

D.R.I. |

Clean Air Act |

Guilty Plea |

$0 |

Yes |

36 |

|

|

E.D. Tenn.; DOJ, Antitrust Division |

Sherman Act |

Guilty plea |

$184,000 |

No |

N/A |

|

|

E.D. Tenn.; DOJ, Antitrust Division |

Sherman Act |

Guilty plea |

$130,000 |

No |

N/A |

|

|

S.D. Cal. |

Money Laundering |

Guilty Plea |

$0 |

No |

36 |

|

|

Onekey, LLC |

S.D.N.Y. |

OSHA |

Guilty Plea |

$218,417 |

Unknown |

36 |

|

S.D. Miss. |

Clean Water Act |

Guilty Plea |

$200,000 |

No |

12 |

|

|

E.D. Tenn.; DOJ, Antitrust Division |

Sherman Act |

Guilty Plea |

$68,000 |

No |

N/A |

|

|

D. Or. |

Clean Air Act |

Guilty Plea |

$148,733 |

No |

36 |

|

|

Quick Tricks Automotive Performance, Inc. and Kloud9Nine, LLC |

S.D. Fla. |

Clean Air Act |

Guilty Plea |

$0 |

No |

36 |

|

D.R.I. |

Federal Meat Inspection Act |

Guilty Plea |

$0 |

No |

N/A |

|

|

D.D.C.; DOJ NSD |

IEEPA |

Guilty Plea |

$83,769 |

No |

60 |

|

|

DOJ Fraud |

Fraud (Securities) |

Guilty Plea |

$39,739,000 |

Yes |

36 |

|

|

DOJ Fraud; S.D.N.Y. |

FCPA |

Guilty Plea |

$206,728,848 |

Yes |

12 |

|

|

D.R.I.; DOJ ENRD |

Failure to Maintain Accurate Oil Record Book |

Guilty Plea |

$2,250,000 |

Yes |

48 |

|

__________________________________________________________

[1] This update addresses developments and statistics through July 31, 2023. NPAs and DPAs are two kinds of voluntary, pre-trial agreements between a corporation and the government, most commonly used by DOJ. They are standard methods to resolve investigations into corporate criminal misconduct and are designed to avoid the severe consequences, both direct and collateral, that conviction would have on a company, its shareholders, and its employees. Though NPAs and DPAs differ procedurally—a DPA, unlike an NPA, is formally filed with a court along with charging documents—both usually require an admission of wrongdoing, payment of fines and penalties, cooperation with the government during the pendency of the agreement, and remedial efforts, such as enhancing a compliance program or cooperating with a monitor who reports to the government. Although NPAs and DPAs are used by multiple agencies, since Gibson Dunn began tracking corporate NPAs and DPAs in 2000, we have identified over 600 agreements initiated by DOJ, and 10 initiated by the U.S. Securities and Exchange Commission (“SEC”).

[2] Memorandum from Lisa O. Monaco, Deputy Attorney General, U.S. Dep’t of Justice, to Assistant Attorney General, Criminal Division, et al., Further Revisions to Corporate Criminal Enforcement Policies Following Discussions with Corporate Crime Advisory Group (Sept. 15, 2022), https://www.justice.gov/opa/speech/file/1535301/download.

[3] Deputy Attorney General Lisa O. Monaco Delivers Remarks on Corporate Criminal Enforcement (Sept. 15, 2022), https://www.justice.gov/opa/speech/deputy-attorney-general-lisa-o-monaco-delivers-remarks-corporate-criminal-enforcement.

[4] Id.

[5] Id.

[6] Deputy Attorney General Lisa Monaco Delivers Remarks at American Bar Association National Institute on White Collar Crime (Mar. 2, 2023), https://www.justice.gov/opa/speech/deputy-attorney-general-lisa-monaco-delivers-remarks-american-bar-association-national; see also DOJ, United States Attorneys’ Offices Voluntary Self-Disclosure Policy, https://www.justice.gov/d9/2023-03/usao_voluntary_self-disclosure_policy_2.21.23.pdf.

[7] Memorandum from DAG Monaco to DOJ on Further Revisions to Corporate Criminal Enforcement Policies (Sept. 15, 2022), https://www.justice.gov/opa/speech/file/1535301/download.

[8] DOJ, United States Attorneys’ Offices Voluntary Self-Disclosure Policy at 4, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.justice.gov/d9/2023-03/usao_voluntary_self-disclosure_policy_2.21.23.pdf

[9] Press Release, ABB Agrees to Pay Over $315 Million to Resolve Coordinated Global Foreign Bribery Case (Dec. 2, 2022), https://www.justice.gov/opa/pr/abb-agrees-pay-over-315-million-resolve-coordinated-global-foreign-bribery-case.

[10] Memorandum from DAG Monaco to DOJ on Further Revisions to Corporate Criminal Enforcement Policies (Sept. 15, 2022), https://www.justice.gov/opa/speech/file/1535301/download.

[11] Principal Associate Deputy Attorney General Marshall Miller Delivers Remarks at the American Bankers Association Financial Crimes Enforcement Conference (Dec. 6, 2022), https://www.justice.gov/opa/speech/principal-associate-deputy-attorney-general-marshall-miller-delivers-remarks-american.

[12] Deputy Attorney General Lisa Monaco Delivers Remarks at American Bar Association National Institute on White Collar Crime (Mar. 2, 2023), https://www.justice.gov/opa/speech/deputy-attorney-general-lisa-monaco-delivers-remarks-american-bar-association-national.

[13] Principal Associate Deputy Attorney General Marshall Miller Delivers Remarks at the American Bankers Association Financial Crimes Enforcement Conference (Dec. 6, 2022), https://www.justice.gov/opa/speech/principal-associate-deputy-attorney-general-marshall-miller-delivers-remarks-american.

[14] Deputy Attorney General Lisa Monaco Delivers Remarks at American Bar Association National Institute on White Collar Crime (Mar. 2, 2023), https://www.justice.gov/opa/speech/deputy-attorney-general-lisa-monaco-delivers-remarks-american-bar-association-national.

[15] Assistant Attorney General Kenneth A. Polite, Jr. Delivers Remarks on Revisions to the Criminal Division’s Corporate Enforcement Policy (Jan. 17, 2023), https://www.justice.gov/opa/speech/assistant-attorney-general-kenneth-polite-jr-delivers-remarks-georgetown-university-law; see also, U.S. Dep’t of Justice, Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy, https://www.justice.gov/criminal-fraud/file/1562831/download.

[16] Assistant Attorney General Kenneth A. Polite, Jr. Delivers Remarks on Revisions to the Criminal Division’s Corporate Enforcement Policy (Jan. 17, 2023), https://www.justice.gov/opa/speech/assistant-attorney-general-kenneth-polite-jr-delivers-remarks-georgetown-university-law.

[17] Id.

[18] Justice Manual § 9-47.120(1) (Nov. 2019).

[19] Id.

[20] Assistant Attorney General Kenneth A. Polite, Jr. Delivers Keynote Address at the Global Investigations Review Live: DC Spring Conference (Mar. 23, 2023), https://www.justice.gov/opa/speech/assistant-attorney-general-kenneth-polite-jr-delivers-keynote-address-global.

[21] Id.