Life Sciences Review and Outlook – 2024

Client Alert | March 8, 2024

This update provides a recap of 2023 highlights for capital markets, M&A activity, royalty finance transactions and clinical funding arrangements, along with expectations for 2024.

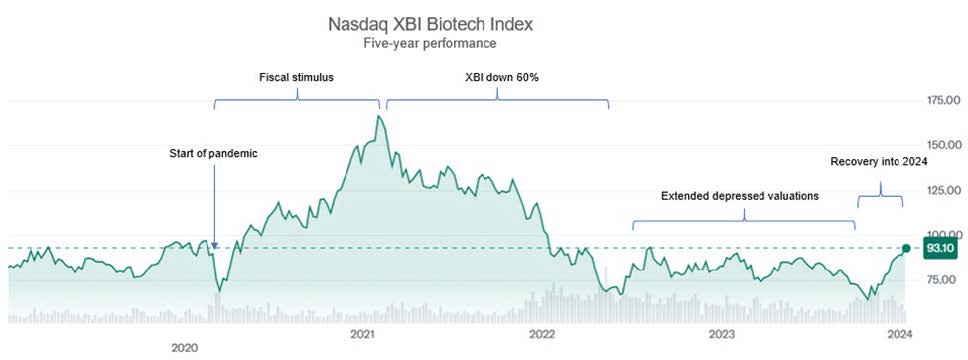

The past five years have been particularly tumultuous in the biopharma sector. Strong capital markets and M&A activity into early 2020 were whipsawed during the pandemic, with equity valuations climbing significantly through early 2021 before dropping dramatically through the fourth quarter of 2023. While dedicated healthcare funds have remained in the market during this time, generalist funds pulled back significantly in 2022 and 2023, leaving the sector with insufficient capital on the whole to support the number of public (and aspiring to be public) biopharma companies. This was reflected in the fact that over 200 Nasdaq-listed biopharma companies were trading below their cash balances as of Q32023. As a result, many biopharma companies sought less dilutive sources of capital, including royalty-based financing and third-party funding of clinical trials, while others explored sales, reverse mergers and liquidations. At the same time, a select group of companies with particularly attractive assets (either de-risked or in a therapeutic space with high investor interest) were still able to raise capital on favorable terms.

Starting in the fourth quarter of 2023, we saw the XBI rally with the broader market, which seemed to signal a bottoming out of the market and an ability more broadly to access capital. Also during this time, large pharma has amassed substantial cash balances coming out of the pandemic and from the sale of blockbuster GLP-1 drugs. This led to a strong year in 2023 for larger M&A transactions (over $1 billion), albeit with the sense that it was a buyer’s market taking advantage of the lower equity valuations of the target companies. Looking ahead, we expect a more stable capital environment in 2024, which will support capital formation and continued M&A activity, although uncertainty remains with increased geopolitical tensions, a pending presidential election in the United States and continued economic uncertainty globally.

As we enter this new year, we are cautiously optimistic that the coming year will provide a favorable deal environment for the biopharma sector and represent a return to a more balanced environment. Please read more below.

We invite you to join our team of seasoned attorneys and industry leaders for a webcast, where we will provide a recap of 2023 highlights for capital markets, M&A activity, royalty finance transactions and clinical funding arrangements, along with expectations for the Life Sciences deal market in 2024.

Register for our Webcast: Please join us on March 12, 2024: “Life Sciences Review and Outlook 2024.”

Gibson Dunn’s lawyers are available to assist in addressing any questions you may have regarding these issues. Please contact the Gibson Dunn lawyer with whom you usually work, any leader or member of the firm’s Life Sciences practice group, or the authors in San Francisco:

Ryan Murr (+1 415.393.837, rmurr@gibsondunn.com)

Branden Berns (+1 415.393.4631, bberns@gibsondunn.com)

Todd Trattner (+1 415.393.8206, ttrattner@gibsondunn.com)

Karen Spindler (+1 415.393.8298, kspindler@gibsondunn.com)

Melanie Neary (+1 415.393.8243, mneary@gibsondunn.com)

© 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.