Securities Litigation 2024 Mid-Year Update

Client Alert | September 4, 2024

This update provides an overview of the major developments in federal and state securities litigation since our Securities Litigation 2023 Year-End Update.

Table of Contents

I. Filing And Settlement Trends

II. What To Watch For In The Supreme Court

III. Delaware Developments

IV. Federal SPAC Litigation

V. ESG Civil Litigation

VI. Cryptocurrency Litigation

VII. Lorenzo Disseminator Liability

VIII. Market Efficiency And “Price Impact” Cases

IX. Other Notable Developments

Gibson Dunn’s 2024 Mid-Year Update covers the following developments:

- We review the Supreme Court’s decisions in Macquarie Infrastructure Corp. v. Moab Partners, L.P., which recognizes that a suit under Rule 10b-5 cannot be based on pure omissions, and SEC v. Jarkesy, which limits the SEC’s power to conduct administrative enforcement proceedings in certain cases. We also preview two cases that will address pleading standards and the nature of “materially misleading” statements under the PSLRA.

- We detail significant developments in Delaware corporate law, including a Delaware Supreme Court ruling on advance notice bylaws and a novel ruling on the duties of controlling stockholders when exercising stockholder-level voting power. We also provide updates on Moelis and Tornetta v. Musk.

- We discuss the SEC’s latest rule applicable to SPACs and its significance along with the fact-specific approach courts have taken in SPAC litigation.

- A growing number of lawsuits challenge public companies’ environmental, social, and governance (ESG) disclosures and policies. We survey recent developments in this space.

- Cryptocurrency saw noteworthy developments in private litigation and in actions by the SEC—which has been ramping up enforcement efforts. We discuss these developments along with court rulings and legislative efforts impacting transactions and compliance.

- We continue to monitor case law developments related to the Supreme Court’s 2019 decision, Lorenzo v. SEC, in which the Supreme Court found that even if the disseminator of a false statement did not “make” or draft that false statement within the meaning of Rule 10b-5(b), the disseminator may still be liable under Rule 10b-5(a) and (c) if they disseminate a false statement with intent to defraud.

- District courts continue to engage with defendants’ attempts to defeat or limit class certification by rebutting the Basic presumption of reliance with evidence that the alleged misstatements had no impact on the stock price. We review several of these opinions in Section VIII, Market Efficiency And “Price Impact” Cases.

- Finally, we address several other notable developments including the following: the Seventh Circuit outlining the procedure for reassessment of mootness fees paid to shareholder plaintiffs after a merger following voluntary dismissal of their suit; the Sixth Circuit joining the majority of circuits in holding that the bespeaks caution doctrine survives the PSLRA; the Ninth Circuit providing additional guidance on determining loss causation and alleged misstatements related to COVID-19; and the SEC’s finalization of amendments to Regulation S-P aimed at enhancing data protections.

I. Filing And Settlement Trends

A recent NERA Economic Consulting (NERA) study provides an overview of recent developments in federal securities litigation filings. This section highlights several notable trends.

A. Filing Trends

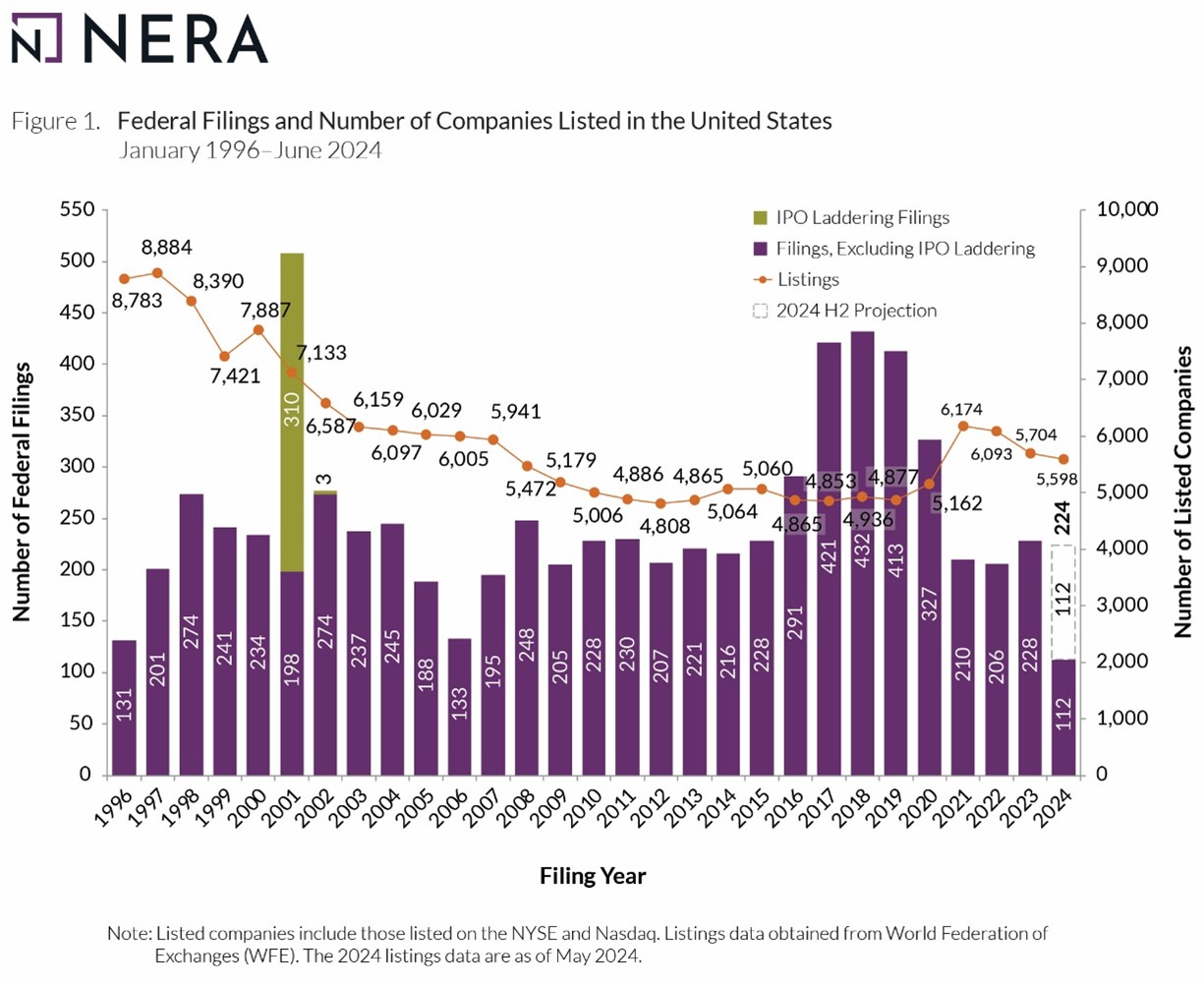

Figure 1 below reflects the federal filing rates from 1996 through 2024. In the first half of 2024, 112 federal cases were filed. On an annualized basis, that number largely matches the number of federal filings in 2023, but it is considerably lower than in the peak years of 2017-2019. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

|

B. Mix Of Cases Filed In 2023

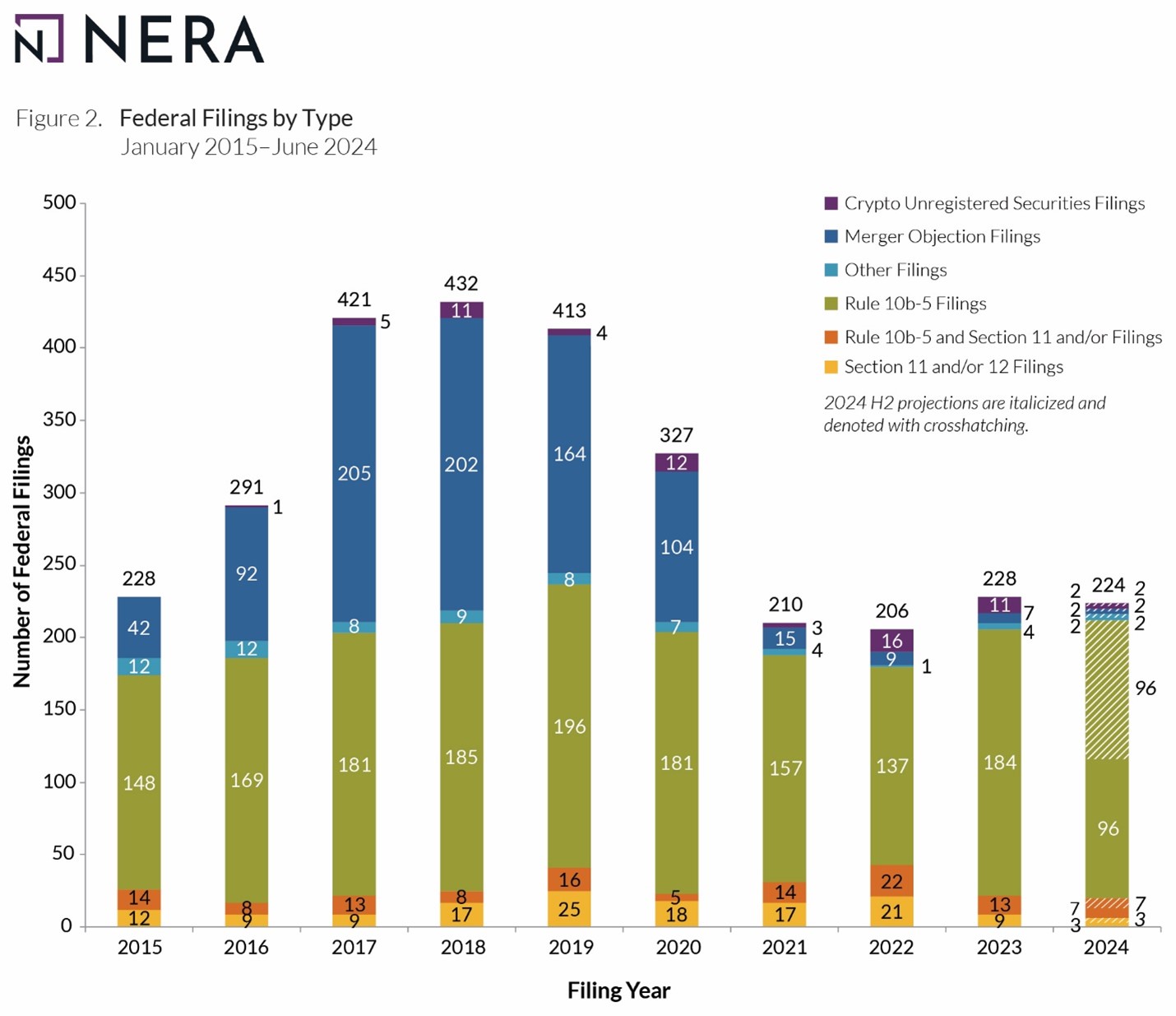

1. Filings By Industry Sector

As shown in Figure 2 below, the distribution of non-merger objections and non-crypto unregistered securities filings in the first half of 2024 varied somewhat from 2023. Notably, after a dip in 2023, the “Health and Technology Services” sector percentage returned to the percentages seen in 2021 and 2022. Similarly, the percentage of “Electronic Technology and Technology Services” filings increased in 2024, returning to levels seen in 2021 and 2022. Together, “Health and Technology Services” and “Electronic Technology and Technology Services” filings once again comprised over 50% of filings after dipping to 41% in 2023. Meanwhile, “Finance” sector filings decreased from 18% to 11%.

Figure 2:

|

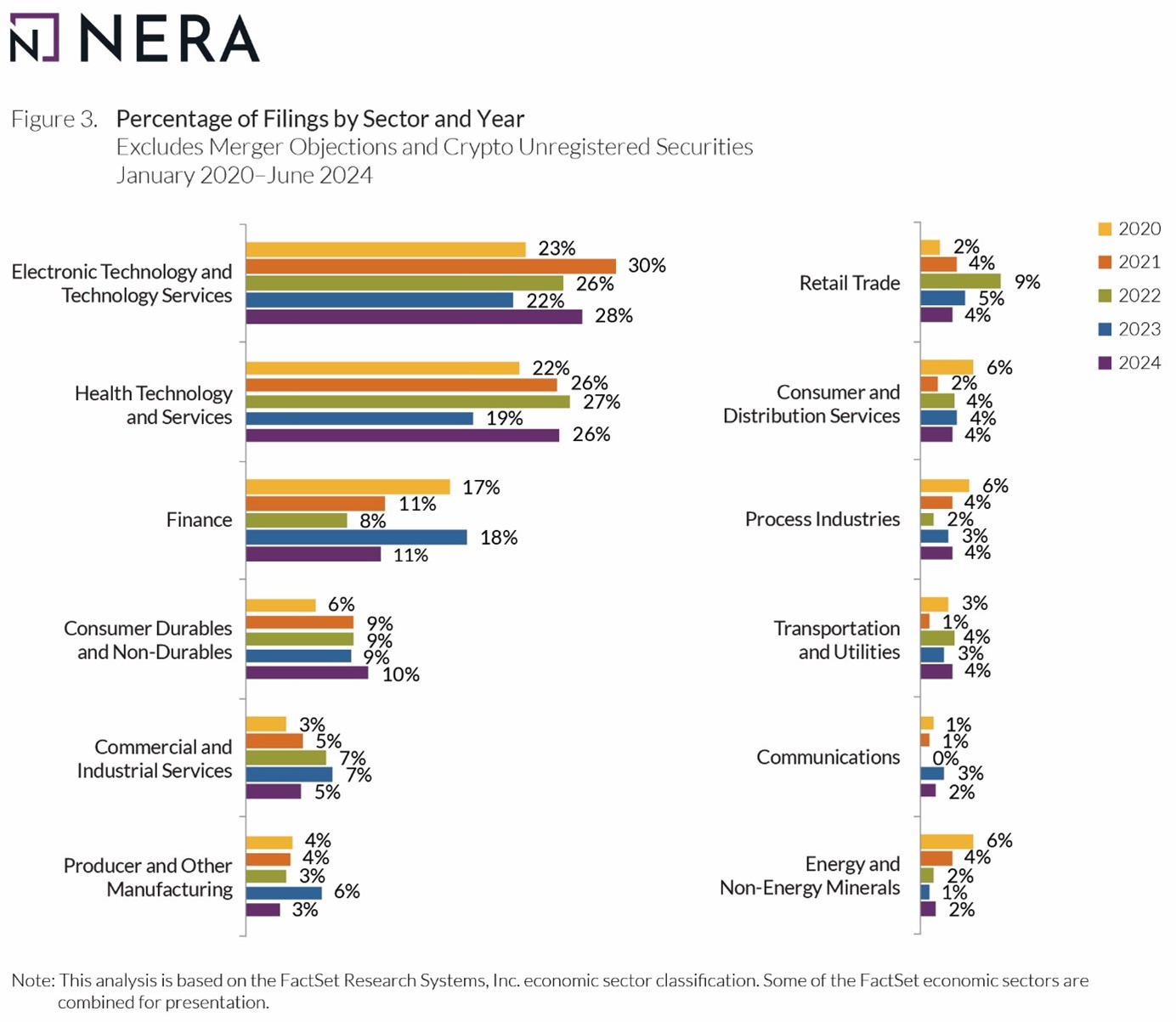

2. Filings By Type

As shown in Figure 3 below, Rule 10b-5 filings make up the vast majority of federal filings so far this year. In fact, projecting out to a full year, filings of other types are slated to end up at their lowest levels in years.

Figure 3:

|

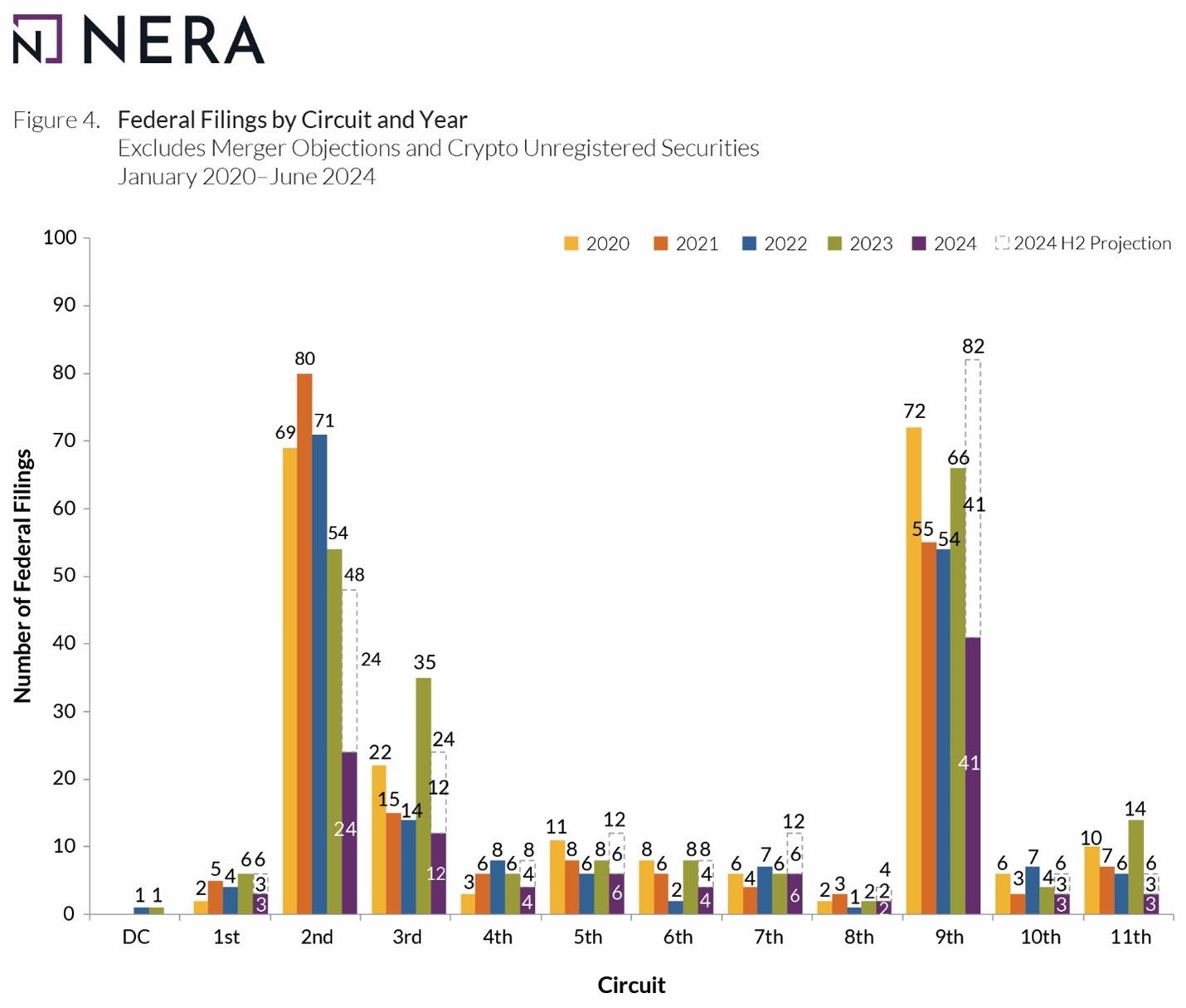

3. Filings By Circuit

Figure 4 provides insight into the distribution of federal filings by Circuit. Most filings occur in the Second and Ninth Circuits. Notably, the number of filings in the Second Circuit has been trending down since 2021. By contrast, the number of filings in the Ninth Circuit has stayed steady or increased over that same period.

Figure 4:

|

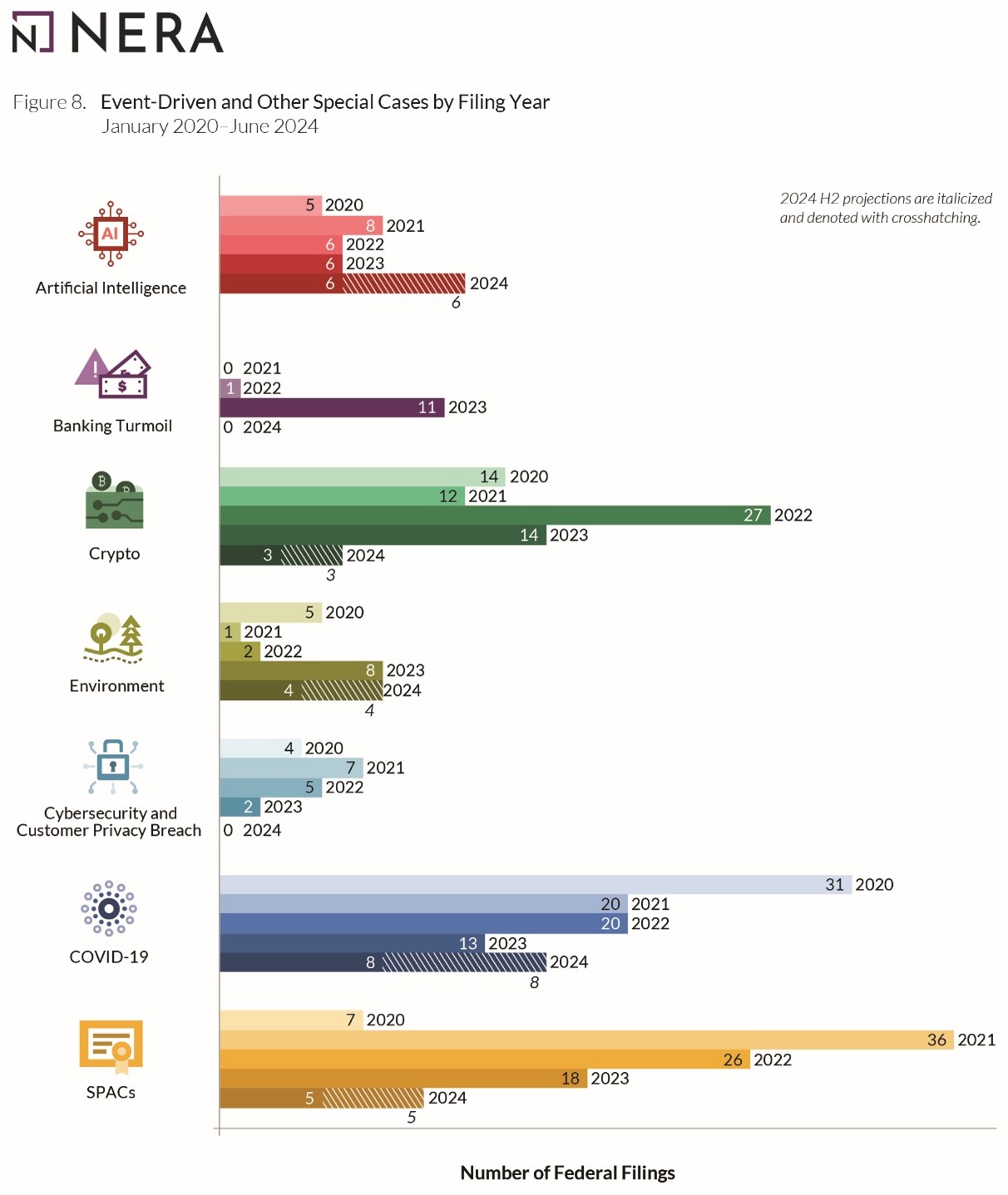

4. Event-Driven And Other Special Cases

Figure 5 illustrates trends in the number of event-driven and other special case filings since 2020. The number of Artificial Intelligence-related filings already equals the total number of such filings in 2023 and 2022. By contrast, SPAC and Cybersecurity and Customer Privacy Breach filings have decreased steadily since 2021. And after 11 such filings in 2023, zero Banking Turmoil cases have been filed this year.

Figure 5:

|

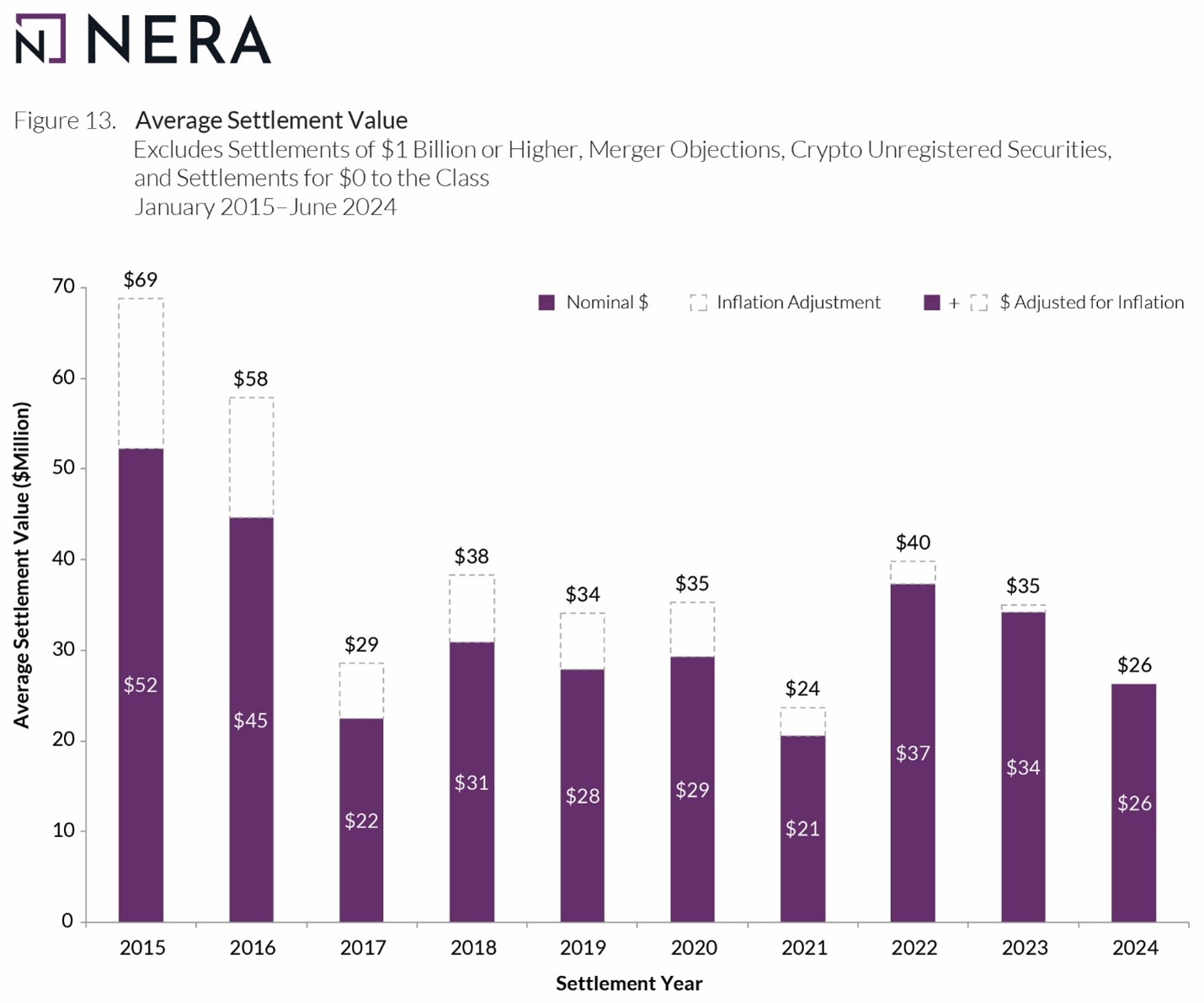

C. Settlement Trends

As reflected in Figure 6 below, the average settlement value so far in 2024 is $26 million. That is a sizable drop from the past two years. If it remains at that level, it would be the second-lowest average settlement value on an inflation-adjusted basis in nearly a decade. (Note that the average settlement value excludes merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

Figure 6:

|

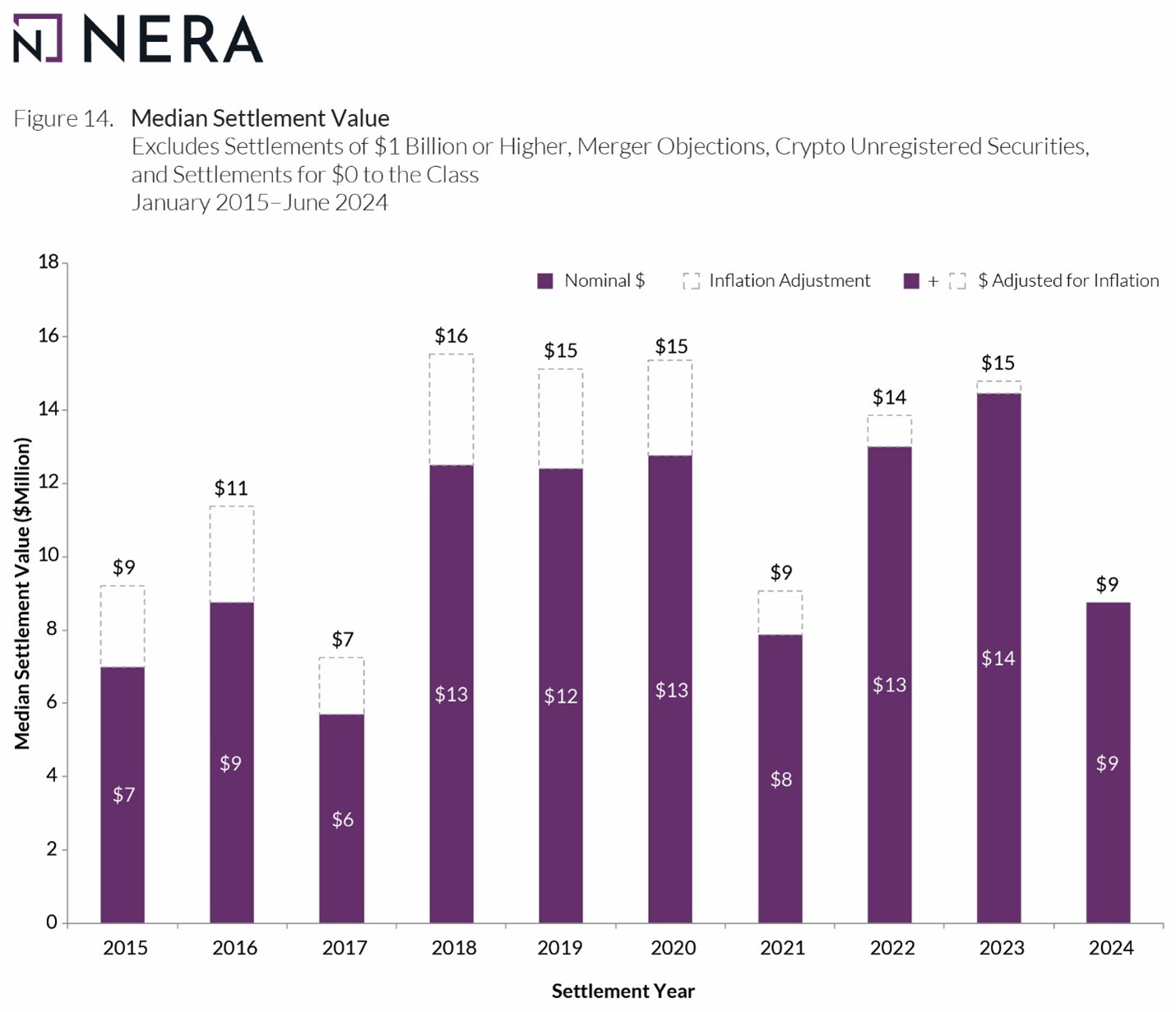

As for median settlement value, that value has likewise dropped noticeably from 2022 and 2023. (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 7:

|

II. What To Watch For In The Supreme Court

A. Recent Supreme Court Decisions

1. Macquarie Infrastructure Corp. v. Moab Partners, L.P. – Rule 10b-5 Does Not Support Private Actions Based On Pure Omissions

On April 12, 2024, the Supreme Court unanimously decided Macquarie Infrastructure Corp. v. Moab Partners, L.P., holding that an issuer of securities does not violate Exchange Act Section 10(b) or the SEC’s Rule 10b-5 by pure omission—that is, by mere nondisclosure of material information—unless that omission renders other, affirmative statements by the issuer misleading. 601 U.S. 257, 265 (2024).

Moab Partners, L.P. filed this private securities-fraud action under Section 10(b) and Rule 10b-5 against the defendants, Macquarie Infrastructure Corp. and related individuals and entities, asserting that the nondisclosure of certain information in Macquarie’s SEC filings constituted an actionably misleading omission of material information. Id. at 261. The information at issue related to the principal assets of a Macquarie subsidiary, storage terminals for a particular high-sulfur fuel oil. Id. The United Nations enacted a 2016 rule that aimed to cap the sulfur content of fuel oil used in shipping, and Macquarie did not disclose in its filings any potential impact of that rule on its subsidiary’s business. Id. In February 2018, Macquarie announced that demand for the subsidiary’s storage had decreased due to a decline in the market for the high-sulfur fuel oil, and Macquarie’s stock price dropped by 41%. Id.

Moab Partners argued that the failure to disclose any risks associated with the 2016 rule violated Macquarie’s duty, under Item 303 of Regulation S-K, to disclose in its annual Form 10-K filing all “known trends or uncertainties that . . . are reasonably likely to have a material . . . impact” on its operations. Id. at 260, 265. According to Moab Partners, nondisclosure of a known trend with material implications in violation of Item 303 constituted a materially misleading omission in violation of Rule 10b-5. See id. at 265.

The Court disagreed, finding no actionable statements or omissions because Moab Partners failed to “plead any statements rendered misleading” by Macquarie’s alleged pure omission. Id. at 265 (emphasis added). Because Rule 10b-5 requires only “disclosure of information necessary to ensure that statements already made are clear and complete,” it covers “half-truths,” but not “pure omissions.” Id. at 264 (emphasis added). A failure to disclose information required by Item 303 can sustain a Rule 10b-5 claim only when the omission renders other affirmative statements misleading. Id. at 265.

This holding affirms the longstanding precedent from Basic Inc. v. Levinson that “[s]ilence, absent a duty to disclose, is not misleading under Rule 10b-5.” Id. (quoting Basic, 485 U.S. 224, 239 n.17 (1988)). It also clarifies that “[e]ven a duty to disclose . . . does not automatically render silence misleading.” Id.

2. SEC v. Jarkesy – Successful Constitutional Challenge To SEC’s Method Of Adjudication

On June 28, 2024, the Supreme Court announced its 6-3 decision in SEC v. Jarkesy, holding that the Seventh Amendment right to a jury trial applies in cases where the SEC seeks civil penalties for securities fraud. 144 S. Ct. 2117 (2024).

In the Dodd-Frank Act of 2010, Congress empowered the SEC to seek civil penalties against violators of its antifraud regulations either in federal court or through “in-house” administrative proceedings. Id. at 2126. In these in-house proceedings, unlike in federal court, there is no opportunity to have the case heard by a jury, and cases are tried before an SEC-appointed administrative law judge (ALJ), rather than by a Senate-confirmed Article III judge. Id. at 2125-26.

Respondents George Jarkesy Jr. and Patriot28 LLC were subject to an SEC enforcement action that sought civil penalties for alleged violations of the federal securities laws’ antifraud provisions. Id. at 2124. The SEC proceeded against Jarkesy and Patriot28 before an SEC ALJ, rather than in court. Id. at 2125. The ALJ ruled for the agency and against the respondents, and after review of the ALJ’s decision, the SEC imposed a penalty of $300,000, ordered disgorgement against Patriot28, and prohibited Jarkesy from participating in the securities industry. See id. at 2127.

The respondents sought review by the U.S. Court of Appeals for the Fifth Circuit, raising constitutional procedural and structural objections. See id. A divided panel of the Fifth Circuit ruled for the respondents, citing three constitutional infirmities. First, because enforcement of the antifraud securities laws is “akin to . . . traditional” causes of action involving debts, where a defendant historically would have been entitled to a jury trial, a defendant facing antifraud securities claims is entitled to a jury trial. Jarkesy v. SEC, 34 F.4th 446, 453-54 (5th Cir. 2022). Second, Congress’s grant of “unfettered” discretion to the SEC to bring enforcement actions in court or administratively was an unconstitutional delegation of power. Id. at 459. Third, the agency structure surrounding ALJs restricted the President’s Article II authority, as it gave ALJs two layers of for-cause protection from removal that blocked the President from exercising “adequate power over . . . removal.” Id. at 463.

The Supreme Court granted certiorari to review all three of the Fifth Circuit’s holdings. See Brief for Petitioner at i. However, the Court declined to reach the nondelegation and ALJ-removal questions, affirming the decision below only on the Seventh Amendment issue. Jarkesy, 144 S. Ct. at 2127-28.

In holding that the respondents were entitled under the Seventh Amendment to a jury trial on these claims, the Court explained that the securities antifraud provisions were intended to “replicate common law fraud” claims that require a jury trial. See id. at 2127. The Seventh Amendment jury right extends to all suits that are “legal in nature”—including those that seek monetary damages in order to punish or deter violations, as distinct from equitable relief like disgorgement. See id. at 2128-30. The antifraud provisions’ resemblance to common-law fraud claims, and the legal nature of the damages remedy, confirmed that the Framers would have intended the jury right to apply to actions enforcing these provisions. See id. at 2128-31.

The Court rejected the SEC’s argument that the case fell under the “public rights” exception for cases that “historically could have been determined exclusively by the executive and legislative branches.” See id. at 2132 (cleaned up). While its public rights doctrine has not always charted a clear course, the Court explained that the doctrine emphasizes that traditional suits at common law should be adjudicated in courts and has maintained a “presumption . . . in favor of Article III courts.” Id. at 2134. Thus, even modern regulatory suits modeled after traditional legal claims should remain with Article III courts, no matter where Congress might have assigned them. See id. at 2131, 2135-36.

As the Court explained in conclusion, “a defendant facing a fraud suit has the right to be tried by a jury of his peers before a neutral adjudicator.” Id. at 2139. Because the SEC’s enforcement action against the respondents involved similar fraud-related claims, the proceeding before an SEC ALJ had violated the respondents’ Seventh Amendment rights.

B. Grants Of Certiorari

1. Facebook, Inc. v. Amalgamated Bank – Whether Risk Disclosures Must Acknowledge Past Incidents

On June 10, 2024, the Supreme Court granted the petition for a writ of certiorari in Facebook, Inc. v. Amalgamated Bank, a private securities-fraud class action challenging the adequacy of Facebook’s disclosures about third-party use of personal data.

The plaintiff shareholders allege that Facebook made fraudulent misstatements in filings where it purportedly characterized the risk that third parties might misuse Facebook user data as a “hypothetical” risk. Petition for Writ of Certiorari at 10, Facebook, Inc. v. Amalgamated Bank, No. 23-980 (Mar. 4, 2024). The plaintiffs contend the risk had already materialized through third parties’ actual misuse of Facebook user data. Id.

In the decision below, the Ninth Circuit ruled that a risk disclosure is materially misleading when it fails to disclose that the identified risk has materialized in the past, even if that past event presents no known risk of harm to the company. In re Facebook, Inc. Sec. Litig., 87 F.4th 934, 949-50 (9th Cir. 2023). The Circuit explained that “[b]ecause Facebook presented the prospect of a breach as purely hypothetical when it had already occurred, such a statement could be misleading even if the magnitude of the ensuing harm was still unknown.” Id. at 950.

According to the petition, this holding placed the Ninth Circuit at odds with its sister circuits. As Facebook argued, the First, Second, Third, Fifth, Tenth, and D.C. Circuits have all held that companies must disclose risks that materialize only when the company knows, or believes with near certainty, that the materialized risk will harm the business. Petition at 19-22. The Sixth Circuit, on the other hand, has held that companies are not required to disclose when risks materialized in the past because “[r]isk disclosures like the ones accompanying 10-Qs and other SEC filings are inherently prospective in nature.” Id. at 18 (quoting Bondali v. Yum! Brands, Inc., 620 F. App’x 483, 491 (6th Cir. 2015)).

Gibson Dunn represents the petitioners in this case, which has been scheduled for oral argument on November 6, 2024.

2. NVIDIA Corp. v. E. Ohman J:or Fonder AB – PSLRA Pleading Standards For Scienter and Falsity

On June 17, 2024, the Supreme Court granted the petition for a writ of certiorari in NVIDIA Corp. v. E. Ohman J:or Fonder AB, another private securities-fraud class action originating in the Ninth Circuit involving alleged violations of Section 10(b) and Rule 10b-5. This case raises two questions regarding the pleading standard for private class actions under the Private Securities Litigation Reform Act of 1995 (PSLRA).

This case was brought by investment management fund E. Öhman J:or Fonder AB and other investors against NVIDIA, a producer of graphics processing units (GPUs). As alleged in the plaintiffs’ complaint, NVIDIA’s GPUs include the “GeForce” branded GPU, which is designed and marketed for use in video gaming, but which began around 2017 to also be used for mining cryptocurrency. E. Ohman J:or Fonder AB v. NVIDIA Corp., 81 F.4th 918, 924-27 (9th Cir. 2023); Petition for Writ of Certiorari at 8, NVIDIA Corp. v. E. Ohman J:or Fonder AB, No. 23-970 (Mar. 4, 2024). Plaintiffs alleged that NVIDIA’s CEO and other defendants made statements that misrepresented the connection between the company’s increased revenues and the fact that cryptocurrency miners—not just video game players—were purchasing GeForce GPUs. E. Ohman J:or Fonder AB, 81 F.4th at 925. Because the demand for GPUs tied to cryptocurrency mining has been “extremely volatile,” subject to changes in the price of cryptocurrency, the company’s denials of a link between its growth and cryptocurrency-related usage were allegedly material to investors and analysts. See id. at 924-27.

To support their claims that NVIDIA had knowingly or recklessly misled investors about the source of demand for GeForce GPUs, plaintiffs’ amended complaint relied heavily on witness statements from former NVIDIA employees and the independent analysis of an expert consulting firm. Id. at 929-30, 937-39. The district court dismissed the amended complaint, finding the plaintiffs had not adequately pleaded the element of scienter under the PSLRA, specifically that plaintiffs’ allegations that NVIDIA as a company had access to certain sales and usage data did not plausibly show that each individual defendant had access to that data, and thus spoke with knowledge or recklessness of falsity. Iron Workers Local 580 Joint Funds v. NVIDIA Corp., 522 F. Supp. 3d 660, 674-75 (N.D. Cal. 2021). The Ninth Circuit reversed, reinstating the amended complaint as to NVIDIA’s CEO based on specific statements from former employees about the company and the CEO’s practices. E. Ohman J:or Fonder AB, 81 F.4th at 937-40. The Ninth Circuit also held that the amended complaint adequately alleged falsity, where it relied primarily on a post hoc expert analysis of NVIDIA’s reported revenues compared to the statements by company insiders at the time. Id. at 930-32.

In NVIDIA, the Supreme Court will consider two questions regarding pleading standards under the PSLRA. First, petitioners, NVIDIA and its CEO, argue one existing circuit split exists on the standard for pleading scienter: namely, whether plaintiffs who seek to rely on “internal company documents must plead with particularity the contents of these documents.” Petition at i. Second, petitioners also claim to identify a new circuit split, created by the decision below, on the element of falsity: whether the PSLRA’s falsity requirement may be satisfied at the pleading stage by expert opinions, in lieu of particularized allegations of fact. Id.

Oral argument in NVIDIA is scheduled to be held on November 13, 2024.

A. The Delaware Supreme Court Underscores The Importance Of Fully Informed Stockholders Under MFW

Two recent Delaware Supreme Court cases emphasize (1) the importance of disclosing conflicts of interest when seeking to fully inform stockholders, and (2) that Delaware courts pay close attention to claims that a minority was fully informed when an entity seeks to obtain business judgment review by employing the procedural devices set forth in Kahn v. M&F Worldwide Corp., 88 A.3d 635 (Del. 2014) (MFW).

In City of Dearborn Police & Fire Revised Retirement System v. Brookfield Asset Management Inc., plaintiffs brought breach of fiduciary duty claims related to a squeeze-out merger. 314 A.3d 1108, 1113 (Del. 2024) (en banc). The trial court dismissed plaintiff’s complaint after concluding defendants complied with MFW’s requirements and applying the business judgment rule. Relevant here, plaintiffs claimed on appeal that the “trial court erred in finding that MFW was satisfied because they failed to adequately plead that the proxy statement was materially deficient.” Id.

Affirming in part and reversing in part, the en banc Supreme Court agreed that the proxy statement omitted important information. Among other things, it held that the “minority stockholders were not adequately informed of certain alleged conflicts of interest between the special committee’s advisors and the counterparty to the Merger.” Id. For example, the proxy failed to disclose that Morgan Stanley—which the controlled target entity’s (TerraForm) special committee retained—had a $470 million stake in Brookfield (TerraForm’s controller). In the Supreme Court’s view, “the $470 million investment, when viewed from the perspective of a reasonable stockholder, was material and should have been disclosed.” Id. at 1133. Similarly, the proxy failed to disclose that Kirkland & Ellis LLP—the law firm TerraForm’s special committee retained—had previously represented “Brookfield and its affiliates” and was “concurrent[ly] represent[ing] . . . a Brookfield affiliate on an unrelated transaction.” Id. at 1134. And, again, the Supreme Court held that “it [wa]s reasonably conceivable that the details of Kirkland’s conflicts, and particularly, the concurrent conflict, were material facts for stockholders that required disclosure.” Id.

City of Sarasota Firefighters’ Pension Fund v. Inovalon Holdings, Inc. is similar in several respects. 2024 WL 1896096 (Del. May 1, 2024) (en banc). There, plaintiffs “asserted several breach of fiduciary duty claims, an unjust enrichment claim, and a claim alleging a breach of the Company’s charter” in connection with “an acquisition of Inovalon Holdings, Inc. . . . by a private equity consortium led by Nordic Capital.” Id. at *1. As in Brookfield, the Court of Chancery dismissed the complaint after finding “the requirements of MFW were met.” Id. at *8. And, as in Brookfield, the Delaware Supreme Court disagreed. Among other things, the Supreme Court explained that the proxy failed to adequately disclose the special committee’s advisors’ conflicts of interest. Id. at *15. Inovalon further underscores the importance of disclosing a special committee’s advisors’ conflicts of interest if an entity wishes to benefit from MFW and the business judgment rule.

B. The Delaware Supreme Court Addresses Advance Notice Bylaws

In Kellner v. AIM ImmunoTech, Inc., the Delaware Supreme Court provided helpful insight into how Delaware courts will review advance notice bylaws. __ A.3d __ , 2024 WL 3370273 (Del. 2024). As explained in our 2023 Year-End Update, the Court of Chancery invalidated several advance notice bylaws that AIM’s Board adopted in connection with a group of stockholders’ activism campaign and proxy contest efforts, reinstated a prior version of one of the bylaws, and then “upheld the board’s rejection of [a stockholder’s] third nomination notice because it failed to comply with the two advance notice bylaws left standing.” Id. at *1.

On appeal, the Delaware Supreme Court affirmed in part and reversed in part. It began by noting the two-part inquiry for assessing challenges to “the adoption, amendment, or enforcement of a Delaware corporation’s advance notice bylaws”: (1) “whether the advance notice bylaws are valid as consistent with the certificate of incorporation, not prohibited by law, and address a proper subject matter,” and (2) “whether the board’s adoption, amendment, or application of the advance notice bylaws were equitable under the circumstances of the case.” Id. The Supreme Court then analyzed the trial record and concluded the advance notice bylaws at issue on appeal were invalid or unenforceable. Id. at *2.

On validity, the Court explained, among other things, that the “DGCL places minimal procedural and substantive requirements on stockholders and directors when addressing bylaws,” that bylaws are “presumed to be valid,” and that a plaintiff challenging a bylaw “must demonstrate that the bylaw cannot operate lawfully under any set of circumstances.” Id. at *9-11. Measured against that lenient standard, the Supreme Court concluded that one bylaw, composed of a 1,099-word single-sentence, was unintelligible and thus invalid, as “[a]n unintelligible bylaw is invalid under ‘any circumstances.’” Id. at *15 (citation omitted). By contrast, the Supreme Court had “no trouble” concluding the remaining bylaws were valid “because they [we]re consistent with the certificate of incorporation, not prohibited by law, and address[ing] a proper subject matter.” Id. at *2, *15.

On enforceability, the Supreme Court reiterated that a finding of facial validity does not preclude a finding of inequity. The Supreme Court then concluded that the board’s actions were inequitable because “it adopted the amended bylaws for the primary purpose of interfering with, and ultimately rejecting, [the at-issue] nominations.” Id. at *2. For example, the Supreme Court reviewed the “agreement, arrangement, or understanding” (AAU) provision and agreed with the Court of Chancery that the “SAP [stockholder associated person] term” included in the AAU provision was unreasonable. That provision “require[d] a nominator to disclose not only personal knowledge but also to take steps to gather information about agreements and understandings between any members of potentially limitless class of third parties and individuals unknown to the nominator.” Id. at *16-17. In other words, “the nominating stockholder must not only respond based on personal knowledge, but also an ill-defined daisy chain of persons.” Id. at *18. The AAU provision thus “functioned as a ‘tripwire’ rather than an information-gathering tool and ‘suggest[ed] an intention to block the ’dissident’s effort.’” Id. at *17 (quoting Kellner v. AIM ImmunoTech Inc., 307 A.3d 998, 1031 (Del. Ch. 2023)). Indeed, the SAP term affected all the valid bylaws, rendering each problematic. Id. at *17-18. Nonetheless, in light of the Court of Chancery’s “findings about [a stockholder’s] and his nominees’ deceptive conduct,” the Supreme Court concluded that “no further action [wa]s warranted.” Id. at *18.

C. Court Of Chancery Issues Novel Ruling Regarding The Exercise Of Stockholder-Level Voting Power By A Controller

On January 4, 2024, the Delaware Court of Chancery issued a novel post-trial decision addressing what it described as “fascinating” dynamics related to a controlling stockholder and a special committee. In re Sears Hometown & Outlet Stores, Inc. S’holder Litig., 309 A.3d 474, 483 (Del. Ch. 2024).

Sears Hometown and Outlet Stores, Inc., a controlled public company, had two business segments, one of which was “good” and one of which was “bad.” Id. at 483. When the controller and a special committee disagreed over how to deal with that divergence, the controller “used his voting power as a stockholder to adopt a bylaw amendment” that complicated—but did not preclude—the special committee’s ability to implement its preferred plan (liquidation of the “bad” business). Id. As the Court explained, the bylaw “ensured that the controller [would] ha[ve] a window to act . . . if the board pursued it[s plan].” Id. In addition, the controller removed “two of the three members of the [s]pecial [c]ommittee” who had “been the most vocal” about the liquidation and replaced them with two individuals he “could be confident . . . . would support his interests.” Id. at 519. As the controller acknowledged at trial, “he had no intention of letting the liquidation plan become reality.” Id. at 483.

With the special committee’s preferred plan effectively off the table, the controller negotiated a transaction with the special committee that ended up eliminating the minority stockholders’ interest in the company. Id. at 502-03. The transaction was not conditioned on a majority of the minority vote, and the board was not permitted to “terminate the agreement to accept a superior proposal.” Id. at 503.

In assessing the events that transpired, the Court noted that, until its decision, “Delaware law [had] not clearly state[d] what standard of review (if any) applies to a controller’s exercise of stockholder voting power.” Id. at 483. To the contrary, “[s]ome authorities suggest[ed] a controller owes no fiduciary duties when voting,” while “[o]ther authorities appl[ied] a fiduciary framework without spelling out the details.” Id.

Ultimately, the Court decided: (1) “[a] controller does not owe any enforceable duties when declining to vote or when voting against a change to the status quo”; (2) “when exercising stockholder-level voting power” to change the status quo, “a controller owes a duty of good faith that demands the controller not harm the corporation or its minority stockholders intentionally”; (3) a “controller . . . owes a duty of care that demands the controller not harm the corporation or its minority stockholders through grossly negligent action”; and (4) “enhanced scrutiny should apply” when a “controller t[akes] action that invade[s] the space typically reserved for the board of directors.” Id. at 483-84, 510, 512.

The Court also contrasted a controller’s duties with those of a director. It noted that whereas “[d]irectors . . . must act affirmatively to promote the best interests of the corporation, and they must subjectively believe that the actions they take serve that end,” “[a] controller need not meet that higher standard when exercising stockholder-level voting rights.” Id.

Applying these principles to the facts of the case, the Court concluded first that the controller “did not breach his fiduciary duties when he engaged in” the interventions discussed above, as he “acted in good faith to protect the Company from a threat of value-destruction,” “identified that threat in good faith, after a reasonable investigation,” and “then responded with a means that fell within the range of reasonableness.” Id. at 519. As the Court explained, “[i]f nothing else had happened, and if the Company had merely continued operating as it had before the [c]ontroller [i]nterven[ed], then judgment would [have] be[en] entered for the defendants.” Id.

But something else did happen. The controller ended up “acquiring the [c]ompany and eliminating the minority stockholders from the enterprise” in the process. Id. Given this, the Court evaluated the transaction under the entire fairness standard. Id. at 519-20. Under that standard, the Court concluded that both the price and process were unfair and held the controller his co-defendants jointly and severally liable for “the difference between the transaction price and the ‘true’ value of the firm.” Id. at 539-41.

D. Court Of Chancery Concludes Plaintiff Failed To Allege Owner Of 26.7% Of Common Stock Was A Controller

In Sciannella v. AstraZeneca UK Limited, the Court of Chancery dismissed a putative class action brought by a former stockholder of Viela Bio, Inc. alleging fiduciary duty breaches by the directors, officers, and former parent company of Viela in connection with their roles “in selling [Viela] to affiliates of Horizon Therapeutics plc.” 2024 WL 3327765, at *1 (Del. Ch. July 8, 2024). One central issue was whether AstraZeneca, “which owned 26.7% of Viela’s outstanding common stock,” “was a controlling stockholder at the time of the [at-issue] transaction.” Id.

In its opinion, the Court found that the “complaint fail[ed] to plead facts to support a reasonable inference” that AstraZeneca was a controlling stockholder. Id. To that end, the Court rejected plaintiff’s claim that the combination of various factors demonstrated that AstraZeneca exercised both general and transaction-specific control.

For example, plaintiff claimed that “AstraZeneca’s equity stake” and “blocking rights” indicated AstraZeneca was a controller. Id. at *17-18. The Court disagreed, finding that a 25% stake and certain blocking rights did not “contribute to an inference of control” because “AstraZeneca only had the right to veto bylaw amendments initiated by stockholders, and then only if the Board did not recommend them.” Id.

Plaintiff also pointed to AstraZeneca having appointed two of Viela’s eight directors and the fact that other defendants had relationships with AstraZeneca, such as by investing in Viela and being previously employed by AstraZeneca. Id. at *19. Again, the Court found these allegations inadequate, either because they were conclusory or insufficient to support a reasonable inference that AstraZeneca dominated the decision-making process. Id. at *19-20.

Plaintiff also highlighted “Support Agreements,” through which AstraZeneca provided support to Viela’s day-to-day operations, including through supply, licensing, and transition services agreements. Id. at *21. Although the Court agreed that these agreements meant “Viela substantially depended on AstraZeneca” in various respects, it nonetheless concluded that plaintiff has not alleged “facts from which it is reasonable to infer that [AstraZeneca] could prevent the [Viela Board] from freely exercising its independent judgment in considering the proposed [M]erger.” Id. at *22 (citation omitted) (alterations in original).

E. Court Of Chancery Issues Opinion In A Suit Alleging Fiduciary Duty Breaches In Connection With Conversion

Palkon v. Maffei addressed the decisions of two Delaware corporations—both of which were controlled by Gregory B. Maffei—”to convert . . . into . . . Nevada corporation[s].” 311 A.3d 255, 261 (Del. Ch. 2024), cert. denied, 2024 WL 1211688 (Del. Ch. Mar. 21, 2024). The two entities were TripAdvisor and Liberty TripAdvisor Holdings, Inc. Liberty owned all of TripAdvisor’s Class B common stock and 21% of its Class A Shares. Id. at 264. As a result, it “exercise[d] 56% of the [TripAdvisor’s] outstanding voting power.” Id. Maffei, Liberty’s CEO and Chairman, “beneficially own[ed] Series B shares carrying 43% of [its] voting power.” Id. For purposes of the motion to dismiss, “defendants concede[d] that Maffei control[ed] both [Liberty] and TripAdvisor.” Id.

Plaintiffs sued, alleging fiduciary duty breaches in connection with the conversion. Id. at 268. They also sought an injunction. Id. at 266. The Court of Chancery denied defendants motion to dismiss after determining entire fairness was the appropriate standard of review while also denying plaintiff’s request for an injunction. Id. at 262.

Accepting the allegations in complaint, the Court explained Maffei effectuated a transaction through which he and the directors received a non-ratable benefit—namely, a “reduction in the unaffiliated stockholders’ litigation rights.” Id. at 261. The absence of a “price” was irrelevant in the Court’s view because entire fairness considers substantive fairness and procedural fairness, and the “floor for substantive fairness is whether stockholders receive at least the substantial equivalent in value of what they had before”—meaning no price is necessary. Id. at 262.

The Court then concluded the plaintiff had pled facts making it reasonably conceivable that the transaction was both substantively and procedurally unfair. On the former, the Court explained that “the stockholders held shares carrying the bundle of rights afforded by Delaware law, including a set of litigation rights” before the conversion, and, “[a]fter the conversion, the stockholders owned shares carrying a different bundle of rights afforded by Nevada law, including a[n allegedly] lesser set of litigation rights.” Id. On the latter, the Court explained that “the goal of procedural fairness is to replicate arm’s length bargaining,” but that defendants made no “effort to replicate arm’s length bargaining.” Id. at 281. Instead, “[m]anagement proposed the conversions, the Board recommended them, and [Liberty] and Maffei approved them.” Id.

The Court nonetheless denied plaintiffs’ requests for an injunction. It found, under the circumstances of the case, that other remedies, such as money damages, could adequately compensate plaintiffs for any losses. Id. at 286-87.

F. Executive Compensation And Post-Trial Ratification – Tornetta v. Musk And Subsequent Developments

The Court of Chancery in Tornetta v. Musk ordered the rescission of Elon Musk’s compensation plan after concluding Musk controlled Tesla with respect to the compensation plan and that defendants failed to prove that Musk’s 2018 compensation plan was entirely fair. 310 A.3d 430 (Del. Ch. 2024). For further details, please see Gibson Dunn’s February 5, 2024 Client Alert.

Several months after the Court’s decision, at its annual stockholders’ meeting, Tesla stockholders approved the ratification of Musk’s pay package. See Press Release, Tesla Releases Results of 2024 Annual Meeting of Stockholders, Tesla (June 13, 2024), https://ir.tesla.com/press-release/tesla-releases-results-2024-annual-meeting-stockholders. The Court has ordered expedited briefing “on the effect of the Tesla stockholders’ June 13, 2024, vote on this action.” Tornetta v. Musk, 2024 WL 3200483, at *1 (Del. Ch. June 27, 2024). With many questions yet to be answered, Gibson Dunn will continue monitoring the case and report on any future developments.

G. Stockholder Agreements And DGCL Section 141 – Moelis And Its Aftermath

As discussed in our February 28, 2024 Client Alert, the Court of Chancery, in West Palm Beach Firefighters’ Pension Fund v. Moelis & Company, ruled on the validity of pre-approval requirements and board- and committee-related designation rights included in a stockholder agreement between a public company and its founder that was entered into before the company went public. 311 A.3d 809 (Del. Ch. 2024). In short, the Court held that the pre-approval requirements and board- and committee-related designation provisions violated one or more subsections of Section 141 of the DGCL because they had “the effect of removing from directors in a very substantial way their duty to use their own best judgment on management matters” or “tend[ed] to limit in a substantial way the freedom of director decisions on matters of management policy.” Id. at 818 (quoting Abercrombie v. Davies, 123 A.2d 893, 899 (Del. Ch. 1956), rev’d on other grounds, 130 A.2d 338 (Del. 1957)).

At the close of its opinion, the Court noted that the Delaware “General Assembly could enact a provision stating what stockholder agreements can do.” Id. at 881. The General Assembly seemingly took heed. In July 2024, the General Assembly passed S.B. 313, which contained what is now Section 122(18) of the DGCL. As set forth in the bill’s synopsis, Section 122(18) “specifically authorizes a corporation to enter into contracts with one or more of its stockholders or beneficial owners of its stock, for such minimum consideration as approved by its board of directors, and provides a non-exclusive list of contract provisions by which a corporation may agree to.”

In the first half of 2024, the number of SPAC IPOs and the value of de-SPAC transactions have decreased significantly since their peak in 2021 (as noted in our Securities Litigation 2023 Mid-Year Update), with only 20 SPAC IPOs as of end of July (see SPAC Statistics by SPAC Insiders). De-SPAC transactions, however, have given rise to significantly more securities class actions than other IPOs (see Securities Class Action Trends 2023: Not a Repeat of Year 2022). In this mid-year update, we first discuss the SEC’s latest rule applicable to SPACs, which has likely changed the litigation landscape moving forward. Next, we look back to the first half of 2024, which many courts have taken a fact-specific approach to SPAC litigation and have not announced any broadly applicable legal doctrines specific to SPAC litigation.

A. SEC’s Special Purpose Acquisition Companies, Shell Companies, and Projections Final Rule

On January 24, 2024, the U.S. Securities and Exchange Commission (the “Commission”), by a three-to-two vote, adopted new rules, most notably a new subpart 1600 to Regulation S-K, and amendments to certain existing rules under Securities Act, Securities Exchange Act, Regulation S-K, Regulation S-T, and Regulation S-X to enhance disclosure and investor protections in SPAC IPOs and subsequent de-SPAC transactions. Special Purpose Acquisition Companies, Shell Companies, and Projections, 17 C.F.R. §§ 210, 229, 230, 232, 240, 249 (2024) (SPAC Rule). The Gibson Dunn team provided its analysis on the Final Rules earlier this year. See Feb. 2, 2024 Client Alert.

1. Key Provisions

The Final Rules overhaul the protections previously available in SPAC IPOs. The four key components of the Final Rules are as follows:

- Disclosure and Investor Protection. The Final Rules impose specific disclosure requirements with respect to, among other things, compensation paid to sponsors, potential conflicts of interest, shareholder dilution, and the fairness of the business combination, for both SPAC IPOs and de‑SPAC transactions.

- Business Combinations Involving Shell Companies. Under the Final Rules, the Commission now deems a business combination transaction involving a reporting shell company and a private operating company as a “sale” of securities under the Securities Act of 1933, as amended (the “Securities Act”). The Final Rules also amend the financial statement requirements applicable to transactions involving shell companies, and amend the previous “blank check company” definition to make clear that SPACs cannot rely on the safe harbor provision against a private right of action for forward-looking statements under the Private Securities Litigation Reform Act of 1995, as amended (the PSLRA), when marketing a de-SPAC transaction.

- The Final Rules amend the Commission’s guidance on the presentation of projections in any filings with the Commission (not only on de-SPAC transactions, but affecting all projections disclosed in reports filed with the Commission) and adds new guidance only for de-SPAC transactions, in both instances to address the reliability of such projections.

- Status of SPACs under the Investment Company Act of 1940. The Commission did not adopt its proposed safe harbor rule under the Investment Company Act, which would have exempted a SPAC from being treated as an “investment company” as long as the SPAC met certain subjective criteria, related to, among other things, the nature and management of the assets held by the SPAC, and the SPAC’s general purpose. Instead, the Commission takes the position that whether a SPAC falls under the definition of investment company depends on specific facts and circumstances, and provides general guidance on what actions might cause a SPAC to be an “investment company.”

2. SPAC Rule In Securities Litigation

Since the Final Rules were announced in January 2024, even before they went into effect in July, some litigants have sought to use the Rules to advance their positions in ongoing cases. For instance, multiple SPAC defendants facing challenges to their financial disclosures have argued that the Final Rules excuse SPAC companies from having to disclose their “net-cash per share” calculation. See, e.g., Opening Br. in Supp. of Def.’s Mot. to Dismiss, In re AST SPACEMOBILE, INC., S’holder Litig., No. 2023-1292, at *48-49 (Del. Ch. Mar. 15, 2024) (highlighting that the SEC “has reevaluated its SPAC-related disclosure requirements and explicitly rejected net cash per share as a required calculation,” because “‘[n]et cash per share has aspects that make it less useful for investors’ than other measures of dilution”); Def.’s Br. in Supp. of their Am. Mot. to Dismiss the Verified Am. Class Action Compl., Schacter v. N. Genesis Sponsor, LLC, No. 2023-1112, at *14 n.8 (Del. Ch. Apr. 25, 2024) (noting the Final Rules are not adding an “explicit net cash per share disclosure requirement,” but only requiring that shareholders “should have the information to perform this calculation based on the disclosure provided in connection with net tangible book value per share, as adjusted”).

Other parties have relied on the Final Rules to clarify that the PSLRA’s safe harbor, 15 U.S.C § 78u–5, which protects forward-looking statements “accompanied by meaningful cautionary language,” no longer applies to SPACs. See, e.g., Appellant’s Reply Br., In re Danimer Scientific, Inc., No. 23-7674, at *20 (2d Cir. Apr. 10, 2024) (arguing the safe harbor is not available to defendants because the Final Rules “[m]ake the PSLRA safe harbor unavailable to SPACs . . . by defining ‘blank check company’ to encompass SPACs (and other companies that would be blank check companies but for the fact that they do not sell penny stock)”). The rule does not have retroactive effect, see 89 Fed. Reg. at 14158, and some Courts have analyzed whether cautionary statements found in SPAC’s proxy statements were protected forward-looking statements—albeit prior to the Final Rule taking effect. For instance, in In re Grab Holdings Ltd. Securities Litigation, the Court analyzed whether the PSLRA safe harbor applied to the seven pre-merger statements contained in a SPAC’s proxy statement. 2024 WL 1076277, at *1 (S.D.N.Y. Mar. 12, 2024). The Court found that, although some of the statements were forward-looking and cautionary, the safe harbor did not extend to statements about future risk when plaintiff failed to disclose that the risk had transpired. See id. at *18. Notably, it is too early to determine the consequences the Final Rules will have on SPAC litigation: the Final Rules do not have retroactive effect and went into effect recently, on July 1, 2024. 89 Fed. Reg. at 14158. We will continue to analyze the Final Rules’ effect in future securities litigation updates.

B. 2024 SPAC-related Securities Litigation

Although the filing of SPAC-related litigation has slowed, courts have issued at least eight SPAC-related opinions in the first half of 2024. Of those cases, three have been dismissed entirely for failing to allege a securities claim. Five of those cases have survived a motion to dismiss. In the below sections, we highlight some of these district court cases.

1. SPAC Claims Dismissed

In cases dismissing SPAC-related securities fraud, courts have thus far rejected plaintiffs’ attempts to develop any hard and fast SPAC laws. For instance, in In re Lottery.com, Inc. Securities Litigation, a district court in the Southern District of New York noted plaintiffs’ arguments that “SPACs are uniquely fraud-enabling” but ultimately rejected finding scienter on that basis alone, saying that it was “unprepared to hold here that SPACs are an exception to the general principle that the prospect of a public offering, standing alone, is insufficient to establish motive.” 2024 WL 454298, at *32 (S.D.N.Y. Feb. 6, 2024). Likewise, in Shafer v. Lightning Emotors, Inc., the Court found plaintiffs failed to allege the pre-de-SPAC transaction statements were false when made, and otherwise found nothing inherently fraudulent about the de-SPAC transaction. 2024 WL 691458, at *6-20 (D. Colo. Feb. 20, 2024), report and recommendation adopted, 2024 WL 1509166, at *1 (D. Colo. Mar. 26, 2024). In Mehedi v. View, Inc., the Northern District of California dismissed plaintiffs’ Sections 10(b) and 14(a) claims because plaintiffs could not allege that their harms were caused by the alleged misleading proxy statement connected with a de-SPAC transaction. 2024 WL 3236706, at *7–20 (N.D. Cal. June 28, 2024). In one derivative action, a California district court found that when a plaintiff owned stock in a SPAC prior to its acquisition of a company in a de-SPAC transaction, plaintiff had standing to bring a derivative claim on behalf of the acquired entity. In re Faraday Future Intelligent Elec. Inc. Derivative Litig., 2024 WL 404495, at *1 (C.D. Cal. Jan. 22, 2024). The Court dismissed the derivative claim, however, because plaintiffs failed to bring a pre-litigation demand to the company. Id. at *14. Below we include more thorough case descriptions.

In re Lottery.com, Inc. Sec. Litig., 2024 WL 454298 (S.D.N.Y. Feb. 6, 2024): Investors filed an action against a SPAC (Trident), the online lottery company that merged with Trident (Lottery), and certain of the SPAC’s and company’s current and former officers. Id. at *1-2. Investors alleged that Lottery and its officers made false statements, both before and after the merger, regarding its internal financial controls and its financial performance. Id. at *6-10. Plaintiffs brought claims pursuant to Section 10(b), Section 20(a), and Section 14(a). Id at *1. Defendants moved to dismiss the Section 10(b) claim, arguing that plaintiffs had failed to establish falsity and scienter. Id. at *13. As to falsity, the Court dismissed claims based on the pre-merger compliance statements, finding they were “akin to other statements about regulatory compliance and integrity that courts have deemed non-actionable puffery,” id. at *16, and dismissed claims based on the pre-merger financial statements as they were “forward looking statements . . . accompanied by sufficient cautionary language,” id. at *17. As to the post-merger financial statements, the Court held for plaintiffs finding that “each of the post-merger financial-performance-related statements was false [or misleading] at the time it was made,” based on Lottery’s own admission in a later-filed Form 8-K that the post-merger financial statements at issue “overstated [the] available unrestricted cash balance,” “improperly recognized revenue in the same amount,” and thus “should no longer be relied upon.” Id. at *22 (cleaned up). Importantly, the Court refused to hold, as defendants wished, that “a statement believed to be true when made, but later shown to be false, is insufficient to establish that a statement of fact is false for purposes of Section 10(b) and Rule 10b-5.” Id. at *21 (internal quotations omitted). In other words, “[w]hether Defendants knew of their falsity when making the statements is the scienter question, not the falsity question.” Id. at *22 (internal quotations omitted). However, the Court found that plaintiffs had failed to adequately plead scienter as to all the statements, finding that “‘[t]he existence, without more, of executive compensation dependent upon stock value does not give rise to a strong inference of scienter.’” Id. at *31 (quoting Acito v. IMCERA Grp., Inc., 47 F.3d 47, 54 (2d Cir. 1995)). “The Court does not ignore Plaintiffs’ allegations that SPACs are uniquely fraud-enabling . . . [but] is unprepared to hold that SPACs are an exception to the general principle that the prospect of a public offering, standing alone, is insufficient to establish motive.” Id. at *32. The Court also did not find plaintiffs had sufficiently pled conscious misbehavior or recklessness on the part of defendants. Id. at *35. The Court dismissed the complaint but granted leave to amend. Id. at *37.

Shafer v. Lightning eMotors, Inc., 2024 WL 691458 (D. Colo. Feb. 20, 2024), report and recommendation adopted, 2024 WL 1509166 (D. Colo. Mar. 26, 2024): Plaintiffs brought a securities fraud class action on behalf of investors in Lightning eMotors against Lightning, “certain of its officers and directors, and the officers, directors, and certain affiliates of the company’s predecessor entity, GigCapital3, Inc.” Id. at *1. Investors alleged that defendants “attempted to set their SPAC apart by selling investors on what they referred to as their ‘unique’ approach to private equity in the SPAC’s registration statement and prospectus filed with the SEC.” Id. at *2. The complaint alleged “plaintiffs state[d] that this strategy worked as GigCapital3 successfully raised $200 million through its IPO” before merging with Lighting Systems through a de-SPAC transaction. Id. “Defendants allegedly sold the deal with Lightning Systems to investors as an ideal match: not only was Lightning Systems’ management a good candidate for the ‘Mentor-Investor’ approach supposedly employed by the GigCapital team, but the company itself was on the cusp of massive growth.” Id. Defendants allegedly continued to make misleading statements until “GigCapital3 issued and disseminated the definitive proxy requesting that eligible shareholders vote to approve the business combination with Lightning Systems.” Id. Plaintiffs alleged that, in truth, “Lightning Systems was not well-positioned to rapidly scale its operations” and that defendants “knew or were reckless in not knowing” its projected financials were unachievable. Id. at *3. So too were representations that “the GigCapital3 team would remain engaged in the post-combination company.” Id. at *2. The Court granted the motion to dismiss finding that plaintiffs failed to adequately allege that the statements at issue were false or materially misleading when made. Id. at *6-18. Further, the Court dismissed plaintiffs’ claim that defendants’ misstatements were part of a fraudulent scheme to unfairly profit from a business combination in violation of Rules 10b-5(a) and 10b-5(c) under the Exchange Act, first and foremost because “it [was] unclear what fraudulent or deceitful conduct [independent of the misleading statements] occurred.” Id. at *20 (emphasis in original).

Mehedi v. View, Inc., 2024 WL 3236706 (N.D. Cal. June 28, 2024): This is a securities fraud suit brought by investors against the View, Inc., which went public through a de-SPAC transaction with CF II (the SPAC), and certain officers and directors of View and CF II. “Plaintiffs allege that Defendants made material misrepresentations to investors concerning a materially misstated and understated warranty accrual related to Legacy View’s ‘smart panels.’” Id. at *1. We first discussed Mehedi in our 2023 Mid-Year Update when the Court granted defendant’s motions to dismiss.

Plaintiffs have since amended their complaint, and the Court again dismissed most of the claims with the exception of plaintiffs’ Section 20(a) claims against certain directors and officers at View and CF II. Id. at *22. “On August 16, 2021, five months after going public, View announced that its Audit Committee began an independent investigation concerning the adequacy of the company’s previously disclosed warranty accrual and that View would not file its Form 10-Q for the second fiscal quarter of 2021.” Id. at *1 (internal citations omitted). “On November 9, 2021, View announced that the Audit Committee ha[d] now substantially completed its independent investigation and has concluded that the Company’s previously reported liabilities associated with all warranty-related obligations and the cost of revenue associated with the recognition of those liabilities were materially misstated.” Id. (internal citations omitted). View also announced that it would release updated financial statements and that its CFO resigned. Id. The lead plaintiff, Stadium Capital, sold all of its stock on September 24, 2021. Id. at *8. In its motion to dismiss opinion, the Court held that Stadium Capital could not attribute its losses to the August 16, 2021 announcement because the “initial disclosure of an investigation can[not] qualify as a corrective disclosure” and further because Stadium Capital sold its stock before the truth was revealed, and thus it cannot plead loss causation. Id. at *9. Plaintiffs’ Section 10(b) claims were accordingly dismissed. Id. at *12. Regarding plaintiffs’ Section 14(a) claim, the Court found that “Stadium Capital sold all of” the shares it purchased pursuant to the Proxy Statement “on March 9, 2021, well before the truth of any alleged misstatements was revealed.” Id. at *16. “Although Stadium Capital bought more View stock, any alleged economic harm from those purchases was not caused by the Proxy Statement because those purchases occurred after the vote solicited by the Proxy Statement.” Id. “Thus, any loss that Stadium Capital suffered was not caused by any alleged misstatements in the Proxy Statement, and Stadium Capital has failed to allege loss causation.” Id.

In re Faraday Future Intelligent Elec. Inc. Derivative Litig., 2024 WL 404495 (C.D. Cal. Jan. 22, 2024): Two investors brought a derivative suit on behalf of the corporation (Faraday) that went public via a de-SPAC transaction. They originally pursued a mix of federal securities fraud and state law claims, but they “app[arently] conceding[d]” that the only claim at-issue was for alleged violations of Section 14(a) of the Exchange Act against officers and directors of the SPAC (Property Solutions Acquisition Corp or “PSAC”). Id. at *1-4. Defendants argued that plaintiffs lack standing to bring claims because “neither of the named plaintiffs plead[ed] he ever owned PSAC stock prior to the merger.” Id. at *4 (internal quotations omitted). Defendants further argued that “any derivative liability would have been extinguished at the time the [m]erger was complete because former shareholders of a merged corporation can no longer satisfy the continuous ownership requirement of FRCO 23.1.” Id. at *5. (internal quotations omitted). Plaintiffs in turn argued, inter alia, that “their complaint sufficiently alleges that each plaintiff were current shareholders of Faraday Future and held Faraday Future common stock at all relevant times.” Id. (cleaned up). Additionally, plaintiffs contended that a plaintiffs who did not own Faraday stock prior to the merger nonetheless had standing under the “continuous wrong” doctrine. Id. The Court found that one plaintiff “first purchased [PSAC] stock . . . on January 11, 2021, before the defined relevant period in the Derivative Action began and has continuously owned thousands of PSAC shares since February 22, 2021.” Id. The Court found this was sufficient to have standing to bring a derivative claim. Id. However, the Court found that the other plaintiff, who acquired PSAC shares after the merger was consummated, lacked standing and the continuous wrong doctrine did not save his claims because “Delaware law makes it clear that what must be decided is when the specific acts of alleged wrongdoing occur, and not when their effect is felt.” Id. at *6. The Court nonetheless dismissed the complaint because plaintiffs failed to plead that they were excused from making a pre-litigation demand on the board. Id. at *13.

2. SPAC Claims That Survived A Motion to Dismiss

Several SPAC cases have survived motions to dismiss, and we highlight a few here. Most notable of these 2024 opinions is Alta Partners, LLC v. Forge Global Holdings, Inc., where plaintiff’s Section 11 claim survived a motion to dismiss on the grounds, among others, that plaintiff could not trace the purchase of a security to the allegedly defective registration statement at issue. 2024 WL 1116682, at *6-8 (S.D.N.Y. Mar. 13, 2024). The Court in Atla Partners disagreed with defendant and found that a plaintiff who purchased Public Warrants from a SPAC prior to its de-SPAC transaction could sufficiently trace its purchases to the S-4 registration statement despite the company’s claim that the warrants were not exercisable until a S-1 registration statement became effective. Id. In other cases, courts have found that material omissions in SPAC proxy statements are actionable, see, e.g., In re Grab Holdings Ltd. Sec. Litig., 2024 WL 1076277 (S.D.N.Y. Mar. 12, 2024), and, similarly, omissions in SPAC merger pitches are actionable as securities fraud, see, e.g., Felipe v. Playstudios Inc, 2024 WL 1380802 (D. Nev. Mar. 31, 2024).

Alta Partners, LLC v. Forge Glob. Holdings, Inc., 2024 WL 1116682 (S.D.N.Y. Mar. 13, 2024): Plaintiff Alta brought claims under Section 11 and for breach of contract and the implied covenant of good faith and fair dealing against Forge in connection with public warrants issued by the SPAC, which ultimately merged with Forge. Id. at *1. Alta alleged that Forge improperly prevented Alta from exercising its warrants and then redeemed the outstanding warrants at a nominal price. See id. Under the agreement governing the warrants, public warrants became exercisable thirty days after the business combination, provided that the warrants were registered on a registration statement and there was a current prospectus. Id. at *2. The warrant agreement also provided that Forge could redeem all outstanding warrants when (1) “the shares were exercisable”“; (2) the “Reference Value” calculated based on Forge’s stock price during a thirty-day period exceeded $18.00 per share; and (3) “an effective registration statement and current prospectus were in place for the underlying shares” for the thirty-day period. Id. Alta alleged it purchased public warrants issued pursuant to or traceable to the Form S-4 registration statement, which became effective on February 14, 2022. Id. at *12. Beginning on April 21, 2022 (thirty days after the completion of the merger on March 21, 2022), Alta repeatedly sought to exercise its warrants while Forge’s stock price skyrocketed, but Forge replied that warrants were not yet registered on the Form S-4, and could not be exercised as until Forge’s later-filed Form S-1 became effective. Id. at *2-3. The Form S-1 was declared effective on June 8, 2022, by which point the share price was below the exercise price of $11.50. Id. at *3. The following day, Forge noticed redemptions of the warrants for $.01 apiece and redeemed the warrants on July 11. Id. As a result, public warrant holders like Alta were never able to exercise the warrants when the stock price was trading above the warrant exercise price, thereby profiting from the exercise. Id. The Court dismissed Alta’s claim that Forge breached the warrant agreement by redeeming the warrants before all required conditions were met. It explained that Alta was reading in a contractual obligation unsupported by unambiguous terms of the warrant agreement. Id. at *4-5. The Court also dismissed Alta’s breach of implied covenant claim because it was “based on conduct permitted under the contract” and was based on the same set of facts as its breach of contract claim in any event. Id. at *6. However, the Court refused to dismiss plaintiff’s Section 11 claim in its entirety. In relevant part, it found that defendants’ representations “would mislead a reasonable investor to believe that the registration was sufficient to permit exercise” of the warrants. Id. at *7 (internal quotations omitted).

Felipe v. Playstudios Inc., 2024 WL 1380802 (D. Nev. Mar. 31, 2024): Plaintiff brought a securities fraud action against Playstudios, a mobile game company that went public via a de-SPAC transaction, alleging that the company misled investors (including through statements in its Proxy) about the prospects of one of its videogames, Kingdom Boss, even though the company had no experience with games of this genre (role playing games or “RPGs”). Id. at *1-4. Plaintiff alleged that the “launch of Kingdom Boss and expansion into the RPG category was a significant component of the Acies-Playstudios merger pitch.” Id. at *3. In a post-merger press release, Playstudios announced that its revenues had missed the low end of its previous estimates and, on a conference call on the same day, announced that it was suspending the development of Kingdom Boss all together. Id. at *3. The Court found all but one of the statements misleading “because they failed to disclose any of the risks associated with the severe playability issues that had materialized as early as [six months prior.]” Id. at *10. The Court found that “Defendants had multiple opportunities to make such disclosures in order to avoid misleading investors . . . [and that] Defendants could have made these disclosures in June prior to the merger vote.” Id. at *10. The Court also found “the omission of these specific risks . . . material” because Playstudios ability to scale the game and generate revenue was a central part of its pitch for the de-SPAC transaction. Id. at *11. The Court denied the motion to dismiss except as to one non-actionable statement. Id. at *21.

In re Grab Holdings Ltd. Sec. Litig., 2024 WL 1076277 (S.D.N.Y. Mar. 12, 2024): Investors filed a securities fraud action against Grab, a “mobile application [provider] . . . that [provides] . . . consumers with ride-hailing services, food-delivery services, business services, and a digital wallet[,]” and certain of its officers pursuant to Sections 11 and 15 of the Securities Act and Sections 14(a), 10(b), and 20(a) of the Exchange Act. Id. at *2. The complaint alleged that defendants misled investors, in connection with a de-SPAC transaction, about Grab’s use of driver and consumer incentives, which negatively impacted the company’s financial performance. Id. at *1-10. The challenged statements were made both pre- and post-merger. Id. Defendants moved to dismiss. Id. at *10. The Court found that plaintiffs had sufficiently pled that a series of pre-merger statements contained in the Proxy Statement were material and misleading. Id. at *24. The Court reasoned, inter alia, that “cautionary words about future risk cannot insulate from liability the failure to disclose risk that has transpired.” Id. at *16 (citation omitted). Further, the Court also found that “by putting the issues of driver retention and incentive amounts in play, defendants assumed ‘a duty to tell the whole truth.’” Id. at *16 (quoting Meyer v. Jinkosolar Holdings Co., 761 F.3d 245, 250 (2d Cir. 2014)). The Court held that none of the remaining pre-merger statements were actionable, including the post-merger statements by Grab’s CEO during a Squawk Box interview on CNBC. Id. at *19-24. The Court granted leave to amend. Id. at *26.

We will continue to monitor the evolution of SPAC litigation and the effect of the SEC’s SPAC Rule.

An increasing number of lawsuits challenge public companies’ environmental, social, and governance (ESG) disclosures and policies. The following section surveys notable developments in pending cases that involve ESG allegations.

In re Oatly Group AB Securities Litigation, No. 21-cv-06360 (S.D.N.Y. July 26, 2021): We reported on this case in our Securities Litigation 2023 Year-End Update. A class of investors sued Oatly Group AB, the world’s largest oat milk company, and several of its officers and directors for “greenwashing” in public disclosures. ECF No. 1 ¶¶ 1-2, 52. Plaintiffs allege that Oatly made false or misleading statements that overstated the sustainability of its product and minimized its environmental impact, thereby artificially inflating Oatly’s share price. ECF No. 1 ¶¶ 43-45. On November 3, 2023, the parties disclosed an intent to settle the litigation. The Court approved the $9.25 million settlement on July 17, 2024. ECF No. 120.

General Retirement System of the City of Detroit v. Verizon Communications Inc., No. 23-cv-05218 (D.N.J. Aug 18, 2023): We first reported on this case in our Securities Litigation 2023 Year-End Update. Plaintiffs allege that Verizon made false or misleading statements regarding its “extensive network of lead cables, the dangers they were posing to people and to the environment, and the costs associated with cleaning up the cables and compensating for any human injuries.” ECF No. 57 ¶ 16. Plaintiffs further allege that Verizon’s stock price dropped after The Wall Street Journal released an article profiling workers who claimed they were suffering from lead exposure. Id. ¶ 306. On April 24, 2024, defendants filed a motion to dismiss, arguing that plaintiffs failed to properly allege materiality and scienter because defendants did not know “the cables posed material risks not understood by the market” and understood that the “public and market at large were aware of the lead-sheathed cables’ existence.” ECF No. 58-1 at 2-3. Defendants also argued the challenged statements were “honestly held opinions” and “too general to be misleading.” Id. at 3. The motion to dismiss remains pending.

Exxon Mobile Corp. v. Arjuna Capital, No. 24-cv-00069 (N.D. Tex. Jan. 21, 2024): We first reported on this case in our Securities Litigation 2023 Year-End Update. In January 2024, Exxon filed a lawsuit seeking a declaratory judgment that would allow it to exclude from its proxy statement a shareholder proposal by two activist investors. Exxon alleged that defendants’ proposal, which asked Exxon to reduce its greenhouse gas emissions more rapidly, “d[id] not seek to improve ExxonMobil’s economic performance or create shareholder value.” ECF No. 1 ¶ 11. Exxon further contended that it could properly exclude defendants’ proposal under the ordinary business (Rule 14a-8(i)(7)) and resubmission exclusions ((i)(12)). Id. ¶¶ 16-17. On May 22, 2024, the Court held that Exxon’s lawsuit was able to proceed against the United States-based Defendant, Arjuna Capital. ECF No. 37. On June 17, 2024, Arjuna Capital agreed to withdraw its proposal and “unconditionally and irrevocably” agreed not to submit any similar proposal. ECF No. 52 at 1. The Court determined that this agreement mooted Exxon’s claim, and the case was dismissed without prejudice. Id. Gibson Dunn represents plaintiff in this action.

Securities Industry & Financial Markets Association v. Ashcroft, No. 23-cv-04154 (W.D. Mo. Aug. 10, 2023): We reported on this case in our Securities Litigation 2023 Year-End Update. In June 2023, the Missouri Securities Division adopted new rules requiring investment professionals to obtain client signatures before providing advice that “incorporates a social objective or other nonfinancial objective.” ECF No. 24 ¶¶ 69, 78. In August 2023, plaintiff, the Securities Industry and Financial Markets Association (SIFMA), filed a lawsuit against Missouri Secretary of State John Ashcroft and Missouri Securities Commissioner Douglas Jacoby, challenging these rules. ECF No. 1 at 41. Plaintiff alleged that the rules are preempted by the National Securities Markets Improvement Act of 1996 and the Employee Retirement Income Security Act, violate the First Amendment, and are unconstitutionally vague. ECF No. 24 ¶¶ 118-47-42. On January 5, 2024, the Court denied defendants’ motion to dismiss. ECF No. 39 at 1. On June 10, 2024, both parties filed motions for summary judgment as to all the claims at issue. ECF Nos. 69, 71. On August 14, 2024, the court granted the plaintiff’s motion for summary judgment (and rejected defendant’s cross-motion for summary judgment), finding that the rules do in fact violate the First Amendment, are unconstitutionally vague, and are preempted by federal laws, namely, the National Securities Markets Improvement Act of 1996 and the Employment Retirement Income Security Act of 1974. ECF No. 115. The judge concluded that the rules carried a significant risk of harm justifying a permanent injunction prohibiting their enforcement. Id. at 20-22.

Browning v. Alexander, et al., No. 23-cv-03293 (D. Md. Dec. 5, 2023): Investors in Enviva Inc., an energy company that manufactures wood pellets used to substitute coal in power generation, filed a shareholder derivative complaint on December 5, 2023. Plaintiff alleged defendants, who include the company’s CEO and co-founder as well as several board members, caused Enviva to make false and misleading statements about the company’s commitment to ESG policies. ECF No. 1 ¶¶ 1-4, 171-78. As one example, plaintiff alleged Enviva’s practice of procuring wood pellets “drives demand for deforestation,” contrary to defendants’ representation that harvesting forests for wood pellets is “sustainable.” Id. ¶ 98. Enviva has since filed for Chapter 11 bankruptcy, and on April 15, 2024, the Court issued a stay for the pendency of Enviva’s bankruptcy proceedings. ECF No. 24.

Alliance for Fair Board Recruitment v. SEC, No. 21-60626 (5th Cir. 2021): The petitioners sued the SEC, alleging that Nasdaq’s Board Diversity Rules are unconstitutional and contrary to federal statutes. ECF No. 1. The Board Diversity Rules, which the SEC approved, require companies that list shares on Nasdaq’s exchange to (1) disclose aggregated information about board members’ diversity characteristics (including race, gender, and sexual orientation) and (2) provide an explanation if less than two board members are diverse. Id. at 3-4. On October 18, 2023, a unanimous Fifth Circuit panel rejected the petitioners’ challenges (ECF No. 289) after which the petitioners sought rehearing en banc (ECF No. 297). The en banc panel of the Fifth Circuit held oral argument on May 14, 2024. ECF No. 508. On July 18, 2024, the Court requested supplemental briefing regarding the operation of one of the Rules at issue, and on July 25, 2024, the parties filed supplemental briefs. ECF Nos. 519, 520. Both Nasdaq and the SEC contend in their briefs that the deadline for companies to request access to a board-recruiting service has expired and that this moots the petitioners’ challenge to the Board Recruiting Service Rule. ECF Nos. 517, 519. The petitioners, the National Center for Public Policy Research and Alliance for Fair Board Recruitment, argued in their own July 25 briefs that the deadline has passed but that this does not affect the justiciability of the case before the Fifth Circuit. ECF Nos. 520, 522. The Fifth Circuit has not yet issued an opinion in connection with its rehearing en banc. Gibson Dunn represents Nasdaq in this action, which intervened as an interested party to defend the Board Diversity Rules.

The cryptocurrency space has seen considerable activity since our last Update. Below, we discuss significant rulings in private lawsuits and lawsuits brought by the SEC, as well as additional developments that may impact cryptocurrencies going forward.

A. Class Actions

Golubowski v. Robinhood Markets, Inc., 2024 WL 269507 (N.D. Cal. Jan. 24, 2024): On January 24, 2024, the district court dismissed without leave to amend a class action complaint against Robinhood Markets, Inc., a crypto and securities trading platform. ECF No. 106 at 1. The same court previously granted Robinhood’s motion to dismiss plaintiffs’ first amended complaint, finding that plaintiffs failed to plead a violation of Section 11 or 12(a) of the Securities Act. ECF No. 90. In their second amended complaint, plaintiffs asserted a new theory for why Robinhood’s offering documents were false or misleading, alleging that the declines in key performance indicators and revenue sources were undisclosed and misrepresented by the offering documents. ECF No. 92. In its January 24, 2024 decision, the Court again dismissed plaintiffs’ claims, finding that Robinhood made adequate disclosures that put investors on notice of lower trading revenues in the second and third quarters of 2021, the “possibility of downward trends,” and the fact that “Robinhood’s business had substantially shifted to rely more on cryptocurrency trading[.]” ECF No. 106 at *12, *14, *16. The Court also found that leave to amend was not warranted as it “would be futile.” Id. at *19.

Williams v. Binance, 96 F. 4th 129 (2d Cir. 2024): On March 8, 2024, the Second Circuit reversed the district court’s dismissal of a putative class action lawsuit against crypto exchange Binance and its CEO. Plaintiffs asserted numerous causes of action under the Securities Act, the Exchange Act, and the Blue Sky statutes of different states and territories, including that defendants offered and sold unregistered securities. ECF No. 82 at 133, 135. Plaintiffs—purchasers of crypto assets on the Binance international electronic exchange—claimed that Binance unlawfully promoted, offered, and sold billions of dollars’ worth of crypto “tokens,” which were not registered as securities. Id. at 132. The U.S. District Court for the Southern District of New York dismissed plaintiffs’ claims, finding that they were impermissibly extraterritorial, that the federal claims were untimely, and that claims under Blue Sky laws of states where none of the named class members resided lacked a sufficient nexus with the allegations. Id. at 135; ECF No. 77. The Second Circuit reversed and remanded, finding that plaintiffs plausibly alleged that class members engaged in domestic transactions, that a narrow subset of the federal claims were timely, and that state law claims brought on behalf of absent putative class members should not have been dismissed at that stage. ECF No. 82 at 136-45. On May 13, 2024, plaintiffs filed a third amended complaint, alleging 11 causes of action, including under Sections 5, 12, and 15 of the Securities Act. ECF No. 104. Gibson Dunn is co-counsel for Binance in this action.

Oberlander v. Coinbase Glob., Inc., 2024 WL 1478773 (2d Cir. Apr. 5, 2024): As reported in our 2023 Mid-Year Litigation Update, in February 2023, the U.S. District Court for the Southern District of New York dismissed a class action lawsuit against the crypto exchange Coinbase and its CEO on the basis that Coinbase was not the “statutory seller” of the allegedly unregistered tokens at issue. Coinbase operates online trading platforms where users can buy and sell digital assets. ECF No. 74 at *1. The nationwide class consists of all persons or entities who bought or sold certain digital assets on the Coinbase trading platforms from October 8, 2019, to March 11, 2022, and it asserted a mix of claims under the Securities Act, the Exchange Act, and the state securities laws of California, Florida, and New Jersey. Id. On April 5, 2024, the Second Circuit concluded that plaintiffs adequately pleaded that Coinbase held title to digital assets traded on its platform and thus plausibly alleged claims under Section 12(a) of the Securities Act. Id. at *3-4. At the same time, the Court affirmed the district court’s dismissal of the Exchange Act claims, concluding the allegations were repetitive and conclusory, and found that the district court erred in dismissing the state law claims on jurisdictional grounds. Id. at *4-5. On July 29, 2024, defendants moved for judgment on the pleadings. ECF No. 83.