Securities Litigation 2024 Year-End Update

Client Alert | February 27, 2025

This update provides an overview of the major developments in federal and state securities litigation since our 2024 Mid-Year Securities Litigation Update.

Introduction

In this update:

- We report on orders from the Supreme Court that dismissed two securities-related cases from the Court’s merits docket, leaving unresolved questions about pleading standards and the nature of misstatements under the PSLRA. We also examine one potential circuit conflict involving federal courts’ jurisdiction to hear securities-related cases under the Class Action Fairness Act.

- We cover recent developments in Delaware, including the latest opinion in Tornetta v. Musk, a recent Delaware Supreme Court opinion addressing aiding and abetting liability, and two new opinions addressing litigation over commercially reasonable efforts clauses.

- Lawsuits challenging public companies’ environmental, social and governance (ESG) disclosures and policies continue to be filed, as do cases challenging ESG policies implemented by states, asset managers, and trading platforms. We survey notable developments in securities cases involving ESG allegations.

- The cryptocurrency space has seen considerable activity since our last Update. Below, we discuss noteworthy new case filings and rulings in various lawsuits, as well as other developments that could impact cryptocurrencies going forward.

- We discuss recent cases addressing price impact issues in the wake Goldman Sachs Group., Inc. v. Arkansas Teacher Retirement System. We also highlight recent opinions addressing market efficiency and preview cases on appeal implicating various reliance-related issues.

- Finally, we address several other notable developments, including a recent opinion from the Second Circuit addressing materiality, a recent opinion from the Ninth Circuit involving a Special Purpose Acquisition Company or “SPAC,” a Tenth Circuit decision pertaining to short-selling, and recent securities lawsuits implicating Artificial Intelligence.

TABLE OF CONTENTS

I. Filing And Settlement Trends

II. What To Watch for In The Supreme Court

I. Filing And Settlement Trends

A recent NERA Economic Consulting (NERA) study provides an overview of federal securities litigation filings in 2024. This section highlights several notable trends.

A. Filing Trends

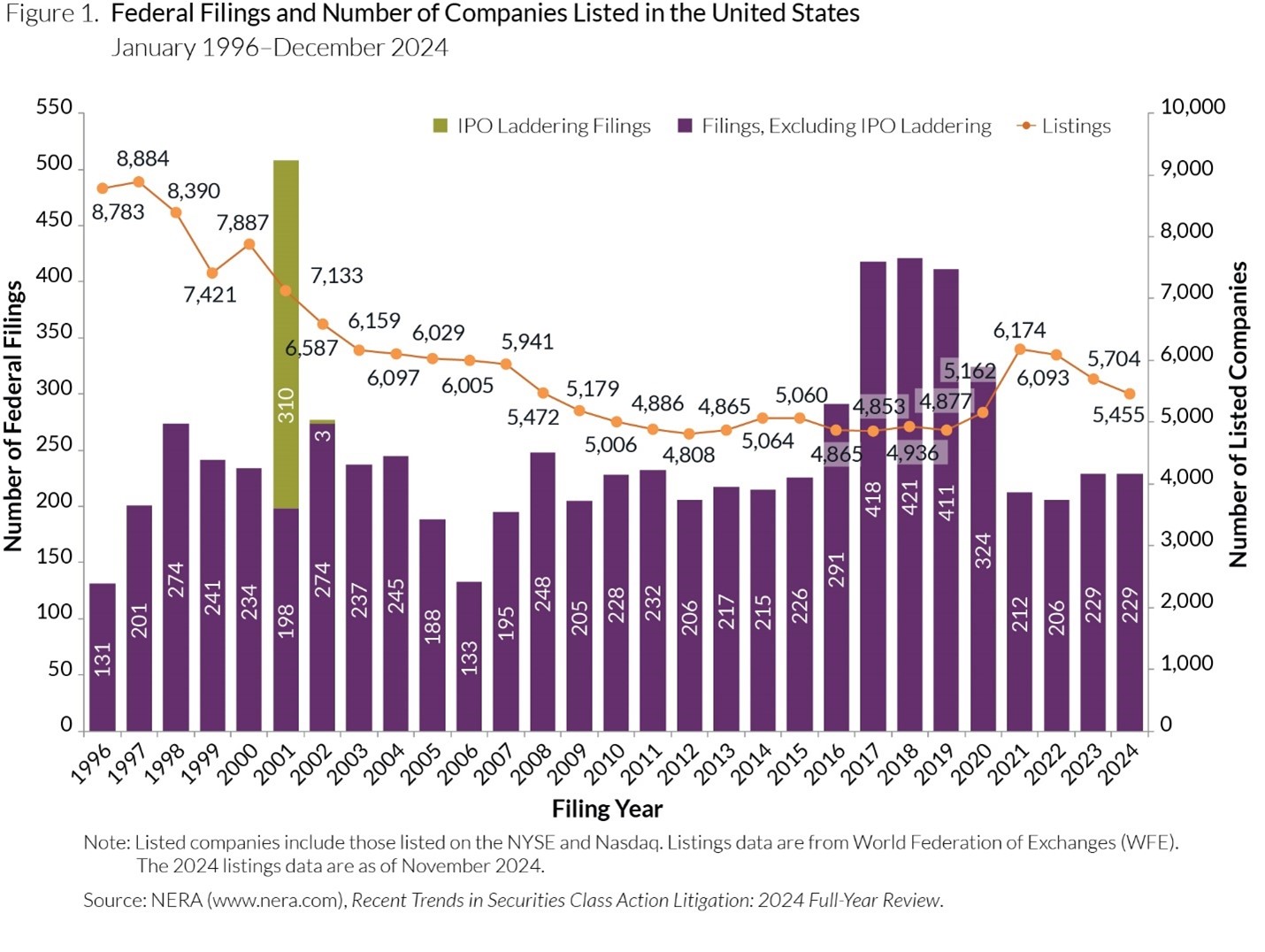

Figure 1 below reflects the federal filing rates from 1996 through 2024. In 2024, 229 federal cases were filed, matching the number of federal filings in 2023. That figure is considerably lower than in the peak years of 2017-2019, but is consistent with the number of filings from 2021 onwards. Note, however, that this figure does not include class action suits filed in state court or state court derivative suits, including those in the Delaware Court of Chancery.

Figure 1:

|

B. Mix Of Cases Filed In 2023

1. Filings By Industry Sector

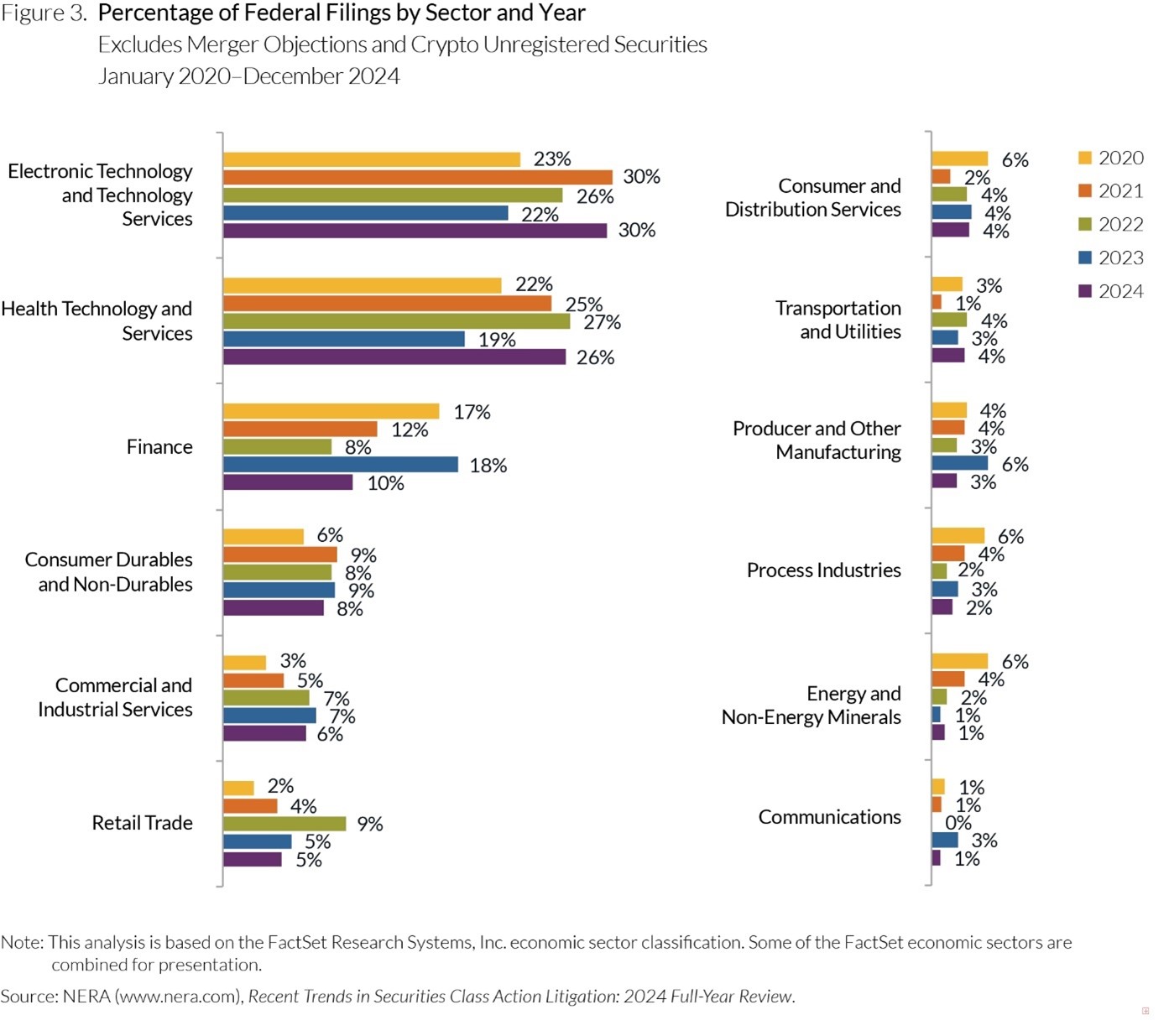

As shown in Figure 2 below, the distribution of non-merger objections and non-crypto unregistered securities filings in 2024, varied somewhat from 2023. Notably, after a dip in 2023, the “Health and Technology Services” sector percentage returned to the percentages seen in 2021 and 2022. Similarly, the percentage of “Electronic Technology and Technology Services” filings increased in 2024, returning to levels last seen in 2021. Together, “Health and Technology Services” and “Electronic Technology and Technology Services” filings once again comprised over 50% of filings after dipping to 41% in 2023. Meanwhile, “Finance” sector filings decreased from 18% to 10%.

Figure 2:

|

2. Filings By Type

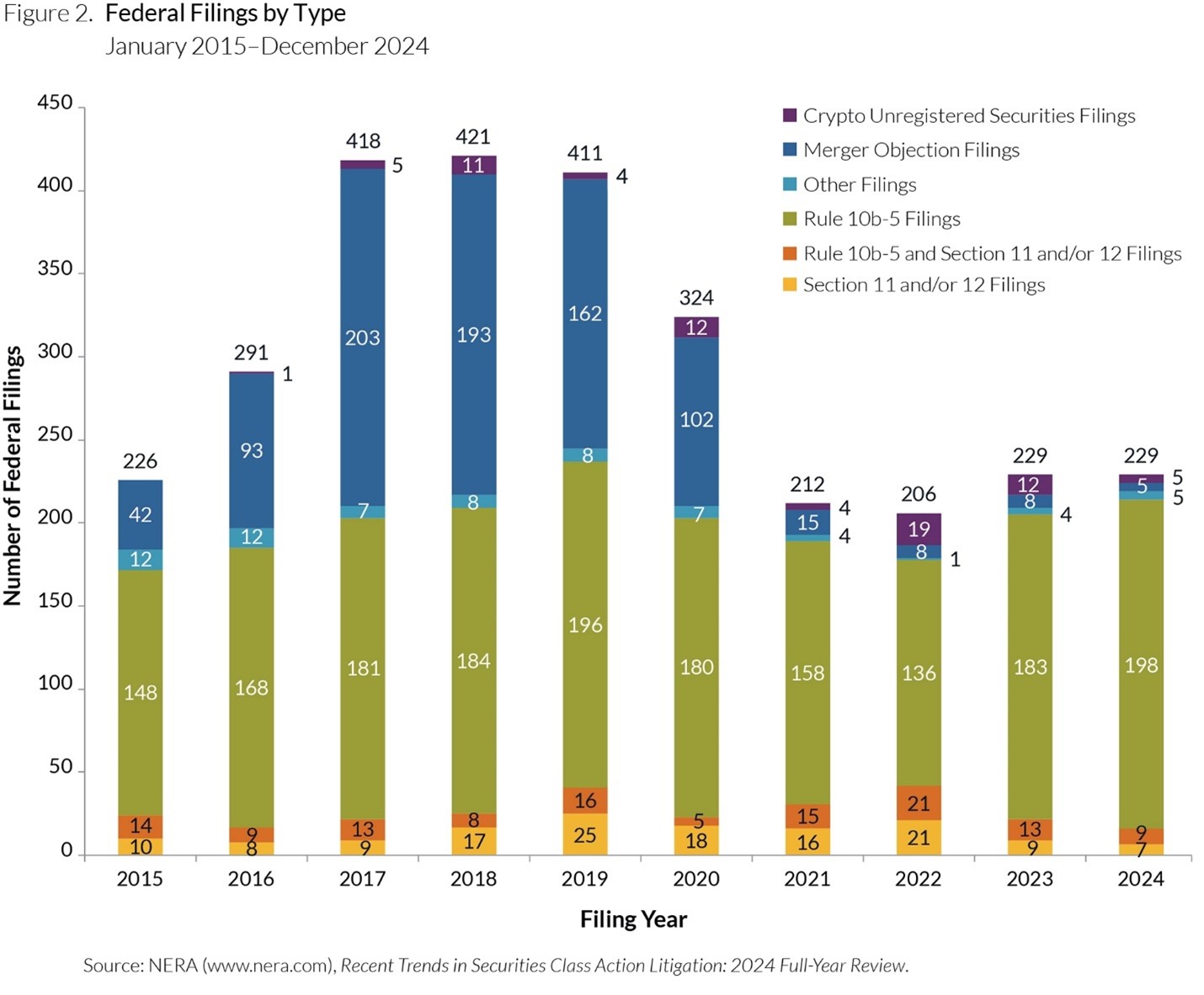

As shown in Figure 3 below, Rule 10b-5 filings make up the vast majority of federal filings this year. In fact, filings of other types are as low as they have been in years.

Figure 3:

|

3. Filings By Circuit

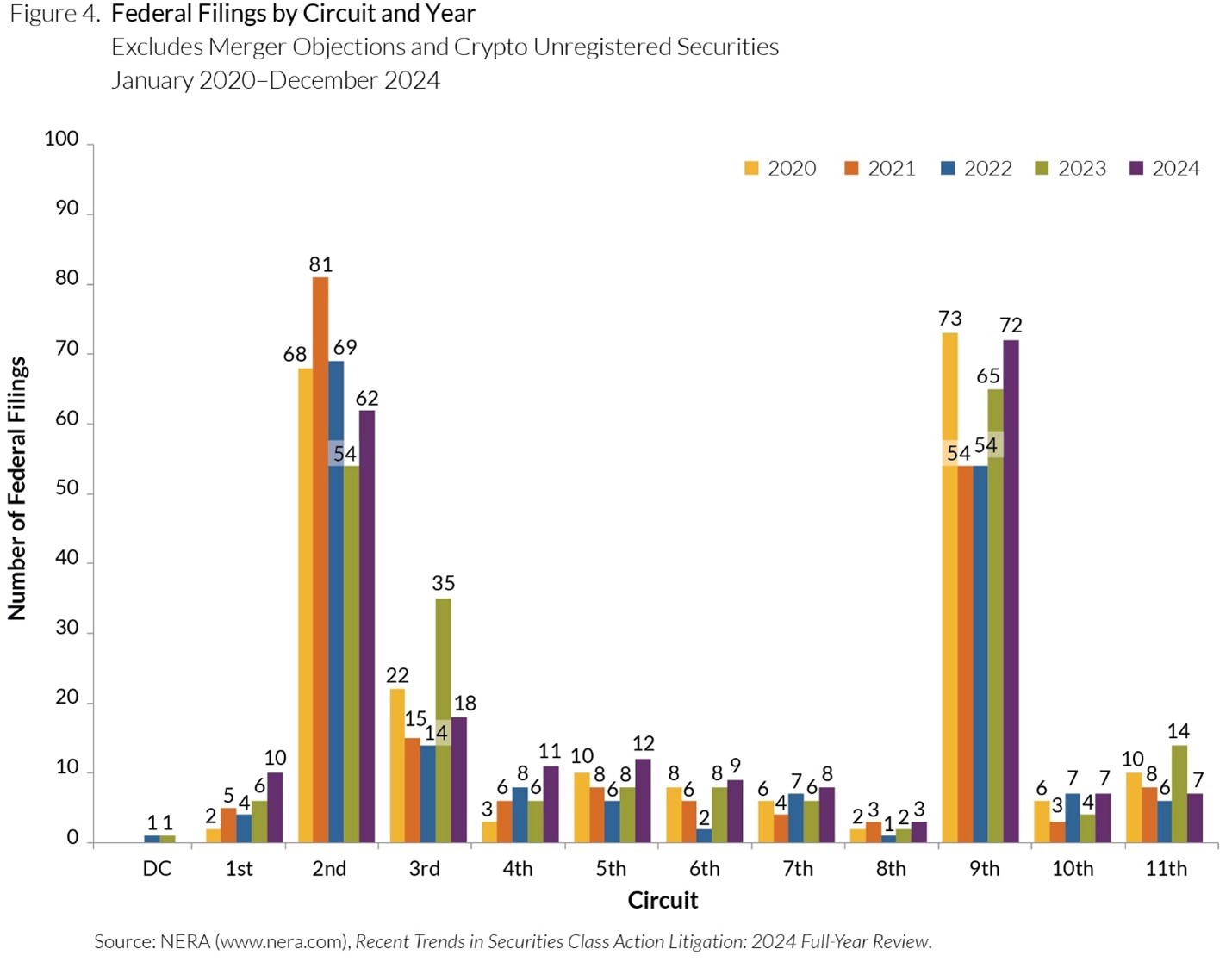

Figure 4 provides insight into the distribution of federal filings by Circuit. Most filings occur in the Second and Ninth Circuits. After trending down from 2021 to 2023, the number of filings in the Second Circuit increased this year. By contrast, the number of filings in the Ninth Circuit has remained steady or increased each year since 2021.

Figure 4:

|

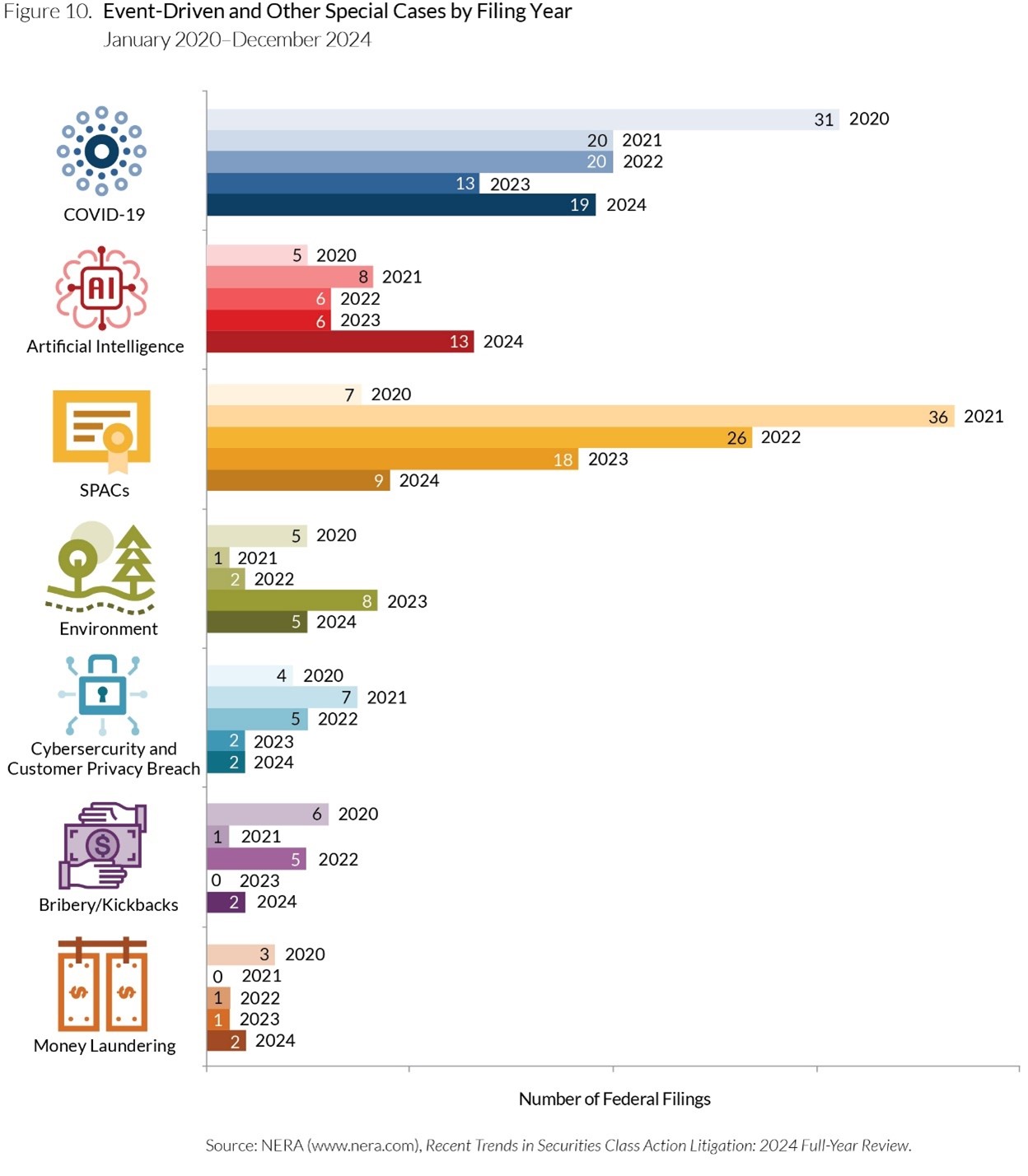

4. Event-Driven And Other Special Cases

Figure 5 illustrates trends in the number of event-driven and other special case filings since 2020. The number of Artificial Intelligence-related filings in 2024, was more than double the number of such filings in 2023 and 2022. By contrast, SPAC and Cybersecurity and Customer Privacy Breach filings have decreased steadily since 2021.

Figure 5:

|

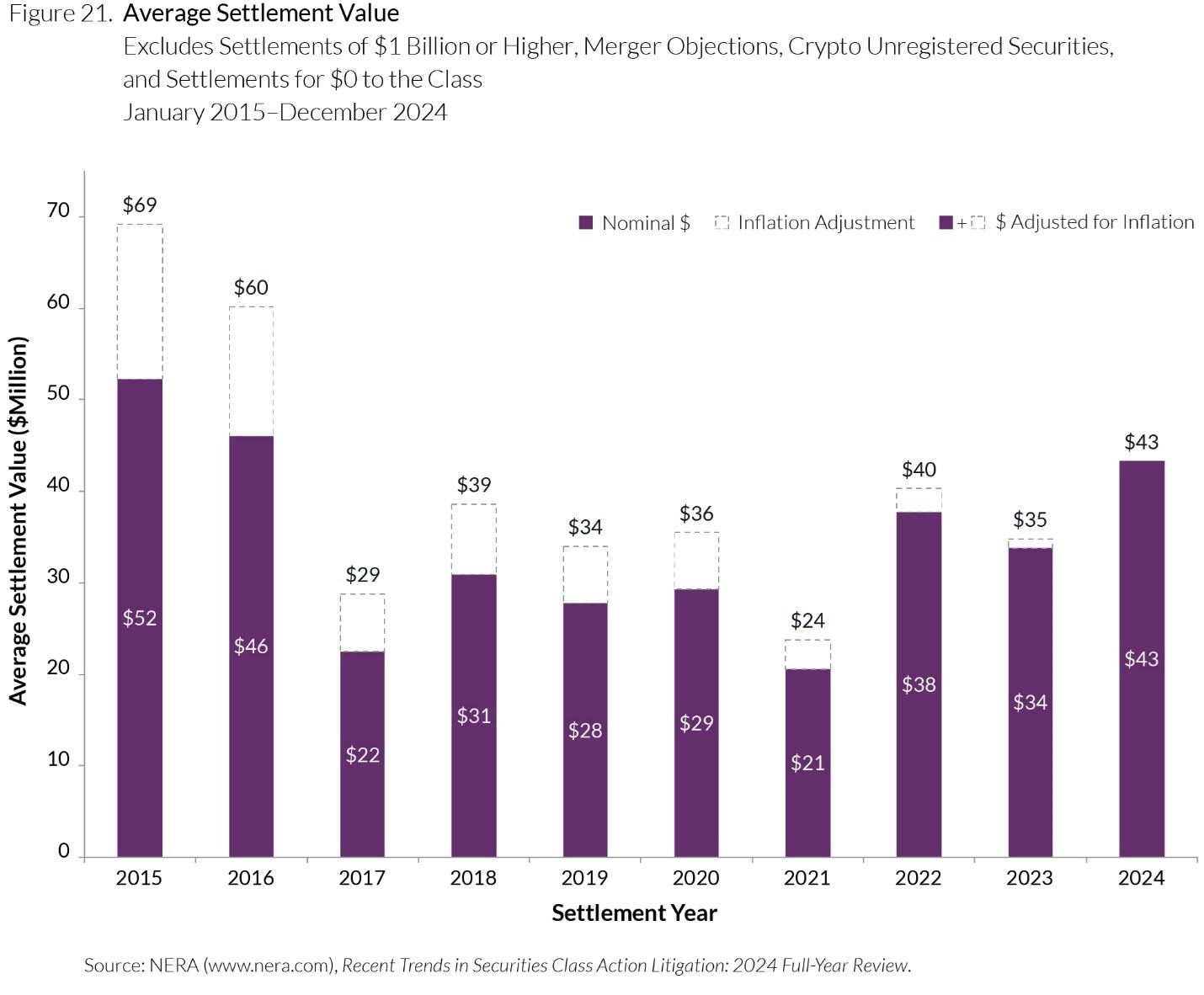

C. Settlement Trends

As reflected in Figure 6 below, the average settlement value in 2024 was $43 million. That is the highest number since 2016, and a significant increase from the mid-year average ($26 million). (Note that the average settlement value excludes merger-objection cases, crypto unregistered securities cases, and cases settling for more than $1 billion or $0 to the class.)

Figure 6:

|

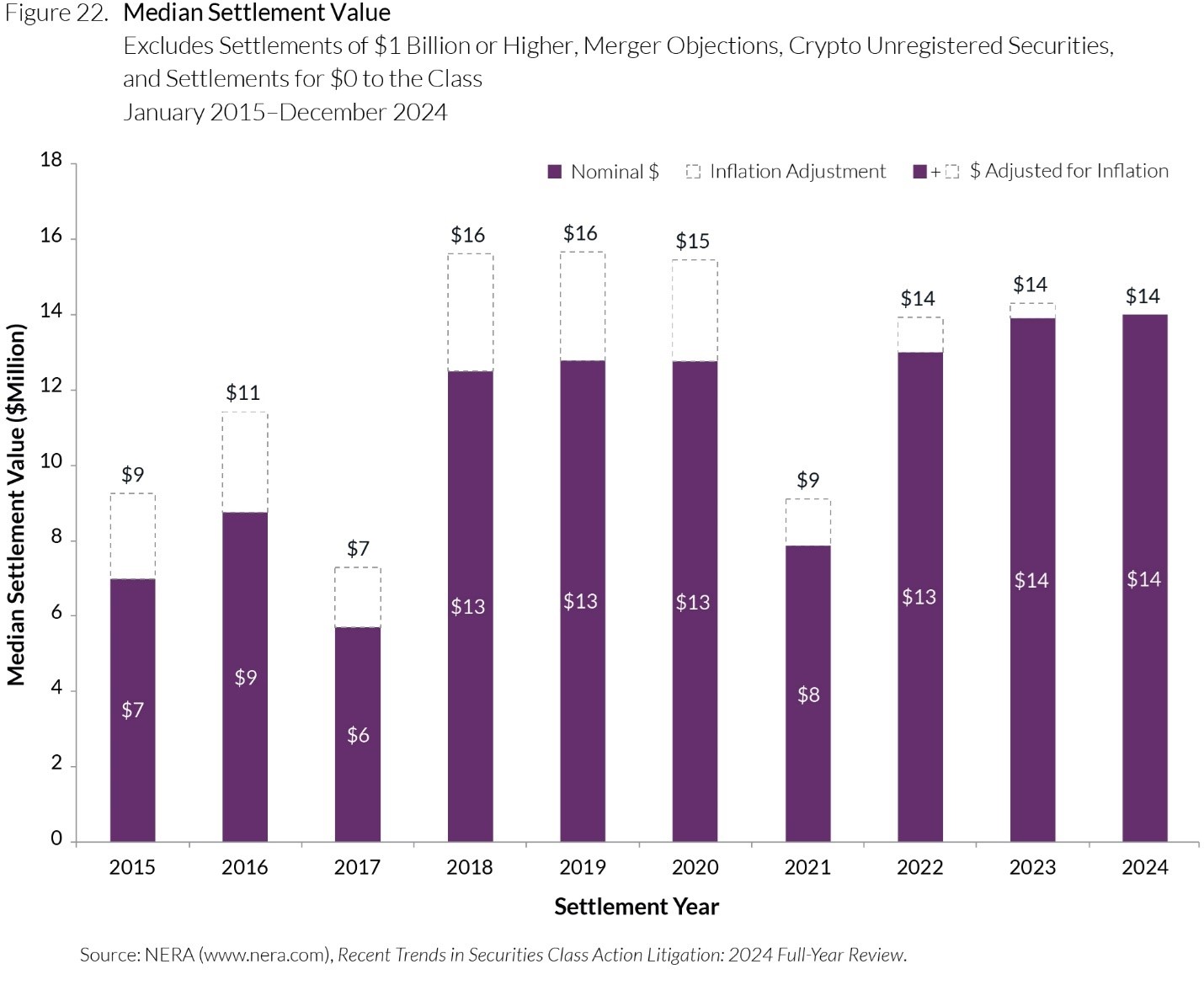

As for median settlement value, it equaled the values from 2022 and 2023. At $14 million, the median settlement value also increased significantly from the mid-year median ($9 million). (Note that median settlement value excludes settlements over $1 billion, merger objection cases, crypto unregistered securities cases, and zero-dollar settlements.)

Figure 7:

|

II. What To Watch For In The Supreme Court

A. Supreme Court Update: Both Securities Cases Heard in November 2024 Dismissed As Improvidently Granted

As our 2024 Mid-Year Update discussed, by the beginning of its 2024 Term, the Supreme Court had granted review in two securities cases: Facebook, Inc. v. Amalgamated Bank, No. 23-980, and NVIDIA Corp. v. E. Ohman J:or Fonder AB, No. 23-970. Each case presented questions about pleading standards in securities class actions, and each petition identified circuit splits on those issues. See Petition for Writ of Certiorari at 16-17, Facebook, Inc., No. 23-980 (Mar. 4, 2024) (“Facebook Pet.”); Petition for Writ of Certiorari at 3-5, NVIDIA Corp., No. 23-970 (Mar. 4, 2024) (“NVIDIA Pet.”). However, after hearing oral argument in November 2024, in each of these cases, the Court issued a per curiam order dismissing each writ as “improvidently granted,” a disposition that sends a case back to the court below without a resolution on the merits. NVIDIA Corp. v. E. Ohman J:or Fonder AB, 2024 WL 5058572 (U.S. Dec. 11, 2024); Facebook, Inc. v. Amalgamated Bank, 604 U.S. 4 (2024); see also Garrett v. McCotter, 807 F.2d 482, 484 n.5 (5th Cir. 1987). These dismissals mean that, for now, lower courts across the country will continue to apply their own circuits’ precedents to these questions.

In Facebook, shareholders alleged that Facebook made misstatements in securities filings, where it had purportedly characterized as “hypothetical” the risk that third parties might misuse Facebook user data when that risk has already allegedly materialized. Facebook Pet. at 10. The Supreme Court granted Facebook’s petition for certiorari to resolve the question of whether risk disclosures are “false or misleading when they do not disclose that a risk has materialized in the past, even if that past event presents no known risk of ongoing or future business harm.” See id. at i; see also Facebook, Inc. v. Amalgamated Bank, 144 S. Ct. 2629 (2024) (granting certiorari in part). Gibson Dunn represents the petitioners in Facebook.

The question of whether such risk disclosures are misstatements unless they also disclose any and all materializations of the disclosed risk, no matter how inconsequential, remains subject to a circuit split. The Supreme Court’s dismissal in Facebook leaves intact the Ninth Circuit’s rule, which holds that a risk disclosure is materially misleading when it fails to disclose a past instance of the risk having materialized, even if the past event poses no known risk of harm. In re Facebook, Inc. Sec. Litig., 87 F.4th 934, 949-50 (9th Cir. 2023). As Facebook argued in its petition for certiorari, this puts the Ninth Circuit at odds with the Sixth Circuit, which treats risk disclosures as prospective only; and with the First, Second, Third, Fifth, Tenth, and D.C. Circuits, which have held that a risk’s materialization in the past must be disclosed only when the company knows or believes that the past event will harm the business. Facebook Pet. at 19-22 (citations omitted).

In NVIDIA, a group of investors brought a securities-fraud class action against NVIDIA, a company that produces graphics processing units (GPUs). E. Ohman J:or Fonder AB v. NVIDIA Corp., 81 F.4th 918, 924-25 (9th Cir. 2023). They alleged that NVIDIA’s CEO and two other defendants (whose dismissal was affirmed by the Ninth Circuit) had misled investors about the extent to which NVIDIA’s revenue growth was linked to demand from cryptocurrency miners. Id. at 924-27. In support of allegations about the falsity of NVIDIA’s statements and its knowledge, the investors’ amended complaint relied on statements from former NVIDIA employees about internal company documents, as well as on the independent analysis of an expert consulting firm. Id. at 929-30, 937-39.

The Supreme Court granted NVIDIA’s petition for certiorari to decide (1) whether, under the heightened pleading standards of the Private Securities Litigation Reform Act (PSLRA), plaintiffs making allegations of scienter based on company-internal documents must “plead with particularity the contents of those documents,” and (2) whether, under the PSLRA, allegations of falsity based on expert opinions—rather than “particularized allegations of fact”—suffice to survive a motion to dismiss. See NVIDIA Pet. at i; see also NVIDIA Corp. v. E. Ohman J:or Fonder AB, 144 S. Ct. 2655 (2024) (granting certiorari). Now, with certiorari dismissed in NVIDIA, both of these questions remain subject to the circuit splits identified in the NVIDIA petition. As to the standard for pleading scienter based on internal documents, the First and Ninth Circuits permit more general allegations, whereas the Second, Third, Fifth, Seventh, and Tenth Circuits require particularized allegations of the documents’ contents. NVIDIA Pet. at 4 (citations omitted). And as to the role of expert opinions in alleging falsity, the Ninth Circuit alone has held that expert opinions suffice; the Second and Fifth Circuits have held that expert opinions can “bolster” factual allegations of falsity but will be insufficient on their own to survive a motion to dismiss. See id. at 5 (citations omitted).

B. Lower Court Development: Circuit Split Recognized On Federal Court Jurisdiction Under The Class Action Fairness Act

After the Court’s dismissals in November and December, there are no securities cases currently pending before the Supreme Court. We highlight one securities-related development from the lower courts, which may reach the Supreme Court for resolution in a future Term.

On September 4, 2024, in Kim v. Cedar Realty Trust, Inc., 116 F.4th 252 (4th Cir. 2024), the Fourth Circuit acknowledged a circuit split on the extent of federal court jurisdiction under the Class Action Fairness Act (CAFA). Although the Second Circuit had determined CAFA did not confer federal subject-matter jurisdiction in a “nearly identical action,” the Kim court found that it was bound by Fourth Circuit precedent to reach a different conclusion. Id. at 260-61.

In Kim, an action brought by a class of preferred stockholders in Cedar Realty, the district court asserted subject-matter jurisdiction under CAFA’s exception to the usual jurisdictional requirement of complete diversity of citizenship between the parties. Id. at 260 (citing 28 U.S.C. §§ 1331, 1332(d)). On appeal, the Fourth Circuit raised the question of its own jurisdiction, noting that CAFA also incorporates carveouts under which there is not federal jurisdiction in cases without complete diversity. Id. Specifically, the court considered whether the Kim action “solely involve[d] a claim” relating to either state-law issues about a business entity’s internal affairs or the “rights, duties (including fiduciary duties), and obligations relating to or created by or pursuant to any security.” Id. at 260 (quoting 28 U.S.C. § 1332(d)(9)(B)-(C)).

The claims in Kim were for breaches of contract and fiduciary duty by Cedar Realty, based on rights and obligations arising from the preferred shares; and for interference with contract and aiding and abetting breaches of fiduciary duty, by Wheeler, which merged with Cedar Realty while the plaintiffs held their preferred stock. Id. at 258-59. The court acknowledged that a panel of the Second Circuit had found that it lacked jurisdiction under CAFA in a “nearly identical action,” Krasner v. Cedar Realty Trust, Inc., 86 F.4th 522 (2d Cir. 2023). Kim, 116 F.4th at 260-61. But the Kim court was bound by prior Fourth Circuit precedent, in which the court held that aiding-and-abetting claims against corporate outsiders do not “relate[] to” either internal corporate governance or rights and duties conferred by a security. Id. at 261 (citing Dominion Energy, Inc. v. City of Warren Police & Fire Ret. Sys., 928 F.3d 325, 335-43 (4th Cir. 2019)). Under that precedent, the Cedar Realty stockholders’ claims against Wheeler were not carved out from CAFA and the court retained federal jurisdiction over the appeal. Id.

For now, under the apparent circuit split identified in Kim, shareholder class actions like these, involving aiding-and-abetting claims against corporate outsiders, may face different treatment in different circuits. In the Fourth Circuit and any others that follow the rule stated in Kim, these cases can remain in federal court, while in the Second Circuit and any other circuits following the Krasner rule, the same claims will be remanded to state court for lack of federal jurisdiction.

A. Ratification In Tornetta v. Musk

On December 2, 2024, the Delaware Chancery Court issued a much-anticipated opinion in Tornetta v. Musk, 326 A.3d 1203 (Del. Ch. 2024). This latest installment in Tornetta addresses the effect on the Court’s post-trial opinion of a subsequent stockholder vote in favor of the compensation award the post-trial opinion ordered rescinded. In short, the Court concluded the subsequent vote had no effect.

Tornetta centers on Elon Musk’s 2018 compensation package. The compensation award was approved at a special meeting of the Tesla Board on January 21, 2018, and then approved by a majority of Tesla’s stockholders in March 2018. Tornetta v. Musk, 310 A.3d 430, 485-86, 490 (2024). The compensation award carried a grant date fair value of $2.6 billion and a maximum value to Musk of $55.8 billion. Id. at 445. That maximum value represented “the largest potential compensation opportunity ever observed in public markets by multiple orders of magnitude.” Id.

On January 30, 2024, the Court issued a post-trial opinion that ordered Elon Musk’s 2018 compensation award rescinded after finding (1) Musk was a conflicted controller with respect to the compensation award, (2) the entire fairness standard applied to the transaction as a result, (3) the defendants failed to prove the March 2018 stockholder vote on the award was “fully informed,” and (4) the defendants failed to prove the transaction was entirely fair. Id. at 501, 520-21, 526-27, 544 (2024). Roughly three months after the Court’s post-trial opinion, Tesla filed a proxy statement in which it recommended that stockholders “ratify” the compensation award that the post-trial opinion ordered rescinded. Tornetta, 326 A.3d at 1218. On June 13, 2024, Tesla stockholders voted in favor of the proposal. Id. at 1219.

On June 28, 2024, certain Tornetta defendants, citing the stockholder vote, filed a Motion to Revise the Tornetta post-trial opinion, which this latest December 2, 2024 opinion denies. Id. at 1219, 1264.

The Court provided four independent bases for doing so, one of which is addressed here—ratification. The Court rejected Tesla’s ratification arguments on the merits. It began by framing the defendants’ arguments as being incorrectly built on agency principles that treat a corporation’s directors as agents of stockholders, with stockholders, as principals, able to “do whatever they want in all contexts.” Id. at 1230. According to the Court, the defendants’ view is contrary to Delaware law, which regards directors as more “analogous to trustees for stockholders.” Id. (citations omitted). Thus, agency principles apply “only by analogy.” Id.

Next, the Court opined that Delaware recognizes two forms of stockholder ratification, one of which was applicable in its view. The Court designated the applicable form of ratification “fiduciary ratification.” Id. Per the Court, fiduciary ratification “allows stockholders to express, through an affirmative vote,” that “a corporate act is ‘consistent with shareholder interests.’” Id. (quoting Vogelstein, 699 A.2d at 335). According to the opinion, the effect of fiduciary ratification varies depending on context, ranging from “act[ing] as a complete defense,” to “hav[ing] no effect.” Id. (quoting Vogelstein, 699 A.2d at 334). “Just as the standard of review increases as conflicts become more direct and serious, the effect of fiduciary ratification diminishes.” Id. (footnote omitted).

Here, the Court explained that the fiduciary ratification was occurring in the context of a conflicted controller transaction. That context, the Court noted, presents “multiple risks to minority stockholders.” Id. Considering those risks and the presumptive application of entire fairness, the Court held that the “maximum effect of stockholder ratification . . . [would be] to shift the burden of proving entire fairness.” Id. at 1232. A standard of review shift, the Court explained, depended instead on the company committing from the outset of the transaction to the requirements set forth in MFW. Id. Tesla did not do so, however, and it could not “‘MFW’ a vote”—i.e., obtain the benefits of MFW by “implementing the MFW protections before” the stockholder ratification vote. Id. at 1233. The Court therefore rejected the ratification argument.

The Court’s post-trial opinion prompted discussion about re-domestication and the relative merits of incorporating in Delaware as compared to states like Texas and Nevada. A detailed discussion of those topics is beyond the scope of this Update, though we note that systemic movement does not appear be occurring—at least not yet. See generally Stephen M. Bainbridge, DExit Drivers: Is Delaware’s Dominance Threatened (UCLA Sch. L. Rsch. Paper No. 24-04), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4909689. This latest opinion, and its recent appeal to the Delaware Supreme Court, suggest those discussions are likely to persist, and we will continue to monitor this case and these issues as developments unfold.

B. The Delaware Supreme Court Reiterates The High Bar for Bringing Aiding And Abetting Claims Against Third-Party Buyers

In its recent decision in In re Mindbody, Inc., Stockholder Litigation, the Delaware Supreme Court reversed a controversial holding that an arms-length buyer’s “passive failure to act rather than active participation or ‘substantial assistance’ can give rise to liability.” 2024 WL 4926910, No. 484, 2023 at *30 (Del. Ch. Dec. 2, 2024). The Court also addressed the several novel issues, “including . . . whether contractual undertakings in merger agreements can create fiduciary duties for third parties to the target’s stockholders.” Id.

As discussed in our April 10, 2023 Client Alert, the Court of Chancery ruled that Mindbody’s founder and CEO, Richard Stollmeyer, breached his Revlon duties. Id. at *22. The Court of Chancery also found that (1) Stollmeyer was liable for breaching his duty of disclosure, (2) Vista Equity Partners Management, LLC (Vista)—Mindbody’s acquirer—was liable for aiding and abetting Stollmeyer’s disclosure breach, and (3) the defendants had waived the issue of settlement credit. Id. at *22. Apart from the Court of Chancery’s aiding and abetting ruling, the Delaware Supreme Court affirmed.

To be liable for aiding and abetting a breach of fiduciary duty, plaintiffs must plead and prove that the third party was a “knowing participa[nt]” in the underlying breach. Id. at *31. For its part, the Court of Chancery “held that Vista’s ‘contractual obligation’ in the [Vista-Mindbody] merger agreement to review Mindbody’s proxy statements and ‘correct’ any misstatements or omissions, and Vista’s subsequent failure to correct omissions, amounted to ‘knowing participation’ in Stollmeyer’s breach of his duty of disclosure.” Id. at *30.

The Delaware Supreme Court disagreed. In reversing the Court of Chancery’s aiding and abetting determination, the Delaware Supreme Court provided an overview of the “knowing participation” element of an aiding and abetting claim. See id. at *31-35. It explained that the “knowing” factor comprises two types of knowledge—i.e., knowledge by the alleged aider and abettor that (1) “the primary party’s conduct constitutes a breach,” and (2) its own conduct was legally improper. Id. at *32 (citation and emphasis omitted). Participation, in turn, generally requires “substantial assistance.” Id. at *33. At least in the corporate governance context, the Supreme Court explained, substantial assistance has generally been limited to “overt participation,” as opposed to a “failure to act” or “passive awareness.” Id. It also cited Section 876 of the Restatement (Second) of Torts approvingly and structured its analysis around the Restatement factors. See id. at *34-36.

Considering these various factors and elements, along with the record, the Supreme Court held that the “the ‘participation’ requirement ha[d] not been established,” and that “aspects of the scienter requirement, namely, Vista’s knowledge of the wrongfulness of its own conduct regarding the disclosure breach, also f[e]ll short.” Id. at *31. Although it described the opinion as “narrow,” the Supreme Court’s analysis in this respect nonetheless included notable commentary. For example, it held that, “in the case before [it],” “a contractual obligation between a target corporation and a third-party buyer to notify the other of potential disclosure violations” did not “create[] an independent duty of disclosure between the third-party buyer and the target’s stockholders that [could] form the basis for secondary aiding and abetting liability,” id. at *38; there are “compelling public policy reasons not to read contractual disclosure-based obligation between a third-party buyer and a target company as implying independent fiduciary duties between the third-party buyer and the target’s stockholders,” id. at *43; taking “no action to facilitate or assist [the primary violator] in his breach,” and instead merely “passively st[anding] by” did not amount to “substantial assistance,” id. at *41; and “when an aiding and abetting claim is brought against a third-party acquirer negotiating at arms’-length, participation should be the most difficult to prove,” id.

As the Court acknowledged, In re Mindbody is unlikely to be the last word on aiding and abetting liability. See id. at *39 n.117 (noting another case on appeal “addresses similar issues with different facts”). Accordingly, we will continue monitoring these issues and provide updates on future cases implicating them.

C. Delaware Supreme Court Affirms Delaware Court Of Chancery’s Dismissal Of Breach Of Fiduciary Claims Against Directors Involved In A SPAC Merger

The Delaware Supreme Court recently affirmed the dismissal of a lawsuit alleging that the sponsor of a special purpose acquisition company (SPAC) and its directors breached their fiduciary duties “by touting an outdated business model that the target had decided to scrap.” In re Hennessy Cap. Acquisition Corp. IV S’holder Litig., 318 A.3d 306, 310 (Del. Ch. 2024), aff’d, No. 245, 2024, 2024 WL 5114140 (Del. Dec. 16, 2024). In doing so, the Supreme Court adopted the reasoning of the Court of Chancery, which provided guidance clarifying that the MultiPlan standard is not as lenient as some had thought. Id.

In 2018, Hennessy Capital Acquisition Corp. IV (Hennessy) was formed as a SPAC. Id. at 311. Hennessy then merged with an entity named Canoo in late 2020. Id. at 314-15. In advance of the merger, Hennessy and Legacy Canoo issued a press release, and Hennessy subsequently issued a proxy, that outlined Canoo’s “three projected revenue streams.” Id. at 313-15. After the merger, Canoo’s board and management changed appreciably, and Canoo’s new leadership publicly announced a shift in Canoo’s business model, resulting in some volatility and an eventual fall in Canoo’s stock price. See id. at 315-17. In June 2022, the plaintiff, a Canoo stockholder, filed a putative class action alleging fiduciary duty breaches, among other claims. Id. at 317-18.

After outlining the “narrow[ness]” of a MultiPlan claim and rejecting the plaintiff’s contention that “the pleading standard is ‘relaxed’ in the context of SPAC claims,” the Court of Chancery dismissed the plaintiff’s breach of fiduciary duty claim. Id. at 319-21. The Court explained that “[t]o state a viable MultiPlan claim, a plaintiff is required to plead facts making it reasonably conceivable that conflicted fiduciaries deprived public stockholders of a fair chance to exercise their redemption rights.” Id. at 320. And in the case of disclosures, the pleaded facts “must provide grounds to infer that the defendants made a material misstatement or omission—one affecting the total mix of information available to public stockholders deciding whether to redeem.” Id. But—notwithstanding the success of prior SPAC-related suits—”[p]oor performance is not . . . indicative of a breach of fiduciary duty,” “[c]onflicts are not a cause of action,” “[a]nd pleading requirements exist even where entire fairness applies.” Id. at 310. “Entire fairness is not . . . a free pass to trial.” Id. at 319. And here, the plaintiff’s allegations were deficient under those standards.

D. Court Of Chancery Issues Opinions Providing Guidance On Commercially Reasonable Efforts Requirements Related To Earnout Provisions

The Court of Chancery issued two cases in the second half of the year finding that buyers failed to use commercially reasonable efforts to achieve agreed-upon milestones in acquisition agreements. See Fortis Advisors LLC v. Johnson & Johnson, 2024 WL 4048060 (Del. Ch. Sept. 4, 2024); S’holder Representative Servs. LLC v. Alexion Pharma., Inc., 2024 WL 4052343 (Del. Ch. Sept. 5, 2024). The opinions address two different types of common commercially reasonable efforts requirements—”inward-facing” and “outward-facing” ones—and provide helpful insight into how courts approach them.

Commercially reasonable efforts requirements are often found in earnout provisions. Earnout provision are a “common risk allocation tool[] in merger agreements” that require a buyer to “pay[] an upfront sum and an additional amount if the seller’s business achieves specific targets by a deadline,” or milestone. Fortis, 2024 WL 4048060, at *1. To lessen the risk for the seller, buyers often provide a contractual assurance that they will “devote commercially reasonable efforts” to reach the milestones. Id.

Fortis Advisors arose out of an acquisition by Johnson & Johnson (J&J) of Auris Health, Inc. (Auris), a venture-backed startup developing surgical robots. Id. As part of the acquisition, J&J agreed to pay $3.4 billion up front and another $2.35 billion upon the achievement of several commercial and regulatory milestones for two of Auris’s products. Id. The merger agreement included an “inward-facing efforts provision,” which required J&J to make “commercially reasonable efforts” to meet these milestones that were to be measured by J&J’s own standards and “usual practice” for such products. Id. at *14. Rather than make efforts to achieve those milestones, however, J&J, the Court found, instituted a series of tests designed to rank one of Auris’s products against another J&J product to determine which product to pursue and which to abandon. Id. at 2.

Among other things, the Court concluded that J&J breached its contractual obligation to use commercially reasonable efforts to reach the agreed-upon milestones for one of Auris’s products. Id. at *24-26. In doing so, the Court noted that J&J agreed to make Auris’s product a “priority medical device,” and that “commercially reasonable efforts” clauses require a party “to take all reasonable steps toward an end.” Id. at 24 (quotation omitted). The Court found that instead, J&J took steps that were “reasonably certain to have caused [the product] to miss its regulatory milestones.” Id. at *26.

Alexion arose out of Alexion Pharmaceuticals, Inc.’s (Alexion) acquisition of Syntimmune, Inc. As part of the acquisition, Alexion agreed to pay $400 million up front and an additional $800 million in installments upon the completion of several development milestones. 2024 WL 4052343, at *1, *14. The merger agreement provided that Alexion would use commercially reasonable efforts to achieve each milestone, and defined the efforts with an “outward-facing metric” of “what a similarly situated company would do” with a similar product. Id. at *1, 14. Alexion eventually terminated the acquired program altogether after its acquisition by AstraZeneca. Id. at *2, *20.

The Court concluded that Alexion breached its obligation to use commercially reasonable efforts to achieve several of the milestones. Id. at *36. In doing so, the Court noted that the merger agreement’s definition of commercially reasonable efforts did not permit Alexion to “consider its own efforts and cost required for the undertaking,” but rather only allowed for the consideration of “anticipated profitability, but only insofar as typical companies might typically consider it.” Id. at *37. As a result, the Court found that Alexion could not “consider[] its self-interest in determining what is commercially reasonable,” but rather could consider “its self-interest only in drawing the upper bound of its commercially reasonable efforts,” namely to ensure that its efforts were not “contrary to prudent business judgment.” Id.

E. The Limits Of Integration Clauses And Benefits Of Anti-Reliance Provisions

Two recent Court of Chancery decisions reinforce the limits of integrations clauses while underscoring the importance of anti-reliance provisions in precluding fraud claims. In Trifecta Multimedia Holdings Inc. v. WCG Clinical Services LLC, the plaintiff alleged that the defendant—in addition to breaching the parties’ purchase agreement—”fraudulently induced it to enter into [the] purchase agreement by claiming that the [defendant] portfolio company would be the best partner for growth, would allow the [plaintiff] healthcare company to continue operating autonomously, would support the [plaintiff] healthcare company’s sales and marketing efforts, and would generally help the [plaintiff] healthcare company secure new contracts and sell its flagship product.” 318 A.3d 450, 454 (Del. Ch. 2024). The Court, after dismissing a handful of statements as puffery, denied the defendant’s motion to dismiss in the main. Id. at 454-55. Among other things, the Court rejected the defendant’s argument that the parties’ purchase agreement precluded reliance, noting that “an integration clause, standing alone, is not sufficient to bar a fraud claim; the agreement must also contain explicit anti-reliance language,” which the parties’ agreement lacked. Id. at 465; see id. at 467.

Cytotheryx Inc. v. Castle Creek Biosciences, Inc. is similar. 2024 WL 4503220, at *3-4 (Del. Ch. Oct. 16, 2024). There, the plaintiff likewise argued that the integration clause in the parties’ agreement “prohibit[ed] any reliance on extra-contractual statements.” Id. at *3. Once again, the Court rejected the plaintiff’s argument, noting not only that the integration clause at issue did not bar the plaintiff’s particular claims but also that the parties’ agreement specifically “preserve[d] [the plaintiff’s] right to bring an action for fraud.” Id. at *5. Together Trifecta and Cytotheryx show that Delaware courts will sustain adequately pleaded fraud claims in the face of integration clauses where explicit anti-reliance provisions are absent.

F. Stockholder Agreements And Moelis

As discussed in our 2024 Mid-Year Update, the Delaware General Assembly passed S.B. 313 in July 2024, which contained what is now Section 122(18) of the Delaware General Corporation Law, in response to West Palm Beach Firefighters’ Pension Fund v. Moelis & Company, 311 A.3d 809 (Del. Ch. 2024). As a reminder, Section 122(18) “specifically authorizes a corporation to enter into contracts with one or more of its stockholders or beneficial owners of its stock, for such minimum consideration as approved by its board of directors, and provides a non-exclusive list of contract provisions by which a corporation may agree to.” Section 122(18), however, “does not apply to or affect any civil action or proceeding completed or pending on or before” August 1, 2024—meaning it has no effect on the Moelis decision. S.B. 313 § 6. Accordingly, on August 16, 2024, Moelis filed a notice of appeal. See Moelis & Co. v. W. Palm Beach Firefighters’ Pension Fund, 340-2024, Doc. No. 74077020 (Del. Supr. Aug. 16, 2024). Briefing is now complete, and we will continue to monitor the case as it proceeds.

A. Environmental Litigation

Swanson v. Danimer Sci., Inc., 2024 WL 4315109 (2d Cir. Sept. 27, 2024): In May 2021, investors filed a putative class action lawsuit against Danimer Scientific, Inc., a bioplastics manufacturer, and certain executives. In re Danimer Sci. Sec. Litig., Case No. 21-cv-02708, ECF No. 1 (E.D.N.Y.). The plaintiffs alleged that the defendants made misleading public statements regarding the biodegradability of Danimer’s products. Id. ¶ 5. They further alleged that when an article published in The Wall Street Journal claimed that the timing in which the company’s product would biodegrade was more variable than suggested, the company’s stock price allegedly dropped. Id. ¶ 6. The United States District Court for the Eastern District of New York dismissed the lawsuit, concluding that the plaintiffs failed to adequately plead that the defendants knowingly made false or misleading statements about the biodegradability of the Danimer’s products. In re Danimer Sci. Sec. Litig., 2023 WL 6385642, at *16 (E.D.N.Y. Sept. 30, 2023). On appeal, the United States Court of Appeals for the Second Circuit affirmed the district court’s dismissal. Swanson, 2024 WL 4315109, at *3. The Second Circuit noted that the plaintiffs’ allegations, even when considered collectively, did not raise a strong inference that the defendants acted with the requisite intent to deceive or defraud investors. Gibson Dunn represented the defendants in this case. Id.

Lyall v. Elsevier Inc., et al., No. 24-cv-12022 (D. Mass.): The plaintiff, a former employee of a subsidiary of RELX PLC, filed a class action complaint against RELX PLC and its subsidiaries (RELX) for violations of federal securities laws on August 6, 2024. ECF No. 1. The plaintiff alleged RELX mislead both consumers and investors by greenwashing, i.e., representing to the public that it was doing more to protect the environment than it was actually doing. Id. ¶ 7. On October 16, 2024, the defendants filed a motion to dismiss the complaint, arguing that the plaintiff failed to comply with the requirements of the Private Securities Litigation Reform Act. ECF No. 12 at 1. Before the Court ruled on that motion, the plaintiff filed an amended complaint. ECF No. 25. The amended complaint continues to assert federal securities claims, alleging that RELX mislead investors by engaging in greenwashing. ECF No. 25. On February 7, 2025, the defendants moved to dismiss. ECF Nos. 28-29.

Texas et al. v. BlackRock Inc., et al., No. 24-cv-00437 (E.D. Tex.): In November 2024, Texas and 10 other states filed a lawsuit against major asset managers—BlackRock, State Street, and Vanguard—alleging their climate-focused investment strategies violated antitrust laws. ECF No. 1. The states claimed that these firms’ ESG initiatives reduced coal production, leading to higher energy prices. Id. ¶¶ 5-6. As of the date of this publication, the defendants have not yet filed an answer or a motion to dismiss the complaint. Gibson Dunn represents BlackRock in this matter.

B. Diversity And Inclusion

Alliance for Fair Board Recruitment v. SEC, No. 21-60626 (5th Cir. 2021): The petitioners in this case sued the SEC, alleging that Nasdaq’s Board Diversity Rules were unconstitutional and contrary to federal statutes. ECF No. 1-2. The Board Diversity Rules, which the SEC approved, required companies that list shares on Nasdaq’s exchange to (1) disclose aggregated information about board members’ diversity characteristics (including race, gender, and sexual orientation) and (2) provide an explanation if less than two board members are diverse. Id. at 3-4. On December 11, 2024, an en banc panel of the Fifth Circuit issued an opinion vacating the SEC’s order approving Nasdaq’s Board Diversity Rules. ECF. No. 532-1. Gibson Dunn represents Nasdaq in this action, which intervened as an interested party.

Kanaly v. McDonald et al., No. 24-cv-08839 (S.D.N.Y): On November 20, 2024, a shareholder filed a derivative complaint against Canadian athletic apparel brand Lululemon. In that lawsuit, the plaintiff, in part, alleged that the defendants made false and/or misleading statements and omissions related to IDEA, Lululemon’s diversity program. ECF No. 1 ¶ 44. Lululemon announced the IDEA program in October 2020, saying the company would aim to reflect “the diversity of the communities the Company serves and operates in around the world by 2025.” Id. ¶ 3. The plaintiff alleges that, in reality, the IDEA program was not structured to combat purported discrimination within Lululemon in any meaningful way. Id. ¶ 4. The plaintiff also alleges that the company’s 11-person board never had more than two racially diverse members during the relevant period, and that the company’s financial statements were silent on racial diversity goals. Id. ¶¶ 58, 77, 162. The defendants have not yet filed a response to the complaint.

McCollum v. Target Corp. et al., No. 25-cv-00021 (M.D. Fla.): On January 9, 2025, the plaintiff filed a shareholder derivative action on behalf of Target Corporation against officers and members of the Board alleging the Target’s Diversity, Equity, and Inclusion (DEI) initiatives and its 2023 LGBTQ Campaign harmed company investors. ECF No. 1. The plaintiff alleges that Target’s DEI initiatives and 2023 LGBTQ Campaign resulted in significant financial harm to investors by alienating a portion of the company’s customer base and leading to a decline in sales and stock value. Id. ¶ 7. The complaint asserts that the company’s directors and officers breached their fiduciary duties by deciding to pursue these initiatives. Id. ¶ 13. The defendants have not yet filed a response to the complaint.

Securities Industry & Financial Markets Association v. Ashcroft et al., No. 23-cv-04154 (W.D. Mo.): We first reported on this case in our Securities Litigation 2023 Year-End Update. In June 2023, the Missouri Securities Division adopted new rules requiring investment professionals to obtain client signatures before providing advice that “incorporates a social objective or other nonfinancial objective.” ECF No. 24 ¶¶ 69, 78. In August 2023, the Securities Industry and Financial Markets Association (SIFMA), filed a lawsuit against Missouri Secretary of State John Ashcroft and Missouri Securities Commissioner Douglas Jacoby, challenging these rules. ECF No. 1 at 41. On August 14, 2024, the U.S. District Court for the Western District of Missouri granted SIFMA’s motion for a permanent injunction, holding that the rules were preempted by federal law, violated the First Amendment, and were unconstitutionally vague. ECF. No. 115; ECF. No. 117 (as amended on August 28, 2024). This decision prevents Missouri from enforcing the contested rules.

A. Class Actions

Naeem Azad v. Caitlyn Jenner, Sophia Hutchins, No. 24-cv-09768 (C.D. Cal.): On November 13, 2024, the plaintiffs filed a class action complaint in the Central District of California against Caitlyn Jenner and Sophia Hutchins, alleging violations of federal and California state securities laws. Specifically, they alleged a “scheme . . . [to] offer[] and s[ell] unregistered securities,” namely, “the cryptocurrency, $JENNER,” and “fraudulently solicit[] financially unsophisticated investors throughout the United States and abroad to purchase the unregistered securities.” ECF No. 1, ¶ 1. The plaintiffs described this cryptocurrency as a “memecoin,” i.e., a “blockchain-based digital asset that draws its inspiration from memes, characters, trends or, as in this case, the social media accounts and online presence of celebrities.” Id. ¶ 2. The value of memecoins, the plaintiffs alleged, is mainly derived from the ability of the “issuer or promoter to attract and sustain community engagement.” Id. ¶ 3. The plaintiffs—purportedly unsophisticated retail investors—accused the defendants of using social media accounts to promote the cryptocurrency without filing registration statements with the SEC or otherwise complying with all federal and state securities laws. Id. ¶¶ 4, 7. They further alleged that the defendants withheld or omitted material information from investors, such as “personal holdings” of the currency, “public wallet addresses she uses to hold or trade” the currency, and other facts. Id. ¶¶ 89-92. The case is in its early stages, and the defendants have not responded to the complaint at the time of this publication.

Hawes v. Argo Blockchain plc, 2024 WL 4451967 (S.D.N.Y. Oct. 9, 2024): On October 9, 2024, the District Court for the Southern District of New York granted defendant Argo Blockchain plc’s (Argo) motion to dismiss a securities fraud class action brought on behalf of investors who bought “American Depositary Receipts” in Argo’s U.S. IPO and in the aftermarket. Id. at *1. The plaintiffs filed their original class action complaint on January 26, 2023, ECF No. 1, and filed their amended complaint on September 26, 2023, ECF No. 45. Argo is a global cryptocurrency mining business, with facilities in Canada and Texas. ECF No. 45, ¶¶ 3-4. “Like many investors in the cryptocurrency arena, [the plaintiffs] lost money – specifically when, in mid-2022, Argo announced that unexpected increases in energy prices and a fall in the price of Bitcoin led to a decline in the price of Argo’s shares and ADRs.” Hawes, 2024 WL 4451967, at *1. The plaintiffs, accordingly, brought claims under the Securities Act and the Securities and Exchange Act, alleging that the defendants made “misleading statements deal[ing] principally with Argo’s capitalization and its ability to withstand adverse market conditions.” Id. The Court dismissed the plaintiffs’ complaint, noting that the “fact that an adverse event occurred following the making of a statement to the market . . . is an insufficient basis from which to infer that the statement was false when made,” and rejected the plaintiffs’ “[h]indsight pleading,” which is “too frequently seen in securities fraud cases.” Id. at *3. The Court also took pains to evaluate, and then reject, every allegedly misleading statement in the plaintiffs’ complaint. As of the date of this publication, no notice of appeal has been filed.

B. Regulatory Lawsuits

SEC v. Payward, Inc., 2024 WL 4819259 (N.D. Cal. Nov. 18, 2024): On November 18, 2024, the United States District Court for the Northern District of California denied a motion by Payward, Inc. (also known as “Kraken”) to certify for interlocutory appeal the Court’s August 23, 2024 order denying Kraken’s motion to dismiss. Id. at *1. The Court ruled that only discovery would establish whether the third-party cryptocurrency assets that are sold, exchanged, and traded on Kraken form the basis of investment contracts such that transactions involving those assets are subject to the securities laws. Id. at *2. On November 19, 2024, the parties filed a joint statement about a discovery dispute concerning the SEC’s objections to Kraken’s requests for three categories of documents concerning (1) Bitcoin and Ether, (2) the SEC’s public statements and testimony regarding digital assets, and (3) the SEC’s internal trading policies on digital assets. ECF No. 108 at 1. The case was referred to a magistrate judge for discovery, ECF No. 109, and the Court denied Kraken’s request to compel the production of these documents on December 16, 2024, ECF No. 113. On December 26, 2024, the Court granted the parties’ stipulated agreement to stay Kraken’s deadline to file objections to the Court’s order until March 31, 2025, so as to allow Kraken time to narrow its document requests. ECF No. 116. On January 24, 2025, the Court granted in part the SEC’s motion for judgment on the pleadings. ECF No. 126.

SEC v. Balina, 2024 WL 4607048 (W.D. Tex. Aug. 16, 2024): On August 16, 2024, the United States District Court for the Western District of Texas granted Ian Balina’s motion to certify its May 22, 2024 order for interlocutory appeal to allow the Fifth Circuit to consider whether Balina’s purported sales, offers to sell, and promotion of Sparkster or “SPRK” was domestic or extraterritorial conduct. Id. at *3. Balina did not seek to appeal the Court’s decision that tokens are securities as a matter of law. As discussed in a previous update, the SEC alleges that Balina, a cryptocurrency investor, sold and promoted SPRK tokens without disclosing his compensation, and the SEC maintains that U.S. securities laws apply because Balina targeted U.S. investors on U.S. social media platforms. ECF No. 1, ¶¶ 1-5. Balina contends that because his transactions occurred outside the United States, they are outside the purview of Section 5(a), 5(c), and 17(b) of the Securities Act. ECF No. 7 at 35. Trial, which had been set for January 13, 2025, is suspended pending resolution of the interlocutory appeal.

SEC v. Cumberland DRW LLC, No. 24-cv-09842 (N.D. Ill.): On October 10, 2024, the SEC charged Chicago-based Cumberland DRW LLC with operating as an unregistered dealer in more than $2 billion of crypto assets. ECF No. 1. On December 31, 2024, the defendant filed an unopposed motion to extend the briefing schedule regarding its motion to dismiss, pointing to news articles asserting that the upcoming change in Presidential administrations could impact crypto-related cases as the Trump administration would likely pull back on crypto-related enforcement. ECF No. 22. The Court denied the request, finding that neither the possibility of withdrawal of the lawsuit due to a change of administration nor the other reasons cited warranted an extension. ECF No. 24. Cumberland’s motion to dismiss, ECF No. 28, filed on January 15, 2025, remains pending.

C. Other Developments

Coinbase, Inc. v. SEC, 2025 WL 78330 (3d. Cir. Jan. 13, 2025): In July 2022—almost a year before the SEC publicly filed an enforcement case against Coinbase in federal court in the Southern District of New York for allegedly operating as an unregistered broker, exchange, and clearing agency—Coinbase petitioned the SEC to create clear rules on how federal securities laws apply to digital assets. The SEC denied Coinbase’s petition in a single paragraph, and Coinbase subsequently sought judicial review of that denial under the Administrative Procedure Act, asking the Third Circuit to order the SEC to institute a notice-and-comment rulemaking proceeding. The Court heard oral argument on September 24, 2024. Coinbase, represented by Gibson Dunn, asserted that (1) the SEC acted arbitrarily and capriciously by bringing enforcement actions seeking to apply the securities laws to digital assets without engaging in rulemaking, (2) digital assets are largely incompatible with existing securities regulations for several reasons, and these workability concerns are fundamental changes in the factual predicates underlying the existing securities-law framework, and (3) the SEC’s order was insufficiently reasoned. The Third Circuit issued its opinion on January 13, 2025, in which it declined to require the SEC to engage in formal notice-and-comment rulemaking regarding the application of securities laws to digital assets, but did require the SEC to provide a more complete explanation for its refusal to engage in such rulemaking. Id. at *1.

Crypto Freedom All. of Texas v. SEC, 2024 WL 4858590 (N.D. Tex. Nov. 21, 2024): As reported in our 2024 Mid-Year Update, CFAT and the Blockchain Association filed an action challenging the SEC’s Dealer Rule on April 23, 2024. Crypto Freedom Alliance of Texas v. SEC, No. 24-cv-361, ECF No. 1, ¶¶ 4, 7 (N.D. Tex. filed Apr. 23, 2024). The plaintiffs sought summary judgment on May 17, 2024. ECF No. 28. The SEC filed a cross-motion for summary judgment on June 26, 2024. ECF No. 38. The Court ruled in favor of the plaintiffs, finding that “Defendants engaged in unlawful agency action taken in excess of their authority.” Crypto Freedom All. of Texas, 2024 WL 4858590 at *1. The Court explained that “the Dealer Rule departs from . . . commonly recognized and historical interpretations by broadly defining a dealer as someone who ‘engage[s] in a regular pattern of buying and selling securities that has the effect of providing liquidity to other market participants.’” Id. at *4 (quoting Further Definition of “As a Part of a Regular Business,” 89 Fed. Reg. at 14944). “The Rule as it currently stands de facto removes the distinction between ‘trader’ and ‘dealer’ as they have commonly been defined for nearly 100 years.” Id. at *5. Accordingly, the Court vacated the Dealer Rule. Id. at *5. On January 17, 2025, the SEC filed a notice of appeal for the Fifth Circuit to review the district court’s decision. ECF No. 53. The SEC subsequently moved to dismiss the appeal, and dismissal was granted.

VI. Market Efficiency And “Price Impact” Cases

A. Price Impact

Because reliance is an essential element of securities fraud, plaintiffs seeking to bring securities claims as class actions must show that reliance can be presumed, rather than proven for each individual class member. To do this, plaintiffs typically invoke the decades-old precedent from Basic Inc. v. Levinson, 485 U.S. 224 (1988), which allows a rebuttable presumption of reliance if certain threshold requirements are met. Basic reasoned that material misrepresentations about a stock that trades in an efficient market would be reflected in the stock’s market price, and that any investor who decided to purchase based on the market price indirectly relied on all public information. See Basic, 485 U.S. at 247. Since the Supreme Court’s 2014 decision in Halliburton Co. v. Erica P. John Fund, Inc., 573 U.S. 258 (2014), defendants have focused on rebutting that presumption of reliance with evidence that the statements at issue did not actually impact the stock price and, therefore, class members trading on the open market did not rely on them.

As we covered in our 2024 Mid-Year Update and our 2023 Year-End Update, in 2021, the Supreme Court in Goldman Sachs Group., Inc. v. Arkansas Teacher Retirement System (“Goldman”) held that courts analyzing whether to certify a class must consider all evidence of price impact, even if the evidence overlaps with materiality and other merits questions. 594 U.S. 113, 121-22 (2021). If a plaintiff’s price impact theory is “inflation-maintenance”—where the price impact of a challenged statement is shown indirectly by a drop in the company’s stock price following a corrective disclosure, instead of by an increase in price when the statement is made—a court must consider whether there is a “mismatch” between the alleged corrective disclosure and challenged statement. Id. at 123. In 2023, the Second Circuit elaborated on the Goldman “mismatch framework,” and held that when plaintiffs rely on the inflation-maintenance theory they cannot simply “identify a specific back-end, price-dropping event” and match it to “a front-end disclosure bearing on the same subject” unless “the front-end disclosure is sufficiently detailed in the first place.” Ark. Tchr. Ret. Sys. v. Goldman Sachs Grp., Inc., 77 F.4th 74, 81, 102 (2d Cir. 2023) (“ATRS”).

This year, the Ninth Circuit will opine for the first time on the application of Goldman. A district judge recently held that a series of negative disclosures related to the “Zillow Offers” group need not “precisely mirror” the alleged misrepresentation to support a finding of price impact, and any mismatch was not sufficient to rebut the presumption of reliance. Jaeger v. Zillow Grp., Inc., ___ F. Supp. 3d ____, 2024 WL 3924557, at *6 (W.D. Wash. Aug. 23, 2024). On January 8, Zillow filed its opening brief with the Ninth Circuit, arguing that the lower court erred, in part by disregarding the Company’s evidence from its expert that “no analyst referred to the allegedly concealed information,” and the “stock price declines were attributable to factors unrelated to the alleged misstatements.” Opening Brief of Defendant-Appellants at 53, Jeager v. Zillow Group, Inc., Case No. 24-6605 (9th Cir. Jan. 8, 2025), ECF No. 10-1.

Lower courts also continue to examine price impact arguments, with a focus on what “mismatch” between the alleged corrective disclosures and the challenged statements is sufficient to defeat the presumption. See, e.g., See, e.g., Pardi v. Tricida, Inc., 2024 WL 4336627, at *7 (N.D. Cal. Sept. 27, 2024).

B. Affiliate Ute Presumption

In 2025, we expect the Sixth Circuit will decide whether the Supreme Court’s decision in Affiliated Ute Citizens of Utah v. United States, 406 U.S. 128 (1972)—which presumes class wide reliance on “omissions” without requiring plaintiffs to prove the Basic prerequisites—applies to cases that have a “mix” of both omissions and misrepresentations. Opening Brief of Defendants at 8-9, In re: FirstEnergy Corp. Sec. Litig., Case No. 23-0303 (6th Cir. Apr. 14, 2023). FirstEnergy has argued that the district court inappropriately extended Affiliated Ute to allegations of incomplete statements or “half-truths,” and has asked the Sixth Circuit to vacate the district court’s decision to certify. Id. at 9. In reaching a decision, the Sixth Circuit will have to consider whether Affiliated Ute can be reconciled with Macquarie Infrastructure Corp. v. Moab Partners, L. P., in which the Supreme Court recently held that “pure omissions” are not actionable under Rule 10b-5 of the Exchange Act, 601 U.S. 257, 260 (2024), as well as decisions from other circuits holding that Affiliated Ute only allows the reliance element to be presumed in cases involving primarily omissions. See, e.g., Binder v. Gillespie, 184 F.3d 1059, 1063-64 (9th Cir. 1999); Waggoner v. Barclays PLC, 875 F.3d 79, 93-96 (2d Cir. 2017); Joseph v. Wiles, 223 F.3d 1155, 1162-63 (10th Cir. 2000), abrogated on other grounds by Cal. Pub. Emps. Ret. Sys. v. ANZ Sec., Inc., 582 U.S. 497 (2017).

C. Basic Presumption

In a fairly recent development, the “meme stock” phenomenon has made it more challenging for investors to invoke the Basic presumption in the first place. The “meme stock” phenomenon began online during the COVID-19 pandemic, when investors began using social media to coordinate “short squeezes,” causing large impacts in the market for the target security.

In Bratya SPRL v. Bed Bath & Beyond Corp., 2024 WL 4332616, at *9-19 (D.D.C. Sept. 27, 2024), Bed Bath & Beyond argued its stock’s status as a meme stock, which put the price “in wild flux” despite the absence of new, value-relevant information, in the weeks before and during the class period, rendered the stock’s market inefficient throughout the class period. Id. at *12. The Court agreed and declined to certify the class. Id. at *19-21. Although the Court noted that typical factors indicated an efficient market, it found the short squeeze dynamics undermined the relevance of the traditional factors by rendering the market so volatile that it cannot possibly have “reflected all public, material information,” including the alleged misstatements. Id. at *12.

In Shupe v. Rocket Companies, Inc., the Court rejected the defendant’s argument that its two-day status as a “meme stock” during the two-month-long class period rendered the market for its stock inefficient. Shupe v. Rocket Companies, Inc., ___ F. Supp. 3d ____, 2024 WL 4349172, at *19-24 (E.D. Mich. Sept. 30, 2024). There, the Court held that the plaintiffs still were entitled to the Basic presumption because “meme-stocks and efficient markets are not mutually exclusive” and even inaccurately priced stocks can still respond to false statements, causing loss. Id. at *23 (citing Halliburton, 573 U.S. at 272). The Rocket Companies court still declined to certify the class because the defendants successfully rebutted the presumption of reliance by demonstrating that the analysts did not report on the alleged misstatement throughout the class period, thus severing the link between price drop and the misrepresentations. Id. at *24-26 (citing ATRS 77 F.4th at 104).

VII. Other Notable Developments

A. Second Circuit Reconsiders And Reverses Prior Decision, Now Finds Auditor Opinions Can Be Material

In New England Carpenters Guaranteed Annuity and Pension Funds v. DeCarlo (“DeCarlo II”), the Second Circuit reconsidered and reversed its own prior opinion concerning 10b-5 claims involving auditor opinions, now concluding that standardized language in auditor opinions may be material to investors. 122 F.4th 28 (2d Cir. 2023) (opinion amended on October 31, 2024).

As detailed in our 2023 Year-End Update, the plaintiffs alleged violations of the Securities Act and the Exchange Act against AmTrust Financial Services, its officers and directors, various underwriters, and its auditor, BDO, arising from AmTrust’s restatement of five years of financial statements. See New Eng. Carpenters Guaranteed Annuity & Pension Funds v. DeCarlo (“DeCarlo I”), 80 F.4th 158, 174-79 (2d Cir. 2023). In DeCarlo I, the Second Circuit affirmed the dismissal of 10b-5 claims against the auditor, finding that the “[c]omplaint fail[ed] to allege any link between BDO’s misstatements in the 2013 Auditor Opinion and the material errors contained in AmTrust’s 2013 Form 10-K,” and called the audit statements “so general . . . that a reasonable investor would not depend on them as a guarantee.” Id. at 182 (internal citations omitted).

Upon reconsideration, the Second Circuit reversed its earlier opinion, now reasoning that “[a]lthough the challenged audit certification reflects standardized language, it is not so general that a reasonable investor would not depend on it as a guarantee.” DeCarlo II, 122 F.4th at 53 (internal citations omitted). The Court further explained that “BDO’s certification that the audit was conducted in accordance with PCAOB standards succinctly conveyed to investors that AmTrust’s audited financial statements were reliable,” and had the auditor not issued an opinion, it “would have alerted investors to potential problems in the company’s financial reports.” Id.

The Second Circuit also found the complaint adequately alleged loss causation against the auditor, explaining that a “[Wall Street Journal] article revealed the specific deficiencies that rendered the audit opinion misleading” and calling the article a “‘clean match’ between the misleading audit opinion and the subsequent disclosure.” Id. at 54. The Court was also satisfied that the complaint adequately alleged scienter by “alleg[ing] that BDO consciously covered up its own misrepresentation that its audit complied with PCAOB standards.” Id. at 55.

B. Ninth Circuit Clarifies SPAC Investors Lack Standing To Challenge Statements Made By The Target Acquisition Company Prior To A De-SPAC Merger

In a follow up to our prior discussion of standing issues related to SPACs in our 2023 Mid-Year Update, the Ninth Circuit became only the second appellate court to analyze standing for 10b-5 claims challenging pre-merger statements made by the target acquisition company. In In re CCIV / Lucid Motors Securities Litigation, the Ninth Circuit addressed the standing of investors who purchased shares in Churchill Capital Corporation IV (CCIV), a SPAC, before its merger with Lucid Motors. 110 F.4th 1181, 1182 (9th Cir. 2024). Reversing the district court’s decision (previously detailed in our 2022 Year-End Securities Litigation Update), the Ninth Circuit held that investors in the SPAC lacked standing to sue for alleged misstatements by the target acquisition company made before the merger because the investors purchased stock in the SPAC, not the target acquisition company that allegedly made the misstatements. Id. at 1187. The Ninth Circuit’s decision is consistent with the Second Circuit’s decision in Menora Mivtachim Insurance Ltd. V. Frutarom Industries Ltd., 54 F.4th 82, 88 (2d Cir. 2022) (“Menora”).

The plaintiffs in CCIV alleged Lucid’s CEO “made misrepresentations about Lucid’s ability to meet certain production targets” before either company publicly announced the merger, though “extensive reporting in the financial press” speculated a deal was imminent. 110 F.4th at 1183. The plaintiffs purchased CCIV stock based on these statements by Lucid’s CEO when Lucid was still a private company and before the merger was announced. Id. The plaintiffs alleged that it was not until the day the merger was announced that the true production targets were revealed to be far below Lucid’s CEO’s projections. Id.

The Ninth Circuit held that the plaintiffs lacked standing. Id. at 1187. Relying on the purchaser-seller rule (or Birnbaum Rule) announced in Blue Chip Stamps v. Manor Drug Stores, 421 U.S. 723, 742 (1975), the Ninth Circuit found that Section 10(b) standing is a “bright-line rule” requiring that a “plaintiff purchased or sold the securities about which the alleged misrepresentations were made.” Id. at 1186. The plaintiffs had urged the Court to instead use a “connected to” standard, which would analyze standing on a “case-by-case basis” by looking at “whether the security plaintiff purchased is sufficiently connected to the misstatement.” Id. The Ninth Circuit declined to adopt that rule, noting the Second Circuit had recently rejected a similar argument in Menora. Id. at 1185 (citing Menora, 54 F.4th at 86). Instead, the Court explained the alleged misrepresentations were those of Lucid when it was a private company, and not of CCIV, the SPAC whose shares the plaintiffs had purchased, and dismissed the case. Id. at 1186-87.

C. Tenth Circuit Rejects Short Sellers’ 10b-5 And Market Manipulation Claims

In In re Overstock Securities Litigation, the Tenth Circuit made it more difficult for short seller investors to challenge statements and actions taken by companies. In brief, it provided an avenue for the defendants to rebut the presumption of reliance against short seller plaintiffs whose lending contracts include an obligation to repurchase shares, while also clarifying market manipulation requires some element of deception. 119 F.4th 787 (10th Cir. 2024).

The short-seller plaintiff alleged that Overstock manipulated the market by announcing plans to issue an unregistered digital dividend to create a short squeeze, which artificially inflated the stock price. Overstock, 119 F.4th at 795-98. The Court ultimately concluded that the short seller failed to plausibly allege reliance as required to bring a 10b-5 claim. Id. at 799. The Court clarified that short sellers (whose investment strategy is based on borrowing the stock and selling it high with an obligation to repurchase it at some point in the future) may rely upon the Basic presumption of reliance. Id. at 800 (citing Basic Inc. v. Levinson, 485 U.S. 224, 248-49 (1988)). But this presumption can be rebutted “by demonstrating that the plaintiff would have bought or sold the stock even if he was aware that the stock’s price was tainted by fraud,” or traded their shares while believing the defendants’ statements were false “because of other unrelated concerns.” Id. (quotations and citations omitted). Here, the short seller admitted it bought shares to cover its position to satisfy its lending contracts because of the dividend, not because of the alleged misrepresentations. Id.

The Tenth Circuit affirmed the dismissal of the short seller’s manipulation claims, holding “that an open-market transaction may qualify as manipulative conduct, but only if accompanied by plausibly alleged deception” and noting that Overstock’s “truthful disclosure of the terms of the upcoming dividend transaction did not deceive investors.” Id. at 802-03. The Court also reasoned that even though an open-market transaction was not inherently manipulative, such a transaction could become so if done with manipulative intent. Id. The Court concluded that manipulative intent required an element of “secrecy” that was not present. Id. at 804.

D. 2024 Marked An Increase In Securities Class Actions Related To Artificial Intelligence

As discussed in the 2024 Mid-Year Update, the number of Artificial Intelligence-related filings are on the rise as both private plaintiffs and the SEC focus on “AI washing” claims, and 2025 will likely be no different.

Similar to “greenwashing” claims, AI washing claims involve allegations that a company’s AI statements or disclosures misrepresented its AI capabilities or failed to disclose risks associated with its use of AI. These claims can be brought against AI companies or companies that use AI for various business purposes. For example, in Hoare v. Oddity Tech Ltd., 24-cv-06571 (S.D.N.Y. July 19, 2024), the plaintiffs alleged that Oddity, a consumer wellness platform that portrayed itself as a “disruptor in the cosmetics industry” falsely claimed to use “proprietary AI technologies to target consumer needs” through the use of algorithms and machine-learning models to match customers with beauty products. Dkt. 1 at ¶ 28. The plaintiffs allege that Oddity “overstated its AI technology and capabilities, and/or the extent to which this technology drove the Company’s sales” because Oddity’s AI-product-matching technology amounted to a normal questionnaire. Id. ¶¶ 44, 47. Similarly, in SEC v. Raz, 24-cv-04466 (S.D.N.Y. June 11, 2024), the SEC alleges that the founder of a technology platform that claimed to use artificial intelligence to match its clients with diverse job candidates from underrepresented backgrounds made false and misleading statements about the platform’s AI capabilities. Dkt. 1 at ¶ 2. The SEC alleges that the technology platform did not actually use AI and automation and “its technology was not as advanced” as the founder claimed. Id. at ¶¶ 67-68. The case is currently stayed pending the conclusion of a criminal case against the founder. See SEC v. Raz, 1:24-cv-04466 (S.D.N.Y. July 31, 2024), Stipulation and Order at 1.

We will continue to monitor these and similar cases in the coming year.

Gibson Dunn lawyers are available to assist in addressing any questions you may have regarding these developments. Please contact the Gibson Dunn lawyer with whom you usually work, the authors, or any of the following leaders and members of the firm’s Securities Litigation practice group:

Christopher D. Belelieu – New York (+1 212.351.3801, cbelelieu@gibsondunn.com)

Jefferson Bell – New York (+1 212.351.2395, jbell@gibsondunn.com)

Michael D. Celio – Palo Alto (+1 650.849.5326, mcelio@gibsondunn.com)

Colin B. Davis – Orange County (+1 949.451.3993, cdavis@gibsondunn.com)

Jonathan D. Fortney – New York (+1 212.351.2386, jfortney@gibsondunn.com)

Monica K. Loseman – Co-Chair, Denver (+1 303.298.5784, mloseman@gibsondunn.com)

Brian M. Lutz – Co-Chair, San Francisco (+1 415.393.8379, blutz@gibsondunn.com)

Mary Beth Maloney – New York (+1 212.351.2315, mmaloney@gibsondunn.com)

Jason J. Mendro – Co-Chair, Washington, D.C. (+1 202.887.3726, jmendro@gibsondunn.com)

Alex Mircheff – Los Angeles (+1 213.229.7307, amircheff@gibsondunn.com)

Lissa M. Percopo – Washington, D.C. (+1 202.887.3770, lpercopo@gibsondunn.com)

Jessica Valenzuela – Palo Alto (+1 650.849.5282, jvalenzuela@gibsondunn.com)

Craig Varnen – Co-Chair, Los Angeles (+1 213.229.7922, cvarnen@gibsondunn.com)

Allison K. Kostecka – Denver (+1 303.298.5718, akostecka@gibsondunn.com)

Mark H. Mixon, Jr. – New York (+1 212.351.2394, mmixon@gibsondunn.com)

© 2025 Gibson, Dunn & Crutcher LLP. All rights reserved. For contact and other information, please visit us at www.gibsondunn.com.

Attorney Advertising: These materials were prepared for general informational purposes only based on information available at the time of publication and are not intended as, do not constitute, and should not be relied upon as, legal advice or a legal opinion on any specific facts or circumstances. Gibson Dunn (and its affiliates, attorneys, and employees) shall not have any liability in connection with any use of these materials. The sharing of these materials does not establish an attorney-client relationship with the recipient and should not be relied upon as an alternative for advice from qualified counsel. Please note that facts and circumstances may vary, and prior results do not guarantee a similar outcome.