FTC Announces Significant Revisions to HSR Premerger Notification Rules and Form

Client Alert | October 11, 2024

The rulemaking changes represent the first major overhaul of the HSR premerger notification requirements in its 45-year history, and are slated to take effect 90 days from when it is published in the Federal Register, likely sometime in January 2025.

On October 10, 2024, the Federal Trade Commission, with concurrence from the Department of Justice, announced the release and upcoming implementation of changes to the Premerger Notification and Report Form (the “HSR Form”) and associated instructions, as well as to the premerger notification rules implementing the Hart-Scott Rodino (“HSR”) Act.[1] The rulemaking changes represent the first major overhaul of the HSR premerger notification requirements in its 45-year history, and are slated to take effect 90 days from when it is published in the Federal Register, likely sometime in January 2025. While notably less expansive and onerous than initially contemplated, the FTC’s changes, detailed below, nevertheless broadly affect all filings for HSR-reportable deals. Companies seeking clearance for mergers in the U.S. will need to expend more time and effort to prepare HSR filings, as they now will be required to provide both additional narrative data about the merger and any overlapping products or services between the merging parties and more documents and financial data than previously required. The information requested will provide U.S. agencies with more insight on the proposed transaction and associated antitrust earlier in the process, creating more inroads for the agencies to justify expanded “Second Request” investigations. The updated HSR rules do not change who has to file, and no change has been made to the method for accepting filings, though the FTC noted that a new electronic filing system is in development and that it will propagate further rulemaking detailing this initiative when it is ready.[2]

The most significant changes to the HSR filing requirements include:

Additional 4(c)/(d) Documents. The new rules expand the scope of required so-called 4(c) and 4(d) documents. The new rules require documents not only created by or for officers and directors of the filer, but also those created by or for the “supervisory deal team lead,” defined as a single individual who has “primary responsibility for supervising the strategic assessment of the deal, and who would not otherwise qualify as a director or officer.”[3] The rules also now require the inclusion of certain ordinary course business documents from all filers, namely any periodic plans and reports that discuss market shares, competition, competitors, or markets of any overlapping product or service that were shared with the Chief Executive Officer or the Board.[4] The document requirement excludes ad hoc reports and is limited to only those documents created within one year of filing. The relevant products and services in scope are those that both the acquiring and acquired persons produce, sell, or are known to be developing.

Transaction and Competitive Overlap Details. Under the new rules, the acquirer will be required to make additional disclosures on the details of the transaction, including a short description of the operating businesses within the acquiring person, other antitrust jurisdictions besides the U.S. where the parties have filed or will file, and any pre-existing diagrams of the deal structure for the transaction.[5] All filing parties will be required to supply transaction rationales, but for acquired persons, a brief description of the transaction rationale is sufficient so long as it is accurate and does not conflict without explanation with stated rationales in documents submitted with the HSR Filing.[6] All filing parties will be required to identify the entities they control that generate revenue for overlapping NAICS codes between the parties, as well as more detailed narrative and geographic information for those overlap businesses.[7]

Prior Acquisitions. The rules expand existing reporting requirements on prior acquisitions, most notably extending the requirement to acquired persons.[8] Both acquirers and acquired persons will be required to note acquisitions for the past 5 years, excluding as de minimis any acquisitions of entities with less than $10 million in total assets and annual net sales in the year prior to the acquisition. The rules also require including transactions in which the filer acquired substantially all of the assets of a business and not merely acquisitions of voting securities or non-corporate interest. This change aligns with the U.S. antitrust agencies’ focus in the December 2023 Merger Guidelines on “roll-up strategies” by acquirers.

Other Affiliations. The new rules require additional information related to the outside affiliations of the filers and their officers and directors. Filers are already required under Item 6(c) of the HSR rules to list as minority ownership any holdings of greater than 5% but less than 50% where there are NAICS code overlaps with the filers. The updated rules eliminate the alternative option for filers just to list all minority holdings, and now must specifically identify only those with potential competitive overlap products or services.[9] The rules will also require the acquiring person to disclose the board and corporate affiliations that each officer and director holds with other entities outside of the filing company, where those entities are in the same industry as the target.[10] The rules include a short lookback period to include affiliations that ended within 3 months of the filing, and exempt non-profit organizations with political or religious purposes. Officer and director affiliations will only be required for acquirer entities that either have responsibility for the reported overlap products and those that indirectly or directly control or are controlled by those entities. The agencies continue to closely monitor companies for new potential officer/director interlocks under Section 8 of the Clayton Act or avenues of improper coordination under Section 1 of the Sherman Act, and through these additional disclosures will be more armed to investigate concerns resulting from the transaction and potential pre-existing concerns separate from the transaction.[11]

Vertical Supply Relationships. The FTC will now require the parties to identify any supplier relationships between the acquirer and acquired persons or any other person that the parties know or believe competes with either party.[12] The rules establish a de minimis exception for lines of business that account for less than $10 million in revenue, but note that parties must include in their calculations the value of goods they supply to themselves in internal transfers for competitive overlap products.[13] Filers will need to include a brief description of the product or service sold or licensed, and list associated revenues for that supply relationship for the most recent fiscal year.

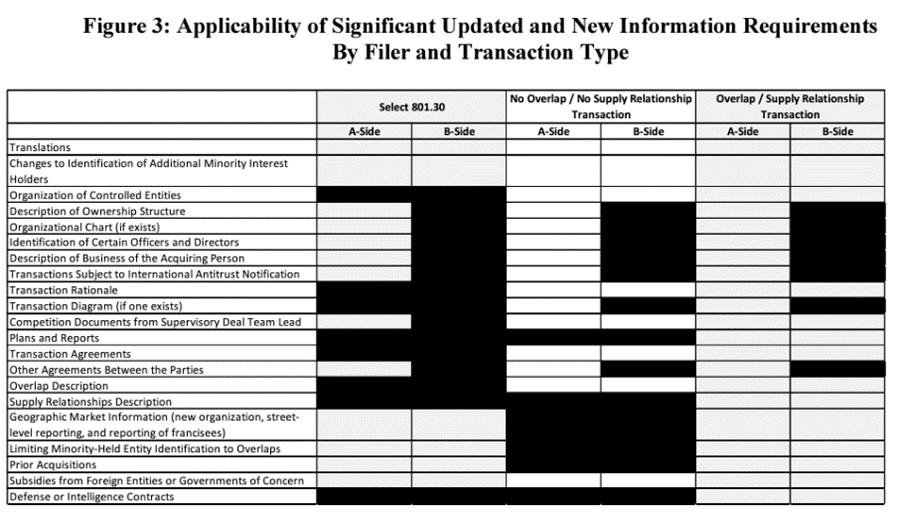

The new rules will exclude some of these new obligations for “select 801.30 transactions,” defined as those acquisitions that “do not result in the acquisition of control to which § 801.30 applies [such as tender offers] and where there is no agreement or contemplated agreement between any entity within the acquiring and acquired person.”[14] The rules also limit additional information requests in some cases for transactions where there are no competitive overlaps:

Additional Key Takeaways

Companies contemplating or pursuing transactions will need to be prepared for additional time and burden under the new rules, and should begin to consider how they will approach the filing early in the deal process. In particular, companies should expect that it will take more time to prepare a filing that complies with the new requirements, and take that into account when negotiating timing terms. The additional volume and scope of information contained in HSR filings also raise the possibility of enhanced scrutiny of transactions generally, and more quickly after the filing is completed.

One potentially positive development: in conjunction with announcing the final rule, the FTC announced the planned reinstatement of early termination of the statutory 30-day waiting period following an HSR filing, which could shorten deal timelines for certain merging parties.

Firms considering transactions should continue to proactively consult with antitrust counsel early in the transaction process to identify and mitigate risk.

Gibson Dunn attorneys are closely monitoring these developments and are available to discuss these issues as applied to your particular business. Please reach out to your Gibson Dunn contacts in the Antitrust and Competition group if you have questions about how the updated rules may affect your M&A plans and how best to prepare. If you are interested in challenging the final rule as Gibson Dunn successfully accomplished against the FTC’s non-compete rule in Ryan, LLC v. FTC, please reach out to your Gibson Dunn contacts in the Administrative Law and Regulatory Practice group.

[1] https://www.ftc.gov/news-events/news/press-releases/2024/10/ftc-finalizes-changes-premerger-notification-form?utm_source=govdelivery

[2] Premerger Notification; Reporting and Waiting Period Requirements, Action: Final Rule (“Final Rule”). October 10, 2024, available at https://www.ftc.gov/system/files/ftc_gov/pdf/p110014hsrfinalrule.pdf, pg.178

[3] Final Rule, pg. 204

[4] Final Rule, pg. 279

[5] Final Rule, pgs. 256-257

[6] Final Rule, pg. 262

[7] Final Rule, pgs. 342-343

[8] Final Rule, pg. 349

[9] Final Rule, pg. 345

[10] Final rule, pg. 248

[11] See In the Matter of QEP Partners, August 16, 2023, https://www.ftc.gov/news-events/news/press-releases/2023/08/ftc-acts-prevent-interlocking-directorate-arrangement-anticompetitive-information-exchange-eqt

[12] Final Rule, pg. 326

[13] Final Rule, pg. 331

[14] Final Rule, pg. 201

[15] Final Rule, pg. 156

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding the issues discussed in this update. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any leader or member of the firm’s Antitrust and Competition, Administrative Law and Regulatory, Mergers and Acquisitions, or Private Equity practice groups:

Antitrust and Competition:

Rachel S. Brass – San Francisco (+1 415.393.8293, rbrass@gibsondunn.com)

Jamie E. France – Washington, D.C. (+1 202.955.8218, jfrance@gibsondunn.com)

Sophia A. Hansell – Washington, D.C. (+1 202.887.3625, shansell@gibsondunn.com)

Kristen C. Limarzi – Washington, D.C. (+1 202.887.3518, klimarzi@gibsondunn.com)

Joshua Lipton – Washington, D.C. (+1 202.955.8226, jlipton@gibsondunn.com)

Michael J. Perry – Washinton, D.C. (+1 202.887.3558, mjperry@gibsondunn.com)

Cynthia Richman – Washington, D.C. (+1 202.955.8234, crichman@gibsondunn.com)

Stephen Weissman – Washington, D.C. (+1 202.955.8678, sweissman@gibsondunn.com)

Administrative Law and Regulatory:

Stuart F. Delery – Washington, D.C. (+1 202.955.8515, sdelery@gibsondunn.com)

Eugene Scalia – Washington, D.C. (+1 202.955.8673, dforrester@gibsondunn.com)

Helgi C. Walker – Washington, D.C. (+1 202.887.3599, hwalker@gibsondunn.com)

Mergers and Acquisitions:

Robert B. Little – Dallas (+1 214.698.3260, rlittle@gibsondunn.com)

Saee Muzumdar – New York (+1 212.351.3966, smuzumdar@gibsondunn.com)

George Sampas – New York (+1 212.351.6300, gsampas@gibsondunn.com)

Private Equity:

Richard J. Birns – New York (+1 212.351.4032, rbirns@gibsondunn.com)

Ari Lanin – Los Angeles (+1 310.552.8581, alanin@gibsondunn.com)

Michael Piazza – Houston (+1 346.718.6670, mpiazza@gibsondunn.com)

John M. Pollack – New York (+1 212.351.3903, jpollack@gibsondunn.com)

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.