The Payoffs and Pitfalls of ESG Due Diligence

Article | April 18, 2024

A recent global survey of dealmakers by BCG and Gibson Dunn reveals a striking consensus: conducting environmental, social, and governance (ESG) due diligence is now indispensable for M&A transactions.

Dealmakers say that the insights gained from these assessments are crucial not only for mitigating risks but also for preserving and enhancing deal value. Although Europe has spearheaded more stringent ESG regulations, dealmakers in all surveyed countries, including those in the US, recognize the importance of performing such assessments before closing a deal.

“The Payoffs and Pitfalls of ESG Due Diligence” report was authored by Jens Kengelbach, Jana Herfurth, Dominik Degen, Dirk Oberbracht, Ferdinand Fromholzer, and Jan Schubert. Download the report here.

About the Survey

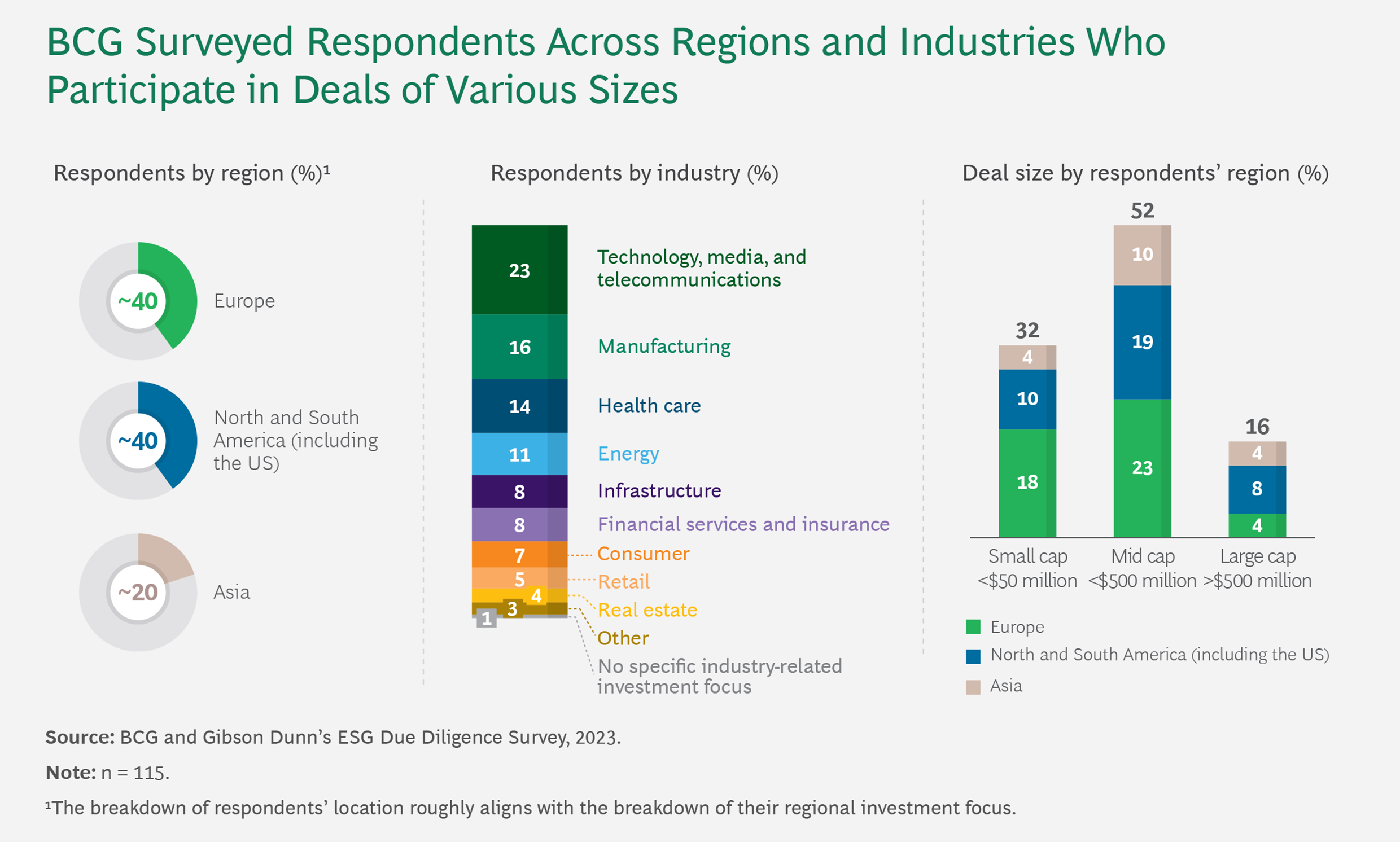

To understand the prevailing ESG due diligence practices in M&A transactions, BCG and Gibson Dunn surveyed 115 dealmakers in Europe, North and South America (including in the US), and Asia. The dealmakers are in various industries and participate in different deal sizes. (See the exhibit below.) The survey participants, who hold positions ranging from managers to roles in the C-suite, have been personally involved in deals during the past three years and are familiar with ESG due diligence practices. Approximately two-thirds of the respondents are corporate executives, while the others are from private equity or venture capital firms or financial institutions.

Website © 2024 Gibson, Dunn & Crutcher LLP. All rights reserved. The report linked above is © 2024 Boston Consulting Group with details included in the report.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.